|

|

市場調査レポート

商品コード

1211140

親水性コーティングの世界市場:基材別 (ポリマー、ガラス/セラミックス、金属、ナノ粒子)・エンドユーザー別 (医療機器、光学機器、自動車、航空宇宙、船舶)・地域別 (アジア太平洋、北米、欧州、中東・アフリカ、南米) の将来予測 (2027年まで)Hydrophilic Coating Market by Substrate (Polymers, Glass/Ceramics, Metals, Nanoparticles), End User (Medical Devices, Optics, Automotive, Aerospace, Marine), and Region (APAC, North America, Europe, MEA, South America) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 親水性コーティングの世界市場:基材別 (ポリマー、ガラス/セラミックス、金属、ナノ粒子)・エンドユーザー別 (医療機器、光学機器、自動車、航空宇宙、船舶)・地域別 (アジア太平洋、北米、欧州、中東・アフリカ、南米) の将来予測 (2027年まで) |

|

出版日: 2023年01月31日

発行: MarketsandMarkets

ページ情報: 英文 220 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の親水性コーティングの市場規模は、2022年の168億米ドルから2027年には225億米ドルに達し、2022年から2027年の間に6.0%のCAGRで成長すると予測されます。

基材別では、ポリマーのセグメントが予測期間中に最も急速に成長すると考えられています。特に体内埋め込み型 (動脈系・静脈系用) 医療機器向けに、摩擦低減用コーティング材として広く活用されています。

エンドユーザー別では、医療機器の分野が予測期間中、最も高いCAGRを維持すると予想されます。慢性疾患の蔓延や高齢化の進展などの要因が医療機器市場の成長、ひいては親水性コーティングの需要増大につながっています。

地域別に見ると、中東・アフリカ市場が予測期間中に最も高いCAGRを記録すると推定されます。自動車需要の増大や医療インフラの建設などが、市場成長の主な促進要因として挙げられます。

当レポートでは、世界の親水性コーティングの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、基材別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- マクロ経済の概要と主な動向

- イントロダクション

- GDPの動向と予測

- 自動車産業の動向

- バリューチェーン分析

- 価格分析

- 親水性コーティングのエコシステムと相互接続市場

- YC・YCCのシフト

- 貿易分析

- 特許分析

- ケーススタディ分析

- 技術分析

- 主な会議とイベント (2023年)

- 関税と規制の状況

第6章 親水性コーティング市場:基材別

- イントロダクション

- ポリマー

- ガラス/セラミックス

- 金属

- ナノ粒子

- その他

第7章 親水性コーティング市場:エンドユーザー別

- イントロダクション

- 医療機器

- 光学機器

- 自動車

- 航空宇宙

- 船舶

- その他

第8章 親水性コーティング市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- トルコ

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- 他のアジア太平洋諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- 他の中東・アフリカ諸国

第9章 競合情勢

- 概要

- 競合リーダーシップマッピング (2021年)

- 中小企業 (SME) のマトリックス (2021年)

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 競合ベンチマーキング

- 市場シェア分析

- 市場ランキング分析

- 収益分析

- 競合シナリオ

- 戦略展開

第10章 企業プロファイル

- 主要企業

- HYDROMER, INC.

- HARLAND MEDICAL SYSTEMS, INC.

- SURMODICS, INC.

- KONINKLIJKE DSM NV

- BIOCOAT, INC.

- ACULON, INC.

- AST PRODUCTS, INC.

- ADVANSOURCE BIOMATERIALS CORPORATION

- SURFACE SOLUTIONS GROUP, LLC

- TELEFLEX, INC

- その他の企業

- BIOINTERACTIONS LTD

- PANGOLIN MEDICAL

- DONTECH INC

- FORMACOAT LLC

- JONINN

- DUKE EMPIRICAL INC

- CUUMED CATHETER MEDICAL CO., LTD

- NOANIX CORPORATION

- LOTUS LEAF COATINGS, INC

- APPLIED MEDICAL COATINGS, LLC

- HEMOTEQ AG

- FSI COATING TECHNOLOGIES, INC (MITSUI CHEMICALS)

- SHANGHAI HUZHENG NANOTECHNOLOGY CO., LTD

- INNOVATIVE SURFACE TECHNOLOGIES INC.

- MEDICHEM NANO TEKNOLOJI SAN. VE TIC. A.S.

第11章 隣接・関連市場

- イントロダクション

- 塗料・コーティング市場の制限

- 塗料・コーティング市場の定義

- 塗料・コーティング市場の市場概要

- 塗料・コーティング市場:技術別の分析

- 塗料・コーティング市場:樹脂の種類別の分析

- 塗料・コーティング市場:エンドユース産業別の分析

- 塗料・コーティング市場:地域別の分析

第12章 付録

The global hydrophilic coating market size is projected to grow from USD 16.8 billion in 2022 to USD 22.5 billion by 2027, at a CAGR of 6.0%, between 2022 and 2027. Hydrophilic coatings provide several benefits that greatly improve the performance of products across a wide spectrum of industries. Matching the chemistry of hydrophilic coatings to a variety of substrate materials, difficult product geometries, and environments in which these coated products are used is a complex process that should be guided by those skilled in the development, manufacturing, and application of hydrophilic coatings. Organizations or companies seeking to improve their product performance and portfolio by incorporating the use of hydrophilic coatings should enlist the assistance of experts. The hydrophilic nature of the coating captures the water and evenly distributes it across the surface of the substrate. By evenly distributing the captured water molecules of the vapor, the fog effect is minimized and creates an optically clear surface for the individual looking through the coated lens. Anti-fog coatings are often used for sports eye protection, workers safety glasses, face shields, military goggles, automobile headlights, aviation windows, and many other applications.

The polymers segment is one of the fastest-growing substrate type segment during the forecast period.

For decades, friction-reducing coatings have been used to facilitate the insertion and placement of devices within the body. These coatings are often used on devices designed for use in arterial and venous systems. Common products that use coatings to reduce friction include stents, catheters, bioabsorbable scaffolds, guidewires, and other products that are in contact with the bloodstream. This is because blood becomes notoriously tacky the longer a device is in the artery or the vein and can result in a device performing sub-optimally. Today, there are a variety of surface modification options available to device engineers, from hydrophobic to hydrophilic coatings. This allows them to select the solution that best matches their specific design and performance requirements. One of the original coatings used in the medical field is polytetrafluorethylene (PTFE). Widely used to coat guidewires, PTFE has the unique property of providing a low-friction surface in the dry state. Unlike hydrophilic polymers, PTFE does not need to be wet to provide lubricity. By contrast, polymers in hydrophilic coatings such as polyvinylpyrrolidone, which is contained in a hydrophilic coated solution, absorb aqueous liquids to make the surface slippery when wet. This feature makes hydrophilic coatings more lubricious than PTFE coatings.

Natural rubber, latex, and synthetic rubber materials provide great physical qualities for a variety of applications, including mechanical strength, low heat resistance, flexibility, and elasticity. Natural rubber is widely employed in many commercially accessible items because of these benefits. Natural rubber is derived from the rubber tree Hevea brasiliensis and is chemically constituted of polymers containing isoprene repeating units (cis 1,4-polyisoprene). Natural rubber is hydrophobic due to its chemical makeup and the existence of unsaturated carbon-carbon double bonds, which can result in the irreversible adsorption of biological components onto its surface. Because latex is incompatible with blood and can cause bacterial, fungal, or protein deposition on the surface, the use of natural rubber for in vivo applications and devices is limited.

Medical devices segment in end user is expected to hold the one of the highest growth during the forecast period.

The medtech business has seen substantial growth and development in recent years. Because of the aging population, the growing burden of chronic illnesses, and doctors' and consumers' increased faith in medical devices, pharmaceutical corporations and the medtech industry have formed stronger collaborations. However, the medtech business is experiencing new hurdles, including an ever-changing regulatory environment, payment decreases, the high cost of modern medical technology, and safety concerns. Despite changing and increasingly complex reimbursement and regulatory processes, the global medtech market is expected to grow at a CAGR of 6% during the forecast period. This increased growth is mainly driven by M&A, increase in R&D expenditure, development of AI-based technologies and rising demand for medtech products in emerging geographies such as Latin America, Asia Pacific, and Middle East and Africa, and pre-established markets such as North America and Europe.

The global medical device industry has witnessed a steady and robust growth fueled by a range of factors such as the rising prevalence of chronic diseases, increasing aging population, and unforeseen demand for digital and connected devices, especially since the pandemic. According to the World Health Organization, the worldwide medical device business was valued at USD 425.2 billion in 2018 and was predicted to increase at a CAGR of 5.4% to roughly USD 612.7 billion in 2025. The industry is predominantly controlled by industrialized countries. In 2017, the US and Europe accounted for 40% and 27% of the worldwide medical device business, respectively. For decades, manufacturers have focused on designing and producing technologies or medical equipment based on the demands of established markets before selling the same items in emerging areas with minor modifications. However, developing nation- or region-specific brand-new cost-effective items would be an efficient strategy for producers. For instance, GE Healthcare designed a compact and portable ultrasound machine for the Chinese market, costing merely USD 15,000 compared to over USD 100,000 for their high-end markets. The machine was an instant hit in China due to its affordability and portability; and it also created new sales opportunities for GE Healthcare in developed countries.

Middle East & Africa hydrophilic coatings market is estimated to register one of the highest CAGR during the forecast period.

The Middle East & Africa includes countries such as South Africa, UAE, Saudi Arabia, and the Rest of Middle East & Africa. Saudi Arabia is investing several billion dollars in upgrading infrastructure in oil & gas, power, and transportation. The country is the largest importer of vehicles and auto parts in the Middle East. The Saudi Arabia market is experiencing a growing demand for smaller, low-priced cars resulting from a growing middle-class population. The Saudi Government is attracting original equipment manufacturers (OEMs) to open facilities in the country and simultaneously developing a domestic automotive design and manufacturing capacity. Vehicle sales in the country are likely to increase, as the Ministry of Economy has initiated a policy of minimizing the price disparity between cars manufactured by local companies and those imported from other countries. The increased sales will play a crucial role in driving the demand for hydrophilic coating in manufacturing various auto parts.

The healthcare sector remains a top priority for the Kingdom of Saudi Arabia (KSA) government. On the back of rapid technological advancements, research, and development, Saudi Arabia is keeping track of global and regional trends. The country continues to allocate an annually increasing budget, a clear indication of the enormous opportunities for growth. One of the key factors for the growth of the Kingdom's healthcare sector is the changing of the population's age profile, which is expected to reach 39.5 million by 2030, an increase of 19.9% from 2017, according to the Euromonitor forecast. As 70% of the population is under the age of 40, it is predicted that the change in the population composition will drive future healthcare requirements and create demand for several specialisms, including pediatrics, lifestyle diseases, long-term care, rehabilitation, home care, and rejuvenation services. Oil revenues fund the free public healthcare system for Saudi citizens and public sector workers. Currently, these are under great pressure. The growing cost of medical technologies, demographic changes, the increasing prevalence of chronic diseases, and the growing demand for quality healthcare are all factors that put more pressure on the healthcare system in Saudi Arabia to adopt cost-containment measures. Saudi Arabia's administration has taken steps to improve the healthcare sector and has devised a National Transformation Plan in cooperation with the Ministry of Health's National Healthcare Project and National e-Health Strategy. According to the International Trade Administration, in 2022, the Saudi Arabian government spent USD 36.8 billion on healthcare and social development and targeted the healthcare sector for privatization. Such initiatives are expected to improve the hydrophilic coating market during the forecast period.

Information was gathered from secondary research and In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the hydrophilic coating market to verify the market size of several segments and subsegments.

- By Company Type: Tier 1 - 46%, Tier 2 - 43%, and Tier 3 - 27%

- By Designation: C Level - 21%, D Level - 23%, and Others - 56%

- By Region: North America - 37%, Asia Pacific- 26%, Europe - 23%, Middle East & Africa - 10%, and South America - 4%

The key companies profiled in this report are Hydromer, Inc (US), Harland Medical Systems, Inc (US), Surmodics, Inc (US), Koninklijke DSM NV (Netherlands), Biocoat, Inc (US), Aculon, Inc (US), AST Products, Inc (US), AdvanSource Biomaterials Corporation (US), Surface Solutions Group, LLC (US), Teleflex, Inc (US), and others.

Research Coverage:

- This report provides detailed segmentation of the hydrophilic coating market based on substrate, end user, and region. Substrate is divided into polymers, glass/ceramics, metals, nanoparticles, and others. Based on end user, the market has been segmented into medical devices, optics, automotive, aerospace, marine, and others. Based on the region, the market has been segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Key Benefits of Buying the Report

From an insight perspective, this research report focuses on various levels of analyses - industry analysis (industry trends), market ranking of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the market; high growth regions; and market drivers, restraints, opportunities, and challenges.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 HYDROPHILIC COATING MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 HYDROPHILIC COATING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary data sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 HYDROPHILIC COATING MARKET SIZE ESTIMATION, BY REGION

- FIGURE 6 HYDROPHILIC COATING MARKET, BY SUBSTRATE

- 2.2.3 SUPPLY-SIDE FORECAST

- FIGURE 7 HYDROPHILIC COATING MARKET: SUPPLY-SIDE FORECAST

- FIGURE 8 METHODOLOGY FOR SUPPLY-SIDE SIZING OF HYDROPHILIC COATING MARKET

- 2.2.4 FACTOR ANALYSIS

- FIGURE 9 FACTOR ANALYSIS OF HYDROPHILIC COATING MARKET

- 2.3 DATA TRIANGULATION

- FIGURE 10 HYDROPHILIC COATING MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 GROWTH RATE FORECAST

3 EXECUTIVE SUMMARY

- TABLE 1 HYDROPHILIC COATING MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 11 POLYMERS SEGMENT TO DOMINATE HYDROPHILIC COATING MARKET

- FIGURE 12 MEDICAL DEVICES END USER TO LEAD HYDROPHILIC COATING MARKET

- FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING HYDROPHILIC COATING MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN HYDROPHILIC COATING MARKET

- FIGURE 14 MARKET GROWTH IN NORTH AMERICA DUE TO GROWING AUTOMOTIVE AND MEDICAL DEVICES INDUSTRIES

- 4.2 HYDROPHILIC COATING MARKET, BY SUBSTRATE

- FIGURE 15 POLYMERS TO BE LARGEST SUBSTRATE SEGMENT DURING FORECAST PERIOD

- 4.3 HYDROPHILIC COATING MARKET: DEVELOPED VS. EMERGING COUNTRIES

- FIGURE 16 DEVELOPING COUNTRIES TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- 4.4 ASIA PACIFIC HYDROPHILIC COATING MARKET: BY SUBSTRATE AND COUNTRY, 2021

- FIGURE 17 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC

- 4.5 HYDROPHILIC COATING MARKET: MAJOR COUNTRIES

- FIGURE 18 INDIA TO REGISTER HIGHEST CAGR IN HYDROPHILIC COATING MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HYDROPHILIC COATING MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing automobile and medical devices production

- 5.2.1.2 Technological advancements in hydrophilic coatings

- 5.2.2 RESTRAINTS

- 5.2.2.1 Rising raw material prices

- 5.2.2.2 High initial cost and lack of skilled workforce

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Establishing authenticity through various certifications

- 5.2.3.2 Increasing public-private partnerships in operational markets of end-use industries

- 5.2.4 CHALLENGES

- 5.2.4.1 Challenges in supply chain

- 5.2.4.2 Stringent regulatory policies and product quality concerns

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 HYDROPHILIC COATING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 PORTER'S FIVE FORCES ANALYSIS: HYDROPHILIC COATING MARKET

- 5.3.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 THREAT OF NEW ENTRANTS

- 5.4 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRIES (%)

- 5.4.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR HYDROPHILIC COATING

- TABLE 4 KEY BUYING CRITERIA FOR HYDROPHILIC COATING

- 5.5 MACROECONOMIC OVERVIEW AND KEY TRENDS

- 5.5.1 INTRODUCTION

- 5.5.2 TRENDS AND FORECAST OF GDP

- TABLE 5 REAL GDP GROWTH BY COUNTRY (ANNUAL PERCENTAGE CHANGE), 2020-2027

- 5.5.3 TRENDS IN AUTOMOTIVE INDUSTRY

- TABLE 6 AUTOMOTIVE INDUSTRY PRODUCTION (2020-2021)

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 23 HYDROPHILIC COATING: VALUE CHAIN ANALYSIS

- 5.7 PRICING ANALYSIS

- FIGURE 24 AVERAGE PRICE COMPETITIVENESS IN HYDROPHILIC COATING MARKET, BY REGION, 2021

- FIGURE 25 AVERAGE PRICE COMPETITIVENESS IN HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2021

- FIGURE 26 AVERAGE PRICE COMPETITIVENESS IN HYDROPHILIC COATING MARKET, BY END USER, 2021

- FIGURE 27 AVERAGE PRICE COMPETITIVENESS IN HYDROPHILIC COATING MARKET, BY COMPANIES, 2021

- 5.8 HYDROPHILIC COATING ECOSYSTEM AND INTERCONNECTED MARKETS

- TABLE 7 HYDROPHILIC COATING MARKET: SUPPLY CHAIN

- FIGURE 28 HYDROPHILIC COATING MARKET: ECOSYSTEM

- 5.9 YC AND YCC SHIFT

- FIGURE 29 CHANGING REVENUE MIX FOR HYDROPHILIC COATING MARKET

- 5.10 TRADE ANALYSIS

- TABLE 8 COUNTRY-WISE EXPORT DATA, 2019-2021 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE IMPORT DATA, 2019-2021 (USD THOUSAND)

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 PUBLICATION TRENDS

- FIGURE 30 NUMBER OF PATENTS PUBLISHED, 2017-2022

- 5.11.3 TOP JURISDICTION

- FIGURE 31 PATENTS PUBLISHED BY JURISDICTIONS, 2017-2022

- 5.11.4 TOP APPLICANTS

- FIGURE 32 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2017-2022

- TABLE 10 RECENT PATENTS BY OWNERS

- 5.12 CASE STUDY ANALYSIS

- 5.13 TECHNOLOGY ANALYSIS

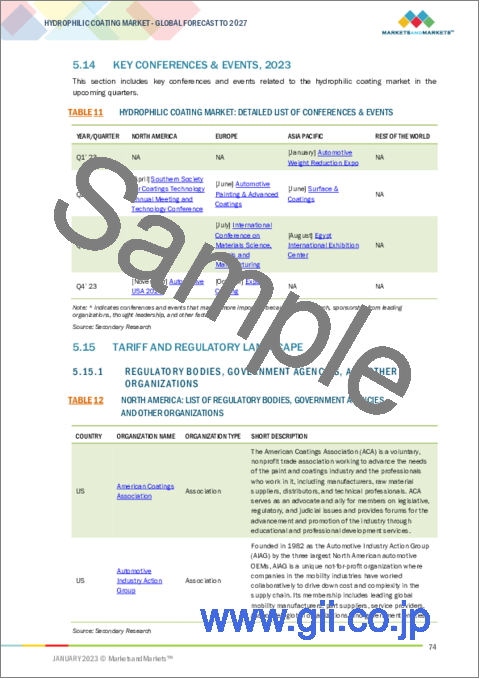

- 5.14 KEY CONFERENCES & EVENTS, 2023

- TABLE 11 HYDROPHILIC COATING MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 HYDROPHILIC COATING MARKET, BY SUBSTRATE

- 6.1 INTRODUCTION

- FIGURE 33 POLYMERS SEGMENT TO LEAD HYDROPHILIC COATING MARKET

- TABLE 14 HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2018-2021 (USD MILLION)

- TABLE 15 HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022-2027 (USD MILLION)

- TABLE 16 HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2018-2021 (KILOTON)

- TABLE 17 HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022-2027 (KILOTON)

- 6.2 POLYMERS

- 6.2.1 HIGH DURABILITY TO CREATE APPLICATIONS IN MULTIPLE END-USE INDUSTRIES

- TABLE 18 POLYMERS: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 19 POLYMERS: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 20 POLYMERS: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 21 POLYMERS: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (KILOTON)

- 6.3 GLASS/CERAMICS

- 6.3.1 GROWING DEMAND FOR EYEWEAR AND ANTI-FOGGING PROPERTY TO DRIVE DEMAND

- TABLE 22 GLASS/CERAMICS: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 23 GLASS/CERAMICS: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 24 GLASS/CERAMICS: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 25 GLASS/CERAMICS: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (KILOTON)

- 6.4 METALS

- 6.4.1 CAPABILITY OF BEARING POTENT FORCE IN UNFAVORABLE CONDITIONS TO SUPPORT MARKET

- TABLE 26 METALS: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 27 METALS: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 28 METALS: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 29 METALS: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (KILOTON)

- 6.5 NANOPARTICLES

- 6.5.1 GROWING DEMAND FOR MEDICAL DEVICES WITH HIGH ACCURACY TO DRIVE MARKET

- TABLE 30 NANOPARTICLES: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 31 NANOPARTICLES: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 32 NANOPARTICLES: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 33 NANOPARTICLES: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (KILOTON)

- 6.6 OTHERS

- TABLE 34 OTHER SUBSTRATES: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 OTHER SUBSTRATES: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 36 OTHER SUBSTRATES: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 37 OTHER SUBSTRATES: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (KILOTON)

7 HYDROPHILIC COATING MARKET, BY END USER

- 7.1 INTRODUCTION

- FIGURE 34 MEDICAL DEVICES SEGMENT TO DOMINATE HYDROPHILIC COATING MARKET

- TABLE 38 HYDROPHILIC COATING MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 39 HYDROPHILIC COATING MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 40 HYDROPHILIC COATING MARKET, BY END USER, 2018-2021 (KILOTON)

- TABLE 41 HYDROPHILIC COATING MARKET, BY END USER, 2022-2027 (KILOTON)

- 7.2 MEDICAL DEVICES

- 7.2.1 INCREASING DEMAND FOR ADVANCED AND PERSONALIZED TREATMENT AND AVAILABILITY OF HEALTHCARE SERVICES TO DRIVE DEMAND

- TABLE 42 MEDICAL DEVICES: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 43 MEDICAL DEVICES: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 44 MEDICAL DEVICES: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 45 MEDICAL DEVICES: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (KILOTON)

- 7.3 OPTICS

- 7.3.1 PREVALENCE OF COMPUTER VISION SYNDROME AND DIGITAL SERVICES TO DRIVE MARKET

- TABLE 46 OPTICS: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 47 OPTICS: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 48 OPTICS: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 49 OPTICS: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (KILOTON)

- 7.4 AUTOMOTIVE

- 7.4.1 ACCELERATING PER CAPITA AND DISPOSABLE INCOME OF POPULACE IN DEVELOPING COUNTRIES TO PROPEL MARKET

- TABLE 50 AUTOMOTIVE: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 51 AUTOMOTIVE: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 52 AUTOMOTIVE: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 53 AUTOMOTIVE: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (KILOTON)

- 7.5 AEROSPACE

- 7.5.1 RISING INVESTMENTS IN AEROSPACE SECTOR TO BOOST DEMAND FOR HYDROPHILIC COATINGS

- TABLE 54 AEROSPACE: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 55 AEROSPACE: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 56 AEROSPACE: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 57 AEROSPACE: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (KILOTON)

- 7.6 MARINE

- 7.6.1 INCREASED TOURISM AND SURGING DEMAND FOR GLOBAL SEA TRADE TO BOOST MARKET

- TABLE 58 MARINE: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 59 MARINE: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 60 MARINE: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 61 MARINE: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (KILOTON)

- 7.7 OTHERS

- TABLE 62 OTHERS: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 63 OTHERS: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 64 OTHERS: HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 65 OTHERS: HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (KILOTON)

8 HYDROPHILIC COATING MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 35 ASIA PACIFIC EMERGING AS STRATEGIC LOCATION FOR HYDROPHILIC COATING MARKET

- TABLE 66 HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 67 HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 68 HYDROPHILIC COATING MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 69 HYDROPHILIC COATING MARKET, BY REGION, 2022-2027 (KILOTON)

- 8.2 NORTH AMERICA

- FIGURE 36 NORTH AMERICA: HYDROPHILIC COATING MARKET SNAPSHOT

- TABLE 70 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 71 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 72 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 73 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 74 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2018-2021 (USD MILLION)

- TABLE 75 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022-2027 (USD MILLION)

- TABLE 76 NORTH AMERICA: HYDROPHILIC COATINGS MARKET, BY SUBSTRATE, 2018-2021 (KILOTON)

- TABLE 77 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022-2027 (KILOTON)

- TABLE 78 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 79 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 80 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2018-2021 (KILOTON)

- TABLE 81 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2022-2027 (KILOTON)

- 8.2.1 US

- 8.2.1.1 Growing automotive and healthcare industries to boost market

- 8.2.2 CANADA

- 8.2.2.1 Government investments in healthcare and automotive sectors to propel market

- 8.2.3 MEXICO

- 8.2.3.1 Favorable trade agreements attracting hydrophilic coating manufacturers to drive market

- 8.3 EUROPE

- FIGURE 37 EUROPE: HYDROPHILIC COATING MARKET SNAPSHOT

- TABLE 82 EUROPE: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 83 EUROPE: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 84 EUROPE: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 85 EUROPE: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 86 EUROPE: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2018-2021 (USD MILLION)

- TABLE 87 EUROPE: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022-2027 (USD MILLION)

- TABLE 88 EUROPE: HYDROPHILIC COATINGS MARKET, BY SUBSTRATE, 2018-2021 (KILOTON)

- TABLE 89 EUROPE: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022-2027 (KILOTON)

- TABLE 90 EUROPE: HYDROPHILIC COATING MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 91 EUROPE: HYDROPHILIC COATING MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 92 EUROPE: HYDROPHILIC COATING MARKET, BY END USER, 2018-2021 (KILOTON)

- TABLE 93 EUROPE: HYDROPHILIC COATING MARKET, BY END USER, 2022-2027 (KILOTON)

- 8.3.1 GERMANY

- 8.3.1.1 Presence of major distribution channels to increase demand

- 8.3.2 UK

- 8.3.2.1 BREXIT to hamper automotive industry growth in short term

- 8.3.3 FRANCE

- 8.3.3.1 Government initiatives and advanced technology in automotive industry to drive market

- 8.3.4 RUSSIA

- 8.3.4.1 Government investments in automotive and medical devices industries to stabilize prices and boost demand

- 8.3.5 SPAIN

- 8.3.5.1 Investments and government approach toward sustainability to drive market

- 8.3.6 ITALY

- 8.3.6.1 High disposable income and rising FII investments

- 8.3.7 TURKIYE

- 8.3.7.1 New manufacturing facilities to boost demand for hydrophilic coatings

- 8.3.8 REST OF EUROPE

- 8.4 ASIA PACIFIC

- FIGURE 38 ASIA PACIFIC: HYDROPHILIC COATING MARKET SNAPSHOT

- TABLE 94 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 95 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 96 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 97 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 98 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2018-2021 (USD MILLION)

- TABLE 99 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022-2027 (USD MILLION)

- TABLE 100 ASIA PACIFIC: HYDROPHILIC COATINGS MARKET, BY SUBSTRATE, 2018-2021 (KILOTON)

- TABLE 101 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022-2027 (KILOTON)

- TABLE 102 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 103 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 104 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY END USER, 2018-2021 (KILOTON)

- TABLE 105 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY END USER, 2022-2027 (KILOTON)

- 8.4.1 CHINA

- 8.4.1.1 Large investments by global manufacturers to boost demand for hydrophilic coatings

- 8.4.2 JAPAN

- 8.4.2.1 High economic growth and government support toward medtech industry to boost demand for hydrophilic coatings

- 8.4.3 SOUTH KOREA

- 8.4.3.1 Technology-driven economy to drive market

- 8.4.4 INDIA

- 8.4.4.1 Resources availability, rapid economic growth, increasing disposable income, and urbanization to drive market

- 8.4.5 REST OF ASIA PACIFIC

- 8.5 SOUTH AMERICA

- FIGURE 39 BRAZIL TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- TABLE 106 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 107 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 108 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 109 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 110 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2018-2021 (USD MILLION)

- TABLE 111 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022-2027 (USD MILLION)

- TABLE 112 SOUTH AMERICA: HYDROPHILIC COATINGS MARKET, BY SUBSTRATE, 2018-2021 (KILOTON)

- TABLE 113 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022-2027 (KILOTON)

- TABLE 114 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 115 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 116 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2018-2021 (KILOTON)

- TABLE 117 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2022-2027 (KILOTON)

- 8.5.1 BRAZIL

- 8.5.1.1 Expansion of production capacity and established distribution channels to propel market

- 8.5.2 ARGENTINA

- 8.5.2.1 Government initiatives to boost demand for hydrophilic coating

- 8.5.3 REST OF SOUTH AMERICA

- 8.6 MIDDLE EAST & AFRICA

- FIGURE 40 SOUTH AFRICA IS FASTEST-GROWING COUNTRY IN REGION

- TABLE 118 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 121 MIDDLE EAST & AFRICA: HYDROPHILIC COATINGS MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 122 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2018-2021 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022-2027 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: HYDROPHILIC COATINGS MARKET, BY SUBSTRATE, 2018-2021 (KILOTON)

- TABLE 125 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022-2027 (KILOTON)

- TABLE 126 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY END USER, 2018-2021 (KILOTON)

- TABLE 129 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY END USER, 2022-2027 (KILOTON)

- 8.6.1 UAE

- 8.6.1.1 Investments in new business ventures and rising medical devices industry to boost market

- 8.6.2 SAUDI ARABIA

- 8.6.2.1 Government investments for production expansion to create immense demand

- 8.6.3 SOUTH AFRICA

- 8.6.3.1 Growth of various manufacturing industries to boost market

- 8.6.4 REST OF MIDDLE EAST & AFRICA

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- TABLE 130 OVERVIEW OF STRATEGIES ADOPTED BY KEY HYDROPHILIC COATING PLAYERS (2018-2022)

- 9.2 COMPETITIVE LEADERSHIP MAPPING, 2021

- 9.2.1 STARS

- 9.2.2 EMERGING LEADERS

- 9.2.3 PARTICIPANTS

- 9.2.4 PERVASIVE PLAYERS

- FIGURE 41 HYDROPHILIC COATING MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 9.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) MATRIX, 2021

- 9.3.1 RESPONSIVE COMPANIES

- 9.3.2 PROGRESSIVE COMPANIES

- 9.3.3 STARTING BLOCKS

- 9.3.4 DYNAMIC COMPANIES

- FIGURE 42 HYDROPHILIC COATING MARKET: EMERGING COMPANIES' COMPETITIVE LEADERSHIP MAPPING, 2021

- 9.4 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 43 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN HYDROPHILIC COATING MARKET

- 9.5 BUSINESS STRATEGY EXCELLENCE

- FIGURE 44 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN HYDROPHILIC COATING MARKET

- 9.6 COMPETITIVE BENCHMARKING

- TABLE 131 HYDROPHILIC COATING MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 132 HYDROPHILIC COATING MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

- TABLE 133 COMPANY EVALUATION MATRIX: HYDROPHILIC COATING

- 9.7 MARKET SHARE ANALYSIS

- FIGURE 45 MARKET SHARE, BY KEY PLAYERS (2021)

- TABLE 134 HYDROPHILIC COATING MARKET: DEGREE OF COMPETITION, 2021

- 9.8 MARKET RANKING ANALYSIS

- FIGURE 46 MARKET RANKING ANALYSIS, 2021

- 9.9 REVENUE ANALYSIS

- FIGURE 47 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017-2021

- 9.10 COMPETITIVE SCENARIO

- 9.10.1 MARKET EVALUATION FRAMEWORK

- TABLE 135 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 136 HIGHEST ADOPTED STRATEGIES

- TABLE 137 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- 9.10.2 MARKET EVALUATION MATRIX

- TABLE 138 COMPANY INDUSTRY FOOTPRINT

- TABLE 139 COMPANY REGION FOOTPRINT

- TABLE 140 COMPANY FOOTPRINT

- 9.11 STRATEGIC DEVELOPMENTS

- TABLE 141 HYDROPHILIC COATING MARKET: PRODUCT LAUNCHES, 2018-2022

- TABLE 142 HYDROPHILIC COATING MARKET: DEALS, 2018-2022

- TABLE 143 HYDROPHILIC COATING MARKET: OTHERS, 2018-2022

10 COMPANY PROFILES

- 10.1 KET PLAYERS

- (Business Overview, Products offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats)**

- 10.1.1 HYDROMER, INC.

- TABLE 144 HYDROMER, INC.: BUSINESS OVERVIEW

- FIGURE 48 HYDROMER, INC.: COMPANY SNAPSHOT

- TABLE 145 HYDROMER, INC: DEALS

- 10.1.2 HARLAND MEDICAL SYSTEMS, INC.

- TABLE 146 HARLAND MEDICAL SYSTEMS, INC.: BUSINESS OVERVIEW

- TABLE 147 HARLAND MEDICAL SYSTEMS, INC.: DEALS

- 10.1.3 SURMODICS, INC.

- TABLE 148 SURMODICS, INC: BUSINESS OVERVIEW

- FIGURE 49 SURMODICS, INC.: COMPANY SNAPSHOT

- 10.1.4 KONINKLIJKE DSM NV

- TABLE 149 KONINKLIJKE DSM NV: BUSINESS OVERVIEW

- FIGURE 50 KONINKLIJKE DSM NV.: COMPANY SNAPSHOT

- 10.1.5 BIOCOAT, INC.

- TABLE 150 BIOCOAT, INC.: BUSINESS OVERVIEW

- TABLE 151 BIOCOAT, INC.: PRODUCT LAUNCH

- 10.1.6 ACULON, INC.

- TABLE 152 ACULON, INC.: BUSINESS OVERVIEW

- TABLE 153 ACULON, INC.: DEALS

- 10.1.7 AST PRODUCTS, INC.

- TABLE 154 AST PRODUCTS, INC.: BUSINESS OVERVIEW

- 10.1.8 ADVANSOURCE BIOMATERIALS CORPORATION

- TABLE 155 ADVANSOURCE BIOMATERIALS CORPORATION: BUSINESS OVERVIEW

- FIGURE 51 ADVANSOURCE BIOMATERIALS CORPORATION (MITSUBISHI CHEMICAL GROUP CORPORATION): COMPANY SNAPSHOT

- 10.1.9 SURFACE SOLUTIONS GROUP, LLC

- TABLE 156 SURFACE SOLUTIONS GROUP, LLC: BUSINESS OVERVIEW

- 10.1.10 TELEFLEX, INC

- TABLE 157 TELEFLEX, INC: BUSINESS OVERVIEW

- FIGURE 52 TELEFLEX, INC: COMPANY SNAPSHOT

- 10.2 OTHER KEY COMPANIES

- 10.2.1 BIOINTERACTIONS LTD

- TABLE 158 BIOINTERACTIONS LTD: BUSINESS OVERVIEW

- 10.2.2 PANGOLIN MEDICAL

- TABLE 159 PANGOLIN MEDICAL: BUSINESS OVERVIEW

- 10.2.3 DONTECH INC

- TABLE 160 DONTECH INC: BUSINESS OVERVIEW

- 10.2.4 FORMACOAT LLC

- TABLE 161 FORMACOAT LLC: BUSINESS OVERVIEW

- 10.2.5 JONINN

- TABLE 162 JONINN: BUSINESS OVERVIEW

- 10.2.6 DUKE EMPIRICAL INC

- TABLE 163 DUKE EMPIRICAL INC: BUSINESS OVERVIEW

- 10.2.7 CUUMED CATHETER MEDICAL CO., LTD

- TABLE 164 CUUMED CATHETER MEDICAL CO., LTD: BUSINESS OVERVIEW

- 10.2.8 NOANIX CORPORATION

- TABLE 165 NOANIX CORPORATION: BUSINESS OVERVIEW

- 10.2.9 LOTUS LEAF COATINGS, INC

- TABLE 166 LOTUS LEAF COATINGS, INC: BUSINESS OVERVIEW

- 10.2.10 APPLIED MEDICAL COATINGS, LLC

- TABLE 167 APPLIED MEDICAL COATINGS, LLC: BUSINESS OVERVIEW

- 10.2.11 HEMOTEQ AG

- TABLE 168 HEMOTEQ AG: BUSINESS OVERVIEW

- 10.2.12 FSI COATING TECHNOLOGIES, INC (MITSUI CHEMICALS)

- TABLE 169 FSI COATING TECHNOLOGIES, INC: BUSINESS OVERVIEW

- 10.2.13 SHANGHAI HUZHENG NANOTECHNOLOGY CO., LTD

- TABLE 170 SHANGHAI HUZHENG NANOTECHNOLOGY CO., LTD: BUSINESS OVERVIEW

- 10.2.14 INNOVATIVE SURFACE TECHNOLOGIES INC.

- TABLE 171 INNOVATIVE SURFACE TECHNOLOGIES INC.: BUSINESS OVERVIEW

- 10.2.15 MEDICHEM NANO TEKNOLOJI SAN. VE TIC. A.S.

- TABLE 172 MEDICHEM NANO TEKNOLOJI SAN. VE TIC. A.S.: BUSINESS OVERVIEW

- *Details on Business Overview, Products offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 ADJACENT AND RELATED MARKETS

- 11.1 INTRODUCTION

- 11.2 PAINTS & COATINGS MARKET LIMITATIONS

- 11.3 PAINTS & COATINGS MARKET DEFINITION

- 11.4 PAINTS & COATINGS MARKET OVERVIEW

- 11.5 PAINTS & COATINGS MARKET ANALYSIS, BY TECHNOLOGY

- TABLE 173 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017-2020 (USD MILLION)

- TABLE 174 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021-2026 (USD MILLION)

- TABLE 175 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017-2020 (KILOTON)

- TABLE 176 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021-2026 (KILOTON)

- TABLE 177 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017-2020 (USD MILLION)

- TABLE 178 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021-2026 (USD MILLION)

- TABLE 179 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017-2020 (KILOTON)

- TABLE 180 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021-2026 (KILOTON)

- 11.6 PAINTS & COATINGS MARKET ANALYSIS, BY RESIN TYPE

- TABLE 181 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017-2020 (USD MILLION)

- TABLE 182 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021-2026 (USD MILLION)

- TABLE 183 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017-2020 (KILOTON)

- TABLE 184 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021-2026 (KILOTON)

- TABLE 185 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017-2020 (USD MILLION)

- TABLE 186 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021-2026 (USD MILLION)

- TABLE 187 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017-2020 (KILOTON)

- TABLE 188 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021-2026 (KILOTON)

- 11.7 PAINTS & COATINGS MARKET ANALYSIS, BY END-USE INDUSTRY

- TABLE 189 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 190 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2021-2026 (USD MILLION)

- TABLE 191 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 192 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2021-2026 (KILOTON)

- 11.8 PAINTS & COATINGS MARKET ANALYSIS, BY REGION

- TABLE 193 PAINTS & COATINGS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 194 PAINTS & COATINGS MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 195 PAINTS & COATINGS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 196 PAINTS & COATINGS MARKET, BY REGION, 2021-2026 (KILOTON)

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS