|

|

市場調査レポート

商品コード

1076185

熱伝導材料の世界市場::化学物質(シリコーン、エポキシ、ポリイミド)、タイプ(グリース、接着剤、テープ、フィルム、ギャップフィラー)、用途(コンピューター、通信、耐久消費財、医療機器)、地域別 - 2027年までの予測Thermal Interface Materials Market by Chemistry (Silicone, Epoxy, Polyimide), Type (Greases & adhesives, Tapes & Films, Gap Fillers), Application (Computers, Telecom, Consumer Durables, Medical Devices) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 熱伝導材料の世界市場::化学物質(シリコーン、エポキシ、ポリイミド)、タイプ(グリース、接着剤、テープ、フィルム、ギャップフィラー)、用途(コンピューター、通信、耐久消費財、医療機器)、地域別 - 2027年までの予測 |

|

出版日: 2022年05月12日

発行: MarketsandMarkets

ページ情報: 英文 200 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の熱伝導材料の市場規模は、2022年の34億米ドルから、10.5%のCAGRで推移し、2027年までに56億米ドルに達すると予測されています。同市場の成長は、主にコンピュータ、通信、医療機器などにおける非晶質ポリエチレンテレフタレート使用の増加、エレクトロニクス業界の成長に起因しています。

地域別では、アジア太平洋が最も成長率の高い市場となっています。

インドネシアやインドなど、同地域の新興国による投資の増加が、この地域の市場成長を支えているため、サーマルインターフェイス材料市場の最大市場となっています。また、電子機器の小型化に対する要求が高まっていることも大きな推進要因となっています。

当レポートでは、世界の熱伝導材料市場について調査し、市場力学、テクノロジー分析、エコシステム、セグメント・地域別の市場分析、競合情勢、主要企業のプロファイルなどの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 市場機会

- 課題

- エコシステム/市場マップ

- 平均販売価格の動向/価格分析

- テクノロジー分析

- 業界の動向

- バリューチェーン分析

- ポーターのファイブフォース分析

第6章 化学別:熱伝導材料市場

- シリコーン

- エポキシ

- ポリイミド

- その他

第7章 タイプ別:熱伝導材料市場

- グリース・接着剤

- テープ・フィルム

- ギャップフィラー

- 金属ベースの熱伝導材料

- 相変化材料

- その他

第8章 用途別:熱伝導材料市場

- コンピューター

- 通信

- 医療機器

- 産業機械

- 耐久消費財

- 自動車用電子機器

- その他

第9章 地域別:熱伝導材料市場

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- インドネシア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- トルコ

- ポーランド

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- その他

第10章 競合情勢

- 主要企業の採用戦略

- 市場ランキング

- 企業評価クアドラント(TIER 1)

- スタートアップ/中小企業の評価クアドラント

- 競合情勢・動向

第11章 企業プロファイル

- 主要企業

- HONEYWELL INTERNATIONAL INC.

- 3M

- HENKEL AG & CO. KGAA

- PARKER HANNIFIN CORP

- DOW

- LAIRD TECHNOLOGIES, INC.

- MOMENTIVE

- INDIUM CORPORATION

- WAKEFIELD THERMAL, INC.

- ZALMAN TECH CO., LTD.

- その他の企業

- TIMTRONICS

- SCHLEGEL ELECTRONIC MATERIALS, INC.

- DENKA COMPANY LTD.

- AREMCO PRODUCTS INC.

- UNIVERSAL SCIENCE

- LORD CORPORATION

- MASTER BOND INC.

- RBC INDUSTRIES

- ELECTROLUBE

- SEMIKRON INTERNATIONAL GMBH

第12章 付録

Growth in the thermal interface materials market can primarily be attributed to the growing involvement of amorphous polyethylene terephthalate in the computers, telecom, medical devices, among others. Thermal interface materials (TIMs) are used to remove the heat generated by semiconductors to maintain the junction temperature of electronic & electrical components within safe operating limits. This heat removal process involves the conduction from a package surface to a heat spreader that can transfer the heat to the ambient environment more efficiently. The global thermal interface materials market size is estimated at USD 3.4 billion in 2022 and is projected to reach USD 5.6 billion by 2027, at a CAGR of 10.5%. Growth in the thermal interface materials market can primarily be attributed to the increasing use of TIMs in end-use industries and the growing electronics industry.

The production of TIMs is driven by its large-scale industrial applications, such as computers, telecom, medical devices, industrial machinery, consumer durables, and automotive electronics. The growing consumer electronics industry is a major driver. The demand for TIMs in developed countries, such as the US, the UK, Germany, and Canada, is high, owing to numerous development strategies adopted by manufacturing companies. The demand for TIMs in Asia Pacific is expected to increase at the highest rate, mainly due to the transportation sector, as China represents the largest automotive market globally. The growing automotive industry is expected to drive the TIMs market in the region. The major challenge for manufacturers of TIMs is the stringent government regulation on the reduction of VOC content. The untapped markets of the Middle East are a major opportunity for the growth of the players in the market. Increasing development strategies are also an excellent growth opportunity for manufacturers to have better control over the cost and quality of products.

"Silicone is the largest and fastest-growing chemistry segment of the thermal interface materials market."

The thermal interface materials market is segmented on the basis of chemistry into silicone, epoxy, polyimide, and others. Silicone is largest and is expected to witness the fastest growth rate. Silicone exhibits good resistance to a wide range of temperatures, from -55°C to +300°C, resistance to chemical attack, resistance to shock & vibration, stability under mechanical stress, stability against weathering, and greater hydrostability. It is also handled without any special precautionary measures and offers easy processing without the need for oven drying or concerns about exothermic heat during the processing. Silicone is used in various TIMs such as greases & adhesives, encapsulants & potting compounds, thermal pads, and gap fillers.

"Greases & adhesives is the largest type segment of the thermal interface materials market."

The thermal interface materials market is segmented on the basis of type into greases & adhesives, tapes & films, gap fillers, metal-based TIMs, phase change materials, and others. Greases & adhesives is largest type. Thermal greases & adhesives are applied to one of the two mating surfaces; when the surfaces are pressed together, the grease spreads to fill the void. Thermal greases & adhesives are normally packaged in a syringe, tube, or a small plastic sachet. OEMs prefer to use greases & adhesives because of their ability to flow into any nook of the intended application and conform to a wide range of surface roughness present on the housing, heat spreader, or heat sink surface. Thermal greases & adhesives have other competitive advantages such as cost, rework-ability, low thermal resistance, and the ability to form ultra-thin bond lines. The manufacturing costs of greases & adhesives are lower as these materials do not need to be coated and cured into a sheet and cut to shape.

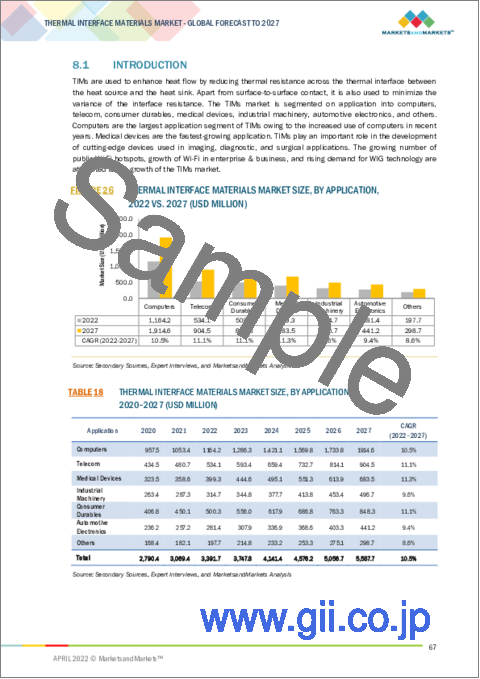

"Computers is the largest application of thermal interface materials market."

The thermal interface materials market is segmented on the basis of applications into computers, telecom, consumer durables, medical devices, industrial machinery, automotive electronics, and others. Among these, the computer segment is the largest application. Computer components, such as CPUs, chipsets, graphics cards, and hard disk drives, are susceptible to failure in case of overheating. TIMs are used in computers to remove the excess heat to maintain the components operating temperature limits. TIMs are used in computers to optimize the performance and reliability for smooth functioning. TIMs are used for improving the heat flow in computers by filling voids or irregularities between the heat sink and SSE base plate mounting surfaces. TIMs have comparatively greater thermal conductivity than the air they replace, thus allowing efficient heat transfer resulting in the improved performance of computers. The use of TIMs in computers is growing at a high rate because of the increased demand for cloud and supercomputing. The increased demand for supercomputing is driving the market for high-performance silicon and TIMs.

"APAC is the fastest-growing market for thermal interface materials."

APAC is the largest market for thermal interface materials market due to increased investments by developing countries of the region, such as Indonesia and India, are supporting market growth in the region. Another major driving factor is the increased demand for the miniaturization of electronic devices.

The breakdown of primary interviews is given below:

- By Company Type: Tier 1 - 15%, Tier 2 - 25%, and Tier 3 -60%

- By Designation: C-Level Executives - 12%, Director-Level - 20%, and Others - 68%

- By Region: North America - 40%, Europe - 30%, APAC - 20%, and South America - 10%

The key companies profiled in this report on the thermal interface materials market include Honeywell International Inc. (US), 3M (US), Henkel AG & Co. KGaA (Germany), Parker Hannifin Corporation (US), Dow Corning Corporation (US), Laird Technologies (US), Momentive Performance Materials (US), Indim Corporation (US), Wakefield-Vette (US), and Zalma Tech Co. Ltd. (South Korea) are the key players operating in the thermal interface materials market.

Research Coverage

The thermal interface materials market has been segmented based on chemistry, type, application, and region. This report covers the thermal interface materials market and forecasts its market size until 2027. It also provides detailed information on company profiles and competitive strategies adopted by the key players to strengthen their position in the thermal interface materials market. The report also provides insights into the drivers and restraints in the thermal interface materials market along with opportunities and challenges. The report also includes profiles of top manufacturers in the thermal interface materials market.

Reasons to Buy the Report

The report is expected to help market leaders/new entrants in the following ways:

1. This report segments the thermal interface materials and provides the closest approximations of revenue numbers for the overall market and its segments across different verticals and regions.

2. This report is expected to help stakeholders understand the pulse of the thermal interface materials market and provide information on key market drivers, restraints, challenges, and opportunities influencing the market growth.

3. This report is expected to help stakeholders obtain an in-depth understanding of the competitive landscape of the thermal interface materials market and gain insights to improve the position of their businesses. The competitive landscape section includes detailed information on strategies, such as merger & acquisition, new product developments, expansions, and collaborations.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF STUDY

- 1.2 MARKET DEFINITION

- TABLE 1 THERMAL INTERFACE MATERIALS MARKET: MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 THERMAL INTERFACE MATERIALS MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED FOR STUDY

- 1.5 CURRENCY

- 1.6 UNIT CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 THERMAL INTERFACE MATERIALS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE APPROACH - 1

- FIGURE 3 THERMAL INTERFACE MATERIALS MARKET: SUPPLY-SIDE APPROACH - 1

- 2.2.2 SUPPLY-SIDE APPROACH - 2

- FIGURE 4 THERMAL INTERFACE MATERIALS MARKET: SUPPLY-SIDE APPROACH - 2

- 2.2.3 SUPPLY-SIDE APPROACH - 3

- FIGURE 5 THERMAL INTERFACE MATERIALS MARKET: SUPPLY-SIDE APPROACH - 3

- 2.2.4 DEMAND-SIDE APPROACH - 1

- FIGURE 6 THERMAL INTERFACE MATERIALS MARKET: DEMAND-SIDE APPROACH - 1

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 9 THERMAL INTERFACE MATERIALS MARKET: DATA TRIANGULATION

- 2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 ASIA PACIFIC DOMINATED THERMAL INTERFACE MATERIALS MARKET IN 2021

- FIGURE 11 SILICONE TO BE LARGEST CHEMISTRY SEGMENT DURING FORECAST PERIOD

- FIGURE 12 GREASES & ADHESIVES TO DOMINATE THERMAL INTERFACE MATERIALS MARKET DURING FORECAST PERIOD

- FIGURE 13 MEDICAL DEVICES TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN THERMAL INTERFACE MATERIALS MARKET

- FIGURE 14 THERMAL INTERFACE MATERIALS MARKET TO REGISTER HIGH GROWTH BETWEEN 2022 AND 2027

- 4.2 THERMAL INTERFACE MATERIALS MARKET, BY CHEMISTRY

- FIGURE 15 SILICONE TO WITNESS HIGHEST GROWTH

- 4.3 THERMAL INTERFACE MATERIALS MARKET, BY TYPE

- FIGURE 16 PHASE CHANGE MATERIALS TO WITNESS HIGHEST GROWTH

- 4.4 THERMAL INTERFACE MATERIALS MARKET, BY APPLICATION

- FIGURE 17 COMPUTERS TO BE LARGEST APPLICATION SEGMENT

- 4.5 THERMAL INTERFACE MATERIALS MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY, 2021

- FIGURE 18 CHINA AND COMPUTERS SEGMENT ACCOUNTED FOR LARGEST SHARES

- 4.6 THERMAL INTERFACE MATERIALS MARKET ATTRACTIVENESS

- FIGURE 19 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THERMAL INTERFACE MATERIALS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for miniaturization of electronic devices

- 5.2.1.2 Growing LED market to drive demand for thermal interface materials

- 5.2.2 RESTRAINTS

- 5.2.2.1 Physical properties limiting performance of thermal interface materials

- TABLE 2 LIMITATIONS OF THERMAL INTERFACE MATERIALS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Electrification in transportation industry

- 5.2.3.2 High-performance thermal interface materials in the form of nanodiamonds

- 5.2.4 CHALLENGES

- 5.2.4.1 Finding optimum operating costs for end users

- 5.2.4.2 Granule size and amount of thermal interface materials applied

- 5.3 ECOSYSTEM/MARKET MAP

- FIGURE 21 THERMAL INTERFACE MATERIALS MARKET: ECOSYSTEM/MARKET MAP

- 5.4 AVERAGE SELLING PRICE TREND/PRICING ANALYSIS

- TABLE 3 THERMAL INTERFACE MATERIALS MARKET: AVERAGE SELLING PRICE TREND, 2021 (USD THOUSAND/METRIC TON)

- 5.5 TECHNOLOGY ANALYSIS

- 5.6 INDUSTRY TRENDS

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 22 VALUE CHAIN ANALYSIS OF THERMAL INTERFACE MATERIALS MARKET

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 PORTER'S FIVE FORCES ANALYSIS OF THERMAL INTERFACE MATERIALS MARKET

- 5.8.1 BARGAINING POWER OF SUPPLIERS

- 5.8.2 THREAT OF NEW ENTRANTS

- 5.8.3 THREAT OF SUBSTITUTES

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 RIVALRY AMONG EXISTING PLAYERS

- 5.8.6 MACROECONOMIC INDICATORS

- 5.8.6.1 INTRODUCTION

- 5.8.7 TRENDS AND FORECAST OF GDP

- TABLE 4 TRENDS AND FORECAST OF GDP, BY KEY COUNTRY, 2016-2023 (USD MILLION)

- 5.8.8 GLOBAL ELECTRONICS INDUSTRY AND ECONOMIC OUTLOOK

- 5.8.9 EXPORT STATISTICS OF ELECTRONICS INDUSTRY, 2019

- TABLE 5 EXPORT STATISTICS OF ELECTRONIC CIRCUIT, 2019 (USD BILLION)

6 THERMAL INTERFACE MATERIALS MARKET, BY CHEMISTRY

- 6.1 INTRODUCTION

- FIGURE 24 THERMAL INTERFACE MATERIALS MARKET SIZE, BY CHEMISTRY, 2022 VS. 2027 (USD MILLION)

- TABLE 6 THERMAL INTERFACE MATERIALS MARKET SIZE, BY CHEMISTRY, 2020-2027 (USD MILLION)

- TABLE 7 THERMAL INTERFACE MATERIALS MARKET SIZE, BY CHEMISTRY, 2020-2027 (TON)

- 6.2 SILICONE

- 6.2.1 SUPERIOR PROPERTIES OVER OTHER THERMAL INTERFACE MATERIALS TO DRIVE DEMAND FOR SILICONE

- TABLE 8 THERMAL INTERFACE MATERIALS MARKET SIZE IN SILICONE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 9 THERMAL INTERFACE MATERIALS MARKET SIZE IN SILICONE, BY REGION, 2020-2027 (TON)

- 6.3 EPOXY

- 6.3.1 GREATER FILLER LOADING RESULTS IN GREATER THERMAL CONDUCTIVITY OF EPOXY

- TABLE 10 THERMAL INTERFACE MATERIALS MARKET SIZE IN EPOXY, BY REGION, 2020-2027 (USD MILLION)

- TABLE 11 THERMAL INTERFACE MATERIALS MARKET SIZE IN EPOXY, BY REGION, 2020-2027 (TON)

- 6.4 POLYIMIDE

- 6.4.1 GROWTH IN ELECTRONICS INDUSTRY TO INCREASE DEMAND FOR POLYIMIDE

- TABLE 12 THERMAL INTERFACE MATERIALS MARKET SIZE IN POLYIMIDE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 13 THERMAL INTERFACE MATERIALS MARKET SIZE IN POLYIMIDE, BY REGION, 2020-2027 (TON)

- 6.5 OTHERS

- TABLE 14 THERMAL INTERFACE MATERIALS MARKET SIZE IN OTHER CHEMISTRIES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 15 THERMAL INTERFACE MATERIALS MARKET SIZE IN OTHER CHEMISTRIES, BY REGION, 2020-2027 (TON)

7 THERMAL INTERFACE MATERIALS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 25 THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 16 THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 17 THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- 7.2 GREASES & ADHESIVES

- 7.2.1 SUPERIOR PROPERTIES AND LOW MANUFACTURING COST DRIVING MARKET IN THIS SEGMENT

- 7.3 TAPES & FILMS

- 7.3.1 INCREASING DEMAND IN TELECOM SECTOR BOOSTING MARKET

- 7.4 GAP FILLERS

- 7.4.1 GROWING END-USE INDUSTRIES IN EUROPE INFLUENCING MARKET GROWTH

- 7.5 METAL-BASED THERMAL INTERFACE MATERIALS

- 7.5.1 GROWING APPLICATIONS IN IT HARDWARE DEVICES TO PROPEL MARKET

- 7.6 PHASE CHANGE MATERIALS

- 7.6.1 WIDESPREAD APPLICATION IN PERSONAL COMPUTERS CONTRIBUTING TO MARKET GROWTH

- 7.7 OTHERS

8 THERMAL INTERFACE MATERIALS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 26 THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- TABLE 18 THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 19 THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 8.2 COMPUTERS

- 8.2.1 ADVANCEMENTS IN SUPERCOMPUTING TECHNOLOGIES TO DRIVE MARKET

- TABLE 20 THERMAL INTERFACE MATERIALS MARKET SIZE IN COMPUTERS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 21 THERMAL INTERFACE MATERIALS MARKET SIZE IN COMPUTERS, BY REGION, 2020-2027 (TON)

- 8.3 TELECOM

- 8.3.1 GROWTH OF WIRELESS INFRASTRUCTURE TO FUEL DEMAND

- TABLE 22 THERMAL INTERFACE MATERIALS MARKET SIZE IN TELECOM, BY REGION, 2020-2027 (USD MILLION)

- TABLE 23 THERMAL INTERFACE MATERIALS MARKET SIZE IN TELECOM, BY REGION, 2020-2027 (TON)

- 8.4 MEDICAL DEVICES

- 8.4.1 INNOVATION AND DEVELOPMENT IN HEALTHCARE INDUSTRY TO BOOST MARKET IN THIS SEGMENT

- TABLE 24 THERMAL INTERFACE MATERIALS MARKET SIZE IN MEDICAL DEVICES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 25 THERMAL INTERFACE MATERIALS MARKET SIZE IN MEDICAL DEVICES, BY REGION, 2020-2027 (TON)

- 8.5 INDUSTRIAL MACHINERY

- 8.5.1 GROWING INDUSTRIAL AUTOMATION TO INCREASE DEMAND IN THIS SEGMENT

- TABLE 26 THERMAL INTERFACE MATERIALS MARKET SIZE IN INDUSTRIAL MACHINERY, BY REGION, 2020-2027 (USD MILLION)

- TABLE 27 THERMAL INTERFACE MATERIALS MARKET SIZE IN INDUSTRIAL MACHINERY, BY REGION, 2020-2027 (TON)

- 8.6 CONSUMER DURABLES

- 8.6.1 DEVELOPMENT IN SMART TECHNOLOGIES TO DRIVE MARKET

- TABLE 28 THERMAL INTERFACE MATERIALS MARKET SIZE IN CONSUMER DURABLES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 29 THERMAL INTERFACE MATERIALS MARKET SIZE IN CONSUMER DURABLES, BY REGION, 2020-2027 (TON)

- 8.7 AUTOMOTIVE ELECTRONICS

- 8.7.1 GROWTH OF ELECTRIC & HYBRID VEHICLES TO DRIVE MARKET

- TABLE 30 THERMAL INTERFACE MATERIALS MARKET SIZE IN AUTOMOTIVE ELECTRONICS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 31 THERMAL INTERFACE MATERIALS MARKET SIZE IN AUTOMOTIVE ELECTRONICS, BY REGION, 2020-2027 (TON)

- 8.8 OTHERS

- TABLE 32 THERMAL INTERFACE MATERIALS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 33 THERMAL INTERFACE MATERIALS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020-2027 (TON)

9 THERMAL INTERFACE MATERIALS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 27 INDIA TO BE FASTEST-GROWING THERMAL INTERFACE MATERIALS MARKET

- TABLE 34 THERMAL INTERFACE MATERIALS MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 35 THERMAL INTERFACE MATERIALS MARKET SIZE, BY REGION, 2020-2027 (TON)

- 9.2 ASIA PACIFIC

- FIGURE 28 ASIA PACIFIC: THERMAL INTERFACE MATERIALS MARKET

- TABLE 36 ASIA PACIFIC: THERMAL INTERFACE MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 37 ASIA PACIFIC: THERMAL INTERFACE MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (TON)

- TABLE 38 ASIA PACIFIC: THERMAL INTERFACE MATERIALS MARKET SIZE, BY CHEMISTRY, 2020-2027 (USD MILLION)

- TABLE 39 ASIA PACIFIC: THERMAL INTERFACE MATERIALS MARKET SIZE, BY CHEMISTRY, 2020-2027 (TON)

- TABLE 40 ASIA PACIFIC: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 41 ASIA PACIFIC: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 42 ASIA PACIFIC: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 43 ASIA PACIFIC: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.2.1 CHINA

- 9.2.1.1 Developed electronics industry to drive market

- TABLE 44 CHINA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 45 CHINA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 46 CHINA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 47 CHINA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.2.2 INDIA

- 9.2.2.1 Growth of aerospace & defense industry influencing market positively

- TABLE 48 INDIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 49 INDIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 50 INDIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 51 INDIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.2.3 JAPAN

- 9.2.3.1 Presence of established electronics manufacturers to drive market

- TABLE 52 JAPAN: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 53 JAPAN: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 54 JAPAN: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 55 JAPAN: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Rising demand from electronics industry to increase demand

- TABLE 56 SOUTH KOREA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 57 SOUTH KOREA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 58 SOUTH KOREA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 59 SOUTH KOREA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.2.5 INDONESIA

- 9.2.5.1 Growing electronics and telecom sectors to propel market growth

- TABLE 60 INDONESIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 61 INDONESIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 62 INDONESIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 63 INDONESIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.2.6 REST OF ASIA PACIFIC

- TABLE 64 REST OF ASIA PACIFIC: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 65 REST OF ASIA PACIFIC: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 66 REST OF ASIA PACIFIC: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 67 REST OF ASIA PACIFIC: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.3 NORTH AMERICA

- FIGURE 29 NORTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SNAPSHOT

- TABLE 68 NORTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 69 NORTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (TON)

- TABLE 70 NORTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 72 NORTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 73 NORTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- TABLE 74 NORTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY CHEMISTRY, 2020-2027 (USD MILLION)

- TABLE 75 NORTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY CHEMISTRY, 2020-2027 (TON)

- 9.3.1 US

- 9.3.1.1 Presence of major players contributing to market growth

- TABLE 76 US: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 77 US: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 78 US: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 79 US: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.3.2 CANADA

- 9.3.2.1 Growing end-use industries such as electronics and telecom

- TABLE 80 CANADA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 81 CANADA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 82 CANADA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 83 CANADA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.3.3 MEXICO

- 9.3.3.1 Leading electronics manufacturing center due to global access through FTA

- TABLE 84 MEXICO: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 85 MEXICO: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 86 MEXICO: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 87 MEXICO: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.4 EUROPE

- FIGURE 30 EUROPE: THERMAL INTERFACE MATERIALS MARKET SNAPSHOT

- TABLE 88 EUROPE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 89 EUROPE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (TON)

- TABLE 90 EUROPE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY CHEMISTRY, 2020-2027 (USD MILLION)

- TABLE 91 EUROPE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY CHEMISTRY, 2020-2027 (TON)

- TABLE 92 EUROPE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 93 EUROPE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 94 EUROPE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 95 EUROPE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.4.1 GERMANY

- 9.4.1.1 High demand for thermal interface materials in various applications

- TABLE 96 GERMANY: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 97 GERMANY: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 98 GERMANY: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 99 GERMANY: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.4.2 UK

- 9.4.2.1 High use of thermal interface materials in medical devices

- TABLE 100 UK: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 101 UK: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 102 UK: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 103 UK: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.4.3 FRANCE

- 9.4.3.1 High usage of thermal interface materials in automotive industry

- TABLE 104 FRANCE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 105 FRANCE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 106 FRANCE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 107 FRANCE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.4.4 RUSSIA

- 9.4.4.1 Increasing demand for high-performance thermal interface materials

- TABLE 108 RUSSIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 109 RUSSIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 110 RUSSIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 111 RUSSIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.4.5 TURKEY

- 9.4.5.1 High demand for thermal grease boosting market

- TABLE 112 TURKEY: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 113 TURKEY: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 114 TURKEY: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 115 TURKEY: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.4.6 POLAND

- 9.4.6.1 High demand in electronic industry driving market

- TABLE 116 POLAND: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 117 POLAND: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 118 POLAND: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 119 POLAND: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.4.7 REST OF EUROPE

- TABLE 120 REST OF EUROPE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 121 REST OF EUROPE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 122 REST OF EUROPE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 123 REST OF EUROPE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.5 SOUTH AMERICA

- TABLE 124 SOUTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 125 SOUTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (TON)

- TABLE 126 SOUTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 127 SOUTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 128 SOUTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 129 SOUTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- TABLE 130 SOUTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY CHEMISTRY, 2020-2027 (USD MILLION)

- TABLE 131 SOUTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY CHEMISTRY, 2020-2027 (TON)

- 9.5.1 BRAZIL

- 9.5.1.1 Growing Internet user base and technological advancement

- TABLE 132 BRAZIL: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 133 BRAZIL: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 134 BRAZIL: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 135 BRAZIL: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.5.2 ARGENTINA

- 9.5.2.1 Increase in population, Internet user base, medical industry, and manufacturing sector

- TABLE 136 ARGENTINA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 137 ARGENTINA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 138 ARGENTINA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 139 ARGENTINA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.5.3 REST OF SOUTH AMERICA

- TABLE 140 REST OF SOUTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 141 REST OF SOUTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 142 REST OF SOUTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 143 REST OF SOUTH AMERICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.6 MIDDLE EAST & AFRICA

- TABLE 144 MIDDLE EAST & AFRICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027(USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027(TON)

- TABLE 146 MIDDLE EAST & AFRICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027(USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027(TON)

- TABLE 148 MIDDLE EAST & AFRICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- TABLE 150 MIDDLE EAST & AFRICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY CHEMISTRY, 2020-2027 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA THERMAL INTERFACE MATERIALS MARKET SIZE, BY CHEMISTRY, 2020-2027 (TON)

- 9.6.1 SAUDI ARABIA

- 9.6.1.1 Population growth, government's fiscal policies, and growth of industrial sector

- TABLE 152 SAUDI ARABIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 153 SAUDI ARABIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 154 SAUDI ARABIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 155 SAUDI ARABIA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.6.2 UAE

- 9.6.2.1 Free-trade zones, proximity to ports, and supportive government investment policies attracting high foreign direct investments

- TABLE 156 UAE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 157 UAE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 158 UAE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 159 UAE: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- TABLE 160 REST OF MIDDLE EAST & AFRICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 161 REST OF MIDDLE EAST & AFRICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 162 REST OF MIDDLE EAST & AFRICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 163 REST OF MIDDLE EAST & AFRICA: THERMAL INTERFACE MATERIALS MARKET SIZE, BY APPLICATION, 2020-2027 (TON)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 31 COMPANIES ADOPTED NEW PRODUCT LAUNCHES AS THE KEY GROWTH STRATEGY, 2014-2022

- 10.3 MARKET RANKING

- FIGURE 32 RANKING OF TOP FIVE PLAYERS IN THERMAL INTERFACE MATERIALS MARKET, 2021

- 10.4 COMPANY EVALUATION QUADRANT (TIER 1)

- 10.4.1 STAR

- 10.4.2 PERVASIVE

- 10.4.3 EMERGING LEADER

- 10.4.4 PARTICIPANT

- FIGURE 33 THERMAL INTERFACE MATERIALS MARKET: COMPANY EVALUATION QUADRANT, 2021

- 10.5 START-UP/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

- 10.5.1 PROGRESSIVE COMPANIES

- 10.5.2 RESPONSIVE COMPANIES

- 10.5.3 STARTING BLOCKS

- 10.5.4 DYNAMIC COMPANIES

- FIGURE 34 STARTUP/SMES EVALUATION QUADRANT FOR THERMAL INTERFACE MATERIALS MARKET

- 10.6 COMPETITIVE SITUATIONS AND TRENDS

- 10.6.1 PRODUCT LAUNCHES

- TABLE 164 THERMAL INTERFACE MATERIALS MARKET: PRODUCT LAUNCHES, JANUARY 2014-JANUARY 2022

- 10.6.2 DEALS

- TABLE 165 THERMAL INTERFACE MATERIALS MARKET: DEALS, JANUARY 2014- JANUARY 2022

- 10.6.3 OTHERS

- TABLE 166 THERMAL INTERFACE MATERIALS MARKET: OTHERS, JANUARY 2014- JANUARY 2022

11 COMPANY PROFILES

- 11.1 KEY COMPANIES

- (Business Overview, Products and solutions, Recent Developments, SWOT analysis, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)**

- 11.1.1 HONEYWELL INTERNATIONAL INC.

- TABLE 167 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 35 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 168 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 169 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 170 HONEYWELL INTERNATIONAL INC.: OTHERS

- FIGURE 36 HONEYWELL INTERNATIONAL INC.: SWOT ANALYSIS

- FIGURE 37 HONEYWELL INTERNATIONAL INC.: WINNING IMPERATIVES

- 11.1.2 3M

- TABLE 171 3M: COMPANY OVERVIEW

- FIGURE 38 3M: COMPANY SNAPSHO

- TABLE 172 3M: PRODUCTS OFFERED

- TABLE 173 3M: DEALS

- TABLE 174 3M.: OTHERS

- FIGURE 39 3M: SWOT ANALYSIS

- FIGURE 40 3M: WINNING IMPERATIVES

- 11.1.3 HENKEL AG & CO. KGAA

- TABLE 175 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- FIGURE 41 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- TABLE 176 HENKEL AG & CO. KGAA: PRODUCTS OFFERED

- TABLE 177 HENKEL AG & CO. KGAA: PRODUCT LAUNCHES

- TABLE 178 HENKEL AG & CO. KGAA.: DEAL

- TABLE 179 HENKEL AG & CO. KGAA: OTHERS

- FIGURE 42 HENKEL AG & CO. KGAA: SWOT ANALYSIS

- FIGURE 43 HENKEL AG & CO. KGAA: WINNING IMPERATIVES

- 11.1.4 PARKER HANNIFIN CORP

- TABLE 180 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- FIGURE 44 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- TABLE 181 PARKER HANNIFIN CORP: PRODUCTS OFFERED

- TABLE 182 PARKER HANNIFIN CORP.: PRODUCT LAUNCHES

- TABLE 183 PARKER HANNIFIN CORP: DEALS

- FIGURE 45 PARKER HANNIFIN CORP: SWOT ANALYSIS

- FIGURE 46 PARKER HANNIFIN CORP: WINNING IMPERATIVES

- 11.1.5 DOW

- TABLE 184 DOW: COMPANY OVERVIEW

- FIGURE 47 DOW: COMPANY SNAPSHOT

- TABLE 185 DOW: PRODUCTS OFFERED

- TABLE 186 DOW: PRODUCT LAUNCHES

- TABLE 187 DOW: OTHERS

- FIGURE 48 DOW: SWOT ANALYSIS

- FIGURE 49 DOW: WINNING IMPERATIVES

- 11.1.6 LAIRD TECHNOLOGIES, INC.

- TABLE 188 LAIRD TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 189 LAIRD TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 190 LAIRD TECHNOLOGIES, INC.: PRODUCT LAUNCH

- 11.1.7 MOMENTIVE

- TABLE 191 MOMENTIVE: COMPANY OVERVIEW

- TABLE 192 MOMENTIVE: PRODUCTS OFFERED

- TABLE 193 MOMENTIVE: PRODUCT LAUNCH

- TABLE 194 MOMENTIVE: DEAL

- TABLE 195 MOMENTIVE: OTHERS

- 11.1.8 INDIUM CORPORATION

- TABLE 196 INDIUM CORPORATION: COMPANY OVERVIEW

- TABLE 197 INDIUM CORPORATION: PRODUCTS OFFERED

- TABLE 198 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- 11.1.9 WAKEFIELD THERMAL, INC.

- TABLE 199 WAKEFIELD THERMAL, INC.: COMPANY OVERVIEW

- TABLE 200 WAKEFIELD THERMAL, INC.: PRODUCTS OFFERED

- TABLE 201 WAKEFIELD THERMAL, INC.: DEALS

- TABLE 202 WAKEFIELD THERMAL, INC.: OTHERS

- 11.1.10 ZALMAN TECH CO., LTD.

- TABLE 203 ZALMAN TECH CO., LTD.: COMPANY OVERVIEW

- TABLE 204 ZALMAN TECH CO., LTD.: PRODUCTS OFFERED

- TABLE 205 ZALMAN TECH CO., LTD.: PRODUCT LAUNCH

- 11.2 OTHER COMPANIES

- 11.2.1 TIMTRONICS

- 11.2.2 SCHLEGEL ELECTRONIC MATERIALS, INC.

- 11.2.3 DENKA COMPANY LTD.

- 11.2.4 AREMCO PRODUCTS INC.

- 11.2.5 UNIVERSAL SCIENCE

- 11.2.6 LORD CORPORATION

- 11.2.7 MASTER BOND INC.

- 11.2.8 RBC INDUSTRIES

- 11.2.9 ELECTROLUBE

- 11.2.10 SEMIKRON INTERNATIONAL GMBH

- *Details on Business Overview, Products and solutions, Recent Developments, SWOT analysis, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 12.3 AVAILABLE CUSTOMIZATIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS