|

|

市場調査レポート

商品コード

1068814

加工デンプンの世界市場:原料(トウモロコシ、キャッサバ、ジャガイモ、小麦)、エンドユーザー(食品・飲料、飼料、工業)、形状(乾燥・液体)、地域別 - 2027年までの予測Modified Starch Market by Raw Material (Corn, Cassava, Potato, Wheat), End-User (Food & Beverages, Feed, and Industrial), Form (Dry and Liquid), and Region (North America, Europe, APAC, South America, Rest of the World) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 加工デンプンの世界市場:原料(トウモロコシ、キャッサバ、ジャガイモ、小麦)、エンドユーザー(食品・飲料、飼料、工業)、形状(乾燥・液体)、地域別 - 2027年までの予測 |

|

出版日: 2022年04月04日

発行: MarketsandMarkets

ページ情報: 英文 219 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の加工デンプンの市場規模は、予測期間中に3.1%のCAGRで推移し、2022年の137億米ドルから、2027年までに159億米ドルに達すると予測されています。

地域別の市場では、アジア太平洋が、予測期間中に3.4%のCAGRでの成長すると予測されています。同地域では、加工デンプン関連の産業用途と技術が急速に変化しており、様々な産業において、ますます需要が拡大しています。

当レポートでは、世界の加工デンプン市場について調査し、市場力学、セグメント・地域別の市場分析、競合情勢、主要企業のプロファイルなどの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 市場における魅力的な機会

- アジア太平洋:原材料および国別市場

- 原材料別市場

- 原材料および地域別市場

- 用途別市場

- 形状別市場

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 市場機会

- 課題

- COVID-19加工デンプン市場への影響

第6章 動向

- 収益シフトの影響

- バリューチェーン

- テクノロジー分析

- 特許分析

- エコシステムマップとサプライチェーン

- ポーターのファイブフォース分析

- 貿易分析

- ケーススタディ

- 主な会議とイベント

- 主な利害関係者と購入基準

- 平均販売価格

第7章 規制の枠組み

- 北米

- 欧州

- アジア太平洋

第8章 原材料別:加工デンプン市場

- コーン

- キャッサバ

- ジャガイモ

- 小麦

- その他

第9章 用途別:加工デンプン市場

- 用途別:加工デンプン市場へのCOVID-19の影響

- 食品と飲料

- ベーカリー・菓子類製品

- 加工食品

- 飲料

- その他

- 飼料

- 豚の飼料

- 反芻動物の飼料

- 養鶏の飼料

- その他

- 産業

- 製紙

- ウィービング・テキスタイル

- 医薬品・医薬品

- 化粧品

- その他

第10章 形状別:加工デンプン市場

- 形状別:加工デンプン市場へのCOVID-19の影響

- 乾燥

- 液体

第11章 機能別:加工デンプン市場

- 増粘剤

- 安定剤

- バインダー

- 乳化剤

- その他

第12章 加工タイプ別:加工デンプン市場

- 物理的改質

- 水熱

- 非水熱

- 化学的改質

- カチオン化デンプン

- エーテル化デンプン

- エステル化デンプン

- 酵素的改質

第13章 地域別:加工デンプン市場

- 地域別:加工デンプン市場へのCOVID-19の影響

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- タイ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の企業

- アフリカ

- 中東

第14章 競合情勢

- 概要

- 主要企業の戦略

- 市場シェア分析

- 主要市場参入企業の収益分析

- 競合シナリオと動向

- 企業評価クアドラント

第15章 企業プロファイル

- ARCHER DANIELS MIDLAND COMPANY

- CARGILL

- INGREDION INCORPORATED

- TATE & LYLE

- ROQUETTE FRERES

- AVEBE U.A.

- GRAIN PROCESSING CORPORATION

- EMSLAND GROUP

- AGRANA

- SMS CORPORATION

- GLOBAL BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED

- SPAC STARCH PRODUCTS(INDIA)LTD.

- QINGDAO CBH CO., LTD.

- TEREOS

- KMC

- BENEO

- ANGEL STARCH & FOOD PVT. LTD.

- SHUBHAM STARCH CHEM PVT. LTD.

- EVEREST STARCH(INDIA)PVT. LTD.

- SHEEKHARR STARCH PVT. LTD.

- SANSTAR BIO-POLYMERS LTD.

- UNIVERSAL BIOPOLYMERS

- SONISH STARCH TECHNOLOGY CO. LTD.

- VENUS STARCH SUPPLIERS

- GROMOTECH AGROCHEM PVT. LTD.

第16章 隣接および関連市場

- 制限

- 片栗粉市場

- エンドウ豆デンプン市場

第17章 付録

The global modified starch market is estimated to be valued at USD 13.7 billion in 2022. It is projected to reach USD 15.9 billion by 2027, recording a CAGR of 3.1% during the forecast period. Starch is a polymeric carbohydrate that consists of a large number of glucose units. Modified starches are manufactured from native starches. Various processing methods such as physical, enzymatic, wet & dry chemical processes, drum drying, and extrusion are used to produce different types of modified starch products. These processes are used to change the properties of native starch, such as its freeze-thaw stability, acid or alkali resistance, and shear stability to meet industrial requirements. Modified starches are used for functions such as thickening, stabilizing, binding, and emulsification. Apart from food products, it is also used in a wide range of non-food applications and the animal feed industry.

"Asia Pacific is projected to witness the growth of 3.4% during the forecast period."

The modified starch market in Asia Pacific is growing at a CAGR of 3.4% due to the rising demand in large economies, such as China, India, Japan, and other Southeast Asian countries. The industrial organization and technology of modified starch processing are changing rapidly in Asia Pacific. Unlike other regions where starch is processed almost entirely by large companies, in Asia Pacific, modified starch processing is done by small and medium-sized firms. Historically, native starch has been largely used for food products in the Asia Pacific region. The industrial applications and technologies involved in modified starch processing are changing rapidly in the Asia Pacific countries. Modified starch is increasingly being demanded by various industries in the region and these industries are incorporating modified raw material of starches in their manufacturing processes and products.

"The corn modified starch dominates the market with 60.5% of total market share in terms of value."

The corn modified starch dominates the market with 60.5% of total market share in terms of value in 2021. The North American modified starch market is dominated by corn starch due to its low price. Similarly, in Europe, the market is almost equally distributed among wheat, potato, and corn. In the Asia Pacific countries, however, the focus is on cassava, along with potato and corn. In some cases, the modified starch industry is likely to choose based on the cost factor of the starch over the quality or ingredient due to cost considerations.

"Modified starches are used to remove the constraints of food applications."

In food, the aim of modified starches is to remove the constraints of food applications (for example, in cooking, freezing/thawing, canning, or sterilization) and make the ingredients compatible with modern food processing. Modified starches are used, for example in food products that need to be microwaved, freeze-dried, cooked at high temperatures, or baked and fried so that the texture of such foods does not change during the cooking process. Modified starches are used in chips, canned soups, cheese sauces, powder-coated foods (cocoa-dusted almonds), and candies. Starch is a binder used especially for sauces or soups, but it is not stable and releases water after long storage in the fridge. The common objective of most of these transformations is to limit the natural tendency of the starch to remove the water. During the cooking of soup, for example, the native starch is hydrated in contact with water. The starch granules expand and the viscosity of the solution increases, giving it a particular texture.

Break-up of Primaries:

- By Company Type: Tier 1 - 40.0%, Tier 2- 30.0%, Tier 3 - 30.0%

- By Designation: Managers - 40.0%, CXOs - 25.0%, and Executives- 35.0%

- By Region: Europe - 30%, Asia Pacific - 50%, North America - 10%, RoW - 10%

Leading players profiled in this report:

- Archer Daniel Midlands Company (US)

- CARGILL (US)

- Ingredion Incorporated (US)

- Tate & Lyle (UK)

- Avebe U.A. (The Netherlands)

- Royal Ingredients Group (The Netherlands)

- Roquette Freres (France)

- Emsland (Germany)

- Grain Processing Corporation (US)

- AGRANA (Austria)

- SMS Corporation (Thailand)

- Global Bio-Chem Technology Group Company Limited (Hong-Kong)

- SPAC Starch Products (India) Ltd. (India)

- Qindao CBH Co., Ltd. (China)

- Tereos (France)

- KMC (Denmark)

Research Coverage:

The report segments the modified starch market on the basis of function, modification type, raw material, form, application and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global modified starch, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the modified starch market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the modified starch market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.4 REGIONS COVERED

- 1.5 PERIODIZATION CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019-2021

- 1.7 VOLUME UNIT CONSIDERED

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 MODIFIED STARCH MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE ANALYSIS

- FIGURE 4 KEY ECONOMIES BASED ON GDP, 2013-2018 (USD TRILLION)

- 2.2.3 SUPPLY-SIDE ANALYSIS

- 2.2.4 MARKET SIZE ESTIMATION

- 2.2.5 APPROACH ONE (BASED ON RAW MATERIAL, BY REGION)

- 2.2.6 APPROACH TWO (BASED ON THE GLOBAL MARKET)

- 2.3 DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION METHODOLOGY

- 2.4 ASSUMPTIONS FOR THE STUDY

- 2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

- FIGURE 6 IMPACT OF COVID-19 ON THE MODIFIED STARCH MARKET SIZE, BY SCENARIO, 2022 VS. 2021 (USD MILLION)

- FIGURE 7 MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2022 VS. 2027 (USD MILLION)

- FIGURE 8 MODIFIED STARCH MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 MODIFIED STARCH MARKET SIZE, BY FORM, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 MODIFIED STARCH MARKET SHARE (VALUE), BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN THE MODIFIED STARCH MARKET

- FIGURE 11 RISE IN DEMAND FOR MODIFIED STARCH DUE TO CONSUMER DEMAND FOR CONVENIENT FOOD PACKAGING GLOBALLY

- 4.2 ASIA PACIFIC: MODIFIED STARCH MARKET, BY RAW MATERIAL & COUNTRY

- FIGURE 12 MODIFIED CORN STARCH AND CHINA TO ACCOUNT FOR THE LARGEST RESPECTIVE MARKET SHARES IN THE ASIA PACIFIC MARKET IN 2022

- 4.3 MODIFIED STARCH MARKET, BY RAW MATERIAL

- FIGURE 13 CORN-BASED MODIFIED STARCH TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

- 4.4 MODIFIED STARCH MARKET, BY RAW MATERIAL & REGION

- FIGURE 14 ASIA PACIFIC TO DOMINATE ACROSS RAW MATERIAL MARKETS DURING THE FORECAST PERIOD

- 4.5 MODIFIED STARCH MARKET, BY APPLICATION

- FIGURE 15 FOOD & BEVERAGE APPLICATIONS TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

- 4.6 MODIFIED STARCH MARKET, BY FORM

- FIGURE 16 DRY MODIFIED STARCH TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

- FIGURE 17 COVID-19 IMPACT ON THE MODIFIED STARCH MARKET: COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 MODIFIED STARCH MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in demand for convenience and processed food

- FIGURE 19 CONSUMER PREFERENCE FOR FOOD PROCESSING

- 5.2.1.2 Functional properties of modified starch and their ease of incorporation in a wide range of food applications

- TABLE 2 RESEARCH CONDUCTED ON THE PHYSICAL MODIFICATION OF STARCH

- 5.2.1.3 Growth in demand for adhesives in a range of industrial applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited sources and high cost of natural additives

- FIGURE 20 US: CASSAVA PRICE TRENDS, 2013-2018 (USD/TONNE)

- 5.2.2.2 Higher demand for gum arabic

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Potential alternative sources of modified starch

- 5.2.3.2 Untapped applications of modified starch

- 5.2.4 CHALLENGES

- 5.2.4.1 Approval from the different regulatory bodies

- 5.2.4.2 Rise in cost of raw materials

- 5.3 COVID-19 IMPACT ON THE MODIFIED STARCH MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 IMPACT OF REVENUE SHIFT

- FIGURE 21 YC-YCC: IMPACT OF REVENUE SHIFT ON THE MODIFIED STARCH MARKET

- 6.3 VALUE CHAIN

- 6.3.1 RESEARCH & DEVELOPMENT

- 6.3.2 SOURCING OF RAW MATERIALS

- 6.3.3 PRODUCTION AND PROCESSING

- 6.3.4 DISTRIBUTION, MARKETING, AND SALES

- FIGURE 22 MODIFIED STARCH MARKET: VALUE CHAIN

- 6.4 TECHNOLOGY ANALYSIS

- FIGURE 23 MODIFIED STARCH MARKET: TECHNOLOGY ANALYSIS

- 6.4.1 PHYSICAL METHODS

- 6.4.2 CHEMICAL METHODS

- 6.4.3 ENZYMATIC METHODS

- 6.5 PATENT ANALYSIS

- TABLE 3 PATENTS PERTAINING TO MODIFIED STARCH, 2021

- 6.6 ECOSYSTEM MAP AND SUPPLY CHAIN

- 6.6.1 MODIFIED STARCH: MARKET MAP OF ECOSYSTEM

- FIGURE 24 MODIFIED STARCH MARKET: SUPPLY CHAIN

- FIGURE 25 ECOSYSTEM VIEW

- 6.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 MODIFIED STARCH MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.7.1 BARGAINING POWER OF SUPPLIERS

- 6.7.2 BARGAINING POWER OF BUYERS

- 6.7.3 THREAT OF SUBSTITUTES

- 6.7.4 THREAT OF NEW ENTRANTS

- 6.7.5 INTENSITY OF COMPETITION RIVALRY

- 6.8 TRADE ANALYSIS

- 6.8.1 CORN STARCH

- TABLE 5 TOP 10 EXPORTERS AND IMPORTERS OF CORN STARCH, 2019 (KT)

- 6.8.2 CASSAVA STARCH

- TABLE 6 TOP 10 EXPORTERS AND IMPORTERS OF CASSAVA STARCH, 2019 (KT)

- 6.8.3 POTATO STARCH

- TABLE 7 TOP 10 EXPORTERS AND IMPORTERS OF POTATO STARCH, 2019 (KT)

- 6.8.4 WHEAT STARCH

- TABLE 8 TOP 10 EXPORTERS AND IMPORTERS OF WHEAT STARCH, 2019 (KT)

- 6.9 CASE STUDIES

- 6.9.1 ROQUETTE: BAKERY PRODUCTS WITH MODIFIED STARCH

- 6.9.2 INGREDION INCORPORATED: COMPANY USES MODIFIED POTATO STARCH TO MAINTAIN THE PULPY GOODNESS

- 6.10 KEY CONFERENCES & EVENTS

- TABLE 9 MODIFIED STARCH MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022-2023

- 6.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING MODIFIED STARCH APPLICATIONS

- TABLE 10 INFLUENCE OF STAKEHOLDERS IN BUYING FOR TOP 3 APPLICATIONS

- 6.11.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- TABLE 11 KEY BUYING CRITERIA FOR MODIFIED STARCH APPLICATIONS

- 6.12 AVERAGE SELLING PRICES

- 6.12.1 AVERAGE SELLING PRICE TREND ANALYSIS

- FIGURE 28 US: CORN PRICES, 2013-2019 (USD/BUSHELS)

- TABLE 12 GLOBAL AVERAGE PRICES OF MODIFIED STARCH, BY RAW MATERIAL, 2018 VS. 2019 (USD/TON)

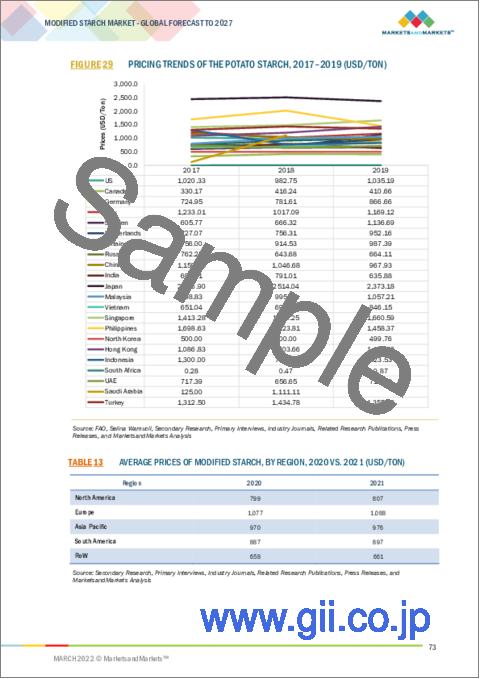

- FIGURE 29 PRICING TRENDS OF THE POTATO STARCH, 2017-2019 (USD/TON)

- TABLE 13 AVERAGE PRICES OF MODIFIED STARCH, BY REGION, 2020 VS. 2021 (USD/TON)

7 REGULATORY FRAMEWORK

- 7.1 INTRODUCTION

- 7.2 MODIFIED STARCH REGULATIONS IN NORTH AMERICA

- 7.2.1 US FOOD AND DRUG ADMINISTRATION

- 7.3 MODIFIED STARCH REGULATIONS IN EUROPE

- 7.4 MODIFIED STARCH REGULATIONS IN THE ASIA PACIFIC

8 MODIFIED STARCH MARKET, BY RAW MATERIAL

- 8.1 INTRODUCTION

- TABLE 14 MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- TABLE 15 MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (KT)

- 8.2 CORN

- 8.2.1 EASY PROCESSIBILITY MAKES CORN STARCH HIGHLY PREFERRED

- TABLE 16 MODIFIED CORN STARCH MARKET SIZE, BY REGION, 2018-2027 (USD MILLION)

- TABLE 17 MODIFIED CORN STARCH MARKET SIZE, BY REGION, 2018-2027 (KT)

- 8.3 CASSAVA

- 8.3.1 CASSAVA MODIFIED STARCH MARKET DRIVEN BY FUNCTIONAL PROPERTIES

- TABLE 18 MODIFIED CASSAVA STARCH MARKET SIZE, BY REGION, 2018-2027 (USD MILLION)

- TABLE 19 MODIFIED CASSAVA STARCH MARKET SIZE, BY REGION, 2018-2027 (KT)

- 8.4 POTATO

- 8.4.1 POTATO STARCH FINDS MAJOR APPLICATION IN THE EUROPEAN MARKET

- TABLE 20 MODIFIED POTATO STARCH MARKET SIZE, BY REGION, 2018-2027 (USD MILLION)

- TABLE 21 MODIFIED POTATO STARCH MARKET SIZE, BY REGION, 2018-2027 (KT)

- 8.5 WHEAT

- 8.5.1 WHEAT MODIFIED STARCH GAINS POPULARITY OWING TO ITS THICKENING AND BLENDING PROPERTIES

- TABLE 22 MODIFIED WHEAT STARCH MARKET SIZE, BY REGION, 2018-2027 (USD MILLION)

- TABLE 23 MODIFIED WHEAT STARCH MARKET SIZE, BY REGION, 2018-2027 (KT)

- 8.6 OTHER RAW MATERIALS

- TABLE 24 OTHER RAW MATERIALS MARKET SIZE, BY REGION, 2018-2027 (USD MILLION)

- TABLE 25 OTHER RAW MATERIALS MARKET SIZE, BY REGION, 2018-2027 (KT)

9 MODIFIED STARCH MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- TABLE 26 MODIFIED STARCH MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- FIGURE 30 MODIFIED STARCH MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- 9.2 COVID-19 IMPACT ON THE MODIFIED STARCH MARKET, BY APPLICATION

- 9.2.1 REALISTIC SCENARIO

- TABLE 27 REALISTIC SCENARIO: MODIFIED STARCH MARKET SIZE, BY APPLICATION, 2019-2021 (USD MILLION)

- 9.2.2 OPTIMISTIC SCENARIO

- TABLE 28 OPTIMISTIC SCENARIO: MODIFIED STARCH MARKET SIZE, BY APPLICATION, 2019-2021 (USD MILLION)

- 9.2.3 PESSIMISTIC SCENARIO

- TABLE 29 PESSIMISTIC SCENARIO: MODIFIED STARCH MARKET SIZE, BY APPLICATION, 2019-2021 (USD MILLION)

- 9.3 FOOD & BEVERAGES

- TABLE 30 MODIFIED STARCH MARKET SIZE IN FOOD & BEVERAGES, BY REGION, 2018-2027 (USD MILLION)

- TABLE 31 MODIFIED STARCH MARKET SIZE IN FOOD & BEVERAGES, BY SUBAPPLICATION, 2018-2027 (USD MILLION)

- 9.3.1 BAKERY & CONFECTIONERY PRODUCTS

- 9.3.1.1 Modified starch improves the texture and quality of bakery products

- TABLE 32 MODIFIED STARCH MARKET SIZE IN BAKERY & CONFECTIONERY PRODUCTS, BY REGION, 2018-2027 (USD MILLION)

- 9.3.2 PROCESSED FOODS

- 9.3.2.1 Modified starch functions as a stabilizer and provides freeze-thaw ability to processed foods

- TABLE 33 MODIFIED STARCH MARKET SIZE IN PROCESSED FOODS, BY REGION, 2018-2027 (USD MILLION)

- 9.3.3 BEVERAGES

- 9.3.3.1 Starches stabilize beverages and provide them with viscosity for desired mouthfeel

- TABLE 34 MODIFIED STARCH MARKET SIZE IN BEVERAGES, BY REGION, 2018-2027 (USD MILLION)

- 9.3.4 OTHER FOOD APPLICATIONS

- TABLE 35 MODIFIED STARCH MARKET SIZE IN OTHER FOOD APPLICATIONS, BY REGION, 2018-2027 (USD MILLION)

- 9.4 FEED

- TABLE 36 MODIFIED STARCH MARKET SIZE IN FEED, BY REGION, 2018-2027 (USD MILLION)

- TABLE 37 MODIFIED STARCH MARKET SIZE IN FEED, BY TYPE, 2018-2027 (USD MILLION)

- 9.4.1 SWINE FEED

- 9.4.1.1 Starch improves digestibility in swine

- 9.4.2 RUMINANT FEED

- 9.4.2.1 Starch provides carbohydrates, helping ruminants gain weight

- 9.4.3 POULTRY FEED

- 9.4.3.1 Starch is an important nutrient source in poultry diets

- 9.4.4 OTHER FEED APPLICATIONS

- 9.5 INDUSTRIAL

- TABLE 38 MODIFIED STARCH MARKET SIZE IN INDUSTRIAL APPLICATIONS, BY REGION, 2018-2027 (USD MILLION)

- TABLE 39 MODIFIED STARCH MARKET SIZE IN INDUSTRIAL APPLICATIONS, BY SUBAPPLICATION, 2018-2027 (USD MILLION)

- 9.5.1 PAPERMAKING

- 9.5.1.1 Modified starch provides internal strength to paper

- TABLE 40 MODIFIED STARCH MARKET SIZE IN PAPERMAKING, BY REGION, 2018-2027 (USD MILLION)

- 9.5.2 WEAVING & TEXTILES

- 9.5.2.1 Starch improves the appearance of fabric

- TABLE 41 MODIFIED STARCH MARKET SIZE IN WEAVING & TEXTILES, BY REGION, 2018-2027 (USD MILLION)

- 9.5.3 MEDICINES & PHARMACEUTICALS

- 9.5.3.1 Modified starch is important in various pharmaceutical applications

- TABLE 42 MODIFIED STARCH MARKET SIZE IN MEDICINES & PHARMACEUTICALS, BY REGION, 2018-2027 (USD MILLION)

- 9.5.4 COSMETICS

- 9.5.4.1 Modified starch provides smoothness to cosmetics

- TABLE 43 MODIFIED STARCH MARKET SIZE IN COSMETICS, BY REGION, 2018-2027 (USD MILLION)

- 9.5.5 OTHER INDUSTRIAL APPLICATIONS

- TABLE 44 MODIFIED STARCH MARKET SIZE IN OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2018-2027 (USD MILLION)

10 MODIFIED STARCH MARKET, BY FORM

- 10.1 INTRODUCTION

- TABLE 45 MODIFIED STARCH MARKET SIZE, BY FORM, 2018-2027 (USD MILLION)

- FIGURE 31 MODIFIED STARCH MARKET SIZE, BY FORM, 2022 VS. 2027 (USD MILLION)

- 10.2 COVID-19 IMPACT ON THE MODIFIED STARCH MARKET, BY FORM

- 10.2.1 REALISTIC SCENARIO

- TABLE 46 REALISTIC SCENARIO: MODIFIED STARCH MARKET SIZE, BY FORM, 2019-2021 (USD MILLION)

- 10.2.2 OPTIMISTIC SCENARIO

- TABLE 47 OPTIMISTIC SCENARIO: MODIFIED STARCH MARKET SIZE, BY FORM, 2019-2021 (USD MILLION)

- 10.2.3 PESSIMISTIC SCENARIO

- TABLE 48 PESSIMISTIC SCENARIO: MODIFIED STARCH MARKET SIZE, BY FORM, 2019-2021 (USD MILLION)

- 10.3 DRY

- 10.3.1 DRY FORM OF MODIFIED STARCH IS CONVENIENT TO USE

- TABLE 49 DRY MODIFIED STARCH MARKET SIZE, BY REGION, 2018-2027 (USD MILLION)

- 10.4 LIQUID

- 10.4.1 LIQUID FORM OF MODIFIED STARCH REQUIRES MORE CARE

- TABLE 50 LIQUID MODIFIED STARCH MARKET SIZE, BY REGION, 2018-2027 (USD MILLION)

11 MODIFIED STARCH MARKET, BY FUNCTION

- 11.1 INTRODUCTION

- 11.2 THICKENERS

- 11.3 STABILIZERS

- 11.4 BINDERS

- 11.5 EMULSIFIERS

- 11.6 OTHER FUNCTIONS

12 MODIFIED STARCH MARKET, BY MODIFICATION TYPE

- 12.1 INTRODUCTION

- 12.2 PHYSICAL MODIFICATION

- TABLE 51 RESEARCH ON THE PHYSICAL MODIFICATION OF STARCH

- 12.2.1 HYDROTHERMAL

- 12.2.2 NON-HYDROTHERMAL

- 12.3 CHEMICAL MODIFICATION

- TABLE 52 CHEMICAL MODIFICATION OF STARCH

- 12.3.1 CATIONIC STARCH

- 12.3.2 ETHERIFIED STARCH

- TABLE 53 ETHERIFIED STARCH IN FOOD APPLICATIONS

- 12.3.3 ESTERIFIED STARCH

- 12.4 ENZYMATIC MODIFICATION

13 MODIFIED STARCH MARKET, BY REGION

- 13.1 INTRODUCTION

- FIGURE 32 REGIONAL SNAPSHOT: NEW HOTSPOTS TO EMERGE IN ASIA PACIFIC, 2022-2027

- TABLE 54 MODIFIED STARCH MARKET SIZE, BY REGION, 2018-2027 (USD MILLION)

- TABLE 55 MODIFIED STARCH MARKET SIZE, BY REGION, 2018-2027 (KT)

- 13.2 COVID-19 IMPACT ON THE MODIFIED STARCH MARKET, BY REGION

- 13.2.1 OPTIMISTIC SCENARIO

- TABLE 56 OPTIMISTIC SCENARIO: MODIFIED STARCH MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- 13.2.2 REALISTIC SCENARIO

- TABLE 57 REALISTIC SCENARIO: MODIFIED STARCH MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- 13.2.3 PESSIMISTIC SCENARIO

- TABLE 58 PESSIMISTIC SCENARIO: MODIFIED STARCH MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- 13.3 NORTH AMERICA

- TABLE 59 NORTH AMERICA: MODIFIED STARCH MARKET SIZE, BY COUNTRY, 2018-2027 (USD MILLION)

- TABLE 60 NORTH AMERICA: MODIFIED STARCH MARKET SIZE, BY COUNTRY, 2018-2027 (KT)

- TABLE 61 NORTH AMERICA: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- TABLE 62 NORTH AMERICA: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (KT)

- TABLE 63 NORTH AMERICA: MODIFIED STARCH MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 64 NORTH AMERICA: MODIFIED STARCH MARKET SIZE, BY FORM, 2018-2027 (USD MILLION)

- 13.3.1 US

- 13.3.1.1 Corn is an important raw material for modified starch in the US

- TABLE 65 US: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.3.2 CANADA

- 13.3.2.1 Canadian government agencies work to incorporate modified starch in various industrial applications

- TABLE 66 CANADA: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.3.3 MEXICO

- 13.3.3.1 Growth of the paper & packaging industry demands modified starch

- TABLE 67 MEXICO: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.4 EUROPE

- TABLE 68 EUROPE: MODIFIED STARCH MARKET SIZE, BY COUNTRY, 2018-2027 (USD MILLION)

- TABLE 69 EUROPE: MODIFIED STARCH MARKET SIZE, BY COUNTRY, 2018-2027 (KT)

- TABLE 70 EUROPE: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- TABLE 71 EUROPE: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (KT)

- TABLE 72 EUROPE: MODIFIED STARCH MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 73 EUROPE: MODIFIED STARCH MARKET SIZE, BY FORM, 2018-2027 (USD MILLION)

- 13.4.1 GERMANY

- 13.4.1.1 Increase in consumption of convenience food drives demand in Germany

- TABLE 74 GERMANY: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.4.2 FRANCE

- 13.4.2.1 High consumption of dairy products fuels the demand for modified starch in France

- TABLE 75 FRANCE: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.4.3 UK

- 13.4.3.1 Growth of the feed industry contributes to the market in the UK

- TABLE 76 UK: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.4.4 SPAIN

- 13.4.4.1 Developed food processing industry propels growth in Spain

- TABLE 77 SPAIN: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.4.5 ITALY

- 13.4.5.1 Widespread baker & confectionery industry in Italy to drive demand

- TABLE 78 ITALY: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.4.6 REST OF EUROPE

- TABLE 79 REST OF EUROPE: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.5 ASIA PACIFIC

- TABLE 80 ASIA PACIFIC: MODIFIED STARCH MARKET SIZE, BY COUNTRY, 2018-2027 (USD MILLION)

- TABLE 81 ASIA PACIFIC: MODIFIED STARCH MARKET SIZE, BY COUNTRY, 2018-2027 (KT)

- TABLE 82 ASIA PACIFIC: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (KT)

- TABLE 84 ASIA PACIFIC: MODIFIED STARCH MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MODIFIED STARCH MARKET SIZE, BY FORM, 2018-2027 (USD MILLION)

- 13.5.1 CHINA

- 13.5.1.1 China dominates in Asia Pacific due to significant changes in lifestyle

- TABLE 86 CHINA: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.5.2 JAPAN

- 13.5.2.1 Rise in the processed food industry in Japan drives the modified starch market

- TABLE 87 JAPAN: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.5.3 INDIA

- 13.5.3.1 The modified starch market is highly fragmented in India

- TABLE 88 INDIA: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.5.4 SOUTH KOREA

- 13.5.4.1 Growth in demand for packaged food drives demand for modified starch in South Korea

- TABLE 89 SOUTH KOREA: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.5.5 THAILAND

- 13.5.5.1 Abundance of cassava as a raw material drives the Thai market

- TABLE 90 THAILAND: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.5.6 REST OF ASIA PACIFIC

- TABLE 91 REST OF ASIA PACIFIC: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.6 SOUTH AMERICA

- TABLE 92 SOUTH AMERICA: MODIFIED STARCH MARKET SIZE, BY COUNTRY, 2018-2027 (USD MILLION)

- TABLE 93 SOUTH AMERICA: MODIFIED STARCH MARKET SIZE, BY COUNTRY, 2018-2027 (KT)

- TABLE 94 SOUTH AMERICA: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- TABLE 95 SOUTH AMERICA MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (KT)

- TABLE 96 SOUTH AMERICA: MODIFIED STARCH MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 97 SOUTH AMERICA: MODIFIED STARCH MARKET SIZE, BY FORM, 2018-2027 (USD MILLION)

- 13.6.1 BRAZIL

- 13.6.1.1 High meat consumption in Brazil to drive the market

- TABLE 98 BRAZIL: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.6.2 ARGENTINA

- 13.6.2.1 Growing feed industry to increase the demand for modified starch in Argentina

- TABLE 99 ARGENTINA: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.6.3 REST OF SOUTH AMERICA

- TABLE 100 REST OF SOUTH AMERICA: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.7 REST OF THE WORLD (ROW)

- TABLE 101 ROW: MODIFIED STARCH MARKET SIZE, BY REGION, 2018-2027 (USD MILLION)

- TABLE 102 ROW: MODIFIED STARCH MARKET SIZE, BY REGION, 2018-2027 (KT)

- TABLE 103 ROW: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- TABLE 104 ROW: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (KT)

- TABLE 105 ROW: MODIFIED STARCH MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

- TABLE 106 ROW: MODIFIED STARCH MARKET SIZE, BY FORM, 2018-2027 (USD MILLION)

- 13.7.1 AFRICA

- 13.7.1.1 Increased demand for food processing ingredients drives market in the region

- TABLE 107 AFRICA: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

- 13.7.2 MIDDLE EAST

- 13.7.2.1 Consumers are witnessing an increased demand for clean-label food products in the Middle East

- TABLE 108 MIDDLE EAST: MODIFIED STARCH MARKET SIZE, BY RAW MATERIAL, 2018-2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES

- TABLE 109 KEY PLAYER STRATEGIES

- 14.3 MARKET SHARE ANALYSIS

- FIGURE 33 MARKET SHARE ANALYSIS, 2020

- 14.4 REVENUE ANALYSIS OF MAJOR MARKET PLAYERS

- FIGURE 34 REVENUE ANALYSIS OF MAJOR MARKET PLAYERS, 2018-2020 (USD BILLION)

- 14.5 COMPETITIVE SCENARIO & TRENDS

- 14.5.1 NEW PRODUCT LAUNCHES

- TABLE 110 NEW PRODUCT LAUNCHES, 2018-2020

- 14.5.2 DEALS

- TABLE 111 DEALS, 2018-2020

- 14.5.3 OTHERS

- TABLE 112 OTHERS, 2018-2020

- 14.6 COMPANY EVALUATION QUADRANT

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 EMERGING COMPANIES

- 14.6.5 COMPETITIVE BENCHMARKING

- TABLE 113 LIST OF KEY STARTUPS

- TABLE 114 MODIFIED STARCH MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS

- 14.6.6 COMPANY EVALUATION MATRIX, 2020 (OVERALL MARKET)

- FIGURE 35 MODIFIED STARCH MARKET COMPANY EVALUATION MATRIX, 2020 (OVERALL MARKET)

- 14.6.7 MARKET EVALUATION FRAMEWORK

- FIGURE 36 MARKET EVALUATION FRAMEWORK, 2018-2021

15 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 15.1 ARCHER DANIELS MIDLAND COMPANY

- TABLE 115 ARCHER DANIELS MIDLAND COMPANY: COMPANY AT A GLANCE

- FIGURE 37 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

- TABLE 116 ARCHER DANIELS MIDLANDS COMPANY: DEALS

- 15.2 CARGILL

- TABLE 117 CARGILL, INCORPORATED: COMPANY AT A GLANCE

- FIGURE 38 CARGILL: COMPANY SNAPSHOT

- TABLE 118 CARGILL: OTHERS

- 15.3 INGREDION INCORPORATED

- TABLE 119 INGREDION INCORPORATED: COMPANY AT A GLANCE

- FIGURE 39 INGREDION INCORPORATED: COMPANY SNAPSHOT

- TABLE 120 INGREDION INCORPORATED: NEW PRODUCT LAUNCHES

- TABLE 121 INGREDION INCORPORATED: DEALS

- 15.4 TATE & LYLE

- TABLE 122 TATE & LYLE: COMPANY AT A GLANCE

- FIGURE 40 TATE & LYLE: COMPANY SNAPSHOT

- TABLE 123 TATE & LYLE: NEW PRODUCT LAUNCHES

- TABLE 124 TATE & LYLE: OTHERS

- 15.5 ROQUETTE FRERES

- TABLE 125 ROQUETTE FRERES: COMPANY AT A GLANCE

- 15.6 AVEBE U.A.

- TABLE 126 AVEBE U.A.: COMPANY AT A GLANCE

- FIGURE 41 AVEBE U.A.: COMPANY SNAPSHOT

- TABLE 127 AVEBE U.A.: OTHERS

- 15.7 GRAIN PROCESSING CORPORATION

- TABLE 128 GRAIN PROCESSING CORPORATION: COMPANY AT A GLANCE

- 15.8 EMSLAND GROUP

- TABLE 129 EMSLAND GROUP: COMPANY AT A GLANCE

- TABLE 130 EMSLAND GROUP: NEW PRODUCTS OFFERED

- TABLE 131 EMSLAND GROUP: DEALS

- 15.9 AGRANA

- TABLE 132 AGRANA BETEILIGUNGS-AG: COMPANY AT A GLANCE

- FIGURE 42 AGRANA: COMPANY SNAPSHOT

- TABLE 133 AGRANA: OTHERS

- 15.10 SMS CORPORATION

- TABLE 134 SMS CORPORATION: COMPANY AT A GLANCE

- TABLE 135 SMS CORPORATION: NEW PRODUCT LAUNCHES

- 15.11 GLOBAL BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED

- TABLE 136 GLOBAL BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED: COMPANY AT A GLANCE

- FIGURE 43 GLOBAL BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED: COMPANY SNAPSHOT

- 15.12 SPAC STARCH PRODUCTS (INDIA) LTD.

- TABLE 137 SPAC STARCH PRODUCTS (INDIA) LTD.: COMPANY AT A GLANCE

- 15.13 QINGDAO CBH CO., LTD.

- TABLE 138 QINGDAO CBH CO., LTD.: COMPANY AT A GLANCE

- 15.14 TEREOS

- TABLE 139 TEREOS: COMPANY AT A GLANCE

- FIGURE 44 TEREOS: COMPANY SNAPSHOT

- 15.15 KMC

- TABLE 140 KMC: COMPANY AT A GLANCE

- 15.16 BENEO

- TABLE 141 BENEO: COMPANY AT A GLANCE

- TABLE 142 BENEO: NEW PRODUCT LAUNCHES

- TABLE 143 BENEO: OTHERS

- 15.17 ANGEL STARCH & FOOD PVT. LTD.

- TABLE 144 ANGEL STARCH & FOOD PVT. LTD.: COMPANY AT A GLANCE

- 15.18 SHUBHAM STARCH CHEM PVT. LTD.

- TABLE 145 SHUBHAM STARCH CHEM PVT. LTD.: COMPANY AT A GLANCE

- 15.19 EVEREST STARCH (INDIA) PVT. LTD.

- TABLE 146 EVEREST STARCH (INDIA) PVT. LTD.: COMPANY AT A GLANCE

- 15.20 SHEEKHARR STARCH PVT. LTD.

- TABLE 147 SHEEKHARR STARCH PVT. LTD.: COMPANY AT A GLANCE

- 15.21 SANSTAR BIO-POLYMERS LTD.

- TABLE 148 SANSTAR BIO-POLYMERS LTD.: COMPANY AT A GLANCE

- 15.22 UNIVERSAL BIOPOLYMERS

- TABLE 149 UNIVERSAL BIOPOLYMERS: COMPANY AT A GLANCE

- 15.23 SONISH STARCH TECHNOLOGY CO. LTD.

- TABLE 150 SONISH STARCH TECHNOLOGY CO. LTD.: COMPANY AT A GLANCE

- 15.24 VENUS STARCH SUPPLIERS

- TABLE 151 VENUS STARCH SUPPLIERS: COMPANY AT A GLANCE

- 15.25 GROMOTECH AGROCHEM PVT. LTD.

- TABLE 152 GROMOTECH AGROCHEM PVT. LTD.: COMPANY AT A GLANCE

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

16 ADJACENT AND RELATED MARKETS

- 16.1 INTRODUCTION

- TABLE 153 ADJACENT MARKETS TO MODIFIED STARCH

- 16.2 LIMITATIONS

- 16.3 POTATO STARCH MARKET

- 16.3.1 MARKET DEFINITION

- 16.3.2 MARKET OVERVIEW

- TABLE 154 POTATO STARCH MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- 16.4 PEA STARCH MARKET

- 16.4.1 MARKET DEFINITION

- 16.4.2 MARKET OVERVIEW

- TABLE 155 PEA STARCH MARKET SIZE, BY GRADE, 2019-2026 (USD BILLION)

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 AVAILABLE CUSTOMIZATIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS