|

|

市場調査レポート

商品コード

1218253

炭素繊維プリプレグの世界市場:樹脂の種類別 (エポキシ、フェノール、熱可塑性、BMI、ポリイミド)・製造工程別 (ホットメルト法、溶剤浸漬法)・エンドユース産業別 (航空宇宙・防衛、自動車、スポーツ・レクリエーション、風力発電) の将来予測 (2027年まで)Carbon Fiber Prepreg Market by Resin Type (Epoxy, Phenolic, Thermoplastic, BMI, Polyimide), Manufacturing Process (Hot Melt, Solvent Dip), End-use Industry (Aerospace & Defense, Automotive, Sports & Recreation, Wind Energy) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 炭素繊維プリプレグの世界市場:樹脂の種類別 (エポキシ、フェノール、熱可塑性、BMI、ポリイミド)・製造工程別 (ホットメルト法、溶剤浸漬法)・エンドユース産業別 (航空宇宙・防衛、自動車、スポーツ・レクリエーション、風力発電) の将来予測 (2027年まで) |

|

出版日: 2023年02月07日

発行: MarketsandMarkets

ページ情報: 英文 285 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の炭素繊維プリプレグの市場規模は、2022年の97億米ドルから2027年には189億米ドルに成長し、予測期間中のCAGRは14.2%と予測されています。

製造工程別では、ホットメルト法が金額ベースで最も急成長しています。ホットメルト法は、溶剤浸漬法よりも機械設備が複雑でないため、圧倒的に多く使用されています。また、有機溶剤の消費・排出がなく、危険性が低いことも特徴です。

樹脂の種類別では、フェノール樹脂が金額ベースで2番目に急成長すると考えられています。フェノール樹脂は鉄よりも軽く、難燃性・防煙性のあるポリエステル樹脂やビニルエステル樹脂よりも20~30%軽量です。

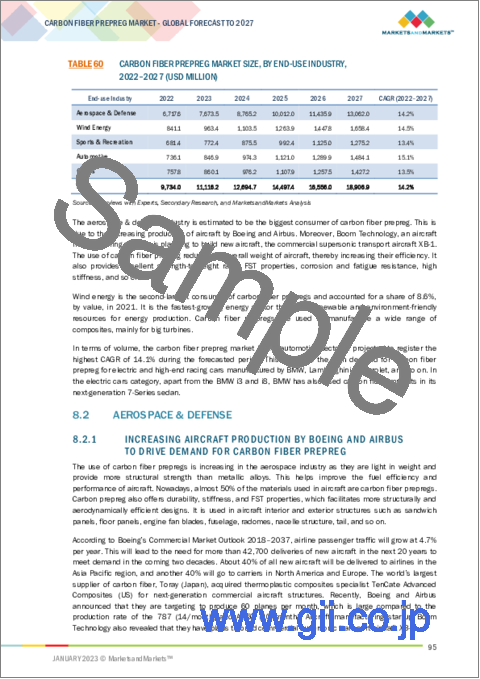

エンドユース産業別では、自動車産業が金額ベースで最も高いCAGRで成長する見通しです。その要因として、電気自動車やハイエンドレーシングカー向け需要の拡大などが挙げられます。

地域別に見ると、欧州が世界最大の市場で、成長率も最も高くなっています。航空宇宙・防衛産業での炭素繊維プリプレグの幅広い用途や、域内の大手航空機メーカーの存在などが、市場成長を促す大きな要因となっています。

当レポートでは、世界の炭素繊維プリプレグの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、製造工程別・樹脂の種類別・エンドユース産業別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- サプライチェーン分析

- 主な利害関係者と購入基準

- 技術分析

- エコシステム:炭素繊維プリプレグ市場

- バリューチェーン分析

- 主要国の輸出入市場

- 日本

- 中国

- 米国

- ドイツ

- フランス

- 価格分析

- 主要企業の平均販売価格:製造工程別

- 平均販売価格:樹脂の種類別

- 平均販売価格:最終用途産業別

- 平均販売価格

- 炭素繊維プリプレグ市場:楽観的・悲観的・現実的なシナリオ

- 主な会議とイベント

- 関税と規制

- 特許分析

- ケーススタディ分析

第6章 炭素繊維プリプレグ市場:製造工程別

- イントロダクション

- ホットメルト法

- 溶剤浸漬法 (ソルベントディップ法)

第7章 炭素繊維プリプレグ市場:樹脂の種類別

- イントロダクション

- エポキシ樹脂

- フェノール樹脂

- 熱可塑性樹脂

- ビスマレイミド樹脂 (BMI)

- ポリイミド樹脂

- その他の樹脂

第8章 炭素繊維プリプレグ市場:エンドユース産業別

- イントロダクション

- 航空宇宙・防衛

- 風力発電

- スポーツ・レクリエーション

- 自動車

- その他

第9章 炭素繊維プリプレグ市場:地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- イントロダクション

- 市場シェア分析

- 市場ランキング

- 大手企業の収益分析

- 競合ベンチマーキング

- 企業評価マトリックス

- 市場評価フレームワーク

- 競合ベンチマーキング

- 中小企業 (SME) の評価マトリックス

第11章 企業プロファイル

- 主要企業

- MITSUBISHI CHEMICAL CARBON FIBER AND COMPOSITES, INC.

- SOLVAY

- TEIJIN LIMITED

- TORAY INDUSTRIES INC.

- HEXCEL CORPORATION

- GURIT HOLDING AG

- ROCK WEST COMPOSITES, INC.

- SGL CARBON

- PARK AEROSPACE CORP.

- AXIOM MATERIALS, INC.

- その他の企業

- WEIHAI GUANGWEI COMPOSITES MATERIALS CO., LTD.

- MALLINDA, INC.

- SICHUAN XINWANXING CARBON FIBER COMPOSITES CO., LTD.

- DEXCRAFT

- 3A ASSOCIATES INCORPORATED

- ROCKMAN ADVANCED COMPOSITES

- KINECO LIMITED

- TAIWAN FIRST LI-BOND CO., LTD.

- NORTH THIN PLY TECHNOLOGY

- TCR COMPOSITES

- PLASTIC REINFORCEMENT FABRICS LTD.

- BARRDAY INC.

- GMS COMPOSITES

- HANKUK CARBON

- ABC COMPOSITES

第12章 付録

The global carbon fiber prepreg market size is expected to grow from USD 9.7 billion in 2022 to USD 18.9 billion by 2027, at a CAGR of 14.2% during the forecast period. Carbon fiber prepregs have properties such as self-adhesiveness, flame retardancy, high service temperatures, high strength, high rigidity, lightweight, and so on. Each type of carbon fiber prepreg provides specific characteristics suitable for different conditions. Carbon fiber prepreg is mainly used for manufacturing components in aerospace & defense, automotive, sporting & recreation, wind, and other industries.

"Hot melt manufacturing process is the fastest-growing manufacturing process of carbon fiber prepreg, in terms of value."

The global carbon fiber prepreg market is categorized based on the manufacturing process into hot melt and solvent dip processes. The hot melt process is dominantly used as the machinery required to perform the hot melt process is less complex than the machinery used in the solvent dip process. Furthermore, this process is less hazardous, and no organic solvents are consumed or emitted during operations.

"Phenolic is the second-fastest-growing resin type of carbon fiber prepreg, in terms of value."

Phenolic resin is expected to grow significantly in upcoming years. Phenolic resin is lighter than steel and is also 20-30% lighter than flame and smoke retardant polyester and vinyl ester resins. Some of the major applications of phenolic resin in the aerospace & defense industry includes ceiling panels, engine nacelle, side wall panels, galleys, floor panels, and many more. In automotive and rail industries, carbon fiber prepregs get widely used in rail interiors, lightweight car bodies, and racing car monocoque.

"Automotive is the fastest-growing end-use industry of carbon fiber prepreg, in terms of value."

The market for carbon fiber prepreg is segmented into the end-use industry as aerospace & defense, automotive, sports & recreation, wind energy, and others. In terms of value, the carbon fiber prepreg market in the automotive sector is projected to register the highest CAGR during the forecasted period. This is due to the high demand for carbon fiber prepreg for electric and high-end racing cars manufactured by BMW, Lamborghini, Chevrolet, etc. In the electric cars category, apart from the BMW i3 and i8, BMW has also used carbon fiber implants in its next-generation 7-Series sedan.

"Europe is the fastest-growing carbon fiber prepreg market."

Europe is the fastest-growing and the biggest market for carbon fiber prepreg. The market in the region is driven by the demand from aerospace & defense, automotive, and wind energy industries. Carbon fiber prepreg is widely used in the aerospace & defense industry, and the presence of large aircraft manufacturers such as Airbus (France) and Boeing (US) in this region has made it the biggest market for carbon fiber prepreg.

This study has been validated through primaries conducted with various industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 60%, Tier 2- 20%, and Tier 3- 20%

- By Designation- C Level- 33%, Director Level- 33%, and Managers- 34%

- By Region- North America- 20%, Europe- 25%, APAC- 25%, Latin America-10%, MEA-20%,

The report provides a comprehensive analysis of the company profiles listed below:

- Mitsubishi Chemical Carbon Fiber and Composites, Inc. (Japan)

- Solvay (Belgium)

- Teijin Limited (Japan)

- Toray Industries Inc. (Japan)

- Hexcel Corporation (US),

- Gurit Holding AG (Switzerland)

- SGL Carbon (Germany)

- Park Aerospace Corp. (US)

- Axiom Materials, Inc. (US)

- Others

Research Coverage

This report covers the global carbon fiber prepreg market and forecasts the market size until 2027. The report includes the market segmentation -Resin Type (epoxy, phenolic, thermoplastic, bismaleimide (BMI), polyimide, and others), Manufacturing Process (hot melt and solvent dip), End-use Industry (aerospace & defense, automotive, sports & recreation, wind energy, and others), and Region (Europe, North America, APAC, Latin America, and MEA). Porter's Five Forces analysis, along with the drivers, restraints, opportunities, and challenges, are discussed in the report. It also provides company profiles and competitive strategies adopted by the major players in the global carbon fiber prepreg market.

Key benefits of buying the report:

The report will help market leaders/new entrants in this market in the following ways:

1. This report segments the global carbon fiber prepreg market comprehensively and provides the closest approximations of the revenues for the overall market and the sub-segments across different verticals and regions.

2. The report helps stakeholders understand the pulse of the carbon fiber prepreg market and provides them with information on key market drivers, restraints, challenges, and opportunities.

3. This report will help stakeholders to understand competitors better and gain more insights to better their position in their businesses. The competitive landscape section includes the competitor ecosystem, new product development, agreement, and acquisitions.

Reasons to buy the report:

The report will help market leaders/new entrants in this market by providing them with the closest approximations of the revenues for the overall carbon fiber prepreg market and the sub-segments. This report will help stakeholders to understand the competitive landscape and gain more insights and position their businesses and market strategies in a better way. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 CARBON FIBER PREPREG MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 IMPACT OF SLOWDOWN

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 CARBON FIBER PREPREG MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - top carbon fiber prepreg manufacturers

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key industry insights

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.2.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- FIGURE 5 CARBON FIBER PREPREG MARKET: DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 ASSUMPTIONS

- 2.8 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY

- FIGURE 6 HOT MELT SEGMENT DOMINATED OVERALL CARBON FIBER PREPREG MARKET IN 2021

- FIGURE 7 EPOXY RESIN SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 8 AEROSPACE & DEFENSE ACCOUNTED FOR LARGEST SHARE OF CARBON FIBER PREPREG MARKET IN 2021

- FIGURE 9 EUROPE LED CARBON FIBER PREPREG MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CARBON FIBER PREPREG MARKET

- FIGURE 10 SIGNIFICANT GROWTH EXPECTED IN CARBON FIBER PREPREG MARKET BETWEEN 2022 AND 2027

- 4.2 CARBON FIBER PREPREG MARKET, BY RESIN TYPE AND REGION, 2021

- FIGURE 11 EUROPE WAS LARGEST MARKET IN 2021

- 4.3 CARBON FIBER PREPREG MARKET, BY MANUFACTURING PROCESS, 2021

- FIGURE 12 HOT MELT CARBON FIBER PREPREG SEGMENT DOMINATED MARKET IN 2021

- 4.4 CARBON FIBER PREPREG MARKET, BY END-USE INDUSTRY, 2021

- FIGURE 13 AEROSPACE & DEFENSE SEGMENT DOMINATED MARKET IN 2021

- 4.5 CARBON FIBER PREPREG MARKET GROWTH, BY KEY COUNTRIES

- FIGURE 14 GERMANY TO BE FASTEST-GROWING CARBON FIBER PREPREG MARKET, (2022-2027)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

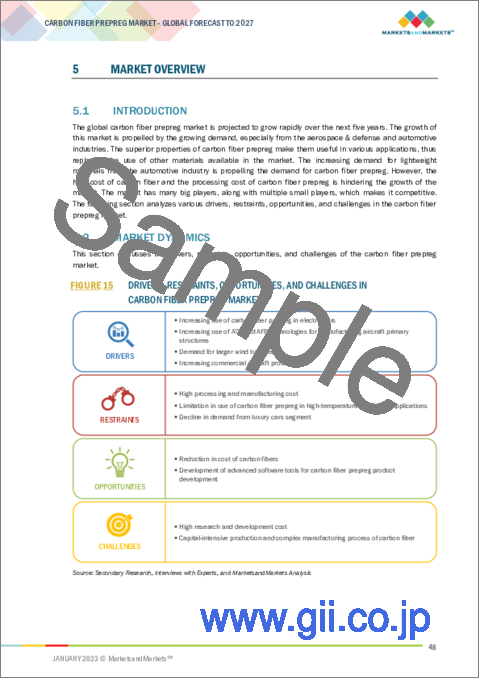

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CARBON FIBER PREPREG MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use of carbon fiber prepreg in electric cars

- TABLE 1 EUROPE: NEW PASSENGER VEHICLES CO2 EMISSIONS, BY MANUFACTURER (2016 AND 2020/21 TARGETS (G/KM)

- 5.2.1.2 Increasing use of ATF and AFP technologies for manufacturing aircraft primary structures

- 5.2.1.3 Demand for larger wind turbines

- TABLE 2 NEW WIND POWER INSTALLATIONS, BY REGION (2020-2025)

- 5.2.1.4 Increasing commercial aircraft production

- 5.2.2 RESTRAINTS

- 5.2.2.1 High processing and manufacturing cost

- 5.2.2.2 Limitation in use of carbon fiber prepreg in high-temperature aerospace applications

- 5.2.2.3 Decline in demand from luxury cars segment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Reduction in cost of carbon fiber

- 5.2.3.2 Development of advanced software tools for carbon fiber prepreg product development

- 5.2.4 CHALLENGES

- 5.2.4.1 High research and development cost

- 5.2.4.2 Capital-intensive and complex manufacturing process of carbon fiber

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 CARBON FIBER PREPREG MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF BUYERS

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 3 CARBON FIBER PREPREG MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 SUPPLY CHAIN ANALYSIS

- TABLE 4 CARBON FIBER PREPREG MARKET: ROLE IN ECOSYSTEM

- 5.5 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- 5.5.2 BUYING CRITERIA

- FIGURE 18 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- 5.6 TECHNOLOGY ANALYSIS

- TABLE 7 COMPARATIVE STUDY OF PREPREG MANUFACTURING PROCESSES

- 5.7 ECOSYSTEM: CARBON FIBER PREPREG MARKET

- 5.8 VALUE CHAIN ANALYSIS

- FIGURE 19 VALUE CHAIN ANALYSIS: CARBON FIBER PREPREG MARKET

- 5.9 KEY MARKETS FOR IMPORT/EXPORT

- 5.9.1 JAPAN

- 5.9.2 CHINA

- 5.9.3 US

- 5.9.4 GERMANY

- 5.9.5 FRANCE

- 5.10 PRICING ANALYSIS

- 5.11 AVERAGE SELLING PRICES OF KEY PLAYERS, BY MANUFACTURING PROCESS

- FIGURE 20 AVERAGE SELLING PRICES OF KEY PLAYERS FOR MANUFACTURING PROCESS (USD/KG)

- TABLE 8 AVERAGE SELLING PRICES OF KEY PLAYERS, BY MANUFACTURING PROCESS (USD/KG)

- 5.12 AVERAGE SELLING PRICE, BY RESIN TYPE

- FIGURE 21 AVERAGE SELLING PRICES OF DIFFERENT RESIN TYPES (USD/KG)

- 5.13 AVERAGE SELLING PRICE, BY END-USE INDUSTRY

- FIGURE 22 AVERAGE SELLING PRICES BASED ON END-USE INDUSTRY (USD/KG)

- 5.14 AVERAGE SELLING PRICE

- TABLE 9 CARBON FIBER PREPREG AVERAGE SELLING PRICE, BY REGION

- 5.15 CARBON FIBER PREPREG MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

- TABLE 10 CARBON FIBER PREPREG MARKET: CAGR (BY VALUE) IN OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

- 5.15.1 OPTIMISTIC SCENARIO

- 5.15.2 PESSIMISTIC SCENARIO

- 5.15.3 REALISTIC SCENARIO

- 5.16 KEY CONFERENCES & EVENTS

- TABLE 11 LIST OF CONFERENCES & EVENTS RELATED TO CARBON FIBER PREPREG AND RELATED MARKETS, 2022-2023

- 5.17 TARIFFS AND REGULATIONS

- 5.17.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.18 PATENT ANALYSIS

- 5.18.1 METHODOLOGY

- 5.18.2 LIST OF PATENTS

- TABLE 16 LIST OF PATENTS

- 5.19 CASE STUDY ANALYSIS

- FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

6 CARBON FIBER PREPREG MARKET, BY MANUFACTURING PROCESS

- 6.1 INTRODUCTION

- FIGURE 24 HOT MELT MANUFACTURING PROCESS TO DOMINATE OVERALL CARBON FIBER PREPREG MARKET

- TABLE 17 CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2018-2021 (KILOTON)

- TABLE 18 CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2018-2021 (USD MILLION)

- TABLE 19 CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2022-2027 (KILOTON)

- TABLE 20 CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2022-2027 (USD MILLION)

- 6.2 HOT MELT PROCESS

- 6.2.1 HIGH-SPEED PRODUCTION WITH NO THERMAL STRESS ON SUBSTRATE FUELING MARKET GROWTH

- FIGURE 25 EUROPE TO BE LARGEST MARKET FOR HOT MELT PROCESS SEGMENT

- 6.2.2 HOT MELT PROCESS MARKET, BY REGION

- TABLE 21 HOT MELT PROCESS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 22 HOT MELT PROCESS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 23 HOT MELT PROCESS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- TABLE 24 HOT MELT PROCESS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3 SOLVENT DIP PROCESS

- 6.3.1 INCREASING DEMAND FOR HIGH-TEMPERATURE RESISTANT PREPREG DRIVING SOLVENT DIP PROCESS

- 6.3.2 SOLVENT DIP PROCESS MARKET, BY REGION

- TABLE 25 SOLVENT DIP PROCESS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 26 SOLVENT DIP PROCESS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 27 SOLVENT DIP PROCESS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- TABLE 28 SOLVENT DIP PROCESS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

7 CARBON FIBER PREPREG MARKET, BY RESIN TYPE

- 7.1 INTRODUCTION

- FIGURE 26 EPOXY RESIN SEGMENT TO DOMINATE OVERALL CARBON FIBER PREPREG MARKET

- TABLE 29 CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 30 CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 31 CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 32 CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- 7.2 EPOXY RESIN

- 7.2.1 EPOXY RESIN SEGMENT DOMINATES OVERALL CARBON FIBER PREPREG MARKET

- FIGURE 27 EUROPE TO DRIVE EPOXY RESIN-BASED CARBON FIBER PREPREG MARKET

- 7.2.2 EPOXY RESIN CARBON FIBER PREPREG MARKET, BY REGION

- TABLE 33 EPOXY RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 34 EPOXY RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 EPOXY RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- TABLE 36 EPOXY RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.3 PHENOLIC RESIN

- 7.3.1 PHENOLIC RESIN SEGMENT TO HAVE HIGH DEMAND FROM AEROSPACE & DEFENSE AND AUTOMOTIVE INDUSTRIES

- FIGURE 28 EUROPE TO DRIVE PHENOLIC RESIN-BASED CARBON FIBER PREPREG MARKET

- 7.3.2 PHENOLIC RESIN CARBON FIBER PREPREG MARKET, BY REGION

- TABLE 37 PHENOLIC RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 38 PHENOLIC RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 39 PHENOLIC RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- TABLE 40 PHENOLIC RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.4 THERMOPLASTIC RESIN

- 7.4.1 DEMAND FOR THERMOPLASTIC RESIN SEGMENT DRIVEN BY ITS ABILITY TO RE-FORM AFTER REPEATED HEATING AND COOLING

- 7.4.2 THERMOPLASTIC RESIN CARBON FIBER PREPREG MARKET, BY REGION

- TABLE 41 THERMOPLASTIC RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 42 THERMOPLASTIC RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 43 THERMOPLASTIC RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- TABLE 44 THERMOPLASTIC RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.5 BISMALEIMIDE RESIN

- 7.5.1 GROWING DEMAND IN HIGH-TEMPERATURE APPLICATIONS DRIVING BMI RESIN SEGMENT

- 7.5.2 BMI RESIN CARBON FIBER PREPREG MARKET, BY REGION

- TABLE 45 BMI RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 46 BMI RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 47 BMI RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- TABLE 48 BMI RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.6 POLYIMIDE RESIN

- 7.6.1 INCREASING USE OF CARBON FIBER PREPREG IN EXTREMELY HIGH-TEMPERATURE DEFENSE AND SPACE APPLICATIONS

- 7.6.2 POLYIMIDE RESIN CARBON FIBER PREPREG MARKET, BY REGION

- TABLE 49 POLYIMIDE RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 50 POLYIMIDE RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 51 POLYIMIDE RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- TABLE 52 POLYIMIDE RESIN CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.7 OTHER RESINS

- 7.7.1 OTHER RESINS CARBON FIBER PREPREG MARKET, BY REGION

- TABLE 53 OTHER RESINS CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 54 OTHER RESINS CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 55 OTHER RESINS CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- TABLE 56 OTHER RESINS CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

8 CARBON FIBER PREPREG MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 29 AEROSPACE & DEFENSE TO BE LARGEST END USER OF CARBON FIBER PREPREG

- TABLE 57 CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 58 CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 59 CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 60 CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.2 AEROSPACE & DEFENSE

- 8.2.1 INCREASING AIRCRAFT PRODUCTION BY BOEING AND AIRBUS TO DRIVE DEMAND FOR CARBON FIBER PREPREG

- TABLE 61 NUMBER OF NEW AIRPLANES REQUIRED, BY REGION, 2019-2038

- FIGURE 30 NORTH AMERICA DOMINATED CARBON FIBER PREPREG MARKET IN AEROSPACE & DEFENSE SEGMENT

- 8.2.2 CARBON FIBER PREPREG MARKET IN AEROSPACE & DEFENSE, BY REGION

- TABLE 62 CARBON FIBER PREPREG MARKET SIZE IN AEROSPACE & DEFENSE, BY REGION, 2018-2021 (KILOTON)

- TABLE 63 CARBON FIBER PREPREG MARKET SIZE IN AEROSPACE & DEFENSE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 64 CARBON FIBER PREPREG MARKET SIZE IN AEROSPACE & DEFENSE, BY REGION, 2022-2027 (KILOTON)

- TABLE 65 CARBON FIBER PREPREG MARKET SIZE IN AEROSPACE & DEFENSE, BY REGION, 2022-2027 (USD MILLION)

- 8.2.3 ASIA PACIFIC: CARBON FIBER PREPREG MARKET IN AEROSPACE & DEFENSE, BY KEY COUNTRIES

- TABLE 66 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE IN AEROSPACE & DEFENSE, BY KEY COUNTRIES, 2018-2021 (KILOTON)

- TABLE 67 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE IN AEROSPACE & DEFENSE, BY KEY COUNTRIES, 2018-2021 (USD MILLION)

- TABLE 68 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE IN AEROSPACE & DEFENSE, BY KEY COUNTRIES, 2022-2027 (KILOTON)

- TABLE 69 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE IN AEROSPACE & DEFENSE, BY KEY COUNTRIES, 2022-2027 (USD MILLION)

- 8.3 WIND ENERGY

- 8.3.1 GROWTH IN INSTALLATION OF OFFSHORE WIND ENERGY TURBINES TO INCREASE DEMAND FOR CARBON FIBER PREPREG

- TABLE 70 ESTIMATED NEW OFFSHORE WIND INSTALLATIONS, BY REGION, 2019-2030

- FIGURE 31 EUROPE ACCOUNTS FOR MAJOR SHARE OF CARBON FIBER PREPREG MARKET IN WIND ENERGY

- 8.3.2 CARBON FIBER PREPREG MARKET IN WIND ENERGY, BY REGION

- TABLE 71 CARBON FIBER PREPREG MARKET SIZE IN WIND ENERGY, BY REGION, 2018-2021 (KILOTON)

- TABLE 72 CARBON FIBER PREPREG MARKET SIZE IN WIND ENERGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 73 CARBON FIBER PREPREG MARKET SIZE IN WIND ENERGY, BY REGION, 2022-2027 (KILOTON)

- TABLE 74 CARBON FIBER PREPREG MARKET SIZE IN WIND ENERGY, BY REGION, 2022-2027 (USD MILLION)

- 8.4 SPORTS & RECREATION

- 8.4.1 DEMAND FOR LIGHTWEIGHT AND HIGH-STRENGTH SPORTING GOODS FUELING USE OF CARBON FIBER PREPREG

- 8.4.2 CARBON FIBER PREPREG MARKET IN SPORTS & RECREATION, BY REGION

- TABLE 75 CARBON FIBER PREPREG MARKET SIZE IN SPORTS & RECREATION, BY REGION, 2018-2021 (KILOTON)

- TABLE 76 CARBON FIBER PREPREG MARKET SIZE IN SPORTS & RECREATION, BY REGION, 2018-2021 (USD MILLION)

- TABLE 77 CARBON FIBER PREPREG MARKET SIZE IN SPORTS & RECREATION, BY REGION, 2022-2027 (KILOTON)

- TABLE 78 CARBON FIBER PREPREG MARKET SIZE IN SPORTS & RECREATION, BY REGION, 2022-2027 (USD MILLION)

- 8.5 AUTOMOTIVE

- 8.5.1 GROWING USE OF CARBON FIBER PREPREG IN ELECTRIC CARS TO SIGNIFICANTLY IMPACT MARKET GROWTH

- 8.5.2 CARBON FIBER PREPREG MARKET IN AUTOMOTIVE, BY REGION

- TABLE 79 CARBON FIBER PREPREG MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018-2021 (KILOTON)

- TABLE 80 CARBON FIBER PREPREG MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 81 CARBON FIBER PREPREG MARKET SIZE IN AUTOMOTIVE, BY REGION, 2022-2027 (KILOTON)

- TABLE 82 CARBON FIBER PREPREG MARKET SIZE IN AUTOMOTIVE, BY REGION, 2022-2027 (USD MILLION)

- 8.6 OTHERS

- 8.6.1 CARBON FIBER PREPREG MARKET IN OTHER INDUSTRIES, BY REGION

- TABLE 83 CARBON FIBER PREPREG MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2018-2021 (KILOTON)

- TABLE 84 CARBON FIBER PREPREG MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2018-2021 (USD MILLION)

- TABLE 85 CARBON FIBER PREPREG MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2022-2027 (KILOTON)

- TABLE 86 CARBON FIBER PREPREG MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2022-2027 (USD MILLION)

9 CARBON FIBER PREPREG MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 32 EUROPE TO DRIVE CARBON FIBER PREPREG MARKET (2022-2027)

- 9.1.1 CARBON FIBER PREPREG MARKET, BY REGION

- TABLE 87 CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 88 CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 89 CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- TABLE 90 CARBON FIBER PREPREG MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 33 NORTH AMERICA: CARBON FIBER PREPREG MARKET SNAPSHOT

- 9.2.1 NORTH AMERICA: CARBON FIBER PREPREG MARKET, BY RESIN TYPE

- TABLE 91 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 92 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 93 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 94 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- 9.2.2 NORTH AMERICA: CARBON FIBER PREPREG MARKET, BY MANUFACTURING PROCESS

- TABLE 95 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2018-2021 (KILOTON)

- TABLE 96 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2018-2021 (USD MILLION)

- TABLE 97 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2022-2027 (KILOTON)

- TABLE 98 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2022-2027 (USD MILLION)

- 9.2.3 NORTH AMERICA: CARBON FIBER PREPREG MARKET, BY END-USE INDUSTRY

- TABLE 99 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 100 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 101 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 102 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.2.4 NORTH AMERICA: CARBON FIBER PREPREG MARKET, BY COUNTRY

- TABLE 103 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 104 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 105 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 106 NORTH AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.2.4.1 US

- 9.2.4.1.1 US dominates carbon fiber prepreg market in North America

- 9.2.4.1.2 US: Carbon fiber prepreg market, by end-use industry

- 9.2.4.1 US

- TABLE 107 US: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 108 US: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 109 US: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 110 US: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.2.4.2 Canada

- 9.2.4.2.1 Aerospace & defense and wind energy to be major consumers of carbon fiber prepreg

- 9.2.4.2.2 Canada: Carbon fiber prepreg market, by end-use industry

- 9.2.4.2 Canada

- TABLE 111 CANADA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 112 CANADA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 113 CANADA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 114 CANADA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.3 EUROPE

- FIGURE 34 CARBON FIBER PREPREG MARKET SNAPSHOT: GERMANY IS LARGEST MARKET IN EUROPE

- 9.3.1 EUROPE: CARBON FIBER PREPREG MARKET, BY RESIN TYPE

- TABLE 115 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 116 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 117 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 118 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- 9.3.2 EUROPE: CARBON FIBER PREPREG MARKET, BY MANUFACTURING PROCESS

- TABLE 119 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2018-2021 (KILOTON)

- TABLE 120 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2018-2021 (USD MILLION)

- TABLE 121 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2022-2027 (KILOTON)

- TABLE 122 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2022-2027 (USD MILLION)

- 9.3.3 EUROPE: CARBON FIBER PREPREG MARKET, BY END-USE INDUSTRY

- TABLE 123 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 124 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 125 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 126 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.3.4 EUROPE: CARBON FIBER PREPREG MARKET, BY COUNTRY

- TABLE 127 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 128 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 129 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 130 EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.3.4.1 Germany

- 9.3.4.1.1 Market driven by increasing wind energy capacity addition and production of lightweight electric cars

- 9.3.4.1.2 Germany: Carbon fiber prepreg market, by end-use industry

- 9.3.4.1 Germany

- TABLE 131 GERMANY: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 132 GERMANY: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 133 GERMANY: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 134 GERMANY: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.3.4.2 France

- 9.3.4.2.1 Aerospace & defense industry to drive carbon fiber prepreg market

- 9.3.4.2.2 France: Carbon fiber prepreg market, by end-use industry

- 9.3.4.2 France

- TABLE 135 FRANCE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 136 FRANCE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 137 FRANCE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 138 FRANCE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.3.4.3 UK

- 9.3.4.3.1 Presence of large aerospace & defense industry and rising offshore wind energy installation driving demand

- 9.3.4.3.2 UK: Carbon fiber prepreg market, by end-use industry

- 9.3.4.3 UK

- TABLE 139 UK: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 140 UK: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 141 UK: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 142 UK: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.3.4.4 Spain

- 9.3.4.4.1 Steady growth of economy and rising aircraft production driving market

- 9.3.4.4.2 Spain: Carbon fiber prepreg market, by end-use industry

- 9.3.4.4 Spain

- TABLE 143 SPAIN: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 144 SPAIN: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 145 SPAIN: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 146 SPAIN: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.3.4.5 Italy

- 9.3.4.5.1 Increasing consumption of carbon fiber prepreg in automotive sector driving market

- 9.3.4.5.2 Italy: Carbon fiber prepreg market, by end-use industry

- 9.3.4.5 Italy

- TABLE 147 ITALY: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 148 ITALY: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 149 ITALY: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 150 ITALY: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.3.4.6 Rest of Europe

- 9.3.4.6.1 Growing consumption of carbon fiber prepreg in aerospace & defense industry

- 9.3.4.6.2 Rest of Europe: Carbon fiber prepreg market, by end-use industry

- 9.3.4.6 Rest of Europe

- TABLE 151 REST OF EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 152 REST OF EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 153 REST OF EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 154 REST OF EUROPE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.4 ASIA PACIFIC

- 9.4.1 IMPACT OF COVID-19

- FIGURE 35 CARBON FIBER PREPREG MARKET SNAPSHOT: JAPAN TO BE FASTEST-GROWING MARKET IN ASIA PACIFIC

- 9.4.2 ASIA PACIFIC: CARBON FIBER PREPREG MARKET, BY RESIN TYPE

- TABLE 155 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 156 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 157 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 158 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- 9.4.3 ASIA PACIFIC: CARBON FIBER PREPREG MARKET, BY MANUFACTURING PROCESS

- TABLE 159 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2018-2021 (KILOTON)

- TABLE 160 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2018-2021 (USD MILLION)

- TABLE 161 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2022-2027 (KILOTON)

- TABLE 162 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2022-2027 (USD MILLION)

- 9.4.4 ASIA PACIFIC: CARBON FIBER PREPREG MARKET, BY END-USE INDUSTRY

- TABLE 163 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 164 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 165 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 166 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.4.5 ASIA PACIFIC: CARBON FIBER PREPREG MARKET, BY COUNTRY

- TABLE 167 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 168 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 169 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 170 ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.4.5.1 China

- 9.4.5.1.1 Aerospace & defense industry dominates carbon fiber prepreg market

- 9.4.5.1 China

- TABLE 171 CHINA: ANNUAL WIND ENERGY CAPACITY INSTALLATIONS, 2012-2017 (MW)

- 9.4.5.1.2 China: Carbon fiber prepreg market, by end-use industry

- TABLE 172 CHINA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 173 CHINA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 174 CHINA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 175 CHINA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.4.5.2 Japan

- 9.4.5.2.1 Presence of large carbon fiber prepreg manufacturers driving market in Japan

- 9.4.5.2.2 Japan: Carbon fiber prepreg market, by end-use industry

- 9.4.5.2 Japan

- TABLE 176 JAPAN: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 177 JAPAN: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 178 JAPAN: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 179 JAPAN: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.4.5.3 Taiwan

- 9.4.5.3.1 Increasing aircraft production and growing automotive industry to drive market

- 9.4.5.3.2 Taiwan: Carbon fiber prepreg market, by end-use industry

- 9.4.5.3 Taiwan

- TABLE 180 TAIWAN: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 181 TAIWAN: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 182 TAIWAN: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 183 TAIWAN: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.4.5.4 South Korea

- 9.4.5.4.1 Growing aerospace & defense industry to increase demand in South Korea

- 9.4.5.4.2 South Korea: Carbon fiber prepreg market, by end-use industry

- 9.4.5.4 South Korea

- TABLE 184 SOUTH KOREA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 185 SOUTH KOREA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 186 SOUTH KOREA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 187 SOUTH KOREA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.4.5.5 Rest of Asia Pacific

- 9.4.5.5.1 Growing aerospace & defense industry to support carbon fiber prepreg market

- 9.4.5.5.2 Rest of Asia Pacific: Carbon fiber prepreg market, by end-use industry

- 9.4.5.5 Rest of Asia Pacific

- TABLE 188 REST OF ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 189 REST OF ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 190 REST OF ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 191 REST OF ASIA PACIFIC: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.5 LATIN AMERICA

- 9.5.1 LATIN AMERICA: CARBON FIBER PREPREG MARKET, BY RESIN TYPE

- TABLE 192 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 193 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 194 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 195 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- 9.5.2 LATIN AMERICA: CARBON FIBER PREPREG MARKET, BY MANUFACTURING PROCESS

- TABLE 196 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2018-2021 (KILOTON)

- TABLE 197 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2018-2021 (USD MILLION)

- TABLE 198 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2022-2027 (KILOTON)

- TABLE 199 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2022-2027 (USD MILLION)

- 9.5.3 LATIN AMERICA: CARBON FIBER PREPREG MARKET, BY END-USE INDUSTRY

- TABLE 200 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 201 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 202 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 203 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.5.4 LATIN AMERICA: CARBON FIBER PREPREG MARKET, BY COUNTRY

- TABLE 204 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 205 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 206 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 207 LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.5.4.1 Brazil

- 9.5.4.1.1 Consolidation of Embraer with Boeing to increase aircraft production

- 9.5.4.1 Brazil

- TABLE 208 BRAZIL: WIND ENERGY CAPACITY INSTALLATIONS, 2010-2020 (MW)

- 9.5.4.1.2 Brazil: Carbon fiber prepreg market, by end-use industry

- TABLE 209 BRAZIL: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 210 BRAZIL: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 211 BRAZIL: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 212 BRAZIL: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.5.4.2 Mexico

- 9.5.4.2.1 Rising demand from automotive and wind energy industries to drive market

- 9.5.4.2.2 Mexico: Carbon fiber prepreg market, by end-use industry

- 9.5.4.2 Mexico

- TABLE 213 MEXICO: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 214 MEXICO: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 215 MEXICO: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 216 MEXICO: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.5.4.3 Rest of Latin America

- 9.5.4.3.1 Growing demand from automotive sector to fuel market growth

- 9.5.4.3.2 Rest of Latin America: Carbon fiber prepreg market, by end-use industry

- 9.5.4.3 Rest of Latin America

- TABLE 217 REST OF LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 218 REST OF LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 219 REST OF LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 220 REST OF LATIN AMERICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET, BY RESIN TYPE

- TABLE 221 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 222 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- TABLE 224 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- 9.6.2 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET, BY MANUFACTURING PROCESS

- TABLE 225 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2018-2021 (KILOTON)

- TABLE 226 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2018-2021 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2022-2027 (KILOTON)

- TABLE 228 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY MANUFACTURING PROCESS, 2022-2027 (USD MILLION)

- 9.6.3 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET, BY END-USE INDUSTRY

- TABLE 229 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 230 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 232 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.6.4 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET, BY COUNTRY

- TABLE 233 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 234 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 236 MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.6.4.1 South Africa

- 9.6.4.1.1 Growing economy supporting growth of carbon fiber prepreg market in South Africa

- 9.6.4.1.2 South Africa: Carbon fiber prepreg market, by end-use industry

- 9.6.4.1 South Africa

- TABLE 237 SOUTH AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 238 SOUTH AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 239 SOUTH AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 240 SOUTH AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.6.4.2 Saudi Arabia

- 9.6.4.2.1 Growing aerospace & defense industry to drive carbon fiber prepreg market

- 9.6.4.2.2 Saudi Arabia: Carbon fiber prepreg market, by end-use industry

- 9.6.4.2 Saudi Arabia

- TABLE 241 SAUDI ARABIA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 242 SAUDI ARABIA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 243 SAUDI ARABIA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 244 SAUDI ARABIA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.6.4.3 UAE

- 9.6.4.3.1 Stringent regulations regarding fuel economy and emission standards likely to drive market

- 9.6.4.3.2 UAE: Carbon fiber prepreg market, by end-use industry

- 9.6.4.3 UAE

- TABLE 245 UAE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 246 UAE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 247 UAE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 248 UAE: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 9.6.4.4 Rest of Middle East & Africa

- 9.6.4.4.1 Steady growth of economy and increasing aircraft production driving market

- 9.6.4.4.2 Rest of Middle East & Africa: Carbon fiber prepreg market, by end-use industry

- 9.6.4.4 Rest of Middle East & Africa

- TABLE 249 REST OF MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 250 REST OF MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 251 REST OF MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 252 REST OF MIDDLE EAST & AFRICA: CARBON FIBER PREPREG MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS

- FIGURE 36 SHARES OF TOP COMPANIES IN CARBON FIBER PREPREG MARKET

- TABLE 253 DEGREE OF COMPETITION: CARBON FIBER PREPREG MARKET

- 10.3 MARKET RANKING

- FIGURE 37 RANKING OF TOP FIVE PLAYERS IN CARBON FIBER PREPREG MARKET

- 10.4 REVENUE ANALYSIS OF TOP PLAYERS

- FIGURE 38 REVENUE ANALYSIS OF TOP CARBON FIBER PREPREG MANUFACTURERS

- 10.5 COMPETITIVE BENCHMARKING

- TABLE 254 COMPANY PRODUCT FOOTPRINT

- TABLE 255 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 256 COMPANY REGION FOOTPRINT

- 10.6 COMPANY EVALUATION MATRIX

- 10.6.1 STARS

- 10.6.2 PERVASIVE PLAYERS

- 10.6.3 PARTICIPANTS

- 10.6.4 EMERGING LEADERS

- FIGURE 39 CARBON FIBER PREPREG MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.6.5 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 40 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS

- 10.6.6 BUSINESS STRATEGY EXCELLENCE

- FIGURE 41 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS

- 10.7 MARKET EVALUATION FRAMEWORK

- TABLE 257 CARBON FIBER PREPREG MARKET: NEW PRODUCT LAUNCH/DEVELOPMENT, 2015-2022

- TABLE 258 CARBON FIBER PREPREG MARKET: DEALS, 2015-2022

- TABLE 259 CARBON FIBER PREPREG MARKET: OTHER DEVELOPMENTS, 2015-2022

- 10.8 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 260 CARBON FIBER PREPREG MARKET: KEY START-UPS/SMES

- TABLE 261 CARBON FIBER PREPREG MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 10.9 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

- 10.9.1 PROGRESSIVE COMPANIES

- 10.9.2 RESPONSIVE COMPANIES

- 10.9.3 DYNAMIC COMPANIES

- 10.9.4 STARTING BLOCKS

- FIGURE 42 CARBON FIBER PREPREG MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2021

11 COMPANY PROFILES

- 11.1 KEY COMPANIES

- (Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, Other developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats)**

- 11.1.1 MITSUBISHI CHEMICAL CARBON FIBER AND COMPOSITES, INC.

- TABLE 262 MITSUBISHI CHEMICAL CARBON FIBER AND COMPOSITES, INC.: COMPANY OVERVIEW

- FIGURE 43 MITSUBISHI CHEMICAL CARBON FIBER AND COMPOSITES, INC.: COMPANY SNAPSHOT

- 11.1.2 SOLVAY

- TABLE 263 SOLVAY: COMPANY OVERVIEW

- FIGURE 44 SOLVAY: COMPANY SNAPSHOT

- 11.1.3 TEIJIN LIMITED

- TABLE 264 TEIJIN LIMITED: COMPANY OVERVIEW

- FIGURE 45 TEIJIN LIMITED: COMPANY SNAPSHOT

- 11.1.4 TORAY INDUSTRIES INC.

- TABLE 265 TORAY: COMPANY OVERVIEW

- FIGURE 46 TORAY INDUSTRIES INC.: COMPANY SNAPSHOT

- 11.1.5 HEXCEL CORPORATION

- TABLE 266 HEXCEL CORPORATION: COMPANY OVERVIEW

- FIGURE 47 HEXCEL CORPORATION: COMPANY SNAPSHOT

- 11.1.6 GURIT HOLDING AG

- TABLE 267 GURIT HOLDING AG: COMPANY OVERVIEW

- FIGURE 48 GURIT HOLDING AG: COMPANY SNAPSHOT

- 11.1.7 ROCK WEST COMPOSITES, INC.

- TABLE 268 ROCK WEST COMPOSITES, INC.: COMPANY OVERVIEW

- 11.1.8 SGL CARBON

- TABLE 269 SGL CARBON: COMPANY OVERVIEW

- FIGURE 49 SGL CARBON: COMPANY SNAPSHOT

- 11.1.9 PARK AEROSPACE CORP.

- TABLE 270 PARK AEROSPACE CORP.: COMPANY OVERVIEW

- FIGURE 50 PARK AEROSPACE CORP.: COMPANY SNAPSHOT

- 11.1.10 AXIOM MATERIALS, INC.

- TABLE 271 AXIOM MATERIALS, INC.: COMPANY OVERVIEW

- 11.2 OTHER COMPANIES

- 11.2.1 WEIHAI GUANGWEI COMPOSITES MATERIALS CO., LTD.

- TABLE 272 WEIHAI GUANGWEI COMPOSITES MATERIALS CO., LTD.: COMPANY OVERVIEW

- 11.2.2 MALLINDA, INC.

- TABLE 273 MALLINDA, INC.: COMPANY OVERVIEW

- 11.2.3 SICHUAN XINWANXING CARBON FIBER COMPOSITES CO., LTD.

- TABLE 274 SICHUAN XINWANXING CARBON FIBER COMPOSITES CO., LTD.: COMPANY OVERVIEW

- 11.2.4 DEXCRAFT

- TABLE 275 DEXCRAFT: COMPANY OVERVIEW

- 11.2.5 3A ASSOCIATES INCORPORATED

- TABLE 276 3A ASSOCIATES INCORPORATED: COMPANY OVERVIEW

- 11.2.6 ROCKMAN ADVANCED COMPOSITES

- TABLE 277 ROCKMAN ADVANCED COMPOSITES: COMPANY OVERVIEW

- 11.2.7 KINECO LIMITED

- TABLE 278 KINECO LIMITED: COMPANY OVERVIEW

- 11.2.8 TAIWAN FIRST LI-BOND CO., LTD.

- TABLE 279 TAIWAN FIRST LI-BOND CO., LTD.: COMPANY OVERVIEW

- 11.2.9 NORTH THIN PLY TECHNOLOGY

- TABLE 280 NORTH THIN PLY TECHNOLOGY: COMPANY OVERVIEW

- 11.2.10 TCR COMPOSITES

- TABLE 281 TCR COMPOSITES: COMPANY OVERVIEW

- 11.2.11 PLASTIC REINFORCEMENT FABRICS LTD.

- TABLE 282 PLASTIC REINFORCEMENT FABRICS LTD.: COMPANY OVERVIEW

- 11.2.12 BARRDAY INC.

- TABLE 283 BARRDAY INC.: COMPANY OVERVIEW

- 11.2.13 GMS COMPOSITES

- TABLE 284 GMS COMPOSITES: COMPANY OVERVIEW

- 11.2.14 HANKUK CARBON

- TABLE 285 HANKUK CARBON: COMPANY OVERVIEW

- 11.2.15 ABC COMPOSITES

- TABLE 286 ABC COMPOSITES: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, Other developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORT

- 12.5 AUTHOR DETAILS