|

|

市場調査レポート

商品コード

1188885

歯列矯正用品の世界市場:製品別 (着脱式/固定式ブレース、アーチワイヤー、アンカー、リガチャー )・患者別 (成人、児童)・ユーザー別 (病院、歯科医院) の将来予測 (2027年)Orthodontic Supplies Market by Product (Removable, Fixed Braces (Bracket (Self Ligating, Lingual, Metal, Aesthetic), Ni-Ti & SS Archwire, Anchorage, Ligature(Elastomeric, Wire)), Patient(Adult, Children), User(Hospital, Clinics) - Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 歯列矯正用品の世界市場:製品別 (着脱式/固定式ブレース、アーチワイヤー、アンカー、リガチャー )・患者別 (成人、児童)・ユーザー別 (病院、歯科医院) の将来予測 (2027年) |

|

出版日: 2023年01月12日

発行: MarketsandMarkets

ページ情報: 英文 249 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の歯列矯正用品の市場規模は、2022年の69億米ドルから2027年には101億米ドルに達すると予測され、予測期間中のCAGRは7.9%となります。

世界各国での不正咬合の蔓延や、歯列矯正治療の利用可能性に関する患者の関心増大が、歯列矯正用品の需要を促進しています。また、歯列矯正用品メーカーのポートフォリオ展示戦略や、企業と歯科医院間の事業協力・提携の拡大が、顧客基盤を増やし、市場の成長をさらに加速させると予想されます。

製品別では、着脱式ブレースのセグメントが、予測期間中に最も高い成長率で成長する見通しです。その要因として、着脱式ブレースの利点に対する患者の関心が高まっていることや、強力な製品を提供するメーカーの存在が高まっていることなどが挙げられます。さらに、着脱式器具のメーカーと歯科医院との協力が、歯列矯正治療へのアクセシビリティの改善につながっています。

エンドユーザー別では、2021年には病院・歯科医院セグメントが最大のシェアを占めています。

地域別に見ると、北米が最大のシェアを占め、欧州がそれに続いています。一方、アジア太平洋が予測期間中に最も高いCAGRで成長する見通しです。

当レポートでは、世界の歯列矯正用品の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、製品別・患者別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 規制状況

- 技術分析

- バリューチェーン分析

- サプライチェーン分析

- 貿易分析

- 価格傾向分析

- 償還シナリオ

- ポーターのファイブフォース分析

- 特許分析

- エコシステムの範囲

- 主な会議とイベント (2021年~2023年)

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向/混乱

- 主な利害関係者と購入基準

第6章 歯列矯正用品市場:製品別

- イントロダクション

- 着脱式ブレース

- 固定式ブレース

- ブラケット

- アーチワイヤー

- アンカー器具

- リガチャー

- 接着剤

- 付属品

第7章 歯列矯正用品市場:患者別

- イントロダクション

- 成人

- 児童・ティーンエイジャー

第8章 歯列矯正用品市場:エンドユーザー別

- イントロダクション

- 病院・歯科医院

- eコマース・プラットフォーム

- その他のエンドユーザー

第9章 歯列矯正用品市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- 他のアジア太平洋諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

- 中東・アフリカ

第10章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 収益シェア分析

- 市場シェア分析

- 競合リーダーシップマッピング:企業評価クアドラント (2021年)

- 競合リーダーシップマッピング (2021年)

- 競合ベンチマーキング

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- 3M

- ENVISTA HOLDINGS CORPORATION

- ALIGN TECHNOLOGY

- DENTSPLY SIRONA

- INSTITUT STRAUMANN AG

- AMERICAN ORTHODONTICS

- HENRY SCHEIN

- ROCKY MOUNTAIN ORTHODONTICS

- G&H ORTHODONTICS

- DENTAURUM

- TP ORTHODONTICS

- GREAT LAKES DENTAL TECHNOLOGIES

- DB ORTHODONTICS

- MORELLI ORTODONTIA

- ULTRADENT PRODUCTS

- ADITEK ORTHODONTICS

- MATT ORTHODONTICS

- JJ ORTHODONTICS

- SINO ORTHO LIMITED

- JISCOP CO., LTD.

- その他の企業

- EURODONTO

- FORESTADENT BERNHARD FORSTER GMBH

- ORTHOMETRIC

- ORTHO CAPS GMBH

- TECNIDENTUSA, LLC.

第12章 付録

The global orthodontic supplies market size is projected to reach USD 10.1 billion by 2027 from USD 6.9 billion in 2022, at a CAGR of 7.9% during the forecast period.

Worldwide prevalence of malocclusion and increasing patient awareness about the availability of orthodontic treatment in the market are propelling the demand for orthodontic supplied. Strategies adopted by orthodontic supplies manufacturer to showcase their orthodontic product portfolio and rising collaboration & partnership among players and dental clinics are anticipated to increase the customer base of the orthodontic supplies market, further accelerating the market growth.

However, dearth of skilled dental professionals in many emerging nations and high cost of orthodontic treatment procedures is likely to hamper the growth of the market.

"The removable braces segment to register the highest growth rate in orthodontic supplies market during the forecast period, by product "

Based on product, the orthodontic supplies market is segmented into fixed braces, removable braces, adhesives, and accessories. The removable braces segment registered the highest CAGR during the forecast period. This is attributed to the rising patient awareness about the advantages offered by removable braces over fixed braces and the growing presence of well established manufacturers with strong offerings in removable braces. Additionally, the strategic collaboration between removable braces manufactures and orthodontic clinics is expected to increase the accessibility of clear aligners treatment among patient. For instance in July 2022, Ormco corporation signed an agreement with Svet Rovnatek, the largest orthodontic clinic in Czech Republic.

"The hospital and dental clinics segment accounted for the largest share of the global orthodontic supplies market, by end users, in 2021"

Based on end user, the orthodontic supplies market is segmented in hospitals & dental clinics, e-commerce platforms, and other end users. The hospitals & dental clinic segment accounted for the largest market share 2021. Factors such as increasing number of malocclusions globally, growing adoption of advanced orthodontic supplies among hospitals & dental clinics, along with the strong emphasis of private equity firm to establish a wide network of dental clinics are anticipated to play a significant role in boosting the growth of this segment.

"The Asia Pacific market to grow at the highest CAGR during the forecast period."

The global orthodontic treatment market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2021, North America accounted for the largest share of this market, followed by Europe. Asia Pacific registered the highest growth during the forecast period. Emerging Asian economies, such as China, India, and Singapore, are likely to provide high orthodontic supplies market growth opportunities. Improved healthcare infrastructure, increasing healthcare expenditures, rising number of dental clinics in and the emergence of small players offering wide range of orthodontic products in the region is likely to support the rapid market growth of Asia Pacific during the forecast period.

A breakdown of the primary participants referred to for this report is provided below:

By Company Type: Tier 1-48%, Tier 2-36%, and Tier 3- 16%

By Designation: C-level-10%, Director-level-14%, and Others-76%

By Region: North America-40%, Europe-32%, Asia Pacific-20%, Latin America-5%, and the Middle East & Africa-3%

The major players operating in the orthodontic supplies market are Align Technology (US), 3M (US), Envista Holdings Corporation (US), Institut Straumann AG (Switzerland), and Dentsply Sirona (US). Other prominent players in this market include Henry Schein (US), American Orthodontics (US), Rocky Mountain Orthodontics (US), G&H Orthodontics (US), Dentaurum (Germany), TP Orthodontics (US), Great Lakes Dental Technologies (US), DB Orthodontics (UK), Morelli Ortodontia (Brazil), Institut Straumann AG (Switzerland), Ultradent Products (US), Aditek Orthodontics (Brazil), MATT Orthodontics (US), JJ Orthodontics (India), Sino Ortho Limited (China), and JISCOP Co., Ltd. (South Korea).

Research Coverage

This report studies the orthodontic supplies market based on the product, application, distribution challenge, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Key Benefits of Buying the Report

This report focuses on various levels of analysis-industry trends, market share of top players, and company profiles, which together form basic views and analyze the competitive landscape, emerging segments of the orthodontic supplies market, and high-growth regions and their drivers, restraints, opportunities, and challenges. The report will help both established firms as well as new entrants/smaller firms to gauge the pulse of the market and garner greater market shares.

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 GEOGRAPHIC SCOPE

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 MAJOR MARKET STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key data from primary sources

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARIES: GLOBAL ORTHODONTIC SUPPLIES MARKET

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

- 2.2.2 USAGE-BASED MARKET ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION: ORTHODONTIC SUPPLIES MARKET

- 2.2.3 PRIMARY RESEARCH VALIDATION

- 2.3 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.4.1 RESEARCH LIMITATIONS

- 2.5 RECESSION IMPACT

- TABLE 1 WORLD ECONOMIC OUTLOOK GROWTH PROGRESSION: GDP PERCENTAGE CHANGES

3 EXECUTIVE SUMMARY

- FIGURE 7 ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

- FIGURE 8 ORTHODONTIC SUPPLIES MARKET, BY PATIENT, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 ORTHODONTIC SUPPLIES MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 GEOGRAPHICAL SNAPSHOT OF ORTHODONTIC SUPPLIES MARKET

4 PREMIUM INSIGHTS

- 4.1 ORTHODONTIC SUPPLIES MARKET OVERVIEW

- FIGURE 11 RISING PREVALENCE OF MALOCCLUSION AND GROWING AWARENESS OF ORTHODONTIC TREATMENT TO BOOST MARKET GROWTH

- 4.2 ORTHODONTIC SUPPLIES MARKET, BY PATIENT, 2022 VS. 2027

- FIGURE 12 ADULT PATIENTS TO DOMINATE ORTHODONTIC SUPPLIES MARKET DURING FORECAST PERIOD

- 4.3 ORTHODONTIC SUPPLIES MARKET, BY END USER, 2022 VS. 2027

- FIGURE 13 HOSPITALS & DENTAL CLINICS TO CAPTURE LARGEST SHARE OF ORTHODONTIC SUPPLIES MARKET IN 2022 AND 2027

- 4.4 ORTHODONTIC SUPPLIES MARKET, BY REGION (2022-2027)

- FIGURE 14 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 ORTHODONTIC SUPPLIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing number of patients with malocclusions, jaw diseases, tooth decay/tooth loss, and jaw pain

- FIGURE 16 GLOBAL PREVALENCE OF MALOCCLUSIONS, 2020

- FIGURE 17 DENTISTS PER 10,000 POPULATION, BY COUNTRY (2019)

- 5.2.1.2 Increasing disposable incomes and expanding middle-class population in developing countries

- 5.2.1.3 Increasing awareness about advanced orthodontic treatments

- 5.2.1.4 Ongoing research and technological advancements in orthodontic products

- 5.2.2 RESTRAINTS

- 5.2.2.1 Risks and complications associated with orthodontic treatments

- TABLE 2 COMPLICATIONS/RISKS ASSOCIATED WITH ORTHODONTIC TREATMENTS

- 5.2.2.2 High cost of advanced orthodontic treatments in some nations

- FIGURE 18 AVERAGE COST OF BRACES IN ADULTS VS. CHILDREN (USD)

- TABLE 3 AVERAGE COST OF DENTAL TREATMENTS, BY COUNTRY (2021)

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth opportunities offered by emerging markets

- 5.2.3.2 Integration with digital technologies such as CAD/CAM and software

- FIGURE 19 PENETRATION OF DIGITAL TECHNOLOGY IN US DENTAL LABS (2015 VS. 2019)

- 5.2.3.3 Increasing use of social media by patients and dental professionals

- 5.2.3.4 Direct-to-consumer orthodontics

- 5.2.4 CHALLENGES

- 5.2.4.1 Dearth of trained dental practitioners

- 5.3 GLOBAL REGULATORY LANDSCAPE

- 5.3.1 US

- 5.3.2 EUROPE

- 5.3.3 ASIA PACIFIC

- 5.3.4 LATIN AMERICA

- 5.3.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4 TECHNOLOGY ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 20 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 21 SUPPLY CHAIN ANALYSIS

- 5.7 TRADE ANALYSIS

- TABLE 7 US DENTAL PRODUCT EXPORTS, 2013-2018 (USD MILLION)

- 5.8 PRICING TREND ANALYSIS

- TABLE 8 AVERAGE SELLING PRICE OF ORTHODONTIC SUPPLIES, BY KEY PLAYER, 2021 (USD)

- TABLE 9 AVERAGE PRICE OF ORTHODONTIC SUPPLIES, BY COUNTRY, 2021 (USD)

- 5.9 REIMBURSEMENT SCENARIO

- TABLE 10 CDT ORTHODONTIC CODES FOR COMPREHENSIVE ORTHODONTIC SERVICES, AS OF 2021

- TABLE 11 CDT ORTHODONTIC CODES FOR OTHER ORTHODONTIC SERVICES, AS OF 2021

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 OVERVIEW

- TABLE 12 ORTHODONTIC SUPPLIES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.10.2 THREAT FROM NEW ENTRANTS

- 5.10.3 THREAT FROM SUBSTITUTES

- 5.10.4 BARGAINING POWER OF SUPPLIERS

- 5.10.5 BARGAINING POWER OF BUYERS

- 5.10.6 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 PATENT ANALYSIS

- FIGURE 22 TOP 10 PATENT APPLICANTS FOR ORTHODONTIC SUPPLIES (JANUARY 2012-DECEMBER 2022)

- FIGURE 23 ORTHODONTIC SUPPLIES: PATENT APPLICATIONS, BY TYPE (JANUARY 2012-DECEMBER 2022)

- 5.12 ECOSYSTEM COVERAGE

- 5.13 KEY CONFERENCES AND EVENTS (2021-2023)

- TABLE 13 ORTHODONTIC SUPPLIES MARKET: DETAILED LIST OF MAJOR CONFERENCES & EVENTS

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 NON-EXTRACTION TREATMENT OF SEVERE CROWDING WITH SELF-LIGATING APPLIANCES

- TABLE 14 CASE 1: TREATMENT OF LOWER ANTERIOR CROWDING WITH SELF-LIGATING DAMON SYSTEM

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.16 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ORTHODONTIC SUPPLIES

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY PRODUCT SEGMENTS (%)

- 5.16.2 KEY BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR ORTHODONTIC SUPPLIES

- TABLE 16 KEY BUYING CRITERIA FOR ORTHODONTIC SUPPLIES

6 ORTHODONTIC SUPPLIES MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 17 ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 6.2 REMOVABLE BRACES

- 6.2.1 GROWING DEMAND FOR INVISIBLE BRACES DUE TO AESTHETIC BENEFITS TO DRIVE GROWTH

- TABLE 18 ORTHODONTIC SUPPLIES MARKET FOR REMOVABLE BRACES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 19 ORTHODONTIC SUPPLIES MARKET FOR REMOVABLE BRACES, BY PATIENT, 2020-2027 (USD MILLION)

- TABLE 20 ORTHODONTIC SUPPLIES MARKET FOR REMOVABLE BRACES, BY END USER, 2020-2027 (USD MILLION)

- 6.3 FIXED BRACES

- TABLE 21 ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 22 ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY PATIENT, 2020-2027 (USD MILLION)

- TABLE 23 ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY END USER, 2020-2027 (USD MILLION)

- TABLE 24 ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY REGION, 2020-2027 (USD MILLION)

- 6.3.1 BRACKETS

- 6.3.1.1 Brackets, by type

- TABLE 25 BRACKETS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 26 BRACKETS MARKET, BY PATIENT, 2020-2027 (USD MILLION)

- TABLE 27 BRACKETS MARKET, BY END USER, 2020-2027 (USD MILLION)

- TABLE 28 BRACKETS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.1.1.1 Conventional brackets

- 6.3.1.1.1.1 Wide adoption in treating orthodontic ailments to drive market

- 6.3.1.1.1 Conventional brackets

- TABLE 29 CONVENTIONAL BRACKETS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.1.1.2 Self-ligating brackets

- 6.3.1.1.2.1 Growing awareness of advantages to boost adoption

- 6.3.1.1.2 Self-ligating brackets

- TABLE 30 SELF-LIGATING BRACKETS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.1.1.3 Lingual brackets

- 6.3.1.1.3.1 Increased efficiency and growing adoption to fuel growth

- 6.3.1.1.3 Lingual brackets

- TABLE 31 LINGUAL BRACKETS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.1.2 Brackets, by material

- TABLE 32 BRACKETS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- 6.3.1.2.1 Metal brackets

- 6.3.1.2.1.1 High durability and increased potential in treatment of serious orthodontic cases to fuel demand

- 6.3.1.2.1 Metal brackets

- TABLE 33 METAL BRACKETS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.1.2.2 Ceramic brackets

- 6.3.1.2.2.1 Growth of cosmetic industry and rising awareness to boost market

- 6.3.1.2.2 Ceramic brackets

- TABLE 34 CERAMIC BRACKETS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.2 ARCHWIRES

- TABLE 35 ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 36 ARCHWIRES MARKET, BY PATIENT, 2020-2027 (USD MILLION)

- TABLE 37 ARCHWIRES MARKET, BY END USER, 2020-2027 (USD MILLION)

- TABLE 38 ARCHWIRES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.2.1 Beta titanium archwires

- 6.3.2.1.1 Low potential for hypersensitivity and excellent formability to increase usage

- 6.3.2.1 Beta titanium archwires

- TABLE 39 BETA TITANIUM ARCHWIRES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.2.2 Nickel titanium archwires

- 6.3.2.2.1 Greater strength than other alloy wires to increase preference

- 6.3.2.2 Nickel titanium archwires

- TABLE 40 NICKEL TITANIUM ARCHWIRES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.2.3 Stainless steel archwires

- 6.3.2.3.1 Compatibility with metal and ceramic brackets to fuel demand

- 6.3.2.3 Stainless steel archwires

- TABLE 41 STAINLESS STEEL ARCHWIRES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.3 ANCHORAGE APPLIANCES

- TABLE 42 ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 43 ANCHORAGE APPLIANCES MARKET, BY PATIENT, 2020-2027 (USD MILLION)

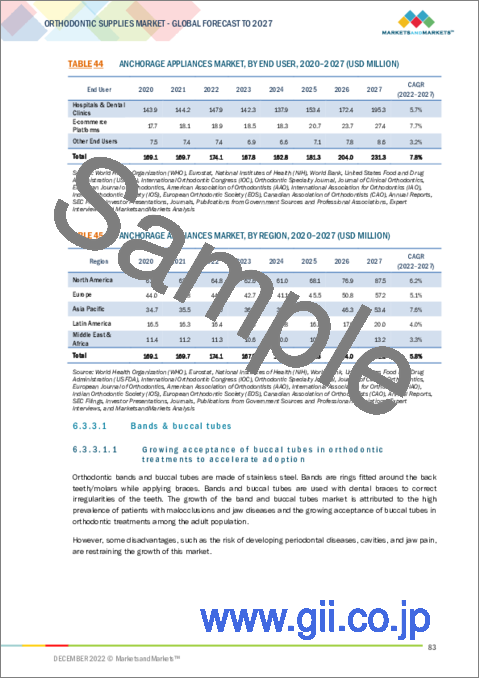

- TABLE 44 ANCHORAGE APPLIANCES MARKET, BY END USER, 2020-2027 (USD MILLION)

- TABLE 45 ANCHORAGE APPLIANCES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.3.1 Bands & buccal tubes

- 6.3.3.1.1 Growing acceptance of buccal tubes in orthodontic treatments to accelerate adoption

- 6.3.3.1 Bands & buccal tubes

- TABLE 46 BANDS & BUCCAL TUBES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.3.2 Miniscrews

- 6.3.3.2.1 Growing availability of orthodontic miniscrews to fuel growth

- 6.3.3.2 Miniscrews

- TABLE 47 MINISCREWS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.4 LIGATURES

- TABLE 48 LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 49 LIGATURES MARKET, BY PATIENT, 2020-2027 (USD MILLION)

- TABLE 50 LIGATURES MARKET, BY END USER, 2020-2027 (USD MILLION)

- TABLE 51 LIGATURES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.4.1 Elastomeric ligatures

- 6.3.4.1.1 Wide variety and low cost to boost adoption

- 6.3.4.1 Elastomeric ligatures

- TABLE 52 ELASTOMERIC LIGATURES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.4.2 Wire ligatures

- 6.3.4.2.1 High risk of laceration to affect adoption rate

- 6.3.4.2 Wire ligatures

- TABLE 53 WIRE LIGATURES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.4 ADHESIVES

- 6.4.1 COMPLICATIONS AND ALLERGIES DUE TO ADHESIVE COMPONENTS TO LIMIT GROWTH

- TABLE 54 ORTHODONTIC SUPPLIES MARKET FOR ADHESIVES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 55 ORTHODONTIC SUPPLIES MARKET FOR ADHESIVES, BY PATIENT, 2020-2027 (USD MILLION)

- TABLE 56 ORTHODONTIC SUPPLIES MARKET FOR ADHESIVES, BY END USER, 2020-2027 (USD MILLION)

- 6.5 ACCESSORIES

- 6.5.1 GROWING USE TO BOOST TREATMENT SUCCESS TO DRIVE ADOPTION

- TABLE 57 ORTHODONTIC SUPPLIES MARKET FOR ACCESSORIES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 58 ORTHODONTIC SUPPLIES MARKET FOR ACCESSORIES, BY PATIENT, 2020-2027 (USD MILLION)

- TABLE 59 ORTHODONTIC SUPPLIES MARKET FOR ACCESSORIES, BY END USER, 2020-2027 (USD MILLION)

7 ORTHODONTIC SUPPLIES MARKET, BY PATIENT

- 7.1 INTRODUCTION

- TABLE 60 ORTHODONTIC SUPPLIES MARKET, BY PATIENT, 2020-2027 (USD MILLION)

- 7.2 ADULTS

- 7.2.1 GROWING FOCUS ON FACIAL AESTHETICS TO DRIVE GROWTH

- TABLE 61 ORTHODONTIC SUPPLIES MARKET FOR ADULTS, BY REGION, 2020-2027 (USD MILLION)

- 7.3 CHILDREN & TEENAGERS

- 7.3.1 HIGH PREVALENCE OF MALOCCLUSION AND RISING ADOPTION OF FIXED BRACES TO SUPPORT GROWTH

- TABLE 62 ORTHODONTIC SUPPLIES MARKET FOR CHILDREN & TEENAGERS, BY REGION, 2020-2027 (USD MILLION)

8 ORTHODONTIC SUPPLIES MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 63 ORTHODONTIC SUPPLIES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.2 HOSPITALS & DENTAL CLINICS

- 8.2.1 IMPROVING HEALTHCARE INFRASTRUCTURE AND INVESTMENTS TO PROMOTE MARKET GROWTH

- TABLE 64 ORTHODONTIC SUPPLIES MARKET FOR HOSPITALS & DENTAL CLINICS, BY REGION, 2020-2027 (USD MILLION)

- 8.3 E-COMMERCE PLATFORMS

- 8.3.1 RISING ACCESSIBILITY & AFFORDABILITY OF ORTHODONTIC SUPPLIES TO FUEL GROWTH OF E-COMMERCE PLATFORMS

- TABLE 65 ORTHODONTIC SUPPLIES MARKET FOR E-COMMERCE PLATFORMS, BY REGION, 2020-2027 (USD MILLION)

- 8.4 OTHER END USERS

- TABLE 66 ORTHODONTIC SUPPLIES MARKET FOR OTHER END USERS, BY REGION, 2020-2027 (USD MILLION)

9 ORTHODONTIC SUPPLIES MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 67 ORTHODONTIC SUPPLIES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 26 NORTH AMERICA: ORTHODONTIC SUPPLIES MARKET SNAPSHOT

- TABLE 68 NORTH AMERICA: ORTHODONTIC SUPPLIES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 69 NORTH AMERICA: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 70 NORTH AMERICA: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 72 NORTH AMERICA: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 73 NORTH AMERICA: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 74 NORTH AMERICA: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 75 NORTH AMERICA: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 76 NORTH AMERICA: ORTHODONTIC SUPPLIES MARKET, BY PATIENT, 2020-2027 (USD MILLION)

- TABLE 77 NORTH AMERICA: ORTHODONTIC SUPPLIES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Rising number of patients for orthodontic treatment to drive growth

- TABLE 78 US: COST OF ORTHODONTIC BRACES, 2020

- TABLE 79 US: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 80 US: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 81 US: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 82 US: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 83 US: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 84 US: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 85 US: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Increasing number of orthodontic procedures among adults to support growth

- TABLE 86 CANADA: COST OF ORTHODONTIC BRACES, 2020

- TABLE 87 CANADA: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 88 CANADA: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 89 CANADA: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 90 CANADA: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 91 CANADA: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 92 CANADA: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 93 CANADA: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.3 EUROPE

- TABLE 94 ORTHODONTIC INSURANCE SERVICES OFFERED IN EUROPEAN COUNTRIES

- TABLE 95 EUROPE: ORTHODONTIC SUPPLIES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 96 EUROPE: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 97 EUROPE: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 98 EUROPE: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 99 EUROPE: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 100 EUROPE: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 101 EUROPE: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 102 EUROPE: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 103 EUROPE: ORTHODONTIC SUPPLIES MARKET, BY PATIENT, 2020-2027 (USD MILLION)

- TABLE 104 EUROPE: ORTHODONTIC SUPPLIES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Germany to dominate market for orthodontic supplies in Europe

- TABLE 105 GERMANY: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 106 GERMANY: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 107 GERMANY: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 108 GERMANY: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 109 GERMANY: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 110 GERMANY: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 111 GERMANY: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Increased awareness of adult orthodontic options and social media to influence adult patients in country

- TABLE 112 UK: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 113 UK: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 114 UK: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 115 UK: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 116 UK: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 117 UK: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 118 UK: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Unfavorable reimbursement policies to restrain optimal growth potential

- TABLE 119 FRANCE: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 120 FRANCE: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 121 FRANCE: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 122 FRANCE: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 123 FRANCE: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 124 FRANCE: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 125 FRANCE: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Strategic collaborations among players and dental research organizations to boost market

- TABLE 126 ITALY: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 127 ITALY: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 128 ITALY: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 129 ITALY: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 130 ITALY: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 131 ITALY: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 132 ITALY: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Continuous investments by manufacturers to support growth

- TABLE 133 SPAIN: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 134 SPAIN: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 135 SPAIN: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 136 SPAIN: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 137 SPAIN: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 138 SPAIN: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 139 SPAIN: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 140 REST OF EUROPE: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 141 REST OF EUROPE: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 142 REST OF EUROPE: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 143 REST OF EUROPE: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 144 REST OF EUROPE: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 145 REST OF EUROPE: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 146 REST OF EUROPE: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 27 ASIA PACIFIC: ORTHODONTIC SUPPLIES MARKET SNAPSHOT

- TABLE 147 ASIA PACIFIC: ORTHODONTIC SUPPLIES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 148 ASIA PACIFIC: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 149 ASIA PACIFIC: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 150 ASIA PACIFIC: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 151 ASIA PACIFIC: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 152 ASIA PACIFIC: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 153 ASIA PACIFIC: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 154 ASIA PACIFIC: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 155 ASIA PACIFIC: ORTHODONTIC SUPPLIES MARKET, BY PATIENT, 2020-2027 (USD MILLION)

- TABLE 156 ASIA PACIFIC: ORTHODONTIC SUPPLIES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Increasing prevalence of malocclusions and jaw diseases to boost demand for orthodontic supplies

- TABLE 157 CHINA: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 158 CHINA: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 159 CHINA: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 160 CHINA: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 161 CHINA: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 162 CHINA: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 163 CHINA: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.4.2 INDIA

- 9.4.2.1 High prevalence of malocclusions among children to drive market

- TABLE 164 INDIA: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 165 INDIA: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 166 INDIA: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 167 INDIA: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 168 INDIA: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 169 INDIA: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 170 INDIA: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.4.3 JAPAN

- 9.4.3.1 Growing penetration of well-established players to boost growth

- TABLE 171 JAPAN: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 172 JAPAN: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 173 JAPAN: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 174 JAPAN: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 175 JAPAN: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 176 JAPAN: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 177 JAPAN: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.4.4 AUSTRALIA

- 9.4.4.1 Government initiatives to increase awareness to favor market growth

- TABLE 178 AUSTRALIA: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 179 AUSTRALIA: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 180 AUSTRALIA: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 181 AUSTRALIA: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 182 AUSTRALIA: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 183 AUSTRALIA: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 184 AUSTRALIA: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Increasing patient population to drive demand for orthodontic treatment

- TABLE 185 SOUTH KOREA: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 186 SOUTH KOREA: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 187 SOUTH KOREA: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 188 SOUTH KOREA: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 189 SOUTH KOREA: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 190 SOUTH KOREA: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 191 SOUTH KOREA: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.4.6 REST OF ASIA PACIFIC

- TABLE 192 REST OF ASIA PACIFIC: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 193 REST OF ASIA PACIFIC: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 194 REST OF ASIA PACIFIC: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 195 REST OF ASIA PACIFIC: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 196 REST OF ASIA PACIFIC: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.5 LATIN AMERICA

- TABLE 199 LATIN AMERICA: ORTHODONTIC SUPPLIES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 200 LATIN AMERICA: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 201 LATIN AMERICA: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 202 LATIN AMERICA: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 203 LATIN AMERICA: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 204 LATIN AMERICA: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 205 LATIN AMERICA: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 206 LATIN AMERICA: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 207 LATIN AMERICA: ORTHODONTIC SUPPLIES MARKET, BY PATIENT, 2020-2027 (USD MILLION)

- TABLE 208 LATIN AMERICA: ORTHODONTIC SUPPLIES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.5.1 BRAZIL

- 9.5.1.1 Rising demand for orthodontic treatment from young patients to boost growth

- TABLE 209 BRAZIL: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 210 BRAZIL: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 211 BRAZIL: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 212 BRAZIL: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 213 BRAZIL: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 214 BRAZIL: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 215 BRAZIL: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.5.2 MEXICO

- 9.5.2.1 Large patient population to drive demand

- TABLE 216 COST OF ORTHODONTIC BRACES IN MEXICO (AS OF 2020)

- TABLE 217 MEXICO: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 218 MEXICO: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 219 MEXICO: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 220 MEXICO: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 221 MEXICO: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 222 MEXICO: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 223 MEXICO: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.5.3 REST OF LATIN AMERICA

- TABLE 224 REST OF LATIN AMERICA: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 225 REST OF LATIN AMERICA: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 226 REST OF LATIN AMERICA: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 227 REST OF LATIN AMERICA: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 228 REST OF LATIN AMERICA: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 229 REST OF LATIN AMERICA: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 230 REST OF LATIN AMERICA: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 LACK OF AWARENESS OF ORTHODONTIC TREATMENT TO RESTRAIN MARKET GROWTH

- TABLE 231 MIDDLE EAST & AFRICA: ORTHODONTIC SUPPLIES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: ORTHODONTIC SUPPLIES MARKET FOR FIXED BRACES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: BRACKETS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: BRACKETS, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: ARCHWIRES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: ANCHORAGE APPLIANCES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: LIGATURES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: ORTHODONTIC SUPPLIES MARKET, BY PATIENT, 2020-2027 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: ORTHODONTIC SUPPLIES MARKET, BY END USER, 2020-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 28 OVERVIEW OF STRATEGIES ADOPTED BY COMPANIES (2019-2022)

- 10.3 REVENUE SHARE ANALYSIS

- FIGURE 29 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN ORTHODONTIC SUPPLIES MARKET, 2021

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 30 MARKET SHARE ANALYSIS OF TOP PLAYERS IN ORTHODONTIC SUPPLIES MARKET, 2021

- TABLE 240 ORTHODONTIC SUPPLIES MARKET: DEGREE OF COMPETITION

- 10.5 COMPETITIVE LEADERSHIP MAPPING: COMPANY EVALUATION QUADRANT (2021)

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 31 ORTHODONTIC SUPPLIES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2021)

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 STARTING BLOCKS

- 10.6.3 RESPONSIVE COMPANIES

- 10.6.4 DYNAMIC COMPANIES

- FIGURE 32 ORTHODONTIC SUPPLIES MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2021

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 241 COMPANY PRODUCT & REGIONAL FOOTPRINT

- TABLE 242 COMPANY PRODUCT FOOTPRINT

- TABLE 243 COMPANY REGIONAL FOOTPRINT

- 10.8 COMPETITIVE SCENARIO

- TABLE 244 KEY PRODUCT LAUNCHES, 2019-2022

- TABLE 245 DEALS, 2019-2022

- TABLE 246 OTHER KEY DEVELOPMENTS, 2019-2022

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

- 11.1.1 3M

- TABLE 247 3M: BUSINESS OVERVIEW

- FIGURE 33 COMPANY SNAPSHOT: 3M (2021)

- 11.1.2 ENVISTA HOLDINGS CORPORATION

- TABLE 248 ENVISTA HOLDINGS CORPORATION: BUSINESS OVERVIEW

- FIGURE 34 COMPANY SNAPSHOT: ENVISTA HOLDINGS CORPORATION (2021)

- 11.1.3 ALIGN TECHNOLOGY

- TABLE 249 ALIGN TECHNOLOGY: BUSINESS OVERVIEW

- FIGURE 35 COMPANY SNAPSHOT: ALIGN TECHNOLOGY (2021)

- 11.1.4 DENTSPLY SIRONA

- TABLE 250 DENTSPLY SIRONA: BUSINESS OVERVIEW

- FIGURE 36 COMPANY SNAPSHOT: DENTSPLY SIRONA (2021)

- 11.1.5 INSTITUT STRAUMANN AG

- TABLE 251 INSTITUT STRAUMANN AG: BUSINESS OVERVIEW

- FIGURE 37 COMPANY SNAPSHOT: INSTITUT STRAUMANN AG (2021)

- 11.1.6 AMERICAN ORTHODONTICS

- TABLE 252 AMERICAN ORTHODONTICS: BUSINESS OVERVIEW

- 11.1.7 HENRY SCHEIN

- TABLE 253 HENRY SCHEIN: BUSINESS OVERVIEW

- FIGURE 38 COMPANY SNAPSHOT: HENRY SCHEIN (2021)

- 11.1.8 ROCKY MOUNTAIN ORTHODONTICS

- TABLE 254 ROCKY MOUNTAIN ORTHODONTICS: BUSINESS OVERVIEW

- 11.1.9 G&H ORTHODONTICS

- TABLE 255 G&H ORTHODONTICS: BUSINESS OVERVIEW

- 11.1.10 DENTAURUM

- TABLE 256 DENTAURUM: BUSINESS OVERVIEW

- 11.1.11 TP ORTHODONTICS

- TABLE 257 TP ORTHODONTICS: BUSINESS OVERVIEW

- 11.1.12 GREAT LAKES DENTAL TECHNOLOGIES

- TABLE 258 GREAT LAKES DENTAL TECHNOLOGIES: BUSINESS OVERVIEW

- 11.1.13 DB ORTHODONTICS

- TABLE 259 DB ORTHODONTICS: BUSINESS OVERVIEW

- 11.1.14 MORELLI ORTODONTIA

- TABLE 260 MORELLI ORTODONTIA: BUSINESS OVERVIEW

- 11.1.15 ULTRADENT PRODUCTS

- TABLE 261 ULTRADENT PRODUCTS: BUSINESS OVERVIEW

- 11.1.16 ADITEK ORTHODONTICS

- TABLE 262 ADITEK ORTHODONTICS: BUSINESS OVERVIEW

- 11.1.17 MATT ORTHODONTICS

- TABLE 263 MATT ORTHODONTICS: BUSINESS OVERVIEW

- 11.1.18 JJ ORTHODONTICS

- TABLE 264 JJ ORTHODONTICS: BUSINESS OVERVIEW

- 11.1.19 SINO ORTHO LIMITED

- TABLE 265 SINO ORTHO LIMITED: BUSINESS OVERVIEW

- 11.1.20 JISCOP CO., LTD.

- TABLE 266 JISCOP CO., LTD.: BUSINESS OVERVIEW

- Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 EURODONTO

- 11.2.2 FORESTADENT BERNHARD FORSTER GMBH

- 11.2.3 ORTHOMETRIC

- 11.2.4 ORTHO CAPS GMBH

- 11.2.5 TECNIDENTUSA, LLC.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS