|

|

市場調査レポート

商品コード

1158992

産業用ヘンプの世界市場:種類別 (ヘンプシード、ヘンプシードオイル、CBDヘンプオイル、ヘンプバスト、ヘンプハード)・原料別 (従来型、オーガニック)・用途別 (食品・飲料、医薬品、繊維、パーソナルケア用品)・地域別の将来予測 (2027年まで)Industrial Hemp Market by Type (Hemp Seed, Hemp Seed Oil, CBD Hemp Oil, Hemp Bast, Hemp Hurd), Source (Conventional, Organic), Application (Food & Beverages Pharmaceuticals, Textiles, Personal Care Products) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 産業用ヘンプの世界市場:種類別 (ヘンプシード、ヘンプシードオイル、CBDヘンプオイル、ヘンプバスト、ヘンプハード)・原料別 (従来型、オーガニック)・用途別 (食品・飲料、医薬品、繊維、パーソナルケア用品)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年11月18日

発行: MarketsandMarkets

ページ情報: 英文 267 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の産業用ヘンプの市場規模は、2022年に68億米ドル、2027年には181億米ドルに達すると予測されており、また21.6%のCAGR (金額ベース) で成長する見通しです。

市場の主な促進要因の1つは、さまざまな国でヘンプ栽培が合法化されたことです。さらに、ヘンプの栄養価の高さや健康への効果に対する認識が高まっていることも、その栽培をさらに後押しすると予想されます。麻の実や麻のオイルに多く含まれる必須脂肪酸は、多くの一般的な病気の予防に役立つことから、食品・飲料や医薬品、パーソナルケア用品への利用が増加しています。

"用途別では、動物栄養での産業用ヘンプの利用が増加し、市場成長を牽引している"

ヘンプミールは繊維、脂肪、タンパク質を多く含むため、畜産用の飼料として期待されており、多くの家畜の飼料において大豆ミールの代替となる可能性があります。また、必須脂肪酸の豊富なヘンプオイルは動物用飼料のサプリメントとして、ヘンプシードとヘンプシードケーキは動物用飼料の脂肪源とタンパク質源として使用することができます。

"種類別では、ヘンプバストの人気拡大が産業用ヘンプ市場の成長を牽引"

ヘンプバストは、強度、耐久性、抗菌・抗カビ性などの優れた特性を持っています。ヘンプ繊維を使った伝統的な織物には、帆布やヘンプデニムなどがあります。また、海水にさらされても腐ったり劣化したりしない丈夫なロープや麻ひも、コードに使用することができます。さらに、ヘンプバストは優れた強度対重量比を持ち、自動車・航空機・ブーツ・建築構造物向け複合パネルの改良に使用されています。

"予測期間中、欧州地域が最も高いCAGRで成長する"

欧州地域は今後、地域別で最も高い成長を遂げると予想されています。域内でヘンプの栽培面積が近年大幅に増加しており、2015年の19.970ha、から2019年には34,960haに75%増加しています。

当レポートでは、世界の産業用ヘンプの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・原料別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 生産シナリオ:ヘンプ生産の拡大

- 高齢者人口の増加

- 市場力学

第6章 産業動向

- イントロダクション

- バリューチェーン分析

- サプライチェーン分析

- マーケットマッピングとエコシステム

- 需要サイド企業

- 供給サイド企業

- エコシステムマップ

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- ナノカプセル化

- クロップステアリング

- ドローン農業

- IoTオートメーション

- 価格分析

- 産業用ヘンプ市場:特許分析

- 貿易分析

- 輸出シナリオ

- 輸入シナリオ

- ケーススタディ:産業用ヘンプ市場

- 主な会議とイベント (2022年~2023年)

- 関税と規制の状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

第7章 産業用ヘンプ市場:種類別

- イントロダクション

- ヘンプシード (大麻種子)

- ヘンプシードオイル

- CBDヘンプオイル

- ヘンプバスト (靭皮繊維)

- ヘンプハード (苧殻)

第8章 産業用ヘンプ市場:原料別

- イントロダクション

- 従来型

- オーガニック

第9章 産業用ヘンプ市場:用途別

- イントロダクション

- 食品・飲料

- テキスタイル

- 医薬品

- パーソナルケア用品

- 動物栄養

- 製紙

- 建設資材

- その他

第10章 産業用ヘンプ市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- オランダ

- 他の欧州諸国

- アジア太平洋

- 中国

- オーストラリア・ニュージーランド

- 日本

- インド

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 南米

- 中東

- アフリカ

第11章 競合情勢

- 概要

- 市場シェア分析

- 主要企業の収益分析:セグメント別

- 主要企業が採用した戦略

- 企業評価クアドラント(主要企業)

- 産業用ヘンプ市場:スタートアップ/中小企業の評価クアドラント

- 競合シナリオ

- 製品の発売

- 資本取引

第12章 企業プロファイル

- 主要企業

- MARIJUANA COMPANY OF AMERICA, INC.

- CRONOS GROUP INC.

- ECOFIBRE LIMITED

- GREEN THUMB INDUSTRIES

- CURALEAF HOLDINGS INC.

- GENCANNA

- HEMPFLAX BV

- KONOPLEX GROUP

- HEMP OIL CANADA

- BAFA

- DUN AGRO HEMP GROUP

- COLORADO HEMP WORKS

- CANAH INTERNATIONAL

- SOUTH HEMP TECNO

- MH MEDICAL HEMP GMBH

- スタートアップ/中小企業

- HEMPOLAND

- BOMBAY HEMP COMPANY PRIVATE LIMITED

- PARKLAND INDUSTRIAL HEMP GROWERS CO-OP. LTD.

- HEMPMEDS BRASIL

- IND HEMP

- BLUE SKY HEMP VENTURES LIMITED

- MINNESOTA HEMP FARMS

- EAST MESA INC.

- AMERICAN HEMP

- VALLEY BIO LTD.

第13章 隣接・関連市場

- イントロダクション

- 制限事項

- ヘンプ市場

- ヘンプ検査市場

第14章 付録

According to MarketsandMarkets, the global industrial hemp market size is estimated to be valued at USD 6.8 billion in 2022 and is projected to reach USD 18.1 billion by 2027, recording a CAGR of 21.6% in terms of value.

Industrial hemp is defined as the plant Cannabis sativa L. and any part of such plant, whether growing or not, with a delta-9-tetrahydrocannabinol (THC) concentration of not more than 0.3% on a dry weight basis. As industrial hemp contains less than 0.3% tetrahydrocannabinol (THC), it has a wide range of applications in the textile, food, and beverage, construction, animal care, personal care, pharmaceutical, paint, lubricant, bioplastic, and biofuel industries. One of the major drivers of the global industrial hemp market is the legalization of hemp cultivation in various countries.

Furthermore, growing awareness of hemp's nutrient-rich profile and its benefits to human health is expected to boost hemp cultivation even more. The high content of essential fatty acids in hemp seed and oil aids in the prevention of many common ailments, leading to its increased use in food and beverages, pharmaceuticals, and personal care products.

"By application, there is an increased use of industrial hemp in animal nutrition, driving the growth of the industrial hemp market"

Hemp production produces byproducts, one of which is hemp meal. Because of its high fiber, fat, and protein content, hemp meal is a potential feedstuff for animal agriculture and a possible substitute for soybean meal in many livestock diets. Furthermore, hemp products face regulatory hurdles before they can be legally incorporated into livestock feedstuffs, due to concerns that tetrahydrocannabinol (THC), found in hemp biomass, could be transferred to animal products intended for human consumption. Hempseed and hempseed cakes could be used as feed materials for all animal species, according to the scientific opinion of the European Food Safety Authority (EFSA) Panel on Additives and Products or Substances Used in Animal Feed, with species-specific differences in the rate of inclusion in the diet. Hemp oil, as a rich source of essential fatty acids, can be used as a supplement in animal feed, while hemp seeds and hempseed cakes can be used as a fat and protein source in animal diets.

"By type, increase in the popularity of hemp bast drives the growth of industrial hemp market"

Hemp bast fibers are cellulosic fibers found in the phloem of bast fiber crops such as industrial hemp which are natural fibers derived from plants. The main components of hemp bast fibers are cellulose (53-91%), hemicellulose (4-18%), lignin (1-21%), and pectin (1-17%). The benefits of bast fibers include lighter product weight, lower energy consumption, and a smaller environmental footprint. Bast fibers can be spun and woven and are thus widely used in the textile industry. Furthermore, bast fibers are far stronger than cotton and do not mildew. Hemp bast fibers have exceptional properties such as strength, durability, and anti-bacterial and anti-fungal properties. Traditional textiles made from hemp fibers include sailcloth and hemp denim. These materials are durable, adaptable, and breathable. The fibers can be used to make strong ropes, twines, and cords that will not rot or degrade even when exposed to salt water. The bast fibers have an excellent strength-to-weight ratio and are used to improve composite panels, which are commonly found in vehicles, aircraft, boots, and ever-changing building structures.

"The European region is projected to grow at the highest CAGR during the forecast period"

In the forecasted period, the European region will be the fastest growing. The area dedicated to hemp cultivation in the EU has increased significantly in recent years, rising 75% from 19.970 ha in 2015 to 34,960 ha in 2019. France has the largest agricultural area dedicated to hemp cultivation in the EU, with nearly 18,000 hectares, followed by Italy, the Netherlands, and Estonia. Simultaneously, hen production increased by 62.4%, from 103,750 tons to 168,455 tons. France produces the most, accounting for more than 70% of EU output, followed by the Netherlands (10%) and Austria (4%). In Europe, hemp fibers are primarily used for specialty pulp and paper, with applications ranging from cigarette paper to Bible paper, bank notes, and technical filters. However, with the European Commission's increased R&D support and funding, new applications of hemp fibers in automotive and construction materials have emerged. The increased consumption of hemp seeds as food, as well as their widespread use in other food products such as smoothies, yogurt, cereals, and bars, particularly in countries such as Germany and the Netherlands, is expected to drive hemp growth in this region.

The break-up of Primaries:

By Value Chain Side: Demand Side-41%, Supply Side-59%

By Designation: CXOs-31%, Managers - 24%, D-Level- 30%, and Executives- 45%

By Region: Europe - 25%, Asia Pacific - 15%, North America - 45%, RoW - 5%, South America-10%

Leading players profiled in this report:

- Marijuana Company of America Inc. (US)

- Cronos Group Inc. (Canada)

- Ecofibre Limited (Australia)

- Green Thumb Industries (US)

- Curaleaf Holdings Inc. (US)

- GenCanna (US)

- HempFlax BV (Netherlands)

- Konoplex Group (Russia)

- Hemp Oil Canada (Canada)

- BAFA (Germany)

- Dun Agro Hemp Group (Netherlands)

- Colorado Hemp Works (US)

- Canah International (Romania)

- South Hemp Tecno (Italy)

- MH Medical Hemp GmbH (Germany)

Research Coverage:

The report segments the industrial hemp market on the basis of type, application, source, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global industrial hemp, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the industrial hemp market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights into the major countries/regions in which the industrial hemp market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017-2021

- 1.7 UNIT CONSIDERED

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 INDUSTRIAL HEMP MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 INDUSTRIAL HEMP MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

- FIGURE 5 INDUSTRIAL HEMP MARKET SIZE ESTIMATION (DEMAND SIDE)

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 INDUSTRIAL HEMP MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 INDUSTRIAL HEMP MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- TABLE 2 INDUSTRIAL HEMP MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 9 INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 INDUSTRIAL HEMP MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 INDUSTRIAL HEMP MARKET SIZE, BY SOURCE, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 INDUSTRIAL HEMP MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL HEMP MARKET

- FIGURE 13 LEGALIZATION OF HEMP CULTIVATION AND PROJECTED BOOST IN CONSUMPTION TO DRIVE MARKET

- 4.2 INDUSTRIAL HEMP MARKET: MAJOR REGIONAL SUBMARKETS

- FIGURE 14 CANADA PROJECTED TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

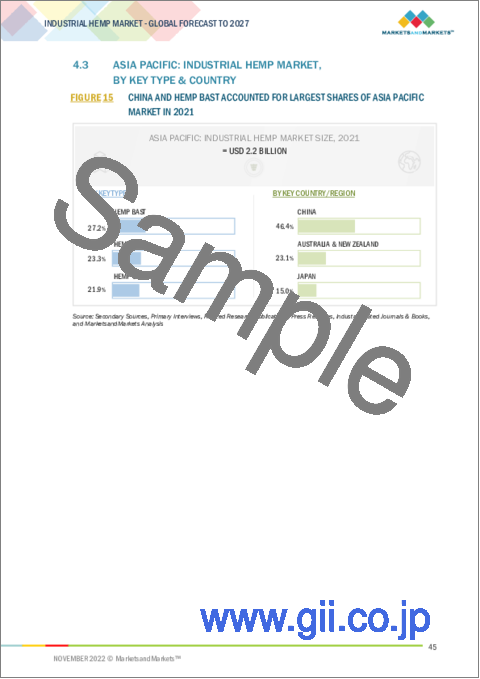

- 4.3 ASIA PACIFIC: INDUSTRIAL HEMP MARKET, BY KEY TYPE & COUNTRY

- FIGURE 15 CHINA AND HEMP BAST ACCOUNTED FOR LARGEST SHARES OF ASIA PACIFIC MARKET IN 2021

- 4.4 INDUSTRIAL HEMP MARKET, BY TYPE & REGION

- FIGURE 16 NORTH AMERICA PROJECTED TO DOMINATE INDUSTRIAL HEMP MARKET ACROSS HEMP SEED, HEMP SEED OIL, AND CBD HEMP OIL SEGMENTS

- 4.5 EUROPE: INDUSTRIAL HEMP MARKET, BY APPLICATION

- FIGURE 17 FOOD & BEVERAGES SEGMENT PROJECTED TO LEAD EUROPEAN MARKET DURING FORECAST PERIOD

- 4.6 INDUSTRIAL HEMP MARKET, BY SOURCE & REGION

- FIGURE 18 ASIA PACIFIC DOMINATED CONVENTIONAL SEGMENT IN 2021

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 PRODUCTION SCENARIO: INCREASING PRODUCTION OF HEMP

- FIGURE 19 EUROPEAN UNION LAND AREA USED FOR HEMP CULTIVATION, 2015-2019 (1,000 HECTARES)

- 5.2.2 INCREASE IN AGING POPULATION

- FIGURE 20 INCREASING POPULATION OF INDIVIDUALS AGED 60 AND ABOVE (2021-2021)

- 5.3 MARKET DYNAMICS

- FIGURE 21 INDUSTRIAL HEMP MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Increasing legalization of industrial hemp cultivation

- TABLE 3 US STATUTES AND PUBLIC ACTS ON INDUSTRIAL HEMP RESEARCH AND CULTIVATION

- 5.3.1.2 Growing use of hemp seed and hemp seed oil in food applications

- 5.3.1.3 Rising incidence of chronic diseases

- 5.3.2 RESTRAINTS

- 5.3.2.1 Complex regulatory structure for use of industrial hemp

- 5.3.2.2 Stigmatization of hemp market

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Development of new industrial hemp-based products

- 5.3.3.2 Increasing preference for edibles across generations

- 5.3.4 CHALLENGES

- 5.3.4.1 Unavailability of suitable seeds for cultivation of industrial hemp

- 5.3.4.2 Lack of processing facilities and planting & harvesting equipment

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.2.2 RAW MATERIAL SOURCING

- 6.2.3 PRODUCTION

- 6.2.4 PACKAGING, STORAGE, AND DISTRIBUTION

- 6.2.5 END USERS AND RETAIL

- FIGURE 22 INDUSTRIAL HEMP MARKET: VALUE CHAIN

- 6.3 SUPPLY CHAIN ANALYSIS

- FIGURE 23 INDUSTRIAL HEMP MARKET: SUPPLY CHAIN

- 6.4 MARKET MAPPING AND ECOSYSTEM

- 6.4.1 DEMAND-SIDE COMPANIES

- 6.4.2 SUPPLY-SIDE COMPANIES

- FIGURE 24 INDUSTRIAL HEMP MARKET: ECOSYSTEM MAP

- 6.4.3 ECOSYSTEM MAP

- TABLE 4 INDUSTRIAL HEMP MARKET: ECOSYSTEM

- 6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN INDUSTRIAL HEMP MARKET

- FIGURE 25 REVENUE SHIFT IMPACTING INDUSTRIAL HEMP MARKET

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 NANOENCAPSULATION

- 6.6.2 CROP STEERING

- 6.6.3 DRONE FARMING

- 6.6.4 IOT AUTOMATION

- 6.7 PRICING ANALYSIS

- 6.7.1 AVERAGE SELLING PRICE, BY PRODUCT TYPE (KEY PLAYERS)

- FIGURE 26 SELLING PRICES OF KEY PLAYERS, BY HEMP PRODUCT TYPE

- TABLE 5 SELLING PRICES OF KEY PLAYERS, BY PRODUCT TYPE

- FIGURE 27 AVERAGE SELLING PRICE IN KEY REGIONS, BY PRODUCT TYPE, 2018-2021 (USD/KG)

- TABLE 6 HEMP SEED: AVERAGE SELLING PRICE, BY REGION, 2018-2021 (USD/KG)

- TABLE 7 HEMP SEED OIL: AVERAGE SELLING PRICE, BY REGION, 2018-2021 (USD/KG)

- TABLE 8 CBD HEMP OIL: AVERAGE SELLING PRICE, BY REGION, 2018-2021 (USD/KG)

- TABLE 9 HEMP BAST: AVERAGE SELLING PRICE, BY REGION, 2018-2021 (USD/KG)

- TABLE 10 HEMP HURD: AVERAGE SELLING PRICE, BY REGION, 2018-2021 (USD/KG)

- 6.8 INDUSTRIAL HEMP MARKET: PATENT ANALYSIS

- FIGURE 28 NUMBER OF PATENTS GRANTED FOR INDUSTRIAL HEMP MARKET, 2011-2021

- FIGURE 29 TOP PATENT APPLICANTS FOR INDUSTRIAL HEMP MARKET, 2019-2022

- FIGURE 30 REGIONAL ANALYSIS OF PATENTS GRANTED FOR INDUSTRIAL HEMP MARKET, 2019-2022

- 6.8.1 MAJOR PATENTS

- TABLE 11 PATENTS IN INDUSTRIAL HEMP MARKET, 2019-2022

- 6.9 TRADE ANALYSIS

- 6.9.1 EXPORT SCENARIO

- FIGURE 31 HEMP EXPORT, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

- 6.9.2 IMPORT SCENARIO

- FIGURE 32 HEMP IMPORT, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

- TABLE 13 IMPORT DATA FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

- 6.10 CASE STUDIES: INDUSTRIAL HEMP MARKET

- 6.10.1 CANVALOOP FIBRE: PROVISION OF ECO-FRIENDLY HEMP

- 6.10.2 ONYX AGRONOMICS: USE OF PRECISION CANNABIS FACILITY

- 6.11 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 14 KEY CONFERENCES AND EVENTS

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.2 REGULATORY FRAMEWORK

- 6.12.2.1 North America

- 6.12.2.1.1 US

- 6.12.2.1.2 Canada

- 6.12.2.2 Europe

- 6.12.2.2.1 Germany

- 6.12.2.2.2 Italy

- 6.12.2.2.3 Denmark

- 6.12.2.2.4 Malta

- 6.12.2.2.5 Netherlands

- 6.12.2.2.6 France

- 6.12.2.2.7 Switzerland

- 6.12.2.2.8 UK

- 6.12.2.2.9 Belgium

- 6.12.2.2.10 Poland

- 6.12.2.2.11 Czech Republic

- 6.12.2.2.12 Spain

- 6.12.2.2.13 Austria

- 6.12.2.2.14 Norway

- 6.12.2.2.15 Finland

- 6.12.2.2.16 Croatia

- 6.12.2.3 Asia Pacific

- 6.12.2.3.1 China

- 6.12.2.3.2 India

- 6.12.2.3.3 Japan

- 6.12.2.3.4 New Zealand

- 6.12.2.3.5 Australia

- 6.12.2.3.6 Thailand

- 6.12.2.3.7 South Korea

- 6.12.2.3.8 Malaysia

- 6.12.2.4 Rest of the World

- 6.12.2.4.1 Chile

- 6.12.2.4.2 Colombia

- 6.12.2.4.3 Uruguay

- 6.12.2.4.4 South Africa

- 6.12.2.1 North America

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 19 INDUSTRIAL HEMP MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 DEGREE OF COMPETITION

- 6.13.2 BARGAINING POWER OF SUPPLIERS

- 6.13.3 BARGAINING POWER OF BUYERS

- 6.13.4 THREAT OF SUBSTITUTES

- 6.13.5 THREAT OF NEW ENTRANTS

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

- 6.14.2 BUYING CRITERIA

- FIGURE 34 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- TABLE 21 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

7 INDUSTRIAL HEMP MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 35 INDUSTRIAL HEMP MARKET SHARE, BY TYPE, 2022 VS. 2027 (BY VALUE)

- TABLE 22 INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 23 INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 24 INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (KT)

- TABLE 25 INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (KT)

- 7.2 HEMP SEED

- 7.2.1 HIGH NUTRIENT PROFILE EXPECTED TO DRIVE DEMAND IN FOOD INDUSTRY

- TABLE 26 HEMP SEED MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 27 HEMP SEED MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 28 HEMP SEED MARKET SIZE, BY REGION, 2018-2021 (KT)

- TABLE 29 HEMP SEED MARKET SIZE, BY REGION, 2022-2027 (KT)

- 7.3 HEMP SEED OIL

- 7.3.1 SUITABLE FOR USE IN PHARMACEUTICALS AND OTHER INDUSTRIES

- TABLE 30 HEMP SEED OIL MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 31 HEMP SEED OIL MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 32 HEMP SEED OIL MARKET SIZE, BY REGION, 2018-2021 (KT)

- TABLE 33 HEMP SEED OIL MARKET SIZE, BY REGION, 2022-2027 (KT)

- 7.4 CBD HEMP OIL

- 7.4.1 GROWING APPLICATION IN PERSONAL CARE AND FOOD & BEVERAGE PRODUCTS TO DRIVE MARKET

- TABLE 34 CBD HEMP OIL MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 CBD HEMP OIL MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 36 CBD HEMP OIL MARKET SIZE, BY REGION, 2018-2021 (KT)

- TABLE 37 CBD HEMP OIL MARKET SIZE, BY REGION, 2022-2027 (KT)

- 7.5 HEMP BAST

- 7.5.1 IDEAL FOR PRODUCTION OF BIOPLASTICS AND CONSTRUCTION MATERIAL DUE TO EXCEPTIONAL STRENGTH-TO-WEIGHT RATIO

- TABLE 38 HEMP BAST MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 39 HEMP BAST MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 40 HEMP BAST MARKET SIZE, BY REGION, 2018-2021 (KT)

- TABLE 41 HEMP BAST MARKET SIZE, BY REGION, 2022-2027 (KT)

- 7.6 HEMP HURD

- 7.6.1 VERSATILITY ACROSS APPLICATIONS TO DRIVE DEMAND

- TABLE 42 HEMP HURD MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 43 HEMP HURD MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 44 HEMP HURD MARKET SIZE, BY REGION, 2018-2021 (KT)

- TABLE 45 HEMP HURD MARKET SIZE, BY REGION, 2022-2027 (KT)

8 INDUSTRIAL HEMP MARKET, BY SOURCE

- 8.1 INTRODUCTION

- FIGURE 36 INDUSTRIAL HEMP MARKET SHARE, BY SOURCE, 2022 VS. 2027(BY VALUE)

- TABLE 46 INDUSTRIAL HEMP MARKET SIZE, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 47 INDUSTRIAL HEMP MARKET SIZE, BY SOURCE, 2022-2027 (USD MILLION)

- 8.2 CONVENTIONAL

- 8.2.1 LOW PRICE OF CONVENTIONAL HEMP SEEDS TO DRIVE MARKET

- TABLE 48 CONVENTIONAL INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 49 CONVENTIONAL INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 8.3 ORGANIC

- 8.3.1 INCREASING DEMAND FOR ORGANIC HEMP PRODUCTS IN FOOD AND PHARMACEUTICALS INDUSTRIES

- TABLE 50 ORGANIC INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 51 ORGANIC INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

9 INDUSTRIAL HEMP MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 37 INDUSTRIAL HEMP MARKET SHARE, BY APPLICATION, 2022 VS. 2027 (BY VALUE)

- TABLE 52 INDUSTRIAL HEMP MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 53 INDUSTRIAL HEMP MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2 FOOD & BEVERAGES

- 9.2.1 WIDE-RANGING APPLICATIONS OF HEMP SEED AND HEMP SEED DERIVATIVES TO DRIVE MARKET

- TABLE 54 FOOD & BEVERAGES: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 55 FOOD & BEVERAGES: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 9.3 TEXTILES

- 9.3.1 DIVERSE BENEFITS OF HEMP FIBER TO DRIVE DEMAND

- TABLE 56 TEXTILES: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 57 TEXTILES: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 9.4 PHARMACEUTICALS

- 9.4.1 GROWING RESEARCH ON EFFICACY OF HEMP TO TREAT VARIOUS DISEASES TO DRIVE DEMAND

- TABLE 58 PHARMACEUTICALS: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 59 PHARMACEUTICALS: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 9.5 PERSONAL CARE PRODUCTS

- 9.5.1 MOISTURIZING AND ANTI-AGING PROPERTIES OF HEMP TO DRIVE DEMAND

- TABLE 60 PERSONAL CARE PRODUCTS: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 61 PERSONAL CARE PRODUCTS: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 9.6 ANIMAL NUTRITION

- 9.6.1 REGULATORY HURDLES FOR INCLUSION OF HEMP IN ANIMAL FEED TO RESTRICT DEMAND

- TABLE 62 ANIMAL NUTRITION: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 63 ANIMAL NUTRITION: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 9.7 PAPER

- 9.7.1 PREFERENCE FOR ECO-FRIENDLY HEMP IN PAPER PRODUCTION TO DRIVE DEMAND

- TABLE 64 PAPER: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 65 PAPER: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 9.8 CONSTRUCTION MATERIALS

- 9.8.1 GROWING DEMAND FOR HEMP DUE TO ITS STRENGTH AND THERMAL INSULATION PROPERTIES TO BOOST DEMAND

- TABLE 66 CONSTRUCTION MATERIALS: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 67 CONSTRUCTION MATERIALS: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 9.9 OTHERS

- TABLE 68 OTHERS: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 69 OTHERS: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

10 INDUSTRIAL HEMP MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 38 INDUSTRIAL HEMP MARKET SHARE (BY VALUE), BY KEY COUNTRY, 2021

- TABLE 70 INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 71 INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 72 INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018-2021 (KT)

- TABLE 73 INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2022-2027 (KT)

- 10.2 NORTH AMERICA

- TABLE 74 NORTH AMERICA: INDUSTRIAL HEMP MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 75 NORTH AMERICA: INDUSTRIAL HEMP MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 76 NORTH AMERICA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 77 NORTH AMERICA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 78 NORTH AMERICA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (KT)

- TABLE 79 NORTH AMERICA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (KT)

- TABLE 80 NORTH AMERICA: INDUSTRIAL HEMP MARKET SIZE, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 81 NORTH AMERICA: INDUSTRIAL HEMP MARKET SIZE, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 82 NORTH AMERICA: INDUSTRIAL HEMP MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 83 NORTH AMERICA: INDUSTRIAL HEMP MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Positive market growth due to legalization of industrial hemp cultivation and production in several states

- TABLE 84 US: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 85 US: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 Increasing demand for hemp-derived products such as CBD concentrates to drive market

- TABLE 86 CANADA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 87 CANADA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.2.3 MEXICO

- 10.2.3.1 High market potential due to conducive conditions for hemp production

- TABLE 88 MEXICO: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 89 MEXICO: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.3 EUROPE

- FIGURE 39 EUROPE: INDUSTRIAL HEMP MARKET SNAPSHOT

- TABLE 90 EUROPE: INDUSTRIAL HEMP MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 91 EUROPE: INDUSTRIAL HEMP MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 92 EUROPE: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 93 EUROPE: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 94 EUROPE: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (KT)

- TABLE 95 EUROPE: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (KT)

- TABLE 96 EUROPE: INDUSTRIAL HEMP MARKET SIZE, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 97 EUROPE: INDUSTRIAL HEMP MARKET SIZE, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 98 EUROPE: INDUSTRIAL HEMP MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 99 EUROPE: INDUSTRIAL HEMP MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.3.1 GERMANY

- 10.3.1.1 Growing application in pharmaceuticals to drive market growth

- TABLE 100 GERMANY: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 101 GERMANY: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Rising demand for hemp-based food products to boost market

- TABLE 102 UK: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 103 UK: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Increasing R&D related to novel applications of hemp fiber to positively influence market

- TABLE 104 FRANCE: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 105 FRANCE: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.3.4 SPAIN

- 10.3.4.1 Investments and acquisitions by major global hemp corporations to drive market

- TABLE 106 SPAIN: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 107 SPAIN: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Increased processing of hemp seeds for human consumption to bolster market

- TABLE 108 ITALY: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 109 ITALY: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.3.6 NETHERLANDS

- 10.3.6.1 Growing applications of hemp in automobile and construction industries to drive market growth

- TABLE 110 NETHERLANDS: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 111 NETHERLANDS: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.3.7 REST OF EUROPE

- 10.3.7.1 Rising use of hemp in food and pharmaceutical products to drive market

- TABLE 112 REST OF EUROPE: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 113 REST OF EUROPE: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 40 ASIA PACIFIC: INDUSTRIAL HEMP MARKET SNAPSHOT

- TABLE 114 ASIA PACIFIC: INDUSTRIAL HEMP MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 115 ASIA PACIFIC: INDUSTRIAL HEMP MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 116 ASIA PACIFIC: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 117 ASIA PACIFIC: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 118 ASIA PACIFIC: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (KT)

- TABLE 119 ASIA PACIFIC: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (KT)

- TABLE 120 ASIA PACIFIC: INDUSTRIAL HEMP MARKET SIZE, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 121 ASIA PACIFIC: INDUSTRIAL HEMP MARKET SIZE, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 122 ASIA PACIFIC: INDUSTRIAL HEMP MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 123 ASIA PACIFIC: INDUSTRIAL HEMP MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Leading producer of hemp fiber and hemp seed due to relaxed regulations

- TABLE 124 CHINA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 125 CHINA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.4.2 AUSTRALIA & NEW ZEALAND

- 10.4.2.1 Increased R&D by food companies to introduce hemp-based products to propel market

- TABLE 126 AUSTRALIA & NEW ZEALAND: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 127 AUSTRALIA & NEW ZEALAND: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.4.3 JAPAN

- 10.4.3.1 Revised drug laws to create opportunities for hemp-based pharmaceuticals

- TABLE 128 JAPAN: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 129 JAPAN: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Increasing introduction of hemp-based products in food and pharmaceuticals industries to boost market

- TABLE 130 INDIA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 131 INDIA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.5.1 Growing inclination for hemp-derived CBD products to positively influence market

- TABLE 132 REST OF ASIA PACIFIC: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.5 REST OF THE WORLD (ROW)

- TABLE 134 ROW: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 135 ROW: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 136 ROW: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 137 ROW: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 138 ROW: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (KT)

- TABLE 139 ROW: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (KT)

- TABLE 140 ROW: INDUSTRIAL HEMP MARKET SIZE, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 141 ROW: INDUSTRIAL HEMP MARKET SIZE, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 142 ROW: INDUSTRIAL HEMP MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 143 ROW: INDUSTRIAL HEMP MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.5.1 SOUTH AMERICA

- 10.5.1.1 Government regulations in favor of hemp to contribute to market growth

- TABLE 144 SOUTH AMERICA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 145 SOUTH AMERICA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Rising application of hemp seed oil in personal care products to drive market

- TABLE 146 MIDDLE EAST: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 147 MIDDLE EAST: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 10.5.3 AFRICA

- 10.5.3.1 South African government support for cultivation of hemp crops to drive market growth

- TABLE 148 AFRICA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 149 AFRICA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS

- TABLE 150 INDUSTRIAL HEMP MARKET SHARE (COMPETITIVE)

- 11.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 41 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2018-2021 (USD MILLION)

- 11.4 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 11.5.1 STARS

- 11.5.2 PERVASIVE PLAYERS

- 11.5.3 EMERGING LEADERS

- 11.5.4 PARTICIPANTS

- FIGURE 42 INDUSTRIAL HEMP MARKET, COMPANY EVALUATION QUADRANT, 2022 (OVERALL MARKET)

- 11.5.5 PRODUCT FOOTPRINT

- TABLE 151 COMPANY PRODUCT SOURCE FOOTPRINT

- TABLE 152 COMPANY PRODUCT TYPE FOOTPRINT

- TABLE 153 COMPANY REGIONAL FOOTPRINT

- TABLE 154 OVERALL COMPANY FOOTPRINT

- 11.6 INDUSTRIAL HEMP MARKET, STARTUP/SME EVALUATION QUADRANT

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 STARTING BLOCKS

- 11.6.3 RESPONSIVE COMPANIES

- 11.6.4 DYNAMIC COMPANIES

- FIGURE 43 INDUSTRIAL HEMP MARKET, COMPANY EVALUATION QUADRANT, 2022 (STARTUP/SME)

- 11.6.5 COMPETITIVE BENCHMARKING

- TABLE 155 INDUSTRIAL HEMP MARKET: KEY STARTUPS/SMES

- TABLE 156 INDUSTRIAL HEMP MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES

- TABLE 157 INDUSTRIAL HEMP MARKET: PRODUCT LAUNCHES, JULY 2019-MARCH 2020

- 11.7.2 DEALS

- TABLE 158 INDUSTRIAL HEMP MARKET: DEALS, MARCH 2018-SEPTEMBER 2022

- TABLE 159 INDUSTRIAL HEMP MARKET: OTHERS, NOVEMBER 2018-JUNE 2022

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 12.1.1 MARIJUANA COMPANY OF AMERICA, INC.

- TABLE 160 MARIJUANA COMPANY OF AMERICA, INC.: BUSINESS OVERVIEW

- FIGURE 44 MARIJUANA COMPANY OF AMERICA, INC.: COMPANY SNAPSHOT

- TABLE 161 MARIJUANA COMPANY OF AMERICA, INC.: PRODUCTS OFFERED

- TABLE 162 MARIJUANA COMPANY OF AMERICA, INC.: PRODUCT LAUNCHES

- TABLE 163 MARIJUANA COMPANY OF AMERICA, INC.: DEALS

- TABLE 164 MARIJUANA COMPANY OF AMERICA, INC.: OTHERS

- 12.1.2 CRONOS GROUP INC.

- TABLE 165 CRONOS GROUP INC.: BUSINESS OVERVIEW

- FIGURE 45 CRONOS GROUP INC.: COMPANY SNAPSHOT

- TABLE 166 CRONOS GROUP INC.: PRODUCTS OFFERED

- TABLE 167 CRONOS GROUP INC.: DEALS

- TABLE 168 CRONOS GROUP INC.: OTHERS

- 12.1.3 ECOFIBRE LIMITED

- TABLE 169 ECOFIBRE LIMITED: BUSINESS OVERVIEW

- FIGURE 46 ECOFIBRE LIMITED: COMPANY SNAPSHOT

- TABLE 170 ECOFIBRE LIMITED: PRODUCTS OFFERED

- TABLE 171 ECOFIBRE LIMITED: OTHERS

- 12.1.4 GREEN THUMB INDUSTRIES

- TABLE 172 GREEN THUMB INDUSTRIES: BUSINESS OVERVIEW

- FIGURE 47 GREEN THUMB INDUSTRIES: COMPANY SNAPSHOT

- TABLE 173 GREEN THUMB INDUSTRIES: PRODUCTS OFFERED

- TABLE 174 GREEN THUMB INDUSTRIES: DEALS

- 12.1.5 CURALEAF HOLDINGS INC.

- TABLE 175 CURALEAF HOLDINGS INC.: BUSINESS OVERVIEW

- FIGURE 48 CURALEAF HOLDINGS INC.: COMPANY SNAPSHOT

- TABLE 176 CURALEAF HOLDINGS INC.: PRODUCTS OFFERED

- TABLE 177 CURALEAF HOLDINGS INC.: DEALS

- TABLE 178 CURALEAF HOLDINGS INC.: OTHERS

- 12.1.6 GENCANNA

- TABLE 179 GENCANNA: BUSINESS OVERVIEW

- TABLE 180 GENCANNA: PRODUCTS OFFERED

- TABLE 181 GENCANNA: DEALS

- 12.1.7 HEMPFLAX BV

- TABLE 182 HEMPFLAX BV: BUSINESS OVERVIEW

- TABLE 183 HEMPFLAX BV: PRODUCTS OFFERED

- TABLE 184 HEMPFLAX BV: DEALS

- TABLE 185 HEMPFLAX BV: OTHERS

- 12.1.8 KONOPLEX GROUP

- TABLE 186 KONOPLEX GROUP: BUSINESS OVERVIEW

- TABLE 187 KONOPLEX GROUP: PRODUCTS OFFERED

- 12.1.9 HEMP OIL CANADA

- TABLE 188 HEMP OIL CANADA: BUSINESS OVERVIEW

- TABLE 189 HEMP OIL CANADA: PRODUCTS OFFERED

- TABLE 190 HEMP OIL CANADA: DEALS

- 12.1.10 BAFA

- TABLE 191 BAFA: BUSINESS OVERVIEW

- TABLE 192 BAFA: PRODUCTS OFFERED

- 12.1.11 DUN AGRO HEMP GROUP

- TABLE 193 DUN AGRO HEMP GROUP: BUSINESS OVERVIEW

- TABLE 194 DUN AGRO HEMP GROUP: PRODUCTS OFFERED

- TABLE 195 DUN AGRO: OTHERS

- 12.1.12 COLORADO HEMP WORKS

- TABLE 196 COLORADO HEMP WORKS: BUSINESS OVERVIEW

- TABLE 197 COLORADO HEMP WORKS: PRODUCTS OFFERED

- 12.1.13 CANAH INTERNATIONAL

- TABLE 198 CANAH INTERNATIONAL: BUSINESS OVERVIEW, 2021

- TABLE 199 CANAH INTERNATIONAL: PRODUCTS OFFERED

- 12.1.14 SOUTH HEMP TECNO

- TABLE 200 SOUTH HEMP TECNO: BUSINESS OVERVIEW

- TABLE 201 SOUTH HEMP TECNO: PRODUCTS OFFERED

- 12.1.15 MH MEDICAL HEMP GMBH

- TABLE 202 MH MEDICAL HEMP GMBH: BUSINESS OVERVIEW

- TABLE 203 MH MEDICAL HEMP GMBH: PRODUCTS OFFERED

- 12.2 STARTUPS/SMES

- 12.2.1 HEMPOLAND

- TABLE 204 HEMPOLAND: BUSINESS OVERVIEW

- TABLE 205 HEMPOLAND: PRODUCTS OFFERED

- TABLE 206 HEMPOLAND: DEALS

- 12.2.2 BOMBAY HEMP COMPANY PRIVATE LIMITED

- TABLE 207 BOMBAY HEMP COMPANY PRIVATE LIMITED: BUSINESS OVERVIEW

- TABLE 208 BOMBAY HEMP COMPANY PRIVATE LIMITED: PRODUCTS OFFERED

- 12.2.3 PARKLAND INDUSTRIAL HEMP GROWERS CO-OP. LTD.

- TABLE 209 PARKLAND INDUSTRIAL HEMP GROWERS CO-OP. LTD.: BUSINESS OVERVIEW

- TABLE 210 PARKLAND INDUSTRIAL HEMP GROWERS CO-OP. LTD.: PRODUCTS OFFERED

- 12.2.4 HEMPMEDS BRASIL

- TABLE 211 HEMPMEDS BRASIL: BUSINESS OVERVIEW

- TABLE 212 HEMPMEDS BRASIL: PRODUCTS OFFERED

- TABLE 213 HEMPMEDS BRASIL.: PRODUCT LAUNCHES

- TABLE 214 HEMPMEDS BRASIL: DEALS

- TABLE 215 HEMPMEDS BRASIL: OTHERS

- 12.2.5 IND HEMP

- TABLE 216 IND HEMP: BUSINESS OVERVIEW

- TABLE 217 IND HEMP: PRODUCTS OFFERED

- TABLE 218 IND HEMP: DEALS

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 12.2.6 BLUE SKY HEMP VENTURES LIMITED

- 12.2.7 MINNESOTA HEMP FARMS

- 12.2.8 EAST MESA INC.

- 12.2.9 AMERICAN HEMP

- 12.2.10 VALLEY BIO LTD.

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 CANNABIS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.3 CANNABIS MARKET, BY TYPE

- TABLE 219 CANNABIS MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 220 CANNABIS MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 221 CANNABIS MARKET, BY PRODUCT TYPE, 2018-2021 (TONS)

- TABLE 222 CANNABIS MARKET, BY PRODUCT TYPE, 2022-2027 (TONS)

- 13.3.4 CANNABIS MARKET, BY APPLICATION

- TABLE 223 CANNABIS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 224 CANNABIS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.4 CANNABIS TESTING MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- 13.4.3 CANNABIS TESTING MARKET, BY PRODUCT & SOFTWARE

- TABLE 225 CANNABIS TESTING MARKET, BY PRODUCT & SOFTWARE, 2018-2025 (USD MILLION)

- 13.4.4 CANNABIS TESTING MARKET, BY SERVICES

- TABLE 226 CANNABIS TESTING MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS