|

|

市場調査レポート

商品コード

1073627

工業用バーナーの世界市場 - 2027年までの予測:バーナーの種類別 (リジェネレイティブ、高熱、放射、直火) 、燃料タイプ別 (石油、ガス、2系統、固形) 、最終用途産業別、動作温度別、オートメーション別、地域別Industrial Burner Market by Type (Regenerative, High Thermal, Radiant, Direct-Fired), Fuel Type (Oil, Gas, Dual, Solid), End Use (F&B, Petrochemical, Power, Chemical, Metals & Mining), Operating Temperature, Automation, Region - Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 工業用バーナーの世界市場 - 2027年までの予測:バーナーの種類別 (リジェネレイティブ、高熱、放射、直火) 、燃料タイプ別 (石油、ガス、2系統、固形) 、最終用途産業別、動作温度別、オートメーション別、地域別 |

|

出版日: 2022年05月04日

発行: MarketsandMarkets

ページ情報: 英文 234 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の工業用バーナーの市場規模は、2022年の推定59億米ドルから、2027年には79億米ドルに達し、予測期間中のCAGRで6.1%の成長が予測されています。

特に欧州で、天然ガスを使用した工業用バーナーの展開が増加していることから、市場は有望な成長の可能性を秘めています。

当レポートでは、世界の工業用バーナー市場について調査分析し、市場概要、業界動向、セグメント別の市場分析、競合情勢、主要企業などについて、最新の情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- COVID-19の健康評価

- COVID-19の経済評価

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- バリューチェーン分析

- 市場マップ

- 価格分析

- 技術分析

- コードと規制の枠組み

- ポーターのファイブフォース分析

- 主要ステークホルダーと購入基準

- ケーススタディ分析

- イノベーションと特許登録

- 主要会議とイベント

第6章 工業用バーナー市場:バーナーの種類別

- リジェネレイティブバーナー

- 高熱放出バーナー

- 放射バーナー

- 直火バーナー

- 自己回復型バーナー

- その他

第7章 工業用バーナー市場:燃料タイプ別

- 石油

- ガス

- 2系統燃料

- 固形燃料

第8章 工業用バーナー市場:オートメーション別

- モノブロック

- デュオブロック

第9章 工業用バーナー市場:動作温度別

- 低温 (華氏1,400度未満)

- 高温 (華氏1,400度超)

第10章 工業用バーナー市場:最終用途産業別

- 食品・飲料

- 発電

- 化学薬品

- 石油化学

- 金属・鉱業

- 自動車

- その他

第11章 地域分析

- アジア太平洋地域

- 北米

- 欧州

- 中東・アフリカ

- 南米

第12章 競合情勢

- 主要企業の戦略

- 上位企業6社の市場シェア分析

- 主要市場企業の収益分析

- 企業の評価象限

- スタートアップ/中小企業の評価象限

- 工業用バーナー市場:企業のフットプリント

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- ANDRITZ GROUP

- NIBE GROUP

- HONEYWELL INTERNATIONAL INC.

- ARISTON GROUP N. V.

- FIVES

- WEISHAUPT

- SELAS HEAT TECHNOLOGY COMPANY

- RIELLO S. P. A.

- C.I.B. UNIGAS S.P.A.

- EBICO

- BALTUR S.P.A.

- OILON GROUP OY

- OXILON PVT LTD

- ZEECO

- ALZETA CORPORATION

- その他の企業

- BLOOM ENGINEERING

- LIMPSFIELD COMBUSTION ENGINEERING

- POWER FLAME INC.

- WESMAN GROUP

- SOOKOOK CORPORATION

- JOHN ZINK HAMWORTHY COMBUSTION

- SAACKE GMBH

- WAYNE COMBUSTION SYSTEMS

- FABER BURNER COMPANY

- MFBURNER

第14章 付録

The industrial burner market is anticipated to grow from an estimated USD 5.9 billion in 2022 to USD 7.9 billion in 2027, at a CAGR of 6.1% during the forecast period. The market has a promising growth potential due to increased deployment of natural gas-based industrial burners, especially in Europe. The rapidly expanding manufacturing sector is also propelling demand for industrial burners and combustion systems. The rising adoption of biofuels, hazardous waste, and hydrogen-based industrial burners are expected to offer lucrative opportunities for the industrial burner market during the forecast period.

"Monoblock: The fastest-growing segment of the industrial burner market, by automation"

The automation segment is categorized as monoblock and duo block. Monoblock burners are compact, have reduced footprint, and are specially designed to minimize NOx emissions. The ease of installation, adjustment, and maintenance of monoblock burners is expected to fuel the growth of the segment during the forecast period.

"Chemicals segment is expected to emerge as the largest segment based on end-user industry"

The industrial burner market has been segmented on the basis of end-user industry into food & beverages, power generation, chemicals, petrochemicals, metals & mining, automotive, and others. The others segment includes textiles, glass, paper and pulp, ceramics, and rubber. The commercial segment is expected to hold the largest market share owing to the growing use of burners in ethylene cracking and other chemical processes. Emerging markets such as Asia Pacific, South Asia, Africa, the Middle East, and Latin America are expected to be the main drivers of this growth, supported by the rising income levels and a growing middle-class population.

" North America is expected to account for the second-largest market size during the forecast period."

North America is expected to be the second-largest and fastest-growing market due to the growing need for petrochemical-derived products and oil & natural gas resources, upgrade of aging power infrastructure, as well as the growth of the chemicals industry. Stringent emission norms, low natural gas prices, and more efficient new natural gas technology prompted plants to transition from coal to natural gas. Thus propelling the growth of natural gas-fired burners in US.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 65%, Tier 2- 24%, and Tier 3- 11%

By Designation: C-Level- 30%, Director Level- 25%, and Others- 45%

By Region: Europe- 20%, Asia Pacific- 33%, North America- 27%, the Middle East & Africa- 12%, and South America- 8%

Note: Others includes product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2017. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The industrial burner market is dominated by a few major players that have a wide regional presence. The leading players in the industrial burner market are ANDRITZ Group (Austria), NIBE Group (Sweden), Honeywell International Inc. (US), Ariston Group N.V. (Italy), Fives (France), and Riello S. p. A. (Italy).

Research Coverage:

The report defines, describes, and forecasts the global industrial burner market, by fuel type, burner type, automation, operating temperature, end-user industry, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the industrial burner market.

Key Benefits of Buying the Report

1. The report identifies and addresses the key markets for industrial burner, which would help equipment manufacturers review the growth in demand.

2. The report helps system providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

3. The report will help key players understand the strategies of their competitors better and help them in making better strategic decisions.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 DEFINITION

- 1.2.1 INDUSTRIAL BURNER MARKET, BY BURNER TYPE: INCLUSIONS & EXCLUSIONS

- 1.2.2 INDUSTRIAL BURNER MARKET, BY AUTOMATION: INCLUSIONS & EXCLUSIONS

- 1.2.3 INDUSTRIAL BURNER MARKET, BY FUEL TYPE: INCLUSIONS & EXCLUSIONS

- 1.2.4 INDUSTRIAL BURNER MARKET, BY OPERATING TEMPERATURE: INCLUSIONS & EXCLUSIONS

- 1.2.5 INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY: INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 INDUSTRIAL BURNER MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 INDUSTRIAL BURNER MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- 2.3 IMPACT OF COVID-19 ON INDUSTRY

- 2.4 SCOPE

- FIGURE 3 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR INDUSTRIAL BURNERS

- 2.5 MARKET SIZE ESTIMATION

- 2.5.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.5.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.5.3 DEMAND-SIDE ANALYSIS

- 2.5.3.1 Assumptions for demand side

- 2.5.3.2 Calculation for demand-side

- 2.5.4 SUPPLY-SIDE ANALYSIS

- FIGURE 6 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF INDUSTRIAL BURNERS

- FIGURE 7 INDUSTRIAL BURNER MARKET: SUPPLY-SIDE ANALYSIS

- 2.5.4.1 Supply-side calculation

- 2.5.4.2 Assumptions for supply side

- FIGURE 8 COMPANY REVENUE ANALYSIS, 2020

- 2.6 FORECAST

3 EXECUTIVE SUMMARY

- TABLE 1 INDUSTRIAL BURNER MARKET SNAPSHOT

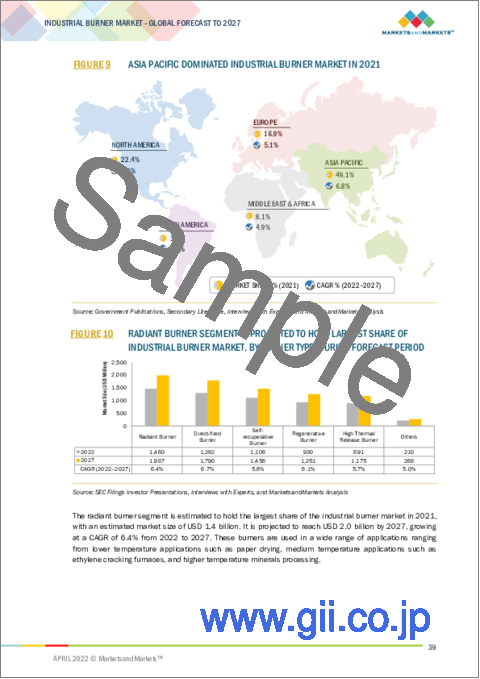

- FIGURE 9 ASIA PACIFIC DOMINATED INDUSTRIAL BURNER MARKET IN 2021

- FIGURE 10 RADIANT BURNER SEGMENT IS PROJECTED TO HOLD LARGEST SHARE OF INDUSTRIAL BURNER MARKET, BY BURNER TYPE, DURING FORECAST PERIOD

- FIGURE 11 MONOBLOCK IS EXPECTED TO LEAD INDUSTRIAL BURNER MARKET, BY AUTOMATION, DURING FORECAST PERIOD

- FIGURE 12 GAS SEGMENT IS PROJECTED TO REGISTER HIGHEST CAGR IN INDUSTRIAL BURNER MARKET, BY FUEL TYPE, DURING FORECAST PERIOD

- FIGURE 13 CHEMICALS SEGMENT IS PROJECTED TO HOLD LARGEST SIZE OF INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, DURING FORECAST PERIOD

- FIGURE 14 HIGH TEMPERATURE (>1400°F) SEGMENT IS PROJECTED TO WITNESS THE HIGHEST CAGR IN INDUSTRIAL BURNER MARKET, BY OPERATING TEMPERATURE, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN INDUSTRIAL BURNER MARKET

- FIGURE 15 SURGING ADOPTION OF DUAL-FUEL INDUSTRIAL BURNERS TO DRIVE INDUSTRIAL BURNER MARKET

- 4.2 INDUSTRIAL BURNER MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC INDUSTRIAL BURNER MARKET IS PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC INDUSTRIAL BURNER MARKET, BY BURNER TYPE AND COUNTRY

- FIGURE 17 DIRECT-FIRED BURNER SEGMENT IN CHINA DOMINATED ASIA PACIFIC INDUSTRIAL BURNER MARKET IN 2021

- 4.4 INDUSTRIAL BURNER MARKET, BY FUEL TYPE

- FIGURE 18 OIL SEGMENT IS PROJECTED TO CONTINUE TO HOLD LARGER SIZE OF INDUSTRIAL BURNER MARKET, BY FUEL TYPE, UNTIL 2027

- 4.5 INDUSTRIAL BURNER MARKET, BY AUTOMATION

- FIGURE 19 MONOBLOCK SEGMENT IS PROJECTED TO CONTINUE TO HOLD LARGER SIZE OF INDUSTRIAL BURNER MARKET, BY AUTOMATION, UNTIL 2027

- 4.6 INDUSTRIAL BURNER MARKET, BY OPERATING TEMPERATURE

- FIGURE 20 HIGH TEMPERATURE (>1400°F) IS PROJECTED TO CONTINUE TO HOLD LARGER SIZE OF INDUSTRIAL BURNER MARKET, BY OPERATING TEMPERATURE, UNTIL 2027

- 4.7 INDUSTRIAL BURNER MARKET, BY BURNER TYPE

- FIGURE 21 RADIANT BURNER SEGMENT TO DOMINATE INDUSTRIAL BURNER MARKET, BY BURNER TYPE, IN 2027

- 4.8 INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY

- FIGURE 22 CHEMICALS SEGMENT TO HOLD LARGEST SHARE OF INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, IN 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 COVID-19 HEALTH ASSESSMENT

- FIGURE 23 COVID-19 GLOBAL PROPAGATION

- FIGURE 24 COVID-19 PROPAGATION IN SELECTED COUNTRIES

- 5.3 COVID-19 ECONOMIC ASSESSMENT

- FIGURE 25 COMPARISON OF GDP FOR SELECT G20 COUNTRIES IN 2020

- 5.4 MARKET DYNAMICS

- FIGURE 26 INDUSTRIAL BURNER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.4.1 DRIVERS

- 5.4.1.1 Increasing power generation worldwide fueling demand for industrial burners

- FIGURE 27 ELECTRICITY CONSUMPTION (TWH), 2017-2020

- 5.4.1.2 Surging adoption of dual-fuel industrial burners to lower imprint of depleting fossil fuels

- TABLE 2 FOSSIL FUEL EMISSION LEVELS (POUNDS PER BILLION BTU OF ENERGY), 2021

- FIGURE 28 COMPARISON OF DEMAND FOR BIOFUEL VS. OTHER FUELS, 2020 & 2026

- 5.4.1.3 Increased deployment of natural gas-based industrial burners, especially in Europe

- TABLE 3 TOP 10 NATURAL GAS CONSUMERS IN WORLD (2020)

- FIGURE 29 BIOFUEL DEMAND, BY REGION, 2019 TO 2026

- 5.4.2 RESTRAINTS

- 5.4.2.1 Significant capital investment requirement for boiler-based burners

- 5.4.2.2 Implementation of stringent government regulations pertaining to environmental pollution

- 5.4.3 OPPORTUNITIES

- 5.4.3.1 Aging power generation infrastructure and increasing refurbishment of industrial burners used in other applications

- 5.4.3.2 Development of sophisticated liquid and gas burners with 3D printing technology

- 5.4.3.3 Adoption of biofuels, hazardous waste, and hydrogen-based industrial burners

- 5.4.4 CHALLENGE

- 5.4.4.1 Complexities associated with retrofitting, maintenance, and replacement of industrial burners

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN INDUSTRIAL BURNER MARKET

- FIGURE 30 REVENUE SHIFT FOR INDUSTRIAL BURNER PROVIDERS

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 31 VALUE CHAIN ANALYSIS: INDUSTRIAL BURNER MARKET

- 5.6.1 RAW MATERIAL SUPPLIERS

- 5.6.2 INDUSTRIAL BURNER PROVIDERS

- 5.6.3 DISTRIBUTORS

- 5.6.4 END USERS

- 5.7 MARKET MAP

- FIGURE 32 MARKET MAP: INDUSTRIAL BURNER MARKET

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE: REGIONAL ANALYSIS

- 5.8.2 REGION-WISE AVERAGE SELLING PRICE TREND

- TABLE 4 REGION-WISE AVERAGE SELLING PRICE OF INDUSTRIAL BURNERS

- 5.9 TECHNOLOGY ANALYSIS

- 5.10 CODES AND REGULATORY FRAMEWORK

- 5.10.1 CODES AND REGULATIONS RELATED TO INDUSTRIAL BURNERS

- TABLE 5 INDUSTRIAL BURNER MARKET: REGULATORY FRAMEWORK

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INDUSTRIAL BURNER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 INDUSTRIAL BURNER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 BARGAINING POWER OF SUPPLIERS

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 THREAT OF SUBSTITUTES

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP END USER

- TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP END USERS (%)

- 5.12.2 BUYING CRITERIA

- FIGURE 35 KEY BUYING CRITERIA FOR TOP 4 END USERS

- TABLE 12 KEY BUYING CRITERIA, BY POWER RATING

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 HEATING SPECIALISTS WEISHAUPT EXPANDED ITS INTERNET OF THINGS (IOT) ACTIVITY WITH NEW GENERATION OF GAS CONDENSING BOILERS

- 5.13.2 INDUSTRIAL PROCESS HEAT: PROCESS STEAM IN DAIRY FACTORY VIA FAST PYROLYSIS BIO-OIL

- 5.13.3 RIELLO BURNERS HELP TO MEET STRICT GLA EMISSION REQUIREMENTS

- 5.14 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 13 INDUSTRIAL BURNERS: INNOVATIONS AND PATENT REGISTRATIONS

- 5.15 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 14 INDUSTRIAL BURNER MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 INDUSTRIAL BURNER MARKET, BY BURNER TYPE

- 6.1 INTRODUCTION

- FIGURE 36 INDUSTRIAL BURNER MARKET, BY BURNER TYPE, 2021

- TABLE 15 INDUSTRIAL BURNER MARKET, BY BURNER TYPE, 2020-2027 (USD MILLION)

- 6.2 REGENERATIVE BURNER

- 6.2.1 REGENERATIVE BURNERS ARE SPECIFICALLY ADOPTED IN HIGH-TEMPERATURE FURNACES

- TABLE 16 REGENERATIVE BURNER: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3 HIGH THERMAL RELEASE BURNER

- 6.3.1 HIGH THERMAL RELEASE BURNERS HAVE LOW NOX EMISSIONS

- TABLE 17 HIGH THERMAL RELEASE BURNER: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.4 RADIANT BURNER

- 6.4.1 RADIANT BURNERS CAN BE USED IN BOTH LOW- AND HIGH-TEMPERATURE APPLICATIONS

- TABLE 18 RADIANT BURNER: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.5 DIRECT-FIRED BURNER

- 6.5.1 DIRECT-FIRED BURNERS OFFER ADVANTAGES OF LOW FUEL CONSUMPTION AND OPERATING COST

- TABLE 19 DIRECT-FIRED BURNER: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.6 SELF-RECUPERATIVE BURNER

- 6.6.1 SELF-RECUPERATIVE BURNERS ARE EASY TO INCORPORATE INTO RETROFIT INSTALLATIONS

- TABLE 20 SELF-RECUPERATIVE BURNER: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

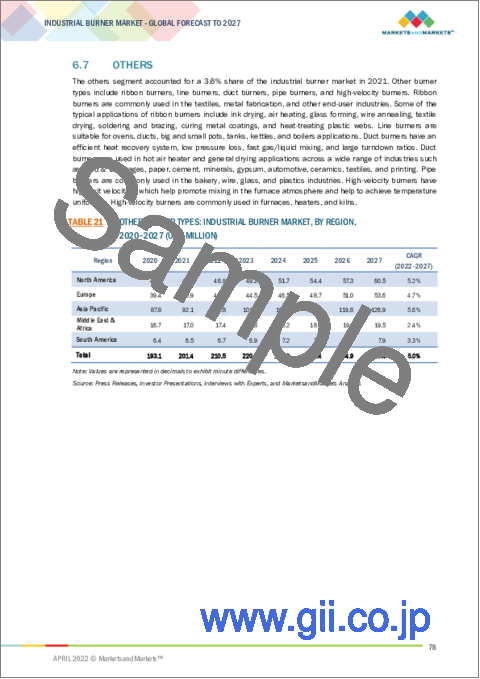

- 6.7 OTHERS

- TABLE 21 OTHER BURNER TYPES: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

7 INDUSTRIAL BURNER MARKET, BY FUEL TYPE

- 7.1 INTRODUCTION

- FIGURE 37 INDUSTRIAL BURNER MARKET, BY FUEL TYPE, 2021

- TABLE 22 INDUSTRIAL BURNER MARKET, BY FUEL TYPE, 2020-2027 (USD MILLION)

- 7.2 OIL

- 7.2.1 OIL-FIRED BURNERS CAN BE USED IN ANY LOCATION

- TABLE 23 OIL: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3 GAS

- 7.3.1 EXPANDING NATURAL GAS DISTRIBUTION NETWORK TO ACCELERATE DEMAND FOR GAS-FIRED INDUSTRIAL BURNERS

- TABLE 24 GAS: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.4 DUAL FUEL

- 7.4.1 DUAL FUEL BURNERS OFFER INCREASED EFFICIENCY AND RELIABILITY

- TABLE 25 DUAL FUEL: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.5 SOLID FUEL

- 7.5.1 INCREASING ADOPTION OF BIOMASS AND INDUSTRIAL WASTE BURNERS TO FUEL DEMAND FOR SOLID FUEL BURNERS

- TABLE 26 SOLID FUEL: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

8 INDUSTRIAL BURNER MARKET, BY AUTOMATION

- 8.1 INTRODUCTION

- FIGURE 38 INDUSTRIAL BURNER MARKET, BY AUTOMATION, 2021

- TABLE 27 INDUSTRIAL BURNER MARKET, BY AUTOMATION, 2020-2027 (USD MILLION)

- 8.2 MONOBLOCK

- 8.2.1 MONOBLOCK BURNERS ARE COMPACT, HAVE REDUCED FOOTPRINT, AND ARE SPECIALLY DESIGNED TO MINIMIZE NOX EMISSIONS

- TABLE 28 MONOBLOCK: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.3 DUOBLOCK

- 8.3.1 INCREASING DEMAND FOR DUOBLOCK BURNERS IN FOOD & BEVERAGES INDUSTRY TO DRIVE MARKET GROWTH

- TABLE 29 DUOBLOCK: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

9 INDUSTRIAL BURNER MARKET, BY OPERATING TEMPERATURE

- 9.1 INTRODUCTION

- FIGURE 39 INDUSTRIAL BURNER MARKET, BY OPERATING TEMPERATURE, 2021

- TABLE 30 INDUSTRIAL BURNER MARKET, BY OPERATING TEMPERATURE, 2020-2027 (USD MILLION)

- 9.2 LOW TEMPERATURE (< 1400°F)

- 9.2.1 LOW-TEMPERATURE BURNERS ARE IDEAL FOR LOW-TEMPERATURE DRYING APPLICATIONS

- TABLE 31 LOW TEMPERATURE (< 1400°F): INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.3 HIGH TEMPERATURE (> 1400°F)

- 9.3.1 HIGH-TEMPERATURE BURNERS ARE USED IN MULTIPLE APPLICATIONS

- TABLE 32 HIGH TEMPERATURE (> 1400°F): INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

10 INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY

- 10.1 INTRODUCTION

- FIGURE 40 INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2021

- TABLE 33 INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 10.2 FOOD & BEVERAGES

- 10.2.1 INCREASE IN USE OF INDUSTRIAL BURNERS IN FOOD PROCESSING FACILITIES TO BOOST MARKET GROWTH

- TABLE 34 FOOD & BEVERAGES: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.3 POWER GENERATION

- 10.3.1 NEED TO REPLACE AND MODERNIZE EXISTING POWER PLANTS TO DRIVE MARKET GROWTH

- TABLE 35 POWER GENERATION: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.4 CHEMICALS

- 10.4.1 GROWING USE OF BURNERS IN ETHYLENE CRACKING AND OTHER CHEMICAL PROCESSES TO BOOST MARKET GROWTH

- TABLE 36 CHEMICALS: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.5 PETROCHEMICALS

- 10.5.1 GROWING NUMBER OF REFINERIES IN ASIA PACIFIC TO ACCELERATE DEMAND FOR BURNERS

- TABLE 37 PETROCHEMICALS: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.6 METALS & MINING

- 10.6.1 INCREASE IN DEMAND FOR BURNERS IN MINING OPERATIONS TO PROPEL MARKET GROWTH

- TABLE 38 METALS & MINING: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.7 AUTOMOTIVE

- 10.7.1 SURGING USE OF INDUSTRIAL BURNERS IN CURING OVEN AND SPRAYING SYSTEMS TO PROPEL MARKET GROWTH

- TABLE 39 AUTOMOTIVE: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.8 OTHERS

- TABLE 40 OTHERS: INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

11 REGIONIONAL ANALYSIS

- 11.1 INTRODUCTION

- 11.2 IMPACT OF COVID-19 ON INDUSTRIAL BURNER MARKET

- FIGURE 41 INDUSTRIAL BURNER MARKET: REGIONAL SNAPSHOT

- FIGURE 42 REGION-WISE SHARE ANALYSIS OF INDUSTRIAL BURNER MARKET,2021

- TABLE 41 INDUSTRIAL BURNER MARKET, BY REGION, 2020-2027 (USD MILLION)

- 11.3 ASIA PACIFIC

- FIGURE 43 ASIA PACIFIC: INDUSTRIAL BURNER MARKET SNAPSHOT

- 11.3.1 BY BURNER TYPE

- TABLE 42 ASIA PACIFIC: INDUSTRIAL BURNER MARKET, BY BURNER TYPE, 2020-2027 (USD MILLION)

- TABLE 43 ASIA PACIFIC: INDUSTRIAL BURNER MARKET, BY BURNER TYPE, 2020-2027 (THOUSAND UNITS)

- 11.3.2 BY FUEL TYPE

- TABLE 44 ASIA PACIFIC: INDUSTRIAL BURNER MARKET, BY FUEL TYPE, 2020-2027 (USD MILLION)

- 11.3.3 BY OPERATING TEMPERATURE

- TABLE 45 ASIA PACIFIC: INDUSTRIAL BURNER MARKET, BY OPERATING TEMPERATURE, 2020-2027 (USD MILLION)

- 11.3.4 BY AUTOMATION

- TABLE 46 ASIA PACIFIC: INDUSTRIAL BURNER MARKET, BY AUTOMATION, 2020-2027 (USD MILLION)

- 11.3.5 BY END-USER INDUSTRY

- TABLE 47 ASIA PACIFIC: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.3.6 BY COUNTRY

- TABLE 48 ASIA PACIFIC: INDUSTRIAL BURNER MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 11.3.6.1 China

- 11.3.6.1.1 LNG capacity addition and increase in EV production to fuel industrial burner market growth

- 11.3.6.1 China

- TABLE 49 CHINA: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.3.6.2 India

- 11.3.6.2.1 Growth of chemicals and petrochemicals industries to fuel growth of industrial burner market

- 11.3.6.2 India

- TABLE 50 INDIA: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.3.6.3 Australia

- 11.3.6.3.1 Favorable government policies for lithium mining to drive market growth

- 11.3.6.3 Australia

- TABLE 51 AUSTRALIA: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.3.6.4 Japan

- 11.3.6.4.1 Sustained growth of manufacturing industry and rising demand for LNG to augment market growth

- 11.3.6.4 Japan

- TABLE 52 JAPAN: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.3.6.5 South Korea

- 11.3.6.5.1 Growth of chemicals industry in South Korea to drive growth of industrial burner market

- 11.3.6.5 South Korea

- TABLE 53 SOUTH KOREA: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.3.6.6 Rest of Asia Pacific

- TABLE 54 REST OF ASIA PACIFIC: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.4 NORTH AMERICA

- FIGURE 44 NORTH AMERICA: INDUSTRIAL BURNER MARKET SNAPSHOT

- 11.4.1 BY BURNER TYPE

- TABLE 55 NORTH AMERICA: INDUSTRIAL BURNER MARKET, BY BURNER TYPE, 2020-2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: INDUSTRIAL BURNER MARKET, BY BURNER TYPE, 2020-2027 (THOUSAND UNITS)

- 11.4.2 BY FUEL TYPE

- TABLE 57 NORTH AMERICA: INDUSTRIAL BURNER MARKET, BY FUEL TYPE, 2020-2027 (USD MILLION)

- 11.4.3 BY OPERATING TEMPERATURE

- TABLE 58 NORTH AMERICA: INDUSTRIAL BURNER MARKET, BY OPERATING TEMPERATURE, 2020-2027 (USD MILLION)

- 11.4.4 BY AUTOMATION

- TABLE 59 NORTH AMERICA: INDUSTRIAL BURNER MARKET, BY AUTOMATION, 2020-2027 (USD MILLION)

- 11.4.5 BY END-USER INDUSTRY

- TABLE 60 NORTH AMERICA: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.4.6 BY COUNTRY

- TABLE 61 NORTH AMERICA: INDUSTRIAL BURNER MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 11.4.6.1 US

- 11.4.6.1.1 Surge in demand for boilers and heating equipment in power generation, petrochemicals, and chemicals industry to drive market growth

- 11.4.6.1 US

- TABLE 62 US: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.4.6.2 Canada

- 11.4.6.2.1 Growing investments in mining industry to provide lucrative opportunities to industrial burner providers

- 11.4.6.2 Canada

- TABLE 63 CANADA: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.4.6.3 Mexico

- 11.4.6.3.1 Increasing investments for refinery capacity additions to boost demand for industrial burners

- 11.4.6.3 Mexico

- TABLE 64 MEXICO: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.5 EUROPE

- 11.5.1 BY BURNER TYPE

- TABLE 65 EUROPE: INDUSTRIAL BURNER MARKET, BY BURNER TYPE, 2020-2027 (USD MILLION)

- TABLE 66 EUROPE: INDUSTRIAL BURNER MARKET, BY BURNER TYPE, 2020-2027 (THOUSAND UNITS)

- 11.5.2 BY FUEL TYPE

- TABLE 67 EUROPE: INDUSTRIAL BURNER MARKET, BY FUEL TYPE, 2020-2027 (USD MILLION)

- 11.5.3 BY OPERATING TEMPERATURE

- TABLE 68 EUROPE: INDUSTRIAL BURNER MARKET, BY OPERATING TEMPERATURE, 2020-2027 (USD MILLION)

- 11.5.4 BY AUTOMATION

- TABLE 69 EUROPE: INDUSTRIAL BURNER MARKET, BY AUTOMATION, 2020-2027 (USD MILLION)

- 11.5.5 BY END-USER INDUSTRY

- TABLE 70 EUROPE: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.5.6 BY COUNTRY

- TABLE 71 EUROPE: INDUSTRIAL BURNER MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 11.5.6.1 Germany

- 11.5.6.1.1 Growth of chemicals and food & beverage industries foster industrial burner market growth

- 11.5.6.1 Germany

- TABLE 72 GERMANY: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.5.6.2 France

- 11.5.6.2.1 Demand for industrial burners in chemicals industry is fueling market growth

- 11.5.6.2 France

- TABLE 73 FRANCE: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.5.6.3 Italy

- 11.5.6.3.1 Increase in demand from food & beverage and automotive industries fuels market growth

- 11.5.6.3 Italy

- TABLE 74 ITALY: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.5.6.4 UK

- 11.5.6.4.1 Discontinuation of coal-fired industrial boilers to spur demand for natural gas-fired industrial boilers

- 11.5.6.4 UK

- TABLE 75 UK: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.5.6.5 Spain

- 11.5.6.5.1 Growing demand for burners in chemical and food processing applications to promote market growth

- 11.5.6.5 Spain

- TABLE 76 SPAIN: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.5.6.6 Rest of Europe

- TABLE 77 REST OF EUROPE: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 BY BURNER TYPE

- TABLE 78 MIDDLE EAST & AFRICA: INDUSTRIAL BURNER MARKET, BY BURNER TYPE, 2020-2027 (USD MILLION)

- TABLE 79 MIDDLE EAST & AFRICA: INDUSTRIAL BURNER MARKET, BY BURNER TYPE, 2020-2027 (THOUSAND UNITS)

- 11.6.2 BY FUEL TYPE

- TABLE 80 MIDDLE EAST & AFRICA: INDUSTRIAL BURNER MARKET, BY FUEL TYPE, 2020-2027 (USD MILLION)

- 11.6.3 BY OPERATING TEMPERATURE

- TABLE 81 MIDDLE EAST & AFRICA: INDUSTRIAL BURNER MARKET, BY OPERATING TEMPERATURE, 2020-2027 (USD MILLION)

- 11.6.4 BY AUTOMATION

- TABLE 82 MIDDLE EAST & AFRICA: INDUSTRIAL BURNER MARKET, BY AUTOMATION, 2020-2027 (USD MILLION)

- 11.6.5 BY END-USER INDUSTRY

- TABLE 83 MIDDLE EAST & AFRICA: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.6.6 BY COUNTRY

- TABLE 84 MIDDLE EAST & AFRICA: INDUSTRIAL BURNER MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 11.6.6.1 Saudi Arabia

- 11.6.6.1.1 Growing crude oil production is prominent driver for industrial burner market

- 11.6.6.1 Saudi Arabia

- TABLE 85 SAUDI ARABIA: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.6.6.2 UAE

- 11.6.6.2.1 Growing investments in petrochemicals sector leading to growth of industrial burner market

- 11.6.6.2 UAE

- TABLE 86 UAE: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.6.6.3 Kuwait

- 11.6.6.3.1 Surplus oil reserves likely to drive market for industrial burner market

- 11.6.6.3 Kuwait

- TABLE 87 KUWAIT: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.6.6.4 South Africa

- 11.6.6.4.1 Developing automotive industry and mining activities will lead to growth of industrial burner market in South Africa

- 11.6.6.4 South Africa

- TABLE 88 SOUTH AFRICA: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.6.6.5 Rest of Middle East & Africa

- TABLE 89 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.7 SOUTH AMERICA

- 11.7.1 BY BURNER TYPE

- TABLE 90 SOUTH AMERICA: INDUSTRIAL BURNER MARKET, BY BURNER TYPE, 2020-2027 (USD MILLION)

- TABLE 91 SOUTH AMERICA: INDUSTRIAL BURNER MARKET, BY BURNER TYPE, 2020-2027 (THOUSAND UNITS)

- 11.7.2 BY FUEL TYPE

- TABLE 92 SOUTH AMERICA: INDUSTRIAL BURNER MARKET, BY FUEL TYPE, 2020-2027 (USD MILLION)

- 11.7.3 BY OPERATING TEMPERATURE

- TABLE 93 SOUTH AMERICA: INDUSTRIAL BURNER MARKET, BY OPERATING TEMPERATURE, 2020-2027 (USD MILLION)

- 11.7.4 BY AUTOMATION

- TABLE 94 SOUTH AMERICA: INDUSTRIAL BURNER MARKET, BY AUTOMATION, 2020-2027 (USD MILLION)

- 11.7.5 BY END-USER INDUSTRY

- TABLE 95 SOUTH AMERICA: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.7.6 BY COUNTRY

- TABLE 96 SOUTH AMERICA: INDUSTRIAL BURNER MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 11.7.6.1 Brazil

- 11.7.6.1.1 Growing focus on diversifying energy mix to foster demand for industrial burners

- 11.7.6.1 Brazil

- TABLE 97 BRAZIL: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.7.6.2 Argentina

- 11.7.6.2.1 Prime focus on food & beverages, chemical, and petrochemical production activities to support market growth

- 11.7.6.2 Argentina

- TABLE 98 ARGENTINA: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

- 11.7.6.3 Rest of South America

- TABLE 99 REST OF SOUTH AMERICA: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020-2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 KEY PLAYERS STRATEGIES

- TABLE 100 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, JANUARY 2018- JANUARY 2022

- 12.2 MARKET SHARE ANALYSIS OF TOP SIX PLAYERS

- TABLE 101 INDUSTRIAL BURNER MARKET: DEGREE OF COMPETITION

- FIGURE 45 INDUSTRIAL BURNER MARKET: MARKET SHARE ANALYSIS, 2020

- 12.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 46 REVENUE OF TOP PLAYERS IN INDUSTRIAL BURNER MARKET FROM 2016 TO 2020

- 12.4 COMPANY EVALUATION QUADRANT

- 12.4.1 STAR

- 12.4.2 PERVASIVE

- 12.4.3 EMERGING LEADER

- 12.4.4 PARTICIPANT

- FIGURE 47 COMPETITIVE LEADERSHIP MAPPING: INDUSTRIAL BURNER MARKET, 2021

- 12.5 STARTUP/SME EVALUATION QUADRANT

- 12.5.1 PROGRESSIVE COMPANY

- 12.5.2 RESPONSIVE COMPANY

- 12.5.3 DYNAMIC COMPANY

- 12.5.4 STARTING BLOCK

- FIGURE 48 INDUSTRIAL BURNER MARKET: START-UP/SME EVALUATION QUADRANT, 2021

- TABLE 102 INDUSTRIAL BURNER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 103 INDUSTRIAL BURNER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.6 INDUSTRIAL BURNER MARKET: COMPANY FOOTPRINT

- TABLE 104 BY FUEL TYPE: COMPANY FOOTPRINT

- TABLE 105 BY END-USER INDUSTRY: COMPANY FOOTPRINT

- TABLE 106 BY REGION: COMPANY FOOTPRINT

- TABLE 107 COMPANY FOOTPRINT

- 12.7 COMPETITIVE SCENARIO

- TABLE 108 INDUSTRIAL BURNER MARKET: DEALS, NOVEMBER 2020

- TABLE 109 INDUSTRIAL BURNER MARKET: OTHERS, NOVEMBER 2019-JANUARY 2022

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business and financial overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)**

- 13.1.1 ANDRITZ GROUP

- TABLE 110 ANDRITZ GROUP: BUSINESS OVERVIEW

- FIGURE 49 ANDRITZ GROUP: COMPANY SNAPSHOT, 2021

- TABLE 111 ANDRITZ GROUP: PRODUCTS OFFERED

- TABLE 112 ANDRITZ GROUP: DEALS

- TABLE 113 ANDRITZ GROUP: SALES CONTRACT

- 13.1.2 NIBE GROUP

- TABLE 114 NIBE GROUP: BUSINESS OVERVIEW

- FIGURE 50 NIBE GROUP: COMPANY SNAPSHOT, 2020

- TABLE 115 NIBE GROUP: PRODUCTS OFFERED

- 13.1.3 HONEYWELL INTERNATIONAL INC.

- TABLE 116 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

- FIGURE 51 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT, 2021

- TABLE 117 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- 13.1.4 ARISTON GROUP N. V.

- TABLE 118 ARISTON GROUP N. V.: BUSINESS OVERVIEW

- FIGURE 52 ARISTON GROUP N. V.: COMPANY SNAPSHOT, 2021

- TABLE 119 ARISTON GROUP N. V.: PRODUCTS OFFERED

- 13.1.5 FIVES

- TABLE 120 FIVES: BUSINESS OVERVIEW

- FIGURE 53 FIVES: COMPANY SNAPSHOT, 2020

- TABLE 121 FIVES: PRODUCTS OFFERED

- TABLE 122 FIVES: SALES CONTRACT

- 13.1.6 WEISHAUPT

- TABLE 123 WEISHAUPT: BUSINESS OVERVIEW

- TABLE 124 WEISHAUPT: PRODUCTS OFFERED

- TABLE 125 WEISHAUPT: EXPANSION

- 13.1.7 SELAS HEAT TECHNOLOGY COMPANY

- TABLE 126 SELAS HEAT TECHNOLOGY COMPANY: BUSINESS OVERVIEW

- TABLE 127 SELAS HEAT TECHNOLOGY COMPANY: PRODUCTS OFFERED

- TABLE 128 SELAS HEAT TECHNOLOGY COMPANY: PRODUCT LAUNCHES

- 13.1.8 RIELLO S. P. A.

- TABLE 129 RIELLO S. P. A.: BUSINESS OVERVIEW

- TABLE 130 RIELLO S. P. A.: PRODUCTS OFFERED

- 13.1.9 C.I.B. UNIGAS S.P.A.

- TABLE 131 C.I.B. UNIGAS S.P.A.: BUSINESS OVERVIEW

- TABLE 132 C.I.B. UNIGAS S.P.A.: PRODUCTS OFFERED

- 13.1.10 EBICO

- TABLE 133 EBICO: BUSINESS OVERVIEW

- TABLE 134 EBICO: PRODUCTS OFFERED

- TABLE 135 EBICO: SALES CONTRACT

- 13.1.11 BALTUR S.P.A.

- TABLE 136 BALTUR S.P.A.: BUSINESS OVERVIEW

- TABLE 137 BALTUR S.P.A.: PRODUCTS OFFERED

- TABLE 138 BALTUR S.P.A.: PRODUCT LAUNCHES

- 13.1.12 OILON GROUP OY

- TABLE 139 OILON GROUP OY: BUSINESS OVERVIEW

- TABLE 140 OILON GROUP OY: PRODUCTS OFFERED

- 13.1.13 OXILON PVT LTD

- TABLE 141 OXILON PVT LTD: BUSINESS OVERVIEW

- TABLE 142 OXILON PVT LTD: PRODUCTS OFFERED

- 13.1.14 ZEECO

- TABLE 143 ZEECO: BUSINESS OVERVIEW

- TABLE 144 ZEECO: PRODUCTS OFFERED

- TABLE 145 ZEECO: EXPANSION

- 13.1.15 ALZETA CORPORATION

- TABLE 146 ALZETA CORPORATION: BUSINESS OVERVIEW

- TABLE 147 ALZETA CORPORATION: PRODUCTS OFFERED

- 13.2 OTHER PLAYERS

- 13.2.1 BLOOM ENGINEERING

- 13.2.2 LIMPSFIELD COMBUSTION ENGINEERING

- 13.2.3 POWER FLAME INC.

- 13.2.4 WESMAN GROUP

- 13.2.5 SOOKOOK CORPORATION

- 13.2.6 JOHN ZINK HAMWORTHY COMBUSTION

- 13.2.7 SAACKE GMBH

- 13.2.8 WAYNE COMBUSTION SYSTEMS

- 13.2.9 FABER BURNER COMPANY

- 13.2.10 MFBURNER

- *Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 INSIGHTS OF INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 AVAILABLE CUSTOMIZATIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS