|

|

市場調査レポート

商品コード

1121211

ナノ衛星・マイクロ衛星の世界市場:コンポーネント別 (ハードウェア、ソフトウェア)・用途別・種類別 (ナノ衛星、マイクロ衛星)・組織規模別・業種別 (政府、民間、商業)・軌道別・周波数別・地域別の将来予測 (2027年まで)Nanosatellite and Microsatellite Market by Component (Hardware, Software), Application, Type (Nanosatellite, Microsatellite), Organization Size, Vertical (Government, Civil, Commercial), Orbit, Frequency and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ナノ衛星・マイクロ衛星の世界市場:コンポーネント別 (ハードウェア、ソフトウェア)・用途別・種類別 (ナノ衛星、マイクロ衛星)・組織規模別・業種別 (政府、民間、商業)・軌道別・周波数別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年08月23日

発行: MarketsandMarkets

ページ情報: 英文 254 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のナノ衛星・マイクロ衛星の市場規模は、2022年に28億米ドル、2027年には67億米ドルに成長し、予測期間中のCAGRは19.3%と予測されています。

"組織規模別では、予測期間中、大企業の部門が最も高い市場シェアを獲得"

大企業 (従業員数1,000人以上の組織) におけるナノ衛星の採用は、今後増加することが予想されます。電子機器の小型化における絶え間ない革新と技術進歩は、ナノ衛星の打ち上げ件数における大企業の比率を大きく拡大すると予想されます。

"用途別では、地球観測・リモートセンシング部門が予測期間中により大きな市場規模を保持する"

地球観測・リモートセンシング部門の市場成長を促進すると予想される要因には、AIとビッグデータの導入による地理空間画像分析の著しい進歩、宇宙産業の民営化、クラウドコンピューティングの成長などがあります。

"業界別では、商用分野が予測期間中に最も高い市場シェアで成長する"

マイクロ衛星は短時間で建設でき、商業用として打ち上げられるため、民間企業にとって魅力的な投資対象です。ナノ衛星の商業的用途には、音声、データ、ビデオ、インターネット、通信、会議などがあります。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と動向

- イントロダクション

- 市場力学

- 産業動向

- バリューチェーン

- エコシステム

- ポーターのファイブフォースモデル

- 主な利害関係者と購入基準

- 技術分析

- 顧客に影響を与える傾向と混乱

- 特許分析

- 価格分析

- ユースケース

- 主な会議とイベント (2022年)

- 関税・規制の影響

第6章 ナノ衛星・マイクロ衛星市場:コンポーネント別

- イントロダクション

- ハードウェア

- 構造

- ペイロード

- 通信システム

- オンボードコンピュータ

- 電力システム

- 推進システム

- ソフトウェア・データ処理

- コマンド・データ処理

- 姿勢決定・制御システム

- 宇宙サービス

- 打ち上げサービス

第7章 ナノ衛星・マイクロ衛星市場:種類別

- イントロダクション

- ナノ衛星

- マイクロ衛星

第8章 ナノ衛星・マイクロ衛星市場:組織規模別

- イントロダクション

- 大企業

- 中小企業

第9章 ナノ衛星・マイクロ衛星市場:用途別

- イントロダクション

- 通信

- 地球観測・リモートセンシング

- 科学研究

- 生物学的実験

- 技術デモンストレーション・検証

- 学校教育

- マッピング・ナビゲーション

- 偵察

第10章 ナノ衛星・マイクロ衛星市場:軌道別

- イントロダクション

- 非極傾斜

- 太陽同期軌道

- 極周回軌道

第11章 ナノ衛星・マイクロ衛星市場:業種別

- イントロダクション

- 政府

- 民間

- 商業

- 防衛

- エネルギー・インフラ

- 海洋・運送

第12章 ナノ衛星・マイクロ衛星市場:周波数別

- イントロダクション

- UHF帯

- VHF帯

- Sバンド

- Xバンド

- KAバンド

- その他

第13章 ナノ衛星・マイクロ衛星市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ロシア

- フランス

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 中東

- アフリカ

- ラテンアメリカ

第14章 競合情勢

- 概要

- 市場評価フレームワーク

- 競合シナリオと動向

- 製品の発売

- 資本取引

- トップ企業のシェア分析

- 過去の収益分析

- 企業評価マトリックス:概要

- 企業の製品フットプリント分析

- 企業の市場ランキング分析

- 新興企業/中小企業の評価マトリックス:調査手法と定義

- 中小企業/新興企業向けの競合ベンチマーキング

第15章 企業プロファイル

- 主要企業

- GOMSPACE

- LOCKHEED MARTIN

- L3HARRIS

- SIERRA NEVADA CORPORATION

- AAC CLYDE SPACE

- PLANET LABS

- SURREY SATELLITE TECHNOLOGY

- NORTHROP GRUMMAN

- OHB SE

- TYVAK

- RAYTHEON INTELLIGENCE & SPACE

- PUMPKIN

- BEYOND GRAVITY

- MILLENNIUM SPACE SYSTEMS

- EXOLAUNCH

- NANOAVIONICS

- GAUSS

- AXELSPACE

- SPIRE GLOBAL

- スタートアップ・中小企業

- C3S

- SWARM

- ALEN SPACE

- DAURIA AEROSPACE

- SATLANTIS

- DHRUVA SPACE

- ASTROCAST

- KEPLER AEROSPACE

第16章 隣接・関連市場

- イントロダクション

- 小型衛星市場

第17章 付録

MarketsandMarkets forecasts the global nanosatellite and microsatellite Market size is expected to grow USD 2.8 billion in 2022 to USD 6.7 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 19.3% during the forecast period.

"By Organization Size, the Large Enterprises segment have the highest market share during the forecast period"

Organizations with more than 1,000 employees are considered large enterprises. The adoption of nanosatellites and microsatellites among large enterprises is expected to increase in the coming years. With advancements in miniaturized technology, these satellites are useful for high precision and complex space missions such as remote-sensing and navigation, maritime and transport management, space and earth observations, disaster management, military intelligence, telecommunication, and other academic purposes. Constant innovation and technological advances in miniaturizations of electronics are expected to boost the growth of large enterprises significantly in the proportion of nanosatellite launches.

"By Application, the Earth Observation and Remote Sensing segment to hold the larger market size during the forecast period"

Earth observation and remote sensing refer to the acquisition of data related to the physical characteristics of Earth without making actual contact. It allows the study of various features of Earth. Some of the factors that are expected to fuel the growth of Earth observation and remote sensing applications are significant advancements in geospatial imagery analytics with the introduction of AI and big data, privatization of the space industry, and the growth of cloud computing.

Nanosatellites and Microsatellites have created new possibilities for Earth observation and remote sensing, which makes use of low-cost miniature satellites to capture images of the Earth and collect data. Due to their improved computing and communication capabilities, as well as proficiencies in making decisions about the time and data to be shared. Small satellites can produce complex images of high quality because of the successful programs that develop and test new hyperspectral imaging systems that are compatible nanosatellite and microsatellite missions. The current hyperspectral data analysis software applications allow for speedy processing, analysis, and interpretation of these images. They assist in keeping an eye on events like hurricanes, storms, floods fires, volcanic eruptions, earthquakes, landslides, oil slicks, environmental pollution, and accidents at factories and power plants.

"By Vertical, the Commercial segment is expected to grow at the highest market share during the forecast period"

Due to their quicker construction and ability to be launched for commercial use, small satellites are an attractive investment for private companies. The commercial sector has been driven by geospatial technology using earth imaging small satellites for agriculture, education, intelligence navigation, mapping, and other uses over the last decade. Nanosatellites and microsatellite help commercial businesses to collect global real-time data and disseminate it to their clients across a vast geographic region for a remarkably low cost. Commercial uses for nanosatellites and microsatellites include voice, data, videos, internet, communication, and conferencing.

The breakup of the profiles of the primary participants is given below:

- By Company: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-Level Executives - 35%, Directors- 25%, Others*-40%

- By Region: North America - 45%, Europe - 20%, Asia Pacific - 30%, Rest of the World - 5%

This research study outlines the market potential, market dynamics, and major vendors operating in the nanosatellite and microsatellite market. Key and innovative vendors in the nanosatellite and microsatellite Market include GomSpace (Denmark), Lockheed Martin (US), L3Harris (US), Sierra Nevada Corporation (US), AAC Clyde Space (Scotland), Planet Labs (US), Surrey Satellite Technology (UK), Northrop Grumman (US), OHB SE (Germany), Tyvak (US), Raytheon Intelligence and Space (US), Pumpkin Space Systems (US), Beyond Gravity (Switzerland), Millennium Space Systems (US), Exolaunch (Germany), Axelspace (US), Nanoavionics (US), GAUSS (Italy), Spire Global (US), Dauria Space (Russia), C3S (Hungary), Swarm (US), Alen Space (Spain), Satlantis (Spain), Dhruva Space (India), Astrocast (Switzerland), Kepler Aerospace (India).

Research Coverage

nanosatellite and microsatellite market is segmented on component, type, deployment type, organization size, orbit, application, vertical, frequency and region. A detailed analysis of the key industry players has been undertaken to provide insights into their business overviews; services; key strategies; new service and product launches; partnerships, agreements, and collaborations; business expansions; and competitive landscape associated with the nanosatellite and microsatellite market.

Key benefits of buying the report

The report is expected to help the market leaders/new entrants in this market by providing them information on the closest approximations of the revenue numbers for the overall nanosatellite and microsatellite market and its segments. This report is also expected to help stakeholders understand the competitive landscape and gain insights to improve the position of their businesses and to plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 UNITED STATES DOLLAR, EXCHANGE RATES, 2018-2021

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 GLOBAL NANOSATELLITE AND MICROSATELLITE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- FIGURE 2 BREAKUP OF PROFILES OF PRIMARY PARTICIPANTS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE): REVENUE OF HARDWARE/SOFTWARE/SERVICES OF NANOSATELLITE AND MICROSATELLITE MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF SOFTWARE/HARDWARE/SERVICES OF NANOSATELLITE AND MICROSATELLITE MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2- BOTTOM-UP (DEMAND-SIDE): SOFTWARE/SERVICES

- 2.4 MARKET FORECAST

- FIGURE 7 FACTOR ANALYSIS

- 2.5 ASSUMPTIONS

- TABLE 2 ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 NANOSATELLITE AND MICROSATELLITE MARKET, 2020-2027

- FIGURE 9 LEADING SEGMENTS IN NANOSATELLITE AND MICROSATELLITE MARKET IN 2022

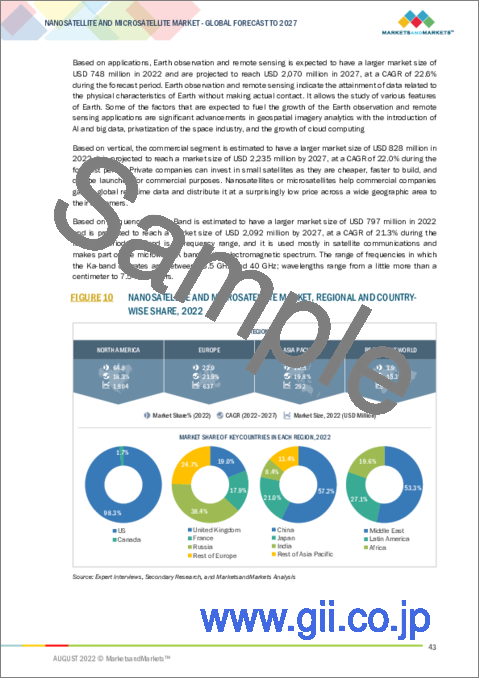

- FIGURE 10 NANOSATELLITE AND MICROSATELLITE MARKET, REGIONAL AND COUNTRY-WISE SHARE, 2022

- FIGURE 11 EUROPE TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NANOSATELLITE AND MICROSATELLITE MARKET

- FIGURE 12 RISING TECHNOLOGICAL ADVANCEMENTS TO DRIVE NANOSATELLITE AND MICROSATELLITE MARKET

- 4.2 NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE

- FIGURE 13 LARGE ENTERPRISES TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 NORTH AMERICAN NANOSATELLITE AND MICROSATELLITE MARKET, 2022

- FIGURE 14 SPACE SERVICES SEGMENT AND US TO ACCOUNT FOR HIGH MARKET SHARES IN NORTH AMERICA IN 2022

- 4.4 ASIA PACIFIC NANOSATELLITE AND MICROSATELLITE MARKET, 2022

- FIGURE 15 HARDWARE AND CHINA TO ACCOUNT FOR HIGH MARKET SHARES IN ASIA PACIFIC IN 2022

- 4.5 NANOSATELLITE AND MICROSATELLITE MARKET, BY COUNTRY

- FIGURE 16 UK TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 NANOSATELLITE AND MICROSATELLITE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Proliferation of LEO-based services to connect remote regions

- 5.2.1.2 Rapid escalation of production and launch of small satellites to revolutionize space industry

- TABLE 3 NUMBER OF NANOSATELLITES LAUNCHED IN APRIL 2021

- 5.2.1.3 Rising demand for Earth observation-related applications

- 5.2.1.4 Development of satellite networks to provide internet access to remote areas

- TABLE 4 KEY INFORMATION ON SATELLITE AND TERRESTRIAL CONNECTIVITY

- 5.2.1.5 Increasing demand for CubeSats

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited access to space

- 5.2.2.2 Stringent government regulations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise in demand for satellite imagery from non-governmental players

- 5.2.3.2 Increase in number of application areas

- 5.2.3.3 Increase in space exploration missions

- 5.2.3.4 Growing technological advancements to transform space exploration

- 5.2.3.5 Use of flexible software-defined technology to alter space missions

- 5.2.3.6 Technological advancements in antennas, ground stations, and other areas

- 5.2.4 CHALLENGES

- 5.2.4.1 Raising capital and funding satellite manufacturing

- 5.2.4.2 Concerns related to space debris

- 5.3 INDUSTRY TRENDS

- 5.3.1 VALUE CHAIN

- FIGURE 18 VALUE CHAIN ANALYSIS FOR NANOSATELLITE AND MICROSATELLITE MARKET

- 5.3.2 ECOSYSTEM

- 5.3.2.1 NANOSATELLITE AND MICROSATELLITE MARKET: ECOSYSTEM

- TABLE 5 NANOSATELLITE AND MICROSATELLITE MARKET: ECOSYSTEM

- 5.3.3 PORTER'S FIVE FORCES MODEL

- TABLE 6 NANOSATELLITE AND MICROSATELLITE MARKET: PORTER'S FIVE FORCES MODEL

- FIGURE 19 NANOSATELLITE AND MICROSATELLITE MARKET: PORTER'S FIVE FORCES MODEL

- 5.3.3.1 Threat of new entrants

- 5.3.3.2 Threat of substitutes

- 5.3.3.3 Bargaining power of buyers

- 5.3.3.4 Bargaining power of suppliers

- 5.3.3.5 Intensity of competitive rivalry

- 5.3.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.4.1 Key stakeholders in buying process

- FIGURE 20 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.3.4.2 Buying criteria

- FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.3.5 TECHNOLOGY ANALYSIS

- 5.3.5.1 Artificial Intelligence

- 5.3.5.2 Internet of Things

- 5.3.5.3 Dynamic Spectrum Access Technologies

- 5.3.5.4 Ultra-High Frequency

- 5.3.5.5 Very High Frequency

- 5.3.6 TRENDS AND DISRUPTIONS IMPACTING BUYERS

- FIGURE 22 REVENUE SHIFT FOR NANOSATELLITE AND MICROSATELLITE MARKET

- 5.3.7 PATENT ANALYSIS

- FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

- TABLE 9 TOP 20 PATENT OWNERS

- FIGURE 24 NUMBER OF PATENTS GRANTED IN 2012-2021

- 5.3.8 PRICING ANALYSIS

- 5.3.8.1 Average selling price trends based on type

- TABLE 10 PRICING RANGE FOR SATELLITES

- 5.3.9 USE CASES

- 5.3.9.1 CASE STUDY 1: RACE(Rendezvous Autonomous CubeSats Experiment), is ESA's latest in-orbit demonstration CubeSat mission

- 5.3.9.2 CASE STUDY 2: Blink gets a space lift

- 5.3.10 KEY CONFERENCES & EVENTS IN 2022

- TABLE 11 NANOSATELLITE AND MICROSATELLITE MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.3.11 TARIFF AND REGULATORY IMPACT

- 5.3.11.1 North America

- 5.3.11.2 Europe

- 5.3.11.3 Asia Pacific

- 5.3.11.4 Rest of the World

6 NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENTS: NANOSATELLITE AND MICROSATELLITE MARKET DRIVERS

- FIGURE 25 SOFTWARE AND DATA PROCESSING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 12 NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 13 NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.2 HARDWARE

- TABLE 14 HARDWARE: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 15 HARDWARE: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.1 STRUCTURE

- 6.2.2 PAYLOAD

- 6.2.3 COMMUNICATION SYSTEM

- 6.2.4 ONBOARD COMPUTER

- 6.2.5 POWER SYSTEMS

- 6.2.6 PROPULSION SYSTEM

- 6.3 SOFTWARE AND DATA PROCESSING

- TABLE 16 SOFTWARE AND DATA PROCESSING: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 17 SOFTWARE AND DATA PROCESSING: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.1 COMMANDS AND DATA HANDLING

- 6.3.2 ATTITUDE DETERMINATION AND CONTROL SYSTEM

- 6.4 SPACE SERVICES

- TABLE 18 SPACE SERVICES: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 19 SPACE SERVICES: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027(USD MILLION)

- 6.5 LAUNCH SERVICES

- TABLE 20 LAUNCH SERVICES: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 21 LAUNCH SERVICES: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

7 NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.1.1 TYPES: NANOSATELLITE AND MICROSATELLITE MARKET DRIVERS

- FIGURE 26 NANOSATELLITE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 22 NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 23 NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2022-2027, (USD MILLION)

- 7.2 NANOSATELLITE

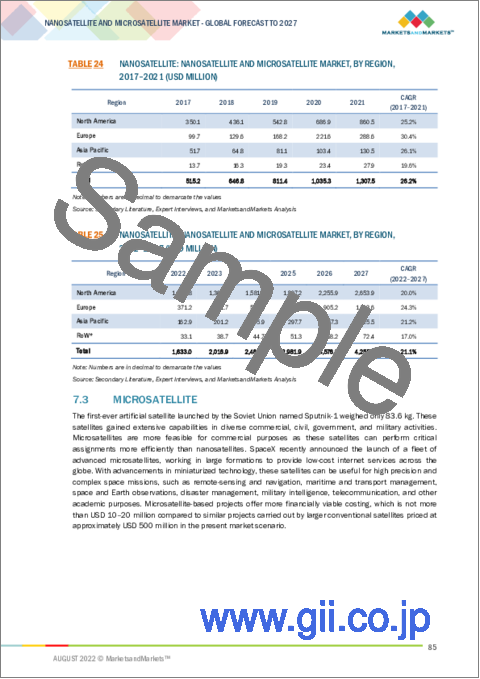

- TABLE 24 NANOSATELLITE: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 25 NANOSATELLITE: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 MICROSATELLITE

- TABLE 26 MICROSATELLITE: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 27 MICROSATELLITE: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

8 NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- FIGURE 27 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 8.1.1 ORGANIZATION SIZE: NANOSATELLITE AND MICROSATELLITE MARKET DRIVERS

- TABLE 28 NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 29 NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 8.2 LARGE ENTERPRISES

- TABLE 30 LARGE ENTERPRISES: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 31 LARGE ENTERPRISES: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- TABLE 32 SMALL AND MEDIUM-SIZED ENTERPRISES: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 33 SMALL AND MEDIUM-SIZED ENTERPRISES: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

9 NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.1.1 APPLICATIONS: MARKET DRIVERS

- FIGURE 28 EARTH OBSERVATION AND REMOTE SENSING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 34 NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 35 NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2 COMMUNICATION

- TABLE 36 COMMUNICATION: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 37 COMMUNICATION: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 EARTH OBSERVATION AND REMOTE SENSING

- TABLE 38 EARTH OBSERVATION AND REMOTE SENSING: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 39 EARTH OBSERVATION AND REMOTE SENSING: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 SCIENTIFIC RESEARCH

- TABLE 40 SCIENTIFIC RESEARCH: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 41 SCIENTIFIC RESEARCH: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 BIOLOGICAL EXPERIMENTS

- TABLE 42 BIOLOGICAL EXPERIMENTS: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 43 BIOLOGICAL EXPERIMENTS: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.6 TECHNOLOGY DEMONSTRATION AND VERIFICATION

- TABLE 44 TECHNOLOGY DEMONSTRATION AND VERIFICATION: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 45 TECHNOLOGY DEMONSTRATION AND VERIFICATION: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.7 ACADEMIC TRAINING

- TABLE 46 ACADEMIC TRAINING: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 47 ACADEMIC TRAINING: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.8 MAPPING AND NAVIGATION

- TABLE 48 MAPPING AND NAVIGATION: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 49 MAPPING AND NAVIGATION: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.9 RECONNAISSANCE

- TABLE 50 RECONNAISSANCE: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 51 RECONNAISSANCE: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

10 NANOSATELLITE AND MICROSATELLITE MARKET, BY ORBIT

- 10.1 INTRODUCTION

- 10.2 NON-POLAR INCLINED

- 10.3 SUN-SYNCHRONOUS ORBIT

- 10.4 POLAR ORBIT

11 NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.1.1 VERTICAL: NANOSATELLITE AND MICROSATELLITE MARKET DRIVERS

- FIGURE 29 COMMERCIAL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 52 NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 53 NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.2 GOVERNMENT

- TABLE 54 GOVERNMENT: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 55 GOVERNMENT: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3 CIVIL

- TABLE 56 CIVIL: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 57 CIVIL: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4 COMMERCIAL

- TABLE 58 COMMERCIAL: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 59 COMMERICAL: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.5 DEFENSE

- TABLE 60 DEFENSE: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 61 DEFENSE: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.6 ENERGY AND INFRASTRUCTURE

- TABLE 62 ENERGY AND INFRASTRUCTURE: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 63 ENERGY AND INFRASTRUCTURE: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.7 MARITIME AND TRANSPORTATION

- TABLE 64 MARITIME AND TRANSPORTATION: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 65 MARITIME AND TRANSPORTATION: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

12 NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY

- 12.1 INTRODUCTION

- 12.1.1 FREQUENCY: NANOSATELLITE AND MICROSATELLITE MARKET DRIVERS

- FIGURE 30 S-BAND TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 66 NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2017-2021 (USD MILLION)

- TABLE 67 NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2022-2027 (USD MILLION)

- 12.2 UHF-BAND

- TABLE 68 UHF-BAND: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 69 UHF-BAND: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.3 VHF-BAND

- TABLE 70 VHF-BAND: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 71 VHF-BAND: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.4 S-BAND

- TABLE 72 S-BAND: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 73 S-BAND: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.5 X-BAND

- TABLE 74 X-BAND: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 75 X-BAND: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.6 KA-BAND

- TABLE 76 KA-BAND: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 77 KA-BAND: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.7 OTHERS

- TABLE 78 OTHERS: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 79 OTHERS: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

13 NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION

- 13.1 INTRODUCTION

- FIGURE 31 EUROPE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 80 NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 81 NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.2 NORTH AMERICA

- 13.2.1 NORTH AMERICA: PESTLE ANALYSIS

- FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 82 NORTH AMERICA: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 83 NORTH AMERICA: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 84 NORTH AMERICA: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 85 NORTH AMERICA: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 86 NORTH AMERICA: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 87 NORTH AMERICA: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 88 NORTH AMERICA: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 89 NORTH AMERICA: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 90 NORTH AMERICA: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 91 NORTH AMERICA: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 92 NORTH AMERICA: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2017-2021 (USD MILLION)

- TABLE 93 NORTH AMERICA: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2022-2027 (USD MILLION)

- TABLE 94 NORTH AMERICA: NANOSATELLITE AND MICROSATELLITE MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 95 NORTH AMERICA: NANOSATELLITE AND MICROSATELLITE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.2.2 US

- 13.2.2.1 Use of nanosatellites and microsatellites in agriculture

- TABLE 96 US: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 97 US: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 98 US: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 99 US: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 100 US: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 101 US: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 102 US: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 103 US: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 104 US: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 105 US: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 106 US: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2017-2021 (USD MILLION)

- TABLE 107 US: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2022-2027 (USD MILLION)

- 13.2.3 CANADA

- 13.2.3.1 Government initiatives to drive market

- 13.3 EUROPE

- 13.3.1 EUROPE: PESTLE ANALYSIS

- FIGURE 33 EUROPE: MARKET SNAPSHOT

- TABLE 108 EUROPE: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 109 EUROPE: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 110 EUROPE: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 111 EUROPE: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 112 EUROPE: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 113 EUROPE: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 114 EUROPE: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 115 EUROPE: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 116 EUROPE: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 117 EUROPE: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 118 EUROPE: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2017-2021 (USD MILLION)

- TABLE 119 EUROPE: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2022-2027 (USD MILLION)

- TABLE 120 EUROPE: NANOSATELLITE AND MICROSATELLITE MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 121 EUROPE: NANOSATELLITE AND MICROSATELLITE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.3.2 UK

- 13.3.2.1 Innovations in satellite technologies to drive market

- TABLE 122 UK: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 123 UK: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 124 UK: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 125 UK: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 126 UK: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 127 UK: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 128 UK: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 129 UK: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 130 UK: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 131 UK: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 132 UK: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2017-2021 (USD MILLION)

- TABLE 133 UK: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2022-2027 (USD MILLION)

- 13.3.3 RUSSIA

- 13.3.3.1 Reliance on self-developed space systems to drive market

- TABLE 134 RUSSIA: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 135 RUSSIA: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 136 RUSSIA: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 137 RUSSIA: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 138 RUSSIA: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 139 RUSSIA: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 140 RUSSIA: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 141 RUSSIA: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 142 RUSSIA: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 143 RUSSIA: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 144 RUSSIA: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2017-2021 (USD MILLION)

- TABLE 145 RUSSIA: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2022-2027 (USD MILLION)

- 13.3.4 FRANCE

- 13.3.4.1 Government encourages to use nanosatellites and microsatellites

- 13.3.5 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 ASIA PACIFIC: PESTLE ANALYSIS

- TABLE 146 ASIA PACIFIC: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 147 ASIA PACIFIC: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 148 ASIA PACIFIC: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 149 ASIA PACIFIC: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 150 ASIA PACIFIC: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 151 ASIA PACIFIC: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 152 ASIA PACIFIC: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 153 ASIA PACIFIC: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 154 ASIA PACIFIC: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 155 ASIA PACIFIC: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 156 ASIA PACIFIC: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2017-2021 (USD MILLION)

- TABLE 157 ASIA PACIFIC: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2022-2027 (USD MILLION)

- TABLE 158 ASIA PACIFIC: NANOSATELLITE AND MICROSATELLITE MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 159 ASIA PACIFIC: NANOSATELLITE AND MICROSATELLITE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.4.2 CHINA

- 13.4.2.1 Dependence on self-made space technology to increase satellite launches

- TABLE 160 CHINA: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 161 CHINA: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 162 CHINA: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 163 CHINA: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 164 CHINA: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 165 CHINA: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 166 CHINA: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 167 CHINA: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 168 CHINA: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 169 CHINA: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 170 CHINA: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2017-2021 (USD MILLION)

- TABLE 171 CHINA: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2022-2027 (USD MILLION)

- 13.4.3 JAPAN

- 13.4.3.1 Involvement of private space companies in government space programs to drive market

- 13.4.4 INDIA

- 13.4.4.1 Upcoming space initiatives to drive market

- 13.4.5 REST OF ASIA PACIFIC

- 13.5 REST OF WORLD

- 13.5.1 REST OF WORLD: PESTLE ANALYSIS

- TABLE 172 REST OF THE WORLD: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 173 REST OF THE WORLD: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 174 REST OF THE WORLD: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 175 REST OF THE WORLD: NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 176 REST OF THE WORLD: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 177 REST OF THE WORLD: NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 178 REST OF THE WORLD: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 179 REST OF THE WORLD: NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 180 REST OF THE WORLD: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 181 REST OF THE WORLD: NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 182 REST OF THE WORLD: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2017-2021 (USD MILLION)

- TABLE 183 REST OF THE WORLD: NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2022-2027 (USD MILLION)

- TABLE 184 REST OF THE WORLD: NANOSATELLITE AND MICROSATELLITE MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 185 REST OF THE WORLD: NANOSATELLITE AND MICROSATELLITE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.5.2 MIDDLE EAST

- 13.5.2.1 Increased private investments in space technology

- 13.5.3 AFRICA

- 13.5.3.1 Countries joining African satellite owners club to drive market

- 13.5.4 LATIN AMERICA

- 13.5.4.1 Low-cost solutions for defense and intelligence to drive market

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 MARKET EVALUATION FRAMEWORK

- FIGURE 34 MARKET EVALUATION FRAMEWORK, 2019-2021

- 14.3 COMPETITIVE SCENARIO AND TRENDS

- 14.3.1 PRODUCT LAUNCHES

- TABLE 186 NANOSATELLITE AND MICROSATELLITE MARKET: PRODUCT LAUNCHES, 2019-2021

- 14.3.2 DEALS

- TABLE 187 DEALS, 2019-2021

- 14.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

- TABLE 188 NANOSATELLITE AND MICROSATELLITE MARKET: DEGREE OF COMPETITION

- FIGURE 35 MARKET SHARE ANALYSIS OF COMPANIES

- 14.5 HISTORICAL REVENUE ANALYSIS

- FIGURE 36 HISTORICAL REVENUE ANALYSIS, 2017-2021

- 14.6 COMPANY EVALUATION MATRIX OVERVIEW

- 14.6.1 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

- TABLE 189 PRODUCT FOOTPRINT WEIGHTAGE

- 14.6.2 STARS

- 14.6.3 EMERGING LEADERS

- 14.6.4 PERVASIVE PLAYERS

- 14.6.5 PARTICIPANTS

- FIGURE 37 NANOSATELLITE AND MICROSATELLITE MARKET: COMPANY EVALUATION MATRIX (2022)

- 14.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 190 COMPANY PRODUCT FOOTPRINT

- TABLE 191 COMPANY COMPONENT FOOTPRINT

- TABLE 192 VERTICAL FOOTPRINT

- TABLE 193 COMPANY REGION FOOTPRINT

- 14.8 COMPANY MARKET RANKING ANALYSIS

- FIGURE 38 RANKING OF KEY PLAYERS IN THE NANOSATELLITE AND MICROSATELLITE MARKET (2022)

- 14.9 START-UP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

- FIGURE 39 START-UPS/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- TABLE 194 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 14.9.1 PROGRESSIVE COMPANIES

- 14.9.2 RESPONSIVE COMPANIES

- 14.9.3 DYNAMIC COMPANIES

- 14.9.4 STARTING BLOCKS

- FIGURE 40 NANOSATELLITE AND MICROSATELLITE MARKET: STARTUP EVALUATION MATRIX (2022)

- 14.10 COMPETITIVE BENCHMARKING FOR SME/START-UPS

- TABLE 195 NANOSATELLITE AND MICROSATELLITE MARKET: DETAILED LIST OF KEY START-UP/SMES

- TABLE 196 NANOSATELLITE AND MICROSATELLITE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (START-UPS/SMES)

- TABLE 197 NANOSATELLITE AND MICROSATELLITE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (START-UPS/SMES)

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

(Business Overview, Products, Solutions & Services, Recent Developments, MnM View)**

- 15.1.1 GOMSPACE

- TABLE 198 GOMSPACE: BUSINESS OVERVIEW

- FIGURE 41 GOMSPACE: COMPANY SNAPSHOT

- TABLE 199 GOMSPACE: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 200 GOMSPACE: PRODUCT LAUNCHES

- TABLE 201 GOMSPACE: DEALS

- 15.1.2 LOCKHEED MARTIN

- TABLE 202 LOCKHEED MARTIN: BUSINESS OVERVIEW

- FIGURE 42 LOCKHEED MARTIN: COMPANY SNAPSHOT

- TABLE 203 LOCKHEED MARTIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 LOCKHEED MARTIN: PRODUCT LAUNCHES

- TABLE 205 LOCKHEED MARTIN: DEALS

- 15.1.3 L3HARRIS

- TABLE 206 L3HARRIS: BUSINESS OVERVIEW

- FIGURE 43 L3HARRIS: COMPANY SNAPSHOT

- TABLE 207 L3HARRIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 L3HARRIS: PRODUCT LAUNCHES

- TABLE 209 L3HARRIS: DEALS

- 15.1.4 SIERRA NEVADA CORPORATION

- TABLE 210 SIERRA NEVADA CORPORATION: BUSINESS OVERVIEW

- TABLE 211 SIERRA NEVADA CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 212 SIERRA NEVADA CORPORATION: PRODUCT LAUNCHES

- TABLE 213 SIERRA NEVADA CORPORATION: DEALS

- 15.1.5 AAC CLYDE SPACE

- TABLE 214 AAC CLYDE SPACE: BUSINESS OVERVIEW

- FIGURE 44 AAC CLYDE SPACE: COMPANY SNAPSHOT

- TABLE 215 AAC CLYDE SPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 AAC CLYDE SPACE: PRODUCT LAUNCHES

- TABLE 217 AAC CLYDE SPACE: DEALS

- 15.1.6 PLANET LABS

- TABLE 218 PLANET LABS: BUSINESS OVERVIEW

- FIGURE 45 PLANET LABS: COMPANY SNAPSHOT

- TABLE 219 PLANET LABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 PLANET LABS: PRODUCT LAUNCHES

- TABLE 221 PLANET LABS: DEALS

- 15.1.7 SURREY SATELLITE TECHNOLOGY

- TABLE 222 SURREY SATELLITE TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 223 SURREY SATELLITE TECHNOLOGY: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 224 SURREY SATELLITE TECHNOLOGY: PRODUCT LAUNCHES

- TABLE 225 SURREY SATELLITE TECHNOLOGY: DEALS

- 15.1.8 NORTHROP GRUMMAN

- TABLE 226 NORTHROP GRUMMAN: BUSINESS OVERVIEW

- FIGURE 46 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- TABLE 227 NORTHROP GRUMMAN: PRODUCT/SOLUTIONS/SERVICES OFFERED

- 15.1.8.3 Recent developments

- TABLE 228 NORTHROP GRUMMAN: DEALS

- 15.1.9 OHB SE

- TABLE 229 OHB SE: BUSINESS OVERVIEW

- FIGURE 47 OHB SE: COMPANY SNAPSHOT

- TABLE 230 OHB SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 OHB SE: PRODUCT LAUNCHES

- TABLE 232 OHB SE: DEALS

- 15.1.10 TYVAK

- TABLE 233 TYVAK: BUSINESS OVERVIEW

- TABLE 234 TYVAK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 TYVAK: PRODUCT LAUNCHES

- 15.1.11 RAYTHEON INTELLIGENCE & SPACE

- 15.1.12 PUMPKIN

- 15.1.13 BEYOND GRAVITY

- 15.1.14 MILLENNIUM SPACE SYSTEMS

- 15.1.15 EXOLAUNCH

- 15.1.16 NANOAVIONICS

- 15.1.17 GAUSS

- 15.1.18 AXELSPACE

- 15.1.19 SPIRE GLOBAL

- *Details on Business Overview, Products, Solutions & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 15.2 STARTUP AND SMES

- 15.2.1 C3S

- 15.2.2 SWARM

- 15.2.3 ALEN SPACE

- 15.2.4 DAURIA AEROSPACE

- 15.2.5 SATLANTIS

- 15.2.6 DHRUVA SPACE

- 15.2.7 ASTROCAST

- 15.2.8 KEPLER AEROSPACE

16 ADJACENT AND RELATED MARKETS

- 16.1 INTRODUCTION

- 16.1.1 LIMITATIONS

- 16.2 SMALL SATELLITE MARKET

- 16.2.1 MARKET DEFINITION

- 16.2.2 MARKET OVERVIEW

- 16.2.2.1 Small Satellite Market, By Subsystem

- TABLE 236 SMALL SATELLITE MARKET, BY SUBSYSTEM, 2021-2026 (USD MILLION)

- 16.2.2.2 Small Satellite Market, By End User

- TABLE 237 SMALL SATELLITE MARKET, BY END-USE, 2021-2026 (USD MILLION)

- TABLE 238 SMALL SATELLITE MARKET, BY COMMERCIAL END USER, 2021-2026 (USD MILLION)

- 16.2.2.3 Small Satellite Market, By Application

- TABLE 239 SMALL SATELLITE MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- 16.2.2.4 Small Satellite Market, By Frequency

- TABLE 240 SMALL SATELLITE MARKET, BY FREQUENCY, 2021-2026 (USD MILLION)

- 16.2.2.5 Small Satellite Market, By Region

- TABLE 241 SMALL SATELLITE MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 242 NORTH AMERICA: SMALL SATELLITE MARKET, BY MASS, 2021-2026 (USD MILLION)

- TABLE 243 EUROPE: SMALL SATELLITE MARKET, BY MASS, 2021-2026 (USD MILLION)

- 16.2.3 LEO SATELLITE MARKET

- 16.2.3.1 Market definition

- 16.2.3.2 Market overview

- 16.2.3.3 LEO Satellite Market, By Type

- TABLE 244 LEO SATELLITE MARKET SIZE, BY SATELLITE TYPE, 2021-2026 (USD MILLION)

- TABLE 245 LEO SATELLITE MARKET SIZE, BY SMALL SATELLITE, 2021-2026 (USD MILLION)

- 16.2.3.4 LEO Satellite Market, By Subsystem

- TABLE 246 LEO SATELLITE MARKET, BY SUBSYSTEM, 2021-2026 (USD MILLION)

- TABLE 247 SATELLITE BUS MARKET, BY SUBTYPE, 2021-2026 (USD MILLION)

- TABLE 248 PROPULSION SYSTEM MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 16.2.3.5 LEO Satellite Market, By Application

- TABLE 249 LEO SATELLITE MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- 16.2.3.6 LEO Satellite Market, By End User

- TABLE 250 LEO SATELLITE MARKET, BY END USER, 2021-2026 (USD MILLION)

- 16.2.4 SATELLITE COMMUNICATION (SATCOM) EQUIPMENT MARKET

- 16.2.4.1 Market definition

- 16.2.4.2 Market overview

- 16.2.4.3 Satellite Communication (SATCOM) Equipment Market, By Solution

- TABLE 251 SATCOM EQUIPMENT MARKET, BY SOLUTION, 2017-2020 (USD MILLION)

- TABLE 252 SATCOM EQUIPMENT MARKET, BY SOLUTION, 2021-2026 (USD MILLION)

- 16.2.4.4 Satellite Communication (SATCOM) Equipment Market, By Platform

- TABLE 253 SATCOM EQUIPMENT MARKET, BY PLATFORM, 2017-2020 (USD MILLION)

- TABLE 254 SATCOM EQUIPMENT MARKET, BY PLATFORM, 2021-2026 (USD MILLION)

- 16.2.4.5 Satellite Communication (SATCOM) Equipment Market, By Technology

- TABLE 255 SATELLITE COMMUNICATION EQUIPMENT MARKET, BY TECHNOLOGY, 2017-2020 (USD MILLION)

- TABLE 256 SATELLITE COMMUNICATION EQUIPMENT MARKET, BY TECHNOLOGY, 2021-2026 (USD MILLION)

- 16.2.4.6 Satellite Communication (SATCOM) Equipment Market, By Vertical

- TABLE 257 SATCOM EQUIPMENT MARKET, BY VERTICAL, 2017-2020 (USD MILLION)

- TABLE 258 SATCOM EQUIPMENT MARKET, BY VERTICAL, 2021-2026 (USD MILLION)

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 AVAILABLE CUSTOMIZATIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS