|

|

市場調査レポート

商品コード

1231104

スマートメーターの世界市場:種類別 (電気、ガス、水道)・コンポーネント別・技術別 (AMI、AMR)・通信方式別 (RF、PLC、セルラー)・エンドユーザー別 (住宅用、商業用、産業用)・地域別の将来予測 (2028年まで)Smart Meter Market by Type (Electric Gas, and Water), Component, Technology (AMI & AMR), Communication (RF, PLC, and Cellular), End-user (Residential, Commercial, Industrial) and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| スマートメーターの世界市場:種類別 (電気、ガス、水道)・コンポーネント別・技術別 (AMI、AMR)・通信方式別 (RF、PLC、セルラー)・エンドユーザー別 (住宅用、商業用、産業用)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年02月23日

発行: MarketsandMarkets

ページ情報: 英文 308 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

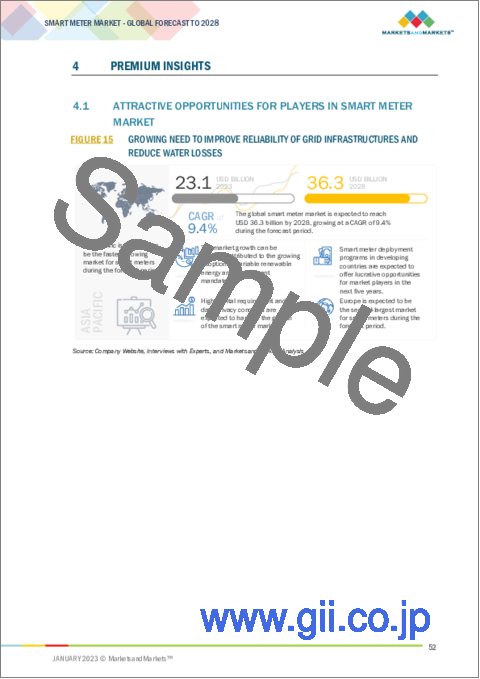

世界のスマートメーターの市場規模は、2023年の231億米ドルから2028年には363億米ドルに達し、予測期間中に9.4%のCAGRで成長する、と予測されています。

世界各国の政府は、将来の電力需要を満たすためにさまざまな取り組みを行っており、エネルギーを生産するための再生可能エネルギー源の使用を促進することで、二酸化炭素排出量を減らすことに注力しています。スマートメーターは、こうした取り組みの実現に重要な役割を果たすことになるでしょう。

コンポーネント別では、ソフトウェアのセグメントが最も急速に成長すると見込まれています。

技術別では、AMI (高度計測インフラ) が最大のセグメントになると考えられています。スマートグリッドプロジェクトの基盤はAMI技術を採用したスマートメーターであり、このようなプロジェクトに対する投資の増加がAMIスマートメーター市場の主要な成長要因となっています。

地域別に見ると、欧州が予測期間中に第2位の市場になると予想されます。欧州連合 (EU) は、気候変動に左右されない経済への近代化と変革をすでに開始しており、2050年までに世界初の気候変動に左右されない主要経済となることを計画しています。

当レポートでは、世界のスマートメーターの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・コンポーネント別・技術別・通信方式別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- マーケットマップ

- バリュー/サプライチェーン分析

- 平均販売価格 (ASP) 分析

- 技術分析

- 関税・法令・規制

- 特許分析

- 貿易分析

- 主な会議とイベント (2022年~2023年)

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

第6章 スマートメーター市場:種類別

- イントロダクション

- スマート電気メーター

- スマートガスメーター

- スマート水道メーター

第7章 スマートメーター市場:コンポーネント別

- イントロダクション

- ハードウェア

- パワーシステム

- マイクロコントローラ

- 通信インターフェース

- ソフトウェア

- 顧客情報システム (CIS)

- メーターデータ管理システム (MDMS)

- 計測・課金ソフトウェア

第8章 スマートメーター市場:技術別

- イントロダクション

- 自動検針 (AMR)

- 高度計測インフラ (AMI)

第9章 スマートメーター市場:通信方式別

- イントロダクション

- 無線周波数 (RF)

- 電力線通信 (PLC)

- セルラー

第10章 スマートメーター市場:エンドユーザー別

- イントロダクション

- 住宅用

- 商業用

- 工業用

第11章 スマートメーター市場:地域別

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- 中東・アフリカ

- 南米

第12章 競合情勢

- 主要企業が採用した戦略:概要

- 上位5社の市場シェア分析 (2021年)

- スマートメーターの市場シェア分析 (2021年)

- 企業収益分析 (5年間分)

- 企業評価マトリックス/クアドラント (2021年)

- スタートアップ/中小企業の評価クアドラント (2021年)

- 競合ベンチマーキング

- スマートメーター市場:企業のフットプリント

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- SCHNEIDER ELECTRIC

- LANDIS+GYR

- ITRON, INC.

- SIEMENS

- WASION GROUP

- BADGER METER, INC.

- SENSUS (XYLEM)

- HONEYWELL INTERNATIONAL

- LARSEN & TOUBRO

- KAMSTRUP A/S

- GENUS POWER INFRASTRUCTURE

- ACLARA TECHNOLOGIES

- OSAKI ELECTRIC CO., LTD. (EDMI)

- SAGEMCOM

- ISKRAEMECO

- その他の企業

- JIANGSU LINYANG ELECTRONICS

- HEXING ELECTRICAL

- NETWORKED ENERGY SERVICES CORPORATION

- PIETRO FIORENTINI

- SECURE METERS

第14章 隣接・関連市場

- イントロダクション

- 制限事項

- スマートメーターの相互接続市場

- スマート水道メーター市場

第15章 付録

The global smart meter market is estimated to grow from USD 23.1 Billion in 2023 to USD 36.3 Billion by 2028; it is expected to record a CAGR of 9.4% during the forecast period. Governments worldwide are undertaking several initiatives to meet future electricity demands and are focusing on reducing carbon footprint by promoting the use of renewable energy sources to produce energy. Smart meters will play a crucial role in achieving these initiatives.

"Software: The fastest segment of the smart meter market, by component "

Based on components, the smart meter market has been split into hardware and software. The customer information system (CIS), meter data management system (MDMS), and metering and billing software are critical software components of smart meters. The software helps manage the operations of smart meters once deployed by the utilities. Smart meter software aids in the detection of abnormal utility consumption patterns and the accurate billing of consumers.

"AMI segment is expected to emerge as the largest segment based on technology"

By technology, the smart meter market has been segmented into AMI & AMR. AMI enables the meters to collect and transmit data on utility and energy use in real-time. The foundation of smart grid projects is smart meters employing AMI technology, and rising investment in such projects serves as a major growth driver for the market for AMI smart meters

"Europe is expected to be the second largest market during the forecast period."

Europe is expected to be the second-largest market in the global smart meters in 2022 and is among the pioneers in adopting smart meters technology. Major western European countries such as France, Germany, Italy, Spain, and the UK are mature markets for smart meters. The European Union has already started the modernization and transformation toward a climate-neutral economy and plans to become the world's first major economy to go climate neutral by 2050.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 45%, Tier 2- 30%and Tier 3- 25%

By Designation: C-Level- 35%, Directors - 25%, and Others- 40%

By Region: North America- 27%, Europe- 20%, Asia Pacific- 33%, the Middle East & Africa- 12%, and South America- 8%

Note: Others includes product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The smart meter market is dominated by a few major players that have a wide regional presence. The leading players in the smart meter market are Schneider Electric (France), Landis+Gyr (Switzerland), Itron (US), Siemens (Germany), Wasion Group (China), Badger Meter (US), and Sensus (Xylem) (US)

Research Coverage:

The report defines, describes, and forecasts the global smart meter market, by type, component, technology, communication, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the smart meter market.

Key Benefits of Buying the Report

1. The report identifies and addresses the key markets for smart meter market, which would help equipment manufacturers review the growth in demand.

2. The report helps system providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

3. The report will help key players understand the strategies of their competitors better and help them in making better strategic decisions.

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 SMART METER MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

- 1.3.2 SMART METER MARKET, BY COMPONENT: INCLUSIONS AND EXCLUSIONS

- 1.3.3 SMART METER MARKET, BY COMMUNICATION: INCLUSIONS AND EXCLUSIONS

- 1.3.4 SMART METER MARKET, BY TECHNOLOGY: INCLUSIONS AND EXCLUSIONS

- 1.3.5 SMART METER MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKETS COVERED

- 1.4.2 REGIONAL SCOPE

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 SMART METER MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key insights from primary sources

- 2.2.2.2 Breakdown of primaries

- 2.3 SCOPE

- FIGURE 3 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR SMART METERS

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Regional analysis

- 2.4.3.2 Country-level analysis

- 2.4.3.3 Assumptions for demand-side analysis

- 2.4.3.4 Calculations for demand-side analysis

- 2.4.4 SUPPLY-SIDE ANALYSIS

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF SMART METERS

- FIGURE 7 SMART METER MARKET: SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Calculations for supply-side analysis

- 2.4.4.2 Assumptions for supply-side analysis

- FIGURE 8 COMPANY REVENUE ANALYSIS, 2021

- 2.5 FORECAST

- 2.6 RISK ASSESSMENT

- 2.7 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- TABLE 1 SNAPSHOT OF SMART METER MARKET

- FIGURE 9 AMI SEGMENT TO HOLD LARGER SHARE OF SMART METER MARKET DURING FORECAST PERIOD

- FIGURE 10 SMART ELECTRIC METER SEGMENT TO LEAD SMART METER MARKET DURING FORECAST PERIOD

- FIGURE 11 CELLULAR SEGMENT TO LEAD SMART METER MARKET DURING FORECAST PERIOD

- FIGURE 12 HARDWARE SEGMENT TO HOLD LARGER SHARE OF SMART METER MARKET DURING FORECAST PERIOD

- FIGURE 13 RESIDENTIAL SEGMENT TO LEAD SMART METER MARKET DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF SMART METER MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMART METER MARKET

- FIGURE 15 GROWING NEED TO IMPROVE RELIABILITY OF GRID INFRASTRUCTURES AND REDUCE WATER LOSSES

- 4.2 ASIA PACIFIC SMART METER MARKET, BY END USER AND COUNTRY

- FIGURE 16 RESIDENTIAL SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC SMART METER MARKET IN 2022

- 4.3 SMART METER MARKET, BY TYPE

- FIGURE 17 SMART ELECTRIC METER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- 4.4 SMART METER MARKET, BY END USER

- FIGURE 18 RESIDENTIAL SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- 4.5 SMART METER MARKET, BY TECHNOLOGY

- FIGURE 19 AMI SEGMENT TO LEAD SMART METER MARKET IN 2028

- 4.6 SMART METER MARKET, BY COMPONENT

- FIGURE 20 HARDWARE SEGMENT TO HOLD LARGER SHARE OF SMART METER MARKET IN 2028

- 4.7 SMART METER MARKET, BY COMMUNICATION

- FIGURE 21 CELLULAR SEGMENT TO DOMINATE SMART METER MARKET IN 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 SMART METER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Supportive government regulations pertaining to digitalization of grids

- FIGURE 23 INVESTMENT SHARE PERCENTAGE OF DIGITAL GRID INFRASTRUCTURE IN GLOBAL ELECTRICITY INVESTMENT, 2014-2019

- 5.2.1.2 Rising adoption of smart meters to monitor utility systems in real time

- 5.2.1.3 Dynamic pricing of utilities

- 5.2.1.4 Reduced blackouts and failures of utility systems

- 5.2.1.5 Increased need to monitor energy consumption to achieve carbon neutrality

- 5.2.2 RESTRAINTS

- 5.2.2.1 High setup and operational costs and limited availability of low-cost digital upgrades

- 5.2.2.2 Decline in infrastructure development investments and low return on investment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Focus of governments worldwide on reducing aggregate technical and commercial losses

- FIGURE 24 GLOBAL INVESTMENTS IN SMART GRID INFRASTRUCTURE, 2014-2019

- 5.2.3.2 Integration of artificial intelligence (AI) and machine learning (ML) technologies into smart meters

- 5.2.3.3 Rising adoption of electric and hybrid vehicles

- FIGURE 25 GLOBAL ELECTRIC VEHICLE (EV) STOCKS, 2016-2020 (MILLION UNITS)

- 5.2.3.4 Increasing focus of developing countries on improving water distribution networks

- TABLE 2 WATER AND WASTEWATER TREATMENT PROJECTS IN INDIA

- 5.2.4 CHALLENGES

- 5.2.4.1 Maintenance, security, and integrity of smart meters and associated data and requirement for skilled professionals

- 5.2.4.2 Dependency on reliable connections between smart meters and smart grid devices to collect highly accurate data

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SMART METER PROVIDERS

- FIGURE 26 REVENUE SHIFT FOR SMART METER PROVIDERS

- 5.4 MARKET MAP

- TABLE 3 SMART METER MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 MARKET MAP/ECOSYSTEM ANALYSIS

- 5.5 VALUE/SUPPLY CHAIN ANALYSIS

- FIGURE 28 SMART METER MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL/COMPONENT PROVIDERS

- 5.5.2 SMART METER MANUFACTURERS

- 5.5.3 DISTRIBUTORS AND AFTER-SALES SERVICE PROVIDERS

- 5.5.4 END USERS

- 5.6 AVERAGE SELLING PRICE (ASP) ANALYSIS

- FIGURE 29 AVERAGE SELLING PRICE OF PRODUCTS OFFERED KEY PLAYERS, BY TYPE

- TABLE 4 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY PLAYERS, BY TYPE (USD)

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 SMART METER MARKET BASED ON DIFFERENT TECHNOLOGIES

- 5.8 TARIFFS, CODES, AND REGULATIONS

- 5.8.1 TARIFFS RELATED TO SMART METER MARKET

- 5.8.2 CODES AND REGULATIONS RELATED TO SMART METER MARKET

- TABLE 5 SMART METER MARKET: CODES AND REGULATIONS

- 5.8.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9 PATENT ANALYSIS

- TABLE 11 SMART METER MARKET: INNOVATION AND PATENT REGISTRATION

- 5.10 TRADE ANALYSIS

- 5.10.1 EXPORT SCENARIO

- TABLE 12 EXPORT SCENARIO FOR HS CODE: 9028, BY COUNTRY, 2019-2021 (USD THOUSAND)

- 5.10.2 IMPORT SCENARIO

- TABLE 13 IMPORT SCENARIO FOR HS CODE: 9028, BY COUNTRY, 2019-2021 (USD THOUSAND)

- 5.11 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 14 SMART METER MARKET: LIST OF CONFERENCES AND EVENTS

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 SMART WATER SYSTEM HELPED CITY OF MONROE TO IDENTIFY INDIVIDUAL LEAKING HOUSES AFTER WINTER STORMS

- 5.12.2 SMART METERING HELPED TURN BUDGET DEFICIT UTILITY COMPANY INTO BUDGET PLUS COMPANY

- 5.12.3 KAMSTRUP HELPED RURAL MUNICIPALITY IN ONEIDA, TENNESSEE, REVERSE WATER LOSS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 SMART METER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 SMART METER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR END USERS

- TABLE 17 KEY BUYING CRITERIA, BY END USER

6 SMART METER MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 33 SMART METER MARKET SHARE, BY TYPE, 2022 (%)

- TABLE 18 SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.2 SMART ELECTRIC METER

- 6.2.1 RISING NEED TO IMPROVE RELIABILITY OF POWER INFRASTRUCTURE

- TABLE 19 SMART ELECTRIC METER: SMART METER MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3 SMART GAS METER

- 6.3.1 GROWING NEED TO REDUCE GAS CONSUMPTION

- TABLE 20 SMART GAS METER: SMART METER MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.4 SMART WATER METER

- 6.4.1 INCREASING NEED TO REDUCE NON-REVENUE WATER LOSSES

- TABLE 21 SMART WATER METER: SMART METER MARKET, BY REGION, 2021-2028 (USD MILLION)

7 SMART METER MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- FIGURE 34 SMART METER MARKET, BY COMPONENT, 2022

- TABLE 22 SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 7.2 HARDWARE

- TABLE 23 HARDWARE: SMART METER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 24 HARDWARE: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 7.2.1 POWER SYSTEM

- 7.2.1.1 Power systems ensure that metering electronics remain operational even when mainline is turned off

- 7.2.2 MICROCONTROLLER

- 7.2.2.1 Integration of AI or IoT with microcontrollers makes them consumer-friendly

- 7.2.3 COMMUNICATION INTERFACE

- 7.2.3.1 Communication interface transmits data from utilities to consumers

- 7.3 SOFTWARE

- TABLE 25 SOFTWARE: SMART METER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 26 SOFTWARE: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 7.3.1 CUSTOMER INFORMATION SYSTEM (CIS)

- 7.3.1.1 Improves communication between consumers and service providers

- 7.3.2 METER DATA MANAGEMENT SYSTEM (MDMS)

- 7.3.2.1 Enables large data management with multiple users

- 7.3.3 METERING AND BILLING SOFTWARE

- 7.3.3.1 Increases billing transparency

8 SMART METER MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- FIGURE 35 AMI SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2022

- TABLE 27 SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.2 AUTOMATIC METER READING (AMR)

- 8.2.1 AUTOMATIC METER READING (AMR) HELPS REDUCE MANUAL INTERVENTION FOR DATA COLLECTION

- TABLE 28 AMR: SMART METER MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3 ADVANCED METERING INFRASTRUCTURE (AMI)

- 8.3.1 ADVANCED METERING INFRASTRUCTURE (AMI) INCREASES RELIABILITY OF SMART METER INFRASTRUCTURE

- TABLE 29 AMI: SMART METER MARKET, BY REGION, 2021-2028 (USD MILLION)

9 SMART METER MARKET, BY COMMUNICATION

- 9.1 INTRODUCTION

- FIGURE 36 SMART METER MARKET, BY COMMUNICATION, 2022

- TABLE 30 SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- 9.2 RADIOFREQUENCY (RF)

- 9.2.1 LOW MAINTENANCE COST

- TABLE 31 RF: SMART METER MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.3 POWER LINE COMMUNICATION (PLC)

- 9.3.1 EXCELLENT COMMUNICATION IN HARD-TO-REACH REGIONS

- TABLE 32 PLC: SMART METER MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.4 CELLULAR

- 9.4.1 COST-EFFECTIVENESS AND FAST DATA TRANSMISSION RATE

- TABLE 33 CELLULAR: SMART METER MARKET, BY REGION, 2021-2028 (USD MILLION)

10 SMART METER MARKET, BY END USER

- 10.1 INTRODUCTION

- FIGURE 37 SMART METER MARKET, BY END USER, 2022

- TABLE 34 SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2 RESIDENTIAL

- 10.2.1 IMPROVED BILLING ACCURACY AND BENEFITS IN REAL-TIME MONITORING

- TABLE 35 RESIDENTIAL: SMART METER MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.3 COMMERCIAL

- 10.3.1 IMPROVED ENERGY EFFICIENCY AND REMOTE MANAGEMENT OF ENERGY CONSUMPTION

- TABLE 36 COMMERCIAL: SMART METER MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.4 INDUSTRIAL

- 10.4.1 RISING NEED TO IMPROVE ENERGY EFFICIENCY AND COMPLY WITH STANDARDS AND REGULATIONS

- TABLE 37 INDUSTRIAL: SMART METER MARKET, BY REGION, 2021-2028 (USD MILLION)

11 SMART METER MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 38 ASIA PACIFIC SMART METER MARKET TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 39 SMART METER MARKET, BY REGION, 2022 (%)

- TABLE 38 SMART METER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 39 SMART METER MARKET, BY REGION, 2021-2028 (MILLION UNITS)

- 11.2 ASIA PACIFIC

- FIGURE 40 ASIA PACIFIC: SNAPSHOT OF SMART METER MARKET

- 11.2.1 RECESSION IMPACT: ASIA PACIFIC

- 11.2.2 BY TYPE

- TABLE 40 ASIA PACIFIC: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.2.3 BY COMMUNICATION

- TABLE 41 ASIA PACIFIC: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- 11.2.4 BY COMPONENT

- TABLE 42 ASIA PACIFIC: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: SMART METER MARKET FOR SOFTWARE, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 44 ASIA PACIFIC: SMART METER MARKET FOR HARDWARE, BY TYPE, 2021-2028 (USD MILLION)

- 11.2.5 BY TECHNOLOGY

- TABLE 45 ASIA PACIFIC: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 11.2.6 BY END USER

- TABLE 46 ASIA PACIFIC: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.7 BY COUNTRY

- TABLE 47 ASIA PACIFIC: SMART METER MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.2.7.1 China

- 11.2.7.1.1 Energy transition and shift toward smart electrification

- 11.2.7.1 China

- TABLE 48 CHINA: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 49 CHINA: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 50 CHINA: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 51 CHINA: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 52 CHINA: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.7.2 Australia

- 11.2.7.2.1 Government-led targets on net zero and renewable energy installations

- 11.2.7.2 Australia

- TABLE 53 AUSTRALIA: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 54 AUSTRALIA: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 55 AUSTRALIA: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 56 AUSTRALIA: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 57 AUSTRALIA: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.7.3 Japan

- 11.2.7.3.1 Rising focus on improving power quality in electricity infrastructure

- 11.2.7.3 Japan

- TABLE 58 JAPAN: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 59 JAPAN: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 60 JAPAN: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 61 JAPAN: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 62 JAPAN: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.7.4 India

- 11.2.7.4.1 Supportive government policies

- 11.2.7.4 India

- TABLE 63 INDIA: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 64 INDIA: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 65 INDIA: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 66 INDIA: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 67 INDIA: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.7.5 South Korea

- 11.2.7.5.1 Rising focus on increasing share of renewable energy supply in power generation

- 11.2.7.5 South Korea

- TABLE 68 SOUTH KOREA: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 69 SOUTH KOREA: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 70 SOUTH KOREA: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 71 SOUTH KOREA: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 72 SOUTH KOREA: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.7.6 Rest of Asia Pacific

- TABLE 73 REST OF ASIA PACIFIC: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 74 REST OF ASIA PACIFIC: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 75 REST OF ASIA PACIFIC: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 76 REST OF ASIA PACIFIC: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3 EUROPE

- FIGURE 41 EUROPE: SNAPSHOT OF SMART METER MARKET

- 11.3.1 RECESSION IMPACT: EUROPE

- 11.3.2 BY TYPE

- TABLE 78 EUROPE: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.3.3 BY COMMUNICATION

- TABLE 79 EUROPE: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- 11.3.4 BY COMPONENT

- TABLE 80 EUROPE: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 81 EUROPE: SMART METER MARKET FOR SOFTWARE, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 82 EUROPE: SMART METER MARKET FOR HARDWARE, BY TYPE, 2021-2028 (USD MILLION)

- 11.3.5 BY TECHNOLOGY

- TABLE 83 EUROPE: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 11.3.6 BY END USER

- TABLE 84 EUROPE: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.7 BY COUNTRY

- TABLE 85 EUROPE: SMART METER MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.3.7.1 UK

- 11.3.7.1.1 Supportive government policies related to smart meter market

- 11.3.7.1 UK

- TABLE 86 UK: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 87 UK: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 88 UK: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 89 UK: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 90 UK: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.7.2 Germany

- 11.3.7.2.1 Rising requirement for smart meters to improve reliability of power infrastructures

- 11.3.7.2 Germany

- TABLE 91 GERMANY: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 92 GERMANY: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 93 GERMANY: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 94 GERMANY: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 95 GERMANY: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.7.3 France

- 11.3.7.3.1 Supportive government regulations to build efficient power infrastructure

- 11.3.7.3 France

- TABLE 96 FRANCE: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 97 FRANCE: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 98 FRANCE: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 99 FRANCE: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 100 FRANCE: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.7.4 Italy

- 11.3.7.4.1 Rollout of next-generation smart meters

- 11.3.7.4 Italy

- TABLE 101 ITALY: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 102 ITALY: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 103 ITALY: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 104 ITALY: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 105 ITALY: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.7.5 Spain

- 11.3.7.5.1 Need for reliable grid operations and reducing NRW losses

- 11.3.7.5 Spain

- TABLE 106 SPAIN: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 107 SPAIN: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 108 SPAIN: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 109 SPAIN: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 110 SPAIN: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.7.6 Poland

- 11.3.7.6.1 Supportive government laws for smart grid development

- 11.3.7.6 Poland

- TABLE 111 POLAND: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 112 POLAND: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 113 POLAND: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 114 POLAND: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 115 POLAND: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.7.7 Rest of Europe

- TABLE 116 REST OF EUROPE: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 117 REST OF EUROPE: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 118 REST OF EUROPE: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 119 REST OF EUROPE: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 120 REST OF EUROPE: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4 NORTH AMERICA

- 11.4.1 RECESSION IMPACT: NORTH AMERICA

- FIGURE 42 NORTH AMERICA: SNAPSHOT OF SMART METER MARKET

- 11.4.2 BY TYPE

- TABLE 121 NORTH AMERICA: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.4.3 BY COMMUNICATION

- TABLE 122 NORTH AMERICA: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- 11.4.4 BY COMPONENT

- TABLE 123 NORTH AMERICA: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 124 NORTH AMERICA: SMART METER MARKET FOR SOFTWARE, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 125 NORTH AMERICA: SMART METER MARKET FOR HARDWARE, BY TYPE, 2021-2028 (USD MILLION)

- 11.4.5 BY TECHNOLOGY

- TABLE 126 NORTH AMERICA: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 11.4.6 BY END USER

- TABLE 127 NORTH AMERICA: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.7 BY COUNTRY

- TABLE 128 NORTH AMERICA: SMART METER MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.4.7.1 US

- 11.4.7.1.1 Implementation of climate change policies and rising investments in smart grid infrastructures

- 11.4.7.1 US

- TABLE 129 US: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 130 US: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 131 US: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 132 US: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 133 US: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.7.2 Canada

- 11.4.7.2.1 Increasing domestic power consumption and upgrade of electric grid infrastructure to incorporate renewable energy

- 11.4.7.2 Canada

- TABLE 134 CANADA: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 135 CANADA: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 136 CANADA: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 137 CANADA: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 138 CANADA: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.7.3 Mexico

- 11.4.7.3.1 Massive smart meter rollout plans and government-led support

- 11.4.7.3 Mexico

- TABLE 139 MEXICO: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 140 MEXICO: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 141 MEXICO: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 142 MEXICO: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 143 MEXICO: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 RECESSION IMPACT: MIDDLE EAST & AFRICA

- 11.5.2 BY TYPE

- TABLE 144 MIDDLE EAST & AFRICA: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.5.3 BY COMMUNICATION

- TABLE 145 MIDDLE EAST & AFRICA: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- 11.5.4 BY COMPONENT

- TABLE 146 MIDDLE EAST & AFRICA: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: SMART METER MARKET FOR SOFTWARE, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: SMART METER MARKET FOR HARDWARE, BY TYPE, 2021-2028 (USD MILLION)

- 11.5.5 BY TECHNOLOGY

- TABLE 149 MIDDLE EAST & AFRICA: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 11.5.6 BY END USER

- TABLE 150 MIDDLE EAST & AFRICA: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.5.7 BY COUNTRY

- TABLE 151 MIDDLE EAST & AFRICA: SMART METER MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.5.7.1 Saudi Arabia

- 11.5.7.1.1 Rising infrastructure development and growing need to enhance operational efficiency

- 11.5.7.1 Saudi Arabia

- TABLE 152 SAUDI ARABIA: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 153 SAUDI ARABIA: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 154 SAUDI ARABIA: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 155 SAUDI ARABIA: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 156 SAUDI ARABIA: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.5.7.2 UAE

- 11.5.7.2.1 Increasing energy consumption and growing need to improve utility operations

- 11.5.7.2 UAE

- TABLE 157 UAE: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 158 UAE: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 159 UAE: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 160 UAE: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 161 UAE: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.5.7.3 South Africa

- 11.5.7.3.1 Growing need to reduce utility debts

- 11.5.7.3 South Africa

- TABLE 162 SOUTH AFRICA: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 163 SOUTH AFRICA: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 164 SOUTH AFRICA: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 165 SOUTH AFRICA: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 166 SOUTH AFRICA: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.5.7.4 Israel

- 11.5.7.4.1 Rising focus on real-time monitoring to manage power usage

- 11.5.7.4 Israel

- TABLE 167 ISRAEL: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 168 ISRAEL: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 169 ISRAEL: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 170 ISRAEL: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 171 ISRAEL: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.5.7.5 Egypt

- 11.5.7.5.1 Replacement of aging utility infrastructure to better manage electricity distribution

- 11.5.7.5 Egypt

- TABLE 172 EGYPT: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 173 EGYPT: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 174 EGYPT: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 175 EGYPT: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 176 EGYPT: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.5.7.6 Qatar

- 11.5.7.6.1 Transition to smart cities and smart infrastructure

- 11.5.7.6 Qatar

- TABLE 177 QATAR: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 178 QATAR: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 179 QATAR: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 180 QATAR: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 181 QATAR: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.5.7.7 Turkey

- 11.5.7.7.1 Reduction in duration of billing and human errors

- 11.5.7.7 Turkey

- TABLE 182 TURKEY: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 183 TURKEY: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 184 TURKEY: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 185 TURKEY: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 186 TURKEY: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.5.7.8 Rest of Middle East & Africa

- TABLE 187 REST OF MIDDLE EAST & AFRICA: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 188 REST OF MIDDLE EAST & AFRICA: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 189 REST OF MIDDLE EAST & AFRICA: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 190 REST OF MIDDLE EAST & AFRICA: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 191 REST OF MIDDLE EAST & AFRICA: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.6 SOUTH AMERICA

- 11.6.1 RECESSION IMPACT: SOUTH AMERICA

- 11.6.2 BY TYPE

- TABLE 192 SOUTH AMERICA: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.6.3 BY COMMUNICATION

- TABLE 193 SOUTH AMERICA: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- 11.6.4 BY COMPONENT

- TABLE 194 SOUTH AMERICA: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 195 SOUTH AMERICA: SMART METER MARKET FOR SOFTWARE, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 196 SOUTH AMERICA: SMART METER MARKET FOR HARDWARE, BY TYPE, 2021-2028 (USD MILLION)

- 11.6.5 BY TECHNOLOGY

- TABLE 197 SOUTH AMERICA: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 11.6.6 BY END USER

- TABLE 198 SOUTH AMERICA: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.6.7 BY COUNTRY

- TABLE 199 SOUTH AMERICA: SMART METER MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.6.7.1 Brazil

- 11.6.7.1.1 Increasing need to improve operational efficiency

- 11.6.7.1 Brazil

- TABLE 200 BRAZIL: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 201 BRAZIL: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 202 BRAZIL: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 203 BRAZIL: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 204 BRAZIL: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.6.7.2 Argentina

- 11.6.7.2.1 Growing demand for renewable energy

- 11.6.7.2 Argentina

- TABLE 205 ARGENTINA: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 206 ARGENTINA: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 207 ARGENTINA: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 208 ARGENTINA: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 209 ARGENTINA: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.6.7.3 Chile

- 11.6.7.3.1 Rising need to modernize utility infrastructure and reduce operational costs

- 11.6.7.3 Chile

- TABLE 210 CHILE: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 211 CHILE: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 212 CHILE: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 213 CHILE: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 214 CHILE: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.6.7.4 Rest of South America

- TABLE 215 REST OF SOUTH AMERICA: SMART METER MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 216 REST OF SOUTH AMERICA: SMART METER MARKET, BY COMMUNICATION, 2021-2028 (USD MILLION)

- TABLE 217 REST OF SOUTH AMERICA: SMART METER MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 218 REST OF SOUTH AMERICA: SMART METER MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 219 REST OF SOUTH AMERICA: SMART METER MARKET, BY END USER, 2021-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 220 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS OF SMART METERS

- 12.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2021

- FIGURE 43 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS IN SMART METER MARKET, 2021

- TABLE 221 SMART METER MARKET: DEGREE OF COMPETITION

- 12.3 SMART METER MARKET SHARE ANALYSIS, 2021

- 12.4 FIVE-YEAR COMPANY REVENUE ANALYSIS

- FIGURE 44 REVENUE ANALYSIS OF TOP FIVE PLAYERS IN SMART METER MARKET, 2017-2021

- 12.5 COMPANY EVALUATION MATRIX/QUADRANT, 2021

- 12.5.1 STARS

- 12.5.2 PERVASIVE PLAYERS

- 12.5.3 EMERGING LEADERS

- 12.5.4 PARTICIPANTS

- FIGURE 45 SMART METER MARKET (GLOBAL): KEY COMPANY EVALUATION MATRIX, 2021

- 12.6 STARTUP/SME EVALUATION QUADRANT, 2021

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 46 SMART METER MARKET: STARTUP/SME EVALUATION QUADRANT, 2021

- 12.7 COMPETITIVE BENCHMARKING

- TABLE 222 SMART METER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 223 SMART METER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.8 SMART METER MARKET: COMPANY FOOTPRINT

- TABLE 224 TYPE: COMPANY FOOTPRINT

- TABLE 225 COMPONENT: COMPANY FOOTPRINT

- TABLE 226 END USER: COMPANY FOOTPRINT

- TABLE 227 REGION: COMPANY FOOTPRINT

- TABLE 228 COMPANY FOOTPRINT

- 12.9 COMPETITIVE SCENARIO

- TABLE 229 SMART METER MARKET: PRODUCT LAUNCHES, SEPTEMBER 2019-NOVEMBER 2022

- TABLE 230 SMART METER MARKET: DEALS, JULY 2019-OCTOBER 2022

- TABLE 231 SMART METER MARKET: OTHERS, JULY 2021-FEBRUARY 2022

13 COMPANY PROFILES

(Business Overview, Products/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

- 13.1 KEY PLAYERS

- 13.1.1 SCHNEIDER ELECTRIC

- TABLE 232 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- FIGURE 47 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 233 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 234 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 235 SCHNEIDER ELECTRIC: DEALS

- TABLE 236 SCHNEIDER ELECTRIC: OTHERS

- 13.1.2 LANDIS+GYR

- TABLE 237 LANDIS+GYR: COMPANY OVERVIEW

- FIGURE 48 LANDIS+GYR: COMPANY SNAPSHOT

- TABLE 238 LANDIS+GYR: PRODUCTS/SOLUTIONS OFFERED

- TABLE 239 LANDIS+GYR: PRODUCT LAUNCHES

- TABLE 240 LANDIS+GYR: DEALS

- TABLE 241 LANDIS+GYR: OTHERS

- 13.1.3 ITRON, INC.

- TABLE 242 ITRON, INC.: COMPANY OVERVIEW

- FIGURE 49 ITRON, INC.: COMPANY SNAPSHOT

- TABLE 243 ITRON, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 244 ITRON, INC.: PRODUCT LAUNCHES

- TABLE 245 ITRON, INC.: DEALS

- TABLE 246 ITRON, INC.: OTHERS

- 13.1.4 SIEMENS

- TABLE 247 SIEMENS: COMPANY OVERVIEW

- FIGURE 50 SIEMENS: COMPANY SNAPSHOT

- TABLE 248 SIEMENS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 249 SIEMENS: DEALS

- TABLE 250 SIEMENS: OTHERS

- 13.1.5 WASION GROUP

- TABLE 251 WASION GROUP: COMPANY OVERVIEW

- FIGURE 51 WASION GROUP: COMPANY SNAPSHOT

- TABLE 252 WASION GROUP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 253 WASION GROUP: DEALS

- 13.1.6 BADGER METER, INC.

- TABLE 254 BADGER METER, INC.: COMPANY OVERVIEW

- FIGURE 52 BADGER METER, INC.: COMPANY SNAPSHOT

- TABLE 255 BADGER METER, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 256 WASION GROUP: PRODUCT LAUNCHES

- TABLE 257 BADGER METER, INC.: DEALS

- 13.1.7 SENSUS (XYLEM)

- TABLE 258 SENSUS (XYLEM): COMPANY OVERVIEW

- FIGURE 53 SENSUS (XYLEM): COMPANY SNAPSHOT

- TABLE 259 SENSUS (XYLEM): PRODUCTS/SOLUTIONS OFFERED

- TABLE 260 SENSUS XYLEM: PRODUCT LAUNCHES

- TABLE 261 SENSUS XYLEM: DEALS

- 13.1.8 HONEYWELL INTERNATIONAL

- TABLE 262 HONEYWELL INTERNATIONAL: COMPANY OVERVIEW

- FIGURE 54 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 263 HONEYWELL INTERNATIONAL: PRODUCTS/SOLUTIONS OFFERED

- TABLE 264 HONEYWELL INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 265 HONEYWELL INTERNATIONAL: DEALS

- 13.1.9 LARSEN & TOUBRO

- TABLE 266 LARSEN & TOUBRO: COMPANY OVERVIEW

- FIGURE 55 LARSEN & TOUBRO: COMPANY SNAPSHOT

- TABLE 267 LARSEN & TOUBRO: PRODUCTS/SOLUTIONS OFFERED

- TABLE 268 LARSEN & TOUBRO: OTHERS

- 13.1.10 KAMSTRUP A/S

- TABLE 269 KAMSTRUP A/S: COMPANY OVERVIEW

- TABLE 270 KAMSTRUP A/S: PRODUCTS/SOLUTIONS OFFERED

- TABLE 271 KAMSTRUP A/S: PRODUCT LAUNCHES

- TABLE 272 KAMSTRUP A/S: DEALS

- TABLE 273 KAMSTRUP A/S: OTHERS

- 13.1.11 GENUS POWER INFRASTRUCTURE

- TABLE 274 GENUS POWER INFRASTRUCTURE: COMPANY OVERVIEW

- FIGURE 56 GENUS POWER INFRASTRUCTURE: COMPANY SNAPSHOT

- TABLE 275 GENUS POWER INFRASTRUCTURE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 276 GENUS POWER INFRASTRUCTURE: DEALS

- 13.1.12 ACLARA TECHNOLOGIES

- TABLE 277 ACLARA TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 278 ACLARA TECHNOLOGIES: PRODUCTS/SOLUTIONS OFFERED

- TABLE 279 ACLARA TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 280 ACLARA TECHNOLOGIES: DEALS

- TABLE 281 ACLARA TECHNOLOGIES: OTHERS

- 13.1.13 OSAKI ELECTRIC CO., LTD. (EDMI)

- TABLE 282 OSAKI ELECTRIC CO., LTD. (EDMI): COMPANY OVERVIEW

- TABLE 283 OSAKI ELECTRIC CO., LTD. (EDMI): PRODUCTS/SOLUTIONS OFFERED

- TABLE 284 OSAKI ELECTRIC CO., LTD. (EDMI): PRODUCT LAUNCHES

- TABLE 285 OSAKI ELECTRIC CO., LTD. (EDMI): DEALS

- TABLE 286 OSAKI ELECTRIC CO. (EDMI): OTHERS

- 13.1.14 SAGEMCOM

- TABLE 287 SAGEMCOM: COMPANY OVERVIEW

- TABLE 288 SAGEMCOM: PRODUCTS/SOLUTIONS OFFERED

- TABLE 289 SAGEMCOM: PRODUCT LAUNCHES

- TABLE 290 SAGEMCOM: DEALS

- 13.1.15 ISKRAEMECO

- TABLE 291 ISKRAEMECO: COMPANY OVERVIEW

- TABLE 292 ISKRAEMECO: PRODUCTS/SOLUTIONS OFFERED

- TABLE 293 ISKRAEMECO: PRODUCT LAUNCHES

- TABLE 294 ISKRAEMECO: DEALS

- TABLE 295 ISKRAEMECO: OTHERS

- 13.2 OTHER PLAYERS

- 13.2.1 JIANGSU LINYANG ELECTRONICS

- TABLE 296 JIANGSU LINYANG ELECTRONICS

- 13.2.2 HEXING ELECTRICAL

- TABLE 297 HEXING ELECTRICAL

- 13.2.3 NETWORKED ENERGY SERVICES CORPORATION

- TABLE 298 NETWORKED ENERGY SERVICES CORPORATION

- 13.2.4 PIETRO FIORENTINI

- TABLE 299 PIETRO FIORENTINI

- 13.2.5 SECURE METERS

- TABLE 300 SECURE METERS

- Details on Business Overview, Products/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 SMART METER INTERCONNECTED MARKETS

- 14.4 SMART WATER METER MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 LIMITATIONS

- 14.4.3 MARKET OVERVIEW

- 14.4.4 SMART WATER METER MARKET, BY METER TYPE

- 14.4.4.1 Electromagnetic Meters

- TABLE 301 ELECTROMAGNETIC METERS: SMART WATER METERING MARKET,

- BY REGION, 2020-2027 (USD MILLION)

- 14.4.4.2 Ultrasonic meters

- TABLE 302 ULTRASONIC METERS: SMART WATER METERING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 14.4.4.3 Smart Mechanical meters

- TABLE 303 SMART MECHANICAL METERS: SMART WATER METERING MARKET,

- BY REGION, 2020-2027 (USD MILLION)

- 14.4.5 SMART METER MARKET, BY COMPONENT

- TABLE 304 SMART WATER METERING MARKET, BY COMPONENT,

- 2020-2027 (USD MILLION)

- 14.4.5.1 Meters & Accessories

- TABLE 305 METERS & ACCESSORIES: SMART WATER METERING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 14.4.5.2 IT Solutions

- TABLE 306 IT SOLUTIONS: SMART WATER METERING MARKET, BY REGION,

- 2020-2027 (USD MILLION)

- 14.4.5.3 Communications

- TABLE 307 COMMUNICATIONS: SMART WATER METERING MARKET, BY REGION,

- 2020-2027 (USD MILLION)

- 14.4.6 SMART METER MARKET, BY REGION

- TABLE 308 SMART WATER METERING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 14.5 US WATER METER MARKET

- 14.5.1 MARKET DEFINITION

- 14.5.2 LIMITATIONS

- 14.5.3 MARKET OVERVIEW

- 14.5.4 US WATER METER MARKET, BY PRODUCT

- TABLE 309 US WATER METER MARKET, BY PRODUCT, 2016-2026 (USD MILLION)

- 14.5.5 US WATER METER MARKET, BY APPLICATION

- TABLE 310 US WATER METER MARKET, BY APPLICATION, 2016-2026 (USD MILLION)

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS