|

|

市場調査レポート

商品コード

1157276

特殊肥料の世界市場:技術別(徐放性肥料、微量栄養素、水溶性肥料、液体肥料)、形態別(乾燥、液体)、適用方法別、タイプ別、作物の種類別、地域別 - 2027年までの予測Specialty Fertilizers Market by Technology (Controlled-release Fertilizers, Micronutrients, Water Soluble Fertilizers, and Liquid Fertilizers), Form (Dry and Liquid), Application Method, Type, Crop Type and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 特殊肥料の世界市場:技術別(徐放性肥料、微量栄養素、水溶性肥料、液体肥料)、形態別(乾燥、液体)、適用方法別、タイプ別、作物の種類別、地域別 - 2027年までの予測 |

|

出版日: 2022年11月14日

発行: MarketsandMarkets

ページ情報: 英文 324 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の特殊肥料の市場規模は、2022年に243億米ドルと推定され、2027年までに337億米ドルに達し、金額ベースのCAGRで6.8%の成長が予測されています。

Gulf Petrochemicals & Chemicals Association(GPCA)によると、特殊肥料は、必須の一次、二次、または微量栄養素を含む、異なる特性を持つ、急成長中の多様な製品群です。特殊肥料は、より高い効率で収穫できるように設計されています。これらの肥料は、緩やかな放出制御が可能で、栄養分の利用効率を高め、コストを削減し、環境へのリスクを最小限に抑えることを目的としています。特殊肥料の市場は、従来の肥料の効果が比較的低いことと、作物の生産性を高める必要性から、大きな伸びを示しています。

"アジア太平洋地域は、特殊肥料の主要市場として優位性を保つと推定される"

アジア太平洋地域は、特殊肥料の主要市場として優位性を維持しています。アジア太平洋地域は、2021年に世界の特殊肥料市場の40.5%を占めました。この地域区分には、中国、インド、日本、オーストラリア・ニュージーランド、ベトナム、その他のアジア太平洋地域が含まれます。アジア太平洋地域は、その大規模な農業や灌漑面積のために肥料の最大の市場の1つです。さらに、この地域では特殊肥料の規制が有利です。中国は、いくつかの多国籍メーカーによる研究開発への投資が増加しているため、アジア太平洋地域の特殊肥料市場で最大のシェアを占めています。

"水溶性肥料は、世界中の特殊肥料市場で急速な人気を集めている"

水溶性肥料は、作物や植物の健康を向上させ、従来の肥料よりも効率的です。水溶性肥料は作物や植物の健康状態を向上させ、従来の肥料よりも効率的であるため、その肥料の効率性が需要を高める主な要因となっています。水溶性肥料は溶解性が高いため、土壌や葉面への施肥が可能です。水溶性肥料を適切かつ十分に葉面散布することで、肥料の使用量を最大で15~25%削減することができます。また、水溶性肥料は溶解性が高いため、収穫時に残留する心配がなく、果樹類に施用することも可能です。

"硫酸カリウム(SOP)は、作物に最適なカリウムと硫黄の供給源となる"

硫酸カリウム(SOP)は、白色の結晶で、水に溶ける不燃性の塩です。植物が病気や害虫に抵抗し、保存期間を延ばし、より美味しく魅力的な農産物を生産するために必要な栄養素を供給する高カリウム・低塩素の肥料で、作物に害を与える過剰な塩化物は含まれていません。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- 概要

- 規制の枠組み

- 規制機関、政府機関、その他の組織

- 特許分析

- バリューチェーン分析

- YC-YCCシフト

- 市場エコシステム

- 貿易分析

- 平均販売価格分析

- 技術分析

- ケーススタディ分析

- 主要会議とイベント

- 主要利害関係者と購入基準

- ポーターのファイブフォース分析

第7章 特殊肥料市場:技術別

- イントロダクション

- 徐放性肥料

- 水溶性肥料

- 液体肥料

- 微量栄養素

- その他

第8章 特殊肥料市場:タイプ別

- イントロダクション

- UAN

- CAN

- 第一リン酸アンモニウム (MAP)

- 硫酸カリウム(SOP)

- 硝酸カリウム

- 尿素誘導体

- NPKの混合

- その他

第9章 特殊肥料市場:作物の種類別

- イントロダクション

- 穀物・穀類

- 油糧種子・豆類

- 果物・野菜

- その他

第10章 特殊肥料市場:適用方法別

- イントロダクション

- 滴下施肥

- 葉面散布

- 土壌

第11章 特殊肥料市場:形態別

- イントロダクション

- 乾燥

- 液体

第12章 特殊肥料市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- ロシア

- ポーランド

- イタリア

- その他

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- ベトナム

- その他

- 南米

- ブラジル

- アルゼンチン

- チリ

- その他

- その他の地域

- 中東

- アフリカ

第13章 競合情勢

- 概要

- 主要企業のセグメント収益分析

- 市場シェア分析

- 主要企業の戦略

- 企業評価象限(主要企業)

- スタートアップ/中小企業の企業評価象限

- 企業フットプリント

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- NUTRIEN, LTD.

- YARA

- ICL

- K+S AKTIENGESELLSCHAFT

- SQM SA

- EUROCHEM GROUP

- CF INDUSTRIES HOLDINGS, INC.

- NUFARM

- THE MOSAIC COMPANY

- OCI NITROGEN

- OCP GROUP

- KINGENTA

- COROMANDEL INTERNATIONAL LIMITED

- DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED

- ZUARI AGRO CHEMICALS LTD.

- スタートアップ/中小企業/その他の企業

- KUGLER COMPANY

- HAIFA NEGEV TECHNOLOGIES

- COMPO EXPERT GMBH

- WILBUR-ELLIS COMPANY LLC

- VALAGRO

- BRANDT

- AGROLIQUID

- PLANT FOOD COMPANY, INC.

- KOCH INDUSTRIES, INC.

- AGZON AGRO

第15章 隣接/関連市場

第16章 付録

According to MarketsandMarkets, the global specialty fertilizers market size is estimated to be valued at USD 24.3 billion in 2022 and is projected to reach USD 33.7 billion by 2027, recording a CAGR of 6.8% in terms of value. As per the Gulf Petrochemicals & Chemicals Association (GPCA), specialty fertilizers are a fast-growing and diverse group of products with different characteristics containing essential primary, secondary, or micro-nutrients. Specialty fertilizers are designed to yield higher efficiency. They are meant for slow or controlled release and aim to enhance nutrient use efficiency, reduce costs, and minimize risk to the environment. The market for specialty fertilizers has seen significant growth due to the comparatively lower effectiveness of conventional fertilizers and the need to boost crop productivity.

"Asia Pacific is estimated to retain its dominance as the leading market for specialty fertilizers."

The Asia Pacific region retains its dominance as the leading market for specialty fertilizers. The Asia Pacific held 40.5% of the global specialty fertilizers market in 2021. This regional segment includes China, India, Japan, Australia & New Zealand, Vietnam, and the Rest of Asia Pacific. These key countries that play an important role in the agriculture sector. Cotton, sugar crops, fruits & vegetables, and cereals are the leading agricultural commodities exported from these countries. The APAC is one of the largest markets for fertigation due to its large agriculture and irrigation area. According to FAOSTAT, the total area of land equipped for irrigation in the Asia Pacific was 1,669 million ha in 2020, which was ~36% of the global area of land equipped for irrigation. The demand for controlled-release fertilizers has been growing in this region due to the increasing investment of overseas business lines in agricultural inputs to meet the demand of crop growers to attain export quality. Additionally, the regulations for specialty fertilizers are favorable in this region. China accounts for the largest share in the Asia Pacific specialty fertilizers market due to the increasing investments by several multinational manufacturers in research & development.

"The Water Soluble Fertilizers is gaining rapid popularity in the specialty fertilizers market across the globe."

Water-soluble fertilizers improve the health of crops and plants and are more efficient than conventional fertilizers. Their efficiency in fertilization is a major factor driving demand. These fertilizers possess high solubility, which enables the user to apply them to the soil and leaves. Adequate and appropriate foliar application of water-soluble fertilizers can reduce the use of fertilizers by up to 15-25%. Due to their high solubility, water-soluble fertilizers can also be applied to fruit crops without the danger of residue during harvest.

The growing demand for fertigation as a mode of application, supported by the increasing adoption of micro-irrigation systems, is expected to fuel the demand for water-soluble fertilizers. Additionally, the increasing demand for better yields, decreasing arable land, increasing cost of fertilizers, ease of application, innovative production practices, product offerings, increased availability, and the advent of microirrigation and mechanized irrigation systems are expected to fuel the demand for water-soluble fertilizers.

"Sulfate of potash provides best source of potassium and sulfur in crops

Sulfate of potash (also known as arcanite, or archaically known as potash of sulfur) is a white crystalline, non-flammable salt soluble in water. It is a high-potassium, low-chloride fertilizer that provides essential nutrients that help plants resist disease and pests, ensure longer shelf life, and produce tastier and more appealing produce without the excess chloride that can harm crops.

Potassium sulfate is an excellent source of nutrition for plants. It also supplies a valuable source of sulfur. Sulfur is required for protein synthesis and enzyme functioning. There are certain soils and crops where the addition of chlorine is avoided. In these cases, potassium sulfate makes a very suitable potassium source. MOP contains a significant amount of chloride. While this is preferable for some crops, it can be harmful to others, such as fruits, vegetables, and nuts, that are sensitive to chlorides. Since many chloride-sensitive crops are high-value, optimizing quality and yield is critical. Furthermore, toxicity can occur if MOP is added to soils already high in chlorides. SOP is an ideal solution when working with chloride-sensitive crops or chloride-rich soils because it is significantly lower in chlorides.

Potassium sulfate contains potassium (K) and sulfur (S), two essential nutrients that plants require for optimal growth and development. It helps correct potassium deficiency in avocado, beans, corn, cherries, citrus, grapes, palms, and roses. It is only one-third as soluble as potassium chloride; thus, it is not as commonly used for addition through irrigation water unless there is a need for additional sulfur. It has softer granules that can easily break down when handles/blended, hence creating dust and fines. Foliar sprays of potassium sulfate are a convenient way to apply additional potassium and sulfur to plants, supplementing the nutrients taken up from the soil. Leaf damage can occur if the concentration is too high.

Greenway Biotech provides potassium sulfate fertilizer, a 100% water-soluble potash fertilizer that contains 53% potassium and 17% sulfur and is essential for plant growth and adjusting the pH of soil or hydroponics systems. SOP is used to activate the enzyme reaction since potassium is one of the essential co-factors in the production of ATP.

Break-up of Primaries:

- By Value chain side: Demand- 41.0% and Supply - 59.0%

- By Designation: Managers - 24.0%, CXOs - 31.0%, and Executives- 45.0%

- By Region: North America - 29.0%, Europe - 24.0%, Asia Pacific - 32.0%, RoW - 15.0%

Leading players profiled in this report:

- Nutrien Ltd. (Canada)

- Yara (Norway)

- ICL (Israel)

- The Mosaic Company (US)

- CF Industries and Holdings, Inc. (US)

- Nufarm (Australia), SQM SA (Chile)

- OCP Group (Morocco)

- Kingenta (China)

- K+S Aktiengesellschaft (Germany)

- OCI Nitrogen (Netherlands)

- EuroChem (Switzerland)

- Coromandel International Limited (India)

- Zuari Agro Chemicals Ltd. (India)

- Deepak Fertilizers and Petrochemicals Corporation Limited (India)

- Kugler Company (US)

- Haifa Negev Technologies (Israel)

- COMPO Expert GmbH (Germany)

- Wilbur-Ellis Company LLC (US)

- Valagro (Italy), BRANDT, Inc. (US)

- AgroLiquid (US)

- Plant Food Company, Inc (US)

- Koch Industries, Inc. (US)

- Agzon Agro (India).

Research Coverage:

The report segments the specialty fertilizers market on the basis of type, technology, form, application method, crop type and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the specialty fertilizers, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the specialty fertilizers market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the specialty fertilizers market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017-2021

- 1.7 UNIT CONSIDERED

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 SPECIALTY FERTILIZERS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 SPECIALTY FERTILIZERS MARKET SIZE ESTIMATION (DEMAND-SIDE)

- FIGURE 5 SPECIALTY FERTILIZERS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 SPECIALTY FERTILIZERS MARKET SIZE ESTIMATION, BY TYPE (SUPPLY-SIDE)

- FIGURE 7 SPECIALTY FERTILIZERS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- TABLE 2 ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

- TABLE 3 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- TABLE 4 SPECIALTY FERTILIZERS MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 9 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 SPECIALTY FERTILIZERS MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 SPECIALTY FERTILIZERS MARKET, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 14 SPECIALTY FERTILIZERS MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SPECIALTY FERTILIZERS MARKET

- FIGURE 15 GROWING NEED FOR HIGH-EFFICIENCY FERTILIZERS TO DRIVE MARKET GROWTH

- 4.2 SPECIALTY FERTILIZERS MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC TO DOMINATE THE SPECIALTY FERTILIZERS MARKET IN TERMS OF VALUE

- 4.3 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY

- FIGURE 17 WATER-SOLUBLE FERTILIZERS TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 18 MONOAMMONIUM PHOSPHATE TO GROW AT THE HIGHEST CAGR IN TERMS OF VOLUME

- 4.4 SPECIALTY FERTILIZERS MARKET, BY FORM

- FIGURE 19 DRY SPECIALTY FERTILIZERS HOLD LARGER MARKET SHARE

- 4.5 SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION

- FIGURE 20 FERTIGATION TO REGISTER LARGEST MARKET SIZE

- 4.6 SPECIALTY FERTILIZERS MARKET, BY CROP TYPE

- FIGURE 21 CEREALS & PULSES DOMINATE CROP MARKET OVER FORECAST PERIOD

- 4.7 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY KEY TECHNOLOGY & COUNTRY

- FIGURE 22 CHINA AND WATER-SOLUBLE FERTILIZERS ACCOUNT FOR SIGNIFICANT SHARES

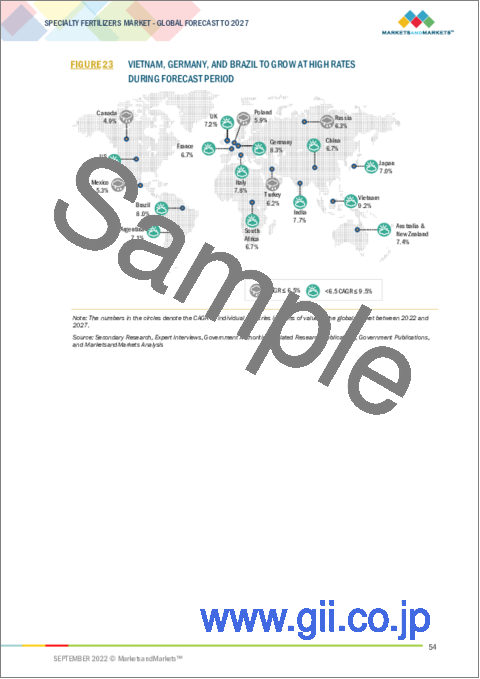

- FIGURE 23 VIETNAM, GERMANY, AND BRAZIL TO GROW AT HIGH RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROINDICATORS

- 5.2.1 RISING CROP LOSSES DUE TO SOIL DEGRADATION

- 5.2.2 RISING IMPORTANCE OF MICRONUTRIENTS IN HUMAN CONSUMPTION

- FIGURE 24 DEFICIENCY OF MACRO AND MICRONUTRIENTS IN INDIAN SOIL, 2019

- 5.3 MARKET DYNAMICS

- FIGURE 25 SPECIALTY FERTILIZERS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.3.1 DRIVERS

- 5.3.1.1 Need to switch to efficient fertilizers to avoid environmental concerns

- FIGURE 26 FACTORS CONTRIBUTING TO WATER POLLUTION

- 5.3.1.2 Favorable government policies and regulations

- 5.3.1.3 Easy application and usage of specialty fertilizers

- 5.3.2 RESTRAINTS

- 5.3.2.1 High R&D costs

- 5.3.2.2 Improper management of controlled-release fertilizers

- 5.3.2.3 High handling costs of liquid fertilizers

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Product innovations and technological advancements in specialty fertilizers

- 5.3.3.2 Crop-specific nutrient management through precision farming

- 5.3.4 CHALLENGES

- 5.3.4.1 Rising prices of specialty fertilizers

- FIGURE 27 FERTILIZER AFFORDABILITY INDEX (UREA, MOP), 2014-2022

- 5.3.4.2 Lack of domestic infrastructure for manufacturing specialty fertilizers in India

6 INDUSTRY TRENDS

- 6.1 OVERVIEW

- 6.2 REGULATORY FRAMEWORK

- 6.2.1 NORTH AMERICA

- 6.2.1.1 US

- 6.2.1.1.1 California

- 6.2.1.1.2 Iowa

- 6.2.1.1.3 Texas

- 6.2.1.1.4 Minnesota

- 6.2.1.1.5 Illinois

- 6.2.1.1.6 Wisconsin

- 6.2.1.1.7 Pennsylvania

- 6.2.1.2 Canada

- 6.2.1.1 US

- 6.2.2 EUROPE

- 6.2.3 ASIA PACIFIC

- 6.2.3.1 India

- 6.2.3.2 China

- 6.2.3.3 Japan

- 6.2.4 SOUTH AMERICA

- 6.2.4.1 Brazil

- 6.2.5 ROW

- 6.2.5.1 South Africa

- 6.2.5.2 Israel

- 6.2.1 NORTH AMERICA

- 6.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.4 PATENT ANALYSIS

- FIGURE 28 NUMBER OF PATENTS APPROVED FOR SPECIALTY FERTILIZERS IN THE GLOBAL MARKET, 2011-2021

- FIGURE 29 JURISDICTIONS WITH HIGHEST PATENT APPROVALS FOR SPECIALTY FERTILIZERS, 2019-2022

- TABLE 10 RECENT PATENTS GRANTED FOR SPECIALTY FERTILIZERS MARKET

- 6.5 VALUE CHAIN ANALYSIS

- FIGURE 30 VALUE CHAIN ANALYSIS

- 6.6 YC-YCC SHIFT

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING BUYERS IN THE SPECIALTY FERTILIZERS MARKET

- 6.7 MARKET ECOSYSTEM

- TABLE 11 SPECIALTY FERTILIZERS MARKET ECOSYSTEM

- FIGURE 32 MARKET MAP

- 6.8 TRADE ANALYSIS

- TABLE 12 EXPORT VALUE OF FERTILIZERS INCLUDING MONOAMMONIUM PHOSPHATE, SULFATE OF POTASH, AND AMMONIUM NITRATE FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- TABLE 13 IMPORT VALUE OF FERTILIZERS INCLUDING MONOAMMONIUM PHOSPHATE, SULFATE OF POTASH, AND AMMONIUM NITRATE FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- 6.9 AVERAGE SELLING PRICE ANALYSIS

- 6.9.1 AVERAGE SELLING PRICE ANALYSIS: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016-2021

- FIGURE 33 PRICING ANALYSIS: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016-2021 (USD/KG)

- 6.9.2 AVERAGE SELLING PRICE ANALYSIS: SPECIALTY FERTILIZERS MARKET, BY REGION, 2016-2021

- FIGURE 34 PRICING ANALYSIS: SPECIALTY FERTILIZERS MARKET, BY REGION, 2016-2021 (USD/KG)

- 6.9.3 INDICATIVE PRICING ANALYSIS

- FIGURE 35 AVERAGE SELLING PRICES OF DISTINGUISHED PLAYERS FOR TOP THREE TECHNOLOGIES

- TABLE 14 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP TECHNOLOGIES IN USD/TON

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 Y-DROP FERTIGATION

- 6.10.2 VARIABLE-RATE TECHNOLOGY/APPLICATION

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 CASE 1: NEW SUSTAINABLE FERTILIZER INCREASED MICRONUTRIENT BIOAVAILABILITY

- 6.11.2 CASE 2: USE OF CRF TO CONTROL HBL IN CITRUS PLANTATIONS

- 6.12 KEY CONFERENCES & EVENTS (2022-2023)

- TABLE 15 SPECIALTY FERTILIZERS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 6.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON THE BUYING PROCESS FOR TOP THREE MODES OF APPLICATION

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE MODES OF APPLICATION

- 6.13.2 BUYING CRITERIA

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TECHNOLOGIES

- TABLE 17 KEY BUYING CRITERIA FOR TOP THREE TECHNOLOGIES

- 6.14 PORTER'S FIVE FORCES ANALYSIS

- TABLE 18 PORTER'S FIVE FORCES ANALYSIS

- 6.14.1 THREAT FROM NEW ENTRANTS

- 6.14.2 THREAT FROM SUBSTITUTES

- 6.14.3 BARGAINING POWER OF SUPPLIERS

- 6.14.4 BARGAINING POWER OF BUYERS

- 6.14.5 INTENSITY OF COMPETITIVE RIVALRY

7 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 38 WATER-SOLUBLE FERTILIZERS PROJECTED TO DOMINATE MARKET

- TABLE 19 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016-2021 (USD MILLION)

- TABLE 20 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 21 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016-2021 (KILOTONS)

- TABLE 22 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022-2027 (KILOTONS)

- 7.2 CONTROLLED-RELEASE FERTILIZERS

- 7.2.1 CONTROLLED-RELEASE FERTILIZERS BALANCE PLANT NUTRIENT NEEDS TO PROTECT CROPS

- TABLE 23 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 24 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 25 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION, 2016-2021 (KILOTONS)

- TABLE 26 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION, 2022-2027 (KILOTONS)

- 7.3 WATER-SOLUBLE FERTILIZERS

- 7.3.1 SIMPLICITY OF USAGE AND EFFICACY IN FERTIGATION TO DRIVE MARKET

- TABLE 27 WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 28 WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 29 WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2016-2021 (KILOTONS)

- TABLE 30 WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2022-2027 (KILOTONS)

- 7.4 LIQUID FERTILIZERS

- 7.4.1 LIQUID FERTILIZERS OFFER PRECISE FERTILIZER DISTRIBUTION

- TABLE 31 LIQUID FERTILIZERS MARKET, BY REGION, 2016-2021 (USD MILLION)

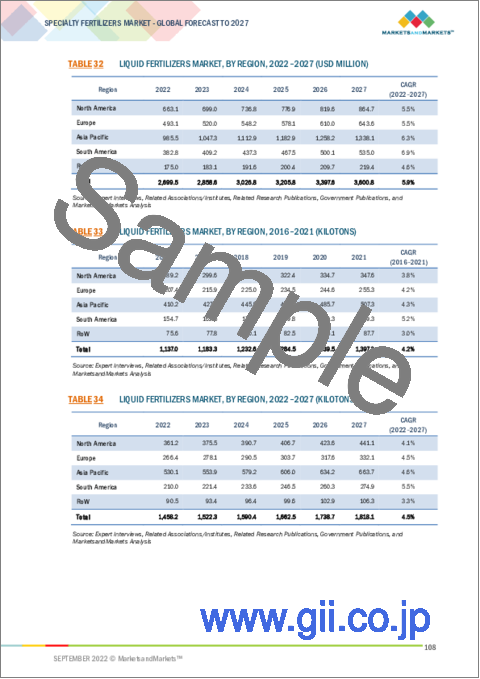

- TABLE 32 LIQUID FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 33 LIQUID FERTILIZERS MARKET, BY REGION, 2016-2021 (KILOTONS)

- TABLE 34 LIQUID FERTILIZERS MARKET, BY REGION, 2022-2027 (KILOTONS)

- 7.5 MICRONUTRIENTS

- 7.5.1 MICRONUTRIENTS ESSENTIAL FOR PLANT GROWTH, WHICH DRIVES DEMAND FOR MICRONUTRIENT FERTILIZERS

- TABLE 35 MICRONUTRIENTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 36 MICRONUTRIENTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 37 MICRONUTRIENTS MARKET, BY REGION, 2016-2021 (KILOTONS)

- TABLE 38 MICRONUTRIENTS MARKET, BY REGION, 2022-2027 (KILOTONS)

- 7.6 OTHER TECHNOLOGIES

- TABLE 39 OTHER TECHNOLOGIES MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 40 OTHER TECHNOLOGIES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 41 OTHER TECHNOLOGIES MARKET, BY REGION, 2016-2021 (KILOTONS)

- TABLE 42 OTHER TECHNOLOGIES MARKET, BY REGION, 2022-2027 (KILOTONS)

8 SPECIALTY FERTILIZERS MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 39 UREA-AMMONIUM NITRATE PROJECTED TO DOMINATE SPECIALTY FERTILIZERS MARKET DURING THE FORECAST PERIOD

- TABLE 43 SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 44 SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 8.2 UREA-AMMONIUM NITRATE

- 8.2.1 REDUCTION OF RESIDUAL AMOUNT OF SOIL NITROGEN DUE TO UAN APPLICATION TO DRIVE MARKET

- TABLE 45 UAN SPECIALTY FERTILIZERS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 46 UAN SPECIALTY FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 CALCIUM AMMONIUM NITRATE

- 8.3.1 CAN PROTECTS PLANTS, PREVENTS LEAF AND BUD DEFORMATION, AND PROMOTES SOIL HEALTH-KEY FACTORS DRIVING ADOPTION

- TABLE 47 CAN SPECIALTY FERTILIZERS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 48 CAN SPECIALTY FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 MONOAMMONIUM PHOSPHATE

- 8.4.1 USAGE OF MONOAMMONIUM PHOSPHATE FOR NEUTRAL AND HIGH-PH SOIL TO DRIVE MARKET

- TABLE 49 MAP SPECIALTY FERTILIZERS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 50 MAP SPECIALTY FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.5 SULFATE OF POTASH

- 8.5.1 SOP PROVIDES BEST SOURCE OF POTASSIUM AND SULFUR IN CROPS

- TABLE 51 SOP SPECIALTY FERTILIZERS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 52 SOP SPECIALTY FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.6 POTASSIUM NITRATE

- 8.6.1 POTASSIUM NITRATE WIDELY USED IN HIGH-VALUE CASH CROPS

- TABLE 53 POTASSIUM NITRATE SPECIALTY FERTILIZERS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 54 POTASSIUM NITRATE SPECIALTY FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.7 UREA DERIVATIVES

- 8.7.1 WIDE USAGE OF UREA DERIVATIVE ATTRIBUTED TO HIGH NITROGEN AVAILABILITY

- TABLE 55 UREA DERIVATIVE SPECIALTY FERTILIZERS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 56 UREA DERIVATIVE SPECIALTY FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.8 BLENDS OF NPK

- 8.8.1 BLENDS OF NPK USED TO PROVIDE BALANCED NUTRIENT FEED TO PLANTS

- TABLE 57 BLENDS OF NPK SPECIALTY FERTILIZERS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 58 BLENDS OF NPK SPECIALTY FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.9 OTHER SPECIALTY FERTILIZERS

- TABLE 59 OTHER SPECIALTY FERTILIZERS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 60 OTHER SPECIALTY FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

9 SPECIALTY FERTILIZERS MARKET, BY CROP TYPE

- 9.1 INTRODUCTION

- FIGURE 40 CEREALS & GRAINS SEGMENT PROJECTED TO DOMINATE THE SPECIALTY FERTILIZERS MARKET DURING THE FORECAST PERIOD

- TABLE 61 SPECIALTY FERTILIZERS MARKET, BY CROP TYPE, 2016-2021 (USD MILLION)

- TABLE 62 SPECIALTY FERTILIZERS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- 9.2 CEREALS & GRAINS

- 9.2.1 EASIER PENETRATION OF ACTIVE INGREDIENTS AND OTHER ADVANTAGES DRIVE USE OF SPECIALTY FERTILIZERS FOR CEREALS & GRAINS

- TABLE 63 SPECIALTY FERTILIZERS MARKET FOR CEREALS & GRAINS, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 64 SPECIALTY FERTILIZERS MARKET FOR CEREALS & GRAINS, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 65 SPECIALTY FERTILIZERS MARKET FOR CEREALS & GRAINS, BY REGION, 2016-2021 (USD MILLION)

- TABLE 66 SPECIALTY FERTILIZERS MARKET FOR CEREALS & GRAINS, BY REGION, 2022-2027 (USD MILLION)

- 9.2.1.1 Corn

- 9.2.1.1.1 Rising corn consumption driving demand for specialty fertilizers to mitigate nutrient deficiencies

- 9.2.1.2 Wheat

- 9.2.1.2.1 Importance of nitrogen in wheat production to drive use of specialty fertilizers

- 9.2.1.3 Rice

- 9.2.1.3.1 Foliar application of specialty fertilizers helps overcome root problems in rice plants

- 9.2.1.4 Other cereals & grains

- 9.2.1.1 Corn

- 9.3 OILSEEDS & PULSES

- 9.3.1 RISING DEMAND FOR HIGH-YIELD AND DISEASE-RESISTANT SOYBEAN SEEDS TO BOOST ADOPTION OF SPECIALTY FERTILIZERS

- TABLE 67 SPECIALTY FERTILIZERS MARKET FOR OILSEEDS & PULSES, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 68 SPECIALTY FERTILIZERS MARKET FOR OILSEEDS & PULSES, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 69 SPECIALTY FERTILIZERS MARKET FOR OILSEEDS & PULSES, BY REGION, 2016-2021 (USD MILLION)

- TABLE 70 SPECIALTY FERTILIZERS MARKET FOR OILSEEDS & PULSES, BY REGION, 2022-2027 (USD MILLION)

- 9.3.1.1 Soybean

- 9.3.1.1.1 Importance of timing of phosphate application in soybean driving demand for CRFs

- 9.3.1.2 Sunflower

- 9.3.1.2.1 Wide applications of sunflower contributing to market growth

- 9.3.1.3 Other oilseeds & pulses

- 9.3.1.1 Soybean

- 9.4 FRUITS & VEGETABLES

- 9.4.1 MICRONUTRIENTS ESSENTIAL FOR FRUITS & VEGETABLES

- TABLE 71 SPECIALTY FERTILIZERS MARKET FOR FRUITS & VEGETABLES, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 72 SPECIALTY FERTILIZERS MARKET FOR FRUITS & VEGETABLES, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 73 SPECIALTY FERTILIZERS MARKET FOR FRUITS & VEGETABLES, BY REGION, 2016-2021 (USD MILLION)

- TABLE 74 SPECIALTY FERTILIZERS MARKET FOR FRUITS & VEGETABLES, BY REGION, 2022-2027 (USD MILLION)

- 9.4.1.1 Pome fruits

- 9.4.1.1.1 Micronutrients rich in Ca, Mg, and B needed for growth of pome fruits

- 9.4.1.2 Citrus fruits

- 9.4.1.2.1 Citrus fertilization with specialty fertilizers produces greater fruit yield

- 9.4.1.3 Leafy vegetables

- 9.4.1.3.1 Requirement of micronutrients for growth to drive market

- 9.4.1.4 Berries

- 9.4.1.4.1 Fertilization of blueberries with controlled-release fertilizers can help in optimum growth

- 9.4.1.5 Roots & tuber vegetables

- 9.4.1.5.1 High nutrient needs to ensure strong demand for fertilizers

- 9.4.1.6 Other fruits & vegetables

- 9.4.1.1 Pome fruits

- 9.5 OTHER CROPS

- TABLE 75 SPECIALTY FERTILIZERS MARKET FOR OTHER CROPS, BY REGION, 2016-2021 (USD MILLION)

- TABLE 76 SPECIALTY FERTILIZERS MARKET FOR OTHER CROPS, BY REGION, 2022-2027 (USD MILLION)

10 SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION

- 10.1 INTRODUCTION

- FIGURE 41 SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

- TABLE 77 SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION, 2016-2021 (USD MILLION)

- TABLE 78 SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION, 2022-2027 (USD MILLION)

- 10.2 FERTIGATION

- 10.2.1 REDUCED LEACHING OF FERTILIZERS AND INCREASED ABSORPTION OF NUTRIENTS TO DRIVE USE OF FERTIGATION

- TABLE 79 FERTILIZER EFFICIENCY VIA FERTIGATION

- TABLE 80 SPECIALTY FERTILIZERS MARKET FOR FERTIGATION, BY REGION, 2016-2021 (USD MILLION)

- TABLE 81 SPECIALTY FERTILIZERS MARKET FOR FERTIGATION, BY REGION, 2022-2027 (USD MILLION)

- 10.3 FOLIAR

- 10.3.1 USAGE OF FOLIAR MODE OF APPLICATION TO AVOID DEFICIENCIES AND REDUCE STRESS TO DRIVE DEMAND

- TABLE 82 SPECIALTY FERTILIZERS MARKET FOR FOLIAR APPLICATIONS, BY REGION, 2016-2021 (USD MILLION)

- TABLE 83 SPECIALTY FERTILIZERS MARKET FOR FOLIAR APPLICATIONS, BY REGION, 2022-2027 (USD MILLION)

- 10.4 SOIL

- 10.4.1 WIDE USAGE OF SOIL APPLICATION TO DRIVE SEGMENT GROWTH

- TABLE 84 SPECIALTY FERTILIZERS MARKET FOR SOIL APPLICATIONS, BY REGION, 2016-2021 (USD MILLION)

- TABLE 85 SPECIALTY FERTILIZERS MARKET FOR SOIL APPLICATIONS, BY REGION, 2022-2027 (USD MILLION)

11 SPECIALTY FERTILIZERS MARKET, BY FORM

- 11.1 INTRODUCTION

- TABLE 86 ADVANTAGES AND DISADVANTAGES OF LIQUID AND DRY FERTILIZERS

- FIGURE 42 DRY FERTILIZERS SEGMENT PROJECTED TO DOMINATE OVERALL MARKET

- TABLE 87 SPECIALTY FERTILIZERS MARKET, BY FORM, 2016-2021 (USD MILLION)

- TABLE 88 SPECIALTY FERTILIZERS MARKET, BY FORM, 2022-2027 (USD MILLION)

- 11.2 DRY SPECIALTY FERTILIZERS

- 11.2.1 EASY STORAGE AND HIGH EFFICIENCY TO BOOST CONSUMPTION OF DRY SPECIALTY FERTILIZERS

- TABLE 89 DRY SPECIALTY FERTILIZERS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 90 DRY SPECIALTY FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3 LIQUID SPECIALTY FERTILIZERS

- 11.3.1 EASE OF APPLICATION TO DRIVE MARKET FOR LIQUID FERTILIZERS

- TABLE 91 LIQUID SPECIALTY FERTILIZERS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 92 LIQUID SPECIALTY FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

12 SPECIALTY FERTILIZERS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 43 GERMANY, ITALY, VIETNAM, AND BRAZIL TO RECORD HIGHEST CAGRS

- FIGURE 44 SPECIALTY FERTILIZERS MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

- TABLE 93 SPECIALTY FERTILIZERS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 94 SPECIALTY FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 95 SPECIALTY FERTILIZERS MARKET, BY REGION, 2016-2021 (KILOTONS)

- TABLE 96 SPECIALTY FERTILIZERS MARKET, BY REGION, 2022-2027 (KILOTONS)

- 12.2 NORTH AMERICA

- TABLE 97 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 98 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 99 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 100 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 101 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016-2021 (USD MILLION)

- TABLE 102 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 103 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016-2021 (KILOTONS)

- TABLE 104 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022-2027 (KILOTONS)

- TABLE 105 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY FORM, 2016-2021 (USD MILLION)

- TABLE 106 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 107 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION, 2016-2021 (USD MILLION)

- TABLE 108 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION, 2022-2027 (USD MILLION)

- TABLE 109 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY CROP TYPE, 2016-2021 (USD MILLION)

- TABLE 110 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- 12.2.1 US

- 12.2.1.1 Sustainable agriculture systems and stringent environmental regulations to drive micronutrients-based specialty fertilizers

- TABLE 111 US: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 112 US: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.2.2 CANADA

- 12.2.2.1 Rising demand from food processing industry for cereals & grains to drive market

- TABLE 113 CANADA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 114 CANADA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.2.3 MEXICO

- 12.2.3.1 Government focus on sustainable agriculture to drive demand for micronutrients-based specialty fertilizers

- TABLE 115 MEXICO: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 116 MEXICO: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3 EUROPE

- TABLE 117 EUROPE: SPECIALTY FERTILIZERS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 118 EUROPE: SPECIALTY FERTILIZERS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 119 EUROPE: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 120 EUROPE: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 121 EUROPE: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016-2021 (USD MILLION)

- TABLE 122 EUROPE: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 123 EUROPE: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016-2021 (KILOTONS)

- TABLE 124 EUROPE: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022-2027 (KILOTONS)

- TABLE 125 EUROPE: SPECIALTY FERTILIZERS MARKET, BY FORM, 2016-2021 (USD MILLION)

- TABLE 126 EUROPE: SPECIALTY FERTILIZERS MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 127 EUROPE: SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION, 2016-2021 (USD MILLION)

- TABLE 128 EUROPE: SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION, 2022-2027 (USD MILLION)

- TABLE 129 EUROPE: SPECIALTY FERTILIZERS MARKET, BY CROP TYPE, 2016-2021 (USD MILLION)

- TABLE 130 EUROPE: SPECIALTY FERTILIZERS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- 12.3.1 GERMANY

- 12.3.1.1 Support for switching from conventional to specialty fertilizers to drive market

- TABLE 131 GERMANY: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 132 GERMANY: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.2 FRANCE

- 12.3.2.1 Growing demand for high-value crops to boost use of specialty fertilizers

- TABLE 133 FRANCE: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 134 FRANCE: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Adoption of agronomic bio-fortification to boost demand for micronutrients

- TABLE 135 UK: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 136 UK: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.4 RUSSIA

- 12.3.4.1 Move toward sustainable agricultural solutions to support domestic crop production

- TABLE 137 RUSSIA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 138 RUSSIA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.5 POLAND

- 12.3.5.1 Poland to showcase strong growth opportunities for market players

- TABLE 139 POLAND: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 140 POLAND: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.6 ITALY

- 12.3.6.1 Rising demand for cereals and grains to drive market growth

- TABLE 141 ITALY: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 142 ITALY: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.7 REST OF EUROPE

- TABLE 143 REST OF EUROPE: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 144 REST OF EUROPE: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4 ASIA PACIFIC

- FIGURE 45 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET SNAPSHOT

- TABLE 145 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 146 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 147 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 148 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 149 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016-2021 (USD MILLION)

- TABLE 150 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 151 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016-2021 (KILOTONS)

- TABLE 152 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022-2027 (KILOTONS)

- TABLE 153 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION, 2016-2021 (USD MILLION)

- TABLE 154 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION, 2022-2027 (USD MILLION)

- TABLE 155 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY FORM, 2016-2021 (USD MILLION)

- TABLE 156 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 157 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY CROP TYPE, 2016-2021 (USD MILLION)

- TABLE 158 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- 12.4.1 CHINA

- 12.4.1.1 Rising consumption of ammonium and phosphorus-based specialty fertilizers to drive market growth

- TABLE 159 CHINA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 160 CHINA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.2 INDIA

- 12.4.2.1 Growing demand for micronutrients for fertilization to drive adoption of innovative specialty fertilizers

- TABLE 161 INDIA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 162 INDIA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.3 JAPAN

- 12.4.3.1 Use of advanced agricultural practices to drive growth

- TABLE 163 JAPAN: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 164 JAPAN: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.4 AUSTRALIA & NEW ZEALAND

- 12.4.4.1 Increasing consumption of specialty fertilizers and decreasing arable land-key growth factors

- TABLE 165 AUSTRALIA & NEW ZEALAND: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 166 AUSTRALIA & NEW ZEALAND: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.5 VIETNAM

- 12.4.5.1 Micronutrient loss caused by soil erosion to drive market

- TABLE 167 VIETNAM: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 168 VIETNAM: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.6 REST OF ASIA PACIFIC

- TABLE 169 REST OF ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.5 SOUTH AMERICA

- FIGURE 46 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET SNAPSHOT, 2022

- TABLE 171 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 172 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 173 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 174 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 175 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016-2021 (USD MILLION)

- TABLE 176 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 177 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016-2021 (KILOTONS)

- TABLE 178 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022-2027 (KILOTONS)

- TABLE 179 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY FORM, 2016-2021 (USD MILLION)

- TABLE 180 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 181 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION, 2016-2021 (USD MILLION)

- TABLE 182 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION, 2022-2027 (USD MILLION)

- TABLE 183 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY CROP TYPE, 2016-2021 (USD MILLION)

- TABLE 184 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- 12.5.1 BRAZIL

- 12.5.1.1 Brazil to dominate Latin American specialty fertilizers market

- TABLE 185 BRAZIL: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 186 BRAZIL: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.5.2 ARGENTINA

- 12.5.2.1 Growing use of agrochemicals and advancements in farming techniques contribute to market growth

- TABLE 187 ARGENTINA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 188 ARGENTINA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.5.3 CHILE

- 12.5.3.1 Increasing demand for controlled-release fertilizers to increase farm productivity

- TABLE 189 CHILE: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 190 CHILE: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.5.4 REST OF SOUTH AMERICA

- TABLE 191 REST OF SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 192 REST OF SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.6 REST OF THE WORLD

- TABLE 193 ROW: SPECIALTY FERTILIZERS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 194 ROW: SPECIALTY FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 195 ROW: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 196 ROW: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 197 ROW: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016-2021 (USD MILLION)

- TABLE 198 ROW: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 199 ROW: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016-2021 (KILOTONS)

- TABLE 200 ROW: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022-2027 (KILOTONS)

- TABLE 201 ROW: SPECIALTY FERTILIZERS MARKET, BY FORM, 2016-2021 (USD MILLION)

- TABLE 202 ROW: SPECIALTY FERTILIZERS MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 203 ROW: SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION, 2016-2021 (USD MILLION)

- TABLE 204 ROW: SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION, 2022-2027 (USD MILLION)

- TABLE 205 ROW: SPECIALTY FERTILIZERS MARKET, BY CROP TYPE, 2016-2021 (USD MILLION)

- TABLE 206 ROW: SPECIALTY FERTILIZERS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- 12.6.1 MIDDLE EAST

- 12.6.1.1 Wide availability of controlled-release fertilizers due to presence of firms such as ICL and Haifa Chemicals

- TABLE 207 MIDDLE EAST: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 208 MIDDLE EAST: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.6.2 AFRICA

- 12.6.2.1 Growing need for liquid fertilizers and micronutrients to combat nutrition deficiency to support market growth

- TABLE 209 AFRICA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 210 AFRICA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022-2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 47 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017-2021 (USD MILLION)

- 13.3 MARKET SHARE ANALYSIS, 2021

- TABLE 211 SPECIALTY FERTILIZERS MARKET: DEGREE OF COMPETITION (CONSOLIDATED)

- 13.4 KEY PLAYER STRATEGIES

- TABLE 212 STRATEGIES ADOPTED BY KEY SPECIALTY FERTILIZER MANUFACTURERS

- 13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 48 SPECIALTY FERTILIZERS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 13.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 STARTING BLOCKS

- 13.6.3 RESPONSIVE COMPANIES

- 13.6.4 DYNAMIC COMPANIES

- FIGURE 49 SPECIALTY FERTILIZERS MARKET: COMPANY EVALUATION QUADRANT, 2021 (START-UPS/SMES)

- 13.6.5 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 213 SPECIALTY FERTILIZERS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 214 SPECIALTY FERTILIZERS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 13.7 COMPANY FOOTPRINT

- TABLE 215 COMPANY PRODUCT FOOTPRINT

- TABLE 216 COMPANY TECHNOLOGY FOOTPRINT

- TABLE 217 COMPANY REGIONAL FOOTPRINT

- TABLE 218 OVERALL COMPANY FOOTPRINT

- 13.8 COMPETITIVE SCENARIO

- 13.8.1 PRODUCT LAUNCHES

- TABLE 219 SPECIALTY FERTILIZERS: PRODUCT LAUNCHES, 2019-2022

- 13.8.2 DEALS

- TABLE 220 SPECIALTY FERTILIZERS: DEALS, 2018-2022

- 13.8.3 OTHER DEVELOPMENTS

- TABLE 221 SPECIALTY FERTILIZERS: OTHER DEVELOPMENTS, 2018-2022

14 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 14.1 KEY PLAYERS

- 14.1.1 NUTRIEN, LTD.

- TABLE 222 NUTRIEN, LTD.: BUSINESS OVERVIEW

- FIGURE 50 NUTRIEN, LTD.: COMPANY SNAPSHOT

- TABLE 223 NUTRIEN, LTD.: PRODUCTS OFFERED

- TABLE 224 NUTRIEN, LTD.: DEALS

- TABLE 225 NUTRIEN, LTD.: OTHER DEVELOPMENTS

- 14.1.2 YARA

- TABLE 226 YARA: BUSINESS OVERVIEW

- FIGURE 51 YARA: COMPANY SNAPSHOT

- TABLE 227 YARA: PRODUCTS OFFERED

- TABLE 228 YARA: DEALS

- 14.1.3 ICL

- TABLE 229 ICL: BUSINESS OVERVIEW

- FIGURE 52 ICL: COMPANY SNAPSHOT

- TABLE 230 ICL: PRODUCTS OFFERED

- TABLE 231 ICL: PRODUCT LAUNCHES

- TABLE 232 ICL: DEALS

- TABLE 233 ICL: OTHER DEVELOPMENTS

- 14.1.4 K+S AKTIENGESELLSCHAFT

- TABLE 234 K+S AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

- FIGURE 53 K+S AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- TABLE 235 K+S AKTIENGESELLSCHAFT: PRODUCTS OFFERED

- TABLE 236 K+S AKTIENGESELLSCHAFT: DEALS

- TABLE 237 K+S AKTIENGESELLSCHAFT: OTHER DEVELOPMENTS

- 14.1.5 SQM SA

- TABLE 238 SQM SA: BUSINESS OVERVIEW

- FIGURE 54 SQM SA: COMPANY SNAPSHOT

- TABLE 239 SQM SA: PRODUCTS OFFERED

- 14.1.6 EUROCHEM GROUP

- TABLE 240 EUROCHEM GROUP: BUSINESS OVERVIEW

- FIGURE 55 EUROCHEM GROUP: COMPANY SNAPSHOT

- TABLE 241 EUROCHEM GROUP: PRODUCTS OFFERED

- TABLE 242 EUROCHEM GROUP: DEALS

- TABLE 243 EUROCHEM GROUP: OTHER DEVELOPMENTS

- 14.1.7 CF INDUSTRIES HOLDINGS, INC.

- TABLE 244 CF INDUSTRIES HOLDINGS, INC.: BUSINESS OVERVIEW

- FIGURE 56 CF INDUSTRIES HOLDINGS, INC.: COMPANY SNAPSHOT

- TABLE 245 CF INDUSTRIES HOLDINGS, INC.: PRODUCTS OFFERED

- TABLE 246 CF INDUSTRIES HOLDINGS, INC.: OTHER DEVELOPMENTS

- 14.1.8 NUFARM

- TABLE 247 NUFARM: BUSINESS OVERVIEW

- FIGURE 57 NUFARM: COMPANY SNAPSHOT

- TABLE 248 NUFARM: PRODUCTS OFFERED

- 14.1.9 THE MOSAIC COMPANY

- TABLE 249 THE MOSAIC COMPANY: BUSINESS OVERVIEW

- FIGURE 58 THE MOSAIC COMPANY: COMPANY SNAPSHOT

- TABLE 250 THE MOSAIC COMPANY: PRODUCTS OFFERED

- TABLE 251 THE MOSAIC COMPANY: PRODUCT LAUNCHES

- TABLE 252 THE MOSAIC COMPANY: DEALS

- 14.1.10 OCI NITROGEN

- TABLE 253 OCI NITROGEN: BUSINESS OVERVIEW

- FIGURE 59 OCI NITROGEN: COMPANY SNAPSHOT

- TABLE 254 OCI NITROGEN: PRODUCTS OFFERED

- TABLE 255 OCI NITROGEN: DEALS

- TABLE 256 OCI NITROGEN: OTHER DEVELOPMENTS

- 14.1.11 OCP GROUP

- TABLE 257 OCP GROUP: BUSINESS OVERVIEW

- FIGURE 60 OCP GROUP: COMPANY SNAPSHOT

- TABLE 258 OCP GROUP: PRODUCTS OFFERED

- TABLE 259 OCP GROUP: PRODUCT LAUNCHES

- TABLE 260 OCP GROUP: DEALS

- TABLE 261 OCP GROUP: OTHER DEVELOPMENTS

- 14.1.12 KINGENTA

- TABLE 262 KINGENTA: BUSINESS OVERVIEW

- FIGURE 61 KINGENTA: COMPANY SNAPSHOT

- TABLE 263 KINGENTA: PRODUCTS OFFERED

- TABLE 264 KINGENTA: DEALS

- 14.1.13 COROMANDEL INTERNATIONAL LIMITED

- TABLE 265 COROMANDEL INTERNATIONAL LIMITED: BUSINESS OVERVIEW

- FIGURE 62 COROMANDEL INTERNATIONAL LIMITED: COMPANY SNAPSHOT

- TABLE 266 COROMANDEL INTERNATIONAL LIMITED: PRODUCTS OFFERED

- TABLE 267 COROMANDEL INTERNATIONAL LIMITED: PRODUCT LAUNCHES

- TABLE 268 COROMANDEL INTERNATIONAL LIMITED: DEALS

- 14.1.14 DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED

- TABLE 269 DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED: BUSINESS OVERVIEW

- FIGURE 63 DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED: COMPANY SNAPSHOT

- TABLE 270 DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED: PRODUCTS OFFERED

- TABLE 271 DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED: PRODUCT LAUNCHES

- 14.1.15 ZUARI AGRO CHEMICALS LTD.

- TABLE 272 ZUARI AGRO CHEMICALS LTD.: BUSINESS OVERVIEW

- FIGURE 64 ZUARI AGRO CHEMICALS: COMPANY SNAPSHOT

- TABLE 273 ZUARI AGRO CHEMICALS LTD: PRODUCTS OFFERED

- 14.2 STARTUPS/SMES/OTHER PLAYERS

- 14.2.1 KUGLER COMPANY

- TABLE 274 KUGLER COMPANY: BUSINESS OVERVIEW

- TABLE 275 KUGLER COMPANY: PRODUCTS OFFERED

- 14.2.2 HAIFA NEGEV TECHNOLOGIES

- TABLE 276 HAIFA NEGEV TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 277 HAIFA NEGEV TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 278 HAIFA NEGEV TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 279 HAIFA NEGEV TECHNOLOGIES: DEALS

- TABLE 280 HAIFA NEGEV TECHNOLOGIES: OTHER DEVELOPMENTS

- 14.2.3 COMPO EXPERT GMBH

- TABLE 281 COMPO EXPERT GMBH: BUSINESS OVERVIEW

- TABLE 282 COMPO EXPERT GMBH: PRODUCTS OFFERED

- TABLE 283 COMPO EXPERT GMBH: DEALS

- 14.2.4 WILBUR-ELLIS COMPANY LLC

- TABLE 284 WILBUR-ELLIS COMPANY LLC: BUSINESS OVERVIEW

- TABLE 285 WILBUR-ELLIS COMPANY LLC: PRODUCTS OFFERED

- 14.2.5 VALAGRO

- TABLE 286 VALAGRO: BUSINESS OVERVIEW

- TABLE 287 VALAGRO: PRODUCTS OFFERED

- TABLE 288 VALAGRO: DEALS

- TABLE 289 VALAGRO: OTHER DEVELOPMENTS

- 14.2.6 BRANDT

- 14.2.7 AGROLIQUID

- 14.2.8 PLANT FOOD COMPANY, INC.

- 14.2.9 KOCH INDUSTRIES, INC.

- 14.2.10 AGZON AGRO

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 ADJACENT & RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 CONTROLLED RELEASE FERTILIZERS MARKET

- 15.2.1 LIMITATIONS

- 15.2.2 MARKET DEFINITION

- 15.2.3 MARKET OVERVIEW

- 15.2.4 CONTROLLED-RELEASE FERTILIZERS MARKET, BY TYPE

- TABLE 290 CONTROLLED-RELEASE FERTILIZERS MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 291 CONTROLLED-RELEASE FERTILIZERS MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 15.2.5 CONTROLLED-RELEASE FERTILIZERS MARKET, BY END USE

- 15.2.6 CONTROLLED-RELEASE FERTILIZERS MARKET, BY MODE OF APPLICATION

- 15.2.7 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION

- TABLE 292 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION, 2018-2020 (USD MILLION)

- TABLE 293 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION, 2021-2026 (USD MILLION)

- 15.3 AGRICULTURAL MICRONUTRIENTS MARKET

- 15.3.1 LIMITATIONS

- 15.3.2 MARKET DEFINITION

- 15.3.3 MARKET OVERVIEW

- 15.3.4 AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE

- TABLE 294 AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 295 AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 15.3.5 AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION

- TABLE 296 AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 297 AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2022-2027 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS