|

|

市場調査レポート

商品コード

1239428

熱電発電機の世界市場:用途別 (廃熱回収、エネルギーハーベスティング、直接発電、コージェネレーション)・温度別 (80℃以下、80~500℃、500℃以上)・ワット数別・種類別・材料別・業種別・コンポーネント別・地域別の将来予測 (2027年まで)Thermoelectric Generators Market by Application (Waste Heat Recovery, Energy Harvesting, Direct Power Generation, Co-Generation), Temperature (<80, 80-500, >500) Wattage, Type, Material, Vertical, Component, Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 熱電発電機の世界市場:用途別 (廃熱回収、エネルギーハーベスティング、直接発電、コージェネレーション)・温度別 (80℃以下、80~500℃、500℃以上)・ワット数別・種類別・材料別・業種別・コンポーネント別・地域別の将来予測 (2027年まで) |

|

出版日: 2023年03月10日

発行: MarketsandMarkets

ページ情報: 英文 272 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の熱電発電機の市場規模は、2022年の7億6,100万米ドルから、2027年には12億3,300万米ドルへと拡大し、2022年から2027年にかけて10.1%のCAGRで成長すると予測されます。

厳しい排ガス規制の中での燃費向上ニーズの拡大が、予測期間中の市場成長を促進します。

熱電発電機 (TEG) は各種業界において、遠隔地における電源の需要により、TEGの採用が増加しています。石油・ガス産業では、ガス燃料熱電発電機 (GTEG) が状態監視センサーの電源として使用されています。この発電機は、非常に信頼性の高い直流電源であるためです。この発電機は、材料の劣化 (腐食)、パイプラインの管理、温室効果ガス排出の制御の監視に役立ちます。また、鉱業では、エネルギー消費を削減し、再生可能なエネルギー源を利用するための新しい技術や方法の適用に注力しています。TEGは、深く掘り下げた採掘活動のためのセンサーに使用されています。

"用途別では、直接発電分野が予測期間中に最も高い成長率で成長する"

世界の熱電発電機市場を用途別見ると、直接発電向けのセグメントが、2022年~2027年に大幅な成長率を示します。直接発電の効率は、熱電発電機だけに限らず、システム全体の効率にも左右されます。システム効率に影響を与える様々な要因は、燃焼効率、排ガス回収、システム熱損失、ファンの消費電力、ポンプの消費電力、パワーコンディショナーの損失などです。このため、直接発電は長寿命で小型の電源として、数多くの用途で使用されています。航空宇宙・鉱業・工業分野での熱電発電機の需要増加が、予測期間中、直接発電のセグメントを牽引すると予想されます。

"業種別では、自動車が基準年に最大のシェアを占めた"

熱電発電機市場を業種別に見ると、自動車セグメントが基準年において最大のシェアを占めています。自動車の製造台数は2020年から2021年の間に3%増加しました。Volkswagen、BMW、Volvoなどの自動車メーカーは、NASAと協力して、燃費向上のための熱電式廃熱回収装置を開発しています。同様に、これらの発電機 (温度差熱発電機) を使ってワイヤレスセンサーに電力を供給すれば、バッテリーの寿命や信頼性の問題が解消されます。熱電発電機とその活用領域におけるこのような進歩が、エンドユーザー側の採用促進につながっています。

"欧州は2022年から2027年の間に高い成長率で成長する"

欧州は予測期間中、より高いCAGRで成長すると予測されます。自動車からのC02排出に関する規制が厳しくなっていることが、欧州のTEG市場を牽引する大きな要因の一つとなっています。EUは、世界最大の再生可能エネルギー利用地域です。EUの電力の約26%、EUの冷暖房産業の17%、EUの輸送エネルギーの6%が再生可能エネルギー源に由来しています。欧州では、電力分野での利用増加や、各種産業での再生可能エネルギー電力の需要増大などを受けて、再生可能エネルギー全体への投資額が大きくなっています。このため、域内の熱電発電機の需要に拍車がかかると予想されます。

当レポートでは、世界の熱電発電機の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、用途別・業種別・種類別・温度別・ワット数別・材料別・コンポーネント別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 熱電発電機市場のエコシステム

- ポーターのファイブフォース分析

- 関税・規制状況

- 貿易データ

- 不況の影響分析

- 平均販売価格

- 主な利害関係者と購入基準

- 主な会議とイベント

第6章 業界動向

- イントロダクション

- 技術動向

- 自動車排気熱電発電機

- ウェアラブル熱電発電機

- 小型熱電発電機

- 太陽熱発電機

- 放射性同位体熱電発電機

- 航空宇宙向け熱電発電機

- 熱電材料の進歩

- 技術分析

- 軟質熱電材料

- 自己修復型・ウェアラブル熱電デバイス

- ユースケース

- メガトレンドの影響

- イノベーションと特許登録

- 熱電冷却器

第7章 熱電発電機市場:用途別

- イントロダクション

- 廃熱回収

- エネルギーハーベスティング (環境発電)

- 直接発電

- コージェネレーション

第8章 熱電発電機市場:業種別

- イントロダクション

- 自動車

- 内燃機関車 (ICE)

- 電気自動車

- 航空宇宙・防衛

- 航空

- 防衛

- 造船

- 軍艦

- 商船

- 工業用

- 化学処理

- アルミニウム製造工場・製鋼所

- ガラス・金属製造工場

- 消費者

- ウェアラブル

- 家電

- 医療

- 埋込型

- ウェアラブル

- 石油・ガス

- 鉱業

- 電気通信

- データセンター

- 通信塔

第9章 熱電発電機市場:種類別

- イントロダクション

- 単段式

- 多段式

第10章 熱電発電機市場:温度別

- イントロダクション

- 低温 (80℃以下)

- 中温 (80~500℃)

- 高温 (500℃以上)

第11章 熱電発電機市場:ワット数別

- イントロダクション

- 低出力 (10W以下)

- 中出力 (10W~1kW)

- 高出力 (1kW以上)

第12章 熱電発電機市場:材料別

- イントロダクション

- テルル化ビスマス

- テルル化鉛

- その他の材料

第13章 熱電発電機市場:コンポーネント別

- イントロダクション

- 熱源

- 熱電モジュール

- コールドサイド

- 電気負荷

第14章 熱電発電機市場:地域別

- イントロダクション

- 不況の影響分析

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- スウェーデン

- ロシア

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- ラテンアメリカ

- 中東

- アフリカ

第15章 競合情勢

- イントロダクション

- 企業概要

- ランク分析 (2021年)

- 収益分析 (2018年~2021年)

- 市場シェア分析 (2021年)

- 競合評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 競合ベンチマーキング

- 競合シナリオ

- 市場評価フレームワーク

- 製品の発売

- 資本取引

- その他

第16章 企業プロファイル

- イントロダクション

- 主要企業

- GENTHERM INC.

- COHERENT CORP.

- FERROTEC HOLDINGS CORPORATION

- LAIRD THERMAL SYSTEMS, INC.

- TECTEG MFR.

- KOMATSU LTD.

- YAMAHA CORPORATION

- TOSHIBA CORPORATION

- MAHLE GMBH

- MURATA MANUFACTURING CO., LTD.

- CUI DEVICES

- ANALOG DEVICES, INC.

- FAURECIA SE

- KYOCERA CORPORATION

- TEC MICROSYSTEMS GMBH

- RIF CORPORATION

- PHONONIC, INC.

- RMT LTD.

- KRYOTHERM

- EVERREDTRONICS LTD.

- HI-Z TECHNOLOGY

- PERPETUA POWER SOURCE TECHNOLOGIES, INC.

- ALIGN SOURCING LLC

- TELEDYNE ENERGY SYSTEMS, INC.

- その他の企業

- P&N TECHNOLOGY (XIAMEN) CO., LTD.

- TE TECHNOLOGY, INC.

- BRIMROSE CORPORATION

- BENTEK SYSTEMS

- WELLEN TECHNOLOGY CO., LTD.

- RGS DEVELOPMENT BV

- PL ENGINEERING LTD.

- MICROPELT

- SHEETAK

- GREENTEG AG

第17章 付録

The thermoelectric generators market is projected to grow from USD 761 Million in 2022 to USD 1,233 Million by 2027, at a CAGR of 10.1% from 2022 to 2027. Growing need for fuel efficiency amidst stringent emission control norms to drive market growth during the forecast period.

Thermoelectric generators (TEG) are used for power generation across automotive, aerospace & defense, industrial, consumer electronics, healthcare, oil & gas mining, and telecommunications industries. The adoption of TEGs in these verticals is increasing, owing to the demand for power sources in remote areas. In the oil & gas industry, gas fuel thermoelectric generators (GTEGs) are used to power condition monitoring sensors as these generators are extremely reliable electric DC power sources. They help monitor material degradation (corrosion), pipeline management, and control of greenhouse gas emissions. Moreover, in mining industry is focusing on applying new technologies and methods to reduce energy consumption and use renewable energy sources. TEGs are used in sensors for deep-down mining activities.

Based on application, directed power generation segment is projected to grow at fastest growth rate during forecast period

Based on application, the thermoelectric generators market is segmented into energy harvesting, waste heat recovery, direct power generation, and co-generation. Among these, directed power generation application segment witness strong growth during 2022-2027. Efficiency in direct power generation is not only limited to thermoelectric generators; it also depends on overall system efficiency. Various factors that affect system efficiency are combustion efficiency, recovery of the exhaust gases, system heat losses, fan power consumption, pump power, and power conditioning losses. Due to this, direct power generation is used in long life and smaller power sources for numerous applications. Increasing demand for thermoelectric generators in the aerospace, mining, and industrial sectors is expected to drive the direct power generation segment during the forecast period.

Based on vertical, Automotive held largest share in base year

Based on vertical, the thermoelectric generators market is segmented into automotive, aerospace & defense, marine, industrial, consumer, healthcare, oil & gas, mining, and telecommunications. Among these, automotive segment held largest share in base year. According to the International Organization of Motor Vehicle Manufacturers (OICA) 2021, vehicle manufacturing increased by 3% between 2020 and 2021. Automobile manufacturers such as Volkswagen, BMW, and Volvo are working with NASA to develop thermoelectric waste heat recovery devices for fuel economy. Similarly, using these generators (with temperature differentials) to power wireless sensors would eliminate battery longevity and reliability difficulties. Such advancements in thermoelectric generators and their applications improve end-user adoption trends.

Europe is anticipated to grow at higher growth rate during 2022-2027

Europe is anticipated to grow at higher CAGR during the forecast period. Increasingly stringent regulations related to C02 emissions from vehicles are one of the major factors driving the market for TEGs in Europe. The EU is the world's largest region that uses renewable energy. According to Eurostat, roughly 26% of the EU's electricity, 17% of the EU heating and cooling industry, and 6% of EU transport energy are derived from renewable energy sources. Europe invests significantly in total renewable energy, owing to its increasing use in the power sector and the growing demand for renewable electrical energy across various industries. This, in turn, is expected to fuel the demand for thermoelectric generators in the region.

The break-up of the profiles of primary participants in the thermoelectric generators market is as follows:

- By Company Type: Tier 1-35%; Tier 2-45%; and Tier 3-20%

- By Designation: C Level Executives-35%; Directors-25%; and Others-40%

- By Region: Asia Pacific-30%; North America-40%; Europe-20%; and Rest of the World-10%

Major players in the thermoelectric generators market are Coherent Corp. (US), Gentherm Inc. (US), Ferrotec Holdings Corporation (Japan), Laird Thermal Systems, Inc. (UK), and Komatsu Ltd. (Japan). These companies adopted strategies including new product launches, new service launches, contracts, partnerships, agreements, collaborations, and expansions. Also focusing on expanding distribution networks in North America, Europe, Asia Pacific, and Rest of the World in turn driving the demand for thermoelectric generators market.

Research Coverage

This research report categorizes classified the thermoelectric generators market into platform, application, range, technology, product, and region. The thermoelectric generators market has been studied for North America, Europe, Asia Pacific, and Rest of the World.

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the thermoelectric generators market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solution; key strategies; contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches associated with the thermoelectric generators market. Competitive analysis of upcoming startups in the thermoelectric generators market ecosystem is covered in this report.

Reasons to Buy this Report

This report is expected to help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall thermoelectric generators market and its segments. This study is also expected to provide application and vertical-wise information, wherein TEG with different power and material is used for different applications and verticals. This report aims at helping the stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. This report is also expected to help them understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities influencing the growth of the market.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on thermoelectric generator system offered by the top players in the market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product and services launches in the thermoelectric generators market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the thermoelectric generators market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the thermoelectric generators market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the thermoelectric generators market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 THERMOELECTRIC GENERATORS MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.3.3 REGIONS COVERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATE

- 1.6 MARKET STAKEHOLDERS

- 1.7 LIMITATIONS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primary interviews

- 2.2 IMPACT OF RECESSION ON THERMOELECTRIC GENERATORS MARKET

- FIGURE 4 IMPACT OF RECESSION ON REVENUE OF KEY PLAYERS

- 2.3 FACTOR ANALYSIS

- 2.3.1 INTRODUCTION

- 2.3.2 DEMAND-SIDE INDICATORS

- 2.3.3 SUPPLY-SIDE INDICATORS

- 2.4 RESEARCH APPROACH AND METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Market size estimation

- 2.4.1.2 Regional split of thermoelectric generators market

- FIGURE 5 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 DATA TRIANGULATION AND VALIDATION

- 2.5.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- FIGURE 7 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- FIGURE 8 RESEARCH ASSUMPTIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 9 WASTE HEAT RECOVERY SEGMENT HELD HIGHEST MARKET SHARE IN 2022

- FIGURE 10 MEDIUM-POWER SEGMENT TO COMMAND LEADING MARKET POSITION FROM 2022 TO 2027

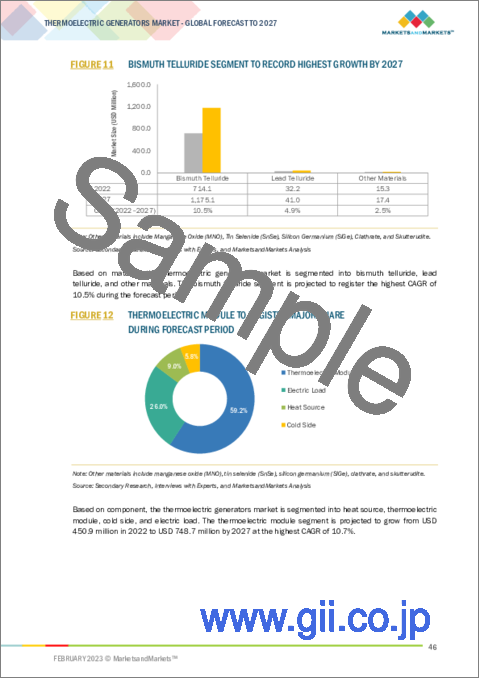

- FIGURE 11 BISMUTH TELLURIDE SEGMENT TO RECORD HIGHEST GROWTH BY 2027

- FIGURE 12 THERMOELECTRIC MODULE TO REGISTER MAJOR SHARE DURING FORECAST PERIOD

- FIGURE 13 EUROPE TO BE FASTEST-GROWING REGION BY 2027

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN THERMOELECTRIC GENERATORS MARKET

- FIGURE 14 NEED FOR DURABLE AND MAINTENANCE-FREE POWER SOURCES

- 4.2 THERMOELECTRIC GENERATORS MARKET, BY TYPE

- FIGURE 15 MULTI-STAGE SEGMENT TO GROW FASTER DURING FORECAST PERIOD

- 4.3 THERMOELECTRIC GENERATORS MARKET, BY VERTICAL

- FIGURE 16 AUTOMOTIVE SEGMENT TO DOMINATE MARKET BY 2027

- 4.4 THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE

- FIGURE 17 LOW TEMPERATURE TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- 4.5 NORTH AMERICA THERMOELECTRIC GENERATORS MARKET, BY COUNTRY

- FIGURE 18 US ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 THERMOELECTRIC GENERATORS MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Need for fuel efficiency amid stringent emission control norms

- FIGURE 20 CARBON DIOXIDE EMISSIONS, BY REGION, 2011-2021

- 5.2.1.2 High demand from remote areas of developing countries

- 5.2.1.3 Durable and maintenance-free power source

- 5.2.2 RESTRAINTS

- 5.2.2.1 Low efficiency of thermoelectric generators

- 5.2.2.2 High initial cost and lack of skilled personnel

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Ongoing research and development to enhance performance

- 5.2.3.2 Widescale adoption of thermoelectric generators across various sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Availability of prominent substitutes and structural complexity

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR THERMOELECTRIC GENERATOR MANUFACTURERS

- FIGURE 22 REVENUE SHIFT CURVE FOR THERMOELECTRIC GENERATORS MARKET

- 5.5 THERMOELECTRIC GENERATORS MARKET ECOSYSTEM

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 MATERIAL SUPPLIERS AND DISTRIBUTORS

- 5.5.4 END USERS

- FIGURE 23 THERMOELECTRIC GENERATORS MARKET ECOSYSTEM MAP

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 PORTER'S FIVE FORCE ANALYSIS

- FIGURE 24 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 TARIFF AND REGULATORY LANDSCAPE

- 5.8 TRADE DATA

- TABLE 4 TRADE DATA FOR THERMOELECTRIC GENERATORS MARKET

- 5.9 RECESSION IMPACT ANALYSIS

- FIGURE 25 SCENARIO ANALYSIS OF THERMOELECTRIC GENERATORS MARKET

- 5.10 AVERAGE SELLING PRICE

- TABLE 5 AVERAGE SELLING PRICE OF THERMOELECTRIC GENERATORS, BY APPLICATION

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.11.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.12 KEY CONFERENCES AND EVENTS

- TABLE 8 CONFERENCES AND EVENTS, 2022-2023

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 AUTOMOTIVE EXHAUST THERMOELECTRIC GENERATORS

- 6.2.2 WEARABLE THERMOELECTRIC GENERATORS

- 6.2.3 MINIATURE THERMOELECTRIC GENERATORS

- 6.2.4 SOLAR THERMOELECTRIC GENERATORS

- 6.2.5 RADIOISOTOPE THERMOELECTRIC GENERATORS

- 6.2.6 THERMOELECTRIC GENERATORS IN AEROSPACE

- 6.2.7 ADVANCEMENTS IN THERMOELECTRIC MATERIALS

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 FLEXIBLE THERMOELECTRIC MATERIALS

- 6.3.2 SELF-HEALING WEARABLE THERMOELECTRIC DEVICES

- 6.4 USE CASES

- 6.4.1 THERMOELECTRIC GENERATORS IN SPACE

- 6.4.2 THERMOELECTRIC GENERATORS IN WASTE HEAT RECOVERY FOR INDUSTRIES AND HOUSEHOLDS

- 6.4.3 THERMOELECTRIC GENERATORS IN HUMAN BODY

- 6.4.4 THERMOELECTRIC GENERATORS IN WASTE HEAT RECOVERY FOR TRANSPORT SYSTEMS

- 6.5 IMPACT OF MEGATRENDS

- 6.5.1 RAPID URBANIZATION AND ADVANCEMENTS

- 6.5.2 FUEL EFFICIENCY

- 6.6 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 9 INNOVATIONS AND PATENT REGISTRATIONS, 2016-2022

- 6.7 THERMOELECTRIC COOLERS

- 6.7.1 USE OF THERMOELECTRIC COOLERS ACROSS VERTICALS

7 THERMOELECTRIC GENERATORS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 28 THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 10 THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 11 THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.2 WASTE HEAT RECOVERY

- 7.2.1 HIGH DEMAND FROM INDUSTRIAL AND AUTOMOTIVE SECTORS

- 7.3 ENERGY HARVESTING

- 7.3.1 USE OF THERMOELECTRIC GENERATORS IN CONSUMER AND HEALTHCARE WEARABLES

- 7.4 DIRECT POWER GENERATION

- 7.4.1 NEED IN AEROSPACE, MINING, AND INDUSTRIAL SECTORS

- 7.5 CO-GENERATION

- 7.5.1 ADVANCEMENTS IN INDUSTRIAL CO-GENERATION SYSTEMS

8 THERMOELECTRIC GENERATORS MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- FIGURE 29 THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 12 THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 13 THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 8.2 AUTOMOTIVE

- TABLE 14 AUTOMOTIVE: THERMOELECTRIC GENERATORS MARKET, BY VEHICLE TYPE, 2019-2021 (USD MILLION)

- TABLE 15 AUTOMOTIVE: THERMOELECTRIC GENERATORS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 8.2.1 IC-POWERED VEHICLES

- 8.2.1.1 Increased consumer demand for fuel efficiency

- 8.2.2 ELECTRIC VEHICLES

- 8.2.2.1 Need for auxiliary power sources

- 8.3 AEROSPACE & DEFENSE

- TABLE 16 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY END USE, 2019-2021 (USD MILLION)

- TABLE 17 AEROSPACE & DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 8.3.1 AVIATION

- 8.3.1.1 Increased use of wireless sensor networks in aircraft

- TABLE 18 AVIATION: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 19 AVIATION: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.3.1.2 Civil aircraft

- 8.3.1.3 Military aircraft

- 8.3.1.4 Unmanned aerial vehicles

- 8.3.2 DEFENSE

- TABLE 20 DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 21 DEFENSE: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.3.2.1 Military vehicles

- 8.3.2.2 Power generators

- 8.3.2.3 Soldier systems

- 8.4 MARINE

- TABLE 22 MARINE: THERMOELECTRIC GENERATORS MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 23 MARINE: THERMOELECTRIC GENERATORS MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- 8.4.1 MILITARY SHIPS

- 8.4.1.1 Need for waste heat energy recovery to power sensors and electronics control on ships

- 8.4.2 COMMERCIAL SHIPS

- 8.4.2.1 Growing concerns regarding maritime carbon emission

- 8.5 INDUSTRIAL

- TABLE 24 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 25 INDUSTRIAL: THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 8.5.1 CHEMICAL PROCESSING

- 8.5.1.1 Used in direct-fired reboilers and reactors

- 8.5.2 ALUMINUM & STEEL FOUNDRY

- 8.5.2.1 Used in smelters & blast furnaces

- 8.5.3 GLASS & METAL CASTING FOUNDRY

- 8.5.3.1 Used in industrial waste heat recovery

- 8.6 CONSUMER

- TABLE 26 CONSUMER: THERMOELECTRIC GENERATORS MARKET, BY END USE, 2019-2021 (USD MILLION)

- TABLE 27 CONSUMER: THERMOELECTRIC GENERATORS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 8.6.1 WEARABLES

- 8.6.1.1 Increasing demand for heart monitoring devices

- 8.6.2 CONSUMER ELECTRONICS

- 8.6.2.1 Rising use of energy-harvesting electronics

- 8.7 HEALTHCARE

- TABLE 28 HEALTHCARE: THERMOELECTRIC GENERATORS MARKET, BY DEVICE TYPE, 2019-2021 (USD MILLION)

- TABLE 29 HEALTHCARE: THERMOELECTRIC GENERATORS MARKET, BY DEVICE TYPE, 2022-2027 (USD MILLION)

- 8.7.1 IMPLANTABLE

- 8.7.1.1 Increased adoption of TEGs in medical devices to harvest ambient heat

- 8.7.2 WEARABLES

- 8.7.2.1 Growing trend of wearable medical devices

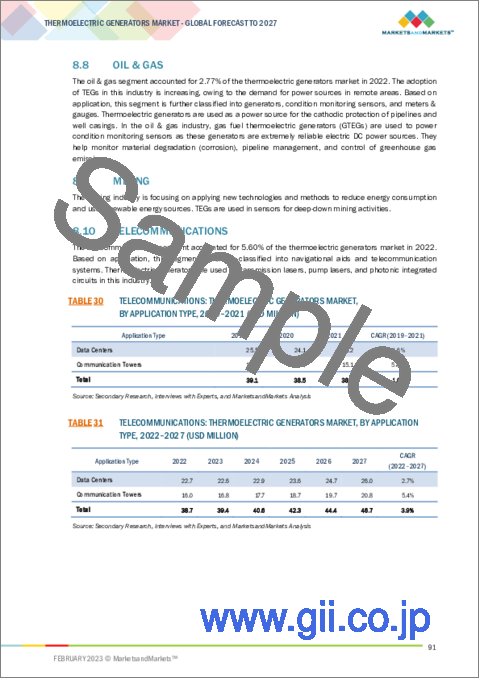

- 8.8 OIL & GAS

- 8.9 MINING

- 8.10 TELECOMMUNICATIONS

- TABLE 30 TELECOMMUNICATIONS: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION TYPE, 2019-2021 (USD MILLION)

- TABLE 31 TELECOMMUNICATIONS: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION TYPE, 2022-2027 (USD MILLION)

- 8.10.1 DATA CENTERS

- 8.10.1.1 Conversion of surplus heat into electricity

- 8.10.2 COMMUNICATION TOWERS

- 8.10.2.1 Increased signal strength to provide 5G services

9 THERMOELECTRIC GENERATORS MARKET, BY TYPE

- 9.1 INTRODUCTION

- FIGURE 30 THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 32 THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 33 THERMOELECTRIC GENERATORS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 9.2 SINGLE-STAGE

- 9.2.1 USED IN LOW-TEMPERATURE APPLICATIONS

- 9.3 MULTI-STAGE

- 9.3.1 USED IN HIGH-TEMPERATURE APPLICATIONS

10 THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE

- 10.1 INTRODUCTION

- FIGURE 31 THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- TABLE 34 THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 35 THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 10.2 LOW-TEMPERATURE (<80°C)

- 10.2.1 INCREASED USE OF WEARABLES IN COMMERCIAL AND HEALTHCARE APPLICATIONS

- 10.3 MEDIUM-TEMPERATURE (80-500°C)

- 10.3.1 RISING AWARENESS OF FUEL EFFICIENCY AND REDUCTION OF CARBON EMISSIONS

- 10.4 HIGH-TEMPERATURE (>500°C)

- 10.4.1 SIGNIFICANCE OF INDUSTRIAL WASTE HEAT

11 THERMOELECTRIC GENERATORS MARKET, BY WATTAGE

- 11.1 INTRODUCTION

- FIGURE 32 THERMOELECTRIC GENERATORS MARKET, BY WATTAGE, 2022-2027 (USD MILLION)

- TABLE 36 THERMOELECTRIC GENERATORS MARKET, BY WATTAGE, 2019-2021 (USD MILLION)

- TABLE 37 THERMOELECTRIC GENERATORS MARKET, BY WATTAGE, 2022-2027 (USD MILLION)

- 11.2 LOW-POWER (<10 W)

- 11.2.1 USED IN CONSUMER AND HEALTHCARE APPLICATIONS

- 11.3 MEDIUM-POWER (10-1 KW)

- 11.3.1 NEED FOR AUTOMOTIVE WASTE HEAT RECOVERY

- 11.4 HIGH-POWER (>1 KW)

- 11.4.1 HIGH POWER DEMAND FROM INDUSTRIAL AND OIL & GAS SECTORS

12 THERMOELECTRIC GENERATORS MARKET, BY MATERIAL

- 12.1 INTRODUCTION

- FIGURE 33 THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- TABLE 38 THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 39 THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 12.2 BISMUTH TELLURIDE

- 12.2.1 USED IN THERMOELECTRIC DEVICES AND MODULES FOR WASTE HEAT RECOVERY

- 12.3 LEAD TELLURIDE

- 12.3.1 REASONABLE PRICE AND HIGH FIGURE OF MERIT ZT

- 12.4 OTHER MATERIALS

13 THERMOELECTRIC GENERATORS MARKET, BY COMPONENT

- 13.1 INTRODUCTION

- FIGURE 34 THERMOELECTRIC GENERATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 40 THERMOELECTRIC GENERATORS MARKET, BY COMPONENT, 2019-2021 (USD MILLION)

- TABLE 41 THERMOELECTRIC GENERATORS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 13.2 HEAT SOURCE

- 13.2.1 INCREASING TREND OF VEHICLE ELECTRIFICATION

- 13.3 THERMOELECTRIC MODULE

- 13.3.1 USE OF EFFICIENT MATERIALS FOR MANUFACTURING THERMOELECTRIC MODULES

- 13.4 COLD SIDE

- 13.4.1 ENHANCED ELECTRICITY CONVERSION CAPACITY

- 13.5 ELECTRIC LOAD

- 13.5.1 GROWING DEMAND FOR EFFICIENT ELECTRIC LOAD DEVICES

14 THERMOELECTRIC GENERATORS MARKET, BY REGION

- 14.1 INTRODUCTION

- FIGURE 35 THERMOELECTRIC GENERATORS MARKET, BY REGION, 2022-2027

- 14.2 RECESSION IMPACT ANALYSIS

- TABLE 42 RECESSION IMPACT ANALYSIS

- 14.3 NORTH AMERICA

- 14.3.1 PESTLE ANALYSIS: NORTH AMERICA

- FIGURE 36 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET SNAPSHOT

- TABLE 43 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 44 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 45 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 46 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 47 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 48 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 50 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY WATTAGE, 2019-2021 (USD MILLION)

- TABLE 52 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY WATTAGE, 2022-2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 54 NORTH AMERICA: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 14.3.2 US

- 14.3.2.1 Use of thermoelectric generators in space applications

- TABLE 55 US: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 56 US: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 57 US: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 58 US: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 59 US: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 60 US: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.3.3 CANADA

- 14.3.3.1 High demand from industrial sector

- TABLE 61 CANADA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 62 CANADA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 63 CANADA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 64 CANADA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 65 CANADA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 66 CANADA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.4 EUROPE

- 14.4.1 PESTLE ANALYSIS: EUROPE

- FIGURE 37 EUROPE: THERMOELECTRIC GENERATORS MARKET SNAPSHOT

- TABLE 67 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 68 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 69 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 70 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 71 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 72 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- TABLE 73 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY WATTAGE, 2019-2021 (USD MILLION)

- TABLE 74 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY WATTAGE, 2022-2027 (USD MILLION)

- TABLE 75 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 76 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- TABLE 77 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 78 EUROPE: THERMOELECTRIC GENERATORS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 14.4.2 UK

- 14.4.2.1 Large-scale use of renewable sources of energy

- TABLE 79 UK: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 80 UK: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 81 UK: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 82 UK: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 83 UK: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 84 UK: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.4.3 GERMANY

- 14.4.3.1 Used for converting solar radiation into electricity

- TABLE 85 GERMANY: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 86 GERMANY: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 87 GERMANY: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 88 GERMANY: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 89 GERMANY: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 90 GERMANY: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.4.4 FRANCE

- 14.4.4.1 Used in automotive applications

- TABLE 91 FRANCE: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 92 FRANCE: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 93 FRANCE: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 94 FRANCE: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 95 FRANCE: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 96 FRANCE: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.4.5 ITALY

- 14.4.5.1 Use of variable renewable energy generators in power plants

- TABLE 97 ITALY: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 98 ITALY: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 99 ITALY: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 100 ITALY: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 101 ITALY: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 102 ITALY: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.4.6 SPAIN

- 14.4.6.1 Increase in solar-powered projects

- TABLE 103 SPAIN: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 104 SPAIN: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 105 SPAIN: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 106 SPAIN: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 107 SPAIN: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 108 SPAIN: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.4.7 SWEDEN

- 14.4.7.1 Deployment in automotive and manufacturing sectors

- TABLE 109 SWEDEN: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 110 SWEDEN: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 111 SWEDEN: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 112 SWEDEN: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 113 SWEDEN: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 114 SWEDEN: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.4.8 RUSSIA

- 14.4.8.1 High domestic demand for military aircraft

- TABLE 115 RUSSIA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 116 RUSSIA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 117 RUSSIA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 118 RUSSIA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 119 RUSSIA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 120 RUSSIA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.4.9 REST OF EUROPE

- 14.4.9.1 Stringent emission norms

- TABLE 121 REST OF EUROPE: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 122 REST OF EUROPE: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 123 REST OF EUROPE: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 124 REST OF EUROPE: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 125 REST OF EUROPE: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 126 REST OF EUROPE: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.5 ASIA PACIFIC

- 14.5.1 PESTLE ANALYSIS: ASIA PACIFIC

- FIGURE 38 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET SNAPSHOT

- TABLE 127 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 128 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 129 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 130 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 131 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 132 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- TABLE 133 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY WATTAGE, 2019-2021 (USD MILLION)

- TABLE 134 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY WATTAGE, 2022-2027 (USD MILLION)

- TABLE 135 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 136 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- TABLE 137 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 138 ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 14.5.2 CHINA

- 14.5.2.1 Industrialization and demand for hybrid vehicles

- TABLE 139 CHINA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 140 CHINA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 141 CHINA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 142 CHINA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 143 CHINA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 144 CHINA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.5.3 INDIA

- 14.5.3.1 Development of environment-friendly energy solutions to control pollution

- TABLE 145 INDIA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 146 INDIA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 147 INDIA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 148 INDIA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 149 INDIA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 150 INDIA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.5.4 JAPAN

- 14.5.4.1 Demand for new-age electric vehicles

- TABLE 151 JAPAN: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 152 JAPAN: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 153 JAPAN: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 154 JAPAN: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 155 JAPAN: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 156 JAPAN: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.5.5 AUSTRALIA

- 14.5.5.1 Increased investment in renewable energy generation

- TABLE 157 AUSTRALIA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 158 AUSTRALIA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 159 AUSTRALIA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 160 AUSTRALIA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 161 AUSTRALIA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 162 AUSTRALIA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.5.6 SOUTH KOREA

- 14.5.6.1 Rise in TEG technology-related R&D projects

- TABLE 163 SOUTH KOREA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 164 SOUTH KOREA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 165 SOUTH KOREA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 166 SOUTH KOREA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 167 SOUTH KOREA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 168 SOUTH KOREA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.5.7 REST OF ASIA PACIFIC

- TABLE 169 REST OF ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.6 REST OF THE WORLD

- 14.6.1 PESTLE ANALYSIS: REST OF THE WORLD

- TABLE 175 REST OF THE WORLD: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 176 REST OF THE WORLD: THERMOELECTRIC GENERATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 177 REST OF THE WORLD: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 178 REST OF THE WORLD: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 179 REST OF THE WORLD: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 180 REST OF THE WORLD: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 181 REST OF THE WORLD: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 182 REST OF THE WORLD: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- TABLE 183 REST OF THE WORLD: THERMOELECTRIC GENERATORS MARKET, BY WATTAGE, 2019-2021 (USD MILLION)

- TABLE 184 REST OF THE WORLD: THERMOELECTRIC GENERATORS MARKET, BY WATTAGE, 2022-2027 (USD MILLION)

- TABLE 185 REST OF THE WORLD: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 186 REST OF THE WORLD: THERMOELECTRIC GENERATORS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 14.6.2 LATIN AMERICA

- 14.6.2.1 Use of thermoelectric generators in manufacturing and energy industries

- TABLE 187 LATIN AMERICA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 188 LATIN AMERICA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 189 LATIN AMERICA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 190 LATIN AMERICA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 191 LATIN AMERICA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 192 LATIN AMERICA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.6.3 MIDDLE EAST

- 14.6.3.1 Demand from oil & gas industry

- TABLE 193 MIDDLE EAST: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 194 MIDDLE EAST: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 195 MIDDLE EAST: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 196 MIDDLE EAST: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 197 MIDDLE EAST: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 198 MIDDLE EAST: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

- 14.6.4 AFRICA

- 14.6.4.1 Adoption of advanced technologies for waste heat recovery and power generation

- TABLE 199 AFRICA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2019-2021 (USD MILLION)

- TABLE 200 AFRICA: THERMOELECTRIC GENERATORS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 201 AFRICA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 202 AFRICA: THERMOELECTRIC GENERATORS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 203 AFRICA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2019-2021 (USD MILLION)

- TABLE 204 AFRICA: THERMOELECTRIC GENERATORS MARKET, BY TEMPERATURE, 2022-2027 (USD MILLION)

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 COMPANY OVERVIEW

- TABLE 205 KEY DEVELOPMENTS BY LEADING PLAYERS IN THERMOELECTRIC GENERATORS MARKET

- 15.3 RANK ANALYSIS, 2021

- FIGURE 39 MARKET RANKING OF KEY PLAYERS, 2021

- 15.4 REVENUE ANALYSIS, 2018-2021

- FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS, 2018-2021

- 15.5 MARKET SHARE ANALYSIS, 2021

- FIGURE 41 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

- TABLE 206 THERMOELECTRIC GENERATORS MARKET: DEGREE OF COMPETITION

- 15.6 COMPETITIVE EVALUATION QUADRANT

- 15.6.1 STARS

- 15.6.2 EMERGING LEADERS

- 15.6.3 PERVASIVE PLAYERS

- 15.6.4 PARTICIPANTS

- FIGURE 42 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

- 15.7 STARTUP/SME EVALUATION QUADRANT

- 15.7.1 PROGRESSIVE COMPANIES

- 15.7.2 RESPONSIVE COMPANIES

- 15.7.3 DYNAMIC COMPANIES

- 15.7.4 STARTING BLOCKS

- FIGURE 43 STARTUP/SME COMPETITIVE LEADERSHIP MAPPING, 2021

- 15.8 COMPETITIVE BENCHMARKING

- TABLE 207 COMPANY FOOTPRINT

- TABLE 208 COMPANY REVENUE/PRODUCT FOOTPRINT

- TABLE 209 COMPANY APPLICATION FOOTPRINT

- TABLE 210 COMPANY REGIONAL FOOTPRINT

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 MARKET EVALUATION FRAMEWORK

- 15.9.2 PRODUCT LAUNCHES

- TABLE 211 PRODUCT LAUNCHES, 2018-2022

- 15.9.3 DEALS

- TABLE 212 DEALS, 2020-2022

- 15.9.4 OTHERS

- TABLE 213 OTHERS, 2020-2022

16 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

- 16.1 INTRODUCTION

- 16.2 KEY PLAYERS

- 16.2.1 GENTHERM INC.

- TABLE 214 GENTHERM INC.: BUSINESS OVERVIEW

- FIGURE 44 GENTHERM INC.: COMPANY SNAPSHOT

- TABLE 215 GENTHERM INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 216 GENTHERM INC.: PRODUCT LAUNCHES

- TABLE 217 GENTHERM INC: OTHERS

- 16.2.2 COHERENT CORP.

- TABLE 218 COHERENT CORP.: BUSINESS OVERVIEW

- FIGURE 45 COHERENT CORP.: COMPANY SNAPSHOT

- TABLE 219 COHERENT CORP.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 220 COHERENT CORP.: PRODUCT LAUNCHES

- TABLE 221 COHERENT CORP.: OTHERS

- 16.2.3 FERROTEC HOLDINGS CORPORATION

- TABLE 222 FERROTEC HOLDINGS CORPORATION: BUSINESS OVERVIEW

- FIGURE 46 FERROTEC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- TABLE 223 FERROTEC HOLDINGS CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 224 FERROTEC HOLDINGS CORPORATION: PRODUCT LAUNCHES

- TABLE 225 FERROTEC HOLDINGS CORPORATION: OTHERS

- 16.2.4 LAIRD THERMAL SYSTEMS, INC.

- TABLE 226 LAIRD THERMAL SYSTEMS, INC.: BUSINESS OVERVIEW

- TABLE 227 LAIRD THERMAL SYSTEMS, INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 228 LAIRD THERMAL SYSTEMS, INC.: PRODUCT LAUNCHES

- 16.2.5 TECTEG MFR.

- TABLE 229 TECTEG MFR.: BUSINESS OVERVIEW

- TABLE 230 TECTEG MFR.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 231 TECTEG MFR.: PRODUCT LAUNCHES

- 16.2.6 KOMATSU LTD.

- TABLE 232 KOMATSU LTD.: BUSINESS OVERVIEW

- FIGURE 47 KOMATSU LTD.: COMPANY SNAPSHOT

- TABLE 233 KOMATSU LTD.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 234 KOMATSU LTD.: PRODUCT LAUNCHES

- 16.2.7 YAMAHA CORPORATION

- TABLE 235 YAMAHA CORPORATION: BUSINESS OVERVIEW

- FIGURE 48 YAMAHA CORPORATION: COMPANY SNAPSHOT

- TABLE 236 YAMAHA CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 237 YAMAHA CORPORATION: PRODUCT LAUNCHES

- TABLE 238 YAMAHA CORPORATION: DEALS

- 16.2.8 TOSHIBA CORPORATION

- TABLE 239 TOSHIBA CORPORATION: BUSINESS OVERVIEW

- FIGURE 49 TOSHIBA CORPORATION: COMPANY SNAPSHOT

- TABLE 240 TOSHIBA CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- 16.2.9 MAHLE GMBH

- TABLE 241 MAHLE GMBH: BUSINESS OVERVIEW

- FIGURE 50 MAHLE GMBH: COMPANY SNAPSHOT

- TABLE 242 MAHLE GMBH: PRODUCT/SOLUTIONS/SERVICES OFFERED

- 16.2.10 MURATA MANUFACTURING CO., LTD.

- TABLE 243 MURATA MANUFACTURING CO., LTD.: BUSINESS OVERVIEW

- FIGURE 51 MURATA MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

- TABLE 244 MURATA MANUFACTURING CO., LTD.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- 16.2.11 CUI DEVICES

- TABLE 245 CUI DEVICES: BUSINESS OVERVIEW

- TABLE 246 CUI DEVICES: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 247 CUI DEVICES: PRODUCT LAUNCHES

- 16.2.12 ANALOG DEVICES, INC.

- TABLE 248 ANALOG DEVICES, INC.: BUSINESS OVERVIEW

- FIGURE 52 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- TABLE 249 ANALOG DEVICES, INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- 16.2.13 FAURECIA SE

- TABLE 250 FAURECIA SE: BUSINESS OVERVIEW

- FIGURE 53 FAURECIA SE: COMPANY SNAPSHOT

- TABLE 251 FAURECIA SE: PRODUCT/SOLUTIONS/SERVICES OFFERED

- 16.2.14 KYOCERA CORPORATION

- TABLE 252 KYOCERA CORPORATION: BUSINESS OVERVIEW

- FIGURE 54 KYOCERA CORPORATION: COMPANY SNAPSHOT

- TABLE 253 KYOCERA CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 254 KYOCERA CORPORATION: PRODUCT LAUNCHES

- TABLE 255 KYOCERA CORPORATION: OTHERS

- 16.2.15 TEC MICROSYSTEMS GMBH

- TABLE 256 TEC MICROSYSTEMS GMBH: BUSINESS OVERVIEW

- TABLE 257 TEC MICROSYSTEMS GMBH: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 258 TEC MICROSYSTEMS GMBH: PRODUCT LAUNCHES

- 16.2.16 RIF CORPORATION

- TABLE 259 RIF CORPORATION: BUSINESS OVERVIEW

- TABLE 260 RIF CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- 16.2.17 PHONONIC, INC.

- TABLE 261 PHONONIC, INC.: BUSINESS OVERVIEW

- TABLE 262 PHONONIC, INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 263 PHONONIC, INC.: DEALS

- 16.2.18 RMT LTD.

- TABLE 264 RMT LTD.: BUSINESS OVERVIEW

- TABLE 265 RMT LTD.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 266 RMT LTD.: PRODUCT LAUNCHES

- 16.2.19 KRYOTHERM

- TABLE 267 KRYOTHERM: BUSINESS OVERVIEW

- TABLE 268 KRYOTHERM: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 269 KRYOTHERM: PRODUCT LAUNCHES

- 16.2.20 EVERREDTRONICS LTD.

- TABLE 270 EVERREDTRONICS LTD.: BUSINESS OVERVIEW

- TABLE 271 EVERREDTRONICS LTD.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- 16.2.21 HI-Z TECHNOLOGY

- TABLE 272 HI-Z TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 273 HI-Z TECHNOLOGY: PRODUCT/SOLUTIONS/SERVICES OFFERED

- 16.2.22 PERPETUA POWER SOURCE TECHNOLOGIES, INC.

- TABLE 274 PERPETUA POWER SOURCE TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 275 PERPETUA POWER SOURCE TECHNOLOGIES, INC.: PRODUCT/SOLUTIONS/ SERVICES OFFERED

- 16.2.23 ALIGN SOURCING LLC

- TABLE 276 ALIGN SOURCING LLC: BUSINESS OVERVIEW

- TABLE 277 ALIGN SOURCING LLC: PRODUCT/SOLUTIONS/SERVICES OFFERED

- 16.2.24 TELEDYNE ENERGY SYSTEMS, INC.

- TABLE 278 TELEDYNE ENERGY SYSTEMS, INC.: BUSINESS OVERVIEW

- FIGURE 55 TELEDYNE ENERGY SYSTEMS, INC.: COMPANY SNAPSHOT

- TABLE 279 TELEDYNE ENERGY SYSTEMS, INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 280 TELEDYNE ENERGY SYSTEMS, INC.: DEALS

- TABLE 281 TELEDYNE ENERGY SYSTEMS, INC.: OTHERS

- 16.3 OTHER PLAYERS

- 16.3.1 P&N TECHNOLOGY (XIAMEN) CO., LTD.

- TABLE 282 P&N TECHNOLOGY (XIAMEN) CO., LTD.: COMPANY OVERVIEW

- 16.3.2 TE TECHNOLOGY, INC.

- TABLE 283 TE TECHNOLOGY, INC.: COMPANY OVERVIEW

- 16.3.3 BRIMROSE CORPORATION

- TABLE 284 BRIMROSE CORPORATION: COMPANY OVERVIEW

- 16.3.4 BENTEK SYSTEMS

- TABLE 285 BENTEK SYSTEMS: COMPANY OVERVIEW

- 16.3.5 WELLEN TECHNOLOGY CO., LTD.

- TABLE 286 WELLEN TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- 16.3.6 RGS DEVELOPMENT BV

- TABLE 287 RGS DEVELOPMENT: COMPANY OVERVIEW

- 16.3.7 PL ENGINEERING LTD.

- TABLE 288 PL ENGINEERING LTD.: COMPANY OVERVIEW

- 16.3.8 MICROPELT

- TABLE 289 MICROPELT: COMPANY OVERVIEW

- 16.3.9 SHEETAK

- TABLE 290 SHEETAK: COMPANY OVERVIEW

- 16.3.10 GREENTEG AG

- TABLE 291 GREENTEG AG: COMPANY OVERVIEW

- Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS