|

|

市場調査レポート

商品コード

1146589

土壌モニタリングの世界市場:提供別(ハードウェア、ソフトウェア、サービス)、システムタイプ別(センシング・画像、地上センシング、ロボット・テレマティクス)、用途別、地域別 - 2027年までの予測Soil Monitoring Market by Offering (Hardware, Software, Services), System Type (Sensing & Imagery, Ground-based Sensing, Robotic & Telematics), Application (Agricultural, Non-agricultural) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 土壌モニタリングの世界市場:提供別(ハードウェア、ソフトウェア、サービス)、システムタイプ別(センシング・画像、地上センシング、ロボット・テレマティクス)、用途別、地域別 - 2027年までの予測 |

|

出版日: 2022年10月20日

発行: MarketsandMarkets

ページ情報: 英文 229 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の土壌モニタリングの市場規模は、2022年に5億5,100万米ドルと推定され、2027年までに10億8,800万米ドルに達し、CAGRで14.6%の成長が予測されています。

土壌モニタリング市場は、持続可能な農業の実践を推進する政府や企業の取り組み、土壌品質の保全の必要性、生態系の安定に関わる政府の厳しい規制、農場の生産性向上のニーズの高まりなどの要因から、飛躍的な成長が見込まれています。

土壌モニタリング市場は有望な段階にあり、予測期間中に大きな成長を遂げると予想されます。地上モニタリングシステムの技術的ノウハウが少ないため、複数の土壌モニタリングセンサーが広く採用されるようになっています。さらに、様々なIoTベースのデバイスを使用し、土壌モニタリングのために企業が提供するいくつかのニッチな提供は、テレマティクスとリモートモニタリングの発展につながっています。

"センシング・画像システム市場が、予測期間中に最も高いCAGRで成長すると推定される"

土壌モニタリングの農業用途では、衛星画像、ドローン、有人飛行機、または航空画像の使用がより顕著であり、これらの画像システムは土壌に関わる生データを収集するため、センシング・画像向け市場は力強い成長が予想されています。リモートセンシング技術は、作物や土壌の変動をマッピングし、モニタリングするための経済的な技術です。リモートセンシング画像は、生育状況の把握、土壌の変動状況の把握、圃場の変動状況のモニタリング、害虫に感染した植物や病気の植物の検出、作物の投入量の向上などに役立ちます。

"2022年から2027年にかけては、ハードウェア向け市場が、最大のシェアを占めると予測される"

ハードウェア向けの土壌モニタリング市場は、大きな成長率で繁栄することが予想され、予測期間中に支配的な地位を占めると予測されています。ハードウェアコンポーネント、センサー、デバイス、装置は、農業および非農業用途でますます採用が進んでいます。

"非農業用途向け市場は、2022年から2027年にかけて最も高いCAGRで成長すると推定される"

非農業用途の土壌モニタリング市場は、予測期間中に最も高いCAGRで成長すると予測されています。非農業用途の土壌モニタリング目的で、複数のセンサー、土壌スキャナー、デバイスの使用が増加しています。

"アジア太平洋地域の土壌モニタリング市場は、2022年~2027年に堅調な成長を遂げると予想される"

アジア太平洋地域のAgTech分野への投資の急増、地上ベースのモニタリングシステムだけでなく、センシングや画像システムの浸透の増加は、土壌モニタリング市場の急成長の主要な要因の一部です。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- 土壌モニタリング市場の主要動向

- バリューチェーン分析

- 技術分析

- 平均販売価格(ASP)分析

- ケーススタディ:土壌モニタリング市場

- エコシステム市場マップ

- 特許分析

- 主な会議とイベント

第7章 土壌モニタリング市場:システムタイプ別

- イントロダクション

- センシング・画像システム

- 地上モニタリングシステム

- その他(テレマティクス・ロボット)

第8章 土壌モニタリング市場:提供別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第9章 土壌モニタリング市場:用途別

- イントロダクション

- 農業

- 非農業

第10章 土壌モニタリング市場:地域別

- イントロダクション

- 南北アメリカ

- 北米

- 南米

- 欧州

- フランス

- ドイツ

- 英国

- イタリア

- スペイン

- ポーランド

- その他

- アジア太平洋地域

- 中国

- オーストラリア

- 日本

- インド

- 韓国

- その他

- その他の地域

- 中東

- アフリカ

第11章 競合情勢

- 概要

- 市場シェア分析 - 土壌モニタリング市場

- 主要企業が採用した戦略

- 主要企業の収益シェア分析

- 企業の評価象限(主要企業)

- 製品フットプリント

- スタートアップ/中小企業の評価象限(その他の企業)

- 製品フットプリント

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- STEVENS WATER MONITORING SYSTEMS INC.

- SGS GROUP

- METER GROUP

- ELEMENT MATERIALS TECHNOLOGY GROUP LIMITED

- THE TORO COMPANY

- CAMPBELL SCIENTIFIC

- SENTEK TECHNOLOGIES

- SPECTRUM TECHNOLOGIES, INC.

- IRROMETER COMPANY, INC.

- CROPX TECHNOLOGIES LTD.

- 中小企業/スタートアップ

- ACCLIMA, INC.

- AQUACHECK USA

- HYDROPOINT

- DELTA-T DEVICES LTD

- IMKO MICROMODULTECHNIK GMBH

- E.S.I. ENVIRONMENTAL SENSORS

- VEGETRONIX

- AQUASPY

- SOIL SCOUT OY

- CAIPOS GMBH

第13章 隣接/関連市場

第14章 付録

The soil monitoring market is estimated to be worth USD 551 million in 2022 and is projected to reach USD 1,088 million by 2027, at a CAGR of 14.6%. The soil monitoring market is expected to grow exponentially owing to factors such as efforts of governments and companies to promote sustainable agriculture practices, need to preserve soil quality, stringent government regulations pertaining to ecological stability, and growing need for farm productivity improvement.

The soil monitoring market is at a promising stage and is expected to see strong growth during the forecast period. The low technical know-how of ground-based monitoring systems has led to the wider adoption of several soil monitoring sensors. Moreover, using various IoT-based devices and several niche offerings provided by companies for soil monitoring has led to the development of telematics and remote monitoring.

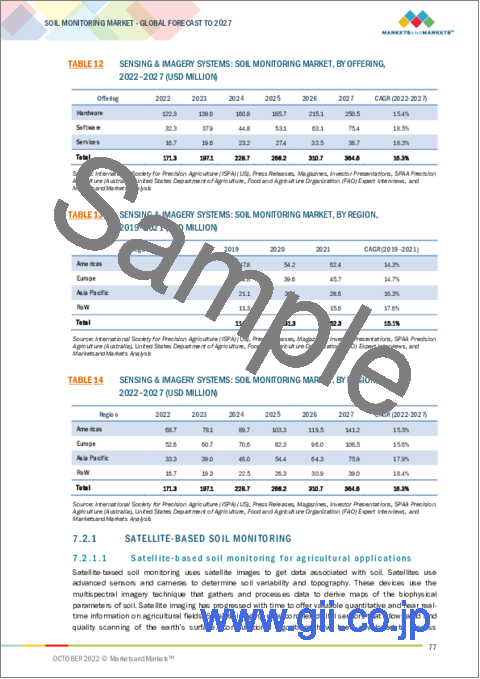

"The market for sensing & imagery systems is estimated to grow at the highest CAGR during the forecast period."

The market for sensing and imagery will witness strong growth as the use of satellite imagery, drones, manned aircraft, or aerial imagery is more prominent in agricultural applications of soil monitoring; these imaging systems gather raw data pertaining to soil. Multispectral and hyperspectral sensors are usually mounted on these airborne vehicles. Remote sensing technology is an economical technique for mapping and monitoring crop and soil variability. Remote sensing imagery helps in pasturing the growth rate, mapping soil variations, monitoring field variability, detecting pest-infected or diseased plants, enhancing crop input, etc. Sensing and imagery systems become complicated in the case of data mapping as they require instrument calibration, atmospheric correction, cloud screening of data, and image processing.

"The market for hardware is estimated to account for the largest share between 2022 and 2027."

The soil monitoring market for hardware is expected to flourish at a significant growth rate and is estimated to hold the dominant position during the forecast period. Hardware components, sensors, devices, and equipment are increasingly adopted in agricultural and non-agricultural applications. The integration of various sensors into remote monitoring solutions owing to the reduced cost of these sensors has resulted in the largest market share of the hardware segment.

"The market for non-agricultural application is estimated to grow at the highest CAGR from 2022 to 2027."

The soil monitoring market for the non-agricultural application is expected to grow at the highest CAGR during the forecast period. The use of several sensors, soil scanners, and devices for soil monitoring purposes for the non-agricultural application has been on the rise. Weather forecasting, flood and drought management, sports turf management, landscaping, and ground care use soil monitoring sensors to optimize their operations.

"Soil monitoring market in the APAC region is expected to witness robust growth during 2022-2027."

The surging investments in the ag-tech sector in APAC, increasing penetration of ground-based monitoring systems as well as sensing and imagery systems are some of the major factors for the fast growth of the soil monitoring market. The region has promising growth prospects in the soil monitoring market owing to the presence of various international and domestic players in the field of soil monitoring in countries such as India, China, Japan, and Australia. Other factors contributing to the growth of the soil monitoring market in the APAC region include strong government support to digitalize agriculture, rising concerns to boost productivity, and integration of advanced systems with various equipment.

Break-up of Primaries

- By Company Type: Tier 1 - 20%, Tier 2 - 45%, and Tier 3 - 35%

- By Designation: C-Level Executives - 35%, Directors - 25%, and Others - 40%

- By Region: Americas- 45%, Europe - 25%, APAC - 20%, and RoW - 10%

The major players in the soil monitoring market include Stevens Water Monitoring Systems (US), SGS Group (Switzerland), METER Group (US), Element Material Technology (UK), The Toro Company (US), Campbell Scientific (US), Sentek Technologies (Australia), Spectrum Technologies (US), Irrometer (US), and CropX Technologies (Israel).

Research Coverage

The report segments the soil monitoring market and forecasts its size, by volume and value, based on offering (hardware, software, and services), system type (sensing and imagery systems, ground-based monitoring systems, others (robotics and telematics systems)), application (agricultural and non-agricultural), and region (Americas, Europe, APAC, and RoW).

The report also provides a comprehensive review of market drivers, restraints, opportunities, and challenges in the soil monitoring market. It covers the qualitative aspects in addition to the quantitative ones.

Reasons to buy this report

- To get a comprehensive overview of the soil monitoring market

- To gain wide-ranging information about the top players in this industry, their product portfolio details, and the key strategies adopted by them

- To gain insights about the major countries/regions in which the soil monitoring market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.1.1 Inclusions and exclusions, by offering segment

- 1.2.1.2 Inclusions and exclusions, by application, system type, and geography segment

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 GEOGRAPHIC SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 List of major secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.3 PRIMARY AND SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for capturing market size by bottom-up analysis (demand side)

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for capturing market size by top-down analysis (supply side)

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY-SIDE APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- FIGURE 7 SOIL MONITORING MARKET FORECAST AND GROWTH ASSUMPTION

- TABLE 1 GLOBAL ECONOMY AND GROWTH OUTLOOK ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 SOFTWARE SEGMENT TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 9 SENSORS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 10 SENSING & IMAGERY SYSTEMS TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 11 AGRICULTURAL APPLICATION TO HOLD LARGER MARKET SHARE IN 2022

- FIGURE 12 AMERICAS HELD LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SOIL MONITORING MARKET

- FIGURE 13 SURGING DEMAND FOR AGRICULTURAL PRODUCTS DUE TO INCREASING GLOBAL POPULATION

- 4.2 SOIL MONITORING MARKET IN ASIA PACIFIC, BY SYSTEM TYPE AND COUNTRY

- FIGURE 14 AUSTRALIA & GROUND-BASED MONITORING SYSTEMS HELD LARGEST SHARE OF SOIL MONITORING MARKET IN ASIA PACIFIC IN 2021

- 4.3 SOIL MONITORING MARKET, BY OFFERING

- FIGURE 15 HARDWARE SEGMENT TO HOLD LARGEST MARKET FROM 2022 TO 2027

- 4.4 SOIL MONITORING MARKET, BY HARDWARE

- FIGURE 16 SENSORS TO HOLD LARGEST MARKET SHARE FROM 2022 TO 2027

- 4.5 SOIL MONITORING MARKET, BY APPLICATION

- FIGURE 17 AGRICULTURAL APPLICATION TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

- 4.6 GEOGRAPHIC ANALYSIS OF SOIL MONITORING MARKET

- FIGURE 18 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 SUSTAINABLE AGRICULTURAL PRACTICES TO DRIVE MARKET GROWTH

- 5.2.1 DRIVERS

- 5.2.1.1 Efforts of governments and companies to promote sustainable agriculture practices

- TABLE 2 SUSTAINABLE AGRICULTURE SCORE OF MAJOR COUNTRIES (ON A SCALE OF 100)

- 5.2.1.2 Need to preserve soil quality

- 5.2.1.3 Stringent government regulations pertaining to ecological stability

- 5.2.1.4 Growing need to improve farm productivity

- FIGURE 20 PROJECTED WORLD POPULATION TILL 2100

- FIGURE 21 IMPACT ANALYSIS: DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Difficulties in monitoring due to spatial variability of soil

- 5.2.2.2 Poor reliability and high costs associated with soil monitoring sensors

- FIGURE 22 IMPACT ANALYSIS: RESTRAINTS

- 5.2.2.3 Low adoption of modern agricultural technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of advanced technologies like IoT and data analytics to promote smart agriculture

- 5.2.3.2 Huge government spending on agriculture

- 5.2.3.3 Digitalization of agriculture and adoption of advanced farming techniques post-COVID-19

- FIGURE 23 IMPACT ANALYSIS: OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of awareness and technical skills

- FIGURE 24 IMPACT ANALYSIS: CHALLENGES

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 MAJOR TRENDS IN SOIL MONITORING MARKET

- 6.2.1 ADOPTION OF IOT DEVICES AND DEVELOPMENT OF CONNECTED ENVIRONMENT

- 6.2.2 EVOLVING WIRELESS MONITORING SYSTEMS

- 6.2.3 DEVELOPMENT OF SMART SENSORS

- 6.3 VALUE CHAIN ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY ORIGINAL EQUIPMENT MANUFACTURERS AND SYSTEM INTEGRATORS

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 SOIL SENSOR TECHNOLOGIES

- FIGURE 26 ADOPTION OF SOIL SENSOR TECHNOLOGIES IN 2021

- 6.5 AVERAGE SELLING PRICE (ASP) ANALYSIS

- FIGURE 27 VOLUMETRIC SOIL MOISTURE SENSORS (AVERAGE SELLING PRICE)

- FIGURE 28 WATER POTENTIAL SOIL MOISTURE SENSORS (AVERAGE SELLING PRICE)

- TABLE 3 AVERAGE SELLING PRICE OF SOIL SENSORS FOR MAJOR COMPANIES

- 6.6 CASE STUDIES: SOIL MONITORING MARKET

- 6.6.1 CASE STUDY 1: SENTEK TECHNOLOGIES

- 6.6.2 CASE STUDY 2: CAMPBELL SCIENTIFIC

- 6.7 ECOSYSTEM MARKET MAP

- TABLE 4 SOIL MONITORING MARKET: ECOSYSTEM

- 6.8 PATENT ANALYSIS

- FIGURE 29 PATENTS GRANTED FOR SOIL MONITORING MARKET, 2011-2021

- FIGURE 30 REGIONAL ANALYSIS OF PATENTS GRANTED FOR SOIL MONITORING MARKET, 2011-2021

- TABLE 5 KEY PATENTS PERTAINING TO SOIL MONITORING MARKET, 2021

- 6.9 KEY CONFERENCES & EVENTS,2022-2023

- TABLE 6 SOIL MONITORING MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022-2023

7 SOIL MONITORING MARKET, BY SYSTEM TYPE

- 7.1 INTRODUCTION

- TABLE 7 SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- FIGURE 31 SENSING & IMAGERY SYSTEMS SEGMENT TO HOLD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 8 SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 7.2 SENSING & IMAGERY SYSTEMS

- TABLE 9 SENSING & IMAGERY SYSTEMS: SOIL MONITORING MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 10 SENSING & IMAGERY SYSTEMS: SOIL MONITORING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 11 SENSING & IMAGERY SYSTEMS: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- FIGURE 32 SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR

- TABLE 12 SENSING & IMAGERY SYSTEMS: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 13 SENSING & IMAGERY SYSTEMS: SOIL MONITORING MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 14 SENSING & IMAGERY SYSTEMS: SOIL MONITORING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.1 SATELLITE-BASED SOIL MONITORING

- 7.2.1.1 Satellite-based soil monitoring for agricultural applications

- 7.2.2 MANNED AIRCRAFT/ AERIAL PHOTOGRAPHY-BASED SOIL MONITORING

- 7.2.2.1 Utilization of aerial photography by large farms

- 7.2.3 DRONE-BASED SOIL MONITORING

- 7.2.3.1 Increasing adoption of drone-based soil monitoring

- 7.3 GROUND-BASED MONITORING SYSTEMS

- 7.3.1 DOES NOT REQUIRE STRONG TECHNICAL KNOWLEDGE

- TABLE 15 GROUND-BASED MONITORING SYSTEMS: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- FIGURE 33 SOFTWARE SEGMENT EXPECTED TO HOLD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 16 GROUND-BASED MONITORING SYSTEMS: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 17 GROUND-BASED MONITORING SYSTEMS: SOIL MONITORING MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 18 GROUND-BASED MONITORING SYSTEMS: SOIL MONITORING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 OTHERS (TELEMATICS & ROBOTICS)

- TABLE 19 OTHERS: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 20 OTHERS: SOIL MONITORING MARKET, BY OFFERING 2022-2027 (USD MILLION)

- TABLE 21 OTHERS: SOIL MONITORING MARKET, BY REGION, 2019-2021 (USD MILLION)

- FIGURE 34 ASIA PACIFIC IS EXPECTED TO HOLD HIGHEST CAGR

- TABLE 22 OTHERS: SOIL MONITORING MARKET, BY REGION, 2022-2027 (USD MILLION)

8 SOIL MONITORING MARKET, BY OFFERING

- 8.1 INTRODUCTION

- TABLE 23 SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- FIGURE 35 SOFTWARE TO EXHIBIT HIGHEST CAGR

- TABLE 24 SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 8.2 HARDWARE

- TABLE 25 HARDWARE: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 26 HARDWARE: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 27 HARDWARE: SOIL MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- FIGURE 36 AGRICULTURAL APPLICATIONS TO HOLD LARGER MARKET SHARE IN 2027

- TABLE 28 HARDWARE: SOIL MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 29 HARDWARE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- TABLE 30 HARDWARE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- TABLE 31 HARDWARE: SOIL MONITORING MARKET, BY REGION, 2019-2021 (USD MILLION)

- FIGURE 37 ASIA PACIFIC TO REGISTER HIGHEST CAGR

- TABLE 32 HARDWARE: SOIL MONITORING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.2.1 SENSORS

- TABLE 33 SENSORS: SOIL MONITORING MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 34 SENSORS: SOIL MONITORING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 8.2.1.1 Volumetric soil moisture sensors

- TABLE 35 VOLUMETRIC SOIL MOISTURE SENSORS: SOIL MONITORING MARKET, BY TYPE, 2019-2021 (USD MILLION)

- FIGURE 38 TDT SENSORS HELD LARGEST MARKET SIZE IN 2021

- TABLE 36 VOLUMETRIC SOIL MOISTURE SENSORS: SOIL MONITORING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 8.2.1.1.1 Neutron probes

- 8.2.1.1.1.1 Neutron probes offer accurate readings when calibrated properly

- 8.2.1.1.2 Capacitance sensors

- 8.2.1.1.2.1 Capacitance sensor account for second-largest share

- 8.2.1.1.3 Time-domain transmissometry sensors

- 8.2.1.1.3.1 Dominance of time-domain transmissometry sensors

- 8.2.1.2 Soil water potential sensors

- 8.2.1.1.1 Neutron probes

- TABLE 37 SOIL WATER POTENTIAL SENSORS: SOIL MONITORING MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 38 SOIL WATER POTENTIAL SENSORS: SOIL MONITORING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 8.2.1.2.1 Tensiometers

- 8.2.1.2.1.1 Used in measuring soil water content

- 8.2.1.2.2 Gypsum blocks

- 8.2.1.2.2.1 Increased demand for gypsum blocks

- 8.2.1.2.3 Granular matrix sensors

- 8.2.1.2.3.1 Capability to capture data on soil moisture

- 8.2.1.3 Others

- 8.2.1.2.1 Tensiometers

- TABLE 39 OTHER SENSORS: SOIL MONITORING MARKET, BY TYPE, 2019-2021 (USD MILLION)

- FIGURE 39 CLIMATE SENSORS TO GROW AT HIGHEST CAGR

- TABLE 40 OTHER SENSORS: SOIL MONITORING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 8.2.1.3.1 Temperature sensors

- 8.2.1.3.1.1 Monitoring soil temperature to boost farm productivity

- 8.2.1.3.2 pH sensors

- 8.2.1.3.2.1 Enable better nutrient absorption to enhance plant growth

- 8.2.1.3.3 Nutrient sensors

- 8.2.1.3.3.1 Nutrient measurement aids in better input management

- 8.2.1.3.4 Climate sensors

- 8.2.1.3.4.1 Global climate change prompts growers to deploy climate sensors

- 8.2.1.3.5 Salinity sensors

- 8.2.1.3.5.1 Prevent soil erosion and land degradation

- 8.2.1.3.1 Temperature sensors

- 8.2.2 SMART IMAGING SYSTEMS

- 8.2.2.1 Increased demand for hyperspectral camera systems

- 8.2.3 DATA LOGGERS AND TELEMETRY SYSTEMS

- 8.2.3.1 Escalated demand for telematics devices

- 8.2.4 PORTABLE SOIL SCANNERS

- 8.2.4.1 Flexibility and mobility to use on targeted sites

- 8.2.5 OTHERS

- 8.3 SOFTWARE

- TABLE 41 SOFTWARE: SOIL MONITORING MARKET, BY DEPLOYMENT TYPE, 2019-2021 (USD MILLION)

- FIGURE 40 ON-PREMISES SOFTWARE TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- TABLE 42 SOFTWARE: SOIL MONITORING MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 43 SOFTWARE: SOIL MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 44 SOFTWARE: SOIL MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 45 SOFTWARE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- TABLE 46 SOFTWARE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- TABLE 47 SOFTWARE: SOIL MONITORING MARKET, BY REGION, 2019-2021 (USD MILLION)

- FIGURE 41 ASIA PACIFIC TO WITNESS TREMENDOUS GROWTH DURING FORECAST PERIOD

- TABLE 48 SOFTWARE: SOIL MONITORING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3.1 ON-PREMISES

- 8.3.1.1 Allow growers to store data locally securely

- 8.3.2 CLOUD-BASED

- 8.3.2.1 Provides remote access to field information

- 8.3.2.2 Software-as-a-service (SaaS)

- 8.3.2.3 Platform-as-a-service (PaaS)

- 8.4 SERVICES

- TABLE 49 SERVICES: SOIL MONITORING MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 50 SERVICES: SOIL MONITORING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 51 SERVICES: SOIL MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 52 SERVICES: SOIL MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 53 SERVICES: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- FIGURE 42 GROUND-BASED MONITORING SYSTEMS TO HOLD LARGEST MARKET SHARE IN 2027

- TABLE 54 SERVICES: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- TABLE 55 SERVICES: SOIL MONITORING MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 56 SERVICES: SOIL MONITORING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4.1 SYSTEM INTEGRATION AND CONSULTING SERVICES

- 8.4.1.1 System integration and consulting services hold major share in market

- 8.4.2 MANAGED SERVICES

- 8.4.2.1 Farm operation services

- 8.4.2.1.1 Demand for farm operation service in soil monitoring market

- 8.4.2.2 Data services

- 8.4.2.2.1 Data-driven farming has created significant demand for data services

- 8.4.2.3 Analytics services

- 8.4.2.3.1 Need to interpret data to meet growing demand for analytics services

- 8.4.2.1 Farm operation services

- 8.4.3 CONNECTIVITY SERVICES

- 8.4.3.1 High demand for connected farming tools

- 8.4.4 ASSISTED PROFESSIONAL SERVICES

- 8.4.4.1 Supply chain management services

- 8.4.4.1.1 Concerns to ensure food security to fuel demand

- 8.4.4.2 Climate information services

- 8.4.4.2.1 Need for sustainable agriculture to boost demand for climate information services

- 8.4.4.1 Supply chain management services

9 SOIL MONITORING MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- TABLE 57 SOIL MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- FIGURE 43 NON-AGRICULTURAL APPLICATION TO GROW AT HIGHER CAGR

- TABLE 58 SOIL MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2 AGRICULTURAL

- TABLE 59 AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY TYPE 2019-2021 (USD MILLION)

- TABLE 60 AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 61 AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- TABLE 62 AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- TABLE 63 AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY REGION, 2019-2021 (USD MILLION)

- FIGURE 44 AMERICAS TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 64 AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2.1 FIELD CROPS (OPEN-FIELD FARMING AND ROW CROPS)

- 9.2.1.1 High adoption of soil monitoring sensors in field crops

- TABLE 65 FIELD CROPS: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- TABLE 66 FIELD CROPS: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 9.2.2 SMART GREENHOUSE & HORTICULTURE

- 9.2.2.1 Crucial role of soil sensors in smart greenhouses

- TABLE 67 SMART GREENHOUSE & HORTICULTURE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- FIGURE 45 GROUND-BASED MONITORING SYSTEMS TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 68 SMART GREENHOUSE & HORTICULTURE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 9.2.3 VERTICAL FARMS

- 9.2.3.1 Adoption of advanced smart sensors in vertical farms

- 9.2.4 OTHERS (FLORICULTURE, ORCHARDS, AND CANNABIS/HEMP)

- TABLE 69 OTHER AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- TABLE 70 OTHER AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 9.3 NON-AGRICULTURAL

- TABLE 71 NON-AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY TYPE, 2019-2021 (USD MILLION)

- FIGURE 46 SPORTS TURF MANAGEMENT TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 72 NON-AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 73 NON-AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 74 NON-AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.1 RESIDENTIAL

- 9.3.1.1 Expanding residential infrastructure has resulted in heightened demand for soil monitoring

- 9.3.2 LANDSCAPING AND GROUND CARE

- 9.3.2.1 Landscaping and ground care in sloping terrains generate substantial demand for soil monitoring

- 9.3.3 SPORTS TURF

- 9.3.3.1 Soil monitoring in sports turf management help to optimize irrigation of sport turfs

- 9.3.4 FORESTRY

- 9.3.4.1 Adoption of soil monitoring to protect forests

- 9.3.5 CONSTRUCTION AND MINING

- 9.3.5.1 Demand for construction and mining verticals for soil monitoring during forecast period

- 9.3.6 WEATHER FORECASTING

- 9.3.6.1 Implementation of soil monitoring to reduce soil erosion

- TABLE 75 WEATHER FORECASTING: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- TABLE 76 WEATHER FORECASTING: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 9.3.7 OTHERS

- TABLE 77 OTHER NON-AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- FIGURE 47 GROUND-BASED MONITORING SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 78 OTHER NON-AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

10 SOIL MONITORING MARKET, BY GEOGRAPHY

- 10.1 INTRODUCTION

- FIGURE 48 GEOGRAPHIC SNAPSHOT: GLOBAL COUNTRY-LEVEL SOIL MONITORING MARKET

- TABLE 79 SOIL MONITORING MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 80 SOIL MONITORING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2 AMERICAS

- TABLE 81 AMERICAS: SOIL MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 82 AMERICAS: SOIL MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 83 AMERICAS: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- TABLE 84 AMERICAS: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- TABLE 85 AMERICAS: SOIL MONITORING MARKET, BY REGION, 2019-2021 (USD MILLION)

- FIGURE 49 NORTH AMERICA TO HOLD MAJOR SHARE DURING FORECAST PERIOD

- TABLE 86 AMERICAS: SOIL MONITORING MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 87 AMERICAS: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 88 AMERICAS: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.2.1 NORTH AMERICA

- TABLE 89 NORTH AMERICA: SOIL MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 90 NORTH AMERICA: SOIL MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 91 NORTH AMERICA: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- FIGURE 50 SENSING & IMAGERY SYSTEMS TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 92 NORTH AMERICA: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- TABLE 93 NORTH AMERICA: SOIL MONITORING MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 94 NORTH AMERICA: SOIL MONITORING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 95 NORTH AMERICA: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 96 NORTH AMERICA: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.2.1.1 US

- 10.2.1.1.1 Early adopter of soil monitoring technology

- 10.2.1.1 US

- TABLE 97 US: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 98 US: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.2.1.2 Canada

- 10.2.1.2.1 Availability of large-sized and favorable government policies to propel growth

- 10.2.1.2 Canada

- TABLE 99 CANADA: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 100 CANADA: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.2.1.3 Mexico

- 10.2.1.3.1 Country to witness growth in soil monitoring technologies

- 10.2.1.3 Mexico

- TABLE 101 MEXICO: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 102 MEXICO: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.2.2 SOUTH AMERICA

- TABLE 103 SOUTH AMERICA: SOIL MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- FIGURE 51 NON-AGRICULTURAL SEGMENT TO WITNESS HIGHER CAGR

- TABLE 104 SOUTH AMERICA: SOIL MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 105 SOUTH AMERICA: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- TABLE 106 SOUTH AMERICA: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- TABLE 107 SOUTH AMERICA: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 108 SOUTH AMERICA: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 109 SOUTH AMERICA: SOIL MONITORING MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 110 SOUTH AMERICA: SOIL MONITORING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.2.2.1 Brazil

- 10.2.2.1.1 Large farm size to surge adoption of soil monitoring technology

- 10.2.2.1 Brazil

- TABLE 111 BRAZIL: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 112 BRAZIL: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.2.2.2 Argentina

- 10.2.2.2.1 Increasing focus toward data-driven farming to boost demand for soil monitoring technology

- 10.2.2.2 Argentina

- TABLE 113 ARGENTINA: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 114 ARGENTINA: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.2.2.3 Rest of South America

- 10.3 EUROPE

- FIGURE 52 SNAPSHOT: SOIL MONITORING MARKET IN EUROPE

- TABLE 115 EUROPE: SOIL MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- FIGURE 53 AGRICULTURAL APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 116 EUROPE: SOIL MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 117 EUROPE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- TABLE 118 EUROPE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- TABLE 119 EUROPE: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 120 EUROPE: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 121 EUROPE: SOIL MONITORING MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- FIGURE 54 UK TO EXHIBIT HIGHEST CAGR

- TABLE 122 EUROPE: SOIL MONITORING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.3.1 FRANCE

- 10.3.1.1 Increasing adoption of modern agriculture techniques to drive market growth

- TABLE 123 FRANCE: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 124 FRANCE: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Germany among early adopter of soil monitoring technology

- TABLE 125 GERMANY: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 126 GERMANY: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Strong commercial support for adoption of precision farming technology

- TABLE 127 UK: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 128 UK: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.3.4 ITALY

- 10.3.4.1 Surging adoption of advanced digital farming techniques to drive market growth

- TABLE 129 ITALY: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 130 ITALY: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.3.5 SPAIN

- 10.3.5.1 Rising concern for water conservation to propel growth

- TABLE 131 SPAIN: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 132 SPAIN: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.3.6 POLAND

- 10.3.6.1 Poland to witness promising growth in eastern European market

- TABLE 133 POLAND: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 134 POLAND: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- FIGURE 55 SNAPSHOT: SOIL MONITORING MARKET IN ASIA PACIFIC

- TABLE 135 ASIA PACIFIC: SOIL MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- FIGURE 56 AGRICULTURAL APPLICATION TO WITNESS HIGHER CAGR

- TABLE 136 ASIA PACIFIC: SOIL MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 137 ASIA PACIFIC: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- TABLE 138 ASIA PACIFIC: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- TABLE 139 ASIA PACIFIC: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 140 ASIA PACIFIC: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 141 ASIA PACIFIC: SOIL MONITORING MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- FIGURE 57 CHINA TO WITNESS HIGHEST CAGR

- TABLE 142 ASIA PACIFIC: SOIL MONITORING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Focus on agricultural research projects to create additional demand for soil monitoring technology

- TABLE 143 CHINA: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 144 CHINA: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.4.2 AUSTRALIA

- 10.4.2.1 Support from local government and surging funding activities in agri-tech space to boost market growth

- TABLE 145 AUSTRALIA: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 146 AUSTRALIA: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.4.3 JAPAN

- 10.4.3.1 Research projects with focus on soil moisture measurement to drive market growth

- TABLE 147 JAPAN: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 148 JAPAN: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Recent government initiatives to spur market growth

- TABLE 149 INDIA: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 150 INDIA: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Rising interest among growers toward digital farming to propel market growth

- TABLE 151 SOUTH KOREA: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 152 SOUTH KOREA: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 ROW (REST OF THE WORLD)

- TABLE 153 ROW: SOIL MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- FIGURE 58 AGRICULTURAL TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 154 ROW: SOIL MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 155 ROW: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019-2021 (USD MILLION)

- TABLE 156 ROW: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- TABLE 157 ROW: SOIL MONITORING MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 158 ROW: SOIL MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 159 ROW: SOIL MONITORING MARKET, BY REGION, 2019-2021 (USD MILLION)

- FIGURE 59 MIDDLE EAST TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 160 ROW: SOIL MONITORING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5.1 MIDDLE EAST

- 10.5.1.1 Increasing trend toward indoor farming to drive market growth

- 10.5.2 AFRICA

- 10.5.2.1 Rising concern for precision irrigation method to propel market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS - SOIL MONITORING MARKET, 2O21

- TABLE 161 SOIL MONITORING MARKET: DEGREE OF COMPETITION

- 11.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.4 REVENUE SHARE ANALYSIS OF KEY PLAYERS

- FIGURE 60 TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN SOIL MONITORING MARKET, 2019-2021 (USD BILLION)

- 11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 61 SOIL MONITORING MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 11.6 PRODUCT FOOTPRINT

- TABLE 162 KEY PLYERS: COMPANY PRODUCT FOOTPRINT, BY OFFERING

- TABLE 163 KEY PLYERS: COMPANY PRODUCT FOOTPRINT, BY APPLICATION

- TABLE 164 KEY PLYERS: COMPANY PRODUCT FOOTPRINT, BY REGIONAL FOOTPRINT

- TABLE 165 KEY PLYERS: COMPANY PRODUCT FOOTPRINT: OVERALL FOOTPRINT

- 11.7 START-UP/SME EVALUATION QUADRANT (OTHER PLAYERS)

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 STARTING BLOCKS

- 11.7.3 RESPONSIVE COMPANIES

- 11.7.4 DYNAMIC COMPANIES

- FIGURE 62 SOIL MONITORING MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

- 11.8 PRODUCT FOOTPRINT

- TABLE 166 OTHER PLAYERS: COMPANY PRODUCT FOOTPRINT, BY OFFERING

- TABLE 167 OTHER PLAYERS: COMPANY PRODUCT FOOTPRINT, BY APPLICATION

- TABLE 168 OTHER PLAYERS: COMPANY PRODUCT FOOTPRINT, BY REGIONAL FOOTPRINT

- TABLE 169 OTHER PLAYERS: COMPANY PRODUCT FOOTPRINT: OVERALL FOOTPRINT

- TABLE 170 OTHER PLAYERS: SOIL MONITORING: COMPETITIVE BENCHMARKING OF KEY START-UPS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- TABLE 171 SOIL MONITORING MARKET: NEW PRODUCT LAUNCHES, 2018-2022

- 11.9.2 DEALS

- TABLE 172 SOIL MONITORING MARKET: DEALS, 2018-2022

- 11.9.3 OTHERS

- TABLE 173 SOIL MONITORING MARKET: EXPANSIONS, 2018 - 2022

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and competitive threats)**

- 12.1.1 STEVENS WATER MONITORING SYSTEMS INC.

- TABLE 174 STEVENS WATER MONITORING SYSTEMS INC.: BUSINESS OVERVIEW

- TABLE 175 STEVENS WATER MONITORING SYSTEMS INC.: DEALS

- 12.1.2 SGS GROUP

- TABLE 176 SGS GROUP: BUSINESS OVERVIEW

- FIGURE 63 SGS GROUP: COMPANY SNAPSHOT

- TABLE 177 SGS GROUP: NEW PRODUCT LAUNCHES

- TABLE 178 SGS GROUP: DEALS

- TABLE 179 SGS GROUP: OTHERS

- 12.1.3 METER GROUP

- TABLE 180 METER GROUP: BUSINESS OVERVIEW

- TABLE 181 METER GROUP: NEW PRODUCT LAUNCHES

- 12.1.4 ELEMENT MATERIALS TECHNOLOGY GROUP LIMITED

- TABLE 182 ELEMENT MATERIALS TECHNOLOGY GROUP LIMITED: BUSINESS OVERVIEW

- TABLE 183 ELEMENT MATERIALS TECHNOLOGY GROUP LIMITED: DEALS

- 12.1.5 THE TORO COMPANY

- TABLE 184 THE TORO COMPANY: BUSINESS OVERVIEW

- FIGURE 64 THE TORO COMPANY: COMPANY SNAPSHOT

- TABLE 185 THE TORO COMPANY: DEALS

- 12.1.6 CAMPBELL SCIENTIFIC

- TABLE 186 CAMPBELL SCIENTIFIC: BUSINESS OVERVIEW

- TABLE 187 CAMPBELL SCIENTIFIC: DEALS

- TABLE 188 CAMPBELL SCIENTIFIC: OTHERS

- 12.1.7 SENTEK TECHNOLOGIES

- TABLE 189 SENTEK TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 190 SENTEK TECHNOLOGIES: NEW PRODUCT LAUNCHES

- TABLE 191 SENTEK TECHNOLOGIES: OTHERS

- 12.1.8 SPECTRUM TECHNOLOGIES, INC.

- TABLE 192 SPECTRUM TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 193 SPECTRUM TECHNOLOGIES, INC.: NEW PRODUCT LAUNCHES

- 12.1.9 IRROMETER COMPANY, INC.

- TABLE 194 IRROMETER COMPANY, INC.: BUSINESS OVERVIEW

- 12.1.10 CROPX TECHNOLOGIES LTD.

- TABLE 195 CROPX TECHNOLOGIES LTD.: BUSINESS OVERVIEW

- TABLE 196 CROPX TECHNOLOGIES LTD.: DEALS

- TABLE 197 CROPX TECHNOLOGIES LTD.: OTHERS

- 12.2 SMES/START-UPS

- 12.2.1 ACCLIMA, INC.

- TABLE 198 ACCLIMA, INC.: BUSINESS OVERVIEW

- 12.2.2 AQUACHECK USA

- TABLE 199 AQUACHECK USA: BUSINESS OVERVIEW

- 12.2.3 HYDROPOINT

- TABLE 200 HYDROPOINT: BUSINESS OVERVIEW

- TABLE 201 HYDROPOINT: NEW PRODUCT LAUNCHES

- 12.2.4 DELTA-T DEVICES LTD

- TABLE 202 DELTA-T DEVICES LTD: BUSINESS OVERVIEW

- TABLE 203 DELTA-T DEVICES LTD: NEW PRODUCT LAUNCHES

- 12.2.5 IMKO MICROMODULTECHNIK GMBH

- TABLE 204 IMKO MICROMODULTECHNIK GMBH: BUSINESS OVERVIEW

- 12.2.6 E.S.I. ENVIRONMENTAL SENSORS

- 12.2.7 VEGETRONIX

- 12.2.8 AQUASPY

- 12.2.9 SOIL SCOUT OY

- 12.2.10 CAIPOS GMBH

- *Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- TABLE 205 ADJACENT MARKETS TO SOIL MONITORING MARKET

- 13.2 LIMITATIONS

- 13.3 SOIL AMENDMENTS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- TABLE 206 SOIL AMENDMENTS MARKET, BY CROP TYPE, 2017-2020 (USD MILLION)

- TABLE 207 SOIL AMENDMENTS MARKET, BY CROP TYPE, 2021-2027 (USD MILLION)

- 13.4 SOIL CONDITIONERS MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- TABLE 208 SOIL CONDITIONERS MARKET, BY TYPE, 2018-2025 (USD MILLION)

- 13.5 SOIL TESTING EQUIPMENT MARKET

- 13.5.1 MARKET DEFINITION

- 13.5.2 MARKET OVERVIEW

- TABLE 209 SOIL TESTING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2017-2025 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS