|

|

市場調査レポート

商品コード

1311269

マイクロホンの世界市場 (~2028年):技術 (MEMS・エレクトレット)・MEMSタイプ (アナログ・デジタル)・通信技術 (有線・Bluetooth・Wi-Fi・AirPlay)・SNR (低音59dB未満・中音60~64dB・高音64dB超)・用途・地域別Microphone Market by Technology (MEMS, Electret), MEMS Type (Analog, Digital), Communication Technology (Wired, Bluetooth, Wi-Fi, AirPlay), SNR (Low <59 dB, Medium 60-64 dB, High >64 dB), Application & Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| マイクロホンの世界市場 (~2028年):技術 (MEMS・エレクトレット)・MEMSタイプ (アナログ・デジタル)・通信技術 (有線・Bluetooth・Wi-Fi・AirPlay)・SNR (低音59dB未満・中音60~64dB・高音64dB超)・用途・地域別 |

|

出版日: 2023年07月07日

発行: MarketsandMarkets

ページ情報: 英文 225 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のマイクロホンの市場規模は、2023年の24億5,400万米ドルから、予測期間中は7.5%のCAGRで推移し、2028年には35億2,600万米ドルの規模に成長すると予測されています。

ソーシャルメディア、オンラインコンテンツ・プラットフォーム、ストリーミングサービスの台頭により、コンテンツ制作が急増しています。その結果、動画、ポッドキャスト、ライブストリーム用に高品質な音声録音を必要とするコンテンツ制作者、ブロガー、ポッドキャスター、ストリーマーの間でマイクロホンの需要が高まっています。マイクロホンは、ハンズフリー通話、音声操作、車載通信システム、ノイズキャンセリング機能などに使用され、自動車のオーディオ体験全体を向上させています。自動車業界では、先進的なオーディオ通信システムの導入が進んでおり、マイクロホンの需要増につながっています。

通信技術別では、ワイヤレスの部門が最大シェアを示しています。ワイヤレスマイクロホン技術は大きく進化し、音質、通信距離、信号の安定性、耐干渉性などの性能向上をもたらしています。先進的なワイヤレスシステムは、デジタル伝送技術、ダイバーシティ受信、周波数の俊敏性を利用し、課題となっているRF環境下でもクリアで信頼性の高い音声信号を提供します。ワイヤレスマイクロホンは、ライブパフォーマンス、コンサート、劇場、放送スタジオ、企業イベント、教育、礼拝堂、スポーツイベントなど、さまざまな業界や環境で使用されています。

用途別では、医療部門が第2位の位置づけを示しています。遠隔医療は音声や映像によるコミュニケーションを通じて患者の遠隔診断や治療を行うもので、大きな支持を得ています。高品質のマイクロホンは、遠隔医療の診察時にクリアで正確な音声伝送に不可欠であり、医療分野のマイクロホン市場の成長に貢献しています。聴覚障害の有病率の上昇と高齢化により、補聴器の需要が増加しています。マイクロホンは補聴器で重要な役割を果たし、外部の音を取り込み、増幅された音声としてユーザーに伝達します。デジタル信号処理やノイズキャンセリングを含む補聴器の技術的進歩が、医療分野におけるマイクロホン市場の成長をさらに後押ししています。

地域別では、北米地域が最大のシェアを示しています。北米には、音楽、映画、テレビ、ゲームなど、活気あるエンターテインメント&メディア産業があり、これらの産業は、レコーディング、放送、ライブパフォーマンスにおいて、高品質のオーディオキャプチャに大きく依存しています。マイクロホンは音を正確に取り込む上で重要な役割を担っており、その結果、これらの業界でマイクロホンの需要が高まっています。

当レポートでは、世界のマイクロホンの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、関連法規制、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステムマッピング

- ポーターのファイブフォース分析

- 主なステークホルダー・購入基準

- 顧客の事業に影響を与える動向/ディスラプション

- 平均販売価格分析

- ケーススタディ分析

- 技術分析

- 特許分析

- 貿易分析

- 料金分析

- 基準と規制状況

- 主な会議とイベント

第6章 マイクロホン市場:技術別

- エレクトレット

- MEMS

- その他

第7章 マイクロホン市場:MEMSタイプ別

- アナログ

- デジタル

第8章 マイクロホン市場:通信技術別

- 有線

- 無線

- BLUETOOTH

- WI-FI

- AIRPLAY

- その他

第9章 マイクロホン市場:信号対雑音比(SNR)

- 低(59 DB未満)

- 中(60-64 DB)

- 高(64 DB超)

第10章 マイクロホン市場:用途別

- 自動車

- セキュリティ・監視

- 家電

- ラップトップ

- スマートフォン

- タブレット

- ウェアラブルデバイス

- スマートスピーカー

- スマートホームアプライアンス

- 産業用

- 医療用

- ノイズモニタリング&センシング

第11章 マイクロホン市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他

第12章 競合情勢

- 主要企業の採用戦略

- 3年間の企業収益分析

- 市場シェア分析

- 主要企業の評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 企業の製品フットプリント分析

- スタートアップ/中小企業の評価マトリックス

- 企業の採用戦略

第13章 企業プロファイル

- 主要企業

- KNOWLES ELECTRONICS LLC

- GOERTEK

- AAC TECHNOLOGIES

- TDK CORPORATION

- INFINEON TECHNOLOGIES AG

- STMICROELECTRONICS

- ZILLTEK TECHNOLOGY

- HOSIDEN CORPORATION

- SONION

- CUI DEVICES

- その他の企業

- SHANDONG GETTOP ACOUSTIC CO., LTD.

- BSE CO. LTD.

- SUZHOU MINXIN MICROELECTRONICS TECHNOLOGY CO., LTD.

- VESPER TECHNOLOGIES, INC.

- SENSIBEL

- PUI AUDIO

- KINGSTATE ELECTRONICS CORPORATION

- HARMONY ELECTRONICS CORPORATION

- DB UNLIMITED

- PARTRON

- STETRON

- ARIOSE ELECTRONICS CO., LTD.

- OMRON CORPORATION

- SANICO ELECTRONICS CO., LTD.

- JLI ELECTRONICS

第14章 付録

The global microphone market is expected to be valued at USD 2,454 million in 2023 and is projected to reach USD 3,526 million by 2028; it is expected to grow at a CAGR of 7.5% from 2023 to 2028. The rise of social media, online content platforms, and streaming services has led to a surge in content creation. As a result, there is a growing demand for microphones among content creators, vloggers, podcasters, and streamers who require high-quality audio recording for their videos, podcasts, and live streams. Microphones are used in hands-free calling, voice-activated controls, in-car communication systems, and noise cancellation features, enhancing the overall audio experience in vehicles. The automotive industry is incorporating advanced audio and communication systems, leading to an increased demand for microphones.

"Wireless communication technology segment to account for the largest market share for microphone market"

Wireless microphone technology has evolved significantly, leading to improved performance in terms of audio quality, range, signal stability, and interference resistance. Advanced wireless systems use digital transmission technologies, diversity reception, and frequency agility to deliver clear and reliable audio signals, even in challenging RF environments. Wireless microphones find applications in various industries and settings, including live performances, concerts, theaters, broadcast studios, corporate events, education, houses of worship, sports events, and more. The versatility of wireless microphones makes them suitable for different environments, enabling professionals and performers to utilize them across a wide range of applications.

"Medical industry to account for second-highest largest CAGR of microphone market."

Telemedicine, which involves remote diagnosis and treatment of patients through audio and video communication, has gained significant traction. High-quality microphones are crucial for clear and accurate audio transmission during telemedicine consultations, contributing to the growth of the microphone market in the medical field. The rising prevalence of hearing impairments and the aging population have led to an increased demand for hearing aids. Microphones play a crucial role in hearing aids, capturing external sounds and transmitting them as amplified audio to the user. Technological advancements in hearing aids, including digital signal processing and noise cancellation, further drive the growth of the microphone market in the medical sector.

"North America to have the highest market share for microphone market."

North America has a vibrant entertainment and media industry, including music, film, television, and gaming. These industries heavily rely on high-quality audio capture for recording, broadcasting, and live performances. Microphones play a vital role in capturing sound accurately, resulting in high demand for microphones in these sectors. North America has a large and thriving consumer electronics market. The region is a major hub for producing, selling, and consuming smartphones, tablets, smart speakers, gaming consoles, and other audio-related devices. The integration of microphones in these devices for voice control, virtual assistants, and communication purposes contributes to the region's high market share of microphones.

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 10%, Tier 2 - 55%, and Tier 3 - 35%

- By Designation: C-level Executives - 45%, Directors - 25%, and Others - 30%

- By Region: North America - 55%, Europe - 20%, Asia Pacific - 15%, RoW - 10%

The key players operating in the microphone market are Knowles Electronics LLC (US), Goertek (China), AAC Technologies (China), TDK Corporation (Japan), and Infineon Technologies (Germany).

Research Coverage:

The research reports the Microphone Market, By SNR (Low, Medium, High), Technology (Electret, MEMS, Others), MEMS Type (Digital, Analog), Communication Technology (Wired, Wireless), Application (Automotive, Security & Surveillance, Consumer Electronics, Industrial, Medical, Noise Monitoring & Sensing), and Region (North America, Europe, Asia Pacific, and RoW). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the microphone market. A detailed analysis of the key industry players has been done to provide insights into their business overviews, products, key strategies, Contracts, partnerships, and agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the microphone market. Competitive analysis of upcoming startups in the microphone market ecosystem is covered in this report.

Key Benefits of Buying the Report

- Analysis of key drivers (Increasing demand for consumer electronics, Growing adoption of voice-controlled applications, Advancements in automotive technology, Adoption of video conferencing and remote collaborations), restraints (Compatibility issues in microphones, Designs constraints), opportunities (Increasing demand for wearable devices and hearables, Advancements in microphone technology, Growth of video content creation and streaming), and challenges (Counterfeit and low-quality products, Competition from established microphone manufacturers) influencing the growth of the microphone market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the microphone market

- Market Development: Comprehensive information about lucrative markets - the report analyses the microphone market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the microphone market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Knowles Electronics LLC (US), Goertek (China), AAC Technologies (China), TDK Corporation (Japan), Infineon Technologies (Germany), among others in the microphone market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 MICROPHONE MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 MICROPHONE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM SALES OF MICROPHONE PRODUCTS AND SOLUTIONS

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- FIGURE 6 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- TABLE 1 RISK FACTOR ANALYSIS

- 2.6 ASSUMPTIONS CONSIDERED TO ANALYZE RECESSION IMPACT

- TABLE 2 ASSUMPTIONS IN EVALUATING RECESSION IMPACT

- 2.7 STUDY LIMITATIONS

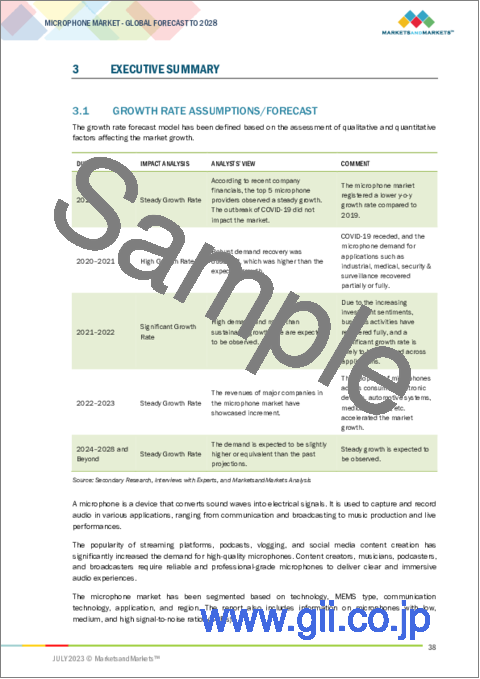

3 EXECUTIVE SUMMARY

- 3.1 GROWTH RATE ASSUMPTIONS/FORECAST

- FIGURE 8 MEMS SEGMENT TO HOLD LARGEST SHARE OF MICROPHONE MARKET, BY TECHNOLOGY, IN 2028

- FIGURE 9 WIRELESS SEGMENT TO COMMAND MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, DURING FORECAST PERIOD

- FIGURE 10 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST SHARE OF MICROPHONE MARKET, BY APPLICATION, IN 2028

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MICROPHONE MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MICROPHONE MARKET

- FIGURE 12 RISING USE OF WEARABLE DEVICES TO DRIVE MARKET

- 4.2 MICROPHONE MARKET IN NORTH AMERICA, BY COUNTRY AND TECHNOLOGY

- FIGURE 13 US AND MEMS TECHNOLOGY TO HOLD LARGEST SHARE OF NORTH AMERICAN MICROPHONE MARKET IN 2023

- 4.3 MICROPHONE MARKET IN ASIA PACIFIC, BY COUNTRY

- FIGURE 14 CHINA TO CAPTURE LARGEST SHARE OF MICROPHONE MARKET IN ASIA PACIFIC THROUGHOUT FORECAST PERIOD

- 4.4 GLOBAL MICROPHONE MARKET, BY COUNTRY

- FIGURE 15 CHINA TO RECORD HIGHEST CAGR IN GLOBAL MICROPHONE MARKET FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 MICROPHONE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for consumer electronics

- 5.2.1.2 Growing adoption of voice-enabled devices

- 5.2.1.3 Technological advancements in automotive sector

- 5.2.1.4 Rising trend of video conferencing and remote collaborations

- FIGURE 17 MICROPHONE MARKET DRIVERS: IMPACT ANALYSIS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Easy availability of counterfeit and low-quality products

- 5.2.2.2 Design-related constraints in microphones

- FIGURE 18 MICROPHONE MARKET RESTRAINTS: IMPACT ANALYSIS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for wearable devices and hearables

- 5.2.3.2 Continuous advancements in microphone technology

- 5.2.3.3 Growth in video content creation and streaming

- FIGURE 19 MICROPHONE MARKET OPPORTUNITIES: IMPACT ANALYSIS

- 5.2.4 CHALLENGES

- 5.2.4.1 Compatibility issues in microphones

- 5.2.4.2 Intense competition witnessed by small/new companies from established microphone manufacturers

- FIGURE 20 MICROPHONE MARKET CHALLENGES: IMPACT ANALYSIS

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 21 MICROPHONE VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM MAPPING

- FIGURE 22 KEY PLAYERS IN MICROPHONE MARKET

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM/VALUE CHAIN

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 IMPACT OF PORTER'S FIVE FORCES ON MICROPHONE MARKET

- FIGURE 23 PORTER'S FIVE FORCES ANALYSIS: MICROPHONE MARKET

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.5 INTENSITY OF COMPETITION RIVALRY

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- 5.6.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MICROPHONE MARKET

- 5.8 AVERAGE SELLING PRICE ANALYSIS

- FIGURE 27 AVERAGE SELLING PRICE OF DIFFERENT TECHNOLOGY-BASED MICROPHONES, BY APPLICATION

- FIGURE 28 AVERAGE SELLING PRICE TRENDS IN MICROPHONE MARKET, BY TECHNOLOGY, 2019-2028

- 5.9 CASE STUDY ANALYSIS

- TABLE 7 USE CASE 1: ZOOM VIDEO COMMUNICATIONS APPROACHED SHURE TO INTEGRATE ITS MICROPHONES INTO ZOOM'S PLATFORM TO ENSURE EFFECTIVE COMMUNICATION IN VIRTUAL MEETINGS

- TABLE 8 USE CASE 2: GOOGLE USED AUDIO-TECHNICA MICROPHONES IN VIDEO CONFERENCING TO ADDRESS CHALLENGE OF POOR-QUALITY AUDIO DURING VIRTUAL MEETINGS

- TABLE 9 USE CASE 3: NIKON USED MICROPHONES FROM RODE MICROPHONES TO ENHANCE AUDIO RECORDING CAPABILITIES OF ITS CAMERAS

- TABLE 10 USE CASE 4: YAMAHA DEPLOYED AUDIO-TECHNICA MICROPHONES IN ITS AUDIO PROCESSING AND CONFERENCING SYSTEMS FOR EFFECTIVE COMMUNICATION

- TABLE 11 USE CASE 5: DJI INTEGRATED MICROPHONES FROM SARAMONIC IN DRONES AND CAMERA SYSTEMS TO ENSURE PROFESSIONAL-GRADE AUDIO CAPTURE CAPABILITIES

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Condenser technology

- 5.10.1.2 Dynamic technology

- 5.10.1.3 Electret condenser technology

- 5.10.1.4 MEMS (microelectromechanical systems) technology

- 5.10.2 COMPLIMENTARY TECHNOLOGIES

- 5.10.2.1 Digital signal processing

- 5.10.2.2 Wireless technology

- 5.10.2.3 Beamforming technology

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Acoustic material technology

- 5.10.3.2 Audio processing and mixing technology

- 5.10.3.3 Voice recognition and natural language processing

- 5.10.3.4 Augmented reality (AR) and virtual reality (VR)

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- FIGURE 29 NUMBER OF PATENTS GRANTED IN MICROPHONE MARKET, 2012-2022

- TABLE 12 LIST OF FEW PATENTS IN MICROPHONE MARKET, 2020-2022

- 5.12 TRADE ANALYSIS

- TABLE 13 IMPORT DATA, BY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 30 IMPORT DATA, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 14 EXPORT DATA, BY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 31 EXPORT DATA, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.13 TARIFF ANALYSIS

- TABLE 15 MFN TARIFFS FOR PRODUCTS EXPORTED BY US

- TABLE 16 MFN TARIFFS FOR PRODUCTS EXPORTED BY CHINA

- TABLE 17 MFN TARIFFS FOR PRODUCTS EXPORTED BY JAPAN

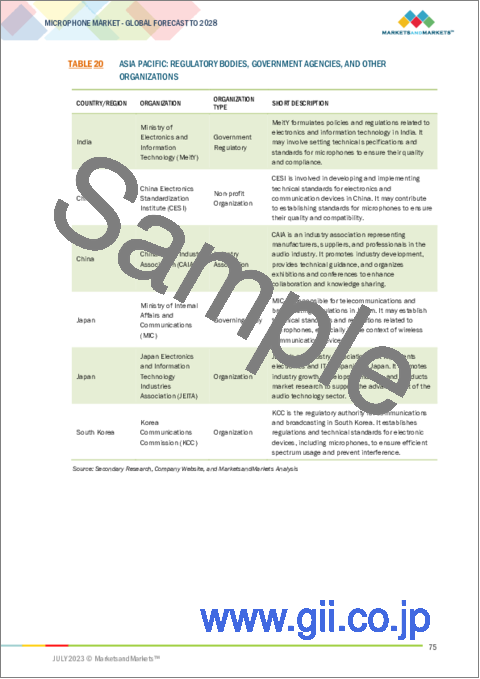

- 5.14 STANDARDS AND REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS AND REGULATIONS RELATED TO MICROPHONE MARKET

- 5.15 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 22 MICROPHONE MARKET: LIST OF CONFERENCES AND EVENTS

6 MICROPHONE MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- FIGURE 32 MEMS MICROPHONES TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- TABLE 23 MICROPHONE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 24 MICROPHONE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 25 MICROPHONE MARKET, BY TECHNOLOGY, 2019-2022 (MILLION UNITS)

- TABLE 26 MICROPHONE MARKET, BY TECHNOLOGY, 2023-2028 (MILLION UNITS)

- 6.2 ELECTRET

- 6.2.1 WIDE ADOPTION OF ELECTRET MICROPHONES IN ACOUSTIC OR ELECTRICAL APPLICATIONS TO DRIVE SEGMENTAL GROWTH

- TABLE 27 ELECTRET: MICROPHONE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 28 ELECTRET: MICROPHONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 29 ELECTRET: MICROPHONE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 30 ELECTRET: MICROPHONE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 31 ELECTRET: MICROPHONE MARKET FOR AUTOMOTIVE APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 32 ELECTRET: MICROPHONE MARKET FOR AUTOMOTIVE APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 33 ELECTRET: MICROPHONE MARKET FOR SECURITY & SURVEILLANCE APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 34 ELECTRET: MICROPHONE MARKET FOR SECURITY & SURVEILLANCE APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 35 ELECTRET: MICROPHONE MARKET FOR CONSUMER ELECTRONICS APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 36 ELECTRET: MICROPHONE MARKET FOR CONSUMER ELECTRONICS APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 37 ELECTRET: MICROPHONE MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 38 ELECTRET: MICROPHONE MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 39 ELECTRET: MICROPHONE MARKET FOR MEDICAL APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 40 ELECTRET: MICROPHONE MARKET FOR MEDICAL APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 41 ELECTRET: MICROPHONE MARKET FOR NOISE MONITORING & SENSING APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 42 ELECTRET: MICROPHONE MARKET FOR NOISE MONITORING & SENSING APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- 6.3 MEMS

- 6.3.1 HIGH PERFORMANCE AND MINIATURIZATION OF MEMS MICROPHONES TO FUEL MARKET GROWTH

- TABLE 43 MEMS: MICROPHONE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 44 MEMS: MICROPHONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 45 MEMS: MICROPHONE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 46 MEMS: MICROPHONE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 47 MEMS: MICROPHONE MARKET FOR AUTOMOTIVE APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 48 MEMS: MICROPHONE MARKET FOR AUTOMOTIVE APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 49 MEMS: MICROPHONE MARKET FOR SECURITY & SURVEILLANCE APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 50 MEMS: MICROPHONE MARKET FOR SECURITY & SURVEILLANCE APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 51 MEMS: MICROPHONE MARKET FOR CONSUMER ELECTRONICS APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 52 MEMS: MICROPHONE MARKET FOR CONSUMER ELECTRONICS APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 53 MEMS: MICROPHONE MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 54 MEMS: MICROPHONE MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 55 MEMS: MICROPHONE MARKET FOR MEDICAL APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 56 MEMS: MICROPHONE MARKET FOR MEDICAL APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 57 MEMS: MICROPHONE MARKET FOR NOISE MONITORING & SENSING APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 58 MEMS: MICROPHONE MARKET FOR NOISE MONITORING & SENSING APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- 6.4 OTHERS

- TABLE 59 OTHERS: MICROPHONE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 60 OTHERS: MICROPHONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 61 OTHERS: MICROPHONE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 62 OTHERS: MICROPHONE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 63 OTHERS: MICROPHONE MARKET FOR AUTOMOTIVE APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 64 OTHERS: MICROPHONE MARKET FOR AUTOMOTIVE APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 65 OTHERS: MICROPHONE MARKET FOR SECURITY & SURVEILLANCE APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 66 OTHERS: MICROPHONE MARKET FOR SECURITY & SURVEILLANCE APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 67 OTHERS: MICROPHONE MARKET FOR CONSUMER ELECTRONICS APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 68 OTHERS: MICROPHONE MARKET FOR CONSUMER ELECTRONICS APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 69 OTHERS: MICROPHONE MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 70 OTHERS: MICROPHONE MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 71 OTHERS: MICROPHONE MARKET FOR MEDICAL APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 72 OTHERS: MICROPHONE MARKET FOR MEDICAL APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 73 OTHERS: MICROPHONE MARKET FOR NOISE MONITORING & SENSING APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 74 OTHERS: MICROPHONE MARKET FOR NOISE MONITORING & SENSING APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

7 MICROPHONE MARKET, BY MEMS TYPE

- 7.1 INTRODUCTION

- FIGURE 33 DIGITAL MEMS MICROPHONES TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- TABLE 75 MICROPHONE MARKET, BY MEMS TYPE, 2019-2022 (USD MILLION)

- TABLE 76 MICROPHONE MARKET, BY MEMS TYPE, 2023-2028 (USD MILLION)

- 7.2 ANALOG

- 7.2.1 INCREASING USE OF ANALOG MEMS MICROPHONES IN VOICE ASSISTANT APPLICATIONS TO ACCELERATE MARKET GROWTH

- TABLE 77 ANALOG: MICROPHONE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 78 ANALOG: MICROPHONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.3 DIGITAL

- 7.3.1 RISING ADOPTION OF DIGITAL MICROPHONES IN CONSUMER AUDIO AND ELECTRONICS TO DRIVE MARKET

- TABLE 79 DIGITAL: MICROPHONE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 80 DIGITAL: MICROPHONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

8 MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY

- 8.1 INTRODUCTION

- FIGURE 34 WIRELESS MICROPHONES TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- TABLE 81 MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 82 MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2023-2028 (USD MILLION)

- 8.2 WIRED

- 8.2.1 HIGH RELIABILITY AND COST-EFFECTIVENESS OF WIRED MICROPHONES TO DRIVE SEGMENTAL GROWTH

- 8.3 WIRELESS

- 8.3.1 INCREASED USE OF SMARTPHONES AND TABLETS TO BOOST DEMAND FOR WIRELESS MICROPHONES

- TABLE 83 WIRELESS: MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 84 MICROPHONE MARKET, BY WIRELESS COMMUNICATION TECHNOLOGY, 2023-2028 (USD MILLION)

- 8.3.2 BLUETOOTH

- 8.3.2.1 Growing use of Bluetooth microphones in broadcasting applications to accelerate market growth

- 8.3.3 WI-FI

- 8.3.3.1 Rising demand for Wi-Fi-enabled microphones in consumer electronics and smart home applications to fuel market growth

- 8.3.4 AIRPLAY

- 8.3.4.1 AirPlay compatibility feature of iPhone and iPad offered by Apple to drive market

- 8.3.5 OTHER WIRELESS COMMUNICATION TECHNOLOGIES

9 SIGNAL-TO-NOISE RATIO (SNR) IN MICROPHONES

- 9.1 INTRODUCTION

- 9.2 LOW (<59 DB)

- 9.3 MEDIUM (60-64 DB)

- 9.4 HIGH (>64 DB)

10 MICROPHONE MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 35 MEDICAL SEGMENT TO RECORD HIGHEST CAGR IN MICROPHONE MARKET, BY APPLICATION, FROM 2023 TO 2028

- TABLE 85 MICROPHONE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 86 MICROPHONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2 AUTOMOTIVE

- 10.2.1 INCREASING IMPORTANCE OF VOICE RECOGNITION AND IVI SYSTEMS IN VEHICLES TO BOOST DEMAND FOR MICROPHONES

- TABLE 87 AUTOMOTIVE: MICROPHONE MARKET, BY MEMS TYPE, 2019-2022 (USD MILLION)

- TABLE 88 AUTOMOTIVE: MICROPHONE MARKET, BY MEMS TYPE, 2023-2028 (USD MILLION)

- TABLE 89 AUTOMOTIVE: MICROPHONE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 90 AUTOMOTIVE: MICROPHONE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 10.3 SECURITY & SURVEILLANCE

- 10.3.1 RISING USE OF COMMERCIAL CCTV AND GUNSHOT DETECTION SYSTEMS TO CONTRIBUTE TO MICROPHONE MARKET GROWTH

- TABLE 91 SECURITY & SURVEILLANCE: MICROPHONE MARKET, BY MEMS TYPE, 2019-2022 (USD MILLION)

- TABLE 92 SECURITY & SURVEILLANCE: MICROPHONE MARKET, BY MEMS TYPE, 2023-2028 (USD MILLION)

- TABLE 93 SECURITY & SURVEILLANCE: MICROPHONE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 94 SECURITY & SURVEILLANCE: MICROPHONE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 10.4 CONSUMER ELECTRONICS

- TABLE 95 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY MEMS TYPE, 2019-2022 (USD MILLION)

- TABLE 96 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY MEMS TYPE, 2023-2028 (USD MILLION)

- TABLE 97 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 98 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 99 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 100 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 101 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY TYPE, 2019-2022 (MILLION UNITS)

- TABLE 102 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY TYPE, 2023-2028 (MILLION UNITS)

- 10.4.1 LAPTOPS

- 10.4.1.1 Surging demand for laptops with inclination toward hybrid and remote working to support market growth

- 10.4.2 SMARTPHONES

- 10.4.2.1 Use of microphones in smartphones to ensure clear and effective voice calls to fuel market growth

- 10.4.3 TABLETS

- 10.4.3.1 Rising demand for microphone-integrated tablets to attend phone calls and conduct voice searches to drive market

- 10.4.4 WEARABLE DEVICES

- 10.4.4.1 Significant investments in developing wearable devices with improved features to boost demand for microphones

- 10.4.5 SMART SPEAKERS

- 10.4.5.1 Increasing use of smart speakers for voice-based messaging and group calls to boost demand for microphones

- 10.4.6 SMART HOME APPLIANCES

- 10.4.6.1 Integration of microphones into smart home appliances to ensure home safety and security to contribute to market growth

- 10.5 INDUSTRIAL

- 10.5.1 NEED TO MONITOR NOISE AND PERFORMANCE LEVELS OF INDUSTRIAL EQUIPMENT TO ACCELERATE DEMAND FOR MICROPHONES

- TABLE 103 INDUSTRIAL: MICROPHONE MARKET, BY MEMS TYPE, 2019-2022 (USD MILLION)

- TABLE 104 INDUSTRIAL: MICROPHONE MARKET, BY MEMS TYPE, 2023-2028 (USD MILLION)

- TABLE 105 INDUSTRIAL: MICROPHONE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 106 INDUSTRIAL: MICROPHONE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 10.6 MEDICAL

- 10.6.1 INCREASED REQUIREMENT FOR MICROPHONE-EMBEDDED HEARING AIDS TO ACCELERATE MARKET GROWTH

- TABLE 107 MEDICAL: MICROPHONE MARKET, BY MEMS TYPE, 2019-2022 (USD MILLION)

- TABLE 108 MEDICAL: MICROPHONE MARKET, BY MEMS TYPE, 2023-2028 (USD MILLION)

- TABLE 109 MEDICAL: MICROPHONE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 110 MEDICAL: MICROPHONE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 10.7 NOISE MONITORING & SENSING

- 10.7.1 HIGH DEMAND FOR NOISE MONITORING SYSTEMS & SENSING INSTRUMENTS IN DEFENSE AND CONSTRUCTION SECTORS TO DRIVE MARKET

- TABLE 111 NOISE MONITORING & SENSING: MICROPHONE MARKET, BY MEMS TYPE, 2019-2022 (USD MILLION)

- TABLE 112 NOISE MONITORING & SENSING: MICROPHONE MARKET, BY MEMS TYPE, 2023-2028 (USD MILLION)

- TABLE 113 NOISE MONITORING & SENSING: MICROPHONE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 114 NOISE MONITORING & SENSING: MICROPHONE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

11 MICROPHONE MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 36 ASIA PACIFIC TO RECORD HIGHEST CAGR IN MICROPHONE MARKET DURING FORECAST PERIOD

- TABLE 115 MICROPHONE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 116 MICROPHONE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 37 NORTH AMERICA: MICROPHONE MARKET SNAPSHOT

- 11.2.1 RECESSION IMPACT ON MARKET IN NORTH AMERICA

- TABLE 117 NORTH AMERICA: MICROPHONE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 118 NORTH AMERICA: MICROPHONE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 119 NORTH AMERICA: MICROPHONE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 120 NORTH AMERICA: MICROPHONE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Growing adoption of smart home appliances and security & surveillance systems to drive market

- 11.2.3 CANADA

- 11.2.3.1 Increasing adoption of telemedicine and remote patient consultation services to boost demand for microphones

- 11.2.4 MEXICO

- 11.2.4.1 Rising demand for microphones in industrial automation applications to drive market

- 11.3 EUROPE

- FIGURE 38 EUROPE: MICROPHONE MARKET SNAPSHOT

- 11.3.1 RECESSION IMPACT ON MARKET IN EUROPE

- TABLE 121 EUROPE: MICROPHONE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 122 EUROPE: MICROPHONE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 123 EUROPE: MICROPHONE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 124 EUROPE: MICROPHONE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Increasing adoption of digital media to boost demand for microphones

- 11.3.3 GERMANY

- 11.3.3.1 Growing focus on adding advanced features to vehicles and in-car systems to support market growth

- 11.3.4 FRANCE

- 11.3.4.1 Increasing investments in industrial automation to create opportunities for microphone providers

- 11.3.5 REST OF EUROPE

- 11.4 ASIA PACIFIC

- FIGURE 39 ASIA PACIFIC: MICROPHONE MARKET SNAPSHOT

- 11.4.1 RECESSION IMPACT ON MARKET IN ASIA PACIFIC

- TABLE 125 ASIA PACIFIC: MICROPHONE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MICROPHONE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: MICROPHONE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 128 ASIA PACIFIC: MICROPHONE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Thriving gaming and AR/VR industry to support market growth

- 11.4.3 JAPAN

- 11.4.3.1 Growing adoption of telemedicine and remote patient monitoring solutions to drive market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Vibrant broadcasting and entertainment industry to support market growth

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 RECESSION IMPACT ON MARKET IN ROW

- TABLE 129 ROW: MICROPHONE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 130 ROW: MICROPHONE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 131 ROW: MICROPHONE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 132 ROW: MICROPHONE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Increasing number of mobile subscriptions to boost demand for microphones

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Rising popularity of digital content creation to support market growth

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY MAJOR PLAYERS IN MICROPHONE MARKET

- TABLE 133 OVERVIEW OF STRATEGIES ADOPTED BY COMPANIES IN MICROPHONE MARKET

- 12.3 THREE-YEAR COMPANY REVENUE ANALYSIS

- FIGURE 40 THREE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MICROPHONE MARKET, 2020-2022

- 12.4 MARKET SHARE ANALYSIS, 2022

- FIGURE 41 SHARE OF MAJOR PLAYERS IN MICROPHONE MARKET, 2022

- TABLE 134 MICROPHONE MARKET: DEGREE OF COMPETITION

- 12.5 EVALUATION MATRIX FOR KEY COMPANIES

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 42 MICROPHONE MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- 12.6 EVALUATION MATRIX FOR STARTUPS/SMES

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 43 MICROPHONE MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- 12.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 135 COMPANY PRODUCT FOOTPRINT

- TABLE 136 COMPANY TECHNOLOGY FOOTPRINT

- TABLE 137 COMPANY COMMUNICATION TECHNOLOGY FOOTPRINT

- TABLE 138 COMPANY APPLICATION FOOTPRINT

- TABLE 139 COMPANY REGION FOOTPRINT

- 12.8 STARTUPS/SMES EVALUATION MATRIX

- 12.8.1 STARTUPS/SMES MATRIX: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 140 STARTUPS/SMES MATRIX: DETAILS ABOUT KEY STARTUPS

- 12.8.2 STARTUPS/SMES PRODUCT FOOTPRINT ANALYSIS

- TABLE 141 STARTUP PRODUCT FOOTPRINT

- TABLE 142 STARTUP TECHNOLOGY FOOTPRINT

- TABLE 143 STARTUP COMMUNICATION TECHNOLOGY FOOTPRINT

- TABLE 144 STARTUP APPLICATION FOOTPRINT

- TABLE 145 STARTUP REGION FOOTPRINT

- 12.9 STRATEGIES ADOPTED BY COMPANIES IN MICROPHONE MARKET

- 12.9.1 PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 146 MICROPHONE MARKET: TOP PRODUCT LAUNCHES AND DEVELOPMENTS, APRIL 2020 TO FEBRUARY 2023

- 12.9.2 DEALS AND OTHER DEVELOPMENTS

- TABLE 147 MICROPHONE MARKET: TOP DEALS AND OTHER DEVELOPMENTS, AUGUST 2021 TO JUNE 2023

13 COMPANY PROFILES

- (Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1 KEY PLAYERS

- 13.1.1 KNOWLES ELECTRONICS LLC

- TABLE 148 KNOWLES ELECTRONICS LLC: COMPANY OVERVIEW

- FIGURE 44 KNOWLES ELECTRONICS LLC: COMPANY SNAPSHOT

- TABLE 149 KNOWLES ELECTRONICS LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 150 KNOWLES ELECTRONICS LLC: PRODUCT LAUNCHES

- TABLE 151 KNOWLES ELECTRONICS LLC: DEALS

- 13.1.2 GOERTEK

- TABLE 152 GOERTEK: COMPANY OVERVIEW

- FIGURE 45 GOERTEK: COMPANY SNAPSHOT

- TABLE 153 GOERTEK: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.3 AAC TECHNOLOGIES

- TABLE 154 AAC TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 46 AAC TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 155 AAC TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 156 AAC TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 157 AAC TECHNOLOGIES: DEALS

- 13.1.4 TDK CORPORATION

- TABLE 158 TDK CORPORATION: COMPANY OVERVIEW

- FIGURE 47 TDK CORPORATION: COMPANY SNAPSHOT

- TABLE 159 TDK CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 160 TDK CORPORATION: PRODUCT LAUNCHES

- TABLE 161 TDK CORPORATION: DEALS

- 13.1.5 INFINEON TECHNOLOGIES AG

- TABLE 162 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- FIGURE 48 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- TABLE 163 INFINEON TECHNOLOGIES AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 164 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 165 INFINEON TECHNOLOGIES AG: DEALS

- 13.1.6 STMICROELECTRONICS

- TABLE 166 STMICROELECTRONICS: COMPANY OVERVIEW

- FIGURE 49 STMICROELECTRONICS: COMPANY SNAPSHOT

- TABLE 167 STMICROELECTRONICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.7 ZILLTEK TECHNOLOGY

- TABLE 168 ZILLTEK TECHNOLOGY: COMPANY OVERVIEW

- FIGURE 50 ZILLTEK TECHNOLOGY: COMPANY SNAPSHOT

- TABLE 169 ZILLTEK TECHNOLOGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 170 ZILLTEK TECHNOLOGY: PRODUCT LAUNCHES

- 13.1.8 HOSIDEN CORPORATION

- TABLE 171 HOSIDEN CORPORATION: COMPANY OVERVIEW

- FIGURE 51 HOSIDEN CORPORATION: COMPANY SNAPSHOT

- TABLE 172 HOSIDEN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 173 HOSIDEN CORPORATION: PRODUCT LAUNCHES

- 13.1.9 SONION

- TABLE 174 SONION: COMPANY OVERVIEW

- TABLE 175 SONION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.10 CUI DEVICES

- TABLE 176 CUI DEVICES: COMPANY OVERVIEW

- TABLE 177 CUI DEVICES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 178 CUI DEVICES: PRODUCT LAUNCHES

- TABLE 179 CUI DEVICES: DEALS

- 13.2 OTHER COMPANIES

- 13.2.1 SHANDONG GETTOP ACOUSTIC CO., LTD.

- 13.2.2 BSE CO. LTD.

- 13.2.3 SUZHOU MINXIN MICROELECTRONICS TECHNOLOGY CO., LTD.

- 13.2.4 VESPER TECHNOLOGIES, INC.

- 13.2.5 SENSIBEL

- 13.2.6 PUI AUDIO

- 13.2.7 KINGSTATE ELECTRONICS CORPORATION

- 13.2.8 HARMONY ELECTRONICS CORPORATION

- 13.2.9 DB UNLIMITED

- 13.2.10 PARTRON

- 13.2.11 STETRON

- 13.2.12 ARIOSE ELECTRONICS CO., LTD.

- 13.2.13 OMRON CORPORATION

- 13.2.14 SANICO ELECTRONICS CO., LTD.

- 13.2.15 JLI ELECTRONICS

- *Details on Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS