|

|

市場調査レポート

商品コード

1125972

肥満手術用デバイスの世界市場:デバイスタイプ別(低侵襲手術用、非侵襲手術用)、処置別(スリーブ状胃切除術、胃バイパス術、肥満再手術、調節性胃バンディング術)、地域別 - 2027年までの予測Bariatric Surgery Devices Market by Device Type (Minimally Invasive (Stapling, Suturing, Vessel Sealing Devices), Non Invasive), Procedure(Sleeve Gastrectomy, Gastric Bypass, Revision Surgery, Adjustable Gastric Banding), Region -Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 肥満手術用デバイスの世界市場:デバイスタイプ別(低侵襲手術用、非侵襲手術用)、処置別(スリーブ状胃切除術、胃バイパス術、肥満再手術、調節性胃バンディング術)、地域別 - 2027年までの予測 |

|

出版日: 2022年09月05日

発行: MarketsandMarkets

ページ情報: 英文 185 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の肥満手術用デバイスの市場規模は、2022年の推定19億米ドルから2027年までに24億米ドルに達し、予測期間中のCAGRで5.4%の成長が予測されています。

肥満手術の実施件数の増加や肥満症例の増加により、関連機器への需要が高まり、肥満手術用デバイス市場の成長を牽引すると予測されます。一方で、医療機器業界における規制状況の変化や肥満手術に関連する術後合併症が、市場の成長をある程度抑制することが予想されます。

"肥満手術用デバイス市場において、予測期間中のデバイスタイプ別では、低侵襲手術用デバイスセグメントが最も高い成長率を占める"

肥満手術用デバイス市場は、低侵襲手術用デバイスと非侵襲手術用デバイスに区分されます。低侵襲手術用デバイスセグメントは、予測期間中に最も高い成長率を記録すると予想されます。低侵襲肥満手術は、体重減少や糖尿病などの併存疾患の寛解という点で、長期的に見てより効果的であるため、肥満の人たちに好まれています。低侵襲手術(MIS)は、肥満の治療だけでなく、高血圧や睡眠時無呼吸症候群などの治療にも非常に有効です。また、MISは将来の健康問題の予防にも役立っています。

"スリーブ状胃切除術セグメントが最も高いCAGRを占める"

処置別では、肥満手術用デバイス市場は、スリーブ状胃切除術、胃バイパス術、肥満再手術、ルーワイ胃バイパス術、調節性胃バンディング術、胆膵路バイパス/十二指腸スイッチ術(BPD/DS)に区分されます。スリーブ状胃切除術セグメントは、予測期間中に最も高いCAGRを記録すると予想されています。胃切除術の実施件数が増加しており、肥満手術用デバイスの取り込みを促進しています。他の減量手術と比較した場合、スリーブ状胃切除術は技術的に容易で、比較的病的状態も少ないため、世界で最も一般的に行われている減量手術となっています。

"アジア太平洋地域は、予測期間中に最も高いCAGRで成長すると予想される"

世界の肥満手術用デバイス市場は、5つの主要地域に区分されています。北米、欧州、アジア太平洋地域、ラテンアメリカ、中東・アフリカです。アジア太平洋地域は、予測期間中に肥満手術用デバイス市場で最も高い成長を示すことが期待されています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 価格分析

- 特許分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 規制情勢

- 貿易分析

- 技術分析

- 主な会議とイベント

- 顧客のビジネスに影響を与える動向/混乱

- 主な利害関係者と購入基準

- ケーススタディ

- PESTLE分析

第6章 肥満手術用デバイス市場:デバイスタイプ別

- イントロダクション

- 低侵襲手術用

- 非侵襲手術用

第7章 肥満手術用デバイス市場:処置別

- イントロダクション

- スリーブ状胃切除術

- 肥満再手術

- 胃バイパス術

- 非侵襲肥満手術

- ルーワイ胃バイパス術

- 調節性胃バンディング術

- 胆膵路バイパス/十二指腸スイッチ術(BPD/DS)

第8章 肥満手術用デバイス市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- その他

- ラテンアメリカ

- 中東・アフリカ

第9章 競合情勢

- 概要

- 主要企業が採用した戦略/有力企業

- 主要市場企業の収益シェア分析

- 市場シェア分析

- 企業の評価象限

- スタートアップ/中小企業の競合リーダーシップマッピング

- 競合ベンチマーキング

- 競合シナリオ

第10章 企業プロファイル

- 主要企業

- JOHNSON & JOHNSON

- MEDTRONIC PLC

- INTUITIVE SURGICAL, INC.

- OLYMPUS CORPORATION

- APOLLO ENDOSURGERY, INC.

- RESHAPE LIFESCIENCES INC.

- SPATZ MEDICAL

- COUSIN BIOTECH

- MEDIFLEX SURGICAL PRODUCTS

- B. BRAUN MELSUNGEN AG

- STANDARD BARIATRICS, INC.

- その他の企業

- RICHARD WOLF GMBH

- MEDSIL

- GRENA LTD

- SURGICAL INNOVATIONS GROUP PLC

- A.M.I. GMBH

- REACH SURGICAL

- SILIMED INDUSTRIA DE IMPLANTES LTDA.

- COOK MEDICAL LLC

- SHANGHAI YISI MEDICAL TECHNOLOGY CO., LTD.

- BOWA-ELECTRONIC GMBH & CO. KG

- TROKAMED GMBH

- ASPIRE BARIATRICS, INC.

- VICTOR MEDICAL INSTRUMENTS CO., LTD.

- APPLIED MEDICAL RESOURCES CORPORATION

第11章 付録

The global bariatric surgery devices market is valued to reach USD 2.4 billion by 2027 from an estimated USD 1.9 billion in 2022, at a CAGR of 5.4% during the forecast period. The growing number of bariatric surgeries performed and increasing obesity cases are expected to result in the increasing demand for associated devices, thereby driving the growth of the bariatric surgery devices market. On the other hand, changing regulatory landscape in the medical device industry and postoperative complications related to bariatric surgeries are expected to restrain market growth to a certain extent.

"The minimally invasive surgical devices segment accounted for the highest growth rate in the bariatric surgery devices market, by device type, during the forecast period"

The bariatric surgery devices market is segmented into minimally invasive surgical devices and non-invasive surgical devices. The minimally invasive surgical devices segment is expected to register the highest growth rate during the forecast period. Minimally invasive bariatric surgeries are preferred for the obese population as they are more effective in the long run in terms of weight loss and the remission of comorbidities such as diabetes. In addition to their ability to treat obesity, minimally invasive surgeries (MIS) are very effective in treating high blood pressure and sleep apnea, among others. MIS also has helped prevent future health problems. Thus, the rising prevalence of obesity and related comorbidities is expected to fuel the uptake of MIS bariatric devices.

"Sleeve gastrectomy segment accounted for the highest CAGR"

Based on procedure, the bariatric surgery devices market is segmented into sleeve gastrectomy, gastric bypass, revision bariatric surgery, non-invasive bariatric surgery, mini-gastric bypass, adjustable gastric banding, and biliopancreatic diversion with duodenal switch (BPD/DS). The sleeve gastrectomy segment is expected to register the highest CAGR during the forecast period. A growing volume of gastrostomies has been performed, fueling the uptake of bariatric surgery devices. When compared to other weight-loss surgeries, sleeve gastrectomy is technically easier with relatively less morbidity and thus has become the most common weight loss surgery performed worldwide.

"The Asia Pacific market is expected to grow at the highest CAGR during the forecast period"

The global bariatric surgery devices market is segmented into five major regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is expected to witness the highest growth in the bariatric surgery devices market during the forecast period. The high growth in this region can primarily be attributed to the region's low labor costs and favorable regulatory environment. Low infrastructure & treatment costs and the availability of highly educated physicians have driven medical tourists to APAC countries, thus supporting the market growth.

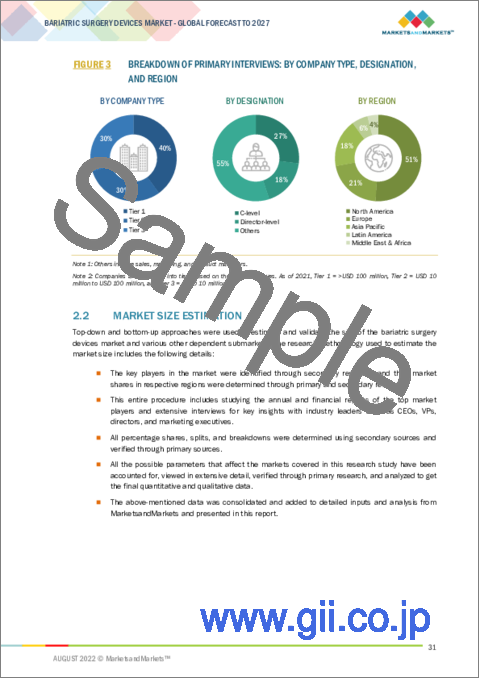

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America - 6% , and the Middle East & Africa - 4%

Lists of Companies Profiled in the Report:

- Johnson & Johnson (US)

- Medtronic plc (Ireland)

- Intuitive Surgical, Inc. (US)

- Apollo Endosurgery, Inc. (US)

- ReShape Lifesciences Inc. (US)

- Olympus Corporation (Japan)

- Spatz Medical (US)

- Cousin Biotech (France)

- Mediflex Surgical Products (US)

- COOK MEDICAL LLC (US)

- B. Braun Melsungen AG (Germany)

- Standard Bariatrics, Inc. (US)

- Richard Wolf GmbH (Germany)

- Grena LTD (UK)

- Surgical Innovations Group plc (UK)

- A.M.I. GmbH (Austria)

- Reach Surgical (China)

- Silimed Industria de Implantes Ltda. (Brazil)

- Shanghai Yisi Medical Technology Co., Ltd. (China)

- BOWA-electronic GmbH & Co. KG (Germany)

- MEDSIL (Russia)

- TROKAMED GmbH (Germany)

- Aspire Bariatrics, Inc. (US)

- Victor Medical Instruments Co., Ltd. (China)

- Applied Medical Resources Corporation (US)

Research Coverage:

This report provides a detailed picture of the global bariatric surgery devices market. It aims at estimating the size and future growth potential of the market across different segments, such as device type, procedure, and region. The report also includes an in-depth competitive analysis of the key market players, along with their company profiles, recent developments, and key market strategies.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall bariatric surgery devices market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 BARIATRIC SURGERY DEVICES MARKET

- 1.3.2 GEOGRAPHIC SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY USED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 BARIATRIC SURGERY DEVICES MARKET: RESEARCH DESIGN METHODOLOGY

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 Secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- 2.2.1.2 Approach 2: Presentations of companies and primary interviews

- 2.2.1.3 Growth forecast

- 2.2.1.4 CAGR projections

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 BARIATRIC SURGERY DEVICES MARKET: TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 GROWTH RATE ASSUMPTIONS

- 2.8 RISK ASSESSMENT

- TABLE 1 RISK ASSESSMENT: BARIATRIC SURGERY DEVICES MARKET

3 EXECUTIVE SUMMARY

- FIGURE 8 BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 BARIATRIC SURGERY DEVICES MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 BARIATRIC SURGERY DEVICES MARKET OVERVIEW

- FIGURE 11 RISING OBESITY RATE WORLDWIDE TO DRIVE MARKET GROWTH

- 4.2 BARIATRIC SURGERY DEVICES MARKET SHARE, BY DEVICE TYPE, 2022 VS. 2027

- FIGURE 12 MINIMALLY INVASIVE SURGICAL DEVICES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.3 BARIATRIC SURGERY DEVICES MARKET SHARE, BY PROCEDURE, 2022 VS. 2027

- FIGURE 13 SLEEVE GASTRECTOMY SEGMENT TO ACCOUNT FOR HIGHER SHARE DURING FORECAST PERIOD

- 4.4 BARIATRIC SURGERY DEVICES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 BARIATRIC SURGERY DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing obesity cases worldwide and subsequent rise in bariatric surgeries

- TABLE 2 REMISSION RATE OF OBESITY-RELATED DISEASES POST-BARIATRIC SURGERY

- 5.2.1.2 Growing demand for minimally invasive surgeries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Changing regulatory landscape in the medical devices industry

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth opportunities in emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Postoperative challenges associated with bariatric surgery

- 5.3 PRICING ANALYSIS

- TABLE 3 AVERAGE SELLING PRICE OF BARIATRIC SURGERY DEVICES (2022)

- 5.4 PATENT ANALYSIS

- FIGURE 16 LIST OF MAJOR PATENTS FOR BARIATRIC SURGERY DEVICES

- TABLE 4 LIST OF KEY PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 17 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING & ASSEMBLY PHASES IN BARIATRIC SURGERY DEVICES MARKET

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 18 BARIATRIC SURGERY DEVICES MARKET: SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- FIGURE 19 BARIATRIC SURGERY DEVICES MARKET: ECOSYSTEM MARKET MAP

- TABLE 5 BARIATRIC SURGERY DEVICES MARKET: ROLE IN ECOSYSTEM

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 BARIATRIC SURGERY DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT FROM NEW ENTRANTS

- 5.8.2 THREAT FROM SUBSTITUTES

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 BARGAINING POWER OF SUPPLIERS

- 5.8.5 DEGREE OF COMPETITION

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 NORTH AMERICA

- 5.9.2.1 US

- TABLE 9 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 10 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- 5.9.2.2 Canada

- TABLE 11 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- 5.9.3 EUROPE

- 5.9.4 ASIA PACIFIC

- 5.9.4.1 China

- TABLE 12 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- 5.9.4.2 Japan

- 5.9.4.3 India

- 5.10 TRADE ANALYSIS

- 5.10.1 TRADE ANALYSIS FOR ARTICLES AND EQUIPMENT FOR BARIATRIC SURGERY DEVICES

- TABLE 13 IMPORT DATA FOR ARTICLES AND EQUIPMENT FOR BARIATRIC SURGERY DEVICES, BY COUNTRY, 2017-2021 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR ARTICLES AND EQUIPMENT FOR BARIATRIC SURGERY DEVICES, BY COUNTRY, 2017-2021 (USD THOUSAND)

- 5.11 TECHNOLOGY ANALYSIS

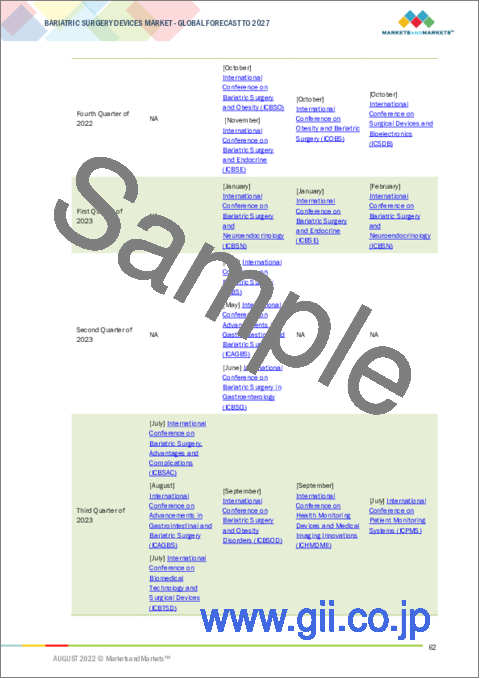

- 5.12 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 15 BARIATRIC SURGERY DEVICES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13.1 REVENUE SOURCES GRADUALLY SHIFTING TOWARD TECHNOLOGY-BASED SOLUTIONS

- 5.13.2 REVENUE SHIFT FOR BARIATRIC SURGERY DEVICES MARKET

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF BARIATRIC SURGERY DEVICES

- TABLE 16 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF BARIATRIC SURGERY DEVICES (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 21 KEY BUYING CRITERIA FOR BARIATRIC SURGERY DEVICES

- TABLE 17 KEY BUYING CRITERIA FOR BARIATRIC SURGERY DEVICES

- 5.15 CASE STUDY

- 5.16 PESTLE ANALYSIS

6 BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE

- 6.1 INTRODUCTION

- TABLE 18 BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- 6.1.1 PRIMARY INSIGHTS

- 6.1.1.1 Key primary insights

- 6.2 MINIMALLY INVASIVE SURGICAL DEVICES

- TABLE 19 KEY PRODUCTS FOR MINIMALLY INVASIVE SURGICAL DEVICES

- TABLE 20 BARIATRIC SURGERY DEVICES MARKET FOR MINIMALLY INVASIVE SURGICAL DEVICES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 21 BARIATRIC SURGERY DEVICES MARKET FOR MINIMALLY INVASIVE SURGICAL DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- 6.2.1 STAPLING DEVICES

- 6.2.1.1 Introduction of new & evolved stapling technologies to drive market

- TABLE 22 BARIATRIC SURGERY DEVICES MARKET FOR STAPLING DEVICES, BY REGION, 2020-2027 (USD MILLION)

- 6.2.2 ENERGY/VESSEL-SEALING DEVICES

- 6.2.2.1 Energy/vessel sealing devices result in reliable hemostasis

- TABLE 23 BARIATRIC SURGERY DEVICES MARKET FOR ENERGY/VESSEL-SEALING DEVICES, BY REGION, 2020-2027 (USD MILLION)

- 6.2.3 SUTURING DEVICES

- 6.2.3.1 Surgical errors associated with suturing devices to restrain market growth

- TABLE 24 BARIATRIC SURGERY DEVICES MARKET FOR SUTURING DEVICES, BY REGION, 2020-2027 (USD MILLION)

- 6.2.4 ACCESSORIES

- 6.2.4.1 Rising number of minimally invasive bariatric techniques drives demand for accessories

- TABLE 25 BARIATRIC SURGERY DEVICES MARKET FOR ACCESSORIES, BY REGION, 2020-2027 (USD MILLION)

- 6.3 NONINVASIVE SURGICAL DEVICES

- 6.3.1 LOWER WEIGHT LOSS EFFECTIVENESS OF NONINVASIVE SURGICAL DEVICES TO LIMIT UPTAKE

- TABLE 26 KEY PRODUCTS IN NONINVASIVE BARIATRIC SURGERY DEVICES MARKET

- TABLE 27 BARIATRIC SURGERY DEVICES MARKET FOR NONINVASIVE SURGICAL DEVICES, BY REGION, 2020-2027 (USD MILLION)

7 BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE

- 7.1 INTRODUCTION

- TABLE 28 BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 7.2 SLEEVE GASTRECTOMY

- 7.2.1 SLEEVE GASTRECTOMY AIDS IN ACHIEVING LONG-TERM WEIGHT LOSS

- TABLE 29 BARIATRIC SURGERY DEVICES MARKET FOR SLEEVE GASTRECTOMY, BY REGION, 2020-2027 (USD MILLION)

- 7.3 REVISION BARIATRIC SURGERY

- 7.3.1 RISING NEED TO MANAGE ACUTE & CHRONIC POSTOPERATIVE COMPLICATIONS TO DRIVE DEMAND FOR REVISION SURGERIES

- TABLE 30 BARIATRIC SURGERY DEVICES MARKET FOR REVISION BARIATRIC SURGERY, BY REGION, 2020-2027 (USD MILLION)

- 7.4 GASTRIC BYPASS

- 7.4.1 HIGHER COMPLEXITIES ASSOCIATED WITH GASTRIC BYPASS TO RESTRAIN MARKET GROWTH

- TABLE 31 BARIATRIC SURGERY DEVICES MARKET FOR GASTRIC BYPASS, BY REGION, 2020-2027 (USD MILLION)

- 7.5 NONINVASIVE BARIATRIC SURGERY

- 7.5.1 LONG-TERM WEIGHT REGAIN TO LIMIT ADOPTION

- TABLE 32 BARIATRIC SURGERY DEVICES MARKET FOR NONINVASIVE BARIATRIC SURGERY, BY REGION, 2020-2027 (USD MILLION)

- 7.6 MINI-GASTRIC BYPASS

- 7.6.1 ADVANTAGES OF MINI-GASTRIC BYPASS OVER TRADITIONAL GASTRIC BYPASS PROCEDURES TO PROPEL MARKET

- TABLE 33 BARIATRIC SURGERY DEVICES MARKET FOR MINI-GASTRIC BYPASS, BY REGION, 2020-2027 (USD MILLION)

- 7.7 ADJUSTABLE GASTRIC BANDING

- 7.7.1 INCREASING PRODUCT RECALLS TO RESTRAIN MARKET GROWTH

- TABLE 34 BARIATRIC SURGERY DEVICES MARKET FOR ADJUSTABLE GASTRIC BANDING, BY REGION, 2020-2027 (USD MILLION)

- 7.8 BILIOPANCREATIC DIVERSION WITH DUODENAL SWITCH (BPD/DS)

- 7.8.1 LONGER RECOVERY PERIOD AND MALABSORPTION COMPLICATIONS TO RESTRAIN MARKET

- TABLE 35 BARIATRIC SURGERY DEVICES MARKET FOR BPD/DS, BY REGION, 2020-2027 (USD MILLION)

8 BARIATRIC SURGERY DEVICES MARKET, BY REGION

- 8.1 INTRODUCTION

- TABLE 36 BARIATRIC SURGERY DEVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.2 NORTH AMERICA

- FIGURE 22 NORTH AMERICA: BARIATRIC SURGERY DEVICES MARKET SNAPSHOT

- TABLE 37 NORTH AMERICA: BARIATRIC SURGERY DEVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 38 NORTH AMERICA: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 39 NORTH AMERICA: MINIMALLY INVASIVE SURGICAL DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 40 NORTH AMERICA: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.2.1 US

- 8.2.1.1 Increasing prevalence of obesity and growing acceptance of bariatric surgery devices to drive market

- TABLE 41 US: ESTIMATED NUMBER OF BARIATRIC SURGERIES, 2011-2020

- TABLE 42 US: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 43 US: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 44 US: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.2.2 CANADA

- 8.2.2.1 Rising government initiatives to curb obesity to drive market

- TABLE 45 CANADA: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 46 CANADA: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 47 CANADA: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.3 EUROPE

- TABLE 48 EUROPE: BARIATRIC SURGERY DEVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 49 EUROPE: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 50 EUROPE: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 51 EUROPE: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.3.1 GERMANY

- 8.3.1.1 Growing healthcare expenditure to increase uptake of bariatric surgery devices

- TABLE 52 GERMANY: PREVALENCE OF ADULT OBESITY BY 2030

- TABLE 53 GERMANY: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 54 GERMANY: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 55 GERMANY: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.3.2 UK

- 8.3.2.1 Growing incidence of obesity and lifestyle diseases to drive market

- TABLE 56 UK: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 57 UK: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 58 UK: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.3.3 FRANCE

- 8.3.3.1 Rising government support for surgical device manufacturers to drive market

- TABLE 59 FRANCE: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 60 FRANCE: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 61 FRANCE: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.3.4 ITALY

- 8.3.4.1 Rising technological advancements to support market uptake for bariatric surgery devices

- TABLE 62 ITALY: PREVALENCE OF ADULT OBESITY BY 2030

- TABLE 63 ITALY: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 64 ITALY: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 65 ITALY: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.3.5 SPAIN

- 8.3.5.1 High incidence of diabetes to drive demand for MIS bariatric devices

- TABLE 66 SPAIN: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 67 SPAIN: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 68 SPAIN: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.3.6 REST OF EUROPE

- TABLE 69 REST OF EUROPE: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 70 REST OF EUROPE: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 71 REST OF EUROPE: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.4 ASIA PACIFIC

- FIGURE 23 ASIA PACIFIC: BARIATRIC SURGERY DEVICES MARKET SNAPSHOT

- TABLE 72 ASIA PACIFIC: BARIATRIC SURGERY DEVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 73 ASIA PACIFIC: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 74 ASIA PACIFIC: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 75 ASIA PACIFIC: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.4.1 CHINA

- 8.4.1.1 High incidence of obesity in children and adults to propel market growth

- TABLE 76 CHINA: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 77 CHINA: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 78 CHINA: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.4.2 JAPAN

- 8.4.2.1 Accessibility to affordable healthcare facilities to support market growth

- TABLE 79 JAPAN: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 80 JAPAN: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 81 JAPAN: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.4.3 INDIA

- 8.4.3.1 Rising government initiatives on obesity awareness to support market growth

- TABLE 82 INDIA: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 83 INDIA: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 84 INDIA: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.4.4 AUSTRALIA

- 8.4.4.1 Increasing initiatives to spread awareness on effective bariatric surgical care to support market growth

- TABLE 85 AUSTRALIA: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 86 AUSTRALIA: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 87 AUSTRALIA: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.4.5 REST OF ASIA PACIFIC

- TABLE 88 REST OF ASIA PACIFIC: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 89 REST OF ASIA PACIFIC: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.5 LATIN AMERICA

- 8.5.1 GROWING EFFORTS TO ENSURE UNIVERSAL HEALTHCARE COVERAGE TO SUPPORT MARKET GROWTH

- TABLE 91 LATIN AMERICA: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 92 LATIN AMERICA: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 93 LATIN AMERICA: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

- 8.6 MIDDLE EAST & AFRICA

- 8.6.1 IMPROVING HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

- TABLE 94 MIDDLE EAST & AFRICA: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE, 2020-2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

- 9.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY COMPANIES

- TABLE 97 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES

- 9.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 24 REVENUE SHARE ANALYSIS OF TOP PLAYERS

- 9.4 MARKET SHARE ANALYSIS

- 9.4.1 BARIATRIC SURGERY DEVICES MARKET

- FIGURE 25 BARIATRIC SURGERY DEVICES MARKET SHARE BY KEY PLAYER (2021)

- TABLE 98 BARIATRIC SURGERY DEVICES MARKET: DEGREE OF COMPETITION

- 9.5 COMPANY EVALUATION QUADRANT

- 9.5.1 LIST OF EVALUATED VENDORS

- 9.5.2 STARS

- 9.5.3 EMERGING LEADERS

- 9.5.4 PERVASIVE PLAYERS

- 9.5.5 PARTICIPANTS

- FIGURE 26 BARIATRIC SURGERY DEVICES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 9.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2021)

- 9.6.1 PROGRESSIVE COMPANIES

- 9.6.2 STARTING BLOCKS

- 9.6.3 RESPONSIVE COMPANIES

- 9.6.4 DYNAMIC COMPANIES

- FIGURE 27 BARIATRIC SURGERY DEVICES MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2021

- 9.7 COMPETITIVE BENCHMARKING

- 9.7.1 PRODUCT & GEOGRAPHIC FOOTPRINT ANALYSIS

- FIGURE 28 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS OF LEADING PLAYERS

- TABLE 99 BARIATRIC SURGERY DEVICES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 100 COMPANY PRODUCT & SERVICE FOOTPRINT

- TABLE 101 COMPANY REGIONAL FOOTPRINT

- TABLE 102 BARIATRIC SURGERY DEVICES MARKET: DETAILED LIST OF KEY START-UPS/SMES

- 9.8 COMPETITIVE SCENARIO

- 9.8.1 PRODUCT LAUNCHES

- TABLE 103 KEY PRODUCT LAUNCHES & REGULATORY APPROVALS

- 9.8.2 DEALS

- TABLE 104 KEY DEALS

- 9.8.3 OTHER DEVELOPMENTS

- TABLE 105 KEY OTHER DEVELOPMENTS

10 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 10.1 KEY PLAYERS

- 10.1.1 JOHNSON & JOHNSON

- TABLE 106 JOHNSON & JOHNSON: BUSINESS OVERVIEW

- FIGURE 29 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2021)

- 10.1.2 MEDTRONIC PLC

- TABLE 107 MEDTRONIC PLC: BUSINESS OVERVIEW

- FIGURE 30 MEDTRONIC PLC: COMPANY SNAPSHOT (2021)

- 10.1.3 INTUITIVE SURGICAL, INC.

- TABLE 108 INTUITIVE SURGICAL, INC: BUSINESS OVERVIEW

- FIGURE 31 INTUITIVE SURGICAL, INC: COMPANY SNAPSHOT (2021)

- 10.1.4 OLYMPUS CORPORATION

- TABLE 109 OLYMPUS CORPORATION: BUSINESS OVERVIEW

- FIGURE 32 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2021)

- 10.1.5 APOLLO ENDOSURGERY, INC.

- TABLE 110 APOLLO ENDOSURGERY, INC: BUSINESS OVERVIEW

- FIGURE 33 APOLLO ENDOSURGERY, INC: COMPANY SNAPSHOT (2021)

- 10.1.6 RESHAPE LIFESCIENCES INC.

- TABLE 111 RESHAPE LIFESCIENCES INC: BUSINESS OVERVIEW

- FIGURE 34 RESHAPE LIFESCIENCES INC: COMPANY SNAPSHOT (2021)

- 10.1.7 SPATZ MEDICAL

- TABLE 112 SPATZ MEDICAL: BUSINESS OVERVIEW

- 10.1.8 COUSIN BIOTECH

- TABLE 113 COUSIN BIOTECH: BUSINESS OVERVIEW

- 10.1.9 MEDIFLEX SURGICAL PRODUCTS

- TABLE 114 MEDIFLEX SURGICAL PRODUCTS: BUSINESS OVERVIEW

- 10.1.10 B. BRAUN MELSUNGEN AG

- TABLE 115 B. BRAUN MELSUNGEN AG: BUSINESS OVERVIEW

- FIGURE 35 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2021)

- 10.1.11 STANDARD BARIATRICS, INC.

- TABLE 116 STANDARD BARIATRICS, INC: BUSINESS OVERVIEW

- 10.2 OTHER PLAYERS

- 10.2.1 RICHARD WOLF GMBH

- TABLE 117 RICHARD WOLF GMBH: COMPANY OVERVIEW

- 10.2.2 MEDSIL

- TABLE 118 MEDSIL: COMPANY OVERVIEW

- 10.2.3 GRENA LTD

- TABLE 119 GRENA LTD: COMPANY OVERVIEW

- 10.2.4 SURGICAL INNOVATIONS GROUP PLC

- TABLE 120 SURGICAL INNOVATIONS GROUP PLC: COMPANY OVERVIEW

- 10.2.5 A.M.I. GMBH

- TABLE 121 A.M.I. GMBH: COMPANY OVERVIEW

- 10.2.6 REACH SURGICAL

- TABLE 122 REACH SURGICAL: COMPANY OVERVIEW

- 10.2.7 SILIMED INDUSTRIA DE IMPLANTES LTDA.

- TABLE 123 SILIMED INDUSTRIA DE IMPLANTES LTDA: COMPANY OVERVIEW

- 10.2.8 COOK MEDICAL LLC

- TABLE 124 COOK MEDICAL LLC: COMPANY OVERVIEW

- 10.2.9 SHANGHAI YISI MEDICAL TECHNOLOGY CO., LTD.

- TABLE 125 SHANGHAI YISI MEDICAL TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- 10.2.10 BOWA-ELECTRONIC GMBH & CO. KG

- TABLE 126 BOWA-ELECTRONIC GMBH & CO. KG: COMPANY OVERVIEW

- 10.2.11 TROKAMED GMBH

- TABLE 127 TROKAMED GMBH: COMPANY OVERVIEW

- 10.2.12 ASPIRE BARIATRICS, INC.

- TABLE 128 ASPIRE BARIATRICS, INC: COMPANY OVERVIEW

- 10.2.13 VICTOR MEDICAL INSTRUMENTS CO., LTD.

- TABLE 129 VICTOR MEDICAL INSTRUMENTS CO., LTD: COMPANY OVERVIEW

- 10.2.14 APPLIED MEDICAL RESOURCES CORPORATION

- TABLE 130 APPLIED MEDICAL RESOURCES CORPORATION: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS