|

|

市場調査レポート

商品コード

1270834

塗料・コーティングの欧州市場:樹脂タイプ別(アクリル、アルキド、エポキシ、ポリエステル、PU、フッ素ポリマー、ビニル)、技術別(水性、溶剤系、粉体)、最終用途産業別(建築、工業)、国別 - 2028年までの予測European Paints and Coatings Market by Resin Type (Acrylic, Alkyd, Epoxy, Polyester, PU, Fluoropolymer, Vinyl), Technology (Waterborne, Solvent borne, Powder), End-use (Architectural and Industrial), and Country - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 塗料・コーティングの欧州市場:樹脂タイプ別(アクリル、アルキド、エポキシ、ポリエステル、PU、フッ素ポリマー、ビニル)、技術別(水性、溶剤系、粉体)、最終用途産業別(建築、工業)、国別 - 2028年までの予測 |

|

出版日: 2023年05月04日

発行: MarketsandMarkets

ページ情報: 英文 308 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

欧州の塗料・コーティングの市場規模は、2023年の372億米ドルから、2028年までに416億米ドルまで拡大し、2023年~2028年のCAGRで2.3%の成長が予測されています。

欧州の塗料・コーティング市場に関連する課題として、厳しい環境規制が挙げられます。さまざまな政府によって採用される規制政策が増加する中、この地域の塗料・コーティングメーカーは、常に新しい政策に準拠するためにプロセスを改善する必要があります。

"アクリル樹脂は、建築向け最終用途産業で最大の成長セグメントと推定される"

アクリル樹脂は、エマルジョン(ラテックス)、ラッカー、エナメル、パウダーなどさまざまな形態で販売されており、その中でも最も一般的な形態はアクリルラテックスです。アクリルポリマーは、アクリル酸とメタクリル酸が主成分で、紫外線を吸収しにくいポリマー構造を持ち、油性塗料やアルキド、エポキシに比べて耐候性、耐酸化性に優れています。アクリルは、良好な色調と光沢保持性を有しています。パウダーコーティングのアクリルは、薄膜のクリアコートから非常に滑らかなコートまで幅広く、優れた耐候性と高光沢の色を持つ高性能な仕上げを提供し、外装耐久性に優れた屋外用途に適しています。アクリル塗料は、水性で扱いやすく、価格も手ごろで、屋根や壁の塗装などさまざまな用途に適しています。水の蒸発によって硬化し、適度な凝集力を持ち、ほとんどの屋根面に良好な接着性を示します。この樹脂ベースの塗料は、多くの建築用途に使用されています。

"ポリウレタン樹脂は、予測期間中、工業向け最終用途産業で最大の市場シェアを獲得する"

ポリウレタン樹脂は、ポリアルコールと有機ジイソシアネートの組み合わせで作られます。ポリウレタン樹脂塗料は、優れた耐久性、強靭性、光沢を持ち、洗浄が容易です。そのため、ポリウレタン樹脂塗料は、世界中のさまざまな用途に使用されています。石油掘削塔、倉庫、工業プラント、耐熱塗料、橋梁など、高い性能が求められる用途にも採用されています。ポリウレタン樹脂塗料は、重量のある外装や内装の構造物塗装、クリーンルーム、製紙工場、発電所、海洋構造物、油田機械、スチールタンクの外面、手すり、コンベヤー、化学処理装置などにも使用されています。

"ドイツは、欧州の塗料・コーティング市場で、最大かつ最も急成長中のセグメントと推定される"

自動車産業により、同国の塗料・コーティングの需要が高まりました。OICAによると、小型商用車212,527台、乗用車3,096,165台を生産しています。ドイツの自動車産業は、欧州で+60%の研究開発成長を生み出しています。自動車産業は、国内産業総収入の24%を生み出しています。2021年にドイツで製造された自動車の77%は、輸出市場向けです。業界は、パンデミックだけでなく、経済不況からも立ち直りつつあり、欧州で最も多くのOEM工場が集中しています。現在、ドイツには44のOEM拠点が立地しています。EUにおけるドイツのOEM市場シェアは、2021年に55%以上となっています。ドイツの乗用車および小型商用車OEMの海外市場売上は、2021年にほぼ2,740億ユーロ(3,021億1,000万米ドル)となり、2020年比で10%増となっています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 購入プロセスにおける主要な利害関係者

- マクロ経済指標と主要な業界動向

- 市場の成長に影響を与える世界経済シナリオ

- バリューチェーン分析

- 価格分析

- 欧州の塗料・コーティングのエコシステムと相互接続された市場

- 購入者/顧客に影響を与える動向/混乱

- 貿易分析

- 基準と規制の状況

- 特許分析

- ケーススタディ

- 技術分析

- 主な会議とイベント(2023年)

- 関税と規制状況

第6章 欧州の塗料・コーティング市場:樹脂タイプ別

- イントロダクション

- アクリル樹脂

- アルキド樹脂

- エポキシ樹脂

- ポリエステル樹脂

- ポリウレタン樹脂

- フッ素ポリマー樹脂

- ビニル樹脂

- その他

第7章 欧州の塗料・コーティング市場:技術別

- イントロダクション

- 水性

- 溶剤系

- 粉体

- その他

第8章 欧州の塗料・コーティング市場:最終用途産業別

- イントロダクション

- 建築

- 住宅

- 非住宅

- インフラ

- 工業

- 一般産業

- OEM

- 木材

- その他

第9章 欧州の塗料・コーティング市場:国別

- イントロダクション

- ドイツ

- ロシア

- 英国

- フランス

- イタリア

- スペイン

- トルコ

- ポーランド

- スウェーデン

- デンマーク

- ノルウェー

- フィンランド

- リトアニア

- ラトビア

- エストニア

- その他の欧州

第10章 競合情勢

- 概要

- 企業の評価象限マトリックス:定義と手法(2022年)

- 製品ポートフォリオの強み

- スタートアップ/中小企業の評価象限(2022年)

- 市場シェア分析

- 上位5社の収益分析

- 市場ランキング分析

- 競合シナリオ

- 競合ベンチマーキング

- 戦略的発展

第11章 企業プロファイル

- 主要企業

- AKZO NOBEL N.V.

- PPG INDUSTRIES, INC.

- THE SHERWIN-WILLIAMS COMPANY

- BASF COATINGS GMBH

- AXALTA COATING SYSTEMS LLC

- RPM INTERNATIONAL INC.

- JOTUN A/S

- HEMPEL A/S

- KANSAI PAINT CO., LTD

- CROMOLOGY(NIPPON PAINT HOLDINGS CO., LTD.)

- その他の企業

- DAW SE

- BECKERS GROUP

- BRILLUX GMBH & CO. KG

- TEKNOS GROUP

- MANKIEWICZ GEBR. & CO.

- MEFFERT AG FARBWERKE

- CORCORPORACAO INDUSTRIAL DO NORTE

- FLUGGER GROUP A/S

- IVM CHEMICALS

- TIGER COATINGS GMBH & CO. KG

- STO CORP.

- REMMERS

- MIPA SE

- WEILBURGER COATINGS GMBH

- FREILACKE

第12章 隣接/関連市場

- イントロダクション

- 塗料・コーティング

- コーティング樹脂市場

第13章 付録

The European Paints and Coatings market is projected to grow from USD 37.2 Billion in 2023 to USD 41.6 Billion by 2028, at a CAGR of 2.3% between 2023-2028. The challenges related to the European Paints and Coatings market are stringent environmental regulations. With the increasing number of regulatory policies adopted by various governments, paints & coatings producers in the region have to improve their processes to comply with the new policies constantly.

"Acrylic resin is estimated to be the largest growing segment in the architectural end-use industry."

Acrylics are available in various forms, such as emulsions (latex), lacquers, enamels, and powders, out of which the most common form is acrylic latex. The chief acrylic polymers are acrylic and methacrylic acid, which provide a polymer structure with little tendency to absorb UV light and increase their resistance to weathering and oxidation compared to oil-based paints, alkyds, or epoxies. Acrylics possess good colors and gloss retention. Acrylic in powder coatings ranges from thin-film clear coats to very smooth coats and provides a high-performance finish with outstanding weather resistance and high-gloss colors, making them ideal for outdoor applications with excellent exterior durability. Acrylic coatings are waterborne, easy to handle, moderately priced, and perform well in various applications such as roof and wall coating. They are cured by water evaporation, exhibiting a reasonable degree of cohesive strength, and provide good adhesion to most roof surfaces. These resin-based coatings are used in numerous architectural applications.

"Polyurethane resin to gain the maximum market share of Industrial End-use industry during the forecast period."

Polyurethane resins are created by combining polyalcohol with organic di-isocyanate. Polyurethane resin paints have exceptional durability, toughness, and gloss and are easy to clean. Polyurethane resin paints are employed in a variety of applications around the world because of their qualities. Polyurethane paints are also employed in applications requiring great performance, such as oil-rig towers, warehouses, industrial plants, heat-resistant coatings, and bridges. Heavy-duty exterior and interior structural coating, clean rooms, paper mills, power plants, offshore structures, oil field machinery, outside surfaces of steel tanks, handrails, conveyors, and chemical processing equipment are some further applications for polyurethane resin paints and coatings.

"Germany is estimated to be the largest and fastest-growing segment of the European Paints and Coatings market."

The automotive industry raised the demand for paints and coatings in the country. According to OICA, it has produced 212,527 light commercial vehicles and 3,096,165 passenger cars. The German automotive sector creates +60% R&D growth in Europe. The automotive industry generates 24% of total domestic industry revenue. 77% of cars manufactured in Germany in 2021 were destined for export markets. The industry is bouncing back from the pandemic as well as the economic recession, with the largest concentration of OEM plants in Europe. There are currently 44 OEM sites located in Germany. German OEM market share in the EU was more than 55 percent in 2021. German passenger car and light commercial vehicle OEM generated foreign market revenue of almost EUR 274 billion (USD 302.11 billion) in 2021 - a ten percent increase over 2020.

Extensive primary interviews have been conducted, and information has been gathered from secondary research to determine and verify the market size of several segments and sub-segments.

Breakdown of Primary Interviews:

- By Company Type: Tier 1 - 46%, Tier 2 - 36%, and Tier 3 - 18%

- By Designation: C Level - 27%, D Level - 10%, and Others - 55%

- By Region: Asia Pacific - 55%, North America - 18%, Europe - 9%, South America-9%, and the Middle East & Africa - 9%

The key companies profiled in this report are Akzo Nobel NV (Netherlands), PPG Industries, Inc. (US), The Sherwin-Williams Company (US), BASF Coatings GmbH (Germany), Jotun A/S (Norway), and Axalta Coating Systems LLC (US).

Research Coverage:

European Paints and Coatings Market by Resin Type (Acrylic, Alkyd, Epoxy, Polyester, PU, Fluoropolymer, Vinyl), by Technology (Waterborne, Solventborne, Powder), by End-use (Architectural and Industrial), and Country (Germany, Russia, UK, France, Italy, Spain, Turkey, Poland, Sweden, Denmark, Norway, Finland, Lithuania, Latvia, Estonia, and Rest of Europe).

Reasons to Buy the Report

From an insight perspective, this research report focuses on various levels of analyses - industry analysis (industry trends), market share analysis of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape, emerging and high-growth segments of the market; high growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on European Paints and Coatings offered by top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the market for European Paints and Coatings across regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SEGMENTATION

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 EUROPEAN PAINTS AND COATINGS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary data sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 2 MARKET ESTIMATION: SUPPLY SIDE

- FIGURE 3 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 4 EUROPEAN PAINTS AND COATINGS MARKET: DATA TRIANGULATION

- 2.4 ASSUMPTIONS AND LIMITATIONS

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 3 EUROPEAN PAINTS AND COATINGS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 5 ACRYLIC TO BE MOST WIDELY USED RESIN TYPE IN MARKET

- FIGURE 6 WATERBORNE TECHNOLOGY TO ACCOUNT FOR LARGEST SHARE OF MARKET

- FIGURE 7 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN EUROPEAN PAINTS AND COATINGS MARKET

- FIGURE 8 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS BETWEEN 2023 AND 2028

- 4.2 EUROPEAN PAINTS AND COATINGS MARKET, BY RESIN TYPE

- FIGURE 9 ACRYLIC RESIN TYPE TO BE LARGEST SEGMENT BY 2028

- 4.3 EUROPEAN PAINTS AND COATINGS MARKET, BY END-USE INDUSTRY AND COUNTRY

- FIGURE 10 GERMANY AND ARCHITECTURAL END-USE INDUSTRY DOMINATED PAINTS AND COATINGS MARKETS IN 2022

- 4.4 EUROPEAN PAINTS AND COATINGS MARKET, BY KEY COUNTRY

- FIGURE 11 GERMANY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN EUROPEAN PAINTS AND COATINGS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for premium paints

- 5.2.1.2 High demand for sustainable coatings from professional and DIY industries

- 5.2.1.3 Rising demand for durable coatings with better performance and aesthetics

- 5.2.1.4 Technological evolution in powder-based coatings

- 5.2.2 RESTRAINTS

- 5.2.2.1 Requirement of more curing time for waterborne paints and coatings

- 5.2.2.2 Trouble attaining thin films with powder coating

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased utilization of fluoropolymers in building and construction industry

- 5.2.3.2 Attractive prospects for powder coatings in EV industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent environmental regulations

- 5.2.4.2 Challenges concerning wastewater disposal

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 EUROPEAN PAINTS AND COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 13 PORTER'S FIVE FORCES ANALYSIS: EUROPEAN PAINTS AND COATINGS MARKET

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.5 KEY STAKEHOLDERS IN BUYING PROCESS

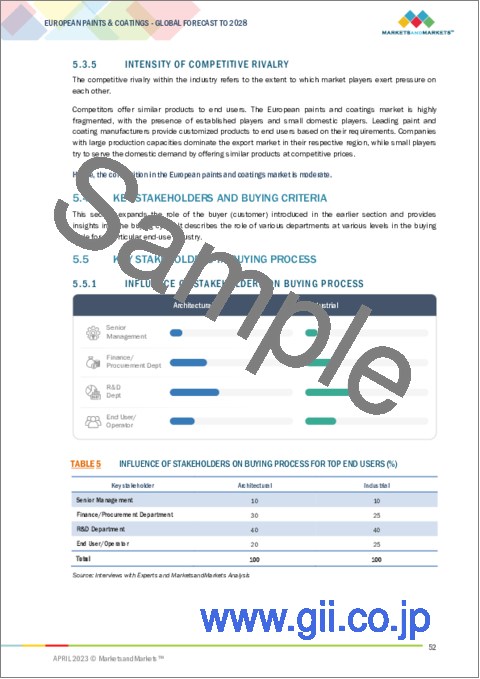

- 5.5.1 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS (%)

- 5.5.2 BUYING CRITERIA

- FIGURE 14 KEY BUYING CRITERIA FOR EUROPEAN PAINTS AND COATINGS

- TABLE 6 KEY BUYING CRITERIA FOR EUROPEAN PAINTS AND COATINGS

- 5.6 MACRO ECONOMIC INDICATORS AND KEY INDUSTRY TRENDS

- 5.6.1 INTRODUCTION

- 5.6.2 TRENDS AND FORECAST OF GDP

- 5.6.3 TRENDS IN AUTOMOTIVE INDUSTRY

- TABLE 7 AUTOMOTIVE INDUSTRY PRODUCTION (2020-2021)

- TABLE 8 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, 2020-2028

- 5.7 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTH

- 5.7.1 RUSSIA-UKRAINE WAR

- 5.7.2 ENERGY CRISIS IN EUROPE

- 5.8 VALUE CHAIN ANALYSIS

- FIGURE 15 EUROPEAN PAINTS AND COATINGS: VALUE CHAIN ANALYSIS

- 5.9 PRICING ANALYSIS

- FIGURE 16 AVERAGE PRICE COMPETITIVENESS IN EUROPEAN PAINTS AND COATINGS MARKET, BY COUNTRY

- FIGURE 17 AVERAGE PRICE COMPETITIVENESS IN EUROPEAN PAINTS AND COATINGS MARKET, BY TECHNOLOGY, 2022

- FIGURE 18 AVERAGE PRICE COMPETITIVENESS IN EUROPEAN PAINTS AND COATINGS MARKET, BY COMPANY, 2022

- 5.10 EUROPEAN PAINTS AND COATINGS ECOSYSTEM AND INTERCONNECTED MARKET

- TABLE 9 EUROPEAN PAINTS AND COATINGS MARKET: SUPPLY CHAIN

- FIGURE 19 EUROPEAN PAINTS AND COATINGS MARKET: ECOSYSTEM

- 5.11 TRENDS/DISRUPTIONS IMPACTING BUYERS/CUSTOMERS

- 5.12 TRADE ANALYSIS

- TABLE 10 COUNTRY-WISE EXPORT DATA FOR AQUEOUS MEDIUM, 2019-2022 (USD THOUSAND)

- TABLE 11 COUNTRY-WISE IMPORT DATA FOR AQUEOUS MEDIUM, 2019-2022 (USD THOUSAND)

- TABLE 12 COUNTRY-WISE EXPORT DATA FOR NON-AQUEOUS MEDIUM, 2019-2022 (USD THOUSAND)

- TABLE 13 COUNTRY-WISE IMPORT DATA FOR NON-AQUEOUS MEDIUM, 2019-2022 (USD THOUSAND)

- 5.13 STANDARDS AND REGULATORY LANDSCAPES

- 5.13.1 BRITISH COATINGS FEDERATION

- 5.13.1.1 Decorative coatings

- 5.13.1.2 Vehicle refinish products

- 5.13.2 EU ECOLABEL

- 5.13.3 BIOCIDES PRODUCTS REGULATION (BPR)

- 5.13.3.1 Exclusion criteria

- 5.13.3.2 Active substances act as substitution

- 5.13.1 BRITISH COATINGS FEDERATION

- 5.14 PATENT ANALYSIS

- 5.14.1 METHODOLOGY

- 5.14.2 PUBLICATION TRENDS

- FIGURE 20 NUMBER OF PATENTS PUBLISHED, 2016-2023

- 5.14.3 TOP JURISDICTION

- FIGURE 21 PATENTS PUBLISHED BY JURISDICTIONS, 2016-2023

- 5.14.4 TOP APPLICANTS

- FIGURE 22 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2016-2023

- TABLE 14 RECENT PATENTS BY OWNERS

- 5.15 CASE STUDIES

- 5.16 TECHNOLOGY ANALYSIS

- 5.17 KEY CONFERENCES AND EVENTS IN 2023

- TABLE 15 PAINTS AND COATINGS MARKET: KEY CONFERENCES AND EVENTS

- 5.18 TARIFF AND REGULATORY LANDSCAPE

- 5.18.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 EUROPEAN PAINTS & COATINGS MARKET, BY RESIN TYPE

- 6.1 INTRODUCTION

- FIGURE 23 ACRYLIC SEGMENT TO LEAD MARKET FOR EUROPEAN PAINTS & COATINGS BY 2028

- FIGURE 24 ACRYLIC SEGMENT TO LEAD MARKET FOR EUROPEAN ARCHITECTURAL PAINTS & COATINGS BY 2028

- FIGURE 25 POLYURETHANE REMAINS DOMINANT RESIN TYPE IN EUROPEAN INDUSTRIAL PAINTS & COATINGS MARKET

- TABLE 17 EUROPEAN PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 18 EUROPEAN PAINTS & COATINGS MARKET, BY RESIN TYPE, 2022-2028 (USD MILLION)

- TABLE 19 EUROPEAN PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 20 EUROPEAN PAINTS & COATINGS MARKET, BY RESIN TYPE, 2022-2028 (KILOTON)

- TABLE 21 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 22 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2022-2028 (USD MILLION)

- TABLE 23 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 24 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2022-2028 (KILOTON)

- TABLE 25 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 26 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2022-2028 (USD MILLION)

- TABLE 27 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 28 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2022-2028 (KILOTON)

- 6.2 ACRYLIC RESIN

- 6.2.1 EXTENSIVE APPLICATION OF ACRYLIC PAINTS AND COATINGS TO DRIVE ACRYLIC RESIN MARKET

- TABLE 29 PROPERTIES AND APPLICATIONS OF ACRYLIC PAINTS AND COATINGS

- TABLE 30 ACRYLIC-BASED PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 31 ACRYLIC-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 32 ACRYLIC-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 33 ACRYLIC-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 6.3 ALKYD RESIN

- 6.3.1 OUTSTANDING MECHANICAL QUALITIES AND SUPERIOR DYEING SPEED OF ALKYD RESIN TO BOOST ALKYD RESIN MARKET

- TABLE 34 PROPERTIES AND APPLICATIONS OF ALKYD RESIN

- TABLE 35 ALKYD-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 36 ALKYD-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 37 ALKYD-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 38 ALKYD-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 6.4 EPOXY RESIN

- 6.4.1 GROWING DEMAND FOR HIGH-PERFORMANCE THERMOSETTING RESINS TO DRIVE MARKET FOR EPOXY PAINTS AND COATINGS

- 6.5 POLYESTER RESIN

- 6.5.1 RISING DEMAND FOR COATINGS WITH OUTSTANDING MECHANICAL PROPERTIES TO BOOST MARKET FOR POLYESTER RESIN

- 6.6 POLYURETHANE RESIN

- 6.6.1 GROWING DEMAND FOR EFFECTIVE COATING MATERIALS FROM TEXTILE SECTOR TO DRIVE MARKET FOR POLYURETHANE RESIN

- TABLE 39 POLYURETHANE-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 40 POLYURETHANE-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 41 POLYURETHANE-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 42 POLYURETHANE-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 6.7 FLUOROPOLYMER RESIN

- 6.7.1 INCREASING ADOPTION OF NON-STICK SURFACE COATING MATERIALS TO PROPEL MARKET FOR FLUOROPOLYMER RESIN

- 6.8 VINYL RESIN

- 6.8.1 GROWING ADOPTION OF WATER-BASED COATINGS IN ARCHITECTURE SECTOR TO DRIVE MARKET FOR VINYL RESIN

- 6.9 OTHER RESIN TYPES

7 EUROPEAN PAINTS & COATINGS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 26 WATERBORNE SEGMENT TO LEAD EUROPEAN PAINTS & COATINGS MARKET DURING FORECAST PERIOD

- TABLE 43 EUROPEAN PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 44 EUROPEAN PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2022-2028 (USD MILLION)

- TABLE 45 EUROPEAN PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 46 EUROPEAN PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2022-2028 (KILOTON)

- 7.2 WATERBORNE

- 7.2.1 ADOPTION OF ENVIRONMENTAL-FRIENDLY RAW MATERIALS TO DRIVE MARKET FOR WATERBORNE COATINGS

- TABLE 47 WATERBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 48 WATERBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 49 WATERBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 50 WATERBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 7.3 SOLVENTBORNE

- 7.3.1 GROWING NEED FOR HIGH-PERFORMANCE COATING APPLICATIONS TO DRIVE DEMAND FOR SOLVENTBORNE COATINGS

- TABLE 51 SOLVENTBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 52 SOLVENTBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 53 SOLVENTBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 54 SOLVENTBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 7.4 POWDER

- 7.4.1 PREFERENCE FOR SUPERIOR-QUALITY AND COST-EFFICIENT COATINGS TO BOOST GROWTH OF POWDER COATINGS MARKET

- TABLE 55 POWDER: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 56 POWDER: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 57 POWDER: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 58 POWDER: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 7.5 OTHER TECHNOLOGIES

8 EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 27 ARCHITECTURAL SEGMENT TO ACHIEVE HIGHER CAGR DURING FORECAST PERIOD

- TABLE 59 EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 60 EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 61 EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 62 EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 8.2 ARCHITECTURAL

- 8.2.1 RISING POPULARITY OF ARCHITECTURAL AESTHETICS TO BOOST DEMAND FOR ARCHITECTURAL COATINGS

- TABLE 63 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 64 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 65 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 66 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 67 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 68 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 69 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 70 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- 8.2.2 RESIDENTIAL

- 8.2.3 NON-RESIDENTIAL

- 8.2.4 INFRASTRUCTURE

- 8.3 INDUSTRIAL

- 8.3.1 RISING ADOPTION OF CORROSION-FREE COATINGS TO DRIVE GROWTH OF INDUSTRIAL COATINGS MARKET

- TABLE 71 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 72 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 73 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 74 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 75 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 76 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 77 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 78 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- 8.3.2 GENERAL INDUSTRIAL

- 8.3.2.1 Rising demand for powder-coated products by homeowners to drive usage of coatings for general industrial purposes

- TABLE 79 GENERAL INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 80 GENERAL INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 81 GENERAL INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 82 GENERAL INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- 8.3.3 OEM

- 8.3.3.1 Growing sales of passenger and commercial vehicles to boost adoption of automotive OEM coatings

- TABLE 83 OEM: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 84 OEM: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 85 OEM: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 86 OEM: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- 8.3.3.2 Passenger cars

- 8.3.3.3 Commercial vehicles

- 8.3.3.4 Heavy-duty equipment

- 8.3.3.5 Rail

- 8.3.3.6 Aerospace

- 8.3.3.7 Marine

- 8.3.4 WOOD

- 8.3.4.1 Increase in construction and infrastructure activities to drive demand for coatings in wood industry

- TABLE 87 WOOD: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 88 WOOD: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 89 WOOD: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 90 WOOD: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- 8.3.5 OTHER END-USE INDUSTRIES

- TABLE 91 OTHER END-USE INDUSTRIES: EUROPEAN PAINTS & COATINGS, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 92 OTHER END-USE INDUSTRIES: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 93 OTHER END-USE INDUSTRIES: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 94 OTHER END-USE INDUSTRIES: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022-2028 (KILOTON)

9 EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY

- 9.1 INTRODUCTION

- 9.2 EUROPE: RECESSION IMPACT

- FIGURE 28 EUROPEAN PAINTS & COATINGS MARKET SNAPSHOT

- TABLE 95 MAJOR INFRASTRUCTURE PROJECTS IN EUROPE

- TABLE 96 EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 97 EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 98 EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 99 EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- 9.1.2 GERMANY

- 9.1.2.1 Favorable economic environment and rising demand for new homes to drive growth

- TABLE 100 GERMANY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 101 GERMANY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 102 GERMANY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 103 GERMANY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 104 GERMANY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 105 GERMANY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 106 GERMANY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 107 GERMANY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 9.1.3 RUSSIA

- 9.1.3.1 Growing population to increase application of architectural paints and coatings

- TABLE 108 RUSSIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 109 RUSSIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 110 RUSSIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 111 RUSSIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 112 RUSSIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 113 RUSSIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 114 RUSSIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 115 RUSSIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 9.1.4 UK

- 9.1.4.1 Growing construction sector, along with government spending, to boost demand for architectural coatings

- TABLE 116 MAJOR INFRASTRUCTURE PROJECTS IN UK

- TABLE 117 UK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 118 UK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 119 UK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 120 UK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 121 UK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 122 UK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 123 UK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 124 UK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 9.1.5 FRANCE

- 9.1.5.1 Reviving economy, coupled with investments in infrastructure, to boost demand

- TABLE 125 FRANCE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 126 FRANCE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 127 FRANCE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 128 FRANCE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 129 FRANCE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 130 FRANCE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 131 FRANCE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 132 FRANCE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 9.1.6 ITALY

- 9.1.6.1 New project finance rules and investment policies to boost market

- TABLE 133 ITALY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 134 ITALY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 135 ITALY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 136 ITALY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 137 ITALY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 138 ITALY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 139 ITALY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 140 ITALY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 9.1.7 SPAIN

- 9.1.7.1 Increase in housing units to boost demand for paints & coatings

- TABLE 141 SPAIN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 142 SPAIN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 143 SPAIN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 144 SPAIN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 145 SPAIN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 146 SPAIN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 147 SPAIN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 148 SPAIN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 9.1.8 TURKEY

- 9.1.8.1 Rapid urbanization and diversification in consumer goods to impact market positively

- TABLE 149 MAJOR INFRASTRUCTURE PROJECTS IN TURKEY

- TABLE 150 TURKEY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 151 TURKEY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 152 TURKEY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 153 TURKEY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 154 TURKEY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 155 TURKEY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 156 TURKEY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 157 TURKEY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 9.1.9 POLAND

- 9.1.9.1 Residential and other infrastructural projects to drive market

- TABLE 158 MAJOR INFRASTRUCTURE PROJECTS IN POLAND

- TABLE 159 POLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 160 POLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 161 POLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 162 POLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 163 POLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 164 POLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 165 POLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 166 POLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 9.1.10 SWEDEN

- 9.1.10.1 New infrastructural projects to drive market

- TABLE 167 SWEDEN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 168 SWEDEN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 169 SWEDEN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 170 SWEDEN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 171 SWEDEN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 172 SWEDEN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 173 SWEDEN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 174 SWEDEN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 9.1.11 DENMARK

- 9.1.11.1 Government support for construction industry growth to drive demand

- TABLE 175 DENMARK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 176 DENMARK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 177 DENMARK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 178 DENMARK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 179 DENMARK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 180 DENMARK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 181 DENMARK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 182 DENMARK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 9.1.12 NORWAY

- 9.1.12.1 Industrial segment to be dominant consumer of paints & coatings

- TABLE 183 NORWAY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 184 NORWAY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 185 NORWAY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 186 NORWAY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 187 NORWAY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 188 NORWAY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 189 NORWAY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 190 NORWAY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 9.1.13 FINLAND

- 9.1.13.1 Demand for new houses to drive architectural paints market

- TABLE 191 FINLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 192 FINLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 193 FINLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 194 FINLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 195 FINLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 196 FINLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 197 FINLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 198 FINLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 9.1.14 LITHUANIA

- 9.1.14.1 Wood industry to drive wood coatings market

- TABLE 199 LITHUANIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 200 LITHUANIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 201 LITHUANIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 202 LITHUANIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 203 LITHUANIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 204 LITHUANIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 205 LITHUANIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 206 LITHUANIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 9.1.15 LATVIA

- 9.1.15.1 Infrastructure and commercial buildings to drive market

- TABLE 207 LATVIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 208 LATVIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 209 LATVIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 210 LATVIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 211 LATVIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 212 LATVIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 213 LATVIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 214 LATVIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 9.1.16 ESTONIA

- 9.1.16.1 Architectural segment to dominate market

- TABLE 215 ESTONIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 216 ESTONIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 217 ESTONIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 218 ESTONIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 219 ESTONIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 220 ESTONIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 221 ESTONIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 222 ESTONIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- 9.1.17 REST OF EUROPE

- TABLE 223 REST OF EUROPE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 224 REST OF EUROPE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 225 REST OF EUROPE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 226 REST OF EUROPE: PAINTS & COATINGS MARKET SIZE, BY -USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 227 REST OF EUROPE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 228 REST OF EUROPE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 229 REST OF EUROPE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 230 REST OF EUROPE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.1.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY EUROPEAN PAINTS AND COATINGS MARKET PLAYERS

- 10.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2022

- 10.2.1 STARS

- 10.2.2 EMERGING LEADERS

- 10.2.3 PERVASIVE PLAYERS

- 10.2.4 PARTICIPANTS

- FIGURE 29 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- 10.3 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 30 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN EUROPEAN PAINTS & COATINGS MARKET

- 10.4 STARTUPS/SMES EVALUATION QUADRANT, 2022

- 10.4.1 PROGRESSIVE COMPANIES

- 10.4.2 RESPONSIVE COMPANIES

- 10.4.3 STARTING BLOCKS

- 10.4.4 DYNAMIC COMPANIES

- FIGURE 31 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES, 2022

- 10.5 MARKET SHARE ANALYSIS

- FIGURE 32 MARKET SHARE, BY KEY PLAYER (2022)

- 10.6 TOP FIVE REVENUE ANALYSIS

- FIGURE 33 REVENUE ANALYSIS OF TOP PLAYERS, 2018-2022

- 10.6.1 AKZO NOBEL NV

- 10.6.2 PPG INDUSTRIES, INC.

- 10.6.3 THE SHERWIN-WILLIAMS COMPANY

- 10.6.4 BASF COATINGS GMBH

- 10.6.5 AXALTA COATING SYSTEMS LLC

- 10.7 MARKET RANKING ANALYSIS

- TABLE 231 MARKET RANKING ANALYSIS, 2022

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 MARKET EVALUATION FRAMEWORK

- TABLE 232 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 233 COMPANY REGION FOOTPRINT

- TABLE 234 OVERALL COMPANY FOOTPRINT

- 10.8.2 MARKET EVALUATION MATRIX

- TABLE 235 STRATEGIC DEVELOPMENTS ADOPTED BY KEY PLAYERS

- TABLE 236 MOST FOLLOWED STRATEGIES BY KEY COMPANIES

- TABLE 237 GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- 10.9 COMPETITIVE BENCHMARKING

- TABLE 238 DETAILED LIST OF KEY MARKET PLAYERS

- TABLE 239 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.10 STRATEGIC DEVELOPMENTS

- TABLE 240 PRODUCT LAUNCHES, 2019-2023

- TABLE 241 DEALS, 2019-2023

11 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 11.1 MAJOR PLAYERS

- 11.1.1 AKZO NOBEL N.V.

- TABLE 242 AKZO NOBEL N.V.: BUSINESS OVERVIEW

- FIGURE 34 AKZO NOBEL N.V.: COMPANY SNAPSHOT

- TABLE 243 AKZO NOBEL N.V.: PRODUCT LAUNCHES

- TABLE 244 AKZO NOBEL N.V.: DEALS

- 11.1.2 PPG INDUSTRIES, INC.

- TABLE 245 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 35 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 246 PPG INDUSTRIES, INC.: DEALS

- TABLE 247 PPG INDUSTRIES, INC.: OTHERS

- 11.1.3 THE SHERWIN-WILLIAMS COMPANY

- TABLE 248 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- FIGURE 36 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- TABLE 249 THE SHERWIN-WILLIAMS COMPANY: PRODUCT LAUNCHES

- TABLE 250 THE SHERWIN-WILLIAMS COMPANY: DEALS

- 11.1.4 BASF COATINGS GMBH

- TABLE 251 BASF COATINGS GMBH: COMPANY OVERVIEW

- FIGURE 37 BASF COATINGS GMBH: COMPANY SNAPSHOT

- TABLE 252 BASF COATINGS GMBH: DEALS

- 11.1.5 AXALTA COATING SYSTEMS LLC

- TABLE 253 AXALTA COATING SYSTEMS LLC: COMPANY OVERVIEW

- FIGURE 38 AXALTA COATING SYSTEMS LLC: COMPANY SNAPSHOT

- TABLE 254 AXALTA COATING SYSTEMS LLC: PRODUCT LAUNCHES

- TABLE 255 AXALTA COATING SYSTEMS LLC: DEALS

- 11.1.6 RPM INTERNATIONAL INC.

- TABLE 256 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 39 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

- 11.1.7 JOTUN A/S

- TABLE 257 JOTUN A/S: COMPANY OVERVIEW

- FIGURE 40 JOTUN A/S: COMPANY SNAPSHOT

- TABLE 258 JOTUN A/S: PRODUCT LAUNCHES

- 11.1.8 HEMPEL A/S

- TABLE 259 HEMPEL A/S: COMPANY OVERVIEW

- FIGURE 41 HEMPEL A/S: COMPANY SNAPSHOT

- TABLE 260 HEMPEL A/S: PRODUCT LAUNCHES

- TABLE 261 HEMPEL A/S: DEALS

- 11.1.9 KANSAI PAINT CO., LTD

- TABLE 262 KANSAI PAINT CO., LTD.: COMPANY OVERVIEW

- FIGURE 42 KANSAI PAINT CO., LTD.: COMPANY SNAPSHOT

- TABLE 263 KANSAI PAINTS CO., LTD.: DEALS

- 11.1.10 CROMOLOGY (NIPPON PAINT HOLDINGS CO., LTD.)

- TABLE 264 CROMOLOGY (NIPPON PAINT HOLDINGS CO., LTD.): COMPANY OVERVIEW

- FIGURE 43 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- TABLE 265 CROMOLOGY (NIPPON PAINT HOLDINGS CO., LTD.): PRODUCT LAUNCHES

- 11.2 OTHER COMPANIES

- 11.2.1 DAW SE

- 11.2.2 BECKERS GROUP

- TABLE 266 BECKERS GROUP: DEALS

- 11.2.3 BRILLUX GMBH & CO. KG

- 11.2.4 TEKNOS GROUP

- TABLE 267 TEKNOS GROUP: PRODUCT LAUNCHES

- TABLE 268 TEKNOS GROUP: DEALS

- 11.2.5 MANKIEWICZ GEBR. & CO.

- 11.2.6 MEFFERT AG FARBWERKE

- 11.2.7 CORCORPORACAO INDUSTRIAL DO NORTE

- 11.2.8 FLUGGER GROUP A/S

- TABLE 269 FLUGGER GROUP: PRODUCT LAUNCHES

- TABLE 270 FLUGGER GROUP: DEALS

- 11.2.9 IVM CHEMICALS

- TABLE 271 IVM CHEMICALS: DEALS

- 11.2.10 TIGER COATINGS GMBH & CO. KG

- 11.2.11 STO CORP.

- 11.2.12 REMMERS

- 11.2.13 MIPA SE

- 11.2.14 WEILBURGER COATINGS GMBH

- TABLE 272 WEILBURGER COATIINGS GMBH: DEALS

- 11.2.15 FREILACKE

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.1.1 LIMITATION

- 12.2 PAINTS & COATINGS

- 12.2.1 ECOSYSTEM AND INTERCONNECTED MARKET

- FIGURE 44 PAINTS & COATINGS: ECOSYSTEM

- 12.3 COATING RESINS MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 COATING RESINS MARKET, BY RESIN TYPE

- TABLE 273 COATING RESINS MARKET, BY RESIN TYPE, 2017-2020 (USD MILLION)

- TABLE 274 COATING RESINS MARKET, BY RESIN TYPE, 2021-2026 (USD MILLION)

- TABLE 275 COATING RESINS MARKET, BY RESIN TYPE, 2017-2020 (KILOTON)

- TABLE 276 COATING RESINS MARKET, BY RESIN TYPE, 2021-2026 (KILOTON)

- 12.3.3.1 Acrylic

- 12.3.3.2 Alkyd

- 12.3.3.3 Vinyl

- 12.3.3.4 Polyurethane

- 12.3.3.5 Epoxy

- 12.3.3.6 Polyester

- 12.3.3.6.1 Unsaturated polyester

- 12.3.3.6.2 Saturated polyester

- 12.3.3.7 Amino

- 12.3.3.8 Others

- 12.3.4 COATING RESINS MARKET, BY TECHNOLOGY

- TABLE 277 COATING RESINS MARKET, BY TECHNOLOGY, 2017-2020 (USD MILLION)

- TABLE 278 COATING RESINS MARKET, BY TECHNOLOGY, 2021-2026 (USD MILLION)

- TABLE 279 COATING RESINS MARKET, BY TECHNOLOGY, 2017-2020 (KILOTON)

- TABLE 280 COATING RESINS MARKET, BY TECHNOLOGY, 2021-2026 (KILOTON)

- 12.3.4.1 Waterborne coatings

- 12.3.4.2 Solventborne coatings

- 12.3.4.3 Powder coatings

- 12.3.4.4 Others

- 12.3.4.4.1 High solids coatings

- 12.3.4.4.2 Radiation curable coatings

- 12.3.5 COATING RESINS MARKET, BY APPLICATION

- TABLE 281 COATING RESINS MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 282 COATING RESINS MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- TABLE 283 COATING RESINS MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 284 COATING RESINS MARKET, BY APPLICATION, 2021-2026 (KILOTON)

- TABLE 285 ARCHITECTURAL COATING RESINS MARKET, BY SUB-APPLICATION, 2017-2020 (USD MILLION)

- TABLE 286 ARCHITECTURAL COATING RESINS MARKET, BY SUB-APPLICATION, 2021-2026 (USD MILLION)

- TABLE 287 ARCHITECTURAL COATING RESINS MARKET, BY SUB-APPLICATION, 2017-2020 (KILOTON)

- TABLE 288 ARCHITECTURAL COATING RESINS MARKET, BY SUB-APPLICATION, 2021-2026 (KILOTON)

- TABLE 289 INDUSTRIAL COATING RESINS MARKET, BY SUB-APPLICATION, 2017-2020 (USD MILLION)

- TABLE 290 INDUSTRIAL COATING RESINS MARKET, BY SUB-APPLICATION, 2021-2026 (USD MILLION)

- TABLE 291 INDUSTRIAL COATING RESINS MARKET, BY SUB-APPLICATION, 2017-2020 (KILOTON)

- TABLE 292 INDUSTRIAL COATING RESINS MARKET, BY SUB-APPLICATION, 2021-2026 (KILOTON)

- 12.3.5.1 Architectural coatings

- 12.3.5.2 Marine & protective coatings

- 12.3.5.3 General industrial coatings

- 12.3.5.4 Automotive coatings

- 12.3.5.5 Wood coatings

- 12.3.5.6 Packaging coatings

- 12.3.5.7 Others

- 12.3.5.7.1 Coil

- 12.3.5.7.2 Aerospace

- 12.3.5.7.3 Graphic arts

- 12.3.6 COATING RESINS MARKET, BY REGION

- TABLE 293 COATING RESINS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 294 COATING RESINS MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 295 COATING RESINS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 296 COATING RESINS MARKET, BY REGION, 2021-2026 (KILOTON)

- 12.3.6.1 Asia Pacific

- 12.3.6.2 Europe

- 12.3.6.3 North America

- 12.3.6.4 Middle East & Africa

- 12.3.6.5 South America

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS