|

|

市場調査レポート

商品コード

1227553

接種剤の世界市場:種類別 (農業用接種剤、サイレージ用接種剤)・微生物別 (細菌、真菌)・作物の種類別 (穀物、油糧種子・豆類、果物・野菜、飼料作物)・形状別 (液体、乾燥)・地域別の将来予測 (2027年まで)Inoculants Market by Type (Agricultural Inoculants and Silage Inoculants), Microbe (Bacterial and Fungal), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Forage Crops), Form (Liquid and Dry) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 接種剤の世界市場:種類別 (農業用接種剤、サイレージ用接種剤)・微生物別 (細菌、真菌)・作物の種類別 (穀物、油糧種子・豆類、果物・野菜、飼料作物)・形状別 (液体、乾燥)・地域別の将来予測 (2027年まで) |

|

出版日: 2023年02月20日

発行: MarketsandMarkets

ページ情報: 英文 266 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の接種剤の市場規模は、2022年に11億米ドル、2027年には17億米ドルに達し、8.1%のCAGR (金額ベース) で成長すると予測されています。

種類別では、農業用接種剤が、分析期間中に最大の市場シェアを獲得すると予測されます。市場の高い成長率を背景に、主要企業は巨額の研究開発費を投じて、接種剤の処方に用いる多機能な新菌株を開発しています。

微生物別では、細菌が分析期間中に最大の市場シェアを獲得する見通しです。微生物をマメ科植物に接種することは、いくつかの植物病害に対して効率的な生物防除法であることが発見されています。さらに、市販のサイレージ用接種剤のほとんどは、乳酸の生産を促進するのに役立つホモ発酵乳酸菌を含んでいます。

作物の種類別では、穀物が分析期間中、最大のセグメントになると考えられています。トウモロコシと小麦の需要の高まりが、農業用接種剤市場の成長に寄与しています。

地域別に見ると、北米地域が世界の接種剤市場で最大の地域になると予測されています。農薬の使用を抑えつつ高収量を求める需要の高まりにより、北米では植物成長調整剤の消費が増加し、それが接種剤市場の成長を促すと予測されます。

当レポートでは、世界の接種剤の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、コンポーネント別・車両タイプ別・サポート技術別・業種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 牛乳と肉製品の需要増加

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- バリューチェーン分析

- サプライチェーン分析

- 技術分析

- 価格動向分析

- 市場マッピングとエコシステム分析

- 顧客ビジネスに影響を与える動向/混乱

- 貿易分析

- 特許分析

- ポーターのファイブフォース分析

- ケーススタディ

- 主な会議とイベント

- 関税と規制の状況

- 規制の枠組み

- 主な利害関係者と購入基準

第7章 接種剤市場:種類別

- イントロダクション

- 農業用接種剤

- 生物防除剤

- 植物抵抗性刺激剤

- サイレージ接種剤

- ホモ発酵性

- 異菌性

第8章 接種剤市場:微生物別

- イントロダクション

- 細菌

- 真菌

- その他の微生物

第9章 接種剤市場:作物の種類別

- イントロダクション

- 穀物

- 油糧種子・豆類

- 果物・野菜

- 飼料

- 他の種類の作物

第10章 接種剤市場:形状別

- イントロダクション

- 乾燥

- 液体

第11章 接種剤市場:適用方式別

- イントロダクション

- 種子処理

- 土壌処理

- その他の適用方式

第12章 接種剤市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- ロシア

- スペイン

- イタリア

- デンマーク

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- インドネシア

- 他のアジア太平洋諸国

- 南米

- ブラジル

- アルゼンチン

- チリ

- 他の南米諸国

- 他の国々 (RoW)

- 中東

- アフリカ

第13章 競合情勢

- 概要

- 主要企業が採用した戦略

- 市場シェア分析

- 主要企業の収益シェア分析

- 企業評価クアドラント(主要企業)

- 製品フットプリント

- スタートアップ/中小企業の評価クアドラント(その他の企業)

- 競合シナリオ

- 製品の発売

- 資本取引

- その他

第14章 企業プロファイル

- 主要企業

- CORTEVA AGRISCIENCE

- BASF SE

- BAYER AG

- NOVOZYMES A/S

- CARGILL, INCORPORATED

- ARCHER DANIELS MIDLAND COMPANY(ADM)

- DSM

- CHR. HANSEN HOLDING A/S

- LALLEMAND INC.

- KEMIN INDUSTRIES, INC.

- VERDESIAN LIFE SCIENCES

- BIO-CAT

- MBFI

- AGRAUXINE

- PROVITA SUPPLEMENTS GMBH

- その他の企業

- NEUGEN BIOLOGICALS PVT LTD

- PRECISION LABORATORIES, LLC

- QUEENSLAND AGRICULTURAL SEEDS

- XITEBIO TECHNOLOGIES INC.

- TERRAMAX, INC.

- SOIL TECHNOLOGIES CORPORATION

- HORTICULTURAL ALLIANCE, LLC.

- AGRI LIFE

- STRONG MICROBIALS

- PRIONS BIO TECH

第15章 隣接・関連市場

- イントロダクション

- 研究の限界

- バイオスティミュラント市場

- バイオ肥料市場

第16章 付録

According to MarketsandMarkets, the global inoculants market size is estimated to be valued at USD 1.1 Billion in 2022. It is anticipated to reach USD 1.7 Billion by 2027, recording a CAGR of 8.1% in value. Agricultural inoculants consist of living organisms as their main mode of action that help in nitrogen fixation, biocontrol of soil-borne diseases, enhancement of mineral uptake, weathering of soil minerals, and providing nutritional or hormonal effects. Agricultural inoculants improve the quality of the soil, enhance the growth of crops, and also increase their yield. These are formulations of bacteria or fungi and are used for remediation and enhancement of the productivity of crops.

"By type, agricultural inoculants is forecasted to gain the largest market share in the inoculants market during the study period."

The agricultural inoculants segment is projected to account for the largest market share during the projected period. Increased usage of bacterial and fungal cultures has resulted in the efficient functioning of the physiological functions of crops, resulting in higher productivity. Agricultural inoculants also allow for increasing farm productivity in areas with adverse conditions by increasing abiotic resistance in crops. Due to the high growth rate of the market, key players are investing huge amounts in R&D activities to develop new multi-functional strains for the formulation of inoculants.

"By microbe, bacterial is anticipated to acquire the largest market share in the inoculants market during the review period."

Bacteria is the most widely used microbe in inoculants. Bacteria belonging to Rhizobium species are usually used as inoculants for legumes. It has been discovered that inoculating legumes with these microbes is an efficient biocontrol method for several plant diseases. Rhizobial strains have been discovered to generate plant resistance to several illnesses and lessen the severity of various diseases in leguminous and non-leguminous plants; however, the primary goal of rhizobial inoculation on crops is to enhance nitrogen availability. Moreover, most commercial inoculants for silage contain homofermentative lactic acid bacteria that help to enhance lactic acid production.

"By crop type, cereals & grains is projected to account for the largest market share in the inoculants market during the study period."

Cereal crops comprise wheat, corn, barley, and rice. Cereals & grains form a key segment of the agricultural inoculants market, as corn and wheat are grown abundantly in different regions of the world. The growing demand for corn and wheat has contributed to the growth of the agricultural inoculants market. The US is one of the major countries to adopt microbial solutions for the cultivation of cereals & grains. Growing support by governments of different countries to encourage sustainable agricultural practices in cereals & grains farm is projected to drive the growth of agricultural inoculants.

"The North America region is projected to account for the largest market share in the inoculants market during the forecast period."

North America is one of the major consumers of agricultural inoculants. Agricultural land in North America has been declining over time due to heavy industrialization, mining, and rapid urbanization. Due to the excessive usage of chemical fertilizers, the fertility of the soil is decreasing significantly. An increase in demand for high yield and production with limited usage of agrochemicals is projected to increase the consumption of plant growth regulators in North America, which in turn, is expected to drive the growth of the inoculants market.

Break-up of Primaries

- By Company Type: Tier 1 - 30%, Tier 2 - 25%, and Tier 3 - 45%

- By Designation: Manager- 25%, CXOs- 40%, and Executives - 35%

- By Region: Asia Pacific - 40%, Europe - 30%, North America- 16%, and RoW- 14%

Leading players profiled in this report include the following:

- Corteva Agriscience (US)

- BASF SE (Germany)

- Bayer AG (Germany)

- Novozymes A/S (Denmark)

- Cargill, Incorporated (US)

- Archer Daniels Midland Company (US)

- DSM (Netherlands)

- Chr. Hansen Holding A/S (Denmark)

- Lallemand Inc. (Canada)

- Kemin Industries, Inc (US)

- Verdesian Life Sciences (US)

- BIO-CAT (US)

- Microbial Biological Fertilizers International (South Africa)

- Agrauxine (US)

- Provita Supplements GmbH (Germany)

Research Coverage

This report segments the inoculants market on the basis of type, microbe, crop type, form, and region. In terms of insights, this research report focuses on various levels of analyses-competitive landscape, pricing insights, end-use analysis, and company profiles-which together comprise and discuss the basic views on the emerging & high-growth segments of the inoculants market, high-growth regions, countries, industry trends, drivers, restraints, opportunities, and challenges.

Reasons to buy this report

- To get a comprehensive overview of the inoculants market

- To gain wide-ranging information about the top players in this industry, their product portfolio details, and the key strategies adopted by them

- To gain insights about the major countries/regions in which the inoculants market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.6.1 CURRENCY (VALUE UNIT)

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018-2021

- 1.6.2 VOLUME UNIT

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 INOCULANTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key primary insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH 1: BOTTOM-UP (BASED ON TYPE, BY REGION)

- 2.2.2 APPROACH 2: TOP-DOWN (BASED ON GLOBAL MARKET AND SUPPLY SIDE)

- 2.3 DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 2 INOCULANTS MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 4 INOCULANTS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 5 INOCULANTS MARKET, BY MICROBE, 2022 VS. 2027 (USD MILLION)

- FIGURE 6 INOCULANTS MARKET, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 7 INOCULANTS MARKET SIZE, BY FORM, 2022 VS. 2027 (USD MILLION)

- FIGURE 8 INOCULANTS MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR INOCULANTS MARKET PLAYERS

- FIGURE 9 SOUTH AMERICA TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.2 EUROPE: INOCULANTS MARKET, BY KEY CROP TYPE AND COUNTRY

- FIGURE 10 GERMANY AND CEREALS & GRAINS SEGMENTS ACCOUNTED FOR LARGEST RESPECTIVE SHARES IN EUROPEAN INOCULANTS MARKET IN 2021

- 4.3 INOCULANTS MARKET, BY TYPE

- FIGURE 11 AGRICULTURAL INOCULANTS TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 INOCULANTS MARKET, BY MICROBE

- FIGURE 12 BACTERIAL INOCULANTS TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 INOCULANTS MARKET, BY CROP TYPE

- FIGURE 13 CEREALS & GRAINS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.6 INOCULANTS MARKET, BY FORM

- FIGURE 14 LIQUID INOCULANTS TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.7 INOCULANTS MARKET, BY CROP TYPE AND REGION

- FIGURE 15 NORTH AMERICA AND CEREALS & GRAINS TO DOMINATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INCREASE IN DEMAND FOR MILK & MEAT PRODUCTS

- FIGURE 16 MILK AND BEEF & BUFFALO MEAT PRODUCTION, 2017-2021 (TON)

- 5.3 MARKET DYNAMICS

- FIGURE 17 INOCULANTS MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Shift in trend toward adoption of organic and environment-friendly farming practices

- 5.3.1.2 Rise in environmental concerns with higher usage of synthetic fertilizers and pesticides

- 5.3.1.3 Increase in feed grain and compound feed prices

- FIGURE 18 FEED GRAIN PRICES, 2017-2022 (USD/TON)

- 5.3.1.4 Expansion in livestock industry, owing to increased demand for animal-based products

- 5.3.2 RESTRAINTS

- 5.3.2.1 Limited awareness regarding both agricultural and silage inoculants

- 5.3.2.2 Shelf life of agricultural inoculants

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Expansion of grassland pastures in South America

- 5.3.3.2 South America: Key producer of soybean and key revenue generator for agricultural inoculants

- TABLE 3 GLOBAL SOYBEAN PRODUCTION, DECEMBER 2022 (MILLION TONS)

- 5.3.4 CHALLENGES

- 5.3.4.1 Limited usage of inoculants worldwide

- 5.3.4.2 Silage losses due to fungi and mycotoxins

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.2.2 SOURCING

- 6.2.3 PRODUCTION AND PROCESSING

- 6.2.4 PACKAGING & STORAGE

- 6.2.5 MARKETING & SALES

- FIGURE 19 VALUE CHAIN ANALYSIS OF INOCULANTS MARKET

- 6.3 SUPPLY CHAIN ANALYSIS

- FIGURE 20 INOCULANTS MARKET: SUPPLY CHAIN

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 BIOENCAPSULATION OF INOCULANTS

- 6.4.2 BIOENCAPSULATED BACTERIA

- 6.4.3 BIOENCAPSULATED FUNGI

- 6.4.4 BIOENCAPSULATION PROCESS

- 6.5 PRICE TREND ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE, BY TYPE

- FIGURE 21 GLOBAL AVERAGE SELLING PRICE, BY TYPE, 2020-2022 (USD/TON)

- TABLE 4 AGRICULTURAL INOCULANTS: AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2022 (USD/TON)

- TABLE 5 SILAGE INOCULANT: AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2022 (USD/TON)

- TABLE 6 AVERAGE SELLING PRICES OF KEY MARKET PLAYERS, BY TYPE, 2021 (USD/TON)

- 6.6 MARKET MAPPING AND ECOSYSTEM ANALYSIS

- 6.6.1 SUPPLY-SIDE ANALYSIS

- 6.6.2 DEMAND-SIDE ANALYSIS

- FIGURE 22 INOCULANTS MARKET MAPPING

- TABLE 7 INOCULANTS MARKET: SUPPLY CHAIN ECOSYSTEM

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 6.8 TRADE ANALYSIS

- TABLE 8 EXPORT VALUE OF SEAWEEDS AND OTHER ALGAE BIOSTIMULANTS, BY KEY COUNTRY, 2021 (USD)

- TABLE 9 IMPORT VALUE OF SEAWEEDS AND OTHER ALGAE BIOSTIMULANTS, BY KEY COUNTRY, 2021 (USD)

- TABLE 10 IMPORT VALUE OF AMINO ACIDS AND THEIR ESTERS, BY KEY COUNTRY, 2021 (USD)

- TABLE 11 EXPORT VALUE OF AMINO ACIDS AND THEIR ESTERS, BY KEY COUNTRY, 2021 (USD)

- 6.9 PATENT ANALYSIS

- FIGURE 24 PATENTS GRANTED FOR INOCULANTS MARKET, 2012-2022

- FIGURE 25 REGIONAL ANALYSIS OF PATENT GRANTED FOR INOCULANTS MARKET, 2012-2022

- TABLE 12 PATENTS PERTAINING TO INOCULANTS, 2012-2022

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 INOCULANTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 DEGREE OF COMPETITION

- 6.10.2 BARGAINING POWER OF SUPPLIERS

- 6.10.3 BARGAINING POWER OF BUYERS

- 6.10.4 THREAT OF SUBSTITUTES

- 6.10.5 THREAT OF NEW ENTRANTS

- 6.11 CASE STUDIES

- TABLE 14 BASF SE LAUNCHED NODULAID FOR STIMULATING NODULATION

- TABLE 15 NOVOZYMES A/S INTRODUCED BIONIQ FOR CEREAL & CANOLA CROP INOCULATION

- 6.12 KEY CONFERENCES AND EVENTS

- TABLE 16 KEY CONFERENCES AND EVENTS IN INOCULANTS MARKET, 2023

- 6.13 TARIFF AND REGULATORY LANDSCAPE

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.14 REGULATORY FRAMEWORK

- 6.14.1 NORTH AMERICA

- 6.14.1.1 US

- 6.14.1.2 Canada

- 6.14.2 EUROPE

- 6.14.3 ASIA PACIFIC

- 6.14.3.1 China

- 6.14.3.2 Australia & New Zealand

- TABLE 21 ENVIRONMENTAL STUDY ISSUES TO BE CONSIDERED IN APPLICATION

- 6.14.3.3 India

- 6.14.4 SOUTH AMERICA

- 6.14.4.1 Brazil

- 6.14.1 NORTH AMERICA

- 6.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY CROP TYPE

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE CROP TYPES

- 6.15.2 BUYING CRITERIA

- TABLE 23 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 27 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

7 INOCULANTS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 28 INOCULANTS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 24 INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 25 INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 26 INOCULANTS MARKET, BY TYPE, 2017-2021 (KT)

- TABLE 27 INOCULANTS MARKET, BY TYPE, 2022-2027 (KT)

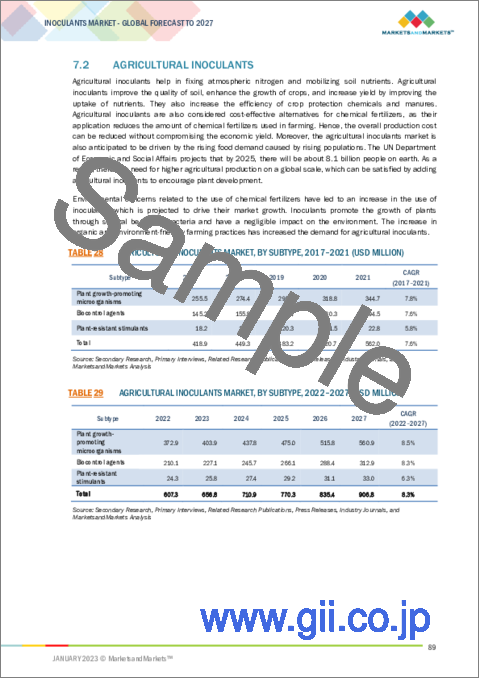

- 7.2 AGRICULTURAL INOCULANTS

- TABLE 28 AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2017-2021 (USD MILLION)

- TABLE 29 AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 30 AGRICULTURAL INOCULANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 31 AGRICULTURAL INOCULANTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 32 AGRICULTURAL INOCULANTS MARKET, BY REGION, 2017-2021 (KT)

- TABLE 33 AGRICULTURAL INOCULANTS MARKET, BY REGION, 2022-2027 (KT)

- 7.2.1 PLANT GROWTH-PROMOTING MICROORGANISMS

- 7.2.1.1 PGPM to help improve crop productivity by enhancing nutrient uptake and soil quality improvement

- 7.2.2 BIOCONTROL AGENTS

- 7.2.2.1 Increase in usage to suppress a broad spectrum of bacterial, fungal, and nematodal diseases

- 7.2.3 PLANT-RESISTANCE STIMULANTS

- 7.2.3.1 Stimulants to reduce water consumption, enhance appearance of crops, increase yield, and protect plants from diseases

- 7.3 SILAGE INOCULANTS

- TABLE 34 SILAGE INOCULANTS MARKET, BY SUBTYPE, 2017-2021 (USD MILLION)

- TABLE 35 SILAGE INOCULANTS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 36 SILAGE INOCULANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 37 SILAGE INOCULANTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 38 SILAGE INOCULANTS MARKET, BY REGION, 2017-2021 (KT)

- TABLE 39 SILAGE INOCULANTS MARKET, BY REGION, 2022-2027 (KT)

- 7.3.1 HOMOFERMENTATIVE

- 7.3.1.1 Homofermentative inoculants to help in faster and more efficient fermentation producing mostly lactic acid

- 7.3.2 HETEROFERMENTATIVE

- 7.3.2.1 Heterofermentative inoculants to aid in keeping silage from heating in warm weather

8 INOCULANTS MARKET, BY MICROBE

- 8.1 INTRODUCTION

- FIGURE 29 INOCULANTS MARKET, BY MICROBE, 2022 VS. 2027 (USD MILLION)

- TABLE 40 INOCULANTS MARKET, BY MICROBE, 2017-2021 (USD MILLION)

- TABLE 41 INOCULANTS MARKET, BY MICROBE, 2022-2027 (USD MILLION)

- 8.2 BACTERIAL

- 8.2.1 BACTERIAL INOCULANTS TO REPLACE FERTILIZERS TO INCREASE CROP PRODUCTIVITY

- TABLE 42 BACTERIAL INOCULANTS MARKET, BY SUBTYPE, 2017-2021 (USD MILLION)

- TABLE 43 BACTERIAL INOCULANTS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 44 BACTERIAL INOCULANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 45 BACTERIAL INOCULANTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.2.2 MODE OF ACTION

- 8.2.2.1 Nitrogen fixation

- 8.2.2.2 Phosphate solubilization

- 8.2.2.3 Sequestering iron

- 8.2.2.4 Modulating phytohormone levels

- 8.2.3 TYPES OF BACTERIAL SOURCES

- 8.2.3.1 Rhizobacteria

- 8.2.3.2 Phosphobacteria

- 8.2.3.3 Azotobacter

- 8.2.3.4 Lactobacillus

- 8.2.3.5 Pediococcus

- 8.2.3.6 Enterococcus

- 8.2.3.7 Other bacterial

- 8.3 FUNGAL

- 8.3.1 INOCULANTS TO RELEASE ENZYMES THAT HELP PLANTS BREAK DOWN NUTRIENTS INTO MORE EASILY UTILIZED FORMS

- TABLE 46 FUNGAL INOCULANTS MARKET, BY SUBTYPE, 2017-2021 (USD MILLION)

- TABLE 47 FUNGAL INOCULANTS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 48 FUNGAL INOCULANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 49 FUNGAL INOCULANTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3.2 TYPES OF FUNGAL SOURCES

- 8.3.2.1 Trichoderma spp.

- 8.3.2.2 Mycorrhiza

- 8.3.2.3 Other fungal

- 8.4 OTHER MICROBES

- TABLE 50 OTHER MICROBIAL INOCULANTS MARKET, BY SUBTYPE, 2017-2021 (USD MILLION)

- TABLE 51 OTHER MICROBIAL INOCULANTS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 52 OTHER MICROBIAL INOCULANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 53 OTHER MICROBIAL INOCULANTS MARKET, BY REGION, 2022-2027 (USD MILLION)

9 INOCULANTS MARKET, BY CROP TYPE

- 9.1 INTRODUCTION

- FIGURE 30 INOCULANTS MARKET BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 54 INOCULANTS MARKET, BY CROP TYPE, 2017-2021 (USD MILLION)

- TABLE 55 INOCULANTS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- 9.2 CEREALS & GRAINS

- 9.2.1 RISE IN DEMAND FOR CORN AND WHEAT TO FUEL MARKET

- TABLE 56 CEREAL & GRAIN CROPS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 57 CEREAL & GRAIN CROPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 OILSEEDS & PULSES

- 9.3.1 INCREASED DEMAND FOR SOYBEAN, CANOLA, PEAS, BEANS, AND OTHER LEGUME CROPS

- TABLE 58 OILSEED & PULSE CROPS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 59 OILSEED & PULSE CROPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 FRUITS & VEGETABLES

- 9.4.1 GREATER USE OF ORGANIC INPUTS FOR FRUIT & VEGETABLE PRODUCTION

- TABLE 60 FRUIT & VEGETABLE CROPS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 61 FRUIT & VEGETABLE CROPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 FORAGE

- 9.5.1 INOCULANTS TO IMPROVE SILAGE QUALITY BY FACILITATING ENSILING PROCESS

- TABLE 62 FORAGE CROPS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 63 FORAGE CROPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.6 OTHER CROP TYPES

- TABLE 64 OTHER CROP TYPES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 65 OTHER CROP TYPES MARKET, BY REGION, 2022-2027 (USD MILLION)

10 INOCULANTS MARKET, BY FORM

- 10.1 INTRODUCTION

- FIGURE 31 INOCULANTS MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

- TABLE 66 INOCULANTS MARKET, BY FORM, 2017-2021 (USD MILLION)

- TABLE 67 INOCULANTS MARKET, BY FORM, 2022-2027 (USD MILLION)

- 10.2 DRY

- 10.2.1 LOW PRICE AND EASY STORAGE PROPERTIES TO DRIVE DEMAND

- TABLE 68 DRY INOCULANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 69 DRY INOCULANTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 LIQUID

- 10.3.1 EASE IN APPLICATION TO FOSTER SEGMENT GROWTH

- TABLE 70 LIQUID INOCULANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 71 LIQUID INOCULANTS MARKET, BY REGION, 2022-2027 (USD MILLION)

11 INOCULANTS MARKET, BY MODE OF APPLICATION

- 11.1 INTRODUCTION

- 11.2 SEED TREATMENT

- 11.3 SOIL TREATMENT

- 11.4 OTHER MODES OF APPLICATION

12 INOCULANTS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 32 INOCULANTS MARKET GROWTH RATE, BY KEY COUNTRY, 2022-2027

- TABLE 72 INOCULANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 73 INOCULANTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 74 INOCULANTS MARKET, BY REGION, 2017-2021 (KT)

- TABLE 75 INOCULANTS MARKET, BY REGION, 2022-2027 (KT)

- 12.2 NORTH AMERICA

- FIGURE 33 NORTH AMERICA: INOCULANTS MARKET SNAPSHOT

- 12.2.1 RECESSION IMPACT ANALYSIS

- FIGURE 34 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- TABLE 76 NORTH AMERICA: INOCULANTS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 77 NORTH AMERICA: INOCULANTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 78 NORTH AMERICA: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 79 NORTH AMERICA: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 80 NORTH AMERICA: INOCULANTS MARKET, BY TYPE, 2017-2021 (KT)

- TABLE 81 NORTH AMERICA: INOCULANTS MARKET, BY TYPE, 2022-2027 (KT)

- TABLE 82 NORTH AMERICA: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2017-2021 (USD MILLION)

- TABLE 83 NORTH AMERICA: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 84 NORTH AMERICA: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2017-2021 (USD MILLION)

- TABLE 85 NORTH AMERICA: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 86 NORTH AMERICA: INOCULANTS MARKET, BY FORM, 2017-2021 (USD MILLION)

- TABLE 87 NORTH AMERICA: INOCULANTS MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 88 NORTH AMERICA: INOCULANTS MARKET, BY MICROBE, 2017-2021 (USD MILLION)

- TABLE 89 NORTH AMERICA: INOCULANTS MARKET, BY MICROBE, 2022-2027 (USD MILLION)

- TABLE 90 NORTH AMERICA: INOCULANTS MARKET, BY CROP TYPE, 2017-2021 (USD MILLION)

- TABLE 91 NORTH AMERICA: INOCULANTS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 US to be largest market for inoculants due to awareness of advantages and high silage production

- TABLE 92 US: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 93 US: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Increase in demand for meat and dairy products to contribute to market growth

- TABLE 94 CANADA: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 95 CANADA: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.2.4 MEXICO

- 12.2.4.1 Advantages of inoculants in combating silage losses to offer high growth opportunities

- TABLE 96 MEXICO: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 97 MEXICO: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 RECESSION IMPACT ANALYSIS

- FIGURE 35 EUROPE: RECESSION IMPACT ANALYSIS

- TABLE 98 EUROPE: INOCULANTS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 99 EUROPE: INOCULANTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 100 EUROPE: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 101 EUROPE: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 102 EUROPE: INOCULANTS MARKET, BY TYPE, 2017-2021 (KT)

- TABLE 103 EUROPE: INOCULANTS MARKET, BY TYPE, 2022-2027 (KT)

- TABLE 104 EUROPE: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2017-2021 (USD MILLION)

- TABLE 105 EUROPE: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 106 EUROPE: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2017-2021 (USD MILLION)

- TABLE 107 EUROPE: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 108 EUROPE: INOCULANTS MARKET, BY FORM, 2017-2021 (USD MILLION)

- TABLE 109 EUROPE: INOCULANTS MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 110 EUROPE: INOCULANTS MARKET, BY MICROBE, 2017-2021 (USD MILLION)

- TABLE 111 EUROPE: INOCULANTS MARKET, BY MICROBE, 2022-2027 (USD MILLION)

- TABLE 112 EUROPE: INOCULANTS MARKET, BY CROP TYPE, 2017-2021 (USD MILLION)

- TABLE 113 EUROPE: INOCULANTS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Rise in demand for organic foods to drive market

- TABLE 114 GERMANY: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 115 GERMANY: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.3 FRANCE

- 12.3.3.1 Increase in growth of organic farmland area year-on-year to fuel market

- TABLE 116 FRANCE: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 117 FRANCE: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.4 UK

- 12.3.4.1 Continuous rise in sale of organic food products to foster market

- TABLE 118 UK: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 119 UK: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.5 RUSSIA

- 12.3.5.1 Increased focus on organic food and meat production to boost market

- TABLE 120 RUSSIA: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 121 RUSSIA: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.6 SPAIN

- 12.3.6.1 Ranked among top ten markets for organic products

- TABLE 122 SPAIN: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 123 SPAIN: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.7 ITALY

- 12.3.7.1 Higher organic food consumption due to rise in health concerns

- TABLE 124 ITALY: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 125 ITALY: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.8 DENMARK

- 12.3.8.1 Investments by government in organic farming to propel market

- TABLE 126 DENMARK: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 127 DENMARK: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.9 REST OF EUROPE

- TABLE 128 REST OF EUROPE: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 129 REST OF EUROPE: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4 ASIA PACIFIC

- 12.4.1 RECESSION IMPACT ANALYSIS

- FIGURE 36 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- TABLE 130 ASIA PACIFIC: INOCULANTS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 131 ASIA PACIFIC: INOCULANTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 132 ASIA PACIFIC: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 133 ASIA PACIFIC: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 134 ASIA PACIFIC: INOCULANTS MARKET, BY TYPE, 2017-2021 (KT)

- TABLE 135 ASIA PACIFIC: INOCULANTS MARKET, BY TYPE, 2022-2027 (KT)

- TABLE 136 ASIA PACIFIC: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2017-2021 (USD MILLION)

- TABLE 137 ASIA PACIFIC: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 138 ASIA PACIFIC: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2017-2021 (USD MILLION)

- TABLE 139 ASIA PACIFIC: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 140 ASIA PACIFIC: INOCULANTS MARKET, BY FORM, 2017-2021 (USD MILLION)

- TABLE 141 ASIA PACIFIC: INOCULANTS MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 142 ASIA PACIFIC: INOCULANTS MARKET, BY MICROBE, 2017-2021 (USD MILLION)

- TABLE 143 ASIA PACIFIC: INOCULANTS MARKET, BY MICROBE, 2022-2027 (USD MILLION)

- TABLE 144 ASIA PACIFIC: INOCULANTS MARKET, BY CROP TYPE, 2017-2021 (USD MILLION)

- TABLE 145 ASIA PACIFIC: INOCULANTS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Increase in organic food market to drive demand for agricultural inoculants

- TABLE 146 CHINA: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 147 CHINA: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.3 INDIA

- 12.4.3.1 Growth in poultry industry to foster demand for silage inoculants

- TABLE 148 INDIA: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 149 INDIA: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.4 JAPAN

- 12.4.4.1 Significant demand for both agricultural and silage inoculants to make it fastest-growing Asia Pacific market

- TABLE 150 JAPAN: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 151 JAPAN: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.5 AUSTRALIA & NEW ZEALAND

- 12.4.5.1 Australia's booming organic food industry and New Zealand's dairy industry to drive demand for inoculants

- TABLE 152 AUSTRALIA & NEW ZEALAND: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 153 AUSTRALIA & NEW ZEALAND: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.6 INDONESIA

- 12.4.6.1 Growth in demand for meat to fuel demand for silage inoculants

- TABLE 154 INDONESIA: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 155 INDONESIA: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.7 REST OF ASIA PACIFIC

- TABLE 156 REST OF ASIA PACIFIC: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.5 SOUTH AMERICA

- FIGURE 37 SOUTH AMERICA: INOCULANTS MARKET SNAPSHOT

- 12.5.1 RECESSION IMPACT ANALYSIS

- FIGURE 38 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- TABLE 158 SOUTH AMERICA: INOCULANTS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 159 SOUTH AMERICA: INOCULANTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 160 SOUTH AMERICA: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 161 SOUTH AMERICA: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 162 SOUTH AMERICA: INOCULANTS MARKET, BY TYPE, 2017-2021 (KT)

- TABLE 163 SOUTH AMERICA: INOCULANTS MARKET, BY TYPE, 2022-2027 (KT)

- TABLE 164 SOUTH AMERICA: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2017-2021 (USD MILLION)

- TABLE 165 SOUTH AMERICA: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 166 SOUTH AMERICA: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2017-2021 (USD MILLION)

- TABLE 167 SOUTH AMERICA: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 168 SOUTH AMERICA: INOCULANTS MARKET, BY FORM, 2017-2021 (USD MILLION)

- TABLE 169 SOUTH AMERICA: INOCULANTS MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 170 SOUTH AMERICA: INOCULANTS MARKET, BY MICROBE, 2017-2021 (USD MILLION)

- TABLE 171 SOUTH AMERICA: INOCULANTS MARKET, BY MICROBE, 2022-2027 (USD MILLION)

- TABLE 172 SOUTH AMERICA: INOCULANTS MARKET, BY CROP TYPE, 2017-2021 (USD MILLION)

- TABLE 173 SOUTH AMERICA: INOCULANTS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- 12.5.2 BRAZIL

- 12.5.2.1 Demand for organic food products to lead to an increase in organic farming in region

- TABLE 174 BRAZIL: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 175 BRAZIL: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.5.3 ARGENTINA

- 12.5.3.1 Increase in demand for organic products to fuel growth

- TABLE 176 ARGENTINA: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 177 ARGENTINA: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.5.4 CHILE

- 12.5.4.1 Shift toward organic farming due to increasing demand from consumers and exports to propel market

- TABLE 178 CHILE: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 179 CHILE: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.5.5 REST OF SOUTH AMERICA

- TABLE 180 REST OF SOUTH AMERICA: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 181 REST OF SOUTH AMERICA: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.6 REST OF THE WORLD (ROW)

- 12.6.1 RECESSION IMPACT ANALYSIS

- FIGURE 39 ROW: RECESSION IMPACT ANALYSIS

- TABLE 182 ROW: INOCULANTS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 183 ROW: INOCULANTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 184 ROW: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 185 ROW: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 186 ROW: INOCULANTS MARKET, BY TYPE, 2017-2021 (KT)

- TABLE 187 ROW: INOCULANTS MARKET, BY TYPE, 2022-2027 (KT)

- TABLE 188 ROW: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2017-2021 (USD MILLION)

- TABLE 189 ROW: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 190 ROW: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2017-2021 (USD MILLION)

- TABLE 191 ROW: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 192 ROW: INOCULANTS MARKET, BY FORM, 2017-2021 (USD MILLION)

- TABLE 193 ROW: INOCULANTS MARKET, BY FORM, 2022-2027 (USD MILLION)

- TABLE 194 ROW: INOCULANTS MARKET, BY MICROBE, 2017-2021 (USD MILLION)

- TABLE 195 ROW: INOCULANTS MARKET, BY MICROBE, 2022-2027 (USD MILLION)

- TABLE 196 ROW: INOCULANTS MARKET, BY CROP TYPE, 2017-2021 (USD MILLION)

- TABLE 197 ROW: INOCULANTS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- 12.6.2 MIDDLE EAST

- 12.6.2.1 Advancements in agricultural industry in Israel, Egypt, and Morocco to boost growth

- TABLE 198 MIDDLE EAST: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 199 MIDDLE EAST: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.6.3 AFRICA

- 12.6.3.1 Rise in focus on production of cereals & grains to drive market

- TABLE 200 AFRICA: INOCULANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 201 AFRICA: INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYER

- TABLE 202 STRATEGIES ADOPTED BY KEY PLAYERS IN INOCULANTS MARKET

- 13.3 MARKET SHARE ANALYSIS

- TABLE 203 GLOBAL INOCULANTS MARKET: DEGREE OF COMPETITION

- 13.4 REVENUE SHARE ANALYSIS OF KEY PLAYERS

- FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS, 2019-2021 (USD BILLION)

- 13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 41 INOCULANTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 13.6 PRODUCT FOOTPRINT

- TABLE 204 COMPANY PRODUCT FOOTPRINT, BY TYPE

- TABLE 205 COMPANY PRODUCT FOOTPRINT, BY MICROBE

- TABLE 206 COMPANY PRODUCT FOOTPRINT, BY CROP TYPE

- TABLE 207 COMPANY PRODUCT FOOTPRINT, BY REGION

- TABLE 208 OVERALL COMPANY PRODUCT FOOTPRINT

- 13.7 STARTUP/SME EVALUATION QUADRANT (OTHER PLAYERS)

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 STARTING BLOCKS

- 13.7.3 RESPONSIVE COMPANIES

- 13.7.4 DYNAMIC COMPANIES

- FIGURE 42 INOCULANTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

- 13.7.5 COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- TABLE 209 DETAILED LIST OF OTHER PLAYERS

- TABLE 210 COMPETITIVE BENCHMARKING (OTHER PLAYERS), 2021

- 13.8 COMPETITIVE SCENARIO

- 13.8.1 PRODUCT LAUNCHES

- TABLE 211 INOCULANTS MARKET: NEW PRODUCT LAUNCHES, 2018-2022

- 13.8.2 DEALS

- TABLE 212 INOCULANTS MARKET: DEALS, 2018-2022

- 13.8.3 OTHERS

- TABLE 213 INOCULANTS MARKET: OTHERS, 2018-2022

14 COMPANY PROFILES

- 14.1 KEY COMPANIES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 14.1.1 CORTEVA AGRISCIENCE

- TABLE 214 CORTEVA AGRISCIENCE: COMPANY OVERVIEW

- FIGURE 43 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

- TABLE 215 CORTEVA AGRISCIENCE: PRODUCTS OFFERED

- TABLE 216 CORTEVA AGRISCIENCE: DEALS

- 14.1.2 BASF SE

- TABLE 217 BASF SE: BUSINESS OVERVIEW

- FIGURE 44 BASF SE: COMPANY SNAPSHOT

- TABLE 218 BASF SE: PRODUCTS OFFERED

- TABLE 219 BASF SE: PRODUCT LAUNCHES

- TABLE 220 BASF SE: DEALS

- 14.1.3 BAYER AG

- TABLE 221 BAYER AG: BUSINESS OVERVIEW

- FIGURE 45 BAYER AG: COMPANY SNAPSHOT

- TABLE 222 BAYER AG: PRODUCTS OFFERED

- TABLE 223 BAYER AG: DEALS

- 14.1.4 NOVOZYMES A/S

- TABLE 224 NOVOZYMES A/S: BUSINESS OVERVIEW

- FIGURE 46 NOVOZYMES A/S: COMPANY SNAPSHOT

- TABLE 225 NOVOZYMES A/S: PRODUCTS OFFERED

- TABLE 226 NOVOZYMES A/S: PRODUCT LAUNCHES

- 14.1.5 CARGILL, INCORPORATED

- TABLE 227 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- FIGURE 47 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- TABLE 228 CARGILL, INCORPORATED: PRODUCTS OFFERED

- 14.1.6 ARCHER DANIELS MIDLAND COMPANY (ADM)

- TABLE 229 ARCHER DANIELS MIDLAND COMPANY: BUSINESS OVERVIEW

- FIGURE 48 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

- TABLE 230 ARCHER DANIELS MIDLAND COMPANY: PRODUCTS OFFERED

- TABLE 231 ARCHER DANIELS MIDLAND COMPANY: DEALS

- 14.1.7 DSM

- TABLE 232 DSM: BUSINESS OVERVIEW

- FIGURE 49 DSM: COMPANY SNAPSHOT

- TABLE 233 DSM: PRODUCTS OFFERED

- 14.1.8 CHR. HANSEN HOLDING A/S

- TABLE 234 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

- FIGURE 50 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

- TABLE 235 CHR. HANSEN HOLDING A/S: PRODUCTS OFFERED

- TABLE 236 CHR. HANSEN HOLDING A/S: DEALS

- 14.1.9 LALLEMAND INC.

- TABLE 237 LALLEMAND INC.: BUSINESS OVERVIEW

- TABLE 238 LALLEMAND INC: PRODUCTS OFFERED

- TABLE 239 LALLEMAND INC.: PRODUCT LAUNCHES

- 14.1.10 KEMIN INDUSTRIES, INC.

- TABLE 240 KEMIN INDUSTRIES, INC.: BUSINESS OVERVIEW

- TABLE 241 KEMIN INC: PRODUCTS OFFERED

- TABLE 242 KEMIN INDUSTRIES, INC.: OTHERS

- 14.1.11 VERDESIAN LIFE SCIENCES

- TABLE 243 VERDESIAN LIFE SCIENCES: BUSINESS OVERVIEW

- TABLE 244 VERDESIAN LIFE SCIENCES: PRODUCTS OFFERED

- TABLE 245 VERDESIAN LIFE SCIENCES: PRODUCT LAUNCHES

- TABLE 246 VERDESIAN LIFE SCIENCES: DEALS

- 14.1.12 BIO-CAT

- TABLE 247 BIO-CAT: BUSINESS OVERVIEW

- TABLE 248 BIO-CAT: PRODUCTS OFFERED

- TABLE 249 BIO-CAT: OTHERS

- 14.1.13 MBFI

- TABLE 250 MICROBIAL BIOLOGICAL FERTILIZERS INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 251 MICROBIAL BIOLOGICAL FERTILIZERS INTERNATIONAL: PRODUCTS OFFERED

- 14.1.14 AGRAUXINE

- TABLE 252 AGRAUXINE: BUSINESS OVERVIEW

- TABLE 253 AGRAUXINE: PRODUCTS OFFERED

- TABLE 254 AGRAUXINE: DEALS

- 14.1.15 PROVITA SUPPLEMENTS GMBH

- TABLE 255 PROVITA SUPPLEMENTS GMBH: BUSINESS OVERVIEW

- TABLE 256 PROVITA SUPPLEMENTS GMBH: PRODUCTS OFFERED

- 14.2 OTHER PLAYERS

- 14.2.1 NEUGEN BIOLOGICALS PVT LTD

- TABLE 257 NEUGEN BIOLOGICALS PVT LTD: BUSINESS OVERVIEW

- TABLE 258 NEUGEN BIOLOGICALS PVT LTD: PRODUCTS OFFERED

- 14.2.2 PRECISION LABORATORIES, LLC

- TABLE 259 PRECISION LABORATORIES, LLC: BUSINESS OVERVIEW

- TABLE 260 PRECISION LABORATORIES, LLC: PRODUCTS OFFERED

- 14.2.3 QUEENSLAND AGRICULTURAL SEEDS

- TABLE 261 QUEENSLAND AGRICULTURAL SEEDS: BUSINESS OVERVIEW

- TABLE 262 QUEENSLAND AGRICULTURAL SEEDS: PRODUCTS OFFERED

- 14.2.4 XITEBIO TECHNOLOGIES INC.

- TABLE 263 XITEBIO TECHNOLOGIES INC.: BUSINESS OVERVIEW

- TABLE 264 XITEBIO TECHNOLOGIES INC.: PRODUCTS OFFERED

- TABLE 265 XITEBIO TECHNOLOGIES INC.: PRODUCT LAUNCHES

- 14.2.5 TERRAMAX, INC.

- TABLE 266 TERRAMAX, INC.: BUSINESS OVERVIEW

- TABLE 267 TERRAMAX, INC.: PRODUCTS OFFERED

- 14.2.6 SOIL TECHNOLOGIES CORPORATION

- TABLE 268 SOIL TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- 14.2.7 HORTICULTURAL ALLIANCE, LLC.

- TABLE 269 HORTICULTURAL ALLIANCE, LLC.: COMPANY OVERVIEW

- 14.2.8 AGRI LIFE

- TABLE 270 AGRI LIFE: COMPANY OVERVIEW

- 14.2.9 STRONG MICROBIALS

- TABLE 271 STRONG MICROBIALS: COMPANY OVERVIEW

- 14.2.10 PRIONS BIO TECH

- TABLE 272 PRIONS BIOTECH PVT LTD.: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- TABLE 273 ADJACENT MARKETS TO INOCULANTS MARKET

- 15.2 STUDY LIMITATIONS

- 15.3 BIOSTIMULANTS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- TABLE 274 BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2027 (USD MILLION)

- 15.4 BIOFERTILIZERS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- TABLE 275 BIOFERTILIZERS MARKET, BY TYPE, 2019-2026 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS