|

|

市場調査レポート

商品コード

1105259

給餌装置の世界市場:種類別 (レール誘導式、コンベアベルト式、自走式)・家畜別 (反芻動物、家禽、豚)・提供製品/サービス別 (ハードウェア、ソフトウェア、サービス)・技術別 (手動式、自動式)・機能別・地域別の将来予測 (2027年まで)Feeding Systems Market by Type (Rail-Guided, Conveyor Belt, Self-Propelled), Livestock (Ruminants, Poultry, Swine), Offering (Hardware, Software, Services), Technology (Manual, Automatic), Function and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 給餌装置の世界市場:種類別 (レール誘導式、コンベアベルト式、自走式)・家畜別 (反芻動物、家禽、豚)・提供製品/サービス別 (ハードウェア、ソフトウェア、サービス)・技術別 (手動式、自動式)・機能別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年07月19日

発行: MarketsandMarkets

ページ情報: 英文 219 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

給餌装置の世界市場は、2022年に27億米ドルと推定されます。

2027年には39億米ドルに達すると予測され、予測期間中に7.7%のCAGRを記録しています。給餌装置市場は、農家の間で給餌装置に対する需要が高まっていることから、世界レベルで明るい見通しが立っています。同市場は、今後5年間で大きく成長すると予測されています。給餌装置市場全体では、北米と欧州が大きなシェアを占めています。アジア太平洋は、すべての地域の中で最も急成長している市場です。新興国と先進国の両方において、牛群サイズの増加、給餌装置の継続的な進歩、家畜のリアルタイム分析により、自動給餌の有利な市場ポテンシャルがあります。

"給餌装置市場は、機能に基づいて、制御、混合、充填、選別、その他の機能に分類される"

機能別では、制御セグメントが予測期間中に最も高いCAGRで成長する見込みです。制御システムは、農場所有者がより良い成長と発展のために、家畜のオンタイム給餌にこだわることを保証します。これらのシステムは、農場での自動給餌のプロセス全体を制御するため、給餌装置ラインの中で最も重要な部分です。技術進歩により、牛1頭1頭の行動や居場所、牛群全体を監視可能な、一体型のモニタリングソリューションが開発されました。このソフトウェアは、個々の牛やグループの繁殖力、健康状態、幸福度、位置、栄養状態について、最も正確で完全な情報を提供します。

"給餌装置市場は、提供方法に基づいて、予測期間中はハードウェアが支配的であると推定される"

2021年のシェアは、ハードウェアが最も大きいです。これは、給餌装置の需要増加、ハードウェアシステムに対する消費者の嗜好の高まり、革新的な製品を導入するための主要企業の技術進歩、乳製品の需要増加、世界の乳牛数の増加などに起因するものです。また、労働力不足による酪農の機械化の進展や、給餌装置への嗜好性の高まりも、ハードウェアシステムの成長を後押ししています。

しかし、同市場は、製品製造にかかるコストが高く、また老舗企業の存在もあり、小規模プレイヤーには高い参入障壁があります。その他の利点に関する認識不足、給餌装置やハードウェアの高価格が、新興国の酪農家による採用を抑制しています。

"予測期間中、アジア太平洋地域が最も高いCAGRで成長する"

急速な工業化に伴い、家畜生産者は増加する食肉需要に対応するため、生産量を増やすために給餌装置を採用しています。インドは、農家による高度な給餌技術の活用という点で未開拓の市場であるため、給餌産業において大きな機会があります。インドの給餌装置市場は成長段階にあり、農家は動物の健康と生産性の直接的な関連性を認識しつつあります。これらの要因は、地元の企業だけでなく、世界な給餌装置プレーヤーにとっても、インドの給餌産業に投資する大きな機会を意味しています。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

第6章 産業動向

- イントロダクション

- バリューチェーン

- 研究開発

- ハードウェアコンポーネントプロバイダーおよびソフトウェアプロバイダー

- サービスプロバイダー

- サプライヤー・ディストリビューター

- エンドユーザー

- サプライチェーン分析

- 技術分析

- 人工知能

- IoT

- 給餌装置用ロボット

- 価格分析

- エコシステム

- 顧客のビジネスに影響を与える傾向/混乱

- 給餌装置市場:特許分析

- 貿易データ:給餌装置市場

- ケーススタディ

- 主要な会議とイベント (2022年~2023年)

- 関税・規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

第7章 給餌装置市場:種類別

- イントロダクション

- レール誘導式給餌装置

- コンベヤー式給餌装置

- ベルト型給餌装置

- パン型給餌装置

- チェーン型給餌装置

- 自走式給餌装置

第8章 給餌装置市場:家畜別

- イントロダクション

- 反芻動物

- 家禽

- 豚

- その他の家畜

第9章 給餌装置市場:技術別

- イントロダクション

- 手動式

- 自動式

- ロボット式・テレメトリー式

- RFID技術

- 誘導・リモートセンシング技術

- その他のサブタイプ

第10章 給餌装置市場:提供製品/サービス別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第11章 給餌装置市場:機能別

- イントロダクション

- 制御

- 混合

- 充填・選別

- その他の機能

第12章 給餌装置市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリアとニュージーランド

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 南米

- 中東

- アフリカ

第13章 競合情勢

- 概要

- 市場シェア分析 (2021年)

- 主要企業の収益分析:セグメント別

- 主要企業が採用した戦略

- 企業評価クアドラント (主要企業、2021年)

- 給餌装置市場:スタートアップ/中小企業の評価クアドラント (2021年)

- 製品の発売、取引、その他の開発

第14章 企業プロファイル

- 主要企業

- DELAVAL

- GEA GROUP AKTIENGESELLSCHAFT

- LELY

- TRIOLET B.V.

- VDL AGROTECH B.V.

- SCALEAQ

- BOUMATIC

- PELLON GROUP OY

- ROVIBEC AGRISOLUTIONS

- CTB, INC. (BERKSHIRE HATHAWAY)

- AFIMILK LTD.

- DAIRYMASTER

- MASKINFABRIKKEN CORMALL A/S

- HETWIN AUTOMATION SYSTEMS GMBH

- JH AGRO A/S

- その他の企業 (中小企業/スタートアップ)

- SCHAUER AGROTRONIC GMBH

- AKVA GROUP

- WASSERBAUER GMBH FEEDING SYSTEMS

- VALMETAL

- VIJAY RAJ POULTRY EQUIPMENTS PVT. LTD

- SIEPLO B.V

- PATZ CORPORATION

- FEEDTECH FEEDING SYSTEMS PTY LTD (TREVASKIS ENGINEERING)

- ONE2FEED A/S

- CLOVERDALE EQUIPMENT, LLC

第15章 付録

The global feeding systems market is estimated to be valued at USD 2.7 billion in 2022. It is projected to reach USD 3.9 billion by 2027, recording a CAGR of 7.7% during the forecast period. The market for feeding systems has a positive outlook at a global level due to the rising demand for feeding systems among farmers. The market is estimated to grow significantly over the next five years. North America and Europe contributed to a significant share of the overall feeding systems market. Asia Pacific is the fastest-growing market, among all the regions. Both developing and developed economies have favorable market potential for automated feeding due to an increase in herd size, continuous advancements in feeding systems, and real-time analysis of livestock.

"The feeding systems market, based on function, has been segmented into into controlling, mixing, filling and screening, and other functions".

Controlling segment withing the function category to grow at the highest CAGR during thr forecast period. Controlling systems ensure that the farm owner sticks to on-time feeding of livestock for better growth and development. These systems are the most critical part of the feeding system line as they control the entire process of automated feeding on the farm. Technological advancements have enabled the development of an all-in-one monitoring solution that monitors the behavior and whereabouts of each cow as well as the entire herd. The software gives the most accurate and complete information about individual cows and groups' fertility, health, well-being, location, and nutritional status.

"The feeding systems market, based on offering, is estimated to be dominated by hardware during the forecast period".

The feeding systems market is segmented, based on offering, into three segments-hardware, software, and services. Hardware accounted for the largest share in 2021. This is attributed to the increasing demand for feeding systems, increasing preference of consumers toward hardware systems, technological advancements by key players to introduce innovative products, the rise in the demand for dairy products, and an increasing number of dairy cattle globally. Moreover, the increasing mechanization in dairy farming due to a shortage of labor, and growing preference for feeding systems are also driving the growth of these hardware systems.

This market, however, possesses a high entry barrier for small players due to the high cost involved in product manufacturing and the presence of well-established players. In addition to this, the lack of awareness about the benefits and the high cost of feeding systems and hardware limit the adoption among dairy farmers in emerging nations.

"Asia Pacific to grow at the highest CAGR during the forecast period."

With rapid industrialization, livestock producers are adopting feeding systems to increase production to cater to the growing demand for meat. India has huge opportunities in the feeding industry, as it has remained an untapped market in terms of the utilization of advanced feeding technologies by farmers. The Indian feeding systems market is in its growth stage; farmers are becoming aware of the direct link between animal health and productivity. These factors imply tremendous opportunities for global feeding systems players as well as local ones to invest in the Indian feeding industry.

Break-up of Primaries:

- By Company: Tier 1 - 40%, Tier 2 - 35%, Tier 3 - 25%

- By Designation: Managers - 25%, D-Level- 30%, and C-Level- 45%

- By Region: Europe - 30%, Asia Pacific - 35%, North America - 25%, RoW - 10%

Leading players profiled in this report:

- DeLaval (Sweden)

- GEA Group Aktiengesellschaft (Germany)

- Lely (Netherlands)

- Trioliet B.V. (Netherlands)

- VDL Agrotech (Netherlands)

- ScaleAQ (Norway)

- BouMatic (US)

- Pellon Group Oy (Finland)

- Rovibec Agrisolutions (Canada)

- CTB, Inc. (US)

- Afimilk Ltd. (Israel)

- Dairymaster (US)

- Maskinfabrikken Cormall A/S (Denmark)

- HETWIN Automation System GmbH (Austria)

- JH AGRO A/S (Denmark)

Research Coverage:

The report segments the feeding systems market on the basis of type, livestock, offering, technology, function and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global feeding systems market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the feeding systems market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the feeding systems market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 FEEDING SYSTEMS MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- FIGURE 2 GEOGRAPHIC SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED, 2019-2021

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 FEEDING SYSTEMS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key primary insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 FEEDING SYSTEMS MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 5 FEEDING SYSTEMS MARKET: TOP-DOWN APPROACH

- FIGURE 6 FEEDING SYSTEMS MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

- FIGURE 7 FEEDING SYSTEMS MARKET SIZE ESTIMATION (DEMAND SIDE)

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 9 FEEDING SYSTEMS MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 RUMINANT SEGMENT TO DOMINATE THE GLOBAL FEEDING SYSTEMS MARKET DURING THE FORECAST PERIOD IN TERMS OF VALUE

- FIGURE 11 PAN FEEDING SYSTEMS SEGMENT TO LEAD THE MARKET IN TERMS OF VALUE BETWEEN 2022 AND 2027

- FIGURE 12 FILLING AND SCREENING SEGMENT TO LEAD THE MARKET IN TERMS OF VALUE IN 2027

- FIGURE 13 EUROPE ACCOUNTED FOR THE LARGEST SHARE IN THE REGION-LEVEL MARKET, IN TERMS OF VALUE, 2021

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF THE FEEDING SYSTEMS MARKET

- FIGURE 14 ASIA PACIFIC IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

- 4.2 FEEDING SYSTEMS MARKET: MAJOR REGIONAL SUBMARKETS

- FIGURE 15 US ACCOUNTED FOR THE LARGEST SHARE IN 2021

- 4.3 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY LIVESTOCK AND COUNTRY

- FIGURE 16 CHINA ACCOUNTED FOR THE LARGEST SHARE IN THE ASIA PACIFIC MARKET IN 2021

- 4.4 FEEDING SYSTEMS MARKET, BY OFFERING

- FIGURE 17 HARDWARE IS PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

- 4.5 FEEDING SYSTEMS MARKET, BY TECHNOLOGY

- FIGURE 18 AUTOMATED SEGMENT IS PROJECTED TO DOMINATE THE FEEDING SYSTEMS MARKET DURING THE FORECAST PERIOD

- 4.6 FEEDING SYSTEMS MARKET, BY TYPE

- FIGURE 19 SELF-PROPELLED FEEDING SYSTEMS SEGMENT TO DOMINATE THE FEEDING SYSTEMS MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 FEEDING SYSTEMS MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing number of dairy farms

- FIGURE 21 WORLD CATTLE INVENTORY, BY COUNTRY, 2020 VS. 2021

- 5.2.1.2 Rising focus on technological advancements and new product launches by major companies

- 5.2.1.3 Growth in the meat, dairy, and aquaculture industries

- FIGURE 22 GLOBAL MEAT PRODUCTION, 2010-2018

- FIGURE 23 MILK PRODUCTION ACROSS THE WORLD, 2010-2018

- 5.2.1.4 Increasing efficiency associated with advanced feeding systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 High setup charges of automatic feeding systems

- 5.2.2.2 Lack of awareness and availability of new technologies to small-scale farmers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for livestock monitoring services in automated feeding systems

- FIGURE 24 LIVESTOCK MONITORING MARKET GROWTH, 2018-2021

- 5.2.3.2 Remarkable growth opportunities for feeding systems in developing countries

- 5.2.3.3 Government programs supporting the aquaculture industry

- 5.2.3.4 Growing concerns of consumers around food safety

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardization of feeding systems technology

- 5.2.4.2 Difficulty in collecting and analyzing the large amount of farm data

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN

- FIGURE 25 FEEDING SYSTEMS MARKET: VALUE CHAIN

- 6.2.1 RESEARCH AND DEVELOPMENT

- 6.2.2 HARDWARE COMPONENT PROVIDERS AND SOFTWARE PROVIDERS

- 6.2.3 SERVICE PROVIDERS

- 6.2.4 SUPPLIERS AND DISTRIBUTORS

- 6.2.5 END USERS

- 6.3 SUPPLY CHAIN ANALYSIS

- FIGURE 26 FEEDING SYSTEM MARKET: SUPPLY CHAIN

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 ARTIFICIAL INTELLIGENCE

- 6.4.2 IOT

- 6.4.3 ROBOTS IN FEEDING SYSTEMS

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE CHARGED BY KEY PLAYERS, IN TERMS OF LIVESTOCK

- FIGURE 27 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP 3 LIVESTOCK

- TABLE 2 AVERAGE SELLING PRICES OF KEY PLAYERS FOR THE TOP 3 LIVESTOCK (USD)

- 6.5.2 AVERAGE SELLING PRICE TREND

- TABLE 3 AVERAGE SELLING PRICE OF VARIOUS FEEDING SYSTEMS

- TABLE 4 AVERAGE SELLING PRICE OF FEEDING SYSTEMS TECHNOLOGY

- FIGURE 28 ASP TREND FOR RFID TAGS ADOPTED IN THE FEEDING SYSTEMS MARKET

- 6.5.3 AVERAGE SELLING PRICE, BY REGION

- FIGURE 29 RUMINANT AUTOMATIC FEEDING SYSTEMS: AVERAGE SELLING PRICE TRENDS, BY REGION, 2019-2021

- 6.6 ECOSYSTEM

- 6.6.1 ECOSYSTEM MAP

- TABLE 5 FEEDING SYSTEMS MARKET: ECOSYSTEM

- FIGURE 30 KEY PLAYERS IN THE FEEDING SYSTEMS ECOSYSTEM

- 6.7 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMERS' BUSINESS

- 6.7.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MANUFACTURERS OF FEEDING SYSTEMS

- FIGURE 31 REVENUE SHIFT FOR THE FEEDING SYSTEMS MARKET

- 6.8 FEEDING SYSTEMS MARKET: PATENT ANALYSIS

- FIGURE 32 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2022

- FIGURE 33 TOP 10 INVESTORS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

- TABLE 6 PATENTS PERTAINING TO FEEDING SYSTEMS, 2020-2022

- FIGURE 34 REGIONAL ANALYSIS OF PATENTS GRANTED FOR THE FEEDING SYSTEMS MARKET, 2022

- 6.9 TRADE DATA: FEEDING SYSTEMS MARKET

- 6.9.1 IMPORTS OF BROILER FEEDING SYSTEMS IN THE US

- TABLE 7 TOP 5 EXPORTERS OF BROILER FEEDING SYSTEMS

- 6.9.2 IMPORTS OF PAN FEEDING SYSTEMS IN INDIA

- TABLE 8 TOP SUPPLIERS OF POULTRY PAN FEEDERS

- 6.10 CASE STUDIES

- 6.10.1 ONE2FEED: MIXING AND FEEDING EFFICIENCY PROVIDED BY AUTOMATED FEEDING SYSTEMS

- 6.10.2 GIORDANO POULTRY PLAST (GPP): EFFECTIVE SOLUTION FOR THE ENTIRE POULTRY PRODUCTION CHAIN

- 6.11 KEY CONFERENCES & EVENTS, 2022-2023

- TABLE 9 KEY CONFERENCES & EVENTS IN THE FEEDING SYSTEMS MARKET

- 6.12 TARIFF & REGULATORY LANDSCAPE

- 6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.2 THE INTERNATIONAL FEED INDUSTRY FEDERATION (IFIF)

- 6.12.3 REGULATIONS

- 6.12.3.1 International Organization for Standardization (ISO)

- 6.12.3.2 International Electronics Symposium (IES)

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 FEEDING SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 DEGREE OF COMPETITION

- 6.13.2 BARGAINING POWER OF SUPPLIERS

- 6.13.3 BARGAINING POWER OF BUYERS

- 6.13.4 THREAT OF SUBSTITUTES

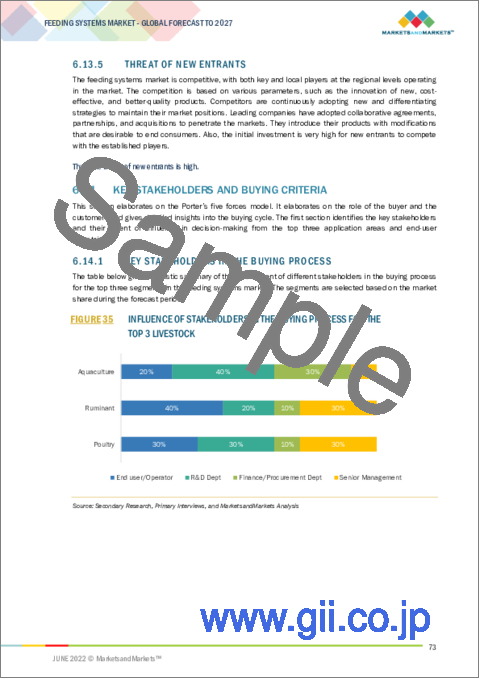

- 6.13.5 THREAT OF NEW ENTRANTS

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN THE BUYING PROCESS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS IN THE BUYING PROCESS FOR THE TOP 3 LIVESTOCK

- TABLE 15 KEY STAKEHOLDERS IN THE BUYING PROCESS FOR THE TOP 3 LIVESTOCK (%)

- 6.14.2 BUYING CRITERIA

- TABLE 16 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 36 BUYING CRITERIA FOR SELECTING SUPPLIERS/VENDORS

7 FEEDING SYSTEMS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 37 SELF-PROPELLED FEEDING SYSTEMS SEGMENT IS PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

- TABLE 17 FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 18 FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.2 RAIL-GUIDED FEEDING SYSTEMS

- 7.2.1 RAIL-GUIDED FEEDING SYSTEMS BOOST THE EFFICIENCY OF FEEDING OPERATIONS

- TABLE 19 RAIL-GUIDED FEEDING SYSTEMS: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 20 RAIL-GUIDED FEEDING SYSTEMS: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 CONVEYOR FEEDING SYSTEMS

- 7.3.1 CONVEYOR FEEDING SYSTEM FACILITATES EVEN DISTRIBUTION OF FODDER AND FEED TO FARM ANIMALS

- TABLE 21 CONVEYOR FEEDING SYSTEMS: FEEDING SYSTEMS MARKET, BY SUBTYPE, 2018-2021 (USD MILLION)

- TABLE 22 CONVEYOR FEEDING SYSTEMS: FEEDING SYSTEMS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- TABLE 23 CONVEYOR FEEDING SYSTEMS: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 24 CONVEYOR FEEDING SYSTEMS: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.2 BELT FEEDING SYSTEMS

- 7.3.2.1 Belt feeding systems reduce labor cost

- TABLE 25 BELT FEEDING SYSTEMS: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 26 BELT FEEDING SYSTEMS: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.3 PAN FEEDING SYSTEMS

- 7.3.3.1 Pan feeding systems promote fast and homogenous feed distribution

- TABLE 27 PAN FEEDING SYSTEMS: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 28 PAN FEEDING SYSTEMS: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.4 CHAIN FEEDING SYSTEMS

- 7.3.4.1 Chain feeding systems are gaining popularity in the poultry industry

- TABLE 29 CHAIN FEEDING SYSTEMS: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 30 CHAIN FEEDING SYSTEMS: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 SELF-PROPELLED FEEDING SYSTEMS

- 7.4.1 SELF-PROPELLED FEEDING SYSTEMS HELP IN PLANNING PRECISE RATION PER HEAD

- TABLE 31 SELF-PROPELLED FEEDING SYSTEMS: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 32 SELF-PROPELLED FEEDING SYSTEMS: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

8 FEEDING SYSTEMS MARKET, BY LIVESTOCK

- 8.1 INTRODUCTION

- FIGURE 38 RUMINANT IS PROJECTED TO DOMINATE THE FEEDING SYSTEMS MARKET DURING THE FORECAST PERIOD

- TABLE 33 FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2018-2021 (USD MILLION)

- TABLE 34 FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2022-2027 (USD MILLION)

- 8.2 RUMINANT

- 8.2.1 CONTROL OVER FEED TIME AND QUANTITY TO INCREASE THE DEMAND FOR RUMINANT FEEDING SYSTEMS

- TABLE 35 RUMINANT: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 RUMINANT: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 POULTRY

- 8.3.1 NEED TO REDUCE LABOR COST TO INCREASE THE DEMAND FOR POULTRY FEEDING SYSTEMS WITH INNOVATIVE TECHNOLOGIES

- TABLE 37 POULTRY: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 38 POULTRY: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 SWINE

- 8.4.1 ADOPTION OF MEASURES TO ENSURE THE PRODUCTION OF SUPERIOR-QUALITY PORK IN THE ASIA PACIFIC REGION TO DRIVE THE MARKET

- TABLE 39 SWINE: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 40 SWINE: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.5 OTHER LIVESTOCK

- TABLE 41 OTHER LIVESTOCK: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 42 OTHER LIVESTOCK: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

9 FEEDING SYSTEMS MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- FIGURE 39 AUTOMATED SEGMENT IS PROJECTED TO DOMINATE THE FEEDING SYSTEMS MARKET DURING THE FORECAST PERIOD

- TABLE 43 FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 44 FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 9.2 MANUAL

- 9.2.1 MANUAL TECHNOLOGIES COME WITH SEVERAL LIMITATIONS

- TABLE 45 MANUAL: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 46 MANUAL: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 AUTOMATED

- 9.3.1 RISING ADOPTION OF CLOUD-BASED TECHNOLOGIES INFLUENCING THE FEEDING SYSTEMS MARKET

- TABLE 47 AUTOMATED: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 48 AUTOMATED: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 49 AUTOMATED: FEEDING SYSTEMS MARKET, BY SUBTYPE, 2018-2021 (USD MILLION)

- TABLE 50 AUTOMATED: FEEDING SYSTEMS MARKET, BY SUBTYPE, 2022-2027 (USD MILLION)

- 9.3.2 ROBOTIC AND TELEMETRY

- 9.3.2.1 Reduction in labor demand and increase in livestock feeding due to automation to drive the demand for robotic and telemetry technologies

- TABLE 51 ROBOTICS AND TELEMETRY: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 52 ROBOTICS AND TELEMETRY: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.3 RFID TECHNOLOGY

- 9.3.3.1 RFID technology provides alternatives to barcode identification for better and effective feeding of livestock

- TABLE 53 RFID TECHNOLOGY: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 54 RFID TECHNOLOGY: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.4 GUIDANCE AND REMOTE-SENSING TECHNOLOGY

- 9.3.4.1 Guidance and remote-sensing technology is widely preferred as it helps in livestock diet optimization

- TABLE 55 GUIDANCE AND REMOTE-SENSING TECHNOLOGY: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 56 GUIDANCE AND REMOTE-SENSING TECHNOLOGY: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.5 OTHER SUBTYPES

- TABLE 57 OTHER SUBTYPES: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 58 OTHER SUBTYPES: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

10 FEEDING SYSTEMS MARKET, BY OFFERING

- 10.1 INTRODUCTION

- FIGURE 40 HARDWARE SEGMENT TO DOMINATE THE FEEDING SYSTEMS MARKET DURING THE FORECAST PERIOD

- TABLE 59 FEEDING SYSTEMS MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 60 FEEDING SYSTEMS MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 10.2 HARDWARE

- 10.2.1 HARDWARE OFFERS HIGH RELIABILITY, REDUCES DAILY WORKLOAD, AND REQUIRES LESS MAINTENANCE

- TABLE 61 HARDWARE: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 62 HARDWARE: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 SOFTWARE

- 10.3.1 SOFTWARE SYSTEMS REDUCE OPERATIONAL ERRORS, RESULTING IN A HIGHER PRODUCTION RATE

- TABLE 63 SOFTWARE: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 64 SOFTWARE: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 SERVICES

- 10.4.1 FACILITATES OPTIMUM USAGE OF RESOURCES BY PROVIDING CLIMATE INFORMATION, FINANCIAL MANAGEMENT, AND INVENTORY CONTROL

- TABLE 65 SERVICES: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 66 SERVICES: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

11 FEEDING SYSTEMS MARKET, BY FUNCTION

- 11.1 INTRODUCTION

- FIGURE 41 FILLING AND SCREENING SEGMENT IS PROJECTED TO DOMINATE THE MARKET THROUGHOUT 2027

- TABLE 67 FEEDING SYSTEMS MARKET, BY FUNCTION, 2018-2021 (USD MILLION)

- TABLE 68 FEEDING SYSTEMS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- 11.2 CONTROLLING

- 11.2.1 CONTROLLING SYSTEMS SIMPLIFY THE PROCESS OF CATTLE FEED MANAGEMENT

- TABLE 69 CONTROLLING: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 70 CONTROLLING: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3 MIXING

- 11.3.1 FEED MIXING EQUIPMENT HELPS IN THE PROPER MIXING OF FEED TO MEET THE NUTRITIONAL REQUIREMENTS OF THE LIVESTOCK

- TABLE 71 MIXING: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 72 MIXING: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4 FILLING AND SCREENING

- 11.4.1 FILLING AND SCREENING EXECUTE A WIDE RANGE OF FEEDING ACTIVITIES, RESULTING IN CONSISTENT HIGH DEMAND

- TABLE 73 FILLING AND SCREENING: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 74 FILLING AND SCREENING: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.5 OTHER FUNCTIONS

- TABLE 75 OTHER FUNCTIONS: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 76 OTHER FUNCTIONS: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

12 FEEDING SYSTEMS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 42 FEEDING SYSTEMS MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

- FIGURE 43 FEEDING SYSTEMS MARKET: REGIONAL AND COUNTRY-LEVEL GROWTH RATES, 2022-2027

- TABLE 77 FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 78 FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.2 NORTH AMERICA

- TABLE 79 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 80 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 81 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 82 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 83 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 84 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 85 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2018-2021 (USD MILLION)

- TABLE 86 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2022-2027 (USD MILLION)

- TABLE 87 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 88 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 89 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY FUNCTION, 2018-2021 (USD MILLION)

- TABLE 90 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 91 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 92 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 93 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY CONVEYOR FEEDING SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 94 NORTH AMERICA: FEEDING SYSTEMS MARKET, BY CONVEYOR FEEDING SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.2.1 US

- 12.2.1.1 Availability of capital and rising awareness regarding the efficient use of feeding systems drive the market

- FIGURE 44 TOP 5 MARKETS FOR US PORK AND PORK PRODUCTS IN 2021

- TABLE 95 US: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 96 US: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.2.2 CANADA

- 12.2.2.1 Increased demand for dairy and poultry drives the growth of the feeding systems market

- TABLE 97 CANADA: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 98 CANADA: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.2.3 MEXICO

- 12.2.3.1 Increased industrial investment in the poultry industry will enhance growth

- TABLE 99 MEXICO: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 100 MEXICO: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3 EUROPE

- FIGURE 45 EUROPE: REGIONAL SNAPSHOT

- TABLE 101 EUROPE: FEEDING SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 102 EUROPE: FEEDING SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 103 EUROPE: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 104 EUROPE: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 105 EUROPE: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 106 EUROPE: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 107 EUROPE: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2018-2021 (USD MILLION)

- TABLE 108 EUROPE: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2022-2027 (USD MILLION)

- TABLE 109 EUROPE: FEEDING SYSTEMS MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 110 EUROPE: FEEDING SYSTEMS MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 111 EUROPE: FEEDING SYSTEMS MARKET, BY FUNCTION, 2018-2021 (USD MILLION)

- TABLE 112 EUROPE: FEEDING SYSTEMS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 113 EUROPE: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 114 EUROPE: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 115 EUROPE: FEEDING SYSTEMS MARKET, BY CONVEYOR FEEDING SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 116 EUROPE: FEEDING SYSTEMS MARKET, BY CONVEYOR FEEDING SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.3.1 GERMANY

- 12.3.1.1 Poultry production in Germany reached record levels in 2020, which will further fuel the market

- TABLE 117 GERMANY: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 118 GERMANY: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.2 UK

- 12.3.2.1 Dairy and poultry sectors to contribute to the growth of the feeding systems market

- TABLE 119 UK: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 120 UK: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.3 FRANCE

- 12.3.3.1 High livestock production drives the demand in the French market

- TABLE 121 FRANCE: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 122 FRANCE: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.4 ITALY

- 12.3.4.1 Demand for feeding systems expected to rise with increase in livestock

- TABLE 123 ITALY: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 124 ITALY: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.5 SPAIN

- 12.3.5.1 Increasing preference for meat and dairy products to drive the market

- TABLE 125 SPAIN: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 126 SPAIN: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.6 REST OF EUROPE

- TABLE 127 REST OF EUROPE: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 128 REST OF EUROPE: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4 ASIA PACIFIC

- FIGURE 46 ASIA PACIFIC: REGIONAL SNAPSHOT

- TABLE 129 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 130 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 131 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 132 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 133 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 134 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 135 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2018-2021 (USD MILLION)

- TABLE 136 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2022-2027 (USD MILLION)

- TABLE 137 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 138 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 139 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY FUNCTION, 2018-2021 (USD MILLION)

- TABLE 140 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 141 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 142 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 143 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY CONVEYOR FEEDING SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 144 ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY CONVEYOR FEEDING SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.4.1 CHINA

- 12.4.1.1 Increased domestic consumption and export of meat and poultry have created a need among farmers to save time

- TABLE 145 CHINA: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 146 CHINA: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.2 INDIA

- 12.4.2.1 Poultry sector to create maximum demand for feeding systems in the country

- TABLE 147 INDIA: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 148 INDIA: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.3 JAPAN

- 12.4.3.1 Drones, artificial intelligence, and cloud computing are being incorporated in feeding systems by Japanese fish farms to minimize costs

- TABLE 149 JAPAN: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 150 JAPAN: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.4 AUSTRALIA & NEW ZEALAND

- 12.4.4.1 Demand for dairy and poultry products will create further demand for associated feeding systems

- TABLE 151 AUSTRALIA & NEW ZEALAND: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 152 AUSTRALIA & NEW ZEALAND: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.5 REST OF ASIA PACIFIC

- TABLE 153 REST OF ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.5 REST OF THE WORLD (ROW)

- TABLE 155 ROW: FEEDING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 156 ROW: FEEDING SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 157 ROW: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 158 ROW: FEEDING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 159 ROW: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 160 ROW: FEEDING SYSTEMS MARKET, BY AUTOMATED TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 161 ROW: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2018-2021 (USD MILLION)

- TABLE 162 ROW: FEEDING SYSTEMS MARKET, BY LIVESTOCK, 2022-2027 (USD MILLION)

- TABLE 163 ROW: FEEDING SYSTEMS MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 164 ROW: FEEDING SYSTEMS MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 165 ROW: FEEDING SYSTEMS MARKET, BY FUNCTION, 2018-2021 (USD MILLION)

- TABLE 166 ROW: FEEDING SYSTEMS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 167 ROW: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 168 ROW: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 169 ROW: FEEDING SYSTEMS MARKET, BY CONVEYOR FEEDING SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 170 ROW: FEEDING SYSTEMS MARKET, BY CONVEYOR FEEDING SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.5.1 SOUTH AMERICA

- 12.5.1.1 The increasing demand for high-quality dairy products and poultry has resulted in the growth of the feeding systems market

- FIGURE 47 BRAZILIAN MEAT CONSUMPTION, 2022

- TABLE 171 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 172 SOUTH AMERICA: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.5.2 MIDDLE EAST

- 12.5.2.1 The increase in the number of livestock and dairy farms propels the demand for feeding systems

- TABLE 173 MIDDLE EAST: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 174 MIDDLE EAST: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.5.3 AFRICA

- 12.5.3.1 Farmers in Africa have been adopting automated feeding systems to meet the consumer demand for meat and poultry products

- TABLE 175 AFRICA: FEEDING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 176 AFRICA: FEEDING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS, 2021

- TABLE 177 FEEDING SYSTEMS MARKET: DEGREE OF COMPETITION

- 13.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 48 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2017-2021 (USD BILLION)

- 13.4 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS), 2021

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 49 FEEDING SYSTEMS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 13.5.5 PRODUCT FOOTPRINT

- TABLE 178 COMPANY FOOTPRINT, BY TYPE

- TABLE 179 COMPANY FOOTPRINT, BY LIVESTOCK

- TABLE 180 COMPANY FOOTPRINT, BY REGION

- TABLE 181 OVERALL COMPANY FOOTPRINT

- 13.6 FEEDING SYSTEMS MARKET: START-UP/SME EVALUATION QUADRANT, 2021

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 STARTING BLOCKS

- 13.6.3 RESPONSIVE COMPANIES

- 13.6.4 DYNAMIC COMPANIES

- 13.6.5 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 182 FEEDING SYSTEMS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 183 FEEDING SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- FIGURE 50 FEEDING SYSTEMS MARKET: COMPANY EVALUATION QUADRANT, 2021 (START-UPS/SMES)

- 13.7 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

- 13.7.1 PRODUCT LAUNCHES

- TABLE 184 PRODUCT LAUNCHES, 2019-2021

- 13.7.2 DEALS

- TABLE 185 DEALS, 2018-2021

- 13.7.3 OTHERS

- TABLE 186 OTHERS, 2019-2021

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)**

- 14.1.1 DELAVAL

- TABLE 187 DELAVAL: BUSINESS OVERVIEW

- FIGURE 51 DELAVAL: COMPANY SNAPSHOT

- TABLE 188 DELAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 DELAVAL: DEALS, 2018-2020

- 14.1.2 GEA GROUP AKTIENGESELLSCHAFT

- TABLE 190 GEA GROUP AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

- FIGURE 52 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- TABLE 191 GEA GROUP AKTIENGESELLSCHAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.3 LELY

- TABLE 192 LELY: BUSINESS OVERVIEW

- TABLE 193 LELY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 LELY: PRODUCT LAUNCHES, 2018-2020

- 14.1.4 TRIOLET B.V.

- TABLE 195 TRIOLET B.V.: BUSINESS OVERVIEW

- TABLE 196 TRIOLIET B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 TRIOLIET B.V.: NEW PRODUCT LAUNCHES, 2018-2020

- TABLE 198 TRIOLIET B.V.: DEALS, 2018

- 14.1.5 VDL AGROTECH B.V.

- TABLE 199 VDL AGROTECH B.V.: BUSINESS OVERVIEW

- TABLE 200 VDL AGROTECH B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 VDL AGROTECH B.V.: DEALS, 2018-2020

- 14.1.6 SCALEAQ

- TABLE 202 SCALEAQ: BUSINESS OVERVIEW

- TABLE 203 SCALEAQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 SCALEAQ: DEALS, 2019

- 14.1.7 BOUMATIC

- TABLE 205 BOUMATIC: BUSINESS OVERVIEW

- TABLE 206 BOUMATIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 BOUMATIC: DEALS, 2021

- 14.1.8 PELLON GROUP OY

- TABLE 208 PELLON GROUP OY: BUSINESS OVERVIEW

- TABLE 209 PELLON GROUP OY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 PELLON GROUP OY: PRODUCT LAUNCHES, 2020

- 14.1.9 ROVIBEC AGRISOLUTIONS

- TABLE 211 ROVIBEC AGRISOLUTIONS: BUSINESS OVERVIEW

- TABLE 212 ROVIBEC AGRISOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.10 CTB, INC. (BERKSHIRE HATHAWAY)

- TABLE 213 CTB, INC.: BUSINESS OVERVIEW

- TABLE 214 CTB, INC.: BRANDS

- 14.1.11 AFIMILK LTD.

- TABLE 215 AFIMILK LTD.: BUSINESS OVERVIEW

- TABLE 216 AFIMILK LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.12 DAIRYMASTER

- TABLE 217 DAIRYMASTER: BUSINESS OVERVIEW

- TABLE 218 DAIRYMASTER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.13 MASKINFABRIKKEN CORMALL A/S

- TABLE 219 MASKINFABRIKKEN CORMALL A/S: BUSINESS OVERVIEW

- TABLE 220 MASKINFABRIKKEN CORMALL A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.14 HETWIN AUTOMATION SYSTEMS GMBH

- TABLE 221 HETWIN AUTOMATION SYSTEMS GMBH: BUSINESS OVERVIEW

- TABLE 222 HETWIN AUTOMATION SYSTEMS GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.15 JH AGRO A/S

- TABLE 223 JH AGRO A/S: BUSINESS OVERVIEW

- TABLE 224 JH AGRO A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2 OTHER PLAYERS (SMES/START-UPS)

- 14.2.1 SCHAUER AGROTRONIC GMBH

- TABLE 225 SCHAUER AGROTRONIC GMBH: BUSINESS OVERVIEW

- TABLE 226 SCHAUER AGROTRONIC GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.2 AKVA GROUP

- TABLE 227 AKVA GROUP: BUSINESS OVERVIEW

- FIGURE 53 AKVA GROUP: COMPANY SNAPSHOT

- TABLE 228 AKVA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 AKVA GROUP: DEALS, 2020-2021

- 14.2.3 WASSERBAUER GMBH FEEDING SYSTEMS

- TABLE 230 WASSERBAUER GMBH FEEDING SYSTEMS: BUSINESS OVERVIEW

- TABLE 231 WASSERBAUER GMBH FEEDING SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 WASSERBAUER GMBH FEEDING SYSTEMS: OTHERS, 2022

- 14.2.4 VALMETAL

- TABLE 233 VALMETAL: BUSINESS OVERVIEW

- TABLE 234 VALMETAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 VALMETAL: DEALS, 2018

- 14.2.5 VIJAY RAJ POULTRY EQUIPMENTS PVT. LTD

- TABLE 236 VIJAY RAJ POULTRY EQUIPMENTS PVT. LTD: BUSINESS OVERVIEW

- TABLE 237 VIJAY RAJ POULTRY EQUIPMENTS PVT. LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.6 SIEPLO B.V

- 14.2.7 PATZ CORPORATION

- 14.2.8 FEEDTECH FEEDING SYSTEMS PTY LTD (TREVASKIS ENGINEERING)

- 14.2.9 ONE2FEED A/S

- 14.2.10 CLOVERDALE EQUIPMENT, LLC

- * Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS