|

|

市場調査レポート

商品コード

1080395

分散型IDの世界市場:IDの種類別・エンドユーザー別・組織規模別・業種別 (BFSI、政府、医療・ライフサイエンス、小売業・eコマース、通信・IT、運輸業・ロジスティクス、不動産、その他)・地域別の将来予測 (2027年まで)Decentralized Identity Market by Identity Type, End User, Organization Size, Vertical (BFSI, Government, Healthcare and Life Sciences, Retail and eCommerce, Telecom and IT, Transport & Logistics, Real Estate, Others) and Region -Global forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 分散型IDの世界市場:IDの種類別・エンドユーザー別・組織規模別・業種別 (BFSI、政府、医療・ライフサイエンス、小売業・eコマース、通信・IT、運輸業・ロジスティクス、不動産、その他)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年05月28日

発行: MarketsandMarkets

ページ情報: 英文 147 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の分散型IDの市場規模は、2022年の2億8,500万米ドルから、88.7%のCAGRで成長し続け、2027年には68億2,200万米ドルに拡大すると予測されます。

市場の主な促進要因として、既存のID管理手法の非効率性や、セキュリティ侵害の発生件数の増加などが挙げられます。

IDの種類別では、生体認証方式が最も高いCAGRで成長する見通しです。エンドユーザー別では、個人ユーザーが最大の市場規模を占めると考えられています。

当レポートでは、世界の分散型IDの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、市場動向の見通し、IDの種類別・エンドユーザー別・組織規模別・業種別・地域別の詳細動向、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 分析方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

- 課題

- バリューチェーン

- エコシステム:分散型ID

- 技術分析

- 人工知能

- ブロックチェーン

- ブロックチェーン技術の種類

- 特許分析

- 顧客に影響を与える傾向とディスラプション

- ポーターのファイブフォース分析

- 関税・規制状況

- 利用事例

- 主要な会議とイベント (2022年~2023年)

第6章 分散型ID市場:IDの種類別

- イントロダクション

- 非生体認証

- 生体認証

第7章 分散型ID市場:エンドユーザー別

- イントロダクション

- 個人

- 企業

第8章 分散型ID市場:組織規模別

- イントロダクション

- 大企業

- 中小企業

第9章 分散型ID市場:業種別

- イントロダクション

- 銀行・金融サービス・保険 (BFSI)

- 政府

- 医療・ライフサイエンス

- 通信・IT

- 小売業・eコマース

- 運輸業・ロジスティクス

- 不動産

- メディア・エンターテインメント

- その他

第10章 分散型ID市場:地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- 概要

- 市場評価フレームワーク

- 主要企業の収益分析

- 企業評価マトリックス

- 競合リーダーシップマッピング

- 企業別の製品フットプリント分析

- スタートアップ向け競合リーダーシップマッピング

- スタートアップ向け競合ベンチマーキング

第12章 企業プロファイル

- イントロダクション

- 主要企業

- MICROSOFT

- ACCENTURE

- PERSISTENT

- WIPRO

- SECUREKEY TECHNOLOGIES

- R3

- AVAST

- VALIDATED ID

- SERTO

- PING IDENTITY

- NUID

- DRAGONCHAIN

- NUGGETS

- FINEMA

- DATARELLA

- CIVIC TECHNOLOGIES

- スタートアップ/中小企業

- 1KOSMOS

- AFFINIDI

- HU-MANITY

- SELFKEY

第13章 隣接/関連市場

- イントロダクション

- デジタルIDソリューション市場

- ブロックチェーンID管理市場

- 本人確認市場

第14章 付録

The decentralized identity market size is projected to grow from USD 285 million in 2022 to USD 6,822 million by 2027, at a Compound Annual Growth Rate (CAGR) of 88.7% during the forecast period. The major factor that has driven demand for this market is Inefficiency of existing identity management practices and rising instances of security breaches.

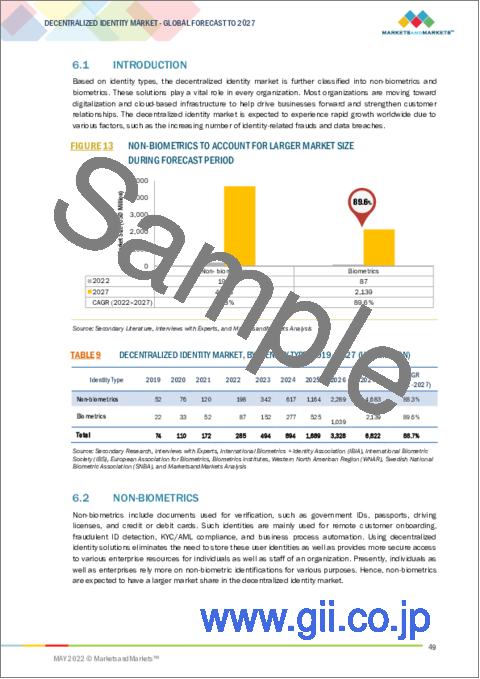

By Identity type, the biometrics decentralized identity to register the highest growth rate during the forecast period

Based on identity types, the decentralized identity market is further classified into non-biometrics and biometrics. Decentralized identity solutions are expected to evolve from use of non-biometric identities to biometrics-based identities, such as fingerprint, facial, handprint, and voice recognition. Biometrics are unique for every individual and can be used for more specific identity verification processes. Such identities are comparatively more secure than conventional non-biometric solutions. Since biometrics binds an identity to a credential and an individual, it is expected to be used by individuals as well as enterprises for verifying their identities in the coming future; this will require the use of decentralized identity solutions for efficient management and handling of the sensitive biometric credential data of individuals. The biometrics subsegment is expected to record a faster CAGR in the decentralized identity market due to increasing demand from customers for secure onboarding, compliance management, and fraud prevention.

By end user, the individual user segment is expected to hold the largest market size during the forecast period

.Based on end user, the decentralized identity market is divided into two categories: individual and enterprise. The individual subsegment includes decentralized identity created and used by individuals for creating and keeping their identities as well as using the same for verifying and authenticating themselves for various purposes. Decentralized identity is one of the most promising new approaches to Identity and Access Management (IAM). According to Thoughtworks, in a decentralized identity system, entities such as individuals gain control over their identities and allow trusted interactions. The biggest advantage of using this approach is that it enables individuals to share different parts of their identity with different services as per their need. For example, the depth of details provided to a health insurer will not be completely shared with a mortgage provider. By using decentralized identity, individuals can share required verification entities with the verifiers. The decentralized identity system includes a single system that enables individuals to authenticate themselves with multiple entities. It has become pretty common to create an account to access various services such as social media, purchase of train/flight tickets, manage bank accounts, and access health services. For some of these services, individuals only need to present a few identifiers, such as name, date of birth, and email. For others, identifiers must be verified to a certain level of assurance to make sure an individual is who he claims to be. An individual could also be verified through driver's license, passport, tax ID number, etc.

Breakdown of primary participants:

- By Company Type: Tier 1 = 35%, Tier 2 = 45%, and Tier 3 = 20%

- By Designation: C-Level Executives = 40%, Directors = 35%, and Others = 25%

- By Region: North America = 45%, Europe = 20%, APAC = 30%, and RoW = 5%

Key and innovative vendors in decentralized identity market include Microsoft (US), Accenture (Ireland), Persistent (India), Wipro (India), SecureKey Technologies (Canada), R3 (US), Avast (Czech Repubic), Validated ID (Spain), Serto (US), Ping Identity (US), NuID (US), Dragonchain (US), Nuggets (UK), Finema (Thailand), Datarella (Germany), Civic Technologies (US), 1Kosmos (US), Affinidy (Singapore), Hu-manity (US), SelfKey (Mauritius).

Research Coverage

The market study covers the decentralized identity market size across segments. It aims at estimating the market size and the growth potential of this market across different segments by identity type, by end user, by organization size, by vertical, and by regions. The study also includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the revenue numbers' closest approximations for the overall decentralized identity market and its sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2015-2022

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 DECENTRALIZED IDENTITY MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 3 DECENTRALIZED IDENTITY MARKET SIZE AND GROWTH, 2019-2026 (USD MILLION, Y-O-Y %)

- FIGURE 2 DECENTRALIZED IDENTITY MARKET TO GROW EXPONENTIALLY FROM 2019 TO 2027

- FIGURE 3 NORTH AMERICA TO ACCOUNT FOR HIGHEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF DECENTRALIZED IDENTITY MARKET

- FIGURE 4 INCREASING IDENTITY RELATED THREATS TO DRIVE DECENTRALIZED IDENTITY MARKET GROWTH

- 4.2 DECENTRALIZED IDENTITY MARKET, BY IDENTITY TYPE, 2022-2027

- FIGURE 5 NON-BIOMETRICS IDENTITY TO HOLD LARGER MARKET SHARE IN 2022

- 4.3 DECENTRALIZED IDENTITY MARKET, BY END USER, 2022-2027

- FIGURE 6 ENTERPRISE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

- 4.4 DECENTRALIZED IDENTITY MARKET INVESTMENT SCENARIO, BY REGION

- FIGURE 7 EUROPE TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 8 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DECENTRALIZED IDENTITY MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rising instances of security breaches and identity related fraud

- 5.2.1.2 End-user advantage of retaining full control over use of identities

- 5.2.1.3 Inefficiency of existing identity management practices

- 5.2.2 RESTRAINTS

- 5.2.2.1 Uncertain regulatory status and lack of common set of standards

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Extensive applications of blockchain identity solutions in banking, cybersecurity and IoT

- 5.2.3.2 Emergence and increasing adoption of SSIs

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of technical knowledge and understanding of blockchain concept

- 5.3 VALUE CHAIN

- FIGURE 9 DECENTRALIZED IDENTITY MARKET VALUE CHAIN

- 5.4 ECOSYSTEM: DECENTRALIZED IDENTITY

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 ARTIFICIAL INTELLIGENCE

- 5.5.2 BLOCKCHAIN

- 5.5.3 TYPES OF BLOCKCHAIN TECHNOLOGY

- 5.5.3.1 Private blockchain

- 5.5.3.2 Public blockchain

- 5.6 PATENT ANALYSIS

- FIGURE 10 DECENTRALIZED IDENTITY MARKET: PATENT ANALYSIS

- 5.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- FIGURE 11 DECENTRALIZED IDENTITY MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 12 PORTERS FIVE FORCES MODEL FOR DECENTRALIZED IDENTITY MARKET

- TABLE 4 PORTERS FIVE FORCES IMPACT ON DECENTRALIZED IDENTITY MARKET

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 DEGREE OF COMPETITION

- 5.9 TARIFF AND REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- 5.9.2 PAYMENT CARD INDUSTRY-DATA SECURITY STANDARD (PCI-DSS)

- 5.9.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)

- 5.9.4 KNOW YOUR CUSTOMER (KYC)

- 5.9.5 ANTI-MONEY LAUNDERING

- 5.10 USE CASES

- 5.10.1 USE CASE: BLOKSEC

- 5.10.2 USE CASE: DIGITAL PERMANENT RESIDENT CARD

- 5.10.3 USE CASE: PUBLIC AUTHORITY IDENTITY CREDENTIALS

- 5.11 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 8 DECENTRALIZED IDENTITY MARKET: CONFERENCES & EVENTS

6 DECENTRALIZED IDENTITY MARKET, BY IDENTITY TYPE

- 6.1 INTRODUCTION

- FIGURE 13 NON-BIOMETRICS TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- TABLE 9 DECENTRALIZED IDENTITY MARKET, BY IDENTITY TYPE, 2019-2027 (USD MILLION)

- 6.2 NON-BIOMETRICS

- 6.2.1 NON-BIOMETRICS: DECENTRALIZED IDENTITY MARKET DRIVERS

- TABLE 10 NON-BIOMETRICS DECENTRALIZED IDENTITY MARKEYT SIZE, BY REGION, 2019-2027 (USD MILLION)

- 6.3 BIOMETRICS

- 6.3.1 BIOMETRICS: DECENTRALIZED IDENTITY MARKET DRIVERS

- TABLE 11 BIOMETRICS DECENTRALIZED IDENTITY MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

7 DECENTRALIZED IDENTITY MARKET, BY END USER

- 7.1 INTRODUCTION

- FIGURE 14 ENTERPRISE SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- TABLE 12 DECENTRALIZED IDENTITY MARKET, BY END USER, 2019-2027 (USD MILLION)

- 7.2 INDIVIDUAL

- 7.2.1 INDIVIDUAL: DECENTRALIZED IDENTITY MARKET DRIVERS

- TABLE 13 DECENTRALIZED IDENTITY MARKET: INDIVIDUAL, BY REGION, 2019-2027 (USD MILLION)

- 7.3 ENTERPRISE

- 7.3.1 ENTERPRISE: DECENTRALIZED IDENTITY MARKET DRIVERS

- TABLE 14 DECENTRALIZED IDENTITY MARKET: ENTERPRISE, BY REGION, 2019-2027 (USD MILLION)

8 DECENTRALIZED IDENTITY MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- FIGURE 15 SMES TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- TABLE 15 DECENTRALIZED IDENTITY MARKET SIZE, BY ORGANIZATION SIZE, 2019-2027 (USD MILLION)

- 8.2 LARGE ENTERPRISES

- 8.2.1 LARGE ENTERPRISES: DECENTRALIZED IDENTITY MARKET DRIVERS

- TABLE 16 LARGE ENTERPRISES MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 8.3 SMES

- 8.3.1 SMES: DECENTRALIZED IDENTITY MARKET DRIVERS

- TABLE 17 SMES MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

9 DECENTRALIZED IDENTITY MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- FIGURE 16 REAL ESTATE TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 18 DECENTRALIZED IDENTITY MARKET SIZE, BY VERTICALS, 2019-2027 (USD MILLION)

- 9.2 BFSI

- 9.2.1 BFSI: DECENTRALIZED IDENTITY MARKET DRIVERS

- TABLE 19 BFSI MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 9.3 GOVERNMENT

- 9.3.1 GOVERNMENT: DECENTRALIZED IDENTITY MARKET DRIVERS

- TABLE 20 GOVERNMENT MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 9.4 HEALTHCARE AND LIFE SCIENCES

- 9.4.1 HEALTHCARE AND LIFE SCIENCES: DECENTRALIZED IDENTITY MARKET DRIVERS

- TABLE 21 HEALTHCARE AND LIFE SCIENCES MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 9.5 TELECOM AND IT

- 9.5.1 TELECOM AND IT: DECENTRALIZED IDENTITY MARKET DRIVERS

- TABLE 22 TELECOM AND IT MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 9.6 RETAIL AND E-COMMERCE

- 9.6.1 RETAIL AND E-COMMERCE: DECENTRALIZED IDENTITY MARKET DRIVERS

- TABLE 23 RETAIL AND E-COMMERCE MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 9.7 TRANSPORT AND LOGISTICS

- 9.7.1 TRANSPORT AND LOGISTICS: DECENTRALIZED IDENTITY MARKET DRIVERS

- TABLE 24 TRANSPORT AND LOGISTICS MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 9.8 REAL ESTATE

- 9.8.1 REAL ESTATE: DECENTRALIZED IDENTITY MARKET DRIVERS

- TABLE 25 REAL ESTATE MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 9.9 MEDIA AND ENTERTAINMENT

- 9.9.1 MEDIA AND ENTERTAINMENT: DECENTRALIZED IDENTITY MARKET DRIVERS

- TABLE 26 MEDIA AND ENTERTAINMENT MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 9.10 OTHERS

- TABLE 27 OTHERS MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

10 DECENTRALIZED IDENTITY MARKET BY REGION

- 10.1 INTRODUCTION

- FIGURE 17 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 28 DECENTRALIZED IDENTITY MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: DECENTRALIZED IDENTITY MARKET DRIVERS

- 10.2.2 NORTH AMERICA: REGULATORY LANDSCAPE

- FIGURE 18 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 29 NORTH AMERICA: DECENTRALIZED IDENTITY MARKET SIZE, BY IDENTITY TYPE, 2019-2027 (USD MILLION)

- TABLE 30 NORTH AMERICA: DECENTRALIZED IDENTITY MARKET SIZE, BY END USER, 2019-2027 (USD MILLION)

- TABLE 31 NORTH AMERICA: DECENTRALIZED IDENTITY MARKET SIZE, BY ORGANIZATION SIZE, 2019-2027 (USD MILLION)

- TABLE 32 NORTH AMERICA: DECENTRALIZED IDENTITY MARKET SIZE, BY VERTICAL, 2019-2027 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: DECENTRALIZED IDENTITY MARKET DRIVERS

- 10.3.2 EUROPE: REGULATORY LANDSCAPE

- TABLE 33 EUROPE: DECENTRALIZED IDENTITY MARKET SIZE, BY IDENTITY TYPE, 2019-2027 (USD MILLION)

- TABLE 34 EUROPE: DECENTRALIZED IDENTITY MARKET SIZE, BY END USER, 2019-2027 (USD MILLION)

- TABLE 35 EUROPE: DECENTRALIZED IDENTITY MARKET SIZE, BY ORGANIZATION SIZE, 2019-2027 (USD MILLION)

- TABLE 36 EUROPE: DECENTRALIZED IDENTITY MARKET SIZE, BY VERTICAL, 2019-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: DECENTRALIZED IDENTITY MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: REGULATORY LANDSCAPE

- FIGURE 19 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 37 ASIA PACIFIC: DECENTRALIZED IDENTITY MARKET SIZE, BY IDENTITY TYPE, 2019-2027 (USD MILLION)

- TABLE 38 ASIA PACIFIC: DECENTRALIZED IDENTITY MARKET SIZE, BY END USER, 2019-2027 (USD MILLION)

- TABLE 39 ASIA PACIFIC: DECENTRALIZED IDENTITY MARKET SIZE, BY ORGANIZATION SIZE, 2019-2027 (USD MILLION)

- TABLE 40 ASIA PACIFIC: DECENTRALIZED IDENTITY MARKET SIZE, BY VERTICAL, 2019-2027 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: DECENTRALIZED IDENTITY MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

- TABLE 41 MIDDLE EAST & AFRICA: DECENTRALIZED IDENTITY MARKET SIZE, BY IDENTITY TYPE, 2019-2027 (USD MILLION)

- TABLE 42 MIDDLE EAST & AFRICA: DECENTRALIZED IDENTITY MARKET SIZE, BY END USER, 2019-2027 (USD MILLION)

- TABLE 43 MIDDLE EAST & AFRICA: DECENTRALIZED IDENTITY MARKET SIZE, BY ORGANIZATION SIZE, 2019-2027 (USD MILLION)

- TABLE 44 MIDDLE EAST & AFRICA: DECENTRALIZED IDENTITY MARKET SIZE, BY VERTICAL, 2019-2027 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: DECENTRALIZED IDENTITY MARKET DRIVERS

- 10.6.2 LATIN AMERICA: REGULATORY LANDSCAPE

- TABLE 45 LATIN AMERICA: DECENTRALIZED IDENTITY MARKET SIZE, BY IDENTITY TYPE, 2019-2027 (USD MILLION)

- TABLE 46 LATIN AMERICA: DECENTRALIZED IDENTITY MARKET SIZE, BY END USER, 2019-2027 (USD MILLION)

- TABLE 47 LATIN AMERICA: DECENTRALIZED IDENTITY MARKET SIZE, BY ORGANIZATION SIZE, 2019-2027 (USD MILLION)

- TABLE 48 LATIN AMERICA: DECENTRALIZED IDENTITY MARKET SIZE, BY VERTICAL, 2019-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET EVALUATION FRAMEWORK

- FIGURE 20 DECENTRALIZED IDENTITY MARKET EVALUATION FRAMEWORK

- 11.3 REVENUE ANALYSIS OF LEADING PLAYERS

- FIGURE 21 DECENTRALIZED IDENTITY MARKET: REVENUE ANALYSIS

- 11.4 COMPANY EVALUATION MATRIX

- 11.4.1 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

- TABLE 49 EVALUATION CRITERIA

- 11.5 COMPETITIVE LEADERSHIP MAPPING

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 22 DECENTRALIZED IDENTITY MARKET (GLOBAL), COMPETITIVE LEADERSHIP MAPPING OF KEY PLAYERS, 2021

- 11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 50 COMPANY PRODUCT FOOTPRINT

- TABLE 51 COMPANY COMPONENT FOOTPRINT

- TABLE 52 COMPANY VERTICAL FOOTPRINT

- TABLE 53 COMPANY REGION FOOTPRINT

- 11.7 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 23 DECENTRALIZED IDENTITY MARKET (GLOBAL), COMPETITIVE LEADERSHIP MAPPING OF START-UPS, 2021

- 11.8 COMPETITIVE BENCHMARKING FOR START-UPS

- 11.8.1 DECENTRALIZED IDENTITY: START-UPS/SMES

- 11.8.2 DECENTRALIZED IDENTITY: COMPETITIVE BENCHMARKING OF START-UPS/SMES

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 12.2.1 MICROSOFT

- TABLE 54 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 24 MICROSOFT: COMPANY SNAPSHOT

- TABLE 55 MICROSOFT: SOLUTIONS OFFERED

- TABLE 56 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 57 IBM: DEALS

- 12.2.2 ACCENTURE

- TABLE 58 ACCENTURE: BUSINESS OVERVIEW

- FIGURE 25 ACCENTURE: COMPANY SNAPSHOT

- TABLE 59 ACCENTURE: SOLUTIONS OFFERED

- TABLE 60 ACCENTURE: DEALS

- 12.2.3 PERSISTENT

- TABLE 61 PERSISTENT: BUSINESS OVERVIEW

- FIGURE 26 PERSISTENT: COMPANY SNAPSHOT

- TABLE 62 PERSISTENT: SOLUTIONS OFFERED

- TABLE 63 PERSISTENT: DEALS

- 12.2.4 WIPRO

- TABLE 64 WIPRO: BUSINESS OVERVIEW

- FIGURE 27 WIPRO: COMPANY SNAPSHOT

- TABLE 65 WIPRO: SOLUTIONS OFFERED

- TABLE 66 WIPRO: DEALS

- 12.2.5 SECUREKEY TECHNOLOGIES

- TABLE 67 SECUREKEY TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 68 SECUREKEY TECHNOLOGIES: SOLUTIONS OFFERED

- TABLE 69 SECUREKEY TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 70 SECUREKEY TECHNOLOGIES: DEALS

- 12.2.6 R3

- TABLE 71 R3: BUSINESS OVERVIEW

- TABLE 72 R3: SOLUTIONS OFFERED

- TABLE 73 R3: PRODUCT LAUNCHES

- TABLE 74 R3: DEALS

- 12.2.7 AVAST

- TABLE 75 AVAST: BUSINESS OVERVIEW

- FIGURE 28 AVAST: COMPANY SNAPSHOT

- TABLE 76 AVAST: SOLUTIONS OFFERED

- TABLE 77 AVAST: DEALS

- 12.2.8 VALIDATED ID

- TABLE 78 VALIDATED ID: BUSINESS OVERVIEW

- TABLE 79 VALIDATED ID: SOLUTIONS OFFERED

- 12.2.9 SERTO

- TABLE 80 SERTO: BUSINESS OVERVIEW

- TABLE 81 SERTO: SOLUTIONS OFFERED

- TABLE 82 SERTO: PRODUCT LAUNCHES

- TABLE 83 SERTO: DEALS

- 12.2.10 PING IDENTITY

- TABLE 84 PING IDENTITY: BUSINESS OVERVIEW

- FIGURE 29 PING IDENTITY: COMPANY SNAPSHOT

- TABLE 85 PING IDENTITY: SOLUTIONS OFFERED

- TABLE 86 PING IDENTITY: PRODUCT LAUNCHES

- TABLE 87 PING IDENTITY: DEALS

- 12.2.11 NUID

- 12.2.12 DRAGONCHAIN

- 12.2.13 NUGGETS

- 12.2.14 FINEMA

- 12.2.15 DATARELLA

- 12.2.16 CIVIC TECHNOLOGIES

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 12.3 STARTUP/SME

- 12.3.1 1KOSMOS

- 12.3.2 AFFINIDI

- 12.3.3 HU-MANITY

- 12.3.4 SELFKEY

13 ADJACENT/RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 DIGITAL IDENTITY SOLUTIONS MARKET

- 13.2.1 MARKET DEFINITION

- TABLE 88 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY COMPONENT, 2016-2020 (USD MILLION)

- TABLE 89 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY COMPONENT, 2021-2026 (USD MILLION)

- TABLE 90 DIGITAL IDENTITY SOLUTIONS SUBSEGMENT MARKET SIZE, BY SOLUTION, 2016-2020 (USD MILLION)

- TABLE 91 DIGITAL IDENTITY SOLUTIONS SUBSEGMENT MARKET SIZE, BY SOLUTION, 2021-2026 (USD MILLION)

- TABLE 92 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY SOLUTION TYPE, 2016-2020 (USD MILLION)

- TABLE 93 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY SOLUTION TYPE, 2021-2026 (USD MILLION)

- TABLE 94 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY AUTHENTICATION TYPE, 2016-2020 (USD MILLION)

- TABLE 95 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY AUTHENTICATION TYPE, 2021-2026 (USD MILLION)

- TABLE 96 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 97 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY VERTICAL, 2021-2026 (USD MILLION)

- TABLE 98 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY REGION, 2016-2020 (USD MILLION)

- TABLE 99 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY REGION, 2021-2026 (USD MILLION)

- 13.3 BLOCKCHAIN IDENTITY MANAGEMENT MARKET

- 13.3.1 MARKET DEFINITION

- TABLE 100 BLOCKCHAIN IDENTITY MANAGEMENT MARKET SIZE, BY PROVIDER, 2016-2023 (USD MILLION)

- TABLE 101 BLOCKCHAIN IDENTITY MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2016-2023 (USD MILLION)

- TABLE 102 BLOCKCHAIN IDENTITY MANAGEMENT MARKET SIZE, BY VERTICAL, 2016-2023 (USD MILLION)

- TABLE 103 BLOCKCHAIN IDENTITY MANAGEMENT MARKET SIZE, BY REGION, 2016-2023 (USD MILLION)

- 13.4 IDENTITY VERIFICATION MARKET

- 13.4.1 MARKET DEFINITION

- TABLE 104 IDENTITY VERIFICATION MARKET SIZE, BY COMPONENT, 2015-2020 (USD MILLION)

- TABLE 105 IDENTITY VERIFICATION MARKET SIZE, BY COMPONENT, 2020-2026 (USD MILLION)

- TABLE 106 IDENTITY VERIFICATION MARKET SIZE, BY TYPE, 2015-2020 (USD MILLION)

- TABLE 107 IDENTITY VERIFICATION MARKET SIZE, BY TYPE, 2020-2026 (USD MILLION)

- TABLE 108 IDENTITY VERIFICATION MARKET SIZE, BY VERTICAL, 2015-2020 (USD MILLION)

- TABLE 109 IDENTITY VERIFICATION MARKET SIZE, BY VERTICAL, 2020-2026 (USD MILLION)

- TABLE 110 IDENTITY VERIFICATION MARKET SIZE, BY REGION, 2015-2020 (USD MILLION)

- TABLE 111 IDENTITY VERIFICATION MARKET SIZE, BY REGION, 2020-2026 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS