|

|

市場調査レポート

商品コード

1233004

分散型アンテナシステム (DAS) の世界市場:提供製品/サービス別・対象範囲別・所有モデル別・業種別・ユーザー施設エリア別・周波数プロトコル別・ネットワークの種類別・信号源別・地域別の将来予測 (2028年まで)Distributed Antenna System Market by Offering, Coverage, Ownership Model, Vertical, User Facility Area, Frequency Protocol, Network Type, Signal Sources and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 分散型アンテナシステム (DAS) の世界市場:提供製品/サービス別・対象範囲別・所有モデル別・業種別・ユーザー施設エリア別・周波数プロトコル別・ネットワークの種類別・信号源別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年02月28日

発行: MarketsandMarkets

ページ情報: 英文 293 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の分散型アンテナシステム (DAS) の市場規模は、2023年の97億米ドルから、2028年には130億米ドルに達し、予測期間中に6.2%のCAGRで成長すると予測されています。

市場成長の主な促進要因として、モバイルデータトラフィックの増加、ネットワーク対象範囲の拡大や中断のない接続に対する需要の高まり、DASの導入が必要となる近代的で持続可能なコンセプトに基づく建物の建設が増加していることなどがあります。しかし、DASの設置に伴う複雑さが、今後の市場の課題となるでしょう。

所有モデル別では、ニュートラルホスト所有方式が最大の市場となり、今後も高いCAGRで成長する見通しです。このモデルは、スタジアム、ショッピングモール、空港などの大きな会場での展開に適しています。

業種別では、医療分野が2023年時点で最大のシェアを占め、予測期間中に大幅な成長を遂げると考えられています。現在、DASはユビキタスセルラーや公共安全通信をカバーすることで、医療分野に大きな利益をもたらしています。

地域別に見ると、アジア太平洋が予測期間中に最も大きく成長すると見込まれています。市場成長の主な要因として、携帯電話の普及、インターネットユーザー数・接続の増加、ネットワーク構築の進展、高帯域幅を必要とするアプリケーションの増加などが挙げられます。

当レポートでは、世界の分散型アンテナシステム (DAS) の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、提供製品/サービス別・対象範囲別・所有モデル別・ユーザー施設エリア別・業種別・周波数プロトコル別・ネットワークの種類別・信号源別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 技術分析

- ケーススタディ分析

- 特許分析

- 貿易分析と関税分析

- 主な利害関係者と購入基準

- ポーターのファイブフォース分析

- 主な会議とイベント (2023年~2024年)

- 規制状況

第6章 分散型アンテナシステム (DAS) 市場:提供製品/サービス別

- イントロダクション

- 成分

- アンテナノード/無線ノード

- ヘッドエンドユニット

- 無線ユニット

- 双方向アンプ (BDA)

- DAS/POI (相互接続点) トレイ

- その他

- サービス

- プリセールスサービス

- 設置サービス

- アフターサービス

第7章 分散型アンテナシステム (DAS) 市場:対象範囲別

- イントロダクション

- 屋内

- アクティブ

- パッシブ

- ハイブリッド

- 屋外

第8章 分散型アンテナシステム (DAS) 市場:所有モデル別

- イントロダクション

- キャリア所有方式

- ニュートラルホスト所有方式

- 企業所有方式

第9章 分散型アンテナシステム (DAS) 市場:ユーザー施設エリア別

- イントロダクション

- 50万平方フィート以上

- 20~50万平方フィート

- 20万平方フィート以下

第10章 分散型アンテナシステム (DAS) 市場:業種別

- イントロダクション

- 商業

- 公共施設

- ホスピタリティ

- 医療

- 教育

- 企業

- 小売

- 空港・交通機関

- 産業用

- 政府

- 公安

第11章 分散型アンテナシステム (DAS) 市場:周波数プロトコル別

- イントロダクション

- セルラー

- VHF/UHF (超短波/極超短波)

- その他

第12章 分散型アンテナシステム (DAS) 市場:ネットワークの種類別

- イントロダクション

- パブリックネットワーク

- プライベートLTE (Long Term Evolution)/CBRS (Citizens Broadband Radio Service)

第13章 分散型アンテナシステム (DAS) 市場:信号源別

- イントロダクション

- オフエアアンテナ (リピーター)

- オンサイト基地局 (BTS)

- スモールセル

第14章 分散型アンテナシステム (DAS) 市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- オランダ

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 中東

- アフリカ

- 南米

- ブラジル

第15章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 市場シェア分析、2021年

- 分散型アンテナシステム (DAS) 市場:大手企業の収益分析

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 企業のフットプリント

- 競合シナリオと動向

- 製品の発売と開発

- 資本取引

- その他

第16章 企業プロファイル

- 主要企業

- COMMSCOPE

- CORNING INCORPORATED

- COMBA TELECOM SYSTEMS HOLDINGS LTD.

- PBE GROUP

- SOLID

- AMERICAN TOWER

- AT&T

- BOINGO WIRELESS, INC.

- DALI WIRELESS

- ZINWAVE

- その他の企業

- WHOOP WIRELESS

- KATHREIN BROADCAST GMBH

- HUBER+SUHNER

- BTI WIRELESS

- JMA WIRELESS

- WESTELL TECHNOLOGIES, INC.

- ADVANCED RF TECHNOLOGIES, INC.

- GALTRONICS

- CONNECTIVITY WIRELESS

- BETACOM INC.

- AIRPLUX TECHNOLOGIES LIMITED

- CELLNEX TELECOM

- VISION TECHNOLOGIES

- VERIDAS TECHNOLOGIES

- HARRIS COMMUNICATIONS

第17章 付録

The DAS market is projected to grow from USD 3 USD 9.7 billion in 2023 to USD 13.0 billion by 2028, registering a CAGR of 6.2% during the forecast period. Some of the major factors that are driving the growth of the distributed antenna system (DAS) market include growing mobile data traffic, rising demand for extended network coverage and uninterrupted connectivity, and rising construction of buildings based on modern and sustainable concepts that necessitate DAS deployments. However, the complexities involved in installing DAS will be a challenge for the market in the future. The major growth opportunities for the market players are increasing requirements for public safety connectivity and a rise in the number of commercial spaces, especially in the ASEAN region.

"Market for neutral-host ownership to grow at higher CAGR during forecast period"

The neutral-host qonership segment of the DAS market is expected to account for the largest market size and highest growth rate during the forecast period. In neutral-host models, the ownership shifts from carriers to building owners, DAS integrators, or third-party system/service providers. An independent, third-party host handles financial, legal, regulatory, and technical responsibilities, including the deployment, installation, and maintenance of the DAS system. The host who owns the system can lease system access to one or more operators. Hence, end users can benefit from a multicarrier DAS, while the host company receives exclusive rights to the system. This model is successful for deployments at large venues, such as stadiums, malls, and airports.

"Healthcare commercial vertical held largest share of DAS market in 2023"

In terms of market size, the healthcare vertical is expected to dominate the DAS market and is likely to witness significant growth during the forecast period. Hospitals use DAS to amplify and extend the coverage of outdoor cellular signals inside hospital buildings to ensure consistent mobile service. With the adoption of telemedicine and telehealth, as well as the increasing number of devices used within hospitals, they will require more bandwidth than current Wi-Fi and DAS infrastructure can provide. At present, DAS provide significant benefits to the healthcare vertical by providing ubiquitous cellular, and public safety communication coverage.

"Asia Pacific to witness highest growth among other regions during forecast period"

Asia Pacific is expected to dominate the DAS market during the forecast period Asia Pacific is one of the emerging markets for DAS components and services. The region has been segmented into China, India, Japan, South Korea, and Rest of Asia Pacific, which includes Australia, New Zealand, Singapore, and other Southeast Asian countries. The major drivers for the growth of the DAS market in Asia Pacific include the growing adoption of phones, rise in the number of internet users (1.2 billion users in 2021), increasing internet connectivity, growing network establishment, and rise in high bandwidth-intensive applications. According to the GSMA Mobility report 2021, the global mobile data usage in Asia Pacific was 11.5 GB per subscriber per month in 2022. The region has become a global focal point for huge investments and business expansions. Asian markets encourage the development of 5G mobile technologies, with commercial deployments already implemented in South Korea, Japan, and China and ready to be deployed in India in the next few years.

In determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the DAS market. The break-up of primary participants for the report has been shown below:

- By company type: Tier 1 - 38 %, Tier 2 - 28%, and Tier 3 - 34%

- By designation: C-Level Executives - 40%, Managers - 30%, and Others - 30%

- By region: North America - 35%, Europe - 20%, Asia Pacific - 35%, and RoW - 10%

The report profiles key players in the DAS market with their respective market ranking analyses. Prominent players profiled in this report include CommScope (US), Corning (US), PBE Axell (UK), Comba Telecom Systems (China), SOLiD Technologies (US), American Tower (US), AT&T (US), Boingo Wireless (US), Dali Wireless (US), Zinwave (US), Whoop Wireless (US), HUBER+SUHNER (Switzerland), JMA Wireless (US), Advanced RF Technologies (ADRF) (US), Galtronics (Canada), Connectivity Wireless (US), Betacom (US), among others.

Research coverage

This research report categorizes the DAS market on the basis of component, product, application, vertical, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the DAS market and forecasts the same till 2028. Apart from these, the report also consists of leadership mapping and analysis of companies in the DAS ecosystem.

Key benefits of buying report

The report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the DAS market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 DISTRIBUTED ANTENNA SYSTEM MARKET SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 DISTRIBUTED ANTENNA SYSTEM MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.3 SECONDARY & PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to capture market size from demand-side analysis

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to capture market size from supply-side analysis

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 IMPACT OF RECESSION

- 2.5 LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- 3.1 RECESSION ANALYSIS

- FIGURE 6 GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 7 MARKET PROJECTIONS FOR DAS MARKET

- FIGURE 8 SERVICE SEGMENT TO HOLD LARGER SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 9 INDOOR SEGMENT TO HOLD LARGER SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET IN 2028

- FIGURE 10 NEUTRAL-HOST OWNERSHIP SEGMENT TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 11 >500 K SQ. FT. SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 12 PUBLIC SAFETY SEGMENT TO GROW AT HIGHER CAGR FROM 2023 TO 2028

- FIGURE 13 NORTH AMERICA HELD LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DISTRIBUTED ANTENNA SYSTEM MARKET

- FIGURE 14 INCREASING M2M CONNECTIONS AND NUMBER OF IOT DEVICES FUELING GROWTH OF DISTRIBUTED ANTENNA SYSTEM MARKET

- 4.2 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OFFERING

- FIGURE 15 SERVICE SEGMENT HELD LARGER SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET IN 2022

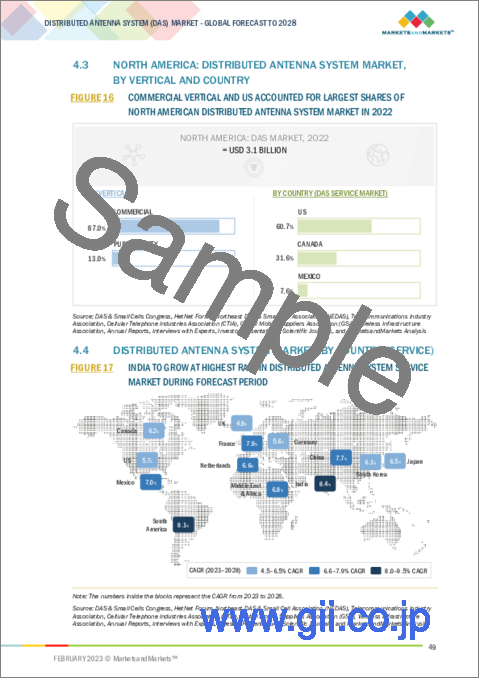

- 4.3 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL AND COUNTRY

- FIGURE 16 COMMERCIAL VERTICAL AND US ACCOUNTED FOR LARGEST SHARES OF NORTH AMERICAN DISTRIBUTED ANTENNA SYSTEM MARKET IN 2022

- 4.4 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COUNTRY (SERVICE)

- FIGURE 17 INDIA TO GROW AT HIGHEST RATE IN DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DISTRIBUTED ANTENNA SYSTEM MARKET: DYNAMICS

- 5.2.1 DRIVERS

- FIGURE 19 DISTRIBUTED ANTENNA SYSTEM MARKET DRIVERS: IMPACT ANALYSIS

- 5.2.1.1 Growing mobile data traffic

- FIGURE 20 RISE IN GLOBAL MOBILE DATA TRAFFIC FROM 2017 TO 2022

- 5.2.1.2 Rising demand for enhanced network coverage and need to eliminate connectivity gaps in buildings

- 5.2.1.3 Growing need for strong and reliable cellular connectivity for Internet of Things (IoT)

- 5.2.1.4 Growing focus on enhancing spectrum efficiency

- 5.2.1.5 Deployment of distributed antenna systems in buildings based on modern and sustainable concepts

- 5.2.2 RESTRAINTS

- FIGURE 21 DISTRIBUTED ANTENNA SYSTEM MARKET RESTRAINTS: IMPACT ANALYSIS

- 5.2.2.1 High costs associated with DAS network deployment

- 5.2.2.2 Routing backhauling issue associated with DAS networks

- 5.2.3 OPPORTUNITIES

- FIGURE 22 DISTRIBUTED ANTENNA SYSTEM MARKET OPPORTUNITIES: IMPACT ANALYSIS

- 5.2.3.1 Growth in requirement for public safety connectivity

- 5.2.3.2 Increase in commercial spaces across Association of Southeast Asian Nations (ASEAN)

- 5.2.3.3 Use of distributed antenna system (DAS) technology in Citizens Broadband Radio Service (CBRS)

- 5.2.4 CHALLENGES

- FIGURE 23 DISTRIBUTED ANTENNA SYSTEM MARKET CHALLENGES: IMPACT ANALYSIS

- 5.2.4.1 Complexities associated with installation of DAS

- FIGURE 24 INSTALLATION PROCEDURE FOR DAS OUTLINED BY BUILDING INDUSTRY CONSULTING SERVICE INTERNATIONAL (BICSI)

- 5.2.4.2 Upgradeability issues of existing DAS networks

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY WIRELESS CARRIERS AND SYSTEM INTEGRATORS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 REVENUE SHIFTS IN DISTRIBUTED ANTENNA SYSTEM MARKET

- 5.6 PRICING ANALYSIS

- 5.6.1 PRICE TREND ANALYSIS FOR DAS DEPLOYMENT

- TABLE 1 PRICE OF DIFFERENT COMPONENTS OF DISTRIBUTED ANTENNA SYSTEMS

- TABLE 2 DISTRIBUTED ANTENNA SYSTEM ANTENNA PRICE LIST

- FIGURE 27 AVERAGE SELLING PRICE OF MAJOR COMPONENTS OF ACTIVE INDOOR DAS

- FIGURE 28 AVERAGE SELLING PRICE ANALYSIS: MAJOR COMPONENTS OF PASSIVE INDOOR DAS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TRENDS IN DISTRIBUTED ANTENNA SYSTEM MARKET

- 5.7.1.1 Bring your own device (BYOD) and DAS

- 5.7.1.2 Citizen Broadband Radio Networks CBRS and DAS

- 5.7.1.3 Small cell and DAS complimenting each other

- 5.7.1 KEY TRENDS IN DISTRIBUTED ANTENNA SYSTEM MARKET

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 COMMSCOPE SUPPORTS ORANGE CAMEROON TO DELIVER SEAMLESS EXPERIENCE TO SUBSCRIBERS FOR AFCON 2022

- 5.8.2 ACTIVE DAS DEPLOYMENT IN HONG KONG

- 5.8.3 MERCY HOSPITAL INSTALLED CEL-FI'S QUATRA DAS TO IMPROVE INDOOR CELLULAR CONNECTIVITY

- 5.8.4 HATCHER STATION HEALTH CLINIC IMPROVED INDOOR COVERAGE WITH NEW DAS SOLUTION

- 5.8.5 QUEEN ALIA INTERNATIONAL AIRPORT'S CELLULAR COVERAGE

- 5.9 PATENT ANALYSIS

- FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 3 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- FIGURE 30 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2022

- 5.9.1 LIST OF MAJOR PATENTS

- TABLE 4 LIST OF MAJOR PATENTS IN DISTRIBUTED ANTENNA SYSTEM MARKET

- 5.10 TRADE ANALYSIS AND TARIFF ANALYSIS

- FIGURE 31 IMPORT DATA FOR HS CODE 852910, BY COUNTRY, 2017-2021 (USD THOUSAND)

- FIGURE 32 EXPORT DATA FOR HS CODE 852910, BY COUNTRY, 2017-2021 (USD THOUSAND)

- 5.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE COMMERCIAL VERTICALS

- TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE COMMERCIAL VERTICALS (%)

- 5.11.2 BUYING CRITERIA

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE COMMERCIAL VERTICALS

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 PORTER'S FIVE FORCES ANALYSIS, 2022

- TABLE 7 DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: PORTER'S FIVE FORCES ANALYSIS (2020)

- 5.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 BARGAINING POWER OF SUPPLIERS

- 5.12.5 THREAT OF NEW ENTRANTS

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 8 DISTRIBUTED ANTENNA SYSTEM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO DISTRIBUTED ANTENNA SYSTEMS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS AND REGULATIONS RELATED TO DISTRIBUTED ANTENNA SYSTEMS

- TABLE 13 NORTH AMERICA: SAFETY STANDARDS FOR DISTRIBUTED ANTENNA SYSTEM MARKET

- TABLE 14 EUROPE: SAFETY STANDARDS FOR DISTRIBUTED ANTENNA SYSTEM MARKET

- TABLE 15 ASIA PACIFIC: SAFETY STANDARDS FOR DISTRIBUTED ANTENNA SYSTEM MARKET

- TABLE 16 REST OF THE WORLD: SAFETY STANDARDS FOR DISTRIBUTED ANTENNA SYSTEM MARKET

6 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 36 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OFFERING

- FIGURE 37 DISTRIBUTED ANTENNA SYSTEM MARKET FOR SERVICE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 17 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 18 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 COMPONENT

- FIGURE 38 RADIO UNIT TO DOMINATE DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 19 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 20 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 21 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMPONENT, 2019-2022 (THOUSAND UNITS)

- TABLE 22 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMPONENT, 2023-2028 (THOUSAND UNITS)

- 6.2.1 ANTENNA NODES/RADIO NODES

- 6.2.1.1 Omnidirectional antennae and directional antennae most common types of antennae

- FIGURE 39 CEILING ANTENNA SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 23 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 24 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 6.2.1.2 Antenna nodes/Radio nodes, by type

- 6.2.1.2.1 Fiberglass antenna

- 6.2.1.2.1.1 Ideal for use as emergency backup antennae

- 6.2.1.2.2 Panel antenna

- 6.2.1.2.2.1 Unidirectional in nature and used in conjunction with interior broadcast antennae in cell booster systems

- 6.2.1.2.3 Wall-mount antenna

- 6.2.1.2.3.1 Designed for use in indoor distributed antenna systems (iDAS) to address coverage issues in buildings

- 6.2.1.2.4 Ceiling antenna

- 6.2.1.2.4.1 Ideal for use in open-plan spaces and drop ceilings

- 6.2.1.2.5 Sector antenna

- 6.2.1.2.5.1 Ideal for creating medium-distance links

- 6.2.1.2.6 Others

- 6.2.1.2.1 Fiberglass antenna

- 6.2.1.2 Antenna nodes/Radio nodes, by type

- TABLE 25 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 26 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY TYPE, 2023-2028 (USD MILLION)

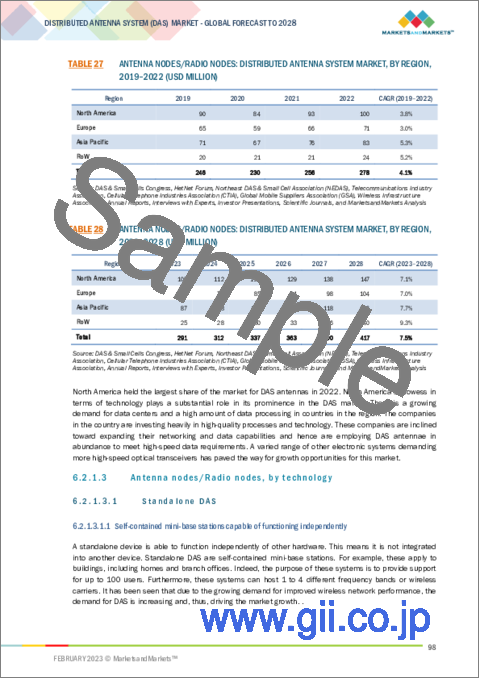

- TABLE 27 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 28 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.1.3 Antenna nodes/Radio nodes, by technology

- 6.2.1.3.1 Standalone DAS

- 6.2.1.3.1.1 Self-contained mini-base stations capable of functioning independently

- 6.2.1.3.2 Integrated antenna

- 6.2.1.3.2.1 Increasing demand for integrated antenna designs in 5G and related applications

- 6.2.1.3.1 Standalone DAS

- 6.2.1.3 Antenna nodes/Radio nodes, by technology

- TABLE 29 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 30 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 6.2.1.4 Antenna nodes/Radio nodes, by coverage

- 6.2.1.4.1 Omni-directional antenna

- 6.2.1.4.1.1 Rising adoption of omnidirectional antennas for indoor applications to push market growth

- 6.2.1.4.2 Directional antenna

- 6.2.1.4.2.1 Consolidating trend of unified communications to fuel demand for directional antennas

- 6.2.1.4.1 Omni-directional antenna

- 6.2.1.4 Antenna nodes/Radio nodes, by coverage

- TABLE 31 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE, 2019-2022 (USD MILLION)

- TABLE 32 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE, 2023-2028 (USD MILLION)

- 6.2.1.5 Antenna nodes/Radio nodes, by configuration

- 6.2.1.5.1 1x1 antenna

- 6.2.1.5.1.1 Used for 2G/3G/4G/5G cellular and Wi-Fi 4/Wi-Fi 6 bands

- 6.2.1.5.2 2x2 antenna

- 6.2.1.5.2.1 2x2 antenna configuration used to increase communication efficiency

- 6.2.1.5.3 4x4 antenna

- 6.2.1.5.3.1 Connects to multiple input/multiple output (MIMO) streams to boost network capacity

- 6.2.1.5.4 Others

- 6.2.1.5.1 1x1 antenna

- 6.2.1.5 Antenna nodes/Radio nodes, by configuration

- TABLE 33 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 34 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 6.2.2 HEAD-END UNITS

- 6.2.2.1 Help to transport signals received by donor antenna to receiver

- 6.2.3 RADIO UNITS

- 6.2.3.1 Receive signals from head-end units and transmit them through antennas

- 6.2.4 BIDIRECTIONAL AMPLIFIERS (BDA)

- 6.2.4.1 Used to amplify downlink signals from donor sites

- 6.2.5 DAS/POINT-OF-INTERFACE (POI) TRAYS

- 6.2.5.1 Provide integrated, convenient, and single connection point when using multiple base stations with common DAS systems

- 6.2.6 OTHERS

- 6.3 SERVICE

- FIGURE 40 INSTALLATION SERVICE TO DOMINATE DISTRIBUTED ANTENNA SYSTEM MARKET FOR SERVICES DURING FORECAST PERIOD

- TABLE 35 DISTRIBUTED ANTENNA SYSTEM MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 36 DISTRIBUTED ANTENNA SYSTEM MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 37 SERVICE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE, 2019-2022 (USD MILLION)

- TABLE 38 SERVICE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE, 2023-2028 (USD MILLION)

- TABLE 39 SERVICE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 40 SERVICE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY TYPE, 2023-2028 (USD MILLION)

- 6.3.1 PRE-SALES SERVICES

- 6.3.1.1 Pres-sales services segment accounted for second-largest share of DAS market for services in 2022

- 6.3.2 INSTALLATION SERVICES

- 6.3.2.1 Installation services segment to dominate DAS market for services during forecast period

- 6.3.3 POST-SALES SERVICES

- 6.3.3.1 Post-sales services held smallest share of DAS market for services in 2022

7 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE

- 7.1 INTRODUCTION

- FIGURE 41 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE

- FIGURE 42 INDOOR COVERAGE SEGMENT TO HOLD LARGER SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 41 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE, 2019-2022 (USD MILLION)

- TABLE 42 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE, 2023-2028 (USD MILLION)

- 7.2 INDOOR

- 7.2.1 IDAS ACCOUNT FOR MAJORITY OF DAS DEPLOYMENT

- FIGURE 43 ACTIVE SEGMENT TO HOLD LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE DURING FORECAST PERIOD

- TABLE 43 INDOOR COVERAGE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 44 INDOOR COVERAGE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 45 ACTIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 46 ACTIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2.2 ACTIVE

- 7.2.2.1 Uses active components to distribute signals

- 7.2.2.2 Analog

- 7.2.2.2.1 Improves efficiency and reliability for machinery and processes

- 7.2.2.3 Digital

- 7.2.2.3.1 Offers data security and fault tolerance

- TABLE 47 ACTIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 48 ACTIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 49 ACTIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMMERCIAL VERTICAL TYPE, 2019-2022 (USD MILLION)

- TABLE 50 ACTIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMMERCIAL VERTICAL TYPE, 2023-2028 (USD MILLION)

- 7.2.3 PASSIVE

- 7.2.3.1 No carrier approval required and considerably cheaper than active DAS

- TABLE 51 PASSIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMMERCIAL VERTICAL TYPE, 2019-2022 (USD MILLION)

- TABLE 52 PASSIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMMERCIAL VERTICAL TYPE, BY TYPE, 2023-2028 (USD MILLION)

- FIGURE 44 COMMERCIAL SEGMENT TO REGISTER HIGHER CAGR IN INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 53 INDOOR: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 54 INDOOR: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 7.2.4 HYBRID

- 7.2.4.1 Offers lower signal loss than purely passive systems

- TABLE 55 HYBRID: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMMERCIAL VERTICAL TYPE, 2019-2022(USD MILLION)

- TABLE 56 HYBRID: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMMERCIAL VERTICAL TYPE, 2023-2028 (USD MILLION)

- 7.3 OUTDOOR

- 7.3.1 USED TO SERVE OUTDOOR AREAS OF HIGH-DENSITY URBAN AND SUBURBAN ENVIRONMENTS

- TABLE 57 OUTDOOR: DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMMERCIAL VERTICAL, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 58 OUTDOOR: DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMMERCIAL VERTICAL, BY TYPE, 2023-2028 (USD MILLION)

8 DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP MODEL

- 8.1 INTRODUCTION

- FIGURE 45 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OWNERSHIP MODEL

- FIGURE 46 NEUTRAL-HOST OWNERSHIP SEGMENT TO REGISTER HIGHEST CAGR IN DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 59 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OWNERSHIP MODEL, 2019-2022 (USD MILLION)

- TABLE 60 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OWNERSHIP MODEL, 2023-2028 (USD MILLION)

- TABLE 61 DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMPONENTS, BY OWNERSHIP MODEL, 2019-2022 (USD MILLION)

- TABLE 62 DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMPONENTS, BY OWNERSHIP MODEL, 2023-2028 (USD MILLION)

- TABLE 63 DISTRIBUTED ANTENNA SYSTEM MARKET FOR SERVICES, BY OWNERSHIP MODEL, 2019-2022 (USD MILLION)

- TABLE 64 DISTRIBUTED ANTENNA SYSTEM MARKET FOR SERVICES, BY OWNERSHIP MODEL, 2023-2028 (USD MILLION)

- FIGURE 47 NEUTRAL-HOST OWNERSHIP SEGMENT TO HOLD LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET FOR INDOOR COVERAGE IN 2028

- TABLE 65 DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET FOR INDOOR COVERAGE, BY OWNERSHIP MODEL, 2019-2022 (USD MILLION)

- TABLE 66 DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET FOR INDOOR COVERAGE, BY OWNERSHIP MODEL, 2023-2028 (USD MILLION)

- TABLE 67 DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET FOR OUTDOOR COVERAGE, BY OWNERSHIP MODEL, 2019-2022 (USD MILLION)

- TABLE 68 DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET FOR OUTDOOR COVERAGE, BY OWNERSHIP MODEL, 2023-2028 (USD MILLION)

- TABLE 69 DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET FOR INDOOR COVERAGE, BY OWNERSHIP MODEL, 2019-2022 (USD MILLION)

- TABLE 70 DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET FOR INDOOR COVERAGE, BY OWNERSHIP MODEL, 2023-2028 (USD MILLION)

- TABLE 71 DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET FOR OUTDOOR COVERAGE, BY OWNERSHIP MODEL, 2019-2022 (USD MILLION)

- TABLE 72 DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET FOR OUTDOOR COVERAGE, BY OWNERSHIP MODEL, 2023-2028 (USD MILLION)

- 8.2 CARRIER OWNERSHIP

- 8.2.1 CARRIER OWNERSHIP MODEL HELD LARGEST MARKET SHARE IN 2022

- 8.3 NEUTRAL-HOST OWNERSHIP

- 8.3.1 PREFERRED FOR DAS DEPLOYMENTS AT LARGE VENUES, SUCH AS STADIUMS, MALLS, AND AIRPORTS

- 8.4 ENTERPRISE OWNERSHIP

- 8.4.1 STANDARDIZATION OF 5G TO FAVOR MARKET GROWTH

9 DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY AREA

- 9.1 INTRODUCTION

- FIGURE 48 DISTRIBUTED ANTENNA SYSTEM MARKET, BY USER FACILITY AREA

- FIGURE 49 >500 K SQ. FT. USER FACILITIES TO HOLD LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 73 DISTRIBUTED ANTENNA SYSTEM MARKET, BY USER FACILITY AREA, 2019-2022 (USD MILLION)

- TABLE 74 DISTRIBUTED ANTENNA SYSTEM MARKET, BY USER FACILITY AREA, 2023-2028 (USD MILLION)

- 9.2 >500 K SQ. FT.

- 9.2.1 >500 K SQ. FT. SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 9.3 200-500 K SQ. FT.

- 9.3.1 GROWING ADOPTION OF DAS IN USER FACILITY AREAS OF 200-500 K SQ. FT. TO ENSURE DATA SECURITY AND PRIVACY TO DRIVE MARKET

- 9.4 <200 K SQ. FT.

- 9.4.1 <200 K SQ. FT. SEGMENT TO HOLD SMALLER MARKET SHARE THAN OTHER SEGMENTS DURING FORECAST PERIOD

10 DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- FIGURE 50 DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL

- FIGURE 51 PUBLIC SAFETY SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 75 DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 76 DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 77 DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMPONENTS, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 78 DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMPONENTS, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 79 DISTRIBUTED ANTENNA SYSTEM MARKET FOR SERVICES, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 80 DISTRIBUTED ANTENNA SYSTEM MARKET FOR SERVICES, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2 COMMERCIAL

- FIGURE 52 DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMMERCIAL VERTICAL

- FIGURE 53 HEALTHCARE TO DOMINATE DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMMERCIAL VERTICAL DURING FORECAST PERIOD

- TABLE 81 DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2019-2022 (USD MILLION)

- TABLE 82 DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2023-2028 (USD MILLION)

- 10.2.1 PUBLIC VENUES

- 10.2.1.1 Use combination of DAS and small cells to offer cellular access to public

- FIGURE 54 ASIA PACIFIC DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN PUBLIC VENUES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 83 PUBLIC VENUES: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 84 PUBLIC VENUES: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023-2028 (USD MILLION)

- 10.2.2 HOSPITALITY

- 10.2.2.1 Deploys DAS to ensure seamless wireless connectivity

- FIGURE 55 ASIA PACIFIC DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN HOSPITALITY VERTICAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 85 HOSPITALITY: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 86 HOSPITALITY: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023-2028 (USD MILLION)

- 10.2.3 HEALTHCARE

- 10.2.3.1 Deploys in-building wireless solutions to maximize operational efficiency and improve patient care

- FIGURE 56 ASIA PACIFIC DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN HEALTHCARE VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 87 HEALTHCARE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 88 HEALTHCARE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023-2028 (USD MILLION)

- 10.2.4 EDUCATION

- 10.2.4.1 Implements CBRS-based private mobile networks to eliminate problem of unreliable coverage

- FIGURE 57 ROW DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN EDUCATION VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 89 EDUCATION: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 90 EDUCATION: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023-2028 (USD MILLION)

- 10.2.5 ENTERPRISE

- 10.2.5.1 Uses DAS to extend coverage and capacity for public mobile network connectivity

- FIGURE 58 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN ENTERPRISE VERTICAL DURING FORECAST PERIOD

- TABLE 91 ENTERPRISE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 92 ENTERPRISE: DAS MARKET FOR INDOOR COVERAGE, BY REGION, 2023-2028 (USD MILLION)

- 10.2.6 RETAIL

- 10.2.6.1 CBRS-based private mobile networks utilized for surveillance and secure staff communication

- FIGURE 59 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN RETAIL VERTICAL DURING FORECAST PERIOD

- TABLE 93 RETAIL: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 94 RETAIL: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023-2028 (USD MILLION)

- 10.2.7 AIRPORT & TRANSPORTATION

- 10.2.7.1 BTS signal sources enable addition of extra capacity in high-occupancy areas

- FIGURE 60 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN AIRPORT & TRANSPORTATION DURING FORECAST PERIOD

- TABLE 95 AIRPORT & TRANSPORTATION: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 96 AIRPORT & TRANSPORTATION: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 97 AIRPORT & TRANSPORTATION: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 98 AIRPORT & TRANSPORTATION: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY REGION, 2023-2028 (USD MILLION)

- 10.2.8 INDUSTRIAL

- 10.2.8.1 Industry 4.0 to increase deployment of distributed antenna systems in industrial vertical

- FIGURE 61 ASIA PACIFIC TO DOMINATE DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN INDUSTRIAL VERTICAL DURING FORECAST PERIOD

- TABLE 99 INDUSTRIAL: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 100 INDUSTRIAL: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 101 INDUSTRIAL: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 102 INDUSTRIAL: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY REGION, 2023-2028 (USD MILLION)

- 10.2.9 GOVERNMENT

- 10.2.9.1 DAS enable effective cellular connectivity, ensure efficient workforce management, and support mission-critical communication services

- FIGURE 62 NORTH AMERICA TO CAPTURE LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN GOVERNMENT VERTICAL DURING FORECAST PERIOD

- TABLE 103 GOVERNMENT: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 104 GOVERNMENT: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023-2028 (USD MILLION)

- 10.3 PUBLIC SAFETY

- 10.3.1 DAS IMPLEMENTATION ENSURES RADIO COMMUNICATION THROUGHOUT BUILDING IN EVENT OF EMERGENCY

- FIGURE 63 NORTH AMERICA TO DOMINATE DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN PUBLIC SAFETY VERTICAL DURING FORECAST PERIOD

- TABLE 105 PUBLIC SAFETY: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 106 PUBLIC SAFETY: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023-2028 (USD MILLION)

11 DISTRIBUTED ANTENNA SYSTEM MARKET, BY FREQUENCY PROTOCOL

- 11.1 INTRODUCTION

- FIGURE 64 DISTRIBUTED ANTENNA SYSTEM MARKET, BY FREQUENCY PROTOCOL

- FIGURE 65 CELLULAR FREQUENCY PROTOCOL TO DOMINATE DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 107 DISTRIBUTED ANTENNA SYSTEM MARKET, BY FREQUENCY PROTOCOL, 2019-2022 (USD MILLION)

- TABLE 108 DISTRIBUTED ANTENNA SYSTEM MARKET, BY FREQUENCY PROTOCOL, 2023-2028 (USD MILLION)

- 11.2 CELLULAR

- 11.2.1 5G ROLLOUT TO BOOST DEMAND FOR DISTRIBUTED ANTENNA SYSTEMS FOR CELLULAR FREQUENCY PROTOCOL DURING FORECAST PERIOD

- TABLE 109 5G FREQUENCY BANDS IN DIFFERENT REGIONS/COUNTRIES

- FIGURE 66 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF CELLULAR DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 110 CELLULAR: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 111 CELLULAR: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 VERY HIGH FREQUENCY/ULTRA-HIGH FREQUENCY (VHF/UHF)

- 11.3.1 INCREASING DEPLOYMENT OF PUBLIC SAFETY NETWORKS TO FUEL DEMAND FOR VHF/UFH DAS

- FIGURE 67 ASIA PACIFIC VHF/UHF DISTRIBUTED ANTENNA SYSTEM MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 112 VHF/UHF: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 113 VHF/UHF: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.4 OTHERS

- FIGURE 68 NORTH AMERICA TO HOLD LARGEST SHARE OF OTHERS DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 114 OTHERS: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 115 OTHERS: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 116 DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY FREQUENCY PROTOCOL, 2019-2022 (USD MILLION)

- TABLE 117 DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY FREQUENCY PROTOCOL, 2023-2028 (USD MILLION)

- TABLE 118 DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY FREQUENCY PROTOCOL, 2019-2022 (USD MILLION)

- TABLE 119 DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY FREQUENCY PROTOCOL, 2023-2028 (USD MILLION)

12 DISTRIBUTED ANTENNA SYSTEM MARKET, BY NETWORK TYPE

- 12.1 INTRODUCTION

- FIGURE 69 DISTRIBUTED ANTENNA SYSTEM MARKET, BY NETWORK TYPE

- FIGURE 70 PUBLIC NETWORK TO ACCOUNT FOR LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 120 DISTRIBUTED ANTENNA SYSTEM MARKET, BY NETWORK TYPE, 2019-2022 (USD MILLION)

- TABLE 121 DISTRIBUTED ANTENNA SYSTEM MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- 12.2 PUBLIC NETWORK

- 12.2.1 STRINGENT GOVERNMENT REGULATIONS FOR SEAMLESS CELLULAR NETWORK COVERAGE TO BOOST DEMAND FOR DAS

- FIGURE 71 NORTH AMERICA TO DOMINATE PUBLIC NETWORK DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 122 PUBLIC NETWORK: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 123 PUBLIC NETWORK: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.3 PRIVATE LONG-TERM EVOLUTION (LTE)/CITIZENS BROADBAND RADIO SERVICE (CBRS)

- 12.3.1 PRIVATE LTE/CBRS OFFERS SEPARATE OR PRIVATE WIRELESS NETWORKS FOR BUSINESSES AND GOVERNMENTS FOR DIFFERENT APPLICATIONS

- FIGURE 72 NORTH AMERICA TO HOLD LARGEST SHARE OF PRIVATE NETWORK DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 124 PRIVATE LTE/CBRS: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 125 PRIVATE LTE/CBRS: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 126 DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY NETWORK TYPE, 2019-2022 (USD MILLION)

- TABLE 127 DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- TABLE 128 DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY NETWORK TYPE, 2019-2022 (USD MILLION)

- TABLE 129 DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY NETWORK TYPE, 2023-2028 (USD MILLION)

13 DISTRIBUTED ANTENNA SYSTEM MARKET, BY SIGNAL SOURCE

- 13.1 INTRODUCTION

- FIGURE 73 DISTRIBUTED ANTENNA SYSTEM MARKET, BY SIGNAL SOURCE

- FIGURE 74 DISTRIBUTED ANTENNA SYSTEM MARKET FOR SMALL CELLS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 130 DISTRIBUTED ANTENNA SYSTEM MARKET, BY SIGNAL SOURCE, 2019-2022 (USD MILLION)

- TABLE 131 DISTRIBUTED ANTENNA SYSTEM MARKET, BY SIGNAL SOURCE, 2023-2028 (USD MILLION)

- 13.2 OFF-AIR ANTENNAS (REPEATERS)

- 13.2.1 DAS WITH OFF-AIR SIGNAL SOURCE USED TO EXTEND NETWORK COVERAGE AT EDGES OF NETWORK

- 13.3 ON-SITE BASE TRANSCEIVER STATION (BTS)

- 13.3.1 BTS RESPONSIBLE FOR CONNECTING MOBILE DEVICES TO NETWORK

- 13.4 SMALL CELLS

- 13.4.1 HAVE UNIQUE CAPABILITY TO HANDLE HIGH DATA RATES FOR MOBILE BROADBAND AND IOT

- TABLE 132 TYPES OF SMALL CELLS

- TABLE 133 COMPARISON BETWEEN OFF-AIR ANTENNAS, ON-SITE BTS, AND

- SMALL CELLS

14 DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION

- 14.1 INTRODUCTION

- FIGURE 75 DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMPONENTS, BY COUNTRY

- FIGURE 76 DISTRIBUTED ANTENNA SYSTEM MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 134 DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 135 DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 136 DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 137 DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 138 DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 139 DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.2 NORTH AMERICA

- FIGURE 77 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM MARKET SNAPSHOT

- TABLE 140 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET,

- BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET,

- BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2019-2022 (USD MILLION)

- TABLE 147 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2023-2028 (USD MILLION)

- TABLE 148 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 149 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY VERTICAL, 2023-2028 (USD MILLION)

- 14.2.1 US

- 14.2.1.1 Advent of 5G network and growing use of mobile IoT applications to drive market

- 14.2.2 CANADA

- 14.2.2.1 Increasing demand for high-speed wired and wireless networking services to support market growth

- 14.2.3 MEXICO

- 14.2.3.1 Rising demand for 5G technology and increase in internet data traffic to propel market growth

- 14.3 EUROPE

- FIGURE 78 EUROPE: DISTRIBUTED ANTENNA SYSTEM MARKET SNAPSHOT

- TABLE 150 EUROPE: DAS COMPONENT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 151 EUROPE: DAS COMPONENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 152 EUROPE: DAS SERVICE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 153 EUROPE: DAS SERVICE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 154 EUROPE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 155 EUROPE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 156 EUROPE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2019-2022 (USD MILLION)

- TABLE 157 EUROPE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2023-2028 (USD MILLION)

- TABLE 158 EUROPE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2019-2022 (USD MILLION)

- TABLE 159 EUROPE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2023-2028 (USD MILLION)

- 14.3.1 UK

- 14.3.1.1 Focus on development of 5G infrastructure to drive market

- 14.3.2 GERMANY

- 14.3.2.1 Digital transformation initiatives to fuel demand for DAS

- 14.3.3 FRANCE

- 14.3.3.1 Presence of several big telecom operators to generate demand for DAS

- 14.3.4 NETHERLANDS

- 14.3.4.1 LTE-M and NB-IoT cellular developments to propel market growth

- 14.3.5 REST OF EUROPE

- 14.4 ASIA PACIFIC

- FIGURE 79 ASIA PACIFIC: DISTRIBUTED ANTENNA SYSTEM MARKET SNAPSHOT

- TABLE 160 ASIA PACIFIC: DAS COMPONENT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 161 ASIA PACIFIC: DAS COMPONENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: DAS SERVICE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: DAS SERVICE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 165 ASIA PACIFIC: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 166 ASIA PACIFIC: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2019-2022 (USD MILLION)

- TABLE 167 ASIA PACIFIC: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2023-2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2019-2022 (USD MILLION)

- TABLE 169 ASIA PACIFIC: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2023-2028 (USD MILLION)

- 14.4.1 CHINA

- 14.4.1.1 5G development initiatives and smart city projects to accelerate market

- 14.4.2 JAPAN

- 14.4.2.1 Increasing number of IoT connections and government initiatives to promote 5G network to induce market growth

- 14.4.3 SOUTH KOREA

- 14.4.3.1 Increasing DAS deployments in enterprises to drive market

- 14.4.4 INDIA

- 14.4.4.1 DAS component and DAS service markets in India to grow at highest rate during forecast period

- 14.4.5 REST OF ASIA PACIFIC

- 14.5 REST OF THE WORLD

- FIGURE 80 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM MARKET SNAPSHOT

- TABLE 170 REST OF THE WORLD: DAS COMPONENT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 171 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 172 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 173 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 174 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 175 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 176 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2019-2022 (USD MILLION)

- TABLE 177 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2023-2028 (USD MILLION)

- TABLE 178 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 179 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY VERTICAL, 2023-2028 (USD MILLION)

- 14.5.1 MIDDLE EAST

- 14.5.1.1 Increasing deployment of DAS in public venues and educational institutes to augment market growth

- 14.5.2 AFRICA

- 14.5.2.1 Rapid automation in industries and high investments in commercial sector to boost market growth

- 14.5.2.2 Country-wise snippets

- 14.5.3 SOUTH AMERICA

- 14.5.3.1 Increasing internet penetration and significant developments in cellular networks to favor market expansion

- 14.5.4 BRAZIL

- 14.5.4.1 Strong presence of various DAS players to support market growth

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 180 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN DAS MARKET

- 15.2.1 PRODUCT PORTFOLIO

- 15.2.2 REGIONAL FOCUS

- 15.2.3 ORGANIC/INORGANIC GROWTH STRATEGIES

- 15.3 MARKET SHARE ANALYSIS, 2021

- TABLE 181 DISTRIBUTED ANTENNA SYSTEM MARKET: DEGREE OF COMPETITION

- 15.4 REVENUE ANALYSIS OF TOP PLAYERS IN DISTRIBUTED ANTENNA SYSTEM MARKET

- FIGURE 81 THREE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN DISTRIBUTED ANTENNA SYSTEM MARKET

- 15.5 COMPANY EVALUATION QUADRANT

- 15.5.1 STARS

- 15.5.2 PERVASIVE PLAYERS

- 15.5.3 EMERGING LEADERS

- 15.5.4 PARTICIPANTS

- FIGURE 82 DISTRIBUTED ANTENNA SYSTEM MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

- 15.6 STARTUPS/SMES EVALUATION QUADRANT

- 15.6.1 PROGRESSIVE COMPANIES

- 15.6.2 RESPONSIVE COMPANIES

- 15.6.3 DYNAMIC COMPANIES

- 15.6.4 STARTING BLOCKS

- FIGURE 83 DISTRIBUTED ANTENNA SYSTEM MARKET (GLOBAL): STARTUPS/SMES EVALUATION QUADRANT, 2021

- 15.7 COMPANY FOOTPRINT

- TABLE 182 COMPANY FOOTPRINT

- TABLE 183 OFFERING FOOTPRINT OF COMPANIES

- TABLE 184 VERTICAL FOOTPRINT OF COMPANIES

- TABLE 185 REGION FOOTPRINT OF COMPANIES

- TABLE 186 DISTRIBUTED ANTENNA SYSTEM MARKET: LIST OF KEY START-UPS/SMES

- TABLE 187 DISTRIBUTED ANTENNA SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 15.8 COMPETITIVE SCENARIOS AND TRENDS

- 15.8.1 PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 188 DISTRIBUTED ANTENNA SYSTEM MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2019- JANUARY 2023

- 15.8.2 DEALS

- TABLE 189 DISTRIBUTED ANTENNA SYSTEM MARKET: DEALS, JANUARY 2019- JANUARY 2023

- 15.8.3 OTHERS

- TABLE 190 DISTRIBUTED ANTENNA SYSTEM MARKET: OTHERS, JANUARY 2019- JANUARY 2023

16 COMPANY PROFILES

(Business Overview, Products/Services/Solutions offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

- 16.1 KEY PLAYERS

- 16.1.1 COMMSCOPE

- TABLE 191 COMMSCOPE: COMPANY OVERVIEW

- FIGURE 84 COMMSCOPE: COMPANY SNAPSHOT

- TABLE 192 COMMSCOPE: PRODUCT LAUNCHES

- TABLE 193 COMMSCOPE: DEALS

- 16.1.2 CORNING INCORPORATED

- TABLE 194 CORNING INCORPORATED: COMPANY OVERVIEW

- FIGURE 85 CORNING INCORPORATED: COMPANY SNAPSHOT

- TABLE 195 CORNING INCORPORATED: PRODUCT LAUNCHES

- TABLE 196 CORNING INCORPORATED: DEALS

- TABLE 197 CORNING INCORPORATED: OTHERS

- 16.1.3 COMBA TELECOM SYSTEMS HOLDINGS LTD.

- TABLE 198 COMBA TELECOM SYSTEMS HOLDINGS LTD.: COMPANY OVERVIEW

- FIGURE 86 COMBA TELECOM SYSTEMS HOLDINGS LTD.: COMPANY SNAPSHOT

- TABLE 199 COMBA TELECOM SYSTEMS HOLDINGS LTD.: PRODUCT LAUNCHES

- TABLE 200 COMBA TELECOM SYSTEMS HOLDINGS LTD.: DEALS

- 16.1.4 PBE GROUP

- TABLE 201 PBE GROUP: COMPANY OVERVIEW

- 16.1.5 SOLID

- TABLE 202 SOLID: COMPANY OVERVIEW

- FIGURE 87 SOLID: COMPANY SNAPSHOT

- TABLE 203 SOLID: PRODUCT LAUNCHES

- 16.1.6 AMERICAN TOWER

- TABLE 204 AMERICAN TOWER: COMPANY OVERVIEW

- FIGURE 88 AMERICAN TOWER: COMPANY SNAPSHOT

- TABLE 205 AMERICAN TOWER: DEALS

- 16.1.7 AT&T

- TABLE 206 AT&T: COMPANY OVERVIEW

- FIGURE 89 AT&T: COMPANY SNAPSHOT

- 16.1.8 BOINGO WIRELESS, INC.

- TABLE 207 BOINGO WIRELESS, INC.: COMPANY OVERVIEW

- TABLE 208 BOINGO WIRELESS, INC.: DEALS

- 16.1.9 DALI WIRELESS

- TABLE 209 DALI WIRELESS: COMPANY OVERVIEW

- TABLE 210 DALI WIRELESS: DEALS

- 16.1.10 ZINWAVE

- TABLE 211 ZINWAVE: COMPANY OVERVIEW

- TABLE 212 ZINWAVE: PRODUCT LAUNCHES

- TABLE 213 ZINWAVE: DEALS

- 16.2 OTHER PLAYERS

- 16.2.1 WHOOP WIRELESS

- 16.2.2 KATHREIN BROADCAST GMBH

- 16.2.3 HUBER+SUHNER

- 16.2.4 BTI WIRELESS

- 16.2.5 JMA WIRELESS

- 16.2.6 WESTELL TECHNOLOGIES, INC.

- 16.2.7 ADVANCED RF TECHNOLOGIES, INC.

- 16.2.8 GALTRONICS

- 16.2.9 CONNECTIVITY WIRELESS

- 16.2.10 BETACOM INC.

- 16.2.11 AIRPLUX TECHNOLOGIES LIMITED

- 16.2.12 CELLNEX TELECOM

- 16.2.13 VISION TECHNOLOGIES

- 16.2.14 VERIDAS TECHNOLOGIES

- 16.2.15 HARRIS COMMUNICATIONS

Details on Business Overview, Products/Services/Solutions offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS