|

|

市場調査レポート

商品コード

1075379

果物・野菜原料の世界市場:カテゴリー(果物、野菜)、由来(有機、慣行)、タイプ(濃縮物、ペースト、ピューレ、NFCジュース、野菜・果実片および粉末)、用途、地域別 - 2027年までの予測Fruit & Vegetable Ingredients Market by Category (Fruits and Vegetables), Nature (Organic, Conventional), Type (Concentrates, Pastes & Purees, NFC Juices, and Pieces & Powders), Application, and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 果物・野菜原料の世界市場:カテゴリー(果物、野菜)、由来(有機、慣行)、タイプ(濃縮物、ペースト、ピューレ、NFCジュース、野菜・果実片および粉末)、用途、地域別 - 2027年までの予測 |

|

出版日: 2022年05月09日

発行: MarketsandMarkets

ページ情報: 英文 192 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の果物・野菜原料の市場規模は、2021年に2,078億米ドルとなりました。

同市場は、予測期間中に5.2%のCAGRで推移する見通しで、2027年までに2,809億米ドルに達すると予測されています。同市場は、天然原料に対する認知度の高まりや、天然原料がもたらすコスト効率などより、大幅な成長が見込まれています。

当レポートでは、世界の果物・野菜原料市場について調査しており、市場力学、ケーススタディ、平均販売価格、セグメント・地域別の市場分析、競合情勢、主要企業のプロファイルなどの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場セグメンテーション

- 市場力学

- 促進要因

- 抑制要因

- 市場機会

- 課題

- COVID-19の影響

第6章 動向

- YC-YCCシフト

- バリューチェーン

- テクノロジー分析

- 特許分析

- エコシステムマップとサプライチェーン

- ポーターのファイブフォース分析

- 貿易分析

- ケーススタディ

- 平均販売価格

- 規制の枠組み

- 主な利害関係者と購入基準

- 主な会議とイベント(2022-2023)

第7章 タイプ別:果物・野菜原料市場

- 野菜・果実片および粉末

- 濃縮物

- ペースト・ピューレ

- NFCジュース

第8章 カテゴリー別:果物・野菜原料市場

- 果物

- 野菜

第9章 由来別:果物・野菜原料市場

- 有機

- 従来型

第10章 用途別:果物・野菜原料市場

- 飲料

- 菓子類製品

- RTE製品

- ベーカリー製品

- スープ・ソース

- 乳製品

- その他

第11章 地域別:果物・野菜原料市場

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- イタリア

- 英国

- スペイン

- ドイツ

- フランス

- オランダ

- ポーランド

- その他

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- アフリカ

- 中東

第12章 競合情勢

- 概要

- 市場シェア分析

- 主要企業の戦略

- 主要市場企業の収益分析

- 企業評価クアドラント

- スタートアップの評価クアドラント

第13章 企業プロファイル

- 主要企業

- CARGILL

- DOHLER

- INGREDION

- AGRANA BETEILIGUNGS-AG

- TATE & LYLE

- KERRY

- ADM

- SUNOPTA

- SYMRISE

- OLAM INTERNATIONAL LTD.

- その他の企業

- SENSIENT TECHNOLOGIES CORPORATION

- KANGMED

- FRUTAROM

- BALCHEM INGREDIENT SOLUTIONS

- SVZ INTERNATIONAL BV

- AARKAY FOOD PRODUCTS LTD.

- RFI INGREDIENTS

- HANS ZIPPERLE AG

- BAOR PRODUCTS

- SAIPRO BIOTECH PRIVATE LIMITED

- TAURA NATURAL INGREDIENTS LTD.

- PILMIFRESH

- VENKATESH NATURAL EXTRACT PVT. LTD

- NATURAL INGREDIENTS

- YAAX INTERNATIONAL, INC.

- FUTURECEUTICALS

- INNOVANUTRA

第14章 隣接および関連市場

- 制限

- 特殊原料市場

- 果物・野菜加工市場

第15章 付録

The fruit & vegetable ingredients market is estimated to be valued at USD 207.8 billion in 2021. It is projected to reach USD 280.9 billion by 2027, recording a CAGR of 5.2% during the forecast period. The global fruit & vegetable ingredients market can be defined as those fruit and vegetable products which are processed naturally or chemically to withstand the flavor and taste to be used in various applications-is witnessing significant growth due to the increasing awareness about the natural ingredients and cost-effectiveness offered by them, along with the enhanced functionalities they provide in comparison to native ingredients. Fruit & vegetable ingredients are a processed or semi-processed form of raw fruit & vegetables, which are transformed into concentrates, pastes & purees, Not from Concentrate (NFC) juices, and pieces & powders. The choice of type of fruit & vegetable ingredient depends upon the application they are to be used in.

"Asia Pacific is projected to witness the growth of 6.4% during the forecast period."

The fruit & vegetable ingredients market in Asia Pacific is growing at a CAGR of 6.4% due to the improved agricultural growth over the past decade, as well as the advancements in the food & beverage industry in this region, have resulted in new opportunities for the fruit & vegetable ingredients market. The rising middle-class population, high disposable incomes of the population, and increased demand for healthy and nutritious food & beverage products with natural fruit & vegetable ingredients, drives the growth of the fruit & vegetable ingredients market.

"The pieces and powders segment dominates the market with 37.2% of total market share in terms of value."

The pieces and powders segment dominates the market with 37.2% of total market share in terms of value. Pieces & powders, in its native form, is more suited for ready-to-eat food product applications and is thus gaining a significant level of importance, especially in Europe. The blending properties of powder fruit and vegetable ingredients is considered to be the best among all ingredients since it enhances the taste and flavor of food and beverages

"Fruit& vegetable ingredients have high demand in the beverage industry."

The dominance of this application can be attributed to the growing significance of varied functionality and continued usage of fruit and vegetable ingredients in a diverse range of beverage applications such as shakes, juices, tea, coffee etc.

Break-up of Primaries:

- By Company Type: Tier 1 - 20.0%, Tier 2- 45.0%, Tier 3 - 35.0%

- By Designation: Managers - 21.0%, CXOs - 29.0%, and Executives- 50.0%

- By Region: Europe - 45%, North America - 25%, Asia Pacific - 18%, South America-8% RoW - 4%

Leading players profiled in this report:

1. ADM(U.S)

2. Cargill (U.S)

3. Ingredion (U.S)

4. Tate & Lyle(U.K)

5. Dohler GmbH (Germany)

6. Kerry (Ireland)

7. Sensient Technologies(U.S)

8. AGRANA Beteiligungs-AG( Austria)

9. SunOpta(Canada)

10. SVZ international bv (Netherlans)

11. Aarkay Food Products Ltd.( India)

12. Hans Zipperle Ag(Italy)

13. Baor Products(Spain)

14. Saipro Biotech Private Limited(India)

15. RFI Ingredients(U.S)

Research Coverage:

The report segments the fruit & vegetable ingredients market on the basis of type, category, nature, application and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global fruit & vegetable ingredients, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the fruit & vegetable ingredients market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the fruit& vegetable ingredients market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.1.1 MARKET INTELLIGENCE

- 1.1.2 COMPETITIVE INTELLIGENCE

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.4 REGIONS COVERED

- 1.5 PERIODIZATION CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED

- 1.7 UNITS CONSIDERED

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 FRUIT & VEGETABLE INGREDIENTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE ANALYSIS

- FIGURE 4 KEY ECONOMIES BASED ON GDP, 2018-2021 (USD TRILLION)

- 2.2.3 SUPPLY-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 APPROACH ONE (BASED ON TYPE, BY REGION)

- 2.3.3 APPROACH TWO (BASED ON GLOBAL MARKET)

- 2.4 DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION METHODOLOGY

- 2.5 ASSUMPTIONS FOR THE STUDY

- 2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

- FIGURE 6 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 7 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 8 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY CATEGORY, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY NATURE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 FRUIT & VEGETABLE INGREDIENTS MARKET (VALUE), BY REGION

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN FRUIT & VEGETABLE INGREDIENTS MARKET

- FIGURE 11 GROWING ADOPTION OF CONVENIENCE FOODS TO DRIVE MARKET GROWTH

- 4.2 EUROPE: FRUIT & VEGETABLE INGREDIENTS MARKET, BY TYPE & COUNTRY (2022)

- FIGURE 12 PIECES & POWDERS SEGMENT TO DOMINATE EUROPEAN FRUIT & VEGETABLE INGREDIENTS MARKET IN 2022

- 4.3 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 PIECES & POWDERS SEGMENT WILL CONTINUE TO DOMINATE FRUIT & VEGETABLE INGREDIENTS MARKET IN 2027

- 4.4 FRUIT & VEGETABLE INGREDIENTS MARKET SHARE, BY TYPE & REGION, 2022 VS. 2027

- FIGURE 14 EUROPE TO DOMINATE FRUIT & VEGETABLE INGREDIENTS MARKET FOR ALL TYPE SEGMENTS

- 4.5 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 15 BEVERAGES ARE LARGEST & FASTEST-GROWING SEGMENT OF FRUIT & VEGETABLE INGREDIENTS MARKET

- 4.6 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY CATEGORY, 2022 VS. 2027 (USD MILLION)

- FIGURE 16 FRUIT INGREDIENTS DOMINATE MARKET DURING FORECAST PERIOD

- 4.7 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY NATURE, 2022 VS. 2027 (USD MILLION)

- FIGURE 17 CONVENTIONAL INGREDIENTS DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET SEGMENTATION

- 5.3 MARKET DYNAMICS

- FIGURE 18 FRUIT & VEGETABLE INGREDIENTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.3.1 DRIVERS

- 5.3.1.1 Growing demand for food preservatives

- 5.3.1.2 Health-promoting activities and government initiatives

- 5.3.1.3 Growing popularity of convenience foods

- 5.3.1.4 Rise in global trade of fruits & vegetables

- 5.3.1.5 Increasing demand for natural ingredients

- 5.3.1.6 Rising demand for sustainable products

- 5.3.2 RESTRAINTS

- 5.3.2.1 Stringent food safety regulations

- 5.3.2.2 Seasonal variations in supply of raw materials and adverse weather conditions

- 5.3.2.3 Dependence on import of fruits & vegetables in certain countries

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Inclination of consumers towards healthier alternatives

- 5.3.3.2 Countries with emerging economies

- 5.3.3.2.1 Emerging markets & changing consumer lifestyles

- TABLE 2 GDP GROWTH OF EMERGING MARKETS, 2021 VS. 2022

- 5.3.3.2.2 Growth opportunities in untapped markets

- 5.3.4 CHALLENGES

- 5.3.4.1 Infrastructural challenges in developing countries

- 5.3.4.2 Demand for clean-label products from consumers

- 5.4 COVID-19 IMPACT

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 YC-YCC SHIFT

- FIGURE 19 FRUIT & VEGETABLE INGREDIENTS MARKET: TRENDS AND DISRUPTIONS AFFECTING CUSTOMERS' BUSINESSES

- 6.3 VALUE CHAIN

- 6.3.1 RESEARCH & DEVELOPMENT

- 6.3.2 SOURCING OF RAW MATERIALS

- 6.3.3 PRODUCTION & PROCESSING

- 6.3.4 DISTRIBUTION, MARKETING, AND SALES

- FIGURE 20 FRUIT & VEGETABLE INGREDIENTS MARKET: VALUE CHAIN

- 6.4 TECHNOLOGY ANALYSIS

- FIGURE 21 FRUIT CANNING PROCESS FLOW

- FIGURE 22 VEGETABLE CANNING PROCESS FLOW

- 6.5 PATENT ANALYSIS

- TABLE 3 KEY PATENTS PERTAINING TO FRUIT & VEGETABLE INGREDIENTS, 2018-2022

- 6.6 ECOSYSTEM MAP AND SUPPLY CHAIN

- 6.6.1 FRUIT & VEGETABLE INGREDIENTS: MARKET MAP OF ECOSYSTEM

- FIGURE 23 FRUIT & VEGETABLE INGREDIENTS MARKET: SUPPLY CHAIN

- 6.6.2 FRUIT & VEGETABLE INGREDIENTS: MARKET MAP

- FIGURE 24 ECOSYSTEM VIEW

- 6.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 FRUIT & VEGETABLE INGREDIENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.7.1 THREAT OF NEW ENTRANTS

- 6.7.2 THREAT OF SUBSTITUTES

- 6.7.3 BARGAINING POWER OF SUPPLIERS

- 6.7.4 BARGAINING POWER OF BUYERS

- 6.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.8 TRADE ANALYSIS

- 6.8.1 PASTES & PUREES

- TABLE 5 TOP 10 EXPORTERS AND IMPORTERS OF PASTES & PUREES, 2020 (USD THOUSAND)

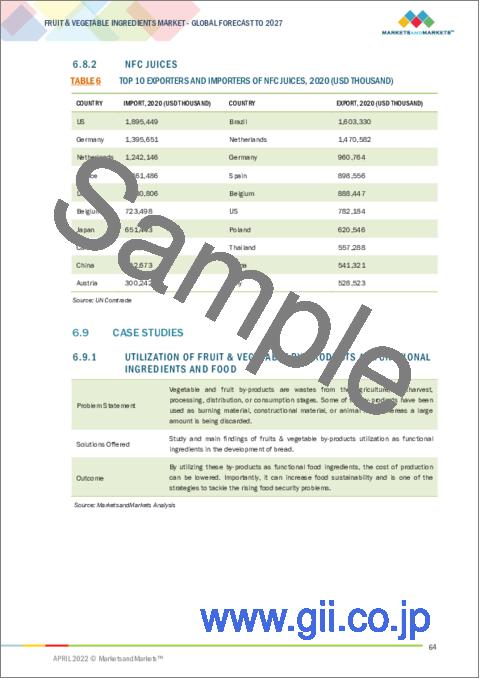

- 6.8.2 NFC JUICES

- TABLE 6 TOP 10 EXPORTERS AND IMPORTERS OF NFC JUICES, 2020 (USD THOUSAND)

- 6.9 CASE STUDIES

- 6.9.1 UTILIZATION OF FRUIT & VEGETABLE BY-PRODUCTS AS FUNCTIONAL INGREDIENTS AND FOOD

- 6.10 AVERAGE SELLING PRICES

- 6.10.1 AVERAGE SELLING PRICE TREND ANALYSIS

- TABLE 7 FRUIT & VEGETABLE INGREDIENTS: AVERAGE SELLING PRICES, BY TYPE (USD/KG)

- 6.11 REGULATORY FRAMEWORK

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

- 6.11.1.1 North America

- 6.11.1.2 Europe

- 6.11.1.3 Asia Pacific

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS IN BUYING FRUIT & VEGETABLE INGREDIENTS FOR FOOD & BEVERAGE, FEED, AND INDUSTRIAL APPLICATIONS

- TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING FOR TOP 3 APPLICATIONS

- 6.12.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- TABLE 9 KEY BUYING CRITERIA FOR FRUIT & VEGETABLE INGREDIENT APPLICATIONS

- 6.13 KEY CONFERENCES & EVENTS, 2022-2023

- TABLE 10 FOOD & BEVERAGE INGREDIENTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022-2023

7 FRUIT & VEGETABLE INGREDIENTS MARKET, BY TYPE

- 7.1 INTRODUCTION

- TABLE 11 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 12 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- FIGURE 27 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2022 VS. 2027 (KT)

- FIGURE 28 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

- 7.2 PIECES & POWDERS

- 7.2.1 GROWTH IN FOOD PROCESSING INDUSTRIES TO PROPEL MARKET FOR PIECES & POWDERS

- TABLE 13 PIECES & POWDERS MARKET SIZE, BY REGION, 2019-2027 (KT)

- TABLE 14 PIECES & POWDERS MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 7.3 CONCENTRATES

- 7.3.1 LOWER STORAGE COSTS ARE A KEY ADVANTAGE OF CONCENTRATES

- TABLE 15 CONCENTRATES MARKET SIZE, BY REGION, 2019-2027 (KT)

- TABLE 16 CONCENTRATES MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 7.4 PASTES & PUREES

- 7.4.1 INCREASING DEMAND FOR READY-TO-EAT SNACKS TO PROPEL MARKET GROWTH

- TABLE 17 PASTES & PUREES MARKET SIZE, BY REGION, 2019-2027 (KT)

- TABLE 18 PASTES & PUREES MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 7.5 NFC JUICES

- 7.5.1 NEGLIGIBLE AMOUNT OF CHEMICAL COMPOSITION WITH NATURAL PROPERTIES HAS INCREASED DEMAND FOR NFC JUICES

- TABLE 19 NFC JUICES MARKET SIZE, BY REGION, 2019-2027 (KT)

- TABLE 20 NFC JUICES MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

8 FRUIT & VEGETABLE INGREDIENTS MARKET, BY CATEGORY

- 8.1 INTRODUCTION

- TABLE 21 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY CATEGORY, 2019-2027 (USD MILLION)

- FIGURE 29 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY CATEGORY, 2022 VS. 2027 (USD MILLION)

- 8.2 FRUITS

- 8.2.1 FRUIT INGREDIENTS ARE LARGEST AND FASTEST-GROWING SEGMENT

- TABLE 22 FRUIT INGREDIENTS MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 8.3 VEGETABLES

- 8.3.1 INCREASING CONSUMPTION OF PROCESSED FOOD & BEVERAGE PRODUCTS TO SUPPORT MARKET GROWTH

- TABLE 23 VEGETABLE INGREDIENTS MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

9 FRUIT & VEGETABLE INGREDIENTS MARKET, BY NATURE

- 9.1 INTRODUCTION

- TABLE 24 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY NATURE, 2019-2027 (USD MILLION)

- FIGURE 30 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY NATURE, 2022 VS. 2027 (USD MILLION)

- 9.2 ORGANIC

- 9.2.1 INCREASING DEMAND FOR ORGANIC FOODS & BEVERAGES FROM ESTABLISHED ECONOMIES TO FAVOR MARKET GROWTH

- TABLE 25 ORGANIC FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 9.3 CONVENTIONAL

- 9.3.1 EASY AVAILABILITY OF CONVENTIONAL INGREDIENTS TO SUPPORT THEIR ADOPTION

- TABLE 26 CONVENTIONAL FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

10 FRUIT & VEGETABLE INGREDIENTS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 31 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- TABLE 27 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY APPLICATION, 2019-2027 (USD MILLION)

- 10.2 BEVERAGES

- 10.2.1 RISE OF HEALTH-CONSCIOUS CONSUMERS TO DRIVE ADOPTION OF BEVERAGES

- FIGURE 32 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE FOR BEVERAGES, BY REGION, 2022 VS. 2027 (USD MILLION)

- TABLE 28 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE FOR BEVERAGES, BY REGION, 2019-2027 (USD MILLION)

- 10.3 CONFECTIONERY PRODUCTS

- 10.3.1 INCREASED SHELF STABILITY AND EASE OF USE ARE BENEFITS OF USING FRUITS & VEGETABLES IN BAKED GOODS

- TABLE 29 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE FOR CONFECTIONERY PRODUCTS, BY REGION, 2019-2027 (USD MILLION)

- 10.4 RTE PRODUCTS

- 10.4.1 FRUIT & VEGETABLE CONCENTRATES ARE ADDED TO RTE PRODUCTS AS THEY IMPART NATURAL COLORS AND FLAVORS

- TABLE 30 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE FOR RTE PRODUCTS, BY REGION, 2019-2027 (USD MILLION)

- 10.5 BAKERY PRODUCTS

- 10.5.1 BAKING WITH NATURAL FRUIT INGREDIENTS RENDERS A NATURAL AND FRESH APPEAL TO PRODUCTS

- TABLE 31 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE FOR BAKERY PRODUCTS, BY REGION, 2019-2027 (USD MILLION)

- 10.6 SOUPS & SAUCES

- 10.6.1 FRUIT & VEGETABLE INGREDIENTS ADD NATURAL FLAVOR TO SOUPS & SAUCES

- TABLE 32 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE FOR SOUPS & SAUCES, BY REGION, 2019-2027 (USD MILLION)

- 10.7 DAIRY PRODUCTS

- 10.7.1 FRUIT INGREDIENTS SWEETEN DAIRY FOODS NATURALLY

- FIGURE 33 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE FOR DAIRY PRODUCTS, BY REGION, 2022 VS. 2027 (USD MILLION)

- TABLE 33 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE FOR DAIRY PRODUCTS, BY REGION, 2019-2027 (USD MILLION)

- 10.8 OTHER APPLICATIONS

- TABLE 34 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2019-2027 (USD MILLION)

11 FRUIT & VEGETABLE INGREDIENTS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 34 FRUIT & VEGETABLE INGREDIENTS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- TABLE 35 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- TABLE 36 FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY REGION, 2019-2027 (KT)

- 11.2 NORTH AMERICA

- TABLE 37 NORTH AMERICA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 38 NORTH AMERICA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY COUNTRY, 2019-2027 (KT)

- TABLE 39 NORTH AMERICA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 40 NORTH AMERICA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY CATEGORY, 2019-2027 (USD MILLION)

- TABLE 41 NORTH AMERICA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY NATURE, 2019-2027 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 US is largest & fastest-growing market for fruit & vegetable ingredients in North America

- TABLE 42 US: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 43 US: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.2.2 CANADA

- 11.2.2.1 Important role of agriculture in Canada to favor market growth

- TABLE 44 CANADA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 45 CANADA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.2.3 MEXICO

- 11.2.3.1 Mexico sources around 90% of its food processing ingredients locally

- TABLE 46 MEXICO: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 47 MEXICO: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.3 EUROPE

- FIGURE 35 EUROPE: FRUIT & VEGETABLE INGREDIENTS MARKET SNAPSHOT

- TABLE 48 EUROPE: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 49 EUROPE: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY COUNTRY, 2019-2027 (KT)

- TABLE 50 EUROPE: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 51 EUROPE: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY CATEGORY, 2019-2027 (USD MILLION)

- TABLE 52 EUROPE: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY NATURE, 2019-2027 (USD MILLION)

- 11.3.1 ITALY

- 11.3.1.1 COVID-19 has accelerated Italy's healthy eating trend

- TABLE 53 ITALY: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 54 ITALY: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.3.2 UK

- 11.3.2.1 Health and wellbeing are key trends driving market growth

- TABLE 55 UK: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 56 UK: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.3.3 SPAIN

- 11.3.3.1 Spain is major producer and exporter of food and agricultural products

- TABLE 57 SPAIN: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- TABLE 58 SPAIN: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- 11.3.4 GERMANY

- 11.3.4.1 Germany is largest market for food & beverages in Europe

- TABLE 59 GERMANY: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 60 GERMANY: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.3.5 FRANCE

- 11.3.5.1 Agri-food industry contributes significantly to French economy

- TABLE 61 FRANCE: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 62 FRANCE: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.3.6 NETHERLANDS

- 11.3.6.1 Netherlands is largest importing country in EU for agricultural products

- TABLE 63 NETHERLANDS: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- TABLE 64 NETHERLANDS: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- 11.3.7 POLAND

- 11.3.7.1 Internal demand and export have stimulated growth in Polish food processing sector

- TABLE 65 POLAND: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 66 POLAND: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.3.8 REST OF EUROPE

- TABLE 67 REST OF EUROPE: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 68 REST OF EUROPE: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.4 ASIA PACIFIC

- TABLE 69 ASIA PACIFIC: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 70 ASIA PACIFIC: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY COUNTRY, 2019-2027 (KT)

- TABLE 71 ASIA PACIFIC: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 72 ASIA PACIFIC: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY CATEGORY, 2019-2027 (USD MILLION)

- TABLE 73 ASIA PACIFIC: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY NATURE, 2019-2027 (USD MILLION)

- 11.4.1 CHINA

- 11.4.1.1 China is largest & fastest-growing country in APAC

- TABLE 74 CHINA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 75 CHINA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.4.2 JAPAN

- 11.4.2.1 Japan has well-developed and innovative food industries

- TABLE 76 JAPAN: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 77 JAPAN: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.4.3 INDIA

- 11.4.3.1 India is world's largest producer of many fresh fruits & vegetables

- TABLE 78 INDIA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 79 INDIA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Fruit & vegetable ingredients account for large portion of Australia's processed food & beverage exports

- TABLE 80 AUSTRALIA & NEW ZEALAND: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 81 AUSTRALIA & NEW ZEALAND: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.4.5 REST OF ASIA PACIFIC

- TABLE 82 REST OF ASIA PACIFIC: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 83 REST OF ASIA PACIFIC: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.5 SOUTH AMERICA

- TABLE 84 SOUTH AMERICA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 85 SOUTH AMERICA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY COUNTRY, 2019-2027 (KT)

- TABLE 86 SOUTH AMERICA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 87 SOUTH AMERICA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY CATEGORY, 2019-2027 (USD MILLION)

- TABLE 88 SOUTH AMERICA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY NATURE, 2019-2027 (USD MILLION)

- 11.5.1 BRAZIL

- 11.5.1.1 Brazil is largest economy in South America

- TABLE 89 BRAZIL: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 90 BRAZIL: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.5.2 ARGENTINA

- 11.5.2.1 F&B industry is among major contributors to Argentine economy

- TABLE 91 ARGENTINA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 92 ARGENTINA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.5.3 REST OF SOUTH AMERICA

- TABLE 93 REST OF SOUTH AMERICA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 94 REST OF SOUTH AMERICA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.6 REST OF THE WORLD (ROW)

- TABLE 95 REST OF THE WORLD: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- TABLE 96 REST OF THE WORLD: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY REGION, 2019-2027 (KT)

- TABLE 97 REST OF THE WORLD: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 98 REST OF THE WORLD: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY CATEGORY, 2019-2027 (USD MILLION)

- TABLE 99 REST OF THE WORLD: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY NATURE, 2019-2027 (USD MILLION)

- 11.6.1 AFRICA

- 11.6.1.1 South Africa is largest exporter of agricultural products in Africa

- TABLE 100 AFRICA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 101 AFRICA: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

- 11.6.2 MIDDLE EAST

- 11.6.2.1 Increasing adoption of healthier food habits in Middle East countries

- TABLE 102 MIDDLE EAST: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 103 MIDDLE EAST: FRUIT & VEGETABLE INGREDIENTS MARKET SIZE, BY TYPE, 2019-2027 (KT)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS

- FIGURE 36 MARKET SHARE ANALYSIS, 2021

- 12.3 KEY PLAYER STRATEGIES

- 12.3.1 DEALS

- TABLE 104 DEALS, 2019-2021

- 12.3.2 OTHER DEVELOPMENTS

- TABLE 105 OTHER DEVELOPMENTS, 2019-2021

- 12.4 REVENUE ANALYSIS OF MAJOR MARKET PLAYERS

- FIGURE 37 REVENUE ANALYSIS OF MAJOR MARKET PLAYERS, 2018-2020

- 12.5 COMPANY EVALUATION QUADRANT

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 38 GLOBAL FRUIT & VEGETABLE INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 12.6 STARTUP EVALUATION QUADRANT

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 STARTING BLOCKS

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 DYNAMIC COMPANIES

- FIGURE 39 GLOBAL FRUIT & VEGETABLE INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT FOR SMES/STARTUPS, 2021

13 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, and MnM View)**

- 13.1 KEY PLAYERS

- 13.1.1 CARGILL

- TABLE 106 CARGILL: BUSINESS OVERVIEW

- FIGURE 40 CARGILL: COMPANY SNAPSHOT

- TABLE 107 CARGILL: PRODUCTS OFFERED

- 13.1.2 DOHLER

- TABLE 108 DOHLER: BUSINESS OVERVIEW

- TABLE 109 DOHLER: PRODUCTS OFFERED

- 13.1.3 INGREDION

- TABLE 110 INGREDION: BUSINESS OVERVIEW

- FIGURE 41 INGREDION: COMPANY SNAPSHOT

- TABLE 111 INGREDION: PRODUCTS OFFERED

- 13.1.4 AGRANA BETEILIGUNGS-AG

- TABLE 112 AGRANA BETEILIGUNGS-AG: BUSINESS OVERVIEW

- FIGURE 42 AGRANA BETEILIGUNGS-AG: COMPANY SNAPSHOT

- TABLE 113 AGRANA BETEILIGUNGS-AG: PRODUCTS OFFERED

- 13.1.5 TATE & LYLE

- TABLE 114 TATE & LYLE: BUSINESS OVERVIEW

- FIGURE 43 TATE & LYLE: COMPANY SNAPSHOT

- TABLE 115 TATE & LYLE: PRODUCTS OFFERED

- TABLE 116 TATE & LYLE: DEALS

- 13.1.6 KERRY

- TABLE 117 KERRY: BUSINESS OVERVIEW

- FIGURE 44 KERRY: COMPANY SNAPSHOT

- TABLE 118 KERRY: PRODUCTS OFFERED

- TABLE 119 KERRY: DEALS

- TABLE 120 KERRY: OTHER DEVELOPMENTS

- 13.1.7 ADM

- TABLE 121 ADM: BUSINESS OVERVIEW

- FIGURE 45 ADM: COMPANY SNAPSHOT

- TABLE 122 ADM: PRODUCTS OFFERED

- 13.1.8 SUNOPTA

- TABLE 123 SUNOPTA: BUSINESS OVERVIEW

- TABLE 124 SUNOPTA: PRODUCTS OFFERED

- 13.1.9 SYMRISE

- TABLE 125 SYMRISE: BUSINESS OVERVIEW

- TABLE 126 SYMRISE: PRODUCTS OFFERED

- 13.1.10 OLAM INTERNATIONAL LTD.

- TABLE 127 OLAM INTERNATIONAL LTD.: BUSINESS OVERVIEW

- FIGURE 46 OLAM INTERNATIONAL LTD.: COMPANY SNAPSHOT

- TABLE 128 OLAM INTERNATIONAL LTD.: PRODUCTS OFFERED

- 13.2 OTHER PLAYERS

- 13.2.1 SENSIENT TECHNOLOGIES CORPORATION

- TABLE 129 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 130 SENSIENT TECHNOLOGIES CORPORATION: PRODUCTS OFFERED

- 13.2.2 KANGMED

- TABLE 131 KANGMED: BUSINESS OVERVIEW

- TABLE 132 KANGMED: PRODUCTS OFFERED

- 13.2.3 FRUTAROM

- TABLE 133 FRUTAROM: BUSINESS OVERVIEW

- TABLE 134 FRUTAROM: PRODUCTS OFFERED

- 13.2.4 BALCHEM INGREDIENT SOLUTIONS

- TABLE 135 BALCHEM INGREDIENT SOLUTIONS: BUSINESS OVERVIEW

- TABLE 136 BALCHEM INGREDIENT SOLUTIONS: PRODUCTS OFFERED

- 13.2.5 SVZ INTERNATIONAL BV

- TABLE 137 SVZ INTERNATIONAL BV: BUSINESS OVERVIEW

- TABLE 138 SVZ INTERNATIONAL BV: PRODUCTS OFFERED

- 13.2.6 AARKAY FOOD PRODUCTS LTD.

- 13.2.7 RFI INGREDIENTS

- 13.2.8 HANS ZIPPERLE AG

- 13.2.9 BAOR PRODUCTS

- 13.2.10 SAIPRO BIOTECH PRIVATE LIMITED

- 13.2.11 TAURA NATURAL INGREDIENTS LTD.

- 13.2.12 PILMIFRESH

- 13.2.13 VENKATESH NATURAL EXTRACT PVT. LTD

- 13.2.14 NATURAL INGREDIENTS

- 13.2.15 YAAX INTERNATIONAL, INC.

- 13.2.16 FUTURECEUTICALS

- 13.2.17 INNOVANUTRA

- * Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 139 ADJACENT MARKETS TO FRUIT & VEGETABLE INGREDIENTS

- 14.2 LIMITATIONS

- 14.3 SPECIALTY INGREDIENTS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- TABLE 140 SPECIALTY INGREDIENTS MARKET SIZE, BY FLAVOR ORIGIN, 2018-2025 (USD MILLION)

- 14.4 FRUIT & VEGETABLE PROCESSING MARKET

- 14.4.1 MARKET DEFINITION

- TABLE 141 PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2015-2022 (USD BILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL:

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS