|

|

市場調査レポート

商品コード

1121762

ポリビニルブチラール(PVB)の世界市場:用途(フィルム・シート、塗料・コーティング、接着剤)、最終用途(自動車、建設、電気・電子)、地域別 - 2027年までの予測Polyvinyl Butyral (PVB) Market by Applications (Films & Sheets, Paints & Coatings, Adhesives), End-use (Automotive, Construction, Electrical & Electronics) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ポリビニルブチラール(PVB)の世界市場:用途(フィルム・シート、塗料・コーティング、接着剤)、最終用途(自動車、建設、電気・電子)、地域別 - 2027年までの予測 |

|

出版日: 2022年08月25日

発行: MarketsandMarkets

ページ情報: 英文 167 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のポリビニルブチラール(PVB)の市場規模は、2022年の37億米ドルから、2027年までに51億米ドルに拡大する見通しで、2022年から2027年の間にCAGR6.5%で成長すると予測されています。

PVBは、自動車のサンルーフ、騒音抑制のための航空機の窓、安全性向上のためのガラスの中間膜などで採用が進んでいます。建設業界におけるPVBフィルム・シートの用途は、住宅市場の成長、良好な人口動態、手頃な価格の上昇に牽引され、予測期間中のPVB市場の成長を支えています。また、PVBフィルムは太陽電池の封止材として使用され、太陽電池の寿命を延ばすことができます。しかし、エチレン酢酸ビニル(EVA)などの代替材料が入手可能であることが、PVB市場の成長を抑制しています。

PVB市場の用途別予測期間において、金額ベースでは接着剤が3番目に急成長している分野である

PVB接着剤は強力な接着特性を持ち、金属、ガラス、皮革、木材、紙などの接着に適しています。PVB樹脂は、PCB接着剤やホットメルト接着剤など、さまざまな接着剤の開発に使用されています。PCB用接着剤は、高い強度と耐性を有し、電気的用途に最適です。PVB接着剤は高い引張強度を持つため、様々な最終用途産業でガラスの破片やパネルの結合に使用されています。

予測期間中の最終用途産業別PVB市場において、建築分野は金額ベースで2番目に急成長している分野と推定される

ポリビニルブチラール(PVB)市場の成長は、主に建設業界の急速な発展に寄与しています。PVB合わせガラスは、商業店舗、政府機関、銀行などで安全・安心のために利用されています。PVBフィルムは、紫外線や色あせから室内家具やプラスチック製品を保護するために、住宅建設で消費されています。また、0.38mm、0.76mm、1.04mmといった低厚さのPVBシートが建築用途で消費されていることも、市場の成長を後押ししています。

PVB市場では、欧州地域が金額ベースで2番目に大きなシェアを占めている

この地域は、建設プロジェクトにおいてエネルギー効率を実現するための厳しい規制があります。自動車、LCV、トラック、バスでの合わせガラスの使用などの安全基準や、確立された自動車産業が市場の成長を支えています。また、太陽光発電のような再生可能エネルギーによるクリーンエネルギー発電への注目も、同地域におけるPVB需要の推進要因になると考えられます。欧州は、フォルクスワーゲン、BMW、ダイムラーといった自動車メーカーが存在することから、自動車の中心地と考えられています。さらに、技術的進歩、新しい政策改革、投資の増加が、予測期間中にPVBの消費を増加させると予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- バリューチェーン分析

- エコシステムマッピング

- 価格分析

- 技術分析

- 顧客のビジネスに影響を与える動向/ディスラプション

- 特許分析

- 2022年から2023年の主な会議とイベント

- 購入決定に影響を与える主な要因

- 関税と規制

- 貿易分析

- ケーススタディ分析

- PVBと代替品の比較

- 顧客分析

- 材料分析

- 自動車生産

第6章 用途別:PVB市場

- イントロダクション

- フィルム・シート

- 塗料・コーティング

- 接着剤

- その他

第7章 最終用途業界別:PVB市場

- イントロダクション

- 自動車

- 建設

- 電気・電子機器

- その他

第8章 地域別:PVB市場

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- タイ

- インドネシア

- その他

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他

第9章 競合情勢

- 概要

- 主要企業の採用戦略

- 市場評価マトリックス

- 市場ランキング分析

- 主要企業の収益分析

- 市場シェア分析

- 企業評価マトリックス

- スタートアップおよび中小企業の評価マトリックス

- 競合ベンチマーキング

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 競合シナリオ

第10章 企業プロファイル

- 主要企業

- KURARAY CO., LTD.

- EASTMAN CHEMICAL COMPANY

- SEKISUI CHEMICAL CO. LTD.

- HUBERGROUP

- CHANG CHUN GROUP

- ANHUI WANWEI BISHENG NEW MATERIAL CO., LTD.

- KINGBOARD(FO GANG)SPECIALTY RESINS LIMITED

- QINGDAO JINUO NEW MATERIALS CO., LTD.

- HUAKAI PLASTIC CO., LTD.

- TRIDEV RESINS PVT. LTD.

- その他の企業

- QINGDAO JIAHUA PLASTICS CO., LTD.

- SIVA CHEMICAL INDUSTRIES

- TANYUN JUNRONG(LIAONING)CHEMICAL RESEARCH INSTITUTE NEW MATERIALS INCUBATOR CO., LTD.

- SYNPOL PRODUCTS PRIVATE LIMITED

- UNIFORM SYNTHETICS PRIVATE LIMITED

- D.R. COATS INK & RESINS PVT. LTD.

- HUZHOU XINFU NEW MATERIALS CO., LTD.

- QINGDAO HAOCHENG INDUSTRIAL COMPANY LIMITED

- ZHEJIANG PULIJIN PLASTIC CO., LTD.

- TIANTAI KANGLAI INDUSTRIAL CO., LTD.

- HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

- GUANGZHOU AOJISI NEW MATERIAL CO. LTD.

- DULITE CO., LTD.

- SINOEVER INTERNATIONAL CO., LTD.

- JINHE ENTERPRISE CO. LIMITED

第11章 付録

The global polyvinyl butyral (PVB) market size is projected to grow from USD 3.7 Billion in 2022 to USD 5.1 Billion by 2027, at a CAGR of 6.5% between 2022 and 2027. PVB are witnessing increased adoption in vehicles sunroof, aircraft windows for noise suppression, and interlayers in glass for enhanced safety. PVB films & sheets applications in construction industry are driven by the growth in residential housing, favorable demographics, and rising affordability which support the growth of PVB market during the forecast period. PVB films are also used in photovoltaic industry as the encapsulation material which enhance the life span of solar panels. However, availability of substitute materials such as ethylene-vinyl acetate (EVA) restricts the growth of the PVB market.

In terms of value, adhesives is the third fastest-growing segment in PVB market, by application, during the forecast period.

PVB adhesives have strong adhesion characteristics and suitable for bonding metal, glass, leather, wood, and paper. PVB resins are used to develop variety of adhesives such as PCB and hot-melt adhesives. PCB adhesives possesses high strength and resistance ideal for electrical applications. PVB adhesives have high tensile strength due to which it is used to bind glass splinters and panels in various end-use industries.

In terms of value, construction is estimated to be second fastest-growing segment in PVB market, by end-use industry, during the forecast period.

The growth of polyvinyl butyral (PVB) market is mainly contributed to the rapid developments in the construction industry. PVB laminating glass is utilized in commercial shops, government buildings, and banks for safety &security. PVB films have consumption in residential construction for protection of indoor furniture and plastic products from ultraviolet radiation and fading. Additionally, consumption of low thickness PVB sheets such as 0.38 millimeters, 0.76 millimeters, and 1.04 millimeters in architectural applications will boost the growth of the market.

Europe region accounted for the second-largest share in the PVB market by value.

The region has stringent regulations to achieve energy efficiency in construction projects. Safety standards such as use of laminated glass in cars, LCVs, trucks, and buses and established automotive industry supports the growth of the market. Focus on clean energy generation by using renewable sources of energy such as solar power produced by photovoltaics is also expected to propel the demand of PVB in the region. Europe is considered an automotive hub, owing to the presence of established automobile manufacturers, such as Volkswagen, BMW, and Daimler. Moreover, technological advancements, new reformed policies, and rising investments in the region is expected to increase the consumption of PVB during the forecast period.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the PVB market, and information was gathered from secondary research to determine and verify the market size of several segments. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives- 20%, Directors - 10%, and Others - 70%

- By Region: APAC - 30%, Europe - 30%, North America - 20%, the Middle East & Africa - 10%, and South America- 10%

Major players operating in the PVB market includes Kuraray Co. Ltd.(Japan), Eastman Chemical Company (US), Sekisui Chemical Co. Ltd.(Japan), Hubergroup (Germany), Chan Chun Group (Taiwan), Anhui WanWei Bisheng New Material Co., Ltd.(China), Kingboard (fo gang) Specialty Resins (China), Qingdao Jinuo New Materials Co., (China), Huakai Plastic (China), Tridev Resin Pvt. Ltd.(India).

Research Coverage:

This report provides detailed segmentation of the PVB market based on by application, by end-use industry, and region. Based on application, the market has been segmented into film & sheets, paints & coatings, and adhesives. Based on end-use industry, the market has been segmented into automotive, construction, and electronics & electricals.

Key Benefits of Buying the Report:

From an insight perspective, this research report focuses on various levels of analyses - industry analysis (industry trends), market ranking of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the PVB market; high growth regions; and market drivers, restraints, opportunities, and challenges.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- TABLE 1 PVB MARKET: INCLUSIONS & EXCLUSIONS

- 1.3.1 MARKET SCOPE

- FIGURE 1 PVB MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.3.3 REGIONAL SCOPE

- 1.4 CURRENCY

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 PVB MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.3 PRIMARY INTERVIEWS

- 2.1.3.1 Primary interviews - demand and supply sides

- 2.1.3.2 Key industry insights

- 2.1.3.3 Breakdown of primary interviews

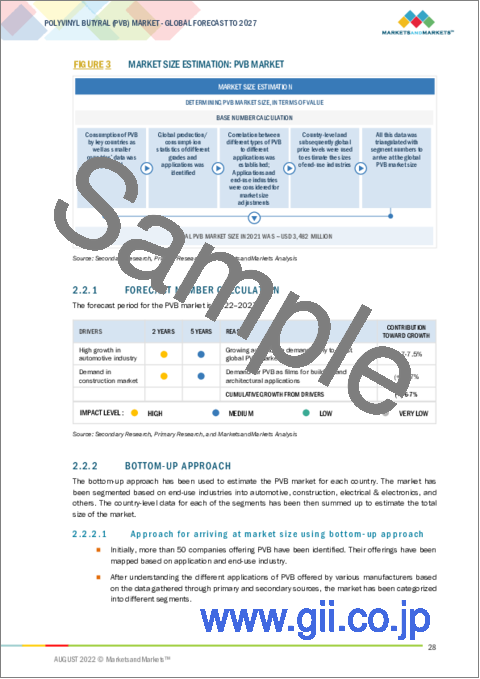

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION: PVB MARKET

- 2.2.1 FORECAST NUMBER CALCULATION

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Approach for arriving at market size using bottom-up approach

- FIGURE 4 PVB MARKET: BOTTOM-UP APPROACH

- 2.2.3 TOP-DOWN APPROACH

- 2.2.3.1 Approach for arriving at market size using top-down approach

- FIGURE 5 PVB MARKET: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 6 PVB MARKET: DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 LIMITATIONS

- 2.6 RISKS ASSOCIATED

- 2.7 ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 FILMS & SHEETS APPLICATION TO ACCOUNT FOR LARGEST SHARE

- FIGURE 8 AUTOMOTIVE INDUSTRY TO ACCOUNT FOR LARGEST SHARE

- FIGURE 9 ASIA PACIFIC LED PVB MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN PVB MARKET

- FIGURE 10 GROWING DEMAND IN PHOTOVOLTAICS APPLICATION TO DRIVE MARKET

- 4.2 ASIA PACIFIC: PVB MARKET, BY END-USE INDUSTRY AND COUNTRY

- FIGURE 11 AUTOMOTIVE INDUSTRY DOMINATED PVB MARKET IN ASIA PACIFIC

- 4.3 PVB MARKET, BY APPLICATION

- FIGURE 12 FILMS & SHEETS TO BE LARGEST APPLICATION OF PVB

- 4.4 PVB MARKET, BY END-USE INDUSTRY

- FIGURE 13 AUTOMOTIVE TO BE LARGEST END-USE INDUSTRY OF PVB

- 4.5 PVB MARKET, BY COUNTRY

- FIGURE 14 THAILAND TO BE FASTEST-GROWING PVB MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PVB MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in end-use industries driving demand in Asia Pacific

- 5.2.1.2 Large-scale demand for PVB films for window and sunroof application in automotive industry

- 5.2.1.3 Growth in construction industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 High recycling activities of PVB

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand from photovoltaics industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent environmental regulations

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 PVB MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 PVB MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF BUYERS

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 17 OVERVIEW OF PVB MARKET VALUE CHAIN

- 5.4.1 RAW MATERIAL SUPPLIERS

- 5.4.2 PVB MANUFACTURERS

- 5.4.3 END USERS

- 5.5 ECOSYSTEM MAPPING

- FIGURE 18 ECOSYSTEM OF PVB MARKET

- TABLE 3 PVB MARKET: ROLE OF STAKEHOLDERS IN ECOSYSTEM

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE BASED ON REGION

- FIGURE 19 PVB PRICES IN DIFFERENT REGIONS, 2020-2027

- 5.6.2 AVERAGE SELLING PRICE BASED ON END-USE INDUSTRY

- TABLE 4 AVERAGE SELLING PRICES BASED ON END-USE INDUSTRY (USD/KG)

- FIGURE 20 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE END-USE INDUSTRIES

- 5.6.3 AVERAGE SELLING PRICES FOR KEY PLAYERS

- TABLE 5 KEY PLAYERS: AVERAGE SELLING PRICES (USD/KG)

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 AUTOCLAVE TECHNOLOGY

- 5.7.1.1 Multilayer extrusion

- 5.7.1.2 Fine particle dispersion

- 5.7.1.3 Wedge angle control

- 5.7.1 AUTOCLAVE TECHNOLOGY

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 21 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.9 PATENT ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 METHODOLOGY

- 5.9.3 DOCUMENT TYPE

- FIGURE 22 TOTAL NUMBER OF PATENTS

- 5.9.4 PUBLICATION TRENDS, 2011-2021

- FIGURE 23 NUMBER OF PATENTS PUBLISHED FROM 2011 TO 2021

- 5.9.5 INSIGHTS

- 5.9.6 LEGAL STATUS OF PATENTS

- FIGURE 24 PATENT ANALYSIS, BY LEGAL STATUS

- 5.9.7 JURISDICTION ANALYSIS

- FIGURE 25 TOP JURISDICTIONS, BY DOCUMENT

- 5.9.8 TOP COMPANIES/APPLICANTS

- FIGURE 26 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- 5.9.8.1 Patents by Saint-Gobain

- TABLE 6 LIST OF PATENTS BY SAINT-GOBAIN GLASS FRANCE

- 5.9.8.2 Patents by Solutia Inc.

- TABLE 7 LIST OF PATENTS BY SOLUTIA INC.

- 5.9.8.3 Patents by Kuraray Co. Ltd.

- TABLE 8 LIST OF PATENTS BY KURARAY EUROPE GMBH

- 5.9.9 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 9 TOP 10 PATENT OWNERS IN US

- 5.10 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 10 PVB MARKET: LIST OF CONFERENCES & EVENTS

- 5.11 KEY FACTORS AFFECTING BUYING DECISION

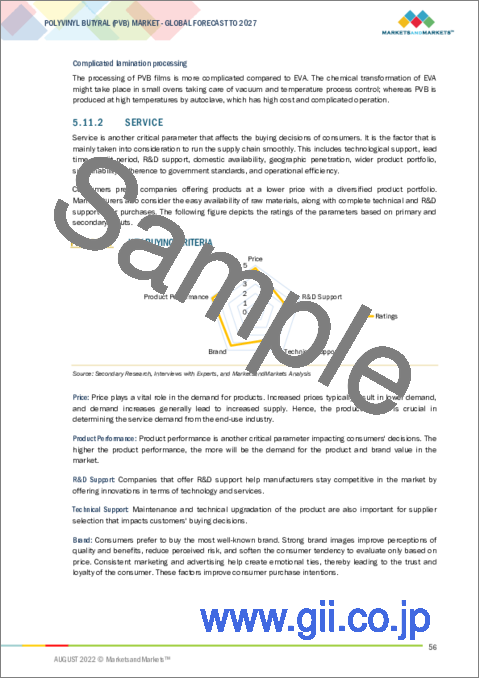

- 5.11.1 QUALITY

- 5.11.2 SERVICE

- FIGURE 27 KEY BUYING CRITERIA

- 5.12 TARIFFS & REGULATIONS

- 5.12.1 ASIA PACIFIC

- 5.12.2 EUROPE

- 5.12.3 NORTH AMERICA

- 5.12.3.1 US

- 5.12.3.2 Canada

- 5.12.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 TRADE ANALYSIS

- FIGURE 28 TOP 5 PVB IMPORTING COUNTRIES

- TABLE 12 IMPORT DATA FOR PVB FILMS & SHEETS, FOIL, AND RELATED MATERIALS (USD THOUSAND)

- TABLE 13 EXPORT DATA FOR PVB FILMS & SHEETS, FOIL, AND RELATED MATERIALS (USD THOUSAND)

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 PVB INTERLAYER FOR DOME-SHAPED GLASS ROOFTOP PROVIDED BY EASTMAN CHEMICAL COMPANY

- 5.15 COMPARISON OF PVB VS SUBSTITUTES

- TABLE 14 COMPARISON OF PVB WITH ITS SUBSTITUTES

- 5.16 CUSTOMER ANALYSIS

- 5.16.1 LIST OF SUPPLIER & END USERS FOR DIFFERENT APPLICATIONS (PRINTING INKS, LACQUERS, WASH PRIMERS, ADHESIVES, CERAMICS)

- 5.16.1.1 List of suppliers

- 5.16.1.2 List of end users

- 5.16.2 LIST OF SUPPLIER & END USERS FOR FILMS & SHEETS APPLICATION

- 5.16.2.1 List of suppliers

- 5.16.2.2 List of end users

- 5.16.1 LIST OF SUPPLIER & END USERS FOR DIFFERENT APPLICATIONS (PRINTING INKS, LACQUERS, WASH PRIMERS, ADHESIVES, CERAMICS)

- 5.17 MATERIAL ANALYSIS

- 5.17.1 POLYVINYL ALCOHOL

- 5.18 MACROECONOMIC DATA

- TABLE 15 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE) OF KEY COUNTRIES, 2018-2025

- 5.18.1 AUTOMOTIVE PRODUCTION

- TABLE 16 AUTOMOTIVE PRODUCTION, BY COUNTRY (MILLION UNITS)

6 PVB MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- FIGURE 29 FILMS & SHEETS TO BE LARGEST APPLICATION OF PVB

- TABLE 17 PVB MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 18 PVB MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- TABLE 19 PVB MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 20 PVB MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 6.2 FILMS & SHEETS

- 6.2.1 AUTOMOTIVE AND CONSTRUCTION INDUSTRIES TO DRIVE FILMS & SHEETS SEGMENT

- 6.3 PAINTS & COATINGS

- 6.3.1 HIGH ADHESIVE STRENGTH AND CORROSION RESISTANCE TO DRIVE MARKET IN PAINTS & COATINGS APPLICATION

- 6.4 ADHESIVES

- 6.4.1 PVB OFFERS GOOD MECHANICAL PROPERTIES TO ADHESIVES

- 6.5 OTHERS

7 PVB MARKET, BY END-USE INDUSTRY

- 7.1 INTRODUCTION

- FIGURE 30 AUTOMOTIVE TO BE DOMINANT END-USE SEGMENT IN PVB MARKET

- TABLE 21 PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 22 PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 23 PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 24 PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 7.2 AUTOMOTIVE

- 7.2.1 CONTINUOUS INNOVATION IN PRODUCTION OF LAMINATED GLASS TO DRIVE MARKET

- 7.3 CONSTRUCTION

- 7.3.1 RAPID DEVELOPMENT OF CONSTRUCTION INDUSTRY TO FUEL MARKET

- 7.4 ELECTRICAL & ELECTRONICS

- 7.4.1 ELECTRICAL & ELECTRONICS SECTOR INCREASINGLY USING PVB FILMS IN PHOTOVOLTAICS APPLICATION

- 7.5 OTHERS

8 PVB MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 31 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 25 PVB MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 26 PVB MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- TABLE 27 PVB MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 28 PVB MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 8.2 ASIA PACIFIC

- FIGURE 32 ASIA PACIFIC: PVB MARKET SNAPSHOT

- TABLE 29 ASIA PACIFIC: PVB MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 30 ASIA PACIFIC: PVB MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 31 ASIA PACIFIC: PVB MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 32 ASIA PACIFIC: PVB MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 33 ASIA PACIFIC: PVB MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 34 ASIA PACIFIC: PVB MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- TABLE 35 ASIA PACIFIC: PVB MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 36 ASIA PACIFIC: PVB MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 37 ASIA PACIFIC: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 38 ASIA PACIFIC: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 39 ASIA PACIFIC: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 40 ASIA PACIFIC: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.2.1 CHINA

- 8.2.1.1 Rising urbanization and industrialization to drive market

- TABLE 41 CHINA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 42 CHINA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 43 CHINA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 44 CHINA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.2.2 JAPAN

- 8.2.2.1 Developed automotive industry to fuel demand for PVB

- TABLE 45 JAPAN: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 46 JAPAN: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 47 JAPAN: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 48 JAPAN: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.2.3 INDIA

- 8.2.3.1 Government policies and projects likely to impact market growth

- TABLE 49 INDIA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 50 INDIA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 51 INDIA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 52 INDIA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.2.4 THAILAND

- 8.2.4.1 Growth in end-use industries to drive market growth

- TABLE 53 THAILAND: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 54 THAILAND: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 55 THAILAND: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 56 THAILAND: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.2.5 INDONESIA

- 8.2.5.1 Growth in solar industry to drive market growth

- TABLE 57 INDONESIA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 58 INDONESIA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 59 INDONESIA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 60 INDONESIA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.2.6 REST OF ASIA PACIFIC

- TABLE 61 REST OF ASIA PACIFIC: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 62 REST OF ASIA PACIFIC: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 63 REST OF ASIA PACIFIC: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 64 REST OF ASIA PACIFIC: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.3 EUROPE

- FIGURE 33 EUROPE: PVB MARKET SNAPSHOT

- TABLE 65 EUROPE: PVB MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 66 EUROPE: PVB MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 67 EUROPE: PVB MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 68 EUROPE: PVB MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 69 EUROPE: PVB MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 70 EUROPE: PVB MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- TABLE 71 EUROPE: PVB MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 72 EUROPE: PVB MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 73 EUROPE: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 74 EUROPE: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 75 EUROPE: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 76 EUROPE: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.3.1 GERMANY

- 8.3.1.1 Automotive industry to be largest consumer of PVB

- TABLE 77 GERMANY: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 78 GERMANY: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 79 GERMANY: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 80 GERMANY: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.3.2 UK

- 8.3.2.1 Government policies to favor growth of construction industry

- TABLE 81 UK: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 82 UK: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 83 UK: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 84 UK: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.3.3 FRANCE

- 8.3.3.1 Large aerospace and automotive industries to drive market

- TABLE 85 FRANCE: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 86 FRANCE: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 87 FRANCE: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 88 FRANCE: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.3.4 ITALY

- 8.3.4.1 Developed automotive sector to drive PVB market

- TABLE 89 ITALY: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 90 ITALY: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 91 ITALY: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 92 ITALY: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.3.5 SPAIN

- 8.3.5.1 Rising adoption of PVB in commercial infrastructure and automotive industry to drive market

- TABLE 93 SPAIN: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 94 SPAIN: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 95 SPAIN: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 96 SPAIN: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.3.6 REST OF EUROPE

- TABLE 97 REST OF EUROPE: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 98 REST OF EUROPE: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 99 REST OF EUROPE: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 100 REST OF EUROPE: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.4 NORTH AMERICA

- TABLE 101 NORTH AMERICA: PVB MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 102 NORTH AMERICA: PVB MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 103 NORTH AMERICA: PVB MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 104 NORTH AMERICA: PVB MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 105 NORTH AMERICA: PVB MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 106 NORTH AMERICA: PVB MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- TABLE 107 NORTH AMERICA: PVB MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 108 NORTH AMERICA: PVB MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 109 NORTH AMERICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 110 NORTH AMERICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 111 NORTH AMERICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 112 NORTH AMERICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.4.1 US

- 8.4.1.1 Automotive industry dominates consumption of PVB

- TABLE 113 US: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 114 US: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 115 US: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 116 US: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.4.2 CANADA

- 8.4.2.1 Government investment in construction sector to contribute to market growth

- TABLE 117 CANADA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 118 CANADA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 119 CANADA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 120 CANADA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.4.3 MEXICO

- 8.4.3.1 Rising foreign investment to drive various end-use industries of PVB

- TABLE 121 MEXICO: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 122 MEXICO: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 123 MEXICO: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 124 MEXICO: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.5 SOUTH AMERICA

- TABLE 125 SOUTH AMERICA: PVB MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 126 SOUTH AMERICA: PVB MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 127 SOUTH AMERICA: PVB MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 128 SOUTH AMERICA: PVB MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 129 SOUTH AMERICA: PVB MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 130 SOUTH AMERICA: PVB MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- TABLE 131 SOUTH AMERICA: PVB MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 132 SOUTH AMERICA: PVB MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 133 SOUTH AMERICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 134 SOUTH AMERICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 135 SOUTH AMERICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 136 SOUTH AMERICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.5.1 BRAZIL

- 8.5.1.1 Rising government initiatives and investments in automotive industry to propel PVB market

- TABLE 137 BRAZIL: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 138 BRAZIL: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 139 BRAZIL: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 140 BRAZIL: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.5.2 ARGENTINA

- 8.5.2.1 Government initiatives to promote electric vehicles to increase consumption of PVB

- TABLE 141 ARGENTINA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 142 ARGENTINA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 143 ARGENTINA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 144 ARGENTINA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.5.3 REST OF SOUTH AMERICA

- TABLE 145 REST OF SOUTH AMERICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 146 REST OF SOUTH AMERICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 147 REST OF SOUTH AMERICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 148 REST OF SOUTH AMERICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.6 MIDDLE EAST & AFRICA

- TABLE 149 MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 150 MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 151 MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 154 MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- TABLE 155 MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 158 MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 159 MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.6.1 SAUDI ARABIA

- 8.6.1.1 Rising residential and commercial construction to propel growth of PVB market

- TABLE 161 SAUDI ARABIA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 162 SAUDI ARABIA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 163 SAUDI ARABIA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 164 SAUDI ARABIA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.6.2 SOUTH AFRICA

- 8.6.2.1 Increasing government investments to create market opportunities

- TABLE 165 SOUTH AFRICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 166 SOUTH AFRICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 167 SOUTH AFRICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 168 SOUTH AFRICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- 8.6.3 REST OF MIDDLE EAST & AFRICA

- TABLE 169 REST OF MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (KILOTON)

- TABLE 170 REST OF MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (KILOTON)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST & AFRICA: PVB MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 34 COMPANIES ADOPTED INVESTMENT & EXPANSION AS KEY GROWTH STRATEGY BETWEEN 2015 AND 2022

- 9.3 MARKET EVALUATION MATRIX

- TABLE 173 PVB MARKET EVALUATION MATRIX

- 9.4 MARKET RANKING ANALYSIS

- FIGURE 35 RANKING OF TOP FIVE PLAYERS IN PVB MARKET, 2022

- 9.5 REVENUE ANALYSIS OF TOP PLAYERS

- TABLE 174 PVB MARKET: REVENUE ANALYSIS (USD BILLION)

- 9.6 MARKET SHARE ANALYSIS

- FIGURE 36 PVB MARKET SHARE, BY COMPANY (2021)

- TABLE 175 PVB MARKET: DEGREE OF COMPETITION

- 9.7 COMPANY EVALUATION MATRIX

- 9.7.1 STARS

- 9.7.2 EMERGING LEADERS

- 9.7.3 PERVASIVE PLAYERS

- 9.7.4 PARTICIPANTS

- FIGURE 37 PVB MARKET: COMPANY EVALUATION MATRIX, 2021

- 9.8 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

- 9.8.1 PROGRESSIVE COMPANIES

- 9.8.2 RESPONSIVE COMPANIES

- 9.8.3 STARTING BLOCKS

- 9.8.4 DYNAMIC COMPANIES

- FIGURE 38 PVB MARKET: START-UPS AND SMES MATRIX, 2021

- 9.9 COMPETITIVE BENCHMARKING

- TABLE 176 PVB MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 177 PVB MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

- 9.9.1 COMPANY FOOTPRINT

- TABLE 178 OVERALL COMPANY FOOTPRINT

- 9.9.2 COMPANY APPLICATION FOOTPRINT

- 9.9.3 COMPANY END-USE INDUSTRY FOOTPRINT

- 9.9.4 COMPANY REGION FOOTPRINT

- 9.10 STRENGTH OF PRODUCT PORTFOLIO

- 9.11 BUSINESS STRATEGY EXCELLENCE

- 9.12 COMPETITIVE SCENARIO

- 9.12.1 EXPANSIONS, COLLABORATIONS, AND INVESTMENTS

- TABLE 179 EXPANSIONS, COLLABORATIONS, AND INVESTMENTS

- 9.12.2 ACQUISITIONS & AGREEMENTS

- TABLE 180 ACQUISITIONS & AGREEMENTS

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weaknesses and competitive threats) **

- 10.1.1 KURARAY CO., LTD.

- TABLE 181 KURARAY CO., LTD.: COMPANY OVERVIEW

- FIGURE 39 KURARAY CO., LTD.: COMPANY SNAPSHOT

- TABLE 182 KURARAY CO., LTD.: PRODUCT OFFERINGS

- TABLE 183 KURARAY CO., LTD.: DEALS

- TABLE 184 KURARAY CO. LTD.: OTHER DEVELOPMENTS

- 10.1.2 EASTMAN CHEMICAL COMPANY

- TABLE 185 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 40 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- TABLE 186 EASTMAN CHEMICAL COMPANY: PRODUCT OFFERINGS

- TABLE 187 EASTMAN CHEMICAL COMPANY: PRODUCT BY MOLECULAR WEIGHT

- TABLE 188 EASTMAN CHEMICAL COMPANY: DEALS

- TABLE 189 EASTMAN CHEMICAL COMPANY: OTHER DEVELOPMENTS

- 10.1.3 SEKISUI CHEMICAL CO. LTD.

- TABLE 190 SEKISUI CHEMICAL CO. LTD.: COMPANY OVERVIEW

- FIGURE 41 SEKISUI CHEMICAL CO. LTD.: COMPANY SNAPSHOT

- TABLE 191 SEKISUI CHEMICAL CO. LTD.: PRODUCT OFFERINGS

- TABLE 192 SEKISUI CHEMICAL CO. LTD.: DEALS

- TABLE 193 SEKISUI CHEMICAL CO. LTD.: OTHER DEVELOPMENTS

- 10.1.4 HUBERGROUP

- TABLE 194 HUBERGROUP: COMPANY OVERVIEW

- TABLE 195 HUBERGROUP: PRODUCT OFFERINGS

- TABLE 196 HUBERGROUP: DEALS

- 10.1.5 CHANG CHUN GROUP

- TABLE 197 CHANG CHUN GROUP: COMPANY OVERVIEW

- TABLE 198 CHANG CHUN GROUP: PRODUCT OFFERINGS

- 10.1.6 ANHUI WANWEI BISHENG NEW MATERIAL CO., LTD.

- TABLE 199 ANHUI WANWEI BISHENG NEW MATERIAL CO. LTD.: COMPANY OVERVIEW

- TABLE 200 ANHUI WANWEI BISHENG NEW MATERIAL CO. LTD.: PRODUCT OFFERINGS

- 10.1.7 KINGBOARD (FO GANG) SPECIALTY RESINS LIMITED

- TABLE 201 KINGBOARD (FO GANG) SPECIALTY RESINS LIMITED: COMPANY OVERVIEW

- TABLE 202 KINGBOARD (FO GANG) SPECIALTY RESINS LIMITED: PRODUCT OFFERINGS

- 10.1.8 QINGDAO JINUO NEW MATERIALS CO., LTD.

- TABLE 203 QINGDAO JINUO NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 204 QINGDAO JINUO NEW MATERIALS CO., LTD.: PRODUCT OFFERINGS

- 10.1.9 HUAKAI PLASTIC CO., LTD.

- TABLE 205 HUAKAI PLASTIC CO., LTD.: COMPANY OVERVIEW

- TABLE 206 HUAKAI PLASTIC CO., LTD.: PRODUCT OFFERINGS

- 10.1.10 TRIDEV RESINS PVT. LTD.

- TABLE 207 TRIDEV RESINS PVT. LTD.: COMPANY OVERVIEW

- TABLE 208 TRIDEV RESINS PVT. LTD.: PRODUCT OFFERINGS

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

- 10.2 OTHER PLAYERS

- 10.2.1 QINGDAO JIAHUA PLASTICS CO., LTD.

- 10.2.2 SIVA CHEMICAL INDUSTRIES

- 10.2.3 TANYUN JUNRONG (LIAONING) CHEMICAL RESEARCH INSTITUTE NEW MATERIALS INCUBATOR CO., LTD.

- 10.2.4 SYNPOL PRODUCTS PRIVATE LIMITED

- 10.2.5 UNIFORM SYNTHETICS PRIVATE LIMITED

- 10.2.6 D.R. COATS INK & RESINS PVT. LTD.

- 10.2.7 HUZHOU XINFU NEW MATERIALS CO., LTD.

- 10.2.8 QINGDAO HAOCHENG INDUSTRIAL COMPANY LIMITED

- 10.2.9 ZHEJIANG PULIJIN PLASTIC CO., LTD.

- 10.2.10 TIANTAI KANGLAI INDUSTRIAL CO., LTD.

- 10.2.11 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

- 10.2.12 GUANGZHOU AOJISI NEW MATERIAL CO. LTD.

- 10.2.13 DULITE CO., LTD.

- 10.2.14 SINOEVER INTERNATIONAL CO., LTD.

- 10.2.15 JINHE ENTERPRISE CO. LIMITED

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORT

- 11.5 AUTHOR DETAILS