|

|

市場調査レポート

商品コード

1331460

Wi-Fi 6の世界市場:オファリング別(ハードウェア、ソリューション、サービス)、ロケーションタイプ別、用途別(イマーシブテクノロジー、IoT・インダストリー4.0、遠隔医療)、業界別(教育、メディア・エンターテイメント、小売・eコマース)、地域別-2028年までの予測Wi-Fi 6 Market by Offering (Hardware, Solution, and Services), Location Type, Application (Immersive Technologies, IoT & Industry 4.0, Telemedicine), Vertical (Education, Media & Entertainment, Retail & eCommerce) and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| Wi-Fi 6の世界市場:オファリング別(ハードウェア、ソリューション、サービス)、ロケーションタイプ別、用途別(イマーシブテクノロジー、IoT・インダストリー4.0、遠隔医療)、業界別(教育、メディア・エンターテイメント、小売・eコマース)、地域別-2028年までの予測 |

|

出版日: 2023年08月08日

発行: MarketsandMarkets

ページ情報: 英文 288 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

Wi-Fi 6の市場規模は、2023年には57億米ドル、2028年には209億米ドルに達すると推定され、年間平均成長率(CAGR)は29.3%と見込まれています。

さまざまなスマートホーム機器がインターネットに接続されており、信頼性の高い高速接続にはWi-Fi 6が適しています。これがWi-Fi 6市場の普及を促進すると予想されます。

Wi-Fi 6ハードウェア・セグメントには、WAP、メッシュ・ルーター、ホーム・ゲートウェイ、ワイヤレス・リピーターが含まれます。Wi-Fi 6を他の機器と統合することで接続性が向上し、ヘルスケアや小売業など無線接続に大きく依存する業界にとっては極めて重要です。接続が途絶えると、日常業務に支障をきたす可能性があります。Wi-Fi 6はソフトウェア・アップデートの代わりにハードウェア・アップデートに依存しているため、パフォーマンスを向上させるには新しいハードウェアが必要です。家庭内のほとんどの機器がWi-Fi 6をサポートしていても、この新技術を利用するにはWi-Fi 6対応ルーターが必要です。

ヘルスケア・ライフサイエンス業界では、Wi-Fi 6はサービスのスケーラビリティと信頼性を高めるための集中データ管理に利用されています。Wi-Fi 6は、密集した場所で複数のデバイスを収容し、より良いカバレッジを提供し、スペクトルリソース管理を改善することができ、最終的にユーザーエクスペリエンスの向上と患者転帰の改善につながります。この技術は、有線から無線構成に移行する医療機器が大量にある病院にとって特に有益です。これらの機器やアクセスポイントをWi-Fi 6にアップグレードすることで、ヘルスケア従事者はより効率的で信頼性の高い患者ケアを提供できます。

ラテンアメリカは、経済的に安定しておらず、インフラの成長も乏しいため、Wi-Fi 6ソリューションやサービスの導入は他の地域よりも遅れています。しかし、IT革命の高まりにより、インターネットやモバイルベースの普及が進んでいます。中南米諸国ではスマートフォンの販売台数も増加しており、Wi-Fi 6技術の採用に拍車をかけています。ラテンアメリカのWi-Fi 6は、地域の通信事業者、機器メーカー、ソリューション・サプライヤーと戦略的関係を築き、現在のインフラ、専門知識、顧客基盤を活用することができます。これらの事業体との協力により、サービスの供給と市場への浸透を加速させることができます。IoT空間では、セキュリティとデータプライバシーを考慮することが重要です。ラテンアメリカのWi-Fi 6は、企業や顧客の信頼を維持するために、データ保護法を遵守し、安全な接続を保証する必要があります。

当レポートでは、世界のWi-Fi 6市場について調査し、製品別、ロケーションタイプ別、用途別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- Wi-Fi 6テクノロジーの略歴

- 生態系/市場マップ

- ケーススタディ分析

- バリューチェーン分析

- 規制状況

- 特許分析

- 2023年から2024年の主要な会議とイベント

- 価格分析

- ポーターファイブフォースモデル

- 主要な利害関係者と購入基準

- バイヤー/クライアントのビジネスに影響を与える動向と混乱

- Wi-Fi 6の倫理と影響

- 技術分析

- Wi-Fi 6の技術ロードマップ

- Wi-Fi 6市場のベストプラクティス

- 現在および新たなビジネスモデル

第6章 Wi-Fi 6市場、オファリング別

- イントロダクション

- ハードウェア

- ソリューション

- サービス

第7章 Wi-Fi 6市場、ロケーションタイプ別

- イントロダクション

- 屋内

- 屋内

第8章 Wi-Fi 6市場、用途別

- イントロダクション

- イマーシブテクノロジー

- HDビデオストリーミングとビデオ会議

- スマートホームデバイス

- IoT・インダストリー4.0

- 遠隔医療

- 公共Wi-Fiと密集環境

- その他

第9章 Wi-Fi 6市場、業界別

- イントロダクション

- 教育

- ヘルスケア・ライフサイエンス

- 小売・eコマース

- 政府・公共部門

- 旅行・ホスピタリティ

- 輸送・物流

- 製造業

- メディア・エンターテイメント

- 住宅

- その他

第10章 Wi-Fi 6市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業が採用した戦略

- 過去の収益分析

- 主要企業の市場シェア分析

- 競合ベンチマーキング

- 主要企業の評価マトリックス調査手法

- 主要参入企業の評価マトリックス

- スタートアップ/中小企業向けの評価マトリックス調査手法

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

- Wi-Fi 6製品のベンチマーキング

- 主要なWi-Fi 6ベンダーの評価と財務指標

第12章 企業プロファイル

- 主要参入企業

- CISCO

- QUALCOMM

- BROADCOM

- HUAWEI .

- JUNIPER NETWORKS

- NETGEAR

- INTEL

- EXTREME NETWORKS

- UBIQUITI NETWORKS

- FORTINET

- ARUBA NETWORKS

- NXP SEMICONDUCTORS

- その他の企業

- AT&T

- D-LINK

- ALCATEL-LUCENT

- TP-LINK

- MEDIATEK

- TELSTRA.

- MURATA MANUFACTURING

- STERLITE TECHNOLOGIES

- RENESAS ELECTRONICS

- H3C TECHNOLOGIES

- KEYSIGHT TECHNOLOGIES

- ROHDE & SCHWARZ

- LITEPOINT

- スタートアップ/中小企業

- CAMBIUM NETWORKS

- SENSCOMM SEMICONDUCTOR

- XUNISON

- REDWAY NETWORKS

- VSORA

- WILUS INC

- FEDERATED WIRELESS

- ACTIONTEC ELECTRONICS

- ADB GLOBAL

- SDMC TECHNOLOGY.

- EDGEWATER WIRELESS SYSTEMS.

第13章 隣接/関連市場

第14章 付録

The Wi-Fi 6 market is estimated at USD 5.7 billion in 2023 to USD 20.9 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 29.3%. Various smart home devices are connected to the internet, and for a reliable and high-speed connection, Wi-Fi 6 is suitable. It is expected to drive the adoption of the Wi-Fi 6 market.

"By offering, hardware segment to hold the largest market size during the forecast period."

The Wi-Fi 6 hardware segment includes WAP, mesh routers, home gateways, and wireless repeaters. Integrating Wi-Fi 6 with other devices has improved connectivity, which is crucial for industries like healthcare and retail that rely heavily on wireless connectivity. A loss of connection can disrupt their daily business operations. New hardware is necessary to improve performance as Wi-Fi 6 relies on hardware updates instead of software updates. Even if most devices in a home support Wi-Fi 6, a Wi-Fi 6-enabled router is needed to take advantage of this new technology.

Based on vertical, the healthcare and life sciences segment is expected to register the fastest growth rate during the forecast period.

In the healthcare & life sciences industry, Wi-Fi 6 is utilized for centralized data management to enhance the scalability and reliability of services. Wi-Fi 6 can accommodate multiple devices in dense locations, providing better coverage, and improving spectrum resource management, ultimately resulting in a better user experience and improved patient outcomes. This technology is particularly beneficial for hospitals where there is a high volume of medical devices that are transitioning from wired to wireless configurations. By upgrading these devices and access points to Wi-Fi 6, healthcare practitioners can provide more efficient and reliable patient care.

"Latin America to register the second-highest growth rate during the forecast period."

Latin America is adopting Wi-Fi 6 solutions and services slower than other regions due to the region's lack of economic stability and poor infrastructure growth. However, the rising IT revolution is leading to the widespread use of the internet and mobile-based applications. The number of smartphones sold in Latin American countries has also increased, which has spurred the adoption of Wi-Fi 6 technology. Wi-Fi 6 in Latin America can establish strategic relationships with regional telecom operators, device makers, and solution suppliers to exploit its current infrastructure, expertise, and customer base. Collaboration with these entities can accelerate the supply of services and market penetration. It is important to consider security and data privacy in the IoT space. Wi-Fi 6 in Latin America must adhere to data protection laws and guarantee safe connectivity to maintain trust among businesses and customers.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 34%, Tier 2 - 43%, and Tier 3 - 23%

- By Designation: C-level -50%, D-level - 30%, and Others - 20%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 30%, Middle East & Africa - 10%, and Latin America- 5%.

The major players in the Wi-Fi 6 market Cisco Systems Inc. (US), Qualcomm Technologies Inc. (US), Broadcom Inc (US), Intel Corporation (US), Huawei technologies (China), NETGEAR Inc (US), Juniper Networks Inc (US), Extreme Networks Inc. (US), Ubiquiti Inc. (US), Fortinet Inc. (US), Aruba Networks (US), NXP Semiconductors (Netherlands), AT&T (US), D-Link Corporation (Taiwan), Alcatel Lucent Enterprise (France), TP-Link Corporation Limited (China), MediaTek Inc. (Taiwan), Telstra (Australia), Murata Manufacturing Co., Ltd. (Japan), Sterlite Technologies Limited (India), Renesas Electronics (Japan), H3C Technologies Co., Ltd. (China), Keysight Technologies (US), LitePoint (US), Rohde & Schwarz (Germany), Cambium Networks, Ltd. (US), Senscomm Semiconductors Co., Ltd. (China), XUNISON (Ireland), Redway Networks Ltd. Company (England), VSORA SAS (France), WILUS Inc. (South Korea), Federated Wireless, Inc. (US), Actiontec Electronics (US), ADB Global (Switzerland), SDMC Technology (China), and Edgewater Wireless (Canada). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their footprint in the Wi-Fi 6 market.

Research Coverage

The market study covers the Wi-Fi 6 market size across different segments. It aims at estimating the market size and the growth potential across different segments, including offerings (hardware, solutions, and services), location type, application, vertical and region. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the global Wi-Fi 6 market's revenue numbers and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Increasing number of internet users, rise in the adoption of IoT devices, and growing need for faster and secure network), restraints (contention loss and co-channel interference), opportunities (increasing deployment of public Wi-Fi), and challenges (data security and privacy concerns) influencing the growth of the Wi-Fi 6 market. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Wi-Fi 6 market. Market Development: Comprehensive information about lucrative markets - the report analyses the Wi-Fi 6 market across various regions. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Wi-Fi 6 market. Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players Cisco Systems Inc. (US), Qualcomm Technologies Inc. (US), Broadcom Inc (US), Intel Corporation (US), Huawei technologies (China), NETGEAR Inc (US), Juniper Networks Inc (US), Extreme Networks Inc. (US), Ubiquiti Inc. (US), Fortinet Inc. (US), Aruba Networks (US), NXP Semiconductors (Netherlands), AT&T (US), D-Link Corporation (Taiwan), Alcatel Lucent Enterprise (France), TP-Link Corporation Limited (China), MediaTek Inc. (Taiwan), Telstra (Australia), Murata Manufacturing Co., Ltd.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 IMPACT OF RECESSION

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primary profiles

- 2.1.2.4 Key data from primary sources

- 2.1.2.5 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 WI-FI 6 MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR COMPANIES IN WI-FI 6 MARKET

- 4.2 WI-FI 6 MARKET, BY OFFERING

- 4.3 WI-FI 6 MARKET, BY LOCATION TYPE

- 4.4 WI-FI 6 MARKET, TOP THREE APPLICATIONS

- 4.5 WI-FI 6 MARKET, BY VERTICAL

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing number of internet users

- 5.2.1.2 Rising adoption of IoT devices

- 5.2.1.3 Growing need for faster and secure network

- 5.2.2 RESTRAINTS

- 5.2.2.1 Contention loss and co-channel interference

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing deployment of public Wi-Fi

- 5.2.4 CHALLENGES

- 5.2.4.1 Data security and privacy concerns

- 5.3 INDUSTRY TRENDS

- 5.3.1 BRIEF HISTORY OF WI-FI 6 TECHNOLOGY

- 5.3.1.1 Brief history of Wi-Fi 6 technology

- 5.3.1.1.1 2009

- 5.3.1.1.2 2014

- 5.3.1.1.3 2019

- 5.3.1.1 Brief history of Wi-Fi 6 technology

- 5.3.2 ECOSYSTEM/MARKET MAP

- 5.3.3 CASE STUDY ANALYSIS

- 5.3.3.1 Case study 1: Southstar Drug improved performance of real-time applications with Huawei Wi-Fi 6

- 5.3.3.2 Case study 2: BEXCO utilized Cisco DNA Assurance and Wi-Fi 6 for high-speed wireless service .

- 5.3.3.3 Case study 3: Vestavia Hills City Schools adopted Aruba Networks Wi-Fi 6 solutions to enable learning without limits

- 5.3.3.4 Case study 4: Fujitsu deployed Broadcoms Wi-Fi 6 solution for smooth wireless network experience

- 5.3.4 VALUE CHAIN ANALYSIS

- 5.3.4.1 Government regulatory authorities

- 5.3.4.2 Wi-Fi solution providers

- 5.3.4.3 Service providers

- 5.3.4.4 System Integrators (SIs)

- 5.3.4.5 Original Equipment Manufacturers (OEMs)

- 5.3.4.6 Customer Premises Equipment (CPE)/connectivity hardware providers

- 5.3.4.7 Mobile Network Operators (MNOs)

- 5.3.5 REGULATORY LANDSCAPE

- 5.3.5.1 REGULATORY BODIES, GOVERNMENT AGENCIES,AND OTHER ORGANIZATIONS

- 5.3.5.2 North America

- 5.3.5.2.1 US

- 5.3.5.2.2 Canada

- 5.3.5.3 Europe

- 5.3.5.4 Asia Pacific

- 5.3.5.4.1 South Korea

- 5.3.5.4.2 China

- 5.3.5.4.3 India

- 5.3.5.5 Middle East & Africa

- 5.3.5.5.1 UAE

- 5.3.5.6 Latin America

- 5.3.5.6.1 Brazil

- 5.3.5.6.2 Mexico

- 5.3.6 PATENT ANALYSIS

- 5.3.7 KEY CONFERENCES & EVENTS, 2023-2024

- 5.3.8 PRICING ANALYSIS

- 5.3.8.1 Average selling price of key players

- 5.3.8.2 Average selling price trend

- 5.3.9 PORTERS FIVE FORCES MODEL

- 5.3.9.1 Threat from new entrants

- 5.3.9.2 Threat from substitutes

- 5.3.9.3 Bargaining power of buyers

- 5.3.9.4 Bargaining power of suppliers

- 5.3.9.5 Intensity of competitive rivalry

- 5.3.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.3.10.1 Key stakeholders in buying criteria

- 5.3.10.2 Buying criteria

- 5.3.11 TRENDS AND DISRUPTIONS IMPACTING BUYERS/CLIENTS BUSINESSES

- 5.3.12 ETHICS AND IMPLICATIONS OF WI-FI 6

- 5.3.12.1 Bias and fairness

- 5.3.12.2 Privacy and security

- 5.3.12.3 Intellectual property

- 5.3.12.4 Accountability and responsibility

- 5.3.12.5 Societal and economic impact

- 5.3.13 TECHNOLOGY ANALYSIS

- 5.3.13.1 Related technologies

- 5.3.13.1.1 Target Wake Time (TWT)

- 5.3.13.1.2 OFDMA

- 5.3.13.1.3 BSS Coloring

- 5.3.13.1.4 MU-MIMO

- 5.3.13.2 Adjacent technologies

- 5.3.13.2.1 5G network

- 5.3.13.2.2 WiMAX

- 5.3.13.2.3 IoT

- 5.3.13.2.4 MulteFire

- 5.3.13.2.5 LTE

- 5.3.13.1 Related technologies

- 5.3.14 TECHNOLOGY ROADMAP OF WI-FI 6

- 5.3.14.1 Short-term roadmap (2023–2025):

- 5.3.14.2 Mid-term roadmap (2026–2028):

- 5.3.14.3 Long-term roadmap (2029–2030):

- 5.3.15 BEST PRACTICES OF WI-FI 6 MARKET

- 5.3.16 CURRENT AND EMERGING BUSINESS MODELS

- 5.3.16.1 SaaS Model

- 5.3.16.2 Consulting Services Model

- 5.3.16.3 Revenue Sharing Model

- 5.3.16.4 Managed Services Model

- 5.3.1 BRIEF HISTORY OF WI-FI 6 TECHNOLOGY

- 5.2.1 DRIVERS

6 WI-FI 6 MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: WI-FI 6 MARKET DRIVERS

- 6.2 HARDWARE

- 6.2.1 WIRELESS ACCESS POINTS

- 6.2.1.1 Need to transmit wireless signals and connect multiple users to single centralized access point to drive market

- 6.2.2 MESH ROUTERS

- 6.2.2.1 Mesh routers to improve speed, coverage, and reliability of devices within network

- 6.2.3 HOME GATEWAYS

- 6.2.3.1 Need to prevent unauthorized access to private network and simplify coordination of things to drive market

- 6.2.4 WIRELESS CONTROLLERS

- 6.2.4.1 Wireless controllers to provide centralized administration and access points control and facilitate configuration, monitoring, and troubleshooting . 88

- 6.2.5 SYSTEM ON CHIP

- 6.2.5.1 Wi-Fi systems on chip to enable compact and efficient design and improve performance and power efficiency

- 6.2.6 OTHER HARDWARE

- 6.2.1 WIRELESS ACCESS POINTS

- 6.3 SOLUTION

- 6.3.1 NEED FOR RELIABILITY AND SCALABILITY, QUICK UPLOADS AND DOWNLOADS, REDUCED LATENCY, AND LONGER BATTERY LIFE TO DRIVE MARKET

- 6.4 SERVICES

- 6.4.1 WI-FI 6 SERVICES TO HELP OFFLOAD BURDEN OF MANAGING NETWORK INFRASTRUCTURE AND FOCUS ON CORE BUSINESS

- 6.4.2 PROFESSIONAL SERVICES

- 6.4.2.1 Services to help in surveying, analyzing, consulting, network planning, designing, implementing, training, and supporting

- 6.4.2.2 Consulting

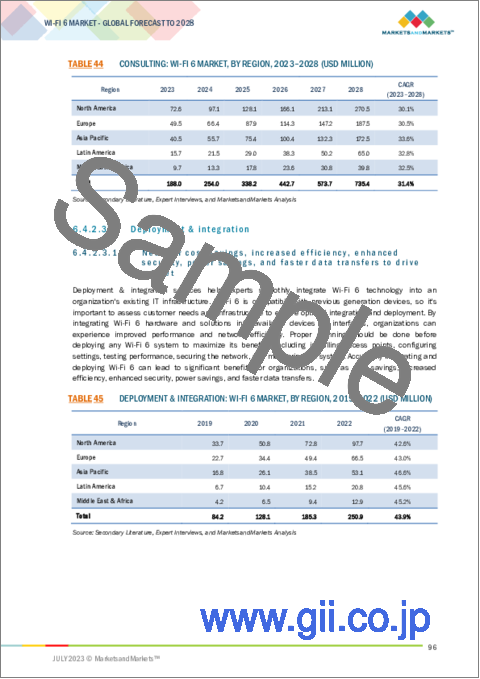

- 6.4.2.2.1 Consulting services to optimize network performance, enhance security, and deploy Wi-Fi 6 technology

- 6.4.2.3 Deployment & integration

- 6.4.2.3.1 Need for cost savings, increased efficiency, enhanced security, power savings, and faster data transfers to drive market

- 6.4.2.4 Support & maintenance

- 6.4.2.4.1 Support & maintenance services to provide troubleshooting, performance monitoring, security audits, and 24x7 technical support

- 6.4.3 MANAGED SERVICES

- 6.4.3.1 Managed services to offer 24x7 remote monitoring to companies with budget constraints and lack of technical expertise

7 WI-FI 6 MARKET, BY LOCATION TYPE

- 7.1 INTRODUCTION

- 7.1.1 LOCATION TYPES: WI-FI 6 MARKET DRIVERS

- 7.2 INDOOR

- 7.2.1 INDOOR POSITIONING IN WLAN TO OFFER COST-EFFECTIVENESS AND REASONABLE POSITIONING ACCURACY

- 7.3 OUTDOOR

- 7.3.1 ENHANCING OUTDOOR CONNECTIVITY WITH WI-FI 6 TO IMPROVE PERFORMANCE AND ACCESSIBILITY TO DRIVE MARKET

8 WI-FI 6 MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 APPLICATIONS: WI-FI 6 MARKET DRIVERS.

- 8.2 IMMERSIVE TECHNOLOGIES

- 8.2.1 NEED FOR IMPROVED SECURITY FEATURES AND TRANSMISSION OF SENSITIVE DATA TO DRIVE DEMAND FOR IMMERSIVE TECHNOLOGIES

- 8.3 HD VIDEO STREAMING & VIDEO CONFERENCING

- 8.3.1 WI-FI 6 IN VIDEO STREAMING TO DELIVER VIDEO CONTENT AND COMMUNICATE WITHOUT PHYSICAL CONNECTION

- 8.4 SMART HOME DEVICES

- 8.4.1 WI-FI 6'S FASTER SPEEDS TO ENABLE FASTER COMMUNICATION BETWEEN DEVICES

- 8.5 IOT & INDUSTRY 4.0

- 8.5.1 IOT & INDUSTRY 4.0 TO IMPROVE PRODUCTIVITY, EFFICIENCY, AND FLEXIBILITY IN MANUFACTURING

- 8.6 TELEMEDICINE

- 8.6.1 WI-FI 6 IN TELEMEDICINE TO ENABLE TRANSMISSION OF MEDICAL IMAGES AND VIDEOS AND CONDUCT TELEHEALTH CONSULTATIONS

- 8.7 PUBLIC WI-FI & DENSE ENVIRONMENTS

- 8.7.1 WI-FI 6 TO INCREASE PRODUCTIVITY IN PUBLIC PLACES BY PROVIDING RELIABLE AND FAST CONNECTION

- 8.8 OTHER APPLICATIONS

9 WI-FI 6 MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.1.1 VERTICALS: WI-FI 6 MARKET DRIVERS

- 9.2 EDUCATION

- 9.2.1 ADVENT OF ELEARNING AND ONLINE EXAM PRACTICES TO DRIVE DEMAND FOR RELIABLE AND SECURE INTERNET ACCESS

- 9.2.2 EDUCATION: WI-FI 6 USE CASES

- 9.2.2.1 Easier communication

- 9.2.2.2 Improved resources for teacher

- 9.2.2.3 Mobile learning

- 9.3 HEALTHCARE & LIFE SCIENCES

- 9.3.1 WI-FI 6 TO PROVIDE MORE EFFICIENT AND RELIABLE PATIENT CARE AND IMPROVE DATA HANDLING AND STORING

- 9.3.2 HEALTHCARE & LIFE SCIENCES: WI-FI 6 USE CASES

- 9.3.2.1 Telemedicine

- 9.3.2.2 Mobile health applications

- 9.3.2.3 Electronic healthcare records

- 9.4 RETAIL & ECOMMERCE

- 9.4.1 INCREASED CAPACITY AND IMPROVED LATENCY OF WI-FI 6 TO HELP RETAILERS COLLECT CUSTOMER DATA TO ANALYZE SHOPPING PATTERNS

- 9.4.2 RETAIL & ECOMMERCE: WI-FI 6 USE CASES

- 9.4.2.1 Analyzing customer shopping patterns . 121

- 9.4.2.2 Provide location-based advertisements and personalized offers

- 9.5 GOVERNMENT & PUBLIC SECTOR

- 9.5.1 WI-FI 6 TO OFFER HIGH-PERFORMANCE, SECURE, AND CONTINUOUSLY MONITORED NETWORKING ENVIRONMENT TO GOVERNMENT

- 9.5.2 GOVERNMENT & PUBLIC SECTOR: WI-FI 6 USE CASES

- 9.5.2.1 Public Wi-Fi

- 9.5.2.2 Emergency communication

- 9.5.2.3 Smart cities

- 9.6 TRAVEL & HOSPITALITY

- 9.6.1 WI-FI 6 TO OFFER ACCURATE INDOOR LOCATION TRACKING, EFFICIENT GEOFENCING, IMPROVED VOICE QUALITY, AND SEAMLESS ROAMING

- 9.6.2 TRAVEL & HOSPITALITY SECTOR: WI-FI 6 USE CASES

- 9.6.2.1 Telephony

- 9.6.2.2 Location services

- 9.6.2.3 IP-CCTV

- 9.7 TRANSPORTATION & LOGISTICS125

- 9.7.1 WI-FI 6 TO PROVIDE REAL-TIME VEHICLE TRACKING, FASTER TICKET PURCHASES, AND INCREASED CAPACITY FOR BUSY TRANSPORTATION

- 9.7.2 TRANSPORTATION & LOGISTICS: WI-FI 6 USE CASES

- 9.7.2.1 Online ticketing

- 9.7.2.2 Fleet management

- 9.8 MANUFACTURING

- 9.8.1 WI-FI 6 TO ENHANCE MACHINE-TO-MACHINE COMMUNICATION, IMPROVE MANAGEMENT, AND MAKE TIMELY DECISIONS

- 9.8.2 MANUFACTURING: WI-FI 6 USE CASES

- 9.8.2.1 Machine-to-machine communication

- 9.8.2.2 Inventory tracking

- 9.8.2.3 Predictive maintenance

- 9.9 MEDIA & ENTERTAINMENT

- 9.9.1 WI-FI 6 TO GATHER VALUABLE DATA ON AUDIENCE BEHAVIOR AND ENHANCE HD VIDEO STREAMING EXPERIENCE

- 9.9.2 MEDIA & ENTERTAINMENT: WI-FI 6 USE CASES

- 9.9.2.1 HD video streaming

- 9.9.2.2 Gaming

- 9.9.2.3 Over-the-Top (OTT) streaming

- 9.9.2.4 Audience analytics and engagement

- 9.10 RESIDENTIAL

- 9.10.1 WI-FI 6 TO SUPPORT HEALTH MONITORING DEVICES AND MANY SECURITY DEVICES WITHOUT COMPROMISING PERFORMANCE

- 9.10.2 RESIDENTIAL: WI-FI 6 USE CASES

- 9.10.2.1 Elderly care

- 9.10.2.2 Home automation

- 9.10.2.3 Security

- 9.11 OTHER VERTICALS

- 9.11.1 MOBILE BANKING

- 9.11.2 WIRELESS POINT-OF-SALE (POS) SYSTEM

- 9.11.3 SMART GRID

- 9.11.4 ASSET MANAGEMENT

- 9.11.4.1 Real-time data analysis

10 WI-FI 6 MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- 10.2.2 NORTH AMERICA: WI-FI 6 MARKET DRIVERS

- 10.2.3 US

- 10.2.3.1 High technological awareness and presence of multiple big tech corporations to drive demand for Wi-Fi 6 solutions

- 10.2.4 CANADA

- 10.2.4.1 Government initiatives and need for faster speed, better performance, and improved battery life to drive market

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- 10.3.2 EUROPE: WI-FI 6 MARKET DRIVERS

- 10.3.3 UK

- 10.3.3.1 Increasing use of cloud-based services, need for high-speed internet, and availability of Wi-Fi 6E devices to drive market

- 10.3.4 GERMANY

- 10.3.4.1 Increasing adoption of cutting-edge technology and development of advanced technologies to drive demand for Wi-Fi 6 solutions

- 10.3.5 FRANCE

- 10.3.5.1 Need for faster connection and adoption of Wi-Fi 6 by government to propel market

- 10.3.6 SPAIN

- 10.3.6.1 Growing demand for smart home appliances and government initiatives to grow awareness about Wi-Fi 6 to drive market

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- 10.4.2 ASIA PACIFIC: WI-FI 6 MARKET DRIVERS

- 10.4.3 CHINA

- 10.4.3.1 Need for enhanced performance and faster speed and adoption of advanced technologies to drive market

- 10.4.4 JAPAN

- 10.4.4.1 Need for faster and more reliable internet connections and investment from government to drive market

- 10.4.5 AUSTRALIA AND NEW ZEALAND

- 10.4.5.1 Need for improved gaming and video streaming experiences and enhanced performance of smart home devices to drive market

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Highly advanced mobile market and active initiatives from government to encourage adoption of Wi-Fi 6 to drive market

- 10.4.7 SOUTHEAST ASIA

- 10.4.7.1 Modification of regulations by IMDA and initiatives by leading companies to drive demand for Wi-Fi 6 solutions

- 10.4.8 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.5.2 MIDDLE EAST & AFRICA: WI-FI 6 MARKET DRIVERS

- 10.5.3 KSA

- 10.5.3.1 Development of wireless technology and adoption of Wi-Fi 6 over cellular data connections to drive market

- 10.5.4 UAE

- 10.5.4.1 Government's focus on digital transformation and eCommerce industry's rapid expansion to drive market

- 10.5.5 SOUTH AFRICA

- 10.5.5.1 Need for mobility and adoption of cloud-based technologies to boost demand for Wi-Fi 6 solutions

- 10.5.6 REST OF MIDDLE EAST & AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: RECESSION IMPACT

- 10.6.2 LATIN AMERICA: WI-FI 6 MARKET DRIVERS

- 10.6.3 BRAZIL

- 10.6.3.1 Need to provide uninterrupted connectivity and adoption of national 6GHz plan to boost demand for Wi-Fi 6 solutions

- 10.6.4 MEXICO

- 10.6.4.1 Increasing use of wireless devices and advancements in social media to drive market

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 HISTORICAL REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS OF KEY PLAYERS

- 11.5 COMPETITIVE BENCHMARKING

- 11.6 EVALUATION MATRIX METHODOLOGY FOR KEY PLAYERS

- 11.7 EVALUATION MATRIX FOR KEY PLAYERS

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.8 EVALUATION MATRIX METHODOLOGY FOR STARTUPS/SMES

- 11.9 EVALUATION MATRIX FOR STARTUPS/SMES

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES

- 11.10.2 DEALS

- 11.11 WI-FI 6 PRODUCT BENCHMARKING.

- 11.11.1 PROMINENT WI-FI 6 HARDWARE DEVICES

- 11.11.1.1 Qualcomm FastConnect 6900 .

- 11.11.1.2 Cisco Catalyst 9130AX

- 11.11.1.3 Broadcom BCM43684

- 11.11.1.4 Huawei WiFi AX3

- 11.11.1.5 Juniper AP24

- 11.11.2 PROMINENT WI-FI 6 TESTING PLATFORMS

- 11.11.2.1 Rohde & Schwarz WLAN IEEE 802.11ax testing

- 11.11.2.2 Keysight WaveTest 6

- 11.11.2.3 LitePoint IQxel-MW 7G.

- 11.11.1 PROMINENT WI-FI 6 HARDWARE DEVICES

- 11.12 VALUATION AND FINANCIAL METRICS OF KEY WI-FI 6 VENDORS

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- 12.1.1 CISCO

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats .

- 12.1.2 QUALCOMM

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 BROADCOM

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered . 223

- 12.1.3.3 Recent developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 HUAWEI .

- 12.1.4.1 Business overview .

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 JUNIPER NETWORKS

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 NETGEAR

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.7 INTEL

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.8 EXTREME NETWORKS

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.9 UBIQUITI NETWORKS

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.10 FORTINET

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.11 ARUBA NETWORKS

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.12 NXP SEMICONDUCTORS

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.1 CISCO

- 12.2 OTHER PLAYERS

- 12.2.1 AT&T

- 12.2.2 D-LINK

- 12.2.3 ALCATEL-LUCENT

- 12.2.4 TP-LINK

- 12.2.5 MEDIATEK

- 12.2.6 TELSTRA.

- 12.2.7 MURATA MANUFACTURING

- 12.2.8 STERLITE TECHNOLOGIES

- 12.2.9 RENESAS ELECTRONICS

- 12.2.10 H3C TECHNOLOGIES

- 12.2.11 KEYSIGHT TECHNOLOGIES

- 12.2.12 ROHDE & SCHWARZ

- 12.2.13 LITEPOINT

- 12.3 STARTUPS/SMES

- 12.3.1 CAMBIUM NETWORKS

- 12.3.2 SENSCOMM SEMICONDUCTOR

- 12.3.3 XUNISON

- 12.3.4 REDWAY NETWORKS

- 12.3.5 VSORA

- 12.3.6 WILUS INC

- 12.3.7 FEDERATED WIRELESS

- 12.3.8 ACTIONTEC ELECTRONICS

- 12.3.9 ADB GLOBAL

- 12.3.10 SDMC TECHNOLOGY.

- 12.3.11 EDGEWATER WIRELESS SYSTEMS.

13 ADJACENT/RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 SD-WAN MARKET

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.3 SD-WAN MARKET, BY COMPONENT

- 13.2.4 SD-WAN MARKET, BY DEPLOYMENT MODE

- 13.2.5 SD-WAN MARKET, BY ORGANIZATION SIZE

- 13.2.6 SD-WAN MARKET, BY END USER

- 13.2.7 SD-WAN MARKET, BY REGION

- 13.3 WI-FI AS A SERVICE MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.3 WI-FI AS A SERVICE MARKET, BY SOLUTION

- 13.3.4 WI-FI AS A SERVICE MARKET, BY LOCATION TYPE

- 13.3.5 WI-FI AS A SERVICE MARKET, BY ORGANIZATION SIZE

- 13.3.6 WI-FI AS A SERVICE MARKET, BY VERTICAL

- 13.3.7 WI-FI AS A SERVICE MARKET, BY REGION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS