|

|

市場調査レポート

商品コード

1164610

ビタミンDの世界市場:アナログ別 (ビタミンD2、ビタミンD3)・形状別 (乾燥、液体)・用途別 (飼料・ペットフード、医薬品、機能性食品、パーソナルケア用品)・エンドユーザー別 (成人、妊婦、児童)・IU強度別・地域別の将来予測 (2027年まで)Vitamin D Market by Analog (Vitamin D2, Vitamin D3), Form (Dry, Liquid), Application (Feed & Pet Food, Pharma, Functional Food, and Personal Care), End Users (Adults, Pregnant Women, and Children), IU Strength and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ビタミンDの世界市場:アナログ別 (ビタミンD2、ビタミンD3)・形状別 (乾燥、液体)・用途別 (飼料・ペットフード、医薬品、機能性食品、パーソナルケア用品)・エンドユーザー別 (成人、妊婦、児童)・IU強度別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年11月25日

発行: MarketsandMarkets

ページ情報: 英文 269 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のビタミンDの市場規模は、2022年に13億米ドル、2027年には19億米ドルに達する見通しで、予測期間中に7.1%のCAGR (金額ベース) で成長すると予測されています。

ビタミンD市場は、世界中で消費量と飼料需要の増加に伴って拡大しています。特に飼料業界では、飼料製品の改良に対するニーズが高まる傾向にあり、栄養添加物に対する要求が強まっており、飼料産業からの各種ビタミンの需要が大幅に増加すると予想されます。さらに、バランスの取れた食生活の維持に対する消費者の関心の高まりや、ビタミンDの欠乏によって引き起こされるいくつかの病気に対する消費者の意識の高まりも、予測期間中のビタミンD市場を後押しすると考えられます。

"形状別では、乾燥セグメントが予測期間中に金額ベースで最も高いCAGRで成長する"

乾燥状のビタミンD市場は、2027年までに最も高いCAGRで成長すると予測されています。メーカー各社は、より安定的で、取り扱いと保管が容易で、幅広い製品に使用できる利便性から、乾燥ビタミンDを好んでいます。

"用途別では、医薬品分野が予測期間中に金額ベースで2番目に大きなシェアを占める"

用途別では医薬品セグメントが、2021年に市場を独占しています。さらに、ビタミンDの効力レベルまたはIUレベルに関連する高いコストのため、医薬品セグメントはより高く評価されています。また、医薬品セグメントは、健康補助食品、注射剤、カプセルに広く使用されているため、最高のCAGRで成長すると予測されています。ただし数量ベースでは、飼料・ペットフード部門が市場を支配してます。

"アナログ別では、ビタミンD3分野が金額ベースで予測期間中に安定した成長率を示す"

2021年の市場シェアは、金額ベースでビタミンD3が最大となっています。ビタミンD3は、ビタミンD2よりも効率的に循環血清25 (OH) D濃度を増加させます。さらに、ビタミンD2はビタミンD3よりも不純物が多く、除去の安定性が低いため、毒性リスクが高くなる可能性があります。動物飼料産業におけるビタミンD3の幅広い用途は、ビタミンD市場を牽引すると推測されます。

"エンドユーザー別では、成人向けが金額ベースで予測期間中に安定した成長率を示すと"

ビタミンDの欠乏は、50歳以上の成人に極めて多く見られます。重度の欠乏症は、骨軟化症、骨減少症、骨粗鬆症、変形性関節症などを引き起こし、深い骨の痛み、成長不良、骨折、弓状の脚、背骨の湾曲、足首、手首、膝の肥厚などの骨格の変形を引き起こします。これらの要因により、予測期間中、成人向けセグメントの成長が最も高くなっています。

"アジア太平洋は推定期間中、金額ベースで最大のシェアを占める"

アジア太平洋地域は、世界最大のビタミンD市場です。この地域では中国が市場を独占しています。アジア太平洋は、急速な経済成長により成長のピークを迎えています。さらに、熟練労働者・原材料・土地・設備を低コストで容易に準備できるため、生産施設を設置するための投資家を引き寄せています。

当レポートでは、世界のビタミンDの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、アナログ別・IU強度別・形状別・用途別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業動向

- イントロダクション

- バリューチェーン分析

- 研究開発

- 外注

- 製造

- 梱包・保管

- 流通

- エンドユーザー

- 価格分析

- 技術分析

- 食品のマイクロカプセル化

- サイクロソーム送達技術

- エコシステムマッピング:ビタミンD市場

- 需要サイド

- 供給サイド

- バイヤーに影響を与えるトレンド/混乱

- 特許分析

- 取引データ:ビタミンD市場

- 主な会議とイベント (2022年~2023年)

- ポーターのファイブフォース分析

- ケーススタディ

- 主な利害関係者と購入基準

- 規制の枠組み

第7章 ビタミンD市場の臨床レビュー

- イントロダクション

- 骨の健康

- くる病

- 骨粗鬆症

- 肌の健康

- 乾癬

- 欠損症の治療

- 免疫力の発達

- インフルエンザ

- CFR 172:人間が消費する食品への直接添加が許可されている食品添加物

- ビタミンD2

- ビタミンD3

第8章 ビタミンD市場:アナログ別

- イントロダクション

- ビタミンD2

- ビタミンD3

第9章 ビタミンD市場:IU強度別

- イントロダクション

第10章 ビタミンD市場:形状別

- イントロダクション

- 乾燥

- 液体

第11章 ビタミンD市場:用途別

- イントロダクション

- 飼料・ペットフード

- 動物飼料

- ペットフード

- 医薬品

- 機能性食品・飲料

- パーソナルケア用品

第12章 ビタミンD市場:エンドユーザー別

- イントロダクション

- 成人

- 妊婦

- 児童

第13章 ビタミンD市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- オランダ

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- 他のアジア太平洋諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 他の国々 (RoW)

- 南アフリカ

- 中東

- 他の中東・アフリカ諸国

第14章 競合情勢

- 概要

- 市場シェア分析 (2021年)

- 主要企業の過去の収益分析

- 企業評価クアドラント (主要企業)

- ビタミンD市場:その他の企業の評価クアドラント (2021年)

- 競合シナリオ

- 資本取引

- その他

第15章 企業プロファイル

- 主要企業

- DSM

- BASF SE

- FERMENTA BIOTECH LIMITED

- ZHEJIANG GARDEN BIOCHEMICAL HIGH-TECH CO., LTD

- DISHMAN GROUP

- TAIZHOU HAISHENG PHARMACEUTICALS CO., LTD.

- ZHEJIANG MEDICINE CO., LTD.

- PHW GROUP

- BIO-TECH PHARMACAL

- DIVI'S NUTRACEUTICALS

- SYNTHESIA, A.S.

- HANGZHOU THINK CHEMICAL CO LTD

- KINGDOMWAY NUTRITION, INC.

- MCKINLEY RESOURCES INC.

- NEWGEN PHARMA

- TAI ZHOU HISOUND PHARMACEUTICALS CO., LTD

- PHARMAVIT

- LYCORED

- STABICOAT VITAMINS

- STERNVITAMIN GMBH & CO. KG

- FARBEST-TALLMAN FOODS CORPORATION

- RABAR ANIMAL NUTRITION

- ADISSEO

第16章 隣接・関連市場

- イントロダクション

- 制限事項

- ビタミン市場

- 飼料添加物市場

第17章 付録

According to MarketsandMarkets, the vitamin D market size is estimated to be valued at USD 1.3 billion in 2022 and is projected to reach USD 1.9 billion by 2027, recording a CAGR of 7.1% during the forecast period in terms of value. The vitamin D market in escalating with the increase in consumption and demand of feed around the world. Moreover, the feed industry is observing an increasing trend in need for improved feed products, that strengthens the requirement for nutritional additives. Furthermore, in developing economies such as China and India, where there is a growing focus on animal nutrition, different vitamins are expected to experience a strong rise in the demand from the feed industry. In addition, increasing consumer concerns regarding maintaining a balanced diet and growing consumer awareness about several diseases caused by vitamin D deficiency will also boost the market of Vitamin D during the forecast period. Food fortification is one of the major trends, which is fueling the vitamin D market in the functional food & beverage industry.

"By form, the dry segment is estimated to grow at the highest CAGR during the forecast period in terms of value."

Vitamins are available in various grades and forms to suit the varying demands in end-use applications such as healthcare, food & beverage, animal feed, and personal care. The forms include spray-dried powder, beadlets, liquid, or crystals. The vitamin D market by dry form is projected to grow at a higher CAGR by 2027. Manufacturers prefer the dry form of vitamin D due to its greater stability, ease of handling and storage, and convenience of usage in a wide range of products. Most of the vitamin D sold is synthetic as compared to natural.

"By application, pharmaceutical segment holds the second largest share during the estimated year in terms of value."

Based on applications, the vitamin D market was dominated by the pharmaceutical segment in 2021, in terms of value. Moreover, due to higher cost associated with potency level or IU level of vitamin D, the pharmaceutical segment is valued higher. The pharmaceuticals segment is also projected to grow at the highest CAGR, owing to its wide usage in health supplements, injectables, and capsules.Globally, the volume market is dominated by the feed & pet food segment in the market.

Vitamin D is gaining traction in the healthcare and pharma industry due to its wide demand in nutritional supplements, owing to its various bone health benefits.

"By analog, vitamin D3 segment is estimated to witness a steady growth rate over the forecast period in terms of value."

Vitamin D3 holds the largest market share in 2021 in terms of value. Vitamin D3 increases circulating serum 25(OH)D concentration more efficiently than vitamin D2. Moreover, the larger impurities and smaller stability in the removal of vitamin D2 may lead to a elevated risk of toxicity than that coupled with vitamin D3. Main sources of vitamin D2 include mushrooms and yeast. The broad applications of vitamin D3 in the animal feed industry are estimated to drive the market for vitamin D.

"By end user, adults segment is estimated to witness the steady growth rate over the forecast period in terms of value."

Vitamin D deficiency is extremely prevalent in adults more than 50 years of age. Severe deficiency results in osteomalacia, osteopenia, osteoporosis, and osteoarthritis, which can lead to deep bone pain, poor growth, fractures, and deformities of the skeleton, such as bowed legs, the curvature of the spine, and thickening of ankles, wrists, and knees. These factors are responsible for the highest growth of the adults segment in the forecast period.

"Asia Pacific holds the largest share during the estimated year in terms of value. "

The Asia Pacific is the largest market for vitamin D globally. China dominates the market in this region. The Asia Pacific is recognising the peak growth due to speedy financial growth. Moreover, the region is drawing investors for setting up construction facilities due to the ease of readiness of skilled labor, raw materials, land, and equipment at a lower cost.

n January 2019, Fermenta Biotech Limited executed a 99-year lease agreement to acquire land of around 40,000-square-meter from the Gujarat Industrial Development Corporation (GIDC) authority, Ankleshwar, Sayakha, for future expansion. The company aimed to commence manufacturing by the end of 2020. This acquisition would increase the production capacity of vitamin D to facilitate product extensions and new product rollouts.

The vitamin D market is segmented region-wise, with a detailed analysis of each region. These regions include North America, Europe, Asia Pacific, South America, and RoW (South Africa, Middle East, Rest of Africa).

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 70%, Tier 2- 25%, and Tier 3- 5%

By Designation: C-level- 50%, D-level- 30%, and Others- 20%

By Region: Asia Pacific- 45%, Europe- 12%, North America- 21%, Rest of the World- 12%, and South America - 10%

Leading players profiled in this report include the following:

- DSM (Netherlands)

- Zhejiang Xinhecheng Co., Ltd. (China)

- Fermenta Biotech Ltd. (India)

- Dishman Group (India)

- Xiamen Jindawei Vitamin Co., Ltd. (China)

- Zhejiang Medicine Co., Ltd (China)

- PHW Group Lohmann & Co. (Germany)

- Sichuan Neijiang Huixin Pharmaceutical Co Ltd (China)

- BASF SE (Germany)

- Bio-Tech Pharmacal (US)

- Divi's Nutraceuticals (India)

- Synthesia, a.s. (CZE)

- HangZhou Think Chemical Co.,Ltd. (China)

- Kingdomway Nutrition, Inc. (CA)

- McKinley Resources Inc. (US)

- NewGen Pharma (US)

- TAI ZHOU HISOU ND PHARMACEUTICAL CO.,LTD (China)

- Pharmavit (Netherlands)

- Lycored (Israel)

- Stabicoat Vitamins (India)

- SternVitamin GmbH & Co. KG (Germany)

- Farbest-Tallman Foods Corporation (US)

- Rabar Animal Nutrition (Australia)

- Adisseo (France)

Research Coverage

This report segments the vitamin D market on the basis of application, analog, end user, form, IU type, and region. In terms of insights, this research report focuses on various levels of analyses-competitive landscape, and company profiles-which together comprise and discuss the basic views on the emerging and high-growth segments of the vitamin D market, high-growth regions, countries, drivers, restraints, opportunities, and challenges.

Reasons to buy this report

- To get a comprehensive overview of the vitamin D market

- To gain wide-ranging information about the top players in this industry, their product portfolio details, and their position in the market

- To gain insights into the major countries/regions, in which the vitamin D market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 VITAMIN D MARKET SEGMENTATION

- FIGURE 2 REGIONAL SEGMENTATION

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2021

- 1.6 VOLUME UNIT CONSIDERED

- 1.7 INCLUSIONS AND EXCLUSIONS

- 1.8 STAKEHOLDERS

- 1.9 LIMITATIONS

- 1.10 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 VITAMIN D MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primary interviews

- 2.1.2.5 Key primary insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 APPROACH ONE - BOTTOM-UP

- FIGURE 5 APPROACH ONE - BOTTOM-UP

- 2.3 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 VITAMIN D MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 8 VITAMIN D MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 VITAMIN D MARKET, BY ANALOG, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 VITAMIN D MARKET, BY IU STRENGTH, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 VITAMIN D MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 ASIA PACIFIC TO GROW AT HIGHEST CAGR IN VITAMIN D MARKET FROM 2022 TO 2027

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN VITAMIN D MARKET

- FIGURE 13 HIGH ADOPTION OF VITAMIN D IN DEVELOPING MARKETS TO BOOST MARKET GROWTH

- 4.2 ASIA PACIFIC: VITAMIN D MARKET, BY ANALOG AND COUNTRY

- FIGURE 14 CHINA TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC MARKET IN 2021

- 4.3 VITAMIN D MARKET, BY APPLICATION

- FIGURE 15 FEED & PET FOOD SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 VITAMIN D MARKET, BY END USER

- FIGURE 16 ADULTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 VITAMIN D MARKET, BY ANALOG

- FIGURE 17 VITAMIN D3 SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.6 VITAMIN D MARKET, BY FORM

- FIGURE 18 DRY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.7 VITAMIN D MARKET, BY IU STRENGTH

- FIGURE 19 500,000 IU SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.8 VITAMIN D MARKET, BY APPLICATION AND REGION

- FIGURE 20 ASIA PACIFIC TO DOMINATE APPLICATION SEGMENT DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.1.1 MACROECONOMIC FACTORS

- 5.2 MARKET DYNAMICS

- FIGURE 21 VITAMIN D MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in demand for functional and nutritionally enriched processed food products

- 5.2.1.2 Rise in preference for fortified food among consumers

- 5.2.1.3 Increase in awareness regarding bone and joint health

- 5.2.1.4 Prevalence of vitamin deficiencies

- 5.2.1.5 Feed fortification due to rise in global meat & dairy product consumption

- FIGURE 22 MEAT CONSUMPTION, BY LIVESTOCK MEAT TYPE, 2015-2024 (KT CWE)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Scarcity of ingredients coupled with high cost

- 5.2.2.2 Constrained supply of raw materials for natural vitamins

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Usage of vitamin D in personal care products

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory factors and standardization

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH & DEVELOPMENT

- 6.2.2 SOURCING

- 6.2.3 MANUFACTURING

- 6.2.4 PACKAGING AND STORAGE

- 6.2.5 DISTRIBUTION

- 6.2.6 END USERS

- FIGURE 23 VALUE CHAIN ANALYSIS: VITAMIN D MARKET

- 6.2.7 PRICING ANALYSIS

- 6.2.7.1 Average selling price trend analysis

- TABLE 2 VITAMIN D MARKET: AVERAGE SELLING PRICE, BY ANALOG, 2019-2022 (USD/KG)

- TABLE 3 VITAMIN D MARKET: AVERAGE SELLING PRICE, BY END USER, 2019-2022 (USD/KG)

- TABLE 4 VITAMIN D MARKET: AVERAGE SELLING PRICE, BY FORM, 2019-2022 (USD/KG)

- TABLE 5 VITAMIN D MARKET: AVERAGE SELLING PRICE, BY IU STRENGTH, 2019-2022 (USD/KG)

- TABLE 6 VITAMIN D MARKET: AVERAGE SELLING PRICE, BY REGION, 2019-2022 (USD/KG)

- TABLE 7 VITAMIN D MARKET: AVERAGE SELLING PRICE, BY APPLICATION, 2019-2022 (USD/KG)

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 FOOD MICROENCAPSULATION

- 6.3.2 CYCLOSOME DELIVERY TECHNOLOGY

- 6.4 ECOSYSTEM MAPPING: VITAMIN D MARKET

- 6.4.1 DEMAND SIDE

- 6.4.2 SUPPLY SIDE

- FIGURE 24 VITAMIN D MARKET: ECOSYSTEM

- TABLE 8 VITAMIN D MARKET: SUPPLY CHAIN (ECOSYSTEM)

- 6.5 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 25 VITAMIN D MARKET: TRENDS IMPACTING BUYERS

- 6.6 PATENT ANALYSIS

- FIGURE 26 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2022

- TABLE 9 PATENTS PERTAINING TO VITAMIN D, 2020-2022

- 6.7 TRADE DATA: VITAMIN D MARKET

- TABLE 10 IMPORT DATA OF VITAMINS, BY COUNTRY, 2019-2020 (USD MILLION)

- TABLE 11 EXPORT DATA OF VITAMINS, BY COUNTRY, 2019-2021 (USD MILLION)

- 6.8 KEY CONFERENCES & EVENTS IN 2022-2023

- 6.9 PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 VITAMIN D MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.9.1 DEGREE OF COMPETITION

- 6.9.2 BARGAINING POWER OF SUPPLIERS

- 6.9.3 BARGAINING POWER OF BUYERS

- 6.9.4 THREAT OF SUBSTITUTES

- 6.9.5 THREAT OF NEW ENTRANTS

- 6.10 CASE STUDIES

- 6.10.1 CASE STUDY 1: OPTIMIZED VITAMIN D PRODUCTION

- 6.10.2 CASE STUDY 2: CO-INNOVATION BRINGING NEW PRODUCTS TO GROWING MARKET

- 6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VITAMIN D APPLICATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VITAMIN D APPLICATIONS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- 6.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12 REGULATORY FRAMEWORK

- 6.12.1 NORTH AMERICA

- 6.12.1.1 US

- 6.12.1.2 Mexico

- 6.12.1.3 Canada

- 6.12.2 EUROPE

- 6.12.2.1 France

- 6.12.2.2 UK

- 6.12.2.3 Rest of Europe

- 6.12.3 ASIA PACIFIC

- 6.12.3.1 India

- 6.12.3.2 China

- 6.12.3.3 Japan

- 6.12.3.4 Australia

- 6.12.4 SOUTH AMERICA

- 6.12.4.1 Brazil

- 6.12.4.2 Argentina

- 6.12.5 MIDDLE EAST

- 6.12.6 REST OF THE WORLD

- 6.12.1 NORTH AMERICA

7 CLINICAL REVIEW OF VITAMIN D MARKET

- 7.1 INTRODUCTION

- TABLE 17 RECOMMENDED DIETARY ALLOWANCE OF VITAMIN D, BY LIFE STAGE & GENDER

- TABLE 18 INDICATION OF VITAMIN D CONCENTRATION IN BLOOD SAMPLES

- 7.2 BONE HEALTH

- 7.2.1 RICKETS

- 7.2.2 OSTEOPOROSIS

- 7.3 SKIN HEALTH

- 7.3.1 PSORIASIS

- 7.3.2 DEFICIENCY TREATMENT

- 7.4 IMMUNITY DEVELOPMENT

- 7.4.1 INFLUENZA

- 7.5 CFR 172: FOOD ADDITIVES PERMITTED FOR DIRECT ADDITION TO FOOD FOR HUMAN CONSUMPTION

- 7.5.1 VITAMIN D2

- 7.5.2 VITAMIN D3

8 VITAMIN D MARKET, BY ANALOG

- 8.1 INTRODUCTION

- FIGURE 29 VITAMIN D3 LEADS MARKET, BY ANALOG, DURING FORECAST PERIOD

- TABLE 19 VITAMIN D MARKET, BY ANALOG, 2019-2021 (USD MILLION)

- TABLE 20 VITAMIN D MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 21 VITAMIN D MARKET, BY ANALOG, 2019-2021 (MT)

- TABLE 22 VITAMIN D MARKET, BY TYPE, 2022-2027 (MT)

- 8.2 VITAMIN D2

- 8.2.1 HEALTH AND WELLNESS PRODUCTS DRIVE MARKET

- TABLE 23 VITAMIN D2 MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 24 VITAMIN D2 MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 25 VITAMIN D2 MARKET, BY REGION, 2019-2021 (MT)

- TABLE 26 VITAMIN D2 MARKET, BY REGION, 2022-2027 (MT)

- 8.3 VITAMIN D3

- 8.3.1 GROWING CONSUMPTION OF VITAMIN D3 IN FEED INDUSTRY TO DRIVE DEMAND IN ASIA PACIFIC

- TABLE 27 VITAMIN D3 MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 28 VITAMIN D3 MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 29 VITAMIN D3 MARKET, BY REGION, 2019-2021 (MT)

- TABLE 30 VITAMIN D3 MARKET, BY REGION, 2022-2027 (MT)

9 VITAMIN D MARKET, BY IU STRENGTH

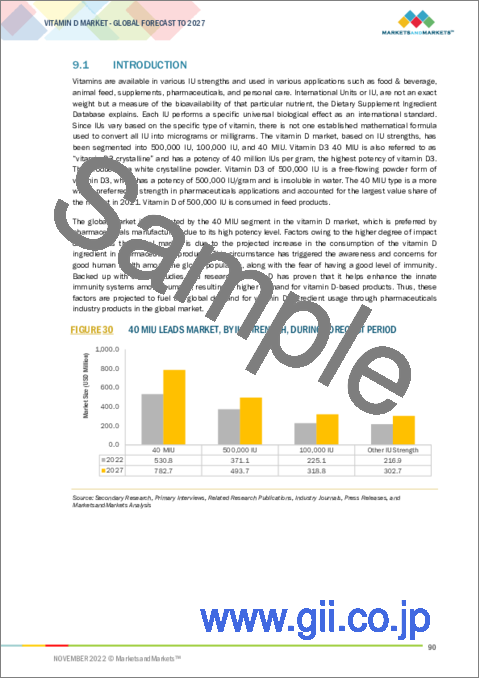

- 9.1 INTRODUCTION

- FIGURE 30 40 MIU LEADS MARKET, BY IU STRENGTH, DURING FORECAST PERIOD

- TABLE 31 VITAMIN D MARKET, BY IU STRENGTH, 2019-2021 (USD MILLION)

- TABLE 32 VITAMIN D MARKET, BY IU STRENGTH, 2022-2027 (USD MILLION)

- TABLE 33 VITAMIN D MARKET, BY IU STRENGTH, 2019-2021 (MT)

- TABLE 34 VITAMIN D MARKET, BY IU STRENGTH, 2022-2027 (MT)

10 VITAMIN D MARKET, BY FORM

- 10.1 INTRODUCTION

- FIGURE 31 DRY FORM LEADS MARKET, BY FORM, DURING FORECAST PERIOD

- TABLE 35 VITAMIN D MARKET, BY FORM, 2019-2021 (USD MILLION)

- TABLE 36 VITAMIN D MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 37 VITAMIN D MARKET, BY FORM, 2019-2021 (MT)

- TABLE 38 VITAMIN D MARKET, BY FORM, 2022-2027 (MT)

- 10.2 DRY

- 10.2.1 CRYSTALLINE FORM OF VITAMIN D TO GAIN TRACTION IN PHARMACEUTICALS INDUSTRY

- TABLE 39 DRY MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 40 DRY MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 41 DRY MARKET, BY REGION, 2019-2021 (MT)

- TABLE 42 DRY MARKET, BY REGION, 2022-2027 (MT)

- 10.3 LIQUID

- 10.3.1 LIQUID FORM OFFERS EASY ABSORPTION OF VITAMIN D

- TABLE 43 LIQUID MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 44 LIQUID MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 45 LIQUID MARKET, BY REGION, 2019-2021 (MT)

- TABLE 46 LIQUID MARKET, BY REGION, 2022-2027 (MT)

11 VITAMIN D MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- FIGURE 32 PHARMACEUTICALS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 47 VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 48 VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 49 VITAMIN D MARKET, BY FEED & PET FOOD APPLICATION, 2019-2021 (USD MILLION)

- TABLE 50 VITAMIN D MARKET, BY FEED & PET FOOD APPLICATION, 2022-2027 (USD MILLION)

- TABLE 51 VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 52 VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- TABLE 53 VITAMIN D MARKET, BY FEED & PET FOOD APPLICATION, 2019-2021 (MT)

- TABLE 54 VITAMIN D MARKET, BY FEED & PET FOOD APPLICATION, 2022-2027 (MT)

- 11.2 FEED & PET FOOD

- 11.2.1 VITAMIN D DEFICIENCY IN LIVESTOCK TO BOOST MARKET

- TABLE 55 FEED & PET FOOD MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 56 FEED & PET FOOD MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 57 FEED & PET FOOD MARKET, BY REGION, 2019-2021 (MT)

- TABLE 58 FEED & PET FOOD MARKET, BY REGION, 2022-2027 (MT)

- 11.2.2 ANIMAL FEED

- 11.2.2.1 Broilers and swine to be major consumers of vitamin D3 in animal feed industry

- TABLE 59 ANIMAL FEED MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 60 ANIMAL FEED MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 61 ANIMAL FEED MARKET, BY REGION, 2019-2021 (MT)

- TABLE 62 ANIMAL FEED MARKET, BY REGION, 2022-2027 (MT)

- 11.2.3 PET FOOD

- 11.2.3.1 Increasing spending on pet health to create opportunity for vitamin D manufacturers in pet food industry

- TABLE 63 PET FOOD MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 64 PET FOOD MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 65 PET FOOD MARKET, BY REGION, 2019-2021 (MT)

- TABLE 66 PET FOOD MARKET, BY REGION, 2022-2027 (MT)

- 11.3 PHARMACEUTICALS

- 11.3.1 RISING INNOVATION TO DRIVE DEMAND FOR VITAMIN D IN PHARMACEUTICALS INDUSTRY

- TABLE 67 PHARMACEUTICALS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 68 PHARMACEUTICALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 69 PHARMACEUTICALS MARKET, BY REGION, 2019-2021 (MT)

- TABLE 70 PHARMACEUTICALS MARKET, BY REGION, 2022-2027 (MT)

- 11.4 FUNCTIONAL FOOD & BEVERAGES

- 11.4.1 RISING AWARENESS REGARDING FUNCTIONAL FOOD & BEVERAGES TO CREATE OPPORTUNITIES FOR FOOD FORTIFICATION

- TABLE 71 SELECTED FOOD SOURCES OF VITAMIN D BY NATIONAL INSTITUTE OF HEALTH OFFICE OF DIETARY SUPPLEMENTS

- TABLE 72 FUNCTIONAL FOOD & BEVERAGES MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 73 FUNCTIONAL FOOD & BEVERAGES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 74 FUNCTIONAL FOOD & BEVERAGES MARKET, BY REGION, 2019-2021 (MT)

- TABLE 75 FUNCTIONAL FOOD & BEVERAGES MARKET, BY REGION, 2022-2027 (MT)

- 11.5 PERSONAL CARE

- 11.5.1 INCREASING SKIN PROBLEMS AMONG CONSUMERS TO DRIVE DEMAND FOR VITAMIN D IN COSMETICS INDUSTRY

- TABLE 76 PERSONAL CARE MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 77 PERSONAL CARE MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 78 PERSONAL CARE MARKET, BY REGION, 2019-2021 (MT)

- TABLE 79 PERSONAL CARE MARKET, BY REGION, 2022-2027 (MT)

12 VITAMIN D MARKET, BY END USER

- 12.1 INTRODUCTION

- FIGURE 33 ADULTS SEGMENT TO LEAD MARKET, BY END USER, DURING FORECAST PERIOD

- TABLE 80 VITAMIN D MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 81 VITAMIN D MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 82 VITAMIN D MARKET, BY END USER, 2019-2021 (MT)

- TABLE 83 VITAMIN D MARKET, BY END USER, 2022-2027 (MT)

- 12.2 ADULTS

- 12.2.1 VITAMIN D DEFICIENCY TO INCREASE CASES OF OSTEOMALACIA, OSTEOPENIA, AND OSTEOPOROSIS

- TABLE 84 ADULTS: VITAMIN D MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 85 ADULTS: VITAMIN D MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 86 ADULTS: VITAMIN D MARKET, BY REGION, 2019-2021 (MT)

- TABLE 87 ADULTS: VITAMIN D MARKET, BY REGION, 2022-2027 (MT)

- 12.3 PREGNANT WOMEN

- 12.3.1 CONSUMPTION OF HEALTH SUPPLEMENTS CONTAINING VITAMIN D BY PREGNANT WOMEN TO DRIVE MARKET

- TABLE 88 PREGNANT WOMEN: VITAMIN D MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 89 PREGNANT WOMEN: VITAMIN D MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 90 PREGNANT WOMEN: VITAMIN D MARKET, BY REGION, 2019-2021 (MT)

- TABLE 91 PREGNANT WOMEN: VITAMIN D MARKET, BY REGION, 2022-2027 (MT)

- 12.4 CHILDREN

- 12.4.1 VITAMIN D DEFICIENCY IN CHILDREN TO INCREASE CASES OF RICKETS

- TABLE 92 CHILDREN: VITAMIN D MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 93 CHILDREN: VITAMIN D MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 94 CHILDREN: VITAMIN D MARKET, BY REGION, 2019-2021 (MT)

- TABLE 95 CHILDREN: VITAMIN D MARKET, BY REGION, 2022-2027 (MT)

13 VITAMIN D MARKET, BY REGION

- 13.1 INTRODUCTION

- FIGURE 34 INDIA TO BE FASTEST-GROWING SUBREGIONAL MARKET

- TABLE 96 VITAMIN D MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 97 VITAMIN D MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 98 VITAMIN D MARKET, BY REGION, 2019-2021 (MT)

- TABLE 99 VITAMIN D MARKET, BY REGION, 2022-2027 (MT)

- 13.2 NORTH AMERICA

- TABLE 100 NORTH AMERICA: VITAMIN D MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 101 NORTH AMERICA: VITAMIN D MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 102 NORTH AMERICA: VITAMIN D MARKET, BY COUNTRY, 2019-2021 (MT)

- TABLE 103 NORTH AMERICA: VITAMIN D MARKET, BY COUNTRY, 2022-2027 (MT)

- TABLE 104 NORTH AMERICA: VITAMIN D MARKET, BY ANALOG, 2019-2021 (USD MILLION)

- TABLE 105 NORTH AMERICA: VITAMIN D MARKET, BY ANALOG, 2022-2027 (USD MILLION)

- TABLE 106 NORTH AMERICA: VITAMIN D MARKET, BY ANALOG, 2019-2021 (MT)

- TABLE 107 NORTH AMERICA: VITAMIN D MARKET, BY ANALOG, 2022-2027 (MT)

- TABLE 108 NORTH AMERICA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 109 NORTH AMERICA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 110 NORTH AMERICA: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019-2021 (USD MILLION)

- TABLE 111 NORTH AMERICA: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022-2027 (USD MILLION)

- TABLE 112 NORTH AMERICA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 113 NORTH AMERICA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- TABLE 114 NORTH AMERICA: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019-2021 (MT)

- TABLE 115 NORTH AMERICA: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022-2027 (MT)

- TABLE 116 NORTH AMERICA: VITAMIN D MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 117 NORTH AMERICA: VITAMIN D MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 118 NORTH AMERICA: VITAMIN D MARKET, BY END USER, 2019-2021 (MT)

- TABLE 119 NORTH AMERICA: VITAMIN D MARKET, BY END USER, 2022-2027 (MT)

- TABLE 120 NORTH AMERICA: VITAMIN D MARKET, BY FORM, 2019-2021 (USD MILLION)

- TABLE 121 NORTH AMERICA: VITAMIN D MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 122 NORTH AMERICA: VITAMIN D MARKET, BY FORM, 2019-2021 (MT)

- TABLE 123 NORTH AMERICA: VITAMIN D MARKET, BY FORM, 2022-2027 (MT)

- TABLE 124 NORTH AMERICA: VITAMIN D MARKET, BY IU STRENGTH, 2019-2021 (USD MILLION)

- TABLE 125 NORTH AMERICA: VITAMIN D MARKET, BY IU STRENGTH, 2022-2027 (USD MILLION)

- TABLE 126 NORTH AMERICA: VITAMIN D MARKET, BY IU STRENGTH, 2019-2021 (MT)

- TABLE 127 NORTH AMERICA: VITAMIN D MARKET, BY IU STRENGTH, 2022-2027 (MT)

- 13.2.1 US

- 13.2.1.1 US to be largest driver for vitamin D market in North America

- TABLE 128 US: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 129 US: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 130 US: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 131 US: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.2.2 CANADA

- 13.2.2.1 Increasing awareness regarding health & wellness among consumers to drive market

- TABLE 132 CANADA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 133 CANADA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 134 CANADA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 135 CANADA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.2.3 MEXICO

- 13.2.3.1 Rising prevalence of bone and joint diseases to boost market

- TABLE 136 MEXICO: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 137 MEXICO: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 138 MEXICO: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 139 MEXICO: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.3 EUROPE

- TABLE 140 EUROPE: VITAMIN D MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 141 EUROPE: VITAMIN D MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 142 EUROPE: VITAMIN D MARKET, BY COUNTRY, 2019-2021 (MT)

- TABLE 143 EUROPE: VITAMIN D MARKET, BY COUNTRY, 2022-2027 (MT)

- TABLE 144 EUROPE: VITAMIN D MARKET, BY ANALOG, 2019-2021 (USD MILLION)

- TABLE 145 EUROPE: VITAMIN D MARKET, BY ANALOG, 2022-2027 (USD MILLION)

- TABLE 146 EUROPE: VITAMIN D MARKET, BY ANALOG, 2019-2021 (MT)

- TABLE 147 EUROPE: VITAMIN D MARKET, BY ANALOG, 2022-2027 (MT)

- TABLE 148 EUROPE: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 149 EUROPE: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 150 EUROPE: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019-2021 (USD MILLION)

- TABLE 151 EUROPE: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022-2027 (USD MILLION)

- TABLE 152 EUROPE: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 153 EUROPE: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- TABLE 154 EUROPE: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019-2021 (MT)

- TABLE 155 EUROPE: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022-2027 (MT)

- TABLE 156 EUROPE: VITAMIN D MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 157 EUROPE: VITAMIN D MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 158 EUROPE: VITAMIN D MARKET, BY END USER, 2019-2021 (MT)

- TABLE 159 EUROPE: VITAMIN D MARKET, BY END USER, 2022-2027 (MT)

- TABLE 160 EUROPE: VITAMIN D MARKET, BY FORM, 2019-2021 (USD MILLION)

- TABLE 161 EUROPE: VITAMIN D MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 162 EUROPE: VITAMIN D MARKET, BY FORM, 2019-2021 (MT)

- TABLE 163 EUROPE: VITAMIN D MARKET, BY FORM, 2022-2027 (MT)

- TABLE 164 EUROPE: VITAMIN D MARKET, BY IU STRENGTH, 2019-2021 (USD MILLION)

- TABLE 165 EUROPE: VITAMIN D MARKET, BY IU STRENGTH, 2022-2027 (USD MILLION)

- TABLE 166 EUROPE: VITAMIN D MARKET, BY IU STRENGTH, 2019-2021 (MT)

- TABLE 167 EUROPE: VITAMIN D MARKET, BY IU STRENGTH, 2022-2027 (MT)

- 13.3.1 GERMANY

- 13.3.1.1 Increasing concern regarding fitness and health of immunity system to drive vitamin D market

- TABLE 168 GERMANY: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 169 GERMANY: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 170 GERMANY: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 171 GERMANY: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.3.2 FRANCE

- 13.3.2.1 Increasing consumer interest in functional foods and rising geriatric population to drive vitamin D market

- TABLE 172 FRANCE: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 173 FRANCE: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 174 FRANCE: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 175 FRANCE: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.3.3 UK

- 13.3.3.1 Consumer demand for healthier and functional foods to boost vitamin D market

- TABLE 176 UK: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 177 UK: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 178 UK: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 179 UK: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.3.4 ITALY

- 13.3.4.1 Scientific experiments, aging population, and changing lifestyles to drive vitamin D market

- TABLE 180 ITALY: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 181 ITALY: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 182 ITALY: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 183 ITALY: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.3.5 SPAIN

- 13.3.5.1 Rising demand for food supplements and nutraceuticals to drive vitamin D market

- TABLE 184 SPAIN: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 185 SPAIN: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 186 SPAIN: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 187 SPAIN: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.3.6 NETHERLANDS

- 13.3.6.1 Usage of vitamin D in feed and pet food industries to be major driver for vitamin D market

- TABLE 188 NETHERLANDS: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 189 NETHERLANDS: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 190 NETHERLANDS: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 191 NETHERLANDS: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.3.7 REST OF EUROPE

- TABLE 192 REST OF EUROPE: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 193 REST OF EUROPE: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 194 REST OF EUROPE: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 195 REST OF EUROPE: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.4 ASIA PACIFIC

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 196 ASIA PACIFIC: VITAMIN D MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 197 ASIA PACIFIC: VITAMIN D MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 198 ASIA PACIFIC: VITAMIN D MARKET, BY COUNTRY, 2019-2021 (MT)

- TABLE 199 ASIA PACIFIC: VITAMIN D MARKET, BY COUNTRY, 2022-2027 (MT)

- TABLE 200 ASIA PACIFIC: VITAMIN D MARKET, BY ANALOG, 2019-2021 (USD MILLION)

- TABLE 201 ASIA PACIFIC: VITAMIN D MARKET, BY ANALOG, 2022-2027 (USD MILLION)

- TABLE 202 ASIA PACIFIC: VITAMIN D MARKET, BY ANALOG, 2019-2021 (MT)

- TABLE 203 ASIA PACIFIC: VITAMIN D MARKET, BY ANALOG, 2022-2027 (MT)

- TABLE 204 ASIA PACIFIC: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 205 ASIA PACIFIC: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 206 ASIA PACIFIC: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019-2021 (USD MILLION)

- TABLE 207 ASIA PACIFIC: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022-2027 (USD MILLION)

- TABLE 208 ASIA PACIFIC: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 209 ASIA PACIFIC: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- TABLE 210 ASIA PACIFIC: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019-2021 (MT)

- TABLE 211 ASIA PACIFIC: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022-2027 (MT)

- TABLE 212 ASIA PACIFIC: VITAMIN D MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 213 ASIA PACIFIC: VITAMIN D MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 214 ASIA PACIFIC: VITAMIN D MARKET, BY END USER, 2019-2021 (MT)

- TABLE 215 ASIA PACIFIC: VITAMIN D MARKET, BY END USER, 2022-2027 (MT)

- TABLE 216 ASIA PACIFIC: VITAMIN D MARKET, BY FORM, 2019-2021 (USD MILLION)

- TABLE 217 ASIA PACIFIC: VITAMIN D MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 218 ASIA PACIFIC: VITAMIN D MARKET, BY FORM, 2019-2021 (MT)

- TABLE 219 ASIA PACIFIC: VITAMIN D MARKET, BY FORM, 2022-2027 (MT)

- TABLE 220 ASIA PACIFIC: VITAMIN D MARKET, BY IU STRENGTH, 2019-2021 (USD MILLION)

- TABLE 221 ASIA PACIFIC: VITAMIN D MARKET, BY IU STRENGTH, 2022-2027 (USD MILLION)

- TABLE 222 ASIA PACIFIC: VITAMIN D MARKET, BY IU STRENGTH, 2019-2021 (MT)

- TABLE 223 ASIA PACIFIC: VITAMIN D MARKET, BY IU STRENGTH, 2022-2027 (MT)

- 13.4.1 CHINA

- 13.4.1.1 China to lead vitamin D market in pharmaceutical, food & beverages, and feed additives industry

- TABLE 224 CHINA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 225 CHINA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 226 CHINA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 227 CHINA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.4.2 INDIA

- 13.4.2.1 Vitamin D deficiency in Indian population to create new opportunities for vitamin D manufacturers

- TABLE 228 INDIA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 229 INDIA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 230 INDIA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 231 INDIA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.4.3 JAPAN

- 13.4.3.1 Japanese personal care industry to fuel vitamin D market growth

- TABLE 232 JAPAN: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 233 JAPAN: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 234 JAPAN: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 235 JAPAN: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.4.4 REST OF ASIA PACIFIC

- TABLE 236 REST OF ASIA PACIFIC: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 237 REST OF ASIA PACIFIC: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 238 REST OF ASIA PACIFIC: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 239 REST OF ASIA PACIFIC: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.5 SOUTH AMERICA

- FIGURE 36 SOUTH AMERICA: MARKET SNAPSHOT

- TABLE 240 SOUTH AMERICA: VITAMIN D MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 241 SOUTH AMERICA: VITAMIN D MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 242 SOUTH AMERICA: VITAMIN D MARKET, BY COUNTRY, 2019-2021 (MT)

- TABLE 243 SOUTH AMERICA: VITAMIN D MARKET, BY COUNTRY, 2022-2027 (MT)

- TABLE 244 SOUTH AMERICA: VITAMIN D MARKET, BY ANALOG, 2019-2021 (USD MILLION)

- TABLE 245 SOUTH AMERICA: VITAMIN D MARKET, BY ANALOG, 2022-2027 (USD MILLION)

- TABLE 246 SOUTH AMERICA: VITAMIN D MARKET, BY ANALOG, 2019-2021 (MT)

- TABLE 247 SOUTH AMERICA: VITAMIN D MARKET, BY ANALOG, 2022-2027 (MT)

- TABLE 248 SOUTH AMERICA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 249 SOUTH AMERICA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 250 SOUTH AMERICA: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019-2021 (USD MILLION)

- TABLE 251 SOUTH AMERICA: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022-2027 (USD MILLION)

- TABLE 252 SOUTH AMERICA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 253 SOUTH AMERICA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- TABLE 254 SOUTH AMERICA: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019-2021 (MT)

- TABLE 255 SOUTH AMERICA: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022-2027 (MT)

- TABLE 256 SOUTH AMERICA: VITAMIN D MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 257 SOUTH AMERICA: VITAMIN D MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 258 SOUTH AMERICA: VITAMIN D MARKET, BY END USER, 2019-2021 (MT)

- TABLE 259 SOUTH AMERICA: VITAMIN D MARKET, BY END USER, 2022-2027 (MT)

- TABLE 260 SOUTH AMERICA: VITAMIN D MARKET, BY FORM, 2019-2021 (USD MILLION)

- TABLE 261 SOUTH AMERICA: VITAMIN D MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 262 SOUTH AMERICA: VITAMIN D MARKET, BY FORM, 2019-2021 (MT)

- TABLE 263 SOUTH AMERICA: VITAMIN D MARKET, BY FORM, 2022-2027 (MT)

- TABLE 264 SOUTH AMERICA: VITAMIN D MARKET, BY IU STRENGTH, 2019-2021 (USD MILLION)

- TABLE 265 SOUTH AMERICA: VITAMIN D MARKET, BY IU STRENGTH, 2022-2027 (USD MILLION)

- TABLE 266 SOUTH AMERICA: VITAMIN D MARKET, BY IU STRENGTH, 2019-2021 (MT)

- TABLE 267 SOUTH AMERICA: VITAMIN D MARKET, BY IU STRENGTH, 2022-2027 (MT)

- 13.5.1 BRAZIL

- 13.5.1.1 Health problems regarding vitamin D deficiency to dominate market

- TABLE 268 BRAZIL: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 269 BRAZIL: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 270 BRAZIL: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 271 BRAZIL: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.5.2 ARGENTINA

- 13.5.2.1 Increase in diseases, such as osteopenia and osteoporosis, to drive demand for vitamin D

- TABLE 272 ARGENTINA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 273 ARGENTINA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 274 ARGENTINA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 275 ARGENTINA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.5.3 REST OF SOUTH AMERICA

- TABLE 276 REST OF SOUTH AMERICA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 277 REST OF SOUTH AMERICA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 278 REST OF SOUTH AMERICA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 279 REST OF SOUTH AMERICA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.6 REST OF THE WORLD

- TABLE 280 REST OF THE WORLD: VITAMIN D MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 281 REST OF THE WORLD: VITAMIN D MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 282 REST OF THE WORLD: VITAMIN D MARKET, BY COUNTRY, 2019-2021 (MT)

- TABLE 283 REST OF THE WORLD: VITAMIN D MARKET, BY COUNTRY, 2022-2027 (MT)

- TABLE 284 REST OF THE WORLD: VITAMIN D MARKET, BY ANALOG, 2019-2021 (USD MILLION)

- TABLE 285 REST OF THE WORLD: VITAMIN D MARKET, BY ANALOG, 2022-2027 (USD MILLION)

- TABLE 286 REST OF THE WORLD: VITAMIN D MARKET, BY ANALOG, 2019-2021 (MT)

- TABLE 287 REST OF THE WORLD: VITAMIN D MARKET, BY ANALOG, 2022-2027 (MT)

- TABLE 288 REST OF THE WORLD: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 289 REST OF THE WORLD: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 290 REST OF THE WORLD: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019-2021 (USD MILLION)

- TABLE 291 REST OF THE WORLD: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022-2027 (USD MILLION)

- TABLE 292 REST OF THE WORLD: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 293 REST OF THE WORLD: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- TABLE 294 REST OF THE WORLD: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019-2021 (MT)

- TABLE 295 REST OF THE WORLD: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022-2027 (MT)

- TABLE 296 REST OF THE WORLD: VITAMIN D MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 297 REST OF THE WORLD: VITAMIN D MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 298 REST OF THE WORLD: VITAMIN D MARKET, BY END USER, 2019-2021 (MT)

- TABLE 299 REST OF THE WORLD: VITAMIN D MARKET, BY END USER, 2022-2027 (MT)

- TABLE 300 REST OF THE WORLD: VITAMIN D MARKET, BY FORM, 2019-2021 (USD MILLION)

- TABLE 301 REST OF THE WORLD: VITAMIN D MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 302 REST OF THE WORLD: VITAMIN D MARKET, BY FORM, 2019-2021 (MT)

- TABLE 303 REST OF THE WORLD: VITAMIN D MARKET, BY FORM, 2022-2027 (MT)

- TABLE 304 REST OF THE WORLD: VITAMIN D MARKET, BY IU STRENGTH, 2019-2021 (USD MILLION)

- TABLE 305 REST OF THE WORLD: VITAMIN D MARKET, BY IU STRENGTH, 2022-2027 (USD MILLION)

- TABLE 306 REST OF THE WORLD: VITAMIN D MARKET, BY IU STRENGTH, 2019-2021 (MT)

- TABLE 307 REST OF THE WORLD: VITAMIN D MARKET, BY IU STRENGTH, 2022-2027 (MT)

- 13.6.1 SOUTH AFRICA

- 13.6.1.1 Functional food and healthcare products to drive demand for vitamin D

- TABLE 308 SOUTH AFRICA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 309 SOUTH AFRICA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 310 SOUTH AFRICA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 311 SOUTH AFRICA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.6.2 MIDDLE EAST

- 13.6.2.1 Highest rate of rickets to create demand for vitamin D

- TABLE 312 MIDDLE EAST: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 313 MIDDLE EAST: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 314 MIDDLE EAST: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 315 MIDDLE EAST: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

- 13.6.3 REST OF AFRICA

- TABLE 316 REST OF AFRICA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 317 REST OF AFRICA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 318 REST OF AFRICA: VITAMIN D MARKET, BY APPLICATION, 2019-2021 (MT)

- TABLE 319 REST OF AFRICA: VITAMIN D MARKET, BY APPLICATION, 2022-2027 (MT)

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 MARKET SHARE ANALYSIS, 2021

- TABLE 320 VITAMIN D MARKET SHARE ANALYSIS, 2021

- 14.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 37 TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2017-2021 (USD BILLION)

- 14.4 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 14.4.1 STARS

- 14.4.2 PERVASIVE PLAYERS

- 14.4.3 EMERGING LEADERS

- 14.4.4 PARTICIPANTS

- FIGURE 38 VITAMIN D MARKET, COMPANY EVALUATION QUADRANT, 2021

- 14.4.5 VITAMIN D PRODUCT FOOTPRINT (KEY PLAYERS)

- TABLE 321 VITAMIN D BY ANALOG FOOTPRINT

- TABLE 322 VITAMIN D BY APPLICATION FOOTPRINT

- TABLE 323 VITAMIN D FOOTPRINT BY FORM SEGMENT

- TABLE 324 VITAMIN D FOOTPRINT BY END USER SEGMENT

- TABLE 325 COMPANY REGIONAL FOOTPRINT

- TABLE 326 OVERALL COMPANY FOOTPRINT

- 14.5 VITAMIN D MARKET, OTHER PLAYERS EVALUATION QUADRANT, 2021

- 14.5.1 PROGRESSIVE COMPANIES

- 14.5.2 STARTING BLOCKS

- 14.5.3 RESPONSIVE COMPANIES

- 14.5.4 DYNAMIC COMPANIES

- FIGURE 39 VITAMIN D MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

- TABLE 327 VITAMIN D: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- 14.6 COMPETITIVE SCENARIO

- 14.6.1 DEALS

- TABLE 328 VITAMIN D MARKET: DEALS, 2019-2022

- 14.6.2 OTHERS

- TABLE 329 VITAMIN D MARKET: OTHERS, 2019-2022

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 15.1.1 DSM

- TABLE 330 DSM: BUSINESS OVERVIEW

- FIGURE 40 DSM: COMPANY SNAPSHOT

- TABLE 331 DSM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 DSM: DEALS

- 15.1.2 BASF SE

- TABLE 333 BASF SE: BUSINESS OVERVIEW

- FIGURE 41 BASF SE: COMPANY SNAPSHOT

- TABLE 334 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.1.3 FERMENTA BIOTECH LIMITED

- TABLE 335 FERMENTA BIOTECH LIMITED: BUSINESS OVERVIEW

- FIGURE 42 FERMENTA BIOTECH LIMITED: COMPANY SNAPSHOT

- TABLE 336 FERMENTA BIOTECH LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.1.4 ZHEJIANG GARDEN BIOCHEMICAL HIGH-TECH CO., LTD

- TABLE 337 ZHEJIANG GARDEN BIOCHEMICAL HIGH-TECH CO., LTD: BUSINESS OVERVIEW

- TABLE 338 ZHEJIANG GARDEN BIOCHEMICAL HIGH-TECH CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.1.5 DISHMAN GROUP

- TABLE 339 DISHMAN GROUP: BUSINESS OVERVIEW

- FIGURE 43 FERMENTA BIOTECH LIMITED: COMPANY SNAPSHOT

- TABLE 340 DISHMAN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.1.6 TAIZHOU HAISHENG PHARMACEUTICALS CO., LTD.

- TABLE 341 TAIZHOU HAISHENG PHARMACEUTICALS CO., LTD.: BUSINESS OVERVIEW

- TABLE 342 TAIZHOU HAISHENG PHARMACEUTICALS CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- 15.1.7 ZHEJIANG MEDICINE CO., LTD.

- TABLE 343 ZHEJIANG MEDICINE CO., LTD.: BUSINESS OVERVIEW

- TABLE 344 ZHEJIANG MEDICINE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.1.8 PHW GROUP

- TABLE 345 PHW GROUP: BUSINESS OVERVIEW

- TABLE 346 PHW GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.1.9 BIO-TECH PHARMACAL

- TABLE 347 BIO-TECH PHARMACAL: BUSINESS OVERVIEW

- TABLE 348 BIO-TECH PHARMACAL: PRODUCTS OFFERED

- 15.1.10 DIVI'S NUTRACEUTICALS

- TABLE 349 DIVI'S NUTRACEUTICALS: BUSINESS OVERVIEW

- TABLE 350 DIVI'S NUTRACEUTICALS: PRODUCTS OFFERED

- 15.1.11 SYNTHESIA, A.S.

- TABLE 351 SYNTHESIA, A.S.: BUSINESS OVERVIEW

- TABLE 352 SYNTHESIA, A.S.: PRODUCTS OFFERED

- 15.1.12 HANGZHOU THINK CHEMICAL CO LTD

- TABLE 353 HANGZHOU THINK CHEMICAL CO LTD: BUSINESS OVERVIEW

- TABLE 354 HANGZHOU THINK CHEMICAL CO LTD: PRODUCTS OFFERED

- 15.1.13 KINGDOMWAY NUTRITION, INC.

- TABLE 355 KINGDOMWAY NUTRITION, INC.: BUSINESS OVERVIEW

- TABLE 356 KINGDOMWAY NUTRITION, INC.: PRODUCTS OFFERED

- 15.1.14 MCKINLEY RESOURCES INC.

- TABLE 357 MCKINLEY RESOURCES INC.: BUSINESS OVERVIEW

- TABLE 358 MCKINLEY RESOURCES INC.: PRODUCTS OFFERED

- 15.1.15 NEWGEN PHARMA

- TABLE 359 NEWGEN PHARMA: BUSINESS OVERVIEW

- TABLE 360 NEWGEN PHARMA: PRODUCTS OFFERED

- 15.1.16 TAI ZHOU HISOUND PHARMACEUTICALS CO., LTD

- TABLE 361 TAI ZHOU HISOUND PHARMACEUTICALS CO., LTD: BUSINESS OVERVIEW

- TABLE 362 TAI ZHOU HISOUND PHARMACEUTICALS CO., LTD: PRODUCTS OFFERED

- 15.1.17 PHARMAVIT

- TABLE 363 PHARMAVIT: BUSINESS OVERVIEW

- TABLE 364 PHARMAVIT: PRODUCTS OFFERED

- 15.1.18 LYCORED

- TABLE 365 LYCORED: BUSINESS OVERVIEW

- TABLE 366 LYCORED: PRODUCTS OFFERED

- 15.1.19 STABICOAT VITAMINS

- TABLE 367 STABICOAT VITAMINS: BUSINESS OVERVIEW

- TABLE 368 STABICOAT VITAMINS: PRODUCTS OFFERED

- 15.1.20 STERNVITAMIN GMBH & CO. KG

- TABLE 369 STERNVITAMIN GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 370 STERNVITAMIN GMBH & CO. KG: PRODUCTS OFFERED

- 15.1.21 FARBEST-TALLMAN FOODS CORPORATION

- TABLE 371 FARBEST-TALLMAN FOODS CORPORATION: BUSINESS OVERVIEW

- TABLE 372 FARBEST-TALLMAN FOODS CORPORATION: PRODUCTS OFFERED

- 15.1.22 RABAR ANIMAL NUTRITION

- TABLE 373 RABAR ANIMAL NUTRITION: BUSINESS OVERVIEW

- TABLE 374 RABAR ANIMAL NUTRITION: PRODUCTS OFFERED

- 15.1.23 ADISSEO

- TABLE 375 ADISSEO: BUSINESS OVERVIEW

- TABLE 376 ADISSEO: PRODUCTS OFFERED

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

16 ADJACENT AND RELATED MARKETS

- 16.1 INTRODUCTION

- TABLE 377 MARKETS ADJACENT TO VITAMIN D MARKET

- 16.2 LIMITATIONS

- 16.3 VITAMINS MARKET

- 16.3.1 MARKET DEFINITION

- 16.3.2 MARKET OVERVIEW

- TABLE 378 VITAMINS MARKET, BY TYPE, 2016-2023 (USD MILLION)

- TABLE 379 VITAMINS MARKET, BY TYPE, 2016-2023 (KT)

- 16.4 FEED ADDITIVES MARKET

- 16.4.1 MARKET DEFINITION

- 16.4.2 MARKET OVERVIEW

- TABLE 380 FEED ADDITIVES MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 381 FEED ADDITIVES MARKET, BY TYPE, 2021-2026 (USD MILLION)

- TABLE 382 FEED ADDITIVES MARKET, BY TYPE, 2017-2020 (USD KT)

- TABLE 383 FEED ADDITIVES MARKET, BY TYPE, 2021-2026 (KT)

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS