|

|

市場調査レポート

商品コード

1103432

骨密度計の世界市場:タイプ別(DEXA、末梢)、用途別(骨減少症・骨粗鬆症、嚢胞性線維症、CKD、体組成測定、関節リウマチ)、エンドユーザー別、地域別 - 2027年までの予測Bone Densitometer Market by Type (DEXA, Peripheral), Application (Osteopenia & Osteoporosis, Cystic Fibrosis, CKD, Body Composition Measurement, Rheumatoid Arthritis), End User (Hospitals & Specialty Clinics, Diagnostic Centres) -Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 骨密度計の世界市場:タイプ別(DEXA、末梢)、用途別(骨減少症・骨粗鬆症、嚢胞性線維症、CKD、体組成測定、関節リウマチ)、エンドユーザー別、地域別 - 2027年までの予測 |

|

出版日: 2022年07月14日

発行: MarketsandMarkets

ページ情報: 英文 148 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

骨密度計は、骨に含まれるカルシウムなどのミネラルの量を測定するための装置です。

主に骨減少症や骨粗鬆症など、骨密度が低くなる疾患の検出に使用されます。世界の骨密度計の市場規模は、2022年の2億9,900万米ドルから2027年までに3億7,800万米ドルに達し、予測期間中のCAGRで4.7%の成長が予測されています。

"骨密度計市場は軸骨密度測定セグメントが最大シェアを占める見込み"

軸骨密度計は、臨床医の様々な要件を満たしており、これが市場成長の主な要因となっています。これらの機器は、主に診断手順で正確な結果を得るために不可欠な中央二重エネルギーX線吸収測定法ベースのツールを含んでいます。

"骨粗鬆症・骨減少症診断セグメントが骨密度計市場で最大のシェアを占めると予想される"

2021年の世界の骨密度計市場では、骨粗鬆症・骨減少症診断セグメントが最大のシェアを占めています。骨粗鬆症を患う老年人口が多いこと、更年期女性における骨粗鬆症のリスクが高まっていることが、セグメントの成長を促す主な要因となっています。

"病院・専門クリニックセグメントが骨密度計市場で最大シェアを占める見込み"

2021年の世界の骨密度計市場では、病院・専門クリニックセグメントが最大のシェアを占めています。病院は高価な機器を購入する経済力があり、骨密度計を効果的に使用できる訓練を受けた専門家がいます。また、専門クリニックでは、骨粗鬆症や骨減少症などの様々な病状診断や、体格測定に骨密度計を使用しています。

"アジア太平洋市場は予測期間中に最も高い成長を遂げる"

アジア太平洋市場は、予測期間中に最も高いCAGRで成長すると推定されます。アジア諸国(特に中国とインド)は、主に老年人口の増加、骨粗鬆症の発生率の増加、医療費の増加、それぞれの医療制度における病院や診療所の数の増加により、予測期間中に市場参加者に大きな成長機会を提供すると予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場促進要因

- 市場抑制要因

- 市場機会

- 市場課題

- 骨密度計市場の経済シナリオに対するCOVID-19の影響の評価

第6章 骨密度計市場:タイプ別

- イントロダクション

- 軸骨密度測定

- 末梢骨密度測定

第7章 骨密度計市場:用途別

- イントロダクション

- 骨粗鬆症・骨減少症診断

- 嚢胞性線維症診断

- 慢性腎臓病診断

- 体組成測定

- 関節リウマチ診断

第8章 骨密度計市場:エンドユーザー別

- イントロダクション

- 病院・専門クリニック

- 診断・画像センター

- その他

第9章 骨密度計市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- アジア太平洋

- 日本

- 中国

- インド

- その他

- ラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- イントロダクション

- 競合リーダーシップマッピング

- 骨密度計市場:地理的評価

- 市場シェア分析

- 競合状況と動向

第11章 企業プロファイル

- 主要企業

- GE HEALTHCARE

- HOLOGIC, INC.

- OSI SYSTEMS, INC.

- DIAGNOSTIC MEDICAL SYSTEMS GROUP

- SWISSRAY GLOBAL HEALTHCARE HOLDING, LTD.

- BEAMMED, LTD.

- ECHOLIGHT S.P.A

- SCANFLEX HEALTHCARE AB

- MEDONICA CO., LTD.

- EUROTEC MEDICAL SYSTEMS S.R.L.

- その他の企業

- AMPALL CO., LTD.

- L'ACN L'ACCESSORIO NUCLEARE S.R.L

- SHENZHEN XRAY ELECTRIC CO., LTD.

- YOZMA BMTECH CO., LTD.

- NANOOMTECH CO., LTD.

- OSTEOSYS CORPORATION

- FURUNO ELECTRIC CO., LTD.

- XIANYANG KANROTA DIGITAL ULTRASOUND SYSTEM, CO., LTD.

- XINGAOYI CO., LTD.

- ANJUE MEDICAL EQUIPMENT CO., LTD.

- GUANGZHOU MEDSINGLONG MEDICAL EQUIPMENT CO., LTD.

- TRIVITRON HEALTHCARE

- OSCARE MEDICAL OY

- CYBERLOGIC, INC.

- NANJING KEJIN INDUSTRIAL CO., LTD.

第12章 付録

Bone densitometers are used to measure the amount of calcium and other minerals in the bones. They are used primarily to detect osteopenia or osteoporosis, diseases in which the bone mineral density is low. The global bone densitometer market is projected to reach USD 378 million by 2027 from USD 299 million in 2022, at a CAGR of 4.7% during the forecast period.

"The axial bone densitometry segment is expected to account for the largest share of the bone densitometer market"

Axial bone densitometers fulfill various requirements of clinicians, which is a major factor driving market growth. These instruments predominantly include central dual-energy X-ray absorptiometry-based tools that are imperative to obtain accurate results in diagnostic procedures.

"The the osteoporosis & osteopenia diagnosis segment is expected to account for the largest share of the bone densitometer market"

The osteoporosis & osteopenia diagnosis segment accounted for the largest share of the global bone densitometer market in 2021. Large geriatric population suffering from osteoporosis and increasing risk of osteoporosis in menopausal women are the key factors driving the segment growth.

"The hospitals & specialty clinics segment is expected to account for the largest share of the bone densitometer market"

The hospitals & specialty clinics segment accounted for the largest share of the global bone densitometer market in 2021. Hospitals have the financial capacity to purchase expensive equipment and have trained professionals who can effectively use bone densitometers. Specialty clinics also use bone densitometers to diagnose various medical conditions, such as osteoporosis and osteopenia, as well as for body mass measurement.

"Asia Pacific market to witness the highest growth during the forecast period"

The APAC market is estimated to grow at the highest CAGR during the forecast period. Asian countries (particularly China and India) are expected to offer significant growth opportunities for market players during the forecast period, primarily due to the rising geriatric population, increasing incidence of osteoporosis, increasing healthcare expenditure, and the growing number of hospitals and clinics in their respective healthcare systems.

A breakdown of the primary participants for the bone densitometer market referred to for this report is provided below:

- By Company Type: Tier 1-33%, Tier 2-45%, and Tier 3-22%

- By Designation: C-level-31%, Director Level-37%, and Others-22%

- By Region: North America-35%, Europe-30%, Asia Pacific-15%, Latin America- 10%, Middle East & Africa-10%

The prominent players in the bone densitometer market include GE Healthcare (US), Hologic, Inc. (US), OSI Systems, Inc. (US), Diagnostic Medical Systems Group (France), Swissray Global Healthcare Holding, Ltd. (Taiwan), BeamMed, Ltd. (Israel), Echolight S.P.A (Italy), Scanflex Healthcare AB (Sweden), Medonica Co., Ltd. (South Korea), Eurotec Systems S.r.l (Italy), AMPall Co., Ltd. (South Korea), L'acn L'accessorio Nucleare S.R.L (Italy), Shenzhen XRAY Electric Co., Ltd. (China), YOZMA BMTech Co., Ltd. (South Korea), Nanoomtech Co., Ltd. (South Korea), Osteosys Corporation (South Korea), FURUNO Electric Co., Ltd. (Japan), Xianyang Kanrota Digital Ultrasound System, Co., Ltd. (China), XinGaoYi Co., Ltd. (China), Anjue Medical Equipment (China), Guangzhou Medsinglong Medical Equipment Co., Ltd. (China), Trivitron Healthcare (India), OsCare Medical Oy (Finland), CyberLogic, Inc. (US), and Nanjing Kejin Industrial Co., Ltd. (China).

Research Coverage:

The report analyzes the market for various bone densitometer and their adoption pattern. It aims at estimating the market size and future growth potential of the global bone densitometer market and different segments such as technology, application, end user, and region. The report also includes an in-depth competitive analysis of the key players in this market along with their company profiles, product & service offerings, and recent developments.

Reasons to Buy the Report

The report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share. Firms purchasing the report could use one or any combination of the below-mentioned five strategies for strengthening their market presence.

This report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the global bone densitometer market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product or service launches in the global bone densitometer market

- Market Development: Comprehensive information on the lucrative emerging regions by type, application, end user, and region

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the global bone densitometer market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, revenue analysis, and products & services of leading players in the global bone densitometer market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.2.1 MARKETS COVERED

- 1.2.2 YEARS CONSIDERED

- 1.3 CURRENCY

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 2 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary sources

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: COMPANY-WISE REVENUE SHARE ANALYSIS (2021)

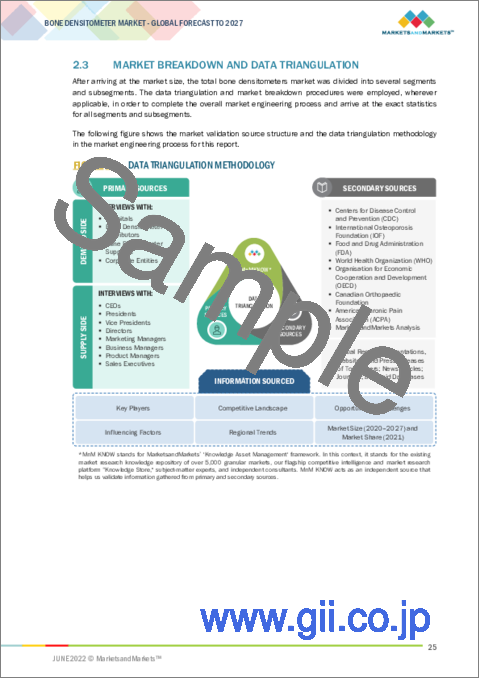

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ESTIMATION

- 2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 BONE DENSITOMETERS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 BONE DENSITOMETERS MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 GEOGRAPHICAL SNAPSHOT OF THE BONE DENSITOMETERS MARKET

4 PREMIUM INSIGHTS

- 4.1 BONE DENSITOMETERS MARKET OVERVIEW

- FIGURE 12 INCREASING PREVALENCE OF OSTEOPOROSIS TO DRIVE THE MARKET FOR BONE DENSITOMETERS

- 4.2 ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY APPLICATION AND COUNTRY (2021)

- FIGURE 13 OSTEOPOROSIS & OSTEOPENIA DIAGNOSIS SEGMENT DOMINATED THE ASIA PACIFIC BONE DENSITOMETERS MARKET IN 2021

- 4.3 BONE DENSITOMETERS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 14 CHINA TO WITNESS THE HIGHEST GROWTH IN THE BONE DENSITOMETERS MARKET FROM 2022 TO 2027

- 4.4 REGIONAL MIX: BONE DENSITOMETERS MARKET (2022-2027)

- FIGURE 15 ASIA PACIFIC TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD (2022-2027)

- 4.5 BONE DENSITOMETERS MARKET: DEVELOPED VS. DEVELOPING COUNTRIES

- FIGURE 16 DEVELOPING COUNTRIES TO REGISTER HIGHER GROWTH RATES DURING THE FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 17 BONE DENSITOMETERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2 MARKET DRIVERS

- 5.2.1 RISING INCIDENCE OF OSTEOPOROSIS

- 5.2.2 GROWING GERIATRIC POPULATION

- 5.2.3 RISING PREVALENCE OF KIDNEY DISEASE

- 5.3 MARKET RESTRAINTS

- 5.3.1 HIGH COST OF BONE DENSITOMETERS

- 5.4 MARKET OPPORTUNITIES

- 5.4.1 GROWTH OPPORTUNITIES IN EMERGING MARKETS

- TABLE 1 EMERGING COUNTRIES: HEALTHCARE EXPENDITURE (% OF GDP), 2015 VS. 2019

- 5.5 MARKET CHALLENGES

- 5.5.1 LACK OF ACCESS TO DIAGNOSTICS

- 5.5.2 UNFAVORABLE REIMBURSEMENT SCENARIO

- 5.5.3 HOSPITAL BUDGET CUTS

- 5.6 ASSESSMENT OF COVID-19 IMPACT ON THE ECONOMIC SCENARIO OF THE BONE DENSITOMETERS MARKET

6 BONE DENSITOMETERS MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- TABLE 2 BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 6.2 AXIAL BONE DENSITOMETRY

- TABLE 3 AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 4 AXIAL BONE DENSITOMETRY MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.2.1 DUAL-ENERGY X-RAY ABSORPTIOMETRY (DEXA)

- 6.2.1.1 Several advantages of DEXA scanners to drive growth in this market segment

- TABLE 5 DUAL-ENERGY X-RAY ABSORPTIOMETRY MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.2.2 QUANTITATIVE COMPUTED TOMOGRAPHY (QCT)

- 6.2.2.1 Several drawbacks of QCT scanners, including relatively high radiation exposure and a higher precision error than that of DEXA, to limit market growth

- TABLE 6 QUANTITATIVE COMPUTED TOMOGRAPHY MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3 PERIPHERAL BONE DENSITOMETRY

- TABLE 7 PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 8 PERIPHERAL BONE DENSITOMETRY MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3.1 QUANTITATIVE ULTRASOUND (QUS)

- 6.3.1.1 Quantitative ultrasound scanners offer advantages such as low exposure to radiation and non-invasive measurement-key factors driving market growth

- TABLE 9 QUANTITATIVE ULTRASOUND MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3.2 RADIOGRAPHIC ABSORPTIOMETRY (RA)

- 6.3.2.1 Technical limitations associated with RA devices to limit market growth

- TABLE 10 RADIOGRAPHIC ABSORPTIOMETRY MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3.3 OTHER PERIPHERAL BONE DENSITOMETRY TECHNOLOGIES

- TABLE 11 OTHER PERIPHERAL BONE DENSITOMETRY TECHNOLOGIES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

7 BONE DENSITOMETERS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 12 BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

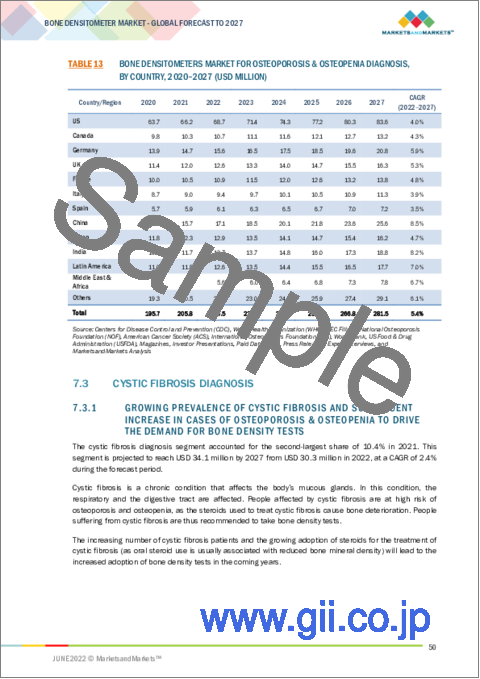

- 7.2 OSTEOPOROSIS & OSTEOPENIA DIAGNOSIS

- 7.2.1 LARGE GERIATRIC POPULATION SUFFERING FROM OSTEOPOROSIS AND INCREASING RISK OF OSTEOPOROSIS IN MENOPAUSAL WOMEN-KEY FACTORS DRIVING GROWTH

- TABLE 13 BONE DENSITOMETERS MARKET FOR OSTEOPOROSIS & OSTEOPENIA DIAGNOSIS, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3 CYSTIC FIBROSIS DIAGNOSIS

- 7.3.1 GROWING PREVALENCE OF CYSTIC FIBROSIS AND SUBSEQUENT INCREASE IN CASES OF OSTEOPOROSIS & OSTEOPENIA TO DRIVE THE DEMAND FOR BONE DENSITY TESTS

- TABLE 14 BONE DENSITOMETERS MARKET FOR CYSTIC FIBROSIS DIAGNOSIS, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.4 CHRONIC KIDNEY DISEASE DIAGNOSIS

- 7.4.1 GROWING PREVALENCE OF CHRONIC KIDNEY DISEASES TO INCREASE THE DEMAND FOR BONE DENSITOMETRY TESTS

- TABLE 15 BONE DENSITOMETERS MARKET FOR CHRONIC KIDNEY DISEASE DIAGNOSIS, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.5 BODY COMPOSITION MEASUREMENT

- 7.5.1 GROWING FOCUS ON ATHLETE PERFORMANCE TO SUPPORT MARKET GROWTH

- TABLE 16 BONE DENSITOMETERS MARKET FOR BODY COMPOSITION MEASUREMENT, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.6 RHEUMATOID ARTHRITIS DIAGNOSIS

- 7.6.1 HIGH RISK OF OSTEOPOROSIS AND OSTEOPOROTIC FRACTURES ASSOCIATED WITH RHEUMATOID ARTHRITIS TO FUEL THE NEED FOR BONE DENSITOMETERS

- TABLE 17 BONE DENSITOMETERS MARKET FOR RHEUMATOID ARTHRITIS DIAGNOSIS, BY COUNTRY, 2020-2027 (USD MILLION)

8 BONE DENSITOMETERS MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 18 BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.2 HOSPITALS & SPECIALTY CLINICS

- 8.2.1 HIGH PURCHASING CAPACITY OF HOSPITALS COMPARED TO DIAGNOSTIC AND AMBULATORY CENTERS TO DRIVE THE ADOPTION OF HIGH-COST DEXA SCANNERS AMONG HOSPITALS

- TABLE 19 BONE DENSITOMETERS MARKET FOR HOSPITALS & SPECIALTY CLINICS, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.3 DIAGNOSTIC & IMAGING CENTERS

- 8.3.1 HIGH COST OF BONE DENSITOMETERS AND CONTINUOUS REIMBURSEMENT CUTS IN OUTPATIENT DIAGNOSTIC IMAGING TO LIMIT GROWTH IN THIS END-USER SEGMENT

- TABLE 20 BONE DENSITOMETERS MARKET FOR DIAGNOSTIC & IMAGING CENTERS, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.4 OTHER END USERS

- TABLE 21 BONE DENSITOMETERS MARKET FOR OTHER END USERS, BY COUNTRY, 2020-2027 (USD MILLION)

9 BONE DENSITOMETERS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 18 BONE DENSITOMETERS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- TABLE 22 BONE DENSITOMETERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 23 BONE DENSITOMETERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 19 NORTH AMERICA: BONE DENSITOMETERS MARKET SNAPSHOT

- TABLE 24 NORTH AMERICA: BONE DENSITOMETERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 25 NORTH AMERICA: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 26 NORTH AMERICA: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 27 NORTH AMERICA: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 28 NORTH AMERICA: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 29 NORTH AMERICA: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Favorable reimbursement scenario in the US to drive market growth

- TABLE 30 US: KEY MACROINDICATORS

- TABLE 31 US: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 32 US: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 33 US: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 34 US: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 35 US: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Growing geriatric population in Canada to support market growth

- TABLE 36 CANADA: KEY MACROINDICATORS

- TABLE 37 CANADA: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 38 CANADA: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 39 CANADA: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 40 CANADA: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 41 CANADA: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3 EUROPE

- TABLE 42 EUROPE: BONE DENSITOMETERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 43 EUROPE: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 44 EUROPE: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 45 EUROPE: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 46 EUROPE: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 47 EUROPE: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Growing prevalence of osteoporosis in Germany to fuel the demand for bone densitometers in the country

- TABLE 48 GERMANY: KEY MACROINDICATORS

- TABLE 49 GERMANY: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 50 GERMANY: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 51 GERMANY: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 52 GERMANY: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 53 GERMANY: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.2 FRANCE

- 9.3.2.1 Increasing healthcare expenditure in France to boost the adoption of bone densitometers

- TABLE 54 FRANCE: KEY MACROINDICATORS

- TABLE 55 FRANCE: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 56 FRANCE: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 57 FRANCE: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 58 FRANCE: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 59 FRANCE: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Increasing number of fragility fracture cases to drive growth in the UK bone densitometers market

- TABLE 60 UK: KEY MACROINDICATORS

- TABLE 61 UK: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 62 UK: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 63 UK: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 64 UK: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 65 UK: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Large geriatric population in the country and subsequent increase in the prevalence of age-related chronic conditions to fuel growth in the market

- TABLE 66 ITALY: KEY MACROINDICATORS

- TABLE 67 ITALY: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 68 ITALY: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 69 ITALY: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 70 ITALY: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 71 ITALY: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Improved monitoring of fragility fractures and their management through national registries to propel the market for bone densitometers in Spain

- TABLE 72 SPAIN: KEY MACROINDICATORS

- TABLE 73 SPAIN: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 74 SPAIN: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 75 SPAIN: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 76 SPAIN: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 77 SPAIN: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 78 REST OF EUROPE: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 79 REST OF EUROPE: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 80 REST OF EUROPE: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 81 REST OF EUROPE: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 82 REST OF EUROPE: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 20 ASIA PACIFIC: BONE DENSITOMETERS MARKET SNAPSHOT

- TABLE 83 ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 84 ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 85 ASIA PACIFIC: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 86 ASIA PACIFIC: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 87 ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 88 ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.1 JAPAN

- 9.4.1.1 Large geriatric population in Japan to fuel the demand for bone densitometers

- TABLE 89 JAPAN: KEY MACROINDICATORS

- TABLE 90 JAPAN: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 91 JAPAN: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 92 JAPAN: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 93 JAPAN: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 94 JAPAN: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Increasing incidence of fractures due to osteoporosis to support market growth

- TABLE 95 CHINA: KEY MACROINDICATORS

- TABLE 96 CHINA: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 97 CHINA: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 98 CHINA: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 99 CHINA: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 100 CHINA: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 Rising osteoporosis & osteoarthritis rates to support the demand for bone densitometers in India

- TABLE 101 INDIA: KEY MACROINDICATORS

- TABLE 102 INDIA: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 103 INDIA: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 104 INDIA: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 105 INDIA: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 106 INDIA: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.4 REST OF ASIA PACIFIC

- TABLE 107 REST OF ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.5 LATIN AMERICA

- 9.5.1 EFFORTS TO CLOSE THE CARE GAP AND INCREASE HEALTHCARE ACCESSIBILITY TO SUPPORT MARKET GROWTH IN LATIN AMERICA

- TABLE 112 LATIN AMERICA: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 113 LATIN AMERICA: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 114 LATIN AMERICA: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 115 LATIN AMERICA: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 116 LATIN AMERICA: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 POLITICAL INSTABILITY IN THE MIDDLE EAST & AFRICA TO HINDER MARKET GROWTH

- TABLE 117 MIDDLE EAST & NORTH AFRICA: NUMBER OF HIP FRACTURES, 2010 VS. 2020

- TABLE 118 MIDDLE EAST & AFRICA: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: BONE DENSITOMETERS MARKET, BY END USER, 2020-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 COMPETITIVE LEADERSHIP MAPPING

- 10.2.1 STARS

- 10.2.2 EMERGING LEADERS

- 10.2.3 PERVASIVE PLAYERS

- 10.2.4 PARTICIPANTS

- FIGURE 21 BONE DENSITOMETERS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.3 BONE DENSITOMETERS MARKET: GEOGRAPHICAL ASSESSMENT

- FIGURE 22 GEOGRAPHIC ASSESSMENT OF KEY PLAYERS IN THE BONE DENSITOMETERS MARKET (2021)

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 23 BONE DENSITOMETERS MARKET SHARE, BY KEY PLAYER, 2021

- 10.5 COMPETITIVE SITUATION AND TRENDS

- 10.5.1 DEALS (2019-2022)

- 10.5.2 OTHER DEVELOPMENTS (2021)

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1.1 GE HEALTHCARE

- TABLE 123 GE HEALTHCARE: BUSINESS OVERVIEW

- FIGURE 24 GE HEALTHCARE: COMPANY SNAPSHOT (2021)

- 11.1.2 HOLOGIC, INC.

- TABLE 124 HOLOGIC, INC.: BUSINESS OVERVIEW

- FIGURE 25 HOLOGIC, INC.: COMPANY SNAPSHOT (2021)

- 11.1.3 OSI SYSTEMS, INC.

- TABLE 125 OSI SYSTEMS, INC.: BUSINESS OVERVIEW

- FIGURE 26 OSI SYSTEMS, INC.: COMPANY SNAPSHOT (2021)

- 11.1.4 DIAGNOSTIC MEDICAL SYSTEMS GROUP

- TABLE 126 DIAGNOSTIC MEDICAL SYSTEMS GROUP: BUSINESS OVERVIEW

- 11.1.5 SWISSRAY GLOBAL HEALTHCARE HOLDING, LTD.

- TABLE 127 SWISSRAY GLOBAL HEALTHCARE HOLDING, LTD.: BUSINESS OVERVIEW

- 11.1.6 BEAMMED, LTD.

- TABLE 128 BEAMMED, LTD.: BUSINESS OVERVIEW

- 11.1.7 ECHOLIGHT S.P.A

- TABLE 129 ECHOLIGHT S.P.A.: BUSINESS OVERVIEW

- 11.1.8 SCANFLEX HEALTHCARE AB

- TABLE 130 SCANFLEX HEALTHCARE AB: BUSINESS OVERVIEW

- 11.1.9 MEDONICA CO., LTD.

- TABLE 131 MEDONICA CO., LTD.: BUSINESS OVERVIEW

- 11.1.10 EUROTEC MEDICAL SYSTEMS S.R.L.

- TABLE 132 EUROTEC MEDICAL SYSTEMS S.R.L.: BUSINESS OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 AMPALL CO., LTD.

- TABLE 133 AMPALL CO., LTD.: BUSINESS OVERVIEW

- 11.2.2 L'ACN L'ACCESSORIO NUCLEARE S.R.L

- TABLE 134 L'ACN L'ACCESSORIO NUCLEARE S.R.L.: BUSINESS OVERVIEW

- 11.2.3 SHENZHEN XRAY ELECTRIC CO., LTD.

- TABLE 135 SHENZHEN XRAY ELECTRIC CO., LTD.: BUSINESS OVERVIEW

- 11.2.4 YOZMA BMTECH CO., LTD.

- TABLE 136 YOZMA BMTECH CO., LTD.: BUSINESS OVERVIEW

- 11.2.5 NANOOMTECH CO., LTD.

- TABLE 137 NANOOMTECH CO., LTD.: BUSINESS OVERVIEW

- 11.2.6 OSTEOSYS CORPORATION

- TABLE 138 OSTEOSYS CORPORATION: BUSINESS OVERVIEW

- 11.2.7 FURUNO ELECTRIC CO., LTD.

- TABLE 139 FURUNO ELECTRIC CO., LTD.: BUSINESS OVERVIEW

- 11.2.8 XIANYANG KANROTA DIGITAL ULTRASOUND SYSTEM, CO., LTD.

- TABLE 140 XIANYANG KANROTA DIGITAL ULTRASOUND SYSTEM, CO., LTD.: BUSINESS OVERVIEW

- 11.2.9 XINGAOYI CO., LTD.

- TABLE 141 XINGAOYI CO., LTD.: BUSINESS OVERVIEW

- 11.2.10 ANJUE MEDICAL EQUIPMENT CO., LTD.

- TABLE 142 ANJUE MEDICAL EQUIPMENT CO., LTD.: BUSINESS OVERVIEW

- 11.2.11 GUANGZHOU MEDSINGLONG MEDICAL EQUIPMENT CO., LTD.

- TABLE 143 GUANGZHOU MEDSINGLONG MEDICAL EQUIPMENT CO., LTD.: BUSINESS OVERVIEW

- 11.2.12 TRIVITRON HEALTHCARE

- TABLE 144 TRIVITRON HEALTHCARE: BUSINESS OVERVIEW

- 11.2.13 OSCARE MEDICAL OY

- TABLE 145 OSCARE MEDICAL OY: BUSINESS OVERVIEW

- 11.2.14 CYBERLOGIC, INC.

- TABLE 146 CYBERLOGIC, INC.: BUSINESS OVERVIEW

- 11.2.15 NANJING KEJIN INDUSTRIAL CO., LTD.

- TABLE 147 NANJING KEJIN INDUSTRIAL CO., LTD.: BUSINESS OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 AVAILABLE CUSTOMIZATIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS