|

|

市場調査レポート

商品コード

1032779

自動車用ポンプの世界市場 (~2027年):タイプ (燃料ポンプ・ウォーターポンプ・燃料噴射ポンプ・ステアリングポンプ・ヘッドライトウォッシャーポンプ)・技術・容量・車両タイプ・販売経路・EV区分 (BEV・HEV・PHEV・FCEV)・オフハイウェイ車両区分・地域別Automotive Pumps Market by Type, Technology (Electric, Mechanical), Displacement, Vehicle Type, Sales Channel (OEM, Aftermarket), EV (BEV, HEV, PHEV, FCEV), Off-Highway Vehicles, Application and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 自動車用ポンプの世界市場 (~2027年):タイプ (燃料ポンプ・ウォーターポンプ・燃料噴射ポンプ・ステアリングポンプ・ヘッドライトウォッシャーポンプ)・技術・容量・車両タイプ・販売経路・EV区分 (BEV・HEV・PHEV・FCEV)・オフハイウェイ車両区分・地域別 |

|

出版日: 2022年04月19日

発行: MarketsandMarkets

ページ情報: 英文 284 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自動車用ポンプの市場規模は予測期間中4.2%のCAGRで推移し、2021年の142億米ドルから、2026年には175億米ドルの規模に成長すると予測されています。

世界の主要自動車メーカーは消費者の需要増に対応するため、低燃費車の導入に注力しています。さらに、公害の増加を抑制するため、いくつかの国では乗用車や商用車に厳しい排出基準を設けています。これらの要因が同市場の成長を後押しすると予測されています。

EV区分別で見ると、HEVの部門が最大の規模を示しています。HEV市場は厳しい排出ガス規制や、低排出ガス車やゼロエミッション車への需要の高まりにより、需要が増加しています。さらに、各国政府がハイブリッド車に対して購入補助金や税金の払い戻しを行っており、成長が見込まれています。また、車両タイプ別では、乗用車の部門が市場をリードすると予測されています。消費者の可処分所得の増加が乗用車の需要を押し上げ、自動車用ポンプ市場の成長を後押ししています。

当レポートでは、世界の自動車用ポンプの市場を調査し、市場の定義と概要、新型コロナウイルス感染症 (COVID-19) およびその他の市場影響因子の分析、法規制環境、技術・特許の動向、ケーススタディ、市場規模の推移・予測、タイプ・車両タイプ・技術・容量・用途・EV区分・オフハイウェイ車両区分・販売経路・地域/主要国など各種区分別の内訳、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 市場機会

- 課題

- ポーターズファイブフォース

- エコシステム

- バリューチェーン分析

- 価格分析

- 技術分析

- 特許分析

- 動向・ディスラプション

- ケーススタディ

- 規制の枠組み

- 貿易データ

- COVID-19の影響

- 市場シナリオ分析

第6章 取引データ

第7章 自動車用ポンプ市場:タイプ別

- 燃料ポンプ

- ウォーターポンプ

- ウィンドシールドウォッシャーポンプ

- ステアリングポンプ

- トランスミッションオイルポンプ

- 燃料噴射ポンプ

- 真空ポンプ

- ヘッドライトウォッシャーポンプ

- 主な産業考察

第8章 自動車用ポンプ市場:車両タイプ別

- 乗用車

- 小型商用車

- 大型商用車

- 主な産業考察

第9章 自動車用ポンプ市場:技術別

- 電気ポンプ

- 機械式ポンプ

- 主な産業考察

第10章 自動車用ポンプ市場:容量別

- 定容量ポンプ

- 可変容量ポンプ

- 主な産業考察

第11章 自動車用ポンプ市場:用途別

- ボディ・インテリア

- エンジン・HVAC

- パワートレイン

- 主な産業考察

第12章 自動車用ポンプ市場:EV区分別

- BEV

- FCEV

- HEV

- PHEV

- 主な産業考察

第13章 自動車用ポンプ市場:オフハイウェイ車両区分別

- 建設機械

- 鉱業設備

- 主な産業考察

第14章 自動車用ポンプ市場:販売経路別

- OEM

- アフターマーケット

- 主な産業考察

第15章 自動車用ポンプ市場:地域別

- アジア太平洋

- 欧州

- 北米

- その他の地域

第16章 競合情勢

- 市場シェア分析

- トップ企業・公開企業の収益分析

- 競合シナリオ

- 企業評価クアドラント

- スタートアップ/SME評価クアドラント

第17章 企業プロファイル

- 主要企業

- AISIN CORPORATION

- DENSO

- ROBERT BOSCH GMBH

- CONTINENTAL AG

- VALEO

- JOHNSON ELECTRIC

- SHW AG

- ZF GROUP

- HITACHI

- RHEINMETALL AUTOMOTIVE

- MAGNA INTERNATIONAL INC.

- MITSUBISHI ELECTRIC CORPORATION

- その他の企業

- MIKUNI CORPORATION

- GMB CORPORATION

- PRICOL LIMITED

- MAHLE GMBH

- MAGNETI MARELLI S.P.A

- CUMMINS

- INFINEON TECHNOLOGIES AG

- HELLA KGAA HEUCK & CO.

- TI FLUID SYSTEMS

- CARTER FUEL SYSTEMS

- BORGWARNER INC

- UCI INTERNATIONAL INC

- STANDARD MOTOR PRODUCTS, INC

- EATON CORPORATION

- MTQ ENGINE SYSTEMS

第18章 推奨事項

第19章 付録

The global automotive pump market is estimated to grow from USD 14.8 billion in 2022 to USD 18.0 billion by 2027, at a CAGR of 4.1%. Major vehicle manufacturers across the globe are focusing on introducing fuel-efficient vehicles to cater to the increased demand from consumers. Moreover, to curb rising pollution, several countries have implemented stringent emission norms for passenger cars and commercial vehicles. These factors are anticipated to push the growth of the market. However, the growth of battery operated vehicles is considered a major restraint for the growth of the automotive pump market. Though the outbreak of pandemic COVID-19 all over the world disturbed the economic and financial structures of the whole world. Auto industry noticed a fall due to production halt of vehicles parts and assembly which has collapsed the economies of US, China, UK, Germany, France, Italy, Japan, and many others countries. However, In H1 2021, automakers around the world have increased level of production due to rise in sales.

"HEV is the largest electric vehicle segment of the automotive pump market during the forecast period."

HEVs comprise an internal combustion engine as well as a battery. Thus, the architecture of an HEV is most suitable for installing pumps for regulating the flow of the fluid. Applications such as cooling, lubrication, and fuel injection require pumps for their efficient operation. Thus, the rising demand for HEV segment vehicles is expected to inflate the demand for automotive pumps and contribute to the growth of the global market. Moreover, the demand for hybrid vehicle market is rising due to stringent emission regulation standards and the growing demand for low or zero-emission vehicles. Furthermore, governments of various countries provide purchase grants and tax rebates for hybrid vehicles. For instance, in June-2021, The Indian government announced decision to extend the second phase of the Faster Adoption and Manufacturing of Hybrid and Electric vehicle (FAME) scheme by two years to March 31, 2024. The scheme, started in 2019 for promoting sales of hybrid and electric vehicles, was supposed to end by 2022. This the government across the globe is planning to launch schemes for promoting electric vehicles, the market for electric vehicles would rise and proportionally with the sales of new electric vehicles, the market for automotive pumps would rise.

"Passenger car segment is expected to dominate the automotive pump market."

The increase in disposable income of consumers has pushed the demand for passenger cars, which, in turn, has driven the growth of the automotive pump market. The passenger car segment is anticipated to hold the largest share in the automotive pump market. The market for automotive pump in passenger cars is expected to grow at a significant rate, particularly in the emerging economies of Asia Pacific. Furthermore, the increasing demand for electric cars by consumers and several amendments in transport policies made by various governments to curb harmful emissions are expected to drive the growth of the passenger car segment.

"Asia Pacific is expected to record the highest growth rate during the forecast period."

The Asia Pacific market is a vast geographical region comprising countries such as Japan, China, India, South Korea, and Thailand. China is the largest producer of automobiles in the world. The country's automotive sector has witnessed significant growth in recent years. Moreover, component manufacturing startups and Tier I companies have strengthened their foothold in the region, thereby inflating the growth of the market. In addition, established automakers in Japan, China, and South Korea are expected to cater to the increased demand for pumps from OEMs in the region.

In-depth interviews were conducted with CEOs, marketing directors, innovation and technology directors, and executives from various key organizations operating in the market.

- By Company Type: Tier I - 47%, Tier II - 33%, and OEMs - 20%

- By Designation: C Level - 43%, D Level - 39%, and Others - 18%

- By Region: Europe - 36%, Asia Pacific - 32%, North America - 24%, and RoW - 8%

The market comprises major manufacturers such as Aisin Corporation (Japan), Denso (Japan), Robert Bosch GmbH (Germany), Valeo (France), Continental AG (Germany) among others. The study includes an in-depth competitive analysis of these key players in the market with their company profiles, recent developments, and key market strategies.

Research Coverage:

The study covers the market across segments. It aims at estimating the market size and future growth potential of this market across different segments such as type, vehicle type, EV, Sales channel, technology, displacement, off-highway vehicles, application, sales channel and region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- TABLE 1 INCLUSIONS & EXCLUSIONS FOR AUTOMOTIVE PUMPS MARKET

- 1.3 MARKET SCOPE

- FIGURE 1 AUTOMOTIVE PUMPS MARKET: SEGMENTS COVERED

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY & PRICING

- 1.5 PACKAGE SIZE

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AUTOMOTIVE PUMPS MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.3 PRIMARY PARTICIPANTS

- 2.2 MARKET ESTIMATION METHODOLOGY

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 6 AUTOMOTIVE PUMPS MARKET: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 7 AUTOMOTIVE PUMPS MARKET: TOP-DOWN APPROACH

- FIGURE 8 AUTOMOTIVE PUMPS MARKET: RESEARCH DESIGN AND METHODOLOGY

- FIGURE 9 RESEARCH APPROACH: AUTOMOTIVE PUMPS MARKET

- 2.3.3 DEMAND-SIDE APPROACH

- FIGURE 10 TOP-DOWN RESEARCH METHODOLOGY APPROACH: COMPANY BASED REVENUE APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 11 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.5.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDE

- 2.6 ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 12 AUTOMOTIVE PUMPS MARKET: MARKET OVERVIEW

- FIGURE 13 AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

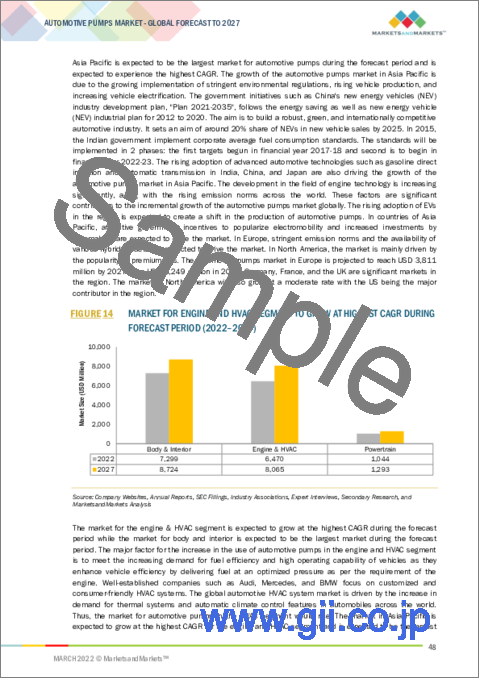

- FIGURE 14 MARKET FOR ENGINE AND HVAC SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD (2022-2027)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE PUMPS MARKET

- FIGURE 15 NEED FOR FUEL-EFFICIENT VEHICLES AND GROWING AUTOMOBILE DEMAND TO DRIVE THE MARKET

- 4.2 AUTOMOTIVE PUMPS MARKET, BY REGION

- FIGURE 16 APAC IS PROJECTED TO BE LARGEST MARKET DURING FORECAST PERIOD

- 4.3 AUTOMOTIVE PUMPS MARKET, BY TYPE

- FIGURE 17 HEADLIGHT WASHER PUMPS ARE EXPECTED TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD (2022-2027)

- 4.4 AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE

- FIGURE 18 PASSENGER CAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD (2022-2027)

- 4.5 AUTOMOTIVE PUMPS MARKET, BY TECHNOLOGY

- FIGURE 19 MARKET FOR ELECTRIC PUMPS IS EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD (2022-2027)

- 4.6 AUTOMOTIVE PUMPS MARKET, BY DISPLACEMENT

- FIGURE 20 MARKET FOR MECHANICAL PUMPS IS EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD (2022-2027)

- 4.7 AUTOMOTIVE PUMPS MARKET, BY EV TYPE

- FIGURE 21 HEVS TO LEAD AUTOMOTIVE PUMPS MARKET, IN TERMS OF SIZE, DURING FORECAST PERIOD (2022-2027)

- 4.8 AUTOMOTIVE PUMPS MARKET, BY APPLICATION

- FIGURE 22 ENGINE & HVAC ARE EXPECTED TO BE FASTEST GROWING APPLICATION SEGMENT DURING FORECAST PERIOD (2022-2027)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- TABLE 2 IMPACT OF MARKET DYNAMICS

- 5.2 MARKET DYNAMICS

- FIGURE 23 AUTOMOTIVE PUMPS MARKET: DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for fuel-efficient vehicles

- FIGURE 24 GLOBAL LIGHT-DUTY VEHICLE FUEL ECONOMY IMPROVEMENTS, NET ZERO SCENARIO, 2015 VS 2025

- 5.2.1.2 Implementation of stringent emission norms by regulatory authorities

- TABLE 3 GLOBAL EMISSION REGULATIONS IN MAJOR COUNTRIES

- FIGURE 25 EMISSION NORMS AND FUTURE OUTLOOK FOR ASIAN COUNTRIES

- FIGURE 26 GOVERNMENT PREPARATIONS FOR EMISSION REDUCTION

- 5.2.1.3 Increasing trend of engine downsizing

- FIGURE 27 ENGINE DOWNSIZING THE ROAD FORWARD FOR THE AUTOMOTIVE INDUSTRY

- 5.2.1.4 Demand for lightweight automotive components

- 5.2.2 RESTRAINTS

- 5.2.2.1 Growing demand for electric vehicles

- FIGURE 28 GLOBAL ELECTRIC VEHICLE SALES (THOUSAND UNITS)

- FIGURE 29 GLOBAL MARKET SHARE OF ELECTRIC CARS (%)

- FIGURE 30 CARBON EMISSIONS FROM POWER AND TRANSPORTATION SECTORS

- 5.2.2.2 Increase in installation of electric power steering in passenger cars

- 5.2.2.3 Growing demand for SUVs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth in usage of ethanol fuel in automotive industry

- FIGURE 31 PRODUCTION OF ETHANOL 2020 (MILLION GALLONS)

- 5.2.3.2 Growing adoption of new technologies

- FIGURE 32 ADVANTAGES AND DISADVANTAGES OF ELECTRIC WATER PUMPS

- 5.2.3.3 Robust growth in sales of plug-in hybrid electric vehicles

- FIGURE 33 GLOBAL PHEV SALES VOLUME, 2019-2021 (THOUSAND UNITS)

- 5.2.3.4 Improving sustainability of passenger and freight transport

- 5.2.4 CHALLENGES

- 5.2.4.1 Increase in cost of electrification of automotive pumps

- FIGURE 34 COST OF ELECTRONICS OUT OF TOTAL COST OF VEHICLE

- 5.2.4.2 Decline in growth of aftermarket

- 5.3 PORTERS FIVE FORCES

- FIGURE 35 PORTER'S FIVE FORCES: AUTOMOTIVE PUMPS MARKET

- TABLE 4 AUTOMOTIVE PUMPS MARKET: IMPACT OF PORTERS FIVE FORCES

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 RIVALRY AMONG EXISTING COMPETITORS

- 5.4 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 2 APPLICATIONS

- TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 2 APPLICATIONS (%)

- 5.4.2 BUYING CRITERIA

- FIGURE 37 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- 5.5 AUTOMOTIVE PUMPS MARKET ECOSYSTEM

- FIGURE 38 AUTOMOTIVE PUMPS MARKET: ECOSYSTEM ANALYSIS

- 5.5.1 AUTOMOTIVE EQUIPMENT SUPPLIERS

- 5.5.2 AUTOMOTIVE PUMPS MANUFACTURERS

- 5.5.3 OEMS

- 5.5.4 END USERS

- TABLE 6 AUTOMOTIVE PUMPS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 39 VALUE CHAIN ANALYSIS

- 5.7 PRICING ANALYSIS

- TABLE 7 AUTOMOTIVE PUMPS MARKET: GLOBAL OEM AVERAGE PRICING ANALYSIS (USD), 2021

- TABLE 8 AUTOMOTIVE PUMPS MARKET: GLOBAL AFTERMARKET AVERAGE PRICING ANALYSIS (USD), 2021

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 IOT-BASED VEHICLES (CONNECTED CAR TECHNOLOGY)

- FIGURE 40 COMPANIES WORKING FOR IOT-BASED VEHICLES

- 5.8.2 EPS

- FIGURE 41 EPS SYSTEM IN VEHICLES

- 5.8.3 NEW AND UPCOMING FUEL PUMP MODULES

- FIGURE 42 BRUSHLESS FUEL PUMP

- 5.9 PATENT ANALYSIS

- 5.9.1 APPROACH

- 5.9.2 DOCUMENT TYPE

- FIGURE 43 PATENTS REGISTERED FOR AUTOMOTIVE PUMPS, 2011-2022

- FIGURE 44 PATENT PUBLICATION TRENDS FOR AUTOMOTIVE PUMPS, 2011-2022

- 5.9.3 LEGAL STATUS OF PATENTS

- FIGURE 45 LEGAL STATUS OF PATENTS FILED FOR AUTOMOTIVE PUMPS

- 5.9.4 JURISDICTION ANALYSIS

- FIGURE 46 HIGHEST NUMBER OF PATENTS FILED BY COMPANIES IN US

- 5.9.5 TOP APPLICANTS

- FIGURE 47 DOW GLOBAL TECHNOLOGIES LLC REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2011 AND 2022

- 5.10 TRENDS AND DISRUPTIONS IN AUTOMOTIVE PUMPS MARKET

- FIGURE 48 TRENDS AND DISRUPTIONS IN AUTOMOTIVE PUMPS MARKET

- 5.11 CASE STUDY

- 5.11.1 RELIABILITY ANALYSIS ON DRIVE SYSTEM OF GEAR-TYPE OIL PUMP WITH VARIABLE DISPLACEMENT

- 5.11.2 CASE STUDY ON HIGH-POWER AUTOMOBILE WATER PUMP BASED ON COMPUTATIONAL FLUID DYNAMICS (CFD)

- 5.12 REGULATORY FRAMEWORK

- FIGURE 49 EMISSION REDUCTION FRAMEWORK OF MAJOR COUNTRIES, 2021

- TABLE 9 EURO VI STANDARDS 2021: EUROPEAN EMISSION NORMS

- TABLE 10 US III STANDARDS 2021: US EMISSION NORMS

- TABLE 11 CHINA 6A, 6B STANDARDS 2021: CHINA EMISSION NORMS

- TABLE 12 JAPAN WLTC STANDARDS 2021: JAPAN EMISSION NORMS

- TABLE 13 BRAZIL L-6 STANDARDS 2021: BRAZIL EMISSION NORMS

- 5.13 TRADE DATA

- TABLE 14 AUTOMOTIVE PUMPS MARKET: TRADE ANALYSIS, 2021 (HS CODE - 8413)

- 5.14 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 15 AUTOMOTIVE PUMPS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.15 TARIFF AND REGULATORY LANDSCAPE

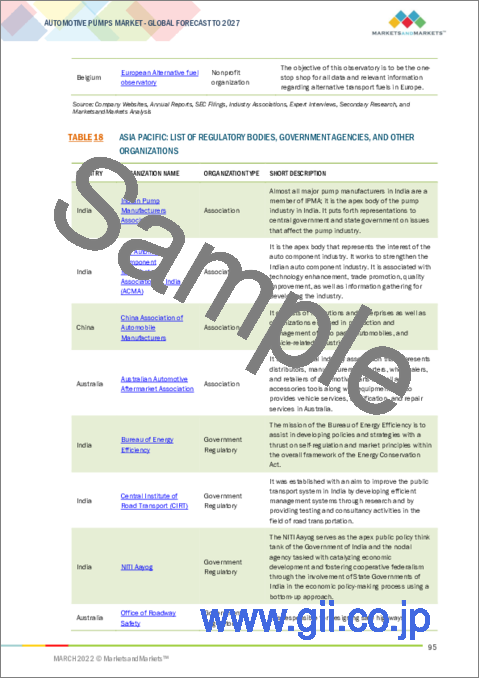

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16 AUTOMOTIVE PUMPS MARKET: COVID-19 IMPACT

- 5.16.1 IMPACT ON RAW MATERIAL SUPPLY

- 5.16.2 COVID-19 IMPACT ON AUTOMOTIVE INDUSTRY

- 5.16.3 OEM ANNOUNCEMENTS

- TABLE 20 OEM ANNOUNCEMENTS

- 5.16.4 IMPACT ON AUTOMOTIVE PRODUCTION

- 5.17 AUTOMOTIVE PUMPS MARKET SCENARIO ANALYSIS

- FIGURE 50 AUTOMOTIVE PUMPS MARKET- FUTURE TRENDS & SCENARIO, 2022-2027 (USD MILLION)

- 5.17.1 MOST LIKELY SCENARIO

- TABLE 21 AUTOMOTIVE PUMPS MARKET (MOST LIKELY SCENARIO), BY REGION, 2022-2027 (USD MILLION)

- 5.17.2 OPTIMISTIC SCENARIO

- TABLE 22 AUTOMOTIVE PUMPS MARKET (OPTIMISTIC), BY REGION, 2022-2027 (USD MILLION)

- 5.17.3 PESSIMISTIC SCENARIO

- TABLE 23 AUTOMOTIVE PUMPS MARKET (PESSIMISTIC), BY REGION, 2022-2027 (USD MILLION)

6 AUTOMOTIVE PUMPS MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 51 STEERING PUMP SEGMENT IS EXPECTED TO DOMINATE AUTOMOTIVE PUMPS MARKET DURING 2022-2027

- TABLE 24 AUTOMOTIVE PUMPS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 25 AUTOMOTIVE PUMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 6.1.1 OPERATIONAL DATA

- TABLE 26 MANUFACTURERS AND APPLICATIONS OF DIFFERENT TYPES OF AUTOMOTIVE PUMPS

- 6.1.2 ASSUMPTIONS

- TABLE 27 ASSUMPTIONS: BY TYPE

- 6.1.3 RESEARCH METHODOLOGY

- 6.1.4 KEY INDUSTRY INSIGHTS

- 6.2 FUEL PUMP

- 6.2.1 STRINGENT EMISSION NORMS WORLDWIDE ARE EXPECTED TO DRIVE AUTOMOTIVE PUMPS MARKET

- TABLE 28 FUEL PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 29 FUEL PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 WATER PUMP

- 6.3.1 INCREASING SALES OF COMMERCIAL VEHICLES IS EXPECTED TO DRIVE WATER PUMP MARKET

- TABLE 30 WATER PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 31 WATER PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4 WINDSHIELD WASHER PUMP

- 6.4.1 IMPROVED EFFICIENCY OF WINDSHIELD WASHING BY ELECTRIC PUMPS TO DRIVE AUTOMOTIVE PUMPS MARKET

- TABLE 32 WINDSHIELD WASHER PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 33 WINDSHIELD WASHER PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5 STEERING PUMP

- 6.5.1 INTEGRATION OF HYDRAULIC STEERING SYSTEMS IN VEHICLES IS EXPECTED TO DRIVE STEERING PUMP MARKET

- TABLE 34 STEERING PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 STEERING PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.6 TRANSMISSION OIL PUMP

- 6.6.1 EMISSION NORMS FOR AUTOMOTIVE INDUSTRY ARE LIKELY TO IMPACT TRANSMISSION OIL PUMP MARKET

- TABLE 36 TRANSMISSION OIL PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 37 TRANSMISSION OIL PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.7 FUEL INJECTION PUMP

- 6.7.1 MECHANICALLY OPERATED FUEL INJECTION PUMPS HAVE LARGER MARKET SHARE DUE TO CONVENTIONAL POWERTRAIN IN VEHICLES

- TABLE 38 FUEL INJECTION PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 39 FUEL INJECTION PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.8 VACUUM PUMP

- 6.8.1 DEMAND FOR HIGHLY EFFICIENT FUEL INJECTION SYSTEMS IS EXPECTED TO BOOST VACUUM PUMP MARKET

- TABLE 40 VACUUM PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 41 VACUUM PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.9 HEADLIGHT WASHER PUMP

- 6.9.1 INCREASE IN PREMIUM VEHICLE SALES IS DRIVING GROWTH OF HEADLIGHT WASHER PUMP MARKET

- TABLE 42 HEADLIGHT WASHER PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 43 HEADLIGHT WASHER PUMP: AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

7 AUTOMOTIVE PUMPS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 52 MECHANICAL PUMP SEGMENT TO DOMINATE AUTOMOTIVE PUMPS MARKET BY 2027 (USD MILLION)

- TABLE 44 AUTOMOTIVE PUMPS MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 45 AUTOMOTIVE PUMPS MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 7.1.1 OPERATIONAL DATA

- TABLE 46 POPULAR AUTOMOTIVE PUMP MANUFACTURERS

- 7.1.2 ASSUMPTIONS

- TABLE 47 ASSUMPTIONS: BY TECHNOLOGY

- 7.1.3 RESEARCH METHODOLOGY

- 7.1.4 KEY INDUSTRY INSIGHTS

- 7.2 ELECTRIC PUMP

- 7.2.1 ELECTRIC SEGMENT TO REGISTER FASTEST GROWTH IN COMING YEARS

- TABLE 48 ELECTRIC PUMP: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 49 ELECTRIC PUMP: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.3 MECHANICAL PUMP

- 7.3.1 MECHANICAL PUMP TO BE LARGE MARKET DURING FORECAST PERIOD

- TABLE 50 MECHANICAL PUMP: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 51 MECHANICAL PUMP: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

8 AUTOMOTIVE PUMPS MARKET, BY DISPLACEMENT

- 8.1 INTRODUCTION

- FIGURE 53 FIXED PUMP SEGMENT TO DOMINATE AUTOMOTIVE PUMPS MARKET BY 2027 (USD MILLION)

- TABLE 52 AUTOMOTIVE PUMPS MARKET, BY DISPLACEMENT, 2018-2021 (USD MILLION)

- TABLE 53 AUTOMOTIVE PUMPS MARKET, BY DISPLACEMENT, 2022-2027 (USD MILLION)

- 8.1.1 OPERATIONAL DATA

- TABLE 54 AUTOMOTIVE PUMPS MANUFACTURERS: DISPLACEMENT TYPE

- 8.1.2 ASSUMPTIONS

- TABLE 55 ASSUMPTIONS: BY DISPLACEMENT

- 8.1.3 RESEARCH METHODOLOGY

- 8.1.4 KEY INDUSTRY INSIGHTS

- 8.2 FIXED DISPLACEMENT

- 8.2.1 FIXED DISPLACEMENT SEGMENT TO LEAD AUTOMOTIVE PUMPS MARKET IN COMING YEARS

- TABLE 56 FIXED PUMP: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 57 FIXED PUMP: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 8.3 VARIABLE DISPLACEMENT

- 8.3.1 REDUCTION IN ENERGY LOSSES TO FUEL DEMAND FOR VARIABLE PUMPS

- TABLE 58 VARIABLE PUMP: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 59 VARIABLE PUMP: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

9 AUTOMOTIVE PUMPS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 54 AUTOMOTIVE PUMPS MARKET, BY APPLICATION, 2022 VS. 2027

- TABLE 60 AUTOMOTIVE PUMPS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 61 AUTOMOTIVE PUMPS MARKET, BY APPLICATION, 2022-2027 USD MILLION)

- 9.1.1 OPERATIONAL DATA

- TABLE 62 APPLICATIONS FOR TYPES OF AUTOMOTIVE PUMPS

- 9.1.2 ASSUMPTIONS

- TABLE 63 ASSUMPTIONS: BY APPLICATION

- 9.1.3 RESEARCH METHODOLOGY

- 9.1.4 KEY INDUSTRY INSIGHTS

- 9.2 BODY & INTERIOR

- 9.2.1 INCREASING DEMAND FOR HCVS AND LCVS FOR GOODS TRANSPORTS WOULD DRIVE MARKET GROWTH

- TABLE 64 BODY & INTERIOR: AUTOMOTIVE PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 65 BODY & INTERIOR: AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 ENGINE & HVAC

- 9.3.1 NEED FOR MAINTAINING OPTIMUM ENGINE TEMPERATURE IS LIKELY TO DRIVE DEMAND FOR AUTOMOTIVE PUMPS FROM ENGINE & HVAC SEGMENT

- TABLE 66 ENGINE & HVAC: AUTOMOTIVE PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 67 ENGINE & HVAC: AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 POWERTRAIN

- 9.4.1 ADVANCEMENTS IN TRANSMISSION TECHNOLOGIES ARE LIKELY TO DRIVE GROWTH OF AUTOMOTIVE PUMPS MARKET IN POWERTRAIN SEGMENT

- TABLE 68 POWERTRAIN: AUTOMOTIVE PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 69 POWERTRAIN: AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

10 AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE

- 10.1 INTRODUCTION

- FIGURE 55 PASSENGER CAR SEGMENT IS EXPECTED TO DOMINATE THE AUTOMOTIVE PUMPS MARKET BY 2027 IN TERMS OF VALUE

- TABLE 70 AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 71 AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 10.1.1 OPERATIONAL DATA

- TABLE 72 MANUFACTURERS OF DIFFERENT TYPES OF AUTOMOTIVE PUMPS AND THEIR TARGET VEHICLE

- 10.1.2 RESEARCH METHODOLOGY

- 10.1.3 KEY INDUSTRY INSIGHTS

- 10.2 PASSENGER CAR (PC)

- 10.2.1 RISE IN DEMAND FOR PASSENGER CARS IS EXPECTED TO DRIVE AUTOMOTIVE PUMPS MARKET

- TABLE 73 PASSENGER CAR: AUTOMOTIVE PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 74 PASSENGER CAR: AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 LIGHT COMMERCIAL VEHICLE (LCV)

- 10.3.1 INCREASING SALES OF LIGHT COMMERCIAL VEHICLES IN NORTH AMERICA IS EXPECTED TO DRIVE AUTOMOTIVE PUMPS MARKET

- TABLE 75 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 76 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 HEAVY COMMERCIAL VEHICLE (HCV)

- 10.4.1 IMPROVED POWERTRAIN AND COOLING SYSTEM TO DRIVE HEAVY COMMERCIAL VEHICLE MARKET

- TABLE 77 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 78 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

11 AUTOMOTIVE PUMPS MARKET, BY EV TYPE

- 11.1 INTRODUCTION

- FIGURE 56 HEV SEGMENT EXPECTED IN AUTOMOTIVE PUMPS MARKET, 2022-2027

- TABLE 79 AUTOMOTIVE PUMPS MARKET, BY EV TYPE, 2018-2021 (USD MILLION)

- TABLE 80 AUTOMOTIVE PUMPS MARKET, BY EV TYPE, 2022-2027 (USD MILLION)

- 11.1.1 OPERATIONAL DATA

- TABLE 81 AUTOMOTIVE PUMP MANUFACTURERS OF PUMPS USED IN EV

- 11.1.2 ASSUMPTIONS

- TABLE 82 ASSUMPTIONS: AUTOMOTIVE PUMPS MARKET, BY EV TYPE

- 11.1.3 RESEARCH METHODOLOGY

- 11.1.4 KEY INDUSTRY INSIGHTS

- 11.2 BATTERY ELECTRIC VEHICLE

- 11.2.1 INCREASE IN DEMAND FOR ZERO-EMISSION MOBILITY EXPECTED TO DRIVE MARKET GROWTH

- TABLE 83 BEV: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 84 BEV: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3 FUEL CELL ELECTRIC VEHICLE

- 11.3.1 GROWING GOVERNMENT EMPHASIS ON MAKING CONSUMERS AWARE OF POLLUTION IS EXPECTED TO PUSH FCEV MARKET GROWTH

- TABLE 85 FCEV: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 86 FCEV: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4 HYBRID ELECTRIC VEHICLES

- 11.4.1 HEV TO HOLD LARGEST SHARE OF AUTOMOTIVE PUMPS MARKET

- TABLE 87 HEV: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2018-2021(USD MILLION)

- TABLE 88 HEV: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.5 PLUG-IN HYBRID VEHICLES

- 11.5.1 HIGH INCLINATION OF MAJOR OEMS TOWARD PRODUCING PHEVS IS PROPELLING GROWTH OF AUTOMOTIVE PUMPS MARKET

- TABLE 89 PHEV: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 90 PHEV: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

12 AUTOMOTIVE PUMPS MARKET, BY OFF-HIGHWAY VEHICLE TYPE

- 12.1 INTRODUCTION

- TABLE 91 OFF-HIGHWAY AUTOMOTIVE PUMPS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 92 OFF-HIGHWAY AUTOMOTIVE PUMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.1.1 OPERATIONAL DATA

- TABLE 93 TOP OFF-HIGHWAY VEHICLE AND PUMP MANUFACTURERS

- 12.1.2 ASSUMPTIONS

- TABLE 94 ASSUMPTIONS: AUTOMOTIVE PUMPS MARKET, BY OFF-HIGHWAY VEHICLE TYPE

- 12.1.3 RESEARCH METHODOLOGY

- 12.1.4 KEY INDUSTRY INSIGHTS

- 12.2 CONSTRUCTION EQUIPMENT

- TABLE 95 GLOBAL AIRPORT CONSTRUCTION PROJECTS, BY YEAR

- 12.3 MINING EQUIPMENT

- TABLE 96 KEY PLAYERS IN AUTONOMOUS MINING EQUIPMENT MARKET

13 AUTOMOTIVE PUMPS MARKET, BY SALES CHANNEL

- 13.1 INTRODUCTION

- FIGURE 57 OEM SEGMENT IS EXPECTED TO DOMINATE AUTOMOTIVE PUMPS MARKET DURING 2022-2027

- TABLE 97 AUTOMOTIVE PUMPS MARKET, BY SALES CHANNEL, 2018-2021 (USD MILLION)

- TABLE 98 AUTOMOTIVE PUMPS MARKET, BY SALES CHANNEL, 2022-2027 (USD MILLION)

- 13.1.1 ASSUMPTIONS

- TABLE 99 ASSUMPTIONS: BY SALES CHANNEL

- 13.1.2 KEY INDUSTRY INSIGHTS

- 13.2 OEM

- 13.3 AFTERMARKET

14 AUTOMOTIVE PUMPS MARKET, BY REGION

- 14.1 INTRODUCTION

- FIGURE 58 ASIA PACIFIC TO DOMINATE AUTOMOTIVE PUMPS MARKET, 2022 VS. 2027 (USD MILLION)

- TABLE 100 AUTOMOTIVE PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 101 AUTOMOTIVE PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 14.2 ASIA PACIFIC

- FIGURE 59 ASIA PACIFIC: AUTOMOTIVE PUMPS MARKET SNAPSHOT

- TABLE 102 ASIA PACIFIC: AUTOMOTIVE PUMPS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 103 ASIA PACIFIC: AUTOMOTIVE PUMPS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 104 ASIA PACIFIC: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 105 ASIA PACIFIC: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 106 ASIA PACIFIC: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 107 ASIA PACIFIC: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.2.1 CHINA

- 14.2.1.1 High production volume of vehicles to drive the market

- TABLE 108 CHINA: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 109 CHINA: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.2.2 INDIA

- 14.2.2.1 Growing FDI in automotive ecosystem to drive the market

- TABLE 110 INDIA: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 111 INDIA: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.2.3 JAPAN

- 14.2.3.1 Growing adoption of electric pumps by OEMs to drive the market

- TABLE 112 JAPAN: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 113 JAPAN: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.2.4 SOUTH KOREA

- 14.2.4.1 Demand for fuel-efficient automobiles to drive the market

- TABLE 114 SOUTH KOREA: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 115 SOUTH KOREA: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.2.5 THAILAND

- 14.2.5.1 Renewable energy source agenda to meet emission targets to drive the market

- TABLE 116 THAILAND: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 117 THAILAND: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.2.6 REST OF ASIA PACIFIC

- 14.2.6.1 Growing investments by leading OEMs in Rest of Asia Pacific to drive the market

- TABLE 118 REST OF ASIA PACIFIC: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.3 EUROPE

- FIGURE 60 EUROPE: AUTOMOTIVE PUMPS MARKET SNAPSHOT

- TABLE 120 EUROPE: AUTOMOTIVE PUMPS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 121 EUROPE: AUTOMOTIVE PUMPS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 122 EUROPE: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 123 EUROPE: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 124 EUROPE: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 125 EUROPE: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.3.1 FRANCE

- 14.3.1.1 High production of LCVs to drive the market

- FIGURE 61 FRANCE PASSENGER CAR REGISTRATION IN JULY 2021

- TABLE 126 FRANCE: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 127 FRANCE: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.3.2 GERMANY

- 14.3.2.1 Presence of leading OEMs to drive the market

- TABLE 128 GERMANY: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 129 GERMANY: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.3.3 RUSSIA

- 14.3.3.1 Construction of new manufacturing plants and demand for commercial vehicles to drive the market

- TABLE 130 RUSSIA: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 131 RUSSIA: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.3.4 SPAIN

- 14.3.4.1 Increasing adoption of electric fleet to drive the market

- TABLE 132 SPAIN: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 133 SPAIN: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.3.5 TURKEY

- 14.3.5.1 Expansion of vehicle production by OEMs to drive the market

- TABLE 134 TURKEY: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 135 TURKEY: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.3.6 UK

- 14.3.6.1 Demand for LCVs to drive the market

- TABLE 136 UK: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 137 UK: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.3.7 REST OF EUROPE

- 14.3.7.1 Government's focus to reduce vehicle emission to drive the market

- TABLE 138 REST OF EUROPE: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 139 REST OF EUROPE: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.4 NORTH AMERICA

- FIGURE 62 NORTH AMERICA: AUTOMOTIVE PUMPS MARKET, 2022 VS. 2027

- TABLE 140 NORTH AMERICA: AUTOMOTIVE PUMPS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 141 NORTH AMERICA: AUTOMOTIVE PUMPS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 142 NORTH AMERICA: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 143 NORTH AMERICA: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 144 NORTH AMERICA: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 145 NORTH AMERICA: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.4.1 CANADA

- 14.4.1.1 Fuel cell and electric vehicle technologies to drive the market

- TABLE 146 CANADA: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 147 CANADA: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.4.2 MEXICO

- 14.4.2.1 Demand for fuel-efficient vehicles to drive market

- TABLE 148 MEXICO: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 149 MEXICO: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.4.3 US

- 14.4.3.1 Increasing efforts from the government to adopt fuel-efficient vehicles to drive the market

- TABLE 150 US: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 151 US: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.5 REST OF THE WORLD (ROW)

- FIGURE 63 ROW: AUTOMOTIVE PUMPS MARKET, BY COUNTRY, 2022 VS. 2027(USD MILLION)

- TABLE 152 ROW: AUTOMOTIVE PUMPS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 153 ROW: AUTOMOTIVE PUMPS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 154 ROW: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 155 ROW: AUTOMOTIVE PUMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 156 ROW: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 157 ROW: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.5.1 BRAZIL

- 14.5.1.1 Low cost of labor and demand for heavy-duty trucks to drive the market

- TABLE 158 BRAZIL: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 159 BRAZIL: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.5.2 IRAN

- 14.5.2.1 Growth in the automotive industry to drive the market

- TABLE 160 IRAN: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 161 IRAN: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 14.5.3 SOUTH AFRICA

- 14.5.3.1 Increasing concerns over environment to drive the market

- TABLE 162 SOUTH AFRICA: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 163 SOUTH AFRICA: AUTOMOTIVE PUMPS MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- FIGURE 64 KEY DEVELOPMENTS BY LEADING PLAYERS, 2019-2022

- 15.2 MARKET SHARE ANALYSIS FOR THE AUTOMOTIVE PUMPS MARKET

- TABLE 164 MARKET SHARE ANALYSIS, 2021

- FIGURE 65 MARKET SHARE ANALYSIS, 2021

- 15.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

- FIGURE 66 TOP PUBLIC/LISTED PLAYERS DOMINATING THE AUTOMOTIVE PUMPS MARKET DURING THE LAST FIVE YEARS

- 15.4 COVID-19 IMPACT ON AUTOMOTIVE PUMPS MARKET

- 15.5 COMPETITIVE SCENARIO

- 15.5.1 COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/ PARTNERSHIPS/AGREEMENTS

- TABLE 165 COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/PARTNERSHIPS/ AGREEMENTS, 2019-2022

- 15.5.2 NEW PRODUCT DEVELOPMENTS, 2019-2022

- TABLE 166 NEW PRODUCT LAUNCHES, 2019-2022

- 15.5.3 MERGERS & ACQUISITIONS, 2019-2022

- TABLE 167 MERGERS & ACQUISITIONS, 2019-2022

- 15.5.4 EXPANSIONS, 2019-2022

- TABLE 168 EXPANSIONS, 2019-2022

- 15.6 COMPANY EVALUATION QUADRANT

- 15.6.1 STARS

- 15.6.2 EMERGING LEADERS

- 15.6.3 PERVASIVE

- 15.6.4 PARTICIPANTS

- FIGURE 67 AUTOMOTIVE PUMPS MARKET: COMPANY EVALUATION QUADRANT, 2021

- 15.6.4.1 COMPETITIVE BENCHMARKING

- 15.6.5 PRODUCT FOOTPRINT

- TABLE 169 COMPANY FOOTPRINT

- 15.6.6 AUTOMOTIVE PUMPS MARKET: REGIONAL FOOTPRINT

- 15.7 STARTUP/SME EVALUATION QUADRANT

- 15.7.1 PROGRESSIVE COMPANIES

- 15.7.2 RESPONSIVE COMPANIES

- 15.7.3 DYNAMIC COMPANIES

- 15.7.4 STARTING BLOCKS

- FIGURE 68 AUTOMOTIVE PUMPS MARKET: START-UP/SME EVALUATION QUADRANT, 2021

- TABLE 170 WINNERS VS. TAIL-ENDERS

16 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 16.1 KEY PLAYERS

- 16.1.1 AISIN CORPORATION

- TABLE 171 AISIN CORPORATION: BUSINESS OVERVIEW

- FIGURE 69 AISIN CORPORATION: COMPANY SNAPSHOT

- TABLE 172 AISIN CORPORATION: PRODUCTS OFFERED

- TABLE 173 AISIN CORPORATION: NEW PRODUCT LAUNCHES

- TABLE 174 AISIN CORPORATION: OTHERS

- 16.1.2 DENSO

- TABLE 175 DENSO: BUSINESS OVERVIEW

- FIGURE 70 DENSO: COMPANY SNAPSHOT

- TABLE 176 DENSO: PRODUCTS OFFERED

- TABLE 177 DENSO: DEALS

- TABLE 178 DENSO: OTHERS

- 16.1.3 ROBERT BOSCH GMBH

- TABLE 179 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

- FIGURE 71 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- TABLE 180 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 181 ROBERT BOSCH GMBH: NEW PRODUCT LAUNCHES

- TABLE 182 ROBERT BOSCH GMBH: OTHERS

- 16.1.4 CONTINENTAL AG

- TABLE 183 CONTINENTAL AG: BUSINESS OVERVIEW

- FIGURE 72 CONTINENTAL AG: COMPANY SNAPSHOT

- TABLE 184 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 185 CONTINENTAL AG: OTHERS

- 16.1.5 VALEO

- TABLE 186 VALEO: BUSINESS OVERVIEW

- FIGURE 73 VALEO: COMPANY SNAPSHOT

- TABLE 187 VALEO: PRODUCTS OFFERED

- TABLE 188 VALEO: NEW PRODUCT LAUNCHES

- 16.1.6 JOHNSON ELECTRIC

- TABLE 189 JOHNSON ELECTRIC: BUSINESS OVERVIEW

- FIGURE 74 JOHNSON ELECTRIC: COMPANY SNAPSHOT

- TABLE 190 JOHNSON ELECTRIC: PRODUCTS OFFERED

- 16.1.7 SHW AG

- TABLE 191 SHW AG: BUSINESS OVERVIEW

- FIGURE 75 SHW AG: COMPANY SNAPSHOT

- TABLE 192 SHW AG: PRODUCTS OFFERED

- 16.1.8 ZF GROUP

- TABLE 193 ZF GROUP: BUSINESS OVERVIEW

- FIGURE 76 ZF GROUP: COMPANY SNAPSHOT

- TABLE 194 ZF GROUP: PRODUCTS OFFERED

- TABLE 195 ZF GROUP: DEALS

- TABLE 196 ZF GROUP: OTHERS

- 16.1.9 HITACHI

- TABLE 197 HITACHI: BUSINESS OVERVIEW

- FIGURE 77 HITACHI: COMPANY SNAPSHOT

- TABLE 198 HITACHI: PRODUCTS OFFERED

- TABLE 199 HITACHI: DEALS

- TABLE 200 HITACHI: OTHERS

- 16.1.10 RHEINMETALL AUTOMOTIVE

- TABLE 201 RHEINMETALL AUTOMOTIVE: BUSINESS OVERVIEW

- FIGURE 78 RHEINMETALL AUTOMOTIVE: COMPANY SNAPSHOT

- TABLE 202 RHEINMETALL AUTOMOTIVE: PRODUCTS OFFERED

- TABLE 203 RHEINMETALL AUTOMOTIVE: NEW PRODUCT LAUNCHES

- TABLE 204 RHEINMETALL AUTOMOTIVE: DEALS

- 16.1.11 MAGNA INTERNATIONAL INC.

- TABLE 205 MAGNA INTERNATIONAL INC: BUSINESS OVERVIEW

- FIGURE 79 MAGNA INTERNATIONAL INC: COMPANY SNAPSHOT

- TABLE 206 MAGNA INTERNATIONAL INC: PRODUCTS OFFERED

- 16.1.12 MITSUBISHI ELECTRIC CORPORATION

- TABLE 207 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

- FIGURE 80 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 208 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS OFFERED

- 16.2 OTHER KEY PLAYERS

- 16.2.1 MIKUNI CORPORATION

- 16.2.2 GMB CORPORATION

- 16.2.3 PRICOL LIMITED

- 16.2.4 MAHLE GMBH

- 16.2.5 MAGNETI MARELLI S.P.A

- 16.2.6 CUMMINS

- 16.2.7 INFINEON TECHNOLOGIES AG

- 16.2.8 HELLA KGAA HEUCK & CO.

- 16.2.9 TI FLUID SYSTEMS

- 16.2.10 CARTER FUEL SYSTEMS

- 16.2.11 BORGWARNER INC

- 16.2.12 STANDARD MOTOR PRODUCTS, INC

- 16.2.13 EATON CORPORATION

- 16.2.14 MTQ ENGINE SYSTEMS

- 16.2.15 TRICO

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

17 RECOMMENDATIONS BY MARKETSANDMARKETS

- 17.1 ASIA PACIFIC TO BE KEY MARKET FOR AUTOMOTIVE PUMPS

- 17.2 INCREASED ADOPTION OF ELECTRIC PUMPS

- 17.3 CONCLUSION

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 AVAILABLE CUSTOMIZATIONS

- 18.3.1 ADDITIONAL COMPANY PROFILES

- 18.3.1.1 Detailed Analysis of the Automotive pumps market, by vehicle Type

- 18.3.1 ADDITIONAL COMPANY PROFILES

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS