|

|

市場調査レポート

商品コード

1072704

冷蔵輸送の世界市場:用途(チルド食品、冷凍食品)、輸送形態、車両タイプ(LCV、MHCV、HCV)、温度(単一温度、複数温度)、技術、地域別 - 2027年までの予測Refrigerated Transport Market by Application (Chilled food & Frozen food), Mode of Transport (Road, Sea, Rail & Air), Vehicle Type (LCV, MHCV & HCV), Temperature (Single & Multi-temperature), Technology and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 冷蔵輸送の世界市場:用途(チルド食品、冷凍食品)、輸送形態、車両タイプ(LCV、MHCV、HCV)、温度(単一温度、複数温度)、技術、地域別 - 2027年までの予測 |

|

出版日: 2022年04月28日

発行: MarketsandMarkets

ページ情報: 英文 350 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の冷蔵輸送の市場規模は、予測期間中に7.2%のCAGRで推移し、2022年の1,134億米ドルから、2027年までに1,607億米ドルに達すると予測されています。

同市場は主に、幅広い種類の食品の国際取引の増加によって牽引されています。国際貿易の関税および非関税障壁の引き下げは、生鮮商品の国境を越えた輸送を促しています。

予測期間中、アジア太平洋が最も急速に成長する見通しです。同地域市場は、10年前までは断片的で、資金も不足していました。しかし、産業革命により、忙しいライフスタイルを送る人口が増加し、賞味期限の長い便利な食品に傾倒するようになり、食品産業における冷蔵輸送の利用が促進されるようになりました。

当レポートでは、世界の冷蔵輸送市場について調査しており、市場力学、貿易データ、特許や価格の分析、エコシステム、セグメント・地域別の市場分析、競合情勢、主要企業のプロファイルなどの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 市場機会

- 課題

第6章 市場のディスラプション

- ブレグジット

- シルクロード

- 米国-英国の貿易と投資の関係

- マクロ経済指標

第7章 動向

- バリューチェーン

- テクノロジー分析

- 価格分析

- 市場マップとエコシステム

- バイヤーに影響を与える動向

- 特許分析

- 貿易データ

- 主な会議とイベント(2022-2023)

- ポーターのファイブフォース分析

- ケーススタディ

第8章 冷蔵輸送市場の規制

- FDA FOOD SAFETY MODERNIZATION ACT(FSMA)

- AGREEMENT ON THE INTERNATIONAL CARRIAGE OF PERISHABLE FOODSTUFFS AND THE SPECIAL EQUIPMENT TO BE USED FOR SUCH CARRIAGE(ATP)

- 欧州

- インド

- 米国

- オーストラリア・ニュージーランド

- コールドチェーンロジスティクスにおける冷媒の使用に関する法律

- アジア太平洋

第9章 用途別:冷蔵輸送市場

- チルド食品

- ミルク

- ベーカリー・菓子類製品

- 乳製品

- 飲料

- 生鮮果物・野菜

- 冷凍食品

- アイスクリーム

- 冷凍乳製品

- 加工肉

- 魚・シーフード

- ベーカリー製品

第10章 輸送方法別:冷蔵輸送市場

- 冷蔵道路輸送

- 冷蔵LCV(バン)

- 冷蔵MHCV(トラック)

- 冷蔵HCV(トレーラーおよびセミトレーラー)

- 冷蔵海上輸送

- 冷蔵鉄道輸送

- 冷蔵航空輸送

第11章 温度別:冷蔵輸送市場

- 単一温度

- 多重温度

第12章 技術別:冷蔵輸送市場

- 蒸気圧縮システム

- 送風熱交換器

- 共晶デバイス

- ハイブリッド

- 純電気

- コンプレッサーテクノロジー

- スクロール

- 開放型レシプロ

- その他

第13章 地域別:冷蔵輸送市場

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 南米

- ブラジル

- アルゼンチン

- その他南米

- その他

- アフリカ

- 中東

第14章 競合情勢

- 概要

- 市場シェア分析(2021)

- 主要企業の収益実績分析

- COVID-19 - 企業ごとの対応

- KELLOGG CO

- GENERAL MILLS INC.

- NESTLE SA

- CONAGRA BRANDS

- TYSON FOODS, INC.

- 企業評価クアドラント(主要企業)

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- NESTLE SA

- TYSON FOODS, INC.

- THE KRAFT HEINZ COMPANY

- GENERAL MILLS INC.

- SMITHFIELD FOODS, INC

- KELLOGG CO.

- CONAGRA BRANDS, INC.

- KERRY GROUP PLC

- DEL MONTE PACIFIC LIMITED

- ARYZTA AG

第16章 競合情勢

- 概要

- 市場シェア分析(2021)

- 主要企業の収益実績分析

- 企業評価クアドラント(主要企業)

- 競合シナリオ

第17章 企業プロファイル

- 主要企業

- UNITED TECHNOLOGIES CORPORATION(CARRIER CORPORATION)

- DAIKIN INDUSTRIES, LTD.,

- INGERSOLL RAND

- CHINA INTERNATIONAL SHIPPING CONTAINERS(GROUP)CO., LTD.

- UTILITY TRAILER MANUFACTURING COMPANY

- SINGAMAS CONTAINER HOLDINGS LIMITED

- HYUNDAI

- SCHMITZ CARGOBULL

- KRONE

- LAMBERET SAS

- TATA MOTORS

- VE COMMERCIAL VEHICLES LIMITED

- SHAANXI TIANHUI INLONG TRADING CO. LTD

- WABASH NATIONAL CORPORATION

- GREAT DANE LLC

第18章 隣接・関連市場

- 制限

- コールドチェーン市場

- 冷凍食品市場

第19章 付録

According to MarketsandMarkets, the refrigerated transport market size is estimated to be valued at USD 113.4 billion in 2022 and is projected to reach USD 160.7 billion by 2027, recording a CAGR of 7.2% during the forecast period in terms of value. The market is primarily driven by increasing international trade of wide range of food products. The globalization has resulted in the trade liberalization, advancements in transport infrastructure & communication technologies, and the growth of multinational companies in the food retail sector. This has resulted in diverse types of fruits, vegetables, or processed food being made available at local supermarkets. Several forces drive and enhance the global trade of perishable commodities. The lowering of tariffs and non-tariff barriers to international trade has encouraged the cross-border movement of perishable commodities.

"By application, frozen foods segment is estimated to grow at the highest CAGR during the forecasted period."

In recent few years, it has been witnessed that frozen foods have gained a significant popularity among the consumers across major economies in the world owing to high degree of convenience and adaption to busy urban lifestyles. These frozen food meal offers meal flexibility and customers can save their time and money from grocery purchase and cooking time. These market trends are promoting the frozen foods market and in turn it will boost the refrigerated trucks market.

"By vehicle type, MHCV was the second largest segment in 2021 and anticipated to grow at a significant growth rate over the forecast period."

The vehicles that are intended for carrying goods and to have a maximum authorized mass of more than seven tons are considered as trucks. Trucks, also referred to as MHCVs, are prominently used for goods transportation. China, the US, and India are growing rapidly and use trucks to transport their goods; thus, there would increase in demand for trucks in countries that witness an increase in demand for refrigerated transport.

"By temperature, single temperature segment is estimated to witness the fastest growth rate over the forecast period."

Single temperature trucks are widely used to transport a set of perishable food items which requires a specific temperature point during the transit. The single temperature trucks have gained huge popularity with the increasing number of hypermarkets and supermarkets across the globe.

"Eutectic devices was the second largest technology available in the refrigerated transport market in 2022."

A eutectic system is suitable for short transportation, where there are regular stops and door openings during distribution; LCVs and MHCVs use it. It consists of hollow tubes, beams, or plates filled with a eutectic solution. This solution stores energy and produces a cooling effect when it is necessary to maintain the refrigerated temperature. As eutectic solutions can store energy, there is no need for fuel or energy to charge the eutectic device at the time of delivery.

"Asia Pacific is estimated to be the fastest growing region over the forecast period. "

The Asia Pacific refrigerated transport market has been fragmented and was under-funded until a decade ago. However, the industrial revolution in the region resulted in the rise in population with busier lifestyles inclined toward convenience food products with an extended shelf-life, thereby fueling the use of refrigerated transport in the food industry.

Various emerging economies are attempting to facilitate improvements in refrigerated transport through regulations and subsidies. For instance, in India, the government is providing the Reefer Vehicles Scheme under the National Mission on Food Processing (NMFP). The scheme's objective is to provide financial assistance to purchase standalone reefer vehicles and mobile pre-cooling vans (reefer unit and reefer cabinet permanently mounted on the vehicle) to transport perishable commodities.

The refrigerated transport market is segmented region-wise, with a detailed analysis of each region. These regions include North America, Europe, Asia Pacific, South America, and RoW (Africa and Middle East).

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 30%, Tier 2- 30%, and Tier 3- 40%

By Designation: CXOs- 40%, Manager- 25%, and Executive- 35%

By Region: Asia Pacific- 40%, Europe- 30%, North America- 16%, and RoW- 14%

Leading players profiled in this report include the following:

- United Technologies Corporation (Carrier Corporation) (US)

- DAIKIN INDUSTRIES Ltd.(Japan),

- Ingersoll Rand (Ireland),

- China International Shipping Containers (Group) Co., Ltd (China),

- Utility Trailer Manufacturing Company (US),

- Singamas Container Holdings Limited (China),

- Hyundai (Korea),

- Schmitz Cargobull (Germany),

- KRONE (Germany),

- LAMBERET SAS (France),

- Tata Motors (India),

- VE Commercial Vehicles Limited (India),

- Shaanxi Tianhui Inlong Trading Co. Ltd (China),

- Wabash National Corporation (US)

- Great Dane LLC (US)

(Refrigerated Transport Service Providers):

- United Technologies Corporation (Carrier Corporation) (US)

- DAIKIN INDUSTRIES Ltd.(Japan),

- Ingersoll Rand (Ireland),

- China International Shipping Containers (Group) Co., Ltd (China),

- Utility Trailer Manufacturing Company (US),

- Singamas Container Holdings Limited (China),

- Hyundai (Korea),

- Schmitz Cargobull (Germany),

- KRONE (Germany),

- LAMBERET SAS (France),

- Tata Motors (India),

- VE Commercial Vehicles Limited (India),

- Shaanxi Tianhui Inlong Trading Co. Ltd (China),

- Wabash National Corporation (US)

- Great Dane LLC (US)

(Frozen and Chilled Food Manufacturer):

- Nestle SA (Switzerland)

- Tyson Foods, Inc. (US)

- The Kraft Heinz Company (US)

- General Mills, Inc. (US)

- Smithfield Foods, Inc (US)

- Kellogg Co. (US)

- Conagra Brands, Inc. (US)

- Kerry Group plc (Ireland)

- Del Monte Pacific Ltd (Singapore)

- Aryzta AG (Switzerland)

Research Coverage

This report segments the refrigerated transport market on the basis of application, vehicle type, temperature, technology, and region. In terms of insights, this research report focuses on various levels of analyses-competitive landscape, end-use analysis, and company profiles-which together comprise and discuss the basic views on the emerging & high-growth segments of the refrigerated transport market, high-growth regions, countries, drivers, restraints, opportunities, and challenges.

Reasons to buy this report

- To get a comprehensive overview of the refrigerated transport market

- To gain wide-ranging information about the top players in this industry, their product portfolio details, and the position in the market

- To gain insights about the major countries/regions, in which the refrigerated transport market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.4 REGIONS COVERED

- 1.4.1 INCLUSIONS AND EXCLUSIONS

- 1.5 PERIODIZATION CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 VOLUME UNIT CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019-2021

- 1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 REFRIGERATED TRANSPORT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key primary insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH ONE - BOTTOM-UP (BASED ON REFRIGERATED TRANSPORT MARKET, BY REGION)

- 2.2.2 APPROACH TWO - TOP DOWN (BASED ON THE GLOBAL MARKET)

- 2.3 DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- 2.4 ASSUMPTIONS FOR THE STUDY

- 2.5 LIMITATIONS AND RISK ASSESSMENT OF THE STUDY

- 2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

- 2.6.1 OPTIMISTIC SCENARIO

- 2.6.2 REALISTIC & PESSIMISTIC SCENARIO

- 2.6.3 SCENARIO-BASED MODELLING

- 2.7 INTRODUCTION TO COVID-19

- 2.8 COVID-19 HEALTH ASSESSMENT

- FIGURE 4 COVID-19: GLOBAL PROPAGATION

- FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

- 2.9 COVID-19 ECONOMIC ASSESSMENT

- FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

- 2.9.1 COVID-19 ECONOMIC IMPACT-SCENARIO ASSESSMENT

- FIGURE 7 CRITERIA IMPACTING THE GLOBAL ECONOMY

- FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY

- TABLE 2 GLOBAL: REFRIGERATED TRANSPORT MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 9 REFRIGERATED TRANSPORT MARKET SIZE FOR CHILLED FOOD PRODUCTS, BY PRODUCT TYPE, 2022 VS 2027 (KILO TON)

- FIGURE 10 REFRIGERATED TRANSPORT MARKET SIZE, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 REFRIGERATED TRANSPORT MARKET SIZE, BY TEMPERATURE, 2022 VS. 2027 (UNIT)

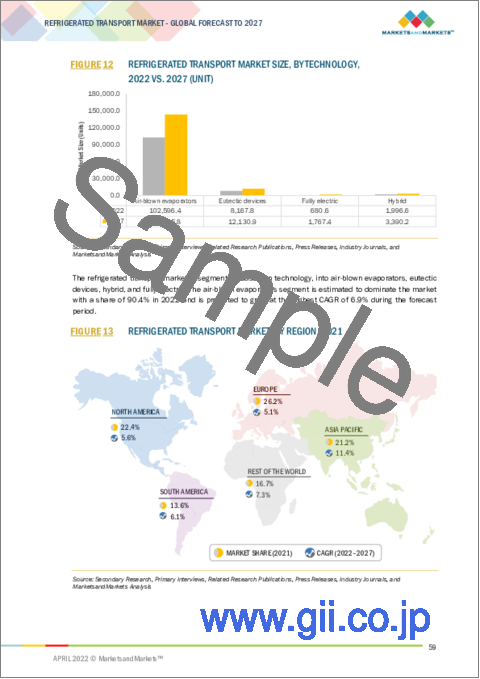

- FIGURE 12 REFRIGERATED TRANSPORT MARKET SIZE, BY TECHNOLOGY, 2022 VS. 2027 (UNIT)

- FIGURE 13 REFRIGERATED TRANSPORT MARKET, BY REGION, 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN THE REFRIGERATED TRANSPORT MARKET

- FIGURE 14 GROWING DEMAND FOR CHILLED & FROZEN FOOD PRODUCTS TO DRIVE THE REFRIGERATED TRANSPORT MARKET

- 4.2 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY APPLICATION AND COUNTRY

- FIGURE 15 CHINA TO ACCOUNT FOR THE LARGEST SHARE IN THE FROZEN PRODUCTS SEGMENT IN THE ASIA PACIFIC MARKET IN 2022

- 4.3 REFRIGERATED TRANSPORT MARKET, BY VEHICLE TYPE

- FIGURE 16 LCV SEGMENT ESTIMATED TO HOLD THE LARGEST SHARE OF THE REFRIGERATED TRANSPORT MARKET IN 2022

- 4.4 REFRIGERATED TRANSPORT MARKET, BY TEMPERATURE

- FIGURE 17 MULTI-TEMPERATURE SEGMENT IS ESTIMATED TO DOMINATE THE REFRIGERATED TRANSPORT MARKET IN 2022

- 4.5 REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY,

- FIGURE 18 AIR-BLOWN EVAPORATORS TECHNOLOGY ESTIMATED TO HOLD A LARGER SHARE OF THE REFRIGERATED TRANSPORT MARKET IN 2022

- 4.6 REFRIGERATED TRANSPORT MARKET, BY APPLICATION AND REGION

- FIGURE 19 ASIA PACIFIC TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

- FIGURE 20 COVID-19 IMPACT ON THE REFRIGERATED TRANSPORT MARKET: COMPARISON OF PRE-AND POST-COVID-19 SCENARIOS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 REFRIGERATED TRANSPORT MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing need for temperature control to prevent food loss and potential health hazards

- FIGURE 22 INDIA: ANNUAL FOOD WASTAGE AS PERCENTAGE OF PRODUCTION, 2020

- 5.2.1.2 Increasing international trade of perishable commodities

- 5.2.1.3 Technological innovations in refrigerated systems and equipment

- 5.2.1.4 Increased demand for frozen perishable commodities

- FIGURE 23 CHINA: BEEF & VEAL PRODUCTION AND CONSUMPTION, 2016-2021 (THOUSAND METRIC TON)

- 5.2.1.5 Growing demand for fresh fruits and vegetables in Europe

- FIGURE 24 SHARE OF FRESH FRUIT AND VEGETABLES IMPORT VALUE IN 2020

- 5.2.2 RESTRAINTS

- 5.2.2.1 High energy costs and the requirement for significant capital investments

- 5.2.2.2 Climate change affecting transportation infrastructure

- 5.2.2.3 Environmental concerns regarding greenhouse gas emissions

- FIGURE 25 ENVIRONMENTAL IMPACT OF THE FOOD SUPPLY CHAIN

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Intermodal transport to save fuel costs

- 5.2.3.2 Integration of multi-temperature systems in trucks and trailers

- 5.2.3.3 Increasing foreign direct investments in emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of transport infrastructure support in emerging markets and skilled resources in developed markets

- 5.2.4.2 Maintaining product integrity during the transportation of perishable commodities

- 5.2.4.3 Rising fuel costs and high capital investment requirement

6 MARKET DISRUPTIONS

- 6.1 BREXIT

- 6.1.1 IMPACT OF BREXIT ON GLOBAL TRADE

- 6.1.1.1 Free internal market

- 6.1.1.2 Most impacted countries include Belgium, the Netherlands, and Germany

- TABLE 3 ESTIMATED MOST FAVOURED NATION (MFN) TARIFF LEVELS, BY KEY SECTOR, 2016

- FIGURE 26 TOP FIVE COMMODITIES EXPORTED BY THE UK TO THE UN, "NOVEMBER" 2021

- FIGURE 27 TOP 5 COMMODITIES IMPORTED BY THE UK FROM THE EU, "NOVEMBER" 2021

- 6.1.2 IMPLICATIONS OF BREXIT ON ROAD TRANSPORT OPERATORS

- 6.1.2.1 Professional competence in road transport

- 6.1.2.2 Permits for road transport

- 6.1.3 APPROVALS FOR VEHICLES

- 6.1.4 INSPECTION AND CUSTOMS CHECKS

- 6.1.5 THE CUMULATIVE EFFECT OF BORDER CONTROL ON JOURNEY TIMES

- 6.1.1 IMPACT OF BREXIT ON GLOBAL TRADE

- 6.2 SILK ROAD

- 6.2.1 THREE MAIN ROUTES

- 6.2.1.1 The Eurasian Land-Bridge with new opportunities

- 6.2.1.2 Volumes are still low, but trade value is higher

- 6.2.1.3 Chinese and European hinterlands more accessible

- 6.2.1 THREE MAIN ROUTES

- 6.3 U.S.- UK TRADE AND INVESTMENT TIES

- FIGURE 28 SHARE OF U.S. AND UK TOTAL TRADE (TOTAL 2020 GOODS AND SERVICES TRADE (EXPORTS AND IMPORTS) WITH SELECTED TRADING PARTNERS)

- 6.4 MACROECONOMIC INDICATORS

- 6.4.1 GROWTH OF THE ORGANIZED RETAIL INDUSTRY

- FIGURE 29 GROWING ORGANIZED RETAIL INDUSTRY IS FUELING THE DEMAND FOR REFRIGERATED TRANSPORT

- 6.4.2 INCREASING NEED FOR REFRIGERATED TRANSPORT

7 INDUSTRY TRENDS

- 7.1 INTRODUCTION

- 7.2 VALUE CHAIN

- 7.2.1 SUPPLY PROCUREMENT

- 7.2.2 TRANSPORT

- 7.2.3 STORAGE & DISTRIBUTION

- 7.2.4 END-PRODUCT MANUFACTURERS

- FIGURE 30 VALUE CHAIN ANALYSIS OF THE REFRIGERATED TRANSPORT MARKET

- 7.3 TECHNOLOGY ANALYSIS

- 7.4 PRICING ANALYSIS: REFRIGERATED TRANSPORT MARKET

- TABLE 4 GLOBAL REFRIGERATED TRANSPORT AVERAGE SELLING PRICE (ASP), BY TECHNOLOGY, 2019-2021 (USD/UNITS)

- TABLE 5 GLOBAL REFRIGERATED TRANSPORT AVERAGE SELLING PRICE (ASP), BY REGION, 2019-2021 (USD/UNITS)

- 7.5 MARKET MAP AND ECOSYSTEM REFRIGERATED TRANSPORT MARKET

- 7.5.1 DEMAND-SIDE

- 7.5.2 SUPPLY-SIDE

- FIGURE 31 REFRIGERATED TRANSPORT MARKET: MARKET MAP

- TABLE 6 REFRIGERATED TRANSPORT MARKET: SUPPLY CHAIN (ECOSYSTEM)

- 7.6 TRENDS IMPACTING BUYERS

- FIGURE 32 REFRIGERATED TRANSPORT MARKET: TRENDS IMPACTING BUYERS

- 7.7 PATENT ANALYSIS

- FIGURE 33 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2021

- FIGURE 34 TOP 10 INVESTORS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 35 TOP 10 APPLICANTS WITH THE HIGHEST NO. OF PATENT DOCUMENTS

- TABLE 7 SOME OF THE PATENTS PERTAINING TO REFRIGERATION TRANSPORT, 2019-2021

- 7.8 TRADE DATA: REFRIGERATED TRANSPORT MARKET

- 7.8.1 TROPICAL FRUITS (AVOCADO, PINEAPPLE, GUAVA, MANGOES, AND FIGS)

- TABLE 8 TOP 10 IMPORTERS AND EXPORTERS OF TROPICAL FRUITS (AVOCADOS, PINEAPPLES, GUAVA, MANGOES, FIGS) (USD MN)

- 7.8.2 POULTRY

- TABLE 9 TOP 10 IMPORTERS AND EXPORTERS OF POULTRY, (USD MN)

- 7.9 KEY CONFERENCES & EVENTS IN 2022-2023

- 7.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 REFRIGERATED TRANSPORT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 7.10.1 DEGREE OF COMPETITION

- 7.10.2 BARGAINING POWER OF SUPPLIERS

- 7.10.3 BARGAINING POWER OF BUYERS

- 7.10.4 THREAT OF SUBSTITUTES

- 7.10.5 THREAT OF NEW ENTRANTS

- 7.11 CASE STUDIES

- 7.11.1 RISING COLD CHAIN LOGISTICS DEMAND FOR TRANSPORT OF PERISHABLE PRODUCTS

- 7.11.2 EURO FOOD GROUP SIGNED AN AGREEMENT WITH CARRIER CORPORATION FOR REFRIGERATED EQUIPMENT SUPPLY

8 REGULATIONS FOR THE REFRIGERATED TRANSPORT MARKET

- 8.1 INTRODUCTION

- 8.2 FDA FOOD SAFETY MODERNIZATION ACT (FSMA)

- 8.3 AGREEMENT ON THE INTERNATIONAL CARRIAGE OF PERISHABLE FOODSTUFFS AND THE SPECIAL EQUIPMENT TO BE USED FOR SUCH CARRIAGE (ATP)

- 8.3.1 SELECTION OF EQUIPMENT AND TEMPERATURE CONDITIONS TO BE OBSERVED FOR THE CARRIAGE OF QUICK (DEEP)-FROZEN AND FROZEN FOODSTUFFS

- TABLE 11 TEMPERATURE CONDITIONS FOR FROZEN FOODS

- 8.3.2 MONITORING THE AIR TEMPERATURE FOR TRANSPORT OF QUICK-FROZEN PERISHABLE FOODSTUFFS

- TABLE 12 TEMPERATURE CONDITIONS FOR CHILLED FOODS

- 8.4 EUROPE

- 8.4.1 TEMPERATURE CONTROL AND LEGISLATION REQUIREMENTS FOR REFRIGERATED TRANSPORT

- 8.5 INDIA

- 8.5.1 COP APPROVAL REQUIREMENTS FOR REFRIGERATED TRANSPORT

- 8.6 US

- 8.6.1 ELECTROLYTE SPILLAGE AND ELECTRICAL SHOCK PROTECTION FOR REFRIGERATED TRANSPORT

- 8.7 AUSTRALIA & NEW ZEALAND

- 8.7.1 FOOD STANDARDS AUSTRALIA NEW ZEALAND (FSANZ)

- 8.8 LEGISLATIONS FOR THE USE OF REFRIGERANTS IN COLD CHAIN LOGISTICS

- 8.9 ASIA PACIFIC

- 8.9.1 EURO-ASIAN TRANSPORT LINKS (EATL)

- 8.9.2 SILK ROAD

9 REFRIGERATED TRANSPORT MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 36 CHILLED FOOD PRODUCTS TO DOMINATE THE REFRIGERATED TRANSPORT MARKET FROM 2022 TO 2027 (KT)

- TABLE 13 REFRIGERATED TRANSPORT MARKET SIZE, BY APPLICATION, 2019-2022 (KT)

- TABLE 14 REFRIGERATED TRANSPORT MARKET, BY APPLICATION, 2023-2027 (KT)

- 9.2 CHILLED FOOD PRODUCTS

- TABLE 15 REFRIGERATED TRANSPORT MARKET SIZE FOR CHILLED FOOD PRODUCTS, BY REGION, 2019-2022 (KT)

- TABLE 16 REFRIGERATED TRANSPORT MARKET SIZE FOR CHILLED FOOD PRODUCTS, BY REGION, 2023-2027 (KT)

- FIGURE 37 REFRIGERATED TRANSPORT MARKET SIZE FOR CHILLED FOOD PRODUCTS, BY TYPE, 2022 VS. 2027 (KT)

- 9.2.1 MILK

- TABLE 17 REFRIGERATED MILK MARKET SIZE, BY REGION, 2019-2022 (KT)

- TABLE 18 REFRIGERATED MILK MARKET SIZE, BY REGION, 2023-2027 (KT)

- 9.2.2 BAKERY & CONFECTIONERY PRODUCTS

- TABLE 19 REFRIGERATED BAKERY & CONFECTIONERY PRODUCTS MARKET SIZE, BY REGION, 2019-2022 (KT)

- TABLE 20 REFRIGERATED BAKERY & CONFECTIONERY PRODUCTS MARKET SIZE, BY REGION, 2023-2027 (KT)

- 9.2.3 DAIRY PRODUCTS

- TABLE 21 REFRIGERATED DAIRY PRODUCTS MARKET SIZE, BY REGION, 2019-2022 (KT)

- TABLE 22 REFRIGERATED DAIRY PRODUCTS MARKET SIZE, BY REGION, 2023-2027 (KT)

- 9.2.4 BEVERAGES

- TABLE 23 REFRIGERATED BEVERAGES MARKET SIZE, BY REGION, 2019-2022 (KT)

- TABLE 24 REFRIGERATED BEVERAGES MARKET SIZE, BY REGION, 2023-2027 (KT)

- 9.2.5 FRESH FRUITS & VEGETABLES

- TABLE 25 REFRIGERATED FRESH FRUITS & VEGETABLE MARKET SIZE, BY REGION, 2019-2022 (KT)

- TABLE 26 REFRIGERATED FRESH FRUITS & VEGETABLE MARKET SIZE, BY REGION, 2023-2027 (KT)

- 9.3 FROZEN FOOD PRODUCTS

- TABLE 27 REFRIGERATED TRANSPORT MARKET SIZE FOR FROZEN FOOD PRODUCTS, BY REGION, 2019-2022 (KT)

- TABLE 28 REFRIGERATED TRANSPORT MARKET SIZE FOR FROZEN FOOD PRODUCTS, BY REGION, 2023-2027 (KT)

- FIGURE 38 REFRIGERATED TRANSPORT MARKET SIZE FOR FROZEN FOOD PRODUCTS, BY TYPE, 2022 VS. 2027 (KT)

- 9.3.1 ICE CREAM

- TABLE 29 REFRIGERATED ICECREAM MARKET SIZE, BY REGION, 2019-2022 (KT)

- TABLE 30 REFRIGERATED ICECREAM MARKET SIZE, BY REGION, 2023-2027 (KT)

- 9.3.2 FROZEN DAIRY PRODUCTS

- TABLE 31 REFRIGERATED FROZEN DAIRY PRODUCTS MARKET SIZE, BY REGION, 2019-2022 (KT)

- TABLE 32 REFRIGERATED FROZEN DAIRY PRODUCTS MARKET SIZE, BY REGION, 2023-2027 (KT)

- 9.3.3 PROCESSED MEAT

- FIGURE 39 CATEGORIES OF PROCESSED MEAT PRODUCTS AND TYPICAL EXAMPLES

- TABLE 33 REFRIGERATED PROCESSED MEAT MARKET SIZE, BY REGION, 2019-2022 (KT)

- TABLE 34 REFRIGERATED PROCESSED MEAT MARKET SIZE, BY REGION, 2023-2027 (KT)

- 9.3.4 FISH & SEAFOOD

- TABLE 35 REFRIGERATED FISH & SEAFOOD MARKET SIZE, BY REGION, 2019-2022 (KT)

- TABLE 36 REFRIGERATED FISH & SEAFOOD MARKET SIZE, BY REGION, 2023-2027 (KT)

- 9.3.5 BAKERY PRODUCTS

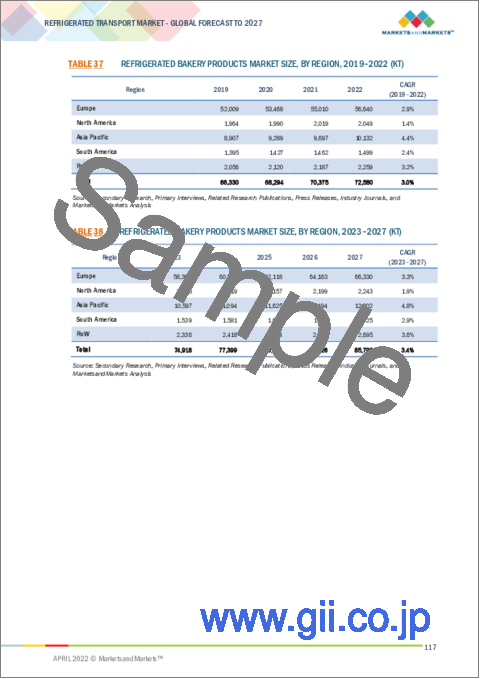

- TABLE 37 REFRIGERATED BAKERY PRODUCTS MARKET SIZE, BY REGION, 2019-2022 (KT)

- TABLE 38 REFRIGERATED BAKERY PRODUCTS MARKET SIZE, BY REGION, 2023-2027 (KT)

10 REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT

- 10.1 INTRODUCTION

- FIGURE 40 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY MODE OF TRANSPORT, 2022 VS. 2027 (UNITS)

- 10.2 REFRIGERATED ROAD TRANSPORT

- TABLE 39 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 40 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY VEHICLE TYPE, 2023-2027 (USD MILLION)

- TABLE 41 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY VEHICLE TYPE, 2019-2022 (UNITS)

- TABLE 42 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY VEHICLE TYPE, 2023-2027 (UNITS)

- 10.3 COVID-19 IMPACT ON THE REFRIGERATED TRANSPORT MARKET BY VEHICLE TYPE

- 10.3.1 OPTIMISTIC SCENARIO

- TABLE 43 OPTIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE REFRIGERATED TRANSPORT MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- 10.3.2 REALISTIC SCENARIO

- TABLE 44 REALISTIC SCENARIO: IMPACT OF COVID-19 ON THE REFRIGERATED TRANSPORT MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- 10.3.3 PESSIMISTIC SCENARIO

- TABLE 45 PESSIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE REFRIGERATED TRANSPORT MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- 10.3.4 REFRIGERATED LCV (VAN)

- TABLE 46 REFRIGERATED LCV MARKET SIZE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 47 REFRIGERATED LCV MARKET SIZE, BY REGION, 2023-2027 (USD MILLION)

- TABLE 48 REFRIGERATED LCV MARKET SIZE, BY REGION, 2019-2022 (UNITS)

- TABLE 49 REFRIGERATED LCV MARKET SIZE, BY REGION, 2023-2027 (UNITS)

- 10.3.5 REFRIGERATED MHCV (TRUCK)

- TABLE 50 REFRIGERATED MHCV MARKET SIZE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 REFRIGERATED MHCV MARKET SIZE, BY REGION, 2023-2027 (USD MILLION)

- TABLE 52 REFRIGERATED MHCV MARKET SIZE, BY REGION, 2019-2022 (UNITS)

- TABLE 53 REFRIGERATED MHCV MARKET SIZE, BY REGION, 2023-2027 (UNITS)

- 10.3.6 REFRIGERATED HCV (TRAILERS & SEMI-TRAILERS)

- TABLE 54 REFRIGERATED HCV MARKET SIZE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 55 REFRIGERATED HCV MARKET SIZE, BY REGION, 2023-2027 (USD MILLION)

- TABLE 56 REFRIGERATED HCV MARKET SIZE, BY REGION, 2019-2022 (UNITS)

- TABLE 57 REFRIGERATED HCV MARKET SIZE, BY REGION, 2023-2027 (UNITS)

- 10.4 REFRIGERATED SEA TRANSPORT

- 10.5 REFRIGERATED RAIL TRANSPORT

- 10.6 REFRIGERATED AIR TRANSPORT

11 REFRIGERATED TRANSPORT MARKET, BY TEMPERATURE

- 11.1 INTRODUCTION

- FIGURE 41 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY TEMPERATURE, 2022 VS. 2027 (UNITS)

- TABLE 58 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY TEMPERATURE, 2019-2022 (UNITS)

- TABLE 59 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY TEMPERATURE, 2023-2027 (UNITS)

- 11.2 SINGLE-TEMPERATURE

- TABLE 60 SINGLE-TEMPERATURE REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY REGION, 2019-2022 (UNITS)

- TABLE 61 SINGLE-TEMPERATURE REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY REGION, 2023-2027 (UNIT)

- 11.3 MULTI-TEMPERATURE

- TABLE 62 MULTI-TEMPERATURE REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY REGION, 2019-2022 (UNITS)

- TABLE 63 MULTI-TEMPERATURE REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY REGION, 2023-2027 (UNITS)

12 REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY

- 12.1 INTRODUCTION

- FIGURE 42 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

- TABLE 64 REFRIGERATED TRANSPORT MARKET SIZE, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 65 REFRIGERATED TRANSPORT MARKET SIZE, BY TECHNOLOGY, 2023-2027 (USD MILLION)

- TABLE 66 REFRIGERATED TRANSPORT MARKET SIZE, BY TECHNOLOGY, 2019-2022 (UNITS)

- TABLE 67 REFRIGERATED TRANSPORT MARKET SIZE, BY TECHNOLOGY, 2023-2027 (UNITS)

- 12.2 COVID-19 IMPACT ON THE REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY

- 12.2.1 OPTIMISTIC SCENARIO

- TABLE 68 OPTIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- 12.2.2 REALISTIC SCENARIO

- TABLE 69 REALISTIC SCENARIO: IMPACT OF COVID-19 ON THE REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- 12.2.3 PESSIMISTIC SCENARIO

- TABLE 70 PESSIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- 12.3 VAPOR COMPRESSION SYSTEMS

- 12.3.1 AIR-BLOWN EVAPORATORS

- TABLE 71 AIR-BLOWN EVAPORATORS: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 72 AIR-BLOWN EVAPOARTORS: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2023-2027 (USD MILLION)

- TABLE 73 AIR-BLOWN EVAPORATORS: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2019-2022 (UNITS)

- TABLE 74 AIR-BLOWN EVAPOARTORS: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2023-2027 (UNITS)

- 12.3.2 EUTECTIC DEVICES

- TABLE 75 EUTECTIC DEVICES: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 76 EUTECTIC DEVICES: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2023-2027 (USD MILLION)

- TABLE 77 EUTECTIC DEVICES: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2019-2022 (UNITS)

- TABLE 78 EUTECTIC DEVICES: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2023-2027 (UNITS)

- 12.3.3 HYBRID

- TABLE 79 HYBRID: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 80 HYBRID: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2023-2027 (USD MILLION)

- TABLE 81 HYBRID: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2019-2022 (UNITS)

- TABLE 82 HYBRID: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2023-2027 (UNITS)

- 12.3.4 FULLY ELECTRIC

- TABLE 83 FULLY ELECTRIC: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 84 FULLY ELECTRIC: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2023-2027 (USD MILLION)

- TABLE 85 FULLY ELECTRIC: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2019-2022 (UNITS)

- TABLE 86 FULLY ELECTRIC: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2023-2027 (UNITS)

- 12.4 COMPRESSOR TECHNOLOGY

- 12.4.1 SCROLL

- 12.4.2 OPEN-RECIP

- 12.4.3 OTHERS

13 REFRIGERATED TRANSPORT MARKET, BY REGION

- 13.1 INTRODUCTION

- FIGURE 43 INDIA TO RECORD THE FASTEST GROWTH RATE DURING THE FORECAST PERIOD

- TABLE 87 REFRIGERATED TRANSPORT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 88 REFRIGERATED TRANSPORT MARKET, BY REGION, 2023-2027 (USD MILLION)

- TABLE 89 REFRIGERATED TRANSPORT MARKET, BY REGION, 2019-2022 (UNITS)

- TABLE 90 REFRIGERATED TRANSPORT MARKET, BY REGION, 2023-2027 (UNITS)

- 13.2 COVID-19 IMPACT ON THE REFRIGERATED TRANSPORT MARKET BY REGION

- 13.2.1 OPTIMISTIC SCENARIO

- TABLE 91 OPTIMISTIC SCENARIO: REFRIGERATED TRANSPORT MARKET, BY REGION, 2020-2023 (USD MILLION)

- 13.2.2 REALISTIC SCENARIO

- TABLE 92 REALISTIC SCENARIO: REFRIGERATED TRANSPORT MARKET, BY REGION, 2020-2023 (USD MILLION)

- 13.2.3 PESSIMISTIC SCENARIO

- TABLE 93 PESSIMISTIC SCENARIO: REFRIGERATED TRANSPORT MARKET, BY REGION, 2020-2023 (USD MILLION)

- 13.3 NORTH AMERICA

- TABLE 94 NORTH AMERICA VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 95 NORTH AMERICA VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (USD MILLION)

- TABLE 96 NORTH AMERICA VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (UNITS)

- TABLE 97 NORTH AMERICA VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (UNITS)

- TABLE 98 NORTH AMERICA CHILLED PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 99 NORTH AMERICA CHILLED PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (KT)

- TABLE 100 NORTH AMERICA FROZEN PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 101 NORTH AMERICA FROZEN PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (KT)

- TABLE 102 NORTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 103 NORTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 104 NORTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 105 NORTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 106 NORTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY TEMPERATURE, 2019-2022 (UNITS)

- TABLE 107 NORTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY TEMPERATURE, 2023-2027 (UNITS)

- TABLE 108 NORTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2023-2027 (USD MILLION)

- TABLE 110 NORTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2019-2022 (UNITS)

- TABLE 111 NORTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2023-2027 (UNITS)

- TABLE 112 NORTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 113 NORTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 114 NORTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 115 NORTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.3.1 US

- 13.3.1.1 Temperature-sensitive dairy, beverages, and meat products make up a significant market for the industry

- TABLE 116 US: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 117 US: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 118 US: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 119 US: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 120 US: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 121 US: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 122 US: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 123 US: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.3.2 CANADA

- 13.3.2.1 The country is a major importer and exporter of agricultural products

- TABLE 124 CANADA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 125 CANADA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 126 CANADA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 127 CANADA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 128 CANADA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 129 CANADA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 130 CANADA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 131 CANADA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.3.3 MEXICO

- 13.3.3.1 Increasing consumption of packaged food products has led to the increased demand for retail distribution

- TABLE 132 MEXICO: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 133 MEXICO: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 134 MEXICO: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 135 MEXICO: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 136 MEXICO: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 137 MEXICO: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 138 MEXICO: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 139 MEXICO: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.4 EUROPE

- FIGURE 44 EUROPE: REFRIGERATED TRANSPORT MARKET SNAPSHOT

- TABLE 140 EUROPE VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 141 EUROPE VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (USD MILLION)

- TABLE 142 EUROPE VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (UNITS)

- TABLE 143 EUROPE VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (UNITS)

- TABLE 144 EUROPE CHILLED PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 145 EUROPE CHILLED PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (KT)

- TABLE 146 EUROPE FROZEN PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 147 EUROPE FROZEN PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (KT)

- TABLE 148 EUROPE: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 149 EUROPE: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 150 EUROPE: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 151 EUROPE: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 152 EUROPE: REFRIGERATED TRANSPORT MARKET, BY TEMPERATURE, 2019-2022 (UNITS)

- TABLE 153 EUROPE: REFRIGERATED TRANSPORT MARKET, BY TEMPERATURE, 2023-2027 (UNITS)

- TABLE 154 EUROPE: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 155 EUROPE: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2023-2027 (USD MILLION)

- TABLE 156 EUROPE: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2019-2022 (UNITS)

- TABLE 157 EUROPE: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2023-2027 (UNITS)

- TABLE 158 EUROPE: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 159 EUROPE: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 160 EUROPE: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 161 EUROPE: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.4.1 UK

- 13.4.1.1 The continuous increase in domestic consumption and higher standards of quality requirements of food products are aiding the growth of the market

- TABLE 162 UK: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 163 UK: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 164 UK: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 165 UK: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 166 UK: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 167 UK: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 168 UK: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 169 UK: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.4.2 GERMANY

- 13.4.2.1 The country is a major importer and exporter of agricultural products

- TABLE 170 GERMANY: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 171 GERMANY: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 172 GERMANY: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 173 GERMANY: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 174 GERMANY: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 175 GERMANY: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 176 GERMANY: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 177 GERMANY: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.4.3 FRANCE

- 13.4.3.1 Growing consumption of meat and meat products is expected to propel the refrigerated transport market

- TABLE 178 FRANCE: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 179 FRANCE: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 180 FRANCE: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 181 FRANCE: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 182 FRANCE: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 183 FRANCE: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 184 FRANCE: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 185 FRANCE: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.4.4 ITALY

- 13.4.4.1 Increasing consumer inclination towards healthy food products and ready-to-eat meals

- TABLE 186 ITALY: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 187 ITALY: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 188 ITALY: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 189 ITALY: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 190 ITALY: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 191 ITALY: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 192 ITALY: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 193 ITALY: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.4.5 SPAIN

- 13.4.5.1 Technological development has contributed to the refrigerated transport market in Spain

- TABLE 194 SPAIN: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 195 SPAIN: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 196 SPAIN: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 197 SPAIN: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 198 SPAIN: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 199 SPAIN: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 200 SPAIN: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 201 SPAIN: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.4.6 REST OF EUROPE

- 13.4.6.1 Development of the refrigerated transport market is dependent on the growing food & beverage industry

- TABLE 202 REST OF EUROPE: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 203 REST OF EUROPE: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 204 REST OF EUROPE: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 205 REST OF EUROPE: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 206 REST OF EUROPE: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 207 REST OF EUROPE: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 208 REST OF EUROPE: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 209 REST OF EUROPE: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.5 ASIA PACIFIC

- FIGURE 45 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET SNAPSHOT

- TABLE 210 ASIA PACIFIC VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 211 ASIA PACIFIC VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (USD MILLION)

- TABLE 212 ASIA PACIFIC VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (UNITS)

- TABLE 213 ASIA PACIFIC VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (UNITS)

- TABLE 214 ASIA PACIFIC CHILLED PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 215 ASIA PACIFIC CHILLED PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (KT)

- TABLE 216 ASIA PACIFIC FROZEN PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 217 ASIA PACIFIC FROZEN PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (KT)

- TABLE 218 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 219 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 220 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 221 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 222 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY TEMPERATURE, 2019-2022 (UNITS)

- TABLE 223 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY TEMPERATURE, 2023-2027 (UNITS)

- TABLE 224 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 225 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2023-2027 (USD MILLION)

- TABLE 226 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2019-2022 (UNITS)

- TABLE 227 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2023-2027 (UNITS)

- TABLE 228 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 229 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 230 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 231 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.5.1 CHINA

- 13.5.1.1 Rising demand for high-quality fresh food products

- TABLE 232 CHINA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 233 CHINA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 234 CHINA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 235 CHINA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 236 CHINA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 237 CHINA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 238 CHINA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 239 CHINA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.5.2 JAPAN

- 13.5.2.1 Growing consumer preference for processed food & beverage products

- TABLE 240 JAPAN: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 241 JAPAN: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 242 JAPAN: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 243 JAPAN: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 244 JAPAN: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 245 JAPAN: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 246 JAPAN: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 247 JAPAN: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.5.3 INDIA

- 13.5.3.1 Change in consumption patterns increase demand for packaged food products

- TABLE 248 INDIA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 249 INDIA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 250 INDIA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 251 INDIA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 252 INDIA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 253 INDIA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 254 INDIA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 255 INDIA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.5.4 SOUTH KOREA

- 13.5.4.1 Increasing trading of perishables attributed to the growth of the refrigerated transport market

- TABLE 256 SOUTH KOREA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 257 SOUTH KOREA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 258 SOUTH KOREA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 259 SOUTH KOREA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 260 SOUTH KOREA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 261 SOUTH KOREA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 262 SOUTH KOREA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 263 SOUTH KOREA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.5.5 REST OF ASIA PACIFIC

- TABLE 264 REST OF ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 265 REST OF ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 266 REST OF ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 267 REST OF ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 268 REST OF ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 269 REST OF ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 270 REST OF ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 271 REST OF ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.6 SOUTH AMERICA

- TABLE 272 SOUTH AMERICA VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 273 SOUTH AMERICA VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (USD MILLION)

- TABLE 274 SOUTH AMERICA VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (UNITS)

- TABLE 275 SOUTH AMERICA VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (UNITS)

- TABLE 276 SOUTH AMERICA CHILLED PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 277 SOUTH AMERICA CHILLED PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (KT)

- TABLE 278 SOUTH AMERICA FROZEN PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 279 SOUTH AMERICA FROZEN PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (KT)

- TABLE 280 SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 281 SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 282 SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 283 SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 284 SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY TEMPERATURE, 2019-2022 (UNITS)

- TABLE 285 SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY TEMPERATURE, 2023-2027 (UNITS)

- TABLE 286 SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 287 SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2023-2027 (USD MILLION)

- TABLE 288 SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2019-2022 (UNITS)

- TABLE 289 SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2023-2027 (UNITS)

- TABLE 290 SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 291 SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 292 SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 293 SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.6.1 BRAZIL

- 13.6.1.1 Growing organized retail sector enhances the refrigerated transport market growth

- TABLE 294 BRAZIL: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 295 BRAZIL: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 296 BRAZIL: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 297 BRAZIL: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 298 BRAZIL: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 299 BRAZIL: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 300 BRAZIL: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 301 BRAZIL: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.6.2 ARGENTINA

- 13.6.2.1 Increasing consumption of convenience food products resulted in the rise in demand for refrigerated transport

- TABLE 302 ARGENTINA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 303 ARGENTINA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 304 ARGENTINA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 305 ARGENTINA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 306 ARGENTINA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 307 ARGENTINA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 308 ARGENTINA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 309 ARGENTINA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.6.3 REST OF SOUTH AMERICA

- TABLE 310 REST OF SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 311 REST OF SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 312 REST OF SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 313 REST OF SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 314 REST OF SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 315 REST OF SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 316 REST OF SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 317 REST OF SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.7 REST OF THE WORLD

- TABLE 318 REST OF THE WORLD VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 319 REST OF THE WORLD VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (USD MILLION)

- TABLE 320 REST OF THE WORLD VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (UNITS)

- TABLE 321 REST OF THE WORLD VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (UNITS)

- TABLE 322 REST OF THE WORLD CHILLED PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 323 REST OF THE WORLD CHILLED PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (KT)

- TABLE 324 REST OF THE WORLD FROZEN PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 325 REST OF THE WORLD FROZEN PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2023-2027 (KT)

- TABLE 326 REST OF THE WORLD: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 327 REST OF THE WORLD: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 328 REST OF THE WORLD: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 329 REST OF THE WORLD: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 330 REST OF THE WORLD: REFRIGERATED TRANSPORT MARKET, BY TEMPERATURE, 2019-2022 (UNITS)

- TABLE 331 REST OF THE WORLD: REFRIGERATED TRANSPORT MARKET, BY TEMPERATURE, 2023-2027 (UNITS)

- TABLE 332 REST OF THE WORLD: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 333 REST OF THE WORLD: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2023-2027 (USD MILLION)

- TABLE 334 REST OF THE WORLD: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2019-2022 (UNITS)

- TABLE 335 REST OF THE WORLD: REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2023-2027 (UNITS)

- TABLE 336 REST OF THE WORLD: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 337 REST OF THE WORLD: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 338 REST OF THE WORLD: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 339 REST OF THE WORLD: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.7.1 AFRICA

- 13.7.1.1 Increase in the export of perishable foods such as fruits & vegetables is the key driver for African refrigerated transport

- TABLE 340 AFRICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 341 AFRICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 342 AFRICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 343 AFRICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 344 AFRICA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 345 AFRICA: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 346 AFRICA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 347 AFRICA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

- 13.7.2 MIDDLE EAST

- 13.7.2.1 Significant reliance on food imports to drive the growth of the refrigerated transport market

- TABLE 348 MIDDLE EAST: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (USD MILLION)

- TABLE 349 MIDDLE EAST: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (USD MILLION)

- TABLE 350 MIDDLE EAST: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019-2022 (UNITS)

- TABLE 351 MIDDLE EAST: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2023-2027 (UNITS)

- TABLE 352 MIDDLE EAST: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2019-2022 (KT)

- TABLE 353 MIDDLE EAST: REFRIGERATED TRANSPORT MARKET, BY CHILLED PRODUCTS, 2023-2027 (KT)

- TABLE 354 MIDDLE EAST: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2019-2022 (KT)

- TABLE 355 MIDDLE EAST: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023-2027 (KT)

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 MARKET SHARE ANALYSIS, 2021

- TABLE 356 FROZEN AND CHILLED FOOD MANUFACTURERS SHARE ANALYSIS, 2021

- 14.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 46 FIVE-YEAR TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2016-2020 (USD BILLION)

- 14.4 COVID-19-SPECIFIC COMPANY RESPONSE

- 14.4.1 KELLOGG CO

- 14.4.2 GENERAL MILLS INC.

- 14.4.3 NESTLE SA

- 14.4.4 CONAGRA BRANDS

- 14.4.5 TYSON FOODS, INC.

- 14.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 14.5.1 STARS

- 14.5.2 PERVASIVE PLAYERS

- 14.5.3 EMERGING LEADERS

- 14.5.4 PARTICIPANTS

- FIGURE 47 FROZEN AND CHILLED FOOD MANUFACTURERS, COMPANY EVALUATION QUADRANT, 2021

- 14.5.5 FROZEN AND CHILLED FOOD FOOTPRINT (KEY PLAYERS)

- TABLE 357 COMPANY FOOTPRINT, BY CHILLED FOOD PRODUCTS

- TABLE 358 COMPANY FOOTPRINT, BY FROZEN FOOD PRODUCTS

- TABLE 359 COMPANY REGIONAL, BY REGIONAL FOOTPRINT

- TABLE 360 OVERALL, COMPANY FOOTPRINT

- TABLE 361 FROZEN AND CHILLED FOOD: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- 14.6 COMPETITIVE SCENARIO

- 14.6.1 NEW PRODUCT LAUNCHES

- TABLE 362 FROZEN AND CHILLED FOOD: NEW PRODUCT LAUNCHES, 2018-2021

- 14.6.2 DEALS

- TABLE 363 FROZEN AND CHILLED FOOD: DEALS, 2018-2022

- 14.6.3 OTHERS

- TABLE 364 FROZEN AND CHILLED FOOD: OTHERS, 2019-2021

15 COMPANY PROFILES

- (Business overview, Products/solutions/services offered, Recent Developments, MNM view)**

- 15.1 KEY PLAYERS

- 15.1.1 NESTLE SA

- TABLE 365 NESTLE SA: BUSINESS OVERVIEW

- FIGURE 48 NESTLE SA: COMPANY SNAPSHOT

- TABLE 366 NESTLE SA: PRODUCTS OFFERED

- TABLE 367 NESTLE SA: NEW PRODUCT LAUNCHES

- TABLE 368 NESTLE SA: OTHERS

- 15.1.2 TYSON FOODS, INC.

- TABLE 369 TYSON FOODS, INC.: BUSINESS OVERVIEW

- FIGURE 49 TYSON FOODS, INC.: COMPANY SNAPSHOT

- TABLE 370 TYSON FOODS, INC.: PRODUCTS OFFERED

- TABLE 371 TYSON FOODS, INC.: DEALS

- 15.1.3 THE KRAFT HEINZ COMPANY

- TABLE 372 THE KRAFT HEINZ COMPANY: BUSINESS OVERVIEW

- FIGURE 50 THE KRAFT HEINZ COMPANY: COMPANY SNAPSHOT

- TABLE 373 THE KRAFT HEINZ COMPANY: PRODUCTS OFFERED

- TABLE 374 THE KRAFT HEINZ COMPANY: DEALS

- 15.1.4 GENERAL MILLS INC.

- TABLE 375 GENERAL MILLS INC.: BUSINESS OVERVIEW

- FIGURE 51 GENERAL MILLS INC.: COMPANY SNAPSHOT

- TABLE 376 GENERAL MILLS INC.: PRODUCTS OFFERED

- TABLE 377 GENERAL MILLS INC.: DEALS

- TABLE 378 GENERAL MILLS INC.: OTHERS

- 15.1.5 SMITHFIELD FOODS, INC

- TABLE 379 SMITHFIELD FOODS, INC: BUSINESS OVERVIEW

- TABLE 380 SMITHFIELD FOODS, INC: PRODUCTS OFFERED

- 15.1.6 KELLOGG CO.

- TABLE 381 KELLOGG CO.: BUSINESS OVERVIEW

- FIGURE 52 KELLOGG CO.: COMPANY SNAPSHOT

- TABLE 382 KELLOGG CO.: PRODUCTS OFFERED

- TABLE 383 KELLOGG CO.: NEW PRODUCT LAUNCHES

- 15.1.7 CONAGRA BRANDS, INC.

- TABLE 384 CONAGRA BRANDS, INC.: BUSINESS OVERVIEW

- FIGURE 53 CONAGRA BRANDS, INC.: COMPANY SNAPSHOT

- TABLE 385 CONAGRA BRANDS, INC.: PRODUCTS OFFERED

- 15.1.8 KERRY GROUP PLC

- TABLE 386 KERRY GROUP PLC: BUSINESS OVERVIEW

- FIGURE 54 KERRY GROUP PLC: COMPANY SNAPSHOT

- TABLE 387 KERRY GROUP PLC: PRODUCTS OFFERED

- 15.1.9 DEL MONTE PACIFIC LIMITED

- TABLE 388 DEL MONTE PACIFIC LIMITED: BUSINESS OVERVIEW

- FIGURE 55 DEL MONTE PACIFIC LIMITED: COMPANY SNAPSHOT

- TABLE 389 DEL MONTE PACIFIC LIMITED: PRODUCTS OFFERED

- 15.1.10 ARYZTA AG

- TABLE 390 ARYZTA AG: BUSINESS OVERVIEW

- FIGURE 56 ARYZTA AG: COMPANY SNAPSHOT

- TABLE 391 ARYZTA AG: PRODUCTS OFFERED

- *Details on Business overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 MARKET SHARE ANALYSIS, 2021

- TABLE 392 REFRIGERATED AND TRANSPORT SERVICE PROVIDERS MANUFACTURERS SHARE ANALYSIS, 2021

- 16.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 57 FIVE-YEAR TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2016-2020 (USD BILLION)

- 16.4 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 16.4.1 STARS

- 16.4.2 PERVASIVE PLAYERS

- 16.4.3 EMERGING LEADERS

- 16.4.4 PARTICIPANTS

- FIGURE 58 REFRIGERATED AND TRANSPORT SERVICE PROVIDERS MANUFACTURERS, COMPANY EVALUATION QUADRANT, 2021

- 16.4.5 REFRIGERATED TRANSPORT SERVICE PROVIDER'S PRODUCT FOOTPRINT (KEY PLAYERS)

- TABLE 393 COMPANY FOOTPRINT, BY MODE OF TRANSPORT

- TABLE 394 COMPANY FOOTPRINT, BY TEMPERATURE

- TABLE 395 REFRIGERATED AND TRANSPORT SERVICE PROVIDERS: COMPETITIVE BENCHMARKING OF MARKET PLAYERS

- 16.5 COMPETITIVE SCENARIO

- 16.5.1 NEW PRODUCT LAUNCHES

- TABLE 396 REFRIGERATED TRANSPORT SERVICE PROVIDERS: NEW PRODUCT LAUNCHES, 2018-2021

- 16.5.2 DEALS

- TABLE 397 REFRIGERATED TRANSPORT SERVICE PROVIDERS: DEALS, 2018-2022

- 16.5.3 OTHERS

- TABLE 398 REFRIGERATED TRANSPORT SERVICE PROVIDERS: OTHERS, 2019-2021

17 COMPANY PROFILES

- (Business overview, Products/solutions/services offered, Recent Developments, MNM view)**

- 17.1 KEY PLAYERS

- 17.1.1 UNITED TECHNOLOGIES CORPORATION (CARRIER CORPORATION)

- TABLE 399 UNITED TECHNOLOGIES CORPORATION (CARRIER CORPORATION): BUSINESS OVERVIEW

- FIGURE 59 UNITED TECHNOLOGIES CORPORATION (CARRIER CORPORATION): COMPANY SNAPSHOT

- TABLE 400 UNITED TECHNOLOGIES CORPORATION (CARRIER CORPORATION): PRODUCTS OFFERED

- TABLE 401 UNITED TECHNOLOGIES CORPORATION (CARRIER CORPORATION): NEW PRODUCT LAUNCHES

- TABLE 402 UNITED TECHNOLOGIES CORPORATION (CARRIER CORPORATION): DEALS

- TABLE 403 UNITED TECHNOLOGIES CORPORATION (CARRIER CORPORATION): OTHERS

- 17.1.2 DAIKIN INDUSTRIES, LTD.,

- TABLE 404 DAIKIN INDUSTRIES, LTD.: BUSINESS OVERVIEW

- FIGURE 60 DAIKIN INDUSTRIES, LTD.: COMPANY SNAPSHOT

- TABLE 405 DAIKIN INDUSTRIES, LTD.: PRODUCTS OFFERED

- TABLE 406 DAIKIN INDUSTRIES, LTD.: DEALS

- 17.1.3 INGERSOLL RAND

- TABLE 407 INGERSOLL RAND: BUSINESS OVERVIEW

- FIGURE 61 INGERSOLL RAND: COMPANY SNAPSHOT

- TABLE 408 INGERSOLL RAND: PRODUCTS OFFERED

- TABLE 409 INGERSOLL RAND: NEW PRODUCT LAUNCHES

- TABLE 410 INGERSOLL RAND: DEALS

- TABLE 411 INGERSOLL RAND: OTHERS

- 17.1.4 CHINA INTERNATIONAL SHIPPING CONTAINERS (GROUP) CO., LTD.

- TABLE 412 CHINA INTERNATIONAL SHIPPING CONTAINERS (GROUP) CO., LTD.: BUSINESS OVERVIEW

- TABLE 413 CHINA INTERNATIONAL SHIPPING CONTAINERS (GROUP) CO., LTD.: PRODUCTS OFFERED

- TABLE 414 CHINA INTERNATIONAL SHIPPING CONTAINERS (GROUP) CO., LTD.: NEW PRODUCT LAUNCHES

- 17.1.5 UTILITY TRAILER MANUFACTURING COMPANY

- TABLE 415 UTILITY TRAILER MANUFACTURING COMPANY: BUSINESS OVERVIEW

- TABLE 416 UTILITY TRAILER MANUFACTURING COMPANY: PRODUCTS/ OFFERED

- TABLE 417 UTILITY TRAILER MANUFACTURING COMPANY: NEW PRODUCT LAUNCHES

- TABLE 418 UTILITY TRAILER MANUFACTURING COMPANY: DEALS

- TABLE 419 UTILITY TRAILER MANUFACTURING COMPANY: OTHERS

- 17.1.6 SINGAMAS CONTAINER HOLDINGS LIMITED

- TABLE 420 SINGAMAS CONTAINER HOLDINGS LIMITED: BUSINESS OVERVIEW

- FIGURE 62 SINGAMAS CONTAINER HOLDINGS LIMITED: COMPANY SNAPSHOT

- TABLE 421 SINGAMAS CONTAINER HOLDINGS LIMITED: PRODUCTS OFFERED

- TABLE 422 SINGAMAS CONTAINER HOLDINGS LIMITED: DEALS

- 17.1.7 HYUNDAI

- TABLE 423 HYUNDAI: BUSINESS OVERVIEW

- FIGURE 63 HYUNDAI: COMPANY SNAPSHOT

- TABLE 424 HYUNDAI: PRODUCTS OFFERED

- TABLE 425 HYUNDAI: NEW PRODUCT LAUNCHES

- TABLE 426 HYUNDAI: OTHERS

- 17.1.8 SCHMITZ CARGOBULL

- TABLE 427 SCHMITZ CARGOBULL: BUSINESS OVERVIEW

- TABLE 428 SCHMITZ CARGOBULL: PRODUCTS OFFERED

- TABLE 429 SCHMITZ CARGOBULL: NEW PRODUCT LAUNCHES

- TABLE 430 SCHMITZ CARGOBULL: OTHERS

- 17.1.9 KRONE

- TABLE 431 KRONE: BUSINESS OVERVIEW

- TABLE 432 KRONE: PRODUCTS OFFERED

- TABLE 433 KRONE: DEALS

- 17.1.10 LAMBERET SAS

- TABLE 434 LAMBERET SAS: BUSINESS OVERVIEW

- TABLE 435 LAMBERET SAS: PRODUCTS OFFERED

- 17.1.11 TATA MOTORS

- TABLE 436 TATA MOTORS: BUSINESS OVERVIEW

- TABLE 437 TATA MOTORS: PRODUCTS OFFERED

- 17.1.12 VE COMMERCIAL VEHICLES LIMITED

- TABLE 438 VE COMMERCIAL VEHICLES LIMITED: BUSINESS OVERVIEW

- TABLE 439 VE COMMERCIAL VEHICLES LIMITED: PRODUCTS OFFERED

- 17.1.13 SHAANXI TIANHUI INLONG TRADING CO. LTD

- TABLE 440 SHAANXI TIANHUI INLONG TRADING CO. LTD: BUSINESS OVERVIEW

- TABLE 441 SHAANXI TIANHUI INLONG TRADING CO. LTD: PRODUCTS OFFERED

- 17.1.14 WABASH NATIONAL CORPORATION

- TABLE 442 WABASH NATIONAL CORPORATION: BUSINESS OVERVIEW

- TABLE 443 WABASH NATIONAL CORPORATION: PRODUCTS OFFERED

- 17.1.15 GREAT DANE LLC

- TABLE 444 GREAT DANE LLC: BUSINESS OVERVIEW

- TABLE 445 GREAT DANE LLC: PRODUCTS OFFERED

- *Details on Business overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

18 ADJACENT AND RELATED MARKETS

- 18.1 INTRODUCTION

- TABLE 446 ADJACENT MARKETS TO REFRIGERATED TRANSPORT MARKET

- 18.2 LIMITATIONS

- 18.3 COLD CHAIN MARKET

- 18.3.1 MARKET DEFINITION

- 18.3.2 MARKET OVERVIEW

- TABLE 447 COLD CHAIN MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

- 18.4 FROZEN FOOD MARKET

- 18.4.1 MARKET DEFINITION

- 18.4.2 MARKET OVERVIEW

- TABLE 448 FROZEN FOOD MARKET SIZE, BY PRODUCT, 2020-2025 (USD BILLION)

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 AVAILABLE CUSTOMIZATIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS