|

|

市場調査レポート

商品コード

1100549

コンデンシングユニットの市場:タイプ(空冷式、水冷式)、用途(産業、商業、輸送)、機能(空調、冷凍、ヒートポンプ)、冷媒タイプ、コンプレッサータイプ、地域別-2027年までの世界予測Condensing Unit Market by Type (Air-cooled, Water-cooled), Application (Industrial, Commercial, Transportation), Function (Air Conditioning, Refrigeration, Heat Pumps), Refrigerant Type, Compressor Type and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| コンデンシングユニットの市場:タイプ(空冷式、水冷式)、用途(産業、商業、輸送)、機能(空調、冷凍、ヒートポンプ)、冷媒タイプ、コンプレッサータイプ、地域別-2027年までの世界予測 |

|

出版日: 2022年07月07日

発行: MarketsandMarkets

ページ情報: 英文 242 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

コンデンシングユニット市場は、2022年の390億米ドルから2027年には571億米ドルに成長し、予測期間中のCAGRは7.9%と予測されています。

新興国における小売業の拡大や、加工食品の消費量の増加が市場を牽引しています。また、中国、インド、タイ、マレーシアなどの新興国における小売店、食品製造、フードサービス、特殊用途などのその他の最終用途も、市場の成長に向けて貢献しています。

"空冷式セグメントは2022年から2027年にかけてコンデンシングユニット市場を金額でリードすると予想されます。"

空冷式コンデンシングユニットは設置が簡単でメンテナンスが少なくて済みますが、水冷式コンデンシングユニットは空冷式コンデンシングユニットに比べて寿命が長く、エネルギー効率も高いです。そのため、空冷式は水冷式に比べ市場シェアが高いです。

"2021年のコンデンシングユニット市場において、用途別では業務用セグメントが金額ベースで最大のシェアを占めています。"

スーパーマーケット、小売店、乳製品キャビネット、飲料キャビネットなど、様々な用途分野からの先進的な冷蔵に対する需要の高まりは、パッケージされた食品&飲料に対する消費者の好みの増加や消費者の一人当たりの所得の増加によるものです。このため、消費者向け用途分野が最大の市場シェアを獲得しています。

"機能別では、空調分野が予測期間中にコンデンシングユニット市場を支配する見込み"

機能別では、コンデンシングユニットが製品の鮮度を長期間保持するために冷蔵倉庫で広く使用されていることから、空調部門がコンデンシングユニット市場を支配すると予想されます。これにより、果物や野菜などの製品の保存期間が延長されます。新鮮な生鮮食品に対する顧客の需要の高まりは、空調用コンデンシングユニットの成長機会を生み出すと期待されています。

"中東・アフリカのコンデンシングユニット市場は、予測期間中、金額ベースで最も高いCAGRで成長すると予測されています。"

中東&アフリカのコンデンシングユニット市場は、予測期間中に最も高いCAGRで成長すると予測されています。中東・アフリカ諸国は、人口増加や生活水準の向上などの要因により、コンデンシングユニット市場の大幅な成長が見込まれており、世界の気温の上昇が中東・アフリカの空調・HVAC市場にプラスの影響を与え、同地域のコンデンシングユニット市場を牽引すると予測されます。

報告書の主要参加者のプロファイルブレイクアップ。

- 企業タイプ別:Tier 1-65%, Tier 2-20%, and Tier 3-15%

- 役職別:C-level Executives-25%, Directors-30%, a Others-45%

- 地域別:North America-20%, Europe-15%, Asia Pacific-55%, South America-7%, Middle East & Africa-3%,

定性的分析の一環として、本調査では市場の促進要因・抑制要因・機会・課題について包括的にレビューしています。また、Emerson Electric Co.(米国)、Carrier Global Corporation(米国)、Danfoss(デンマーク)、GEA Group Aktiengesellschaft(ドイツ)、BITZER SE(ドイツ)など、様々な市場のプレーヤーが採用する競争戦略についても論じています。

調査対象。

本レポートでは、コンデンシングユニット市場をタイプ、用途、機能、冷媒タイプ、コンプレッサータイプ、地域に基づいて定義しています。市場促進要因・阻害要因・機会・業界特有の課題など、市場の成長に影響を与える主要な要因に関する詳細情報を提供しています。主要企業を戦略的にプロファイリングし、その市場シェアとコアコンピタンスを包括的に分析するとともに、新製品投入、事業拡大、市場での提携など、競合の発展を追跡・分析しています。

レポート購入の理由

本レポートは、コンデンシングユニット市場とそのセグメントの収益数の最も近い概算を提供することで、市場のリーダー/新規参入者を支援することが期待されます。また、本レポートは、利害関係者が市場の競合情勢について理解を深め、自社のビジネスのポジションを向上させるための洞察を得て、適切な市場参入戦略を立てるのに役立つと期待されています。また、利害関係者が市場の鼓動を理解し、主要な市場促進要因・課題・機会に関する情報を提供することを可能にします。

目次

第1章 イントロダクション

- 研究の目的

- 市場の定義

- 包含と除外

- マーケットスコープ

- 通貨

- 考慮される単位

- 調査の制限

- 利害関係者

第2章 調査手法

- 調査データ

- 二次データ

- 二次資料からの重要なデータ

- 一次データ

- 一次資料からの主要なデータ

- 一次インタビューの内訳

- 二次データ

- 考慮される需要側マトリックス

- 市場規模の見積もり

- ボトムアップアプローチ

- トップダウンアプローチ

- 供給側分析の計算

- 予報

- 成長率の仮定/成長予測

- データの三角測量

- 需要側の市場規模を計算する際の主な仮定

- 制限

- リスク分析

第3章 エグゼクティブサマリー

第4章 重要考察

- コンデンシングユニット市場におけるプレーヤーにとっての重要な機会

- 地域別のコンデンシングユニット市場

- タイプおよび用途別のアジア太平洋地域のコンデンシングユニット市場

- タイプ別のコンデンシングユニット市場

- 機能別のコンデンシングユニット市場

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 新興経済国で成長している小売部門

- 空調ユニットと冷凍の需要の増加

- エレクトロニクスおよびデータセンター市場の成長

- 抑制要因

- コンデンシングユニットで使用される冷媒に関する厳しい環境規制

- 市場機会

- 効率的なコンデンシングユニットのイントロダクションつながる技術の進歩

- 自然冷媒の需要の増加

- 課題

- 世界のHVACシステム市場におけるサプライチェーンの混乱

- 促進要因

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 供給企業の交渉力

- 代替品の脅威

- 買い手の交渉力

- 競争力のある競争企業間の敵対関係

- ケーススタディ分析

- DANFOSSは、同社初のトランスクリプト式CO2ブースター冷凍システムの設置においてKRIOFROSTを支援しました

- ポリシーと規制

- 冷媒管理規則の改訂セクション608

- 可燃性と毒性の問題

- 欧州

- EUのF-GAS規制

- モントリオール議定書

- デンマーク

- 北米

- EPAによる重要な新しい代替政策(SNAP)

- アジア太平洋地域

- 日本:改正Fガス法

- 中国(FECO):HCFCSの推奨代替品の最初のカタログ

- 規制機関、政府機関、およびその他の組織

- エコシステム/マーケットマップ

- バリューチェーン分析

- ハーメチックコンデンシングユニット

- スクロールコンデンシングユニット

- 半ハーメチックコンデンシングユニット

- 平均価格トレンド

- 2022年から2023年の主要な会議とイベント

- 主要な利害関係者と購入基準

- 購入プロセスの主要な利害関係者

- 購入基準

- 貿易データ

- テクノロジー分析

- 特許分析

第6章 コンプレッサータイプ別のコンデンシングユニット市場

- イントロダクション

- レシプロコンプレッサー

- 燃料需要に対する長期的かつ効果的な空気圧縮機能

- スクリューコンプレッサー

- 需要を増やすためのノイズのない操作機能

- ロータリーコンプレッサー

- ホテルや病院から市場を推進するための需要

- その他

第7章 タイプ別のコンデンシングユニット市場

- イントロダクション

- 空冷式コンデンシングユニット

- このセグメントを推進するための低メンテナンスおよび設置コスト

- 水冷式コンデンシングユニット

- 燃料需要に対するエネルギー効率の高い機能

第8章 冷媒タイプ別のコンデンシングユニット市場

- イントロダクション

- フルオロカーボン

- 需要を高めるための大型冷蔵庫へのフルオロカーボンの適用

- ハイドロクロロフルオロカーボン(HCFC)

- ハイドロフルオロカーボン(HFC)

- ハイドロフルオロオレフィン(HFO)

- 需要を高めるための大型冷蔵庫へのフルオロカーボンの適用

- 炭化水素

- 燃料の成長に対する炭化水素の非毒性機能

- イソブタン

- プロパン

- その他

- 燃料の成長に対する炭化水素の非毒性機能

- 無機物

- 需要を推進するための無機物の輸送および産業用途

- アンモニア

- CO2

- その他

- 需要を推進するための無機物の輸送および産業用途

第9章 機能別のコンデンシングユニット市場

- イントロダクション

- 空調

- 需要を推進するためのコールドストレージセクターの成長

- 冷凍

- ホテルや病院からの需要は需要を促進する

- ヒートポンプ

- 燃料需要に対するインフラプロジェクトの増加

第10章 用途別のコンデンシングユニット市場

- イントロダクション

- 商業

- 需要を促進するための小売セクターの成長

- 産業

- 需要を推進するための石油化学産業における需要の増加

- 輸送

- このセグメントを推進するための低い運用コストと高い効率

第11章 地域別のコンデンシングユニット市場

- イントロダクション

- アジア太平洋地域

- 中国

- 市場を後押しするために急速に成長している冷却エネルギー部門

- インド

- 所得水準の上昇と食料生産の増加により、高い成長機会を創出

- 日本

- 需要を推進するための冷凍食品市場の成長

- 韓国

- 市場を牽引するためのコールドチェーン業界への投資の拡大

- タイ

- 市場を牽引するための農業供給およびその他の食品の成長

- マレーシア

- 需要を増やすための冷凍器具の高い浸透

- シンガポール

- 市場を動かすために人々が食料に多額の支出をしている

- インドネシア

- 市場を推進するための成長するコールドチェーン産業

- その他アジア太平洋地域

- 中国

- 北米

- 米国

- 需要を刺激する食品の需要の高まり

- カナダ

- 市場を牽引するための食品腐敗と食品ロスの削減に関連する規制

- メキシコ

- 温度制御された貯蔵および倉庫から燃料市場への成長市場

- 米国

- 欧州

- ドイツ

- 市場を後押しするための冷蔵保管と輸送のニーズの高まり

- 英国

- 成長を促進するための大手企業別効率的なコールドチェーンサービスの増加

- フランス

- 市場を牽引する大規模なスーパーマーケットチェーンの存在

- イタリア

- 成長する食品小売業界と、需要を推進するためのすぐに食べられるパック食品の保管

- スペイン

- 成長を促進するためのエアコンの需要の増加

- その他欧州

- ドイツ

- 中東およびアフリカ

- サウジアラビア

- 急速な都市化と需要を促進する主要なプレーヤーの存在

- トルコ

- 成長を促進するためのHVAC&R産業の成長

- アラブ首長国連邦

- 市場を牽引するための飲食品産業の成長

- その他中東およびアフリカの残りの部分

- サウジアラビア

- 南米

- ブラジル

- 人口の増加と、需要を高めるための冷蔵の巨大な市場の可能性

- コロンビア

- 市場機会を創出するための消費者向け食品の輸出の増加

- アルゼンチン

- 市場を牽引するための果物の輸出の増加

- その他南米

- ブラジル

第12章 競合情勢

- キープレーヤー別採用された戦略

- 収益分析

- 市場ランキング分析、2021年

- 会社の評価マトリックス

- スターズ

- 新興リーダー

- パーベイシブプレイヤー

- 参加者

- 競合シナリオ

第13章 企業プロファイル

- エマソンエレクトリック株式会社

- キャリア

- ダンフォス

- GEA GROUP AKTIENGESELLSCHAFT

- ビッツァー

- ヒートクラフトワールドワイド冷蔵庫

- バルティモアエアコイルカンパニー

- ドリンスパ

- SCM FRIGO SPA

- DAIKIN APPLIED

- EVAPCO、INC。

- フラコールドスパ

- HOWE CORPORATION

- HUSSMANN CORPORATION

- ブルースターリミテッド株式会社

- MTASPA

- TECUMSEH PRODUCTS COMPANY LLC

- ELGIN S/A

- エンブラコLLC

- グッドコールド

- マルチコントロールSA

- 他のプレイヤー

- FREEZEINDIA MANUFACTURING PRIVATE LIMITED

- ナショナルコンフォートプロダクツ

- パトン株式会社

- 安全な空気技術

- SHANGHAI GENERAL FUSHI REFRIGERATION EQUIPMENTCO., LTD.

- SHREE REFRIGERATIONS

- SHANGHAI ZHAOXUE REFRIGERATION EQUIPMENT CO., LTD.

- ZHEJIANG BEIFENG REFRIGERATION EQUIPMENT CO., LTD.

- ADVANSOR A/S

第14章 付録

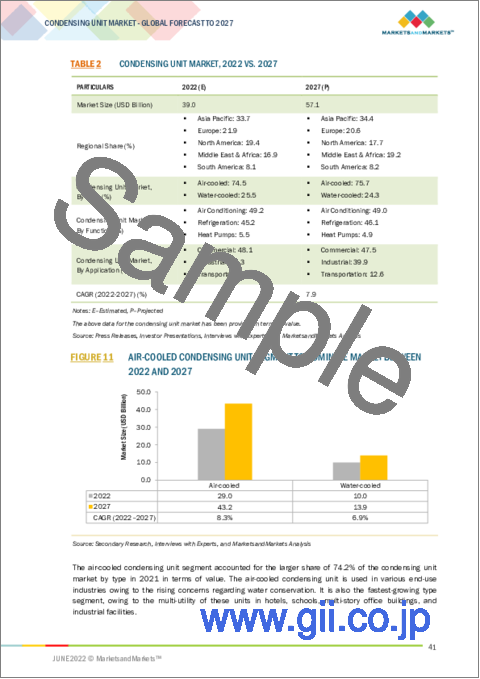

The condensing unit market is projected to grow from USD 39.0 billion in 2022 and reach USD 57.1 billion by 2027, at a CAGR of 7.9% during the forecast period. The growing retail sectors in emerging economies, along with the rise in consumption of processed foods, is driving the market. Also, other end-use industries, such as retail stores, food production, food services, and specialized applications in emerging economies such as China, India, Thailand, and Malaysia, are contributing towards the growth of the market.

"The air-cooled segment is expected to lead the condensing unit market from 2022 to 2027, by value."

Air-cooled condensing units are easy to install and require low maintenance, whereas water-cooled condensing units have a longer life and higher energy efficiency as compared to air-cooled condensing units. Thus, air-cooled has greater market share in comparison with water-cooled condensing unit.

"Commercial segment accounted for the largest share of the condensing unit market in year 2021, by the application, in terms of value."

The growing demand for advanced refrigeration from various application areas, such as supermarkets, retail stores, dairy cabinets, and drink cabinets is due to increasing consumer preference for packaged food & drinks and increased per capita income of consumers. This has helped the consumer application segment to have the largest market share.

"Air conditioning segment, by function, is expected to dominate the condensing unit market during the forecast year"

By function, the air conditioning segment is expected to dominate the condensing unit market as condensing units are extensively used in cold storage units to retain the freshness of the products over a longer period of time. This extends the shelf life of products such as fruits and vegetables. Growing demand of customers for fresh perishable products is expected to create growth opportunities for air conditioning condensing unit.

"Middle East & Africa condensing unit market is projected to grow at the highest CAGR during the forecast period, in terms of value."

The Middle East & Africa condensing unit market is projected to grow at the highest CAGR during the forecast period. The Middle East & African countries have substantial growth prospects for the condensing unit market because of factors such as the increase in population and living standards, and rising global temperatures are expected to positively impact the air conditioning and HVAC market in the Middle East & Africa, thereby driving the condensing units market in the region.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: C-level Executives - 25%, Directors - 30%, a Others - 45%

- By Region: North America - 20%, Europe - 15%, Asia Pacific - 55%, South America - 7%, Middle East & Africa - 3%,

As a part of qualitative analysis, the research provides a comprehensive review of market drivers, restraints, opportunities, and challenges. It also discusses competitive strategies adopted by varied market players, such Emerson Electric Co. (US), Carrier Global Corporation (US), Danfoss (Denmark), GEA Group Aktiengesellschaft (Germany), BITZER SE (Germany), and others.

Research Coverage:

The report defines the condensing unit market based on type, application, function, refrigerant type, compressor type and region. It provides detailed information regarding the major factors influencing the growth of the market, such as drivers, restraints, opportunities, and industry-specific challenges. It strategically profiles key players and comprehensively analyzes their market shares and core competencies as well as tracks and analyzes competitive developments, such as new product launches, expansions, and partnerships undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them the closest approximations of revenue numbers of the condensing unit market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- TABLE 1 CONDENSING UNIT MARKET: INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 CONDENSING UNIT MARKET SEGMENTATION

- FIGURE 2 REGIONAL SCOPE

- FIGURE 3 YEARS CONSIDERED FOR THE STUDY

- 1.5 CURRENCY

- 1.6 UNITS CONSIDERED

- 1.7 RESEARCH LIMITATIONS

- 1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 4 CONDENSING UNIT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.2 DEMAND-SIDE MATRIX CONSIDERED

- FIGURE 5 MAIN MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR CONDENSING UNITS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 METHODOLOGY FOR SUPPLY-SIDE SIZING OF CONDENSING UNIT MARKET (1/2)

- FIGURE 9 METHODOLOGY FOR SUPPLY-SIDE SIZING OF CONDENSING UNIT MARKET (2/2)

- 2.3.2.1 Calculations for supply-side analysis

- 2.3.3 FORECAST

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- FIGURE 10 CONDENSING UNIT MARKET: DATA TRIANGULATION

- 2.6 KEY ASSUMPTIONS WHILE CALCULATING DEMAND-SIDE MARKET SIZE

- 2.7 LIMITATIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- TABLE 2 CONDENSING UNIT MARKET, 2022 VS. 2027

- FIGURE 11 AIR-COOLED CONDENSING UNIT SEGMENT TO DOMINATE MARKET BETWEEN 2022 AND 2027

- FIGURE 12 INDUSTRIAL SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

- FIGURE 13 AIR CONDITIONING SEGMENT TO LEAD MARKET BETWEEN 2022 AND 2027

- FIGURE 14 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN CONDENSING UNIT MARKET

- FIGURE 15 CONDENSING UNIT MARKET TO WITNESS MODERATE GROWTH BETWEEN 2022 AND 2027

- 4.2 CONDENSING UNIT MARKET, BY REGION

- FIGURE 16 MIDDLE EAST & AFRICA MARKET TO GROW AT HIGHEST RATE BETWEEN 2022 AND 2027

- 4.3 ASIA PACIFIC CONDENSING UNIT MARKET, BY TYPE AND APPLICATION

- FIGURE 17 COMMERCIAL APPLICATION AND AIR-COOLED SEGMENT DOMINATED ASIA PACIFIC CONDENSING UNIT MARKET IN 2021

- 4.4 CONDENSING UNIT MARKET, BY TYPE

- FIGURE 18 AIR-COOLED SEGMENT TO LEAD MARKET BETWEEN 2022 AND 2027

- 4.5 CONDENSING UNIT MARKET, BY FUNCTION

- FIGURE 19 REFRIGERATION SEGMENT TO GROW AT HIGHEST RATE BETWEEN 2022 AND 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CONDENSING UNIT MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing retail sector in emerging economies

- 5.2.1.2 Increasing demand for air conditioning units and refrigeration

- 5.2.1.3 Growth in the electronics and data center market

- FIGURE 21 IMPACT OF DRIVERS ON CONDENSING UNIT MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent environmental regulations on refrigerants used in condensing units

- FIGURE 22 IMPACT OF RESTRAINTS ON CONDENSING UNIT MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements leading to the introduction of efficient condensing units

- 5.2.3.2 Increasing demand for natural refrigerants

- TABLE 3 FACTORS INFLUENCING GROWTH OF NATURAL REFRIGERANTS

- FIGURE 23 IMPACT OF OPPORTUNITIES ON CONDENSING UNIT MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain disruption in the global HVAC systems market

- FIGURE 24 IMPACT OF CHALLENGES ON CONDENSING UNIT MARKET

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 CONDENSING UNIT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 CASE STUDY ANALYSIS

- 5.4.1 DANFOSS ASSISTED KRIOFROST IN INSTALLING THE COMPANY'S FIRST TRANSCRITICAL CO2 BOOSTER REFRIGERATION SYSTEM

- 5.5 POLICIES AND REGULATIONS

- 5.6 REVISED SECTION 608 OF REFRIGERANT MANAGEMENT REGULATIONS

- 5.7 FLAMMABILITY AND TOXICITY ISSUES

- 5.8 EUROPE

- 5.8.1 EU F-GAS REGULATIONS

- 5.8.2 MONTREAL PROTOCOL

- 5.8.3 DENMARK

- 5.9 NORTH AMERICA

- 5.9.1 SIGNIFICANT NEW ALTERNATIVE POLICY (SNAP) BY EPA

- 5.10 ASIA PACIFIC

- 5.10.1 JAPAN: REVISED F-GAS LAW

- 5.10.2 CHINA (FECO): FIRST CATALOGUE OF RECOMMENDED SUBSTITUTES FOR HCFCS

- TABLE 5 RECOMMENDED SUBSTITUTES FOR R22 IN DIFFERENT SECTORS

- 5.10.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 ECOSYSTEM/MARKET MAP

- FIGURE 26 CONDENSING UNIT MARKET: ECOSYSTEM/MARKET MAP

- TABLE 10 CONDENSING UNIT MARKET: ECOSYSTEM

- 5.12 VALUE CHAIN ANALYSIS

- FIGURE 27 COMPONENTS ACCOUNT FOR MAJOR VALUE ADDITION

- 5.12.1 HERMETIC CONDENSING UNIT

- 5.12.2 SCROLL CONDENSING UNIT

- 5.12.3 SEMI-HERMETIC CONDENSING UNIT

- 5.13 AVERAGE PRICE TREND

- TABLE 11 AVERAGE PRICE OF CONDENSING UNIT IN KEY REGIONS, BY TYPE, 2021 (USD)

- FIGURE 28 GLOBAL AVERAGE PRICE OF CONDENSING UNIT, BY TYPE

- FIGURE 29 ASIA PACIFIC AVERAGE PRICE OF CONDENSING UNIT, BY TYPE

- 5.14 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 12 CONDENSING UNIT MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.15 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- 5.15.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- 5.16 TRADE DATA

- TABLE 15 CONDENSING UNIT EXPORT DATA

- TABLE 16 CONDENSING UNIT IMPORT DATA

- 5.17 TECHNOLOGY ANALYSIS

- 5.18 PATENT ANALYSIS

- FIGURE 32 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

- FIGURE 33 PUBLICATION TRENDS - LAST 10 YEARS

- FIGURE 34 LEGAL STATUS OF PATENTS

- FIGURE 35 TOP JURISDICTION, BY DOCUMENT

- FIGURE 36 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- TABLE 17 LIST OF PATENTS BY MIDEA GROUP CO., LTD

- TABLE 18 LIST OF PATENTS BY GREE ELECTRIC APPLIANCES INC. ZHUHAI

- TABLE 19 LIST OF PATENTS BY AUX AIR CONDITIONING CO., LTD

- TABLE 20 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6 CONDENSING UNIT MARKET, BY COMPRESSOR TYPE

- 6.1 INTRODUCTION

- 6.2 RECIPROCATING COMPRESSORS

- 6.2.1 LONG-TERM AND EFFECTIVE AIR COMPRESSION FEATURES TO FUEL DEMAND

- 6.3 SCREW COMPRESSORS

- 6.3.1 NOISE-FREE OPERATIONAL FEATURE TO INCREASE DEMAND

- 6.4 ROTARY COMPRESSORS

- 6.4.1 DEMAND FROM HOTELS AND HOSPITALS TO PROPEL MARKET

- 6.5 OTHERS

7 CONDENSING UNIT MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 37 AIR-COOLED CONDENSING UNIT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 21 CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 22 CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (USD BILLION)

- TABLE 23 CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 24 CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 7.2 AIR-COOLED CONDENSING UNIT

- 7.2.1 LOW MAINTENANCE AND INSTALLATION COSTS TO DRIVE THIS SEGMENT

- 7.3 WATER-COOLED CONDENSING UNIT

- 7.3.1 ENERGY-EFFICIENT FEATURE TO FUEL DEMAND

8 CONDENSING UNIT MARKET, BY REFRIGERANT TYPE

- 8.1 INTRODUCTION

- 8.2 FLUOROCARBONS

- 8.2.1 APPLICATION OF FLUOROCARBONS IN LARGE REFRIGERATORS TO BOOST DEMAND

- 8.2.1.1 Hydrochlorofluorocarbons (HCFCs)

- TABLE 25 HCFC: APPLICATIONS AND GWP

- 8.2.1.2 Hydrofluorocarbons (HFCs)

- TABLE 26 HFC: APPLICATIONS AND GWP

- 8.2.1.3 Hydrofluoroolefins (HFOs)

- TABLE 27 HFO: APPLICATIONS AND GWP

- 8.2.1 APPLICATION OF FLUOROCARBONS IN LARGE REFRIGERATORS TO BOOST DEMAND

- 8.3 HYDROCARBONS

- 8.3.1 NON-TOXIC FEATURE OF HYDROCARBONS TO FUEL GROWTH

- 8.3.1.1 Isobutane

- TABLE 28 ISOBUTANE: APPLICATIONS AND GWP

- 8.3.1.2 Propane

- TABLE 29 PROPANE: APPLICATIONS AND GWP

- 8.3.1.3 Others

- 8.3.1 NON-TOXIC FEATURE OF HYDROCARBONS TO FUEL GROWTH

- 8.4 INORGANICS

- 8.4.1 TRANSPORT AND INDUSTRIAL APPLICATIONS OF INORGANICS TO PROPEL DEMAND

- 8.4.1.1 Ammonia

- TABLE 30 AMMONIA: APPLICATIONS AND GWP

- 8.4.1.2 CO2

- TABLE 31 CO2: APPLICATIONS AND GWP

- 8.4.1.3 Others

- TABLE 32 OTHERS: APPLICATIONS AND GWP

- 8.4.1 TRANSPORT AND INDUSTRIAL APPLICATIONS OF INORGANICS TO PROPEL DEMAND

9 CONDENSING UNIT MARKET, BY FUNCTION

- 9.1 INTRODUCTION

- TABLE 33 CONDENSING UNIT MARKET: FUNCTION SEGMENT BREAKDOWN

- FIGURE 38 AIR CONDITIONING SEGMENT TO DOMINATE CONDENSING UNIT MARKET DURING FORECAST PERIOD

- TABLE 34 CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2018-2021 (USD BILLION)

- TABLE 35 CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2022-2027 (USD BILLION)

- TABLE 36 CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2018-2021 (THOUSAND UNIT)

- TABLE 37 CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2022-2027 (THOUSAND UNIT)

- 9.2 AIR CONDITIONING

- 9.2.1 GROWING COLD STORAGE SECTOR TO PROPEL DEMAND

- 9.3 REFRIGERATION

- 9.3.1 DEMAND FROM HOTELS AND HOSPITALS TO DRIVE DEMAND

- 9.4 HEAT PUMPS

- 9.4.1 INCREASING INFRASTRUCTURAL PROJECTS TO FUEL DEMAND

10 CONDENSING UNIT MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 39 INDUSTRIAL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 38 CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (USD BILLION)

- TABLE 39 CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 40 CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 41 CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- 10.2 COMMERCIAL

- 10.2.1 GROWING RETAIL SECTOR TO FUEL DEMAND

- 10.3 INDUSTRIAL

- 10.3.1 INCREASING DEMAND IN PETROCHEMICAL INDUSTRY TO PROPEL DEMAND

- 10.4 TRANSPORTATION

- 10.4.1 LOW OPERATIONAL COST AND HIGH EFFICIENCY TO DRIVE THIS SEGMENT

- TABLE 42 TRANSPORT REFRIGERATION: KEY APPLICATIONS, END-USE INDUSTRIES, AND COMMON REFRIGERANTS

11 CONDENSING UNIT MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 40 ASIA PACIFIC TO BE LARGEST CONDENSING UNIT MARKET DURING FORECAST PERIOD

- TABLE 43 CONDENSING UNIT MARKET SIZE, BY REGION, 2018-2021 (USD BILLION)

- TABLE 44 CONDENSING UNIT MARKET SIZE, BY REGION, 2022-2027 (USD BILLION)

- TABLE 45 CONDENSING UNIT MARKET SIZE, BY REGION, 2018-2021 (THOUSAND UNIT)

- TABLE 46 CONDENSING UNIT MARKET SIZE, BY REGION, 2022-2027 (THOUSAND UNIT)

- 11.2 ASIA PACIFIC

- FIGURE 41 ASIA PACIFIC: CONDENSING UNIT MARKET SNAPSHOT

- TABLE 47 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 48 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 49 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018-2021 (THOUSAND UNIT)

- TABLE 50 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022-2027 (THOUSAND UNIT)

- TABLE 51 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 52 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 53 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 54 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- TABLE 55 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2018-2021 (THOUSAND UNIT)

- TABLE 56 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2022-2027 (THOUSAND UNIT)

- 11.2.1 CHINA

- 11.2.1.1 Rapidly growing cooling energy sector to boost market

- TABLE 57 CHINA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 58 CHINA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 59 CHINA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 60 CHINA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.2.2 INDIA

- 11.2.2.1 Rise in income levels and growing food production to create high growth opportunities

- TABLE 61 INDIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 62 INDIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 63 INDIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 64 INDIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.2.3 JAPAN

- 11.2.3.1 Growth in frozen food market to propel demand

- TABLE 65 JAPAN: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 66 JAPAN: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 67 JAPAN: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 68 JAPAN: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Growing investments in cold chain industry to drive market

- TABLE 69 SOUTH KOREA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 70 SOUTH KOREA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 71 SOUTH KOREA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 72 SOUTH KOREA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.2.5 THAILAND

- 11.2.5.1 Growing agricultural supply and other food products to drive market

- TABLE 73 THAILAND: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 74 THAILAND: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 75 THAILAND: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 76 THAILAND: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.2.6 MALAYSIA

- 11.2.6.1 High penetration of refrigeration appliances to increase demand

- TABLE 77 MALAYSIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 78 MALAYSIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 79 MALAYSIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 80 MALAYSIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.2.7 SINGAPORE

- 11.2.7.1 High spending of people on food to drive market

- TABLE 81 SINGAPORE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 82 SINGAPORE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 83 SINGAPORE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 84 SINGAPORE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.2.8 INDONESIA

- 11.2.8.1 Growing cold chain industry to propel market

- TABLE 85 INDONESIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 86 INDONESIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 87 INDONESIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 88 INDONESIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.2.9 REST OF ASIA PACIFIC

- TABLE 89 REST OF ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 90 REST OF ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 91 REST OF ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 92 REST OF ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.3 NORTH AMERICA

- FIGURE 42 NORTH AMERICA: CONDENSING UNIT MARKET SNAPSHOT

- TABLE 93 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 94 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 95 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018-2021 (THOUSAND UNIT)

- TABLE 96 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022-2027 (THOUSAND UNIT)

- TABLE 97 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 98 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 99 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 100 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- TABLE 101 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2018-2021 (THOUSAND UNIT)

- TABLE 102 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2022-2027 (THOUSAND UNIT)

- 11.3.1 US

- 11.3.1.1 Growing demand for food products to fuel demand

- TABLE 103 US: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 104 US: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 105 US: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 106 US: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.3.2 CANADA

- 11.3.2.1 Regulations related to reduction in food spoilage and food loss to drive market

- TABLE 107 CANADA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 108 CANADA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 109 CANADA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 110 CANADA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.3.3 MEXICO

- 11.3.3.1 Growing market for temperature-controlled storage and warehouse to fuel market

- TABLE 111 MEXICO: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 112 MEXICO: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 113 MEXICO: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 114 MEXICO: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.4 EUROPE

- FIGURE 43 EUROPE: CONDENSING UNIT MARKET SNAPSHOT

- TABLE 115 EUROPE: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 116 EUROPE: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 117 EUROPE: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018-2021 (THOUSAND UNIT)

- TABLE 118 EUROPE: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022-2027 (THOUSAND UNIT)

- TABLE 119 EUROPE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 120 EUROPE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 121 EUROPE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 122 EUROPE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- TABLE 123 EUROPE: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2018-2021 (THOUSAND UNIT)

- TABLE 124 EUROPE: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2022-2027 (THOUSAND UNIT)

- 11.4.1 GERMANY

- 11.4.1.1 Rising need for refrigerated storage and transportation to boost market

- TABLE 125 GERMANY: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 126 GERMANY: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 127 GERMANY: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 128 GERMANY: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.4.2 UK

- 11.4.2.1 Increasing efficient cold chain services by major companies to fuel growth

- TABLE 129 UK: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 130 UK: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 131 UK: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 132 UK: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.4.3 FRANCE

- 11.4.3.1 Presence of large supermarket chains to drive market

- TABLE 133 FRANCE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 134 FRANCE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 135 FRANCE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 136 FRANCE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.4.4 ITALY

- 11.4.4.1 Growing food retail industry and storage of ready-to-eat packed food products to propel demand

- TABLE 137 ITALY: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 138 ITALY: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 139 ITALY: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 140 ITALY: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.4.5 SPAIN

- 11.4.5.1 Increasing demand for air conditioners to fuel growth

- TABLE 141 SPAIN: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 142 SPAIN: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 143 SPAIN: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 144 SPAIN: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.4.6 REST OF EUROPE

- TABLE 145 REST OF EUROPE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 146 REST OF EUROPE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 147 REST OF EUROPE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 148 REST OF EUROPE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.5 MIDDLE EAST & AFRICA

- TABLE 149 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 150 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 151 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018-2021 (THOUSAND UNIT)

- TABLE 152 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022-2027 (THOUSAND UNIT)

- TABLE 153 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 154 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 155 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 156 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- TABLE 157 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2018-2021 (THOUSAND UNIT)

- TABLE 158 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2022-2027 (THOUSAND UNIT)

- 11.5.1 SAUDI ARABIA

- 11.5.1.1 Rapid urbanization and presence of major players to drive demand

- TABLE 159 SAUDI ARABIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 160 SAUDI ARABIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 161 SAUDI ARABIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 162 SAUDI ARABIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.5.2 TURKEY

- 11.5.2.1 Growing HVAC&R industry to fuel growth

- TABLE 163 TURKEY: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 164 TURKEY: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 165 TURKEY: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 166 TURKEY: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.5.3 UAE

- 11.5.3.1 Growing food & beverage industry to drive market

- TABLE 167 UAE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 168 UAE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 169 UAE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 170 UAE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 171 REST OF MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 172 REST OF MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 173 REST OF MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 174 REST OF MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.6 SOUTH AMERICA

- TABLE 175 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018-2021 (THOUSAND UNIT)

- TABLE 176 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022-2027 (THOUSAND UNIT)

- TABLE 177 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 178 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 179 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 180 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 181 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 182 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- TABLE 183 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2018-2021 (THOUSAND UNIT)

- TABLE 184 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2022-2027 (THOUSAND UNIT)

- 11.6.1 BRAZIL

- 11.6.1.1 Growing population along with huge market potential for cold storage to enhance demand

- TABLE 185 BRAZIL: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 186 BRAZIL: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 187 BRAZIL: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 188 BRAZIL: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.6.2 COLOMBIA

- 11.6.2.1 Increasing exports of consumer food products to create market opportunities

- TABLE 189 COLOMBIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 190 COLOMBIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 191 COLOMBIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 192 COLOMBIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.6.3 ARGENTINA

- 11.6.3.1 Increase in export of fruits to drive market

- TABLE 193 ARGENTINA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 194 ARGENTINA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 195 ARGENTINA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 196 ARGENTINA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

- 11.6.4 REST OF SOUTH AMERICA

- TABLE 197 REST OF SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018-2021 (THOUSAND UNIT)

- TABLE 198 REST OF SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022-2027 (THOUSAND UNIT)

- TABLE 199 REST OF SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018-2021 (THOUSAND UNIT)

- TABLE 200 REST OF SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022-2027 (THOUSAND UNIT)

12 COMPETITIVE LANDSCAPE

- 12.1 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 201 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS

- 12.2 REVENUE ANALYSIS

- FIGURE 44 REVENUE ANALYSIS FOR KEY COMPANIES OVER LAST 5 YEARS

- 12.3 MARKET RANKING ANALYSIS, 2021

- FIGURE 45 CONDENSING UNIT MARKET: RANKING ANALYSIS (2021)

- TABLE 202 CONDENSING UNIT MARKET: TYPE FOOTPRINT

- TABLE 203 CONDENSING UNIT MARKET: APPLICATION FOOTPRINT

- TABLE 204 CONDENSING UNIT MARKET: REGION FOOTPRINT

- 12.4 COMPANY EVALUATION MATRIX

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 PARTICIPANTS

- FIGURE 46 CONDENSING UNIT MARKET: COMPANY EVALUATION MATRIX, 2020

- 12.5 COMPETITIVE SCENARIO

- TABLE 205 CONDENSING UNIT MARKET: PRODUCT LAUNCHES, 2018-2022

- TABLE 206 CONDENSING UNIT MARKET: DEALS, 2018-2022

- TABLE 207 CONDENSING UNIT MARKET: OTHER DEVELOPMENTS, 2018-2022

13 COMPANY PROFILES

(Business Overview, Products, Solutions & Services, Recent Developments, MnM View)**

- 13.1 EMERSON ELECTRIC CO.

- TABLE 208 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- FIGURE 47 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- TABLE 209 EMERSON ELECTRIC CO: PRODUCT OFFERINGS

- TABLE 210 EMERSON ELECTRIC CO.: PRODUCT LAUNCH

- 13.2 CARRIER

- TABLE 211 CARRIER: COMPANY OVERVIEW

- FIGURE 48 CARRIER: COMPANY SNAPSHOT

- TABLE 212 CARRIER: PRODUCT OFFERINGS

- TABLE 213 CARRIER: DEALS

- 13.3 DANFOSS

- TABLE 214 DANFOSS: COMPANY OVERVIEW

- FIGURE 49 DANFOSS: COMPANY SNAPSHOT

- TABLE 215 DANFOSS: PRODUCT OFFERINGS

- TABLE 216 DANFOSS: PRODUCT LAUNCH

- TABLE 217 DANFOSS: DEALS

- 13.4 GEA GROUP AKTIENGESELLSCHAFT

- TABLE 218 GEA GROUP AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- FIGURE 50 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- TABLE 219 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT OFFERINGS

- 13.5 BITZER

- TABLE 220 BITZER: COMPANY OVERVIEW

- TABLE 221 BITZER: PRODUCTS OFFERED

- TABLE 222 BITZER: PRODUCT LAUNCH

- TABLE 223 BITZER: DEALS

- TABLE 224 BITZER.: OTHERS

- 13.6 HEATCRAFT WORLDWIDE REFRIGERATION

- TABLE 225 HEATCRAFT WORLDWIDE REFRIGERATION: COMPANY OVERVIEW

- TABLE 226 HEATCRAFT WORLDWIDE REFRIGERATION: PRODUCT OFFERINGS

- TABLE 227 HEATCRAFT WORLDWIDE REFRIGERATION: PRODUCT LAUNCH

- 13.7 BALTIMORE AIRCOIL COMPANY

- TABLE 228 BALTIMORE AIRCOIL COMPANY: COMPANY OVERVIEW

- TABLE 229 BALTIMORE AIRCOIL COMPANY: PRODUCTS OFFERED

- TABLE 230 BALTIMORE AIRCOIL COMPANY: PRODUCT LAUNCH

- TABLE 231 BALTIMORE AIRCOIL COMPANY: DEALS

- TABLE 232 BALTIMORE AIRCOIL COMPANY: OTHERS

- 13.8 DORIN S.P.A.

- TABLE 233 DORIN S.P.A.: COMPANY OVERVIEW

- TABLE 234 DORIN S.P.A: PRODUCTS OFFERED

- TABLE 235 DORIN S.P.A.: PRODUCT LAUNCH

- 13.9 SCM FRIGO S.P.A.

- TABLE 236 SCM FRIGO S.P.A.: COMPANY OVERVIEW

- TABLE 237 SCM FRIGO S.P.A.: PRODUCTS OFFERED

- TABLE 238 S.C.M FRIGO S.P.A.: OTHERS

- 13.10 DAIKIN APPLIED

- TABLE 239 DAIKIN APPLIED: COMPANY OVERVIEW

- FIGURE 51 DAIKIN APPLIED: COMPANY SNAPSHOT

- TABLE 240 DAIKIN APPLIED: PRODUCTS OFFERED

- TABLE 241 DAIKIN APPLIED: OTHERS

- 13.11 EVAPCO, INC.

- TABLE 242 EVAPCO, INC.: COMPANY OVERVIEW

- TABLE 243 EVAPCO, INC.: PRODUCTS OFFERED

- TABLE 244 EVAPCO, INC.: DEALS

- 13.12 FRASCOLD S.P.A.

- TABLE 245 FRASCOLD S.P.A.: COMPANY OVERVIEW

- TABLE 246 FRASCOLD S.P.A.: PRODUCTS OFFERED

- TABLE 247 FRASCOLD SPA: DEALS

- TABLE 248 FRASCOLD SPA S.P.A.: OTHERS

- 13.13 HOWE CORPORATION

- TABLE 249 HOWE CORPORATION: COMPANY OVERVIEW

- TABLE 250 HOWE CORPORATION: PRODUCTS OFFERED

- 13.14 HUSSMANN CORPORATION

- TABLE 251 HUSSMAN CORPORATION: COMPANY OVERVIEW

- TABLE 252 HUSSMAN CORPORATION: PRODUCTS OFFERED

- TABLE 253 HUSSMAN CORPORATION: PRODUCT LAUNCH

- 13.15 BLUE STAR LIMITED CORPORATION

- TABLE 254 BLUE STAR LIMITED: COMPANY OVERVIEW

- FIGURE 52 BLUE STAR LIMITED: COMPANY SNAPSHOT

- TABLE 255 BLUE STAR LIMITED: PRODUCTS OFFERED

- TABLE 256 BLUE STAR LIMITED: OTHERS

- 13.16 MTA S.P.A.

- TABLE 257 MTA S.P.A: COMPANY OVERVIEW

- TABLE 258 MTA S.P.A.: PRODUCTS OFFERED

- 13.17 TECUMSEH PRODUCTS COMPANY LLC

- TABLE 259 TECUMSEH PRODUCTS COMPANY LLC: COMPANY OVERVIEW

- TABLE 260 TECUMSEH PRODUCTS COMPANY LLC: PRODUCTS OFFERED

- TABLE 261 TECUMSEH PRODUCTS COMPANY LLC: PRODUCT LAUNCH

- 13.18 ELGIN S/A

- TABLE 262 ELGIN S/A: COMPANY OVERVIEW

- TABLE 263 ELGIN S/A: PRODUCTS OFFERED

- 13.19 EMBRACO LLC

- TABLE 264 EMBRACO LLC: COMPANY OVERVIEW

- TABLE 265 EMBRACO LLC: PRODUCTS OFFERED

- TABLE 266 EMBRACO LLC: PRODUCT LAUNCH

- TABLE 267 EMBRACO LLC: OTHERS

- 13.20 GOOD COLD

- TABLE 268 GOOD COLD: COMPANY OVERVIEW

- TABLE 269 GOOD COLD: PRODUCTS OFFERED

- 13.21 MULTICONTROL SA

- TABLE 270 MULTICONTROL SA: COMPANY OVERVIEW

- TABLE 271 MULTICONTROL SA: PRODUCTS OFFERED

- 13.22 OTHER PLAYERS

- 13.22.1 FREEZEINDIA MANUFACTURING PRIVATE LIMITED

- TABLE 272 FREEZEINDIA MANUFACTURING PRIVATE LIMITED: COMPANY OVERVIEW

- 13.22.2 NATIONAL COMFORT PRODUCTS

- TABLE 273 NATIONAL COMFORT PRODUCTS: COMPANY OVERVIEW

- 13.22.3 PATTON LTD.

- TABLE 274 PATTON LTD.: COMPANY OVERVIEW

- 13.22.4 SAFE AIR TECHNOLOGY

- TABLE 275 SAFE AIR TECHNOLOGY: COMPANY OVERVIEW

- 13.22.5 SHANGHAI GENERAL FUSHI REFRIGERATION EQUIPMENT CO. LTD

- TABLE 276 SHANGHAI GENERAL FUSHI REFRIGERATION EQUIPMENT CO. LTD: COMPANY OVERVIEW

- 13.22.6 SHREE REFRIGERATIONS

- TABLE 277 SHREE REFRIGERATIONS: COMPANY OVERVIEW

- 13.22.7 SHANGHAI ZHAOXUE REFRIGERATION EQUIPMENT CO., LTD.

- TABLE 278 SHANGHAI ZHAOXUE REFRIGERATION EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- 13.22.8 ZHEJIANG BEIFENG REFRIGERATION EQUIPMENT CO., LTD

- TABLE 279 ZHEJIANG BEIFENG REFRIGERATION EQUIPMENT CO., LTD: COMPANY OVERVIEW

- 13.22.9 ADVANSOR A/S

- TABLE 280 ADVANSOR A/S: COMPANY OVERVIEW

- *Details on Business Overview, Solutions, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATION

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS