|

|

市場調査レポート

商品コード

1207202

北米のFOG (Fat, Oil and Grease) 市場:種類別 (ブラウングリース、イエローグリース)・発生源別 (レストラン/ファストフード店、食品加工施設、水処理施設)・用途別・国別 (米国、カナダ、メキシコ) の将来予測 (2044年まで)North America FOG Market by Type (Brown & Yellow grease), Generation (Restaurants/fast food restaurants, Food Processing Facility, Water Treatment Facility), Application, and Country (US, Canada, Mexico) - Global Forecast to 2044 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 北米のFOG (Fat, Oil and Grease) 市場:種類別 (ブラウングリース、イエローグリース)・発生源別 (レストラン/ファストフード店、食品加工施設、水処理施設)・用途別・国別 (米国、カナダ、メキシコ) の将来予測 (2044年まで) |

|

出版日: 2023年01月23日

発行: MarketsandMarkets

ページ情報: 英文 112 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

北米のFOG (Fat, Oil and Grease:廃水中の脂肪・油・グリース) の市場規模は、2022年の95億米ドルから、2044年には256億米ドルに成長し、予測期間中のCAGRは4.6%と予測されています。

ブラウングリースの適切なリサイクルにより、埋立地からのメタンガスの排出を削減することができます。バイオ燃料分野の原料として、ブラウングリースは温室効果ガスの排出を減らし、気候変動の影響を軽減するのに役立ち、バイオ燃料とバイオディーゼルの生産に安価な選択肢を提供します。

イエローグリース (使用済み食用油) の市場を発生源別に見ると、レストラン/ファーストフード店のセグメントが最大のシェアを占めています。持続可能なエネルギー資源と環境保全の意識の高まりにより、イエローグリース市場は拡大すると考えられます。

ブラウングリース (廃水から回収した油脂) 燃料は、北米のFOG市場で最も急速に成長しているセグメントです。ブラウングリースを予熱すると、ディーゼル燃料と組み合わせてバイオボイラーの粗燃料として利用でき、使用前と使用後にシステムの点火と洗浄を行うことができます。

国別にみると、米国市場が最大の市場シェアを占めると予測されています。バイオ燃料の生産拡大や、政府の支援策・補助金などが、市場の促進材料となっています。特に、バイオ燃料の原料にもなるトウモロコシの価格上昇や、よりクリーンな代替燃料の需要の高まりにより、イエローグリースの需要拡大が見込まれています。

当レポートでは、北米のFOG市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、発生源別・国別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- サプライチェーン分析

- 顧客のビジネスに影響を与えるトレンドと混乱

- 接続市場:エコシステム

- ケーススタディ

- 業界の将来展望

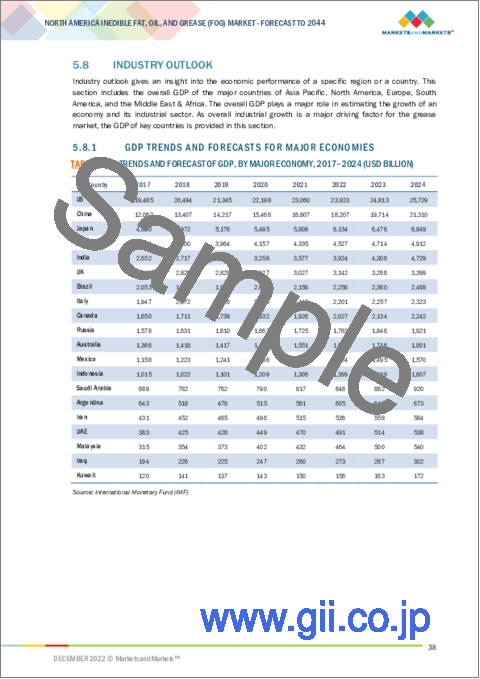

- 主要国のGDPの動向と予測

- 主な会議とイベント (2022年~2023年)

- 主な利害関係者と購入基準

- 規制状況

第6章 北米のFOG市場:発生源別

- イントロダクション

- ブラウングリース

- レストラン/ファストフード店

- 食品加工施設

- 水処理施設

- イエローグリース

- レストラン/ファストフード店

- 食品加工施設

第7章 北米のFOG市場:用途別

- イントロダクション

- イエローグリース

- 燃料

- ペットフードフィラー

- その他

- ブラウングリース

- 燃料

- ペットフードフィラー

- その他

- 処分料金 (tipping fee):一次投入額

第8章 国別の北米市場

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

第9章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 主要企業の市場シェア分析 (2022年)

- 主要企業の戦略

- 企業評価クアドラント

- スタートアップ/中小企業 (SME) の評価クアドラント

- 競合ベンチマーキング

- 競争状況と動向

- 製品の発売

- 資本取引

- その他の開発

第10章 企業プロファイル

- DARLING INGREDIENTS, INC.

- BAKER COMMODITIES INC.

- RESTAURANT TECHNOLOGIES, INC.

- MOPAC

- DOWNEY RIDGE ENVIRONMENTAL COMPANY

- その他の企業

- GF COMMODITIES LLC.

- MAHONEY ENVIRONMENTAL INC.

- INDABA RENEWABLE FUELS CALIFORNIA LLC

- GRAND NATURAL INC.

- ACE GREASE SERVICE INC.

- SEQUENTIAL

- GENUINE BIO-FUEL INC.

- ROCKY MOUNTAIN SUSTAINABLE ENTERPRISES, LLC

- GREEN ENERGY BIOFUEL

- A&A GREASE & PUMPING SERVICE

- A&P GREASE TRAPPERS

- SMISSON-MATHIS ENERGY SOLUTIONS

- SOUTHWASTE DISPOSAL LLC

- FARMERS UNION INDUSTRIES LLC

第11章 付録

The North America FOG market size is projected to grow from USD 9.5 billion in 2022 to USD 25.6 billion by 2044, at a CAGR of 4.6% during the forecast period . Appropriate recycling of brown grease reduces landfilling and landfill-related methane emissions. As a feedstock for the biofuels sector, brown grease helps reduce greenhouse gas emissions and lessen the impact of climate change and offers a less expensive option for biofuel and biodiesel production.

"Yellow grease, Restaurants/fast-food restaurants segment has the largest share in North America FOG market in 2021."

Yellow grease is produced from used cooking oil as well as other fats and oils gathered from commercial or industrial cooking operations. The yellow grease market will increase due to the growing awareness of sustainable energy resources and environmental conservation. The restaurants and food industry is evolving that directly impacting the overall production of brown grease from used cooking oil.

" Brown grease fuel is the fastest segment in the North America FOG market"

Brown grease is collected through grease traps installed in commercial, industrial, or municipal sewage treatment plants to separate grease and oil from wastewater. When preheated, brown grease can be utilized as crude bio-boiler fuel in conjunction with diesel fuel to prime and clean the system before and after each usage. According to international convention, CO2 emissions from biofuel combustion are excluded from national greenhouse gas emissions inventories as growing the biomass feedstocks used for biofuel production may offset the CO2 produced when biofuels are burned.

"US FOG market is projected to have largest market share during the forecast period."

The US FOG market for yellow and brown grease is likely to be driven by the increasing production of biofuels and government initiatives and subsidies on biofuels production. According to the US Energy Information Administration, the US production of biodiesel was 159 million gallons in December 2020. Biodiesel production from the Midwest region accounted for 72% of the US total production. The demand for yellow grease is expected to increase in the region due to the increased corn prices, which is also used as feedstock for biofuel, and the rising demand for cleaner fuel alternatives.

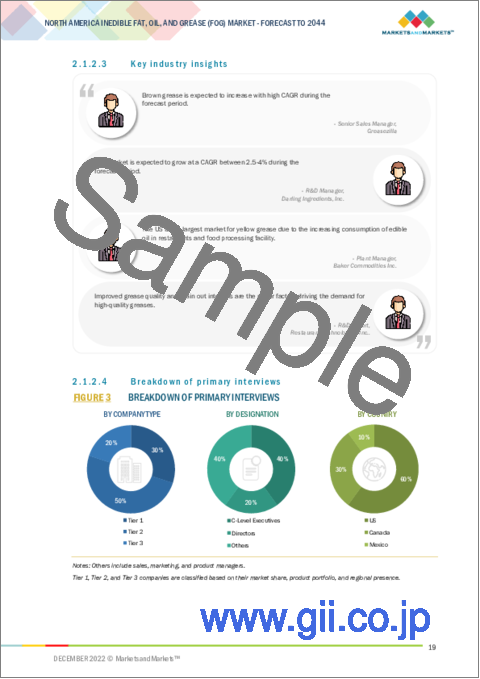

In-depth interviews were performed with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from several key organizations working in the North America FOG market.

By Department: Tier 1: 30%, Tier 2: 50%, Tier 3: 20%

By Designation: Directors: 20%, CXOs: 40%, and Others: 40%

By Region: US: 60%, Canada: 30%, Mexico: 10%,

The North America FOG market comprises major manufacturers, such as Darling Ingredients, Inc. (US), Restaurant Technologies Inc. (US), Downey Ridge Environmental Company (US), Baker Commodities Inc. (US), Mopac (US), Grease Cycle LLC (US).

Research Coverage

The market study covers the North America FOG market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on type, generation, application, and region. The study also includes an in-depth competitive analysis of key players in the market, along with their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to enhance their position in the North America FOG market.

Key Benefits of Buying the Report

The report is projected to help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers of the overall North America FOG market and its segments and sub-segments. This report is projected to help stakeholders understand the market's competitive landscape and gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 NORTH AMERICA INEDIBLE FAT, OIL, AND GREASE (FOG) MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 RESEARCH LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 NORTH AMERICA FOG MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Critical secondary inputs

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Critical primary inputs

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.2 MARKET SIZE ESTIMATION APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 6 NORTH AMERICA FOG MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS

- 2.6 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 7 YELLOW GREASE ACCOUNTED FOR LARGER SHARE IN 2021

- FIGURE 8 FUEL SEGMENT LED NORTH AMERICA FOG MARKET IN 2021

- FIGURE 9 US ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICA FOG MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN NORTH AMERICA FOG MARKET

- FIGURE 10 GROWING DEMAND FROM FUEL APPLICATION TO DRIVE FOG MARKET

- 4.2 NORTH AMERICA: FOG MARKET, BY TYPE AND COUNTRY (2021)

- FIGURE 11 YELLOW GREASE ACCOUNTED FOR LARGER SHARE

- 4.3 FOG MARKET, BY KEY COUNTRIES

- FIGURE 12 CANADA TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN NORTH AMERICA FOG MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing biodiesel production in North America

- 5.2.1.2 Growing demand for brown grease

- 5.2.2 RESTRAINTS

- 5.2.2.1 Unstable economic condition

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements leading to innovation

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of awareness in developing economies

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 14 NORTH AMERICA FOG MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 15 NORTH AMERICA FOG MARKET: SUPPLY CHAIN

- 5.4.1 RAW MATERIAL

- 5.4.2 GREASE COLLECTION

- 5.4.3 DISTRIBUTION

- 5.4.4 END USER

- 5.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 16 NORTH AMERICA FOG MARKET: CHANGING REVENUE MIX

- 5.6 CONNECTED MARKET: ECOSYSTEM

- FIGURE 17 NORTH AMERICA FOG MARKET: ECOSYSTEM

- 5.7 CASE STUDIES

- FIGURE 18 ASSESSMENT OF LUBRICANTS INDUSTRY

- FIGURE 19 MARKET SIZE ASSESSMENT OF LUBRICANTS AND SPECIALTIES OF LUBE OIL REFINERY

- FIGURE 20 STRATEGIC ASSESSMENT OF OFF-HIGHWAY LUBRICANT INDUSTRY

- 5.8 INDUSTRY OUTLOOK

- 5.8.1 GDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

- TABLE 1 TRENDS AND FORECAST OF GDP, BY MAJOR ECONOMY, 2017-2024 (USD BILLION)

- 5.9 KEY CONFERENCES & EVENTS (2022-2023)

- TABLE 2 NORTH AMERICA FOG MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

- TABLE 3 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP TWO END-USE APPLICATIONS (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR FUEL AND PET FOOD FILLERS

- TABLE 4 KEY BUYING CRITERIA FOR NORTH AMERICA FOG MARKET IN TOP 2 END-USE APPLICATIONS

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATIONS RELATED TO GREASE

6 NORTH AMERICA FOG MARKET, BY GENERATION

- 6.1 INTRODUCTION

- TABLE 5 NORTH AMERICA: ACTUAL FOG MARKET SIZE, BY TYPE, 2020-2044 (THOUSAND GALLON)

- TABLE 6 NORTH AMERICA: ACTUAL FOG MARKET SIZE, BY TYPE, 2020-2044 (USD MILLION)

- TABLE 7 NORTH AMERICA: POTENTIAL FOG MARKET SIZE, BY TYPE, 2020-2044 (THOUSAND GALLON)

- TABLE 8 NORTH AMERICA: POTENTIAL FOG MARKET SIZE, BY TYPE, 2020-2044 (USD MILLION)

- 6.2 BROWN GREASE

- 6.2.1 RESTAURANTS/FAST FOOD RESTAURANTS

- 6.2.2 FOOD PROCESSING FACILITY

- 6.2.3 WATER TREATMENT FACILITY

- FIGURE 23 RESTAURANTS/FAST FOOD RESTAURANTS SEGMENT DOMINATES BROWN GREASE MARKET IN 2022

- TABLE 9 BROWN GREASE MARKET SIZE, BY GENERATION, 2020-2044 (THOUSAND GALLON)

- TABLE 10 BROWN GREASE MARKET SIZE, BY GENERATION, 2020-2044 (USD MILLION)

- 6.3 YELLOW GREASE

- 6.3.1 RESTAURANTS/FAST FOOD RESTAURANTS

- 6.3.2 FOOD PROCESSING FACILITY

- FIGURE 24 RESTAURANTS/FAST FOOD RESTAURANTS SEGMENT DOMINATES YELLOW GREASE MARKET IN 2022

- TABLE 11 YELLOW GREASE MARKET SIZE, BY GENERATION, 2020-2044 (THOUSAND GALLON)

- TABLE 12 YELLOW GREASE MARKET SIZE, BY GENERATION, 2020-2044 (USD MILLION)

7 NORTH AMERICA FOG MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 YELLOW GREASE

- 7.2.1 FUEL

- 7.2.2 PET FOOD FILLERS

- 7.2.3 OTHERS

- FIGURE 25 FUEL SEGMENT DOMINATES NORTH AMERICA YELLOW GREASE MARKET IN 2022

- TABLE 13 NORTH AMERICA FOG MARKET: YELLOW GREASE MARKET SIZE, BY APPLICATION, 2020-2044 (THOUSAND GALLON)

- TABLE 14 NORTH AMERICA FOG MARKET: YELLOW GREASE MARKET SIZE, BY APPLICATION, 2020-2044 (USD MILLION)

- 7.3 BROWN GREASE

- 7.3.1 FUEL

- 7.3.2 PET FOOD FILLERS

- 7.3.3 OTHERS

- FIGURE 26 FUEL SEGMENT DOMINATES NORTH AMERICA BROWN GREASE MARKET IN 2022

- TABLE 15 NORTH AMERICA FOG MARKET: BROWN GREASE MARKET SIZE, BY APPLICATION, 2020-2044 (THOUSAND GALLON)

- TABLE 16 NORTH AMERICA FOG MARKET: BROWN GREASE MARKET SIZE, BY APPLICATION, 2020-2044 (USD MILLION)

- 7.4 TIPPING FEE: PRIMARY INPUTS

8 NORTH AMERICA FOG MARKET, BY COUNTRY

- 8.1 INTRODUCTION

- FIGURE 27 CANADA TO BE FASTEST-GROWING FOG MARKET

- 8.2 NORTH AMERICA

- TABLE 17 NORTH AMERICA: ACTUAL FOG MARKET SIZE, BY COUNTRY, 2020-2044 (THOUSAND GALLON)

- TABLE 18 NORTH AMERICA: ACTUAL FOG MARKET SIZE, BY COUNTRY, 2020-2044 (USD MILLION)

- TABLE 19 NORTH AMERICA: POTENTIAL FOG MARKET SIZE, BY COUNTRY, 2020-2044 (THOUSAND GALLON)

- TABLE 20 NORTH AMERICA: POTENTIAL FOG MARKET SIZE, BY COUNTRY, 2020-2044 (USD MILLION)

- FIGURE 28 NORTH AMERICA: FOG MARKET SNAPSHOT

- 8.2.1 US

- 8.2.1.1 Growing government initiatives in biofuel production to drive market

- TABLE 21 US BIOFUELS SUPPLY AND DISPOSITION IN 2021 (BILLION GALLON)

- FIGURE 29 US MONTHLY BIODIESEL PRODUCTION, 2018-2020

- TABLE 22 US: ACTUAL FOG MARKET SIZE, BY TYPE, 2020-2044 (THOUSAND GALLON)

- TABLE 23 US: ACTUAL FOG MARKET SIZE, BY TYPE, 2020-2044 (USD MILLION)

- TABLE 24 US: POTENTIAL FOG MARKET SIZE, BY TYPE, 2020-2044 (THOUSAND GALLON)

- TABLE 25 US: POTENTIAL FOG MARKET SIZE, BY TYPE, 2020-2044 (USD MILLION)

- TABLE 26 US: ACTUAL BROWN GREASE MARKET SIZE, BY GENERATION, 2020-2044 (THOUSAND GALLON)

- TABLE 27 US: ACTUAL BROWN GREASE MARKET SIZE, BY GENERATION, 2020-2044 (USD MILLION)

- TABLE 28 US: ACTUAL YELLOW GREASE MARKET SIZE, BY GENERATION, 2020-2044 (THOUSAND GALLON)

- TABLE 29 US: ACTUAL YELLOW GREASE MARKET SIZE, BY GENERATION, 2020-2044 (USD MILLION)

- TABLE 30 US: ACTUAL BROWN GREASE MARKET SIZE, BY APPLICATION, 2020-2044 (THOUSAND GALLON)

- TABLE 31 US: ACTUAL BROWN GREASE MARKET SIZE, BY APPLICATION, 2020-2044 (USD MILLION)

- TABLE 32 US: ACTUAL YELLOW GREASE MARKET SIZE, BY APPLICATION, 2020-2044 (THOUSAND GALLON)

- TABLE 33 US: ACTUAL YELLOW GREASE MARKET SIZE, BY APPLICATION, 2020-2044 (USD MILLION)

- 8.2.2 CANADA

- 8.2.2.1 Government's focus to minimize greenhouse gas emissions to support market

- TABLE 34 CANADA: ACTUAL FOG MARKET SIZE, BY TYPE, 2020-2044 (THOUSAND GALLON)

- TABLE 35 CANADA: ACTUAL FOG MARKET SIZE, BY TYPE, 2020-2044 (USD MILLION)

- TABLE 36 CANADA: POTENTIAL FOG MARKET SIZE, BY TYPE, 2020-2044 (THOUSAND GALLON)

- TABLE 37 CANADA: POTENTIAL FOG MARKET SIZE, BY TYPE, 2020-2044 (USD MILLION)

- TABLE 38 CANADA: ACTUAL BROWN GREASE MARKET SIZE, BY GENERATION, 2020-2044 (THOUSAND GALLON)

- TABLE 39 CANADA: ACTUAL BROWN GREASE MARKET SIZE, BY GENERATION, 2020-2044 (USD MILLION)

- TABLE 40 CANADA: ACTUAL YELLOW GREASE MARKET SIZE, BY GENERATION, 2020-2044 (THOUSAND GALLON)

- TABLE 41 CANADA: ACTUAL YELLOW GREASE MARKET SIZE, BY GENERATION, 2020-2044 (USD MILLION)

- TABLE 42 CANADA: ACTUAL BROWN GREASE MARKET SIZE, BY APPLICATION, 2020-2044 (THOUSAND GALLON)

- TABLE 43 CANADA: ACTUAL BROWN GREASE MARKET SIZE, BY APPLICATION, 2020-2044 (USD MILLION)

- TABLE 44 CANADA: ACTUAL YELLOW GREASE MARKET SIZE, BY APPLICATION, 2020-2044 (THOUSAND GALLON)

- TABLE 45 CANADA: ACTUAL YELLOW GREASE MARKET SIZE, BY APPLICATION, 2020-2044 (USD MILLION)

- 8.2.3 MEXICO

- 8.2.3.1 Growing investment in energy & infrastructure sector to drive growth

- TABLE 46 MEXICO: POTENTIAL FOG MARKET SIZE, BY TYPE, 2020-2044 (THOUSAND GALLON)

- TABLE 47 MEXICO: POTENTIAL FOG MARKET SIZE, BY TYPE, 2020-2044 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 30 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN FOG MARKET

- 9.2.1 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- TABLE 48 FOG MARKET: SHARE OF KEY PLAYERS

- 9.3 KEY PLAYERS' STRATEGIES

- TABLE 49 STRATEGIC POSITIONING OF KEY PLAYERS

- 9.4 COMPANY EVALUATION QUADRANT

- 9.4.1 STARS

- 9.4.2 PERVASIVE PLAYERS

- 9.4.3 EMERGING LEADERS

- 9.4.4 PARTICIPANTS

- FIGURE 31 FOG MARKET: COMPANY EVALUATION QUADRANT, 2022

- 9.5 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

- 9.5.1 RESPONSIVE COMPANIES

- 9.5.2 DYNAMIC COMPANIES

- 9.5.3 STARTING BLOCKS

- 9.5.4 PROGRESSIVE COMPANIES

- FIGURE 32 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- 9.6 COMPETITIVE BENCHMARKING

- TABLE 50 FOG MARKET: DETAILED LIST OF KEY PLAYERS

- TABLE 51 FOG MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 9.7 COMPETITIVE SITUATION AND TRENDS

- 9.7.1 PRODUCT LAUNCHES

- TABLE 52 FOG MARKET: PRODUCT LAUNCHES

- 9.7.2 DEALS

- TABLE 53 FOG MARKET: ACQUISITIONS

- 9.7.3 OTHER DEVELOPMENTS

- TABLE 54 FOG MARKET: EXPANSIONS

10 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM view, Key strategies, Strategic choices, Weaknesses and competitive threats) **

- 10.1 DARLING INGREDIENTS, INC.

- TABLE 55 DARLING INGREDIENTS, INC.: COMPANY OVERVIEW

- FIGURE 33 DARLING INGREDIENTS, INC.: COMPANY SNAPSHOT

- TABLE 56 DARLING INGREDIENTS, INC.: DEALS

- TABLE 57 DARLING INGREDIENTS, INC.: OTHERS

- 10.2 BAKER COMMODITIES INC.

- TABLE 58 BAKER COMMODITIES INC.: COMPANY OVERVIEW

- TABLE 59 BAKER COMMODITIES INC.: PRODUCT LAUNCHES

- 10.3 RESTAURANT TECHNOLOGIES, INC.

- TABLE 60 RESTAURANT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 61 RESTAURANT TECHNOLOGIES, INC.: DEALS

- TABLE 62 RESTAURANT TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- 10.4 MOPAC

- TABLE 63 MOPAC: COMPANY OVERVIEW

- 10.5 DOWNEY RIDGE ENVIRONMENTAL COMPANY

- TABLE 64 DOWNEY RIDGE ENVIRONMENTAL COMPANY: COMPANY OVERVIEW

- TABLE 65 DOWNEY RIDGE ENVIRONMENTAL COMPANY: PRODUCT LAUNCHES

- TABLE 66 DOWNEY RIDGE ENVIRONMENTAL COMPANY: OTHERS

- 10.6 OTHER PLAYERS

- 10.6.1 GF COMMODITIES LLC.

- TABLE 67 GF COMMODITIES LLC.: COMPANY OVERVIEW

- 10.6.2 MAHONEY ENVIRONMENTAL INC.

- TABLE 68 MAHONEY ENVIRONMENTAL INC.: COMPANY OVERVIEW

- 10.6.3 INDABA RENEWABLE FUELS CALIFORNIA LLC

- TABLE 69 INDABA RENEWABLE FUELS CALIFORNIA LLC: COMPANY OVERVIEW

- 10.6.4 GRAND NATURAL INC.

- TABLE 70 GRAND NATURAL INC.: COMPANY OVERVIEW

- 10.6.5 ACE GREASE SERVICE INC.

- TABLE 71 ACE GREASE SERVICE INC.: COMPANY OVERVIEW

- 10.6.6 SEQUENTIAL

- TABLE 72 SEQUENTIAL: COMPANY OVERVIEW

- 10.6.7 GENUINE BIO-FUEL INC.

- TABLE 73 GENUINE BIO-FUEL INC.: COMPANY OVERVIEW

- 10.6.8 ROCKY MOUNTAIN SUSTAINABLE ENTERPRISES, LLC

- TABLE 74 ROCKY MOUNTAIN SUSTAINABLE ENTERPRISES, LLC: COMPANY OVERVIEW

- 10.6.9 GREEN ENERGY BIOFUEL

- TABLE 75 GREEN ENERGY BIOFUEL: COMPANY OVERVIEW

- 10.6.10 A&A GREASE & PUMPING SERVICE

- TABLE 76 A&A GREASE & PUMPING SERVICE: COMPANY OVERVIEW

- 10.6.11 A&P GREASE TRAPPERS

- TABLE 77 A&P GREASE TRAPPERS: COMPANY OVERVIEW

- 10.6.12 SMISSON-MATHIS ENERGY SOLUTIONS

- TABLE 78 SMISSON-MATHIS ENERGY SOLUTIONS: COMPANY OVERVIEW

- 10.6.13 SOUTHWASTE DISPOSAL LLC

- TABLE 79 SOUTHWASTE DISPOSAL LLC: COMPANY OVERVIEW

- 10.6.14 FARMERS UNION INDUSTRIES LLC

- TABLE 80 FARMERS UNION INDUSTRIES LLC: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM view, Key strategies, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS