|

|

市場調査レポート

商品コード

1089145

灌漑オートメーションの世界市場:システム(自動、半自動)、コンポーネント(コントローラ、バルブ、スプリンクラー、センサー、その他)、灌漑タイプ(スプリンクラー、点滴、表面)、自動化タイプ、最終用途、地域別 - 2027年までの予測Irrigation Automation Market by System (Automatic, Semi-automatic), Component (Controllers, Valves, Sprinklers, Sensors, Other components), Irrigation Type (Sprinkler, Drip, Surface), Automation Type, End-Use and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 灌漑オートメーションの世界市場:システム(自動、半自動)、コンポーネント(コントローラ、バルブ、スプリンクラー、センサー、その他)、灌漑タイプ(スプリンクラー、点滴、表面)、自動化タイプ、最終用途、地域別 - 2027年までの予測 |

|

出版日: 2022年06月07日

発行: MarketsandMarkets

ページ情報: 英文 274 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の灌漑オートメーションの市場規模は、2022年の42億米ドルから、2027年までに17.2%のCAGRで成長し、92億米ドルに達すると予測されています。

同市場の成長を促進する主な機会には、灌漑オートメーション導入を目指す大規模農場の存在が挙げられます。

当レポートでは、世界の灌漑オートメーション市場について調査し、市場力学、エコシステム、特許や貿易、セグメント・地域別の市場分析、競合情勢、主要企業のプロファイルなどの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 市場機会

- 課題

- 市場力学におけるCOVID-19の影響

- 顧客のビジネスに影響を与える動向/ディスラプション

- 価格分析

- バリューチェーン分析

- 市場エコシステム

- 技術分析

- 特許分析

- 貿易分析

- 主な会議とイベント

- 関税と規制状況

- 規制機関、政府機関、その他の組織

- ポーターのファイブフォース分析

- ケーススタディ

- 主要利害関係者と購入基準

第6章 システム別:灌漑オートメーション市場

- 自動

- 半自動

第7章 コンポーネント別:灌漑オートメーション市場

- コントローラー

- バルブ

- センサー

- 気象ベースセンサー

- 土壌ベースセンサー

- 灌水施肥センサー

- スプリンクラー

- その他

第8章 自動化タイプ別:灌漑オートメーション市場

- 時間ベースシステム

- ボリュームベースシステム

- リアルタイムフィードバックシステム

- コンピュータベース灌漑制御システム

第9章 灌漑タイプ別:灌漑オートメーション市場

- 点滴灌漑

- スプリンクラー灌漑

- 表面灌漑

第10章 最終用途別:灌漑オートメーション市場

- 農業

- 温室

- オープンフィールド

- 非農業

- 住宅

- 芝・景観

- ゴルフコース

第11章 地域別:灌漑オートメーション市場

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- スペイン

- フランス

- ドイツ

- 英国

- イタリア

- ロシア

- その他

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- 中東

- アフリカ

第12章 競合情勢

- 概要

- 主要企業の戦略

- 主要企業の収益分析

- 市場シェア分析(2021年)

- COVID-19 - 企業ごとの対応

- 企業評価クアドラント(主要企業)

- スタートアップ/中小企業の評価クアドラント(2020年)

- 競合シナリオと動向

第13章 企業プロファイル

- NETAFIM

- LINDSAY CORPORATION

- VALMONT INDUSTRIES INC.

- THE TORO COMPANY

- JAIN IRRIGATION SYSTEMS

- HUNTER INDUSTRIES

- RAIN BIRD

- HYDROPOINT DATA SYSTEMS

- WEATHERMATIC

- NELSON IRRIGATION

- CALSENSE

- GALCON

- RUBICON WATER

- IRRITEC S.P.A

- MOTTECH WATER SOLUTIONS LTD.

- WATERBIT INC.

- GROWLINK

- RANCH SYSTEMS

- BLURAIN

- AVANIJAL AGRI AUTOMATION PVT LTD.

- IRRIGATION AUTOMATION SYSTEMS

- SIGNATURE CONTROL SYSTEMS, INC.

- SUPERIOR

- HOLMAN INDUSTRIES

- BACCARA

第14章 隣接・関連市場

- 制限

- スマート灌漑市場

- スマート水管理市場

第15章 付録

The global market for irrigation automation is estimated at USD 4.2 Billion in 2022; it is projected to grow at a CAGR of 17.2% to reach USD 9.2 Billion by 2027. Key opportunities that promote the growth of this market include the presence of large-sized farms, which makes the adoption of irrigation automation ideal.

The automatic irrigation system is growing at a high CAGR in the global irrigation automation market during the forecast period

Automatic irrigation automation systems require no human intervention, which is why it is widely being adopted among the educated farmers. Automatic systems have a central controller that allows the growers to adjust when, where, and how much water is to be applied. Most controllers have a percentage adjust control so that it is simpler to adjust as the weather gets warmer or cooler and irrigation requirements change. Companies such as Rain Bird Corporation (US), The Toro Company (US), Hunter Industries (US), and Lindsay Corporation (US) provide automatic solutions which do not require human intervention once correctly installed in the field. These solutions have hardware components such as controllers, sensors, valves, and software components, which include central control units that are integrated to achieve a fully automatic irrigation system.

The sensors component segment is the fastest growing irrigation automation market during the forecast period

Sensors are used in irrigation automation to increase the efficiency of systems by mapping soil moisture, pH of soil, etc. Sensors such as freeze sensors, soil, rain and wind sensors are used. The farmers are upgrading their irrigation automation systems to sensor based systems to increase the efficiency and productivity of crops while reducing the labor costs and saving time. Companies such as Rain Bird (US), The Toro Company (US), and Hunter industries (US) provide a wide range of sensors that are equally efficient with manual, semi-automatic, and fully automatic irrigation systems. Sensors are majorly used in developed countries that use fully automated irrigation systems. However, the segment is anticipated to witness highest growth among the developing regions such as Asia Pacific during the forecast period.

Real-time feedback system segment, by automation, is projected to be the fastest growing segment in the irrigation automation market during the forecast period.

The demand for real-time feedback systems is growing during the study period since most automated irrigation systems are operated by using sensors for rain, tensiometers, weather, and temperature. This data is further used for the decision-making process of irrigation. With real-time feedback systems, farmers can get real-time data on the various stages of irrigation on their field through laptops or mobile phones. Real-time feedback systems have benefitted farmers by reducing irrigation costs, crop losses, production time, and pesticide application while improving yield and quality. North America is the largest consumer of real-time feedback system owing to early adoption of automation technology. However, Asia Pacific is the fastest growing region in terms of adoption of real-time feedback systems.

The non-agricultural segment, by end use is witnessing a highest growth rate in the global irrigation automation market

Turfs & landscape, golf courses and residential areas are considered under the non-agricultural end use segment. In the non-agricultural segment, sprinklers are primarily being used as they are more effective and covers a larger area compared to drip irrigation. Residential users often adopt technology-oriented irrigation systems to effectively maintain the landscape with less labor and reduced water wastage and water bills. According to the data provided by the US geological survey, golf course irrigation accounts for 0.5% of the 408 billion gallons of water used per day in the US. Soil moisture sensors and controllers are an excellent tool to help optimize the irrigation of sports turf and prevent overwatering and leaching of fertilizers and other chemicals into the ground.

Break-up of Primaries

- By Company Type: Tier 1- 55%, Tier 2 - 35%, and Tier 3 -10%

- By Designation: C-level - 40%, Director level - 30%, and Executives - 30%

- By Region: Asia Pacific - 35%, Europe - 30%, North America - 20%, South America- 10%, Rest of the World (RoW) - 5%

Leading players profiled in this report

- Netafim (Israel)

- Lindsay Corporation (US)

- The Toro Company (US)

- Jain Irrigation Systems (India)

- Valmont Industries Inc. (US)

- Rain Bird (US)

- Hunter Industries (US)

- Irritec S.p.A(Italy)

- Superior (US)

- Weathermatic (US)

- Galcon (Israel)

- BACCARA (Israel)

- Waterbit Inc. (US)

- Holman Industries (Australia)

- Mottech Water Solutions Ltd. (Israel)

- Ranch Systems (US)

- Irrigation Automation Systems (US)

- Signature Controls Systems, Inc. (US)

- Nelson Irrigation (US)

- Calsense (US)

- HydroPoint Data Systems (US)

- Rubicon Water (Australia)

- Growlink (US)

- Avanijal Agri Automation Pvt Ltd. (India)

- Blurain (India)

Research Coverage

This report segments the irrigation automation market based on system, component, irrigation tupe, automation type, end use, and region. In terms of insights, this research report focuses on various levels of analyses-competitive landscape, end-use analysis, and company profiles-which together comprise and discuss the basic views on the emerging & high-growth segments of the irrigation automation market, the high-growth regions, countries, government initiatives, market disruption, drivers, restraints, opportunities, and challenges.

Reasons to buy this report

- To get a comprehensive overview of the irrigation automation market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions, in which the irrigation automation market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- TABLE 1 INCLUSION AND EXCLUSION

- 1.4 REGIONS COVERED

- 1.5 PERIODIZATION CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES CONSIDERED, 2015-2021

- 1.7 UNITS CONSIDERED

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 IRRIGATION AUTOMATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of Key Primary Interview Participants

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.4 Primary sources

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 IRRIGATION AUTOMATION MARKET SIZE ESTIMATION (SUPPLY-SIDE)

- FIGURE 5 DEMAND-SIDE ASPECTS OF MARKET SIZING

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 IRRIGATION AUTOMATION MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 IRRIGATION AUTOMATION MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 ASSUMPTIONS FOR THE STUDY

- 2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- TABLE 3 IRRIGATION AUTOMATION MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 9 IRRIGATION AUTOMATION MARKET SIZE, BY SYSTEM, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 IRRIGATION AUTOMATION MARKET SIZE, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 IRRIGATION AUTOMATION MARKET SIZE, BY END USE, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 IRRIGATION AUTOMATION MARKET SHARE, BY REGION, 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN THE IRRIGATION AUTOMATION MARKET

- FIGURE 14 INCREASING NEED FOR WATER CONSERVATION TO PROPEL THE GROWTH OF THE IRRIGATION AUTOMATION MARKET

- 4.2 IRRIGATION AUTOMATION MARKET: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

- FIGURE 15 INDIA TO BE THE FASTEST-GROWING MARKET FOR IRRIGATION AUTOMATION DURING THE FORECAST PERIOD

- 4.3 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET, BY KEY TYPE & COUNTRY

- FIGURE 16 CHINA ACCOUNTED FOR THE LARGEST SHARE IN THE ASIA PACIFIC MARKET IN 2022

- 4.4 IRRIGATION AUTOMATION MARKET, BY IRRIGATION TYPE

- FIGURE 17 DRIP IRRIGATION SEGMENT TO DOMINATE THE IRRIGATION AUTOMATION MARKET IN 2022

- 4.5 IRRIGATION AUTOMATION MARKET, BY AUTOMATION TYPE

- FIGURE 18 REAL-TIME FEEDBACK SYSTEM SEGMENT TO DOMINATE THE IRRIGATION AUTOMATION MARKET IN 2022

- 4.6 IRRIGATION AUTOMATION MARKET, BY COMPONENT

- FIGURE 19 CONTROLLERS SEGMENT TO DOMINATE THE IRRIGATION AUTOMATION MARKET DURING THE FORECAST PERIOD

- 4.7 IRRIGATION AUTOMATION MARKET, BY REGION

- FIGURE 20 ASIA PACIFIC TO DOMINATE THE OF IRRIGATION AUTOMATION DURING THE FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INCREASE IN AREA UNDER IRRIGATION

- 5.2.1.1 Growth in the population size to drive the demand for food

- FIGURE 21 WORLD POPULATION GROWTH SCENARIO, 1700-2050 (MILLION)

- 5.2.1 INCREASE IN AREA UNDER IRRIGATION

- 5.3 MARKET DYNAMICS

- FIGURE 22 GOVERNMENT SUPPORT TOWARD THE IMPROVEMENT OF IRRIGATION EFFICIENCY TO DRIVE THE GROWTH OF THE MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Increased mechanization and adoption of smart agricultural technologies

- FIGURE 23 LEVEL OF MECHANIZATION OF AGRICULTURE IN CERTAIN COUNTRIES

- 5.3.1.2 Government initiatives to promote water conservation

- 5.3.1.3 Awareness among farmers about the benefits of automated irrigation technologies

- 5.3.2 RESTRAINTS

- 5.3.2.1 High costs associated with the installation and lack of technical knowledge

- 5.3.2.2 Data management and data aggregation in irrigation automation systems

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Government subsidies on automated farming technology

- 5.3.3.2 Presence of large farms across the globe

- FIGURE 24 IRRIGATED AREA AND TOTAL CULTIVATED LAND, BY COUNTRY, 2021 (MHA)

- 5.3.4 CHALLENGES

- 5.3.4.1 Lack of good infrastructure for the efficient functioning of irrigation automation systems

- 5.3.4.2 Implementation of automated irrigation in fragmented land holdings

- 5.4 IMPACT OF COVID-19 ON MARKET DYNAMICS

- 5.5 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER'S BUSINESS

- 5.6 PRICING ANALYSIS

- TABLE 4 IRRIGATION CONTROLLERS SELLING PRICE, BY KEY COMPANY, 2021 (USD)

- TABLE 5 IRRIGATION WATER FLOW METERS SELLING PRICE, BY KEY COMPANY, 2021 (USD)

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS

- 5.8 MARKET ECOSYSTEM

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 INTEGRATION OF IOT WITH AUTOMATION IN IRRIGATION

- 5.9.2 INTEGRATION OF ARTIFICIAL INTELLIGENCE WITH IRRIGATION SYSTEMS

- 5.9.3 REMOTE SENSING AND IRRIGATION INTELLIGENCE

- 5.9.3.1 Remote sensing for soil moisture estimation

- 5.9.4 TEMPUS DC SERIES CONTROLLERS

- 5.9.5 CLOUD-BASED PLATFORM FOR IRRIGATION AUTOMATION

- 5.10 PATENT ANALYSIS

- 5.10.1 INTRODUCTION

- FIGURE 26 NUMBER OF PATENTS APPROVED FOR IRRIGATION AUTOMATION, 2016-2020

- TABLE 6 MAJOR PATENTS RELATED TO IRRIGATION AUTOMATION, 2018-2022

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO

- 5.11.1.1 Import scenario

- TABLE 7 IMPORT DATA, BY COUNTRY, 2017-2020 (USD MILLION)

- 5.11.2 EXPORT SCENARIO

- 5.11.2.1 Export scenario

- TABLE 8 EXPORT DATA, BY COUNTRY, 2016-2020 (USD MILLION)

- 5.11.1 IMPORT SCENARIO

- 5.12 KEY CONFERENCES & EVENTS

- TABLE 9 IRRIGATION AUTOMATION MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022-2023

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF

- TABLE 10 US: MFN TARIFFS FOR IRRIGATION AUTOMATION PRODUCTS EXPORTED, 2021

- TABLE 11 CHINA: MFN TARIFFS FOR IRRIGATION AUTOMATION PRODUCTS EXPORTED, 2021

- 5.13.1.1 Positive impact of tariffs on irrigation automation

- 5.13.1.2 Negative impact of tariffs on irrigation automation

- 5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1 US

- 5.14.1.1 United States Department of Agriculture (USDA)

- 5.14.2 EUROPE

- 5.14.2.1 Regulation 167/2013 on wheeled agricultural or forestry tractors

- 5.14.3 ASIA PACIFIC

- 5.14.1 US

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 IMPACT OF PORTER'S FIVE FORCES ON THE IRRIGATION AUTOMATION MARKET

- FIGURE 27 IRRIGATION AUTOMATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF COMPETITIVE RIVALRY

- 5.15.2 BARGAINING POWER OF SUPPLIERS

- 5.15.3 BARGAINING POWER OF BUYERS

- 5.15.4 THREAT OF SUBSTITUTES

- 5.15.5 THREAT OF NEW ENTRANTS

- 5.16 CASE STUDIES

- 5.16.1 HYDROPOINT'S WEATHERTRAK HELPS LEED PLATINUM RESEARCH CAMPUS ACHIEVE SUSTAINABILITY GOALS

- 5.16.2 DROUGHT MANAGEMENT IN CALIFORNIA'S OJAI VALLEY WITH IOT BASED SOLUTIONS

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING IRRIGATION AUTOMATION PRODUCTS

- TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR IRRIGATION AUTOMATION PRODUCTS

- 5.17.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR IRRIGATION AUTOMATION PRODUCTS

- TABLE 14 KEY BUYING CRITERIA FOR IRRIGATION AUTOMATION PRODUCTS

6 IRRIGATION AUTOMATION MARKET, BY SYSTEM

- 6.1 INTRODUCTION

- FIGURE 30 IRRIGATION AUTOMATION MARKET SIZE, BY SYSTEM, 2022 VS. 2027 (USD MILLION)

- TABLE 15 IRRIGATION AUTOMATION MARKET SIZE, BY SYSTEM, 2019-2021 (USD MILLION)

- TABLE 16 IRRIGATION AUTOMATION MARKET SIZE, BY SYSTEM, 2022-2027 (USD MILLION)

- 6.2 AUTOMATIC

- 6.2.1 FULLY AUTOMATIC SYSTEMS PROVIDE GROWERS THE FLEXIBILITY TO ADJUST THE CONTROLS PERIODICALLY

- TABLE 17 AUTOMATIC: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 18 AUTOMATIC: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3 SEMI-AUTOMATIC

- 6.3.1 SEMI-AUTOMATIC IRRIGATION SYSTEMS ARE MORE PREFERRED DUE TO THEIR COST-EFFECTIVENESS AND THE ABILITY TO RESET AFTER EVERY IRRIGATION CYCLE

- TABLE 19 SEMI-AUTOMATIC: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 20 SEMI-AUTOMATIC: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

7 IRRIGATION AUTOMATION MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- FIGURE 31 IRRIGATION AUTOMATION MARKET SIZE, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

- FIGURE 32 STRUCTURE OF IRRIGATION AUTOMATION PROCESS WITH BASIC COMPONENTS

- TABLE 21 IRRIGATION AUTOMATION MARKET SIZE, BY COMPONENT, 2019-2021 (USD MILLION)

- TABLE 22 IRRIGATION AUTOMATION MARKET SIZE, BY COMPONENT, 2022-2027 (USD MILLION)

- 7.2 CONTROLLERS

- 7.2.1 CONTROLLERS PERFORM THE TRIPLE ACTION OF MONITORING, CONTROLLING, AND ANALYZING WATER LEVELS, AIDING THEIR GROWTH AMONG FARMERS

- TABLE 23 CONTROLLERS: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 24 CONTROLLERS: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.3 VALVES

- 7.3.1 VALVES ARE EFFECTIVE IN THE MODULATION OF FLOW RATE AS WELL AS PREVENTION OF BACKFLOW ALONG WITH ON-OFF CONTROL

- TABLE 25 VALVES: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 26 VALVES: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.4 SENSORS

- 7.4.1 WASTAGE OF WATER DUE TO UNNECESSARY IRRIGATION DURING WINDY AND RAINY WEATHER CAN BE CONTROLLED USING SENSORS

- 7.4.2 WEATHER-BASED SENSORS

- 7.4.3 SOIL-BASED SENSORS

- 7.4.4 FERTIGATION SENSORS

- TABLE 27 SENSORS: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 28 SENSORS: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.5 SPRINKLERS

- 7.5.1 SHIFT TOWARD EFFICIENT WATERING BY LANDSCAPE AND GOLF COURSE OWNERS IS INCREASING THE DEMAND FOR AUTOMATED SPRINKLER SYSTEMS

- TABLE 29 SPRINKLERS: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 30 SPRINKLERS: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

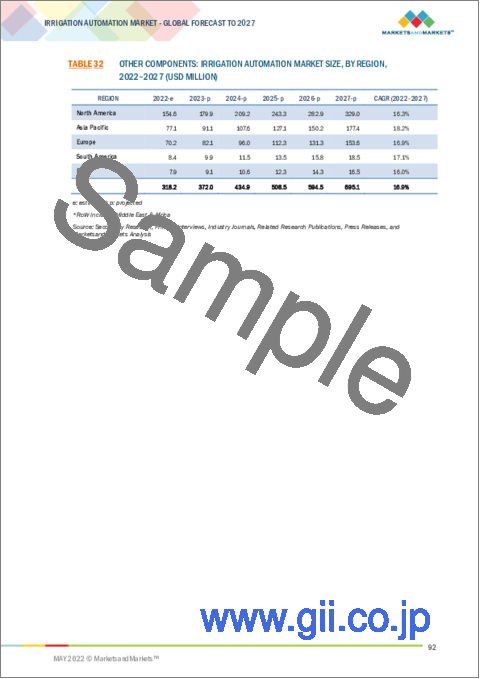

- 7.6 OTHER COMPONENTS

- 7.6.1 COMPONENTS SUCH AS FLOW METERS AND PRESSURE GAUGES ASSIST THE IRRIGATION AUTOMATION PROCESS BY DETERMINING THE PRESSURE AND WATER FLOW

- TABLE 31 OTHER COMPONENTS: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 32 OTHER COMPONENTS: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

8 IRRIGATION AUTOMATION MARKET, BY AUTOMATION TYPE

- 8.1 INTRODUCTION

- FIGURE 33 IRRIGATION AUTOMATION MARKET SIZE, BY AUTOMATION TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 33 IRRIGATION AUTOMATION MARKET SIZE, BY AUTOMATION TYPE, 2019-2021 (USD MILLION)

- TABLE 34 IRRIGATION AUTOMATION MARKET SIZE, BY AUTOMATION TYPE, 2022-2027 (USD MILLION)

- 8.2 TIME-BASED SYSTEM

- 8.2.1 TIME-BASED SYSTEMS OPTIMIZE THE IRRIGATION SCHEDULE AIDING IN BETTER YIELD

- TABLE 35 TIME-BASED SYSTEM: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 36 TIME-BASED SYSTEM: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 8.3 VOLUME-BASED SYSTEM

- 8.3.1 VOLUME-BASED SYSTEMS ARE VERSATILE AS THEY CAN FUNCTION WITHOUT A POWER SOURCE

- TABLE 37 VOLUME-BASED SYSTEM: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 38 VOLUME-BASED SYSTEM: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 8.4 REAL-TIME FEEDBACK SYSTEM

- 8.4.1 GROWING AWARENESS AMONG FARMERS ABOUT THE AVAILABILITY OF REAL-TIME DATA ON THE IRRIGATION PROCESS LED TO AN INCREASED DEMAND FOR THIS SYSTEM

- TABLE 39 REAL-TIME FEEDBACK SYSTEM: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 40 REAL-TIME FEEDBACK SYSTEM: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 8.5 COMPUTER-BASED IRRIGATION CONTROL SYSTEM

- 8.5.1 R&D EFFORTS TO LAUNCH AFFORDABLE COMPUTER-BASED IRRIGATION CONTROL SYSTEMS TO IMPROVE FARM PRODUCTIVITY IN DEVELOPING REGIONS

- TABLE 41 COMPUTER-BASED IRRIGATION CONTROL SYSTEM: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 42 COMPUTER-BASED IRRIGATION CONTROL SYSTEM: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

9 IRRIGATION AUTOMATION MARKET, BY IRRIGATION TYPE

- 9.1 INTRODUCTION

- FIGURE 34 IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 43 IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 44 IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- TABLE 45 IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 46 IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- 9.2 DRIP IRRIGATION

- 9.2.1 AUTOMATION SYSTEMS INCREASE THE EFFICIENCY OF THE DRIP IRRIGATION PROCESS BY ALLOWING IRRIGATION BASED ON REAL-TIME DATA

- TABLE 47 DRIP IRRIGATION: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 48 DRIP IRRIGATION: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 49 DRIP IRRIGATION AUTOMATION MARKET, BY REGION, 2019-2021 (MILLION HA)

- TABLE 50 DRIP IRRIGATION AUTOMATION MARKET, BY REGION, 2022-2027 (MILLION HA)

- 9.3 SPRINKLER IRRIGATION

- 9.3.1 HIGH USAGE OF SPRINKLER SYSTEMS IN PROFESSIONAL LAWNS AND GOLF COURSES INCREASES THE DEMAND FOR THE AUTOMATION PROCESS

- TABLE 51 SPRINKLER IRRIGATION: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 52 SPRINKLER IRRIGATION: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 53 SPRINKLER IRRIGATION: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (MILLION HA)

- TABLE 54 SPRINKLER IRRIGATION: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (MILLION HA)

- 9.4 SURFACE IRRIGATION

- 9.4.1 HIGH LABOR REQUIREMENTS AND LOW WATER USE EFFICIENCY INCREASE THE DEMAND FOR AUTOMATION IN SURFACE IRRIGATION SYSTEMS

- TABLE 55 SURFACE IRRIGATION: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 56 SURFACE IRRIGATION: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 57 SURFACE IRRIGATION: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (MILLION HA)

- TABLE 58 SURFACE IRRIGATION: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (MILLION HA)

10 IRRIGATION AUTOMATION MARKET, BY END USE

- 10.1 INTRODUCTION

- FIGURE 35 IRRIGATION AUTOMATION MARKET SIZE, BY END USE, 2022 VS. 2027 (USD MILLION)

- TABLE 59 IRRIGATION AUTOMATION MARKET SIZE, BY END USE, 2019-2021 (USD MILLION)

- TABLE 60 IRRIGATION AUTOMATION MARKET SIZE, BY END USE, 2022-2027 (USD MILLION)

- 10.2 AGRICULTURAL

- 10.2.1 REAL-TIME MONITORING OF SOIL CONDITIONS AND LESS HUMAN INTERVENTION RESULT IN AN INCREASED DEMAND FOR IRRIGATION AUTOMATION

- 10.2.2 GREENHOUSES

- 10.2.3 OPEN FIELDS

- TABLE 61 IRRIGATION AUTOMATION MARKET SIZE IN AGRICULTURAL END USES, BY REGION, 2019-2021 (USD MILLION)

- TABLE 62 IRRIGATION AUTOMATION MARKET SIZE IN AGRICULTURAL END USES, BY REGION, 2022-2027 (USD MILLION)

- 10.3 NON-AGRICULTURAL

- 10.3.1 STRINGENT RULES ABOUT EFFICIENT WATER USAGE IN LANDSCAPES AND LAWS ARE MAKING GROWERS SHIFT TOWARD AUTOMATED IRRIGATION METHODS

- 10.3.2 RESIDENTIAL

- 10.3.3 TURF & LANDSCAPES

- 10.3.4 GOLF COURSES

- TABLE 63 IRRIGATION AUTOMATION MARKET SIZE IN NON-AGRICULTURAL END USES, BY REGION, 2019-2021 (USD MILLION)

- TABLE 64 IRRIGATION AUTOMATION MARKET SIZE IN NON-AGRICULTURAL END USES, BY REGION, 2022-2027 (USD MILLION)

11 IRRIGATION AUTOMATION MARKET, BY REGION

- 11.1 INTRODUCTION

- TABLE 65 IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (MILLION HA)

- TABLE 66 IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (MILLION HA)

- TABLE 67 IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 68 IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 69 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2019-2021 (MILLION HA)

- TABLE 70 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2022-2027 (MILLION HA)

- TABLE 71 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 72 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 73 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 74 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 75 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 76 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- TABLE 77 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY SYSTEM, 2019-2021 (USD MILLION)

- TABLE 78 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY SYSTEM, 2022-2027 (USD MILLION)

- TABLE 79 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY COMPONENT, 2019-2021 (USD MILLION)

- TABLE 80 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 81 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY AUTOMATION TYPE, 2019-2021 (USD MILLION)

- TABLE 82 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY AUTOMATION TYPE, 2022-2027 (USD MILLION)

- TABLE 83 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY END USE, 2019-2021 (USD MILLION)

- TABLE 84 NORTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY END USE, 2022-2027 (USD MILLION)

- 11.2.1 UNITED STATES

- 11.2.1.1 Pressure on the agricultural industry by government regulations to decrease the water footprint in irrigation driving the market

- FIGURE 37 US HARVESTED ACRES IRRIGATED FOR SELECTED MAJOR IRRIGATED CROPS, 2017

- TABLE 85 UNITED STATES: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 86 UNITED STATES: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 87 UNITED STATES: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 88 UNITED STATES: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.2.2 CANADA

- 11.2.2.1 Decrease in annual precipitation increased the water scarcity in the region that led growers to adopt more efficient irrigation ways

- FIGURE 38 CANADA: IRRIGATION WATER USED FOR DIFFERENT CROPS, 2020

- TABLE 89 CANADA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 90 CANADA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 91 CANADA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 92 CANADA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.2.3 MEXICO

- 11.2.3.1 Mexico witnessed an increase in surface irrigation automation systems

- TABLE 93 MEXICO: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 94 MEXICO: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 95 MEXICO: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 96 MEXICO: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.3 EUROPE

- FIGURE 39 EUROPE: IRRIGABLE AND IRRIGATED AREAS FOR DIFFERENT COUNTRIES, 2016 (THOUSAND HA)

- TABLE 97 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2019-2021 (MILLION HA)

- TABLE 98 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2022-2027 (MILLION HA)

- TABLE 99 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 100 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 101 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 102 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 103 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 104 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- TABLE 105 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY SYSTEM, 2019-2021 (USD MILLION)

- TABLE 106 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY SYSTEM, 2022-2027 (USD MILLION)

- TABLE 107 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY COMPONENT, 2019-2021 (USD MILLION)

- TABLE 108 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 109 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY AUTOMATION TYPE, 2019-2021 (USD MILLION)

- TABLE 110 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY AUTOMATION TYPE, 2022-2027 (USD MILLION)

- TABLE 111 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY END USE, 2019-2021 (USD MILLION)

- TABLE 112 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY END USE, 2022-2027 (USD MILLION)

- 11.3.1 SPAIN

- 11.3.1.1 Regulations for water used in agriculture imposed by the Spanish government drive the market for irrigation automation

- TABLE 113 SPAIN: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 114 SPAIN: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 115 SPAIN: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 116 SPAIN: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.3.2 FRANCE

- 11.3.2.1 Golf courses and lawns demand more automation systems that allow growers to adjust and control irrigation remotely

- TABLE 117 FRANCE: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 118 FRANCE: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 119 FRANCE: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 120 FRANCE: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.3.3 GERMANY

- 11.3.3.1 Decreasing annual precipitation rates, as well as groundwater levels, drive the market for the irrigation automation process in Germany

- FIGURE 40 IRRIGATION WITH GROUNDWATER AND SURFACE WATER IN DIFFERENT FEDERAL STATES OF GERMANY, 2017 (HA)

- TABLE 121 GERMANY: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 122 GERMANY: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 123 GERMANY: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 124 GERMANY: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.3.4 UNITED KINGDOM

- 11.3.4.1 Dual benefits of saving water and money by reducing water bills drive the market in the UK

- TABLE 125 UNITED KINGDOM: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 126 UNITED KINGDOM: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 127 UNITED KINGDOM: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 128 UNITED KINGDOM: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.3.5 ITALY

- 11.3.5.1 Improved golf course management drives the market for more efficient watering techniques in the region

- TABLE 129 ITALY: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 130 ITALY: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 131 ITALY: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 132 ITALY: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.3.6 RUSSIA

- 11.3.6.1 Drastic climate change and declining soil fertility drive the market for fertigation and weather-based sensors in the region

- TABLE 133 RUSSIA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 134 RUSSIA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 135 RUSSIA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 136 RUSSIA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.3.7 REST OF EUROPE

- 11.3.7.1 Cost of a fully automated irrigation system is one of the major hindering factors in its adoption by farmers

- TABLE 137 REST OF EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 138 REST OF EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 139 REST OF EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 140 REST OF EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.4 ASIA PACIFIC

- TABLE 141 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2019-2021 (MILLION HA)

- TABLE 142 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2022-2027 (MILLION HA)

- TABLE 143 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 144 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 145 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 146 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 147 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 148 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- TABLE 149 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY SYSTEM, 2019-2021 (USD MILLION)

- TABLE 150 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY SYSTEM, 2022-2027 (USD MILLION)

- TABLE 151 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY COMPONENT, 2019-2021 (USD MILLION)

- TABLE 152 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 153 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY AUTOMATION TYPE, 2019-2021 (USD MILLION)

- TABLE 154 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY AUTOMATION TYPE, 2022-2027 (USD MILLION)

- TABLE 155 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY END USE, 2019-2021 (USD MILLION)

- TABLE 156 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY END USE, 2022-2027 (USD MILLION)

- 11.4.1 CHINA

- 11.4.1.1 Government policies are targeted at strengthening irrigation infrastructure for better water management

- TABLE 157 CHINA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 158 CHINA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 159 CHINA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 160 CHINA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.4.2 INDIA

- 11.4.2.1 Poor management of water resources and changes in rainfall patterns led to less availability of water for agriculture

- TABLE 161 INDIA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 162 INDIA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 163 INDIA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 164 INDIA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.4.3 JAPAN

- 11.4.3.1 Japan is moving toward robotic farm systems, which increase productivity with minimum use of water, energy, and labor

- TABLE 165 JAPAN: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 166 JAPAN: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 167 JAPAN: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 168 JAPAN: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.4.4 AUSTRALIA

- 11.4.4.1 Reducing freshwater level in the Murray-Darling basin pressurizes farmers to adopt more efficient water use techniques in agriculture

- TABLE 169 AUSTRALIA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 170 AUSTRALIA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 171 AUSTRALIA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 172 AUSTRALIA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.5.1 Growing cultivation of water-demanding crops led to the adoption of surface irrigation automation systems

- TABLE 173 REST OF ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 174 REST OF ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 175 REST OF ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.5 SOUTH AMERICA

- TABLE 177 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2019-2021 (MILLION HA)

- TABLE 178 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2022-2027 (MILLION HA)

- TABLE 179 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 180 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 181 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 182 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 183 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 184 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- TABLE 185 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY SYSTEM, 2019-2021 (USD MILLION)

- TABLE 186 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY SYSTEM, 2022-2027 (USD MILLION)

- TABLE 187 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY COMPONENT, 2019-2021 (USD MILLION)

- TABLE 188 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 189 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY AUTOMATION TYPE, 2019-2021 (USD MILLION)

- TABLE 190 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY AUTOMATION TYPE, 2022-2027 (USD MILLION)

- TABLE 191 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY END USE, 2019-2021 (USD MILLION)

- TABLE 192 SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY END USE, 2022-2027 (USD MILLION)

- 11.5.1 BRAZIL

- 11.5.1.1 Water scarcity and farm characteristics induced the use of efficient irrigation systems in Brazil

- TABLE 193 BRAZIL: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 194 BRAZIL: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 195 BRAZIL: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 196 BRAZIL: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.5.2 ARGENTINA

- 11.5.2.1 Increasing water pollution due to industrial activities and chemical runoff from farms limit the water availability in Argentina leading to the increasing focus on water conservation for agriculture

- TABLE 197 ARGENTINA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 198 ARGENTINA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 199 ARGENTINA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 200 ARGENTINA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.3.1 Government is enforcing rules to improve irrigation systems and infrastructure to enable better use of natural resources

- TABLE 201 REST OF SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 202 REST OF SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 203 REST OF SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 204 REST OF SOUTH AMERICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.6 REST OF THE WORLD

- TABLE 205 REST OF THE WORLD: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2019-2021 (MILLION HA)

- TABLE 206 REST OF THE WORLD: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2022-2027 (MILLION HA)

- TABLE 207 REST OF THE WORLD: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 208 REST OF THE WORLD: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 209 REST OF THE WORLD: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 210 REST OF THE WORLD: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 211 REST OF THE WORLD: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 212 REST OF THE WORLD: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- TABLE 213 REST OF THE WORLD: IRRIGATION AUTOMATION MARKET SIZE, BY SYSTEM, 2019-2021 (USD MILLION)

- TABLE 214 REST OF THE WORLD: IRRIGATION AUTOMATION MARKET SIZE, BY SYSTEM, 2022-2027 (USD MILLION)

- TABLE 215 REST OF THE WORLD: IRRIGATION AUTOMATION MARKET SIZE, BY COMPONENT, 2019-2021 (USD MILLION)

- TABLE 216 REST OF THE WORLD: IRRIGATION AUTOMATION MARKET SIZE, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 217 REST OF THE WORLD: IRRIGATION AUTOMATION MARKET SIZE, BY AUTOMATION TYPE, 2019-2021 (USD MILLION)

- TABLE 218 REST OF THE WORLD: IRRIGATION AUTOMATION MARKET SIZE, BY AUTOMATION TYPE, 2022-2027 (USD MILLION)

- TABLE 219 REST OF THE WORLD: IRRIGATION AUTOMATION MARKET SIZE, BY END USE, 2019-2021 (USD MILLION)

- TABLE 220 REST OF THE WORLD (ROW): IRRIGATION AUTOMATION MARKET SIZE, BY END USE, 2022-2027 (USD MILLION)

- 11.6.1 MIDDLE EAST

- 11.6.1.1 Arid climatic conditions and depleting groundwater reserves are two significant factors driving the market in the region

- TABLE 221 MIDDLE EAST: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 222 MIDDLE EAST: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 223 MIDDLE EAST: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 224 MIDDLE EAST: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

- 11.6.2 AFRICA

- 11.6.2.1 Changes in climate and decreasing amount of rainfall demand efficient water management solutions

- TABLE 225 AFRICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (MILLION HA)

- TABLE 226 AFRICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (MILLION HA)

- TABLE 227 AFRICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019-2021 (USD MILLION)

- TABLE 228 AFRICA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2022-2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES

- 12.3 REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018-2021 (USD MILLION)

- 12.4 MARKET SHARE ANALYSIS, 2021

- FIGURE 42 IRRIGATION AUTOMATION MARKET SHARE ANALYSIS, 2018-2021

- TABLE 229 IRRIGATION AUTOMATION MARKET: DEGREE OF COMPETITION

- 12.5 COVID-19-SPECIFIC COMPANY RESPONSE

- 12.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 12.6.1 STARS

- 12.6.2 PERVASIVE PLAYERS

- 12.6.3 EMERGING LEADERS

- 12.6.4 PARTICIPANTS

- FIGURE 43 IRRIGATION AUTOMATION MARKET, COMPANY EVALUATION QUADRANT, 2021 (OVERALL MARKET)

- 12.6.5 PRODUCT FOOTPRINT

- TABLE 230 COMPANY FOOTPRINT, BY SYSTEM

- TABLE 231 COMPANY FOOTPRINT, BY COMPONENT

- TABLE 232 COMPANY FOOTPRINT, BY END USE

- TABLE 233 COMPANY REGIONAL, BY FOOTPRINT

- TABLE 234 OVERALL COMPANY FOOTPRINT

- 12.6.6 COMPETITIVE BENCHMARKING

- TABLE 235 IRRIGATION AUTOMATION MARKET: DETAILED LIST OF KEY STARTUPS/ SMES

- TABLE 236 IRRIGATION AUTOMATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/ SMES

- 12.7 IRRIGATION AUTOMATION MARKET, START-UP/SME EVALUATION QUADRANT, 2020

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 STARTING BLOCKS

- 12.7.3 RESPONSIVE COMPANIES

- 12.7.4 DYNAMIC COMPANIES

- FIGURE 44 IRRIGATION AUTOMATION MARKET: COMPANY EVALUATION QUADRANT, 2020 (STARTUP/SMES)

- 12.8 COMPETITIVE SCENARIO AND TRENDS

- 12.8.1 IRRIGATION AUTOMATION MARKET

- 12.8.2 PRODUCT LAUNCHES

- TABLE 237 IRRIGATION AUTOMATION MARKET: NEW PRODUCT LAUNCHES, JANUARY 2018- MAY 2022

- 12.8.3 DEALS

- TABLE 238 IRRIGATION AUTOMATION MARKET: DEALS, JANUARY 2018-MAY 2022

13 COMPANY PROFILES

- (Business Overview, Products Offered, MnM View, Key Strengths/Right to win, Strategic choices made, and Weakness and competitive threats)**

- 13.1 NETAFIM

- TABLE 239 NETAFIM: BUSINESS OVERVIEW

- TABLE 240 NETAFIM: PRODUCTS OFFERED

- 13.2 LINDSAY CORPORATION

- TABLE 241 LINDSAY CORPORATION: BUSINESS OVERVIEW

- FIGURE 45 LINDSAY CORPORATION: COMPANY SNAPSHOT

- TABLE 242 LINDSAY CORPORATION SYNGENTA: PRODUCTS OFFERED

- TABLE 243 LINDSAY CORPORATION: PRODUCT LAUNCHES

- TABLE 244 LINDSAY CORPORATION: DEALS

- 13.3 VALMONT INDUSTRIES INC.

- TABLE 245 VALMONT INDUSTRIES INC.: BUSINESS OVERVIEW

- FIGURE 46 VALMONT INDUSTRIES INC.: COMPANY SNAPSHOT

- TABLE 246 VALMONT INDUSTRIES INC.: PRODUCTS OFFERED

- TABLE 247 VALMONT INDUSTRIES INC.: PRODUCT LAUNCHES

- TABLE 248 VALMONT INDUSTRIES INC.: DEALS

- 13.4 THE TORO COMPANY

- TABLE 249 THE TORO COMPANY: BUSINESS OVERVIEW

- FIGURE 47 THE TORO COMPANY: COMPANY SNAPSHOT

- TABLE 250 THE TORO COMPANY: PRODUCTS OFFERED

- TABLE 251 THE TORO COMPANY: DEALS

- 13.5 JAIN IRRIGATION SYSTEMS

- TABLE 252 JAIN IRRIGATION SYSTEMS: BUSINESS OVERVIEW

- FIGURE 48 JAIN IRRIGATION SYSTEMS: COMPANY SNAPSHOT

- TABLE 253 JAIN IRRIGATION SYSTEMS: PRODUCTS OFFERED

- 13.6 HUNTER INDUSTRIES

- TABLE 254 HUNTER INDUSTRIES: BUSINESS OVERVIEW

- TABLE 255 HUNTER INDUSTRIES: PRODUCTS OFFERED

- 13.7 RAIN BIRD

- TABLE 256 RAIN BIRD: BUSINESS OVERVIEW

- TABLE 257 RAIN BIRD: PRODUCTS OFFERED

- TABLE 258 RAIN BIRD: PRODUCT LAUNCHES

- TABLE 259 RAIN BIRD: DEALS

- 13.8 HYDROPOINT DATA SYSTEMS

- TABLE 260 HYDROPOINT DATA SYSTEMS: BUSINESS OVERVIEW

- TABLE 261 HYDROPOINT DATA SYSTEMS: PRODUCTS OFFERED

- 13.9 WEATHERMATIC

- TABLE 262 WEATHERMATIC: BUSINESS OVERVIEW

- TABLE 263 WEATHERMATIC: PRODUCTS OFFERED

- TABLE 264 WEATHERMATIC: DEALS

- 13.10 NELSON IRRIGATION

- TABLE 265 NELSON IRRIGATION: BUSINESS OVERVIEW

- TABLE 266 NELSON IRRIGATION: PRODUCTS OFFERED

- 13.11 CALSENSE

- TABLE 267 CALSENSE: BUSINESS OVERVIEW

- TABLE 268 CALSENSE: PRODUCTS OFFERED

- 13.12 GALCON

- TABLE 269 GALCON: BUSINESS OVERVIEW

- TABLE 270 GALCON: PRODUCTS OFFERED

- 13.13 RUBICON WATER

- TABLE 271 RUBICON WATER: BUSINESS OVERVIEW

- TABLE 272 RUBICON WATER: PRODUCTS OFFERED

- 13.14 IRRITEC S.P.A

- TABLE 273 IRRITEC S.P.A: BUSINESS OVERVIEW

- TABLE 274 PLANT HEALTH CARE: PRODUCTS OFFERED

- 13.15 MOTTECH WATER SOLUTIONS LTD.

- TABLE 275 MOTTECH WATER SOLUTIONS LTD.: BUSINESS OVERVIEW

- TABLE 276 MOTTECH WATER SOLUTIONS LTD.: PRODUCTS OFFERED

- 13.16 WATERBIT INC.

- TABLE 277 WATERBIT INC.: BUSINESS OVERVIEW

- TABLE 278 WATERBIT INC.: PRODUCTS OFFERED

- 13.17 GROWLINK

- TABLE 279 GROWLINK: BUSINESS OVERVIEW

- TABLE 280 AGRAUXINE: PRODUCTS OFFERED

- 13.18 RANCH SYSTEMS

- TABLE 281 RANCH SYSTEMS: BUSINESS OVERVIEW

- TABLE 282 RANCH SYSTEMS: PRODUCTS OFFERED

- 13.19 BLURAIN

- TABLE 283 BLURAIN: BUSINESS OVERVIEW

- TABLE 284 BLURAIN: PRODUCTS OFFERED

- 13.20 AVANIJAL AGRI AUTOMATION PVT LTD.

- TABLE 285 AVANIJAL AGRI AUTOMATION PVT LTD.: BUSINESS OVERVIEW

- TABLE 286 AVANIJAL AGRI AUTOMATION PVT LTD.: PRODUCTS OFFERED

- 13.21 IRRIGATION AUTOMATION SYSTEMS

- TABLE 287 IRRIGATION AUTOMATION SYSTEMS: BUSINESS OVERVIEW

- TABLE 288 IRRIGATION AUTOMATION SYSTEMS: PRODUCTS OFFERED

- TABLE 289 IRRIGATION AUTOMATION SYSTEMS: NEW PRODUCT LAUNCHES

- TABLE 290 IRRIGATION AUTOMATION SYSTEMS: DEALS

- 13.22 SIGNATURE CONTROL SYSTEMS, INC.

- TABLE 291 SIGNATURE CONTROLS SYSTEMS, INC.: BUSINESS OVERVIEW

- TABLE 292 SIGNATURE CONTROLS SYSTEMS, INC.: PRODUCTS OFFERED

- 13.23 SUPERIOR

- TABLE 293 SUPERIOR: BUSINESS OVERVIEW

- TABLE 294 SUPERIOR: PRODUCTS OFFERED

- 13.24 HOLMAN INDUSTRIES

- TABLE 295 HOLMAN INDUSTRIES: BUSINESS OVERVIEW

- TABLE 296 HOLMAN INDUSTRIES: PRODUCTS OFFERED

- 13.25 BACCARA

- TABLE 297 BACCARA: BUSINESS OVERVIEW

- TABLE 298 BACCARA: PRODUCTS OFFERED

- *Details on Business Overview, Products Offered, MnM View, Key Strengths/Right to win, Strategic choices made, and Weakness and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 299 ADJACENT MARKETS TO THE IRRIGATION AUTOMATION MARKET

- 14.2 LIMITATIONS

- 14.3 SMART IRRIGATION MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 SMART IRRIGATION MARKET, BY COMPONENT

- TABLE 300 SMART IRRIGATION MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- 14.3.4 SMART IRRIGATION MARKET, BY APPLICATION

- TABLE 301 SMART IRRIGATION MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- 14.3.5 SMART IRRIGATION MARKET, BY REGION

- TABLE 302 SMART IRRIGATION MARKET, BY REGION, 2021-2026 (USD MILLION)

- 14.4 SMART WATER MANAGEMENT MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- 14.4.3 SMART WATER MANAGEMENT MARKET, BY OFFERING

- TABLE 303 SMART WATER MANAGEMENT MARKET, BY OFFERING, 2021-2026 (USD MILLION)

- 14.4.4 SMART WATER MANAGEMENT MARKET, BY END USER

- TABLE 304 SMART WATER MANAGEMENT MARKET, BY END USER, 2021-2026 (USD MILLION)

- 14.4.5 SMART WATER MANAGEMENT MARKET, BY REGION

- TABLE 305 SMART WATER MANAGEMENT MARKET, BY REGION, 2021-2026 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS