|

|

市場調査レポート

商品コード

1123765

Bluetooth 5.0の世界市場:コンポーネント別(ハードウェア、ソフトウェア、サービス)、アプリケーション別(オーディオストリーミング、データ転送、位置情報サービス)、エンドユーザー別、地域別 - 2027年までの予測Bluetooth 5.0 Market by Component (Hardware, Software, Services), Application (Audio Streaming, Data Transfer, Location Services), End User (Automotive, Wearables, Consumer Electronics, Retail and Logistics) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| Bluetooth 5.0の世界市場:コンポーネント別(ハードウェア、ソフトウェア、サービス)、アプリケーション別(オーディオストリーミング、データ転送、位置情報サービス)、エンドユーザー別、地域別 - 2027年までの予測 |

|

出版日: 2022年08月30日

発行: MarketsandMarkets

ページ情報: 英文 236 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のBluetooth 5.0の市場規模は、2022年の41億米ドルから2027年までに70億米ドルに達し、予測期間中にCAGRで11.0%の成長が予測されています。

デジタルキーの認知度や受容度の向上により、スマートフォンによるアクセスやコントロール機能に対する需要が高まっており、Bluetooth技術は自動車のアクセスコントロールにおいて重要な役割を果たし、Bluetooth 5.0市場の成長を牽引しています。

"サービスコンポーネントが、予測期間中に高いCAGRを占める"

Bluetooth 5.0市場は、プロフェッショナルサービスとマネージドサービスに基づいて分類されています。プロフェッショナルサービスは、トレーニング・コンサルティングサービス、展開・統合サービス、サポート・メンテナンスサービスにさらに分類されます。サービスに対する需要は、Bluetooth 5.0技術の採用レベルに直接関連します。Bluetooth 5.0は、IoTと安全性、信頼性、信用性の高い無線接続技術に大きく貢献するため、採用が進んでいます。接続技術の急速な変化は、トレーニング、サービス、サポート需要の増加につながります。

"2022年、オーディオストリーミングアプリケーションが最大の市場シェアを占める"

オーディオストリーミングの面では、Bluetooth 5はBluetooth 4.2などの従来製品よりはるかに堅牢です。Bluetooth 5.0は、8倍のデータを2倍の速度で4倍の範囲に送信することができるため、信頼性の高い技術として考えられています。また、データを効率的に移動させるために、Bluetoothはクラシックモードとローエナジーモードで機能します。BLEは、ビーコン、ウェアラブルセンサー、低消費電力IoTデバイスなどの周辺機器のエネルギー使用量を削減します。Bluetooth 5.0では帯域幅が拡大され、2つのデバイスを同時にブロードキャストすることが可能になりました。これにより、ユーザーは2つ目のオーディオプログラムのストリーミング、複数の部屋へのオーディオの送信、ステレオ効果の作成、2組のヘッドフォン間でのオーディオの共有が可能になります。

"地域別では、アジア太平洋地域が予測期間中に高いCAGRを記録"

アジア太平洋地域におけるBluetooth 5.0市場の成長は、企業の急速なデジタル化によって大きく牽引されています。この地域は、インド、日本、中国、韓国、オーストラリアなどの新興経済国で構成されています。ウェアラブルデバイス、スマートホームデバイス、その他のスマートデバイスの利用が増加しています。また、スマート農業やスマートヘルスケアデバイスが選択されるようになっています。IoTの利用が進んでおり、それに伴い各国ではデータのプライバシー問題が発生しています。データ保護に関する包括的な政策の枠組みを定めており、日本と韓国は世界で最も進んだ枠組みを有しています。Bluetooth 5.0市場の分析対象地域は、中国、日本、インド、その他のアジア太平洋地域です。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン

- ケーススタディ分析

- ポーターのファイブフォース分析

- 特許分析

- 技術分析

- エコシステム

- 市場企業の価格モデル

- 主な会議とイベント

- バイヤー/クライアントに影響を与える混乱

- 主な利害関係者と購入基準

- 規制情勢

第6章 Bluetooth 5.0市場:コンポーネント別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第7章 Bluetooth 5.0市場:アプリケーション別

- イントロダクション

- オーディオストリーミング

- データ転送

- 位置情報サービス

- デバイスネットワーク

第8章 Bluetooth 5.0市場:エンドユーザー別

- イントロダクション

- コンシューマーエレクトロニクス

- ウェアラブル

- 工業計測・診断

- ヘルスケア

- 小売・物流

- 自動車

- スマートホーム/ビル

- その他

第9章 Bluetooth 5.0市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他

- アジア太平洋地域

- 中国

- 日本

- インド

- その他

- 中東・アフリカ

- アラブ首長国連邦

- 南アフリカ

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

第10章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 主要企業の市場シェア分析

- 過去の収益分析

- 競合ベンチマーキング

- 企業の評価象限

- スタートアップ/中小企業の評価象限

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- QUALCOMM

- NORDIC SEMICONDUCTOR

- MEDIATEK

- STMICROELECTRONICS

- NXP SEMICONDUCTORS

- MICROCHIP TECHNOLOGY

- ON SEMICONDUCTOR

- TEXAS INSTRUMENTS

- SYNOPSYS

- QORVO

- INFINEON TECHNOLOGIES

- SILICON LABS

- REALTEK

- BROADCOM

- RENESAS

- GOODIX TECHNOLOGY

- TAIYO YUDEN

- スタートアップ/中小企業

- TELIT

- ESPRESSIF SYSTEMS

- FEASYCOM

- ATMOSIC TECHNOLOGIES

- CEVA

- LAIRD CONNECTIVITY

- VIRSCIENT

- INVENTEK SYSTEMS

- INSIGHT SIP

第12章 隣接/関連市場

第13章 付録

The global Bluetooth 5.0 market size is expected to grow from USD 4.1 billion in 2022 to USD 7.0 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 11.0% during the forecast period. Increasing recognition and acceptance of digital keys have increased the demand for more smartphone access and control capabilities and Bluetooth technology plays a crucial role in automotive access control driving the Bluetooth 5.0 market growth.

Services component is estimated to account higher CAGR during the forecast period

The Bluetooth 5.0 market has been classified based on professional and managed services. Professional services have been further segmented into training and consulting services, deployment and integration services, and support and maintenance services. The demand for services is directly associated with the adoption level of Bluetooth 5.0 technology. The adoption of Bluetooth 5.0 is increasing as it makes a big portion of the contribution to IoT and wireless connectivity technology that is secure, reliable, and trustworthy. The rapid change in connectivity technology leads to increased training, service, and support demand.

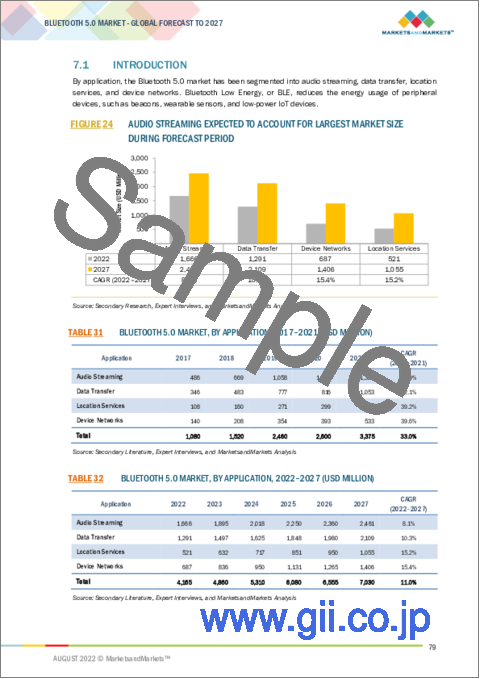

Audio Streaming application is expected account for the largest market share during 2022

In terms of audio streaming, Bluetooth 5 is much more robust than its predecessors, such as Bluetooth 4.2. Bluetooth 5.0 is considered as a reliable technology as it enables transmitting eight times more data, at twice the speed, across four times the range. Also, to move data efficiently, Bluetooth functions in Classic and Low Energy modes. BLE reduces the energy usage of peripheral devices, such as beacons, wearable sensors, and low-power IoT devices. The enlarged bandwidth of Bluetooth 5.0 permits broadcasting of two devices at once. This means the user can stream a second audio program, transmit audio to multiple rooms, create a stereo effect, or share audio between two sets of headphones.

Among regions, APAC to hold higher CAGR during the forecast period

The growth of the Bluetooth 5.0 market in Asia Pacific is highly driven by the rapid digitalization of enterprises across the region. The region comprises emerging economies, such as India, Japan, China, South Korea, and Australia. There is increasing use of wearable devices, smart home devices, and other smart devices across the country. People are also opting for smart agriculture and smart healthcare devices. Also, there is usage of IoT in the region, and with that comes data privacy issues for countries. Countries in the region have laid down comprehensive policy frameworks for data protection, with Japan and Korea having some of the most advanced frameworks in the world. The regions analyzed for the Bluetooth 5.0 market in this region are China, Japan, India, and rest of Asia Pacific.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the Bluetooth 5.0 market.

- By Company: Tier I: 62%, Tier II: 23%, and Tier III: 15%

- By Designation: C-Level Executives: 38%, Directors: 30%, and others: 32%

- By Region: North America: 40%, Europe: 15%, Asia Pacific: 35%, Middle East and Africa: 5%, Latin America: 5%

The report includes the study of key players offering Bluetooth 5.0 hardware, software, and services. It profiles major vendors in the global Bluetooth 5.0 market. The major vendors in the global Bluetooth 5.0 market include Qualcomm (US), Nordic Semiconductor (Norway), ON Semiconductor (US), Broadcom (US), Silicon Labs (US), Realtek (Taiwan), Microchip Technology (US), NXP Semiconductors (Netherlands), Texas Instruments (US), MediaTek (Taiwan), Synopsys (US), STMicroelectronics (Switzerland), Qorvo (US), Renesas (Japan), Infineon Technologies (Germany), Goodix Technology (China), Telit (US), Espressif Systems (China), Taiyo Yuden (Japan), Feasycom (China), Atmosic Technologies (US), Ceva (France), Laird Connectivity (US), Inventek Systems (US), Insight SiP (France), and Virscient (New Zealand).

Research Coverage

The market study covers the Bluetooth 5.0 market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as component, application, end user, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Bluetooth 5.0 market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 BLUETOOTH 5.0 MARKET SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- FIGURE 2 BLUETOOTH 5.0 MARKET: GEOGRAPHIC SCOPE

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2019-2021

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 BLUETOOTH 5.0 MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Primary sources

- 2.1.2.5 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE FROM HARDWARE/SOFTWARE/SERVICES

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- 2.2.3 BLUETOOTH 5.0 MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- 2.2.4 BLUETOOTH 5.0 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- 2.2.5 GROWTH FORECAST ASSUMPTIONS

- TABLE 2 MARKET GROWTH ASSUMPTIONS

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- TABLE 3 RISK ASSESSMENT FOR BLUETOOTH 5.0 MARKET

3 EXECUTIVE SUMMARY

- FIGURE 10 BLUETOOTH 5.0 MARKET, REGIONAL AND COUNTRY-WISE SHARE, 2022

4 PREMIUM INSIGHTS

- 4.1 BLUETOOTH 5.0 MARKET OVERVIEW

- FIGURE 11 ADDRESS POINT-TO-POINT CONNECTIVITY AND INDOOR POSITIONING AND LOCATION SERVICES TO DRIVE MARKET

- 4.2 BLUETOOTH 5.0 MARKET, BY COMPONENT

- FIGURE 12 HARDWARE SEGMENT EXPECTED TO DOMINATE MARKET BY 2027

- 4.3 BLUETOOTH 5.0 MARKET, BY APPLICATION

- FIGURE 13 AUDIO STREAMING SEGMENT EXPECTED TO DOMINATE MARKET IN 2022

- 4.4 BLUETOOTH 5.0 MARKET, BY END USER

- FIGURE 14 RETAIL AND LOGISTICS SEGMENT EXPECTED TO DOMINATE MARKET BY 2027

- 4.5 ASIA PACIFIC: BLUETOOTH 5.0 MARKET, BY COMPONENT AND END USER

- FIGURE 15 HARDWARE AND RETAIL AND LOGISTICS SEGMENTS EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 MARKET OVERVIEW

- 5.2 MARKET DYNAMICS

- FIGURE 16 BLUETOOTH 5.0 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing investments in IoT devices

- 5.2.1.2 Rising demand for connected wearables

- 5.2.1.3 Increasing acceptance of digital keys

- 5.2.2 RESTRAINTS

- 5.2.2.1 Packet interference

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High adoption of Bluetooth location service devices

- 5.2.3.2 Rising awareness about Bluetooth beacon technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Security and access concerns

- 5.3 VALUE CHAIN

- FIGURE 17 BLUETOOTH 5.0 MARKET: VALUE CHAIN

- 5.4 CASE STUDY ANALYSIS

- 5.4.1 CASE STUDY 1: REDUCING ENERGY COSTS WITH SMART LIGHTING

- 5.4.2 CASE STUDY 2: USING BLUETOOTH MESH FOR WAREHOUSES TO DECREASE COSTS

- 5.4.3 CASE STUDY 3: INSTALLING BLUETOOTH AR NAVIGATION IN TRAIN STATIONS FOR BETTER EXPERIENCE

- 5.4.4 CASE STUDY 4: DEPLOYING SMART ALERT SERVICE FOR ALZHEIMER'S PATIENTS

- 5.4.5 CASE STUDY 5: USING IOT GLUCOMETER FOR BETTER PATIENT CARE

- 5.4.6 CASE STUDY 6: BLE ENABLING EMERGENCY RESPONSE FOR CARDIAC ARRESTS

- 5.4.7 CASE STUDY 7: USING IOT FOR ENHANCED ACCESS

- 5.4.8 CASE STUDY 8: DEVELOPING AVIA BLUETOOTH SMART LOCK FOR HIGH SECURITY

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 BLUETOOTH 5.0 MARKET: PORTER'S FIVE FORCES MODEL ANALYSIS

- 5.5.1 THREAT FROM NEW ENTRANTS

- 5.5.2 THREAT FROM SUBSTITUTES

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 BARGAINING POWER OF SUPPLIERS

- 5.5.5 DEGREE OF COMPETITION

- 5.6 PATENT ANALYSIS

- 5.6.1 METHODOLOGY

- 5.6.2 DOCUMENT TYPES

- TABLE 5 PATENTS FILED, 2020-2022

- 5.6.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 18 NUMBER OF PATENTS GRANTED ANNUALLY, 2020-2022

- 5.6.3.1 Top applicants

- FIGURE 19 TOP TEN PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2020-2022

- TABLE 6 TOP TEN PATENT OWNERS IN BLUETOOTH 5.0 MARKET, 2020-2022

- TABLE 7 LIST OF PATENTS IN BLUETOOTH 5.0 MARKET, 2020-2022

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 INTRODUCTION

- 5.7.2 IOT

- 5.7.3 MESH NETWORKING

- 5.7.4 BEACON

- 5.8 ECOSYSTEM

- TABLE 8 ECOSYSTEM: BLUETOOTH 5.0 MARKET

- 5.9 PRICING MODEL OF MARKET PLAYERS

- TABLE 9 PRICING MODELS AND INDICATIVE PRICE POINTS, 2021-2022

- 5.10 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 10 BLUETOOTH 5.0 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.11 DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 20 BLUETOOTH 5.0 MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, FOR TOP THREE END USERS

- TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, FOR TOP THREE END USERS

- 5.12.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE END USERS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.1.1 North America

- 5.13.1.2 Europe

- 5.13.1.3 Asia Pacific

- 5.13.1.3.1 China

- 5.13.1.3.2 India

- 5.13.1.3.3 Australia

- 5.13.1.3.4 Japan

- 5.13.1.4 Middle East and Africa

- 5.13.1.4.1 UAE

- 5.13.1.4.2 Saudi Arabia

- 5.13.1.5 Latin America

- 5.13.1.5.1 Brazil

- 5.13.1.5.2 Mexico

6 BLUETOOTH 5.0 MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- FIGURE 23 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 17 BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 18 BLUETOOTH 5.0 MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.2 HARDWARE

- 6.2.1 INCREASE IN DEMAND FOR RELIABLE AND SECURE WIRELESS CONNECTIVITY

- 6.2.2 HARDWARE: BLUETOOTH 5.0 MARKET DRIVERS

- TABLE 19 HARDWARE: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 20 HARDWARE: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.3 SYSTEM-ON-CHIP

- 6.2.4 RF COMPONENTS

- 6.2.5 DEVELOPMENT BOARDS

- 6.2.6 SENSORS AND CONTROLS

- 6.3 SOFTWARE

- 6.3.1 NEED FOR REAL-TIME MONITORING OF APPLICATIONS AND CELLULAR IOT

- 6.3.2 SOFTWARE: BLUETOOTH 5.0 MARKET DRIVERS

- TABLE 21 SOFTWARE: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 22 SOFTWARE: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.3 SOFTWARE DEVELOPMENT KIT

- 6.3.4 PROTOCOL STACKS

- 6.4 SERVICES

- 6.4.1 BLUETOOTH LE TO DRIVE INNOVATION IN PC/MOBILE PERIPHERAL DEVICES

- 6.4.2 SERVICES: BLUETOOTH 5.0 MARKET DRIVERS

- TABLE 23 SERVICES: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 24 SERVICES: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 25 SERVICES: BLUETOOTH 5.0 MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 26 SERVICES: BLUETOOTH 5.0 MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 6.4.3 PROFESSIONAL SERVICES

- TABLE 27 PROFESSIONAL SERVICES: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 28 PROFESSIONAL SERVICES: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4.3.1 Training and consulting

- 6.4.3.1.1 Need for use of technology to advise clients on critical issues

- 6.4.3.2 Deployment and integration

- 6.4.3.2.1 Deployment of Bluetooth 5.0 to overcome connectivity and transmission challenges

- 6.4.3.3 Support and maintenance

- 6.4.3.3.1 Technology to enhance performance analysis

- 6.4.3.1 Training and consulting

- 6.4.4 MANAGED SERVICES

- 6.4.4.1 Optimum network performance through use of Bluetooth services

- TABLE 29 MANAGED SERVICES: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 30 MANAGED SERVICES: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

7 BLUETOOTH 5.0 MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 24 AUDIO STREAMING EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 31 BLUETOOTH 5.0 MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 32 BLUETOOTH 5.0 MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.2 AUDIO STREAMING

- 7.2.1 BLUETOOTH 5 TRANSMITS EIGHT TIMES MORE DATA THAN ITS PREDECESSORS

- 7.2.2 AUDIO STREAMING: BLUETOOTH 5.0 MARKET DRIVERS

- TABLE 33 AUDIO STREAMING: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 34 AUDIO STREAMING: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.3 WIRELESS HEADSETS

- 7.2.4 WIRELESS SPEAKERS

- 7.2.5 IN-CAR SYSTEMS

- 7.3 DATA TRANSFER

- 7.3.1 INCREASING USE OF WIRELESS BLUETOOTH DATA TRANSFER DEVICES

- 7.3.2 DATA TRANSFER: BLUETOOTH 5.0 MARKET DRIVERS

- TABLE 35 DATA TRANSFER: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 36 DATA TRANSFER: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.3 SPORTS AND FITNESS

- 7.3.4 HEALTH AND WELLNESS

- 7.3.5 PC PERIPHERALS AND ACCESSORIES

- 7.4 LOCATION SERVICES

- 7.4.1 SUPPORT FOR VEHICLE-TO-EVERYTHING COMMUNICATIONS TO DRIVE 5G ADOPTION

- 7.4.2 LOCATION SERVICES: BLUETOOTH 5.0 MARKET DRIVERS

- TABLE 37 LOCATION SERVICES: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 38 LOCATION SERVICES: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4.3 POINT-OF-INTEREST INFORMATION

- 7.4.4 INDOOR NAVIGATION

- 7.4.5 ASSET AND ITEM TRACKING

- 7.4.6 SPACE UTILIZATION

- 7.5 DEVICE NETWORKS

- 7.5.1 BLUETOOTH DEVICE NETWORKS CONNECT THOUSANDS OF DEVICES SECURELY

- 7.5.2 DEVICE NETWORKS: BLUETOOTH 5.0 MARKET DRIVERS

- TABLE 39 DEVICE NETWORKS: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 40 DEVICE NETWORKS: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.5.3 CONTROL SYSTEMS

- 7.5.4 MONITORING SYSTEMS

- 7.5.5 AUTOMATION SYSTEMS

8 BLUETOOTH 5.0 MARKET, BY END USER

- 8.1 INTRODUCTION

- FIGURE 25 WEARABLES SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 41 BLUETOOTH 5.0 MARKET, BY END USER, 2017-2021 (USD MILLION)

- TABLE 42 BLUETOOTH 5.0 MARKET, BY END USER, 2022-2027 (USD MILLION)

- 8.2 CONSUMER ELECTRONICS

- 8.2.1 INCREASING USE OF WIRELESS CONNECTIVITY WITH BLUETOOTH IN CONSUMER ELECTRONICS

- 8.2.2 CONSUMER ELECTRONICS: BLUETOOTH 5.0 MARKET DRIVERS

- TABLE 43 CONSUMER ELECTRONICS: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 44 CONSUMER ELECTRONICS: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 WEARABLES

- 8.3.1 GROWING USE OF WELLNESS DEVICES

- 8.3.2 WEARABLES: BLUETOOTH 5.0 MARKET DRIVERS

- TABLE 45 WEARABLES: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 46 WEARABLES: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 INDUSTRIAL MEASUREMENTS AND DIAGNOSTICS

- 8.4.1 NEED FOR BLUETOOTH PLATFORM FOR WIRELESS MEASUREMENTS

- 8.4.2 INDUSTRIAL MEASUREMENTS AND DIAGNOSTICS: BLUETOOTH 5.0 MARKET DRIVERS

- TABLE 47 INDUSTRIAL MEASUREMENTS AND DIAGNOSTICS: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 48 INDUSTRIAL MEASUREMENTS AND DIAGNOSTICS: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.5 HEALTHCARE

- 8.5.1 USE OF BLUETOOTH TECHNOLOGY IN PATIENT CARE

- 8.5.2 HEALTHCARE: BLUETOOTH 5.0 MARKET DRIVERS

- TABLE 49 HEALTHCARE: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 50 HEALTHCARE: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.6 RETAIL AND LOGISTICS

- 8.6.1 NEED FOR CONVENIENT RETAIL SPACE NAVIGATION

- 8.6.2 RETAIL AND LOGISTICS: BLUETOOTH 5.0 MARKET DRIVERS

- TABLE 51 RETAIL AND LOGISTICS: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 52 RETAIL AND LOGISTICS: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.7 AUTOMOTIVE

- 8.7.1 GROWING NEED FOR CONVENIENCE

- 8.7.2 AUTOMOTIVE: BLUETOOTH 5.0 MARKET DRIVERS

- TABLE 53 AUTOMOTIVE: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 54 AUTOMOTIVE: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.8 SMART HOME/BUILDING

- 8.8.1 BLUETOOTH DEVICES ENABLE AUTOMATION AND CONTROL, CONDITION MONITORING, AND INDOOR LOCATION SERVICES

- 8.8.2 SMART HOME/BUILDING: BLUETOOTH 5.0 MARKET DRIVERS

- TABLE 55 SMART HOME/BUILDING: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 56 SMART HOME/BUILDING: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.9 OTHER END USERS

- 8.9.1 OTHER END USERS: BLUETOOTH 5.0 MARKET DRIVERS

- TABLE 57 OTHER END USERS: BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 58 OTHER END USERS: BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

9 BLUETOOTH 5.0 MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 26 BLUETOOTH 5.0 MARKET: REGIONAL SNAPSHOT (2022)

- TABLE 59 BLUETOOTH 5.0 MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 60 BLUETOOTH 5.0 MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: PESTLE ANALYSIS

- FIGURE 27 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 61 NORTH AMERICA: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 62 NORTH AMERICA: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 63 NORTH AMERICA: BLUETOOTH 5.0 MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 64 NORTH AMERICA: BLUETOOTH 5.0 MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 65 NORTH AMERICA: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 66 NORTH AMERICA: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 67 NORTH AMERICA: BLUETOOTH 5.0 MARKET, BY END USER, 2017-2021 (USD MILLION)

- TABLE 68 NORTH AMERICA: BLUETOOTH 5.0 MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 69 NORTH AMERICA: BLUETOOTH 5.0 MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 70 NORTH AMERICA: BLUETOOTH 5.0 MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 Rising demand for wearable healthcare devices for adults

- TABLE 71 US: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 72 US: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 73 US: BLUETOOTH 5.0 MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 74 US: BLUETOOTH 5.0 MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 75 US: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 76 US: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 77 US: BLUETOOTH 5.0 MARKET, BY END USER, 2017-2021 (USD MILLION)

- TABLE 78 US: BLUETOOTH 5.0 MARKET, BY END USER, 2022-2027 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 IoT technology to assist in development of smart cities

- TABLE 79 CANADA: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 80 CANADA: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 81 CANADA: BLUETOOTH 5.0 MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 82 CANADA: BLUETOOTH 5.0 MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 83 CANADA: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 84 CANADA: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 85 CANADA: BLUETOOTH 5.0 MARKET, BY END USER, 2017-2021 (USD MILLION)

- TABLE 86 CANADA: BLUETOOTH 5.0 MARKET, BY END USER, 2022-2027 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 EUROPE: PESTLE ANALYSIS

- TABLE 87 EUROPE: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 88 EUROPE: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 89 EUROPE: BLUETOOTH 5.0 MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 90 EUROPE: BLUETOOTH 5.0 MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 91 EUROPE: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 92 EUROPE: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 93 EUROPE: BLUETOOTH 5.0 MARKET, BY END USER, 2017-2021 (USD MILLION)

- TABLE 94 EUROPE: BLUETOOTH 5.0 MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 95 EUROPE: BLUETOOTH 5.0 MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 96 EUROPE: BLUETOOTH 5.0 MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Increased government measures to protect privacy

- TABLE 97 UK: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 98 UK: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 99 UK: BLUETOOTH 5.0 MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 100 UK: BLUETOOTH 5.0 MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 101 UK: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 102 UK: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 103 UK: BLUETOOTH 5.0 MARKET, BY END USER, 2017-2021 (USD MILLION)

- TABLE 104 UK: BLUETOOTH 5.0 MARKET, BY END USER, 2022-2027 (USD MILLION)

- 9.3.3 GERMANY

- 9.3.3.1 Healthcare sector to opt for wearable devices

- 9.3.4 FRANCE

- 9.3.4.1 France to lead smart home devices market

- 9.3.5 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: PESTLE ANALYSIS

- FIGURE 28 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 105 ASIA PACIFIC: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 106 ASIA PACIFIC: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 107 ASIA PACIFIC: BLUETOOTH 5.0 MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 108 ASIA PACIFIC: BLUETOOTH 5.0 MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 109 ASIA PACIFIC: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 110 ASIA PACIFIC: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 111 ASIA PACIFIC: BLUETOOTH 5.0 MARKET, BY END USER, 2017-2021 (USD MILLION)

- TABLE 112 ASIA PACIFIC: BLUETOOTH 5.0 MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 113 ASIA PACIFIC: BLUETOOTH 5.0 MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 114 ASIA PACIFIC: BLUETOOTH 5.0 MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Country's dependence on emerging technologies

- TABLE 115 CHINA: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 116 CHINA: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 117 CHINA: BLUETOOTH 5.0 MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 118 CHINA: BLUETOOTH 5.0 MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 119 CHINA: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 120 CHINA: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 121 CHINA: BLUETOOTH 5.0 MARKET, BY END USER, 2017-2021 (USD MILLION)

- TABLE 122 CHINA: BLUETOOTH 5.0 MARKET, BY END USER, 2022-2027 (USD MILLION)

- 9.4.3 JAPAN

- 9.4.3.1 Increasing IoT adoption in consumer and industrial sectors

- 9.4.4 INDIA

- 9.4.4.1 Increasing adoption of smart devices

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST AND AFRICA

- 9.5.1 MIDDLE EAST AND AFRICA: PESTLE ANALYSIS

- TABLE 123 MIDDLE EAST AND AFRICA: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 124 MIDDLE EAST AND AFRICA: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 125 MIDDLE EAST AND AFRICA: BLUETOOTH 5.0 MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 126 MIDDLE EAST AND AFRICA: BLUETOOTH 5.0 MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 127 MIDDLE EAST AND AFRICA: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 128 MIDDLE EAST AND AFRICA: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 129 MIDDLE EAST AND AFRICA: BLUETOOTH 5.0 MARKET, BY END USER, 2017-2021 (USD MILLION)

- TABLE 130 MIDDLE EAST AND AFRICA: BLUETOOTH 5.0 MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 131 MIDDLE EAST AND AFRICA: BLUETOOTH 5.0 MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 132 MIDDLE EAST AND AFRICA: BLUETOOTH 5.0 MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.5.2 UAE

- 9.5.2.1 Bluetooth helps government access new telemedicine applications

- TABLE 133 UAE: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 134 UAE: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 135 UAE: BLUETOOTH 5.0 MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 136 UAE: BLUETOOTH 5.0 MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 137 UAE: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 138 UAE: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 139 UAE: BLUETOOTH 5.0 MARKET, BY END USER, 2017-2021 (USD MILLION)

- TABLE 140 UAE: BLUETOOTH 5.0 MARKET, BY END USER, 2022-2027 (USD MILLION)

- 9.5.3 SOUTH AFRICA

- 9.5.3.1 Smart city project initiatives, such as Silicon Delta, to increase market growth

- 9.5.4 REST OF MIDDLE EAST AND AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: PESTLE ANALYSIS

- TABLE 141 LATIN AMERICA: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 142 LATIN AMERICA: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 143 LATIN AMERICA: BLUETOOTH 5.0 MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 144 LATIN AMERICA: BLUETOOTH 5.0 MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 145 LATIN AMERICA: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 146 LATIN AMERICA: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 147 LATIN AMERICA: BLUETOOTH 5.0 MARKET, BY END USER, 2017-2021 (USD MILLION)

- TABLE 148 LATIN AMERICA: BLUETOOTH 5.0 MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 149 LATIN AMERICA: BLUETOOTH 5.0 MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 150 LATIN AMERICA: BLUETOOTH 5.0 MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.6.2 BRAZIL

- 9.6.2.1 Growing use of smart medical devices

- TABLE 151 BRAZIL: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 152 BRAZIL: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 153 BRAZIL: BLUETOOTH 5.0 MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 154 BRAZIL: BLUETOOTH 5.0 MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 155 BRAZIL: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 156 BRAZIL: BLUETOOTH 5.0 MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 157 BRAZIL: BLUETOOTH 5.0 MARKET, BY END USER, 2017-2021 (USD MILLION)

- TABLE 158 BRAZIL: BLUETOOTH 5.0 MARKET, BY END USER, 2022-2027 (USD MILLION)

- 9.6.3 MEXICO

- 9.6.3.1 Rising demand for smartphones and wearable electronics

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 159 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN BLUETOOTH 5.0 MARKET

- 10.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

- TABLE 160 BLUETOOTH 5.0 MARKET: DEGREE OF COMPETITION

- 10.4 HISTORICAL REVENUE ANALYSIS

- FIGURE 29 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS, 2019-2021 (USD MILLION)

- 10.5 COMPETITIVE BENCHMARKING

- TABLE 161 BLUETOOTH 5.0 MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 162 BLUETOOTH 5.0 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 163 BLUETOOTH 5.0 MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS

- 10.6 COMPANY EVALUATION QUADRANT

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- FIGURE 30 KEY PLAYERS OF BLUETOOTH 5.0 MARKET, COMPANY EVALUATION MATRIX, 2022

- 10.7 STARTUP/SME EVALUATION QUADRANT

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- FIGURE 31 STARTUP/SME BLUETOOTH 5.0 MARKET EVALUATION MATRIX, 2022

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 PRODUCT LAUNCHES

- TABLE 164 PRODUCT LAUNCHES, 2019-2022

- 10.8.2 DEALS

- TABLE 165 DEALS, 2020-2022

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- (Business Overview, Products, Solutions, Services offered, Recent Developments, MnM View)**

- 11.1.1 QUALCOMM

- TABLE 166 QUALCOMM: BUSINESS OVERVIEW

- FIGURE 32 QUALCOMM: COMPANY SNAPSHOT

- TABLE 167 QUALCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 QUALCOMM: PRODUCT LAUNCHES

- TABLE 169 QUALCOMM: DEALS

- 11.1.2 NORDIC SEMICONDUCTOR

- TABLE 170 NORDIC SEMICONDUCTOR: BUSINESS OVERVIEW

- FIGURE 33 NORDIC SEMICONDUCTOR: COMPANY SNAPSHOT

- TABLE 171 NORDIC SEMICONDUCTOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 NORDIC SEMICONDUCTOR: PRODUCT LAUNCHES

- TABLE 173 NORDIC SEMICONDUCTOR: DEALS

- 11.1.3 MEDIATEK

- TABLE 174 MEDIATEK: BUSINESS OVERVIEW

- FIGURE 34 MEDIATEK: COMPANY SNAPSHOT

- TABLE 175 MEDIATEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 MEDIATEK: PRODUCT LAUNCHES

- 11.1.4 STMICROELECTRONICS

- TABLE 177 STMICROELECTRONICS: BUSINESS OVERVIEW

- FIGURE 35 STMICROELECTRONICS: COMPANY SNAPSHOT

- TABLE 178 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 180 STMICROELECTRONICS: DEALS

- 11.1.5 NXP SEMICONDUCTORS

- TABLE 181 NXP SEMICONDUCTORS: BUSINESS OVERVIEW

- FIGURE 36 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- TABLE 182 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 NXP SEMICONDUCTORS: DEALS

- 11.1.6 MICROCHIP TECHNOLOGY

- TABLE 184 MICROCHIP TECHNOLOGY: BUSINESS OVERVIEW

- FIGURE 37 MICROCHIP TECHNOLOGY: COMPANY SNAPSHOT

- TABLE 185 MICROCHIP TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 MICROCHIP TECHNOLOGY: DEALS

- 11.1.7 ON SEMICONDUCTOR

- TABLE 187 ON SEMICONDUCTOR: BUSINESS OVERVIEW

- FIGURE 38 ON SEMICONDUCTOR: COMPANY SNAPSHOT

- TABLE 188 ON SEMICONDUCTOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 ON SEMICONDUCTOR: DEALS

- 11.1.8 TEXAS INSTRUMENTS

- TABLE 190 TEXAS INSTRUMENTS: BUSINESS OVERVIEW

- FIGURE 39 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

- TABLE 191 TEXAS INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 TEXAS INSTRUMENTS: PRODUCT LAUNCHES

- TABLE 193 TEXAS INSTRUMENTS: DEALS

- 11.1.9 SYNOPSYS

- TABLE 194 SYNOPSYS: BUSINESS OVERVIEW

- FIGURE 40 SYNOPSYS: COMPANY SNAPSHOT

- TABLE 195 SYNOPSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 SYNOPSYS: DEALS

- 11.1.10 QORVO

- TABLE 197 QORVO: BUSINESS OVERVIEW

- FIGURE 41 QORVO: COMPANY SNAPSHOT

- TABLE 198 QORVO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 QORVO: DEALS

- 11.1.11 INFINEON TECHNOLOGIES

- TABLE 200 INFINEON TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 42 INFINEON TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 201 INFINEON TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 INFINEON TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 203 INFINEON TECHNOLOGIES: DEALS

- 11.1.12 SILICON LABS

- TABLE 204 SILICON LABS: BUSINESS OVERVIEW

- FIGURE 43 SILICON LABS: COMPANY SNAPSHOT

- TABLE 205 SILICON LABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 SILICON LABS: PRODUCT LAUNCHES

- TABLE 207 SILICON LABS: DEALS

- 11.1.13 REALTEK

- TABLE 208 REALTEK: BUSINESS OVERVIEW

- FIGURE 44 REALTEK: COMPANY SNAPSHOT

- TABLE 209 REALTEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 REALTEK: PRODUCT LAUNCHES

- 11.1.14 BROADCOM

- TABLE 211 BROADCOM: BUSINESS OVERVIEW

- FIGURE 45 BROADCOM: COMPANY SNAPSHOT

- TABLE 212 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 BROADCOM: PRODUCT LAUNCHES

- TABLE 214 BROADCOM: DEALS

- 11.1.15 RENESAS

- TABLE 215 RENESAS: BUSINESS OVERVIEW

- FIGURE 46 RENESAS: COMPANY SNAPSHOT

- TABLE 216 RENESAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 RENESAS: PRODUCT LAUNCHES

- TABLE 218 RENESAS: DEALS

- 11.1.16 GOODIX TECHNOLOGY

- TABLE 219 GOODIX TECHNOLOGY: BUSINESS OVERVIEW

- FIGURE 47 GOODIX TECHNOLOGY: COMPANY SNAPSHOT

- TABLE 220 GOODIX TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 GOODIX TECHNOLOGY: PRODUCT LAUNCHES

- TABLE 222 GOODIX TECHNOLOGY: DEALS

- 11.1.17 TAIYO YUDEN

- *Details on Business Overview, Products, Solutions, Services offered Recent Developments, MnM View might not be captured in case of unlisted companies.

- 11.2 STARTUP/SMES

- 11.2.1 TELIT

- 11.2.2 ESPRESSIF SYSTEMS

- 11.2.3 FEASYCOM

- 11.2.4 ATMOSIC TECHNOLOGIES

- 11.2.5 CEVA

- 11.2.6 LAIRD CONNECTIVITY

- 11.2.7 VIRSCIENT

- 11.2.8 INVENTEK SYSTEMS

- 11.2.9 INSIGHT SIP

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 INDOOR LOCATION MARKET

- 12.2.1 INDOOR LOCATION MARKET: MARKET DEFINITION

- 12.2.2 INDOOR LOCATION MARKET: MARKET OVERVIEW

- 12.2.3 INDOOR LOCATION MARKET, BY COMPONENT

- TABLE 223 INDOOR LOCATION MARKET, BY COMPONENT, 2017-2020 (USD MILLION)

- TABLE 224 INDOOR LOCATION MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- TABLE 225 SOLUTIONS: INDOOR LOCATION MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 226 SOLUTIONS: INDOOR LOCATION MARKET, BY TYPE, 2021-2026 (USD MILLION)

- TABLE 227 INDOOR TRACKING: INDOOR LOCATION MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 228 INDOOR TRACKING: INDOOR LOCATION MARKET, BY TYPE, 2021-2026 (USD MILLION)

- TABLE 229 INDOOR LOCATION MARKET, BY SERVICE, 2017-2020 (USD MILLION)

- TABLE 230 INDOOR LOCATION MARKET, BY SERVICE, 2021-2026 (USD MILLION)

- TABLE 231 PROFESSIONAL SERVICES: INDOOR LOCATION MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 232 PROFESSIONAL SERVICES: INDOOR LOCATION MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 12.2.4 INDOOR LOCATION MARKET, BY ORGANIZATION SIZE

- TABLE 233 INDOOR LOCATION MARKET, BY ORGANIZATION SIZE, 2017-2020 (USD MILLION)

- TABLE 234 INDOOR LOCATION MARKET, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- 12.2.5 INDOOR LOCATION MARKET, BY TECHNOLOGY

- TABLE 235 INDOOR LOCATION MARKET, BY TECHNOLOGY, 2017-2020 (USD MILLION)

- TABLE 236 INDOOR LOCATION MARKET, BY TECHNOLOGY, 2021-2026 (USD MILLION)

- 12.2.6 INDOOR LOCATION MARKET, BY DEPLOYMENT MODE

- TABLE 237 INDOOR LOCATION MARKET, BY DEPLOYMENT MODE, 2017-2020 (USD MILLION)

- TABLE 238 INDOOR LOCATION MARKET, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- 12.2.7 INDOOR LOCATION MARKET, BY APPLICATION

- TABLE 239 INDOOR LOCATION MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 240 INDOOR LOCATION MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- 12.2.8 INDOOR LOCATION MARKET, BY VERTICAL

- TABLE 241 INDOOR LOCATION MARKET, BY VERTICAL, 2017-2020 (USD MILLION)

- TABLE 242 INDOOR LOCATION MARKET, BY VERTICAL, 2021-2026 (USD MILLION)

- 12.2.9 INDOOR LOCATION MARKET, BY REGION

- TABLE 243 INDOOR LOCATION MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 244 INDOOR LOCATION MARKET, BY REGION, 2021-2026 (USD MILLION)

- 12.3 SMART BUILDINGS MARKET

- 12.3.1 SMART BUILDINGS MARKET: MARKET DEFINITION

- 12.3.2 SMART BUILDINGS MARKET: MARKET OVERVIEW

- 12.3.3 SMART BUILDINGS MARKET, BY COMPONENT

- TABLE 245 SMART BUILDINGS MARKET, BY COMPONENT, 2017-2020 (USD MILLION)

- TABLE 246 SMART BUILDINGS MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- TABLE 247 SERVICES: SMART BUILDINGS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 248 SERVICES: SMART BUILDING MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 12.3.4 SMART BUILDINGS MARKET, BY SOLUTION

- TABLE 249 SMART BUILDINGS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 250 SMART BUILDINGS MARKET, BY TYPE, 2021-2026 (USD MILLION)

- TABLE 251 INFRASTRUCTURE MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 252 INFRASTRUCTURE MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2021-2026 (USD MILLION)

- TABLE 253 SAFETY AND SECURITY MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 254 SAFETY AND SECURITY MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2021-2026 (USD MILLION)

- TABLE 255 ENERGY MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 256 ENERGY MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2021-2026 (USD MILLION)

- TABLE 257 NETWORK MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 258 NETWORK MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 12.3.5 SMART BUILDINGS MARKET, BY BUILDING TYPE

- TABLE 259 SMART BUILDINGS MARKET, BY BUILDING TYPE, 2017-2020 (USD MILLION)

- TABLE 260 SMART BUILDINGS MARKET, BY BUILDING TYPE, 2021-2026 (USD MILLION)

- 12.3.6 SMART BUILDINGS MARKET, BY REGION

- TABLE 261 SMART BUILDINGS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 262 SMART BUILDINGS MARKET, BY REGION, 2021-2026 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS