|

|

市場調査レポート

商品コード

1073623

HMO (ヒトミルクオリゴ糖) の世界市場 - 2027年までの予測:タイプ別 (2FL、3FL、3SL、6SL) 、用途別 (乳児用調製粉乳、機能性食品・飲料、栄養補助食品) 、濃度別 (酸性、中性) 、地域別HMO Market by Type (2' Fl, 3' Fl, 3' Sl, 6' Sl), Application (Infant Formula, Functional Food & Beverages, Food Supplement), Concentration (Acidic, Neutral) & Region (North America, Europe, APAC, South America, RoW) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| HMO (ヒトミルクオリゴ糖) の世界市場 - 2027年までの予測:タイプ別 (2FL、3FL、3SL、6SL) 、用途別 (乳児用調製粉乳、機能性食品・飲料、栄養補助食品) 、濃度別 (酸性、中性) 、地域別 |

|

出版日: 2022年04月29日

発行: MarketsandMarkets

ページ情報: 英文 228 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のHMO (ヒトミルクオリゴ糖) の市場規模は、2022年の推定1億9,900万米ドルから、2027年までに5億5,600万米ドルに達し、予測期間中のCAGRで22.7%の成長が予測されています。

HMO (ヒトミルクオリゴ糖) は乳児の成長に寄与する主要な栄養素で、ヒトの母乳中に豊富に含まれています。現在、乳児用調製粉乳で人工的に合成され、母乳を与えられない乳児に恩恵を与え、その成長を支援し、病気から保護するために使用されています。

当レポートでは、世界のHMO (ヒトミルクオリゴ糖) 市場について調査分析し、市場概要、業界動向、セグメント別の市場分析、競合情勢、主要企業などについて、最新の情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 主要会議とイベント

- 主要ステークホルダーと購入基準

第6章 業界動向

- 概要

- 規制の枠組み

- 北米

- EU

- アジア太平洋地域

- 南米

- その他の地域

- 規制当局

- 特許分析

- バリューチェーン分析

- HMO (ヒトミルクオリゴ糖) 市場に対するCOVID-19の影響

- HMO (ヒトミルクオリゴ糖) 市場のバイヤーに影響を与える動向/混乱

- 市場エコシステム

- 技術分析

- ポーターのファイブフォース分析

- ケーススタディ分析

- 価格分析

第7章 HMO (ヒトミルクオリゴ糖) 市場:タイプ別

- 2FL

- 3FL

- 3SL

- 6SL

第8章 HMO (ヒトミルクオリゴ糖) 市場:用途別

- 機能性食品・飲料

- 栄養補助食品

- その他

第9章 HMO (ヒトミルクオリゴ糖) 市場:濃度別

- 中性

- 酸性

第10章 HMO (ヒトミルクオリゴ糖) 市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- その他の欧州

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- その他のアジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- その他の地域

- 中東

- アフリカ

第11章 競合情勢

- 概要

- 市場シェア分析

- 主要企業戦略

- 主要企業の過去の収益分析

- COVID-19固有の企業の対応

- 企業評価象限 (主要企業)

- 製品のフットプリント

- スタートアップ/中小企業の評価象限 (その他の企業)

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- DSM

- BASF SE.

- CHR HANSENHOLDING A/S

- DUPONT

- NESTLE

- BIOSYNTH CARBOSYNTH

- INBIOSE NV.

- GNUBIOTICS SCIENCES S.A.

- ABBOTT LABORATORIES

- ROYAL FRIESLANDCAMPINA N.V

- ELICITYL S.A

- DEXTRA LABORATORIES LTD.

- スタートアップ/中小企業/その他の企業

- ZUCHEM INC.

- ADVANCED PROTEIN TECHNOLOGIES CORP.

- CONAGEN INC.

- KYOWA HAKKO BIO CO. LTD.

- MEDOLAC LABORATORIES

- エンドユーザー企業のプロファイル

- H & H GROUP

- LAYER ORIGIN NUTRITION

- STANDARD PROCESS INC.

- RECKITT BENCKISER GROUP

- AMAZON

第13章 隣接・関連市場

第14章 付録

The global market for HMO market is estimated to be valued at USD 199 million in 2022. It is projected to reach USD 556 million by 2027, recording a CAGR of 22.7% during the forecast period. Human milk oligosaccharides (HMOs) are part of the functional ingredients of breast milk. They are the third most abundant component of milk after lactose and lipids. HMOs act as prebiotics; they support beneficial bacteria growth and have anti-pathogenic effects. Recent studies show that HMOs can boost infant health and reduce disease risk. HMOs are the main nutrients that benefit infants' growth and are abundantly present in human milk. Currently, HMOs have been synthesized artificially in infant milk formulations to benefit infants who cannot be fed with breast milk, support their growth, and provide them with protection against diseases.

"Asia Pacific is projected to witness the growth of 23.2% during the forecast period."

The Asia Pacific region accounts USD 92.6 Million of the market size in global market for HMO. The region is expected to grow at the highest CAGR during the forecast period, retaining its dominance as the leading market for HMOs. Asia Pacific is the most densely populated region consisting of countries like China, India, Japan, Australia & New Zealand and Others. It is also one of the key markets for HMOs. China is a dominant market in the region, as it is one of the largest consumers of infant formulas in the world. Hence, any market fluctuation in China is expected to significantly affect the global infant formulas market, which will, in turn, affect the HMO market. China is expected to be the largest market for human milk oligosaccharides (HMO) in 2022. The country has witnessed high adoption of infant formula crafted with premium ingredients, including HMOs, mainly due to the increasing income level, modernization, and middle-class population. The government in China has started easing its stand on the one-child policy and is allowing couples to have two children. This is expected to increase the number of newborn infants, which will, in turn, boost the demand for HMOs.

"The type 2' FL is gaining rapid popularity in the HMO market across the globe."

HMOs are known to have Bifidus, a beneficial bacteria species also known as Bifidobacterium. 2'FL selectively grows in intestinal Bifidobacterium because of three different bifidobacterial categories, such as B. dentium, Bifidobacterium bifidum, and B. infantis. On account of their numerous health benefits and a wide array of applications, 2'FL-based HMOs have become popular over the past few years. Various government agencies are granting their approval for their industrial and commercial use. For instances; in July 2021, according to Taiwan Food and Drug Administration, Taiwan authorized the usage of 2'FL Human Milk Oligosaccharides (HMO) in infant formula, milk formula for children aged below seven years, food formula for kids aged below seven years, and growing-up formula. The allowed use of this formula is 1.2g/liter. The 2'FL segment is estimated to dominate the market in 2022, as a result of rigorous and ongoing research in the development of 2'FL-based HMOs by key players.

"Extensive R&D activities by infant formula manufacturers."

In Infant formula is made from industrially modified. It is intended to be used as a substitute for breast milk and is formulated by manufacturers to mimic the nutritional composition of breast milk for the overall growth and development of infants. According to an article published by the National Library of Medicine in June 2019, from the age of 6 months, an infant's energy and nutrient requirements start to exceed those provided by breast milk. A lot of research and activities are being conducted by the key market players for developing HMO-based infant formula, baby food etc. for supporting the infant health across the world. Manufacturers involved in the development of infant formulas are constantly engaged in the research and development activities for creating new formulas and ingredients as per the customer requirements. For instance; in January 2019, Nestle (Switzerland) opened a new R&D center in Ireland. The company made an investment of USD 30.0 million for the same. The center is likely to focus on developing products for infant nutrition. Infant formulas, by providing for the deficiencies, play an important role in the development of infants.

Break-up of Primaries:

- By HMO Manufacturers: Managers - 50.0%, Directors - 30.0%, Junior Level Employees - 20.0%

- By Designation: Managers - 30.0%, CXOs - 26.0%, and Executives- 44.0%

- By Country: India - 55%, US - 20%, UK - 20%, China - 5%

Leading players profiled in this report:

- DSM (Netherlands)

- BASF SE (Germany)

- CHR Hansen Holding A/S (Denmark)

- DUPONT (US)

- Nestle (Switzerland)

- Biosynth Carbosynth (US)

- Inbiose N.V (Belgium)

- Gnubiotics Sciences S.A ( Switzerland)

- Abbott Laboratories (US)

- Royal Friesland Campina N.V (Netherlands)

- Elicityl S.A (France)

- Dextra Laboratories (UK)

Research Coverage:

The report segments the HMO market on the basis of type, end-user, nature, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the HMO, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the HMO market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the HMO market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.4 REGIONS COVERED

- 1.5 PERIODIZATION CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES CONSIDERED, 2017-2021

- 1.7 UNITS CONSIDERED

- 1.8 STAKEHOLDERS

- 1.9 INTRODUCTION TO COVID-19

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 HUMAN MILK OLIGOSACCHARIDES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 HUMAN MILK OLIGOSACCHARIDES MARKET SIZE ESTIMATION, BY TYPE (SUPPLY-SIDE)

- FIGURE 5 HUMAN MILK OLIGOSACCHARIDES MARKET SIZE ESTIMATION (DEMAND-SIDE)

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 HUMAN MILK OLIGOSACCHARIDES MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 HUMAN MILK OLIGOSACCHARIDES MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 ASSUMPTIONS FOR THE STUDY

- 2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

- 2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

- 2.6.1 SCENARIO-BASED MODELLING

- 2.7 COVID-19 HEALTH ASSESSMENT

- FIGURE 9 COVID-19: GLOBAL PROPAGATION

- FIGURE 10 COVID-19 PROPAGATION: SELECT COUNTRIES

- 2.8 COVID-19 ECONOMIC ASSESSMENT

- FIGURE 11 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

- 2.8.1 COVID-19 ECONOMIC IMPACT-SCENARIO ASSESSMENT

- FIGURE 12 CRITERIA IMPACTING GLOBAL ECONOMY

- FIGURE 13 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY

- TABLE 3 HUMAN MILK OLIGOSACCHARIDES MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 14 HUMAN OLIGOSACCHARIDES MARKET, BY TYPE, 2022 VS. 2027

- FIGURE 15 HUMAN OLIGOSACCHARIDES MARKET, BY APPLICATION, 2022 VS. 2027

- FIGURE 16 HUMAN OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2022 VS. 2027

- FIGURE 17 HUMAN MILK OLIGOSACCHARIDES MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN THE HUMAN MILK OLIGOSACCHARIDES MARKET

- FIGURE 18 HUMAN MILK OLIGOSACCHARIDES IMPART MEMORY ENHANCEMENT, GUT HEALTH MAINTENANCE, AND BRAIN DEVELOPMENT TO INFANTS

- 4.2 HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION

- FIGURE 19 ASIA PACIFIC EXPECTED TO DOMINATE THE HUMAN MILK OLIGOSACCHARIDES MARKET BY 2027 IN TERMS OF VALUE

- FIGURE 20 ASIA PACIFIC EXPECTED TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD, BY VOLUME TERMS

- 4.3 HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE

- FIGURE 21 2'FL SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD BY VALUE TERMS

- FIGURE 22 MARKET FOR 2'FL-BASED HMOS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE BY 2027 IN TERMS OF VOLUME

- 4.4 HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION

- FIGURE 23 NEUTRAL HUMAN MILK OLIGOSACCHARIDES SEGMENT EXPECTED TO ACCOUNT FOR A LARGER SIZE DURING THE FORECAST PERIOD

- 4.5 HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION

- FIGURE 24 DEMAND FOR HMOS IN INFANT FORMULA APPLICATION EXPECTED TO BE THE HIGHEST DURING THE FORECAST PERIOD

- 4.6 ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE & KEY COUNTRY

- FIGURE 25 CHINA AND 2'FL MARKET SEGMENTS ACCOUNTED FOR A SIGNIFICANT SHARE IN THE HUMAN MILK OLIGOSACCHARIDES MARKET

- FIGURE 26 CANADA, THE US, MEXICO, AND CHINA EXPECTED TO GROW AT A SIGNIFICANT RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 DIGITALIZATION OF THE RETAIL INDUSTRY

- FIGURE 27 EU: ONLINE PURCHASES OF GOODS & SERVICES, 2018

- 5.2.2 RISE IN THE NUMBER OF DUAL-INCOME HOUSEHOLDS

- FIGURE 28 US: EMPLOYMENT STATUS OF PARENTS WITH CHILDREN UNDER 18 YEARS, 2020

- 5.2.3 RAPID URBANIZATION ACROSS REGIONS

- FIGURE 29 URBAN AND RURAL POPULATIONS IN THE WORLD, 2016-2020

- 5.3 MARKET DYNAMICS

- FIGURE 30 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Rise in the infant population

- FIGURE 31 GROWTH IN INFANT POPULATION, 2010-2020 (THOUSAND)

- 5.3.1.2 Growth in health awareness leading to increased consumption of dietary supplements

- FIGURE 32 US: DIETARY CONSUMPTION RATE, BY AGE GROUP, 2020

- 5.3.1.3 Extensive R&D initiatives by companies operating in the infant formula market

- 5.3.2 RESTRAINTS

- 5.3.2.1 Higher production costs associated with the development of HMO-composed supplements and food products

- 5.3.2.2 Stringent regulations and trade policies in the infant formula and dietary supplement industries

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Emergence of alternative animal milk oligosaccharides

- 5.3.3.2 Adoption of advanced technologies in the functional food industry

- 5.3.4 CHALLENGES

- 5.3.4.1 Complex industrial process to extract oligosaccharides from milk

- 5.3.4.2 Lack of consumer awareness regarding benefits associated with HMO-formulated products

- 5.4 KEY CONFERENCES & EVENTS

- TABLE 4 HUMAN MILK OLIGOSACCHARIDES MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022-2023

- 5.5 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.5.1 KEY STAKEHOLDERS IN THE BUYING PROCESS

- TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 MODES OF APPLICATIONS

- 5.5.2 BUYING CRITERIA

- FIGURE 33 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 MODES OF APPLICATION

6 INDUSTRY TRENDS

- 6.1 OVERVIEW

- 6.2 REGULATORY FRAMEWORK

- 6.3 NORTH AMERICA

- 6.3.1 CANADA

- 6.3.2 US

- 6.3.3 MEXICO

- 6.4 EUROPEAN UNION (EU)

- 6.5 ASIA PACIFIC

- 6.5.1 JAPAN

- 6.5.2 CHINA

- 6.5.3 INDIA

- 6.5.4 AUSTRALIA & NEW ZEALAND

- 6.6 SOUTH AMERICA

- 6.6.1 BRAZIL

- 6.6.2 ARGENTINA

- 6.7 REST OF THE WORLD (ROW)

- 6.7.1 MIDDLE EAST

- 6.8 REGULATORY BODIES

- 6.9 PATENT ANALYSIS

- FIGURE 34 HUMAN MILK OLIGOSACCHARIDES MARKET: PATENT ANALYSIS, BY APPLICANT, 2017-2021

- FIGURE 35 HUMAN MILK OLIGOSACCHARIDES MARKET: PATENT ANALYSIS, BY REGION, 2017-2021

- FIGURE 36 HUMAN MILK OLIGOSACCHARIDES MARKET: PATENT ANALYSIS, BY LEGAL STATUS, 2017-2021

- TABLE 7 RECENT PATENTS GRANTED WITH RESPECT TO HMOS

- 6.10 VALUE CHAIN ANALYSIS

- FIGURE 37 VALUE CHAIN ANALYSIS

- 6.11 COVID-19 IMPACT ON THE HUMAN MILK OLIGOSACCHARIDES MARKET

- 6.12 TREND/DISRUPTION IMPACTING BUYERS IN THE HUMAN MILK OLIGOSACCHARIDES MARKET

- FIGURE 38 REVENUE SHIFT FOR THE HUMAN MILK OLIGOSACCHARIDES MARKET

- 6.13 MARKET ECOSYSTEM

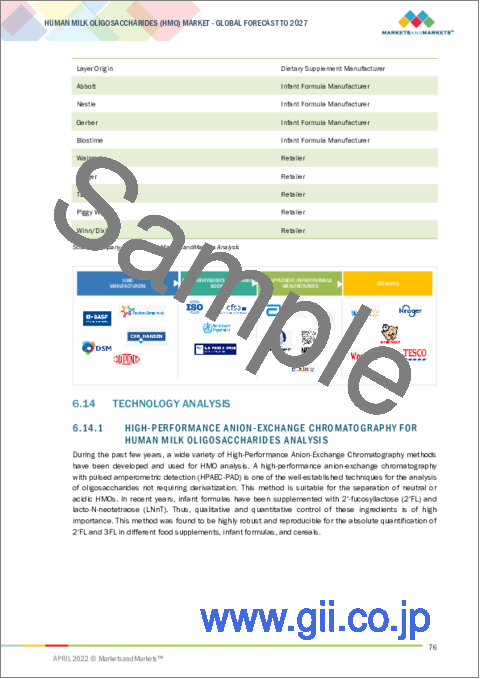

- TABLE 8 HUMAN MILK OLIGOSACCHARIDES MARKET: ECOSYSTEM

- 6.14 TECHNOLOGY ANALYSIS

- 6.14.1 HIGH-PERFORMANCE ANION-EXCHANGE CHROMATOGRAPHY FOR HUMAN MILK OLIGOSACCHARIDES ANALYSIS

- 6.14.2 CAPILLARY ELECTROPHORESIS FOR HUMAN MILK OLIGOSACCHARIDES ANALYSIS

- 6.15 PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 PORTER'S FIVE FORCES ANALYSIS

- 6.15.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.15.2 BARGAINING POWER OF SUPPLIERS

- 6.15.3 BARGAINING POWER OF BUYERS

- 6.15.4 THREAT OF SUBSTITUTES

- 6.15.5 THREAT OF NEW ENTRANTS

- 6.16 CASE STUDY ANALYSIS

- 6.16.1 USE CASE 1: LAYER ORIGIN INTRODUCED EASY-TO-USE AND EFFICIENT-TO-HMO PREBIOTIC PILLS AND POWDER FOR ADULTS

- 6.17 PRICE ANALYSIS

- 6.17.1 INTRODUCTION

- 6.17.2 PRICE ANALYSIS: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD PER/KG)

- 6.17.3 PRICE ANALYSIS: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (USD PER/KG)

7 HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 39 HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 10 HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (TONS)

- TABLE 11 HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (TONS)

- TABLE 12 HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 13 HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.1.1 HUMAN MILK OLIGOSACCHARIDES MARKET: COVID-19 IMPACT ANALYSIS, BY TYPE

- TABLE 14 REALISITIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 15 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 16 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- 7.2 2'FL

- 7.2.1 AUTHORIZATION OF HMOS BY GOVERNMENT BODIES FOR CONSUMPTION

- TABLE 17 2'FL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 18 2'FL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 19 2'FL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (TONS)

- TABLE 20 2'FL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (TONS)

- 7.3 3'FL

- 7.3.1 PREBIOTIC QUALITY OF 3'FL EXPECTED TO PROPEL THE GROWTH OF THE HUMAN MILK OLIGOSACCHARIDES MARKET IN THE UPCOMING YEARS

- TABLE 21 3'FL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 22 3'FL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 23 3'FL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (TONS)

- TABLE 24 3'FL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (TONS)

- 7.4 3'SL

- 7.4.1 SIGNIFICANCE OF 3'SL IN LANGUAGE DEVELOPMENT DURING EARLY CHILDHOOD

- TABLE 25 3'SL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 26 3'SL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 27 3'SL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (TONS)

- TABLE 28 3'SL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (TONS)

- 7.5 6'SL

- 7.5.1 WIDE USAGE OF HMOS ACROSS INDUSTRIES

- TABLE 29 6'SL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 30 6'SL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 31 6'SL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (TONS)

- TABLE 32 6'SL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (TONS)

8 HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 40 HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- TABLE 33 HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 34 HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.1.1 EXTENSIVE R&D ACTIVITIES BY INFANT FORMULA MANUFACTURERS

- TABLE 35 INFANT FORMULA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 36 INFANT FORMULA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.2 FUNCTIONAL FOOD & BEVERAGES

- 8.2.1 ROLE OF FAST-PACED LIFESTYLE AND GROWING ADOPTION OF CONVENIENCE FOOD PRODUCTS IN THE GROWTH OF FUNCTIONAL FOOD & BEVERAGES

- TABLE 37 FUNCTIONAL FOOD & BEVERAGES: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 38 FUNCTIONAL FOOD & BEVERAGES: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 FOOD SUPPLEMENTS

- 8.3.1 GROWING HEALTH AWARENESS AND DEMAND FOR NUTRITION-RICH FOOD PRODUCTS

- TABLE 39 FOOD SUPPLEMENTS: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 40 FOOD SUPPLEMENTS: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 OTHER APPLICATIONS

- 8.4.1 WIDE USAGE OF HMOS ACROSS INDUSTRIES

- TABLE 41 OTHER APPLICATIONS: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 42 OTHER APPLICATIONS: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (USD MILLION)

9 HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION

- 9.1 INTRODUCTION

- FIGURE 41 HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2022 VS. 2027 (USD MILLION)

- TABLE 43 HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2017-2021 (USD MILLION)

- TABLE 44 HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2022-2027 (USD MILLION)

- 9.2 NEUTRAL

- 9.2.1 RISING CONSUMER CONCERNS REGARDING GUT HEALTH AND IMMUNITY IN INFANTS

- TABLE 45 NEUTRAL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 46 NEUTRAL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 ACIDIC

- 9.3.1 IMITATION OF HUMAN MILK IN PREMIUM INFANT FORMULAS

- TABLE 47 ACIDIC: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 48 ACIDIC: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (USD MILLION)

10 HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 42 CHINA EXPECTED TO ACCOUNT FOR THE LARGEST SHARE IN THE HUMAN MILK OLIGOSACCHARIDES MARKET IN 2022

- FIGURE 43 HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

- TABLE 49 GLOBAL HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 50 GLOBAL HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 51 GLOBAL HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2021 (TONS)

- TABLE 52 GLOBAL HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2022-2027 (TONS)

- TABLE 53 GLOBAL HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 54 GLOBAL HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 55 GLOBAL HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (TONS)

- TABLE 56 GLOBAL HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (TONS)

- TABLE 57 GLOBAL HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 58 GLOBAL HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 59 GLOBAL HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2017-2021(USD MILLION)

- TABLE 60 GLOBAL HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2022-2027 (USD MILLION)

- 10.2 HUMAN MILK OLIGOSACCHARIDES MARKET: COVID-19 IMPACT ANALYSIS - BY REGION

- TABLE 61 REALISITIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 62 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 63 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017-2022 (USD MILLION)

- 10.3 NORTH AMERICA

- FIGURE 44 NORTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET SNAPSHOT, 2022

- TABLE 64 NORTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 65 NORTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 66 NORTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 67 NORTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 68 NORTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (TONS)

- TABLE 69 NORTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (TONS)

- TABLE 70 NORTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 71 NORTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 72 NORTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2017-2021 (USD MILLION)

- TABLE 73 NORTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2022-2027 (USD MILLION)

- 10.3.1 US

- 10.3.1.1 Increased demand from end-user companies, such as Nestle S.A. (Switzerland) and Danone S.A. (France)

- TABLE 74 US: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 75 US: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.3.2 CANADA

- 10.3.2.1 Cronobacter Sakazakii or Salmonella Newport infection among infants hindering the Canadian human milk oligosaccharides market

- TABLE 76 CANADA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 77 CANADA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.3.3 MEXICO

- 10.3.3.1 Rise in per capita expenditure on nutritious and healthy foods estimated to boost the market

- TABLE 78 MEXICO: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 79 MEXICO: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.4 EUROPE

- TABLE 80 EUROPE: HUMAN MILK OLIGOSACCHARIDES MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 81 EUROPE: HUMAN MILK OLIGOSACCHARIDES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 82 EUROPE: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 83 EUROPE: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 84 EUROPE: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (TONS)

- TABLE 85 EUROPE: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (TONS)

- TABLE 86 EUROPE: HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 87 EUROPE: HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 88 EUROPE: HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2017-2021 (USD MILLION)

- TABLE 89 EUROPE: HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2022-2027 (USD MILLION)

- 10.4.1 GERMANY

- 10.4.1.1 Continuous research and development in the HMO segment

- TABLE 90 GERMANY: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 91 GERMANY: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.4.2 UK

- 10.4.2.1 Introduction of HMO-based infant formulas

- TABLE 92 UK: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 93 UK: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.4.3 FRANCE

- 10.4.3.1 Strategic initiatives taken by local players

- TABLE 94 FRANCE: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 95 FRANCE: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.4.4 SPAIN

- 10.4.4.1 Consumer preference for clean-label ingredients paving the way for 2'FL dietary supplement products

- TABLE 96 SPAIN: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 97 SPAIN: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.4.5 ITALY

- 10.4.5.1 Increasing popularity of HMO-based adult supplements

- TABLE 98 ITALY: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 99 ITALY: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.4.6 REST OF EUROPE

- 10.4.6.1 Aggressive marketing around infant formulas and misleading health claims hindering human milk oligosaccharides market growth

- TABLE 100 REST OF EUROPE: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 101 REST OF EUROPE: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.5 ASIA PACIFIC

- FIGURE 45 ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET SNAPSHOT, 2022

- TABLE 102 ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 103 ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 104 ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 105 ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 106 ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (TONS)

- TABLE 107 ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (TONS)

- TABLE 108 ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 109 ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 110 ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2017-2021 (USD MILLION)

- TABLE 111 ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2022-2027 (USD MILLION)

- 10.5.1 CHINA

- 10.5.1.1 Continuous research & development in the field of HMO expected to expand the market

- TABLE 112 CHINA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 113 CHINA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.5.2 INDIA

- 10.5.2.1 Millennial population playing an important role in driving the demand for HMO-based food products

- TABLE 114 INDIA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 115 INDIA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.5.3 JAPAN

- 10.5.3.1 Stringent rules and regulations by the Japanese government bodies challenging human milk oligosaccharides market growth

- TABLE 116 JAPAN: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 117 JAPAN: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.5.4 AUSTRALIA & NEW ZEALAND

- 10.5.4.1 Approval for the use of 2'FL HMOs in infant formula

- TABLE 118 AUSTRALIA & NEW ZEALAND: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 119 AUSTRALIA & NEW ZEALAND: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.5.5 REST OF ASIA PACIFIC

- 10.5.5.1 Strategic decisions undertaken

- TABLE 120 REST OF ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.6 SOUTH AMERICA

- TABLE 122 SOUTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 123 SOUTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 124 SOUTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 125 SOUTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 126 SOUTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (TONS)

- TABLE 127 SOUTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (TONS)

- TABLE 128 SOUTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 129 SOUTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 130 SOUTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2017-2021 (USD MILLION)

- TABLE 131 SOUTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2022-2027 (USD MILLION)

- 10.6.1 BRAZIL

- 10.6.1.1 Infant formulas gaining popularity due to their ease of use

- TABLE 132 BRAZIL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 133 BRAZIL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.6.2 ARGENTINA

- 10.6.2.1 Growing inclination toward functional food

- TABLE 134 ARGENTINA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 135 ARGENTINA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.3.1 Influence of health and wellness trends

- TABLE 136 REST OF SOUTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 137 REST OF SOUTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.7 REST OF THE WORLD (ROW)

- TABLE 138 ROW: HUMAN MILK OLIGOSACCHARIDES MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 139 ROW: HUMAN MILK OLIGOSACCHARIDES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 140 ROW: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 141 ROW: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 142 ROW: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (TONS)

- TABLE 143 ROW: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (TONS)

- TABLE 144 ROW: HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 145 ROW: HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 146 ROW: HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2017-2021 (USD MILLION)

- TABLE 147 ROW: HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION, 2022-2027 (USD MILLION)

- 10.7.1 MIDDLE EAST

- 10.7.1.1 Complementary food feeding among infants

- TABLE 148 MIDDLE EAST: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 149 MIDDLE EAST: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.7.2 AFRICA

- 10.7.2.1 Prevalence of vitamin deficiency among women and children

- TABLE 150 AFRICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 151 AFRICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2022-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS, 2021

- TABLE 152 HUMAN MILK OLIGOSACCHARIDES MARKET: DEGREE OF COMPETITION

- 11.3 KEY PLAYER STRATEGIES

- 11.4 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 46 THREE-YEAR TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2019-2021 (USD BILLION)

- 11.5 COVID-19-SPECIFIC COMPANY RESPONSE

- 11.5.1 DSM

- 11.5.2 BASF SE

- 11.5.3 DUPONT

- 11.5.4 CHR HANSEN HOLDING A/S

- 11.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 47 HUMAN MILK OLIGOSACCHARIDES MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 11.7 PRODUCT FOOTPRINT

- TABLE 153 COMPANY, BY TYPE FOOTPRINT

- TABLE 154 COMPANY, BY APPLICATION FOOTPRINT

- TABLE 155 COMPANY, BY REGIONAL FOOTPRINT

- TABLE 156 COMPANY, BY OVERALL FOOTPRINT

- 11.8 START-UP/SME EVALUATION QUADRANT (OTHER PLAYERS)

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 STARTING BLOCKS

- 11.8.3 RESPONSIVE COMPANIES

- 11.8.4 DYNAMIC COMPANIES

- TABLE 157 DETAILED LIST OF KEY STARTUP/SMES

- TABLE 158 HUMAN MILK OLIGOSACCHARIDES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- FIGURE 48 HUMAN MILK OLIGOSACCHARIDES MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 NEW PRODUCT LAUNCHES

- TABLE 159 HUMAN MILK OLIGOSACCHARIDES MARKET: NEW PRODUCT LAUNCHES, 2018-2021

- 11.9.2 DEALS

- TABLE 160 HUMAN MILK OLIGOSACCHARIDES MARKET: DEALS, 2018-2021

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business overview, Products offered, Recent Developments, MNM view)**

- 12.1.1 DSM

- TABLE 161 DSM: BUSINESS OVERVIEW

- FIGURE 49 DSM: COMPANY SNAPSHOT

- TABLE 162 DSM: PRODUCTS OFFERED

- TABLE 163 DSM: DEALS

- 12.1.2 BASF SE.

- TABLE 164 BASF SE.: BUSINESS OVERVIEW

- FIGURE 50 BASF SE.: COMPANY SNAPSHOT

- TABLE 165 BASF SE.: PRODUCTS OFFERED

- TABLE 166 BASF SE: NEW PRODUCT LAUNCHES

- TABLE 167 BASF SE.: DEALS

- 12.1.3 CHR HANSENHOLDING A/S

- TABLE 168 CHR HANSEN HOLDING A/S: BUSINESS OVERVIEW

- FIGURE 51 CHR. HANSEN HOLDINGS A/S: COMPANY SNAPSHOT

- TABLE 169 CHR. HANSEN HOLDINGS A/S: PRODUCTS OFFERED

- TABLE 170 CHR. HANSEN HOLDING A/S: DEALS

- 12.1.4 DUPONT

- TABLE 171 DUPONT: BUSINESS OVERVIEW

- FIGURE 52 DUPONT: COMPANY SNAPSHOT

- TABLE 172 DUPONT: PRODUCTS OFFERED

- TABLE 173 DUPONT: NEW PRODUCT LAUNCHES

- TABLE 174 DUPONT: DEALS

- 12.1.5 NESTLE

- TABLE 175 NESTLE: BUSINESS OVERVIEW

- FIGURE 53 NESTLE: COMPANY SNAPSHOT

- TABLE 176 NESTLE: PRODUCTS OFFERED

- TABLE 177 NESTLE: NEW PRODUCT LAUNCHES

- 12.1.6 BIOSYNTH CARBOSYNTH

- TABLE 178 BIOSYNTH CARBOSYNTH: BUSINESS OVERVIEW

- TABLE 179 BIOSYNTH CARBOSYNTH: PRODUCTS OFFERED

- TABLE 180 BIOSYNTH CARBOSYNTH: DEALS

- 12.1.7 INBIOSE NV.

- TABLE 181 INBIOSE NV.: BUSINESS OVERVIEW

- TABLE 182 INBIOSE NV: PRODUCTS OFFERED

- 12.1.8 GNUBIOTICS SCIENCES S.A.

- TABLE 183 GNUBIOTICS SCIENCES S.A.: BUSINESS OVERVIEW

- TABLE 184 GNUBIOTICS SCIENCES S.A.: PRODUCTS OFFERED

- TABLE 185 GNUBIOTICS SCIENCES S.A.: NEW PRODUCT LAUNCHES

- 12.1.9 ABBOTT LABORATORIES

- TABLE 186 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- FIGURE 54 ABBOTT LABORATORIES: COMPANY SNAPSHOT

- TABLE 187 ABBOTT LABORATORIES: PRODUCTS OFFERED

- TABLE 188 ABBOTT LABORATORIES: NEW PRODUCT LAUNCHES

- 12.1.10 ROYAL FRIESLANDCAMPINA N.V

- TABLE 189 ROYAL FRIESLANDCAMPINA N.V: BUSINESS OVERVIEW

- FIGURE 55 ROYAL FRIESLANDCAMPINA N.V: COMPANY SNAPSHOT

- TABLE 190 ROYAL FRIESLANDCAMPINA N.V: PRODUCTS OFFERED

- TABLE 191 ROYAL FRIESLANDCAMPINA N.V: NEW PRODUCT LAUNCHES

- TABLE 192 ROYAL FRIESLANDCAMPINA N.V: DEALS

- 12.1.11 ELICITYL S.A

- TABLE 193 ELICITYL S.A.: BUSINESS OVERVIEW

- TABLE 194 ELICITYL S.A: PRODUCTS OFFERED

- 12.1.12 DEXTRA LABORATORIES LTD.

- TABLE 195 DEXTRA LABORATORIES LTD.: BUSINESS OVERVIEW

- TABLE 196 DEXTRA LABORATORIES LTD.: PRODUCTS OFFERED

- 12.2 START-UPS/SME'S/OTHER PLAYERS

- 12.2.1 ZUCHEM INC.

- TABLE 197 ZUCHEM INC.: COMPANY OVERVIEW

- 12.2.2 ADVANCED PROTEIN TECHNOLOGIES CORP.

- TABLE 198 ADVANCED PROTEIN TECHNOLOGIES CORP.: COMPANY OVERVIEW

- 12.2.3 CONAGEN INC.

- TABLE 199 CONAGEN INC.: COMPANY OVERVIEW

- 12.2.4 KYOWA HAKKO BIO CO. LTD.

- TABLE 200 KYOWA HAKKA BIO CO. LTD.: COMPANY OVERVIEW

- 12.2.5 MEDOLAC LABORATORIES

- TABLE 201 MEDOLAC LABORATORIES: COMPANY OVERVIEW

- 12.3 END USER COMPANY PROFILES

- 12.3.1 H & H GROUP

- TABLE 202 H&H GROUP: BUSINESS OVERVIEW

- TABLE 203 H&H GROUP: PRODUCTS OFFERED

- 12.3.2 LAYER ORIGIN NUTRITION

- TABLE 204 LAYER ORIGIN NUTRITION: BUSINESS OVERVIEW

- TABLE 205 LAYER ORIGIN NUTRITION: PRODUCTS OFFERED

- 12.3.3 STANDARD PROCESS INC.

- TABLE 206 STANDARD PROCESS INC.: BUSINESS OVERVIEW

- TABLE 207 STANDARD PROCESS INC.: PRODUCTS OFFERED

- 12.3.4 RECKITT BENCKISER GROUP

- TABLE 208 RECKITT BENCKISER GROUP: BUSINESS OVERVIEW

- TABLE 209 RECKITT BENCKISER GROUP: PRODUCTS OFFERED

- 12.3.5 AMAZON

- TABLE 210 AMAZON: BUSINESS OVERVIEW

- TABLE 211 AMAZON: PRODUCTS OFFERED

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 INFANT FORMULA INGREDIENTS MARKET

- 13.2.1 LIMITATIONS

- 13.2.2 MARKET DEFINITION

- 13.2.3 MARKET OVERVIEW

- 13.2.4 INFANT FORMULA INGREDIENTS MARKET, BY INGREDIENT

- TABLE 212 INFANT FORMULA INGREDIENTS MARKET SIZE, BY INGREDIENT, 2017-2025 (USD MILLION)

- TABLE 213 INFANT FORMULA INGREDIENTS MARKET SIZE, BY INGREDIENT, 2017-2025 (KT)

- 13.2.5 INFANT FORMULA INGREDIENTS MARKET, BY REGION

- TABLE 214 INFANT FORMULA INGREDIENTS MARKET SIZE, BY REGION, 2017-2025 (USD BILLION)

- TABLE 215 INFANT FORMULA INGREDIENTS MARKET SIZE, BY REGION, 2017-2025 (KT)

- 13.3 FUNCTIONAL FOOD INGREDIENTS MARKET

- 13.3.1 LIMITATIONS

- 13.3.2 MARKET DEFINITION

- 13.3.3 MARKET OVERVIEW

- 13.3.4 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE

- TABLE 216 FUNCTIONAL FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 217 FUNCTIONAL FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2021-2026 (USD MILLION)

- 13.3.5 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION

- TABLE 218 FUNCTIONAL FOOD INGREDIENTS MARKET SIZE, BY REGION, 2016-2020 (USD MILLION)

- TABLE 219 FUNCTIONAL FOOD INGREDIENTS MARKET SIZE, BY REGION, 2021-2026 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS