|

|

市場調査レポート

商品コード

1161445

軟質包装の世界市場:包装の種類別 (パウチ、バッグ、ロールストック、フィルム・ラップ)・印刷技術別 (フレキソ印刷、グラビア印刷、デジタル印刷)・エンドユース産業別・材料別 (紙、プラスチック、金属)・地域別の将来予測 (2027年まで)Flexible Packaging Market by Packaging Type (Pouches, Bags, Roll Stock, Films & Wraps), Printing Technology (Flexography, Rotogravure, Digital Printing), End-user Industry, Material (Paper, Plastic, Metal) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 軟質包装の世界市場:包装の種類別 (パウチ、バッグ、ロールストック、フィルム・ラップ)・印刷技術別 (フレキソ印刷、グラビア印刷、デジタル印刷)・エンドユース産業別・材料別 (紙、プラスチック、金属)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年11月22日

発行: MarketsandMarkets

ページ情報: 英文 278 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の軟質包装の市場は、2022年に2,489億米ドルに達した後、4.8%のCAGRで成長し、2027年には3,155億米ドルに達すると予測されています。

"包装の種類別では、パウチが予測期間中に最も高いCAGRで成長する"

パウチベースの軟質包装は、牛乳、紅茶、コーヒー、ケチャップなど、食品・飲料業界におけるさまざまな食品の包装に広く使用されています。さらに、パウチはバルクコーヒーの包装や乾燥肉、燻製肉などの食品に最適です。使いやすく、ヒートシール可能で、複数のサイズとフォーマットに適用可能です。

"材料別では、プラスチックが予測期間中に最も高いCAGRで成長する"

パウチやフィルムなどのプラスチック製軟質包装製品は、石鹸、洗剤、スナック菓子、ナムキーン、ケチャップ、チョコレート、キャンディ、その他の食品など、さまざまな製品の包装に使用されています。プラスチック製軟質包装市場は、硬質包装よりも高い成長率で拡大しており、保存期間の延長や食品の安全性の維持、熱や病原体などの外部からのバリア保護など、さまざまな機能を提供しています。

"エンドユーズ産業別では、パーソナルケア用品・化粧品が予測期間中に最も高いCAGRで成長する"

軟質包装は美容業界において、教育水準と環境意識の高い消費者の共感を得られるような包装を提供します。さらに、気密性が高く、パーソナルケア用品・化粧品の企業から販売されるパウダー・ジェル・オイルの鮮度を保つのに必要な強力な保護バリア機能を備えています。軟質包装製品は、石鹸、化粧品・香水、ティッシュやナプキンなど、さまざまな製品の包装に使用されています。

"印刷技術別では、フレキソ印刷が予測期間中に最も高いCAGRを達成する"

フレキソ印刷は、軟質包装の印刷に広く用いられています。他の印刷工程との主な違いは、プラスチック、ゴム、UV感光性ポリマーなどの柔軟な素材で作られた版を使用する点です。また、フレキソ印刷で使用されるインクは低粘度であるため、印刷物の速乾性が高く、印刷工程を高速化し、最終的には生産コストを削減することができます。

"予測期間中、アジア太平洋市場のCAGが最も高くなる"

最も成長率の高いフレキシブルパッケージング市場は、アジア太平洋 (インド、中国、日本、オーストラリア、韓国など) で発生しています。これらの国々では、開発活動の活発化と急速な経済拡大により、軟質包装市場の拡大が見込まれています。さらに、これらの国々では都市化が進んでいるため、食品・飲料・一般消費財の巨大な顧客基盤となっており、これが予測期間中の軟質包装市場の成長につながったのです。

当レポートでは、世界の軟質包装の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、材料別・包装の種類別・印刷技術別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業動向

- バリューチェーン分析

- ポーターのファイブフォース分析

- 特許分析

- 価格分析

- 技術分析

- 貿易分析

- マーケットマッピング/エコシステムマップ

- ケーススタディ分析

- 規制機関、政府機関、その他の組織

- 主な会議とイベント (2022年~2023年)

第7章 軟質包装市場:材料別

- イントロダクション

- プラスチック

- 紙

- 金属

第8章 軟質包装市場:包装の種類別

- イントロダクション

- パウチ

- ロールストック

- バッグ

- フィルム・ラップ

- その他

第9章 軟質包装市場:印刷技術別

- イントロダクション

- フレキソ印刷

- グラビア印刷

- デジタル印刷

- その他

第10章 軟質包装市場:用途別

- イントロダクション

- 食品

- 飲料

- 医薬品・ヘルスケア

- パーソナルケア用品・化粧品

- その他

第11章 軟質包装市場、地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- 他のアジア太平洋諸国

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- イタリア

- スペイン

- 他の欧州諸国

- 中東

- サウジアラビア

- アラブ首長国連邦

- 他の中東諸国

- アフリカ

- 南アフリカ

- ナイジェリア

- ケニア

- モロッコ

- エジプト

- 他のアフリカ諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

第12章 競合情勢

- 概要

- 市場シェア分析

- 上位企業の収益分析

- 企業評価クアドラント

- 中小企業マトリックス (2021年)

- 競合シナリオ

- 戦略展開

- 製品の発売

第13章 企業プロファイル

- 主要企業

- WESTROCK COMPANY

- BERRY GLOBAL GROUP, INC.

- AMCOR LIMITED

- MONDI GROUP

- SONOCO PRODUCTS COMPANY

- HUHTAMAKI OYJ

- CONSTANTIA FLEXIBLES

- SEALED AIR CORPORATION

- TRANSCONTINENTAL INC.

- DS SMITH

- その他の企業

- NOVOLEX-CARLYLE GROUP

- BISCHOF+KLEIN SE & CO. KG

- UFLEX LIMITED

- SILAFRICA

- PROAMPAC

- ALUFLEXPACK AG

- PPC FLEXIBLE PACKAGING LLC.

- PRINTPACK, INC.

- NOVUS HOLDINGS LTD.

- AHLSTROM

- COSMO FILMS LIMITED

- LINEAR PLASTICS AND PACKAGING.

- WIHURI GROUP

- GUALA PACK S.P.A.

- C-P FLEXIBLE PACKAGING

第14章 付録

The market for flexible packaging is approximated to be USD 248.9 billion in 2022, and it is projected to reach USD 315.5 billion by 2027 at a CAGR of 4.8%. Out of five packaging types (pouches, bags, roll stocks, films & wraps, and others), Pouches are the major packaging type of flexible packaging. Pouches have the largest market share because of its excellent properties, such as low weight, resale ability, vacuum sealing, low package-to-product ratio, and others. The demand for pouches is higher in the food and beverages industry, where these are used for packing several food items such as tea, coffee, milk, ketchup, and others.

By Packaging Type, Pouches accounted for the highest CAGR during the forecast period

Pouches-based flexible packaging is widely used in packing various food items in the food and beverage industry; some of them are milk, tea, coffee, ketchup, and other food items. In addition to this, Pouches are ideal for bulk coffee packaging and food items such as dried or smoked meats. They are easy to use, heat sealable, and available in convenient packaging with multiple sizes and formats. It is widely used in the food and beverages industry because of its excellent properties such as low weight, resale ablility, vacuum sealing, low package-to-product ratio, and others.

By Material, Plastic accounted for the highest CAGR during the forecast period

Flexible packaging products are made up of various raw materials such as paper, plastic, and metal. Plastic flexible packaging products, such as pouches, and films, are used for packing various ranges of products such as soaps, detergents, snacks, namkeen, ketchup, chocolate, candies, and other food items. The flexible plastic packaging market is expanding at a higher rate than its counterpart, rigid plastic packaging, serving a variety of functions from increasing shelf life and maintaining food safety to offering barrier protection from heat and pathogens and other external entities.

By End Use Industry, Personal care and cosmetics accounted for the highest CAGR during the forecast period

Flexible packaging offers the beauty industry packaging that resonates with educated and eco-conscious consumers. In addition to this, being airtight, it has a strong protective barrier material that aids in preserving the freshness of powder, gels, and oils sold by personal care and cosmetic firms. Flexible Packaging products are used for packaging different products such as soaps, cosmetics & perfumes, and facial tissues & napkins.

By Printing Technology, Flexography accounted for the highest CAGR during the forecast period

Flexography is widely used in flexible packaging printing. The flexography printing process involves image preparation, plate making, printing, and finishing. The main difference between flexography and other printing processes is that it uses plates made of flexible materials, such as plastic, rubber, and UV-sensitive polymer. The inks used in flexography are of low viscosity, which enables the print to dry quickly and speed up the printing process, eventually saving production costs.

APAC is projected to account for the highest CAGR in the flexible packaging market during the forecast period

The fastest-growing flexible packaging market is occur in the Asia Pacific region. The various countries which are covered in this region are India, China, Japan, Australia, South Korea, and the Rest of Asia Pacific. Countries such as India, China, and Japan are expected to rise in the flexible packaging market due to growing developmental activities and rapid economic expansion. In addition to this, rising urbanization in these countries results in representing a huge customer base for food, beverages, and FMCG products which led to the growth of the flexible packaging market in the forecast period.

By Company Type: Tier 1: 35%, Tier 2: 40%, and Tier 3: 25%

By Designation: C-level Executives: 40%, Directors: 35%, and Others: 25%

By Region: North America: 20%, Europe: 35%, Asia Pacific: 25%, Middle East & Africa: 15%, and South America: 5%.

Companies Covered: Huhtamaki Oyj (Finland), Berry Global Group Inc. (US), Amcor Limited. (Australia), Mondi Group.(UK), Sonoco Products Company (US), Westrock Company (US), Constantia Flexibles (Austria), Sealed Air Corporation (US), Transcontinental Inc (Canada), DS Smith (UK)

Research Coverage

The market study covers the Flexible Packaging market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on application, packaging type, material, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the flexible packaging market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall flexible packaging market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 FLEXIBLE PACKAGING MARKET SEGMENTATION

- 1.5 YEARS CONSIDERED

- 1.5.1 REGIONS COVERED

- 1.6 CURRENCY CONSIDERED

- 1.7 UNIT CONSIDERED

- 1.8 STAKEHOLDERS

- 1.9 LIMITATIONS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 FLEXIBLE PACKAGING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary insights

- FIGURE 2 LIST OF STAKEHOLDERS AND BREAKDOWN OF PRIMARY INTERVIEWS

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY SIDE

- 2.3 DATA TRIANGULATION

- FIGURE 6 FLEXIBLE PACKAGING MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS

- 2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY

- FIGURE 7 POUCHES SEGMENT TO LEAD FLEXIBLE PACKAGING MARKET BY 2027

- FIGURE 8 FLEXOGRAPHY SEGMENT ESTIMATED TO DOMINATE MARKET IN 2022

- FIGURE 9 FOOD TO BE LARGEST SEGMENT IN FLEXIBLE PACKAGING MARKET DURING FORECAST PERIOD

- FIGURE 10 PLASTIC SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF FLEXIBLE PACKAGING MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 ASIA PACIFIC MARKET TO GROW AT HIGHER RATE DUE TO RAPID INDUSTRIALIZATION AND GROWING END-USE INDUSTRIES

- FIGURE 12 DOWNSIZING OF PACKAGING PROPELLING MARKET

- 4.2 FLEXIBLE PACKAGING MARKET, BY MATERIAL TYPE

- FIGURE 13 PAPER TO BE FASTEST-GROWING SEGMENT

- 4.3 FLEXIBLE PACKAGING MARKET, BY REGION AND APPLICATION

- FIGURE 14 FOOD SEGMENT AND ASIA PACIFIC LED FLEXIBLE PACKAGING MARKET IN 2021

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 FLEXIBLE PACKAGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Cost-effectiveness and increased product shelf life

- 5.2.1.2 Rising demand from end-use industries and increasing e-commerce sales

- FIGURE 16 ONLINE RETAIL SALES

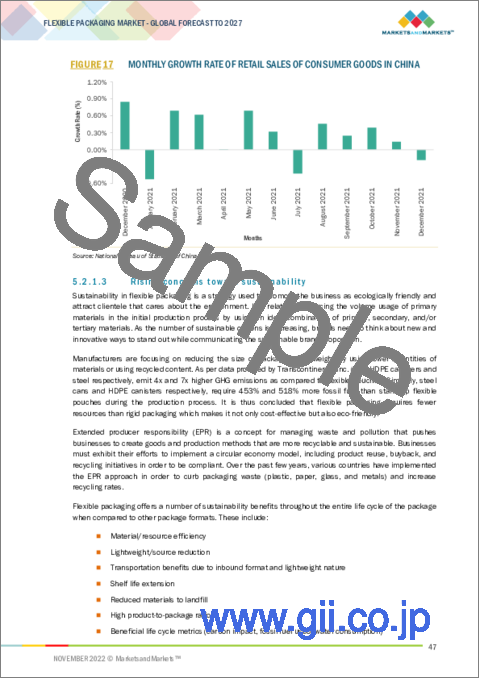

- FIGURE 17 MONTHLY GROWTH RATE OF RETAIL SALES OF CONSUMER GOODS IN CHINA

- 5.2.1.3 Rising concerns toward sustainability

- TABLE 2 PACKAGE COMPARISON

- 5.2.2 RESTRAINTS

- 5.2.2.1 Non-availability of efficient recycling infrastructure

- 5.2.2.2 Rising prices of raw materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for sustainable packaging

- 5.2.3.2 Better substitute for traditional packaging materials

- 5.2.4 CHALLENGES

- 5.2.4.1 Rapid changes in technologies

6 INDUSTRY TRENDS

- 6.1 VALUE CHAIN ANALYSIS

- FIGURE 18 FLEXIBLE PACKAGING MARKET: VALUE CHAIN ANALYSIS

- 6.1.1 PROMINENT COMPANIES

- 6.1.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 6.2 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 FLEXIBLE PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 FLEXIBLE PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.2.1 THREAT OF SUBSTITUTES

- 6.2.2 BARGAINING POWER OF BUYERS

- 6.2.3 THREAT OF NEW ENTRANTS

- 6.2.4 BARGAINING POWER OF SUPPLIERS

- 6.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.3 PATENT ANALYSIS

- 6.3.1 METHODOLOGY

- 6.3.2 DOCUMENT TYPE

- FIGURE 20 DOCUMENT TYPE (2018-2022)

- FIGURE 21 PUBLICATION TRENDS, 2018-2022

- 6.3.3 INSIGHTS

- FIGURE 22 JURISDICTION ANALYSIS (TILL 2022)

- 6.3.4 TOP APPLICANTS

- FIGURE 23 TOP APPLICANTS, BY NUMBER OF PATENTS (TILL 2022)

- 6.4 PRICING ANALYSIS

- 6.4.1 CHANGES IN FLEXIBLE PACKAGING PRICING IN 2021

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 VARIOUS PRINTING METHODS FOR FLEXIBLE PRODUCTS

- 6.5.1.1 Rotogravure

- 6.5.1.2 Lithography

- 6.5.1.3 Flexography

- 6.5.1.4 Digital printing

- 6.5.2 FORM FILL SEAL MACHINE FOR FLEXIBLE PACKAGING

- 6.5.3 STRETCHABLE PAPER FOR NOVEL PAPER APPLICATIONS

- 6.5.1 VARIOUS PRINTING METHODS FOR FLEXIBLE PRODUCTS

- 6.6 TRADE ANALYSIS

- TABLE 4 IMPORTING COUNTRIES FOR 48 PAPER AND PAPERBOARD; ARTICLES OF PAPER PULP, OF PAPER OR OF PAPERBOARD, 2021 (USD BILLION)

- TABLE 5 EXPORTING COUNTRIES FOR 48 PAPER AND PAPERBOARD; ARTICLES OF PAPER PULP, OF PAPER OR OF PAPERBOARD, 2021 (USD BILLION)

- TABLE 6 IMPORTING COUNTRIES FOR 3,920 PLASTICS, PLATES, SHEETS, FILMS, FOILS, STRIPS (NON-ADHESIVE), NON-CELLULAR, NOT REINFORCED, LAMINATED SUPPORTED, OR COMBINED WITH OTHER MATERIALS, 2021 (USD BILLION)

- TABLE 7 EXPORTING COUNTRIES FOR 3,920 PLASTICS, PLATES, SHEETS, FILMS, FOILS, STRIPS (NON-ADHESIVE), NON-CELLULAR, NOT REINFORCED, LAMINATED SUPPORTED, OR COMBINED WITH OTHER MATERIALS, 2021 (USD BILLION)

- 6.7 MARKET MAPPING/ECOSYSTEM MAP

- FIGURE 24 ECOSYSTEM MAP

- 6.8 CASE STUDY ANALYSIS

- TABLE 8 PAPERPAK CASE STUDY FOR KATHMANDU

- TABLE 9 PAPERPAK CASE STUDY FOR HARPER, INC.

- 6.9 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 11 FLEXIBLE PACKAGING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

7 FLEXIBLE PACKAGING MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- FIGURE 25 PLASTIC SEGMENT TO LEAD FLEXIBLE PACKAGING MARKET DURING FORECAST PERIOD

- TABLE 12 FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 13 FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- 7.2 PLASTIC

- 7.2.1 MOST WIDELY USED MATERIAL IN FLEXIBLE PACKAGING

- 7.3 PAPER

- 7.3.1 SUSTAINABILITY A KEY FACTOR

- 7.4 METAL

- 7.4.1 EFFECTIVE BARRIER FOR MOISTURE

8 FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE

- 8.1 INTRODUCTION

- FIGURE 26 POUCHES SEGMENT TO LEAD FLEXIBLE PACKAGING MARKET DURING FORECAST PERIOD

- TABLE 14 FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 15 FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- 8.2 POUCHES

- 8.2.1 ECONOMICAL AND EFFICIENT PACKAGING

- 8.3 ROLLSTOCK

- 8.3.1 DESIGNED TO INCREASE SHELF LIFE

- 8.4 BAGS

- 8.4.1 PROVIDE ESTHETIC IMPACT AND MARKETING EXPOSURE

- 8.5 FILMS & WRAPS

- 8.5.1 RISING DEMAND DUE TO INCREASING ONLINE SALES AND E-COMMERCE

- 8.6 OTHERS

- 8.6.1 CONVENIENT, EASY TO HANDLE, AND ENVIRONMENT-FRIENDLY

9 FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY

- 9.1 INTRODUCTION

- FIGURE 27 FLEXOGRAPHY SEGMENT TO LEAD FLEXIBLE PACKAGING MARKET DURING FORECAST PERIOD

- TABLE 16 FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 17 FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (KILOTON)

- 9.2 FLEXOGRAPHY

- 9.2.1 SPEEDS UP PRINTING PROCESS

- 9.3 ROTOGRAVURE

- 9.3.1 PROVIDES QUALITY IMAGES

- 9.4 DIGITAL PRINTING

- 9.4.1 REDUCES ENVIRONMENTAL IMPACT

- 9.5 OTHERS

- 9.5.1 LOWER INVESTMENT AND LESS FLOOR SPACE

10 FLEXIBLE PACKAGING MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 28 FOOD SEGMENT TO DOMINATE FLEXIBLE PAPER PACKAGING MARKET DURING FORECAST PERIOD

- TABLE 18 FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 19 FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 10.2 FOOD

- 10.2.1 RISING UTILIZATION OF CONVENIENCE FOODS TO BOOST MARKET

- 10.3 BEVERAGES

- 10.3.1 SHIFT IN CONSUMER PREFERENCE TO BOOST MARKET

- 10.4 PHARMACEUTICAL & HEALTHCARE

- 10.4.1 RISE IN DEMAND FOR PHARMACEUTICAL PRODUCTS TO BOOST MARKET

- 10.5 PERSONAL CARE & COSMETICS

- 10.5.1 AFFORDABLE SMALL SIZE PACKAGING TO BOOST MARKET

- 10.6 OTHERS

11 FLEXIBLE PACKAGING MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 29 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

- TABLE 20 GLOBAL: FLEXIBLE PACKAGING MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 21 GLOBAL: FLEXIBLE PACKAGING MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 22 GLOBAL: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 23 GLOBAL: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 24 GLOBAL: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 25 GLOBAL: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 26 GLOBAL: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 27 GLOBAL: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 28 GLOBAL: FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 29 GLOBAL: FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (KILOTON)

- 11.2 ASIA PACIFIC

- FIGURE 30 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SNAPSHOT

- TABLE 30 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 31 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 32 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 33 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 34 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 35 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 36 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 37 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 38 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 39 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (KILOTON)

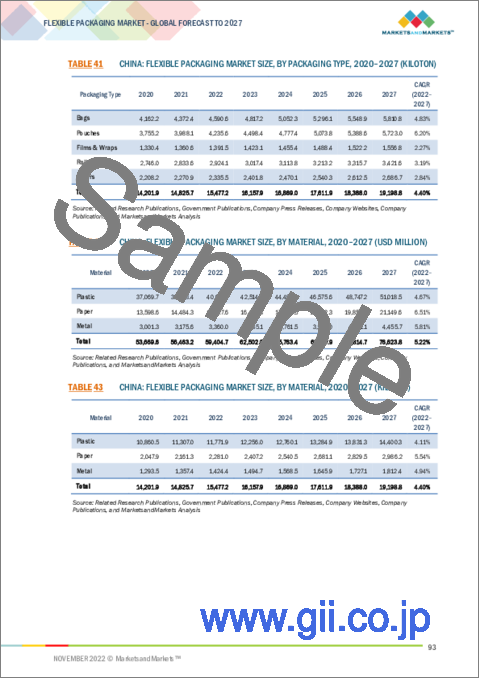

- 11.2.1 CHINA

- 11.2.1.1 Increasing demand for consumer goods to drive market

- TABLE 40 CHINA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 41 CHINA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 42 CHINA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 43 CHINA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 44 CHINA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 45 CHINA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.2.2 JAPAN

- 11.2.2.1 Increasing disposable income and rising urbanization to drive market

- TABLE 46 JAPAN: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 47 JAPAN: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 48 JAPAN: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 49 JAPAN: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 50 JAPAN: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 51 JAPAN: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.2.3 INDIA

- 11.2.3.1 High demand from organized retail and e-commerce sectors

- TABLE 52 INDIA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 53 INDIA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 54 INDIA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 55 INDIA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 56 INDIA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 57 INDIA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Rising demand for ready-to-eat and processed food

- TABLE 58 SOUTH KOREA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 59 SOUTH KOREA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 60 SOUTH KOREA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 61 SOUTH KOREA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 62 SOUTH KOREA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 63 SOUTH KOREA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.2.5 REST OF ASIA PACIFIC

- TABLE 64 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 65 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 66 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 67 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 68 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 69 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.3 NORTH AMERICA

- TABLE 70 NORTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 72 NORTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 73 NORTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 74 NORTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 75 NORTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 76 NORTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 77 NORTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 78 NORTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 79 NORTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (KILOTON)

- 11.3.1 US

- 11.3.1.1 Leading market in North America

- TABLE 80 US: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 81 US: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 82 US: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 83 US: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 84 US: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 85 US: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.3.2 CANADA

- 11.3.2.1 Rising demand from food & beverage and home & personal care industries to drive market

- TABLE 86 CANADA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 87 CANADA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 88 CANADA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 89 CANADA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 90 CANADA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 91 CANADA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.3.3 MEXICO

- 11.3.3.1 Rising investments in consumer-packaged goods (CPGs) companies to boost market

- TABLE 92 MEXICO: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 93 MEXICO: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 94 MEXICO: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 95 MEXICO: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 96 MEXICO: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 97 MEXICO: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.4 EUROPE

- TABLE 98 EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 99 EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 100 EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 101 EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 102 EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 103 EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 104 EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 105 EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 106 EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 107 EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (KILOTON)

- 11.4.1 GERMANY

- 11.4.1.1 Market growth due to high demand for pharmaceutical packaging

- TABLE 108 GERMANY: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 109 GERMANY: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 110 GERMANY: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 111 GERMANY: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 112 GERMANY: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 113 GERMANY: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.4.2 UK

- 11.4.2.1 Growth of healthcare industry to offer lucrative opportunities

- TABLE 114 UK: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 115 UK: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 116 UK: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 117 UK: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 118 UK: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 119 UK: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.4.3 FRANCE

- 11.4.3.1 Growing pharmaceutical industry to boost market

- TABLE 120 FRANCE: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 121 FRANCE: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 122 FRANCE: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 123 FRANCE: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 124 FRANCE: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 125 FRANCE: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.4.4 RUSSIA

- 11.4.4.1 Rising demand from various end-use industries to drive market

- TABLE 126 RUSSIA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 127 RUSSIA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 128 RUSSIA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 129 RUSSIA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 130 RUSSIA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 131 RUSSIA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.4.5 ITALY

- 11.4.5.1 Rising demand from retail, food, and healthcare industries to drive market

- TABLE 132 ITALY: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 133 ITALY: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 134 ITALY: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 135 ITALY: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 136 ITALY: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 137 ITALY: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.4.6 SPAIN

- 11.4.6.1 Increase in demand from retail, home & personal care, pharmaceutical, and food & beverage industries to drive market

- TABLE 138 SPAIN: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 139 SPAIN: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 140 SPAIN: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 141 SPAIN: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 142 SPAIN: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 143 SPAIN: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.4.7 REST OF EUROPE

- TABLE 144 REST OF EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 145 REST OF EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 146 REST OF EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 147 REST OF EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 148 REST OF EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 149 REST OF EUROPE: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.5 MIDDLE EAST

- TABLE 150 MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 151 MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 152 MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 153 MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 154 MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 155 MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 156 MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 157 MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 158 MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 159 MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (KILOTON)

- 11.5.1 SAUDI ARABIA

- 11.5.1.1 Favorable trade agreements to support market growth

- TABLE 160 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 161 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 162 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 163 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 164 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 165 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.5.2 UAE

- 11.5.2.1 Growing packaged food consumption to propel market

- TABLE 166 UAE: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 167 UAE: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 168 UAE: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 169 UAE: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 170 UAE: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 171 UAE: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.5.3 REST OF MIDDLE EAST

- TABLE 172 REST OF MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 173 REST OF MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 174 REST OF MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 175 REST OF MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- TABLE 176 REST OF MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 11.6 AFRICA

- TABLE 178 AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 179 AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 180 AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 181 AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 182 AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 183 AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 184 AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 185 AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (KILOTON)

- TABLE 186 AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 187 AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- 11.6.1 SOUTH AFRICA

- 11.6.1.1 Beverage industry to drive market

- TABLE 188 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 189 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 190 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 191 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 192 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 193 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- 11.6.2 NIGERIA

- 11.6.2.1 Food processing industry to drive market

- TABLE 194 NIGERIA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 195 NIGERIA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 196 NIGERIA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 197 NIGERIA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 198 NIGERIA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 199 NIGERIA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- 11.6.3 KENYA

- 11.6.3.1 Increasing demand for food to drive market

- TABLE 200 KENYA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 201 KENYA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 202 KENYA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 203 KENYA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 204 KENYA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 205 KENYA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- 11.6.4 MOROCCO

- 11.6.4.1 Market driven by food processing industry

- TABLE 206 MOROCCO: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 207 MOROCCO: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 208 MOROCCO: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 209 MOROCCO: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 210 MOROCCO: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 211 MOROCCO: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- 11.6.5 EGYPT

- 11.6.5.1 Growth of food processing industry to drive market

- TABLE 212 EGYPT: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 213 EGYPT: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 214 EGYPT: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 215 EGYPT: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 216 EGYPT: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 217 EGYPT: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- 11.6.6 REST OF AFRICA

- TABLE 218 REST OF AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 219 REST OF AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 220 REST OF AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 221 REST OF AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 222 REST OF AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 223 REST OF AFRICA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- 11.7 SOUTH AMERICA

- TABLE 224 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 225 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 226 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 227 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 228 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 229 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 230 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 231 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2020-2027 (KILOTON)

- TABLE 232 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 233 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- 11.7.1 BRAZIL

- 11.7.1.1 Dominating market in region

- TABLE 234 BRAZIL: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 235 BRAZIL: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 236 BRAZIL: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 237 BRAZIL: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 238 BRAZIL: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 239 BRAZIL: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- 11.7.2 ARGENTINA

- 11.7.2.1 Rising demand for food packaging to drive market

- TABLE 240 ARGENTINA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 241 ARGENTINA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 242 ARGENTINA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 243 ARGENTINA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 244 ARGENTINA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 245 ARGENTINA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

- 11.7.3 REST OF SOUTH AMERICA

- TABLE 246 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (USD MILLION)

- TABLE 247 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2020-2027 (KILOTON)

- TABLE 248 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 249 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 250 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 251 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL, 2020-2027 (KILOTON)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- FIGURE 31 COMPANIES ADOPTED NEW PRODUCT LAUNCHES AS KEY GROWTH STRATEGY BETWEEN 2019 AND 2022

- 12.2 MARKET SHARE ANALYSIS

- FIGURE 32 FLEXIBLE PACKAGING MARKET: MARKET SHARE ANALYSIS

- 12.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 33 REVENUE ANALYSIS FOR KEY COMPANIES IN FLEXIBLE PACKAGING MARKET

- 12.4 COMPANY EVALUATION QUADRANT

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PARTICIPANTS

- 12.4.4 PERVASIVE COMPANIES

- FIGURE 34 COMPETITIVE LEADERSHIP MAPPING: FLEXIBLE PACKAGING MARKET, 2021

- 12.5 SME MATRIX, 2021

- 12.5.1 PROGRESSIVE COMPANIES

- 12.5.2 RESPONSIVE COMPANIES

- 12.5.3 DYNAMIC COMPANIES

- 12.5.4 STARTING BLOCKS

- FIGURE 35 SME MATRIX: FLEXIBLE PACKAGING MARKET, 2021

- 12.6 COMPETITIVE SCENARIO

- 12.6.1 STRATEGIC DEVELOPMENTS

- TABLE 252 STRATEGIC DEVELOPMENTS, 2018-2022

- 12.6.2 PRODUCT LAUNCHES

- TABLE 253 PRODUCT LAUNCHES, 2018-2022

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, Deals, Product launches, Others, MnM view, Right to win, Strategic overview, Weaknesses and competitive threats) **

- 13.1.1 WESTROCK COMPANY

- TABLE 254 WESTROCK COMPANY: COMPANY OVERVIEW

- FIGURE 36 WESTROCK COMPANY: COMPANY SNAPSHOT

- 13.1.2 BERRY GLOBAL GROUP, INC.

- TABLE 255 BERRY GLOBAL GROUP, INC.: COMPANY OVERVIEW

- FIGURE 37 BERRY GLOBAL GROUP, INC.: COMPANY SNAPSHOT

- 13.1.3 AMCOR LIMITED

- TABLE 256 AMCOR LIMITED: COMPANY OVERVIEW

- FIGURE 38 AMCOR LIMITED: COMPANY SNAPSHOT

- 13.1.4 MONDI GROUP

- TABLE 257 MONDI GROUP: COMPANY OVERVIEW

- FIGURE 39 MONDI GROUP: COMPANY SNAPSHOT

- 13.1.5 SONOCO PRODUCTS COMPANY

- TABLE 258 SONOCO PRODUCTS COMPANY: COMPANY OVERVIEW

- FIGURE 40 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

- 13.1.6 HUHTAMAKI OYJ

- TABLE 259 HUHTAMAKI OYJ: COMPANY OVERVIEW

- FIGURE 41 HUHTAMAKI OYJ: COMPANY SNAPSHOT

- 13.1.7 CONSTANTIA FLEXIBLES

- TABLE 260 CONSTANTIA FLEXIBLES: COMPANY OVERVIEW

- FIGURE 42 CONSTANTIA FLEXIBLES: COMPANY SNAPSHOT

- 13.1.8 SEALED AIR CORPORATION

- TABLE 261 SEALED AIR CORPORATION: COMPANY OVERVIEW

- FIGURE 43 SEALED AIR CORPORATION: COMPANY SNAPSHOT

- 13.1.9 TRANSCONTINENTAL INC.

- TABLE 262 TRANSCONTINENTAL INC.: COMPANY OVERVIEW

- FIGURE 44 TRANSCONTINENTAL INC: COMPANY SNAPSHOT

- 13.1.10 DS SMITH

- TABLE 263 DS SMITH: COMPANY OVERVIEW

- FIGURE 45 DS SMITH: COMPANY SNAPSHOT

- 13.2 OTHER PLAYERS

- 13.2.1 NOVOLEX-CARLYLE GROUP

- TABLE 264 NOVOLEX-CARLYLE GROUP: COMPANY OVERVIEW

- 13.2.2 BISCHOF + KLEIN SE & CO. KG

- TABLE 265 BISCHOF + KLEIN SE & CO. KG: COMPANY OVERVIEW

- 13.2.3 UFLEX LIMITED

- TABLE 266 UFLEX LIMITED: COMPANY OVERVIEW

- 13.2.4 SILAFRICA

- TABLE 267 SILAFRICA: COMPANY OVERVIEW

- 13.2.5 PROAMPAC

- TABLE 268 PROAMPAC: COMPANY OVERVIEW

- 13.2.6 ALUFLEXPACK AG

- TABLE 269 ALUFLEXPACK AG: COMPANY OVERVIEW

- 13.2.7 PPC FLEXIBLE PACKAGING LLC.

- TABLE 270 PPC FLEXIBLE PACKAGING LLC.: COMPANY OVERVIEW

- 13.2.8 PRINTPACK, INC.

- TABLE 271 PRINTPACK, INC.: COMPANY OVERVIEW

- 13.2.9 NOVUS HOLDINGS LTD.

- TABLE 272 NOVUS HOLDINGS LTD.: COMPANY OVERVIEW

- 13.2.10 AHLSTROM

- TABLE 273 AHLSTROM: COMPANY OVERVIEW

- 13.2.11 COSMO FILMS LIMITED

- TABLE 274 COSMO FILMS LIMITED: COMPANY OVERVIEW

- 13.2.12 LINEAR PLASTICS AND PACKAGING.

- TABLE 275 LINEAR PLASTICS AND PACKAGING: COMPANY OVERVIEW

- 13.2.13 WIHURI GROUP

- TABLE 276 WIHURI GROUP: COMPANY OVERVIEW

- 13.2.14 GUALA PACK S.P.A.

- TABLE 277 GUALA PACK S.P.A.: COMPANY OVERVIEW

- 13.2.15 C-P FLEXIBLE PACKAGING

- TABLE 278 C-P FLEXIBLE PACKAGING: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, Deals, Product launches, Others, MnM view, Right to win, Strategic overview, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS