|

|

市場調査レポート

商品コード

1118548

コーティング用樹脂の世界市場:樹脂タイプ別(アクリル、アルキド、ポリウレタン、ビニル、エポキシ)、技術別(水性、溶剤系)、用途別(建築、一般工業、自動車、木材、包装)、地域別 - 2027年までの予測Coating Resins Market by Resin Type (Acrylic, Alkyd, Polyurethane, Vinyl, Epoxy), Technology (Waterborne, Solventborne), Application (Architectural, General Industrial, Automotive, Wood, Packaging) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| コーティング用樹脂の世界市場:樹脂タイプ別(アクリル、アルキド、ポリウレタン、ビニル、エポキシ)、技術別(水性、溶剤系)、用途別(建築、一般工業、自動車、木材、包装)、地域別 - 2027年までの予測 |

|

出版日: 2022年08月18日

発行: MarketsandMarkets

ページ情報: 英文 408 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のコーティング用樹脂の市場規模は、2022年の539億米ドルから2027年までに709億米ドルへ、2022年から2027年の間にCAGRで5.7%の成長が予測されています。

コーティング用樹脂市場の使用に関連する抑制要因は、欧州経済圏からの輸出需要の減少です。

"一般工業セグメントは、2022年から2027年の間にコーティング用樹脂市場で最も急速に成長するセグメント"

日常生活で使用される粉体塗装製品は、照明器具、アンテナ、電気部品などです。一般工業用コーティングは、学校やオフィスの観覧席、サッカーゴール、バスケットボールのバックスタンド、ロッカー、カフェテリアのテーブルなどのコーティングに使用されています。農家では、粉体塗装された農機具や園芸用具が使用されています。スポーツ愛好家には、自転車、キャンプ用品、ゴルフクラブ、ゴルフカート、スキーポール、エクササイズ器具などが粉体塗装されています。オフィスワーカーには、粉体塗装されたファイル用引き出し、コンピュータキャビネット、金属製棚、陳列棚が使用されています。家庭用機器では、電子部品、雨どい・樋、体重計、郵便受け、衛星放送受信アンテナ、工具箱、消火器などに粉体塗装が施されています。

"予測期間中、アジア太平洋地域がコーティング用樹脂市場の最速成長地域になる"

アジア太平洋地域は、金額・数量ともに最大のコーティング用樹脂市場であり、予測期間中、最も急成長するコーティング用樹脂市場になると予測されています。この地域は、過去10年間にわたり経済成長を遂げてきました。

アジア太平洋地域には、経済発展の度合いが異なるさまざまな経済諸国が含まれています。この地域の成長は、主に自動車、消費財・家電、建築・建設、家具などの産業にわたる大規模な投資と相まって、高い経済成長率を達成していることに起因しています。コーティング用樹脂市場の主要企業は、アジア太平洋地域、特に中国とインドで生産能力を拡大しています。アジア太平洋地域への生産シフトの利点は、生産コストの低さ、熟練したコスト効率の高い労働力の入手、現地の新興市場により良い形でサービスを提供できることです。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- マクロ指標分析

- バリューチェーン分析

- 平均販売価格分析

- 主な利害関係者と購入基準

- エコシステム/市場マップ

- コーティング用樹脂メーカーの収益シフトと新たな収益ポケット

- 輸出入貿易統計

- 規則

- 特許分析

- ケーススタディ分析

- 技術分析

- 主な会議とイベント

- 関税・規制情勢

第6章 コーティング用樹脂市場:樹脂タイプ別

- イントロダクション

- アクリル

- アルキド

- ビニル

- ポリウレタン

- エポキシ

- 不飽和ポリエステル

- 飽和ポリエステル

- アミノ

- その他

第7章 コーティング用樹脂市場:技術別

- イントロダクション

- 水性

- 溶剤系

- 粉体

- その他

第8章 コーティング用樹脂市場:用途別

- イントロダクション

- 建築

- 船舶・保護

- 一般工業

- 自動車

- 木材

- 包装

- コイル

- その他

第9章 コーティング用樹脂市場:地域別

- イントロダクション

- アジア太平洋地域

- 中国

- インド

- 日本

- インドネシア

- パキスタン

- フィリピン

- マレーシア

- バングラデシュ

- スリランカ

- その他

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- トルコ

- スペイン

- ロシア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- アラブ首長国連邦

- エジプト

- ナイジェリア

- エチオピア

- ケニア

- イスラエル

- ヨルダン

- その他

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- その他

第10章 競合情勢

- 概要

- 企業の評価象限マトリックス(主要企業)

- 製品ポートフォリオの強み

- 中小企業マトリックス

- 市場シェア分析

- 収益分析

- 競合ベンチマーキング

- 市場ランキング分析

第11章 企業プロファイル

- 主要企業

- ARKEMA

- BASF SE

- COVESTRO AG

- ALLNEX

- DOW

- THE SHERWIN-WILLIAMS COMPANY

- EVONIK INDUSTRIES AG

- POLYNT-REICHHOLD

- HUNTSMAN INTERNATIONAL LLC

- MITSUBISHI CHEMICAL CORPORATION

- その他の企業

- TORAY INDUSTRIES, INC.

- MITSUI CHEMICALS, INC.

- SOLVAY

- EASTMAN CHEMICAL COMPANY

- DIC CORPORATION

- THE LUBRIZOL CORPORATION

- MOMENTIVE PERFORMANCE MATERIALS INC.

- CELANESE CORPORATION

- OLIN CORPORATION

- WACKER CHEMIE AG

- HEXION

- KRATON CORPORATION

- PERSTORP AB

- WANHUA CHEMICAL GROUP CO., LTD.

- KUKDO CHEMICAL CO., LTD.

- HELIOS RESINS

- SYNTHOPOL

- SYNTHOMER PLC

- NAMA CHEMICALS

- SAUDI INDUSTRIAL RESINS LIMITED

- ATUL LTD.

- GULF CHEMICAL & INDUSTRIAL OILS CO.

- INDUSTRIAL CHEMICALS & RESINS CO.

- HITECH INDUSTRIES FZE

- ESTERPOL

- その他の関連企業

第12章 付録

The coating resins market is projected to grow from USD 53.9 Billion in 2022 to USD 70.9 Billion by 2027, at a CAGR of 5.7% between 2022 and 2027. The restraints related to the use of coating resins market is reduced export demand from European economies.

"General Industrial segment is estimated to be the fastest growing segment of the coating resins market between 2022 and 2027."

The powder-coated products used in daily life include lighting fixtures, antennas, and electrical components. General industrial coatings are used to coat bleachers, soccer goals, basketball backstops, lockers, and cafeteria tables in schools and offices. Farmers use powder-coated agricultural equipment and garden tools. Sports enthusiasts use powder-coated bicycles, camping equipment, golf clubs, golf carts, ski poles, exercise equipment, and other sports equipment. Office workers use powder-coated file drawers, computer cabinets, metal shelving, and display racks. Homeowners use electronic components, gutters and downspouts, bathroom scales, mailboxes, satellite dishes, toolboxes, and fire extinguishers that benefit from the powder-coated finish.

"Asia Pacific is forecasted to be the fastest-growing coating resins market during the forecast period."

Asia Pacific is the largest coating resins market, in terms of both value and volume, and is projected to be the fastest-growing coating resins market during the forecast period. The region has witnessed economic growth over the last decade.

According to the IMF and World Economic Outlook, China and Japan were the world's second-and third-largest economies, respectively, in 2021. The United Nations Population Fund states that Asia Pacific accounts for 60% of the world's population, which is 4.3 billion people. The region includes the world's most populous countries, China and India. This is projected to become an increasingly important driver for the global construction industry over the next two decades.

Asia Pacific encompasses a diverse range of economies with different levels of economic development. The growth of the region is mainly attributed to the high economic growth rate coupled with heavy investments across industries, such as automotive, consumer goods & appliances, building & construction, and furniture. The key players in the coating resins market are expanding their production capacities in Asia Pacific, especially in China and India. The advantages of shifting production to Asia Pacific are the low cost of production, availability of skilled and cost-effective labor, and the ability to serve the local emerging markets in a better manner.

Breakdown of Primary Interviews:

- By Company Type: Tier 1 - 46%, Tier 2 - 36%, and Tier 3 - 18%

- By Designation: C Level - 18%, D Level - 27%, and Others - 55%

- By Region: Asia Pacific - 55%, North America - 18%, Europe - 9%, South America-9%, and the Middle East & Africa - 9%

The key companies profiled in this report are Arkema (France), BASF SE (Germany), Covestro AG (Germany), Allnex (Germany), and Dow (US).

Research Coverage:

The coating resins market has been segmented based on Resin (Alkyd, Polyurethane, Acrylic), Technology (Waterborne, Solventborne, Powder Coatings), Application (Architectural Coatings, Marine & Protective Coatings, General Industrial Coatings, Automotive Coatings, Wood Coatings, Packaging Coatings, Coil Coatings), Region (Asia Pacific, North America, Europe, South America, Middle East & Africa).

Reasons to Buy the Report

From an insight perspective, this research report focuses on various levels of analyses - industry analysis (industry trends), market share analysis of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the market; high growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on coating resins offered by top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the market for coating resins across regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.1 OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 MARKET INCLUSIONS

- 1.2.2 MARKET EXCLUSIONS

- 1.3 MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 COATING RESINS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary data sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 2 COATING RESINS MARKET (BY VALUE)

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 5 COATING RESINS MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

- 2.7 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.8 PRICING ASSUMPTIONS

3 EXECUTIVE SUMMARY

- TABLE 1 COATING RESINS MARKET SNAPSHOT (2022 VS. 2027)

- FIGURE 6 ACRYLIC RESIN TYPE HELD LARGEST MARKET SHARE IN 2021

- FIGURE 7 WATERBORNE TECHNOLOGY CAPTURED LARGEST MARKET SHARE IN 2021

- FIGURE 8 ARCHITECTURAL COATINGS SEGMENT WAS LARGEST APPLICATION IN 2021

- FIGURE 9 ASIA PACIFIC DOMINATED COATING RESINS MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COATING RESINS MARKET

- FIGURE 10 COATING RESINS MARKET TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

- 4.2 COATING RESINS MARKET, BY RESIN TYPE

- FIGURE 11 POLYURETHANE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.3 COATING RESINS MARKET, BY APPLICATION

- FIGURE 12 GENERAL INDUSTRIAL COATINGS TO BE FASTEST-GROWING APPLICATION DURING FORECAST PERIOD

- 4.4 ASIA PACIFIC COATING RESINS MARKET, BY APPLICATION AND COUNTRY

- FIGURE 13 ARCHITECTURAL COATINGS SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES

- 4.5 COATING RESINS MARKET, BY MAJOR COUNTRIES

- FIGURE 14 INDIA TO EMERGE AS A LUCRATIVE MARKET FOR COATING RESINS DURING FORECAST PERIOD

- 4.6 COATING RESINS MARKET, DEVELOPED VS. DEVELOPING COUNTRIES

- FIGURE 15 DEVELOPING MARKETS TO GROW FASTER THAN DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR COATING RESINS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in demand from construction and automotive industries

- 5.2.1.2 Eco-friendly coating systems

- 5.2.1.3 Availability of durable coatings with better performance and aesthetics

- 5.2.1.4 Lower price and higher efficiency

- 5.2.1.5 Technological advancements in powder coating technology

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatile raw material prices and fluctuations in demand due to competition from other industries using resins

- 5.2.2.2 Reduced export demand from European economies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth potential in less regulated regions

- 5.2.3.2 Investments in emerging markets

- 5.2.3.3 Attractive prospects for powder coatings in shipbuilding and pipeline industries

- 5.2.3.4 Increase in use of powder coatings in automotive industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Pressure of cutting prices

- 5.2.4.2 Stringent regulatory policies

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 COATING RESINS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS OF COATING RESINS MARKET

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 DEGREE OF COMPETITION

- 5.4 MACROINDICATOR ANALYSIS

- 5.4.1 INTRODUCTION

- 5.4.2 GDP TRENDS

- TABLE 3 TRENDS AND FORECAST OF GDP: ANNUAL PERCENTAGE CHANGE, BY COUNTRY, 2019-2027

- 5.4.3 AUTOMOTIVE INDUSTRY TRENDS

- TABLE 4 AUTOMOTIVE INDUSTRY PRODUCTION, BY COUNTRY, 2018-2021

- 5.4.4 CONSTRUCTION INDUSTRY TRENDS

- FIGURE 18 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014-2035

- 5.4.5 AEROSPACE INDUSTRY TRENDS

- TABLE 5 GROWTH INDICATORS FOR AEROSPACE INDUSTRY, 2015-2033

- TABLE 6 GROWTH INDICATORS FOR AEROSPACE INDUSTRY, BY REGION, 2015-2033

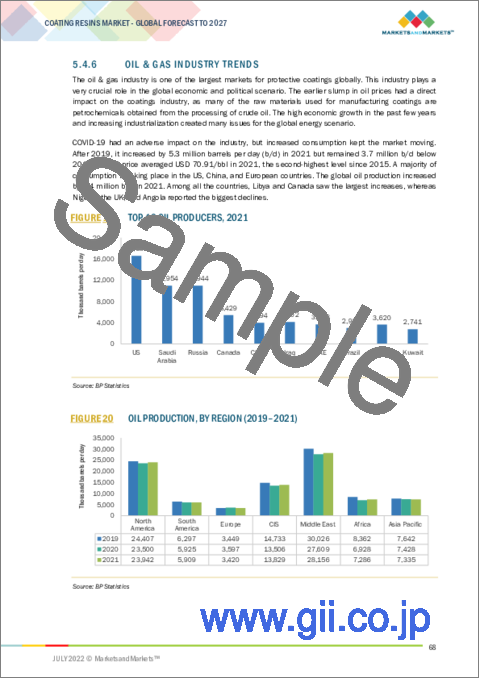

- 5.4.6 OIL & GAS INDUSTRY TRENDS

- FIGURE 19 TOP 10 OIL PRODUCERS, 2021

- FIGURE 20 OIL PRODUCTION, BY REGION (2019-2021)

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 21 COATING RESINS: VALUE CHAIN ANALYSIS

- 5.5.1 VALUE CHAIN ANALYSIS (COATING RESINS): COST POINTS IN DIFFERENT SEGMENTS

- FIGURE 22 VALUE CHAIN ANALYSIS (COATING RESINS): COST POINTS IN DIFFERENT SEGMENTS

- 5.6 AVERAGE SELLING PRICE ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE OF COATING RESINS, BY REGION, 2021

- FIGURE 24 AVERAGE SELLING PRICE OF COATING RESINS, BY RESIN TYPE, 2021

- FIGURE 25 AVERAGE SELLING PRICE OF COATING RESINS, BY TECHNOLOGY, 2021

- FIGURE 26 AVERAGE SELLING PRICE OF COATING RESINS, BY APPLICATION, 2021

- 5.7 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRIES (%)

- 5.7.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR COATING RESINS

- TABLE 8 KEY BUYING CRITERIA FOR COATING RESINS

- 5.8 ECOSYSTEM/MARKET MAP

- TABLE 9 COATING RESINS MARKET: ECOSYSTEM

- FIGURE 29 COATING RESINS MARKET: ECOSYSTEM

- 5.9 REVENUE SHIFT AND NEW REVENUE POCKETS FOR COATING RESIN MANUFACTURERS

- FIGURE 30 REVENUE SHIFT IN COATING RESINS MARKET

- 5.10 EXPORT-IMPORT TRADE STATISTICS

- TABLE 10 EXPORT DATA FOR EPOXIDE RESINS, BY COUNTRY, 2020-2021

- TABLE 11 IMPORT DATA FOR EPOXIDE RESINS, BY COUNTRY, 2020-2021

- TABLE 12 EXPORT DATA FOR POLYURETHANE RESINS, BY COUNTRY, 2020-2021

- TABLE 13 IMPORT DATA FOR POLYURETHANE RESINS, BY COUNTRY, 2020-2021

- TABLE 14 EXPORT DATA FOR ACRYLIC RESINS, BY COUNTRY, 2020-2021

- TABLE 15 IMPORT DATA FOR ACRYLIC RESINS, BY COUNTRY, 2020-2021

- 5.11 REGULATIONS

- 5.11.1 EPOXY RESIN SYSTEMS IN LIQUID CONDITION: FINAL MIX (A + B COMP.)

- 5.11.2 EPOXY SYSTEM IN CURED, SOLID, AND NON-REINFORCED CONDITIONS

- 5.11.3 FLEXIBLE VINYL AND URETHANE COATING AND PRINTING: NEW SOURCE PERFORMANCE STANDARDS (NSPS)

- 5.12 PATENTS ANALYSIS

- 5.12.1 METHODOLOGY

- 5.12.2 TOTAL NUMBER OF DOCUMENT COUNTS, 2011-2021

- FIGURE 31 TOTAL DOCUMENT COUNT, 2011-2021

- 5.12.3 PUBLICATION TRENDS, 2011-2021

- FIGURE 32 NUMBER OF PATENTS PUBLISHED, 2011-2021

- 5.12.4 LEGAL STATUS OF PATENTS

- FIGURE 33 LEGAL STATUS OF PATENTS, 2011-2021

- 5.12.5 PATENT ANALYSIS: BY JURISDICTION

- FIGURE 34 PATENTS PUBLISHED BY EACH JURISDICTION, 2011-2021

- 5.12.6 TOP APPLICANTS

- FIGURE 35 PATENTS PUBLISHED BY MAJOR APPLICANTS

- TABLE 16 LIST OF PATENTS BY PPG IND OHIO INC.

- TABLE 17 LIST OF PATENTS BY DOW GLOBAL TECHNOLOGIES LLC

- TABLE 18 LIST OF PATENTS BY BASF SE/BASF COATINGS GMBH

- 5.12.7 TOP 10 PATENT OWNERS (US), 2011-2021

- 5.13 CASE STUDY ANALYSIS

- 5.14 TECHNOLOGY ANALYSIS

- 5.15 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 19 COATING RESINS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.16 TARIFF AND REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA-PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 COATING RESINS MARKET, BY RESIN TYPE

- 6.1 INTRODUCTION

- 6.1.1 THERMOPLASTIC COATINGS

- 6.1.2 THERMOSET COATINGS

- FIGURE 36 ACRYLIC WAS LARGEST RESIN TYPE SEGMENT IN 2021

- TABLE 24 COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 25 COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 26 COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 27 COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- 6.2 ACRYLIC

- 6.2.1 LARGEST CATEGORY OF BINDER RESINS USED FOR COATING APPLICATIONS

- TABLE 28 PROPERTIES AND APPLICATIONS OF ACRYLIC COATING RESINS

- TABLE 29 ACRYLIC COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 30 ACRYLIC COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 31 ACRYLIC COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 32 ACRYLIC COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 6.3 ALKYD

- 6.3.1 DISTINGUISHED FOR RAPID DRYING, GOOD ADHESION, ELASTICITY, AND RESISTANCE TO MARRING

- TABLE 33 PROPERTIES AND APPLICATIONS OF ALKYD COATING RESINS

- TABLE 34 ALKYD COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 ALKYD COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 36 ALKYD COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 37 ALKYD COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 6.4 VINYL

- 6.4.1 DEVELOPMENT OF DISPERSION TYPE OF VINYL RESINS TO BOOST THIS SEGMENT

- TABLE 38 PROPERTIES AND APPLICATIONS OF VINYL COATING RESINS

- TABLE 39 VINYL COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 40 VINYL COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 41 VINYL COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 42 VINYL COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 6.5 POLYURETHANE

- 6.5.1 HIGH-PERFORMANCE CHARACTERISTICS TO INCREASE DEMAND FOR THIS RESIN TYPE

- TABLE 43 PROPERTIES AND APPLICATIONS OF POLYURETHANE COATING RESINS

- TABLE 44 POLYURETHANE COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 45 POLYURETHANE COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 46 POLYURETHANE COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 47 POLYURETHANE COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 6.6 EPOXY

- 6.6.1 OFFERS A UNIQUE COMBINATION OF ADHESION, CHEMICAL RESISTANCE, AND PHYSICAL PROPERTIES

- TABLE 48 PROPERTIES AND APPLICATIONS OF EPOXY COATING RESINS

- TABLE 49 EPOXY COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 50 EPOXY COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 51 EPOXY COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 52 EPOXY COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 6.7 UNSATURATED POLYESTER

- 6.7.1 EASE OF MANUFACTURING AND COST-EFFECTIVENESS TO PROPEL DEMAND FOR THIS RESIN

- TABLE 53 PROPERTIES AND APPLICATIONS OF UNSATURATED POLYESTER COATING RESINS

- TABLE 54 UNSATURATED POLYESTER COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 55 UNSATURATED POLYESTER COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 56 UNSATURATED POLYESTER COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 57 UNSATURATED POLYESTER COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 6.8 SATURATED POLYESTER

- 6.8.1 MULTI-CHARACTERISTIC RESINS WITH SUPERIOR PROPERTIES

- TABLE 58 PROPERTIES AND APPLICATIONS OF SATURATED POLYESTER COATING RESINS

- TABLE 59 SATURATED POLYESTER COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 60 SATURATED POLYESTER COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 61 SATURATED POLYESTER COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 62 SATURATED POLYESTER COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 6.9 AMINO

- 6.9.1 EXCELLENT TENSILE STRENGTH, HARDNESS, AND IMPACT RESISTANCE TO DRIVE MARKET

- TABLE 63 PROPERTIES AND APPLICATIONS OF AMINO COATING RESINS

- TABLE 64 AMINO COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 65 AMINO COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 66 AMINO COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 67 AMINO COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 6.10 OTHERS

- TABLE 68 OTHER COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 69 OTHER COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 70 OTHER COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 71 OTHER COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

7 COATING RESINS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 37 WATERBORNE COATINGS TO BE LARGEST TECHNOLOGY SEGMENT DURING FORECAST PERIOD

- TABLE 72 COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

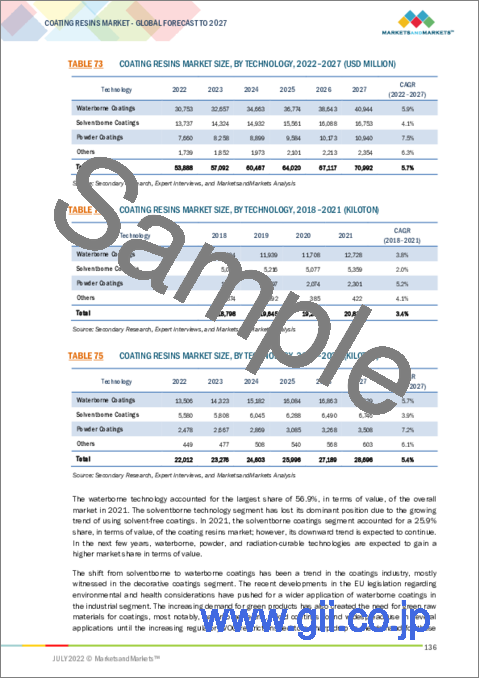

- TABLE 73 COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 74 COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 75 COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- 7.2 WATERBORNE COATINGS

- 7.2.1 TYPE

- FIGURE 38 TYPES OF WATERBORNE COATINGS

- 7.2.2 RESIN TYPES USED IN FORMULATION OF WATERBORNE COATINGS

- 7.2.3 APPLICATIONS OF WATERBORNE COATINGS

- 7.2.4 ADVANTAGES AND DISADVANTAGES OF WATERBORNE COATINGS

- FIGURE 39 DRIVERS AND RESTRAINTS IN WATERBORNE COATINGS MARKET

- TABLE 76 WATERBORNE COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 77 WATERBORNE COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 78 WATERBORNE COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 79 WATERBORNE COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 7.3 SOLVENTBORNE COATINGS

- TABLE 80 TRADITIONAL FORMULATION SOLVENTS USED FOR EACH RESIN TYPE

- 7.3.1 ADVANTAGES AND DISADVANTAGES OF SOLVENTBORNE COATINGS

- TABLE 81 SOLVENTBORNE COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 82 SOLVENTBORNE COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 83 SOLVENTBORNE COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 84 SOLVENTBORNE COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 7.4 POWDER COATINGS

- 7.4.1 TYPE

- FIGURE 40 TYPES OF POWDER COATINGS

- FIGURE 41 DRIVERS AND RESTRAINTS IN POWDER COATINGS MARKET

- TABLE 85 POWDER COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 86 POWDER COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 87 POWDER COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 88 POWDER COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 7.5 OTHERS

- 7.5.1 HIGH-SOLIDS COATINGS

- 7.5.1.1 Type

- FIGURE 42 TYPES OF HIGH-SOLIDS COATINGS

- 7.5.1.2 Application

- 7.5.1.2.1 Product finishing

- 7.5.1.2.2 Automotive applications

- 7.5.1.3 Advantages and disadvantages

- 7.5.1.2 Application

- FIGURE 43 DRIVERS AND RESTRAINTS IN HIGH-SOLIDS COATINGS MARKET

- 7.5.2 RADIATION-CURABLE COATINGS

- 7.5.2.1 Type

- FIGURE 44 TYPES OF RADIATION-CURABLE COATINGS

- 7.5.2.2 Resin systems

- 7.5.2.3 Applications

- 7.5.2.4 Advantages

- 7.5.2.5 Disadvantages

- FIGURE 45 DRIVERS AND RESTRAINTS IN RADIATION-CURABLE COATINGS MARKET

- TABLE 89 OTHER TECHNOLOGIES: COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 90 OTHER TECHNOLOGIES: COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 91 OTHER TECHNOLOGIES: COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 92 OTHER TECHNOLOGIES: COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 7.5.1 HIGH-SOLIDS COATINGS

8 COATING RESINS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 46 ARCHITECTURAL COATINGS APPLICATION TO LEAD COATING RESINS MARKET

- TABLE 93 COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 94 COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 95 COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 96 COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 8.2 ARCHITECTURAL COATINGS

- 8.2.1 OFFER DECORATIVE AND PROTECTIVE FEATURES FOR INTERIOR AND EXTERIOR SURFACES

- TABLE 97 COATING RESINS MARKET SIZE IN ARCHITECTURAL COATINGS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 98 COATING RESINS MARKET SIZE IN ARCHITECTURAL COATINGS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 99 COATING RESINS MARKET SIZE IN ARCHITECTURAL COATINGS, BY REGION, 2018-2021 (KILOTON)

- TABLE 100 COATING RESINS MARKET SIZE IN ARCHITECTURAL COATINGS, BY REGION, 2022-2027 (KILOTON)

- 8.3 MARINE & PROTECTIVE COATINGS

- 8.3.1 INCREASING USE OF EPOXY RESINS IN MARINE & PROTECTIVE COATINGS TO BOOST MARKET

- TABLE 101 COATING RESINS MARKET SIZE IN MARINE & PROTECTIVE COATINGS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 102 COATING RESINS MARKET SIZE IN MARINE & PROTECTIVE COATINGS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 103 COATING RESINS MARKET SIZE IN MARINE & PROTECTIVE COATINGS, BY REGION, 2018-2021 (KILOTON)

- TABLE 104 COATING RESINS MARKET SIZE IN MARINE & PROTECTIVE COATINGS, BY REGION, 2022-2027 (KILOTON)

- 8.4 GENERAL INDUSTRIAL COATINGS

- 8.4.1 INCREASING PER CAPITA INCOME TO SUPPORT MARKET GROWTH FOR GENERAL INDUSTRIAL COATINGS

- TABLE 105 COATING RESINS MARKET SIZE IN GENERAL INDUSTRIAL COATINGS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 106 COATING RESINS MARKET SIZE IN GENERAL INDUSTRIAL COATINGS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 107 COATING RESINS MARKET SIZE IN GENERAL INDUSTRIAL COATINGS, BY REGION, 2018-2021 (KILOTON)

- TABLE 108 COATING RESINS MARKET SIZE IN GENERAL INDUSTRIAL COATINGS, BY REGION, 2022-2027 (KILOTON)

- 8.5 AUTOMOTIVE COATINGS

- 8.5.1 PASSENGER CAR SALES IN DEVELOPING COUNTRIES TO DRIVE AUTOMOTIVE COATINGS SEGMENT

- TABLE 109 COATING RESINS MARKET SIZE IN AUTOMOTIVE COATINGS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 110 COATING RESINS MARKET SIZE IN AUTOMOTIVE COATINGS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 111 COATING RESINS MARKET SIZE IN AUTOMOTIVE COATINGS, BY REGION, 2018-2021 (KILOTON)

- TABLE 112 COATING RESINS MARKET SIZE IN AUTOMOTIVE COATINGS, BY REGION, 2022-2027 (KILOTON)

- 8.6 WOOD COATINGS

- 8.6.1 NEW HOME-BUILDING ACTIVITIES TO PROPEL DEMAND FOR WOOD COATINGS

- TABLE 113 COATING RESINS MARKET SIZE IN WOOD COATINGS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 114 COATING RESINS MARKET SIZE IN WOOD COATINGS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 115 COATING RESINS MARKET SIZE IN WOOD COATINGS, BY REGION, 2018-2021 (KILOTON)

- TABLE 116 COATING RESINS MARKET SIZE IN WOOD COATINGS, BY REGION, 2022-2027 (KILOTON)

- 8.7 PACKAGING COATINGS

- 8.7.1 FOOD & BEVERAGE INDUSTRY TO POSITIVELY INFLUENCE PACKAGING COATINGS SEGMENT

- TABLE 117 COATING RESINS MARKET SIZE IN PACKAGING COATINGS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 118 COATING RESINS MARKET SIZE IN PACKAGING COATINGS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 119 COATING RESINS MARKET SIZE IN PACKAGING COATINGS, BY REGION, 2018-2021 (KILOTON)

- TABLE 120 COATING RESINS MARKET SIZE IN PACKAGING COATINGS, BY REGION, 2022-2027 (KILOTON)

- 8.8 COIL COATINGS

- 8.8.1 CORROSION RESISTANCE AND DURABILITY PROPERTIES OF COIL COATINGS TO DRIVE MARKET

- TABLE 121 COATING RESINS MARKET SIZE IN COIL COATINGS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 122 COATING RESINS MARKET SIZE IN COIL COATINGS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 123 COATING RESINS MARKET SIZE IN COIL COATINGS, BY REGION, 2018-2021 (KILOTON)

- TABLE 124 COATING RESINS MARKET SIZE IN COIL COATINGS, BY REGION, 2022-2027 (KILOTON)

- 8.9 OTHERS

- 8.9.1 AEROSPACE

- 8.9.2 GRAPHIC ARTS

- TABLE 125 COATING RESINS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 126 COATING RESINS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 127 COATING RESINS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018-2021 (KILOTON)

- TABLE 128 COATING RESINS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2022-2027 (KILOTON)

9 COATING RESINS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 47 COATING RESINS MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR

- TABLE 129 COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 130 COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 131 COATING RESINS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 132 COATING RESINS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 9.2 ASIA PACIFIC

- FIGURE 48 ASIA PACIFIC: COATING RESINS MARKET SNAPSHOT

- TABLE 133 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 134 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 135 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 136 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 137 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 138 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 139 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 140 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 141 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 142 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 143 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 144 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 145 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 146 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 147 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 148 ASIA PACIFIC: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.2.1 CHINA

- 9.2.1.1 World's largest producer and consumer of coatings

- 9.2.2 INDIA

- 9.2.2.1 Construction and automotive industries to be key consumers of coating resins

- TABLE 149 INDIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 150 INDIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 151 INDIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 152 INDIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 153 INDIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 154 INDIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 155 INDIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 156 INDIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 157 INDIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 158 INDIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 159 INDIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 160 INDIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.2.3 JAPAN

- 9.2.3.1 Demand for architectural coatings to increase

- 9.2.4 INDONESIA

- 9.2.4.1 Investments in new automobile manufacturing capacities to boost market

- TABLE 161 INDONESIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 162 INDONESIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 163 INDONESIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 164 INDONESIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 165 INDONESIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 166 INDONESIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 167 INDONESIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 168 INDONESIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 169 INDONESIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 170 INDONESIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 171 INDONESIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 172 INDONESIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.2.5 PAKISTAN

- 9.2.5.1 Recovering construction and automotive industries to drive market

- TABLE 173 PAKISTAN: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 174 PAKISTAN: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 175 PAKISTAN: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 176 PAKISTAN: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 177 PAKISTAN: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 178 PAKISTAN: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 179 PAKISTAN: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 180 PAKISTAN: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 181 PAKISTAN: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 182 PAKISTAN: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 183 PAKISTAN: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 184 PAKISTAN: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.2.6 PHILIPPINES

- 9.2.6.1 Government initiative to boost construction industry

- TABLE 185 PHILIPPINES: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 186 PHILIPPINES: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 187 PHILIPPINES: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 188 PHILIPPINES: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 189 PHILIPPINES: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 190 PHILIPPINES: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 191 PHILIPPINES: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 192 PHILIPPINES: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 193 PHILIPPINES: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 194 PHILIPPINES: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 195 PHILIPPINES: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 196 PHILIPPINES: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.2.7 MALAYSIA

- 9.2.7.1 Large automotive industry to generate significant demand for coatings

- TABLE 197 MALAYSIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 198 MALAYSIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 199 MALAYSIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 200 MALAYSIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 201 MALAYSIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 202 MALAYSIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 203 MALAYSIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 204 MALAYSIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 205 MALAYSIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 206 MALAYSIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 207 MALAYSIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 208 MALAYSIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.2.8 BANGLADESH

- 9.2.8.1 To become a regional hub for manufacturing by 2030

- 9.2.9 SRI LANKA

- 9.2.9.1 Recovery in industries affected by dependency on imports in recent past

- 9.2.10 REST OF ASIA PACIFIC

- 9.3 EUROPE

- FIGURE 49 EUROPE: COATING RESINS MARKET SNAPSHOT

- TABLE 209 EUROPE: COATING RESINS MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 210 EUROPE: COATING RESINS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 211 EUROPE: COATING RESINS MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 212 EUROPE: COATING RESINS MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 213 EUROPE: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 214 EUROPE: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 215 EUROPE: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 216 EUROPE: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 217 EUROPE: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 218 EUROPE: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 219 EUROPE: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 220 EUROPE: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 221 EUROPE: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 222 EUROPE: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 223 EUROPE: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 224 EUROPE: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.3.1 GERMANY

- 9.3.1.1 At the forefront of automotive design, performance, and innovation

- 9.3.2 FRANCE

- 9.3.2.1 Reviving economy after 2011 slowdown to boost demand for coating resins

- 9.3.3 ITALY

- 9.3.3.1 More than 50% growth expected in residential construction

- 9.3.4 UK

- 9.3.4.1 Steps taken by government to boost construction industry

- 9.3.5 TURKEY

- 9.3.5.1 One of leading markets for paints & coatings in Europe

- 9.3.6 SPAIN

- 9.3.6.1 Among largest exporters of automobiles

- 9.3.7 RUSSIA

- 9.3.7.1 High demand in architectural coatings application due to high population

- 9.3.8 REST OF EUROPE

- 9.4 NORTH AMERICA

- FIGURE 50 NORTH AMERICA: COATING RESINS MARKET SNAPSHOT

- TABLE 225 NORTH AMERICA: COATING RESINS MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 226 NORTH AMERICA: COATING RESINS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 227 NORTH AMERICA: COATING RESINS MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 228 NORTH AMERICA: COATING RESINS MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 229 NORTH AMERICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 230 NORTH AMERICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 231 NORTH AMERICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 232 NORTH AMERICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 233 NORTH AMERICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 234 NORTH AMERICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 235 NORTH AMERICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 236 NORTH AMERICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 237 NORTH AMERICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 238 NORTH AMERICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 239 NORTH AMERICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 240 NORTH AMERICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.4.1 US

- 9.4.1.1 Growing residential and non-residential housing sectors to propel market

- 9.4.2 CANADA

- 9.4.2.1 Construction industry to be major contributor to coating resins market growth

- 9.4.3 MEXICO

- 9.4.3.1 Automobile sales estimated to show robust growth

- 9.5 MIDDLE EAST & AFRICA

- TABLE 241 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 244 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 245 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 248 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 249 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 252 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 253 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 254 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 256 MIDDLE EAST & AFRICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.5.1 SAUDI ARABIA

- 9.5.1.1 Mega construction projects to boost demand for coating resins

- TABLE 257 SAUDI ARABIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 258 SAUDI ARABIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 259 SAUDI ARABIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 260 SAUDI ARABIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 261 SAUDI ARABIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 262 SAUDI ARABIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 263 SAUDI ARABIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 264 SAUDI ARABIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 265 SAUDI ARABIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 266 SAUDI ARABIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 267 SAUDI ARABIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 268 SAUDI ARABIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 New infrastructural developments to increase demand for coating resins

- TABLE 269 SOUTH AFRICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 270 SOUTH AFRICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 271 SOUTH AFRICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 272 SOUTH AFRICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 273 SOUTH AFRICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 274 SOUTH AFRICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 275 SOUTH AFRICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 276 SOUTH AFRICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 277 SOUTH AFRICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 278 SOUTH AFRICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 279 SOUTH AFRICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 280 SOUTH AFRICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.5.3 UAE

- 9.5.3.1 Automotive industry- One of biggest drivers of economic growth

- TABLE 281 UAE: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 282 UAE: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 283 UAE: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 284 UAE: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 285 UAE: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 286 UAE: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 287 UAE: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 288 UAE: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 289 UAE: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 290 UAE: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 291 UAE: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 292 UAE: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.5.4 EGYPT

- 9.5.4.1 New business and residential projects under construction

- TABLE 293 EGYPT: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 294 EGYPT: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 295 EGYPT: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 296 EGYPT: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 297 EGYPT: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 298 EGYPT: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 299 EGYPT: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 300 EGYPT: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 301 EGYPT: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 302 EGYPT: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 303 EGYPT: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 304 EGYPT: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.5.5 NIGERIA

- 9.5.5.1 Rise of local production in automotive industry

- TABLE 305 NIGERIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 306 NIGERIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 307 NIGERIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 308 NIGERIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 309 NIGERIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 310 NIGERIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 311 NIGERIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 312 NIGERIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 313 NIGERIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 314 NIGERIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 315 NIGERIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 316 NIGERIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.5.6 ETHIOPIA

- 9.5.6.1 Recovery in industries impacted by COVID-19 to contribute to market growth

- TABLE 317 ETHIOPIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 318 ETHIOPIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 319 ETHIOPIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 320 ETHIOPIA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 321 ETHIOPIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 322 ETHIOPIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 323 ETHIOPIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 324 ETHIOPIA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 325 ETHIOPIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 326 ETHIOPIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 327 ETHIOPIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 328 ETHIOPIA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.5.7 KENYA

- 9.5.7.1 Increase in local automobile production

- TABLE 329 KENYA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 330 KENYA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 331 KENYA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 332 KENYA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 333 KENYA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 334 KENYA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 335 KENYA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 336 KENYA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 337 KENYA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 338 KENYA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 339 KENYA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 340 KENYA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.5.8 ISRAEL

- 9.5.8.1 To become a world leader in new automotive solutions

- 9.5.9 JORDAN

- 9.5.9.1 Recovery from economic breakdown to drive market

- TABLE 341 JORDAN: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 342 JORDAN: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 343 JORDAN: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 344 JORDAN: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 345 JORDAN: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 346 JORDAN: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 347 JORDAN: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 348 JORDAN: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 349 JORDAN: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 350 JORDAN: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 351 JORDAN: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 352 JORDAN: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.5.10 REST OF MIDDLE EAST & AFRICA

- 9.6 SOUTH AMERICA

- TABLE 353 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 354 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 355 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 356 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 357 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 358 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 359 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 360 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 361 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 362 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 363 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 364 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 365 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 366 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 367 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 368 SOUTH AMERICA: COATING RESINS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 9.6.1 BRAZIL

- 9.6.1.1 New qualified infrastructural projects to boost consumption of coating resins

- 9.6.2 ARGENTINA

- 9.6.2.1 Increase in population and improved economic conditions

- 9.6.3 COLOMBIA

- 9.6.3.1 Demographic shifts, urbanization, and growth of labor productivity

- 9.6.4 REST OF SOUTH AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.1.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY COATING RESINS PLAYERS

- 10.2 COMPANY EVALUATION QUADRANT MATRIX (KEY PLAYERS)

- 10.2.1 STARS

- 10.2.2 EMERGING LEADERS

- 10.2.3 PERVASIVE PLAYERS

- 10.2.4 PARTICIPANTS

- FIGURE 51 COATING RESINS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.3 STRENGTH OF PRODUCT PORTFOLIO

- 10.4 SME MATRIX (2021)

- 10.4.1 RESPONSIVE COMPANIES

- 10.4.2 PROGRESSIVE COMPANIES

- 10.4.3 STARTING BLOCKS

- 10.4.4 DYNAMIC COMPANIES

- FIGURE 52 COATING RESINS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.5 MARKET SHARE ANALYSIS

- FIGURE 53 MARKET SHARE, BY KEY PLAYERS (2021)

- 10.6 REVENUE ANALYSIS

- 10.6.1 ARKEMA

- 10.6.2 BASF SE

- 10.6.3 COVESTRO

- 10.6.4 ALLNEX

- 10.6.5 DOW

- FIGURE 54 REVENUE ANALYSIS, 2017-2021

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 369 COATING RESINS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 370 COATING RESINS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 10.8 MARKET RANKING ANALYSIS

- FIGURE 55 MARKET RANKING ANALYSIS, 2021

- 10.8.1 COMPETITIVE SITUATION AND TRENDS

- TABLE 371 COATING RESINS MARKET: PRODUCT LAUNCHES, 2016-2022

- TABLE 372 COATING RESINS MARKET: DEALS, 2016-2022

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 11.1.1 ARKEMA

- TABLE 373 ARKEMA: COMPANY OVERVIEW

- FIGURE 56 ARKEMA: COMPANY SNAPSHOT

- TABLE 374 ARKEMA: PRODUCT LAUNCHES

- TABLE 375 ARKEMA: DEALS

- 11.1.2 BASF SE

- TABLE 376 BASF SE: COMPANY OVERVIEW

- FIGURE 57 BASF SE: COMPANY SNAPSHOT

- TABLE 377 BASF SE: PRODUCT LAUNCHES

- TABLE 378 BASF SE: DEALS

- 11.1.3 COVESTRO AG

- TABLE 379 COVESTRO AG: COMPANY OVERVIEW

- FIGURE 58 COVESTRO AG: COMPANY SNAPSHOT

- TABLE 380 COVESTRO AG: PRODUCT LAUNCHES

- TABLE 381 COVESTRO AG: DEALS

- 11.1.4 ALLNEX

- TABLE 382 ALLNEX: COMPANY OVERVIEW

- TABLE 383 ALLNEX: PRODUCT LAUNCHES

- TABLE 384 ALLNEX: DEALS

- 11.1.5 DOW

- TABLE 385 DOW: COMPANY OVERVIEW

- FIGURE 59 DOW: COMPANY SNAPSHOT

- 11.1.6 THE SHERWIN-WILLIAMS COMPANY

- TABLE 386 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- FIGURE 60 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- TABLE 387 THE SHERWIN-WILLIAMS COMPANY: DEALS

- 11.1.7 EVONIK INDUSTRIES AG

- TABLE 388 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- FIGURE 61 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- TABLE 390 EVONIK INDUSTRIES AG: DEALS

- 11.1.8 POLYNT-REICHHOLD

- TABLE 391 POLYNT-REICHHOLD: COMPANY OVERVIEW

- FIGURE 62 POLYNT-REICHHOLD: COMPANY SNAPSHOT

- TABLE 392 POLYNT-REICHHOLD: DEALS

- TABLE 393 POLYNT-REICHHOLD: OTHERS

- 11.1.9 HUNTSMAN INTERNATIONAL LLC

- TABLE 394 HUNTSMAN INTERNATIONAL LLC: COMPANY OVERVIEW

- FIGURE 63 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

- TABLE 395 HUNTSMAN INTERNATIONAL LLC: DEALS

- 11.1.10 MITSUBISHI CHEMICAL CORPORATION

- TABLE 396 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- FIGURE 64 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

- 11.2 OTHER COMPANIES

- 11.2.1 TORAY INDUSTRIES, INC.

- TABLE 397 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- 11.2.2 MITSUI CHEMICALS, INC.

- TABLE 398 MITSUI CHEMICALS, INC.: COMPANY OVERVIEW

- 11.2.3 SOLVAY

- TABLE 399 SOLVAY: COMPANY OVERVIEW

- 11.2.4 EASTMAN CHEMICAL COMPANY

- TABLE 400 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- 11.2.5 DIC CORPORATION

- TABLE 401 DIC CORPORATION: COMPANY OVERVIEW

- TABLE 402 DIC CORPORATION: DEALS

- 11.2.6 THE LUBRIZOL CORPORATION

- TABLE 403 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

- 11.2.7 MOMENTIVE PERFORMANCE MATERIALS INC.

- TABLE 404 MOMENTIVE PERFORMANCE MATERIALS INC.: COMPANY OVERVIEW

- 11.2.8 CELANESE CORPORATION

- TABLE 405 CELANESE CORPORATION: COMPANY OVERVIEW

- 11.2.9 OLIN CORPORATION

- TABLE 406 OLIN CORPORATION: COMPANY OVERVIEW

- 11.2.10 WACKER CHEMIE AG

- TABLE 407 WACKER CHEMIE AG: COMPANY OVERVIEW

- TABLE 408 WACKER CHEMIE AG: OTHERS

- 11.2.11 HEXION

- TABLE 409 HEXION: COMPANY OVERVIEW

- TABLE 410 HEXION: DEALS

- 11.2.12 KRATON CORPORATION

- TABLE 411 KRATON CORPORATION: COMPANY OVERVIEW

- 11.2.13 PERSTORP AB

- TABLE 412 PERSTORP AB: COMPANY OVERVIEW

- TABLE 413 PERSTORP AB: OTHERS

- 11.2.14 WANHUA CHEMICAL GROUP CO., LTD.

- TABLE 414 WANHUA CHEMICAL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 415 WANHUA CHEMICAL GROUP CO., LTD.: DEALS

- 11.2.15 KUKDO CHEMICAL CO., LTD.

- TABLE 416 KUKDO CHEMICAL CO., LTD.: COMPANY OVERVIEW

- 11.2.16 HELIOS RESINS

- TABLE 417 HELIOS RESINS: COMPANY OVERVIEW

- 11.2.17 SYNTHOPOL

- TABLE 418 SYNTHOPOL: COMPANY OVERVIEW

- 11.2.18 SYNTHOMER PLC

- TABLE 419 SYNTHOMER PLC: COMPANY OVERVIEW

- 11.2.19 NAMA CHEMICALS

- TABLE 420 NAMA CHEMICALS: COMPANY OVERVIEW

- 11.2.20 SAUDI INDUSTRIAL RESINS LIMITED

- TABLE 421 SAUDI INDUSTRIAL RESINS LIMITED: COMPANY OVERVIEW

- 11.2.21 ATUL LTD.

- TABLE 422 ATUL LTD.: COMPANY OVERVIEW

- 11.2.22 GULF CHEMICAL & INDUSTRIAL OILS CO.

- TABLE 423 GULF CHEMICAL & INDUSTRIAL OILS CO.: COMPANY OVERVIEW

- 11.2.23 INDUSTRIAL CHEMICALS & RESINS CO.

- TABLE 424 INDUSTRIAL CHEMICALS & RESINS CO.: COMPANY OVERVIEW

- 11.2.24 HITECH INDUSTRIES FZE

- TABLE 425 HITECH INDUSTRIES FZE: COMPANY OVERVIEW

- 11.2.25 ESTERPOL

- TABLE 426 ESTERPOL: COMPANY OVERVIEW

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 11.2.26 OTHER RELATED COMPANIES

- TABLE 427 OTHER RELATED COMPANIES

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS