|

|

市場調査レポート

商品コード

1141975

貯水システムの世界市場:材料別(鋼、ガラス繊維、コンクリート、プラスチック)、用途別、最終用途別(住宅、商業、工業、自治体)、地域別 - 2027年までの予測Water Storage Systems Market by Material (Steel, Fiberglass, Concrete, Plastic), Application, End Use (Residential, Commercial, Industrial, and Municipal), and Region (North America, Europe, APAC, MEA, South America) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 貯水システムの世界市場:材料別(鋼、ガラス繊維、コンクリート、プラスチック)、用途別、最終用途別(住宅、商業、工業、自治体)、地域別 - 2027年までの予測 |

|

出版日: 2022年10月19日

発行: MarketsandMarkets

ページ情報: 英文 205 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の貯水システムの市場規模は、2022年の165億米ドルから2027年までに251億米ドルに達し、2022年から2027年の間にCAGRで8.7%の成長が予測されています。

住宅、商業、工業、自治体のエンドユーザーが、建設業界の成長により市場成長を牽引しています。この増加には、水不足、急激な人口増加と都市化、厳格な節水・排水規則、気候条件の変化など、さまざまな原因が絡んでいます。

プラスチックセグメントが、材料別で、予測期間中に最も急成長しているセグメントの1つ

材料別では、プラスチックセグメントが、予測期間中に最大のセグメントの1つになると予想されます。プラスチックは、最大20,000ガロンの容量を持つタンクの製造に使用されます。プラスチックタンクは、水だけでなく、塩素、漂白剤、酸などの化学物質の貯蔵にも適しており、そのほとんどが回転成形プロセスを用いて食品グレードの標準プラスチックで作られています。このため、貯水中の藻類や雑菌の繁殖を抑制することができます。

雨水採取・集水セグメントが、予測期間中に2番目に高いCAGRを記録すると予想される

雨水集水タンクは、雨水タンク、雨水採取タンク、雨水貯蔵タンクとも呼ばれます。雨水タンクは、特に水不足や乾燥した天候、汚染された水源がある場合、水源を補う良い方法です。

自治体セグメントが、予測期間中、貯水システム市場の最大のシェアを占めると予想される

住宅団地や住宅・公共サービス会社では、自治体の水を利用します。利用する水の量は、拡大する人口需要によって決定されます。自治体の水道システムには、大規模かつ包括的な供給・配送ネットワークが必要です。水処理施設からの水は、自治体のネットワークを介して分配される前に保管する必要があります。地方自治体のシステムでは、貯水システムを利用して、必要に応じて水を貯蔵および提供しています。自治体の貯水システムには、特定の区画に水を供給するために使用される巨大な貯水タンクが含まれています。

アジア太平洋地域の貯水システム市場は、予測期間中に最も高いCAGRを記録すると推定される

欧州は、2021年に貯水システム市場の19.2%のシェアを占め、予測期間中に7.4%のCAGRを記録すると予測されます。欧州の市場は、ドイツ、フランス、英国、イタリア、スペイン、その他の欧州(ロシア、オランダ、ベルギー、ウクライナ、ギリシャ)を対象に調査しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 促進要因

- 抑制要因

- 機会

- 課題

- 貯水システムの種類

- バリューチェーン分析

- ポーターのファイブフォース分析

- マクロ経済指標

第6章 貯水システム市場:材料別

- イントロダクション

- コンクリート

- 鋼

- ガラス繊維

- プラスチック

- その他

第7章 貯水システム市場:用途別

- イントロダクション

- 水圧破砕用貯水・集水

- オンサイト上下水集水

- 飲料水貯蔵

- 雨水採取・集水

- 防火用貯水

- その他

第8章 貯水システム市場:最終用途別

- イントロダクション

- 自治体

- 工業

- 商業

- 住宅

第9章 貯水システム市場:地域別

- イントロダクション

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第10章 競合情勢

- 概要

- 競合リーダーシップマッピング

- 中小企業マトリックス

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 競合ベンチマーキング

- 市場シェア分析

- 市場ランキング分析

- 収益分析

- 競合シナリオ

- 戦略的発展

第11章 企業プロファイル

- 主要企業

- CST INDUSTRIES, INC.

- ZCL COMPOSITES, INC.

- SYNALLOY CORPORATION

- AG GROWTH INTERNATIONAL INC.

- MCDERMOTT INTERNATIONAL, INC.

- BH TANK

- FIBER TECHNOLOGY CORPORATION

- CALDWELL TANKS

- CONTAINMENT SOLUTIONS INC.

- MAGUIRE IRON INC.

- その他の企業

- SNYDER INDUSTRIES

- CROM CORPORATION

- TANK CONNECTION

- CONTAIN ENVIRO SERVICES LTD

- HMT LLC

- DN TANKS

- SINTEX PLASTICS TECHNOLOGY LIMITED

- BALMORAL TANKS LIMITED

- SUPERIOR TANK CO. INC

- PITTSBURG TANK & TOWER GROUP

第12章 隣接/関連市場

第13章 付録

The global water storage systems market size is projected to grow from USD 16.5 billion in 2022 to USD 25.1 billion by 2027, at a CAGR of 8.7%, between 2022 and 2027. Residential, commercial, industrial, and municipal end users are driving the market growth thanks to the growing construction industry. A variety of causes contribute to this increase, including water shortages, fast exponential population growth and urbanization, rigorous water conservation and discharge rules, and changing climate conditions.

The plastic segment is one of the fastest-growing material segment during the forecast period.

Based on material, the plastic segment is expected to be one of the largest segment during the forecast period. Plastics are used to manufacture tanks with a capacity of up to 20,000 gallons. Plastic tanks are suitable for storing water as well as chemicals such as chlorine, bleaches, and acids, and are mostly made of food-grade standard plastic using a rotational molding process. This helps in inhibiting the growth of algae and other bacteria in the stored water.

A plastic storage tank is a huge container meant to store water for households, agriculture, irrigation, and industrial applications. Water tanks are manufactured in a variety of styles to satisfy the demands of certain applications, with specialty models designed to meet specific criteria and regulations. The term plastic water tank refers to a broad category of plastic tanks used to store water..

The rainwater harvesting & collection segment is expected to register the second-highest CAGR during the forecast period.

Rainwater collection tanks can also be referred to as rain tanks, rainwater harvesting tanks, or rainwater storage tanks. Rainwater tanks are a good way to supplement water sources, especially during times of shortage, dry weather, or contaminated water supplies. The UV inhibitors included in rainwater storage tanks prevent the tank from sun deterioration, allowing it to be utilized both indoors and outdoors. Because they are resistant to impact, corrosion, and rust and, thus, have a long lifespan. Rainwater tanks with capacities ranging from 100 to 12,500 gallons are available.

Rainwater harvesting is a technique for collecting, storing, and reusing rainwater for household or commercial applications. Rainwater is collected from a variety of hard surfaces, such as rooftops and other constructed aboveground hard surfaces, and stored in tanks for later use. Rainwater harvesting and collecting systems exist in a variety of sizes and designs, depending on the amount of precipitation and the available space. Water is purified and stored for later use in purification systems.

The water storage systems market in the municipal segment is expected to hold the largest share during the forecast period.

Housing estates and residential & public service firms utilize municipal water. The amount of water utilized is determined by the expanding population's demand. Municipal water systems require a large and comprehensive network of supply and delivery. Water from water treatment facilities must be kept before being distributed via the municipal network. In the municipal system, water storage systems are utilized to store and provide water as needed. Municipal water storage systems contain enormous storage tanks used to provide water to certain divisions. All activities require these water storage systems, whether for pre-treatment storage or post-treatment storage. As per a study published by the International Institute for Applied Systems Analysis in June 2018, by the 2050s, water demand in Asia is projected to be higher than in all other continents put together. As a result of socioeconomic development in Asia, municipal water demand will rise by a minimum of 176% and up to 245%.

Asia Pacific water storage systems market is estimated to register the highest CAGR during the forecast period.

Europe accounted for a share of 19.2% of the water storage systems market in 2021 and is expected to register a CAGR of 7.4% during the forecast period. The market in Europe has been studied for Germany, France, the UK, Italy, Spain, and the Rest of Europe (Russia, Netherlands, Belgium, Ukraine, and Greece).

According to EurEau, the drinking water system in Europe has an overall length of 4.3 million kilometers or 11 times the distance between the Earth and the Moon. This infrastructure needs upkeep and reinvestment to ensure the operation and supply everyone with pure, safe water that meets the high requirements. The extent of the drinking water distribution network per linked resident varies from 4.35 meters per linked resident in Romania to 19.57 meters per connected resident in Finland.

Information was gathered from secondary research and In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the water storage systems market to verify the market size of several segments and subsegments.

- By Company Type: Tier 1 - 46%, Tier 2 - 43%, and Tier 3 - 27%

- By Designation: C Level - 21%, D Level - 23%, and Others - 56%

- By Region: North America - 37%, Asia Pacific- 26%, Europe - 23%, Middle East & Africa - 10%, and South America - 4%

The key companies profiled in this report are CST Industries Inc. (US), ZCL Composites Inc. (Canada), Synalloy Corporation (US), AG Growth International Inc. (Canada), McDermott International Inc. (US), BH Tank (US), Fiber Technology Corporation (US), Caldwell Tanks (US), Containment Solutions Inc. (US), and Maguire Iron Inc. (US).

Research Coverage:

- This report provides detailed segmentation of the water storage systems market based on material, application, end use, and region. Material is divided into steel, fiberglass, plastic, concrete, and others. Application is divided into Hydraulic fracture storage & collection, Onsite water & wastewater collection, Potable water storage systems, Fire suppression reserve & storage, Rainwater harvesting & collection, and Others (irrigation, secondary containment systems, and marine). Based on end use, the market has been segmented into residential, commercial, industrial, and municipal. Based on the region, the market has been segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Key Benefits of Buying the Report

From an insight perspective, this research report focuses on various levels of analyses - industry analysis (industry trends), market ranking of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the market; high growth regions; and market drivers, restraints, opportunities, and challenges.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 WATER STORAGE SYSTEMS: MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 WATER STORAGE SYSTEMS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary data sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 3 WATER STORAGE SYSTEMS MARKET SIZE ESTIMATION, BY REGION

- FIGURE 4 WATER STORAGE SYSTEMS MARKET, BY END USE

- 2.2.2 SUPPLY-SIDE FORECAST

- FIGURE 5 WATER STORAGE SYSTEMS MARKET: SUPPLY-SIDE FORECAST

- FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF WATER STORAGE SYSTEMS MARKET

- 2.2.3 DEMAND-SIDE FORECAST

- FIGURE 7 WATER STORAGE SYSTEMS MARKET: DEMAND-SIDE FORECAST

- 2.2.4 FACTOR ANALYSIS

- FIGURE 8 FACTOR ANALYSIS OF WASTE STORAGE SYSTEMS MARKET

- 2.3 DATA TRIANGULATION

- FIGURE 9 WATER STORAGE SYSTEMS MARKET: DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- 2.5 LIMITATIONS

- 2.6 GROWTH RATE FORECAST

3 EXECUTIVE SUMMARY

- TABLE 1 WATER STORAGE SYSTEMS MARKET SNAPSHOT (2022 VS. 2027)

- FIGURE 10 CONCRETE WATER STORAGE SYSTEMS TO LEAD OVERALL MARKET DURING FORECAST PERIOD

- FIGURE 11 ONSITE WATER & WASTEWATER COLLECTION SEGMENT EXPECTED TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

- FIGURE 12 MUNICIPAL END USE TO ACCOUNT FOR HIGHEST SHARE DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO BE LARGEST AND FASTEST-GROWING MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN WATER STORAGE SYSTEMS MARKET

- FIGURE 14 MARKET TO WITNESS MODERATE GROWTH BETWEEN 2022 AND 2027

- 4.2 WATER STORAGE SYSTEMS MARKET, BY END USE

- FIGURE 15 MUNICIPAL TO BE LARGEST END-USE SEGMENT DURING FORECAST PERIOD

- 4.3 WATER STORAGE SYSTEMS MARKET: DEVELOPED VS. EMERGING COUNTRIES

- FIGURE 16 EMERGING COUNTRIES TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- 4.4 ASIA PACIFIC WATER STORAGE SYSTEMS MARKET, BY END USE AND COUNTRY, 2021

- FIGURE 17 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC

- 4.5 WATER STORAGE SYSTEMS MARKET, BY MAJOR COUNTRIES

- FIGURE 18 CHINA TO REGISTER HIGHEST CAGR IN WATER STORAGE SYSTEMS MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN WATER STORAGE SYSTEMS MARKET

- 5.1.1 DRIVERS

- 5.1.1.1 Rapidly increasing population

- TABLE 2 POPULATION OF TOP FOUR COUNTRIES, 2009 & 2050

- 5.1.1.2 Limited availability of water

- 5.1.1.3 Growth of end-use industries

- 5.1.2 RESTRAINTS

- 5.1.2.1 Fluctuation in raw material prices

- 5.1.2.2 High initial investment

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Recycling and reuse offer opportunities for growth

- 5.1.3.2 Significant opportunities for growth in emerging countries

- 5.1.4 CHALLENGES

- 5.1.4.1 Tank and water quality issues

- 5.2 TYPES OF WATER STORAGE SYSTEMS

- 5.2.1 UNDERGROUND TANKS

- 5.2.2 ABOVEGROUND TANKS

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 20 WATER STORAGE SYSTEMS MARKET: VALUE CHAIN ANALYSIS

- TABLE 3 WATER STORAGE SYSTEMS MARKET: ECOSYSTEM

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 PORTER'S FIVE FORCES ANALYSIS: WATER STORAGE SYSTEMS MARKET

- TABLE 4 WATER STORAGE SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREAT OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 INTRODUCTION

- 5.5.2 GDP TRENDS AND FORECAST

- TABLE 5 GDP TRENDS AND FORECAST, PERCENTAGE CHANGE

- 5.5.3 TRENDS AND FORECASTS FOR GLOBAL CONSTRUCTION INDUSTRY

- FIGURE 22 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014-2035

- 5.5.4 EXPORT-IMPORT TRADE STATISTICS

- TABLE 6 EXPORT DATA FOR RESERVOIRS, TANKS, VATS, AND SIMILAR CONTAINERS, OF IRON OR STEEL, FOR ANY MATERIAL OTHER THAN COMPRESSED OR LIQUEFIED GAS, OF A CAPACITY OF > 300 L, NOT FITTED WITH MECHANICAL OR THERMAL EQUIPMENT, WHETHER OR NOT LINED OR HEAT-INSULATED (USD THOUSAND) - HS CODE (730900)

- TABLE 7 IMPORT DATA FOR RESERVOIRS, TANKS, VATS, AND SIMILAR CONTAINERS, OF IRON OR STEEL, FOR ANY MATERIAL OTHER THAN COMPRESSED OR LIQUEFIED GAS, OF A CAPACITY OF > 300 L, NOT FITTED WITH MECHANICAL OR THERMAL EQUIPMENT, WHETHER OR NOT LINED OR HEAT-INSULATED (USD THOUSAND) - HS CODE (730900)

- 5.5.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 WATER STORAGE SYSTEMS MARKET, BY MATERIAL

- 6.1 INTRODUCTION

- FIGURE 23 FIBERGLASS SEGMENT PROJECTED TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 11 WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 12 WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 6.2 CONCRETE

- 6.2.1 SUPERIOR STRENGTH, RESISTANCE TO CORROSION, AND DURABILITY TO DRIVE DEMAND FOR CONCRETE WATER STORAGE TANKS

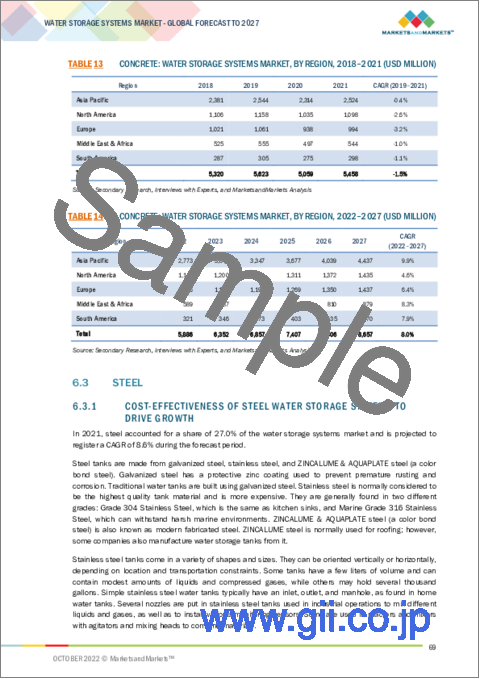

- TABLE 13 CONCRETE: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 14 CONCRETE: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 STEEL

- 6.3.1 COST-EFFECTIVENESS OF STEEL WATER STORAGE SYSTEMS TO DRIVE GROWTH

- TABLE 15 STEEL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 16 STEEL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4 FIBERGLASS

- 6.4.1 FIBERGLASS OFFERS HIGH MECHANICAL STRENGTH, MINIMAL DETERIORATION, AND NON-CORROSION

- TABLE 17 FIBERGLASS: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 18 FIBERGLASS: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5 PLASTIC

- 6.5.1 ASIA PACIFIC TO WITNESS HIGHEST GROWTH FOR PLASTIC WATER STORAGE SYSTEMS MARKET

- TABLE 19 PLASTIC: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 20 PLASTIC: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.6 OTHERS

- 6.6.1 ASIA PACIFIC TO REMAIN DOMINANT MARKET FOR OTHERS SEGMENT

- TABLE 21 OTHERS: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 22 OTHERS: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

7 WATER STORAGE SYSTEMS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 24 RAINWATER HARVESTING & COLLECTION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 23 WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 24 WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.2 HYDRAULIC FRACTURE STORAGE & COLLECTION

- 7.2.1 INCREASING OIL & GAS ACTIVITIES TO DRIVE GROWTH OF HYDRAULIC FRACTURE STORAGE & COLLECTION SYSTEMS

- TABLE 25 HYDRAULIC FRACTURE STORAGE & COLLECTION: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 26 HYDRAULIC FRACTURE STORAGE & COLLECTION: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 ONSITE WATER & WASTEWATER COLLECTION

- 7.3.1 STRINGENT ENVIRONMENTAL REGULATIONS ABOUT REUSE & RELEASE OF POLLUTED PROCESSED WATER TO DRIVE MARKET

- TABLE 27 ONSITE WATER & WASTEWATER COLLECTION: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 28 ONSITE WATER & WASTEWATER COLLECTION: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 7.4 POTABLE WATER STORAGE

- 7.4.1 FRESHWATER SCARCITY COUPLED WITH INCREASING POPULATION TO DRIVE DEMAND IN POTABLE WATER STORAGE APPLICATION

- TABLE 29 POTABLE WATER STORAGE: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 30 POTABLE WATER STORAGE: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.5 RAINWATER HARVESTING & COLLECTION

- 7.5.1 INCREASING CONCERNS REGARDING AVAILABILITY OF WATER RESOURCES TO DRIVE RAINWATER HARVESTING & COLLECTION

- TABLE 31 RAINWATER HARVESTING & COLLECTION: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 32 RAINWATER HARVESTING & COLLECTION: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.6 FIRE SUPPRESSION RESERVE & STORAGE

- 7.6.1 INCREASING SAFETY STANDARDS AND GOVERNMENT REGULATIONS REGARDING PROTECTION AGAINST FIRE TO FUEL GROWTH

- TABLE 33 FIRE SUPPRESSION RESERVE & STORAGE: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 34 FIRE SUPPRESSION RESERVE & STORAGE: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.7 OTHERS

- 7.7.1 INCREASING IRRIGATION ACTIVITIES TO DRIVE MARKET IN OTHER APPLICATIONS SEGMENT

- TABLE 35 OTHER APPLICATIONS: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 OTHER APPLICATIONS: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

8 WATER STORAGE SYSTEMS MARKET, BY END USE

- 8.1 INTRODUCTION

- FIGURE 25 MUNICIPAL SEGMENT DOMINATES WATER STORAGE SYSTEMS MARKET

- TABLE 37 WATER STORAGE SYSTEMS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 38 WATER STORAGE SYSTEMS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 8.2 MUNICIPAL

- 8.2.1 INCREASING POPULATION AND RAPID URBANIZATION DRIVING DEMAND IN MUNICIPAL SEGMENT

- TABLE 39 MUNICIPAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 40 MUNICIPAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 INDUSTRIAL

- 8.3.1 GOVERNMENT REGULATIONS, ENVIRONMENTAL NORMS, AND INDUSTRIALIZATION TO DRIVE INDUSTRIAL WATER STORAGE SYSTEMS MARKET

- TABLE 41 INDUSTRIAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 42 INDUSTRIAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 COMMERCIAL

- 8.4.1 GROWING URBANIZATION DRIVING GROWTH OF MARKET IN COMMERCIAL SECTOR

- TABLE 43 COMMERCIAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 44 COMMERCIAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.5 RESIDENTIAL

- 8.5.1 RISING WATER DEMAND AND GROWING WATER SCARCITY FUELING NEED FOR RESIDENTIAL WATER STORAGE SYSTEMS

- TABLE 45 RESIDENTIAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 46 RESIDENTIAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

9 WATER STORAGE SYSTEMS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 26 ASIA PACIFIC WATER STORAGE SYSTEMS MARKET PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

- TABLE 47 WATER STORAGE SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 48 WATER STORAGE SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 49 WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 50 WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- TABLE 51 WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 52 WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 53 WATER STORAGE SYSTEMS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 54 WATER STORAGE SYSTEMS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 9.2 ASIA PACIFIC

- FIGURE 27 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET SNAPSHOT

- TABLE 55 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 56 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 57 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 58 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- TABLE 59 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 60 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 61 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 62 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 9.2.1 CHINA

- 9.2.1.1 China to lead water storage systems market in Asia Pacific

- TABLE 63 CHINA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 64 CHINA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.2.2 JAPAN

- 9.2.2.1 Fiberglass to be fastest-growing material type during forecast period

- TABLE 65 JAPAN: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 66 JAPAN: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.2.3 INDIA

- 9.2.3.1 Booming economy, population growth, and rapid urbanization to drive market

- TABLE 67 INDIA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 68 INDIA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Growing awareness about water scarcity to drive water storage systems market

- TABLE 69 SOUTH KOREA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 70 SOUTH KOREA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.2.5 AUSTRALIA

- 9.2.5.1 Stringent regulations and fluctuating rainfall to drive growth of water storage systems

- TABLE 71 AUSTRALIA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 72 AUSTRALIA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.2.6 REST OF ASIA PACIFIC

- 9.2.6.1 Increasing population and scarcity of water to drive growth in Rest of Asia Pacific

- TABLE 73 REST OF ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 74 REST OF ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.3 NORTH AMERICA

- FIGURE 28 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET SNAPSHOT

- TABLE 75 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 76 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 77 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 78 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- TABLE 79 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 80 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 81 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 82 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 9.3.1 US

- 9.3.1.1 Aging water infrastructure and significant capital investment to drive market

- TABLE 83 US: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 84 US: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.3.2 CANADA

- 9.3.2.1 Lack of investment in water infrastructure to restrain market growth during forecast period

- TABLE 85 CANADA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 86 CANADA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.3.3 MEXICO

- 9.3.3.1 Rainwater harvesting to cope with severe water scarcity to drive market

- TABLE 87 MEXICO: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 88 MEXICO: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.4 EUROPE

- FIGURE 29 EUROPE: WATER STORAGE SYSTEMS MARKET SNAPSHOT

- TABLE 89 EUROPE: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 90 EUROPE: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 91 EUROPE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 92 EUROPE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- TABLE 93 EUROPE: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 94 EUROPE: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 95 EUROPE: WATER STORAGE SYSTEMS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 96 EUROPE: WATER STORAGE SYSTEMS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 9.4.1 GERMANY

- 9.4.1.1 High population expected to drive growth of water storage systems market

- TABLE 97 GERMANY: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 98 GERMANY: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.4.2 FRANCE

- 9.4.2.1 Climate change expected to influence water storage systems market in France

- TABLE 99 FRANCE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 100 FRANCE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.4.3 UK

- 9.4.3.1 Scarcity of water to drive growth of water storage systems market in UK

- TABLE 101 UK: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 102 UK: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.4.4 ITALY

- 9.4.4.1 Rainwater harvesting and stringent regulations to fuel growth of market

- TABLE 103 ITALY: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 104 ITALY: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.4.5 SPAIN

- 9.4.5.1 Dependence on reservoirs to drive growth of water storage systems market

- TABLE 105 SPAIN: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 106 SPAIN: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.4.6 REST OF EUROPE

- 9.4.6.1 Increasing capital expenditure on maintenance of water reserves to fuel growth

- TABLE 107 REST OF EUROPE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 108 REST OF EUROPE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.5 MIDDLE EAST & AFRICA

- FIGURE 30 SOUTH AFRICA TO REGISTER HIGHEST GROWTH IN MIDDLE EAST & AFRICA

- TABLE 109 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 9.5.1 SAUDI ARABIA

- 9.5.1.1 Concrete remains dominant water storage systems market in Saudi Arabia

- TABLE 117 SAUDI ARABIA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 118 SAUDI ARABIA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.5.2 UAE

- 9.5.2.1 High consumption in air conditioning systems driving growth in UAE

- TABLE 119 UAE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 120 UAE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.5.3 SOUTH AFRICA

- 9.5.3.1 Government support to drive growth of water storage systems market in South Africa

- TABLE 121 SOUTH AFRICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 122 SOUTH AFRICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.5.4 REST OF MIDDLE EAST & AFRICA

- 9.5.4.1 Increasing population and water scarcity fueling growth of water storage systems

- TABLE 123 REST OF MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 124 REST OF MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.6 SOUTH AMERICA

- FIGURE 31 BRAZIL ACCOUNTS FOR HIGHEST SHARE OF SOUTH AMERICAN WATER STORAGE SYSTEMS MARKET

- TABLE 125 SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 126 SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 127 SOUTH AMERICA WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 128 SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- TABLE 129 SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 130 SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 131 SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 132 SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY END USE, 2022-2027 (USD MILLION)

- 9.6.1 BRAZIL

- 9.6.1.1 Brazil dominates water storage systems market in South America

- TABLE 133 BRAZIL: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 134 BRAZIL: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.6.2 ARGENTINA

- 9.6.2.1 Increasing oil & gas exploration to drive growth of market in Argentina

- TABLE 135 ARGENTINA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 136 ARGENTINA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.3.1 Plastic material segment to account for largest share in Rest of South America

- TABLE 137 REST OF SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 138 REST OF SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- TABLE 139 OVERVIEW OF STRATEGIES ADOPTED BY KEY WATER STORAGE SYSTEMS PLAYERS (2018-2022)

- 10.2 COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.2.1 STARS

- 10.2.2 EMERGING LEADERS

- 10.2.3 PARTICIPANTS

- 10.2.4 PERVASIVE PLAYERS

- FIGURE 32 WATER STORAGE SYSTEMS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.3 SME MATRIX, 2021

- 10.3.1 RESPONSIVE COMPANIES

- 10.3.2 PROGRESSIVE COMPANIES

- 10.3.3 STARTING BLOCKS

- 10.3.4 DYNAMIC COMPANIES

- FIGURE 33 WATER STORAGE SYSTEMS MARKET: START-UP/SME COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.4 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 34 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN WATER STORAGE SYSTEMS MARKET

- 10.5 BUSINESS STRATEGY EXCELLENCE

- FIGURE 35 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN WATER STORAGE SYSTEMS MARKET

- 10.6 COMPETITIVE BENCHMARKING

- TABLE 140 WATER STORAGE SYSTEMS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 141 WATER STORAGE SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 142 COMPANY EVALUATION MATRIX: WATER STORAGE SYSTEMS

- 10.7 MARKET SHARE ANALYSIS

- FIGURE 36 MARKET SHARE OF KEY PLAYERS (2021)

- TABLE 143 WATER STORAGE SYSTEMS MARKET: DEGREE OF COMPETITION, 2021

- 10.8 MARKET RANKING ANALYSIS

- FIGURE 37 MARKET RANKING ANALYSIS, 2021

- 10.9 REVENUE ANALYSIS

- FIGURE 38 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2016-2020

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 MARKET EVALUATION FRAMEWORK

- TABLE 144 STRATEGIC DEVELOPMENTS BY MARKET PLAYERS

- TABLE 145 MOST ADOPTED STRATEGIES

- TABLE 146 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY PLAYERS

- 10.10.2 MARKET EVALUATION MATRIX

- TABLE 147 COMPANY END-USE FOOTPRINT

- TABLE 148 COMPANY REGION FOOTPRINT

- TABLE 149 COMPANY OVERALL FOOTPRINT

- 10.11 STRATEGIC DEVELOPMENTS

- TABLE 150 WATER STORAGE SYSTEMS MARKET: PRODUCT LAUNCHES, 2018-2022

- TABLE 151 WATER STORAGE SYSTEMS MARKET: DEALS, 2018-2022

- TABLE 152 WATER STORAGE SYSTEMS MARKET: OTHERS, 2018-2022

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 11.1.1 CST INDUSTRIES, INC.

- TABLE 153 CST INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 154 CST INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 155 CST INDUSTRIES, INC.: DEALS

- TABLE 156 CST INDUSTRIES, INC.: OTHERS

- 11.1.2 ZCL COMPOSITES, INC.

- TABLE 157 ZCL COMPOSITES, INC: COMPANY OVERVIEW

- 11.1.3 SYNALLOY CORPORATION

- TABLE 158 SYNALLOY CORPORATION: COMPANY OVERVIEW

- FIGURE 39 SYNALLOY CORPORATION: COMPANY SNAPSHOT

- 11.1.4 AG GROWTH INTERNATIONAL INC.

- TABLE 159 AG GROWTH INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 40 AG GROWTH INTERNATIONAL INC.: COMPANY SNAPSHOT

- 11.1.5 MCDERMOTT INTERNATIONAL, INC.

- TABLE 160 MCDERMOTT INTERNATIONAL, INC.: COMPANY OVERVIEW

- FIGURE 41 MCDERMOTT INTERNATIONAL, INC.: COMPANY SNAPSHOT

- TABLE 161 MCDERMOTT INTERNATIONAL, INC.: DEALS

- 11.1.6 BH TANK

- TABLE 162 BH TANK: COMPANY OVERVIEW

- 11.1.7 FIBER TECHNOLOGY CORPORATION

- TABLE 163 FIBER TECHNOLOGY CORPORATION: COMPANY OVERVIEW

- 11.1.8 CALDWELL TANKS

- TABLE 164 CALDWELL TANKS: COMPANY OVERVIEW

- 11.1.9 CONTAINMENT SOLUTIONS INC.

- TABLE 165 CONTAINMENT SOLUTIONS INC: COMPANY OVERVIEW

- 11.1.10 MAGUIRE IRON INC.

- TABLE 166 MAGUIRE IRON INC.: COMPANY OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 SNYDER INDUSTRIES

- TABLE 167 SNYDER INDUSTRIES: COMPANY OVERVIEW

- 11.2.2 CROM CORPORATION

- TABLE 168 CROM CORPORATION: COMPANY OVERVIEW

- 11.2.3 TANK CONNECTION

- TABLE 169 TANK CONNECTION: COMPANY OVERVIEW

- 11.2.4 CONTAIN ENVIRO SERVICES LTD

- TABLE 170 CONTAIN ENVIRO SERVICES LTD: COMPANY OVERVIEW

- 11.2.5 HMT LLC

- TABLE 171 HMT LLC: COMPANY OVERVIEW

- 11.2.6 DN TANKS

- TABLE 172 DN TANKS: COMPANY OVERVIEW

- 11.2.7 SINTEX PLASTICS TECHNOLOGY LIMITED

- TABLE 173 SINTEX PLASTICS TECHNOLOGY LIMITED: COMPANY OVERVIEW

- 11.2.8 BALMORAL TANKS LIMITED

- TABLE 174 BALMORAL TANKS LIMITED: COMPANY OVERVIEW

- 11.2.9 SUPERIOR TANK CO. INC

- TABLE 175 SUPERIOR TANK CO. INC: COMPANY OVERVIEW

- 11.2.10 PITTSBURG TANK & TOWER GROUP

- TABLE 176 PITTSBURG TANK & TOWER GROUP: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 WASTEWATER TREATMENT SERVICES MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE

- TABLE 177 WASTEWATER TREATMENT SERVICES MARKET SIZE, BY SERVICE TYPE, 2016-2019 (USD MILLION)

- TABLE 178 WASTEWATER TREATMENT SERVICES MARKET SIZE, BY SERVICE TYPE, 2020-2026 (USD MILLION)

- 12.3.3.1 Design & engineering consulting

- 12.3.3.2 Building & installation service

- 12.3.3.3 Operation & process control

- 12.3.3.4 Maintenance & repair

- 12.3.3.5 Others

- 12.3.4 WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY

- TABLE 179 WASTEWATER TREATMENT SERVICES MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 180 WASTEWATER TREATMENT SERVICES MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (USD MILLION)

- 12.3.4.1 Municipal

- 12.3.4.2 Industrial

- TABLE 181 WASTEWATER TREATMENT SERVICES MARKET SIZE IN INDUSTRIAL END-USE INDUSTRY, BY INDUSTRY TYPE, 2016-2019 (USD MILLION)

- TABLE 182 WASTEWATER TREATMENT SERVICES MARKET SIZE IN INDUSTRIAL END-USE INDUSTRY, BY INDUSTRY TYPE, 2020-2026 (USD MILLION)

- 12.3.4.2.1 Chemical & pharma

- 12.3.4.2.2 Oil & gas

- 12.3.4.2.3 Food, pulp & paper

- 12.3.4.2.4 Metal & mining

- 12.3.4.2.5 Power generation

- 12.3.4.2.6 Others

- 12.3.5 WASTEWATER TREATMENT SERVICES MARKET, BY REGION

- TABLE 183 WASTEWATER TREATMENT SERVICES MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

- TABLE 184 WASTEWATER TREATMENT SERVICES MARKET SIZE, BY REGION, 2020-2026 (USD MILLION)

- 12.3.5.1 North America

- 12.3.5.2 Europe

- 12.3.5.3 Asia Pacific

- 12.3.5.4 Middle East & Africa

- 12.3.5.5 South America

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS