|

|

市場調査レポート

商品コード

1208345

鉄筋の世界市場:種類別 (異形鉄筋、軟質鉄筋)・塗装の種類別 (普通炭素鋼鉄筋、亜鉛メッキ鉄筋、エポキシ塗装鉄筋)・製造工程別・鉄筋のサイズ別・エンドユース別 (インフラ、住宅、産業)・地域別の将来予測 (2030年まで)Steel Rebar Market by Type (Deformed and Mild), Coating Type (Plain Carbon Steel Rebar, Galvanized Steel Rebar, Epoxy-Coated Steel Rebar), Process Type, Bar Size, End-use (Infrastructure, Housing, and Industrial) and Region - Global Forecast to 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 鉄筋の世界市場:種類別 (異形鉄筋、軟質鉄筋)・塗装の種類別 (普通炭素鋼鉄筋、亜鉛メッキ鉄筋、エポキシ塗装鉄筋)・製造工程別・鉄筋のサイズ別・エンドユース別 (インフラ、住宅、産業)・地域別の将来予測 (2030年まで) |

|

出版日: 2023年01月25日

発行: MarketsandMarkets

ページ情報: 英文 256 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の鉄筋の市場規模は、2022年に2,245億米ドル、2030年には3,174億米ドルに達すると予測されています。

また、CAGRは4.4%に達する見通しです。

種類別では、異形鉄筋が予測期間中に最も高いCAGRで成長する見通しです。異形鉄筋はセメントとの間に協力は引張力を発生させ、その結果、構造物全体の延命に役立ちます。都市化の進展や消費者のライフスタイルの変化など、構造物に対する需要が高まっていることから、今後、異形鉄筋の需要は増加すると考えられます。

製造工程別では、電気炉が予測期間中に最も高いCAGRになると考えられています。この方法は、他の製鋼方法よりも設備投資が少なくて済むため、予測期間中の鉄筋市場の牽引役となっています。

塗装の種類別では、普通炭素鋼鉄筋が予測期間中に最も高いCAGRで成長すると見込まれています。この製品は引張強度が高く、硬度や強度などの機械的性質に優れ、さらに安価なことから、今後の鉄筋市場の成長をサポートします。

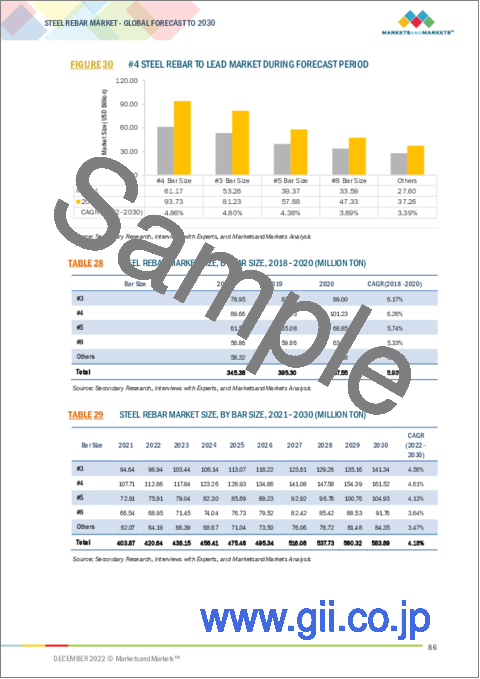

鉄筋のサイズ別では、4号サイズの鉄筋が予測期間中にCAGRが最も高くなる見通しです。この種の鉄筋は構造物に高い強度を提供します。そのため、予測期間において鉄筋市場の成長に貢献すると考えられています。

エンドユース部門別では、インフラ部門が予測期間中に最も高いCAGRで成長すると予測されています。各国政府のインフラ強化の取り組みにより、鉄骨需要が今後大きく成長すると見込まれています。

地域別では、アジア太平洋地域が予測期間中、最も高いCAGRを占めると予測されています。インド・中国・日本などの国々は、開発活動の活発化と急速な経済拡大により、鉄筋市場の上昇を示すことが期待されます。また、これらの国々では都市化が進んでいるため、住宅や非住宅の構造物、その他の建設活動に対する需要が高まっています。これが、予測期間中の鉄筋市場の成長につながっています。

当レポートでは、世界の鉄筋の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・製造工程別・塗装の種類別・鉄筋のサイズ別・エンドユース部門別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- YC&YCCシフト

- エコシステム

- 規制状況

- 技術分析

- 特許分析

- ケーススタディ分析

- 貿易分析

- 主な会議とイベント (2023年~2024年)

- 主な利害関係者と購入基準

- サプライチェーン分析

- 価格分析

第6章 鉄筋市場:種類別

- イントロダクション

- 異形

- 軟鋼

第7章 鉄筋市場:製造工程別

- イントロダクション

- 転炉 (BOS)

- 電気アーク炉

第8章 鉄筋市場:塗装の種類別

- イントロダクション

- 普通炭素鋼鉄筋

- 亜鉛メッキ鉄筋

- エポキシ塗装鉄筋

第9章 鉄筋市場:鉄筋のサイズ別

- イントロダクション

- 3号サイズ

- 4号サイズ

- 5号サイズ

- 8号サイズ

- その他

第10章 鉄筋市場:エンドユース部門別

- イントロダクション

- インフラ

- 住宅用

- 工業用

第11章 鉄筋市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- ウクライナ

- トルコ

- 他の欧州諸国

- 中東・アフリカ (MEA)

- アラブ首長国連邦

- サウジアラビア

- カタール

- イラン

- エジプト

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

第12章 競合情勢

- 概要

- 市場シェア分析

- 企業評価クアドラント

- 中小企業マトリックス (2021年)

- 競合シナリオ

- 資本取引

- 製品発売

第13章 企業プロファイル

- 主要企業

- NIPPON STEEL CORPORATION

- ARCELORMITTAL

- GERDAU SA

- NUCOR CORPORATION

- COMMERCIAL METALS COMPANY

- TATA STEEL LIMITED

- STEEL AUTHORITY OF INDIA LIMITED

- MECHEL PAO

- STEEL DYNAMICS, INC.

- NLMK GROUP

- その他の企業

- METINVEST HOLDING LLC

- PAO SEVERSTAL

- WUHAN IRON AND STEEL CORPORATION

- SOHAR STEEL GROUP

- BYER STEEL CORPORATION

- CELSA STEEL UK LIMITED

- DAIDO STEEL CO., LTD

- ACERINOX S.A.

- HYUNDAI STEEL CO., LTD.

- JIANGSU SHAGANG GROUP COMPANY LIMITED

- HBIS GROUP

- EVRAZ PLC

- SWISS STEEL GROUP

- SUNFLAG IRON & STEEL CO. LTD

- OUTOKUMPU OYJ

第14章 カスタマイズ:インドの鉄筋市場

- イントロダクション

- 市場概要:インド

- 市場力学

- 価格分析

- 企業プロファイル:インドの鉄筋市場

- TATA STEEL LIMITED

- STEEL AUTHORITY OF INDIA LIMITED

- JSW STEEL LIMITED

- RASHTRIYA ISPAT NIGAM LIMITED

- JINDAL STEEL &POWER LIMITED

- KAMDHENU LIMITED

第15章 付録

The market for steel rebar is approximated to be USD 224.5 billion in 2022, and it is projected to reach USD 317.4 billion by 2030 at a CAGR of 4.4%. Out of the two steel rebar types (deformed and mild), deformed has the largest market share because they have ribs, lugs, or indentation on its surface, which provides the grip to the concrete in a better way which contributes to enhancing the overall life of the structure.

By Type, Deformed accounted for the highest CAGR during the forecast period

Deformed steel rebar comes with surface protruding ribs and straight strips, which helps to increase the strength between concrete and steel bars and it helps to create a strong pull between steel bars and cement. Hence, as a result of this, these types effectively contribute to increasing the overall life of the structure. Because of the low carbon content in the deformed steel rebar, it helps to improve the ductility and other mechanical & welding properties, which is useful for various construction activities such as highways, buildings, industries, plants, etc. Due to rising urbanization, rapid changes in consumer lifestyles, and other factors that enhance the demand for the structures; as a result, of this, the demand for deformed steel rebar will rise in the forecast period.

By Process, Electric Arc Furnace accounted for the highest CAGR during the forecast period

Electric arc furnace (a steel-making process) has become very popular. In this process, scrap steel is used, and with the help of high-power electric arcs, this scrap steel is melted down in the liquid form. This type of process uses a three-phase alternating current (AC) to melt the steel cost-effectively. This method requires less capital investment than other steel-making methods, which helps drive the steel rebar market in the forecast period.

By Coating Type, Plain Carbon Steel Rebar accounted for the highest CAGR during the forecast period

This type of steel rebar is widely used in several construction projects with the help of various sizes. This type of rebar is produced from carbon steel, sometimes known as a black bar. It is used in many applications where high ultimate tensile strength is required. However, due to the low carbon content in the bar, its ductility is low. Apart from this, this steel rebar has excellent mechanical properties, such as hardness, strength, etc., and is inexpensive in nature. Thus, this helps in leading the growth of the rebar in the forecast period.

By Bar Size Type, #4 Steel Rebar accounted for the highest CAGR during the forecast period

This type of steel rebar has a high thickness than that of #3 steel rebar. This type of bar size is ideal for highways and columns, swimming pool frames, and other residential & light construction activities. This type of bar size provides high strength to the structure. As a result of this, the #4 bar size helped to grow the market of steel rebar in the forecast period.

By End Use Sector, the Infrastructure segment accounted for the highest CAGR during the forecast period

Infrastructure segments include several construction projects such as roads, highways, bridge construction, sewage systems, airports, and stadiums, among others, as steel rebar can increase the tensile strength of the surrounding concrete and makes the structure well strong. Hence, steel rebar is used in making roads, bridges, manufacturing plants, power plants, and many more. Due to government initiatives of several countries in strengthen the infrastructure, the demand for steel rebar is projected to grow in the forecast period.

Asia Pacific is projected to account for the highest CAGR in the steel rebar market during the forecast period

The fastest-growing steel rebar market is expected to occur in the Asia Pacific region. Countries such as India, China, and Japan are expected to witness a rise in the steel rebar market due to growing developmental activities and rapid economic expansion. In addition, rising urbanization in these countries results in growing demands for residential & non-residential structures and other construction activities. This has lead to the growth of the steel rebar market in the forecast period. Countries covered in this region are India, China, Japan, and the Rest of Asia Pacific.

Further in-depth interviews were conducted with the Chief Experience Officer (CXO), Managers, Marketing Officers, Production Officers, and other related key executives from various key companies and organizations operating in the steel rebar market.

By Department: Sales/Export/Marketing: 46.7%, Production: 30%, and CXOs: 23.3%

By Designation: Managers: 55.7%, CXOs: 23.3%, and Executives: 21%

By Region: North America: 30%, Europe: 23%, Asia Pacific: 27%, Middle East & Africa: 15%, and South America: 5%.

Companies Covered: Nippon Steel Corporation. (Japan), ArcelorMittal (Luxembourg), Tata Steel Limited (India), Nucor Corporation (US), and NLMK Group (Russia), Steel Authority of India Limited (India), Gerdau SA (Brazil), Steel Dynamics, Inc.(US), Mechel PAO (Russia), Commercial Metals Company (US).

Research Coverage

The market study covers the Steel rebar market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on application, type, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the steel rebar market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall steel rebar market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- TABLE 1 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 RESEARCH LIMITATIONS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 STEEL REBAR MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- FIGURE 3 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY SIDE

- 2.3 DATA TRIANGULATION

- FIGURE 7 STEEL REBAR MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS

- 2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY

- FIGURE 8 BASIC OXYGEN STEELMAKING PROCESS TO LEAD STEEL REBAR MARKET IN 2021

- FIGURE 9 ASIA PACIFIC: LARGEST STEEL REBAR MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN STEEL REBAR MARKET

- FIGURE 10 STEEL REBAR MARKET TO GROW AT MODEST RATE DURING FORECAST PERIOD

- 4.2 STEEL REBAR MARKET, BY END-USE SECTOR

- FIGURE 11 INFRASTRUCTURE SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- 4.3 STEEL REBAR MARKET, BY PROCESS AND REGION

- FIGURE 12 BASIC OXYGEN STEELMAKING PROCESS AND ASIA PACIFIC REGION LED STEEL REBAR MARKET IN 2021

- 4.4 STEEL REBAR MARKET, BY REGION

- FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF STEEL REBAR MARKET IN 2021

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN STEEL REBAR MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid infrastructure development and urbanization

- TABLE 2 URBANIZATION, BY REGION, 2021-2050 (IN MILLION)

- 5.2.1.2 Growth prospects in oil & gas industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Construction industry's vulnerability to crisis

- 5.2.2.2 Shortage of skilled individuals and lack of knowledge

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 New opportunities as a result of technological advancements

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental challenges

- 5.2.4.2 Problem of excess capacity

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 STEEL REBAR MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 YC & YCC SHIFT

- 5.4.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR STEEL REBAR MANUFACTURERS

- FIGURE 16 REVENUE SHIFT FOR STEEL REBAR MANUFACTURERS

- 5.5 ECOSYSTEM

- FIGURE 17 ECOSYSTEM FOR STEEL REBAR MARKET

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 BRITISH STANDARD (BS 4449):

- 5.6.2 CONSTRUCTION PRODUCTS REGULATION (CPR 305/2011):

- 5.6.3 CARES:

- 5.6.4 GREENPRO:

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 MICROALLOYING AND THERMO MECHANICAL TREATMENT (TMT)

- 5.7.2 POTATO-BASED BIODEGRADABLE FOAM TO CONTROL DUST EMISSIONS

- 5.7.3 LOW-CARBON STEEL

- 5.8 PATENT ANALYSIS

- 5.8.1 INTRODUCTION

- 5.8.2 METHODOLOGY

- FIGURE 18 GRANTED PATENTS ARE 28% OF TOTAL COUNT

- FIGURE 19 PUBLICATION TRENDS - LAST FIVE YEARS

- 5.8.3 INSIGHTS

- FIGURE 20 JURISDICTION ANALYSIS

- FIGURE 21 TOP 10 COMPANIES/APPLICANTS WITH HIGH NUMBER OF PATENTS

- TABLE 4 PATENTS BY SWIMC LLC

- TABLE 5 PATENTS BY UNIV KING SAUD

- TABLE 6 PATENTS BY UNIV ZHEJIANG

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 HYDROGEN-BASED STEELMAKING: ARCELORMITTAL CASE

- 5.9.2 LIFECYCLE ASSESSMENT OF STEEL REBAR PRODUCTION WITH INDUCTION MELTING FURNACE

- 5.9.3 SELF-HEALING STEEL

- 5.9.4 LCA AND LCC OF WORLD'S LONGEST PIER: CASE STUDY ON NICKEL-CONTAINING STAINLESS-STEEL REBAR

- 5.10 TRADE ANALYSIS

- TABLE 7 STEEL REBAR IMPORT DATA, 2021 (USD BILLION)

- TABLE 8 STEEL REBAR EXPORT DATA, 2021 (USD BILLION)

- TABLE 9 INDIA: STEEL REBAR IMPORT DATA, 2021 (USD MILLION)

- TABLE 10 INDIA: STEEL REBAR EXPORT DATA, 2021 (USD MILLION)

- 5.11 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 11 STEEL REBAR MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES (%)

- 5.12.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR HOUSING AND INDUSTRIAL END-USE INDUSTRIES

- TABLE 13 KEY BUYING CRITERIA FOR STEEL REBAR IN END-USE INDUSTRIES

- 5.13 SUPPLY CHAIN ANALYSIS

- FIGURE 24 SUPPLY CHAIN OF STEEL REBAR MARKET

- 5.14 PRICING ANALYSIS

- 5.14.1 STEEL REBAR PRICE TREND FOR THIRD QUARTER OF 2022

- 5.14.1.1 Asia Pacific

- 5.14.1.2 Europe

- 5.14.1.3 North America

- 5.14.2 STEEL REBAR PRICE TREND FOR SECOND QUARTER OF 2022

- 5.14.2.1 Asia Pacific

- 5.14.2.2 Europe

- 5.14.2.3 North America

- 5.14.3 STEEL REBAR PRICE TREND FOR FIRST QUARTER OF 2022

- 5.14.3.1 Asia Pacific

- 5.14.3.2 Europe

- 5.14.3.3 North America

- FIGURE 25 STEEL REBAR PRICE TREND IN US, 2017-2022

- FIGURE 26 STEEL REBAR PRICE TREND IN UK, 2017-2022

- 5.14.1 STEEL REBAR PRICE TREND FOR THIRD QUARTER OF 2022

6 STEEL REBAR MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 27 DEFORMED STEEL REBAR SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 14 STEEL REBAR MARKET SIZE, BY TYPE, 2018-2020 (MILLION TON)

- TABLE 15 STEEL REBAR MARKET SIZE, BY TYPE, 2021-2030 (MILLION TON)

- TABLE 16 STEEL REBAR MARKET SIZE, BY TYPE, 2018-2020 (USD BILLION)

- TABLE 17 STEEL REBAR MARKET SIZE, BY TYPE, 2021-2030 (USD BILLION)

- 6.2 DEFORMED

- 6.2.1 DEFORMED STEEL REBAR PREFERRED DUE TO ABILITY TO BOND WELL WITH CONCRETE

- 6.3 MILD

- 6.3.1 LIMITED APPLICATIONS OF MILD STEEL REBAR TO INHIBIT FUTURE GROWTH

7 STEEL REBAR MARKET, BY PROCESS

- 7.1 INTRODUCTION

- TABLE 18 TYPICAL ANALYSIS (WT%) OF BOS AND EAF STEEL REBAR

- FIGURE 28 ELECTRIC ARC FURNACE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 19 STEEL REBAR MARKET SIZE, BY PROCESS, 2018-2020 (MILLION TON)

- TABLE 20 STEEL REBAR MARKET SIZE, BY PROCESS, 2021-2030 (MILLION TON)

- TABLE 21 STEEL REBAR MARKET SIZE, BY PROCESS, 2018-2020 (USD BILLION)

- TABLE 22 STEEL REBAR MARKET SIZE, BY PROCESS, 2021-2030 (USD BILLION)

- 7.2 BASIC OXYGEN STEELMAKING

- 7.2.1 HIGH EFFICIENCY FOR MASS PRODUCTION AND SUPERIOR QUALITY MAKE BOS PREFERRED PROCESS FOR STEEL REBAR MANUFACTURING

- 7.3 ELECTRIC ARC FURNACE

- 7.3.1 GOVERNMENT MANDATES TO IMPROVE RECYCLABILITY OF STEEL SCRAP, LOW CAPITAL INVESTMENT, ENERGY EFFICIENCY, AND ENVIRONMENTAL FRIENDLINESS TO DRIVE DEMAND FOR EAF STEEL REBAR

8 STEEL REBAR MARKET, BY COATING TYPE

- 8.1 INTRODUCTION

- FIGURE 29 PLAIN CARBON STEEL REBAR TO LEAD MARKET GROWTH DURING FORECAST PERIOD

- TABLE 23 STEEL REBAR MARKET SIZE, BY COATING TYPE, 2018-2020 (MILLION TON)

- TABLE 24 STEEL REBAR MARKET SIZE, BY COATING TYPE, 2021-2030 (MILLION TON)

- TABLE 25 STEEL REBAR MARKET SIZE, BY COATING TYPE, 2018-2020 (USD BILLION)

- TABLE 26 STEEL REBAR MARKET SIZE, BY COATING TYPE, 2021-2030 (USD BILLION)

- 8.2 PLAIN CARBON STEEL REBAR

- 8.2.1 PREFERABLE DUE TO THEIR LOW COST AND DURABILITY

- 8.3 GALVANIZED STEEL REBAR

- 8.3.1 PREFERABLE DUE TO THEIR HIGH CORROSION RESISTANCE

- 8.4 EPOXY-COATED STEEL REBAR

- 8.4.1 PREFERABLE DUE TO HIGH CORROSION RESISTANCE AND UNIVERSAL APPLICATIONS

9 STEEL REBAR MARKET, BY BAR SIZE

- 9.1 INTRODUCTION

- TABLE 27 US REBAR SIZE CHART

- FIGURE 30 #4 STEEL REBAR TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 28 STEEL REBAR MARKET SIZE, BY BAR SIZE, 2018-2020 (MILLION TON)

- TABLE 29 STEEL REBAR MARKET SIZE, BY BAR SIZE, 2021-2030 (MILLION TON)

- TABLE 30 STEEL REBAR MARKET SIZE, BY BAR SIZE, 2018-2020 (USD BILLION)

- TABLE 31 STEEL REBAR MARKET SIZE, BY BAR SIZE, 2021-2030 (USD BILLION)

- 9.2 #3 BAR SIZE

- 9.2.1 WIDELY USED IN SWIMMING POOL FRAMES AND ROAD & HIGHWAY PAVING

- 9.3 #4 BAR SIZE

- 9.3.1 PREFERABLE FOR ADDING STRENGTH TO HIGHWAYS AS WELL AS COLUMNS AND SLABS

- 9.4 #5 BAR SIZE

- 9.4.1 PREFERABLE FOR PRE-CAST MASONRY OF HIGHWAY & BRIDGE CONSTRUCTION

- 9.5 #8 BAR SIZE

- 9.5.1 PREFERABLE FOR MEDIUM-TO-HEAVY COMMERCIAL APPLICATIONS

- 9.6 OTHERS

10 STEEL REBAR MARKET, BY END-USE SECTOR

- 10.1 INTRODUCTION

- FIGURE 31 INFRASTRUCTURE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 32 STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 33 STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- TABLE 34 STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 35 STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- 10.2 INFRASTRUCTURE

- 10.2.1 INCREASING INVESTMENT IN MAJOR INFRASTRUCTURE PROJECTS GLOBALLY TO DRIVE DEMAND

- 10.3 HOUSING

- 10.3.1 GROWING POPULATION AND RAPID URBANIZATION TO CREATE NEED FOR NEW RESIDENTIAL HOUSING

- 10.4 INDUSTRIAL

- 10.4.1 USE OF VALUE-ADDED PRODUCTS IN OIL & GAS AND MANUFACTURING SECTORS TO DRIVE DEMAND

11 STEEL REBAR MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 32 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR STEEL REBAR DURING FORECAST PERIOD

- TABLE 36 STEEL REBAR MARKET SIZE, BY REGION, 2018-2020 (MILLION TON)

- TABLE 37 STEEL REBAR MARKET SIZE, BY REGION, 2021-2030 (MILLION TON)

- TABLE 38 HISTORIC STEEL REBAR MARKET SIZE, BY REGION, 2018-2020 (USD BILLION)

- TABLE 39 STEEL REBAR MARKET SIZE, BY REGION, 2021-2030 (USD BILLION)

- 11.2 NORTH AMERICA

- FIGURE 33 NORTH AMERICA: STEEL REBAR MARKET SNAPSHOT

- 11.2.1 NORTH AMERICA STEEL REBAR MARKET, BY COUNTRY

- TABLE 40 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY COUNTRY, 2018-2020 (USD BILLION)

- TABLE 41 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY COUNTRY, 2021-2030 (USD BILLION)

- TABLE 42 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY COUNTRY, 2018-2020 (MILLION TON)

- TABLE 43 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY COUNTRY, 2021-2030 (MILLION TON)

- TABLE 44 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY PROCESS, 2018-2020 (USD BILLION)

- TABLE 45 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY PROCESS, 2021-2030 (USD BILLION)

- TABLE 46 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY PROCESS, 2018-2020 (MILLION TON)

- TABLE 47 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY PROCESS, 2021-2030 (MILLION TON)

- TABLE 48 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY TYPE, 2018-2020 (USD BILLION)

- TABLE 49 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY TYPE, 2021-2030 (USD BILLION)

- TABLE 50 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY TYPE, 2018-2020 (MILLION TON)

- TABLE 51 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY TYPE, 2021-2030 (MILLION TON)

- TABLE 52 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 53 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 54 NORTH AMERICA: HISTORIC STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 55 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.2.2 US

- 11.2.2.1 Inadequate infrastructure facilities to draw more investments, thus increasing demand

- TABLE 56 US: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 57 US: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 58 US: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 59 US: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.2.3 CANADA

- 11.2.3.1 Rise in residential and non-residential construction activities to trigger market

- TABLE 60 CANADA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 61 CANADA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 62 CANADA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 63 CANADA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TONS)

- 11.2.4 MEXICO

- 11.2.4.1 Increase in infrastructure investment to drive growth

- TABLE 64 MEXICO: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 65 MEXICO: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 66 MEXICO: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 67 MEXICO: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.3 ASIA PACIFIC

- FIGURE 34 ASIA PACIFIC: STEEL REBAR MARKET SNAPSHOT

- TABLE 68 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY COUNTRY, 2018-2020 (USD BILLION)

- TABLE 69 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY COUNTRY, 2021-2030 (USD BILLION)

- TABLE 70 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY COUNTRY, 2018-2020 (MILLION TON)

- TABLE 71 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY COUNTRY, 2021-2030 (MILLION TON)

- TABLE 72 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY PROCESS, 2018-2020 (USD BILLION)

- TABLE 73 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY PROCESS, 2021-2030 (USD BILLION)

- TABLE 74 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY PROCESS, 2018-2020 (MILLION TON)

- TABLE 75 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY PROCESS, 2021-2030 (MILLION TON)

- TABLE 76 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY TYPE, 2018-2020 (USD BILLION)

- TABLE 77 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY TYPE, 2021-2030 (USD BILLION)

- TABLE 78 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY TYPE, 2018-2020 (MILLION TON)

- TABLE 79 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY TYPE, 2021-2030 (MILLION TON)

- TABLE 80 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 81 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 82 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 83 ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.3.1 CHINA

- 11.3.1.1 Low carbon construction to accelerate demand

- TABLE 84 CHINA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 85 CHINA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 86 CHINA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 87 CHINA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.3.2 JAPAN

- 11.3.2.1 Increasing construction projects to accelerate market growth

- TABLE 88 JAPAN: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 89 JAPAN: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 90 JAPAN: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 91 JAPAN: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.3.3 INDIA

- 11.3.3.1 Government initiatives to boost demand

- TABLE 92 INDIA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 93 INDIA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 94 INDIA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 95 INDIA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.3.4 SOUTH KOREA

- 11.3.4.1 Growth in private infrastructure to increase demand

- TABLE 96 SOUTH KOREA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 97 SOUTH KOREA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 98 SOUTH KOREA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 99 SOUTH KOREA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.3.5 REST OF ASIA PACIFIC

- TABLE 100 REST OF ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 101 REST OF ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 102 REST OF ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 103 REST OF ASIA PACIFIC: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.4 EUROPE

- FIGURE 35 EUROPE: STEEL REBAR MARKET SNAPSHOT

- TABLE 104 EUROPE: STEEL REBAR MARKET SIZE, BY COUNTRY, 2018-2020 (USD BILLION)

- TABLE 105 EUROPE: STEEL REBAR MARKET SIZE, BY COUNTRY, 2021-2030 (USD BILLION)

- TABLE 106 EUROPE: STEEL REBAR MARKET SIZE, BY COUNTRY, 2018-2020 (MILLION TON)

- TABLE 107 EUROPE: STEEL REBAR MARKET SIZE, BY COUNTRY, 2021-2030 (MILLION TON)

- TABLE 108 EUROPE: STEEL REBAR MARKET SIZE, BY PROCESS, 2018-2020 (USD BILLION)

- TABLE 109 EUROPE: STEEL REBAR MARKET SIZE, BY PROCESS, 2021-2030 (USD BILLION)

- TABLE 110 EUROPE: STEEL REBAR MARKET SIZE, BY PROCESS, 2018-2020 (MILLION TON)

- TABLE 111 EUROPE: STEEL REBAR MARKET SIZE, BY PROCESS, 2021-2030 (MILLION TON)

- TABLE 112 EUROPE: STEEL REBAR MARKET SIZE, BY TYPE, 2018-2020 (USD BILLION)

- TABLE 113 EUROPE: STEEL REBAR MARKET SIZE, BY TYPE, 2021-2030 (USD BILLION)

- TABLE 114 EUROPE: STEEL REBAR MARKET SIZE, BY TYPE, 2018-2020 (MILLION TON)

- TABLE 115 EUROPE: STEEL REBAR MARKET SIZE, BY TYPE, 2021-2030 (MILLION TON)

- TABLE 116 EUROPE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 117 EUROPE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 118 EUROPE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 119 EUROPE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.4.1 GERMANY

- 11.4.1.1 Increasing infrastructure spending to drive growth

- TABLE 120 GERMANY: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 121 GERMANY: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 122 GERMANY: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 123 GERMANY: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.4.2 FRANCE

- 11.4.2.1 Stagnant market for steel rebar due to low demand

- TABLE 124 FRANCE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 125 FRANCE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 126 FRANCE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 127 FRANCE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.4.3 UK

- 11.4.3.1 Construction industry to witness sluggish growth, impacting steel rebar market

- TABLE 128 UK: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 129 UK: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 130 UK: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 131 UK: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.4.4 ITALY

- 11.4.4.1 Weak demand and pessimistic forecasts to dampen market growth

- TABLE 132 ITALY: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 133 ITALY: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 134 ITALY: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 135 ITALY: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.4.5 SPAIN

- 11.4.5.1 Government investment in infrastructure to drive growth

- TABLE 136 SPAIN: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 137 SPAIN: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 138 SPAIN: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 139 SPAIN: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.4.6 RUSSIA

- 11.4.6.1 Government investment in road construction plan and growth in infrastructure to drive market

- TABLE 140 RUSSIA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 141 RUSSIA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 142 RUSSIA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 143 RUSSIA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.4.7 UKRAINE

- 11.4.7.1 Ukraine to be world's second-largest exporter of steel rebar

- TABLE 144 UKRAINE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 145 UKRAINE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 146 UKRAINE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 147 UKRAINE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.4.8 TURKEY

- 11.4.8.1 Expanding production capacity and developing novel technology for steel rebar production to attract consumers

- TABLE 148 TURKEY: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 149 TURKEY: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.4.9 REST OF EUROPE

- TABLE 150 REST OF EUROPE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 151 REST OF EUROPE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 152 REST OF EUROPE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 153 REST OF EUROPE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.5 MIDDLE EAST & AFRICA (MEA)

- TABLE 154 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY COUNTRY, 2018-2020 (USD BILLION)

- TABLE 155 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY COUNTRY, 2021-2030 (USD BILLION)

- TABLE 156 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY COUNTRY, 2018-2020 (MILLION TON)

- TABLE 157 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY COUNTRY, 2021-2030 (MILLION TON)

- TABLE 158 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY PROCESS, 2018-2020 (USD BILLION)

- TABLE 159 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY PROCESS, 2021-2030 (USD BILLION)

- TABLE 160 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY PROCESS, 2018-2020 (MILLION TON)

- TABLE 161 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY PROCESS, 2021-2030 (MILLION TON)

- TABLE 162 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY TYPE, 2018-2020 (USD BILLION)

- TABLE 163 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY TYPE, 2021-2030 (USD BILLION)

- TABLE 164 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY TYPE, 2018-2020 (MILLION TON)

- TABLE 165 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY TYPE, 2021-2030 (MILLION TON)

- TABLE 166 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 167 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 168 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 169 MIDDLE EAST & AFRICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.5.1 UAE

- 11.5.1.1 Investments from government and recovery in construction industry to drive demand

- TABLE 170 UAE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 171 UAE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 172 UAE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 173 UAE: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.5.2 SAUDI ARABIA

- 11.5.2.1 New infrastructural projects to accelerate demand

- TABLE 174 SAUDI ARABIA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 175 SAUDI ARABIA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 176 SAUDI ARABIA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 177 SAUDI ARABIA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.5.3 QATAR

- 11.5.3.1 Government initiatives to boost market

- TABLE 178 QATAR: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 179 QATAR: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 180 QATAR: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 181 QATAR: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.5.4 IRAN

- 11.5.4.1 Developing construction, manufacturing, tourism, and healthcare sectors to increase demand

- TABLE 182 IRAN: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 183 IRAN: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 184 IRAN: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 185 IRAN: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.5.5 EGYPT

- 11.5.5.1 Huge investment in residential and infrastructure sectors to drive market

- TABLE 186 EGYPT: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 187 EGYPT: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 188 EGYPT: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 189 EGYPT: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.6 SOUTH AMERICA

- TABLE 190 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY COUNTRY, 2018-2020 (USD BILLION)

- TABLE 191 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY COUNTRY, 2021-2030 (USD BILLION)

- TABLE 192 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY COUNTRY, 2018-2020 (MILLION TON)

- TABLE 193 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY COUNTRY, 2021-2030 (MILLION TON)

- TABLE 194 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY PROCESS, 2018-2020 (USD BILLION)

- TABLE 195 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY PROCESS, 2021-2030 (USD BILLION)

- TABLE 196 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY PROCESS, 2018-2020 (MILLION TON)

- TABLE 197 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY PROCESS, 2021-2030 (MILLION TON)

- TABLE 198 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY TYPE, 2018-2020 (USD BILLION)

- TABLE 199 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY TYPE, 2021-2030 (USD BILLION)

- TABLE 200 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY TYPE, 2018-2020 (MILLION TON)

- TABLE 201 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY TYPE, 2021-2030 (MILLION TON)

- TABLE 202 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 203 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 204 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 205 SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.6.1 BRAZIL

- 11.6.1.1 Government focus on infrastructure spending to drive market

- TABLE 206 BRAZIL: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 207 BRAZIL: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 208 BRAZIL: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 209 BRAZIL: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.6.2 ARGENTINA

- 11.6.2.1 Investments in transport, energy, education, and healthcare projects to drive market

- TABLE 210 ARGENTINA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 211 ARGENTINA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 212 ARGENTINA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 213 ARGENTINA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

- 11.6.3 REST OF SOUTH AMERICA

- TABLE 214 REST OF SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (USD BILLION)

- TABLE 215 REST OF SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (USD BILLION)

- TABLE 216 REST OF SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2018-2020 (MILLION TON)

- TABLE 217 REST OF SOUTH AMERICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2021-2030 (MILLION TON)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- FIGURE 36 COMPANIES ADOPTED NEW PRODUCT LAUNCHES AS KEY GROWTH STRATEGY BETWEEN 2018 AND 2022

- 12.2 MARKET SHARE ANALYSIS

- FIGURE 37 STEEL REBAR: MARKET SHARE ANALYSIS

- 12.3 COMPANY EVALUATION QUADRANT

- 12.3.1 STARS

- 12.3.2 EMERGING LEADERS

- 12.3.3 PARTICIPANTS

- 12.3.4 PERVASIVE COMPANIES

- FIGURE 38 COMPETITIVE LEADERSHIP MAPPING: STEEL REBAR MARKET, 2021

- 12.4 SME MATRIX, 2021

- 12.4.1 PROGRESSIVE COMPANIES

- 12.4.2 RESPONSIVE COMPANIES

- 12.4.3 DYNAMIC COMPANIES

- 12.4.4 STARTING BLOCKS

- FIGURE 39 SME MATRIX: STEEL REBAR MARKET, 2021

- 12.5 COMPETITIVE SCENARIO

- 12.5.1 DEALS

- TABLE 218 DEALS 2018-2022

- 12.5.2 PRODUCT LAUNCHES

- TABLE 219 PRODUCT LAUNCHES, 2018-2022

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 13.1.1 NIPPON STEEL CORPORATION

- TABLE 220 NIPPON STEEL CORPORATION: COMPANY OVERVIEW

- FIGURE 40 NIPPON STEEL CORPORATION: COMPANY SNAPSHOT

- TABLE 221 NIPPON STEEL CORPORATION: DEALS

- TABLE 222 NIPPON STEEL CORPORATION: PRODUCT LAUNCHES

- TABLE 223 NIPPON STEEL CORPORATION.: OTHERS

- 13.1.2 ARCELORMITTAL

- TABLE 224 ARCELORMITTAL: COMPANY OVERVIEW

- FIGURE 41 ARCELORMITTAL: COMPANY SNAPSHOT

- TABLE 225 ARCELORMITTAL: DEALS

- TABLE 226 ARCELORMITTAL: OTHERS

- 13.1.3 GERDAU SA

- TABLE 227 GERDAU SA: COMPANY OVERVIEW

- FIGURE 42 GERDAU SA: COMPANY SNAPSHOT

- TABLE 228 GERDAU SA: DEALS

- TABLE 229 GERDAU SA: OTHERS

- 13.1.4 NUCOR CORPORATION

- TABLE 230 NUCOR CORPORATION: COMPANY OVERVIEW

- FIGURE 43 NUCOR CORPORATION: COMPANY SNAPSHOT

- TABLE 231 NUCOR CORPORATION: DEALS

- TABLE 232 NUCOR CORPORATION: PRODUCT LAUNCHES

- TABLE 233 NUCOR CORPORATION: OTHERS

- 13.1.5 COMMERCIAL METALS COMPANY

- TABLE 234 COMMERCIAL METALS COMPANY: COMPANY OVERVIEW

- FIGURE 44 COMMERCIAL METALS COMPANY: COMPANY SNAPSHOT

- TABLE 235 COMMERCIAL METALS COMPANY: DEALS

- TABLE 236 COMMERCIAL METALS COMPANY: PRODUCT LAUNCHES

- TABLE 237 COMMERCIAL METALS COMPANY: OTHERS

- 13.1.6 TATA STEEL LIMITED

- TABLE 238 TATA STEEL LIMITED: COMPANY OVERVIEW

- FIGURE 45 TATA STEEL LIMITED: COMPANY SNAPSHOT

- TABLE 239 TATA STEEL LIMITED: DEALS

- TABLE 240 TATA STEEL LIMITED: PRODUCT LAUNCHES

- TABLE 241 TATA STEEL LIMITED: OTHERS

- 13.1.7 STEEL AUTHORITY OF INDIA LIMITED

- TABLE 242 STEEL AUTHORITY OF INDIA LIMITED: BUSINESS OVERVIEW

- FIGURE 46 STEEL AUTHORITY OF INDIA LIMITED: COMPANY SNAPSHOT

- TABLE 243 STEEL AUTHORITY OF INDIA LIMITED: DEALS

- TABLE 244 STEEL AUTHORITY OF INDIA LIMITED: PRODUCT LAUNCHES

- TABLE 245 STEEL AUTHORITY OF INDIA LIMITED: OTHERS

- 13.1.8 MECHEL PAO

- TABLE 246 MECHEL PAO: COMPANY OVERVIEW

- FIGURE 47 MECHEL PAO: COMPANY SNAPSHOT

- TABLE 247 MECHEL PAO: DEALS

- TABLE 248 MECHEL PAO: OTHERS

- 13.1.9 STEEL DYNAMICS, INC.

- TABLE 249 STEEL DYNAMICS, INC.: COMPANY OVERVIEW

- FIGURE 48 STEEL DYNAMICS, INC.: COMPANY SNAPSHOT

- TABLE 250 STEEL DYNAMICS, INC.: DEALS

- TABLE 251 STEEL DYNAMICS, INC.: OTHERS

- 13.1.10 NLMK GROUP

- TABLE 252 NLMK GROUP: BUSINESS OVERVIEW

- FIGURE 49 NLMK GROUP: COMPANY SNAPSHOT

- TABLE 253 NLMK GROUP: DEALS

- TABLE 254 NLMK GROUP: OTHERS

- 13.2 OTHER PLAYERS

- 13.2.1 METINVEST HOLDING LLC

- TABLE 255 METINVEST HOLDING LLC: COMPANY OVERVIEW

- 13.2.2 PAO SEVERSTAL

- TABLE 256 PAO SEVERSTAL: COMPANY OVERVIEW

- 13.2.3 WUHAN IRON AND STEEL CORPORATION

- TABLE 257 WUHAN IRON AND STEEL CORPORATION: COMPANY OVERVIEW

- 13.2.4 SOHAR STEEL GROUP

- TABLE 258 SOHAR STEEL GROUP: COMPANY OVERVIEW

- 13.2.5 BYER STEEL CORPORATION

- TABLE 259 BYER STEEL CORPORATION: COMPANY OVERVIEW

- 13.2.6 CELSA STEEL UK LIMITED

- TABLE 260 CELSA STEEL UK LIMITED: COMPANY OVERVIEW

- 13.2.7 DAIDO STEEL CO., LTD

- TABLE 261 DAIDO STEEL CO., LTD.: COMPANY OVERVIEW

- 13.2.8 ACERINOX S.A.

- TABLE 262 ACERINOX S.A.: COMPANY OVERVIEW

- 13.2.9 HYUNDAI STEEL CO., LTD.

- TABLE 263 HYUNDAI STEEL CO., LTD.: COMPANY OVERVIEW

- 13.2.10 JIANGSU SHAGANG GROUP COMPANY LIMITED

- TABLE 264 JIANGSU SHAGANG GROUP COMPANY LIMITED: COMPANY OVERVIEW

- 13.2.11 HBIS GROUP

- TABLE 265 HBIS GROUP: COMPANY OVERVIEW

- 13.2.12 EVRAZ PLC

- TABLE 266 EVRAZ PLC: COMPANY OVERVIEW

- 13.2.13 SWISS STEEL GROUP

- TABLE 267 SWISS STEEL GROUP: COMPANY OVERVIEW

- 13.2.14 SUNFLAG IRON & STEEL CO. LTD

- TABLE 268 SUNFLAG IRON & STEEL CO. LTD.: COMPANY OVERVIEW

- 13.2.15 OUTOKUMPU OYJ

- TABLE 269 OUTOKUMPU OYJ: COMPANY OVERVIEW

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 CUSTOMIZATION: INDIA STEEL REBAR MARKET

- 14.1 INTRODUCTION

- 14.2 MARKET OVERVIEW: INDIA

- 14.2.1 INTRODUCTION

- 14.3 MARKET DYNAMICS

- 14.3.1 DRIVERS

- 14.3.1.1 Government initiative and rapid infrastructure development

- 14.3.2 RESTRAINTS

- 14.3.2.1 Low per capita consumption due to overall poverty

- 14.3.3 OPPORTUNITIES

- 14.3.3.1 Market shifting to higher grades

- 14.3.4 CHALLENGES

- 14.3.4.1 Expensive coal imports from Australia

- 14.3.4.2 India yet to adopt steel in construction similar to western countries

- 14.3.4.3 Power shortage might hamper steel production

- 14.3.1 DRIVERS

- 14.4 PRICING ANALYSIS

- FIGURE 50 STEEL REBAR PRICE TREND IN INDIA 2017-2022

- 14.5 COMPANY PROFILE: INDIA STEEL REBAR MARKET

- 14.5.1 TATA STEEL LIMITED

- TABLE 270 TATA STEEL LIMITED: COMPANY OVERVIEW

- FIGURE 51 TATA STEEL LIMITED: COMPANY SNAPSHOT

- 14.5.2 STEEL AUTHORITY OF INDIA LIMITED

- TABLE 271 STEEL AUTHORITY OF INDIA LIMITED: COMPANY OVERVIEW

- FIGURE 52 STEEL AUTHORITY OF INDIA LIMITED: COMPANY SNAPSHOT

- 14.5.3 JSW STEEL LIMITED

- TABLE 272 JSW STEEL LIMITED: COMPANY OVERVIEW

- FIGURE 53 JSW STEEL LIMITED: COMPANY SNAPSHOT

- 14.5.4 RASHTRIYA ISPAT NIGAM LIMITED

- TABLE 273 RASHTRIYA ISPAT NIGAM LIMITED: COMPANY OVERVIEW

- FIGURE 54 RASHTRIYA ISPAT NIGAM LIMITED: COMPANY SNAPSHOT

- 14.5.5 JINDAL STEEL & POWER LIMITED

- TABLE 274 JINDAL STEEL & POWER LIMITED: COMPANY OVERVIEW

- FIGURE 55 JINDAL STEEL & POWER LIMITED: COMPANY SNAPSHOT

- 14.5.6 KAMDHENU LIMITED

- TABLE 275 KAMDHENU LIMITED: COMPANY OVERVIEW

- FIGURE 56 KAMDHENU LIMITED: COMPANY SNAPSHOT

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS