|

|

市場調査レポート

商品コード

1148675

植物性レザーの世界市場:製品種類別 (パイナップルレザー、サボテンレザー、マッシュルームレザー、アップルレザー)・用途別 (ファッション (衣料品、アクセサリー、フットウェア)、自動車内装、家庭用)・地域別の将来予測 (2027年まで)Plant-Based Leather Market by Product Type (Pineapple Leather, Cactus Leather, Mushroom Leather, Apple Leather), Application (Fashion (Clothing, Accessories, and Footwear, Automotive Interior, Home) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 植物性レザーの世界市場:製品種類別 (パイナップルレザー、サボテンレザー、マッシュルームレザー、アップルレザー)・用途別 (ファッション (衣料品、アクセサリー、フットウェア)、自動車内装、家庭用)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年10月19日

発行: MarketsandMarkets

ページ情報: 英文 225 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の植物性レザーの市場規模は、2027年までに9,700万米ドルに達し、2022年から2027年にかけて7.5%のCAGRで成長すると予測されています。

動物愛護に関する懸念の高まりや、動物性皮革産業からの二酸化炭素排出量の増加により、顧客の行動が変化しています。現在、倫理的で環境に優しく、残酷ではない製品に対する需要が急増しているため、業界関係者は動物性皮革を植物性の代替品で代用するようになり、植物性レザー市場の拡大が所持ています。

"植物性レザーのファッション業界での高い需要"

植物性レザー市場の2021年の市場シェアは、ファッション分野が最も大きいです。国際的なブランドが、植物由来の皮革をコレクションに取り入れており、従来型の皮革から植物性レザーへと徐々に移行していくと予想されます。

"アジア太平洋:予測期間中の大幅な成長の見通し"

インドとバングラデシュの確立された皮革産業や豊富な原材料が、アジア太平洋の植物性レザー市場の成長を促進しています。植物性レザーは農業廃棄物のリサイクルによって生産されるため、年間何トンもの農業廃棄物を生産するアジア太平洋には、この産業が急成長する大きな機会があります。東南アジアのフィリピンは、パイナップルの最大生産国の一つであり、この地域でパイナップルレザー市場が拡大する大きな可能性を提供しています。アジア太平洋の植物性レザー市場は、多くの国内企業や多国籍企業が市場シェアを争っているため、競争が激しくなっています。

当レポートでは、世界の植物性レザー (植物由来皮革) の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、製品種類別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 産業動向

- イントロダクション

- 顧客のビジネスに影響を与えるトレンド

- 価格分析

- バリューチェーン

- 研究・製品開発

- 原料調達

- 生産・加工

- 認証/規制機関

- マーケティング・販売

- エコシステム/市場マップ

- 技術分析

- 関税と規制の状況

- 特許分析

- ポーターのファイブフォース分析

- 主な会議とイベント (2022年~2023年)

- 主な利害関係者と購入基準

- 購入基準

第7章 植物性レザー市場:製品種類別

- イントロダクション

- パイナップルレザー

- サボテンレザー

- マッシュルームレザー

- アップルレザー

- その他の製品

第8章 植物性レザー市場:用途別

- イントロダクション

- ファッション

- 衣料品

- アクセサリー

- フットウェア

- その他

- 自動内装

- 家庭用・その他の室内装飾

第9章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- イタリア

- スペイン

- 英国

- フランス

- スイス

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- インドネシア

- タイ

- オーストラリア・ニュージーランド

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 南米

- 中東・アフリカ

第10章 競合情勢

- 概要

- 市場評価フレームワーク

- 市場シェア分析

- 企業評価クアドラント:定義と方法論

- 製品発売・資本取引・その他の動向

第11章 企業プロファイル

- ANANAS ANAM

- MALAI ECO

- BIOLEATHER

- FRUITLEATHER ROTTERDAM

- BZ LEATHER

- NATURAL FIBER WELDING, INC.

- NUPELLE

- NOVA MILAN

- ECOVATIVE LLC.

- MABEL SRL

- MYCOWORKS

- PANGAIA GRADO ZERO SRL

- DESSERTO

- PEEL LAB

- BEYOND LEATHER MATERIALS

第12章 隣接・関連市場

- イントロダクション

- 制限事項

- バイオベース皮革市場

- 合成皮革 (人工皮革) 市場

第13章 付録

The plant-based leather market is projected to reach USD 97 million by 2027 growing at a CAGR of 7.5% from 2022 to 2027. Soaring concerns around animal welfare and the increased carbon footprint generated by animal leather industries leading to global warming have altered customer behavior. There is presently a surging demand for ethical, eco-friendly, and cruelty-free products, which has led industry stakeholders to substitute animal leather with a plant-based alternative, causing the expansion of the plant-based leather market.

"Plant-based leather has a high demand in the fashion industry"

The plant-based leather market has been segmented based on application into fashion (clothing, accessories, and footwear) and other applications (automotive interior and home and interior decor). The fashion sector accounted for the largest market share in 2021. International brands such as Tommy Hilfiger, Stella McCartney, and Gucci are incorporating plant-based leather in their collections and are anticipated to shift from conventional leather to plant-based leather gradually.

"Asia Pacific is projected to witness substantial growth during the forecast period in the plant-based leather market"

The well-established leather industries in India and Bangladesh and abundant raw materials are propelling the growth of the plant-based leather market in Asia Pacific. Given that plant-based leather is produced by recycling agricultural waste, Asia Pacific having produced tons of agro-waste yearly, has a significant opportunity for the industry to grow rapidly. The Philippines, a country in South-East Asia, is one of the largest pineapple producers, offering great potential for the pineapple leather market to expand in this area. The Asia Pacific plant-based leather market is competitive in nature, with many domestic and multinational players competing for market share.

Break-up of Primaries:

By Company Type: Tier 1 - 55%, Tier 2- 35%, Tier 3 - 10%

By Designation: C level - 40%, Managers - 30%, Executives - 30%

By Region: North America - 30%, Europe - 30%, Asia Pacific - 25%, RoW -15%

Leading players profiled in this report:

- Ananas Anam (UK)

- DESSERTO (Mexico)

- NUPELLE (Taiwan)

- Natural Fiber Welding, Inc. (US)

- PEEL Lab (Japan)

- Malai Eco (India)

- Nova Milan (UK)

- PANGAIA GRADO ZERO SRL (Italy)

- bioleather (India)

- MABEL SRL (Italy)

- Beyond Leather Materials (Denmark)

- Fruitleather Rotterdam (Netherlands)

- Ecovative LLC. (US)

- MycoWorks (US)

- BZ LEATHER (China)

Research Coverage:

The report segments the plant-based leather market based on product type, application, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging and high-growth segments of the global plant-based leather market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the plant-based leather market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the plant-based leather market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 PLANT-BASED LEATHER: MARKET SEGMENTATION

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.3.1 REGIONAL SEGMENTATION

- FIGURE 2 PLANT-BASED LEATHER: REGIONAL SEGMENTATION

- 1.4 YEARS CONSIDERED

- FIGURE 3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 4 PLANT-BASED LEATHER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- FIGURE 5 KEY DATA FROM SECONDARY SOURCES

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- TABLE 3 PRIMARY INTERVIEWS WITH EXPERTS

- 2.1.2.2 List of key primary interview participants

- TABLE 4 LIST OF KEY PRIMARY INTERVIEW PARTICIPANTS

- 2.1.2.3 Key industry insights

- FIGURE 6 KEY INDUSTRY INSIGHTS

- 2.1.2.4 Breakdown of primary interviews

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.5 Primary sources

- FIGURE 8 PRIMARY SOURCES

- 2.2 MARKET SIZE ESTIMATION

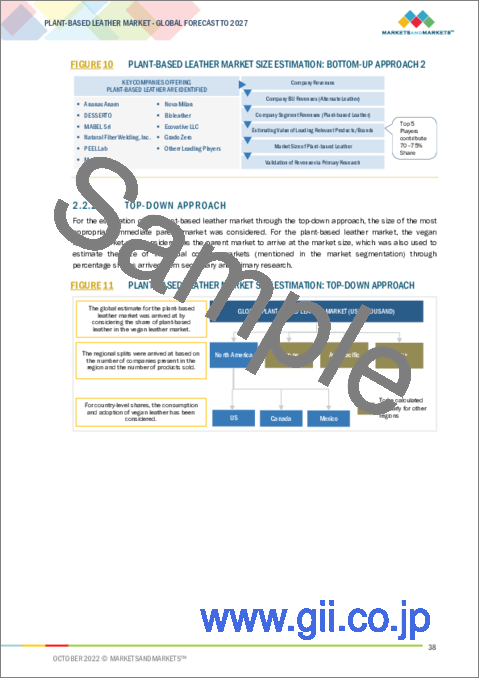

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 9 PLANT-BASED LEATHER MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 1

- FIGURE 10 PLANT-BASED LEATHER MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 2

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 11 PLANT-BASED LEATHER MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 13 ASSUMPTIONS CONSIDERED IN PLANT-BASED LEATHER MARKET

- 2.5 LIMITATIONS

- FIGURE 14 LIMITATION AND RISK ASSESSMENT OF STUDY

3 EXECUTIVE SUMMARY

- TABLE 5 PLANT-BASED LEATHER MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 15 PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022 VS. 2027 (USD THOUSAND)

- FIGURE 16 PLANT-BASED LEATHER MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD THOUSAND)

- FIGURE 17 PLANT-BASED LEATHER MARKET SHARE, BY REGION, 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PLANT-BASED LEATHER MARKET

- FIGURE 18 INVESTMENTS IN DEVELOPING LEATHER FROM INNOVATIVE PLANT MATERIALS TO DRIVE PLANT-BASED LEATHER MARKET

- 4.2 PLANT-BASED LEATHER MARKET: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

- FIGURE 19 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- 4.3 EUROPE: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE & COUNTRY

- FIGURE 20 ITALY TO ACCOUNT FOR LARGEST SHARE OF EUROPEAN MARKET IN 2022

- 4.4 PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE

- FIGURE 21 MUSHROOM LEATHER TO DOMINATE PLANT-BASED LEATHER MARKET IN 2022

- 4.5 PLANT-BASED LEATHER MARKET, BY APPLICATION

- FIGURE 22 FASHION SEGMENT TO DOMINATE PLANT-BASED LEATHER MARKET IN 2022

- 4.6 PLANT-BASED LEATHER MARKET, BY FASHION APPLICATION

- FIGURE 23 ACCESSORIES SEGMENT TO CONTINUE TO DOMINATE MARKET FOR FASHION APPLICATION SEGMENT DURING FORECAST PERIOD

- 4.7 PLANT-BASED LEATHER MARKET, BY OTHER APPLICATION

- FIGURE 24 AUTOMOTIVE INTERIOR SEGMENT TO HOLD LARGER SIZE OF PLANT-BASED LEATHER MARKET IN 2027

- 4.8 PLANT-BASED LEATHER MARKET, BY REGION

- FIGURE 25 EUROPE TO CONTINUE TO DOMINATE PLANT-BASED LEATHER MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 26 MARKET DYNAMICS: PLANT-BASED LEATHER MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for vegan and cruelty-free products

- 5.2.1.2 Harmful effects of conventional leather on environment and humans

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of plant-based leather and price-conscious consumers from emerging economies

- 5.2.2.2 Lack of operational scalability of plant-based leather industry

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Scope for continuous research and development

- 5.2.4 CHALLENGES

- 5.2.4.1 Concerns over quality and consumer perception toward plant-based leather

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS IMPACTING CUSTOMER BUSINESS

- 6.3 PRICING ANALYSIS

- 6.3.1 AVERAGE SELLING PRICE OF PLANT-BASED LEATHER OFFERED BY KEY PLAYERS, BY PRODUCT TYPE

- TABLE 6 AVERAGE SELLING PRICE OF PLANT-BASED LEATHER OFFERED BY KEY PLAYERS, BY PRODUCT TYPE (USD/SQ. METER)

- 6.3.2 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 7 AVERAGE SELLING PRICE OF PLANT-BASED LEATHER, BY REGION (USD/SQ. METER)

- 6.4 VALUE CHAIN

- 6.4.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.4.2 RAW MATERIAL SOURCING

- 6.4.3 PRODUCTION & PROCESSING

- 6.4.4 CERTIFICATIONS/REGULATORY BODIES

- 6.4.5 MARKETING & SALES

- FIGURE 27 VALUE CHAIN ANALYSIS OF PLANT-BASED LEATHER MARKET

- 6.5 ECOSYSTEM/MARKET MAP

- TABLE 8 PLANT-BASED LEATHER MARKET: ECOSYSTEM

- FIGURE 28 PLANT-BASED LEATHER ECOSYSTEM MAP

- 6.6 TECHNOLOGY ANALYSIS

- 6.7 TARIFF AND REGULATORY LANDSCAPE

- 6.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.7.2 NORTH AMERICA

- 6.7.2.1 US

- 6.7.3 EUROPE

- 6.7.4 ASIA PACIFIC

- 6.7.4.1 India

- 6.8 PATENT ANALYSIS

- TABLE 10 LIST OF IMPORTANT PATENTS FOR PLANT-BASED LEATHER, 2020-2021

- 6.9 PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 PLANT-BASED LEATHER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 PLANT-BASED LEATHER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.9.1 THREAT OF NEW ENTRANTS

- 6.9.2 THREAT OF SUBSTITUTES

- 6.9.3 BARGAINING POWER OF SUPPLIERS

- 6.9.4 BARGAINING POWER OF BUYERS

- 6.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.10 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 12 PLANT-BASED LEATHER MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2022-2023

- 6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PLANT-BASED LEATHER FOR VARIOUS APPLICATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PLANT-BASED LEATHER

- 6.12 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR VARIOUS APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR TOP APPLICATIONS

7 PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- FIGURE 32 PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022 VS. 2027 (USD THOUSAND)

- TABLE 15 PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 16 PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 17 PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (THOUSAND SQUARE METER)

- TABLE 18 PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (THOUSAND SQUARE METER)

- 7.2 PINEAPPLE LEATHER

- 7.2.1 SUSTAINABILITY AND MULTIFUNCTIONALITY OF PINEAPPLE LEATHER TO INCREASE ITS ADOPTION IN FASHION AND AUTOMOTIVE INDUSTRIES

- TABLE 19 PINEAPPLE LEATHER: PLANT-BASED LEATHER MARKET, BY REGION, 2019-2021 (USD THOUSAND)

- TABLE 20 PINEAPPLE LEATHER: PLANT-BASED LEATHER MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 7.3 CACTUS LEATHER

- 7.3.1 LIMITED ENVIRONMENTAL IMPACT AND MULTIFUNCTIONALITY OF CACTUS LEATHER TO DRIVE MARKET

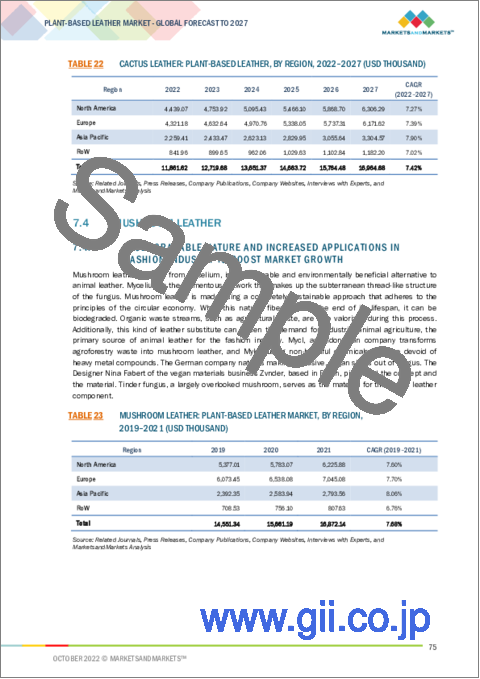

- TABLE 21 CACTUS LEATHER: PLANT-BASED LEATHER MARKET, BY REGION, 2019-2021 (USD THOUSAND)

- TABLE 22 CACTUS LEATHER: PLANT-BASED LEATHER, BY REGION, 2022-2027 (USD THOUSAND)

- 7.4 MUSHROOM LEATHER

- 7.4.1 BIODEGRADABLE NATURE AND INCREASED APPLICATIONS IN FASHION INDUSTRY TO BOOST MARKET GROWTH

- TABLE 23 MUSHROOM LEATHER: PLANT-BASED LEATHER MARKET, BY REGION, 2019-2021 (USD THOUSAND)

- TABLE 24 MUSHROOM LEATHER: PLANT-BASED LEATHER MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 7.5 APPLE LEATHER

- 7.5.1 INCREASING APPLICATIONS OF APPLE LEATHER FOR SHOES AND ACCESSORIES TO DRIVE MARKET

- TABLE 25 APPLE LEATHER: PLANT-BASED LEATHER MARKET, BY REGION, 2019-2021 (USD THOUSAND)

- TABLE 26 APPLE LEATHER: PLANT-BASED LEATHER MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 7.6 OTHER PRODUCTS

- TABLE 27 OTHER PRODUCTS: PLANT-BASED LEATHER MARKET, BY REGION, 2019-2021 (USD THOUSAND)

- TABLE 28 OTHER PRODUCTS: PLANT-BASED LEATHER MARKET, BY REGION, 2022-2027 (USD THOUSAND)

8 PLANT-BASED LEATHER MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 33 FASHION SEGMENT IS PROJECTED TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- TABLE 29 PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 30 PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 31 FASHION: PLANT-BASED LEATHER MARKET, BY FASHION TYPE, 2019-2021 (USD THOUSAND)

- TABLE 32 FASHION: PLANT-BASED LEATHER MARKET, FASHION TYPE, 2022-2027 (USD THOUSAND)

- TABLE 33 OTHERS: PLANT-BASED LEATHER MARKET, TYPE, 2019-2021 (USD THOUSAND)

- TABLE 34 OTHERS: PLANT-BASED LEATHER MARKET, TYPE, 2022-2027 (USD THOUSAND)

- 8.2 FASHION

- TABLE 35 FASHION: PLANT-BASED LEATHER MARKET, BY REGION, 2019-2021 (USD THOUSAND)

- TABLE 36 FASHION: PLANT-BASED LEATHER MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 8.2.1 CLOTHING

- 8.2.1.1 Young consumers shifting from conventional leather products to sustainable alternatives

- TABLE 37 CLOTHING: PLANT-BASED LEATHER MARKET, BY REGION, 2019-2021 (USD THOUSAND)

- TABLE 38 CLOTHING: PLANT-BASED LEATHER MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 8.2.2 ACCESSORIES

- 8.2.2.1 Increased demand for cruelty-free fashion materials

- TABLE 39 ACCESSORIES: PLANT-BASED LEATHER MARKET, BY REGION, 2019-2021 (USD THOUSAND)

- TABLE 40 ACCESSORIES: PLANT-BASED LEATHER MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 8.2.3 FOOTWEAR

- 8.2.3.1 International shoe brands moving toward plant-based leather

- TABLE 41 FOOTWEAR: PLANT-BASED LEATHER MARKET, BY REGION, 2019-2021 (USD THOUSAND)

- TABLE 42 FOOTWEAR: PLANT-BASED LEATHER MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 8.3 OTHERS

- TABLE 43 OTHERS: PLANT-BASED LEATHER MARKET, BY REGION, 2019-2021 (USD THOUSAND)

- TABLE 44 OTHERS: PLANT-BASED LEATHER MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 8.3.1 AUTOMOTIVE INTERIORS

- 8.3.1.1 Luxurious car brands replacing animal leather with plant leather

- TABLE 45 AUTOMOTIVE INTERIORS: PLANT-BASED LEATHER MARKET, BY REGION, 2019-2021 (USD THOUSAND)

- TABLE 46 AUTOMOTIVE INTERIORS: PLANT-BASED LEATHER MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 8.3.2 HOME AND OTHER INTERIOR DECOR

- 8.3.2.1 Vegan population generating increased demand for plant-based home decor accessories

- TABLE 47 HOME AND OTHER INTERIOR DECOR: PLANT-BASED LEATHER MARKET, BY REGION, 2019-2021 (USD THOUSAND)

- TABLE 48 HOME AND OTHER INTERIOR DECOR: PLANT-BASED LEATHER MARKET, BY REGION, 2022-2027 (USD THOUSAND)

9 GEOGRAPHIC ANALYSIS

- 9.1 INTRODUCTION

- FIGURE 34 PLANT-BASED LEATHER MARKET SHARE, BY KEY COUNTRY, 2021

- TABLE 49 PLANT-BASED LEATHER MARKET, BY REGION, 2019-2021 (USD THOUSAND)

- TABLE 50 PLANT-BASED LEATHER MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- TABLE 51 PLANT-BASED LEATHER MARKET, BY REGION, 2019-2021 (THOUSAND SQUARE METER)

- TABLE 52 PLANT-BASED LEATHER MARKET, BY REGION, 2022-2027 (THOUSAND SQUARE METER)

- 9.2 NORTH AMERICA

- TABLE 53 NORTH AMERICA: PLANT-BASED LEATHER MARKET, BY COUNTRY, 2019-2021 (USD THOUSAND)

- TABLE 54 NORTH AMERICA: PLANT-BASED LEATHER MARKET, BY COUNTRY, 2022-2027 (USD THOUSAND)

- TABLE 55 NORTH AMERICA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 56 NORTH AMERICA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 57 NORTH AMERICA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (THOUSAND SQUARE METER)

- TABLE 58 NORTH AMERICA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (THOUSAND SQUARE METER)

- TABLE 59 NORTH AMERICA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 60 NORTH AMERICA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 61 NORTH AMERICA: PLANT-BASED LEATHER MARKET, BY FASHION TYPE, 2019-2021 (USD THOUSAND)

- TABLE 62 NORTH AMERICA: PLANT-BASED LEATHER MARKET, BY FASHION TYPE, 2022-2027 (USD THOUSAND)

- TABLE 63 NORTH AMERICA: PLANT-BASED LEATHER MARKET, BY OTHER APPLICATION TYPE, 2019-2021 (USD THOUSAND)

- TABLE 64 NORTH AMERICA: PLANT-BASED LEATHER MARKET, BY OTHER APPLICATION TYPE, 2022-2027 (USD THOUSAND)

- 9.2.1 US

- 9.2.1.1 Investments in new technologies and shift toward environmentally sustainable products

- TABLE 65 US: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 66 US: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 67 US: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 68 US: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 69 US: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 70 US: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 71 US: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 72 US: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.2.2 CANADA

- 9.2.2.1 New upcoming brands introducing plant-based leather products to fulfill rising consumer demand

- TABLE 73 CANADA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 74 CANADA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 75 CANADA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 76 CANADA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 77 CANADA: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 78 CANADA: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 79 CANADA: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 80 CANADA: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.2.3 MEXICO

- 9.2.3.1 Collaborations between plant-based leather manufacturing and end-product manufacturing companies

- TABLE 81 MEXICO: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 82 MEXICO: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 83 MEXICO: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 84 MEXICO: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 85 MEXICO: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 86 MEXICO: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 87 MEXICO: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 88 MEXICO: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.3 EUROPE

- FIGURE 35 EUROPE: MARKET SNAPSHOT

- TABLE 89 EUROPE: PLANT-BASED LEATHER MARKET, BY COUNTRY, 2019-2021 (USD THOUSAND)

- TABLE 90 EUROPE: PLANT-BASED LEATHER MARKET, BY COUNTRY, 2022-2027 (USD THOUSAND)

- TABLE 91 EUROPE: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 92 EUROPE: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 93 EUROPE: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (THOUSAND SQUARE METER)

- TABLE 94 EUROPE: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (THOUSAND SQUARE METER)

- TABLE 95 EUROPE: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 96 EUROPE: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 97 EUROPE: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 98 EUROPE: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 99 EUROPE: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 100 EUROPE: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.3.1 GERMANY

- 9.3.1.1 Introduction of new sources of raw materials for plant-based leather becoming primary focus of fashion experts

- TABLE 101 GERMANY: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 102 GERMANY: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 103 GERMANY: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 104 GERMANY: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 105 GERMANY: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 106 GERMANY: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 107 GERMANY: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 108 GERMANY: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.3.2 ITALY

- 9.3.2.1 Presence of key luxury fashion brands and their rising acceptance of vegan and sustainable fashion accelerating industry growth

- TABLE 109 ITALY: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 110 ITALY: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 111 ITALY: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 112 ITALY: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 113 ITALY: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 114 ITALY: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 115 ITALY: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 116 ITALY: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.3.3 SPAIN

- 9.3.3.1 Various end-product manufacturing companies introducing products with plant-based leather for multiple applications

- TABLE 117 SPAIN: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 118 SPAIN: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 119 SPAIN: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 120 SPAIN: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 121 SPAIN: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 122 SPAIN: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 123 SPAIN: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 124 SPAIN: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.3.4 UK

- 9.3.4.1 Growing presence of consumers willing to pay premium prices for clean and sustainable products

- TABLE 125 UK: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 126 UK: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 127 UK: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 128 UK: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 129 UK: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 130 UK: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 131 UK: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 132 UK: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.3.5 FRANCE

- 9.3.5.1 New product launches by various start-ups to boost market for plant-based leather

- TABLE 133 FRANCE: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 134 FRANCE: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 135 FRANCE: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 136 FRANCE: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 137 FRANCE: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 138 FRANCE: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 139 FRANCE: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 140 FRANCE: PLANT-BASED LEATHER MARKET SIZE, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.3.6 SWITZERLAND

- 9.3.6.1 Investments in new product development to create lucrative opportunities in plant-based leather market

- TABLE 141 SWITZERLAND: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 142 SWITZERLAND: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 143 SWITZERLAND: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 144 SWITZERLAND: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 145 SWITZERLAND: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 146 SWITZERLAND: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 147 SWITZERLAND: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 148 SWITZERLAND: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.3.7 REST OF EUROPE

- TABLE 149 REST OF EUROPE: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 150 REST OF EUROPE: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 151 REST OF EUROPE: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 152 REST OF EUROPE: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 153 REST OF EUROPE: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 154 REST OF EUROPE: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 155 REST OF EUROPE: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 156 REST OF EUROPE: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.4 ASIA PACIFIC

- TABLE 157 ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY COUNTRY, 2019-2021 (USD THOUSAND)

- TABLE 158 ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY COUNTRY, 2022-2027 (USD THOUSAND)

- TABLE 159 ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 160 ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 161 ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (THOUSAND SQUARE METER)

- TABLE 162 ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (THOUSAND SQUARE METER)

- TABLE 163 ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 164 ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 165 ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 166 ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 167 ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 168 ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.4.1 CHINA

- 9.4.1.1 Increased demand for leather goods

- TABLE 169 CHINA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 170 CHINA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 171 CHINA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 172 CHINA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 173 CHINA: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 174 CHINA: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 175 CHINA: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 176 CHINA: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.4.2 INDIA

- 9.4.2.1 Environmental consciousness among consumers and growing vegetarianism

- TABLE 177 INDIA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 178 INDIA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 179 INDIA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 180 INDIA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 181 INDIA: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 182 INDIA: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 183 INDIA: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 184 INDIA: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.4.3 JAPAN

- 9.4.3.1 Increased demand for natural products, strong R&D, and abundant raw materials

- TABLE 185 JAPAN: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 186 JAPAN: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 187 JAPAN: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 188 JAPAN: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 189 JAPAN: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 190 JAPAN: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 191 JAPAN: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 192 JAPAN: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Application of plant-based leather in automobiles

- TABLE 193 SOUTH KOREA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 194 SOUTH KOREA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 195 SOUTH KOREA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 196 SOUTH KOREA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 197 SOUTH KOREA: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 198 SOUTH KOREA: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 199 SOUTH KOREA: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 200 SOUTH KOREA: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.4.5 INDONESIA

- 9.4.5.1 Plant-based leather using fermentation technique

- TABLE 201 INDONESIA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 202 INDONESIA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 203 INDONESIA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 204 INDONESIA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 205 INDONESIA: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 206 INDONESIA: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 207 INDONESIA: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 208 INDONESIA: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.4.6 THAILAND

- 9.4.6.1 Teak leather emerging as popular plant-based leather

- TABLE 209 THAILAND: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 210 THAILAND: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 211 THAILAND: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 212 THAILAND: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 213 THAILAND: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 214 THAILAND: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 215 THAILAND: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 216 THAILAND: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.4.7 AUSTRALIA & NEW ZEALAND

- 9.4.7.1 Kangaroo leather being gradually replaced with plant-based leather due to ethical concerns

- TABLE 217 AUSTRALIA & NEW ZEALAND: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 218 AUSTRALIA & NEW ZEALAND: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 219 AUSTRALIA & NEW ZEALAND: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 220 AUSTRALIA & NEW ZEALAND: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 221 AUSTRALIA & NEW ZEALAND: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 222 AUSTRALIA & NEW ZEALAND: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 223 AUSTRALIA & NEW ZEALAND: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 224 AUSTRALIA & NEW ZEALAND: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.4.8 REST OF ASIA PACIFIC

- TABLE 225 REST OF ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 226 REST OF ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 227 REST OF ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 228 REST OF ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 229 REST OF ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 230 REST OF ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 231 REST OF ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 232 REST OF ASIA PACIFIC: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.5 ROW

- TABLE 233 ROW: PLANT-BASED LEATHER MARKET, BY REGION, 2019-2021 (USD THOUSAND)

- TABLE 234 ROW: PLANT-BASED LEATHER MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- TABLE 235 ROW: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 236 ROW: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 237 ROW: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (THOUSAND SQUARE METER)

- TABLE 238 ROW: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (THOUSAND SQUARE METER)

- TABLE 239 ROW: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 240 ROW: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 241 ROW: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 242 ROW: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 243 ROW: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 244 ROW: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.5.1 SOUTH AMERICA

- 9.5.1.1 Large amount of pineapple and cactus harvest waste

- TABLE 245 SOUTH AMERICA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 246 SOUTH AMERICA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 247 SOUTH AMERICA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 248 SOUTH AMERICA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 249 SOUTH AMERICA: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 250 SOUTH AMERICA: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 251 SOUTH AMERICA: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 252 SOUTH AMERICA: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

- 9.5.2 MIDDLE EAST & AFRICA

- 9.5.2.1 Local brands shifting from animal leather to plant-based leather due to sustainability concerns

- TABLE 253 MIDDLE EAST & AFRICA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019-2021 (USD THOUSAND)

- TABLE 254 MIDDLE EAST & AFRICA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022-2027 (USD THOUSAND)

- TABLE 255 MIDDLE EAST & AFRICA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2019-2021 (USD THOUSAND)

- TABLE 256 MIDDLE EAST & AFRICA: PLANT-BASED LEATHER MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 257 MIDDLE EAST & AFRICA: PLANT-BASED LEATHER MARKET, BY FASHION, 2019-2021 (USD THOUSAND)

- TABLE 258 MIDDLE EAST & AFRICA: PLANT-BASED LEATHER MARKET, BY FASHION, 2022-2027 (USD THOUSAND)

- TABLE 259 MIDDLE EAST & AFRICA: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019-2021 (USD THOUSAND)

- TABLE 260 MIDDLE EAST & AFRICA: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022-2027 (USD THOUSAND)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 MARKET EVALUATION FRAMEWORK

- FIGURE 36 MARKET EVALUATION FRAMEWORK, 2019-2022

- 10.3 MARKET SHARE ANALYSIS

- TABLE 261 PLANT-BASED LEATHER MARKET SHARE ANALYSIS, 2021

- 10.4 COMPANY EVALUATION QUADRANT: DEFINITIONS AND METHODOLOGY

- 10.4.1 STARS

- 10.4.2 EMERGING LEADERS

- 10.4.3 PERVASIVE PLAYERS

- 10.4.4 PARTICIPANTS

- FIGURE 37 PLANT-BASED LEATHER MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 10.4.5 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 262 COMPANY FOOTPRINT, BY PRODUCT TYPE

- TABLE 263 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 264 COMPANY FOOTPRINT, BY REGION

- TABLE 265 OVERALL COMPANY FOOTPRINT

- 10.5 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

- 10.5.1 PRODUCT LAUNCHES

- TABLE 266 PLANT-BASED LEATHER MARKET: NEW PRODUCT LAUNCHES, 2019-2022

- 10.5.2 DEALS

- TABLE 267 PLANT-BASED LEATHER MARKET: DEALS, 2019-2022

- 10.5.3 OTHER DEVELOPMENTS

- TABLE 268 PLANT-BASED LEATHER MARKET: OTHER DEVELOPMENTS, 2019-2022

11 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 11.1 ANANAS ANAM

- TABLE 269 ANANAS ANAM: BUSINESS OVERVIEW

- TABLE 270 ANANAS ANAM: PRODUCTS OFFERED

- TABLE 271 ANANAS ANAM: PRODUCT LAUNCHES

- TABLE 272 ANANAS ANAM: DEALS

- TABLE 273 ANANAS ANAM: OTHERS

- 11.2 MALAI ECO

- TABLE 274 MALAI ECO: BUSINESS OVERVIEW

- TABLE 275 MALAI ECO: PRODUCTS OFFERED

- 11.3 BIOLEATHER

- TABLE 276 BIOLEATHER: BUSINESS OVERVIEW

- TABLE 277 BIOLEATHER: PRODUCTS OFFERED

- TABLE 278 BIOLEATHER: OTHERS

- 11.4 FRUITLEATHER ROTTERDAM

- TABLE 279 FRUITLEATHER ROTTERDAM: BUSINESS OVERVIEW

- TABLE 280 FRUITLEATHER ROTTERDAM: PRODUCTS OFFERED

- 11.5 BZ LEATHER

- TABLE 281 BZ LEATHER: BUSINESS OVERVIEW

- TABLE 282 BZ LEATHER: PRODUCTS OFFERED

- 11.6 NATURAL FIBER WELDING, INC.

- TABLE 283 NATURAL FIBER WELDING, INC.: BUSINESS OVERVIEW

- TABLE 284 NATURAL FIBER WELDING, INC.: PRODUCTS OFFERED

- TABLE 285 NATURAL FIBER WELDING, INC.: DEALS

- TABLE 286 NATURAL FIBER WELDING, INC.: OTHERS

- 11.7 NUPELLE

- TABLE 287 NUPELLE: BUSINESS OVERVIEW

- TABLE 288 NUPELLE: PRODUCTS OFFERED

- TABLE 289 NUPELLE: PRODUCT LAUNCHES

- TABLE 290 NUPELLE: DEALS

- 11.8 NOVA MILAN

- TABLE 291 NOVA MILAN: BUSINESS OVERVIEW

- TABLE 292 NOVA MILAN: PRODUCTS OFFERED

- 11.9 ECOVATIVE LLC.

- TABLE 293 ECOVATIVE LLC.: BUSINESS OVERVIEW

- TABLE 294 ECOVATIVE LLC.: PRODUCTS OFFERED

- TABLE 295 ECOVATIVE LLC.: DEALS

- 11.10 MABEL SRL

- TABLE 296 MABEL SRL.: BUSINESS OVERVIEW

- TABLE 297 MABEL SRL: PRODUCTS OFFERED

- TABLE 298 MABEL SRL: DEALS

- 11.11 MYCOWORKS

- TABLE 299 MYCOWORKS.: BUSINESS OVERVIEW

- TABLE 300 MYCOWORKS: PRODUCTS OFFERED

- 11.12 PANGAIA GRADO ZERO SRL

- TABLE 301 PANGAIA GRADO ZERO SRL: BUSINESS OVERVIEW

- TABLE 302 PANGAIA GRADO ZERO SRL: PRODUCTS OFFERED

- 11.13 DESSERTO

- TABLE 303 DESSERTO: BUSINESS OVERVIEW

- TABLE 304 DESSERTO: PRODUCTS OFFERED

- TABLE 305 DESSERTO: DEALS

- TABLE 306 DESSERTO: OTHERS

- 11.14 PEEL LAB

- TABLE 307 PEEL LAB: BUSINESS OVERVIEW

- TABLE 308 PEEL LAB: PRODUCTS OFFERED

- 11.15 BEYOND LEATHER MATERIALS

- TABLE 309 BEYOND LEATHER MATERIALS: BUSINESS OVERVIEW

- TABLE 310 BEYOND LEATHER MATERIALS: PRODUCTS OFFERED

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- TABLE 311 ADJACENT MARKETS TO PLANT-BASED LEATHER MARKET

- 12.2 LIMITATIONS

- 12.3 BIO-BASED LEATHER MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 BIO-BASED LEATHER MARKET, BY SOURCE

- TABLE 312 BIO-BASED LEATHER MARKET, BY SOURCE, 2016-2019 (USD THOUSAND)

- TABLE 313 BIO-BASED LEATHER MARKET, BY SOURCE, 2020-2026 (USD THOUSAND)

- TABLE 314 BIO-BASED LEATHER MARKET, BY SOURCE, 2016-2019 (THOUSAND SQ. METER)

- TABLE 315 BIO-BASED LEATHER MARKET, BY SOURCE, 2020-2026 (THOUSAND SQ. METER)

- 12.3.4 BIO-BASED LEATHER MARKET, BY REGION

- TABLE 316 BIO-BASED LEATHER MARKET SIZE, BY REGION, 2016-2019 (USD THOUSAND)

- TABLE 317 BIO-BASED LEATHER MARKET SIZE, BY REGION, 2020-2026 (USD THOUSAND)

- TABLE 318 BIO-BASED LEATHER MARKET SIZE, BY REGION, 2016-2019 (THOUSAND SQ. METER)

- TABLE 319 BIO-BASED LEATHER MARKET SIZE, BY REGION, 2020-2026 (THOUSAND SQ. METER)

- 12.4 SYNTHETIC LEATHER (ARTIFICIAL LEATHER) MARKET

- 12.4.1 MARKET DEFINITION

- 12.4.2 MARKET OVERVIEW

- 12.4.3 SYNTHETIC LEATHER MARKET, BY TYPE

- TABLE 320 SYNTHETIC LEATHER MARKET SIZE, BY TYPE, 2016-2019 (MILLION SQ. METER)

- TABLE 321 SYNTHETIC LEATHER MARKET SIZE, BY TYPE, 2020-2025 (MILLION SQ. METER)

- TABLE 322 SYNTHETIC LEATHER MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

- TABLE 323 SYNTHETIC LEATHER MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

- 12.4.4 SYNTHETIC LEATHER MARKET, BY REGION

- TABLE 324 SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2016-2019 (MILLION SQ. METER)

- TABLE 325 SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2020-2025 (MILLION SQ. METER)

- TABLE 326 SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

- TABLE 327 SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS