|

|

市場調査レポート

商品コード

1099211

過活動膀胱治療(OAB)市場:タイプ別(抗コリン薬(ソリフェナシン、オキシブチニン、トルテロジン、ダリフェナシン)、ミラベグロン)、ボトックス、神経調節)、疾患タイプ別(特発性OAB、神経因性OAB)、地域別 - 2027年までの世界予測Overactive Bladder Treatment (OAB) Market by Drug type ( Anticholinergic (Solifenacin, Oxybutynin, Tolterodine, Darifenacin), Mirabegron), Botox, Neuromodulation, Disease Type (Idopathic OAB and Neurogenic OAB) and Region - Global Forecasts to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 過活動膀胱治療(OAB)市場:タイプ別(抗コリン薬(ソリフェナシン、オキシブチニン、トルテロジン、ダリフェナシン)、ミラベグロン)、ボトックス、神経調節)、疾患タイプ別(特発性OAB、神経因性OAB)、地域別 - 2027年までの世界予測 |

|

出版日: 2022年07月05日

発行: MarketsandMarkets

ページ情報: 英文 203 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

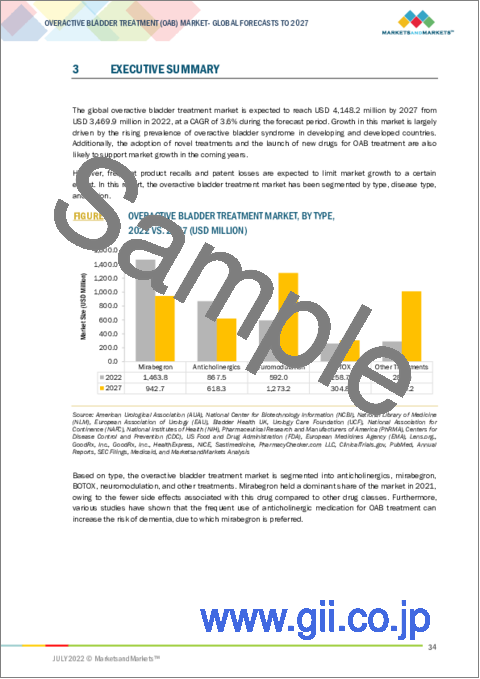

過活動膀胱治療の世界市場は、2022年の35億米ドルから2027年には42億米ドルに達すると予測され、予測期間中のCAGRは3.6%となります。

世界中で過活動膀胱の有病率が上昇していることと、利用可能な治療オプションに関する認知度が高まっていることが、市場の成長を後押ししています。また、OABの治療における神経調節技術の使用は、さらに大きな好影響をもたらすと予想されます。

"2021年の過活動膀胱(OAB)治療市場はミラベグロンセグメントが支配的"

過活動膀胱治療市場は、タイプ別に、抗コリン薬、ミラベグロン、ボトックス、神経調節、その他の治療法に分類されます。ミラベグロンは、市場で入手可能な他の薬物クラスと比較して、この薬物に関連する副作用が少ないことから、2021年の市場で圧倒的なシェアを占めています。さらに、神経セグメンテーション分野は、OAB用の新しいSNMおよびPTNSの市場投入により、より速いペースで成長すると予想されます。

"特発性過活動膀胱は、予測期間中に過活動膀胱治療薬市場で最も高い成長を遂げる"

過活動膀胱治療市場は、疾患タイプに基づき、特発性過活動膀胱と神経原性過活動膀胱に区分されます。特発性過活動膀胱は、特発性過活動膀胱疾患の有病率の高さと治療薬の使用増加により、より大きな市場シェアを占めています。

"2021年は北米が圧倒的なシェアを占める"

過活動膀胱(OAB)治療市場は、地域的には、北米、欧州、アジア太平洋、中南米、中東・アフリカに区分されます。2021年、北米はOAB治療市場の主要シェアを占めています。北米は、この地域のOAB治療市場の成熟につながる主要な市場プレーヤーの大部分を保持しています。さらに、米国の有利な償還政策は、北米の市場成長を予測する主要な要因の1つとなっています。

本レポートで行った主なインタビューは以下のように分類

- 企業タイプ別:Supply Side:80.0%, Demand Side:20.0%

- 役職別:Managers:45.0%, CXOs & Directors:30.0%, Excecutives:25.0%

- 地域別:North America:55%, Europe:20%, Asia Pacific:10%, Latin America:10%, and the Middle East and Africa:5%

本レポートに掲載された企業プロファイル一覧

- アステラス製薬株式会社(日本)

- テバ・ファーマシューティカル・インダストリーズ(イスラエル)

- ファイザー株式会社(米国)

- アッヴィー社(米国)

- Viatris Inc.(米国)

- 久光製薬株式会社(日本)

- ジョンソン・エンド・ジョンソンサービスインク(米国)

- エンドー・ファーマシューティカルズ・インク(アイルランド)

- ルパン(インド)

- アムニール・ファーマシューティカルズLLC(米国)

- サン・ファーマシューティカル・インダストリーズ社(インド)

- グレンマーク(インド)

- マクロード・ファーマシューティカルズ・リミテッド(インド)

- メドトロニック(アイルランド)

- アジャンタファーマ(インド)

- グラニュールスインディアリミテッド(インド)

- ウロバント・サイエンシズ(米国)

- アポテックス社(カナダ)

- ラボリー(米国)

- インタス・ファーマシューティカルズLtd.(インド)

- バイエル薬品(ドイツ)

- メディトックス(韓国)

- アルサーックス・ファーマシューティカルズ(米国)

- 大鵬薬品工業株式会社(日本)

- ヒューゲル社(韓国)

調査対象

本レポートでは、世界の過活動膀胱治療市場の詳細な実態を把握することができます。タイプ、疾患タイプ、地域などの異なるセグメントにおける市場規模と今後の成長可能性を推定することを目的としています。また、市場成長に影響を与える要因(促進要因、市場抑制要因、機会など)を分析しています。利害関係者向けに市場の機会を評価し、市場リーダー向けに競合情勢の詳細を提供しています。また、マイクロマーケットについて、その成長動向、展望、細胞分析市場全体への貢献度に関しても調査しています。レポートでは、4つの主要地域に関して、市場セグメントの収益を予測しています。

レポートを購入する理由

本レポートは、以下のポイントに関する洞察を提供

- 市場の浸透。細胞分析市場のトップ企業25社が提供する細胞分析に関する包括的な情報。過活動膀胱治療市場をタイプ別、疾患タイプ別、地域別に分析したレポートです。

- 市場の新興国市場。有利な新興市場に関する包括的な情報です。主要地域別に各種細胞解析の市場を分析しています。

- 市場の多様化。過活動膀胱(OAB)治療市場における新製品、未開拓地域、最近の開発、投資に関する情報を網羅的に提供します。

- 競合の評価。過活動膀胱治療市場における主要企業の市場ランキングと戦略に関する詳細な評価。

目次

第1章 イントロダクション

- 研究の目的

- 市場の定義

- 包含と除外

- マーケットスコープ

- 対象となる市場

- 考慮される年

- 通貨

- 制限

- 利害関係者

- 変更の概要

第2章 調査手法

- 調査アプローチ

- 1次調査

- トップダウンおよびボトムアップのアプローチ

- データ三角測量アプローチ

- 2次調査

- COVID-19固有の仮定

- 調査の制限

- リスクアセスメント

- 成長率の仮定/成長予測

- サプライサイド

- 需要側

- 一次専門家からの洞察

第3章 エグゼクティブサマリー

第4章 重要考察

- 過活動膀胱治療市場の市場概要

- アジア太平洋:タイプおよび国別の過活動膀胱治療市場シェア(2021年)

- 過活動膀胱治療市場シェア、疾患タイプ別、2022年対 2027年

- 過活動膀胱治療市場:地理的成長機会の機会

第5章 市場概要

- イントロダクション

- 市場力学

- 市場促進要因

- 過活動膀胱症候群の有病率の上昇

- 急速に高齢化する人口とそれに続くOABを特徴とする疾患の発生率の上昇

- 革新的な膀胱内療法の開発と使用

- 今後数年間で成長する研究開発投資と新しい治療法の開始

- 市場抑制要因

- 頻繁な製品リコール

- 抗コリン薬の副作用の増加

- 市場機会

- 特定の薬剤の新しい治療法、堅牢なパイプライン、および特許の崖

- 市場の課題

- 社会的不名誉とOABについての認識の欠如

- 市場促進要因

- 過活動膀胱治療市場に対する不確実性の影響

- 過活動膀胱治療市場に対するCOVID-19の影響

- 顧客のビジネスに影響を与える動向/混乱

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 規制シナリオ

- 製薬業界

- 規制要件

- EUの規制

- 米国の規制

- 規制要件

- 医療機器産業

- 規制要件

- EUの規制

- 米国の規制

- 規制要件

- 製薬業界

- テクノロジー分析

- 2022年から2023年の主要な会議とイベント

- 特許分析

- ポーターのファイブフォース分析

- 新規参入者からの脅威

- 代替品からの脅威

- 買い手の交渉力

- 供給企業の交渉力

- 競争の競合

- 価格分析

- 主要な利害関係者と購入基準

- パイプライン分析

第6章 過活動膀胱治療市場:タイプ別

- イントロダクション

- ミラベグロン

- 抗コリン薬と比較してより少ない副作用がこの市場セグメントの成長を促進する可能性があります

- 抗コリン薬

- ソリフェナシン

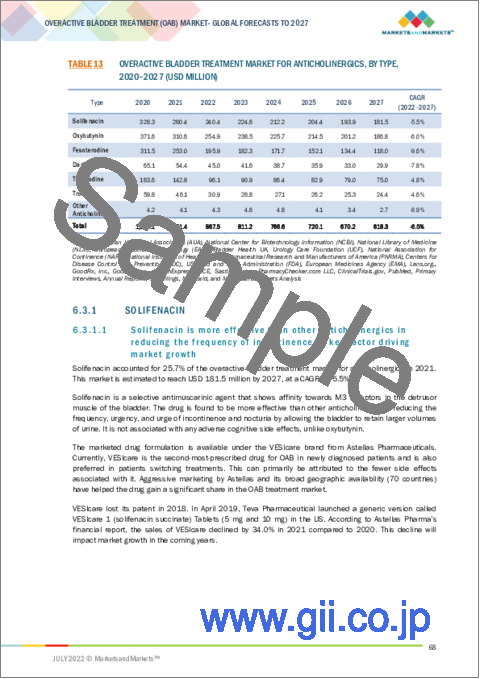

- ソリフェナシンは、失禁の頻度を減らすのに他の抗コリン薬よりも効果的です-市場の成長を促進する重要な要因

- オキシブチニン

- オキシブチニンは、OAB市場で最も広く処方されている抗コリン薬です。

- フェソテロジン

- フェソテロジンは、排尿筋のムスカリン性アセチルコリン受容体に対して抗ムスカリン作用を示し、膀胱収縮の減少をもたらします

- ダリフェナシン

- ダリフェナシンのコストは他の抗コリン薬よりも高く、市場の成長をある程度抑制する可能性があります

- トルテロジン

- トルテロジンは、副作用が少なく、長期的な臨床効果があるため、OABで3番目に処方されている薬です。

- トロスピウム

- トロスピウムは口渇の発生率が低いことに関連しており、その結果、その中止率は比較的低くなります

- その他の抗コリン薬

- ソリフェナシン

- ボトックス

- 抗コリン薬よりもボトックスの有効性が高いため、人気のある治療法の選択肢になります

- 神経修飾

- この市場セグメントの成長を促進するための過活動膀胱治療のための神経調節の採用の増加

- その他の治療法

第7章 過活動膀胱治療市場:疾患タイプ別

- イントロダクション

- 特発性過活動膀胱症候群

- この市場での燃料成長のために特発性OABを治療するために使用される薬剤の償還の利用可能性

- 神経因性過活動膀胱症候群

- パーキンソン病

- 市場の成長を促進するためのパーキンソン病の治療のための抗コリン薬およびベータアドレナリン作動薬の使用の増加

- 脳卒中

- OABの発生率を高め、OAB治療の需要を高めるための脳卒中の有病率の上昇

- 多発性硬化症

- MSのOAB治療市場の成長をサポートするための有利な償還方針

- 脊髄損傷

- SCIにおける膀胱過活動の高い有病率は、神経因性膀胱過活動治療市場の成長に貢献しています

- その他の障害

- パーキンソン病

第8章 過活動膀胱治療市場:地域別

- イントロダクション

- 北米

- 米国

- 有利な償還政策により、米国は膀胱過活動治療の最大の市場となっています

- カナダ

- 過活動膀胱を治療してカナダの市場成長を促進するためのBOTOXの使用と需要の増加

- 米国

- 欧州

- ドイツ

- 特に女性における高齢化とOABの高い有病率は、ドイツの対象患者グループを増加させると予想されます

- 英国

- OAB市場の成長を促進するための英国でのイニシアチブと意識向上キャンペーン

- フランス

- 他の国に比べてフランスの返済率が低いと、市場の成長がある程度制限される可能性があります

- イタリア

- イタリアの製薬業界は、OAB製薬会社に有利な成長機会を提供することが期待されています

- スペイン

- スペインの人口動態の変化とOABの有病率の高さは、過活動膀胱治療市場に大きな成長機会をもたらします

- その他欧州

- ドイツ

- アジア太平洋地域

- 日本

- 日本の市場の成長を促進するための治療オプションの進歩

- 中国

- OAB治療のためのBOTOXの採用の拡大は、中国を儲かる市場にします

- インド

- インドはジェネリック医薬品の世界最大の生産国であり、市場の成長を促進する重要な要因です

- オーストラリア

- 高齢化人口の増加は、オーストラリアでOABに苦しむ患者の数を増やす可能性があります-この市場の成長をサポートする主要な要因

- その他アジア太平洋地域

- 日本

- ラテンアメリカ

- ブラジル

- 市場の成長を促進するために国内で過活動膀胱薬の使用が増加

- メキシコ

- メキシコの市場の成長を促進するためのOABの普及率の上昇

- その他ラテンアメリカ

- ブラジル

- 中東およびアフリカ

- 中東の意識の高まりは、中東およびアフリカの市場の成長を促進する可能性があります

第9章 競合情勢

- イントロダクション

- キープレーヤー別採用された勝つためのアプローチ

- 市場シェア分析

- 収益分析

- 会社評価象限

- スターズ

- 新興リーダー

- パーベイシブプレイヤー

- 参加者

- トップ20プレーヤーの競合ベンチマーキング

- 会社の足跡(20社)

- 会社の製品のフットプリント(20社)

- 会社の地域フットプリント(20社)

- 会社の評価象限:新興企業/中小企業

- プログレッシブカンパニー

- スターティングブロック

- レスポンシブ企業

- ダイナミックな企業

- 競合ベンチマーキング/SMEプレーヤーの競争力のあるベンチマーク

- 競合シナリオと動向

- 製品の発売と承認

- 取引

第10章 企業プロファイル

- KEY PLAYERS

- ASTELLAS PHARMA INC.

- TEVA PHARMACEUTICAL INDUSTRIES LTD.

- PFIZER INC.

- ABBVIE INC.

- VIATRIS INC.

- HISAMITSU PHARMACEUTICAL CO., INC.

- JOHNSON & JOHNSON SERVICES, INC.

- ENDO PHARMACEUTICALS INC.

- LUPIN

- AMNEAL PHARMACEUTICALS LLC

- SUN PHARMACEUTICAL INDUSTRIES LTD.

- GLENMARK

- MACLEODS PHARMACEUTICALS LTD.

- MEDTRONIC

- AJANTA PHARMA

- GRANULES INDIA LIMITED

- OTHER PLAYERS

- UROVANT SCIENCES

- APOTEX INC.

- LABORIE

- INTAS PHARMACEUTICALS LTD.

- BAYER AG

- MEDYTOX

- ALTHERX PHARMACEUTICALS

- TAIHO PHARMACEUTICAL CO., LTD.

- HUGEL, INC.

第11章 付録

The global overactive bladder treatment market is projected to reach USD 4.2 billion by 2027 from USD 3.5 billion in 2022, at a CAGR of 3.6% during the forecast period. Rising prevalence of overactive bladder across the globe coupled with rising awareness about treatment options available is driving the growth of the market. Additionally, use of neuromodulation techniques for the treatment of OAB is further expected to have significant positive impact.

"Mirabergon segment dominates the overactive bladder (OAB) treatment market in 2021."

Based on type, the overactive bladder treatment market is segmented into anticholinergics, mirabegron, BOTOX, neuromodulation, and other treatments. Mirabegron held a dominant share of the market in 2021, owing to the lesser side-effects associated with this drug compared to other drug classes available in the market. Furthermore, neuromodulation segment is expected to grow at faster pace owing to launch of new SNM & PTNS for OAB in market.

"The idiopathic overactive bladder segment will witness the highest growth in overactive bladder treatment market during the forecast period."

Based on disease type, the overactive bladder treatment market is segmented into idiopathic overactive bladder and neurogenic overactive bladder. The idiopathic overactive bladder segment accounted for a larger market share due to the higher prevalence of idiopathic overactive bladder disorders and increased use of drugs for the treatment.

"North America held dominant share in 2021."

Geographically, the overactive bladder (OAB) treatment market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In 2021, North America accounted for the major share in the OAB treatment market. North America holds majority of the key market players leading to maturity of OAB treatment market in this region. Furthermore, favorable reimbursement policies in US is one of the leading factor projecting market growth in North America.

The primary interviews conducted for this report can be categorized as follows:

- By Company Type - Supply Side: 80.0%, Demand Side: 20.0%

- By Designation - Managers: 45.0%, CXOs & Directors:30.0%, Excecutives:25.0%

- By Region - North America: 55%, Europe: 20%, Asia Pacific: 10%, Latin America: 10%, and the Middle East and Africa: 5%

List of Companies Profiled in the Report

- Astellas Pharma Inc. (Japan)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Pfizer Inc. (US)

- Abbvie Inc. (US)

- Viatris Inc. (US)

- Hisamitsu Pharmaceutical Co., Inc. (Japan)

- Johnson & Johnson Services, Inc. (US)

- Endo Pharmaceuticals Inc. (Ireland)

- Lupin (India)

- Amneal Pharmaceuticals Llc (US)

- Sun Pharmaceutical Industries Ltd. (India)

- Glenmark (India)

- Macleods Pharmaceuticals Ltd (India)

- Medtronic (Ireland)

- Ajanta Pharma (India)

- Granules India Limited (India)

- Urovant Sciences (US)

- Apotex Inc. (Canada)

- Laborie (US)

- Intas Pharmaceuticals Ltd. (India)

- Bayer Ag (Germany)

- Medytox (South Korea)

- Altherx Pharmaceuticals (US)

- Taiho Pharmaceutical Co., Ltd. (Japan)

- Hugel, Inc. (South Korea)

Research Coverage:

This report provides a detailed picture of the global overactive bladder treatment market. It aims at estimating the size and future growth potential of the market across different segments, such as type, disease type and region. The report also analyzes factors (such as drivers, restraints, and opportunities) affecting the market growth. It evaluates the opportunities in the market for stakeholders and provides details of the competitive landscape for market leaders. The report also studies micromarkets with respect to their growth trends, prospects, and contributions to the total cell analysis market. The report forecasts the revenue of the market segments with respect to four major regions.

Reasons to Buy the Report:

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on cell analysis offered by the top 25 players in the cell analysis market. The report analyses the overactive bladder treatment market by type, disease type and region.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various cell analysis across key geographic regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the overactive bladder (OAB) treatment market.

- Competitive Assessment: In-depth assessment of market ranking and strategies of the leading players in the overactive bladder treatment market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 PRIMARY RESEARCH

- FIGURE 2 OVERACTIVE BLADDER TREATMENT MARKET: PRIMARY RESPONDENTS

- 2.1.2 TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: REVENUE-BASED ESTIMATION

- 2.2 DATA TRIANGULATION APPROACH

- FIGURE 5 DATA TRIANGULATION METHODOLOGY

- 2.2.1 SECONDARY RESEARCH

- 2.2.2 COVID-19-SPECIFIC ASSUMPTIONS

- 2.3 RESEARCH LIMITATIONS

- 2.4 RISK ASSESSMENT

- 2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.5.1 SUPPLY SIDE

- 2.5.2 DEMAND SIDE

- 2.5.2.1 Insights from primary experts

3 EXECUTIVE SUMMARY

- FIGURE 6 OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 7 OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE 2022 VS. 2027 (USD MILLION)

- FIGURE 8 GEOGRAPHICAL SNAPSHOT OF THE OVERACTIVE BLADDER TREATMENT MARKET

4 PREMIUM INSIGHTS

- 4.1 OVERACTIVE BLADDER TREATMENT MARKET OVERVIEW

- FIGURE 9 RISING PREVALENCE OF OVERACTIVE BLADDER SYNDROME AND FAVORABLE REIMBURSEMENT POLICIES ARE KEY FACTORS DRIVING MARKET GROWTH

- 4.2 ASIA PACIFIC: OVERACTIVE BLADDER TREATMENT MARKET SHARE, BY TYPE AND COUNTRY (2021)

- FIGURE 10 MIRABEGRON ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC MARKET IN 2021

- 4.3 OVERACTIVE BLADDER TREATMENT MARKET SHARE, BY DISEASE TYPE, 2022 VS. 2027

- FIGURE 11 IDIOPATHIC OVERACTIVE BLADDER SYNDROME SEGMENT WILL CONTINUE TO DOMINATE THE MARKET IN 2027

- 4.4 OVERACTIVE BLADDER TREATMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 12 US TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 13 OVERACTIVE BLADDER TREATMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 1 OVERACTIVE BLADDER TREATMENT MARKET: IMPACT ANALYSIS

- 5.2.1 MARKET DRIVERS

- 5.2.1.1 Rising prevalence of overactive bladder syndrome

- 5.2.1.2 Rapidly aging population and subsequent rise in incidence of diseases characterized by OAB

- FIGURE 14 PROJECTED GROWTH IN THE ELDERLY POPULATION ABOVE 60, 2015 VS. 2030 VS. 2050

- 5.2.1.3 Development and use of innovative intravesical therapies

- 5.2.1.4 Growing R&D investments and the launch of novel therapies in the coming years

- 5.2.2 MARKET RESTRAINTS

- 5.2.2.1 Frequent product recalls

- 5.2.2.2 Increased side effects of anticholinergic drugs

- 5.2.3 MARKET OPPORTUNITIES

- 5.2.3.1 Novel treatments, robust pipelines, and patent cliff of certain drugs

- 5.2.4 MARKET CHALLENGES

- 5.2.4.1 Social stigma and lack of awareness about OAB

- 5.3 IMPACT OF UNCERTAINTIES ON THE OVERACTIVE BLADDER TREATMENT MARKET

- FIGURE 15 SPECTRUM OF SCENARIOS BASED ON THE IMPACT OF UNCERTAINTIES ON THE GROWTH OF THE OVERACTIVE BLADDER TREATMENT MARKET

- 5.4 IMPACT OF COVID-19 ON THE OVERACTIVE BLADDER TREATMENT MARKET

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 16 REVENUE SHIFT AND NEW POCKETS FOR THE OVERACTIVE BLADDER TREATMENT MARKET

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 17 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASE

- 5.7 SUPPLY CHAIN ANALYSIS

- FIGURE 18 DIRECT DISTRIBUTION-THE PREFERRED STRATEGY OF PROMINENT COMPANIES

- 5.8 ECOSYSTEM ANALYSIS

- FIGURE 19 ECOSYSTEM ANALYSIS OF THE PHARMACEUTICAL INDUSTRY

- FIGURE 20 ECOSYSTEM ANALYSIS OF THE UROLOGY DEVICES INDUSTRY

- 5.9 REGULATORY SCENARIO

- 5.9.1 PHARMACEUTICAL INDUSTRY

- 5.9.1.1 Regulatory requirements

- 5.9.1.1.1 EU regulations

- 5.9.1.1.2 US regulations

- 5.9.1.1 Regulatory requirements

- 5.9.2 MEDICAL DEVICE INDUSTRY

- 5.9.2.1 Regulatory requirements

- 5.9.2.1.1 EU regulations

- 5.9.2.1.2 US regulations

- 5.9.2.1 Regulatory requirements

- TABLE 2 LIST OF REGULATORY AUTHORITIES

- 5.9.1 PHARMACEUTICAL INDUSTRY

- 5.10 TECHNOLOGY ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 3 OVERACTIVE BLADDER TREATMENT MARKET: LIST OF CONFERENCES AND EVENTS

- 5.12 PATENT ANALYSIS

- FIGURE 21 LIST OF MAJOR PATENTS IN THE OVERACTIVE BLADDER TREATMENT MARKET

- TABLE 4 OVERVIEW OF PATENTS IN THE OVERACTIVE BLADDER TREATMENT MARKET

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 OVERACTIVE BLADDER TREATMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT FROM NEW ENTRANTS

- 5.13.2 THREAT FROM SUBSTITUTES

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 BARGAINING POWER OF SUPPLIERS

- 5.13.5 DEGREE OF COMPETITION

- 5.14 PRICING ANALYSIS

- TABLE 6 COST OF DRUGS USED IN OVERACTIVE BLADDER TREATMENT IN VARIOUS REGIONS (GENERICS)

- TABLE 7 COST OF BOTOX AND NEUROMODULATION USED IN OVERACTIVE BLADDER TREATMENT IN VARIOUS REGIONS

- TABLE 8 COST OF BRANDED DRUGS USED IN OVERACTIVE BLADDER TREATMENT IN VARIOUS REGIONS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- FIGURE 22 KEY STAKEHOLDERS IN PHARMACEUTICAL COMPANIES AND THEIR INFLUENCE ON THE BUYING PROCESS

- FIGURE 23 KEY BUYING CRITERIA FOR OVERACTIVE BLADDER TREATMENT PRODUCTS AMONG END USERS

- 5.16 PIPELINE ANALYSIS

- FIGURE 24 PIPELINE ANALYSIS: PHASES OF DRUGS IN CLINICAL TRIALS

6 OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE

- 6.1 INTRODUCTION

- TABLE 9 OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 10 OVERACTIVE BLADDER TREATMENT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2 MIRABEGRON

- 6.2.1 FEWER SIDE EFFECTS COMPARED WITH ANTICHOLINERGICS ARE LIKELY TO PROPEL THE GROWTH OF THIS MARKET SEGMENT

- TABLE 11 OVERACTIVE BLADDER TREATMENT MARKET FOR MIRABEGRON, BY REGION, 2020-2027 (USD MILLION)

- 6.3 ANTICHOLINERGICS

- TABLE 12 OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 13 OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- 6.3.1 SOLIFENACIN

- 6.3.1.1 Solifenacin is more effective than other anticholinergics in reducing the frequency of incontinence-a key factor driving market growth

- TABLE 14 OVERACTIVE BLADDER TREATMENT MARKET FOR SOLIFENACIN, BY REGION, 2020-2027 (USD MILLION)

- 6.3.2 OXYBUTYNIN

- 6.3.2.1 Oxybutynin is the most widely prescribed anticholinergic drug in the OAB market

- TABLE 15 OVERACTIVE BLADDER TREATMENT MARKET FOR OXYBUTYNIN, BY REGION, 2020-2027 (USD MILLION)

- 6.3.3 FESOTERODINE

- 6.3.3.1 Fesoterodine exhibits antimuscarinic effects on the muscarinic acetylcholine receptors in the detrusor muscle, leading to a decrease in bladder contractions

- TABLE 16 OVERACTIVE BLADDER TREATMENT MARKET FOR FESOTERODINE, BY REGION, 2020-2027 (USD MILLION)

- 6.3.4 DARIFENACIN

- 6.3.4.1 Cost of darifenacin is higher than other anticholinergics, which is likely to restrain market growth to a certain extent

- TABLE 17 OVERACTIVE BLADDER TREATMENT MARKET FOR DARIFENACIN, BY REGION, 2020-2027 (USD MILLION)

- 6.3.5 TOLTERODINE

- 6.3.5.1 Tolterodine is the third-most-prescribed drug for OAB as it has fewer side effects and offers long-term clinical efficacy

- TABLE 18 OVERACTIVE BLADDER TREATMENT MARKET FOR TOLTERODINE, BY REGION, 2020-2027 (USD MILLION)

- 6.3.6 TROSPIUM

- 6.3.6.1 Trospium is associated with a lower incidence of dry mouth, as a result of which its discontinuation rate is relatively low

- TABLE 19 OVERACTIVE BLADDER TREATMENT MARKET FOR TROSPIUM, BY REGION, 2020-2027 (USD MILLION)

- 6.3.7 OTHER ANTICHOLINERGICS

- TABLE 20 OVERACTIVE BLADDER TREATMENT MARKET FOR OTHER ANTICHOLINERGICS, BY REGION, 2020-2027 (USD MILLION)

- 6.4 BOTOX

- 6.4.1 HIGHER EFFICACY OF BOTOX THAN ANTICHOLINERGICS MAKES IT A POPULAR TREATMENT ALTERNATIVE

- TABLE 21 OVERACTIVE BLADDER TREATMENT MARKET FOR BOTOX, BY REGION, 2020-2027 (USD MILLION)

- 6.5 NEUROMODULATION

- 6.5.1 INCREASING ADOPTION OF NEUROMODULATION FOR OVERACTIVE BLADDER TREATMENT TO DRIVE GROWTH IN THIS MARKET SEGMENT

- TABLE 22 OVERACTIVE BLADDER TREATMENT MARKET FOR NEUROMODULATION, BY REGION, 2020-2027 (USD MILLION)

- 6.6 OTHER TREATMENTS

- TABLE 23 OVERACTIVE BLADDER TREATMENT MARKET FOR OTHER TREATMENTS, BY REGION, 2020-2027 (USD MILLION)

7 OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE

- 7.1 INTRODUCTION

- TABLE 24 OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- 7.2 IDIOPATHIC OVERACTIVE BLADDER SYNDROME

- 7.2.1 AVAILABILITY OF REIMBURSEMENTS FOR DRUGS USED TO TREAT IDIOPATHIC OAB TO FUEL GROWTH IN THIS MARKET

- TABLE 25 IDIOPATHIC OVERACTIVE BLADDER TREATMENT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3 NEUROGENIC OVERACTIVE BLADDER SYNDROME

- TABLE 26 NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 27 NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 7.3.1 PARKINSON'S DISEASE

- 7.3.1.1 Increased use of anticholinergics and beta-adrenergic agonists for the treatment of Parkinson's disease to drive market growth

- TABLE 28 NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET FOR PARKINSON'S DISEASE, BY REGION, 2020-2027 (USD MILLION)

- 7.3.2 STROKES

- 7.3.2.1 Rising prevalence of strokes to increase the incidence of OAB and fuel the demand for OAB treatment

- TABLE 29 NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET FOR STROKES, BY REGION, 2020-2027 (USD MILLION)

- 7.3.3 MULTIPLE SCLEROSIS

- 7.3.3.1 Favorable reimbursement policies to support the growth of the OAB treatment market for MS

- TABLE 30 NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET FOR MULTIPLE SCLEROSIS, BY REGION, 2020-2027 (USD MILLION)

- 7.3.4 SPINAL CORD INJURIES

- 7.3.4.1 High prevalence of bladder overactivity in SCI contributes to the growth of the neurogenic bladder overactivity treatment market

- TABLE 31 NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET FOR SPINAL CORD INJURIES, BY REGION, 2020-2027 (USD MILLION)

- 7.3.5 OTHER DISORDERS

- TABLE 32 NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET FOR OTHER DISORDERS, BY REGION, 2020-2027 (USD MILLION)

8 OVERACTIVE BLADDER TREATMENT MARKET, BY REGION

- 8.1 INTRODUCTION

- TABLE 33 OVERACTIVE BLADDER TREATMENT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.2 NORTH AMERICA

- FIGURE 25 NORTH AMERICA: OVERACTIVE BLADDER TREATMENT MARKET SNAPSHOT

- TABLE 34 NORTH AMERICA: OVERACTIVE BLADDER TREATMENT MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 35 NORTH AMERICA: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 36 NORTH AMERICA: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 37 NORTH AMERICA: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 38 NORTH AMERICA: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.2.1 US

- 8.2.1.1 Favorable reimbursement policies make the US the largest market for bladder overactivity treatment

- TABLE 39 US: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 40 US: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 41 US: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 42 US: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.2.2 CANADA

- 8.2.2.1 Increased use of and demand for BOTOX to treat overactive bladder to drive market growth in Canada

- TABLE 43 CANADA: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 44 CANADA: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 45 CANADA: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 46 CANADA: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.3 EUROPE

- TABLE 47 EUROPE: OVERACTIVE BLADDER TREATMENT MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 48 EUROPE: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 49 EUROPE: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 50 EUROPE: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 51 EUROPE: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.1 GERMANY

- 8.3.1.1 Aging population and a high prevalence of OAB, especially in women, are expected to increase target patient groups in Germany

- TABLE 52 GERMANY: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 53 GERMANY: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 54 GERMANY: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 55 GERMANY: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.2 UK

- 8.3.2.1 Initiatives and awareness campaigns in the UK to drive growth in the OAB market

- TABLE 56 ANNUAL COST OF OVERACTIVE BLADDER TREATMENT IN THE UK

- TABLE 57 UK: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 58 UK: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 59 UK: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 60 UK: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.3 FRANCE

- 8.3.3.1 Low reimbursement rate in France compared to other countries may limit market growth to a certain extent

- TABLE 61 REIMBURSEMENT RATES FOR OVERACTIVE BLADDER TREATMENT IN FRANCE

- TABLE 62 FRANCE: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 63 FRANCE: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 64 FRANCE: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 65 FRANCE: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.4 ITALY

- 8.3.4.1 Italian pharmaceutical industry is expected to offer lucrative growth opportunities to OAB drug manufacturers

- TABLE 66 ITALY: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 67 ITALY: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 68 ITALY: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 69 ITALY: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.5 SPAIN

- 8.3.5.1 Changing demographics and high OAB prevalence in Spain offer significant growth opportunities for the bladder overactivity treatment market

- TABLE 70 SPAIN: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 71 SPAIN: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 72 SPAIN: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 73 SPAIN: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.6 REST OF EUROPE

- TABLE 74 REST OF EUROPE: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 75 REST OF EUROPE: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 76 REST OF EUROPE: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 77 REST OF EUROPE: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.4 ASIA PACIFIC

- FIGURE 26 ASIA PACIFIC: OVERACTIVE BLADDER TREATMENT MARKET SNAPSHOT

- TABLE 78 ASIA PACIFIC: OVERACTIVE BLADDER TREATMENT MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 79 ASIA PACIFIC: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 80 ASIA PACIFIC: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 81 ASIA PACIFIC: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 82 ASIA PACIFIC: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.1 JAPAN

- 8.4.1.1 Advancements in treatment options to fuel growth in the market in Japan

- TABLE 83 JAPAN: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 84 JAPAN: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 85 JAPAN: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 86 JAPAN: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.2 CHINA

- 8.4.2.1 Growing adoption of BOTOX for OAB treatment makes China a lucrative market

- TABLE 87 CHINA: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 88 CHINA: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 89 CHINA: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 90 CHINA: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.3 INDIA

- 8.4.3.1 India is the world's largest producer of generic drugs- a key factor driving market growth

- TABLE 91 INDIA: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 92 INDIA: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 93 INDIA: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 94 INDIA: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.4 AUSTRALIA

- 8.4.4.1 Growing aging population is likely to increase the number of patients suffering from OAB in Australia-a major factor supporting the growth of this market

- TABLE 95 AUSTRALIA: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 96 AUSTRALIA: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 97 AUSTRALIA: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 98 AUSTRALIA: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.5 REST OF ASIA PACIFIC

- TABLE 99 REST OF ASIA PACIFIC: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 100 REST OF ASIA PACIFIC: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 101 REST OF ASIA PACIFIC: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.5 LATIN AMERICA

- TABLE 103 LATIN AMERICA: OVERACTIVE BLADDER TREATMENT MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 104 LATIN AMERICA: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 105 LATIN AMERICA: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 106 LATIN AMERICA: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 107 LATIN AMERICA: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.5.1 BRAZIL

- 8.5.1.1 Increased use of overactive bladder drugs in the country to drive growth in the market

- FIGURE 27 DISTRIBUTION OF POPULATION IN BRAZIL (ABOVE-60 AGE GROUP), 2004-2050

- TABLE 108 BRAZIL: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 109 BRAZIL: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 110 BRAZIL: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 111 BRAZIL: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.5.2 MEXICO

- 8.5.2.1 Rising prevalence of OAB to drive growth in the market in Mexico

- TABLE 112 MEXICO: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 113 MEXICO: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 114 MEXICO: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 115 MEXICO: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.5.3 REST OF LATIN AMERICA

- TABLE 116 REST OF LATIN AMERICA: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 117 REST OF LATIN AMERICA: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 118 REST OF LATIN AMERICA: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 119 REST OF LATIN AMERICA: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.6 MIDDLE EAST & AFRICA

- 8.6.1 RISING AWARENESS OF OAB IS LIKELY TO DRIVE THE GROWTH OF THE MARKET IN THE MIDDLE EAST & AFRICA

- TABLE 120 MIDDLE EAST & AFRICA: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: OVERACTIVE BLADDER TREATMENT MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE, 2020-2027 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: NEUROGENIC OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020-2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

- FIGURE 28 OVERACTIVE BLADDER TREATMENT MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- 9.3 MARKET SHARE ANALYSIS

- FIGURE 29 OVERACTIVE BLADDER TREATMENT MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS (2021)

- TABLE 124 OVERACTIVE BLADDER TREATMENT MARKET: DEGREE OF COMPETITION

- 9.4 REVENUE ANALYSIS

- FIGURE 30 REVENUE ANALYSIS FOR KEY COMPANIES (2019-2021)

- 9.5 COMPANY EVALUATION QUADRANT

- 9.5.1 STARS

- 9.5.2 EMERGING LEADERS

- 9.5.3 PERVASIVE PLAYERS

- 9.5.4 PARTICIPANTS

- FIGURE 31 OVERACTIVE BLADDER TREATMENT MARKET: COMPANY EVALUATION MATRIX, 2021

- 9.6 COMPETITIVE BENCHMARKING OF TOP 20 PLAYERS

- 9.6.1 COMPANY FOOTPRINT (20 COMPANIES)

- TABLE 125 COMPANY FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE OVERACTIVE BLADDER TREATMENT MARKET

- 9.6.2 COMPANY PRODUCT FOOTPRINT (20 COMPANIES)

- TABLE 126 PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE OVERACTIVE BLADDER TREATMENT MARKET

- 9.6.3 COMPANY REGIONAL FOOTPRINT (20 COMPANIES)

- TABLE 127 REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE OVERACTIVE BLADDER TREATMENT MARKET

- 9.7 COMPANY EVALUATION QUADRANT: START-UPS/SMES

- 9.7.1 PROGRESSIVE COMPANIES

- 9.7.2 STARTING BLOCKS

- 9.7.3 RESPONSIVE COMPANIES

- 9.7.4 DYNAMIC COMPANIES

- FIGURE 32 OVERACTIVE BLADDER TREATMENT MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2021

- 9.7.5 COMPETITIVE BENCHMARKING OF START-UP/SME PLAYERS

- TABLE 128 OVERACTIVE BLADDER TREATMENT MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 129 OVERACTIVE BLADDER TREATMENT MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (START-UPS/SMES)

- 9.8 COMPETITIVE SCENARIO AND TRENDS

- 9.8.1 PRODUCT LAUNCHES & APPROVALS

- TABLE 130 PRODUCT LAUNCHES & APPROVALS, JANUARY 2019-MAY 2022

- 9.8.2 DEALS

- TABLE 131 DEALS, JANUARY 2019-MAY 2022

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 10.1.1 ASTELLAS PHARMA INC.

- TABLE 132 ASTELLAS PHARMA INC.: BUSINESS OVERVIEW

- FIGURE 33 ASTELLAS PHARMA INC.: COMPANY SNAPSHOT (2021)

- 10.1.2 TEVA PHARMACEUTICAL INDUSTRIES LTD.

- TABLE 133 TEVA PHARMACEUTICAL INDUSTRIES LTD.: BUSINESS OVERVIEW

- FIGURE 34 TEVA PHARMACEUTICAL INDUSTRIES LTD.: COMPANY SNAPSHOT (2021)

- 10.1.3 PFIZER INC.

- TABLE 134 PFIZER INC.: BUSINESS OVERVIEW

- FIGURE 35 PFIZER INC.: COMPANY SNAPSHOT (2021)

- 10.1.4 ABBVIE INC.

- TABLE 135 ABBVIE INC.: BUSINESS OVERVIEW

- FIGURE 36 ABBVIE INC.: COMPANY SNAPSHOT (2021)

- 10.1.5 VIATRIS INC.

- TABLE 136 VIATRIS INC.: BUSINESS OVERVIEW

- FIGURE 37 VIATRIS INC.: COMPANY SNAPSHOT (2021)

- 10.1.6 HISAMITSU PHARMACEUTICAL CO., INC.

- TABLE 137 HISAMITSU PHARMACEUTICAL CO., INC.: BUSINESS OVERVIEW

- FIGURE 38 HISAMITSU PHARMACEUTICAL CO., INC.: COMPANY SNAPSHOT (2020)

- 10.1.7 JOHNSON & JOHNSON SERVICES, INC.

- TABLE 138 JOHNSON & JOHNSON SERVICES, INC.: BUSINESS OVERVIEW

- FIGURE 39 JOHNSON & JOHNSON SERVICES, INC.: COMPANY SNAPSHOT (2021)

- 10.1.8 ENDO PHARMACEUTICALS INC.

- TABLE 139 ENDO PHARMACEUTICALS INC.: BUSINESS OVERVIEW

- FIGURE 40 ENDO PHARMACEUTICALS INC.: COMPANY SNAPSHOT

- 10.1.9 LUPIN

- TABLE 140 LUPIN: BUSINESS OVERVIEW

- FIGURE 41 LUPIN: COMPANY SNAPSHOT (2021)

- 10.1.10 AMNEAL PHARMACEUTICALS LLC

- TABLE 141 AMNEAL PHARMACEUTICALS LLC: BUSINESS OVERVIEW

- FIGURE 42 AMNEAL PHARMACEUTICALS LLC: COMPANY SNAPSHOT (2021)

- 10.1.11 SUN PHARMACEUTICAL INDUSTRIES LTD.

- TABLE 142 SUN PHARMACEUTICAL INDUSTRIES LTD.: BUSINESS OVERVIEW

- FIGURE 43 SUN PHARMACEUTICAL INDUSTRIES LTD.: COMPANY SNAPSHOT (2021)

- 10.1.12 GLENMARK

- TABLE 143 GLENMARK: BUSINESS OVERVIEW

- FIGURE 44 GLENMARK: COMPANY SNAPSHOT (2021)

- 10.1.13 MACLEODS PHARMACEUTICALS LTD.

- TABLE 144 MACLEODS PHARMACEUTICALS LTD.: BUSINESS OVERVIEW

- FIGURE 45 MACLEODS PHARMACEUTICALS LTD.: COMPANY SNAPSHOT (2021)

- 10.1.14 MEDTRONIC

- TABLE 145 MEDTRONIC: BUSINESS OVERVIEW

- FIGURE 46 MEDTRONIC: COMPANY SNAPSHOT (2021)

- 10.1.15 AJANTA PHARMA

- TABLE 146 AJANTA PHARMA: BUSINESS OVERVIEW

- FIGURE 47 AJANTA PHARMA: COMPANY SNAPSHOT (2021)

- 10.1.16 GRANULES INDIA LIMITED

- TABLE 147 GRANULES INDIA LIMITED: BUSINESS OVERVIEW

- FIGURE 48 GRANULES INDIA LIMITED: COMPANY SNAPSHOT (2021)

- 10.2 OTHER PLAYERS

- 10.2.1 UROVANT SCIENCES

- TABLE 148 UROVANT SCIENCES: BUSINESS OVERVIEW

- 10.2.2 APOTEX INC.

- TABLE 149 APOTEX INC.: BUSINESS OVERVIEW

- 10.2.3 LABORIE

- TABLE 150 LABORIE: BUSINESS OVERVIEW

- 10.2.4 INTAS PHARMACEUTICALS LTD.

- TABLE 151 INTAS PHARMACEUTICALS LTD.: BUSINESS OVERVIEW

- 10.2.5 BAYER AG

- TABLE 152 BAYER AG: BUSINESS OVERVIEW

- 10.2.6 MEDYTOX

- TABLE 153 MEDYTOX: BUSINESS OVERVIEW

- 10.2.7 ALTHERX PHARMACEUTICALS

- TABLE 154 ALTHERX PHARMACEUTICALS: BUSINESS OVERVIEW

- 10.2.8 TAIHO PHARMACEUTICAL CO., LTD.

- TABLE 155 TAIHO PHARMACEUTICAL CO., LTD.: BUSINESS OVERVIEW

- 10.2.9 HUGEL, INC.

- TABLE 156 HUGEL, INC.: BUSINESS OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 AVAILABLE CUSTOMIZATIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS