|

|

市場調査レポート

商品コード

1087893

無人地上車両(UGV)の世界市場 - 2027年までの予測:機動性、用途別(軍事、商業、法執行機関、連邦の法執行機関)、操作モード別、サイズ別、システム別、地域別Unmanned Ground Vehicles Market by Mobility, Application (Military, Commercial, Law Enforcement, Federal Law Enforcement), Mode of Operation, Size, System, and Region (North America, Europe, APAC, Middle East and Rest of the World) - Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 無人地上車両(UGV)の世界市場 - 2027年までの予測:機動性、用途別(軍事、商業、法執行機関、連邦の法執行機関)、操作モード別、サイズ別、システム別、地域別 |

|

出版日: 2022年06月02日

発行: MarketsandMarkets

ページ情報: 英文 266 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

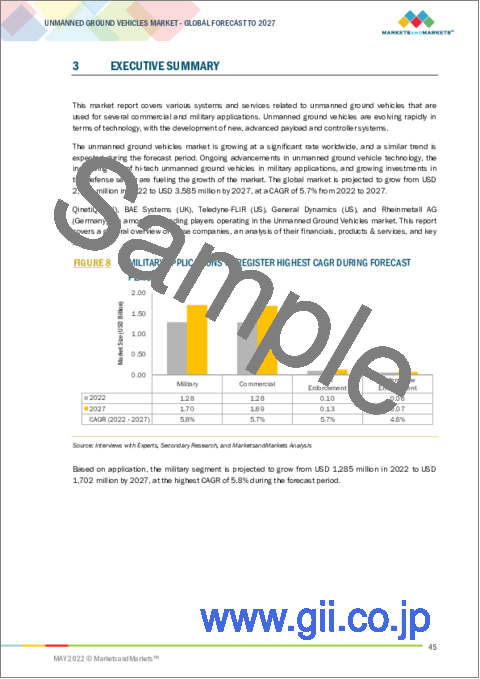

世界の無人地上車両(UGV)の市場規模は、2022年の推定27億米ドルから、2027年までに36億米ドルに達し、2022年~2027年の予測期間中のCAGRで5.7%の成長が予測されています。

市場の成長は、戦闘支援、ISR、地雷除去などの軍事用途、消火活動、CBRNなどの商業用途の増加に起因する可能性があります。

当レポートでは、世界の無人地上車両(UGV)市場について調査分析し、市場概要、業界動向、セグメント別の市場分析、競合情勢、主要企業などについて、最新の情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 需要側の影響

- 顧客のビジネスに影響を与える動向/混乱

- 市場エコシステム

- 価格分析

- 関税規制情勢

- 貿易データ

- 特許分析

- 無人地上車両(UGV)市場のバリューチェーン分析

- 技術分析

- ポーターのファイブフォースモデル

- 主要な利害関係者と購入基準

- ユースケース

- 主要会議とイベント

第6章 業界動向

- サプライチェーン分析

- 新興の業界動向

- メガトレンドの影響

- イノベーションと特許登録

第7章 無人地上車両(UGV)市場:機動性別

- 装輪式

- 装軌式

- ハイブリッド

- 脚型

第8章 無人地上車両(UGV)市場:サイズ別

- 小(10~200ポンド)

- 中(200~500ポンド)

- 大(500~1,000ポンド)

- 特大(1,000~2,000ポンド)

- 超大(2,000ポンド超)

第9章 無人地上車両(UGV)市場:操作モード別

- テザー式

- 遠隔操作型

- 自律型

第10章 無人地上車両(UGV)市場:システム別

- ペイロード

- 制御システム

- ナビゲーションシステム

- 電力系統

- その他

第11章 無人地上車両(UGV)市場:用途別

- 軍事

- 法執行機関

- 連邦の法施行機関

- 商業

第12章 無人地上車両(UGV)市場:地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- ポーランド

- ロシア

- その他の欧州

- アジア太平洋

- 日本

- オーストラリア

- 中国

- インド

- 韓国

- その他のアジア太平洋

- 中東

- イスラエル

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他の中東

- その他の地域

第13章 競合情勢

- 主要企業の市場シェア分析

- 収益分析

- ランク分析

- 競合の評価象限

- 競合ベンチマーキング

- 主要なスタートアップ/中小企業の詳細リストと競合ベンチマーキング

- 競合シナリオ

第14章 企業プロファイル

- イントロダクション

- 主要企業

- NORTHROP GRUMMAN CORPORATION

- LOCKHEED MARTIN

- BAE SYSTEMS

- RHEINMETALL AG

- QINETIQ

- GENERAL DYNAMICS

- THALES GROUP

- L3HARRIS TECHNOLOGIES

- ASELSAN A.S.

- TELEDYNE TECHNOLOGIES

- HEXAGON AB

- ISRAEL AEROSPACE INDUSTRIES

- ST ENGINEERING

- ELBIT SYSTEMS

- ECA GROUP

- MISTUBISHI ELECTRIC

- LIG NEX 1

- OSHKOSH CORP.

- HYUNDAI MOTOR COMPANY

- HORIBA LTD.

- TEXTRON INC.

- その他の企業

- COBHAM PLC

- RE2, INC.

- AUTONOMOUS SOLUTIONS, INC.

- ICOR TECHNOLOGY

- NEXTER GROUP

第15章 付録

The unmanned ground vehicles market is estimated to be USD 2.7 billion in 2022 and is projected to reach USD 3.6billion by 2027, at a CAGR of 5.7% from 2022 to 2027. Growth of this market can be attributed to the rise in military applications like combat support, ISR, mine clearance, etc., and commercial applications like firefighting, CBRN.

"Development of smart robots for combat operations"

Smart robots are an integral part of modern warfare, and, thus, different countries across the globe are increasing, including these robots in their defense forces. They are essential for combat operations and assist defense forces in various missions. Smart robots are designed to handle a broad range of combat tasks, from picking up snipers to carrying out target acquisitions. These robots can map a potentially large hostile area by accurately identifying and detecting different threats.

The defense forces of different countries focus on developing new robot technologies to enhance their combat capabilities. For instance, the Defense Advanced Research Projects Agency (DARPA) has been financing the development of a robotic submarine system since 2020 for use in several applications, right from detecting underwater mines to engaging in anti-submarine operations to protecting ships at harbors.

"Increased defense budgets of different countries for unmanned systems"

In the last 10 years, emerging economies such as India, China, and Singapore have increased their defense budgets. The US topped the list for military spending in 2021, followed by China, Saudi Arabia, and Russia. According to the Stockholm International Peace Research Institute (SIPRI), India was the third-largest country in terms of military spending in 2021. The UAE has increased its defense spending by 136% over the past 10 years, owing to its increasing GDP and unrest in the Middle East. In 2021, China increased its defense budget, which is predicted to increase in the coming years. These economies are increasingly investing in defense operations and are potential UGVs and related military robotics markets.

.

"Fully autonomous UGVs: The largest segment of the unmanned ground vehicles market, by Mode of operation."

The fully autonomous operation does not have any human involvement or interference. The autonomous mode enables self sufficiency and can thus perform tasks and execute operations without human intervention. Advanced capabilities, such as secure communications and control, autonomous path following and obstacle avoidance, automatic target tracking, and data compression in UGVs are expected to aid the military in Reconnaissance, Surveillance, and Target Acquisition (RSTA) missions.

"Intelligence, Surveillance, & Reconnaissance (ISR): The fastest-growing segment of the unmanned ground vehicles market, by Military Application "

Intelligence, Surveillance, and Reconnaissance (ISR) is one of the major applications where military satellites are used. UAVs, UGVs, USVs, ROVs, AUVs, etc., are extensively used in ISR applications. Small UGVs are mainly utilized in the military sector to provide battlefield intelligence. Armed forces worldwide no longer rely on human scouts and instead use small robots, which can remain almost invisible to the enemy. These robots help monitor enemy forces or specific areas and send video images to the ground station with GPS assistance.

UGVs, such as the 510 PackBot developed by the iRobot Corporation/Endeavour Robotics (US), are widely used for ISR operations by the US military. The global naval forces use remotely Operated Vehicles (ROVs) for situational awareness and recognition of incoming threats through their remote sensing capabilities. ROVs use sensors, cameras, sonars, and echo sonar systems to collect complex data from their surroundings.

"North America: The largest contributing region in the unmanned ground vehicles market."

North America includes the US and Canada. The US is one of the largest global developers, operators, and exporters of unmanned military systems. Thus, it accounts for a large share of the North American region in the global unmanned ground vehicles market. The main functions of UGVs include ensuring border security, Intelligence, Surveillance & Reconnaissance (ISR), and minimizing the risks of terrorism on domestic assets and the population. North American countries are awarding several contracts to major players in the unmanned ground vehicles market to deliver UGVs with combat capabilities, thus driving the growth of the unmanned ground vehicles market in the region. For instance, the US has deployed several unmanned systems along the Mexican border to ensure that the gang-related violence and conflicts in Northern Mexico do not affect its internal security. Canada has also undertaken several measures to develop ground robotic vehicles for military functions.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-35%; Tier 2-45%; and Tier 3-20%

- ByDesignation: CLevel-35%; Directors-25%;and Others-40%

- By Region: North America-25%; Europe-15%; AsiaPacific-45%; Middle East- 10%; and Rest of the World -5%

Raytheon Technologies Corporation (US), Thales Group (France), Northrop Grumman Corp. (US), L3harris Technologies (US), HEXAGON AB (Sweden), and Furuno Electric (Japan) are the key players in the unmanned ground vehicles market.

Research Coverage

The study covers theunmanned ground vehicles marketacross various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based onApplication,Mobility, Size, Mode of Operation, System,and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Reasons to Buy this Report

This report is expected to help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall unmanned ground vehicles marketandits segments. This study is also expected to provide regionwise information aboutthe end use, and wherein unmanned ground vehicles are used. This report aims at helping the stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. This report is also expected to help them understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities influencing the growth of the market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF STUDY

- 1.2 MARKET DEFINITION

- 1.3 MARKETS SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 UNMANNED GROUND VEHICLE MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED FOR STUDY

- 1.4 INCLUSIONS & EXCLUSIONS

- 1.5 CURRENCY & PRICING

- 1.6 USD EXCHANGE RATES

- 1.7 LIMITATIONS

- 1.8 MARKET STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION & REGION

- 2.1.3 DEMAND-SIDE INDICATORS

- 2.1.4 SUPPLY-SIDE ANALYSIS

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 SEGMENTS AND SUBSEGMENTS

- 2.3 RESEARCH APPROACH & METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- TABLE 1 UNMANNED GROUND VEHICLES MARKET ESTIMATION PROCEDURE

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.5 GROWTH RATE ASSUMPTIONS

- 2.6 ASSUMPTIONS FOR RESEARCH STUDY

- 2.7 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 8 MILITARY APPLICATIONS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 PAYLOAD SYSTEMS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 AUTONOMOUS UGVS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 SMALL UGVS SEGMENT TO ACCOUNT FOR HIGHEST MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 12 WHEELED UGV TO HOLD LARGEST SHARE IN MARKET IN 2022

- FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF UNMANNED GROUND VEHICLES MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN UNMANNED GROUND VEHICLES MARKET

- FIGURE 14 INCREASING DEMAND FOR UGVS IN MILITARY OPERATIONS RESPONSIBLE FOR MARKET GROWTH

- 4.2 UNMANNED GROUND VEHICLES MARKET, BY APPLICATION

- FIGURE 15 MILITARY SEGMENT TO COMMAND HIGHEST MARKET SHARE FROM 2018 TO 2027

- 4.3 UNMANNED GROUND VEHICLES MARKET, BY SYSTEM

- FIGURE 16 PAYLOAD SYSTEMS SEGMENT EXPECTED TO DOMINATE MARKET FROM 2018 TO 2027

- 4.4 UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION

- FIGURE 17 AUTONOMOUS UGVS TO LEAD MARKET FROM 2018 TO 2027

- 4.5 UNMANNED GROUND VEHICLES MARKET, BY SIZE

- FIGURE 18 SMALL UGVS TO WITNESS UPWARD TREND FROM 2018 TO 2027

- 4.6 UNMANNED GROUND VEHICLES MARKET, BY MOBILITY

- FIGURE 19 WHEELED UGVS TO SHOWCASE HIGHEST MARKET SHARE FROM 2018 TO 2027

- 4.7 UNMANNED GROUND VEHICLES MARKET, BY COUNTRY

- FIGURE 20 JAPAN PROJECTED TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 UNMANNED GROUND VEHICLES MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use of robots in areas affected by chemical, biological, radiological, and nuclear (CBRN) attacks

- 5.2.1.2 Growing demand for autonomous systems in defense and commercial sectors

- 5.2.1.3 Rising adoption of UGVs for counter-insurgency operations

- 5.2.1.4 Development of smart robots for combat operations

- 5.2.1.5 Improving ISR and target acquisition capabilities of defense forces

- 5.2.2 RESTRAINTS

- 5.2.2.1 Requirement for developing sophisticated and highly reliable UGVs

- 5.2.2.2 Lack of advanced visual capabilities in UGVs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of fully autonomous UGVs

- 5.2.3.2 Increased defense budgets of different countries for unmanned systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Requirement for continuous and uninterrupted power supply in UGVs

- 5.2.4.2 Hardware and software malfunctions

- 5.2.5 DEMAND-SIDE IMPACT

- 5.2.5.1 Key developments from January 2019 to May 2022

- TABLE 2 KEY DEVELOPMENTS IN UNMANNED GROUND VEHICLES MARKET, 2019-2022

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- FIGURE 22 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- 5.4 MARKET ECOSYSTEM

- FIGURE 23 UNMANNED GROUND VEHICLES, MARKET ECOSYSTEM

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 PRIVATE AND SMALL ENTERPRISES

- 5.4.3 END USERS

- TABLE 3 UNMANNED GROUND VEHICLES MARKET ECOSYSTEM

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE ANALYSIS OF UNMANNED GROUND VEHICLES IN 2021

- FIGURE 24 AVERAGE SELLING PRICE OF UNMANNED GROUND VEHICLES OFFERED BY TOP PLAYERS

- 5.6 TARIFF REGULATORY LANDSCAPE

- 5.6.1 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER AGENCIES

- 5.6.2 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER AGENCIES

- 5.6.3 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER AGENCIES

- 5.6.4 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER AGENCIES

- 5.6.5 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER AGENCIES

- 5.7 TRADE DATA

- 5.7.1 TRADE ANALYSIS

- TABLE 4 COUNTRY-WISE IMPORTS, 2019-2021 (USD THOUSAND)

- TABLE 5 COUNTRY-WISE EXPORTS, 2019-2021 (USD THOUSAND)

- 5.8 PATENT ANALYSIS

- FIGURE 25 LIST OF MAJOR PATENTS FOR UNMANNED GROUND VEHICLES

- TABLE 6 LIST OF MAJOR PATENTS FOR UNMANNED GROUND VEHICLES

- 5.9 VALUE CHAIN ANALYSIS OF UNMANNED GROUND VEHICLES MARKET

- FIGURE 26 VALUE CHAIN ANALYSIS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGY

- 5.10.1.1 Design and implementation of solar-powered UGVs

- 5.10.1.2 Development of multi-payload UGVs

- 5.10.2 COMPLIMENTARY TECHNOLOGY

- 5.10.2.1 Electro-optical and radar sensor payloads for unmanned vehicles

- 5.10.1 KEY TECHNOLOGY

- 5.11 PORTER'S FIVE FORCES MODEL

- 5.11.1 UNMANNED GROUND VEHICLES MARKET: PORTER'S FIVE FORCE ANALYSIS

- FIGURE 27 UNMANNED GROUND VEHICLES MARKET: PORTER'S FIVE FORCE ANALYSIS

- 5.11.2 THREAT OF NEW ENTRANTS

- 5.11.3 THREAT OF SUBSTITUTES

- 5.11.4 BARGAINING POWER OF SUPPLIERS

- 5.11.5 BARGAINING POWER OF BUYERS

- 5.11.6 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING UNMANNED GROUND VEHICLES, BY APPLICATION

- TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING UNMANNED GROUND VEHICLES, BY APPLICATION (%)

- 5.12.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR UNMANNED GROUND VEHICLES, BY MOBILITY

- TABLE 8 KEY BUYING CRITERIA FOR UNMANNED GROUND VEHICLES, BY MOBILITY

- 5.13 USE CASES

- 5.13.1 VIKING MULTIROLE UNMANNED GROUND VEHICLE DEVELOPED BY HORIBA MIRA FOR UK MINISTRY OF DEFENCE

- 5.14 KEY CONFERENCES & EVENTS, 2022-23

- TABLE 9 UNMANNED GROUND VEHICLES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 30 SUPPLY CHAIN ANALYSIS

- 6.2.1 MAJOR COMPANIES

- 6.2.2 SMALL AND MEDIUM ENTERPRISES

- 6.2.3 END USERS/CUSTOMERS

- 6.3 EMERGING INDUSTRY TRENDS

- TABLE 10 ADVANCEMENTS IN UNMANNED GROUND VEHICLES IN KEY NATIONS

- 6.3.1 UNMANNED GROUND VEHICLES FOR SWARM OPERATIONS

- 6.3.2 CROSS-PLATFORM COMMUNICATION

- 6.3.2.1 SwarmDiver by Aquabotix (Australia)

- 6.3.2.2 Lockheed Martin (US) launched UAV on command from AUV

- 6.3.3 REMOTE CONTROL STATION

- 6.3.4 ROBOTIC FOLLOWER ADVANCED TECHNOLOGY DEMONSTRATION

- 6.3.5 SEMI-AUTONOMOUS ROBOTICS FOR FUTURE COMBAT SYSTEMS

- 6.3.6 M160 ANTI-PERSONNEL MINE-CLEARING SYSTEM

- 6.3.7 PACKBOT AND TALON FAMILY OF SYSTEMS

- 6.3.8 ROUTE RECONNAISSANCE AND CLEARANCE ROBOT PROGRAM

- 6.3.9 APPLIQUE KITS

- 6.3.10 SUPERVISED AUTONOMY TO NEUTRALIZE AND DETECT IEDS

- 6.3.11 SQUAD MISSION SUPPORT SYSTEM

- 6.3.12 BRAIN COMPUTER INTERACTION TECHNOLOGIES

- 6.4 IMPACT OF MEGATRENDS

- 6.4.1 ROBOT CONSTRUCTION USING 3D PRINTING TECHNOLOGY

- 6.4.1.1 UGV prototype developed by MITRE Corporation (US)

- 6.4.2 MULTI-MISSION UNMANNED GROUND VEHICLES

- 6.4.2.1 MMUGV developed by Rheinmetall AG (Germany)

- 6.4.2.2 Viking Multirole unmanned ground vehicle developed by Horiba Mira for UK Ministry of Defence

- 6.4.1 ROBOT CONSTRUCTION USING 3D PRINTING TECHNOLOGY

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS (2012-2022)

- TABLE 11 INNOVATIONS AND PATENT REGISTRATIONS

7 UNMANNED GROUND VEHICLES MARKET, BY MOBILITY

- 7.1 INTRODUCTION

- FIGURE 31 WHEELED UNMANNED GROUND VEHICLES SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 12 UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 13 UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- 7.2 WHEELED

- 7.2.1 INCREASING DEMAND FOR WHEELED ROBOTS FOR SURVEILLANCE APPLICATIONS TO PROPEL MARKET GROWTH

- 7.3 TRACKED

- 7.3.1 USE OF TRACKED ROBOTS FOR ROUGH, OFF-ROAD, AND UNPREDICTABLE TERRAINS TO RAISE MARKET DEMAND

- 7.4 HYBRID

- 7.4.1 DYNAMIC, FAST, AND ENERGY-EFFICIENT FEATURES OF HYBRID ROBOTS TO BE KEY FACTORS DRIVING MARKET GROWTH

- 7.5 LEGGED

- 7.5.1 HIGH ADAPTABILITY OF LEGGED ROBOTS FOR LARGE NUMBER OF APPLICATIONS TO BOOST THEIR DEMAND

8 UNMANNED GROUND VEHICLES MARKET, BY SIZE

- 8.1 INTRODUCTION

- FIGURE 32 SMALL UNMANNED GROUND VEHICLES SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 14 UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 15 UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- 8.2 SMALL (10-200 LBS)

- 8.2.1 DEMAND FOR SMALL UGVS ON RISE DUE TO COMPACT SIZE AND MANEUVERABILITY

- 8.3 MEDIUM (200-500 LBS)

- 8.3.1 MEDIUM UGVS CARRYING CRITICAL MISSIONS TO DRIVE SEGMENT GROWTH

- 8.4 LARGE (500-1,000 LBS)

- 8.4.1 LARGE UGVS TO HAVE HIGH DEMAND FOR MILITARY APPLICATIONS

- 8.5 VERY LARGE (1,000-2,000 LBS)

- 8.5.1 VERY LARGE ROBOTS TO BE USED FOR LONG-RANGE OPERATIONS DUE TO HIGH ENDURANCE

- 8.6 EXTREMELY LARGE (>2,000 LBS)

- 8.6.1 EXTREMELY LARGE ROBOTS MAINLY USED IN MILITARY AND COMMERCIAL APPLICATIONS TO BOOST SEGMENT DEMAND

9 UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION

- 9.1 INTRODUCTION

- FIGURE 33 AUTONOMOUS UNMANNED GROUND VEHICLES SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 16 UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2018-2021 (USD MILLION)

- TABLE 17 UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2022-2027 (USD MILLION)

- 9.2 TETHERED

- 9.2.1 ASSISTANCE FOR HUMANS FOR LINE-OF-SITE MISSION BY TETHERED OPERATIONS TO DRIVE MARKET GROWTH

- 9.3 TELEOPERATED

- 9.3.1 TELEOPERATED UGVS DEPLOYED FOR MINE DETECTION AND CLEARING OPERATIONS TO BOOST MARKET DEMAND

- 9.4 AUTONOMOUS

- FIGURE 34 SEMI-AUTONOMOUS UNMANNED GROUND VEHICLES SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 18 AUTONOMOUS UNMANNED GROUND VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 19 AUTONOMOUS UNMANNED GROUND VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 9.4.1 FULLY AUTONOMOUS

- 9.4.1.1 Fully autonomous UGVs to assist soldiers in target tracking, surveillance, and reconnaissance missions

- 9.4.2 SEMI-AUTONOMOUS

- 9.4.2.1 Semi-autonomous UGVs to have greater adoption as weapon platform

10 UNMANNED GROUND VEHICLES MARKET, BY SYSTEM

- 10.1 INTRODUCTION

- FIGURE 35 PAYLOAD SYSTEMS SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 20 UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 21 UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- 10.2 PAYLOADS

- 10.2.1 INCREASING DEMAND FOR SENSOR PAYLOADS FOR MILITARY UGVS TO DRIVE MARKET

- FIGURE 36 SENSOR PAYLOADS PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 22 UNMANNED GROUND VEHICLE PAYLOADS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 23 UNMANNED GROUND VEHICLE PAYLOADS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.2.2 SENSORS

- 10.2.2.1 Growth of UGVs in advanced military applications to increase demand for smaller, lighter, and less-expensive payloads

- 10.2.3 RADARS

- 10.2.3.1 Radars on land used as defense and surveillance tool to drive segment growth

- 10.2.4 LASERS

- 10.2.4.1 Robots equipped with laser designators to provide immediate targeting of assets by smart munitions

- 10.2.5 CAMERAS

- 10.2.5.1 UGVs equipped with different cameras to be used for specific applications

- 10.2.6 MOTOR ENCODERS

- 10.2.6.1 Availability of configurations of motor encoder payloads to drive market segment

- 10.2.7 ARTICULATED ARMS

- 10.2.7.1 Articulated arms to be widely used for surveillance activities

- 10.2.8 GPS ANTENNAS

- 10.2.8.1 Market for GPS antennas projected to grow at highest CAGR during forecast period

- 10.2.9 OTHER PAYLOADS

- 10.3 CONTROLLER SYSTEMS

- 10.3.1 GROWING DEMAND FOR UGVS TO ENABLE DEVELOPMENT OF COMPACT AND LIGHTWEIGHT CONTROL UNITS

- 10.4 NAVIGATION SYSTEMS

- 10.4.1 NAVIGATION SYSTEMS TO PLAY IMPORTANT ROLE IN MOBILITY OF UGVS

- 10.5 POWER SYSTEMS

- 10.5.1 DEVELOPMENT OF SOLAR RECHARGEABLE BATTERIES TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 37 SOLAR RECHARGEABLE BATTERIES PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 24 UNMANNED GROUND VEHICLE POWER SYSTEMS MARKET, BY BATTERY TYPE, 2018-2021 (USD MILLION)

- TABLE 25 UNMANNED GROUND VEHICLE POWER SYSTEMS MARKET, BY BATTERY TYPE, 2022-2027 (USD MILLION)

- 10.5.2 SOLAR RECHARGEABLE BATTERY

- 10.5.2.1 Technological advancements in solar-based power systems to raise market demand

- 10.5.3 ELECTRIC NON-SOLAR RECHARGEABLE BATTERY

- 10.5.3.1 Increasing use of efficient & long-lasting lithium-ion batteries in UGVs to amplify market

- 10.5.3.1.1 Lithium-ion battery

- 10.5.3.1.2 Sealed lead-acid battery

- 10.5.3.1.3 Nickel cadmium

- 10.5.3.1.4 Nickel metal hydride battery

- 10.5.3.1 Increasing use of efficient & long-lasting lithium-ion batteries in UGVs to amplify market

- 10.6 OTHER SYSTEMS

11 UNMANNED GROUND VEHICLES MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- FIGURE 38 MILITARY SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 26 UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 27 UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.2 MILITARY

- FIGURE 39 EXPLOSIVE ORDINANCE DISPOSAL (EOD) SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 28 UNMANNED GROUND VEHICLES MARKET FOR MILITARY APPLICATIONS, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 29 UNMANNED GROUND VEHICLES MARKET FOR MILITARY APPLICATIONS, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.1 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

- 11.2.1.1 UGVs in military sector to provide battlefield intelligence

- 11.2.2 SEARCH & RESCUE

- 11.2.2.1 UGVs for search & rescue applications to witness high adoption during forecast period

- 11.2.3 COMBAT SUPPORT

- 11.2.3.1 Combat support applications to grow at highest CAGR during forecast period

- 11.2.4 TRANSPORTATION

- 11.2.4.1 Increase in operation by reducing ratio of support personnel to combat troops enabled by transportation robots

- TABLE 30 MILITARY TRANSPORTATION ROBOTS, BY COMPANY

- 11.2.5 EXPLOSIVE ORDNANCE DISPOSAL (EOD)

- 11.2.5.1 Explosive Ordnance Disposal (EOD) robots to identify and neutralize dangerous objects

- FIGURE 40 EOD ROBOT PAYLOADS

- TABLE 31 EOD ROBOTS, BY COMPANY

- 11.2.6 MINE CLEARANCE

- 11.2.6.1 Mine reconnaissance and area clearance operations expanded by UGVs

- 11.2.7 FIREFIGHTING

- 11.2.7.1 Increase in use of firefighting robots to address fire situations to avoid casualties

- 11.2.8 OTHER MILITARY APPLICATIONS

- 11.3 LAW ENFORCEMENT

- 11.3.1 UGVS FOR LAW ENFORCEMENT APPLICATIONS SURGED DUE TO TERRORIST ACTIVITIES

- 11.4 FEDERAL LAW ENFORCEMENT

- 11.4.1 UGVS EXTENSIVELY USED BY FEDERAL LAW ENFORCEMENT AGENCIES FOR DANGEROUS MISSIONS

- 11.5 COMMERCIAL

- FIGURE 41 AUTONOMOUS DELIVERY SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 32 UNMANNED GROUND VEHICLES MARKET FOR COMMERCIAL APPLICATIONS, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 33 UNMANNED GROUND VEHICLES MARKET FOR COMMERCIAL APPLICATIONS, BY TYPE, 2022-2027 (USD MILLION)

- 11.5.1 FIREFIGHTING

- 11.5.1.1 Rise in use of robots to address accidents caused by fires and prevent casualties

- 11.5.2 OIL & GAS

- 11.5.2.1 Oil & gas industry to be major sector to use UGVs for more productivity and safety

- 11.5.3 AGRICULTURE

- 11.5.3.1 Use of UGVs in agriculture sector to boost productivity

- 11.5.4 CBRN

- 11.5.4.1 Protective action taken to prevent interaction, mitigation, and containment of CBRN agents using UGVs

- 11.5.5 AUTONOMOUS DELIVERY

- 11.5.5.1 Autonomous feature of UGVs to promote usage of UGVs for delivery services

- 11.5.6 PHYSICAL SECURITY

- 11.5.6.1 Autonomous robots to be used in physical security activities

12 UNMANNED GROUND VEHICLES MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 42 NORTH AMERICA HELD LARGEST SHARE OF UNMANNED GROUND VEHICLES MARKET IN 2022

- TABLE 34 UNMANNED GROUND VEHICLES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 UNMANNED GROUND VEHICLES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.2 NORTH AMERICA

- FIGURE 43 NORTH AMERICA: NUMBER OF UGVS DELIVERED IN 2021

- 12.2.1 PESTLE ANALYSIS: NORTH AMERICA

- FIGURE 44 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET SNAPSHOT

- TABLE 36 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 37 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 38 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 39 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 40 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2018-2021 (USD MILLION)

- TABLE 41 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2022-2027 (USD MILLION)

- TABLE 42 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 43 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 44 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 45 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- TABLE 46 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 47 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 Increasing R&D and venture capitalist activities in robotics aid market growth in US

- TABLE 48 US: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 49 US: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 50 US: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 51 US: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 52 US: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 53 US: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Technological developments in UGVs to fuel growth in unmanned ground vehicles market in Canada

- TABLE 54 CANADA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 55 CANADA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 56 CANADA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 57 CANADA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 58 CANADA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 59 CANADA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3 EUROPE

- FIGURE 45 EUROPE: NUMBER OF UGVS DELIVERED IN 2021

- 12.3.1 PESTLE ANALYSIS: EUROPE

- FIGURE 46 EUROPE: UNMANNED GROUND VEHICLES MARKET SNAPSHOT

- TABLE 60 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 61 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 62 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 63 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 64 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2018-2021 (USD MILLION)

- TABLE 65 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2022-2027 (USD MILLION)

- TABLE 66 EUROPE: AUTONOMOUS UNMANNED GROUND VEHICLES MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 67 EUROPE: AUTONOMOUS UNMANNED GROUND VEHICLES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 68 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 69 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 70 EUROPE: UNMANNED GROUND VEHICLES MARKET FOR MILITARY APPLICATIONS, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 71 EUROPE: UNMANNED GROUND VEHICLES MARKET FOR MILITARY APPLICATIONS, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 72 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 73 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- TABLE 74 EUROPE: UNMANNED GROUND VEHICLE PAYLOADS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 75 EUROPE: UNMANNED GROUND VEHICLE PAYLOADS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 76 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 77 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Investments to develop multi-functional and technologically advanced land robots to drive market growth in Germany

- TABLE 78 GERMANY: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 79 GERMANY: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 80 GERMANY: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 81 GERMANY: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 82 GERMANY: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 83 GERMANY: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.3 FRANCE

- 12.3.3.1 Increasing deployment of UGVs for security and surveillance missions to uplift market growth in France

- TABLE 84 FRANCE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 85 FRANCE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 86 FRANCE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 87 FRANCE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 88 FRANCE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 89 FRANCE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.4 UK

- 12.3.4.1 Increasing procurement of military UGVs resulting in growth of unmanned ground vehicles market in UK

- TABLE 90 UK: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 91 UK: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 92 UK: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 93 UK: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 94 UK: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 95 UK: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.5 POLAND

- 12.3.5.1 Development of UGVs equipped with advanced payloads resulting in increasing demand for UGVs in Poland

- TABLE 96 POLAND: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 97 POLAND: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 98 POLAND: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 99 POLAND: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 100 POLAND: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 101 POLAND: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.6 RUSSIA

- 12.3.6.1 Development and integration of autonomous and robotic systems in military force by Russian MoD to push market growth

- TABLE 102 RUSSIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 103 RUSSIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 104 RUSSIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 105 RUSSIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 106 RUSSIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 107 RUSSIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.7 REST OF EUROPE

- 12.3.7.1 Presence of major military robot manufacturing companies to contribute to market growth in Rest of Europe

- TABLE 108 REST OF EUROPE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 109 REST OF EUROPE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 110 REST OF EUROPE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 111 REST OF EUROPE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 112 REST OF EUROPE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 113 REST OF EUROPE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4 ASIA PACIFIC

- FIGURE 47 ASIA PACIFIC: NUMBER OF UGVS DELIVERED IN 2021

- 12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

- FIGURE 48 ASIA PACIFIC: REGIONAL SNAPSHOT

- TABLE 114 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 115 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 116 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 117 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 118 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2018-2021 (USD MILLION)

- TABLE 119 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2022-2027 (USD MILLION)

- TABLE 120 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 121 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 122 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 123 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- TABLE 124 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 125 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.4.2 JAPAN

- 12.4.2.1 Technologically advanced and significant defense budget for development of UGV technologies to drive Japanese market

- TABLE 126 JAPAN: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 127 JAPAN: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 128 JAPAN: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 129 JAPAN: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 130 JAPAN: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 131 JAPAN: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.3 AUSTRALIA

- 12.4.3.1 UGVs for search and track operation to boost market in Australia

- TABLE 132 AUSTRALIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 133 AUSTRALIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 134 AUSTRALIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 135 AUSTRALIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 136 AUSTRALIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 137 AUSTRALIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.4 CHINA

- 12.4.4.1 Patroling and RSTA operations by UGVs to fuel market in China

- TABLE 138 CHINA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 139 CHINA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 140 CHINA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 141 CHINA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 142 CHINA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 143 CHINA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.5 INDIA

- 12.4.5.1 Enhanced border surveillance by UGVs to combat increased cross-border terrorism to upscale market in India

- TABLE 144 INDIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 145 INDIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 146 INDIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 147 INDIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 148 INDIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 149 INDIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Large investments in robotics technologies to raise demand for unmanned ground vehicles in South Korea

- TABLE 150 SOUTH KOREA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 151 SOUTH KOREA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 152 SOUTH KOREA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 153 SOUTH KOREA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 154 SOUTH KOREA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 155 SOUTH KOREA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.7 REST OF ASIA PACIFIC

- 12.4.7.1 Growing demand for UGVs for security purposes to increase growth of UGVs market in Rest of Asia Pacific

- TABLE 156 REST OF ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.5 MIDDLE EAST

- FIGURE 49 MIDDLE EAST: NUMBER OF UGVS DELIVERED IN 2021

- 12.5.1 PESTLE ANALYSIS: MIDDLE EAST

- FIGURE 50 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET SNAPSHOT

- TABLE 162 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 163 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 164 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 165 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 166 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2018-2021 (USD MILLION)

- TABLE 167 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2022-2027 (USD MILLION)

- TABLE 168 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 169 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 170 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 171 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- TABLE 172 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 173 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.5.2 ISRAEL

- 12.5.2.1 Patrolling and RSTA purposes fulfilled by UGVs to boost market in Israel

- TABLE 174 ISRAEL: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 175 ISRAEL: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 176 ISRAEL: UNMANNED GROUND VEHICLES MARKET, BY SIZE , 2018-2021 (USD MILLION)

- TABLE 177 ISRAEL: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 178 ISRAEL: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 179 ISRAEL: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.5.3 SAUDI ARABIA

- 12.5.3.1 Investments in expanding military and security to fuel the growth of UGVs market in Arabia

- TABLE 180 SAUDI ARABIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 181 SAUDI ARABIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 182 SAUDI ARABIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 183 SAUDI ARABIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 184 SAUDI ARABIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 185 SAUDI ARABIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.5.4 UAE

- 12.5.4.1 Increased procurement of UGVs for firefighting to expand market in UAE

- TABLE 186 UAE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 187 UAE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 188 UAE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 189 UAE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 190 UAE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 191 UAE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.5.5 TURKEY

- 12.5.5.1 Increased procurement of UGVs for military operations to develop unmanned ground vehicles market in Turkey

- TABLE 192 TURKEY: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 193 TURKEY: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 194 TURKEY: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 195 TURKEY: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 196 TURKEY: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 197 TURKEY: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.5.6 REST OF MIDDLE EAST

- 12.5.6.1 Increasing requirement for unmanned systems for military operations to raise market demand in Rest of Middle East

- TABLE 198 REST OF MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 199 REST OF MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 200 REST OF MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 201 REST OF MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 202 REST OF MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 203 REST OF MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.6 REST OF THE WORLD

- FIGURE 51 REST OF THE WORLD: NUMBER OF UGVS DELIVERED IN 2021

- 12.6.1 PESTLE ANALYSIS: REST OF THE WORLD

- FIGURE 52 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET SNAPSHOT

- TABLE 204 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 205 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 206 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 207 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 208 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2018-2021 (USD MILLION)

- TABLE 209 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2022-2027 (USD MILLION)

- TABLE 210 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 211 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 212 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 213 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- TABLE 214 REST OF THE WORLD: UNMANNED GROUND VEHICLE PAYLOADS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 215 REST OF THE WORLD: UNMANNED GROUND VEHICLE PAYLOADS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 216 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 217 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.6.2 LATIN AMERICA

- TABLE 218 LATIN AMERICA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 219 LATIN AMERICA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 220 LATIN AMERICA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 221 LATIN AMERICA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 222 LATIN AMERICA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 223 LATIN AMERICA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.6.3 AFRICA

- TABLE 224 AFRICA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018-2021 (USD MILLION)

- TABLE 225 AFRICA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022-2027 (USD MILLION)

- TABLE 226 AFRICA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018-2021 (USD MILLION)

- TABLE 227 AFRICA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022-2027 (USD MILLION)

- TABLE 228 AFRICA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 229 AFRICA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- TABLE 230 KEY DEVELOPMENTS BY LEADING PLAYERS IN UNMANNED GROUND VEHICLES MARKET BETWEEN JANUARY 2019 AND MAY 2022

- 13.2 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2021

- TABLE 231 DEGREE OF COMPETITION

- FIGURE 53 REVENUE GENERATED BY MAJOR PLAYERS IN UNMANNED GROUND VEHICLES MARKET, 2021

- 13.3 REVENUE ANALYSIS 2019 - 2021

- FIGURE 54 COLLECTIVE REVENUE SHARE OF TOP 5 PLAYERS

- 13.4 RANK ANALYSIS, 2021

- FIGURE 55 REVENUE SHARE OF TOP 5 PLAYERS IN UNMANNED GROUND VEHICLES MARKET IN 2021

- TABLE 232 COMPANY REGION FOOTPRINT

- TABLE 233 COMPANY APPLICATION FOOTPRINT

- TABLE 234 COMPANY MOBILITY FOOTPRINT

- 13.5 COMPETITIVE EVALUATION QUADRANT

- 13.5.1 STARS

- 13.5.2 PERVASIVE COMPANIES

- 13.5.3 EMERGING LEADERS

- 13.5.4 PARTICIPANTS

- FIGURE 56 UNMANNED GROUND VEHICLES MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

- 13.6 COMPETITIVE BENCHMARKING

- FIGURE 57 UNMANNED GROUND VEHICLES MARKET COMPETITIVE LEADERSHIP MAPPING (SME), 2021

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 STARTING BLOCKS

- 13.6.4 DYNAMIC COMPANIES

- 13.7 DETAILED LIST & COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 235 UNMANNED GROUND VEHICLES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 236 UNMANNED GROUND VEHICLES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.8 COMPETITIVE SCENARIO

- 13.8.1 NEW PRODUCT LAUNCHES

- TABLE 237 NEW PRODUCT DEVELOPMENT, JANUARY 2019 - MAY 2022

- 13.8.2 DEALS

- TABLE 238 DEALS, JANUARY 2019- MAY 2022

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- (Business overview, Products offered, Recent developments, MnM view, Key Strengths/Right to win, Strategic choices made, and Weakness and competitive threats)**

- 14.2.1 NORTHROP GRUMMAN CORPORATION

- TABLE 239 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- FIGURE 58 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- TABLE 240 NORTHROP GRUMMAN CORPORATION: DEALS

- 14.2.2 LOCKHEED MARTIN

- TABLE 241 LOCKHEED MARTIN: BUSINESS OVERVIEW

- FIGURE 59 LOCKHEED MARTIN: COMPANY SNAPSHOT

- TABLE 242 LOCKHEED MARTIN: DEALS

- 14.2.3 BAE SYSTEMS

- TABLE 243 BAE SYSTEMS: BUSINESS OVERVIEW

- FIGURE 60 BAE SYSTEMS: COMPANY SNAPSHOT

- 14.2.4 RHEINMETALL AG

- TABLE 244 RHEINMETALL AG: BUSINESS OVERVIEW

- FIGURE 61 RHEINMETALL AG: COMPANY SNAPSHOT

- TABLE 245 RHEINMETALL AG: NEW PRODUCT DEVELOPMENT

- TABLE 246 RHEINMETALL AG: DEALS

- 14.2.5 QINETIQ

- TABLE 247 QINETIQ: BUSINESS OVERVIEW

- FIGURE 62 QINETIQ: COMPANY SNAPSHOT

- TABLE 248 QINETIQ: NEW PRODUCT DEVELOPMENT

- TABLE 249 QINETIQ: DEALS

- 14.2.6 GENERAL DYNAMICS

- TABLE 250 GENERAL DYNAMICS: BUSINESS OVERVIEW

- FIGURE 63 GENERAL DYNAMICS: COMPANY SNAPSHOT

- TABLE 251 GENERAL DYNAMICS: DEALS

- 14.2.7 THALES GROUP

- TABLE 252 THALES GROUP: BUSINESS OVERVIEW

- FIGURE 64 THALES GROUP: COMPANY SNAPSHOT

- 14.2.8 L3HARRIS TECHNOLOGIES

- TABLE 253 L3HARRIS TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 65 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 254 L3HARRIS TECHNOLOGIES: DEALS

- 14.2.9 ASELSAN A.S.

- TABLE 255 ASELSAN A.S.: BUSINESS OVERVIEW

- FIGURE 66 ASELSAN A.S.: COMPANY SNAPSHOT

- TABLE 256 ASELSAN A.S.: DEALS

- 14.2.10 TELEDYNE TECHNOLOGIES

- TABLE 257 TELEDYNE TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 67 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 258 TELEDYNE TECHNOLOGIES: DEALS

- 14.2.11 HEXAGON AB

- TABLE 259 HEXAGON AB: BUSINESS OVERVIEW

- FIGURE 68 HEXAGON AB: COMPANY SNAPSHOT

- 14.2.12 ISRAEL AEROSPACE INDUSTRIES

- TABLE 260 ISRAEL AEROSPACE INDUSTRIES: BUSINESS OVERVIEW

- FIGURE 69 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

- TABLE 261 ISRAEL AEROSPACE INDUSTRIES: NEW PRODUCT DEVELOPMENT

- TABLE 262 ISRAEL AEROSPACE INDUSTRIES: DEALS

- 14.2.13 ST ENGINEERING

- TABLE 263 ST ENGINEERING: BUSINESS OVERVIEW

- FIGURE 70 ST ENGINEERING: COMPANY SNAPSHOT

- TABLE 264 ST ENGINEERING: NEW PRODUCT DEVELOPMENT

- 14.2.14 ELBIT SYSTEMS

- TABLE 265 ELBIT SYSTEMS: BUSINESS OVERVIEW

- FIGURE 71 ELBIT SYSTEMS: COMPANY SNAPSHOT

- TABLE 266 ELBIT SYSTEMS: NEW PRODUCT DEVELOPMENT

- 14.2.15 ECA GROUP

- TABLE 267 ECA GROUP: BUSINESS OVERVIEW

- FIGURE 72 ECA GROUP: COMPANY SNAPSHOT

- TABLE 268 ECA GROUP: DEALS

- 14.2.16 MISTUBISHI ELECTRIC

- TABLE 269 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

- FIGURE 73 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

- TABLE 270 MITSUBISHI ELECTRIC: NEW PRODUCT DEVELOPMENT

- 14.2.17 LIG NEX 1

- TABLE 271 LIG NEX 1: BUSINESS OVERVIEW

- FIGURE 74 LIG NEX 1: COMPANY SNAPSHOT

- 14.2.18 OSHKOSH CORP.

- TABLE 272 OSHKOSH CORP.: BUSINESS OVERVIEW

- FIGURE 75 OSHKOSH CORP.: COMPANY SNAPSHOT

- 14.2.19 HYUNDAI MOTOR COMPANY

- TABLE 273 HYUNDAI MOTOR COMPANY: BUSINESS OVERVIEW

- FIGURE 76 HYUNDAI MOTOR COMPANY: COMPANY SNAPSHOT

- TABLE 274 HYUNDAI MOTOR COMPANY: NEW PRODUCT DEVELOPMENT

- 14.2.20 HORIBA LTD.

- TABLE 275 HORIBA LTD.: BUSINESS OVERVIEW

- FIGURE 77 HORIBA LTD.: COMPANY SNAPSHOT

- TABLE 276 HORIBA LTD.: DEALS

- 14.2.21 TEXTRON INC.

- TABLE 277 TEXTRON INC.: BUSINESS OVERVIEW

- FIGURE 78 TEXTRON INC.: COMPANY SNAPSHOT

- TABLE 278 TEXTRON INC.: NEW PRODUCT DEVELOPMENT

- TABLE 279 TEXTRON INC.: DEALS

- 14.3 OTHER PLAYERS

- 14.3.1 COBHAM PLC

- TABLE 280 COBHAM PLC: BUSINESS OVERVIEW

- 14.3.2 RE2, INC.

- TABLE 281 RE2, INC.; BUSINESS OVERVIEW

- 14.3.3 AUTONOMOUS SOLUTIONS, INC.

- TABLE 282 AUTONOMOUS SOLUTIONS, INC.: BUSINESS OVERVIEW

- TABLE 283 AUTONOMOUS SOLUTIONS, INC.: DEALS

- 14.3.4 ICOR TECHNOLOGY

- TABLE 284 ICOR TECHNOLOGY: BUSINESS OVERVIEW

- 14.3.5 NEXTER GROUP

- TABLE 285 NEXTER GROUP: BUSINESS OVERVIEW

- TABLE 286 NEXTER GROUP: NEW PRODUCT DEVELOPMENT

- *Details on Business overview, Products offered, Recent developments, MnM view, Key Strengths/Right to win, Strategic choices made, and Weakness and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATION

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS