|

|

市場調査レポート

商品コード

1248049

医療向けITの世界市場:コンポーネント別 (医療機器、システム・ソフトウェア、サービス、コネクティビティ技術)・用途別 (遠隔医療、コネクテッド画像診断、入院患者モニタリング)・エンドユーザー別・地域別の将来予測 (2028年まで)IoT in Healthcare Market by Component (Medical Device, Systems & Software, Services, and Connectivity Technology), Application (Telemedicine, Connected Imaging, and Inpatient Monitoring), End User and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 医療向けITの世界市場:コンポーネント別 (医療機器、システム・ソフトウェア、サービス、コネクティビティ技術)・用途別 (遠隔医療、コネクテッド画像診断、入院患者モニタリング)・エンドユーザー別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年03月21日

発行: MarketsandMarkets

ページ情報: 英文 240 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の医療向けITの市場規模は、2023年の1,277億米ドルから、予測期間中に17.8%のCAGRで成長し、2028年には2,892億米ドルに成長すると予測されます。

コスト削減と効率化のために、医療のさまざまなプロセスを自動化して業務を合理化する必要性が、市場を牽引します。

"入院患者モニタリング分野は、予測期間中に高いCAGRで成長する"

入院患者モニタリングとは、患者の生理機能を継続的にモニタリングし、管理上の意思決定や治療介入を行うプロセスです。コスト削減のために人員を減らし、物理的な接触を最小限にするために、IoT (モノのインターネット)・人工知能 (AI)・ロボティクスなどの技術の導入に注目が集まっていることが、市場を牽引することになる

"臨床研究機関:予測期間中に最も高いCAGRで成長するセグメント"

臨床研究機関は、より多くのデータを収集し、より効果的に患者を監視し、より効率的に臨床試験を管理するために、IoTベース技術を採用しています。また、臨床研究機関はまた、IoTを活用して、より迅速な分析と情報フローを実現し、ひいてはより迅速な運営と成果を達成します。

"北米は2022年に、最大の市場シェアを獲得する"

医療向けIT市場全体では、北米が最大のシェアを占めると予想されています。同地域の医療機関は、慢性疾患の浸透を受けて、疾患拡大シナリオに対抗するための革新的ソリューションの開発に直ちに取り掛かりました。そして、既存の医療機関にハイテクソリューションを迅速に提供しようとしています。医療用IT、電子カルテ (EMR)、デジタルヘルス、動画対応遠隔医療、モバイルヘルス (mヘルス)、遠隔患者モニタリング、IoT、AI、仮想現実 (VR)、エクスポネンシャル医療、ePatient、ヒアラブル・ウェアラブル機器などのコネクテッドヘルスソリューションは、同地域のあらゆる医療機関で採用されています。

当レポートでは、世界の医療向けITの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、コンポーネント別・用途別・コネクティビティ技術別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 要因分析

- 促進要因と機会

- 抑制要因と課題

- 使用事例

- 業界動向

- 技術分析

- 価格分析

- 特許分析

- ポーターのファイブフォース分析

- 主な会議とイベント (2023年)

- バリューチェーン分析

第6章 医療向けIT市場:コンポーネント別

- イントロダクション

- 医療機器

- 据置型医療機器

- 埋込型医療機器

- ウェアラブル型・外付け式医療機器

- システム・ソフトウェア

- 遠隔デバイス管理

- ネットワーク帯域幅管理

- データ分析

- アプリケーションセキュリティ

- ネットワークセキュリティー

- サービス

- 導入・インテグレーション

- コンサルティング

- サポート・整備

第7章 医療向けIT市場:用途別

- イントロダクション

- 遠隔医療

- ストアアンドフォワード式遠隔医療

- 遠隔患者モニタリング

- インタラクティブ式遠隔医療

- 臨床手術・ワークフロー管理

- コネクテッド画像診断

- 入院患者モニタリング

- 投薬管理

- その他の用途

第8章 医療向けIT市場:コネクティビティ技術別

- イントロダクション

- Wi-Fi

- BLE (Bluetooth Low Energy)

- ZigBee

- NFC (近距離無線通信)

- セルラー

- 衛星

第9章 医療向けIT市場:エンドユーザー別

- イントロダクション

- 病院・外科センター・クリニック

- 臨床研究機関

- 政府・防衛機関

- 研究・診断検査室

第10章 医療向けIT市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 他のアジア太平洋諸国

- 中東・アフリカ

- 中東

- アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第11章 競合情勢

- 概要

- 主要企業採用した戦略

- 収益分析

- 企業の市場ランキング分析

- 上位企業の市場シェア分析

- 企業評価クアドラント

- 企業の製品フットプリント分析

- 中小企業/スタートアップ向け競合ベンチマーキング

- スタートアップ/中小企業の評価マトリックス:手法と定義

- 競合シナリオと動向

- 製品の発売

- 資本取引

第12章 企業プロファイル

- 主要企業

- CISCO

- IBM

- GE HEALTHCARE

- MICROSOFT

- SAP

- MEDTRONIC

- ROYAL PHILIPS

- RESIDEO TECHNOLOGIES

- SECURITAS

- その他の企業

- BOSCH

- ARMIS

- ORACLE

- PTC

- HUAWEI

- SIEMENS

- R-STYLE LAB

- HQSOFTWARE

- OXAGILE

- SOFTWEB SOLUTIONS

- OSP LABS

- COMARCH SA

- TELIT

- KORE WIRELESS

- SCIENCESOFT

- INTEL

- AGAMATRIX

- WELCH ALLYN

- ALIVECOR

- SENSELY

- CLOVER HEALTH

第13章 隣接/関連市場

- イントロダクション

- 制限事項

- IoTインテグレーション市場

- インシデント・緊急対応市場

第14章 付録

The global IoT in healthcare market size is projected to grow from USD 127.7 billion in 2023 to USD 289.2 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 17.8% during the forecast period.

The need to streamline operations by automating a range of healthcare processes in order to reduce costs and improve efficiency will drive the market.

Inpatient Monitoring segment to grow at a higher CAGR during the forecast period.,

In-patient monitoring is a process that involves continuous monitoring of a patient's physiological functions for guiding management decisions and making therapeutic interventions. The increasing focus on the deployment of technologies such as IoT, AI, and robotics to reduce manpower for cost-savings and to minimize physical contact will drive the market

Clinical Research Organizations segment to grow at the highest CAGR during the forecast period.

Clinical Research Organizations are adopting to IoT based technology to collect more data, monitor patients more effectively, and manage clinical trials more efficiently. Also, IoT is enabling faster analysis and information flow to clinical research organizations, thereby helping them with faster operations and outcomes.

North America region to record the highest market share in the IoT in Healthcare market in 2022

North America is expected to have the largest share in the overall IoT in Healthcare market. The penetration of chronic diseases has led organizations in the region to readily develop innovative solutions for combating the rising disease scenario. Hence, healthcare organizations are rapidly moving toward providing high-tech solutions for the already-established healthcare system in the region. Connected health solutions, including health IT, Electronic Medical Record (EMR), digital health, video-enabled telehealth and telemedicine, mobile health and mHealth, remote patient monitoring, IoT, AI, Virtual Reality (VR), exponential medicine, ePatient, hearables, and wearables are being adopted by healthcare providers across the region

- By Company Type: Tier 1 - 45%, Tier 2 - 40%, and Tier 3 - 15%

- By Designation: C-level - 40%, Directors - 35%, Managers- 15%, and Others - 10%

- By Region: North America - 15%, Europe - 35%, Asia Pacific - 40%, and Rest of the World (RoW)- 10%

This research study outlines the market potential, market dynamics, and major vendors operating in the IoT in Healthcare market. Key and innovative vendors in the IoT in Healthcare market include Cisco (US), IBM (US), GE Healthcare (US), Microsoft (US), SAP (Germany), Medtronic (Ireland), Royal Philips (Netherlands), Resideo Technologies (US), Securitas (Sweden), Bosch (Germany), Armis (US), Oracle (US), PTC (US), Huawei (China), Seimens ( Germany), R-Style Lab (US), HQSoftware (Estonia), Oxagile (US), Softweb Solutions (US), OSP Labs (US), Comarch SA (Poland), Telit (UK), Kore Wireless (US), ScienceSoft (US), Intel (US), AgaMatrix (US), Welch Allyn (US), AliveCor (US), Sensly (US), Clover Health (US). These vendors have adopted many organic as well as inorganic growth strategies, such as new product launches, and partnerships and collaborations, to expand their offerings and market shares in the IoT in Healthcare market.

Research coverage

The market study covers the IoT in Healthcare market across different segments. It aims at estimating the market size and the growth potential of this market across different segments based on component, application, end-user and regions. The study also includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key benefits of buying the report

The report is expected to help the market leaders/new entrants in this market by providing them information on the closest approximations of the revenue numbers for the overall IoT in Healthcare market and its segments. This report is also expected to help stakeholders understand the competitive landscape and gain insights to improve the position of their businesses and to plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

- 1.5.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 IOT IN HEALTHCARE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) - REVENUE OF IOT IN HEALTHCARE DEVICES, SYSTEMS & SOFTWARE, AND SERVICES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1-BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL MEDICAL DEVICES, SYSTEMS AND SOFTWARE, AND SERVICES OF IOT IN HEALTHCARE

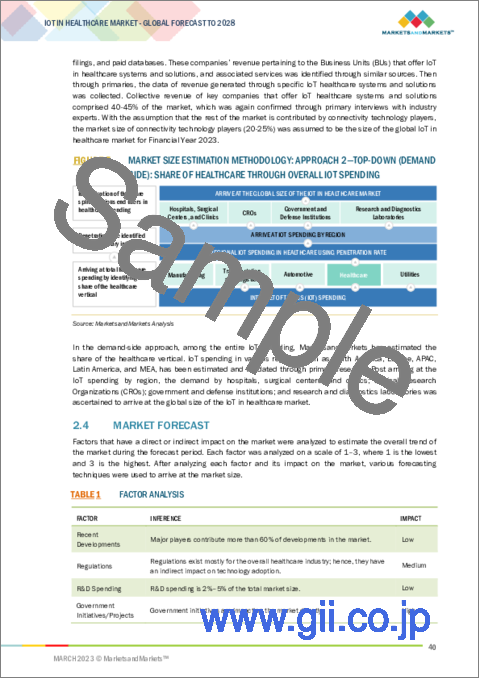

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2-TOP-DOWN (DEMAND SIDE): SHARE OF HEALTHCARE THROUGH OVERALL IOT SPENDING

- 2.4 MARKET FORECAST

- TABLE 1 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 IMPACT OF RECESSION

- FIGURE 6 IOT IN HEALTHCARE MARKET: TO WITNESS SLIGHT DIP IN Y-O-Y IN 2023

3 EXECUTIVE SUMMARY

- FIGURE 7 IOT IN HEALTHCARE MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR COMPANIES IN IOT IN HEALTHCARE MARKET

- FIGURE 8 REDUCED COST OF CARE AND EVOLUTION OF ARTIFICIAL INTELLIGENCE TECHNOLOGY TO DRIVE GROWTH

- 4.2 IOT IN HEALTHCARE MARKET, BY COMPONENT AND REGION, 2023

- FIGURE 9 MEDICAL DEVICES SEGMENT AND NORTH AMERICA TO DOMINATE IN 2023

- 4.3 IOT IN HEALTHCARE MARKET, BY REGION, 2023

- FIGURE 10 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 MARKET OVERVIEW

- 5.2 MARKET DYNAMICS

- FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IOT IN HEALTHCARE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption of IoMT in healthcare industry

- 5.2.1.2 Rising focus on active patient engagement and patient-centric care

- 5.2.1.3 Growing need for cost control measures in healthcare

- 5.2.1.4 Increased adoption of high-speed network technologies for IoT connectivity

- 5.2.1.5 Evolution of complementing technologies such as artificial intelligence and big data

- 5.2.1.6 Need for healthcare in remote locations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Outdated infrastructure hindering digital growth of medical industry

- 5.2.2.2 Internet disruptions leading to IoT device issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Low doctor-to-patient ratio leading to increased dependency on self-operated eHealth platforms

- 5.2.3.2 Government initiatives for promoting digital health

- FIGURE 12 HEALTHCARE SPENDING, BY COUNTRY, 2021 (% OF GDP)

- 5.2.3.3 IoT for COVID-19 patient monitoring

- 5.2.3.4 Health insurers with IoT-connected intelligent devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Increase in cyberattacks due to data security constrictions

- 5.2.4.2 Integration of multiple devices and protocols leading to data overload

- 5.2.4.3 High cost of technology implementation

- 5.3 FACTOR ANALYSIS

- 5.3.1 DRIVERS AND OPPORTUNITIES

- 5.3.2 RESTRAINTS AND CHALLENGES

- 5.4 USE CASES

- 5.4.1 USE CASE 1: CONNECTED HEALTHCARE

- 5.4.2 USE CASE 2: ASSET TRACKING

- 5.4.3 USE CASE 3: REMOTE PATIENT MONITORING

- 5.5 INDUSTRY TRENDS

- 5.5.1 EVOLUTION

- FIGURE 13 EVOLUTION OF IOT IN HEALTHCARE

- 5.5.2 REGULATORY IMPLICATIONS

- 5.5.2.1 ISO STANDARDS - ISO 27799:2008 and ISO/TR 27809:2007

- 5.5.2.2 Internet of Medical Things Resilience Partnership Act (2017)

- 5.5.2.3 Health Insurance Portability and Accountability Act

- 5.5.2.4 HIPAA Privacy Rule

- 5.5.2.5 HIPAA Security Rule

- 5.5.2.6 CEN ISO/IEEE 11073

- 5.5.2.7 CEN/CENELEC

- TABLE 2 KEY USE CASES

- 5.6 TECHNOLOGICAL ANALYSIS

- 5.6.1 ARTIFICIAL INTELLIGENCE

- 5.6.2 MACHINE LEARNING

- 5.6.3 NATURAL LANGUAGE PROCESSING

- 5.6.4 BIG DATA

- 5.6.5 SPEECH RECOGNITION

- 5.6.6 5G

- 5.7 PRICING ANALYSIS

- TABLE 3 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.8 PATENT ANALYSIS

- FIGURE 14 TOP TEN PATENT APPLICANTS (GLOBAL)

- TABLE 4 TOP TWENTY PATENT OWNERS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 IOT IN HEALTHCARE MARKET: PORTER'S FIVE FORCES MODEL

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY CONFERENCES AND EVENTS, 2023

- TABLE 6 IOT IN HEALTHCARE MARKET: KEY CONFERENCES AND EVENTS

- 5.11 VALUE CHAIN ANALYSIS

- FIGURE 15 IOT IN HEALTHCARE MARKET: VALUE CHAIN ANALYSIS

6 IOT IN HEALTHCARE MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- FIGURE 16 SYSTEMS & SOFTWARE SEGMENT TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- TABLE 7 IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018-2022 (USD BILLION)

- TABLE 8 IOT IN HEALTHCARE MARKET, BY COMPONENT, 2023-2028 (USD BILLION)

- 6.2 MEDICAL DEVICES

- 6.2.1 MEDICAL DEVICES: IOT IN HEALTHCARE MARKET DRIVERS

- FIGURE 17 IMPLANTED MEDICAL DEVICES SEGMENT TO BE LARGEST SUBSEGMENT BY 2028

- TABLE 9 MEDICAL DEVICES: IOT IN HEALTHCARE MARKET, BY TYPE, 2018-2022 (USD BILLION)

- TABLE 10 MEDICAL DEVICES: IOT IN HEALTHCARE MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 11 MEDICAL DEVICES: IOT IN HEALTHCARE MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 12 MEDICAL DEVICES: IOT IN HEALTHCARE MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 13 MEDICAL DEVICES: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 14 MEDICAL DEVICES: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 6.2.2 STATIONARY MEDICAL DEVICES

- 6.2.2.1 Technological advancements in medical technology

- TABLE 15 STATIONARY MEDICAL DEVICES MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 16 STATIONARY MEDICAL DEVICES MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 17 STATIONARY MEDICAL DEVICES: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 18 STATIONARY MEDICAL DEVICES: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 6.2.3 IMPLANTED MEDICAL DEVICES

- 6.2.3.1 Increasing demand for minimally invasive procedures

- TABLE 19 IMPLANTED MEDICAL DEVICES MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 20 IMPLANTED MEDICAL DEVICES MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 21 IMPLANTED MEDICAL DEVICES: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 22 IMPLANTED MEDICAL DEVICES: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 6.2.4 WEARABLE EXTERNAL MEDICAL DEVICES

- 6.2.4.1 Increasing focus on preventative healthcare

- TABLE 23 WEARABLE EXTERNAL MEDICAL DEVICES MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 24 WEARABLE EXTERNAL MEDICAL DEVICES MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 25 WEARABLE EXTERNAL MEDICAL DEVICES: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 26 WEARABLE EXTERNAL MEDICAL DEVICES: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 6.3 SYSTEMS & SOFTWARE

- 6.3.1 SYSTEMS & SOFTWARE: IOT IN HEALTHCARE MARKET DRIVERS

- FIGURE 18 APPLICATION SECURITY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 27 SYSTEMS & SOFTWARE: IOT IN HEALTHCARE MARKET, BY TYPE, 2018-2022 (USD BILLION)

- TABLE 28 SYSTEMS & SOFTWARE: IOT IN HEALTHCARE MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 29 SYSTEMS & SOFTWARE: IOT IN HEALTHCARE MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 30 SYSTEMS & SOFTWARE: IOT IN HEALTHCARE MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 31 SYSTEMS & SOFTWARE: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 32 SYSTEMS & SOFTWARE: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 6.3.2 REMOTE DEVICE MANAGEMENT

- 6.3.2.1 Need to improve patient outcomes

- TABLE 33 REMOTE DEVICE MANAGEMENT MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 34 REMOTE DEVICE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 35 REMOTE DEVICE MANAGEMENT: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 36 REMOTE DEVICE MANAGEMENT: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 6.3.3 NETWORK BANDWIDTH MANAGEMENT

- 6.3.3.1 Need for timely transmission of data

- TABLE 37 NETWORK BANDWIDTH MANAGEMENT MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 38 NETWORK BANDWIDTH MANAGEMENT MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 39 NETWORK BANDWIDTH MANAGEMENT: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 40 NETWORK BANDWIDTH MANAGEMENT: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 6.3.4 DATA ANALYTICS

- 6.3.4.1 Need to analyze large datasets and gain insights

- TABLE 41 DATA ANALYTICS MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 42 DATA ANALYTICS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 43 DATA ANALYTICS: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 44 DATA ANALYTICS: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 6.3.5 APPLICATION SECURITY

- 6.3.5.1 Security breaches in IoT healthcare

- TABLE 45 APPLICATION SECURITY MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 46 APPLICATION SECURITY MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 47 APPLICATION SECURITY: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 48 APPLICATION SECURITY: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

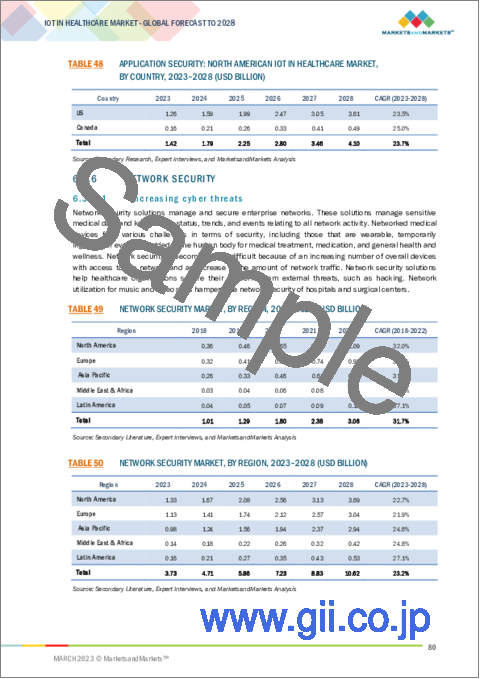

- 6.3.6 NETWORK SECURITY

- 6.3.6.1 Increasing cyber threats

- TABLE 49 NETWORK SECURITY MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 50 NETWORK SECURITY MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 51 NETWORK SECURITY: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 52 NETWORK SECURITY: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 6.4 SERVICES

- 6.4.1 SERVICES: IOT IN HEALTHCARE MARKET DRIVERS

- FIGURE 19 DEPLOYMENT & INTEGRATION SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- TABLE 53 SERVICES: IOT IN HEALTHCARE MARKET, BY TYPE, 2018-2022 (USD BILLION)

- TABLE 54 SERVICES: IOT IN HEALTHCARE MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 55 SERVICES: IOT IN HEALTHCARE MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 56 SERVICES: IOT IN HEALTHCARE MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 57 SERVICES: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 58 SERVICES: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 6.4.2 DEPLOYMENT & INTEGRATION

- 6.4.2.1 Integrating operational and enterprise environments for secured IoT experience

- TABLE 59 DEPLOYMENT & INTEGRATION MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 60 DEPLOYMENT & INTEGRATION MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 61 DEPLOYMENT & INTEGRATION: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 62 DEPLOYMENT & INTEGRATION: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 6.4.3 CONSULTING

- 6.4.3.1 Need to implement data management processes and systems

- TABLE 63 CONSULTING MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 64 CONSULTING MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 65 CONSULTING: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 66 CONSULTING: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 6.4.4 SUPPORT & MAINTENANCE

- 6.4.4.1 Need for healthcare organizations to ensure optimal performance and prevent downtime

- TABLE 67 SUPPORT & MAINTENANCE MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 68 SUPPORT & MAINTENANCE MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 69 SUPPORT & MAINTENANCE: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 70 SUPPORT & MAINTENANCE: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

7 IOT IN HEALTHCARE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 20 IN-PATIENT MONITORING SEGMENT TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- TABLE 71 IOT IN HEALTHCARE MARKET, BY APPLICATION, 2018-2022 (USD BILLION)

- TABLE 72 IOT IN HEALTHCARE MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- 7.2 TELEMEDICINE

- 7.2.1 TELEMEDICINE: IOT IN HEALTHCARE MARKET DRIVERS

- TABLE 73 TELEMEDICINE: IOT IN HEALTHCARE MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 74 TELEMEDICINE: IOT IN HEALTHCARE MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 75 TELEMEDICINE: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 76 TELEMEDICINE: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 7.2.2 STORE-AND-FORWARD TELEMEDICINE

- 7.2.2.1 Need to improve diagnostic accuracy

- 7.2.3 REMOTE PATIENT MONITORING

- 7.2.3.1 Need to improve patient outcome and convenience

- 7.2.4 INTERACTIVE TELEMEDICINE

- 7.2.4.1 Need to provide real-time communication

- 7.3 CLINICAL OPERATIONS & WORKFLOW MANAGEMENT

- 7.3.1 CLINICAL OPERATIONS & WORKFLOW MANAGEMENT: IOT IN HEALTHCARE MARKET DRIVERS

- TABLE 77 CLINICAL OPERATIONS & WORKFLOW MANAGEMENT: IOT IN HEALTHCARE MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 78 CLINICAL OPERATIONS & WORKFLOW MANAGEMENT: IOT IN HEALTHCARE MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 79 CLINICAL OPERATIONS & WORKFLOW MANAGEMENT: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 80 CLINICAL OPERATIONS & WORKFLOW MANAGEMENT: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 7.4 CONNECTED IMAGING

- 7.4.1 CONNECTED IMAGING: IOT IN HEALTHCARE MARKET DRIVERS

- TABLE 81 CONNECTED IMAGING: IOT IN HEALTHCARE MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 82 CONNECTED IMAGING: IOT IN HEALTHCARE MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 83 CONNECTED IMAGING: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 84 CONNECTED IMAGING: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 7.5 IN-PATIENT MONITORING

- 7.5.1 IN-PATIENT MONITORING: IOT IN HEALTHCARE MARKET DRIVERS

- TABLE 85 IN-PATIENT MONITORING: IOT IN HEALTHCARE MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 86 IN-PATIENT MONITORING: IOT IN HEALTHCARE MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 87 IN-PATIENT MONITORING: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 88 IN-PATIENT MONITORING: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 7.6 MEDICATION MANAGEMENT

- 7.6.1 MEDICATION MANAGEMENT: IOT IN HEALTHCARE MARKET DRIVERS

- TABLE 89 MEDICATION MANAGEMENT: IOT IN HEALTHCARE MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 90 MEDICATION MANAGEMENT: IOT IN HEALTHCARE MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 91 MEDICATION MANAGEMENT: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 92 MEDICATION MANAGEMENT: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 7.7 OTHER APPLICATIONS

- TABLE 93 OTHER APPLICATIONS: IOT IN HEALTHCARE MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 94 OTHER APPLICATIONS: IOT IN HEALTHCARE MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 95 OTHER APPLICATIONS: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 96 OTHER APPLICATIONS: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

8 IOT IN HEALTHCARE MARKET, BY CONNECTIVITY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 WI-FI

- 8.2.1 IMPROVED DATA TRANSMISSION SPEED

- 8.3 BLUETOOTH LOW ENERGY

- 8.3.1 INCREASED RANGE AND EASY INTEGRATION

- 8.4 ZIGBEE

- 8.4.1 LOW COST AND LOW POWER CONSUMPTION

- 8.5 NEAR-FIELD COMMUNICATION

- 8.5.1 INCREASING EFFICIENCY OF HEALTHCARE DELIVERY

- 8.6 CELLULAR

- 8.6.1 WIDE COVERAGE OFFERED BY CELLULAR NETWORKS

- 8.7 SATELLITE

9 IOT IN HEALTHCARE MARKET, BY END USER

- 9.1 INTRODUCTION

- FIGURE 21 CLINICAL RESEARCH ORGANIZATIONS SEGMENT TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- TABLE 97 IOT IN HEALTHCARE MARKET, BY END USER, 2018-2022 (USD BILLION)

- TABLE 98 IOT IN HEALTHCARE MARKET, BY END USER, 2023-2028 (USD BILLION)

- 9.2 HOSPITALS, SURGICAL CENTERS, AND CLINICS

- 9.2.1 HOSPITALS, SURGICAL CENTERS, AND CLINICS: IOT IN HEALTHCARE MARKET DRIVERS

- TABLE 99 HOSPITALS, SURGICAL CENTERS, AND CLINICS: IOT IN HEALTHCARE MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 100 HOSPITALS, SURGICAL CENTERS, AND CLINICS: IOT IN HEALTHCARE MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 101 HOSPITALS, SURGICAL CENTERS, AND CLINICS: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 102 HOSPITALS, SURGICAL CENTERS, AND CLINICS: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 9.3 CLINICAL RESEARCH ORGANIZATIONS

- 9.3.1 CLINICAL RESEARCH ORGANIZATIONS: IOT IN HEALTHCARE MARKET DRIVERS

- TABLE 103 CLINICAL RESEARCH ORGANIZATIONS: IOT IN HEALTHCARE MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 104 CLINICAL RESEARCH ORGANIZATIONS: IOT IN HEALTHCARE MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 105 CLINICAL RESEARCH ORGANIZATION: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 106 CLINICAL RESEARCH ORGANIZATION: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 9.4 GOVERNMENT AND DEFENSE INSTITUTIONS

- 9.4.1 GOVERNMENT AND DEFENSE INSTITUTIONS: IOT IN HEALTHCARE MARKET DRIVERS

- TABLE 107 GOVERNMENT AND DEFENSE INSTITUTIONS: IOT IN HEALTHCARE MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 108 GOVERNMENT AND DEFENSE INSTITUTIONS: IOT IN HEALTHCARE MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 109 GOVERNMENT AND DEFENSE INSTITUTIONS: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 110 GOVERNMENT AND DEFENSE INSTITUTIONS: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 9.5 RESEARCH AND DIAGNOSTIC LABORATORIES

- 9.5.1 RESEARCH AND DIAGNOSTIC LABORATORIES: IOT IN HEALTHCARE MARKET DRIVERS

- TABLE 111 RESEARCH AND DIAGNOSTIC LABORATORIES: IOT IN HEALTHCARE MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 112 RESEARCH AND DIAGNOSTIC LABORATORIES: IOT IN HEALTHCARE MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 113 RESEARCH AND DIAGNOSTIC LABORATORIES: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 114 RESEARCH AND DIAGNOSTIC LABORATORIES: NORTH AMERICAN IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

10 IOT IN HEALTHCARE MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 22 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING 2023-2028

- FIGURE 23 GEOGRAPHIC SNAPSHOT OF GLOBAL IOT IN HEALTHCARE MARKET

- TABLE 115 IOT IN HEALTHCARE MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 116 IOT IN HEALTHCARE MARKET, BY REGION, 2023-2028 (USD BILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: PESTLE ANALYSIS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- 10.2.3 NORTH AMERICA: IOT IN HEALTHCARE MARKET DRIVERS

- FIGURE 24 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 117 NORTH AMERICA: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018-2022 (USD BILLION)

- TABLE 118 NORTH AMERICA: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2023-2028 (USD BILLION)

- TABLE 119 NORTH AMERICA: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2018-2022 (USD BILLION)

- TABLE 120 NORTH AMERICA: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2023-2028 (USD BILLION)

- TABLE 121 NORTH AMERICA: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2018-2022 (USD BILLION)

- TABLE 122 NORTH AMERICA: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2023-2028 (USD BILLION)

- TABLE 123 NORTH AMERICA: IOT IN HEALTHCARE MARKET, BY SERVICE, 2018-2022 (USD BILLION)

- TABLE 124 NORTH AMERICA: IOT IN HEALTHCARE MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 125 NORTH AMERICA: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2018-2022 (USD BILLION)

- TABLE 126 NORTH AMERICA: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 127 NORTH AMERICA: IOT IN HEALTHCARE MARKET, BY END USER, 2018-2022 (USD BILLION)

- TABLE 128 NORTH AMERICA: IOT IN HEALTHCARE MARKET, BY END USER, 2023-2028 (USD BILLION)

- TABLE 129 NORTH AMERICA: IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 130 NORTH AMERICA: IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 10.2.4 US

- 10.2.4.1 Rising prevalence of chronic diseases and growing aging population

- TABLE 131 US: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018-2022 (USD BILLION)

- TABLE 132 US: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2023-2028 (USD BILLION)

- TABLE 133 US: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2018-2022 (USD BILLION)

- TABLE 134 US: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2023-2028 (USD BILLION)

- TABLE 135 US: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2018-2022 (USD BILLION)

- TABLE 136 US: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2023-2028 (USD BILLION)

- TABLE 137 US: IOT IN HEALTHCARE MARKET, BY SERVICE, 2018-2022 (USD BILLION)

- TABLE 138 US: IOT IN HEALTHCARE MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 139 US: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2018-2022 (USD BILLION)

- TABLE 140 US: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 141 US: IOT IN HEALTHCARE MARKET, BY END USER, 2018-2022 (USD BILLION)

- TABLE 142 US: IOT IN HEALTHCARE MARKET, BY END USER, 2023-2028 (USD BILLION)

- 10.2.5 CANADA

- 10.2.5.1 Need to curtail escalating healthcare costs and implementation of favorable government initiatives

- TABLE 143 CANADA: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018-2022 (USD BILLION)

- TABLE 144 CANADA: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2023-2028 (USD BILLION)

- TABLE 145 CANADA: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2018-2022 (USD BILLION)

- TABLE 146 CANADA: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2023-2028 (USD BILLION)

- TABLE 147 CANADA: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2018-2022 (USD BILLION)

- TABLE 148 CANADA: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2023-2028 (USD BILLION)

- TABLE 149 CANADA: IOT IN HEALTHCARE MARKET, BY SERVICE, 2018-2022 (USD BILLION)

- TABLE 150 CANADA: IOT IN HEALTHCARE MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 151 CANADA: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2018-2022 (USD BILLION)

- TABLE 152 CANADA: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 153 CANADA: IOT IN HEALTHCARE MARKET, BY END USER, 2018-2022 (USD BILLION)

- TABLE 154 CANADA: IOT IN HEALTHCARE MARKET, BY END USER, 2023-2028 (USD BILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: PESTLE ANALYSIS

- 10.3.2 EUROPE: RECESSION IMPACT

- 10.3.3 EUROPE: IOT IN HEALTHCARE MARKET DRIVERS

- TABLE 155 EUROPE: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018-2022 (USD BILLION)

- TABLE 156 EUROPE: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2023-2028 (USD BILLION)

- TABLE 157 EUROPE: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2018-2022 (USD BILLION)

- TABLE 158 EUROPE: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2023-2028 (USD BILLION)

- TABLE 159 EUROPE: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2018-2022 (USD BILLION)

- TABLE 160 EUROPE: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2023-2028 (USD BILLION)

- TABLE 161 EUROPE: IOT IN HEALTHCARE MARKET, BY SERVICE, 2018-2022 (USD BILLION)

- TABLE 162 EUROPE: IOT IN HEALTHCARE MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 163 EUROPE: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2018-2022 (USD BILLION)

- TABLE 164 EUROPE: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 165 EUROPE: IOT IN HEALTHCARE MARKET, BY END USER, 2018-2022 (USD BILLION)

- TABLE 166 EUROPE: IOT IN HEALTHCARE MARKET, BY END USER, 2023-2028 (USD BILLION)

- TABLE 167 EUROPE: IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 168 EUROPE: IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 10.3.4 UK

- 10.3.4.1 Rising adoption of Real-Time Healthcare Systems (RTHS) and other Healthcare Information Systems (HCIS)

- TABLE 169 UK: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018-2022 (USD BILLION)

- TABLE 170 UK: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2023-2028 (USD BILLION)

- TABLE 171 UK: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2018-2022 (USD BILLION)

- TABLE 172 UK: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2023-2028 (USD BILLION)

- TABLE 173 UK: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2018-2022 (USD BILLION)

- TABLE 174 UK: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2023-2028 (USD BILLION)

- TABLE 175 UK: IOT IN HEALTHCARE MARKET, BY SERVICE, 2018-2022 (USD BILLION)

- TABLE 176 UK: IOT IN HEALTHCARE MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 177 UK: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2018-2022 (USD BILLION)

- TABLE 178 UK: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 179 UK: IOT IN HEALTHCARE MARKET, BY END USER, 2018-2022 (USD BILLION)

- TABLE 180 UK: IOT IN HEALTHCARE MARKET, BY END USER, 2023-2028 (USD BILLION)

- 10.3.5 GERMANY

- 10.3.5.1 Growing demand for effective self-health management and home-care solutions

- TABLE 181 GERMANY: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018-2022 (USD BILLION)

- TABLE 182 GERMANY: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2023-2028 (USD BILLION)

- TABLE 183 GERMANY: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2018-2022 (USD BILLION)

- TABLE 184 GERMANY: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2023-2028 (USD BILLION)

- TABLE 185 GERMANY: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2018-2022 (USD BILLION)

- TABLE 186 GERMANY: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2023-2028 (USD BILLION)

- TABLE 187 GERMANY: IOT IN HEALTHCARE MARKET, BY SERVICE, 2018-2022 (USD BILLION)

- TABLE 188 GERMANY: IOT IN HEALTHCARE MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 189 GERMANY: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2018-2022 (USD BILLION)

- TABLE 190 GERMANY: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 191 GERMANY: IOT IN HEALTHCARE MARKET, BY END USER, 2018-2022 (USD BILLION)

- TABLE 192 GERMANY: IOT IN HEALTHCARE MARKET, BY END USER, 2023-2028 (USD BILLION)

- 10.3.6 FRANCE

- 10.3.6.1 Huge demand for innovative healthcare solutions driving market for IoT in healthcare

- TABLE 193 FRANCE: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018-2022 (USD BILLION)

- TABLE 194 FRANCE: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2023-2028 (USD BILLION)

- TABLE 195 FRANCE: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2018-2022 (USD BILLION)

- TABLE 196 FRANCE: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2023-2028 (USD BILLION)

- TABLE 197 FRANCE: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2018-2022 (USD BILLION)

- TABLE 198 FRANCE: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2023-2028 (USD BILLION)

- TABLE 199 FRANCE: IOT IN HEALTHCARE MARKET, BY SERVICE, 2018-2022 (USD BILLION)

- TABLE 200 FRANCE: IOT IN HEALTHCARE MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 201 FRANCE: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2018-2022 (USD BILLION)

- TABLE 202 FRANCE: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 203 FRANCE: IOT IN HEALTHCARE MARKET, BY END USER, 2018-2022 (USD BILLION)

- TABLE 204 FRANCE: IOT IN HEALTHCARE MARKET, BY END USER, 2023-2028 (USD BILLION)

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: PESTLE ANALYSIS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- 10.4.3 ASIA PACIFIC: IOT IN HEALTHCARE MARKET DRIVERS

- FIGURE 25 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 205 ASIA PACIFIC: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018-2022 (USD BILLION)

- TABLE 206 ASIA PACIFIC: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2023-2028 (USD BILLION)

- TABLE 207 ASIA PACIFIC: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2018-2022 (USD BILLION)

- TABLE 208 ASIA PACIFIC: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2023-2028 (USD BILLION)

- TABLE 209 ASIA PACIFIC: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2018-2022 (USD BILLION)

- TABLE 210 ASIA PACIFIC: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2023-2028 (USD BILLION)

- TABLE 211 ASIA PACIFIC: IOT IN HEALTHCARE MARKET, BY SERVICE, 2018-2022 (USD BILLION)

- TABLE 212 ASIA PACIFIC: IOT IN HEALTHCARE MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 213 ASIA PACIFIC: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2018-2022 (USD BILLION)

- TABLE 214 ASIA PACIFIC: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 215 ASIA PACIFIC: IOT IN HEALTHCARE MARKET, BY END USER, 2018-2022 (USD BILLION)

- TABLE 216 ASIA PACIFIC: IOT IN HEALTHCARE MARKET, BY END USER, 2023-2028 (USD BILLION)

- TABLE 217 ASIA PACIFIC: IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 218 ASIA PACIFIC: IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 10.4.4 CHINA

- 10.4.4.1 Strong telecommunications network creating influx of IoT deployments

- TABLE 219 CHINA: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018-2022 (USD BILLION)

- TABLE 220 CHINA: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2023-2028 (USD BILLION)

- TABLE 221 CHINA: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2018-2022 (USD BILLION)

- TABLE 222 CHINA: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2023-2028 (USD BILLION)

- TABLE 223 CHINA: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2018-2022 (USD BILLION)

- TABLE 224 CHINA: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2023-2028 (USD BILLION)

- TABLE 225 CHINA: IOT IN HEALTHCARE MARKET, BY SERVICE, 2018-2022 (USD BILLION)

- TABLE 226 CHINA: IOT IN HEALTHCARE MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 227 CHINA: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2018-2022 (USD BILLION)

- TABLE 228 CHINA: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 229 CHINA: IOT IN HEALTHCARE MARKET, BY END USER, 2018-2022 (USD BILLION)

- TABLE 230 CHINA: IOT IN HEALTHCARE MARKET, BY END USER, 2023-2028 (USD BILLION)

- 10.4.5 JAPAN

- 10.4.5.1 Rising overall healthcare expenditure and growing geriatric population

- TABLE 231 JAPAN: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018-2022 (USD BILLION)

- TABLE 232 JAPAN: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2023-2028 (USD BILLION)

- TABLE 233 JAPAN: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2018-2022 (USD BILLION)

- TABLE 234 JAPAN: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2023-2028 (USD BILLION)

- TABLE 235 JAPAN: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2018-2022 (USD BILLION)

- TABLE 236 JAPAN: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2023-2028 (USD BILLION)

- TABLE 237 JAPAN: IOT IN HEALTHCARE MARKET, BY SERVICE, 2018-2022 (USD BILLION)

- TABLE 238 JAPAN: IOT IN HEALTHCARE MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 239 JAPAN: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2018-2022 (USD BILLION)

- TABLE 240 JAPAN: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 241 JAPAN: IOT IN HEALTHCARE MARKET, BY END USER, 2018-2022 (USD BILLION)

- TABLE 242 JAPAN: IOT IN HEALTHCARE MARKET, BY END USER, 2023-2028 (USD BILLION)

- 10.4.6 INDIA

- 10.4.6.1 Government initiatives driving market

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: PESTLE ANALYSIS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.5.3 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET DRIVERS

- TABLE 243 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018-2022 (USD BILLION)

- TABLE 244 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2023-2028 (USD BILLION)

- TABLE 245 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2018-2022 (USD BILLION)

- TABLE 246 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2023-2028 (USD BILLION)

- TABLE 247 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2018-2022 (USD BILLION)

- TABLE 248 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2023-2028 (USD BILLION)

- TABLE 249 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET, BY SERVICE, 2018-2022 (USD BILLION)

- TABLE 250 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 251 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2018-2022 (USD BILLION)

- TABLE 252 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 253 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET, BY END USER, 2018-2022 (USD BILLION)

- TABLE 254 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET, BY END USER, 2023-2028 (USD BILLION)

- TABLE 255 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET, BY SUB-REGION, 2018-2022 (USD BILLION)

- TABLE 256 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET, BY SUB-REGION, 2023-2028 (USD BILLION)

- 10.5.4 MIDDLE EAST

- 10.5.4.1 National Transformation Plan and aims of Saudi Vision 2030 driving market

- TABLE 257 MIDDLE EAST: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018-2022 (USD BILLION)

- TABLE 258 MIDDLE EAST: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2023-2028 (USD BILLION)

- TABLE 259 MIDDLE EAST: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2018-2022 (USD BILLION)

- TABLE 260 MIDDLE EAST: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2023-2028 (USD BILLION)

- TABLE 261 MIDDLE EAST: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2018-2022 (USD BILLION)

- TABLE 262 MIDDLE EAST: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2023-2028 (USD BILLION)

- TABLE 263 MIDDLE EAST: IOT IN HEALTHCARE MARKET, BY SERVICE, 2018-2022 (USD BILLION)

- TABLE 264 MIDDLE EAST: IOT IN HEALTHCARE MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 265 MIDDLE EAST: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2018-2022 (USD BILLION)

- TABLE 266 MIDDLE EAST: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 267 MIDDLE EAST: IOT IN HEALTHCARE MARKET, BY END USER, 2018-2022 (USD BILLION)

- TABLE 268 MIDDLE EAST: IOT IN HEALTHCARE MARKET, BY END USER, 2023-2028 (USD BILLION)

- 10.5.5 AFRICA

- 10.5.5.1 Rapid growth in access to ICT, particularly mobile phones and network connectivity

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: PESTLE ANALYSIS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- 10.6.3 LATIN AMERICA: IOT IN HEALTHCARE MARKET DRIVERS

- TABLE 269 LATIN AMERICA: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018-2022 (USD BILLION)

- TABLE 270 LATIN AMERICA: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2023-2028 (USD BILLION)

- TABLE 271 LATIN AMERICA: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2018-2022 (USD BILLION)

- TABLE 272 LATIN AMERICA: IOT IN HEALTHCARE MARKET, BY MEDICAL DEVICE, 2023-2028 (USD BILLION)

- TABLE 273 LATIN AMERICA: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2018-2022 (USD BILLION)

- TABLE 274 LATIN AMERICA: IOT IN HEALTHCARE MARKET, BY SYSTEMS & SOFTWARE, 2023-2028 (USD BILLION)

- TABLE 275 LATIN AMERICA: IOT IN HEALTHCARE MARKET, BY SERVICE, 2018-2022 (USD BILLION)

- TABLE 276 LATIN AMERICA: IOT IN HEALTHCARE MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 277 LATIN AMERICA: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2018-2022 (USD BILLION)

- TABLE 278 LATIN AMERICA: IOT IN HEALTHCARE MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 279 LATIN AMERICA: IOT IN HEALTHCARE MARKET, BY END USER, 2018-2022 (USD BILLION)

- TABLE 280 LATIN AMERICA: IOT IN HEALTHCARE MARKET, BY END USER, 2023-2028 (USD BILLION)

- TABLE 281 LATIN AMERICA: IOT IN HEALTHCARE MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 282 LATIN AMERICA: IOT IN HEALTHCARE MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 10.6.4 BRAZIL

- 10.6.4.1 Increasing adoption of smartphone technology driving market

- 10.6.5 MEXICO

- 10.6.5.1 Government efforts toward healthcare digitalization fueling market growth

- 10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE ANALYSIS

- FIGURE 26 HISTORICAL REVENUE ANALYSIS, 2018-2022

- 11.4 COMPANY MARKET RANKING ANALYSIS

- FIGURE 27 RANKING OF KEY PLAYERS IN IOT IN HEALTHCARE MARKET, 2022

- 11.5 MARKET SHARE ANALYSIS OF TOP PLAYERS

- TABLE 283 IOT IN HEALTHCARE MARKET: DEGREE OF COMPETITION

- FIGURE 28 MARKET SHARE ANALYSIS OF COMPANIES IN IOT IN HEALTHCARE MARKET

- 11.6 COMPANY EVALUATION QUADRANTS

- 11.6.1 DEFINITIONS AND METHODOLOGY

- FIGURE 29 EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- 11.6.1.1 Stars

- 11.6.1.2 Emerging leaders

- 11.6.1.3 Pervasive players

- 11.6.1.4 Participants

- FIGURE 30 IOT IN HEALTHCARE MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 284 COMPANY PRODUCT FOOTPRINT

- 11.7.1 END-USER FOOTPRINT

- TABLE 285 COMPANY END-USER FOOTPRINT

- 11.7.2 COMPONENT FOOTPRINT

- TABLE 286 COMPANY COMPONENT FOOTPRINT

- 11.7.3 REGIONAL FOOTPRINT

- TABLE 287 COMPANY REGION FOOTPRINT

- 11.8 COMPETITIVE BENCHMARKING FOR SMES/STARTUPS

- TABLE 288 IOT IN HEALTHCARE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 11.9 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

- TABLE 289 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- FIGURE 31 IOT IN HEALTHCARE MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 11.10 COMPETITIVE SCENARIO AND TRENDS

- 11.10.1 PRODUCT LAUNCHES

- TABLE 290 IOT IN HEALTHCARE MARKET: PRODUCT LAUNCHES, 2020-2022

- 11.10.2 DEALS

- TABLE 291 IOT IN HEALTHCARE MARKET: DEALS, 2019-2022

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

(Business overview, Products offered, Recent developments, MnM view, Key strengths, Strategic choices made, and Weaknesses and competitive threats)*

- 12.1.1 CISCO

- TABLE 292 CISCO: BUSINESS OVERVIEW

- FIGURE 32 CISCO: COMPANY SNAPSHOT

- TABLE 293 CISCO: PRODUCTS OFFERED

- TABLE 294 CISCO: DEALS

- 12.1.2 IBM

- TABLE 295 IBM: BUSINESS OVERVIEW

- FIGURE 33 IBM: COMPANY SNAPSHOT

- TABLE 296 IBM: PRODUCTS OFFERED

- TABLE 297 IBM: PRODUCT LAUNCHES

- 12.1.3 GE HEALTHCARE

- TABLE 298 GE HEALTHCARE: BUSINESS OVERVIEW

- FIGURE 34 GE HEALTHCARE: COMPANY SNAPSHOT

- TABLE 299 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 300 GE HEALTHCARE: PRODUCT LAUNCHES

- TABLE 301 GE HEALTHCARE: DEALS

- 12.1.4 MICROSOFT

- TABLE 302 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 35 MICROSOFT: COMPANY SNAPSHOT

- TABLE 303 MICROSOFT: PRODUCTS OFFERED

- TABLE 304 MICROSOFT: PRODUCT LAUNCHES

- 12.1.5 SAP

- TABLE 305 SAP: BUSINESS OVERVIEW

- FIGURE 36 SAP: COMPANY SNAPSHOT

- TABLE 306 SAP: PRODUCTS OFFERED

- TABLE 307 SAP: PRODUCT LAUNCHES

- 12.1.6 MEDTRONIC

- TABLE 308 MEDTRONIC: BUSINESS OVERVIEW

- FIGURE 37 MEDTRONIC: COMPANY SNAPSHOT

- TABLE 309 MEDTRONIC: PRODUCTS OFFERED

- TABLE 310 MEDTRONIC: PRODUCT LAUNCHES

- 12.1.7 ROYAL PHILIPS

- TABLE 311 ROYAL PHILIPS: BUSINESS OVERVIEW

- FIGURE 38 ROYAL PHILIPS: COMPANY SNAPSHOT

- TABLE 312 ROYAL PHILIPS: PRODUCTS OFFERED

- TABLE 313 ROYAL PHILIPS: PRODUCT LAUNCHES

- TABLE 314 ROYAL PHILIPS: DEALS

- 12.1.8 RESIDEO TECHNOLOGIES

- TABLE 315 RESIDEO TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 39 RESIDEO TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 316 RESIDEO TECHNOLOGIES: PRODUCTS OFFERED

- 12.1.9 SECURITAS

- TABLE 317 SECURITAS: BUSINESS OVERVIEW

- FIGURE 40 SECURITAS: COMPANY SNAPSHOT

- TABLE 318 SECURITAS: PRODUCTS OFFERED

- TABLE 319 SECURITAS: DEALS

- 12.2 OTHER PLAYERS

- 12.2.1 BOSCH

- 12.2.2 ARMIS

- 12.2.3 ORACLE

- 12.2.4 PTC

- 12.2.5 HUAWEI

- 12.2.6 SIEMENS

- 12.2.7 R-STYLE LAB

- 12.2.8 HQSOFTWARE

- 12.2.9 OXAGILE

- 12.2.10 SOFTWEB SOLUTIONS

- 12.2.11 OSP LABS

- 12.2.12 COMARCH SA

- 12.2.13 TELIT

- 12.2.14 KORE WIRELESS

- 12.2.15 SCIENCESOFT

- 12.2.16 INTEL

- 12.2.17 AGAMATRIX

- 12.2.18 WELCH ALLYN

- 12.2.19 ALIVECOR

- 12.2.20 SENSELY

- 12.2.21 CLOVER HEALTH

Details on Business overview, Products offered, Recent developments, MnM view, Key strengths, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 IOT INTEGRATION MARKET

- 13.3.1 MARKET OVERVIEW

- 13.3.2 IOT INTEGRATION MARKET, BY SERVICE

- TABLE 320 IOT INTEGRATION MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 321 IOT INTEGRATION MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- 13.3.3 IOT INTEGRATION MARKET, BY ORGANIZATION SIZE

- TABLE 322 IOT INTEGRATION MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 323 IOT INTEGRATION MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 13.3.4 IOT INTEGRATION MARKET, BY REGION

- 13.3.4.1 Europe

- TABLE 324 EUROPE: IOT INTEGRATION MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 325 EUROPE: IOT INTEGRATION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.4 INCIDENT AND EMERGENCY MARKET

- 13.4.1 MARKET OVERVIEW

- TABLE 326 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 327 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 13.4.2 INCIDENT AND EMERGENCY MARKET, BY COMMUNICATION TOOL AND DEVICE

- TABLE 328 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMMUNICATION TOOL AND DEVICE, 2016-2021 (USD MILLION)

- TABLE 329 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMMUNICATION TOOL AND DEVICE, 2022-2027 (USD MILLION)

- 13.4.3 INCIDENT AND EMERGENCY MARKET, BY REGION

- 13.4.3.1 Asia Pacific

- TABLE 330 ASIA PACIFIC: INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 331 ASIA PACIFIC: INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS