|

|

市場調査レポート

商品コード

1076183

船舶航行管理の世界市場:エンドユーザー(商業、防衛)、コンポーネント(機器、ソリューション、サービス)、投資(ブラウンフィールド、グリーンフィールド)、システム、搭載コンポーネント(機器、ソリューション)、地域別(2022年~2027年)Vessel Traffic Management Market by End User (Commercial, Defense), Component (Equipment, Solution, Service), Investment (Brownfield, Greenfield), System, Onboard Components (Equipment, Solution), and Region (2022-2027) |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 船舶航行管理の世界市場:エンドユーザー(商業、防衛)、コンポーネント(機器、ソリューション、サービス)、投資(ブラウンフィールド、グリーンフィールド)、システム、搭載コンポーネント(機器、ソリューション)、地域別(2022年~2027年) |

|

出版日: 2022年05月12日

発行: MarketsandMarkets

ページ情報: 英文 205 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の船舶航行管理の市場規模は、予測期間中に8.4%のCAGRで成長する見通しで、2022年の58億米ドルから、2027年までに87億米ドルに達すると予測されています。

当レポートでは、世界の船舶航行管理市場について調査し、市場力学、テクノロジー分析、市場のエコシステム、セグメント・地域別の市場分析、競合情勢、主要企業のプロファイルなどの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 制限

- 市場機会

- 課題

- COVID-19の影響シナリオ

- COVID-19による市場への影響

- テクノロジー分析

- 顧客のビジネスに影響を与える動向/ディスラプション

- 価格分析

- 市場のエコシステム

- バリューチェーン分析

- 貿易データ

- ポーターのファイブフォースモデル

- 主な利害関係者と購入基準

- 主な会議とイベント(2022-2023)

- 規制状況業界のための関税規制の風景

第6章 動向

- 新たな業界の動向

- AIと機械学習

- 海洋IoT

- ブロックチェーンとビッグデータ分析

- サイバーセキュリティ

- イノベーションと特許登録(2018-2021)

- メガトレンドの影響

第7章 コンポーネント別:船舶航行管理市場

- 装置

- 通信

- ナビゲーション

- 監視と監視

- ソリューション

- センサーインテグレーター

- 電子海図(ENC)

- マルチセンサートラッカー

- ルーティングモニター

- その他

- サービス

- メンテナンスサービス

- オペレーションサービス

第8章 エンドユーザー別:船舶航行管理市場

- 商業分野

- 港

- 内陸港

- 漁港

- オフショア

- 防衛分野

第9章 システム別:船舶航行管理市場

- 港湾管理情報システム

- 世界海上遭難安全システム(GMDSS)

- 河川情報システム

- AtoN管理および健康監視システム

- その他

第10章 投資別:船舶航行管理市場

- グリーンフィールド

- ブラウンフィールド

第11章 搭載コンポーネント別:船舶航行管理市場

- 装置

- コミュニケーション

- ナビゲーション

- 監視と監視

- ソリューション

- センサーインテグレーター

- 電子海図(ENC)

- マルチセンサートラッカー

- ルーティングモニター

第12章 地域分析

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 英国

- ノルウェー

- スウェーデン

- デンマーク

- フランス

- その他

- アジア太平洋

- PESTLE分析

- 中国

- インド

- シンガポール

- インドネシア

- 韓国

- オーストラリア

- その他

- 中東

- PESTLE分析

- サウジアラビア

- アラブ首長国連邦

- カタール

- その他

- ラテンアメリカ

- PESTLE分析

- ブラジル

- アルゼンチン

- その他

- アフリカ

- PESTLE分析

- 南アフリカ

- エジプト

- アルジェリア

- その他

第13章 競合情勢

- 市場シェア分析(2021)

- 主要市場参入企業5社の収益分析(2020)

- 企業評価クアドラント

- スタートアップの評価クアドラント

- 競合ベンチマーキング

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- KONGSBERG GRUPPEN

- WARTSILA

- THALES GROUP

- LEONARDO S.P.A.

- SAAB

- INDRA SISTEMAS

- TOKYO KEIKI

- HENSOLDT

- FREQUENTIS

- FURUNO

- JAPAN RADIO CO. LTD.

- TERMA

- VISSIM

- ELCOME INTERNATIONAL LLC

- ST ENGINEERING

- MARLAN MARITIME TECHNOLOGIES

- XANATOS MARINE LTD.

- SEA SURVEILLANCE AS

- M-NAV SOLUTIONS

- A.ST.I.M. S.R.L.

- その他の企業

- MARICO MARINE

- GEM ELETTRONICA

- HORIZONTE AS

- SCORTEL

- ELMAN S.R.L.

第15章 付録

The Vessel Traffic Management Market is projected to grow from USD 5.8 billion in 2022 to USD 8.7 billion by 2027, at a CAGR of 8.4% during the forecast period.

The COVID-19 outbreak has led to several challenges for various industries such as aviation and consumer electronics. These industries faced many economic problems post the COVID-19 outbreak. Since the beginning of the outbreak, the transportation industry has been among the most severely hit sectors globally. Due to most countries imposing nationwide lockdowns and travel and transportation restrictions, the shipping industry was affected extremely.This outbreak has also put the shipping and marine industries in worse position since their workforces have been shut down for the sake of safety and preventing the spread of COVID-19.

With the support of the Maritime and Port Authority of Singapore, Fujitsu Limited, Singapore Management University (SMU), and A*STAR's Institute of High-Performance Computing (IHPC) announced their collaboration to develop innovative new technologies for vessel traffic management in the Port of Singapore (MPA). These predictive technologies will use artificial intelligence (AI) and big data analytics to help manage Singapore's port and surrounding seas, which see a lot of seaborne trade and traffic. The technologies will also be evaluated using real-world data in order to enhance congestion predictions and the detection of probable accidents and other danger hotspots before they happen at sea. The Urban Computing and Engineering Centre of Excellence (UCE CoE), a public-private collaboration comprising of the Agency for Science, Technology and Research (A*STAR), SMU, and Fujitsu, was founded in 2014 to perform research and development for these new marine technologies.

Based on component, service segment is expected to have the largest market share in 2022 as well as witness the highest CAGR growth across the forecast period. Many ports are equipping VTMS systems to make their ports more efficient and reliable. With new systems require operation and maintenance services. These factors drive the market growth.

Based on system, Port management information system is expected to grow with largest CAGR. Most ports across the world have adopted some form port management information system for the efficient and reliable working of their ports.

Break-up of profile of primary participants in the vessel traffic management market:

- By Company Type: Tier 1 - 20%, Tier 2 - 55%, and Tier 3 - 25%

- By Designation: C Level - 50%, Director Level - 25%, and Others - 25%

- By Region: North America -60%, Europe - 20%, AsiaPacific - 10%,South America- 5%, and RoW - 5%

Major players operating in the vessel traffic management market include Kongsberg Gruppen (Norway), Saab SA (Sweden), Leonardo S.p.A. (Italy), Wartsila (Finland), Thales Group (France), among others. These key players offer VTMS solutions and services to different key stakeholders.

Research Coverage:

This research report categorizes the vessel traffic management market on the basis of End User(commercial and defense), Based on component (Equipment, Solution, Services),Investment (Brownfield, Greenfield), System and Onbaord Components. These segments have been mapped across major regions, namely, North America, Europe, Asia Pacific, Middle East, Latin America, and Africa. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the vessel traffic management market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; new product launches; mergers; and partnerships, agreements, and collaborations; and recent developments associated with the sustainable aviation fuel market. In addition, the startups in vessel traffic managementmarket ecosystem are covered in this report to provide usable insights and developments happening in the emerging market of vessel traffic management.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall vessel traffic management market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on vessel traffic management market offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches, contracts, agreements, and expansion plans in the vessel traffic management market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the vessel traffic management market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the vessel traffic management market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the vessel traffic management market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 VESSEL TRAFFIC MANAGEMENT MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- FIGURE 2 VESSEL TRAFFIC MANAGEMENT MARKET REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED FOR THE STUDY

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN VESSEL TRAFFIC MANAGEMENT MARKET

- 1.5 CURRENCY & PRICING

- 1.6 LIMITATIONS

- 1.7 MARKET STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- FIGURE 3 VESSEL TRAFFIC MANAGEMENT MARKET TO GROW AT HIGHER RATE THAN PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 4 RESEARCH PROCESS FLOW

- FIGURE 5 VESSEL TRAFFIC MANAGEMENT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.2 DEMAND & SUPPLY-SIDE ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.2.1 Port expansion and modernization programs across regions to influence market growth

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.3.1 Next-gen vessel traffic management system

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 SEGMENTS AND SUBSEGMENTS

- 2.4 RESEARCH APPROACH & METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 VESSEL TRAFFIC MANAGEMENT MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.3 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.5 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.6 GROWTH RATE ASSUMPTIONS

- 2.7 ASSUMPTIONS FOR RESEARCH STUDY

- 2.8 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 9 SERVICE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 10 PORT MANAGEMENT INFORMATION SYSTEM SEGMENT ACQUIRED LARGER MARKET SHARE IN 2022

- FIGURE 11 VESSEL TRAFFIC MANAGEMENT MARKET IN NORTH AMERICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN VESSEL TRAFFIC MANAGEMENT MARKET

- FIGURE 12 INCREASING PORT MODERNIZATION AND INTRODUCTION OF ADVANCED PORT MANAGEMENT SYSTEMS EXPECTED TO DRIVE MARKET FROM 2O22 TO 2027

- 4.2 VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER

- FIGURE 13 COMMERCIAL SECTOR SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

- 4.3 VESSEL TRAFFIC MANAGEMENT MARKET END USER, BY COMMERCIAL SECTOR

- FIGURE 14 INLAND PORT SEGMENT PROJECTED TO DOMINATE MARKET FROM 2022 TO 2027

- 4.4 VESSEL TRAFFIC MANAGEMENT MARKET, BY INVESTMENT

- FIGURE 15 BROWNFIELD INVESTMENT SEGMENT PROJECTED TO HAVE HIGHEST MARKET SHARE FROM 2022 TO 2027

- 4.5 VESSEL TRAFFIC MANAGEMENT MARKET, BY COUNTRY

- FIGURE 16 VESSEL TRAFFIC MANAGEMENT MARKET IN DENMARK PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased vessel congestion at ports

- 5.2.1.2 Need for automation

- 5.2.2 RESTRAINTS

- 5.2.2.1 Effect of natural disasters on ports

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Next-generation vessel traffic management systems

- 5.2.3.2 Technological advances in maritime traffic management

- 5.2.4 CHALLENGES

- 5.2.4.1 VTMS facility location

- 5.2.4.2 Automated identification system (AIS) disadvantages

- 5.3 COVID-19 IMPACT SCENARIOS

- 5.4 COVID-19 IMPACT ON VESSEL TRAFFIC MANAGEMENT MARKET

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 AI IN VTS

- 5.5.2 E-NAVIGATION IN VESSEL TRAFFIC MANAGEMENT

- 5.5.3 GLOBAL NAVIGATION SATELLITE SYSTEM (GNSS)

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- FIGURE 18 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- 5.7 PRICING ANALYSIS

- TABLE 2 AVERAGE SELLING PRICE RANGE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY EQUIPMENT (USD)

- FIGURE 19 PRICING ANALYSIS FOR VESSEL TRAFFIC MANAGEMENT SYSTEM, BY EQUIPMENT (USD THOUSAND)

- 5.8 MARKET ECOSYSTEM

- 5.8.1 PROMINENT COMPANIES

- 5.8.2 PRIVATE AND SMALL ENTERPRISES

- 5.8.3 END USERS

- FIGURE 20 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET ECOSYSTEM

- TABLE 3 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET ECOSYSTEM

- 5.9 VALUE CHAIN ANALYSIS OF VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET

- FIGURE 21 VALUE CHAIN ANALYSIS

- 5.10 TRADE DATA

- 5.10.1 TRADE ANALYSIS

- TABLE 4 COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

- TABLE 5 COUNTRY-WISE IMPORTS, 2019-2020 (USD THOUSAND)

- 5.11 PORTER'S FIVE FORCES MODEL

- 5.11.1 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.11.2 THREAT OF NEW ENTRANTS

- 5.11.3 THREAT OF SUBSTITUTES

- 5.11.4 BARGAINING POWER OF SUPPLIERS

- 5.11.5 BARGAINING POWER OF BUYERS

- 5.11.6 COMPETITION IN THE INDUSTRY

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR VESSEL TRAFFIC MANAGEMENT SYSTEM

- TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR VESSEL TRAFFIC MANAGEMENT SYSTEM (%)

- 5.12.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR VESSEL TRAFFIC MANAGEMENT SYSTEMS

- TABLE 7 KEY BUYING CRITERIA FOR VESSEL TRAFFIC MANAGEMENT SYSTEMS

- 5.13 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 8 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.14 TARIFF REGULATORY LANDSCAPE FOR SHIPPING INDUSTRY

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 EMERGING INDUSTRY TRENDS

- 6.2.1 AI AND MACHINE LEARNING

- 6.2.2 MARINE IOT

- 6.2.3 BLOCKCHAIN AND BIG DATA ANALYTICS

- 6.2.4 CYBERSECURITY

- 6.3 INNOVATIONS AND PATENTS REGISTRATIONS, 2018-2021

- 6.4 IMPACT OF MEGATRENDS

7 VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- FIGURE 24 SERVICE SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

- TABLE 13 VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 14 VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 7.2 EQUIPMENT

- FIGURE 25 NAVIGATION SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

- TABLE 15 VESSEL TRAFFIC MANAGEMENT MARKET, BY EQUIPMENT, 2018-2021 (USD MILLION)

- TABLE 16 VESSEL TRAFFIC MANAGEMENT MARKET, BY EQUIPMENT, 2022-2027 (USD MILLION)

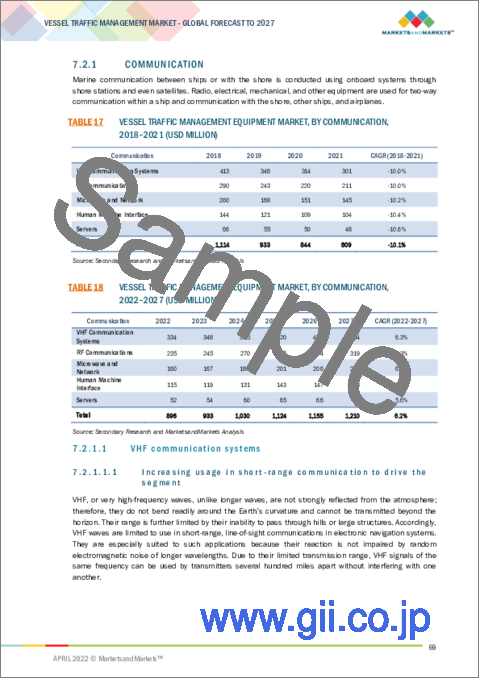

- 7.2.1 COMMUNICATION

- TABLE 17 VESSEL TRAFFIC MANAGEMENT EQUIPMENT MARKET, BY COMMUNICATION, 2018-2021 (USD MILLION)

- TABLE 18 VESSEL TRAFFIC MANAGEMENT EQUIPMENT MARKET, BY COMMUNICATION, 2022-2027 (USD MILLION)

- 7.2.1.1 VHF communication systems

- 7.2.1.1.1 Increasing usage in short-range communication to drive the segment

- 7.2.1.2 RF communications

- 7.2.1.2.1 Increasing usage for wireless data transfer and voice transfer applications to drive the segment

- 7.2.1.3 Microwave and network

- 7.2.1.3.1 Increasing usage for satellite communications, radar signals, smartphones, and navigational applications to drive the segment

- 7.2.1.4 Human machine interface (HMI)

- 7.2.1.4.1 Increasing usage of HMI on ports and harbors to drive the segment

- 7.2.1.5 Servers

- 7.2.1.5.1 New technological trends to drive the segment

- 7.2.1.1 VHF communication systems

- 7.2.2 NAVIGATION

- TABLE 19 VESSEL TRAFFIC MANAGEMENT EQUIPMENT MARKET, BY NAVIGATION, 2018-2021 (USD MILLION)

- TABLE 20 VESSEL TRAFFIC MANAGEMENT EQUIPMENT MARKET, BY NAVIGATION, 2022-2027 (USD MILLION)

- 7.2.2.1 Automatic identification system (AIS) receivers and base stations

- 7.2.2.1.1 Increasing usage of AIS receivers and base stations creates efficient link between the sea and monitoring center

- 7.2.2.2 Direction finders

- 7.2.2.2.1 Increasing usage by ports to provide navigational aid for ships

- 7.2.2.3 Radar

- 7.2.2.3.1 Increasing usage to detect illegal activities across shore and coastline to drive the segment

- 7.2.2.1 Automatic identification system (AIS) receivers and base stations

- 7.2.3 SURVEILLANCE & MONITORING

- TABLE 21 VESSEL TRAFFIC MANAGEMENT EQUIPMENT MARKET, BY SURVEILLANCE & MONITORING, 2018-2021 (USD MILLION)

- TABLE 22 VESSEL TRAFFIC MANAGEMENT EQUIPMENT MARKET, BY SURVEILLANCE & MONITORING, 2022-2027 (USD MILLION)

- 7.2.3.1 Unmanned aerial vehicles

- 7.2.3.1.1 Increasing usage of UAVs at ports to make security more efficient and reactive

- 7.2.3.2 CCTV surveillance camera

- 7.2.3.2.1 Need for latest technology CCTV cameras to provide optimum security

- 7.2.3.3 Sensors

- 7.2.3.3.1 Advanced sensor technologies used to prevent port accidents

- 7.2.3.1 Unmanned aerial vehicles

- 7.3 SOLUTION

- FIGURE 26 ROUTING MONITOR SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

- TABLE 23 VESSEL TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2018-2021 (USD MILLION)

- TABLE 24 VESSEL TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- 7.3.1 SENSOR INTEGRATOR

- 7.3.1.1 Sensor integrator key to providing efficient navigation and decision-making capabilities

- 7.3.2 ELECTRONIC NAVIGATION CHART (ENC)

- 7.3.2.1 ENCs provide an array of advantages for planning, monitoring, and executing voyages

- 7.3.3 MULTI-SENSOR TRACKER

- 7.3.3.1 Ensures flexible sensor input filtering to provide efficient data to create traffic maps

- 7.3.4 ROUTING MONITOR

- 7.3.4.1 Increasing usage to reduce risk and minimize transit time

- 7.3.5 OTHERS

- 7.4 SERVICE

- FIGURE 27 OPERATION SERVICE SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

- TABLE 25 VESSEL TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2018-2021 (USD MILLION)

- TABLE 26 VESSEL TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- 7.4.1 MAINTENANCE SERVICE

- 7.4.1.1 Periodic upkeep of equipment vital for offering decision making support to operators

- 7.4.2 OPERATION SERVICE

- 7.4.2.1 Provides critical support for decision making to operators through various data points

8 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER

- 8.1 INTRODUCTION

- FIGURE 28 COMMERCIAL SECTOR SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 27 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 28 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 8.2 COMMERCIAL SECTOR

- TABLE 29 VESSEL TRAFFIC MANAGEMENT SYSTEM END USER MARKET, BY COMMERCIAL SECTOR, 2018-2021 (USD MILLION)

- TABLE 30 VESSEL TRAFFIC MANAGEMENT SYSTEM END USER MARKET, BY COMMERCIAL SECTOR, 2022-2027 (USD MILLION)

- 8.2.1 PORTS AND HARBOR

- 8.2.1.1 Ports serve as commerce transfer centers and are typically located near natural harbors

- 8.2.2 INLAND PORT

- 8.2.2.1 Increasing usage for leisure purposes and ferries and fishing operations to drive the segment

- 8.2.3 FISHING PORT

- 8.2.3.1 Fishing ports are frequently marketed as ports that are primarily utilized for recreational or aesthetic purposes

- 8.2.4 OFFSHORE

- 8.2.4.1 Increasing adoption of advanced technologies in offshore ports to ensure safe operations

- 8.3 DEFENSE SECTOR

- 8.3.1 NEED TO PREVENT PIRACY AND OTHER ILLEGAL ACTIVITIES TO DRIVE THE SEGMENT

9 VESSEL TRAFFIC MANAGEMENT MARKET, BY SYSTEM

- 9.1 INTRODUCTION

- FIGURE 29 PORT MANAGEMENT INFORMATION SYSTEM SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

- TABLE 31 VESSEL TRAFFIC MANAGEMENT MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 32 VESSEL TRAFFIC MANAGEMENT MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- 9.2 PORT MANAGEMENT INFORMATION SYSTEM

- 9.2.1 PMI IS SINGLE SOURCE OF ADEQUATE AND ACCURATE INFORMATION

- 9.3 GLOBAL MARITIME DISTRESS SAFETY SYSTEM (GMDSS)

- 9.3.1 SHIPS FITTED WITH GMDSS EQUIPMENT ARE SAFER AT SEA AND MORE LIKELY TO RECEIVE ASSISTANCE IN EVENT OF DISTRESS

- 9.4 RIVER INFORMATION SYSTEM

- 9.4.1 RIS COMBINES EQUIPMENT AND RELATED HARDWARE AND SOFTWARE DESIGNED TO OPTIMIZE TRAFFIC AND TRANSPORT PROCESSES

- 9.5 ATON MANAGEMENT & HEALTH MONITORING SYSTEM

- 9.5.1 GOAL OF ATON SYSTEMS IS TO PROMOTE SAFE NAVIGATION ON WATERWAYS

- 9.6 OTHERS

10 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY INVESTMENT

- 10.1 INTRODUCTION

- FIGURE 30 BROWNFIELD SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

- TABLE 33 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY INVESTMENT, 2018-2021 (USD MILLION)

- TABLE 34 VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY INVESTMENT, 2022-2027 (USD MILLION)

- 10.2 GREENFIELD

- 10.2.1 MAJOR BUSINESSES ADOPT GREENFIELD INVESTMENT STRATEGY TO BREAKDOWN ENTRANCE BARRIERS

- 10.3 BROWNFIELD

- 10.3.1 BROWNFIELD INVESTMENT USED TO JOIN A NEW FOREIGN MARKET THROUGH COMPANIES THAT ALREADY HAVE A PRESENCE THERE

11 VESSEL TRAFFIC MANAGEMENT MARKET, BY ONBOARD COMPONENT

- 11.1 INTRODUCTION

- 11.2 EQUIPMENT

- 11.2.1 COMMUNICATION

- 11.2.1.1 VHF communication systems

- 11.2.1.1.1 Increasing usage in short-range communication to drive the segment

- 11.2.1.2 RF communications

- 11.2.1.2.1 Increasing usage for wireless data transfer and voice transfer applications to drive the segment

- 11.2.1.3 Microwave and network

- 11.2.1.3.1 Increasing usage for satellite communications, radar signals, smartphones, and navigational applications to drive the segment

- 11.2.1.4 Human machine interface (HMI)

- 11.2.1.4.1 Increasing need for advanced and reliable HMI systems on ship bridges to drive the segment

- 11.2.1.1 VHF communication systems

- 11.2.2 NAVIGATION

- 11.2.2.1 Automatic identification system (AIS) receivers

- 11.2.2.1.1 Increasing usage of AIS receivers to create efficient link between sea and monitoring center

- 11.2.2.2 Direction finders

- 11.2.2.2.1 Increasing usage by ships to establish efficient navigation paths

- 11.2.2.3 Radar

- 11.2.2.3.1 Increasing usage to detect illegal activities around the vicinity of the ship

- 11.2.2.1 Automatic identification system (AIS) receivers

- 11.2.3 SURVEILLANCE & MONITORING

- 11.2.3.1 CCTV Surveillance Camera

- 11.2.3.1.1 Need for latest technology CCTV cameras to provide optimum security onboard ships

- 11.2.3.2 Sensors

- 11.2.3.2.1 Advanced sensor technologies used for navigation and ship stability

- 11.2.3.1 CCTV Surveillance Camera

- 11.2.1 COMMUNICATION

- 11.3 SOLUTION

- 11.3.1 SENSOR INTEGRATOR

- 11.3.1.1 Sensor integrator key to providing efficient navigation and decision-making capabilities

- 11.3.2 ELECTRONIC NAVIGATION CHART (ENC)

- 11.3.2.1 ENCs provide an array of advantages for planning, monitoring, and executing voyages

- 11.3.3 MULTI-SENSOR TRACKER

- 11.3.3.1 Ensures flexible sensor input filtering to provide efficient data to create traffic maps

- 11.3.4 ROUTING MONITOR

- 11.3.4.1 Increasing usage to reduce risk and minimize transit time

- 11.3.1 SENSOR INTEGRATOR

12 REGIONAL ANALYSIS

- 12.1 INTRODUCTION

- FIGURE 31 VESSEL TRAFFIC MANAGEMENT MARKET: REGIONAL SNAPSHOT

- 12.2 COVID-19 IMPACT ON VESSEL TRAFFIC MANAGEMENT MARKET

- TABLE 35 VESSEL TRAFFIC MANAGEMENT MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 VESSEL TRAFFIC MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.3 NORTH AMERICA

- FIGURE 32 NORTH AMERICA: VESSEL TRAFFIC MANAGEMENT MARKET SNAPSHOT

- 12.3.1 PESTLE ANALYSIS: NORTH AMERICA

- TABLE 37 NORTH AMERICA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 38 NORTH AMERICA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 39 NORTH AMERICA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 40 NORTH AMERICA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 41 NORTH AMERICA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 42 NORTH AMERICA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.3.2 US

- 12.3.2.1 Increasing fleet size and recreational sea transport to drive the market

- TABLE 43 US: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 44 US: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 45 US: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 46 US: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.3.3 CANADA

- 12.3.3.1 Investments in upgrade of indigenous marine industry to drive the market

- TABLE 47 CANADA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 48 CANADA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 49 CANADA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 50 CANADA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.4 EUROPE

- FIGURE 33 EUROPE: VESSEL TRAFFIC MANAGEMENT MARKET SNAPSHOT

- 12.4.1 PESTLE ANALYSIS

- TABLE 51 EUROPE: VESSEL TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 52 EUROPE: VESSEL TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 53 EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 54 EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 55 EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 56 EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.4.2 UK

- 12.4.2.1 Increasing investments in port development programs to drive the market

- TABLE 57 UK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 58 UK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 59 UK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 60 UK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.4.3 NORWAY

- 12.4.3.1 Strategic regional to drive the market

- TABLE 61 NORWAY: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 62 NORWAY VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 63 NORWAY: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 64 NORWAY: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.4.4 SWEDEN

- 12.4.4.1 Benefit of sea trade as environmental-friendly alternative to drive the market

- TABLE 65 SWEDEN: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 66 SWEDEN: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 67 SWEDEN: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 68 SWEDEN: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.4.5 DENMARK

- 12.4.5.1 Increase in fleet sizes and tonnage to drive the market

- TABLE 69 DENMARK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 70 DENMARK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 71 DENMARK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 72 DENMARK: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.4.6 FRANCE

- 12.4.6.1 Increasing funding by government to develop competitive trading to drive the market

- TABLE 73 FRANCE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 74 FRANCE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 75 FRANCE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 76 FRANCE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.4.7 REST OF EUROPE

- TABLE 77 REST OF EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 78 REST OF EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 79 REST OF EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 80 REST OF EUROPE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.5 ASIA PACIFIC

- FIGURE 34 ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET SNAPSHOT

- 12.5.1 PESTLE ANALYSIS: ASIA PACIFIC

- TABLE 81 ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 82 ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 83 ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 84 ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 85 ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 86 ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.5.2 CHINA

- 12.5.2.1 Increasing trade of essential and industrial goods through maritime transport to drive the market

- TABLE 87 CHINA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 88 CHINA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 89 CHINA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 90 CHINA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.5.3 INDIA

- 12.5.3.1 Increasing maritime activity to drive Vessel traffic

- TABLE 91 INDIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 92 INDIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 93 INDIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 94 INDIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.5.4 SINGAPORE

- 12.5.4.1 Port Development of Tuas mega-port to incorporate increasing vessel traffic

- TABLE 95 SINGAPORE: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 96 SINGAPORE: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 97 SINGAPORE: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 98 SINGAPORE: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.5.5 INDONESIA

- 12.5.5.1 Increasing trading activity and vessel traffic to drive requirement for VTM systems

- TABLE 99 INDONESIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 100 INDONESIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 101 INDONESIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 102 INDONESIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.5.6 SOUTH KOREA

- 12.5.6.1 Increasing international trade to drive the market

- TABLE 103 SOUTH KOREA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 104 SOUTH KOREA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 105 SOUTH KOREA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 106 SOUTH KOREA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.5.7 AUSTRALIA

- 12.5.7.1 Strategic location in South Pacific to drive the market

- TABLE 107 AUSTRALIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 108 AUSTRALIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 109 AUSTRALIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 110 AUSTRALIA: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.5.8 REST OF ASIA PACIFIC

- TABLE 111 REST OF ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 114 REST OF ASIA PACIFIC: VESSEL TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.6 MIDDLE EAST

- 12.6.1 PESTLE ANALYSIS

- TABLE 115 MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 116 MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 117 MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 118 MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 119 MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 120 MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.6.2 SAUDI ARABIA (KSA)

- 12.6.2.1 Increasing maritime development outlining the Kingdom's Vision 2030 to drive the market

- TABLE 121 SAUDI ARABIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 122 SAUDI ARABIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 123 SAUDI ARABIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 124 SAUDI ARABIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.6.3 UAE

- 12.6.3.1 Advantage of being a logistics and marine center to drive the market

- TABLE 125 UAE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 126 UAE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 127 UAE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 128 UAE: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.6.4 QATAR

- 12.6.4.1 Increasing investments in transportation industry to drive the market

- TABLE 129 QATAR: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 130 QATAR: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 131 QATAR: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 132 QATAR: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.6.5 REST OF MIDDLE EAST

- TABLE 133 REST OF MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 134 REST OF MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 135 REST OF MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 136 REST OF MIDDLE EAST: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.7 LATIN AMERICA

- 12.7.1 PESTLE ANALYSIS

- TABLE 137 LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 138 LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 139 LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 140 LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 141 LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 142 LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.7.2 BRAZIL

- 12.7.2.1 Thriving and dominant port trade to drive the market

- TABLE 143 BRAZIL: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 144 BRAZIL: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 145 BRAZIL: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 146 BRAZIL: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- 12.7.3 ARGENTINA

- 12.7.3.1 Growing trade relations with countries across the world to drive the market

- TABLE 147 ARGENTINA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 148 ARGENTINA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 149 ARGENTINA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 150 ARGENTINA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.7.4 REST OF LATIN AMERICA

- TABLE 151 REST OF LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 152 REST OF LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- TABLE 153 REST OF LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 154 REST OF LATIN AMERICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.8 AFRICA

- 12.8.1 PESTLE ANALYSIS: AFRICA

- TABLE 155 AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 156 AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 157 AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 158 AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 159 AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 160 AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.8.2 SOUTH AFRICA

- 12.8.2.1 Strategic position in sea commerce route to drive the market

- TABLE 161 SOUTH AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 162 SOUTH AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 163 SOUTH AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 164 SOUTH AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- 12.8.3 EGYPT

- 12.8.3.1 Geostrategic location at crossroads of three continents to drive the market

- TABLE 165 EGYPT: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 166 EGYPT: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 167 EGYPT: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 168 EGYPT: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- 12.8.4 ALGERIA

- 12.8.4.1 Increasing investments in freight transport to drive the market

- TABLE 169 ALGERIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 170 ALGERIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 171 ALGERIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 172 ALGERIA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- 12.8.5 REST OF AFRICA

- 12.8.5.1 Increasing investments in transportation help increase the economy of the countries in the region

- TABLE 173 REST OF AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 174 REST OF AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 175 REST OF AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 176 REST OF AFRICA: VESSEL TRAFFIC MANAGEMENT SYSTEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 MARKET SHARE ANALYSIS, 2021

- TABLE 177 DEGREE OF COMPETITION

- FIGURE 35 MARKET SHARE OF TOP PLAYERS IN VESSEL TRAFFIC MANAGEMENT MARKET, 2021 (%)

- 13.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2020

- FIGURE 36 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS IN VESSEL TRAFFIC MANAGEMENT MARKET

- 13.4 COMPANY EVALUATION QUADRANT

- 13.4.1 STARS

- 13.4.2 EMERGING LEADERS

- 13.4.3 PERVASIVE PLAYERS

- 13.4.4 PARTICIPANTS

- FIGURE 37 VESSEL TRAFFIC MANAGEMENT MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

- TABLE 178 COMPANY PRODUCT FOOTPRINT

- TABLE 179 COMPANY FOOTPRINT BY COMPONENT

- TABLE 180 COMPANY FOOTPRINT BY END USER

- TABLE 181 COMPANY REGION FOOTPRINT

- 13.5 STARTUPS EVALUATION QUADRANT

- 13.5.1 PROGRESSIVE COMPANIES

- 13.5.2 RESPONSIVE COMPANIES

- 13.5.3 DYNAMIC COMPANIES

- 13.5.4 STARTING BLOCKS

- FIGURE 38 VESSEL TRAFFIC MANAGEMENT MARKET STARTUPS/SME COMPETITIVE LEADERSHIP MAPPING, 2021

- 13.6 COMPETITIVE BENCHMARKING

- TABLE 182 VESSEL TRAFFIC MANAGEMENT MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 183 VESSEL TRAFFIC MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- 13.7 COMPETITIVE SCENARIO

- 13.7.1 DEALS

- TABLE 184 DEALS, 2017-2021

- 13.7.2 PRODUCT LAUNCHES

- TABLE 185 PRODUCT LAUNCHES, 2017-2021

14 COMPANY PROFILES

- 14.1 KEY COMPANIES

- (Business overview, Products/solutions/services offered, Recent developments, Deals, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)**

- 14.1.1 KONGSBERG GRUPPEN

- TABLE 186 KONGSBERG GRUPPEN: BUSINESS OVERVIEW

- FIGURE 39 KONGSBERG GRUPPEN: COMPANY SNAPSHOT

- TABLE 187 KONGSBERG GRUPPEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 KONGSBERG GRUPPEN: DEALS

- 14.1.2 WARTSILA

- TABLE 189 WARTSILA: BUSINESS OVERVIEW

- FIGURE 40 WARTSILA: COMPANY SNAPSHOT

- TABLE 190 WARTSILA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 WARTSILA: DEAL

- 14.1.3 THALES GROUP

- TABLE 192 THALES GROUP: BUSINESS OVERVIEW

- FIGURE 41 THALES GROUP: COMPANY SNAPSHOT

- TABLE 193 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 THALES GROUP: DEALS

- 14.1.4 LEONARDO S.P.A.

- TABLE 195 LEONARDO S.P.A.: BUSINESS OVERVIEW

- FIGURE 42 LEONARDO S.P.A.: COMPANY SNAPSHOT

- TABLE 196 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 LEONARDO S.P.A.: DEALS

- 14.1.5 SAAB

- TABLE 198 SAAB: BUSINESS OVERVIEW

- FIGURE 43 SAAB: COMPANY SNAPSHOT

- TABLE 199 SAAB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 SAAB: PRODUCT DEVELOPMENTS

- TABLE 201 SAAB: DEALS

- 14.1.6 INDRA SISTEMAS

- TABLE 202 INDRA SISTEMAS: BUSINESS OVERVIEW

- FIGURE 44 INDRA SISTEMAS: COMPANY SNAPSHOT

- TABLE 203 INDRA SISTEMAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 INDRA SISTEMAS: DEAL

- 14.1.7 TOKYO KEIKI

- TABLE 205 TOKYO KEIKI: BUSINESS OVERVIEW

- FIGURE 45 TOKYO KEIKI: COMPANY SNAPSHOT

- TABLE 206 TOKYO KEIKI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.8 HENSOLDT

- TABLE 207 HENSOLDT: BUSINESS OVERVIEW

- FIGURE 46 HENSOLDT: COMPANY SNAPSHOT

- TABLE 208 HENSOLDT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 HENSOLDT: DEALS

- 14.1.9 FREQUENTIS

- TABLE 210 FREQUENTIS: BUSINESS OVERVIEW

- FIGURE 47 FREQUENTIS: COMPANY SNAPSHOT

- TABLE 211 FREQUENTIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 FREQUENTIS: DEALS

- 14.1.10 FURUNO

- TABLE 213 FURUNO: BUSINESS OVERVIEW

- FIGURE 48 FURUNO: COMPANY SNAPSHOT

- TABLE 214 FURUNO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.11 JAPAN RADIO CO. LTD.

- TABLE 215 JAPAN RADIO CO. LTD.: BUSINESS OVERVIEW

- TABLE 216 JAPAN RADIO CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 JAPAN RADIO CO. LTD.: DEALS

- 14.1.12 TERMA

- TABLE 218 TERMA: BUSINESS OVERVIEW

- TABLE 219 TERMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 TERMA: DEALS

- 14.1.13 VISSIM

- TABLE 221 VISSIM: BUSINESS OVERVIEW

- TABLE 222 VISSIM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 VISSIM: DEALS

- 14.1.14 ELCOME INTERNATIONAL LLC

- TABLE 224 ELCOME INTERNATIONAL LLC: BUSINESS OVERVIEW

- TABLE 225 ELCOME INTERNATIONAL LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 ELCOME INTERNATIONAL LLC: DEALS

- 14.1.15 ST ENGINEERING

- TABLE 227 ST ENGINEERING: BUSINESS OVERVIEW

- FIGURE 49 ST ENGINEERING: COMPANY SNAPSHOT

- TABLE 228 ST ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.16 MARLAN MARITIME TECHNOLOGIES

- TABLE 229 MARLAN MARITIME TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 230 MARLAN MARITIME TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.17 XANATOS MARINE LTD.

- TABLE 231 XANATOS MARINE LTD.: BUSINESS OVERVIEW

- TABLE 232 XANATOS MARINE LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 XANATOS MARINE LTD.: DEALS

- 14.1.18 SEA SURVEILLANCE AS

- TABLE 234 SEA SURVEILLANCE AS: BUSINESS OVERVIEW

- TABLE 235 SEA SURVEILLANCE AS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.19 M-NAV SOLUTIONS

- TABLE 236 M-NAV SOLUTIONS: BUSINESS OVERVIEW

- TABLE 237 M-NAV SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.20 A.ST.I.M. S.R.L.

- TABLE 238 A.ST.I.M. S.R.L.: BUSINESS OVERVIEW

- TABLE 239 A.ST.I.M. S.R.L.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2 OTHER PLAYERS

- 14.2.1 MARICO MARINE

- 14.2.2 GEM ELETTRONICA

- 14.2.3 HORIZONTE AS

- 14.2.4 SCORTEL

- 14.2.5 ELMAN S.R.L.

- *Details on Business overview, Products/solutions/services offered, Recent developments, Deals, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATION

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS