|

|

市場調査レポート

商品コード

1100551

患者体温モニタリング市場:製品(ウェアラブル、デジタル、スマート、連続、赤外線)、部位(腋窩、口腔、鼓膜、侵襲)、用途(発熱、麻酔、低体温)、エンドユーザー(病院、在宅医療、ASC)別-2027年までの世界予測Patient Temperature Monitoring Market by Product (Wearable, Digital, Smart, Continuous, Infrared), Site (Axillary, Oral,Tympanic, Invasive), Application (Fever, Anesthesia, Hypothermia), End User (Hospitals, Home Care, ASCs) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 患者体温モニタリング市場:製品(ウェアラブル、デジタル、スマート、連続、赤外線)、部位(腋窩、口腔、鼓膜、侵襲)、用途(発熱、麻酔、低体温)、エンドユーザー(病院、在宅医療、ASC)別-2027年までの世界予測 |

|

出版日: 2022年07月07日

発行: MarketsandMarkets

ページ情報: 英文 256 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の患者体温モニタリング市場は、2022年の36億米ドルから2027年には49億米ドルに達すると予測され、予測期間中のCAGRは6.4%です。

この市場の成長は、感染症の発生率の上昇、老人や小児人口の増加、高度な体温モニタリングデバイスの需要の増加などが主な要因となっています。

"患者体温モニタリング市場において、製品別ではハンドヘルド型体温モニタリングデバイス部門が最大のシェアを占める"

患者体温モニタリング市場は、ウェアラブル連続モニタリングセンサー、スマート体温モニタリングパッチ、テーブルトップ体温モニタリングデバイス、ハンドヘルド体温モニタリングデバイス、侵襲的体温モニタリングデバイスにセグメント化されています。2021年には、ハンドヘルド体温モニタリングデバイスのセグメントが患者体温モニタリング市場で最大のシェアを占めました。このセグメントの大きなシェアは、デバイスが提供する高精度、費用対効果、携帯性、使いやすさに起因するものです。

"エンドユーザー別では、病院セグメントが最大のシェアを占めている"

患者体温モニタリング市場は、病院、看護施設、在宅ケア環境、外来ケアセンター、その他のエンドユーザーに区分されています。2021年には、病院が患者体温モニタリング市場の最大のエンドユーザーとなると推定されます。このセグメントの大きなシェアは、感染症やウイルスの高い有病率や増加、非侵襲的なモニタリングへの熱意の高まりに起因していると考えられます。

"アジア太平洋地域:患者体温モニタリング市場が最も成長している地域"

世界の患者体温モニタリング市場は、北米、欧州、アジア太平洋地域、ラテンアメリカ、中東・アフリカに区分されます。アジア太平洋地域は、予測期間中に最も高いCAGRを記録すると予測されています。美容整形手術の需要拡大、人口の増加、献血・輸血事例の増加などの要因が、アジア太平洋地域の市場成長を促進しています。

本レポートのために実施した主なインタビューは以下のように分類されます。

- 企業タイプ別:Tier 1-40%, Tier 2-30%, and Tier 3-30%

- 役職別:C-level-27%, D-level-18%, and Others-55%

- 地域別:North America-51%, Europe-21%, Asia Pacific-18%, Latin America-6% , and the Middle East & Africa-4%

レポートでプロファイリングした企業プロファイルの一覧です。

- カーディナル・ヘルス社(米国)

- 3M(米国)

- Koninklijke Philips N.V.(オランダ)

- ドラッガーヴェルク(ドイツ)

- ヒルロムホールディングス(米国)

- ベクトン・ディッキンソンアンドカンパニー(米国)

- オムロンヘルスケア株式会社(日本)

- マシモコーポレーション(米国)

- ブラウンGmbH(ドイツ)

- テルモ株式会社(日本)

- ポールハルトマンAG(ドイツ)

- ベーラーGmbH(ドイツ)

- マイクロライフ(台湾)

- オメガエンジニアリング(米国)

- iHealth(米国)

- ブリッグスヘルスケア(米国)

- DeltaTrak Inc.(米国)

- Exergen Corporation(米国)

- メディサナGmbH(ドイツ)

- ジェラザムメディカルAg(ドイツ)

- 米国ン・ダイアグノスティック・コーポレーション(米国)

- ヌレカ(インド)

- A&Dメディカル(米国)

- Actherm, Inc.(中国)

- Cosinuss GmbH(ドイツ)

- Vandelay(SFT Technologies India Pvt Ltd)(インド)

- キンサ(米国)

- Easytem(韓国)

- ヒックスサーモメーターズインディアリミテッド(インド)

- Sanomedics, Inc.(米国)。

調査対象。

本レポートは、世界の患者体温モニタリング市場の詳細な情報を提供します。製品、部位、用途、エンドユーザー、地域など、さまざまなセグメントにおける市場規模と今後の成長可能性を推計することを目的としています。また、主要な市場プレイヤーの企業プロファイル、最近の発展、主要な市場戦略とともに、詳細な競合分析も掲載しています。

レポート購入の主なメリット

本レポートは、患者体温モニタリング市場全体とそのサブセグメントに関する収益数の最も近い概算を提供することで、市場リーダー/新規参入者を支援します。また、利害関係者が競合情勢をより良く理解し、自社のビジネスをより良く位置づけ、適切な市場参入戦略を立てるためのより多くの洞察を得るのに役立ちます。本レポートは、利害関係者が市場の脈動を理解し、主要な市場促進要因・阻害要因・機会・課題に関する情報を提供することを可能にします。

目次

第1章 イントロダクション

- 調査目的

- 市場の定義

- 包含と除外

- マーケットスコープ

- 対象となる市場

- 考慮される年

- 通貨

- 制限

- 利害関係者

- 変更の概要

第2章 調査手法

- 調査データ

- 調査アプローチ

- 二次データ

- 二次資料からの重要なデータ

- 一次データ

- 一次情報源

- 一次資料からの主要なデータ

- 業界の重要な洞察

- 一次インタビューの内訳

- 二次データ

- 市場規模の見積もり

- ボトムアップアプローチ

- アプローチ1:会社の収益見積もりアプローチ

- アプローチ2:企業のプレゼンテーションと一次面接

- 成長予測

- CAGR予測

- トップダウンアプローチ

- ボトムアップアプローチ

- 市場の内訳とデータの三角測量

- 市場シェア

- 研究の仮定

- リスクアセスメント

- リスク評価:患者体温モニタリング市場

- 成長率の仮定

第3章 エグゼクティブサマリー

第4章 重要考察

- 患者体温モニタリング市場概要

- 患者体温モニタリング市場シェア、製品別、2022年対。 2027年

- 患者体温モニタリング市場シェア、サイト別、2022年対2027年

- 患者体温モニタリング市場シェア、用途別、2022年対2027年

- エンドユーザー別患者体温モニタリング市場シェア、2022年対。 2027年

- 患者体温モニタリング市場:地理成長機会

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 人口の増加と感染症の有病率の増加が市場の成長を促進

- 継続的な体温モニタリングに対する意識の高まり

- 連続体温モニタリング装置の需要の増加

- 外科的処置の数の増加

- 抑制要因

- 新興諸国における高度な体温モニタリング装置の高コスト

- 新興諸国における非侵襲的かつ継続的な体温モニタリングに関する認識の欠如

- 適切なサプライチェーン管理の欠如

- 市場機会

- 新興市場での成長機会の増加

- ヘルスケアインフラの開発

- 課題

- 赤外線および水銀温度計の使用に関連する問題

- 直腸温モニタリングに関する懸念

- メーカー間の激しい競合

- COVID-19が患者の体温モニタリング市場に与える影響

- 促進要因

- 価格分析

- 指標となる価格設定モデルの分析

- 特許分析

- バリューチェーン分析

- サプライチェーン分析

- 生態系マップ分析

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 代替品の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 競争の競合

- PESTLE分析

- 規制状況

- 規制機関、政府機関、およびその他の組織

- 北米

- 米国

- カナダ

- 欧州

- アジア太平洋地域

- 中国

- 日本

- インド

- ラテンアメリカ

- ブラジル

- メキシコ

- 中東

- アフリカ

- 貿易分析

- 患者体温モニタリング製品の取引分析

- テクノロジー分析

- 2022年から2023年の主要な会議とイベント

- 顧客のビジネスに影響を与える傾向/混乱

- COVID-19技術的高度な体温モニタリングにシフトするための収入源

- 主要な利害関係者と購入基準

- 購入プロセスの主要な利害関係者

- 購入基準

- ケーススタディ

- ケーススタディ1

第6章 製品別の患者体温モニタリング市場

- イントロダクション

- ウェアラブル連続モニタリングセンサー

- 需要を促進するために提供される多様な機能

- スマート体温モニタリングパッチ

- 市場の成長を促進するために提供される長期モニタリング

- テーブルトップ体温モニタリング装置

- 非侵襲的なバイタルサインモニタリングデバイス

- 市場の成長を妨げるこれらのデバイスの高コスト

- 連続コア体温モニタリング装置

- 市場の成長を促進するための心停止、頭部外傷、脳卒中の発生率の増加

- 非侵襲的なバイタルサインモニタリングデバイス

- ハンドヘルド体温モニタリング装置

- 水銀温度計

- 毒性、怪我のリスクの増加、および市場の成長を妨げる交差感染

- デジタル体温計

- 市場の成長を促進する非侵襲的かつ非外傷性の機能

- 赤外線温度計

- 表面温度に対する応答時間の短縮と患者の快適性の向上により、市場の成長を促進

- 水銀温度計

- 侵襲型体温モニタリング装置

- 市場の成長を妨げる菌血症の蔓延の増加

第7章 患者体温モニタリング市場:部位別

- イントロダクション

- 非侵襲的な体温モニタリング

- 口腔体温モニタリング

- 市場の成長を促進するための正確な温度測定

- 腋窩および側頭動脈の体温モニタリング

- 市場の成長を促進するためのアクセシビリティの容易さ

- 鼓膜体温モニタリング

- 市場の成長を促進する多目的機能

- 口腔体温モニタリング

- 侵襲型体温モニタリング装置

- 食道体温モニタリング

- 市場の成長を促進する高感度と精度

- 上咽頭体温モニタリング

- 市場の成長を妨げる鼻血と副鼻腔炎のリスクの上昇

- 膀胱体温モニタリング

- 市場での採用を制限するための膀胱または尿路感染の高コストとリスク

- 直腸体温モニタリング

- 市場の成長を促進する高精度で正確な結果

- 食道体温モニタリング

第8章 用途別患者体温モニタリング市場

- イントロダクション

- 発熱

- セグメントの成長を後押しする感染症の有病率の上昇

- 低体温症

- 市場の成長を促進するための小児人口と外科的処置の増加

- 輸血

- セグメントの成長を促進するための溶血および献血の発生率の増加

- 麻酔

- セグメントの成長を促進する悪性高熱症別死亡率の上昇

- その他の用途

第9章 エンドユーザー別患者体温モニタリング市場

- イントロダクション

- 病院

- 2021年に病院がエンドユーザー市場を支配

- 手術室

- セグメントの成長を促進するための手術中の体温モニタリングの必要性

- 緊急治療室

- セグメントの成長を促進するための即時ケアの要件の増加

- 集中治療室

- セグメントの成長を促進するための治療とモニタリングに重大な注意を払う必要のある病気の数の増加

- 在宅医療

- セグメントの成長をサポートするために長期的なケアを必要とする世界の老人人口の増加

- 看護施設

- 慢性疾患の有病率の高まりとセグメントの成長をサポートするための短期看護施設の需要

- 外来治療センター (ACS)

- セグメントの成長を促進するために、入院患者から外来患者への患者ケアの段階的なシフト

- その他のエンドユーザー

第10章 地域別の患者体温モニタリング市場

- イントロダクション

- 北米

- 米国

- 市場の成長を促進するための高齢者人口の増加と慢性疾患の発生率

- カナダ

- 市場の成長を推進するための外科手術の数の増加

- 米国

- 欧州

- ドイツ

- 市場の成長を促進する周術期ケアのための体温モニタリング装置に対する高い需要

- 英国

- 市場の成長を促進するための疾病有病率とヘルスケア費の増加

- フランス

- 強力なヘルスケア制度と老人・小児人口の増加により、セグメントの成長を推進

- イタリア

- セグメントの成長を促進する生活習慣病の発生率の上昇

- スペイン

- 市場の成長を促進するための高齢化人口の増加

- その他欧州

- ドイツ

- アジア太平洋地域

- 中国

- 大規模な人口基盤、慢性疾患の増加、および市場成長を促進するための政府の有利な支援

- 日本

- 市場の成長をサポートするための有望な償還シナリオと十分に開発されたヘルスケアシステム

- インド

- 市場の成長を促進するためのターゲット患者人口の増加

- その他アジア太平洋地域

- 中国

- ラテンアメリカ

- 市場のヘルスケアをサポートするための医療費の増加

- 中東・アフリカ

- セグメントの成長を促進するための意識向上イニシアチブの向上

第11章 競合情勢

- 概要

- キープレーヤー戦略/有力企業

- 患者体温モニタリング市場でプレーヤー別展開された戦略の概要

- トップマーケットプレーヤーの収益分配分析

- 市場シェア分析

- 患者体温モニタリング市場

- 会社評価象限

- 評価されたベンダーのリスト

- スターズ

- 新興リーダー

- パーベイシブプレイヤー

- 参加者

- 競合リーダーシップマッピング(2021年)

- プログレッシブカンパニー

- スターティングブロック

- レスポンシブ企業

- ダイナミックな企業

- 競合ベンチマーキング

- 製品と地理的なフットプリント分析

- 競合シナリオ

- 製品の発売

- 取引

第12章 企業プロファイル

- 主要企業

- CARDINAL HEALTH INC.

- 3M

- KONINKLIJKE PHILIPS N.V.

- DRAGERWERK AG & CO. KGAA

- HILL-ROM HOLDINGS, INC.

- BECTON, DICKINSON AND COMPANY

- OMRON HEALTHCARE INC.(A PART OF OMRON CORPORATION)

- MASIMO CORPORATION

- BRAUN GMBH(SUBSIDIARY OF PROCTER & GAMBLE)

- TERUMO CORPORATION

- その他の企業

- PAUL HARTMANN AG

- BEURER GMBH

- MICROLIFE

- OMEGA ENGINEERING, INC.

- IHEALTH

- BRIGGS HEALTHCARE

- DELTATRAK, INC.

- EXERGEN CORPORATION

- MEDISANA GMBH

- GERATHERM MEDICAL AG

- AMERICAN DIAGNOSTIC CORPORATION

- NURECA

- A&D MEDICAL

- ACTHERM INC.(EASYWELL BIOMEDICALS INC.)

- COSINUSS GMBH

- VANDELAY(SFT TECHNOLOGIES INDIA PVT LTD)

- KINSA

- EASYTEM CO., LTD.

- HICKS THERMOMETERS INDIA LIMITED

- SANOMEDICS, INC.

第13章 付録

The global patient temperature monitoring market is projected to reach USD 4.9 billion by 2027 from USD 3.6 billion in 2022, at a CAGR of 6.4% during the forecast period . Growth in this market is mostly driven by the rising incidence of infectious diseases coupled with increasing geriatric and pediatirc population along with growing demand for advanced temperature monitoring devices.

"Handheld temperature monitoring devices segment accounted for the largest share of the patient temperature monitoring market, by product."

The patient temperature monitoring market is segmented into wearable continuous monitoring sensors, smart temperature monitoring patches, table-top temperature monitoring devices, handheld temperature monitoring devices, and invasive temperature monitoring devices. In 2021, the handheld temperature monitoring devices segment accounted for the largest share of the patient temperature monitoring market. The large share of this segment can be attributed to the high precision, cost-effectiveness, portability, and ease-of-use offered by the devices.

"Hospitals segment accounted for the largest share in the market, by end users."

The patient temperature monitoring market has been segmented into hospitals, nursing facilities, home care settings, ambulatory care centers, and other end users. In 2021, hospitals are estimated to be the largest end users of the patient temperature monitoring market. The large share of this segment can be attributed to the high and growing prevalence of infectious diseases and viruses and growing keenness for non-invasive monitoring.

"Asia Pacific: The fastest-growing region patient temperature monitoring market."

The global patient temperature monitoring market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is projected to register the highest CAGR during the forecast period. Factors such growing demand for cosmetic surgeries, increasing population, and rising blood donations and transfusion cases are driving the growth of the market in the Asia Pacific.

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America - 6% , and the Middle East & Africa - 4%

Lists of Companies Profiled in the Report:

- Cardinal Health Inc. (US)

- 3M (US)

- Koninklijke Philips N.V. (Netherlands)

- Dragerwerk (Germany)

- Hill-Rom Holdings, Inc. (US)

- Becton, Dickinson and Company (US)

- Omron Healthcare Inc. (Japan)

- Masimo Corporation (US)

- Braun GmbH (Germany)

- Terumo Corporation (Japan)

- Paul Hartmann AG (Germany)

- Beurer GmbH (Germany)

- Microlife (Taiwan)

- Omega Engineering (US)

- iHealth (US)

- Briggs Healthcare (US)

- DeltaTrak Inc. (US)

- Exergen Corporation (US)

- Medisana GmbH (Germany)

- Geratherm Medical Ag (Germany)

- American Diagnostic Corporation (US)

- Nureca (India)

- A&D Medical (US)

- Actherm, Inc. (China)

- Cosinuss GmbH (Germany)

- Vandelay (SFT Technologies India Pvt Ltd) (India)

- Kinsa (US)

- Easytem Co., Ltd.(South Korea)

- Hicks Thermometers India Limited (India)

- Sanomedics, Inc. (US).

Research Coverage:

This report provides a detailed picture of the global patient temperature monitoring market. It aims at estimating the size and future growth potential of the market across different segments, such as product, site,application, end user, and region. The report also includes an in-depth competitive analysis of the key market players, along with their company profiles, recent developments, and key market strategies.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall patient temperature monitoring market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 PATIENT TEMPERATURE MONITORING MARKET, BY SEGMENTATION

- FIGURE 2 PATIENT TEMPERATURE MONITORING MARKET, BY REGION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH APPROACH

- FIGURE 3 PATIENT TEMPERATURE MONITORING MARKET: RESEARCH DESIGN METHODOLOGY

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Primary sources

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach 1: Company revenue estimation approach

- FIGURE 6 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- 2.3.1.2 Approach 2: Presentations of companies and primary interviews

- 2.3.1.3 Growth forecast

- 2.3.1.4 CAGR projections

- FIGURE 7 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 8 PATIENT TEMPERATURE MONITORING MARKET: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- 2.5 MARKET SHARE

- 2.6 STUDY ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- 2.7.1 RISK ASSESSMENT: PATIENT TEMPERATURE MONITORING MARKET

- 2.8 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2022 VS. 2027 (USD MILLION)

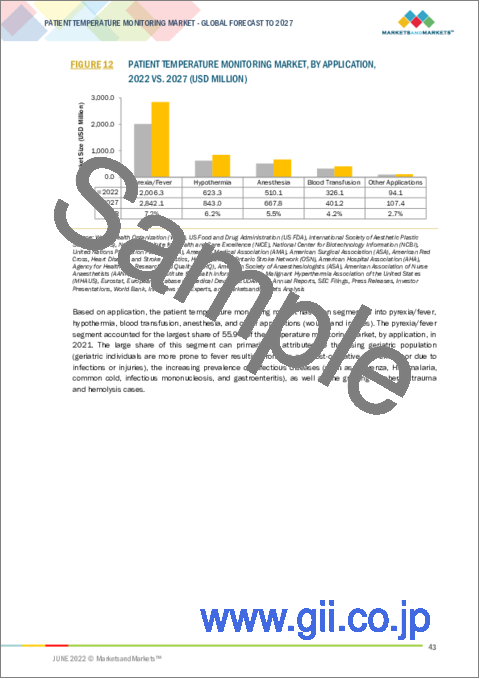

- FIGURE 12 PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 14 PATIENT TEMPERATURE MONITORING MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 PATIENT TEMPERATURE MONITORING MARKET OVERVIEW

- FIGURE 15 RISING PREVALENCE OF INFECTIOUS DISEASES AND INCREASING NUMBER OF SURGICAL PROCEDURES TO DRIVE MARKET GROWTH

- 4.2 PATIENT TEMPERATURE MONITORING MARKET SHARE, BY PRODUCT, 2022 VS. 2027

- FIGURE 16 HANDHELD TEMPERATURE MONITORING DEVICES SEGMENT TO DOMINATE MARKET IN 2027

- 4.3 PATIENT TEMPERATURE MONITORING MARKET SHARE, BY SITE, 2022 VS. 2027

- FIGURE 17 NON-INVASIVE TEMPERATURE MONITORING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 PATIENT TEMPERATURE MONITORING MARKET SHARE, BY APPLICATION, 2022 VS. 2027

- FIGURE 18 PYREXIA/FEVER SEGMENT TO DOMINATE MARKET IN 2027

- 4.5 PATIENT TEMPERATURE MONITORING MARKET SHARE, BY END USER, 2022 VS. 2027

- FIGURE 19 HOSPITALS SEGMENT TO DOMINATE MARKET IN 2027

- 4.6 PATIENT TEMPERATURE MONITORING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 20 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 PATIENT TEMPERATURE MONITORING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising population and increasing prevalence of infectious diseases to drive market growth

- 5.2.1.2 Rising awareness for continuous temperature monitoring

- 5.2.1.3 Increasing demand for continuous temperature monitoring devices

- 5.2.1.4 Increasing number of surgical procedures

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of advanced temperature monitoring devices in developing countries

- 5.2.2.2 Lack of awareness regarding non-invasive and continuous temperature monitoring in developing countries

- 5.2.2.3 Lack of proper supply chain management

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing growth opportunities in emerging markets

- 5.2.3.2 Developing healthcare infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues related to use of infrared and mercury thermometers

- 5.2.4.2 Concerns related to rectal temperature monitoring

- 5.2.4.3 Intense competition amongst manufacturers

- 5.2.5 IMPACT OF COVID-19 ON PATIENT TEMPERATURE MONITORING MARKET

- 5.3 PRICING ANALYSIS

- 5.3.1 INDICATIVE PRICING MODEL ANALYSIS

- TABLE 1 AVERAGE SELLING PRICE OF PATIENT TEMPERATURE MONITORING PRODUCTS (2022)

- 5.4 PATENT ANALYSIS

- FIGURE 22 PATENT ANALYSIS FOR PATIENT TEMPERATURE MONITORING DEVICES

- TABLE 2 LIST OF KEY PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 23 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND DISTRIBUTION PHASES

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 24 PATIENT TEMPERATURE MONITORING MARKET: SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM MAP ANALYSIS

- FIGURE 25 PATIENT TEMPERATURE MONITORING MARKET: ECOSYSTEM MAP

- TABLE 3 PATIENT TEMPERATURE MONITORING MARKET: ROLE IN ECOSYSTEM

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 PATIENT TEMPERATURE MONITORING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 BARGAINING POWER OF SUPPLIERS

- 5.8.5 DEGREE OF COMPETITION

- 5.9 PESTLE ANALYSIS

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 NORTH AMERICA

- 5.10.2.1 US

- 5.10.2.2 Canada

- 5.10.3 EUROPE

- 5.10.4 ASIA PACIFIC

- 5.10.4.1 China

- 5.10.4.2 Japan

- 5.10.4.3 India

- 5.10.5 LATIN AMERICA

- 5.10.5.1 Brazil

- 5.10.5.2 Mexico

- 5.10.6 MIDDLE EAST

- 5.10.7 AFRICA

- 5.11 TRADE ANALYSIS

- 5.11.1 TRADE ANALYSIS FOR PATIENT TEMPERATURE MONITORING PRODUCTS

- TABLE 10 IMPORT DATA FOR ARTICLES AND EQUIPMENT FOR PATIENT TEMPERATURE MONITORING PRODUCTS, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 11 EXPORT DATA FOR ARTICLES AND EQUIPMENT FOR PATIENT TEMPERATURE MONITORING PRODUCTS, BY COUNTRY, 2017-2021 (USD MILLION)

- 5.12 TECHNOLOGY ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 12 PATIENT TEMPERATURE MONITORING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.14.1 REVENUE SOURCES TO SHIFT TOWARD TECHNOLOGICAL ADVANCED TEMPERATURE MONITORING DUE TO COVID-19 PANDEMIC

- FIGURE 26 REVENUE SHIFT IN PATIENT TEMPERATURE MONITORING MARKET

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF PATIENT TEMPERATURE MONITORING PRODUCTS

- TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF PATIENT TEMPERATURE MONITORING PRODUCTS

- 5.15.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR PATIENT TEMPERATURE MONITORING PRODUCTS

- TABLE 14 KEY BUYING CRITERIA FOR PATIENT TEMPERATURE MONITORING PRODUCTS

- 5.16 CASE STUDIES

- 5.16.1 CASE STUDY 1

6 PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 15 PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 6.2 WEARABLE CONTINUOUS MONITORING SENSORS

- 6.2.1 VERSATILE FUNCTIONALITIES OFFERED TO DRIVE DEMAND

- TABLE 16 WEARABLE CONTINUOUS MONITORING SENSORS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3 SMART TEMPERATURE MONITORING PATCHES

- 6.3.1 LONG-TERM MONITORING OFFERED TO DRIVE MARKET GROWTH

- TABLE 17 SMART TEMPERATURE MONITORING PATCHES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.4 TABLE-TOP TEMPERATURE MONITORING DEVICES

- TABLE 18 TABLE-TOP TEMPERATURE MONITORING DEVICES AVAILABLE

- TABLE 19 TABLE-TOP TEMPERATURE MONITORING DEVICES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 20 TABLE-TOP TEMPERATURE MONITORING DEVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.4.1 NON-INVASIVE VITAL SIGNS MONITORING DEVICES

- 6.4.1.1 High costs of these devices to hinder market growth

- TABLE 21 NON-INVASIVE VITAL SIGNS MONITORING DEVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

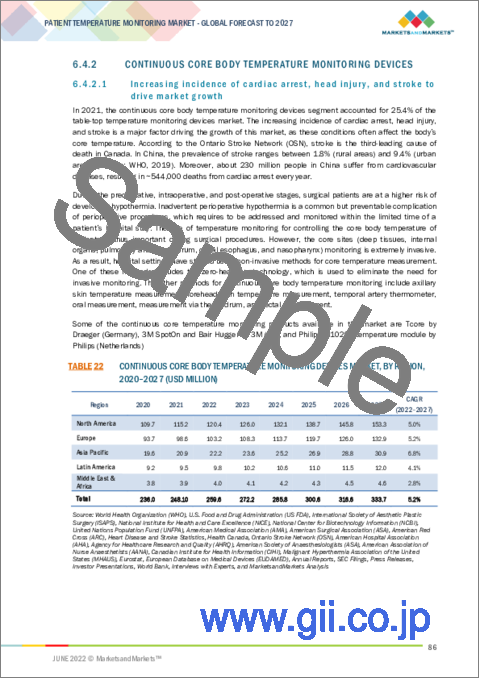

- 6.4.2 CONTINUOUS CORE BODY TEMPERATURE MONITORING DEVICES

- 6.4.2.1 Increasing incidence of cardiac arrest, head injury, and stroke to drive market growth

- TABLE 22 CONTINUOUS CORE BODY TEMPERATURE MONITORING DEVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.5 HANDHELD TEMPERATURE MONITORING DEVICES

- TABLE 23 HANDHELD TEMPERATURE MONITORING DEVICES AVAILABLE

- TABLE 24 HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 25 HANDHELD TEMPERATURE MONITORING DEVICES, BY REGION, 2020-2027 (USD MILLION)

- 6.5.1 MERCURY THERMOMETERS

- 6.5.1.1 Toxicity, increased risk of injury, and cross infection to hinder market growth

- TABLE 26 MERCURY THERMOMETERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.5.2 DIGITAL THERMOMETERS

- 6.5.2.1 Non-invasive and non-traumatic features to drive market growth

- TABLE 27 DIGITAL THERMOMETERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.5.3 INFRARED THERMOMETERS

- 6.5.3.1 Faster response time for surface temperatures and better patient comfort to drive market growth

- TABLE 28 INFRARED THERMOMETERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.6 INVASIVE TEMPERATURE MONITORING DEVICES

- 6.6.1 INCREASING PREVALENCE OF BLOODSTREAM INFECTIONS TO HINDER MARKET GROWTH

- TABLE 29 INVASIVE TEMPERATURE MONITORING DEVICES, BY REGION, 2020-2027 (USD MILLION)

7 PATIENT TEMPERATURE MONITORING MARKET, BY SITE

- 7.1 INTRODUCTION

- TABLE 30 PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- 7.2 NON-INVASIVE TEMPERATURE MONITORING

- TABLE 31 NON-INVASIVE TEMPERATURE MONITORING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 32 NON-INVASIVE TEMPERATURE MONITORING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.2.1 ORAL TEMPERATURE MONITORING

- 7.2.1.1 Accurate temperature reading to drive market growth

- TABLE 33 ORAL TEMPERATURE MONITORING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.2.2 AXILLARY AND TEMPORAL ARTERY TEMPERATURE MONITORING

- 7.2.2.1 Ease in accessibility to drive market growth

- TABLE 34 AXILLARY AND TEMPORAL ARTERY TEMPERATURE MONITORING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.2.3 TYMPANIC MEMBRANE TEMPERATURE MONITORING

- 7.2.3.1 Multipurpose functionalities to drive market growth

- TABLE 35 TYMPANIC MEMBRANE TEMPERATURE MONITORING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3 INVASIVE TEMPERATURE MONITORING DEVICES

- TABLE 36 INVASIVE TEMPERATURE MONITORING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 37 INVASIVE TEMPERATURE MONITORING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3.1 ESOPHAGEAL TEMPERATURE MONITORING

- 7.3.1.1 High sensitivity and accuracy to drive market growth

- TABLE 38 ESOPHAGEAL TEMPERATURE MONITORING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3.2 NASOPHARYNX TEMPERATURE MONITORING

- 7.3.2.1 Rising risk of epistaxis and sinusitis to hinder market growth

- TABLE 39 NASOPHARYNX TEMPERATURE MONITORING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3.3 URINARY BLADDER TEMPERATURE MONITORING

- 7.3.3.1 High cost and risk of bladder or urine infection to limit market adoption

- TABLE 40 URINARY BLADDER TEMPERATURE MONITORING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3.4 RECTAL TEMPERATURE MONITORING

- 7.3.4.1 High precision and accurate results to drive market growth

- TABLE 41 RECTAL TEMPERATURE MONITORING MARKET, BY REGION, 2020-2027 (USD MILLION)

8 PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- TABLE 42 PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.2 PYREXIA/FEVER

- 8.2.1 RISING PREVALENCE OF INFECTIOUS DISEASES TO BOOST SEGMENT GROWTH

- TABLE 43 PATIENT TEMPERATURE MONITORING MARKET FOR PYREXIA/FEVER, BY REGION, 2020-2027 (USD MILLION)

- 8.3 HYPOTHERMIA

- 8.3.1 INCREASING PEDIATRIC POPULATION AND SURGICAL PROCEDURES TO DRIVE MARKET GROWTH

- TABLE 44 PATIENT TEMPERATURE MONITORING MARKET FOR HYPOTHERMIA, BY REGION, 2020-2027 (USD MILLION)

- 8.4 BLOOD TRANSFUSION

- 8.4.1 GROWING INCIDENCE OF HEMOLYSIS AND BLOOD DONATIONS TO DRIVE SEGMENT GROWTH

- TABLE 45 PATIENT TEMPERATURE MONITORING MARKET FOR BLOOD TRANSFUSION, BY REGION, 2020-2027 (USD MILLION)

- 8.5 ANESTHESIA

- 8.5.1 RISING MORTALITY RATE DUE TO MALIGNANT HYPERPYREXIA TO DRIVE SEGMENT GROWTH

- TABLE 46 PATIENT TEMPERATURE MONITORING MARKET FOR ANESTHESIA, BY REGION, 2020-2027 (USD MILLION)

- 8.6 OTHER APPLICATIONS

- TABLE 47 PATIENT TEMPERATURE MONITORING MARKET FOR OTHER APPLICATIONS, BY REGION, 2020-2027 (USD MILLION)

9 PATIENT TEMPERATURE MONITORING MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 48 PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2 HOSPITALS

- 9.2.1 HOSPITALS DOMINATED END USER MARKET IN 2021

- TABLE 49 PATIENT TEMPERATURE MONITORING MARKET FOR HOSPITALS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 50 PATIENT TEMPERATURE MONITORING MARKET FOR HOSPITALS, BY REGION, 2020-2027 (USD MILLION)

- 9.3 OPERATING ROOMS

- 9.3.1 NECESSITY OF TEMPERATURE MONITORING DURING SURGERIES TO DRIVE SEGMENT GROWTH

- TABLE 51 PATIENT TEMPERATURE MONITORING MARKET FOR OPERATING ROOMS, BY REGION, 2020-2027 (USD MILLION)

- 9.4 EMERGENCY ROOMS

- 9.4.1 INCREASING REQUIREMENT OF IMMEDIATE CARE TO DRIVE SEGMENT GROWTH

- TABLE 52 PATIENT TEMPERATURE MONITORING MARKET FOR EMERGENCY ROOMS, BY REGION, 2020-2027 (USD MILLION)

- 9.5 INTENSIVE CARE UNITS

- 9.5.1 RISING NUMBER OF ILLNESSES REQUIRING CRITICAL ATTENTION FOR TREATMENT AND MONITORING TO DRIVE SEGMENT GROWTH

- TABLE 53 PATIENT TEMPERATURE MONITORING MARKET FOR INTENSIVE CARE UNITS, BY REGION, 2020-2027 (USD MILLION)

- 9.6 HOME CARE SETTINGS

- 9.6.1 RISE IN GLOBAL GERIATRIC POPULATION REQUIRING LONG-TERM CARE TO SUPPORT SEGMENT GROWTH

- TABLE 54 PATIENT TEMPERATURE MONITORING MARKET FOR HOME CARE SETTINGS, BY REGION, 2020-2027 (USD MILLION)

- 9.7 NURSING FACILITIES

- 9.7.1 GROWING PREVALENCE OF CHRONIC DISEASES AND DEMAND FOR SHORT-TERM NURSING CARE FACILITIES TO SUPPORT SEGMENT GROWTH

- TABLE 55 PATIENT TEMPERATURE MONITORING MARKET FOR NURSING FACILITIES, BY REGION, 2020-2027 (USD MILLION)

- 9.8 AMBULATORY CARE CENTERS

- 9.8.1 GRADUAL SHIFT OF PATIENT CARE FROM INPATIENT TO OUTPATIENT SETTINGS TO DRIVE SEGMENT GROWTH

- TABLE 56 PATIENT TEMPERATURE MONITORING MARKET FOR AMBULATORY CARE CENTERS, BY REGION, 2020-2027 (USD MILLION)

- 9.9 OTHER END USERS

- TABLE 57 PATIENT TEMPERATURE MONITORING MARKET FOR OTHER END USERS, BY REGION, 2020-2027 (USD MILLION)

10 PATIENT TEMPERATURE MONITORING MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 58 PATIENT TEMPERATURE MONITORING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 29 NORTH AMERICA: PATIENT TEMPERATURE MONITORING MARKET SNAPSHOT

- TABLE 59 NORTH AMERICA: PATIENT TEMPERATURE MONITORING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 60 NORTH AMERICA: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 62 NORTH AMERICA: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 63 NORTH AMERICA: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Rising geriatric population and incidence of chronic diseases to drive market growth

- TABLE 64 US: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 65 US: PATIENT TEMPERATURE MONITORING MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 66 US: PATIENT TEMPERATURE MONITORING MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 67 US: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 68 US: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 69 US: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 Increasing number of surgical procedures to propel market growth

- TABLE 70 CANADA: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 71 CANADA: PATIENT TEMPERATURE MONITORING MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 72 CANADA: PATIENT TEMPERATURE MONITORING MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 73 CANADA: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 74 CANADA: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 75 CANADA: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3 EUROPE

- TABLE 76 EUROPE: PATIENT TEMPERATURE MONITORING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 77 EUROPE: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 78 EUROPE: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 79 EUROPE: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 80 EUROPE: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.1 GERMANY

- 10.3.1.1 High demand for temperature monitoring devices for perioperative care to drive market growth

- TABLE 81 GERMANY: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 82 GERMANY: PATIENT TEMPERATURE MONITORING MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 83 GERMANY: PATIENT TEMPERATURE MONITORING MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 84 GERMANY: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 85 GERMANY: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 86 GERMANY: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Increase in disease prevalence and healthcare expenditure to drive market growth

- TABLE 87 UK: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 88 UK: PATIENT TEMPERATURE MONITORING MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 89 UK: PATIENT TEMPERATURE MONITORING MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 90 UK: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 91 UK: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 92 UK: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Strong healthcare system and growth in geriatric-pediatric population to propel segment growth

- TABLE 93 FRANCE: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 94 FRANCE: PATIENT TEMPERATURE MONITORING MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 95 FRANCE: PATIENT TEMPERATURE MONITORING MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 96 FRANCE: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 97 FRANCE: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 98 FRANCE: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.4 ITALY

- 10.3.4.1 Rising incidence of lifestyle diseases to drive segment growth

- TABLE 99 ITALY: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 100 ITALY: PATIENT TEMPERATURE MONITORING MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 101 ITALY: PATIENT TEMPERATURE MONITORING MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 102 ITALY: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 103 ITALY: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 104 ITALY: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.5 SPAIN

- 10.3.5.1 Growing aging population to drive market growth

- TABLE 105 SPAIN: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 106 SPAIN: PATIENT TEMPERATURE MONITORING MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 107 SPAIN: PATIENT TEMPERATURE MONITORING MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 108 SPAIN: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 109 SPAIN: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 110 SPAIN: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 111 REST OF EUROPE: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 112 REST OF EUROPE: PATIENT TEMPERATURE MONITORING MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 113 REST OF EUROPE: PATIENT TEMPERATURE MONITORING MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 114 REST OF EUROPE: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 115 REST OF EUROPE: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 116 REST OF EUROPE: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 30 ASIA PACIFIC: PATIENT TEMPERATURE MONITORING MARKET SNAPSHOT

- TABLE 117 ASIA PACIFIC: PATIENT TEMPERATURE MONITORING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 118 ASIA PACIFIC: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 119 ASIA PACIFIC: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 120 ASIA PACIFIC: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 121 ASIA PACIFIC: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Large population base, increased chronic diseases, and favorable government support to drive market growth

- TABLE 122 CHINA: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 123 CHINA: PATIENT TEMPERATURE MONITORING MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 124 CHINA: PATIENT TEMPERATURE MONITORING MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 125 CHINA: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 126 CHINA: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 127 CHINA: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Promising reimbursement scenario and well-developed healthcare system to support market growth

- TABLE 128 JAPAN: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 129 JAPAN: PATIENT TEMPERATURE MONITORING MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 130 JAPAN: PATIENT TEMPERATURE MONITORING MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 131 JAPAN: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 132 JAPAN: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 133 JAPAN: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Growing target patient population to drive market growth

- TABLE 134 INDIA: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 135 INDIA: PATIENT TEMPERATURE MONITORING MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 136 INDIA: PATIENT TEMPERATURE MONITORING MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 137 INDIA: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 138 INDIA: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 139 INDIA: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.4 REST OF ASIA PACIFIC

- TABLE 140 REST OF ASIA PACIFIC: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: PATIENT TEMPERATURE MONITORING MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: PATIENT TEMPERATURE MONITORING MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 INCREASING HEALTHCARE EXPENDITURE TO SUPPORT MARKET GROWTH

- TABLE 146 LATIN AMERICA: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 147 LATIN AMERICA: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 148 LATIN AMERICA: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 149 LATIN AMERICA: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 INCREASING AWARENESS INITIATIVES TO DRIVE SEGMENT GROWTH

- TABLE 150 MIDDLE EAST & AFRICA: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: PATIENT TEMPERATURE MONITORING MARKET, BY SITE, 2020-2027 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: PATIENT TEMPERATURE MONITORING MARKET, BY END USER, 2020-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN PATIENT TEMPERATURE MONITORING MARKET

- TABLE 154 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PATIENT TEMPERATURE MONITORING MANUFACTURING COMPANIES

- 11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 31 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN PATIENT TEMPERATURE MONITORING MARKET

- 11.4 MARKET SHARE ANALYSIS

- 11.4.1 PATIENT TEMPERATURE MONITORING MARKET

- FIGURE 32 PATIENT TEMPERATURE MONITORING MARKET SHARE, BY KEY PLAYERS (2021)

- TABLE 155 PATIENT TEMPERATURE MONITORING MARKET: DEGREE OF COMPETITION

- 11.5 COMPANY EVALUATION QUADRANT

- 11.5.1 LIST OF EVALUATED VENDORS

- 11.5.2 STARS

- 11.5.3 EMERGING LEADERS

- 11.5.4 PERVASIVE PLAYERS

- 11.5.5 PARTICIPANTS

- FIGURE 33 PATIENT TEMPERATURE MONITORING MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 11.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2021)

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 STARTING BLOCKS

- 11.6.3 RESPONSIVE COMPANIES

- 11.6.4 DYNAMIC COMPANIES

- FIGURE 34 PATIENT TEMPERATURE MONITORING MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2021

- 11.7 COMPETITIVE BENCHMARKING

- 11.7.1 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS

- FIGURE 35 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS OF TOP PLAYERS

- TABLE 156 PATIENT TEMPERATURE MONITORING MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 157 COMPANY PRODUCT & SERVICE FOOTPRINT

- TABLE 158 COMPANY REGIONAL FOOTPRINT

- TABLE 159 PATIENT TEMPERATURE MONITORING MARKET: DETAILED LIST OF KEY START-UPS/SMES

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT LAUNCHES

- TABLE 160 KEY PRODUCT LAUNCHES AND REGULATORY APPROVALS

- 11.8.2 DEALS

- TABLE 161 KEY DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business overview, Products & services offered, Recent Developments, MNM view)**

- 12.1.1 CARDINAL HEALTH INC.

- TABLE 162 CARDINAL HEALTH INC.: COMPANY OVERVIEW

- FIGURE 36 CARDINAL HEALTH INC.: COMPANY SNAPSHOT (2021)

- 12.1.2 3M

- TABLE 163 3M: COMPANY OVERVIEW

- FIGURE 37 3M: COMPANY SNAPSHOT (2021)

- 12.1.3 KONINKLIJKE PHILIPS N.V.

- TABLE 164 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- FIGURE 38 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2021)

- 12.1.4 DRAGERWERK AG & CO. KGAA

- TABLE 165 DRAGERWERK AG & CO. KGAA: COMPANY OVERVIEW

- FIGURE 39 DRAGERWERK AG & CO. KGAA: COMPANY SNAPSHOT (2021)

- 12.1.5 HILL-ROM HOLDINGS, INC.

- TABLE 166 HILL-ROM HOLDINGS, INC.: COMPANY OVERVIEW

- FIGURE 40 HILL-ROM HOLDINGS, INC.: COMPANY SNAPSHOT (2021)

- 12.1.6 BECTON, DICKINSON AND COMPANY

- TABLE 167 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- FIGURE 41 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2021)

- 12.1.7 OMRON HEALTHCARE INC. (A PART OF OMRON CORPORATION)

- TABLE 168 OMRON HEALTHCARE INC: COMPANY OVERVIEW

- FIGURE 42 OMRON HEALTHCARE INC.: COMPANY SNAPSHOT (2021)

- 12.1.8 MASIMO CORPORATION

- TABLE 169 MASIMO CORPORATION: COMPANY OVERVIEW

- FIGURE 43 MASIMO CORPORATION: COMPANY SNAPSHOT (2021)

- 12.1.9 BRAUN GMBH (SUBSIDIARY OF PROCTER & GAMBLE)

- TABLE 170 PROCTER & GAMBLE: COMPANY OVERVIEW

- FIGURE 44 PROCTER & GAMBLE: COMPANY SNAPSHOT (2021)

- 12.1.10 TERUMO CORPORATION

- TABLE 171 TERUMO CORPORATION: COMPANY OVERVIEW

- FIGURE 45 TERUMO CORPORATION: COMPANY SNAPSHOT (2021)

- *Details on Business overview, Products & services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 PAUL HARTMANN AG

- TABLE 172 PAUL HARTMANN AG: COMPANY OVERVIEW

- 12.2.2 BEURER GMBH

- TABLE 173 BEURER GMBH: COMPANY OVERVIEW

- 12.2.3 MICROLIFE

- TABLE 174 MICROLIFE: COMPANY OVERVIEW

- 12.2.4 OMEGA ENGINEERING, INC.

- TABLE 175 OMEGA ENGINEERING, INC.: COMPANY OVERVIEW

- 12.2.5 IHEALTH

- TABLE 176 IHEALTH: COMPANY OVERVIEW

- 12.2.6 BRIGGS HEALTHCARE

- TABLE 177 BRIGGS HEALTHCARE: COMPANY OVERVIEW

- 12.2.7 DELTATRAK, INC.

- TABLE 178 DELTATRAK, INC.: COMPANY OVERVIEW

- 12.2.8 EXERGEN CORPORATION

- TABLE 179 EXERGEN CORPORATION: COMPANY OVERVIEW

- 12.2.9 MEDISANA GMBH

- TABLE 180 MEDISANA GMBH: COMPANY OVERVIEW

- 12.2.10 GERATHERM MEDICAL AG

- TABLE 181 GERATHERM MEDICAL AG: COMPANY OVERVIEW

- 12.2.11 AMERICAN DIAGNOSTIC CORPORATION

- TABLE 182 AMERICAN DIAGNOSTIC CORPORATION: COMPANY OVERVIEW

- 12.2.12 NURECA

- TABLE 183 NURECA: COMPANY OVERVIEW

- 12.2.13 A&D MEDICAL

- TABLE 184 A&D MEDICAL: COMPANY OVERVIEW

- 12.2.14 ACTHERM INC. (EASYWELL BIOMEDICALS INC.)

- TABLE 185 ACTHERM INC.: COMPANY OVERVIEW

- 12.2.15 COSINUSS GMBH

- TABLE 186 COSINUSS GMBH: COMPANY OVERVIEW

- 12.2.16 VANDELAY (SFT TECHNOLOGIES INDIA PVT LTD)

- TABLE 187 VANDELAY: COMPANY OVERVIEW

- 12.2.17 KINSA

- TABLE 188 KINSA: COMPANY OVERVIEW

- 12.2.18 EASYTEM CO., LTD.

- TABLE 189 EASYTEM CO. LTD.: COMPANY OVERVIEW

- 12.2.19 HICKS THERMOMETERS INDIA LIMITED

- TABLE 190 HICKS THERMOMETERS INDIA LIMITED: COMPANY OVERVIEW

- 12.2.20 SANOMEDICS, INC.

- TABLE 191 SANOMEDICS, INC.: COMPANY OVERVIEW

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATION

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS