|

|

市場調査レポート

商品コード

1093676

ネットワークデバイスの世界市場:接続性(WiFi、セルラー、LoRa、ZigBee、Bluetooth)、デバイスタイプ(ルーター、ゲートウェイ、アクセスポイント)、用途(住宅、商業、企業、産業、輸送)、地域別 - 2027年までの予測Network Devices Market by Connectivity (WiFi, Cellular, LoRa, ZigBee, Bluetooth), Device Type (Router, Gateway, Access Point), Application (Residential, Commercial, Enterprise, Industrial, Transportation) and Geography - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ネットワークデバイスの世界市場:接続性(WiFi、セルラー、LoRa、ZigBee、Bluetooth)、デバイスタイプ(ルーター、ゲートウェイ、アクセスポイント)、用途(住宅、商業、企業、産業、輸送)、地域別 - 2027年までの予測 |

|

出版日: 2022年06月14日

発行: MarketsandMarkets

ページ情報: 英文 231 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のネットワークデバイスの市場規模は、予測期間中に6.6%のCAGRで推移し、2022年の264億米ドルから、2027年までに364億米ドルに達すると予測されています。

地域別では、アジア太平洋市場が予測期間中に最も高いCAGRで成長すると予想されます。同地域市場の成長要因には、商業・産業空間におけるインターネットの普及、ワイヤレス接続の拡大、ITインフラの改善などが挙げられます。

当レポートでは、世界のネットワークデバイス市場について調査し、市場力学、セグメント・地域別の市場分析、競合情勢、主要企業のプロファイルなどの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 市場機会

- 課題

- 関税と規制

- 基準

- ケーススタディ

- 価格分析

- バリューチェーン分析

- エコシステム/マーケットマップ

- 技術分析

- WiFiおよびセルラーテクノロジーの動向

- 特許分析

- 貿易データ

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 顧客に影響を与える動向とディスラプション

- 主な会議とイベント(2022年~2023年)

第6章 デバイスタイプ別:ネットワークデバイス市場

- ルーター

- ゲートウェイ

- アクセスポイント

第7章 タイプ別:ネットワークデバイス市場

- 屋内

- 屋外

第8章 接続性別:ネットワークデバイス市場

- WiFi

- セルラー

- WiFi+その他

- LORA

- その他

第9章 用途別:ネットワークデバイス市場

- 住宅用ネットワーク

- 商業用ネットワーク

- 企業用ネットワーク

- 産業用ネットワーク

- 輸送用ネットワーク

第10章 地域分析

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- その他

- アジア太平洋

- 中国

- 日本

- 韓国

- その他

- その他の地域

- 南米

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要企業の戦略/市場評価フレームワーク

- 市場シェア分析:ネットワークデバイス市場(2021年)

- 過去の収益分析

- 企業評価クアドラント

- 競合ベンチマーキング

- スタートアップ/中小企業の評価マトリックス

- 競合ベンチマーキング

- 競合状況・動向

第12章 企業プロファイル

- 主要企業

- CISCO SYSTEMS

- HUAWEI

- HP ENTERPRISE

- JUNIPER NETWORKS

- SIERRA WIRELESS

- CRADLEPOINT

- DIGI INTERNATIONAL

- TELTONIKA

- MULTITECH

- INSEEGO

- SCHNEIDER ELECTRIC

- GENERAL ELECTRIC

- EXTREME NETWORKS

- その他企業

- SIEMENS

- MOXA

- ROBUSTEL

- ADVANTECH

- LYNX TECHNOLOGIES

- LANTRONIX

- D-LINK

- TP-LINK TECHNOLOGIES

- BELKIN INTERNATIONAL

- ADTRAN

- ASUSTEK COMPUTER

- HMS NETWORKS

- CASA SYSTEMS

- NOKIA

第13章 付録

The network devices market is expected to grow from USD 26.4 billion in 2022 and is projected to reach USD 36.4 billion by 2027; it is expected to grow at a CAGR of 6.6% during the forecast period. WiFi network deployment helps enterprises rapidly build and connect business applications. The WiFi network also provides greater flexibility, scalability, reliability, and cost-effective benefits in connecting mission-critical business applications. Core industry sectors are keen on automating and digitalizing their business processes to streamline business operations and drive new business revenue opportunities. As the number of Internet users is expected to continue to grow significantly in coming years, the demand for network devices including routers, gateways and access points is also expected to rise simultaneously.The majority of devices and connectivity hardware used for wireless network deployment are sourced from China due to the region's low-cost advantage; however, in the early days of the pandemic, most countries ceased their imports and export activities to some extent to avoid the spread of COVID-19. With a decline in the supply of networking modules and connectivity hardware, the enterprise sector witnessed a major hit in 2020.

"Market for WiFI access points to have highest CAGR during the forecast period"

The network devices market for WiFi access points is expected to grow at the highest CAGR during the forecast period. The growing inclination towards smartphones, laptops, and tablets is creating a surge in demand for Internet service providers and access point (AP) providers. This is expected to result in a conducive environment for the access points market. Increasing demand for access points to improve the digital infrastructure across commercial and enterprise sectors in India, China, and Japan is expected to boost the AP market. Favorable government initiatives to promote the digitalization and industrialization of developing economies will also positively influence the market. AP devices have become necessary for many businesses, institutions, and home users. The use of APs can help eliminate the problems of poor WiFi coverage, slow connectivity, dead zones, and weak signals.

"Outdoor network devices segment to have higher growth throughout the forecast period"

The vast majority of routers deployed are not rugged and weatherproof and are deployed in indoor settings such as homes, retail stores, manufacturing facilities, and offices. In fact, almost all network devices (especially gateways) are deployed indoors. WiFi is not suitable for long range outdoor use, and outdoor routers use cellular connectivity. Outdoor 4G/LTE routers are ideal for delivering optimal network connectivity to outdoor environments such as oil and mining sites, and to serve as reliable communication backbones for critical communication applications.4G LTE routers can also provide an excellent 4G LTE connection enabling instant POS setup for credit card access in remote areas where there is no fixed line Internet connection. Since cellular and outdoor routers and APs are comparatively more expensive than indoor WiFi routers, the indoor routers segment held the larger share of the market.

"Market for industrial application to grow at highest CAGR during the forecast period"

The market for industrial networking is expected to record the highest CAGR during the forecast period. Industrial applications mainly include utilities (energy and water) and automated manufacturing. Industrial networks deal with transfer of data on a large scale.Since the inception of Industry 4.0, the penetration of AI and IIoT technologies in the manufacturing sector has been increasing rapidly. AI-and IIoT-Integrated systems allow optimization of manufacturing processes,send early alerts, contribute to quality control, and forecast equipment failure in machinery. By gathering precise data, manufacturers can develop innovative AI applications to differentiate themselves from their competitors.

"Market in APAC to grow at highest CAGR during the forecast period"

The network devices market in APAC is expected to see the fastest growth during the forecast period. The APAC region is a leading industrial hub and an emerging and important market for several other sectors as well. The growing penetration of the Internet across the commercial and industrial spaces, as well as increasing reach of wireless connectivity and improving IT infrastructure are among the key determinants of growth forthe network devices market in APAC. In February 2021, China's Ministry of Industry announced plans for a hi-tech transformation of manufacturing to offset rising production costs and consolidate its position in the global supplychain. Beijing will help modernize the sector with advancements in 5G, cloud computing and IoT. China aims to build 30 fully connected 5G factories in 10 key industries by 2023;the country has fast-tracked industrial Internet development through integration with 5G technologies.These initiatives are expected to fuel th egrowth of industrial Internet inthe APAC region.

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the network devices marketspace. The break-up of primary participants for the report has been shown below:

- By Company Type: Tier 1- 40%, Tier 2- 35%, and Tier 3 - 25%

- By Designation: C-level Executives- 35%, Directors- 40%, and Others - 25%

- By Region:North America-40%,APAC- 30%, Europe - 20%,and RoW - 10%

The report profiles key players in the network devices market with their respective market ranking analysis. Prominent players profiled in this report areCisco Systems (US), Cradlepoint (US), Juniper Networks (US), Huawei (China), HP Enterprise (US), Digi International (US), Sierra Wireless (Canada), Nokia (Finland), Inseego (US), Teltokina Networks (Lithuania), Extreme Networks (US), D-Link (Taiwan), TP-LINK (China), Moxa (Taiwan), Adtran (US), Schneider Electric (France), General Electric (US), Siemens (Germany), Multitech (US), Casa Systems (US), Advantech (Taiwan), Robustel (China), Lantronix (US), HMS Networks (Sweden), ASUSTek Computer (Taiwan), and Belkin International (US).

Research Coverage:

This research report categorizes the network devices marketon the basis ofdevice type, type, connectivity, application, and geography. The report describes the major drivers, restraints, challenges, and opportunities pertaining tothenetwork devices market and forecasts the same till 2027(including analysis of COVID-19 impact on the market). Apart from these, the report also consists of leadership mapping and analysis of all the companies included in thenetwork devices ecosystem.

Key Benefits of Buying the Report

The report would help leaders/new entrants in this market in the following ways:

1. This report segments the network devices market comprehensively and provides the closest market size projection for all subsegments across different regions.

2. The report helps stakeholders understand the pulse of the market and provides them with information on key drivers, restraints, challenges, and opportunities for market growth.

3. This report would help stakeholders understand their competitors better and gain more insights to improve their position in the business. The competitive landscape section includes competitor ecosystem, product launches, deals, and expansions.

4. The analysis of the top 27 companies, based on the strength of the market rank as well as the product footprint will help stakeholders visualize the market positioning of these key players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- FIGURE 1 NETWORK DEVICES MARKET: SEGMENTATION

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY & PRICING

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 NETWORK DEVICES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.1.1 Key industry insights

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primary interviews

- 2.1.3.2 Key data from primary sources

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.1.1 Approach for obtaining market size using bottom-up analysis (supply side)

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY SIDE (TOP-DOWN APPROACH)

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Approach to arrive at the market size using bottom-up analysis (demand side)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND SIDE (BOTTOM-UP APPROACH)

- 2.2.3 MARKET PROJECTIONS

- 2.2.1 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.4.1 ASSUMPTIONS

- 2.4.2 LIMITATIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 GROWTH PROJECTIONS OF NETWORK DEVICES MARKET IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

- FIGURE 9 INDOOR NETWORK DEVICES TO HAVE LARGER MARKET SHARE IN 2021

- FIGURE 10 ROUTERS SEGMENT TO LEAD NETWORK DEVICES MARKET DURING FORECAST PERIOD

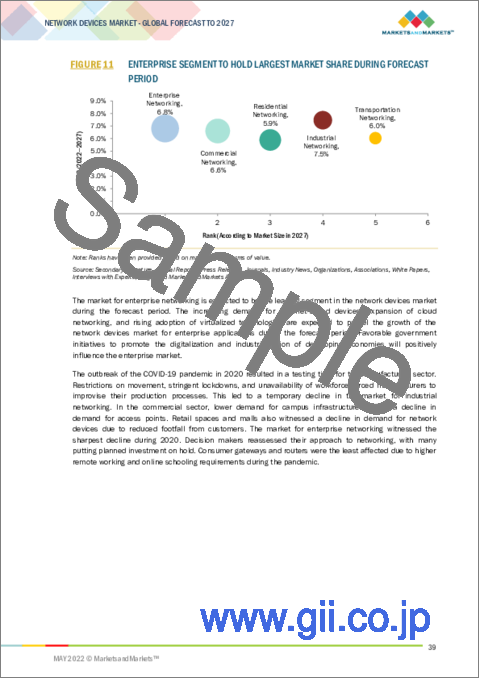

- FIGURE 11 ENTERPRISE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 NETWORK DEVICES MARKET IN NORTH AMERICA TO HAVE HIGHEST SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN NETWORK DEVICES MARKET

- FIGURE 13 INCREASED FOCUS ON DIGITAL TRANSFORMATION ACROSS SECTORS DRIVING GROWTH OF NETWORK DEVICES MARKET

- 4.2 NETWORK DEVICES MARKET, BY DEVICE TYPE

- FIGURE 14 ROUTERS TO HOLD LARGEST SHARE OF NETWORK DEVICES MARKET IN 2027

- 4.3 NETWORK DEVICES MARKET, BY CONNECTIVITY

- FIGURE 15 NETWORK DEVICES WITH WIFI CONNECTIVITY TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 NETWORK DEVICES MARKET, BY APPLICATION

- FIGURE 16 ENTERPRISE APPLICATION TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 NETWORK DEVICES MARKET, BY COUNTRY

- FIGURE 17 CHINA TO REGISTER HIGHEST CAGR IN NETWORK DEVICES MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 IMPACT OF DRIVERS AND OPPORTUNITIES ON NETWORK DEVICES MARKET

- FIGURE 19 IMPACT OF RESTRAINTS AND CHALLENGES ON NETWORK DEVICES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increased focus on digital transformation across various sectors

- 5.2.1.2 Worldwide growth in number of Internet users

- FIGURE 20 INTERNET USERS AS A PERCENTAGE OF REGIONAL POPULATION, 2018 VS. 2023

- 5.2.1.3 Rising adoption of CYOD trend due to COVID-19 pandemic

- 5.2.1.4 Continuous development of WiFi standards

- 5.2.2 RESTRAINTS

- 5.2.2.1 Contention loss and co-channel interference in WiFi access points

- 5.2.2.2 Disruption in network devices hardware supply chain due to COVID-19

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for carrier WiFi

- 5.2.3.2 Growing wireless networking with advent of Industry 4.0 and IIoT

- 5.2.3.3 Increasing emergence of connectivity for smart homes

- 5.2.3.4 Rising adoption of connected devices in hospitality and education sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Poor user experience in high-density environments

- 5.2.4.2 Data security and privacy concerns in open networks

- 5.3 TARIFFS AND REGULATIONS

- 5.3.1 TARIFFS RELATED TO NETWORK DEVICES

- 5.3.2 REGULATIONS

- 5.3.3 NORTH AMERICA

- 5.3.3.1 Federal Communications Commission (FCC)

- 5.3.4 EUROPE

- 5.3.4.1 Body of European Regulators for Electronic Communications (BEREC)

- 5.3.4.2 CE

- 5.3.4.3 Restriction of Hazardous Substances in Electrical and Electronic Equipment (RoHS)

- 5.3.4.4 International Special Committee on Radio Interference (CISPR)

- 5.3.5 APAC

- 5.3.5.1 Voluntary Control Council for Interference (VCCI)

- 5.3.5.2 Infocomm Media Development Authority (IMDA)

- 5.4 STANDARDS

- 5.4.1 STANDARDS

- TABLE 1 HISTORY OF WIFI STANDARDS

- 5.4.2 IEEE 802.11

- 5.4.3 IEEE 802.11A

- 5.4.4 IEEE 802.11B

- 5.4.5 IEEE 802.11G

- 5.4.6 IEEE 802.11N

- 5.4.7 IEEE 802.11AC

- 5.4.8 IEEE 802.11AX

- 5.5 CASE STUDIES

- 5.5.1 NTTPC COMMUNICATIONS DEPLOYS CISCO INTEGRATED SERVICE ROUTERS WITH IOS EMBEDDED EVENT MANAGER TO REDUCE OVERALL OPERATIONS COST

- 5.5.2 D-LINK HELPS FOOD PROCESSING COMPANY IN WASHINGTON ELIMINATE NETWORK DOWNTIME AND ENABLE ROUND-THE-CLOCK EFFICIENCY

- 5.5.3 TP-LINK ASSISTS CHASE GRAMMAR SCHOOL WITH WIRELESS OPTIMIZATION FOR INTERNET CONNECTIVITY

- 5.5.4 CISCO HELPS TOKIO MARINE & NICHIDO FIRE INSURANCE TO REVOLUTIONIZE WORKING STYLE

- 5.5.5 SOUTHSTAR DRUG DEPLOYS HUAWEI WIFI 6 SOLUTION FOR SMOOTH WIRELESS NETWORK EXPERIENCE

- 5.6 PRICING ANALYSIS

- TABLE 2 PRICING ANALYSIS

- TABLE 3 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP 3 APPLICATIONS (USD)

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS OF NETWORK DEVICE ECOSYSTEM

- 5.8 ECOSYSTEM/MARKET MAP

- FIGURE 22 NETWORK DEVICE MARKET ECOSYSTEM

- TABLE 4 NETWORK DEVICES MARKET: SUPPLY CHAIN

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY EMERGING TECHNOLOGIES

- 5.9.1.1 WiFi 6

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Software-based Routing

- 5.9.1 KEY EMERGING TECHNOLOGIES

- 5.10 WIFI AND CELLULAR TECHNOLOGY TRENDS

- 5.10.1 WIMAX

- 5.10.2 LONG-TERM EVOLUTION (LTE)

- 5.10.3 5G

- 5.11 PATENT ANALYSIS

- TABLE 5 LIST OF MAJOR PATENTS (2019-2021)

- FIGURE 23 NETWORK DEVICE PATENTS PUBLISHED, BY COUNTRY, 2015-2020

- FIGURE 24 NUMBER OF PATENTS GRANTED ANNUALLY OVER THE LAST TEN YEARS

- FIGURE 25 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

- TABLE 6 TOP 20 NETWORK DEVICE APPLICANT COMPANIES DURING 2015-2020

- 5.12 TRADE DATA

- 5.12.1 IMPORT SCENARIO

- FIGURE 26 IMPORT DATA FOR HS CODE 851762, BY COUNTRY, 2016-2020

- TABLE 7 IMPORT DATA FOR HS CODE 851762, BY COUNTRY, 2016-2020 (USD THOUSAND)

- 5.12.2 EXPORT SCENARIO

- FIGURE 27 EXPORT DATA FOR HS CODE 851762, BY COUNTRY, 2016-2020

- TABLE 8 EXPORT DATA FOR HS CODE 851762, BY COUNTRY, 2016-2020 (USD THOUSAND)

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 PORTER'S FIVE FORCES IMPACT ON THE NETWORK DEVICES MARKET

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 11 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- 5.15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- FIGURE 30 YC-YCC SHIFT FOR NETWORK DEVICES MARKET

- 5.16 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 12 NETWORK DEVICES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 NETWORK DEVICES MARKET, BY DEVICE TYPE

- 6.1 INTRODUCTION

- FIGURE 31 ROUTERS SEGMENT TO HOLD LARGEST SHARE OF NETWORK DEVICES MARKET DURING FORECAST PERIOD

- TABLE 13 NETWORK DEVICES MARKET, BY DEVICE TYPE, 2018-2021 (USD BILLION)

- TABLE 14 NETWORK DEVICES MARKET, BY DEVICE TYPE, 2022-2027 (USD BILLION)

- TABLE 15 NETWORK DEVICES MARKET, BY DEVICE TYPE, 2018-2021 (MILLION UNITS)

- TABLE 16 NETWORK DEVICES MARKET, BY DEVICE TYPE, 2022-2027 (MILLION UNITS)

- 6.2 ROUTERS

- 6.2.1 WIDESPREAD USE OF INDUSTRIAL ROUTERS FOR MANUFACTURING AND UTILITIES APPLICATIONS IN INDOOR AND OUTDOOR ENVIRONMENTS

- TABLE 17 ROUTERS MARKET, BY APPLICATION, 2018-2021 (USD BILLION)

- TABLE 18 ROUTERS MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 19 ROUTERS MARKET, BY APPLICATION, 2018-2021 (MILLION UNITS)

- TABLE 20 ROUTERS MARKET, BY APPLICATION, 2022-2027 (MILLION UNITS)

- 6.3 GATEWAYS

- 6.3.1 RUGGEDIZED INDUSTRIAL GATEWAYS SUITED TO SEVERE AND REMOTE ENVIRONMENTS

- TABLE 21 GATEWAYS MARKET, BY APPLICATION, 2018-2021 (USD BILLION)

- TABLE 22 GATEWAYS MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 23 GATEWAYS MARKET, BY APPLICATION, 2018-2021 (MILLION UNITS)

- TABLE 24 GATEWAYS MARKET, BY APPLICATION, 2022-2027 (MILLION UNITS)

- 6.4 ACCESS POINTS

- 6.4.1 DESIGNED TO CONNECT WIRELESS DEVICES IN VARIOUS ENVIRONMENTS

- TABLE 25 ACCESS POINTS MARKET, BY APPLICATION, 2018-2021 (USD BILLION)

- TABLE 26 ACCESS POINTS MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 27 ACCESS POINTS MARKET, BY APPLICATION, 2018-2021 (MILLION UNITS)

- TABLE 28 ACCESS POINTS MARKET, BY APPLICATION, 2022-2027 (MILLION UNITS)

7 NETWORK DEVICES MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 32 INDOOR SEGMENT TO HOLD LARGER SHARE OF NETWORK DEVICES MARKET DURING FORECAST PERIOD

- TABLE 29 NETWORK DEVICES MARKET, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 30 NETWORK DEVICES MARKET, BY TYPE, 2022-2027 (USD BILLION)

- 7.2 INDOOR

- 7.2.1 SUITED TO SEVERAL APPLICATIONS DESPITE LIMITED WIFI RANGE

- 7.2.2 INDOOR: MARKET DRIVERS

- 7.2.3 INDOOR: COVID-19 IMPACT

- 7.3 OUTDOOR

- 7.3.1 OUTDOOR DEVICES HELP EXTEND INTERNAL WIRELESS NETWORKS

- 7.3.2 OUTDOOR: MARKET DRIVERS

- 7.3.3 OUTDOOR: COVID-19 IMPACT

8 NETWORK DEVICES MARKET, BY CONNECTIVITY

- 8.1 INTRODUCTION

- FIGURE 33 WIFI CONNECTIVITY TO HOLD LARGEST SHARE OF NETWORK DEVICES MARKET DURING FORECAST PERIOD

- TABLE 31 NETWORK DEVICES MARKET, BY CONNECTIVITY, 2018-2021 (MILLION UNITS)

- TABLE 32 NETWORK DEVICES MARKET, BY CONNECTIVITY, 2022-2027 (MILLION UNITS)

- 8.2 WIFI

- 8.2.1 OPERATES IN FREQUENCY BAND OF AROUND 2.4 GHZ AND 5.0 GHZ

- 8.3 CELLULAR

- 8.3.1 WIDE USE OF EVOLVING CELLULAR-BASED TECHNOLOGIES IN NETWORK DEVICES

- 8.4 WIFI+OTHERS

- 8.4.1 WIFI+OTHERS ENCOMPASSES WIFI ALONG WITH BLUETOOTH, ZIGBEE, AND/OR LORA

- 8.5 LORA

- 8.5.1 EXPLICITLY DESIGNED FOR LONG-RANGE, LOW-POWER COMMUNICATIONS

- 8.6 OTHERS

- 8.6.1 BLUETOOTH AND ZIGBEE CONNECTIVITY

9 NETWORK DEVICES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 34 ENTERPRISE NETWORKING TO HOLD LARGEST SHARE OF NETWORK DEVICES MARKET DURING FORECAST PERIOD

- TABLE 33 NETWORK DEVICES MARKET, BY APPLICATION, 2018-2021 (USD BILLION)

- TABLE 34 NETWORK DEVICES MARKET, BY APPLICATION, 2022-2027 (USD BILLION)

- TABLE 35 NETWORK DEVICES MARKET, BY APPLICATION, 2018-2021 (MILLION UNITS)

- TABLE 36 NETWORK DEVICES MARKET, BY APPLICATION, 2022-2027 (MILLION UNITS)

- 9.2 RESIDENTIAL NETWORKING

- 9.2.1 INCEASING DEMAND FOR WIRELESS NETWORKING TO CONTROL DOMESTIC DEVICES

- TABLE 37 RESIDENTIAL NETWORK DEVICES MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 38 RESIDENTIAL NETWORK DEVICES MARKET, BY REGION, 2022-2027 (USD BILLION)

- TABLE 39 RESIDENTIAL NETWORK DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 40 RESIDENTIAL NETWORK DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 41 RESIDENTIAL NETWORK DEVICES MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 42 RESIDENTIAL NETWORK DEVICES MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 43 RESIDENTIAL NETWORK DEVICES MARKET IN APAC, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 44 RESIDENTIAL NETWORK DEVICES MARKET IN APAC, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 45 RESIDENTIAL NETWORK DEVICES MARKET IN ROW, BY REGION, 2018-2021 (USD BILLION)

- TABLE 46 RESIDENTIAL NETWORK DEVICES MARKET IN ROW, BY REGION, 2022-2027 (USD BILLION)

- 9.3 COMMERCIAL NETWORKING

- 9.3.1 WIDE USE OF COMMERCIAL NETWORKS TO IMPROVE RETAIL OPERATIONS

- TABLE 47 COMMERCIAL NETWORK DEVICES MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 48 COMMERCIAL NETWORK DEVICES MARKET, BY REGION, 2022-2027 (USD BILLION)

- TABLE 49 COMMERCIAL NETWORK DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 50 COMMERCIAL NETWORK DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 51 COMMERCIAL NETWORK DEVICES MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 52 COMMERCIAL NETWORK DEVICES MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 53 COMMERCIAL NETWORK DEVICES MARKET IN APAC, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 54 COMMERCIAL NETWORK DEVICES MARKET IN APAC, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 55 COMMERCIAL NETWORK DEVICES MARKET IN ROW, BY REGION, 2018-2021 (USD BILLION)

- TABLE 56 COMMERCIAL NETWORK DEVICES MARKET IN ROW, BY REGION, 2022-2027 (USD BILLION)

- 9.4 ENTERPRISE NETWORKING

- 9.4.1 SIGNIFICANT INCREASE IN DEMAND DUE TO COVID-10 PANDEMIC

- TABLE 57 ENTERPRISE NETWORK DEVICES MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 58 ENTERPRISE NETWORK DEVICES MARKET, BY REGION, 2022-2027 (USD BILLION)

- TABLE 59 ENTERPRISE NETWORK DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 60 ENTERPRISE NETWORK DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 61 ENTERPRISE NETWORK DEVICES MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 62 ENTERPRISE NETWORK DEVICES MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 63 ENTERPRISE NETWORK DEVICES MARKET IN APAC, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 64 ENTERPRISE NETWORK DEVICES MARKET IN APAC, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 65 ENTERPRISE NETWORK DEVICES MARKET IN ROW, BY REGION, 2018-2021 (USD BILLION)

- TABLE 66 ENTERPRISE NETWORK DEVICES MARKET IN ROW, BY REGION, 2022-2027 (USD BILLION)

- 9.5 INDUSTRIAL NETWORKING

- 9.5.1 GROWING NEED FOR ADVANCED WIDE-AREA NETWORKING SOLUTIONS

- TABLE 67 INDUSTRIAL NETWORK DEVICES MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 68 INDUSTRIAL NETWORK DEVICES MARKET, BY REGION, 2022-2027 (USD BILLION)

- TABLE 69 INDUSTRIAL NETWORK DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 70 INDUSTRIAL NETWORK DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 71 INDUSTRIAL NETWORK DEVICES MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 72 INDUSTRIAL NETWORK DEVICES MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 73 INDUSTRIAL NETWORK DEVICES MARKET IN APAC, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 74 INDUSTRIAL NETWORK DEVICES MARKET IN APAC, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 75 INDUSTRIAL NETWORK DEVICES MARKET IN ROW, BY REGION, 2018-2021 (USD BILLION)

- TABLE 76 INDUSTRIAL NETWORK DEVICES MARKET IN ROW, BY REGION, 2022-2027 (USD BILLION)

- 9.6 TRANSPORTATION NETWORKING

- 9.6.1 RISING DEPLOYMENT IN PUBLIC ROAD TRANSPORTATION SYSTEMS AND RAILWAYS

- TABLE 77 TRANSPORTATION NETWORK DEVICES MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 78 TRANSPORTATION NETWORK DEVICES MARKET, BY REGION, 2022-2027 (USD BILLION)

- TABLE 79 TRANSPORTATION NETWORK DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 80 TRANSPORTATION NETWORK DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 81 TRANSPORTATION NETWORK DEVICES MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 82 TRANSPORTATION NETWORK DEVICES MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 83 TRANSPORTATION NETWORK DEVICES MARKET IN APAC, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 84 TRANSPORTATION NETWORK DEVICES MARKET IN APAC, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 85 TRANSPORTATION NETWORK DEVICES MARKET IN ROW, BY REGION, 2018-2021 (USD BILLION)

- TABLE 86 TRANSPORTATION NETWORK DEVICES MARKET IN ROW, BY REGION, 2022-2027 (USD BILLION)

10 GEOGRAPHIC ANALYSIS

- 10.1 INTRODUCTION

- FIGURE 35 NORTH AMERICA TO LEAD NETWORK DEVICES MARKET DURING FORECAST PERIOD

- TABLE 87 NETWORK DEVICES MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 88 NETWORK DEVICES MARKET, BY REGION, 2022-2027 (USD BILLION)

- 10.2 NORTH AMERICA

- FIGURE 36 NETWORK DEVICES MARKET SNAPSHOT IN NORTH AMERICA

- TABLE 89 NETWORK DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 90 NETWORK DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 91 NETWORK DEVICES MARKET IN NORTH AMERICA, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 92 NETWORK DEVICES MARKET IN NORTH AMERICA, BY TYPE, 2022-2027 (USD BILLION)

- 10.2.1 US

- 10.2.1.1 Largest market in North America due to high number of router installations

- TABLE 93 NETWORK DEVICES MARKET IN THE US, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 94 NETWORK DEVICES MARKET IN THE US, BY TYPE, 2022-2027 (USD BILLION)

- 10.2.2 CANADA

- 10.2.2.1 Increasing deployment of WiFi networks leading to market growth

- TABLE 95 NETWORK DEVICES MARKET IN CANADA, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 96 NETWORK DEVICES MARKET IN CANADA, BY TYPE, 2022-2027 (USD BILLION)

- 10.2.3 MEXICO

- 10.2.3.1 Rapid industrialization to boost nascent market

- TABLE 97 NETWORK DEVICES MARKET IN MEXICO, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 98 NETWORK DEVICES MARKET IN MEXICO, BY TYPE, 2022-2027 (USD BILLION)

- 10.3 EUROPE

- FIGURE 37 NETWORK DEVICES MARKET SNAPSHOT IN EUROPE

- TABLE 99 NETWORK DEVICES MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 100 NETWORK DEVICES MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD BILLION)

- TABLE 101 NETWORK DEVICES MARKET IN EUROPE, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 102 NETWORK DEVICES MARKET IN EUROPE, BY TYPE, 2022-2027 (USD BILLION)

- 10.3.1 UK

- 10.3.1.1 Active government support for cloud-based projects to boost market

- TABLE 103 NETWORK DEVICES MARKET IN THE UK, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 104 NETWORK DEVICES MARKET IN THE UK, BY TYPE, 2022-2027 (USD BILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Widespread adoption of industrial networking to fuel market growth

- TABLE 105 NETWORK DEVICES MARKET IN THE GERMANY, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 106 NETWORK DEVICES MARKET IN THE GERMANY, BY TYPE, 2022-2027 (USD BILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Accelerated investments in 5G technology for industrial networking

- TABLE 107 NETWORK DEVICES MARKET IN FRANCE, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 108 NETWORK DEVICES MARKET IN FRANCE, BY TYPE, 2022-2027 (USD BILLION)

- 10.3.4 REST OF EUROPE

- TABLE 109 NETWORK DEVICES MARKET IN THE REST OF EUROPE, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 110 NETWORK DEVICES MARKET IN THE REST OF EUROPE, BY TYPE, 2022-2027 (USD BILLION)

- 10.4 APAC

- FIGURE 38 NETWORK DEVICES MARKET SNAPSHOT IN APAC

- TABLE 111 NETWORK DEVICES MARKET IN APAC, BY COUNTRY, 2018-2021 (USD BILLION)

- TABLE 112 NETWORK DEVICES MARKET IN APAC, BY COUTRY, 2022-2027 (USD BILLION)

- TABLE 113 NETWORK DEVICES MARKET IN APAC, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 114 NETWORK DEVICES MARKET IN APAC, BY TYPE, 2022-2027 (USD BILLION)

- 10.4.1 CHINA

- 10.4.1.1 Challenging market due to complex and difficult regulatory environments

- TABLE 115 NETWORK DEVICES MARKET IN CHINA, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 116 NETWORK DEVICES MARKET IN CHINA, BY TYPE, 2022-2027 (USD BILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Growing telecom industry to provide greater scope for networking

- TABLE 117 NETWORK DEVICES MARKET IN JAPAN, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 118 NETWORK DEVICES MARKET IN JAPAN, BY TYPE, 2022-2027 (USD BILLION)

- 10.4.3 SOUTH KOREA

- 10.4.3.1 Rising government support for deployment of 5G network

- TABLE 119 NETWORK DEVICES MARKET IN SOUTH KOREA, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 120 NETWORK DEVICES MARKET IN SOUTH KOREA, BY TYPE, 2022-2027 (USD BILLION)

- 10.4.4 REST OF APAC

- TABLE 121 NETWORK DEVICES MARKET IN REST OF APAC, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 122 NETWORK DEVICES MARKET IN REST OF APAC, BY TYPE, 2022-2027 (USD BILLION)

- 10.5 ROW

- FIGURE 39 MARKET IN MIDDLE EAST & AFRICA TO GROW AT SLIGHTLY HIGHER RATE DURING FORECAST PERIOD

- TABLE 123 NETWORK DEVICES MARKET IN ROW, BY REGION, 2018-2021 (USD MILLION)

- TABLE 124 NETWORK DEVICES MARKET IN ROW, BY REGION, 2022-2027 (USD MILLION)

- TABLE 125 NETWORK DEVICES MARKET IN ROW, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 126 NETWORK DEVICES MARKET IN ROW, BY TYPE, 2022-2027 (USD MILLION)

- 10.5.1 SOUTH AMERICA

- 10.5.1.1 Increasing Internet penetration opening up new growth opportunities in residential sector

- TABLE 127 NETWORK DEVICES MARKET IN SOUTH AMERICA, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 128 NETWORK DEVICES MARKET IN SOUTH AMERICA, BY TYPE, 2022-2027 (USD BILLION)

- 10.5.2 MIDDLE EAST & AFRICA

- 10.5.2.1 Growing adoption of WiFi in Middle East to boost market

- TABLE 129 NETWORK DEVICES MARKET IN MIDDLE EAST & AFRICA, BY TYPE, 2018-2021 (USD BILLION)

- TABLE 130 NETWORK DEVICES MARKET IN MIDDLE EAST & AFRICA, BY TYPE, 2022-2027 (USD BILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES OF KEY PLAYERS / MARKET EVALUATION FRAMEWORK

- TABLE 131 OVERVIEW OF STRATEGIES ADOPTED BY TOP FIVE INDUSTRIAL NETWORK DEVICE MANUFACTURERS FROM 2019 TO 2021

- 11.2.1 PRODUCT PORTFOLIO

- 11.2.2 REGIONAL FOCUS

- 11.2.3 MANUFACTURING FOOTPRINT

- 11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

- 11.3 MARKET SHARE ANALYSIS: NETWORK DEVICES MARKET, 2021

- TABLE 132 DEGREE OF COMPETITION

- 11.4 HISTORICAL REVENUE ANALYSIS

- FIGURE 40 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS

- 11.5 COMPANY EVALUATION QUADRANT

- 11.5.1 STAR

- 11.5.2 EMERGING LEADER

- 11.5.3 PERVASIVE

- 11.5.4 PARTICIPANT

- FIGURE 41 NETWORK DEVICES COMPANY EVALUATION QUADRANT, 2021

- 11.6 COMPETITIVE BENCHMARKING

- TABLE 133 OVERALL COMPANY FOOTPRINT (27 PLAYERS)

- TABLE 134 COMPANY OFFERING FOOTPRINT (27 PLAYERS)

- TABLE 135 FOOTPRINT OF DIFFERENT COMPANIES FOR VARIOUS APPLICATIONS (27 PLAYERS)

- TABLE 136 FOOTPRINT OF DIFFERENT COMPANIES FOR VARIOUS REGIONS (27 PLAYERS)

- 11.7 START-UP/SME EVALUATION MATRIX

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 42 NETWORK DEVICES MARKET: START-UP/SME EVALUATION MATRIX, 2021

- 11.8 COMPETITIVE BENCHMARKING

- TABLE 137 NETWORK DEVICES MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 138 NETWORK DEVICES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

- 11.9 COMPETITIVE SITUATIONS AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- TABLE 139 PRODUCT LAUNCHES, 2019-2021

- 11.9.2 DEALS

- TABLE 140 DEALS, 2019-2021

- 11.9.3 OTHERS

- TABLE 141 EXPANSIONS, 2019-2021

12 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 12.1 KEY PLAYERS

- 12.1.1 CISCO SYSTEMS

- TABLE 142 CISCO SYSTEMS: BUSINESS OVERVIEW

- FIGURE 43 CISCO SYSTEMS: COMPANY SNAPSHOT

- 12.1.2 HUAWEI

- TABLE 143 HUAWEI: BUSINESS OVERVIEW

- FIGURE 44 HUAWEI: COMPANY SNAPSHOT

- 12.1.3 HP ENTERPRISE

- TABLE 144 HP ENTERPRISE: BUSINESS OVERVIEW

- FIGURE 45 HP ENTERPRISE: COMPANY SNAPSHOT

- 12.1.4 JUNIPER NETWORKS

- TABLE 145 JUNIPER NETWORKS: BUSINESS OVERVIEW

- FIGURE 46 JUNIPER NETWORKS: COMPANY SNAPSHOT

- 12.1.5 SIERRA WIRELESS

- TABLE 146 SIERRA WIRELESS: BUSINESS OVERVIEW

- FIGURE 47 SIERRA WIRELESS: COMPANY SNAPSHOT

- 12.1.6 CRADLEPOINT

- TABLE 147 CRADLEPOINT: BUSINESS OVERVIEW

- 12.1.7 DIGI INTERNATIONAL

- TABLE 148 DIGI INTERNATIONAL: BUSINESS OVERVIEW

- FIGURE 48 DIGI INTERNATIONAL: COMPANY SNAPSHOT

- 12.1.8 TELTONIKA

- TABLE 149 TELTONIKA: BUSINESS OVERVIEW

- 12.1.9 MULTITECH

- TABLE 150 MULTITECH: BUSINESS OVERVIEW

- 12.1.10 INSEEGO

- TABLE 151 INSEEGO: BUSINESS OVERVIEW

- FIGURE 49 INSEEGO: COMPANY SNAPSHOT

- 12.1.11 SCHNEIDER ELECTRIC

- TABLE 152 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- FIGURE 50 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- 12.1.12 GENERAL ELECTRIC

- TABLE 153 GENERAL ELECTRIC: BUSINESS OVERVIEW

- FIGURE 51 GENERAL ELECTRIC: COMPANY SNAPSHOT

- 12.1.13 EXTREME NETWORKS

- TABLE 154 EXTREME NETWORKS: BUSINESS OVERVIEW

- FIGURE 52 EXTREME NETWORKS: COMPANY SNAPSHOT

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 12.2 OTHER KEY PLAYERS

- 12.2.1 SIEMENS

- 12.2.2 MOXA

- 12.2.3 ROBUSTEL

- 12.2.4 ADVANTECH

- 12.2.5 LYNX TECHNOLOGIES

- 12.2.6 LANTRONIX

- 12.2.7 D-LINK

- 12.2.8 TP-LINK TECHNOLOGIES

- 12.2.9 BELKIN INTERNATIONAL

- 12.2.10 ADTRAN

- 12.2.11 ASUSTEK COMPUTER

- 12.2.12 HMS NETWORKS

- 12.2.13 CASA SYSTEMS

- 12.2.14 NOKIA

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS