|

|

市場調査レポート

商品コード

1093675

骨・関節用健康サプリメントの世界市場:種類別 (ビタミンD、ビタミンK、カルシウム、コラーゲン、オメガ3脂肪酸、グルコサミン・コンドロイチン)・流通チャネル別・形状別 (錠剤、カプセル、液体、粉末)・対象消費者別・地域別の将来予測 (2027年まで)Bone & Joint Health Supplements Market by Type (Vitamin D, Vitamin K, Calcium, Collagen, Omega 3-Fatty Acid, Glucosamine-Chondroitin), Distribution Channels, Form (Tablets, Capsules, Liquid, Powder), Target Consumers and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 骨・関節用健康サプリメントの世界市場:種類別 (ビタミンD、ビタミンK、カルシウム、コラーゲン、オメガ3脂肪酸、グルコサミン・コンドロイチン)・流通チャネル別・形状別 (錠剤、カプセル、液体、粉末)・対象消費者別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年06月20日

発行: MarketsandMarkets

ページ情報: 英文 256 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の骨・関節用健康サプリメントの市場規模は、2022年には117億米ドル、2027年までに176億米ドルに達すると予測されています。

また、予測期間中に8.5%のCAGRで成長する見通しです。所得の増加により、家計は予算を増やし、食料などの必需品に加え、健康や栄養に費やすようになりました。食品/スポーツ用サプリメントの人気が高まっており、特にベジタリアンは、健康維持のためにタンパク質の必要量を満たす必要性をますます感じています。

地域別に見ると、北米が7.9%のCAGRで成長していくと予測されています。対象消費者別では、高齢者が圧倒的なシェアを占めています。流通チャネル別では、「その他の流通チャネル」 (食品専門店、コンビニエンスストア、消費者向け直販、フィットネスクラブ、eコマースなど) が最も成長率が高く、予測期間中に9.2%で成長すると予測されています。

当レポートでは、世界の骨・関節用健康サプリメントの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、市場動向の見通し、種類別・形状別・対象消費者別・流通チャネル別・地域別の詳細動向、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 分析方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- マクロ経済指標

- 高齢者人口

- 肥満症患者の人口比率の上昇

- 重要な事実

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

- 課題

第6章 産業動向

- 概要

- 規制枠組み

- 規制機関、政府機関、その他の組織

- 貿易分析

- 特許分析

- バリューチェーン分析

- 研究・開発

- 製造

- 包装・保管

- 流通

- エンドユーザー

- 顧客のビジネスに影響を与える傾向/ディスラプション

- エコシステム/市場マップ

- 技術分析

- 食品のマイクロカプセル化

- バイオテクノロジー

- 革新的で破壊的な技術

- ポーターのファイブフォース分析

- 主要な会議とイベント (2022年~2023年)

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 平均販売価格

第7章 骨・関節用健康サプリメント市場:種類別

- イントロダクション

- ビタミンD

- ビタミンK

- カルシウム

- コラーゲン

- オメガ3脂肪酸

- グルコサミン・コンドロイチン

- その他の種類

第8章 骨・関節用健康サプリメント市場:形状別

- イントロダクション

- 錠剤

- カプセル

- 液体

- 粉末

- その他の形式

第9章 骨・関節用健康サプリメント市場:対象消費者別

- イントロダクション

- 乳幼児

- 児童

- 成人

- 妊娠中の女性

- 高齢者

第10章 骨・関節用健康サプリメント市場:流通チャネル別

- イントロダクション

- スーパーマーケット/ハイパーマーケット

- 薬局・ドラッグストア

- 健康・美容品店

- その他の流通チャネル

第11章 骨・関節用健康サプリメント市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- 他のアジア太平洋諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 他の国々

- アフリカ

- 中東

第12章 競合情勢

- 概要

- 主要企業の過去の収益分析

- 市場シェア分析 (2021年)

- 主要企業の戦略

- 企業評価クアドラント (主要企業)

- 製品のフットプリント

- スタートアップ/中小企業の評価象限 (その他の企業)

第13章 企業プロファイル

- 主要企業

- BAYER AG

- PROCTER & GAMBLE

- AMWAY

- BASF SE

- ADM

- RECKITT BENCKISER GROUP PLC

- PFIZER

- VITA LIFE SCIENCES

- NATURE'S SUNSHINE PRODUCTS, INC.

- GLANBIA PLC

- ARAZO NUTRITION

- NATURE'S BOUNTY

- BUTTERFLY AYURVEDA PVT. LTD.

- HERBS NUTRIPRODUCTS PVT. LTD.

- MILLENNIUM HERBAL CARE

- その他の企業

- VITAWIN

- NUTRAMAX LABORATORIES CONSUMER CARE, INC.

- SIMPLY SUPPLEMENTS

- LOVE LIFE SUPPLEMENTS LTD.,

- NOW FOODS

- BELLAVITA HEALTHCARE PRIVATE LIMITED

- VITACO

- NUTRAVITA

- LIFE EXTENSION

- PURE ENCAPSULATIONS, LLC.

第14章 隣接・関連市場

- イントロダクション

- 栄養補助食品市場

- ニュートラシューティカル製品市場

- ビタミンD市場

- コラーゲン市場

第15章 付録

The global bone & joint health supplements market is estimated to be valued at USD 11.7 billion in 2022. It is projected to reach USD 17.6 billion by 2027, recording a CAGR of 8.5% during the forecast period. Rising incomes have prompted households to increase their budgets and spend more on health and nutrition in addition to necessities such as food. Nutrition bars, in addition to protein supplements, are gaining popularity, particularly in urban areas. According to experts, food/sport supplements are becoming more popular, particularly vegetarians, increasingly feel the need to meet their protein requirements in order to stay healthy.

"North America is projected to witness the growth of 7.9% during the forecast period."

The bone & joint health supplements market in North America is growing at a CAGR of 7.9% due to the rising awareness related to health trends, the popularity of bone & joint health supplements is witnessing a surge in the region. Insufficient exercise, low vitamin D levels, and inadequate calcium are becoming more widely recognized in modern life. Vitamin D deficiency affects around 70% of children in the United States. Adults have been shown to have a similar level of vitamin D deficiency. Vitamin D is found in oily fish such as salmon and swordfish, as well as smaller amounts in tuna and other seafood. Vitamin D is difficult to obtain in sufficient amounts through diet alone. Along with that, insufficient exercise, low vitamin D levels, and inadequate calcium are becoming more widely recognized in modern life. Vitamin D deficiency affects around 70% of children in the United States. Adults have been shown to have a similar level of vitamin D deficiency. More than three-quarters of Americans take nutritional supplements each year, a clear trend that demonstrates the importance of supplementation in their overall health and wellness routines.

"The elderly people segment dominated the bone & joint health supplements market by target consumers. It is estimated at USD 5,410.2 million in 2022."

It is projected that the elderly people segment by target consumers will witness the highest growth during the forecast period, owing to the increasing aging populations associated with it. Aging gracefully, adopting a healthy lifestyle, staying active are some of the key goals of the majority of the aging population. As one ages, it becomes a challenge to get the right amount of vitamins and minerals for the body. Fortunately, consumption of bone and joint health supplement fills the gap for such deficiencies. Many older adults in the United States take one or more bone and joint supplements either as a pill or drink. Popular supplements include some nutrients that are under consumed among older adults, including calcium and vitamins D and calcium. Among all other vitamins, vitamin D has been consumed at a higher rate. In older adults, vitamin D helps to support skeletal health by building and protecting bones.

"Other distributions channels is fastest growing segment. It is projected to grow at 9.2% during forecast period."

Others distribution channels includes speciality food stores, convenience stores, direct-to-consumer, fitness institutes, and E-commerce. Many companies and retailers offer online services to facilitate consumers in terms of placing an order as well as delivering the same. Several one-stop shops are present on the web in easing the purchasing process of the consumers. These online retails also offer a variety of options for a particular bone and joint health supplement product at discounted rates than traditional retail prices to attract more customers. Since the last decade, the increased frequency of online shopping had created opportunities to enhance the product sales of leading online players as well as for regional domestic e-retailers, such as Wheafree in India and Healthy Supplies Ltd. in the UK.

Break-up of Primaries:

- By Value chain side: Supply side-59%, Demand side-41%

- By Designation: CXOs- 31%, Managers- 24%, Executives - 45%

- By Region: Europe - 29%, Asia Pacific - 32%, North America - 24%, RoW - 15%

Leading players profiled in this report:

- Bayer AG(Germany)

- Procter & Gamble (US)

- Amway (US)

- Basf SE (Germany)

- Archer Daniels Midland (US)

- Reckitt Benckiser (UK)

- Pfizer (US)

- Vita Life Sciences Ltd (Australia)

- Arazo Nutrition (US)

- Nature's Sunshine Products, Inc (US)

- (France)

- Glanbia Plc (Ireland)

- Vitawin(India)

- Nutramax Laboratories Consumer Care, Inc(US)

- Simply Supplements(UK)

- Love Life Supplements(UK)

- Now Foods(US)

- Bellavita Healthcare Pvt Ltd(India)

- Vitaco(New Zealand)

- Nutravita(UK)

- Life Extension(US)

- Pure Encapsulations, LLC (US)

- Herbs Nutriproducts Pvt. Ltd. (India)

- Millennium Herbal Care (India)

Research Coverage:

The report segments the bone & joint health supplements market on the basis of type, distribution channel, form, target consumer and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global starter cultures, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the bone & joint health supplements market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the bone & joint health supplements market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 REGIONS COVERED

- 1.5 PERIODIZATION CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017-2021

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 BONE & JOINT HEALTH SUPPLEMENTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE ESTIMATION, BY TYPE (SUPPLY-SIDE)

- FIGURE 5 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE ESTIMATION (DEMAND-SIDE)

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 ASSUMPTIONS FOR THE STUDY

- 2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- TABLE 2 BONE & JOINT HEALTH SUPPLEMENTS MARKET SNAPSHOT, 2022 VS. 2027

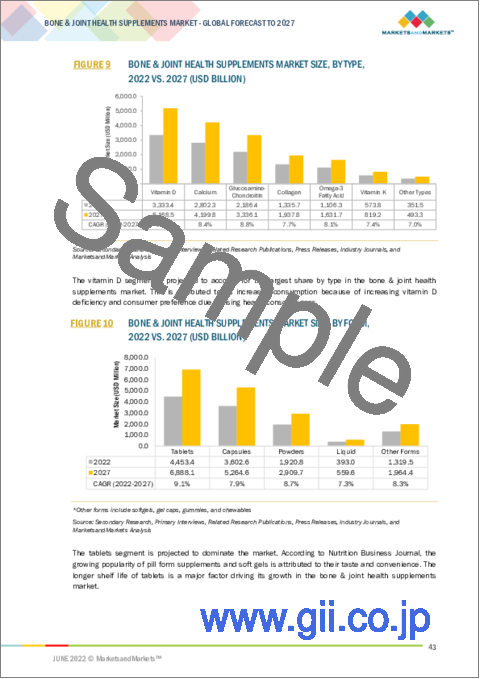

- FIGURE 9 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD BILLION)

- FIGURE 10 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2022 VS. 2027 (USD BILLION)

- FIGURE 11 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022 VS. 2027 (USD BILLION)

- FIGURE 12 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TARGET CONSUMER, 2022 VS. 2027 (USD BILLION)

- FIGURE 13 BONE & JOINT HEALTH SUPPLEMENTS MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE BONE & JOINT HEALTH SUPPLEMENTS MARKET

- FIGURE 14 EMERGING ECONOMIES OFFER OPPORTUNITIES FOR MARKET GROWTH

- 4.2 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENT MARKET, BY TYPE & COUNTRY

- FIGURE 15 VITAMIN D FORMED THE DOMINANT SEGMENT IN TERMS OF TYPE, IN THE NORTH AMERICAN BONE & JOINT HEALTH SUPPLEMENTS MARKET

- 4.3 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY TARGET CONSUMERS

- FIGURE 16 ELDERLY SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

- 4.4 BONE & JOINT HEALTH SUPPLEMENT MARKET, BY FORM AND BY REGION

- FIGURE 17 NORTH AMERICA LED THE BONE & JOINT HEALTH SUPPLEMENTS MARKET IN 2021

- 4.5 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY REGION

- FIGURE 18 THE US ACCOUNTED FOR THE LARGEST SHARE OF THE GLOBAL BONE & JOINT HEALTH SUPPLEMENTS MARKET IN 2021

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 AGING POPULATION

- FIGURE 19 POPULATION AGED 65 & ABOVE (% OF TOTAL POPULATION) (2016-2020)

- 5.2.2 GLOBAL POPULATION IS WITNESSING A HIGH PROPORTION OF OBESITY

- 5.2.3 KEY FACTS

- 5.3 MARKET DYNAMICS

- FIGURE 20 DIETARY SUPPLEMENTS MARKET: MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Increase in the prevalence of vitamin D deficiencies across the globe is expected to boost demand

- 5.3.1.2 Shift in consumer preferences due to the rising health awareness

- 5.3.1.3 Aging population to drive the market growth

- FIGURE 21 AGING POPULATION IN JAPAN, 2014 - 2021

- FIGURE 22 AGING POPULATION IN CHINA, 2014 - 2021

- FIGURE 23 AGING POPULATION IN UK, 2014 - 2021

- FIGURE 24 AGING POPULATION IN GERMANY, 2014 - 2021

- FIGURE 25 PERCENTAGE OF US ADULTS BY AGE TAKING DIETARY SUPPLEMENTS, 2021

- 5.3.1.4 Growing retail sale of nutritional & fortified products

- FIGURE 26 RETAIL SALE OF NUTRITIONAL AND FORTIFIED PRODUCTS IN AUSTRALIA (USD MILLION), 2018-2022

- 5.3.2 RESTRAINTS

- 5.3.2.1 High R&D investments and high cost of clinical trials

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Rise in the number of osteoporosis patients is anticipated to propel the market demand

- 5.3.3.2 Food fortification to satisfy consumer awareness about micronutrient deficiencies

- 5.3.4 CHALLENGES

- 5.3.4.1 Consumer skepticism associated with nutraceutical products

- 5.3.4.2 Regulatory influence

6 INDUSTRY TRENDS

- 6.1 OVERVIEW

- 6.2 REGULATORY FRAMEWORK

- 6.2.1 NORTH AMERICA

- 6.2.1.1 Canada

- 6.2.1.2 US

- 6.2.1.3 Mexico

- 6.2.2 EUROPEAN UNION

- 6.2.3 ASIA PACIFIC

- 6.2.3.1 Japan

- 6.2.3.2 China

- 6.2.3.3 India

- 6.2.3.4 Australia & New Zealand

- 6.2.4 SOUTH AMERICA

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.5 MIDDLE EAST

- 6.2.1 NORTH AMERICA

- 6.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA-PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.4 TRADE ANALYSIS

- TABLE 8 KEY EXPORTING COUNTRIES WITH EXPORT VALUE OF VITAMINS & VITAMIN SUPPLEMENTS, 2021 (USD MILLION)

- FIGURE 27 IMPORT TARIFF OF KEY COUNTRIES ON VITAMINS & VITAMIN SUPPLEMENTS, 2020 (%)

- 6.5 PATENT ANALYSIS

- FIGURE 28 NO OF PATENTS GRANTED FOR BONE & JOINT HEALTH SUPPLEMENTS MARKET, 2011-2021

- FIGURE 29 REGIONAL ANALYSIS OF PATENT GRANTED FOR BONE & JOINT HEALTH SUPPLEMENTS MARKET, 2011-2021

- TABLE 9 KEY PATENTS PERTAINING TO BONE & JOINT HEALTH SUPPLEMENTS, 2021

- 6.6 VALUE CHAIN ANALYSIS

- FIGURE 30 BONE & HEALTH SUPPLEMENTS: VALUE CHAIN ANALYSIS

- 6.6.1 RESEARCH & DEVELOPMENT

- 6.6.2 MANUFACTURING

- 6.6.3 PACKAGING AND STORAGE

- 6.6.4 DISTRIBUTION

- 6.6.5 END USER

- 6.7 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER'S BUSINESS

- FIGURE 31 YC-YCC SHIFT FOR THE BONE & JOINT HEALTH SUPPLEMENTS MARKET

- 6.8 ECOSYSTEM/MARKET MAP

- TABLE 10 DIETARY SUPPLEMENTRS MARKET: ECOSYSTEM

- 6.8.1 MARKET MAP

- FIGURE 32 BONE & JOINT HEALTH SUPPLEMENTS MARKET: MARKET MAP

- 6.9 TECHNOLOGY ANALYSIS

- 6.9.1 FOOD MICROENCAPSULATION

- 6.9.1.1 Encapsulation of Omega-3 to mask the odor

- 6.9.2 BIOTECHNOLOGY

- 6.9.3 INNOVATIVE AND DISRUPTIVE TECH

- 6.9.3.1 Robotics as a key technological trend leading to innovations in the market

- 6.9.3.2 3D printing to uplift the future of the dietary supplements market with high end products

- 6.9.3.3 Hologram Sciences: Consumer-facing digital platforms for personalized nutrition and advice

- 6.9.1 FOOD MICROENCAPSULATION

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 BONE & JOINT HEALTH SUPPLEMENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 DEGREE OF COMPETITION

- 6.10.2 BARGAINING POWER OF SUPPLIERS

- 6.10.3 BARGAINING POWER OF BUYERS

- 6.10.4 THREAT OF SUBSTITUTES

- 6.10.5 THREAT OF NEW ENTRANTS

- 6.11 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 12 BONE AND JOINT HEALTH SUPPLEMENTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 6.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE FORMS

- TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE FORMS (%)

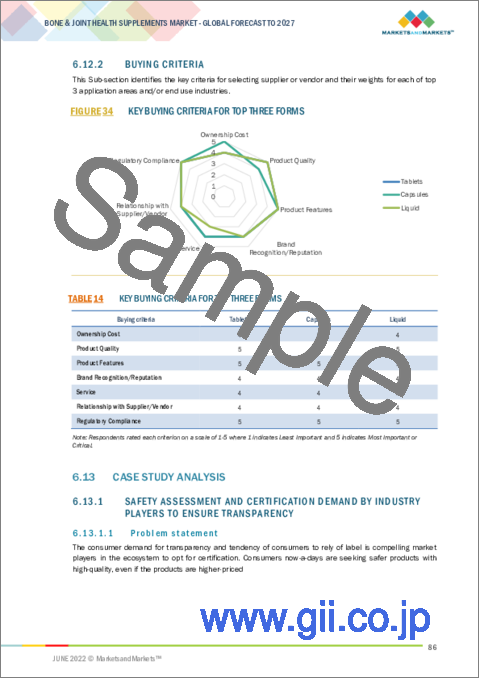

- 6.12.2 BUYING CRITERIA

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE FORMS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE FORMS

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 SAFETY ASSESSMENT AND CERTIFICATION DEMAND BY INDUSTRY PLAYERS TO ENSURE TRANSPARENCY

- 6.13.1.1 Problem statement

- 6.13.1.2 Solution offered

- 6.13.1.3 Outcome

- 6.13.2 FRUNUTTA STARTED OFFERING EASY-TO-USE AND EFFICIENT-TO-TAKE VITAMIN AND MINERAL PILLS THAT DISSOLVE INSTANTLY

- 6.13.2.1 Problem statement

- 6.13.2.2 Solution offered

- 6.13.2.3 Outcome

- 6.13.3 NOW FOODS AVAILS FLAVOURED DIETARY SUPPLEMENT PRODUCTS

- 6.13.3.1 Problem statement

- 6.13.3.2 Solution offered

- 6.13.3.3 Outcome

- 6.13.4 BAYER AG: HOW CAN WE MAKE OUR EXTENDED LIFESPAN A HEALTHY ONE?

- 6.13.4.1 Problem statement

- 6.13.4.2 Solution offered

- 6.13.4.3 Outcome

- 6.13.1 SAFETY ASSESSMENT AND CERTIFICATION DEMAND BY INDUSTRY PLAYERS TO ENSURE TRANSPARENCY

- 6.14 AVERAGE SELLING PRICES

- FIGURE 35 PRICING ANALYSIS: BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY TYPE

- FIGURE 36 PRICING ANALYSIS OF KEY PLAYERS: BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY REGION

- FIGURE 37 PRICING ANALYSIS: BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY FORM (2017-2021), USD/KG

- FIGURE 38 PRICING ANALYSIS: BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY REGION (2017-2021), USD/KG

7 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 39 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY TYPE, 2022 VS 2027 (USD MILLION)

- TABLE 15 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 16 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 7.2 VITAMIN D

- 7.2.1 DEFICIENCY OF VITAMIN D IS THE KEY FACTOR DRIVING THEIR USAGE

- TABLE 17 VITAMIN D: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 18 VITAMIN D: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.3 VITAMIN K

- 7.3.1 VITAMIN K PLAYS A VITAL ROLE IN BONE HEALTH

- TABLE 19 VITAMIN K: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 20 VITAMIN K: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.4 CALCIUM

- 7.4.1 LACTOSE INTOLERANCE PEOPLE DRIVING THE GROWTH OF CALCIUM SUPPLEMENTS

- TABLE 21 CALCIUM: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 22 CALCIUM: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.5 COLLAGEN

- 7.5.1 RISE IN THE AGING POPLUATION IN DEVELOPED COUNTRIES CONTRIBUTES TO HIGHER GROWTH OF THE COLLAGEN MARKET IN FUTURE

- TABLE 23 COLLAGEN: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 24 COLLAGEN: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.6 OMEGA 3 FATTY ACID

- 7.6.1 OMEGA 3 FATTY ACIDS HAVE ANTI-INFLAMMATORY EFFECTS

- TABLE 25 OMEGA 3 FATTY ACID: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 26 OMEGA 3 FATTY ACID: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.7 GLUCOSAMINE AND CHONDROITIN

- 7.7.1 HEALTH-CONSCIOUS PEOPLE ARE TAKING GLUCOSAMINE AND CHONDROITIN AS A PREVENTIVE MEASURE AGAINST ARTHRITIS

- TABLE 27 GLUCOSAMINE AND CHONDROITIN: BONE & JOINT HEALTH SUPPLEMENT MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 28 GLUCOSAMINE AND CHONDRAITIN: BONE & JOINT HEALTH SUPPLEMENT MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.8 OTHER TYPES

- 7.8.1 VEGAN AND VEGETARIAN PEOPLE ARE DRIVING THE DEMAND FOR PLANT BASED SUPPLEMENTS

- TABLE 29 OTHER TYPES: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 30 OTHER TYPES: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

8 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY FORM

- 8.1 INTRODUCTION

- FIGURE 40 BONE & JOINT HEALTH SUPPLEMENTS MARKET SHARE, BY FORM, 2022 VS. 2027 (USD MILLION)

- TABLE 31 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2017-2021 (USD MILLION)

- TABLE 32 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2022-2027 (USD MILLION)

- TABLE 33 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2017-2021 (KILOTONS)

- TABLE 34 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2022-2027 (KILOTONS)

- 8.2 TABLETS

- 8.2.1 LONG LIFE IS THE KEY TO THE GROWTH OF THE TABLET FORM OF BONE & JOINT HEALTH SUPPLEMENTS

- TABLE 35 TABLETS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 36 TABLETS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 37 TABLETS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (KILOTONS)

- TABLE 38 TABLETS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (KILOTONS)

- 8.3 CAPSULES

- 8.3.1 FASTER ABSORPTION OF NUTRIENTS THROUGH CAPSULES

- TABLE 39 CAPSULES: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 40 CAPSULES: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 41 CAPSULES: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (KILOTONS)

- TABLE 42 CAPSULES: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (KILOTONS)

- 8.4 LIQUID

- 8.4.1 HIGH ABSORPTION OF LIQUIDS UPON CONSUMPTION IS EXPECTED TO PROPEL THE MARKET GROWTH OF LIQUID SUPPLEMENTS

- TABLE 43 LIQUID: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 44 LIQUID: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 45 LIQUID: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (KILOTONS)

- TABLE 46 LIQUID: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (KILOTONS)

- 8.5 POWDER

- 8.5.1 EASY RELEASE OF ACTIVE INGREDIENTS DRIVING THE USAGE OF THE POWDER FORM

- TABLE 47 POWDER: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 48 POWDER: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 49 POWDER: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (KILOTONS)

- TABLE 50 POWDER: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (KILOTONS)

- 8.6 OTHER FORMS

- 8.6.1 RELATIVELY LOW-COST DRIVING DEMAND OF OTHER SEGMENT

- TABLE 51 OTHER FORMS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 52 OTHER FORMS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 53 OTHER FORMS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (KILOTONS)

- TABLE 54 OTHER FORMS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (KILOTONS)

9 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY TARGET CONSUMER

- 9.1 INTRODUCTION

- FIGURE 41 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY TARGET CONSUMER, 2022 VS. 2027 (USD MILLION)

- TABLE 55 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TARGET CONSUMER, 2017-2021 (USD MILLION)

- TABLE 56 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TARGET CONSUMER, 2022-2027 (USD MILLION)

- 9.2 INFANTS

- 9.2.1 ESSENTIAL NUTRIENTS REQUIRED FOR INFANT NUTRITION TRIGGER THE DEMAND FOR BONE & JOINT HEALTH SUPPLEMENTS

- TABLE 57 INFANTS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 58 INFANTS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 9.3 CHILDREN

- 9.3.1 RISE IN CONSUMPTION OF NUTRIENTS AMONG CHILDREN PROPELLING THE DEMAND FOR BONE & JOINT HEALTH SUPPLEMENTS

- TABLE 59 CHILDREN: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 60 CHILDREN: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 9.4 ADULTS

- 9.4.1 DEFICIENCY OF SEVERAL MINERALS AND VITAMINS IN ADULTS

- TABLE 61 ADULTS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 62 ADULTS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 9.5 PREGNANT WOMEN

- 9.5.1 REQUIREMENT FOR OPTIMAL NUTRITION DURING PREGNANCY DRIVING THE DEMAND FOR BONE & JOINT HEALTH SUPPLEMENTS

- TABLE 63 PREGNANT WOMEN: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 64 PREGNANT WOMEN: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 9.6 ELDERLY

- 9.6.1 NEED FOR CONSUMPTION OF BONE & JOINT HEALTH SUPPLEMENTS BY THE AGING POPULATION

- TABLE 65 ELDERLY: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 66 ELDERLY: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

10 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL

- 10.1 INTRODUCTION

- FIGURE 42 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2022 VS. 2027 (USD MILLION)

- TABLE 67 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2017-2021 (USD MILLION)

- TABLE 68 BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022-2027 (USD MILLION)

- 10.2 SUPERMARKETS/HYPERMARKETS

- 10.2.1 SUPERMARKETS OF DEVELOPED COUNTRIES CONTRIBUTE A MAJOR SHARE OF BONE & JOINT HEALTH SUPPLEMENTS

- TABLE 69 SUPERMARKETS/HYPERMARKETS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 70 SUPERMARKETS/HYPERMARKETS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 10.3 PHARMACIES & DRUG STORES

- 10.3.1 ELDERLY PEOPLE PREFER PHARMACIES OVER CONVENTIONAL STORE

- TABLE 71 PHARMACIES & DRUG STORES: BONE & JOINT HEALTH MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 72 PHARMACIES & DRUG STORES: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 10.4 HEALTH AND BEAUTY STORES

- 10.4.1 PATIENT-DIRECTED APPROACH DRIVES THE MARKET FOR HEALTH CENTERS, GLOBALLY

- TABLE 73 HEALTH & BEAUTY STORES: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 74 HEALTH & BEAUTY STORES: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 10.5 OTHER DISTRIBUTION CHANNELS

- 10.5.1 EASY ACCESSIBILITY TO A WIDE RANGE OF HEALTH PRODUCTS AIDS SALES OF BONE & JOINT HEALTH SUPPLEMENTS

- TABLE 75 OTHER DISTRIBUTION CHANNELS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 76 OTHER DISTRIBUTION CHANNELS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

11 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 43 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

- FIGURE 44 INDIA IS EXPECTED TO REGISTER THE HIGHEST CAGR IN THE GLOBAL BONE & JOINT HEALTH SUPPLEMENTS MARKET FROM 2022 TO 2027

- TABLE 77 GLOBAL BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 78 GLOBAL BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 79 GLOBAL BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (KILOTONS)

- TABLE 80 GLOBAL BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (KILOTONS)

- 11.2 NORTH AMERICA

- FIGURE 45 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SNAPSHOT

- TABLE 81 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 82 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 83 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 84 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 85 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2017-2021 (USD MILLION)

- TABLE 86 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2022-2027 (USD MILLION)

- TABLE 87 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2017-2021 (KILOTONS)

- TABLE 88 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2022-2027 (KILOTONS)

- TABLE 89 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TARGET CONSUMER, 2017-2021 (USD MILLION)

- TABLE 90 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TARGET CONSUMER, 2022-2027 (USD MILLION)

- TABLE 91 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2017-2021 (USD MILLION)

- TABLE 92 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022-2027 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 Vitamin D deficiency fueling the growth of the bone & joint health supplements market

- TABLE 93 US: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 94 US: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.2 CANADA

- 11.2.2.1 Markets for Omega-3 fatty acids, vitamin d, and calcium as bone & joint health supplements gaining an opportunity

- FIGURE 46 DEATHS BY DISEASES OF THE MUSCULOSKELETAL SYSTEM AND CONNECTIVE TISSUE IN CANADA

- TABLE 95 CANADA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 96 CANADA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.3 MEXICO

- 11.2.3.1 Malnutrition and obesity triggering the demand for bone & joint health supplements

- TABLE 97 MEXICO: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 98 MEXICO: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.3 EUROPE

- TABLE 99 EUROPE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 100 EUROPE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 101 EUROPE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 102 EUROPE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 103 EUROPE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2017-2021 (USD MILLION)

- TABLE 104 EUROPE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2022-2027 (USD MILLION)

- TABLE 105 EUROPE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2017-2021 (KILOTONS)

- TABLE 106 EUROPE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2022-2027 (KILOTONS)

- TABLE 107 EUROPE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TARGET CONSUMER, 2017-2021 (USD MILLION)

- TABLE 108 EUROPE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TARGET CONSUMER, 2022-2027 (USD MILLION)

- TABLE 109 EUROPE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2017-2021 (USD MILLION)

- TABLE 110 EUROPE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022-2027 (USD MILLION)

- 11.3.1 GERMANY

- 11.3.1.1 Surge in demand for plant-based food products provides an avenue for herbal supplements

- TABLE 111 GERMANY: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 112 GERMANY: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Increasing risk of arthritis gaining popularity for bone & joint health supplements

- TABLE 113 UK: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 114 UK: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Government support for promoting the consumption of nutritional supplements

- TABLE 115 FRANCE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 116 FRANCE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.4 ITALY

- 11.3.4.1 Higher prevalence of vitamin d deficiency driving the demand for bone & joint health supplements

- TABLE 117 ITALY: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 118 ITALY: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.5 SPAIN

- 11.3.5.1 Consumer preference for clean-label ingredients paving the way for bone & joint health supplement products

- TABLE 119 SPAIN: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 120 SPAIN: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.6 REST OF EUROPE

- 11.3.6.1 Rising aging population and growing awareness about the importance of consuming healthy foods

- TABLE 121 REST OF EUROPE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 122 REST OF EUROPE: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 47 ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SNAPSHOT

- TABLE 123 ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 124 ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 125 ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 126 ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 127 ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2017-2021 (USD MILLION)

- TABLE 128 ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2022-2027 (USD MILLION)

- TABLE 129 ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2017-2021 (KILOTONS)

- TABLE 130 ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2022-2027 (KILOTONS)

- TABLE 131 ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TARGET CONSUMER, 2017-2021 (USD MILLION)

- TABLE 132 ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TARGET CONSUMER, 2022-2027 (USD MILLION)

- TABLE 133 ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2017-2021 (USD MILLION)

- TABLE 134 ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022-2027 (USD MILLION)

- 11.4.1 CHINA

- 11.4.1.1 Elderly and the millennial population are the forefront users of nutritional supplements for bone & joint health

- TABLE 135 CHINA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 136 CHINA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.2 INDIA

- 11.4.2.1 The millennial population play a key role in driving the demand for bone & joint health supplements

- TABLE 137 INDIA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 138 INDIA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.3 JAPAN

- 11.4.3.1 Rise in the aging population is driving the growth of the market

- FIGURE 48 JAPAN: COUNTRIES WITH THE LARGEST SHARE OF POPULATION AGED 65 OR OVER, 2019

- TABLE 139 JAPAN: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 140 JAPAN: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.4 REST OF ASIA PACIFIC

- 11.4.4.1 Surge in the consumption rate of several types of healthy food products helping the growth of nutritional supplements of bone & joint supplements

- TABLE 141 REST OF ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.5 SOUTH AMERICA

- TABLE 143 SOUTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 144 SOUTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 145 SOUTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 146 SOUTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 147 SOUTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2017-2021 (USD MILLION)

- TABLE 148 SOUTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2022-2027 (USD MILLION)

- TABLE 149 SOUTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2017-2021 (KILOTONS)

- TABLE 150 SOUTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2022-2027 (KILOTONS)

- TABLE 151 SOUTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TARGET CONSUMER, 2017-2021 (USD MILLION)

- TABLE 152 SOUTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TARGET CONSUMER, 2022-2027 (USD MILLION)

- TABLE 153 SOUTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2017-2021 (USD MILLION)

- TABLE 154 SOUTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022-2027 (USD MILLION)

- 11.5.1 BRAZIL

- 11.5.1.1 Increasing obesity is driving the consumers toward bone & joint health supplements

- TABLE 155 BRAZIL: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 156 BRAZIL: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.5.2 ARGENTINA

- 11.5.2.1 Increase in the osteoporosis concern influencing the growth of bone & joint health supplements

- TABLE 157 ARGENTINA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 158 ARGENTINA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.3.1 Influence of health and wellness trends contributing to the market growth

- TABLE 159 REST OF SOUTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 160 REST OF SOUTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.6 REST OF THE WORLD

- TABLE 161 REST OF THE WORLD: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 162 REST OF THE WORLD: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 163 REST OF THE WORLD: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 164 REST OF THE WORLD: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 165 REST OF THE WORLD: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2017-2021 (USD MILLION)

- TABLE 166 REST OF THE WORLD: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2022-2027 (USD MILLION)

- TABLE 167 REST OF THE WORLD: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2017-2021 (KILOTONS)

- TABLE 168 REST OF THE WORLD: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2022-2027 (KILOTONS)

- TABLE 169 REST OF THE WORLD: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TARGET CONSUMER, 2017-2021 (USD MILLION)

- TABLE 170 REST OF THE WORLD: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TARGET CONSUMER, 2022-2027 (USD MILLION)

- TABLE 171 REST OF THE WORLD: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2017-2021 (USD MILLION)

- TABLE 172 REST OF THE WORLD: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022-2027 (USD MILLION)

- 11.6.1 AFRICA

- 11.6.1.1 Prevalence of vitamin deficiency among women and children results in concerning authorities providing food products, including bone & joint health supplements

- TABLE 173 AFRICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 174 AFRICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 11.6.2 MIDDLE EAST

- 11.6.2.1 Use of bone & joint health supplements for the pharmaceuticals and sports nutrition segments

- TABLE 175 MIDDLE EAST: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 176 MIDDLE EAST: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 49 THREE-YEAR TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2019-2021 (USD BILLION)

- 12.3 MARKET SHARE ANALYSIS, 2021

- TABLE 177 BONE & JOINT HEALTH SUPPLEMENTS MARKET: DEGREE OF COMPETITION

- 12.4 KEY PLAYER STRATEGIES

- 12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 12.5.1 STARS

- 12.5.2 PERVASIVE PLAYERS

- 12.5.3 EMERGING LEADERS

- 12.5.4 PARTICIPANTS

- FIGURE 50 BONE & JOINT HEALTH SUPPLEMENTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 12.6 PRODUCT FOOTPRINT

- TABLE 178 COMPANY, BY TYPE FOOTPRINT

- TABLE 179 COMPANY, BY APPLICATION FOOTPRINT

- TABLE 180 COMPANY, BY REGIONAL FOOTPRINT

- TABLE 181 COMPANY, BY OVERALL FOOTPRINT

- 12.7 START-UP/SME EVALUATION QUADRANT (OTHER PLAYERS)

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 STARTING BLOCKS

- 12.7.3 RESPONSIVE COMPANIES

- 12.7.4 DYNAMIC COMPANIES

- FIGURE 51 BONE & JOINT HEALTH SUPPLEMENTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

- TABLE 182 DETAILED LIST OF KEY STARTUP/SMES

- TABLE 183 BONE & JOINT HEALTH MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- 12.7.5 NEW PRODUCT LAUNCHES

- TABLE 184 BONE & JOINT HEALTH SUPPLEMENTS MARKET: NEW PRODUCT LAUNCHES, 2018-2021

- 12.7.6 DEALS

- TABLE 185 BONE & JOINT HEALTH SUPPLEMENTS MARKET: DEALS, 2018-2021

13 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 13.1 KEY PLAYERS

- 13.1.1 BAYER AG

- TABLE 186 BAYER AG: BUSINESS OVERVIEW

- FIGURE 52 BAYER: COMPANY SNAPSHOT

- TABLE 187 BAYER AG: PRODUCTS OFFERED

- 13.1.2 PROCTER & GAMBLE

- TABLE 188 PROCTER & GAMBLE: BUSINESS OVERVIEW

- FIGURE 53 PROCTER & GAMBLE: COMPANY SNAPSHOT

- TABLE 189 PROCTER & GAMBLE: PRODUCTS OFFERED

- 13.1.3 AMWAY

- FIGURE 54 AMWAY: COMPANY SNAPSHOT

- TABLE 190 AMWAY: PRODUCTS OFFERED

- 13.1.4 BASF SE

- TABLE 191 BASF SE: BUSINESS OVERVIEW

- FIGURE 55 BASF SE: COMPANY SNAPSHOT

- TABLE 192 BASF SE: PRODUCTS OFFERED

- 13.1.5 ADM

- TABLE 193 ADM: BUSINESS OVERVIEW

- FIGURE 56 ADM: COMPANY SNAPSHOT

- TABLE 194 ADM: PRODUCTS OFFERED

- 13.1.6 RECKITT BENCKISER GROUP PLC

- TABLE 195 RECKITT BENCKISER GROUP PLC: BUSINESS OVERVIEW

- FIGURE 57 RECKITT BENCKISER: COMPANY SNAPSHOT

- TABLE 196 RECKITT BENCKISER: PRODUCTS OFFERED

- 13.1.7 PFIZER

- TABLE 197 PFIZER: BUSINESS OVERVIEW

- FIGURE 58 PFIZER: COMPANY SNAPSHOT

- TABLE 198 PFIZER: PRODUCTS OFFERED

- 13.1.8 VITA LIFE SCIENCES

- TABLE 199 VITA LIFE SCIENCES: BUSINESS OVERVIEW

- FIGURE 59 VITA LIFE SCIENCES: COMPANY SNAPSHOT

- TABLE 200 VITA LIFE SCIENCES: PRODUCTS OFFERED

- 13.1.9 NATURE'S SUNSHINE PRODUCTS, INC.

- TABLE 201 NATURE'S SUNSHINE PRODUCTS, INC.: BUSINESS OVERVIEW

- FIGURE 60 NATURE'S SUNSHINE PRODUCTS, INC.: COMPANY SNAPSHOT

- TABLE 202 NATURE'S SUNSHINE PRODUCTS, INC.: PRODUCTS OFFERED

- 13.1.10 GLANBIA PLC

- TABLE 203 GLANBIA PLC: BUSINESS OVERVIEW

- FIGURE 61 GLANBIA PLC: COMPANY SNAPSHOT

- TABLE 204 GLANBIA PLC: PRODUCTS OFFERED

- 13.1.11 ARAZO NUTRITION

- TABLE 205 ARAZO NUTRITION: BUSINESS OVERVIEW

- TABLE 206 ARAZO NUTRITION: PRODUCTS OFFERED

- 13.1.12 NATURE'S BOUNTY

- TABLE 207 NATURE'S BOUNTY: BUSINESS OVERVIEW

- TABLE 208 NATURE'S BOUNTY: PRODUCTS OFFERED

- 13.1.13 BUTTERFLY AYURVEDA PVT. LTD.

- TABLE 209 BUTTERFLY AYURVEDA PVT. LTD.: BUSINESS OVERVIEW

- TABLE 210 BUTTERFLY AYURVEDA PVT. LTD.: PRODUCTS OFFERED

- 13.1.14 HERBS NUTRIPRODUCTS PVT. LTD.

- TABLE 211 HERBS NUTRIPRODUCTS PVT. LTD.: BUSINESS OVERVIEW

- TABLE 212 HERBS NUTRIPRODUCTS PVT. LTD: PRODUCTS OFFERED

- TABLE 213 HERBS NUTRIPRODUCTS PVT. LTD.: OTHERS

- 13.1.15 MILLENNIUM HERBAL CARE

- TABLE 214 MILLENNIUM HERBAL CARE: BUSINESS OVERVIEW

- TABLE 215 MILLENNIUM HERBAL CARE: PRODUCTS OFFERED

- 13.2 OTHER PLAYERS

- 13.2.1 VITAWIN

- 13.2.2 NUTRAMAX LABORATORIES CONSUMER CARE, INC.

- 13.2.3 SIMPLY SUPPLEMENTS

- 13.2.4 LOVE LIFE SUPPLEMENTS LTD.,

- 13.2.5 NOW FOODS

- 13.2.6 BELLAVITA HEALTHCARE PRIVATE LIMITED

- 13.2.7 VITACO

- 13.2.8 NUTRAVITA

- 13.2.9 LIFE EXTENSION

- 13.2.10 PURE ENCAPSULATIONS, LLC.

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 216 ADJACENT MARKETS TO THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET

- 14.2 LIMITATIONS

- 14.3 DIETARY SUPPLEMENTS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- TABLE 217 DIETARY SUPPLEMENTS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 218 DIETARY SUPPLEMENTS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 14.4 NUTRACEUTICAL PRODUCTS MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- TABLE 219 NUTRACEUTICAL PRODUCTS MARKET SIZE, BY TYPE, 2017-2025 (USD BILLION)

- 14.5 VITAMIN D MARKET

- 14.5.1 MARKET DEFINITION

- 14.5.2 MARKET OVERVIEW

- TABLE 220 VITAMIN D MARKET SIZE, BY ANALOG, 2016-2019 (USD MILLION)

- TABLE 221 VITAMIN D MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

- 14.6 COLLAGEN MARKET

- 14.6.1 MARKET DEFINITION

- 14.6.2 MARKET OVERVIEW

- TABLE 222 COLLAGEN MARKET SIZE, BY SOURCE, 2019-2026 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS