|

|

市場調査レポート

商品コード

1104961

栄養強化剤の世界市場:種類別 (ミネラル、ビタミン、炭水化物、プレバイオティクス、プロバイオティクス)・用途別 (穀物および穀物ベース製品、バルク食品)・プロセス別 (ドラム乾燥、ダスティング)・地域別の将来予測 (2027年まで)Food Fortifying Agents Market by Type (Minerals, Vitamins, Carbohydrates, Prebiotics, Probiotics), Application (Cereal & Cereal-based Products, Bulk Food Items), Process (Drum Drying, Dusting) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 栄養強化剤の世界市場:種類別 (ミネラル、ビタミン、炭水化物、プレバイオティクス、プロバイオティクス)・用途別 (穀物および穀物ベース製品、バルク食品)・プロセス別 (ドラム乾燥、ダスティング)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年07月15日

発行: MarketsandMarkets

ページ情報: 英文 238 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

栄養強化剤市場は、2027年には1,280億米ドルに達し、2022年から2027年にかけてCAGR10.1%で成長すると予測されています。

栄養強化剤による健康効果に対する消費者の意識の高まりと、消費者による予防医療への取り組みが、栄養強化剤市場の需要を促進しています。

"ビタミン類は金額ベースで市場全体の26.0%を占め、市場を独占している"

ビタミンは、バイタルアミンとも呼ばれ、身体の正常な代謝と成長を確保するために微量ながら不可欠な栄養素です。通常、1日あたり数ミリグラム (mg) またはマイクログラム (μg) の少量が必要とされるため、微量栄養素に分類されます。ビタミンAおよびプロビタミンA、ビタミンB (B1、B2、B3、B5、B6、B9、B12) 、ビタミンC、ビタミンD、ビタミンEおよびビタミンKの13種類が特定されています。例外として、ビタミンDは太陽光の皮膚への作用により合成されます。慢性疾患のリスク上昇とビタミンの効果に関する消費者の意識の高まりにより、この分野では最大のシェアを占めています。

"バルク食品業界では、栄養強化剤の需要が大きい"

この用途の優位性は、高品質な食品への需要の高まりと健康動向の変化によるものであり、その結果、栄養強化剤の需要が増加しているものと考えられます。消費者の健康意識の高まりにより、機能性食品・飲料や栄養補助食品、乳児用調製粉乳、乳製品など、さまざまな用途で健康に役立つ栄養強化剤を提供するよう企業が求めていることが、この市場の原動力となっています。バルク食品の強化は、微量栄養素の適切な手段であり、一般住民に広く消費されています。これは、特定の対象集団における欠乏に対処するための介入プログラムのために意図されています。

"アジア太平洋は、予測期間中に10.8%の成長を示す見通し"

アジア太平洋の栄養強化剤市場は、消費者の健康志向の高まりと栄養強化剤のマルチベネフィットにより、CAGR10.8%で成長中です。アジア太平洋の栄養強化剤市場は、多くの国内企業や多国籍企業が市場シェアを争っており、競争的な市場となっています。消費者の間でブランド力を高めるために、大手企業が採用する戦略的アプローチとして、企業の合併、拡大、買収、提携、新製品開発などが重視されています。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

第6章 産業動向

- イントロダクション

- サプライチェーン分析

- 主要な業界考察

- ポーターのファイブフォース分析

- 主要な会議とイベント (2022年~2023年)

第7章 規制の枠組み

- 概要

- 北米

- カナダ

- 米国

- メキシコ

- 欧州連合 (EU)

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア・ニュージーランド

- 他の国々 (RoW)

- ブラジル

- 食事の動向

- 推奨される栄養素の摂取量

第8章 栄養強化剤市場:種類別

- イントロダクション

- ミネラル

- ビタミン

- 脂質

- 炭水化物

- タンパク質とアミノ酸

- プレバイオティクス

- プロバイオティクス

- その他の種類

第9章 栄養強化剤市場:用途別

- イントロダクション

- 穀物および穀物ベース製品

- 乳製品および乳製品ベースの製品

- 油脂

- バルク食品

- 飲料

- 乳児用調製粉乳

- 栄養補助食品

- その他の用途

第10章 栄養強化剤市場:プロセス別

- イントロダクション

- 栄養強化に使用される技術・プロセスの種類

- パウダーエンリッチメント

- プレミックスとコーティング

- ドラム乾燥

- ダスティング

- マイクロカプセル化プロセスにおける噴霧乾燥

第11章 栄養強化剤市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- オランダ

- ポーランド

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア・ニュージーランド

- 他のアジア太平洋諸国

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 他の地域 (RoW)

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他の国々

第12章 競合情勢

- 概要

- 市場シェア分析 (2021年)

- 主要企業の過去の収益分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:その他の企業

- 競合シナリオ

- 新製品の発売

- 取引

- その他の開発

第13章 企業プロファイル

- 主要企業

- CARGILL

- INGREDION

- TATE & LYLE

- DSM

- ARLA FOODS AMBA

- CHR. HANSEN HOLDING A/S

- DUPONT

- ARCHER DANIELS MIDLAND COMPANY

- BASF SE

- NESTLE SA

- WENDA INGREDIENTS, LLC

- ROYAL COSUN

- STRATUM NUTRITION

- A&B INGREDIENTS, INC.

第14章 隣接・関連市場

- イントロダクション

- 制限

- 特殊食品原料市場

- 機能性食品原料市場

第15章 付録

The food fortifying agents market is projected to reach USD 128.0 Billion by 2027 growing at a CAGR of 10.1% from 2022 to 2027. Increasing consumer awareness with respect to the health benefits associated with fortifying agents and growing preventive healthcare measures undertaken by the consumers is proliferating the demand for food fortifying agents market.

"The vitamins segment dominates the market with 26.0% of total market share in terms of value."

Vitamins, also known as vital amines, are essential in micro quantities to ensure normal metabolism and growth of the body. They are classified as micronutrients because they are normally required in small amounts; usually a few milligrams (mg) or micrograms (μg) per day. A total of 13 vitamins have been identified, namely, vitamin A & provitamin A, vitamin B (B1, B2, B3, B5, B6, B9, and B12), vitamin C, vitamin D, vitamin E, and vitamin K. Most vitamins cannot be synthesized by the body, as a result of which, they must be obtained through external sources. An exception is vitamin D, which can be synthesized by the action of sunlight on the skin. The segment held the largest share owing to rising risks of chronic diseases and consumer awareness regarding benefits of vitamins.

"Food fortifying agents have high demand in bulk food items industry."

The dominance of this application can be attributed due to the increasing demand for high-quality food products and changing health trends, which in turn increases the demand for food fortifying agents. The market is driven by the growing health awareness among consumers, urging companies to offer various food fortifying agents for various applications, such as functional foods, beverages, dietary supplements, infant formula, and dairy, due to their health benefits. Fortification of bulk food items is an appropriate vehicle for the micronutrient and is widely consumed by the general population; it is intended for intervention programs to address the deficiency in a specific target population.

"Asia Pacific is projected to witness the growth of 10.8% during the forecast period."

The food fortifying agents market in Asia Pacific is growing at a CAGR of 10.8% due to the increasing health-consciousness among the consumers and the multi-benefits of food fortifying agents. The Asia Pacific food fortifying agent market is competitive in nature having a large number of domestic and multinational players competing for market share. Emphasis is given on the merger, expansion, acquisition, and partnership of the companies along with new product development as strategic approaches adopted by the leading companies to boost their brand presence among consumers.

Break-up of Primaries:

By Company Type: Tier 1 - 47%, Tier 2- 35% , Tier 3 - 18%

By Designation: C level - 52% -, Director -level - 28%Others - 20%

By Region: Europe - 35% North America -29% , Asia Pacific - 24% , RoW -12%

Leading players profiled in this report:

- Cargill (US)

- DSM (Netherlands)

- CHR.Hansen Holdings A/S (Denmark)

- DuPont (US)

- BASF SE (Germany)

- Arla Foods Amba (Denmark)

- Tate & Lyle (UK)

- Ingredion (US)

- Archer Daniels Midland Company (US)

- Nestle SA (Switzerland)

Research Coverage:

The report segments the food fortifying agents market on the basis of type, application, process, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global food fortifying agents market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the food fortifying agents market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the food fortifying agents market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 FOOD FORTIFYING AGENTS MARKET SEGMENTATION

- FIGURE 2 REGIONAL SEGMENTATION

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2021

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 LIMITATIONS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 FOOD FORTIFYING AGENTS (FFA) MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.2.2.1 Rising population

- FIGURE 4 GLOBAL POPULATION, 1950-2050

- 2.2.2.1.1 Increase in middle-class population, 2009-2030

- 2.2.2.2 Growth of the food & beverage industry

- 2.2.2.2.1 Key segments in the food sector

- 2.2.3 SUPPLY-SIDE ANALYSIS

- 2.2.3.1 Regulatory bodies and organizations in different countries

- 2.2.3.2 Changing and improvised technologies

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.5 RESEARCH ASSUMPTIONS & LIMITATIONS

- 2.5.1 ASSUMPTIONS

- FIGURE 8 ASSUMPTIONS

- 2.5.2 LIMITATIONS

- FIGURE 9 LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 2 GLOBAL FOOD FORTIFYING AGENTS MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 10 FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 ASIA PACIFIC EXPECTED TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF THE FOOD FORTIFYING AGENTS MARKET

- FIGURE 13 INCREASING DEMAND FOR FORTIFYING AGENTS IN DIETARY SUPPLEMENTS DRIVES THE MARKET GROWTH

- 4.2 NORTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION AND COUNTRY

- FIGURE 14 US TO ACCOUNT FOR THE LARGEST SHARE IN THE APPLICATION SEGMENT IN NORTH AMERICA IN 2022

- 4.3 FOOD FORTIFYING AGENTS MARKET, BY TYPE

- FIGURE 15 VITAMINS SEGMENT IS ESTIMATED TO HOLD THE LARGEST SHARE OF THE FOOD FORTIFYING AGENTS MARKET IN 2022

- 4.4 FOOD FORTIFYING AGENTS MARKET, BY APPLICATION

- FIGURE 16 BULK FOOD ITEMS SEGMENT IS ESTIMATED TO DOMINATE THE FOOD FORTIFYING AGENTS MARKET IN 2022

- 4.5 FOOD FORTIFYING AGENTS MARKET, BY APPLICATION AND REGION

- FIGURE 17 NORTH AMERICA TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 18 INCREASING DEMAND FOR FORTIFYING AGENTS IN DIETARY SUPPLEMENTS DRIVES THE FOOD FORTIFYING AGENTS MARKET

- 5.1.1 DRIVERS

- 5.1.1.1 Consumer awareness about the health benefits of fortifying agents and increasing focus on preventive healthcare

- 5.1.1.2 Increasing demand for fortifying agents in dietary supplements

- 5.1.1.3 Increase in application profiling and existing applications finding new markets

- 5.1.1.4 Increasing cases of chronic diseases

- FIGURE 19 MAIN CAUSES OF DEATH WORLDWIDE ACROSS ALL AGES, 2019

- 5.1.2 RESTRAINTS

- 5.1.2.1 High cost involved in R&D activities

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Growing applications of food fortifying agents

- 5.1.3.2 Technical assistance by governments

- 5.1.3.3 Growing demand from emerging economies

- 5.1.4 CHALLENGES

- 5.1.4.1 Price differences in fortified vs. non-fortified products

- 5.1.4.2 Multi-page labeling on the rise

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 20 SUPPLY CHAIN INTEGRITY IN THE FOOD FORTIFYING AGENTS MARKET

- 6.3 KEY INDUSTRY INSIGHTS

- FIGURE 21 NEW FORMULATIONS: EASING THE APPLICATION OF FOOD FORTIFYING AGENTS

- 6.4 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 PORTER'S FIVE FORCES ANALYSIS

- 6.4.1 THREAT OF NEW ENTRANTS

- 6.4.2 THREAT OF SUBSTITUTES

- 6.4.3 BARGAINING POWER OF SUPPLIERS

- 6.4.4 BARGAINING POWER OF BUYERS

- 6.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.5 KEY CONFERENCES & EVENTS IN 2022-2023

7 REGULATORY FRAMEWORK

- 7.1 OVERVIEW

- TABLE 3 DEFINITIONS & REGULATIONS FOR FOOD FORTIFYING AGENTS WORLDWIDE

- 7.2 NORTH AMERICA

- 7.2.1 CANADA

- 7.2.2 US

- 7.2.3 MEXICO

- 7.3 EUROPEAN UNION (EU)

- 7.4 ASIA PACIFIC

- 7.4.1 JAPAN

- 7.4.2 CHINA

- 7.4.3 INDIA

- 7.4.4 AUSTRALIA & NEW ZEALAND

- 7.5 REST OF THE WORLD (ROW)

- 7.5.1 BRAZIL

- 7.6 DIETARY TRENDS

- TABLE 4 PREVALENCE OF MICRONUTRIENT DEFICIENCY AND RISK FACTORS ATTACHED

- 7.6.1 RECOMMENDED NUTRIENT INTAKES

- TABLE 5 FAO/WHO-RECOMMENDED NUTRIENT INTAKES (RNIS) FOR SELECTED POPULATION SUBGROUPS

8 FOOD FORTIFYING AGENTS MARKET, BY TYPE

- 8.1 INTRODUCTION

- TABLE 6 FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 7 FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- FIGURE 23 FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- 8.2 MINERALS

- 8.2.1 INCREASING APPLICATION OF MINERALS IN FOOD PRODUCTS DUE TO RISING HEALTH BENEFITS

- TABLE 8 MINERALS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 9 MINERALS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

- 8.3 VITAMINS

- 8.3.1 GROWING CONSUMER AWARENESS OF CARDIOVASCULAR HEALTH

- TABLE 10 FAT- & WATER-SOLUBLE VITAMINS

- TABLE 11 VITAMINS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 12 VITAMINS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

- 8.4 LIPIDS

- 8.4.1 RISING CONSUMPTION OF OMEGA-3 FATTY ACIDS TO REDUCE THE RISK OF CHRONIC HEART DISEASES

- TABLE 13 LIPIDS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 14 LIPIDS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

- 8.5 CARBOHYDRATES

- 8.5.1 GROWING APPLICATION OF NUTRIENTS IN FOOD & BEVERAGE PRODUCTS

- TABLE 15 CARBOHYDRATES: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 16 CARBOHYDRATES: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

- 8.6 PROTEINS & AMINO ACIDS

- 8.6.1 INCREASING HEALTH BENEFITS OF PROTEINS & AMINO ACIDS TO SUPPORT MARKET GROWTH

- TABLE 17 RECOMMENDED DIETARY ALLOWANCE (RDA) FOR PROTEINS IN DIFFERENT AGE GROUPS

- TABLE 18 FUNCTIONS OF PROTEIN

- TABLE 19 PROTEINS & AMINO ACIDS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 20 PROTEINS & AMINO ACIDS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

- 8.7 PREBIOTICS

- 8.7.1 GROWING PREFERENCE FOR NATURAL ALTERNATIVES OVER CONVENTIONAL MEDICINES

- TABLE 21 PREBIOTICS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

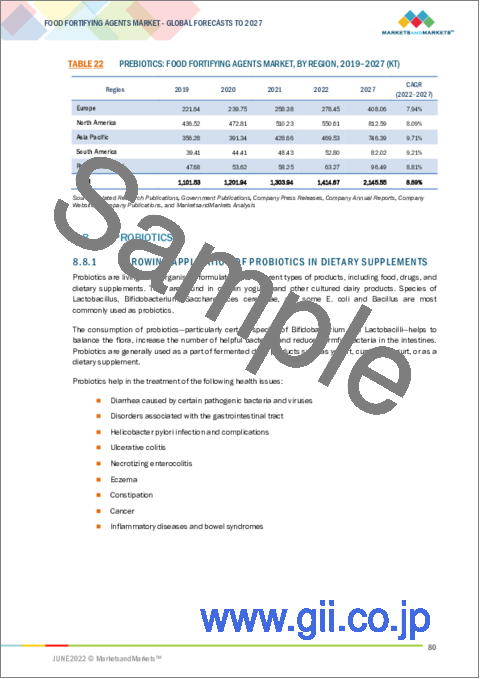

- TABLE 22 PREBIOTICS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

- 8.8 PROBIOTICS

- 8.8.1 GROWING APPLICATION OF PROBIOTICS IN DIETARY SUPPLEMENTS

- TABLE 23 PROBIOTICS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 24 PROBIOTICS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

- 8.9 OTHER TYPES

- 8.9.1 INCREASING APPLICATION OF OTHER FOOD FORTIFYING AGENTS TO MAINTAIN SPINE HEALTH SUPPORTS MARKET GROWTH

- TABLE 25 OTHER TYPES: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 26 OTHER TYPES: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

9 FOOD FORTIFYING AGENTS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- TABLE 27 FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 28 FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- FIGURE 24 FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- 9.2 CEREALS & CEREAL-BASED PRODUCTS

- 9.2.1 FORTIFIED BREAKFAST CEREALS PLAY A SIGNIFICANT ROLE IN ENSURING NUTRITIONAL ADEQUACY

- TABLE 29 CEREALS & CEREAL-BASED PRODUCTS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 30 CEREALS & CEREAL-BASED PRODUCTS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

- 9.3 DAIRY & DAIRY-BASED PRODUCTS

- 9.3.1 ENHANCES THE NUTRITIONAL VALUE OF DAIRY & DAIRY-BASED PRODUCTS

- TABLE 31 DAIRY & DAIRY-BASED PRODUCTS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 32 DAIRY & DAIRY-BASED PRODUCTS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

- 9.4 FATS & OILS

- 9.4.1 INCREASING POPULARITY OF FORTIFIED EDIBLE OIL AMONG CONSUMERS

- TABLE 33 FATS & OILS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 34 FATS & OILS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

- 9.5 BULK FOOD ITEMS

- 9.5.1 FORTIFICATION OF BULK FOOD ITEMS IS AN APPROPRIATE VEHICLE FOR MICRONUTRIENTS

- TABLE 35 BULK FOOD ITEMS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 36 BULK FOOD ITEMS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

- 9.6 BEVERAGES

- 9.6.1 THERE IS INCREASING AWARENESS AMONG CONSUMERS REGARDING GUT HEALTH AND IMMUNITY

- TABLE 37 BEVERAGES: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 38 BEVERAGES: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

- 9.7 INFANT FORMULA

- 9.7.1 RISING ECONOMIC GROWTH OF CONSUMERS WITH A PREFERENCE FOR CONVENIENCE FOODS

- TABLE 39 INFANT FORMULA: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 40 INFANT FORMULA: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

- 9.8 DIETARY SUPPLEMENTS

- 9.8.1 GROWING OMEGA-3 SUPPLEMENTS' DEMAND DUE TO NUMEROUS HEALTH BENEFITS

- TABLE 41 DIETARY SUPPLEMENTS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 42 DIETARY SUPPLEMENTS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

- 9.9 OTHER APPLICATIONS

- 9.9.1 INCREASING FOCUS ON FEED, WITH INCREASED OPPORTUNITIES IN DAIRY AND MEAT INDUSTRIES, CONTRIBUTES TO THE GROWTH OF THIS SEGMENT

- TABLE 43 OTHER APPLICATIONS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 44 OTHER APPLICATIONS: FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

10 FOOD FORTIFYING AGENTS MARKET, BY PROCESS

- 10.1 OVERVIEW

- 10.2 TYPES OF TECHNOLOGIES AND PROCESSES USED IN FOOD FORTIFICATION

- 10.2.1 POWDER ENRICHMENT

- 10.2.2 PREMIXES AND COATINGS

- 10.2.3 DRUM DRYING

- 10.2.4 DUSTING

- 10.2.5 SPRAY DRYING UNDER THE MICROENCAPSULATION PROCESS

11 FOOD FORTIFYING AGENTS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 25 INDIA IS PROJECTED TO BE THE FASTEST-GROWING MARKET FOR FOOD FORTIFYING AGENTS

- TABLE 45 FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 46 FOOD FORTIFYING AGENTS MARKET, BY REGION, 2019-2027 (KT)

- 11.2 NORTH AMERICA

- FIGURE 26 NORTH AMERICA: FOOD FORTIFYING AGENTS MARKET SNAPSHOT

- TABLE 47 NORTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 48 NORTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY COUNTRY, 2019-2027 (KT)

- TABLE 49 NORTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 50 NORTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 51 NORTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 52 NORTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.2.1 US

- 11.2.1.1 US is a growing food fortifying agents market for bakery, confectionery, and convenience food products

- TABLE 53 US: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 54 US: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 55 US: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 56 US: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.2.2 CANADA

- 11.2.2.1 Increasing usage of healthy food additives is driving the market for food fortifying agents

- TABLE 57 CANADA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 58 CANADA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 59 CANADA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 60 CANADA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.2.3 MEXICO

- 11.2.3.1 There is a growing demand for fortified food & beverage products in Mexico

- TABLE 61 MEXICO: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 62 MEXICO: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 63 MEXICO: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 64 MEXICO: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.3 EUROPE

- TABLE 65 EUROPE: FOOD FORTIFYING AGENTS MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 66 EUROPE: FOOD FORTIFYING AGENTS MARKET, BY COUNTRY, 2019-2027 (KT)

- TABLE 67 EUROPE: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 68 EUROPE: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 69 EUROPE: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 70 EUROPE: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.3.1 GERMANY

- 11.3.1.1 Growing food & beverage industry is driving the growth of the German food fortifying agents market

- TABLE 71 GERMANY: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 72 GERMANY: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 73 GERMANY: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 74 GERMANY: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.3.2 UK

- 11.3.2.1 Increasing consumer inclination toward a healthy diet is driving the demand for food fortifying agents in the UK

- TABLE 75 UK: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 76 UK: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 77 UK: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 78 UK: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.3.3 FRANCE

- 11.3.3.1 The market is driven by increasing health awareness among consumers

- TABLE 79 FRANCE: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 80 FRANCE: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 81 FRANCE: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 82 FRANCE: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.3.4 ITALY

- 11.3.4.1 Growing demand for essential oils and omega-3 fatty acids in cuisines is driving the market in Italy

- TABLE 83 ITALY: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 84 ITALY: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 85 ITALY: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 86 ITALY: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.3.5 SPAIN

- 11.3.5.1 Growing consumer awareness for clean label products

- TABLE 87 SPAIN: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 88 SPAIN: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 89 SPAIN: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 90 SPAIN: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.3.6 NETHERLANDS

- 11.3.6.1 Increasing demand for innovative food fortifying agents

- TABLE 91 NETHERLANDS: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 92 NETHERLANDS: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 93 NETHERLANDS: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 94 NETHERLANDS: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.3.7 POLAND

- 11.3.7.1 Rapid development in the field of food flavors in the food processing industry

- TABLE 95 POLAND: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 96 POLAND: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 97 POLAND: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 98 POLAND: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.3.8 REST OF EUROPE

- TABLE 99 REST OF EUROPE: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 100 REST OF EUROPE: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 101 REST OF EUROPE: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 102 REST OF EUROPE: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.4 ASIA PACIFIC

- FIGURE 27 ASIA PACIFIC: FOOD FORTIFYING AGENTS MARKET SNAPSHOT

- TABLE 103 ASIA PACIFIC: FOOD FORTIFYING AGENTS MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 104 ASIA PACIFIC: FOOD FORTIFYING AGENTS MARKET, BY COUNTRY, 2019-2027 (KT)

- TABLE 105 ASIA PACIFIC: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 106 ASIA PACIFIC: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 107 ASIA PACIFIC: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 108 ASIA PACIFIC: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.4.1 CHINA

- 11.4.1.1 Rising demand for high-quality processed food drives the food fortifying agents market

- TABLE 109 CHINA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 110 CHINA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 111 CHINA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 112 CHINA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.4.2 JAPAN

- 11.4.2.1 Increasing incidences of chronic conditions leading to the growth of the food fortifying agents market

- TABLE 113 JAPAN: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 114 JAPAN: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 115 JAPAN: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 116 JAPAN: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.4.3 INDIA

- 11.4.3.1 Consistent rise in demand for dietary supplements fuels the growth of the market

- TABLE 117 INDIA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 118 INDIA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 119 INDIA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 120 INDIA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Growing demand for canned food and beverages

- TABLE 121 SOUTH KOREA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 122 SOUTH KOREA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 123 SOUTH KOREA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 124 SOUTH KOREA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.4.5 AUSTRALIA & NEW ZEALAND

- 11.4.5.1 Rapid increase in demand for nutritional food products with low-calorie food ingredients is driving the market growth

- TABLE 125 AUSTRALIA & NEW ZEALAND: FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 126 AUSTRALIA & NEW ZEALAND: FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 127 AUSTRALIA & NEW ZEALAND: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 128 AUSTRALIA & NEW ZEALAND: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.4.6 REST OF ASIA PACIFIC

- TABLE 129 REST OF ASIA PACIFIC: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 131 REST OF ASIA PACIFIC: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.5 SOUTH AMERICA

- TABLE 133 SOUTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 134 SOUTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY COUNTRY, 2019-2027 (KT)

- TABLE 135 SOUTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 136 SOUTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 137 SOUTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 138 SOUTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.5.1 BRAZIL

- 11.5.1.1 Thriving food processing sector in Brazil to drive the market growth

- TABLE 139 BRAZIL: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 140 BRAZIL: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 141 BRAZIL: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 142 BRAZIL: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.5.2 ARGENTINA

- 11.5.2.1 Growing bakery industry and increasing consumption of bakery products to fuel the market growth in Argentina

- TABLE 143 ARGENTINA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 144 ARGENTINA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 145 ARGENTINA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 146 ARGENTINA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.5.3 REST OF SOUTH AMERICA

- TABLE 147 REST OF SOUTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 148 REST OF SOUTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 149 REST OF SOUTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 150 REST OF SOUTH AMERICA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.6 REST OF THE WORLD (ROW)

- TABLE 151 ROW: FOOD FORTIFYING AGENTS MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 152 ROW: FOOD FORTIFYING AGENTS MARKET, BY COUNTRY, 2019-2027 (KT)

- TABLE 153 ROW: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 154 ROW: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 155 ROW: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 156 ROW: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.6.1 UAE

- 11.6.1.1 Increasing convenience for ready-to-eat food products is driving the UAE market for food fortifying agents

- TABLE 157 UAE: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 158 UAE: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 159 UAE: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 160 UAE: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.6.2 SAUDI ARABIA

- 11.6.2.1 Growth in the retail channels is driving the Saudi Arabian market for food fortifying agents

- TABLE 161 SAUDI ARABIA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 162 SAUDI ARABIA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 163 SAUDI ARABIA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 164 SAUDI ARABIA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.6.3 SOUTH AFRICA

- 11.6.3.1 Growing oilseed processing industry fuels the demand for food fortifying agents

- TABLE 165 SOUTH AFRICA: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 166 SOUTH AFRICA: FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 167 SOUTH AFRICA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 168 SOUTH AFRICA: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

- 11.6.4 OTHERS IN ROW

- 11.6.4.1 Rising demand for premium food products will fuel the market growth in this region

- TABLE 169 OTHERS IN ROW: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 170 OTHERS IN ROW: FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019-2027 (KT)

- TABLE 171 OTHERS IN ROW: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 172 OTHERS IN ROW: FOOD FORTIFYING AGENTS MARKET, BY APPLICATION, 2019-2027 (KT)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2021

- TABLE 173 FOOD FORTIFYING AGENTS: MARKET SHARE ANALYSIS, 2021

- 12.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 28 TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2017-2021 (USD BILLION)

- 12.4 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- 12.4.1 STARS

- 12.4.2 PERVASIVE PLAYERS

- 12.4.3 EMERGING LEADERS

- 12.4.4 PARTICIPANTS

- FIGURE 29 FOOD FORTIFYING AGENTS MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS (2021)

- 12.4.5 FOOD FORTIFYING AGENTS: FOOTPRINT, BY TYPE (KEY PLAYERS)

- TABLE 174 COMPANY FOOTPRINT, BY TYPE

- TABLE 175 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 176 COMPANY FOOTPRINT, BY REGION

- TABLE 177 OVERALL COMPANY FOOTPRINT

- 12.5 COMPANY EVALUATION MATRIX FOR OTHER PLAYERS

- 12.5.1 PROGRESSIVE COMPANIES

- 12.5.2 STARTING BLOCKS

- 12.5.3 RESPONSIVE COMPANIES

- 12.5.4 DYNAMIC COMPANIES

- FIGURE 30 FOOD FORTIFYING AGENTS MARKET: COMPANY EVALUATION MATRIX FOR OTHER PLAYERS (2021)

- 12.6 COMPETITIVE SCENARIO

- 12.6.1 NEW PRODUCT LAUNCHES

- TABLE 178 FOOD FORTIFYING AGENTS MARKET: NEW PRODUCT LAUNCHES, 2019-2022

- 12.6.2 DEALS

- TABLE 179 FOOD FORTIFYING AGENTS MARKET: DEALS, 2019-2022

- 12.6.3 OTHER DEVELOPMENTS

- TABLE 180 FOOD FORTIFYING AGENTS MARKET: OTHER DEVELOPMENTS, 2019-2022

13 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 13.1 KEY PLAYERS

- 13.1.1 CARGILL

- TABLE 181 CARGILL: BUSINESS OVERVIEW

- FIGURE 31 CARGILL: COMPANY SNAPSHOT

- TABLE 182 CARGILL: PRODUCTS OFFERED

- TABLE 183 CARGILL: NEW PRODUCT LAUNCHES

- 13.1.2 INGREDION

- TABLE 184 INGREDION: BUSINESS OVERVIEW

- FIGURE 32 INGREDION: COMPANY SNAPSHOT

- TABLE 185 INGREDION: PRODUCTS OFFERED

- TABLE 186 INGREDION: NEW PRODUCT LAUNCHES

- TABLE 187 INGREDION: DEALS

- TABLE 188 INGREDION: OTHER DEVELOPMENTS

- 13.1.3 TATE & LYLE

- TABLE 189 TATE & LYLE: BUSINESS OVERVIEW

- FIGURE 33 TATE & LYLE: COMPANY SNAPSHOT

- TABLE 190 TATE & LYLE: PRODUCTS OFFERED

- TABLE 191 TATE & LYLE: DEALS

- 13.1.4 DSM

- TABLE 192 DSM: BUSINESS OVERVIEW

- FIGURE 34 DSM: COMPANY SNAPSHOT

- TABLE 193 DSM: PRODUCTS OFFERED

- TABLE 194 DSM: DEALS

- 13.1.5 ARLA FOODS AMBA

- TABLE 195 ARLA FOODS AMBA: BUSINESS OVERVIEW

- FIGURE 35 ARLA FOODS AMBA: COMPANY SNAPSHOT

- TABLE 196 ARLA FOODS AMBA: PRODUCTS OFFERED

- TABLE 197 ARLA FOODS AMBA: NEW PRODUCT LAUNCHES

- TABLE 198 ARLA FOODS AMBA: OTHER DEVELOPMENTS

- 13.1.6 CHR. HANSEN HOLDING A/S

- TABLE 199 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

- FIGURE 36 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

- TABLE 200 CHR. HANSEN HOLDING A/S: PRODUCTS OFFERED

- TABLE 201 CHR. HANSEN HOLDING A/S: DEALS

- TABLE 202 CHR. HANSEN HOLDING A/S: PRODUCT LAUNCHES

- 13.1.7 DUPONT

- TABLE 203 DUPONT: BUSINESS OVERVIEW

- FIGURE 37 DUPONT: COMPANY SNAPSHOT

- TABLE 204 DUPONT: PRODUCTS OFFERED

- TABLE 205 DUPONT: DEALS

- TABLE 206 DUPONT: PRODUCT LAUNCHES

- 13.1.8 ARCHER DANIELS MIDLAND COMPANY

- TABLE 207 ARCHER DANIELS MIDLAND COMPANY: BUSINESS OVERVIEW

- FIGURE 38 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

- TABLE 208 ARCHER DANIELS MIDLAND COMPANY: PRODUCTS OFFERED

- TABLE 209 ARCHER DANIELS MIDLAND COMPANY: DEALS

- TABLE 210 ARCHER DANIELS MIDLAND COMPANY: OTHERS

- 13.1.9 BASF SE

- TABLE 211 BASF SE: BUSINESS OVERVIEW

- FIGURE 39 BASF SE: COMPANY SNAPSHOT

- TABLE 212 BASF SE: PRODUCTS OFFERED

- TABLE 213 BASF SE: PRODUCT LAUNCHES

- TABLE 214 BASF SE: DEALS

- 13.1.10 NESTLE SA

- TABLE 215 NESTLE SA: BUSINESS OVERVIEW

- FIGURE 40 NESTLE SA: COMPANY SNAPSHOT

- TABLE 216 NESTLE SA: PRODUCTS OFFERED

- TABLE 217 NESTLE SA: NEW PRODUCT LAUNCHES

- TABLE 218 NESTLE SA: DEALS

- TABLE 219 NESTLE SA: OTHERS

- 13.1.11 WENDA INGREDIENTS, LLC

- TABLE 220 WENDA INGREDIENTS, LLC: BUSINESS OVERVIEW

- TABLE 221 WENDA INGREDIENTS, LLC: PRODUCTS OFFERED

- 13.1.12 ROYAL COSUN

- TABLE 222 ROYAL COSUN: BUSINESS OVERVIEW

- FIGURE 41 ROYAL COSUN: COMPANY SNAPSHOT

- TABLE 223 ROYAL COSUN: PRODUCTS OFFERED

- 13.1.13 STRATUM NUTRITION

- TABLE 224 STRATUM NUTRITION: BUSINESS OVERVIEW

- TABLE 225 STRATUM NUTRITION: PRODUCTS OFFERED

- 13.1.14 A&B INGREDIENTS, INC.

- TABLE 226 A&B INGREDIENTS, INC.: BUSINESS OVERVIEW

- TABLE 227 A&B INGREDIENTS, INC.: PRODUCTS OFFERED

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 228 ADJACENT MARKETS TO THE FOOD FORTIFYING AGENTS MARKET

- 14.2 LIMITATIONS

- 14.3 SPECIALTY FOOD INGREDIENTS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- TABLE 229 ACIDULANTS MARKET, BY FOOD APPLICATION, 2022-2027 (USD MILLION)

- 14.4 FUNCTIONAL FOOD INGREDIENTS MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- TABLE 230 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2021-2026 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS