|

|

市場調査レポート

商品コード

1399271

ドローン物流および輸送の世界市場:プラットフォーム別、用途別、ソリューション別、ユーザー別、航続距離別、地域別-2030年までの予測Drone Logistics and Transportation Market by Platform (Freight, Passenger, Ambulance Drones), Application (Logistics, Transportation), Solution (Hardware, Software, Infrastructure), User, Range, and Region - Global Forecast to 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ドローン物流および輸送の世界市場:プラットフォーム別、用途別、ソリューション別、ユーザー別、航続距離別、地域別-2030年までの予測 |

|

出版日: 2023年12月15日

発行: MarketsandMarkets

ページ情報: 英文 276 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | プラットフォーム別、用途別、ソリューション別、航続距離別、ユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、アフリカ、中南米、中東 |

ドローン物流および輸送の市場規模は2023年に9億米ドルとなり、2023年から2030年までのCAGRは50.1%になると見込まれています。

同市場は、2030年には161億米ドルに達すると予測されています。過去数十年間、ドローンを利用した物流・輸送分野は、従来の輸送・物流経路に比べて自律的な運用とコスト削減が可能なため、導入が増加しています。これは、ドローンの自律性技術の急速な成熟と、この市場の進化に必要なインフラとソフトウェアソリューションの準備が整ったためです。民間航空企業の関与の高まりとインフラへの政府投資は、ドローン物流および輸送市場の競争とイノベーションを刺激しています。

プラットフォーム別では、貨物用ドローンは、配達用ドローンと貨物用飛行体にさらに細分化され、旅客用ドローンは、ドローンタクシー、エアシャトル、個人用飛行体にさらに細分化されます。DLT市場の貨物ドローン分野は、2023年の9億米ドルから成長し、予測期間中のCAGRは41.2%で、2030年には99億米ドルに達すると予測されています。

ソリューション別では、ハードウェアは2023年の7億4,000万米ドルから2030年には131億3,000万米ドルへとCAGR 51.3%を記録し、最も高い成長が見込まれます。

ユーザー別では、政府防衛と商業に区分されます。商業セグメントは、2023年の8億3,986万米ドルから2030年には137億6,550万米ドルに成長し、CAGRは49.7%と最も高くなると予測されています。

当レポートでは、世界のドローン物流および輸送市場について調査し、プラットフォーム別、用途別、ソリューション別、ユーザー別、航続距離別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向と混乱

- 景気後退の影響分析

- 貿易データ分析

- 平均販売価格分析

- エコシステム分析

- プラットフォームメーカー

- ドローンサービスプロバイダー

- 物流パートナー

- バリューチェーン分析

- 使用事例分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 関税と規制状況

- 主要な会議とイベント

第6章 業界の動向

- イントロダクション

- 主要な技術動向

- メガトレンドの影響

- 技術分析

- イノベーションと特許登録

第7章 ドローン物流および輸送市場、プラットフォーム別

- イントロダクション

- 貨物ドローン

- 乗客用ドローン

- 救急車ドローン

第8章 ドローン物流および輸送市場、ソリューション別

- イントロダクション

- ハードウェア

- ソフトウェア

- インフラ

第9章 ドローン物流および輸送市場、用途別

- イントロダクション

- 物流

- 輸送

第10章 ドローン物流および輸送市場、ユーザー別

- イントロダクション

- 政府と防衛

- 商業用

第11章 ドローン物流および輸送市場、航続距離別

- イントロダクション

- 至近距離(50キロメートル未満)

- 短距離(50~150キロメートル)

- 中距離(150~650キロメートル)

- 長距離(650キロメートル超)

第12章 ドローン物流および輸送市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東

- アフリカ

- ラテンアメリカ

第13章 競合情勢

- イントロダクション

- 競合の概要

- 市場ランキング分析、2022年

- 収益分析、2022年

- 市場シェア分析、2022年

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- ALPHABET INC.

- HARDIS GROUP

- ZIPLINE

- VOLOCOPTER GMBH

- TEXTRON INC.

- THE BOEING COMPANY

- AIRBUS

- JOBY AVIATION

- MATTERNET, INC.

- FLIRTEY INC.

- EHANG

- KALERIS

- CANA LLC

- DRONESCAN

- DRONE DELIVERY CANADA CORP.

- その他の企業

- FLYTREX

- ELROY AIR

- SKYCART INC.

- ALTITUDE ANGEL

- SPEEDBIRD AERO

- SKYPORTS LIMITED

- INFINIUM ROBOTICS

- WORKHORSE GROUP INC.

- AGEAGLE AERIAL SYSTEMS INC.

- AIRMAP INC.

第15章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Platform, Application, Solution, Range, User and Region |

| Regions covered | North America, Europe, APAC, Africa, LATAM, Middle East |

The drone logistics and transport market is valued at USD 0.9 billion in 2023 and is projected to reach USD 16.1 billion by 2030, at a CAGR of 50.1% from 2023 to 2030. Over the last few decades, the drone based logistics and transportation segments have seen increased adoption due to the autonomous operations and cost savings involved compared to the traditional transportation and logistics pathways. This was enabled due to the rapid maturation of technology in drone autonomy as well as the readiness of infrastructure and software solutions that are required for this market to evolve. Growing involvement of commercial aviation enterprises and government investments in infrastructure are stimulating competition and innovation of drone logistics and transport market.

Based on platform, the freight drones segment will register the highest growth during the forecast period.

Based on platform, the DLT market is segmented into freight drones, passenger drones, and air ambulance drones. The freight drones are further sub-segmented into delivery drones and cargo air vehicle and passenger drones are further sub-segmented into drone taxi, air shuttle, and personal air vehicles. The freight drone segment of the DLT market is expected to grow from USD 0.9 billion in 2023 and is projected to reach USD 9.9 billion by 2030, at a CAGR of 41.2% during the forecast period.

Based on the solution, the hardware segment will register the highest growth during the forecast period.

Based on solutions, the DLT market is segmented into hardware, software, and infrastructure solutions. Of these segments, hardware is expected to have the highest growth from USD 0.74 billion in 2023 to USD 13.13 billion in 2030, registering a CAGR of 51.3%. Based on hardware, the drone logistics and transportation market has been further segmented into airframe, avionics & sensory payload, propulsion, and software. With significant investments in the development of drone infrastructure, the possibility of using drones for the transportation of passengers and cargo is gaining traction. Prototypes to ease the problem of congested traffic in urban areas in the form of cost-effective passenger drones are being developed. The major solutions required for the use of drones for passenger and cargo transportation include the development of infrastructure and reliable aerial vehicles.

Based on application, the Logistics segment is estimated to have the highest growth during the forecast period.

Based on application, the drone logistics and transportation market has been segmented into logistics and transportation. The logistics segment of the drone logistics and transportation market is projected to grow from USD 0.9 billion in 2023 to USD 9.9 billion by 2030, at the highest CAGR of 41.2%. The logistics segment of the market consists of postal & package delivery, healthcare & pharmacy, retail & food, precision agriculture, industry delivery, weapons & ammunition, and maritime logistic services, all based on autonomous or semi-autonomous drones.

Based on users, the commercial segment is estimated to have the highest growth during the forecast period.

Based on operation users, the drone logistics and transportation market has been segmented into government defense and commercial. The commercial segment is projected to grow from USD 839.86 million in 2023 to USD 13,765.50 million by 2030, at the highest CAGR of 49.7%. Reduction of human intervention leading to increased efficiency is driving the commercial segment of the DLT market.

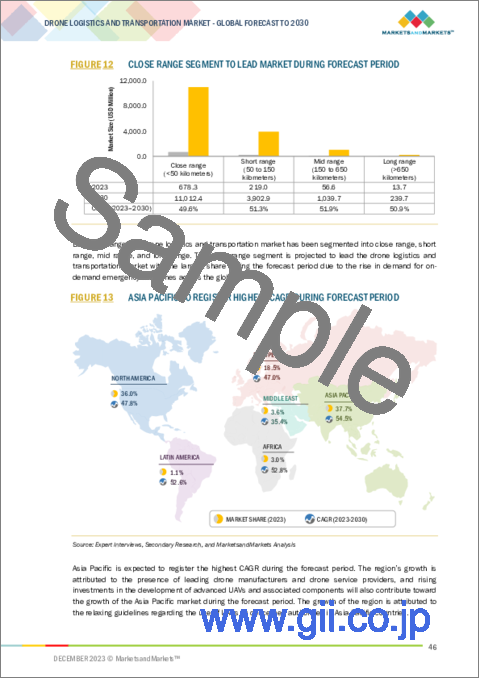

Based on range, the close range (<50 Km) segment is estimated to have the largest market share in 2023.

Based on range, the drone logistics and transportation market has been segmented into Close range (<50 kilometers), Short range (50 to 150 kilometers), Mid range (150 to 650 kilometers), and long range (>650 kilometers). The close range (<50 kilometers) segment is estimated to account for the largest share (70%) of the drone logistics and transportation market in 2023. Their compact size and maneuverability make them ideal for navigating congested urban environments, significantly reducing delivery time and bypassing traffic bottlenecks. Additionally, they excel in delivering to remote or hard-to-reach areas, particularly where traditional ground transportation is inefficient or impractical. This versatility, coupled with their environmentally friendly nature and reduced operational costs, makes close-range delivery drones an indispensable tool for logistics companies seeking to optimize last-mile deliveries and gain a competitive edge in the dynamic landscape of drone logistics.

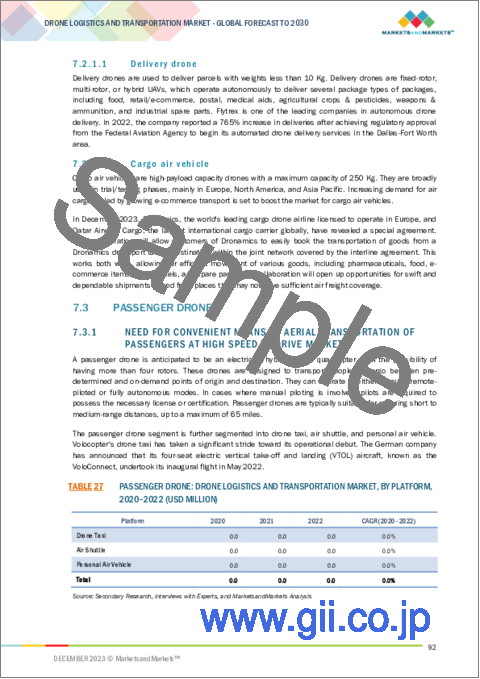

Based on regions, the Asia Pacific region is estimated to have the highest growth during the forecast period.

The Asia Pacific region is estimated to account for the largest share of 37.7% of the drone logistics and transportation market in 2023. The growth of the region is attributed to the relaxing guidelines regarding the use of UAVs by concerned authorities in Asia Pacific countries. For instance, The Civil Aviation Authority of Singapore (CAAS) and its regional counterparts began collaboration in November 2023, on a framework for safety rules and standards to regulate air taxi and drone operations.

The break-up of the profile of primary participants in the DLT market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Middle East- 10%, Rest of the World (RoW) - 5%

Major companies profiled in the report include Alphabet Inc. (US), Hardis Group (France), Zipline (US), Volocopter GmbH (Germany), Textron Inc. (US) among others.

Research Coverage:

This market study covers the drone logistics and transportation market across various segments and subsegments. It aims to estimate this market's size and growth potential across different parts based on size, operational orbits, application, component, end user, and region. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall drone logistics and transportation market. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities. The drone logistics and transportation market is experiencing substantial growth, primarily driven by the exchange of real-time information. The increasing trend toward international cooperation and joint operations among nations is fostering demand for logistics and transport drones, contributing to regional and global stability. The report provides insights on the following pointers:

- Market Drivers: Market Drivers such as demand for last mile delivery and increasing demand for autonomous air ambulance vehicles among other drivers covered in the report.

- Market Penetration: Comprehensive information on logistics and transport drones offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the drone logistics and transportation market

- Market Development: Comprehensive information about lucrative markets - the report analyses the drone logistics and transportation market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the drone logistics and transportation market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the drone logistics and transportation market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 DRONE LOGISTICS AND TRANSPORTATION MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.6 CURRENCY & PRICING

- TABLE 2 USD EXCHANGE RATES

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 RECESSION IMPACT ANALYSIS (RIA)

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- TABLE 3 KEY PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology for delivery drones

- TABLE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.1.2 Market size estimation methodology for cargo drones

- 2.3.1.3 Market size estimation methodology for passenger and ambulance drones

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.1.4 Regional split of drone logistics and transportation market

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 8 FREIGHT DRONE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 HARDWARE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 LOGISTICS SEGMENT TO DOMINATE MARKET CAGR DURING FORECAST PERIOD

- FIGURE 11 COMMERCIAL USER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 CLOSE RANGE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DRONE LOGISTICS AND TRANSPORTATION MARKET

- FIGURE 14 INCREASING DEMAND FOR FAST AND EFFICIENT DELIVERY TO DRIVE MARKET

- 4.2 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY FREIGHT DRONE PLATFORM

- FIGURE 15 CARGO AIR VEHICLE SEGMENT TO HAVE LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.3 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY USER

- FIGURE 16 COMMERCIAL SEGMENT TO CAPTURE LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.4 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY LOGISTICS APPLICATION

- FIGURE 17 RETAIL & FOOD SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY REGION

- FIGURE 18 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DRONE LOGISTICS AND TRANSPORTATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for autonomous last-mile deliveries

- 5.2.1.2 Increasing requirement for time-sensitive deliveries in healthcare industry

- 5.2.1.3 Growing need to reduce CO2 emissions and carbon footprints

- 5.2.1.4 Decreasing price of drone components

- 5.2.1.5 Increasing requirement for autonomous air ambulance vehicles

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of skilled drone operators

- 5.2.2.2 Safety and security issues

- 5.2.2.3 Uncertainty in regulatory frameworks

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing zero-emission initiatives

- 5.2.3.2 Growing use of UAVs for cargo delivery in military and commercial applications

- 5.2.3.3 Technological advancements for enhanced accuracy in package deliveries

- 5.2.4 CHALLENGES

- 5.2.4.1 Restrictions imposed on commercial UAVs in various countries

- TABLE 5 RESTRICTIONS IMPOSED ON USE OF UAVS IN VARIOUS COUNTRIES

- 5.2.4.2 Limited implementation of ground infrastructure

- 5.2.4.3 Lack of proper air traffic management for UAVs

- 5.2.4.4 Data security and data encryption concerns

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN DRONE LOGISTICS AND TRANSPORTATION MARKET

- FIGURE 20 REVENUE SHIFT IN DRONE LOGISTICS AND TRANSPORTATION MARKET

- 5.4 RECESSION IMPACT ANALYSIS

- FIGURE 21 DRONE LOGISTICS AND TRANSPORTATION MARKET: RECESSION IMPACT ANALYSIS

- 5.5 TRADE DATA ANALYSIS

- FIGURE 22 DRONE LOGISTICS AND TRANSPORTATION MARKET: IMPORT DATA FOR TOP 10 COUNTRIES

- TABLE 6 COUNTRY-WISE IMPORTS, 2019-2022 (USD MILLION)

- FIGURE 23 DRONE LOGISTICS AND TRANSPORTATION MARKET: EXPORT DATA FOR TOP 10 COUNTRIES

- TABLE 7 COUNTRY-WISE EXPORTS, 2019-2022 (USD MILLION)

- 5.6 AVERAGE SELLING PRICE ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TRANSPORTATION APPLICATION

- FIGURE 24 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TRANSPORTATION APPLICATION (USD MILLION)

- TABLE 8 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TRANSPORTATION APPLICATION (USD MILLION)

- 5.6.2 AVERAGE SELLING PRICE OF KEY PLAYERS, BY LOGISTICS APPLICATION

- FIGURE 25 AVERAGE SELLING PRICE OF KEY PLAYERS, BY LOGISTICS APPLICATION (USD MILLION)

- TABLE 9 AVERAGE SELLING PRICE OF KEY PLAYERS, BY LOGISTICS APPLICATION (USD MILLION)

- 5.6.3 INDICATIVE SELLING PRICE, BY REGION

- TABLE 10 INDICATIVE SELLING PRICE, BY REGION (USD MILLION)

- 5.7 ECOSYSTEM ANALYSIS

- 5.7.1 PROMINENT COMPANIES

- PLATFORM MANUFACTURERS

- 5.7.2 SMALL AND PRIVATE ENTERPRISES

- DRONE SERVICE PROVIDERS

- LOGISTICS PARTNERS

- 5.7.3 END USERS

- FIGURE 26 DRONE LOGISTICS AND TRANSPORTATION MARKET MAP

- TABLE 11 DRONE LOGISTICS AND TRANSPORTATION MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- FIGURE 27 DRONE LOGISTICS AND TRANSPORTATION MARKET ECOSYSTEM

- 5.8 VALUE CHAIN ANALYSIS

- FIGURE 28 DRONE LOGISTICS AND TRANSPORTATION MARKET: VALUE CHAIN ANALYSIS

- 5.9 USE CASE ANALYSIS

- 5.9.1 USE CASE 1: BELUGA DRONE FOR MISSION-CRITICAL OPERATIONS

- 5.9.2 USE CASE 2: FASTEST CONTACT-FREE DELIVERIES

- 5.9.3 USE CASE 3: DRONES IN EMERGENCY AMBULANCE SERVICES

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 IMPACT OF PORTER'S FIVE FORCES ON DRONE LOGISTICS AND TRANSPORTATION MARKET

- FIGURE 29 DRONE LOGISTICS AND TRANSPORTATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM (%)

- 5.11.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA IN DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM

- TABLE 14 KEY BUYING CRITERIA IN DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES AND EVENTS

- TABLE 19 DRONE LOGISTICS AND TRANSPORTATION MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 KEY TECHNOLOGICAL TRENDS

- 6.2.1 CLOUD COMPUTING

- 6.2.2 WIRELESS CHARGING

- 6.2.3 AUTOMATED GROUND CONTROL STATIONS

- 6.2.4 DRONE SWARM TECHNOLOGY

- 6.2.5 COMPUTER VISION

- 6.2.6 MULTI-SENSOR DATA FUSION

- 6.2.7 ADVANCED ALGORITHMS AND ANALYTICS

- 6.2.8 DRONE INSURANCE

- TABLE 20 INSURANCE COVERAGE OFFERED

- TABLE 21 FIVE COMPANIES PROVIDING DRONE INSURANCE

- 6.3 IMPACT OF MEGATRENDS

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 HYDROGEN POWER

- 6.4.2 UPGRADES IN DRONE TRACKING AND NAVIGATION

- 6.4.3 IMPROVED COMPUTER VISION AND MOTION PLANNING

- 6.4.4 REDUCTION IN DRONE NOISE

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS

- FIGURE 32 LIST OF MAJOR PATENTS FOR DRONE LOGISTICS AND TRANSPORTATION MARKET

- TABLE 22 DRONE LOGISTICS AND TRANSPORTATION MARKET: PATENT ANALYSIS

7 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- FIGURE 33 FREIGHT DRONE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 23 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 24 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- 7.2 FREIGHT DRONE

- 7.2.1 EMERGENCE OF E-COMMERCE AND GROWING DEMAND FOR SAME-DAY DELIVERIES TO DRIVE MARKET

- TABLE 25 FREIGHT DRONE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 26 FREIGHT DRONE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- 7.2.1.1 Delivery drone

- 7.2.1.2 Cargo air vehicle

- 7.3 PASSENGER DRONE

- 7.3.1 NEED FOR CONVENIENT MEANS OF AERIAL TRANSPORTATION OF PASSENGERS AT HIGH SPEED TO DRIVE MARKET

- TABLE 27 PASSENGER DRONE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 28 PASSENGER DRONE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- 7.3.1.1 Drone taxi

- 7.3.1.2 Air shuttle

- 7.3.1.3 Personal air vehicle

- 7.4 AMBULANCE DRONE

- 7.4.1 ABILITY TO DRASTICALLY REDUCE RESPONSE TIMES IN EMERGENCY SITUATIONS TO DRIVE MARKET

8 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION

- 8.1 INTRODUCTION

- FIGURE 34 HARDWARE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 29 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 30 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 8.2 HARDWARE

- TABLE 31 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY HARDWARE SOLUTION, 2020-2022 (USD MILLION)

- TABLE 32 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY HARDWARE SOLUTION, 2023-2030 (USD MILLION)

- 8.2.1 AIRFRAME

- 8.2.1.1 Growing demand for drone airframes with large payload-carrying capacity to drive market

- 8.2.2 AVIONICS & SENSORY PAYLOAD

- 8.2.2.1 Need for drones with advanced flight control and communications systems to drive market

- 8.2.3 PROPULSION

- 8.2.3.1 Growing use of delivery drones in commercial applications to drive market

- 8.2.4 SOFTWARE

- 8.2.4.1 In-house software development to minimize R&D expenses to drive market

- 8.3 SOFTWARE

- TABLE 33 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOFTWARE SOLUTION, 2020-2022 (USD MILLION)

- TABLE 34 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOFTWARE SOLUTION, 2023-2030 (USD MILLION)

- 8.3.1 ROUTE PLANNING AND OPTIMIZING

- 8.3.1.1 Innovations in route planning software to drive market

- 8.3.2 INVENTORY MANAGEMENT

- 8.3.2.1 Need for efficiency in drone package delivery services to drive market

- 8.3.3 LIVE TRACKING

- 8.3.3.1 Live tracking to locate drones in real time to enable smooth delivery and transportation to drive market

- 8.3.4 FLEET MANAGEMENT

- 8.3.4.1 Successful delivery of goods and transportation requiring sophisticated fleet management solutions to drive market

- 8.3.5 COMPUTER VISION

- 8.3.5.1 Need to make drone deliveries more accessible to drive market

- 8.4 INFRASTRUCTURE

- TABLE 35 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY INFRASTRUCTURE SOLUTION, 2020-2022 (USD MILLION)

- TABLE 36 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY INFRASTRUCTURE SOLUTION, 2023-2030 (USD MILLION)

- 8.4.1 GROUND CONTROL STATIONS

- 8.4.1.1 Growing demand for ease of drone monitoring and controlling to drive market

- 8.4.2 CHARGING STATIONS

- 8.4.2.1 Wireless charging stations to increase range and efficiency of drones

- 8.4.3 LANDING PADS

- 8.4.3.1 Growing demand for convenience in delivery and transportation to drive market

- 8.4.4 MICRO-FULFILMENT CENTERS

- 8.4.4.1 Increasing benefits of mobile micro-fulfillment centers for delivery to drive market

9 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 35 LOGISTICS SEGMENT TO LEAD MARKET IN 2023

- TABLE 37 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 38 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 9.2 LOGISTICS

- TABLE 39 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY LOGISTICS, 2020-2022 (USD MILLION)

- TABLE 40 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY LOGISTICS, 2023-2030 (USD MILLION)

- 9.2.1 POSTAL & PACKAGE DELIVERY

- 9.2.1.1 Drone trials to test feasibility and profitability of using them for postal & package delivery to drive market

- 9.2.2 HEALTHCARE & PHARMACY

- 9.2.2.1 Demand for easy access to healthcare supplies and other pharmacy-related products to drive market

- 9.2.3 RETAIL & FOOD DELIVERY

- 9.2.3.1 Better customer satisfaction and modified supply chains for retailers to drive market

- 9.2.4 PRECISION AGRICULTURE DELIVERY

- 9.2.4.1 Growing concerns over climate change and demand for reforestation to drive market

- 9.2.5 INDUSTRIAL DELIVERY

- 9.2.5.1 Need to reduce transit time between two production units to drive market

- 9.2.6 WEAPONS & AMMUNITION DELIVERY

- 9.2.6.1 Demand for precise material delivery capability for frontline squads to drive market

- 9.2.7 MARITIME DELIVERY

- 9.2.7.1 Need for autonomous ship-to-ship and shore-to-ship aerial delivery services for military applications to drive market

- 9.3 TRANSPORTATION

- TABLE 41 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 42 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY TRANSPORTATION, 2023-2030 (USD MILLION)

- 9.3.1 PATIENT TRANSPORT

- 9.3.1.1 Special emergency medical service permits for critical patients to drive market

- 9.3.2 PASSENGER TRANSPORT

- 9.3.2.1 Quiet, safe, and environmentally clean transportation option

10 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY USER

- 10.1 INTRODUCTION

- FIGURE 36 COMMERCIAL USER SEGMENT TO LEAD MARKET IN 2023

- TABLE 43 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY USER, 2020-2022 (USD MILLION)

- TABLE 44 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY USER, 2023-2030 (USD MILLION)

- 10.1.1 GOVERNMENT & DEFENSE

- 10.1.1.1 To be faster-growing user than commercial segment

- 10.1.2 COMMERCIAL

- 10.1.2.1 Growing application of drones in commercial logistics industry to drive market

11 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY RANGE

- 11.1 INTRODUCTION

- FIGURE 37 MID RANGE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 45 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY RANGE, 2020-2022 (USD MILLION)

- TABLE 46 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY RANGE, 2023-2030 (USD MILLION)

- 11.2 CLOSE RANGE (<50 KILOMETERS)

- 11.2.1 RISING ON-DEMAND FOOD DELIVERIES TO DRIVE MARKET

- 11.3 SHORT RANGE (50 TO 150 KILOMETERS)

- 11.3.1 SIGNIFICANT INVESTMENT IN NEXT-GEN EVTOLS TO DRIVE MARKET

- 11.4 MID-RANGE (150 TO 650 KILOMETERS)

- 11.4.1 SUBSTANTIAL INVESTMENT IN R&D TO DEVELOP NEW BATTERY TECHNOLOGIES TO DRIVE MARKET

- 11.5 LONG RANGE (>650 KILOMETERS)

- 11.5.1 INCREASING DEMAND FOR EMISSION REDUCTION TO DRIVE MARKET

12 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 38 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 47 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 48 DRONE LOGISTICS AND TRANSPORTATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 RECESSION IMPACT ANALYSIS

- 12.2.2 PESTLE ANALYSIS

- FIGURE 39 NORTH AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET SNAPSHOT

- TABLE 49 NORTH AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 54 NORTH AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.2.3 US

- 12.2.3.1 Growing adoption of drones for commercial and military applications to drive market

- TABLE 55 US: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 56 US: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 57 US: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 58 US: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.2.4 CANADA

- 12.2.4.1 Supportive regulations and government initiatives to drive market

- TABLE 59 CANADA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 60 CANADA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 61 CANADA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 62 CANADA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 RECESSION IMPACT ANALYSIS

- 12.3.2 PESTLE ANALYSIS

- FIGURE 40 EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET SNAPSHOT

- TABLE 63 EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 64 EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 66 EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 67 EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 68 EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Technological developments by key players to drive market

- TABLE 69 UK: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 70 UK: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 71 UK: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 72 UK: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.3.4 GERMANY

- 12.3.4.1 Increasing demand for commercial drone services to drive market

- TABLE 73 GERMANY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 74 GERMANY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 75 GERMANY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 76 GERMANY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.3.5 FRANCE

- 12.3.5.1 Development of fully autonomous drones for commercial and defense applications to drive market

- TABLE 77 FRANCE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 78 FRANCE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 79 FRANCE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 80 FRANCE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.3.6 ITALY

- 12.3.6.1 Rising demand for drones by healthcare industry to drive market

- TABLE 81 ITALY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 82 ITALY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 83 ITALY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 84 ITALY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.3.7 SWITZERLAND

- 12.3.7.1 Development of modern infrastructure for safe landing and take-off of cargo drones to drive market

- TABLE 85 SWITZERLAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 86 SWITZERLAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 87 SWITZERLAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 88 SWITZERLAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.3.8 NORWAY

- 12.3.8.1 Favorable government initiatives to drive market

- TABLE 89 NORWAY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 90 NORWAY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 91 NORWAY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 92 NORWAY: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.3.9 SWEDEN

- 12.3.9.1 Surge in demand for drones for emergency medical transportation services to drive market

- TABLE 93 SWEDEN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 94 SWEDEN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 95 SWEDEN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 96 SWEDEN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.3.10 REST OF EUROPE

- TABLE 97 REST OF EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 98 REST OF EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 99 REST OF EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 100 REST OF EUROPE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.4 ASIA PACIFIC

- 12.4.1 RECESSION IMPACT ANALYSIS

- 12.4.2 PESTLE ANALYSIS

- FIGURE 41 ASIA PACIFIC: DRONE LOGISTICS AND TRANSPORTATION MARKET SNAPSHOT

- TABLE 101 ASIA PACIFIC: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 ASIA PACIFIC: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 106 ASIA PACIFIC: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.4.3 CHINA

- 12.4.3.1 Presence of leading drone manufacturers and drone service providers to drive market

- TABLE 107 CHINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 108 CHINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 109 CHINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 110 CHINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.4.4 INDIA

- 12.4.4.1 Rising investments in advanced UAVs and associated components to drive market

- TABLE 111 INDIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 112 INDIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 113 INDIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 114 INDIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.4.5 JAPAN

- 12.4.5.1 Increasing adoption of drones for defense applications to drive market

- TABLE 115 JAPAN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 116 JAPAN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 117 JAPAN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 118 JAPAN: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.4.6 AUSTRALIA

- 12.4.6.1 Favorable government initiatives and regulations to drive market

- TABLE 119 AUSTRALIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 120 AUSTRALIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 121 AUSTRALIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 122 AUSTRALIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.4.7 NEW ZEALAND

- 12.4.7.1 Growing demand for aerial transportation & logistic services to drive market

- TABLE 123 NEW ZEALAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 124 NEW ZEALAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 125 NEW ZEALAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 126 NEW ZEALAND: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.4.8 MALAYSIA

- 12.4.8.1 Modernization of air infrastructure to drive market

- TABLE 127 MALAYSIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 128 MALAYSIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 129 MALAYSIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 130 MALAYSIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.4.9 SINGAPORE

- 12.4.9.1 Established regulatory framework to drive market

- TABLE 131 SINGAPORE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 132 SINGAPORE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 133 SINGAPORE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 134 SINGAPORE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.4.10 SOUTH KOREA

- 12.4.10.1 Increasing use of drones to provide good transportation and healthcare services in remote areas to drive market

- TABLE 135 SOUTH KOREA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 136 SOUTH KOREA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 137 SOUTH KOREA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 138 SOUTH KOREA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.5 MIDDLE EAST

- 12.5.1 RECESSION IMPACT ANALYSIS

- 12.5.2 PESTLE ANALYSIS

- FIGURE 42 MIDDLE EAST: DRONE LOGISTICS AND TRANSPORTATION MARKET SNAPSHOT

- TABLE 139 MIDDLE EAST: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 140 MIDDLE EAST: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 141 MIDDLE EAST: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 142 MIDDLE EAST: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.5.3 UAE

- 12.5.3.1 Rising adoption of UAVs for commercial recreational activities to drive market

- TABLE 143 UAE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 144 UAE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 145 UAE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 146 UAE: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.5.4 ISRAEL

- 12.5.4.1 Rising investment by key players to improve drone services to drive market

- TABLE 147 ISRAEL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 148 ISRAEL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 149 ISRAEL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 150 ISRAEL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.5.5 SAUDI ARABIA

- 12.5.5.1 Focus of key players on development of drones for commercial applications to drive market

- TABLE 151 SAUDI ARABIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 152 SAUDI ARABIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 153 SAUDI ARABIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 154 SAUDI ARABIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.6 AFRICA

- 12.6.1 RECESSION IMPACT ANALYSIS

- 12.6.2 PESTLE ANALYSIS

- FIGURE 43 AFRICA: DRONE LOGISTICS AND TRANSPORTATION MARKET SNAPSHOT

- TABLE 155 AFRICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 156 AFRICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 157 AFRICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 158 AFRICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.7 LATIN AMERICA

- 12.7.1 RECESSION IMPACT ANALYSIS

- 12.7.2 PESTLE ANALYSIS

- FIGURE 44 LATIN AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET SNAPSHOT

- TABLE 159 LATIN AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 160 LATIN AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 161 LATIN AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 162 LATIN AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 163 LATIN AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 164 LATIN AMERICA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.7.3 BRAZIL

- 12.7.3.1 UAV-supportive regulations and rising end user interest in drone services to drive market

- TABLE 165 BRAZIL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 166 BRAZIL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 167 BRAZIL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 168 BRAZIL: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.7.4 MEXICO

- 12.7.4.1 Increase in use of drones for emergency medical services to drive market

- TABLE 169 MEXICO: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 170 MEXICO: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 171 MEXICO: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 172 MEXICO: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.7.5 COLOMBIA

- 12.7.5.1 Growing use of drones to transport medicine and medical equipment in rural areas to drive market

- TABLE 173 COLOMBIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 174 COLOMBIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 175 COLOMBIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 176 COLOMBIA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.7.6 ARGENTINA

- 12.7.6.1 Surge in adoption of UAVs by healthcare authorities to drive market

- TABLE 177 ARGENTINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 178 ARGENTINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 179 ARGENTINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 180 ARGENTINA: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 12.7.7 PERU

- 12.7.7.1 Growing focus on addressing challenges in Amazon Rainforest to drive market

- TABLE 181 PERU: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 182 PERU: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 183 PERU: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 184 PERU: DRONE LOGISTICS AND TRANSPORTATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 COMPETITIVE OVERVIEW

- 13.2.1 KEY PLAYERS' STRATEGIES/ RIGHT TO WIN

- TABLE 185 KEY DEVELOPMENTS OF LEADING PLAYERS IN DRONE LOGISTICS AND TRANSPORTATION MARKET (2020-2O23)

- 13.3 MARKET RANKING ANALYSIS, 2022

- FIGURE 45 RANKING ANALYSIS OF KEY PLAYERS IN DRONE LOGISTICS AND TRANSPORTATION MARKET, 2022

- 13.4 REVENUE ANALYSIS, 2022

- FIGURE 46 REVENUE ANALYSIS FOR KEY COMPANIES IN DRONE LOGISTICS AND TRANSPORTATION MARKET

- 13.5 MARKET SHARE ANALYSIS, 2022

- FIGURE 47 MARKET SHARE OF KEY PLAYERS, 2022

- TABLE 186 DRONE LOGISTICS AND TRANSPORTATION MARKET: DEGREE OF COMPETITION

- 13.6 COMPANY EVALUATION MATRIX

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- FIGURE 48 COMPANY EVALUATION MATRIX, 2022

- 13.6.5 COMPANY FOOTPRINT

- TABLE 187 DRONE LOGISTICS AND TRANSPORTATION MARKET: COMPANY OVERALL FOOTPRINT

- 13.7 STARTUP/SME EVALUATION MATRIX

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- FIGURE 49 STARTUP/SME EVALUATION MATRIX, 2022

- 13.7.5 COMPETITIVE BENCHMARKING

- TABLE 188 DRONE LOGISTICS AND TRANSPORTATION MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 13.8 COMPETITIVE SCENARIO

- 13.8.1 MARKET EVALUATION FRAMEWORK

- 13.8.2 PRODUCT LAUNCHES

- TABLE 189 PRODUCT LAUNCHES, JANUARY 2020-SEPTEMBER 2023

- 13.8.3 DEALS

- TABLE 190 DEALS, JANUARY 2020-NOVEMBER 2023

- 13.8.4 OTHERS

- TABLE 191 OTHERS, JUNE 2020-OCTOBER 2023

14 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 14.1 KEY PLAYERS

- 14.1.1 ALPHABET INC.

- TABLE 192 ALPHABET INC.: COMPANY OVERVIEW

- FIGURE 50 ALPHABET INC.: COMPANY SNAPSHOT

- TABLE 193 ALPHABET INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 194 ALPHABET INC.: PRODUCT LAUNCHES

- TABLE 195 ALPHABET INC.: DEALS

- TABLE 196 ALPHABET INC.: OTHERS

- 14.1.2 HARDIS GROUP

- TABLE 197 HARDIS GROUP: COMPANY OVERVIEW

- TABLE 198 HARDIS GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 199 HARDIS GROUP: OTHERS

- 14.1.3 ZIPLINE

- TABLE 200 ZIPLINE: COMPANY OVERVIEW

- TABLE 201 ZIPLINE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 202 ZIPLINE: PRODUCT LAUNCHES

- TABLE 203 ZIPLINE: DEALS

- 14.1.4 VOLOCOPTER GMBH

- TABLE 204 VOLOCOPTER GMBH: COMPANY OVERVIEW

- TABLE 205 VOLOCOPTER GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 206 VOLOCOPTER GMBH: DEALS

- TABLE 207 VOLOCOPTER GMBH: OTHERS

- 14.1.5 TEXTRON INC.

- TABLE 208 TEXTRON INC.: COMPANY OVERVIEW

- FIGURE 51 TEXTRON INC.: COMPANY SNAPSHOT

- TABLE 209 TEXTRON INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 210 TEXTRON INC.: PRODUCT LAUNCHES

- 14.1.6 THE BOEING COMPANY

- TABLE 211 THE BOEING COMPANY: COMPANY OVERVIEW

- FIGURE 52 THE BOEING COMPANY: COMPANY SNAPSHOT

- TABLE 212 THE BOEING COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 213 THE BOEING COMPANY: PRODUCT LAUNCHES

- 14.1.7 AIRBUS

- TABLE 214 AIRBUS: COMPANY OVERVIEW

- FIGURE 53 AIRBUS: COMPANY SNAPSHOT

- TABLE 215 AIRBUS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 216 AIRBUS: DEALS

- 14.1.8 JOBY AVIATION

- TABLE 217 JOBY AVIATION: COMPANY OVERVIEW

- FIGURE 54 JOBY AVIATION: COMPANY SNAPSHOT

- TABLE 218 JOBY AVIATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 219 JOBY AVIATION: DEALS

- TABLE 220 JOBY AVIATION: OTHERS

- 14.1.9 MATTERNET, INC.

- TABLE 221 MATTERNET, INC.: COMPANY OVERVIEW

- TABLE 222 MATTERNET, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 223 MATTERNET, INC.: PRODUCT LAUNCHES

- TABLE 224 MATTERNET, INC.: DEALS

- TABLE 225 MATTERNET, INC.: OTHERS

- 14.1.10 FLIRTEY INC.

- TABLE 226 FLIRTEY INC.: COMPANY OVERVIEW

- TABLE 227 FLIRTEY INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 228 FLIRTEY INC.: DEALS

- TABLE 229 FLIRTEY INC.: OTHERS

- 14.1.11 EHANG

- TABLE 230 EHANG: COMPANY OVERVIEW

- FIGURE 55 EHANG: COMPANY SNAPSHOT

- TABLE 231 EHANG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 232 EHANG: PRODUCT LAUNCHES

- TABLE 233 EHANG: DEALS

- TABLE 234 EHANG: OTHERS

- 14.1.12 KALERIS

- TABLE 235 KALERIS: COMPANY OVERVIEW

- TABLE 236 KALERIS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 237 KALERIS: DEALS

- TABLE 238 KALERIS: OTHERS

- 14.1.13 CANA LLC

- TABLE 239 CANA LLC: COMPANY OVERVIEW

- TABLE 240 CANA LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.14 DRONESCAN

- TABLE 241 DRONESCAN: COMPANY OVERVIEW

- TABLE 242 DRONESCAN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.15 DRONE DELIVERY CANADA CORP.

- TABLE 243 DRONE DELIVERY CANADA CORP.: COMPANY OVERVIEW

- FIGURE 56 DRONE DELIVERY CANADA CORP.: COMPANY SNAPSHOT

- TABLE 244 DRONE DELIVERY CANADA CORP.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 245 DRONE DELIVERY CANADA CORP.: PRODUCT LAUNCHES

- TABLE 246 DRONE DELIVERY CANADA CORP.: DEALS

- TABLE 247 DRONE DELIVERY CANADA CORP.: OTHERS

- 14.2 OTHER PLAYERS

- 14.2.1 FLYTREX

- TABLE 248 FLYTREX: COMPANY OVERVIEW

- 14.2.2 ELROY AIR

- TABLE 249 ELROY AIR: COMPANY OVERVIEW

- 14.2.3 SKYCART INC.

- TABLE 250 SKYCART INC.: COMPANY OVERVIEW

- 14.2.4 ALTITUDE ANGEL

- TABLE 251 ALTITUDE ANGEL: COMPANY OVERVIEW

- 14.2.5 SPEEDBIRD AERO

- TABLE 252 SPEEDBIRD AERO: COMPANY OVERVIEW

- 14.2.6 SKYPORTS LIMITED

- TABLE 253 SKYPORTS LIMITED: COMPANY OVERVIEW

- 14.2.7 INFINIUM ROBOTICS

- TABLE 254 INFINIUM ROBOTICS: COMPANY OVERVIEW

- 14.2.8 WORKHORSE GROUP INC.

- TABLE 255 WORKHORSE GROUP INC.: COMPANY OVERVIEW

- 14.2.9 AGEAGLE AERIAL SYSTEMS INC.

- TABLE 256 AGEAGLE AERIAL SYSTEMS INC.: COMPANY OVERVIEW

- 14.2.10 AIRMAP INC.

- TABLE 257 AIRMAP INC.: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS