|

|

市場調査レポート

商品コード

1149319

ジオメンブレンの市場:種類別 (HDPE、LDPE・LLDPE、PVC、EPDM、PP)・製造工程別 (押出加工、カレンダー加工)・用途別 (鉱業、廃棄物管理、水管理、土木建設)・地域別の将来予測 (2027年まで)Geomembranes Market by Type (HDPE, LDPE & LLDPE, PVC, EPDM, PP), Manufacturing Process (Extrusion, Calendering), Application (Mining, Waste Management, Water Management, Civil Construction), and Geography - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ジオメンブレンの市場:種類別 (HDPE、LDPE・LLDPE、PVC、EPDM、PP)・製造工程別 (押出加工、カレンダー加工)・用途別 (鉱業、廃棄物管理、水管理、土木建設)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年11月02日

発行: MarketsandMarkets

ページ情報: 英文 195 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のジオメンブレンの市場規模は、2022年の26億米ドルから、2027年には37億米ドルへと、予測期間中に7.6%のCAGRで成長すると予測されています。

ジオメンブレン市場の成長は主に、アジア太平洋や南米での採掘活動の増加、廃棄物や水の管理活動に対する高い需要などに起因しています。さらに、インフラ整備への支出の増加も、予測期間中の市場を牽引するものと思われます。しかし、原料価格の変動は市場の成長を制限する可能性があります。

"種類別では、HDPEメンブレンのセグメントが予測期間中に高いCAGRで成長する"

種類別では、HDPEがジオメンブレン市場で最大であり、また最も急速に成長しているセグメントです。HDPEメンブレンは低価格で入手可能で、他のポリエチレンタイプに比べ高密度 (0.94g/cm3以上) です。また、入手しやすく、長期間の耐久性があります。また、耐薬品性や耐紫外線性にも優れています。造園・鉱山・水産養殖・エネルギー・廃棄物・水など、さまざまな用途で使用されています。

"鉱業用途は、予測期間中に最大の市場シェアを有する"

鉱業はジオメンブレン市場において最大のアプリケーションとなることが予想されます。ジオメンブレンは、耐薬品性、高温度範囲、低透水性、耐候性、耐紫外線性、高い引裂・穿孔性などの優れた特性により、鉱山操業による環境への影響を抑制する封じ込めシステムを始め、鉱業におけるさまざまな用途に使用されています。

"予測期間中、アジア太平洋が最も高い成長率を示す"

アジア太平洋諸国は、鉱業・建設業に関連する開発活動の増加により、予測期間中に最も高い成長率を示すと予想されます。中国・インド・韓国・インドネシアなどの国々の人口の多さは、アジア太平洋の鉱業部門に大きなチャンスを与えています。また、人口が多いということは、廃棄物の発生量や清潔な水の需要も多いということであり、廃棄物や水の管理に対するニーズが高まることになります。このような要因が、同地域のジオメンブレン市場を牽引しています。

当レポートでは、世界のジオメンブレンの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・用途別・製造工程別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- バリューチェーン分析

- 研究開発

- 製造、配合、処方

- 流通、マーケティング、販売

- エコシステム

- 平均販売価格の分析

- 関税と規制の状況

- 技術分析

- 特許分析

- ケーススタディ分析

- マクロ経済指標

- GDPの動向と予測

- 鉱業の動向

- 建設統計

第6章 ジオメンブレン市場:種類別

- イントロダクション

- HDPE (高密度ポリエチレン)

- LDPE (低密度ポリエチレン)・LLDPE (鎖状低密度ポリエチレン)

- PVC (ポリ塩化ビニル)

- EPDM (エチレンプロピレンジエンモノマー)

- PP (ポリプロピレン)

- その他

第7章 ジオメンブレン市場:用途別

- イントロダクション

- 鉱業

- 廃棄物管理

- 水管理

- 土木建設

- その他

第8章 ジオメンブレン市場:製造工程別

- イントロダクション

- 押出加工

- カレンダー加工

- その他

第9章 ジオメンブレン市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- インドネシア

- 韓国

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- 他の欧州諸国

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- アラブ首長国連邦

- 他の中東・アフリカ諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

第10章 競合情勢

- 概要

- 市場評価フレームワーク

- 市場シェア (2021年)

- 市場ランキング

- 企業評価マトリックス:定義

- 競合リーダーシップ・マッピング

- 製品フットプリント (中小企業)

- 戦略フットプリント (中小企業)

- SOLMAX

- RAVEN INDUSTRIES

- AGRU

- CARLISLE CONSTRUCTION MATERIALS LLC

- ATARFIL

- 主な市場動向

- 買収

- 拡張

第11章 企業プロファイル

- 主要企業

- SOLMAX

- RAVEN INDUSTRIES

- AGRU

- CARLISLE CONSTRUCTION MATERIALS LLC

- ATARFIL

- FIRESTONE BUILDING PRODUCTS

- JUTA

- MACCAFERRI

- PLASTIKA KRITIS

- NAUE GROUP

- その他の企業

- ANHUI HUIFENG NEW SYNTHETIC MATERIALS

- CARTHAGE MILLS

- ENVIRONMENTAL PROTECTION

- GEOFABRICS

- GEOSYNTHETICS LIMITED

- GINEGAR PLASTIC PRODUCTS

- GLOBAL SYNTHETICS

- LAYFIELD GROUP

- CETCO

- NILEX

- SOTRAFA

- SOPREMA

- TEXEL INDUSTRIES LIMITED

- TITAN ENVIRONMENTAL CONTAINMENT

- US FABRICS

第12章 付録

The global geomembranes market size is expected to grow from USD 2.6 billion in 2022 to USD 3.7 billion by 2027, at a CAGR of 7.6% during the forecast period. The growth in the geomembrane market is primarily attributed to an increase in mining activities in APAC and South America, and high demand for waste and water management activities. Furthermore, an increase in spending on infrastructure development will also drive the market during the forecast period. However, fluctuations in raw material prices can restrict the growth of the market.

The HDPE membranes type segment is projected to grow at a higher CAGR during the forecast period

By type, HDPE is the largest as well as the fastest-growing segment in the geomembranes market. The geomembranes market has been categorized as HDPE, LDPE & LLDPE, PVC, EPDM, and PP. HDPE membranes are available for low price and has a dense configuration (>0.94 g/cm3) when compared with other polyethylene types. They are easily available and have long-term durability. They also possess excellent chemical and UV resistance. These membranes are used in various applications, such as landscaping, mining, aquaculture, energy, waste, and water.

The mining application is expected to have largest market share during the forecast period

Based on application, the geomembrane market has been categorized into mining, waste management, waste management, and civil construction. Mining is expected to be the largest application in the geomembranes market. Geomembranes have various applications in the mining industry such as containment system that restrains the effect of mining operations on the environment owing to their excellent properties such as chemical resistance, elevated temperature range, low permeability, weatherability, UV resistance, and high tear and puncture resistance.

APAC is expected to have the highest growth rate during the forecast period

APAC is expected to have the highest growth rate during the forecast period owing to an increase in development activity related to the mining and construction industry. The large population of countries like China, India, South Korea, Indonesia, and others countries provide huge opportunities for the mining sectors of APAC. Moreover, high population also results in high amount of waste generation and demand for clean water, which will, in turn, drive the need for waste and water management. The above-mentioned factors will drive the geomembrane market in this region.

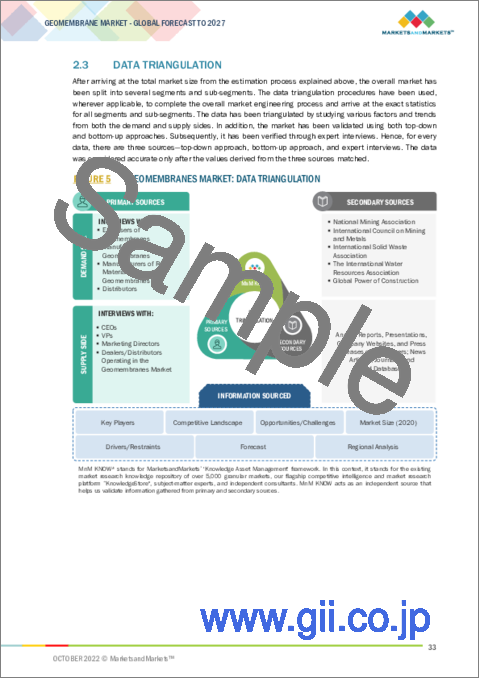

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the geomembranes marketplace.

- By Company Type - Tier 1: 30%, Tier: 40%, and Tier 3: 30%

- By Designation - C Level: 30%, Directors: 50%, Others: 20%

- By Region - APAC: 40%, Europe: 30%, North America: 10%, South America:10%, and Middle East & Africa: 10%

The geomembranes market comprises major solution providers, such as Solmax (Canada), Raven Industries (US), AGRU (Austria), Carlisle Construction Materials LLC (US), Atarfil (Spain), PLASTIKA KRITIS (Greece), JUTA (Czech Republic), Maccaferri (Italy), Firestone Building Products (US), The NAUE group (Germany), Anhui Huifeng New Synthetic Materials (China), Carthage Mills (US), Environmental Protection (US), Geofabrics (Australia), Geosynthetics Limited (UK), Ginegar Plastic Products (Israel), Global Synthetics (Australia), Layfield Group (Canada), CETCO (US), Nilex (Canada), SOTRAFA (Spain), SOPREMA (France), Texel Industries Limited (India), Titan Environmental Containment (Canada), and US Fabrics (US). The study includes an in-depth competitive analysis of these key players in the geomembranes market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The market study covers the geomembranes market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as provider, application, organization size, and region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants with the closest approximations of the geomembranes market revenue and its sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKET SEGMENTATION

- 1.4.2 REGIONS COVERED

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 GEOMEMBRANES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- FIGURE 2 GEOMEMBRANES MARKET ANALYSIS THROUGH SECONDARY RESEARCH

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 GEOMEMBRANES MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 GEOMEMBRANES MARKET: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 5 GEOMEMBRANES MARKET: DATA TRIANGULATION

- 2.4 LIMITATIONS

- 2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 6 HDPE GEOMEMBRANES TO DOMINATE MARKET IN 2022

- FIGURE 7 MINING APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 APAC TO BE FASTEST-GROWING GEOMEMBRANES MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN GEOMEMBRANES MARKET

- FIGURE 9 HIGH GROWTH PROJECTED DURING FORECAST PERIOD

- 4.2 GEOMEMBRANES MARKET, BY TYPE

- FIGURE 10 HDPE TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- 4.3 GEOMEMBRANES MARKET, BY APPLICATION

- FIGURE 11 MINING TO DOMINATE GEOMEMBRANES APPLICATIONS MARKET

- 4.4 GLOBAL GEOMEMBRANES MARKET, BY COUNTRY

- FIGURE 12 INDIA TO REGISTER HIGHEST CAGR

- 4.5 APAC: GEOMEMBRANES MARKET, BY APPLICATION AND COUNTRY, 2022

- FIGURE 13 MINING SEGMENT AND CHINA TO HOLD LARGEST SHARES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 DRIVERS, RESTRAINTS, AND OPPORTUNITIES IN GEOMEMBRANES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increased mining activities in APAC and South America

- FIGURE 15 APAC TO LEAD GLOBAL MINING INDUSTRY

- 5.2.1.2 Growing concerns for waste and water management activities

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuating raw material prices on account of volatility in crude oil prices

- FIGURE 16 CRUDE OIL PRICE FLUCTUATIONS, 2001-2020

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing spending on infrastructural developments

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT FROM SUBSTITUTES

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 THREAT FROM NEW ENTRANTS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 18 VALUE CHAIN ANALYSIS

- 5.4.1 RESEARCH & DEVELOPMENT

- 5.4.2 MANUFACTURING, COMPOUNDING, AND FORMULATION

- 5.4.3 DISTRIBUTION, MARKETING, AND SALES

- 5.5 ECOSYSTEM

- FIGURE 19 GEOMEMBRANES MARKET ECOSYSTEM

- 5.6 AVERAGE SELLING PRICE ANALYSIS

- FIGURE 20 PRICE ANALYSIS FOR GEOMEMBRANES MARKET

- 5.7 TARIFF AND REGULATORY LANDSCAPE

- TABLE 1 REGULATORY LANDSCAPE, BY REGION/COUNTRY

- 5.8 TECHNOLOGY ANALYSIS

- 5.9 PATENT ANALYSIS

- 5.9.1 OVERVIEW

- 5.9.1.1 Methodology

- TABLE 2 PATENT ANALYSIS

- FIGURE 21 PATENT APPLICATIONS FOR GEOMEMBRANES MARKET

- FIGURE 22 GLOBAL PACE OF PATENT PROPAGATION

- FIGURE 23 PATENT JURISDICTION ANALYSIS

- FIGURE 24 TOP APPLICANTS

- TABLE 3 LIST OF PATENTS: UNIVERSITY OF HOHAI

- TABLE 4 LIST OF PATENTS: BEIJING GEO ENVIRON ENGINEERING & TECHNOLOGY

- TABLE 5 LIST OF PATENTS: POWERCHINA HUADONG ENGINEERING CORP LTD.

- TABLE 6 LIST OF PATENTS: WATERSHED GEOSYNTHETICS LLC

- 5.9.1 OVERVIEW

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 EXTREME SLOPE WITH AGRU HDPE GEOMEMBRANE

- 5.10.2 SINGAPORE LANDFILL

- 5.11 MACROECONOMIC INDICATORS

- 5.11.1 GDP TRENDS AND FORECASTS

- TABLE 7 PROJECTED GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2018-2021

- 5.11.2 TRENDS IN MINING INDUSTRY

- TABLE 8 MINERAL PRODUCTION STATISTICS, BY REGION, 2014-2018 (BILLION METRIC TONS)

- 5.11.3 CONSTRUCTION STATISTICS

- TABLE 9 VALUE-ADDED STATISTICS IN INDUSTRIES (INCLUDING CONSTRUCTION), BY COUNTRY, 2018 (USD MILLION)

6 GEOMEMBRANES MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 25 HDPE GEOMEMBRANES TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 10 POTENTIAL ADVANTAGES AND DISADVANTAGES OF SOME TYPES

- TABLE 11 APPROXIMATE WEIGHT PERCENTAGE FORMULATIONS OF SOME TYPES

- TABLE 12 GEOMEMBRANES MARKET SIZE, BY TYPE, 2018-2021 (MILLION SQUARE METER)

- TABLE 13 GEOMEMBRANES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 14 GEOMEMBRANES MARKET SIZE, BY TYPE, 2022-2027 (MILLION SQUARE METER)

- TABLE 15 GEOMEMBRANES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 6.2 HDPE

- 6.2.1 HDPE TO ACCOUNT FOR LARGEST MARKET SHARE

- 6.3 LDPE & LLDPE

- 6.3.1 LOW DENSITY ALONG WITH HIGH ELASTICITY AND FLEXIBILITY TO BOOST DEMAND

- 6.4 PVC

- 6.4.1 BETTER QUALITY OF PVC GEOMEMBRANES TO SUPPORT USAGE

- 6.5 EPDM

- 6.5.1 SUPERIOR PROPERTIES OF EPDM GEOMEMBRANES TO BOOST DEMAND

- 6.6 PP

- 6.6.1 LOW LEVELS OF CRYSTALLINITY IN PP TO DRIVE END-USER PREFERENCE

- 6.7 OTHERS

7 GEOMEMBRANES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 26 MINING TO HOLD LARGEST SHARE OF APPLICATIONS MARKET

- TABLE 16 GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 17 GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 18 GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 19 GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.2 MINING

- 7.2.1 MINING TO DOMINATE APPLICATIONS MARKET

- TABLE 20 GEOMEMBRANES MARKET SIZE FOR MINING, BY REGION, 2018-2021 (MILLION SQUARE METER)

- TABLE 21 GEOMEMBRANES MARKET SIZE FOR MINING, BY REGION, 2018-2021 (USD MILLION)

- TABLE 22 GEOMEMBRANES MARKET SIZE FOR MINING, BY REGION, 2022-2027 (MILLION SQUARE METER)

- TABLE 23 GEOMEMBRANES MARKET SIZE FOR MINING, BY REGION, 2022-2027 (USD MILLION)

- 7.3 WASTE MANAGEMENT

- 7.3.1 POPULATION GROWTH TO DRIVE WASTE MANAGEMENT ACTIVITIES

- TABLE 24 GEOMEMBRANES MARKET SIZE FOR WASTE MANAGEMENT, BY REGION, 2018-2021 (MILLION SQUARE METER)

- TABLE 25 GEOMEMBRANES MARKET SIZE FOR WASTE MANAGEMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 26 GEOMEMBRANES MARKET SIZE FOR WASTE MANAGEMENT, BY REGION, 2022-2027 (MILLION SQUARE METER)

- TABLE 27 GEOMEMBRANES MARKET SIZE FOR WASTE MANAGEMENT, BY REGION, 2022-2027 (USD MILLION)

- 7.4 WATER MANAGEMENT

- 7.4.1 GEOMEMBRANES USAGE TO PREVENT CONTAMINATION OF GROUNDWATER TO DRIVE MARKET

- TABLE 28 GEOMEMBRANES MARKET SIZE FOR WATER MANAGEMENT, BY REGION, 2018-2021 (MILLION SQUARE METER)

- TABLE 29 GEOMEMBRANES MARKET SIZE FOR WATER MANAGEMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 30 GEOMEMBRANES MARKET SIZE FOR WATER MANAGEMENT, BY REGION, 2022-2027 (MILLION SQUARE METER)

- TABLE 31 GEOMEMBRANES MARKET SIZE FOR WATER MANAGEMENT, BY REGION, 2022-2027 (USD MILLION)

- 7.5 CIVIL CONSTRUCTION

- 7.5.1 POTENTIAL TO PREVENT WATER SEEPAGE TO DRIVE USE OF GEOMEMBRANES IN CIVIL CONSTRUCTION

- TABLE 32 GEOMEMBRANES MARKET SIZE FOR CIVIL CONSTRUCTION, BY REGION, 2018-2021 (MILLION SQUARE METER)

- TABLE 33 GEOMEMBRANES MARKET SIZE FOR CIVIL CONSTRUCTION, BY REGION, 2018-2021 (USD MILLION)

- TABLE 34 GEOMEMBRANES MARKET SIZE FOR CIVIL CONSTRUCTION, BY REGION, 2022-2027 (MILLION SQUARE METER)

- TABLE 35 GEOMEMBRANES MARKET SIZE FOR CIVIL CONSTRUCTION, BY REGION, 2022-2027 (USD MILLION)

- 7.6 OTHERS

- TABLE 36 GEOMEMBRANES MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018-2021 (MILLION SQUARE METER)

- TABLE 37 GEOMEMBRANES MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 38 GEOMEMBRANES MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2022-2027 (MILLION SQUARE METER)

- TABLE 39 GEOMEMBRANES MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2022-2027 (USD MILLION)

8 GEOMEMBRANES MARKET, BY MANUFACTURING PROCESS

- 8.1 INTRODUCTION

- 8.2 EXTRUSION

- 8.2.1 WIDE USAGE OF BLOWN-FILM EXTRUSION TO DRIVE MARKET GROWTH

- 8.3 CALENDERING

- 8.3.1 HIGH PRODUCTION RATE AND ACCURACY TO SPECIFICATIONS DRIVING GROWTH OF CALENDERING

- 8.4 OTHERS

9 GEOMEMBRANES MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 27 APAC TO REGISTER HIGHEST GROWTH

- TABLE 40 GEOMEMBRANES MARKET SIZE, BY REGION, 2018-2021 (MILLION SQUARE METER)

- TABLE 41 GEOMEMBRANES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 42 GEOMEMBRANES MARKET SIZE, BY REGION, 2022-2027 (MILLION SQUARE METER)

- TABLE 43 GEOMEMBRANES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 9.2 APAC

- FIGURE 28 APAC: GEOMEMBRANES MARKET SNAPSHOT

- TABLE 44 APAC: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2018-2021 (MILLION SQUARE METER)

- TABLE 45 APAC: GEOMEMBRANE MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 46 APAC: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2022-2027 (MILLION SQUARE METER)

- TABLE 47 APAC: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 48 APAC: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 49 APAC: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 50 APAC: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 51 APAC: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 52 APAC: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018-2021 (MILLION SQUARE METER)

- TABLE 53 APAC: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 54 APAC: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022-2027 (MILLION SQUARE METER)

- TABLE 55 APAC: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 9.2.1 CHINA

- 9.2.1.1 China to dominate APAC geomembranes market

- TABLE 56 CHINA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 57 CHINA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 58 CHINA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 59 CHINA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2.2 INDIA

- 9.2.2.1 Industrialization and urbanization to drive market growth

- TABLE 60 INDIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 61 INDIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 62 INDIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 63 INDIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2.3 JAPAN

- 9.2.3.1 Government investments in construction industry to drive market

- TABLE 64 JAPAN: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 65 JAPAN: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 66 JAPAN: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 67 JAPAN: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2.4 AUSTRALIA

- 9.2.4.1 Ongoing projects for improving infrastructure to boost market

- TABLE 68 AUSTRALIA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 69 AUSTRALIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 70 AUSTRALIA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 71 AUSTRALIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2.5 INDONESIA

- 9.2.5.1 Civil construction projects to drive demand for geomembranes

- TABLE 72 INDONESIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 73 INDONESIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 74 INDONESIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 75 INDONESIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2.6 SOUTH KOREA

- 9.2.6.1 Government initiatives to support construction industry and end-user demand

- TABLE 76 SOUTH KOREA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 77 SOUTH KOREA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 78 SOUTH KOREA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 79 SOUTH KOREA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2.7 REST OF APAC

- TABLE 80 REST OF APAC: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 81 REST OF APAC: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 82 REST OF APAC: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 83 REST OF APAC: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.3 EUROPE

- FIGURE 29 EUROPE: GEOMEMBRANES MARKET SNAPSHOT

- TABLE 84 EUROPE: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2018-2021 (MILLION SQUARE METER)

- TABLE 85 EUROPE: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 86 EUROPE: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2022-2027 (MILLION SQUARE METER)

- TABLE 87 EUROPE: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 88 EUROPE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 89 EUROPE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 90 EUROPE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 91 EUROPE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 92 EUROPE: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018-2021 (MILLION SQUARE METER)

- TABLE 93 EUROPE: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 94 EUROPE: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022-2027 (MILLION SQUARE METER)

- TABLE 95 EUROPE: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Residential infrastructure to drive demand for geomembranes

- TABLE 96 GERMANY: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 97 GERMANY: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 98 GERMANY: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 99 GERMANY: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Upcoming projects in construction to boost market

- TABLE 100 UK: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 101 UK: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 102 UK: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 103 UK: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Growing construction industry and foreign investments to drive market

- TABLE 104 FRANCE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 105 FRANCE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 106 FRANCE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 107 FRANCE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Waste management and civil constructions to influence geomembranes market

- TABLE 108 ITALY: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 109 ITALY: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 110 ITALY: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 111 ITALY: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Huge investments in construction projects to influence market

- TABLE 112 SPAIN: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 113 SPAIN: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 114 SPAIN: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 115 SPAIN: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.3.6 RUSSIA

- 9.3.6.1 Government investments to support construction industry

- TABLE 116 RUSSIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 117 RUSSIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 118 RUSSIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 119 RUSSIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.3.7 REST OF EUROPE

- TABLE 120 REST OF EUROPE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 121 REST OF EUROPE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 122 REST OF EUROPE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 123 REST OF EUROPE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.4 NORTH AMERICA

- FIGURE 30 NORTH AMERICA: GEOMEMBRANES MARKET SNAPSHOT

- TABLE 124 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2018-2021 (MILLION SQUARE METER)

- TABLE 125 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 126 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2022-2027 (MILLION SQUARE METER)

- TABLE 127 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 128 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 129 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 130 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 131 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 132 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018-2021 (MILLION SQUARE METER)

- TABLE 133 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 134 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022-2027 (MILLION SQUARE METER)

- TABLE 135 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 9.4.1 US

- 9.4.1.1 US to dominate North American market

- TABLE 136 US: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 137 US: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 138 US: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 139 US: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 9.4.2 CANADA

- 9.4.2.1 Government initiatives for construction sector to drive market

- TABLE 140 CANADA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 141 CANADA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 142 CANADA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 143 CANADA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.4.3 MEXICO

- 9.4.3.1 Government policies and trade relationships to drive construction industry

- TABLE 144 MEXICO: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 145 MEXICO: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 146 MEXICO: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 147 MEXICO: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.5 MIDDLE EAST & AFRICA

- TABLE 148 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2018-2021 (MILLION SQUARE METER)

- TABLE 149 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2022-2027 (MILLION SQUARE METER)

- TABLE 151 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 153 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 155 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018-2021 (MILLION SQUARE METER)

- TABLE 157 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022-2027 (MILLION SQUARE METER)

- TABLE 159 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 9.5.1 SAUDI ARABIA

- 9.5.1.1 Support for residential construction sector to drive growth

- TABLE 160 SAUDI ARABIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 161 SAUDI ARABIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 162 SAUDI ARABIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 163 SAUDI ARABIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 Rising government focus on construction to drive geomembrane demand

- TABLE 164 SOUTH AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND SQUARE METER)

- TABLE 165 SOUTH AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 166 SOUTH AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 167 SOUTH AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.5.3 UAE

- 9.5.3.1 Political and economic stability to drive investments in construction industry

- TABLE 168 UAE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 169 UAE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 170 UAE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 171 UAE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 172 REST OF MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 173 REST OF MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 174 REST OF MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 175 REST OF MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.6 SOUTH AMERICA

- TABLE 176 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2018-2021 (MILLION SQUARE METER)

- TABLE 177 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION )

- TABLE 178 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2022-2027 (MILLION SQUARE METER)

- TABLE 179 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 180 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 181 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 182 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 183 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 184 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018-2021 (MILLION SQUARE METER)

- TABLE 185 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 186 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022-2027 (MILLION SQUARE METER)

- TABLE 187 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 9.6.1 BRAZIL

- 9.6.1.1 High population to drive demand for infrastructure and geomembranes

- TABLE 188 BRAZIL: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 189 BRAZIL: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 190 BRAZIL: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 191 BRAZIL: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.6.2 ARGENTINA

- 9.6.2.1 Growing opportunities in mining to drive market

- TABLE 192 ARGENTINA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 193 ARGENTINA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 194 ARGENTINA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 195 ARGENTINA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.6.3 REST OF SOUTH AMERICA

- TABLE 196 REST OF SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (MILLION SQUARE METER)

- TABLE 197 REST OF SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 198 REST OF SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (MILLION SQUARE METER)

- TABLE 199 REST OF SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- FIGURE 31 KEY GROWTH STRATEGIES ADOPTED BETWEEN 2017 AND 2022

- 10.2 MARKET EVALUATION FRAMEWORK

- 10.3 MARKET SHARE, 2021

- FIGURE 32 TOP FIVE COMPANIES ACCOUNTED FOR DOMINANT MARKET SHARE IN 2021

- 10.4 MARKET RANKING

- FIGURE 33 SOLMAX DOMINATED MARKET IN 2021

- 10.5 COMPANY EVALUATION MATRIX DEFINITIONS

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 34 COMPANY EVALUATION MATRIX, 2021

- FIGURE 35 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN GEOMEMBRANES MARKET

- FIGURE 36 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN GEOMEMBRANES MARKET

- 10.6 COMPETITIVE LEADERSHIP MAPPING FOR SMES

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 37 GEOMEMBRANES MARKET COMPETITIVE LEADERSHIP MAPPING FOR SMES, 2021

- 10.7 PRODUCT FOOTPRINT (SMES)

- FIGURE 38 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS IN GEOMEMBRANES (SMES) MARKET

- 10.8 STRATEGY FOOTPRINT (SMES)

- FIGURE 39 STRATEGY FOOTPRINT ANALYSIS OF TOP PLAYERS IN GEOMEMBRANES (SMES) MARKET

- 10.8.1 SOLMAX

- 10.8.2 RAVEN INDUSTRIES

- 10.8.3 AGRU

- 10.8.4 CARLISLE CONSTRUCTION MATERIALS LLC

- 10.8.5 ATARFIL

- 10.9 KEY MARKET DEVELOPMENTS

- 10.9.1 ACQUISITIONS

- TABLE 200 ACQUISITIONS, 2017-2022

- 10.9.2 EXPANSIONS

- TABLE 201 EXPANSIONS, 2017-2022

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- (Business Overview, Solutions, Products & Services, Recent Developments, MnM View)**

- 11.1.1 SOLMAX

- TABLE 202 SOLMAX: BUSINESS OVERVIEW

- 11.1.2 RAVEN INDUSTRIES

- TABLE 203 RAVEN INDUSTRIES: BUSINESS OVERVIEW

- FIGURE 40 RAVEN INDUSTRIES: COMPANY SNAPSHOT

- 11.1.3 AGRU

- TABLE 204 AGRU: BUSINESS OVERVIEW

- 11.1.4 CARLISLE CONSTRUCTION MATERIALS LLC

- TABLE 205 CARLISLE CONSTRUCTION MATERIALS LLC: BUSINESS OVERVIEW

- 11.1.5 ATARFIL

- TABLE 206 ATARFIL: BUSINESS OVERVIEW

- 11.1.6 FIRESTONE BUILDING PRODUCTS

- TABLE 207 FIRESTONE BUILDING PRODUCTS: BUSINESS OVERVIEW

- 11.1.7 JUTA

- TABLE 208 JUTA: BUSINESS OVERVIEW

- 11.1.8 MACCAFERRI

- TABLE 209 MACCAFERRI: BUSINESS OVERVIEW

- 11.1.9 PLASTIKA KRITIS

- TABLE 210 PLASTIKA KURTIS: BUSINESS OVERVIEW

- 11.1.10 NAUE GROUP

- TABLE 211 NAUE GROUP: BUSINESS OVERVIEW

- *Details on Business Overview, Solutions, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 11.2 ADDITIONAL PLAYERS

- 11.2.1 ANHUI HUIFENG NEW SYNTHETIC MATERIALS

- 11.2.2 CARTHAGE MILLS

- 11.2.3 ENVIRONMENTAL PROTECTION

- 11.2.4 GEOFABRICS

- 11.2.5 GEOSYNTHETICS LIMITED

- 11.2.6 GINEGAR PLASTIC PRODUCTS

- 11.2.7 GLOBAL SYNTHETICS

- 11.2.8 LAYFIELD GROUP

- 11.2.9 CETCO

- 11.2.10 NILEX

- 11.2.11 SOTRAFA

- 11.2.12 SOPREMA

- 11.2.13 TEXEL INDUSTRIES LIMITED

- 11.2.14 TITAN ENVIRONMENTAL CONTAINMENT

- 11.2.15 US FABRICS

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 AVAILABLE CUSTOMIZATIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS