|

|

市場調査レポート

商品コード

1069884

合成紙の世界市場:原材料別 (BOPP、HDPE、PET、PVC)・用途別 (印刷、ラベル・タグ、包装)・エンドユース産業別 (工業、施設、商業・小売業)・地域別の将来予測 (2027年まで)Synthetic Paper Market by Raw Material (BOPP, HDPE, PET, and PVC), Application (Printing, Labels & Tags, Packaging), End-use Industry (Industrial, Institutional, and Commercial/Retail) and Geography - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 合成紙の世界市場:原材料別 (BOPP、HDPE、PET、PVC)・用途別 (印刷、ラベル・タグ、包装)・エンドユース産業別 (工業、施設、商業・小売業)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年04月12日

発行: MarketsandMarkets

ページ情報: 英文 193 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の合成紙の市場規模は、2021年に7億6,600万米ドル、2027年までに12億8,600万米ドルに達する見通しです。

また、2022年から2027年の間に9.2%のCAGRで成長すると予測されています。市場の主な促進要因として、医薬品や輸送、食品・飲料などの産業で合成紙の利用が拡大していることや、政府の厳格な規制、世界各国での人口増加・都市化などが挙げられます。

原材料別ではBOPPが、用途別では印刷が、エンドユース産業別では工業が最大のセグメントとなっています。地域別ではアジア太平洋が最大の市場で、予測期間中に9.4%のCAGRで成長すると見込まれています。

当レポートでは、世界の合成紙の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、市場動向の見通し、原材料別・用途別・エンドユース産業別・地域別の詳細動向、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 分析方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- 概要

- 市場力学

- 促進要因

- 抑制要因

- 市場機会

- 課題

- COVID-19の経済的評価

- COVID-19の合成紙市場への影響

- イントロダクション

- 製紙・包装業界への影響

- 世界各国へのCOVID-19の影響

第6章 産業動向

- バリューチェーン

- ポーターのファイブフォース分析

- V4の義務

- YC・YCCのシフト

- 貿易分析

- エコシステム

- 価格分析

- 技術分析

- ケーススタディの分析

- 規制分析

- 主要な会議とイベント (2022年)

- 規制状況

- 合成紙の特許分析

第7章 合成紙市場:原材料別

- イントロダクション

- BOPP (二軸延伸ポリプロピレン)

- HDPE (高密度ポリエチレン)

- PET (ポリエチレンテレフタレート)

- PVC (ポリ塩化ビニル)

第8章 合成紙市場:用途別

- イントロダクション

- 印刷

- 包装

- ラベル・タグ

- その他

第9章 合成紙市場:エンドユース産業別

- イントロダクション

- 工業

- 業務用

- 商業/小売業

第10章 合成紙市場:地域別分析

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 台湾

- 韓国

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- 他の欧州諸国

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 中東・アフリカ

- 南アフリカ

- アラブ首長国連邦

- 他の中東・アフリカ諸国

第11章 競合情勢

- 概要

- 主要企業の戦略

- 市場ランキング

- 上位企業の収益分析

- 市場シェア分析

- 企業評価クアドラント

- 競合ベンチマーキング

- 競合リーダーシップマッピング:中小企業

- 競合シナリオと動向

- 資本取引

- その他

第12章 企業プロファイル

- 主要企業

- PPG INDUSTRIES, INC.

- SEIKO EPSON CORPORATION

- AGFA-GEVAERT GROUP

- YUPO CORPORATION

- ARJOBEX SAS

- AMERICAN PROFOL INC.

- HOP INDUSTRIES CORPORATION

- RELYCO SALES, INC.

- TRANSILWRAP COMPANY, INC.

- MDV PAPIER-UND KUNSTSTOFFVEREDELUNG GMBH

- その他の企業

- COSMO FILMS LTD.

- NEENAH INC.

- TOYOBO CO. LTD.

- HWASEUNG INDUSTRIES CO., LTD.

- INNOVIA FLIMS

- NAN YA PLASTICS CORPORATION

- VALERON STRENGTH FILMS

- ALUMINIUM FERON GMBH & CO. KG

- HUANYUAN PLASTIC FILM CO., LTD.

- TAMERICA PRODUCTS INC.

- RUIAN RIFO PACKAGING MATERIAL CO., LTD.

- KAVERI METALLISING & COATING INDUSTRIES PVT. LTD.

- SHIJIAZHUANG DADAO PACKAGING MATERIALS CO.LTD.

- ELASTIN INTERNATIONAL CORP.

- MASTERPIECE GRAPHIX

第13章 付録

The growth of the global synthetic paper market is directly related to the strict government regulation against deforestation which results in high demand for conventional resources. For over more four decades, the global demand for paper has increased by 400%, with harvested trees accounting for 35% of all paper produced. The environmentally friendly manufacturing and recyclable nature of synthetic paper will help it gain market share in the forecasted period. The increasing population and urbanization in different world regions are the major determinants of the global synthetic paper market growth. The rise of China as a global manufacturing powerhouse has increased the demand for synthetic paper globally.

The global synthetic paper market size is estimated at USD 766 million in 2021 and is projected to reach USD 1,286 million by 2027, at a CAGR of 9.2%, between 2022 and 2027. Growth in the synthetic paper market can primarily be attributed to the growing involvement of synthetic paper in the industries such as pharmaceuticals, transportation and food & beverage among others.

Synthetic paper is manufactured with synthetic resins derived from petroleum (primary material). Resin selection plays a major role in the attributes exhibited by different synthetic papers. It is preferred over conventional paper due to its excellent chemical, tear, oil, and moisture resistance, printability, heat sealability, durability, and high strength. Synthetic paper is usually made up of BOPP, HDPE, and others (polystyrene, polyamide, polyethylene, and polyvinyl chloride) and are used by various end-use industries, such as food & beverages, cosmetics, transportation, pharmaceuticals, chemical, and advertising.

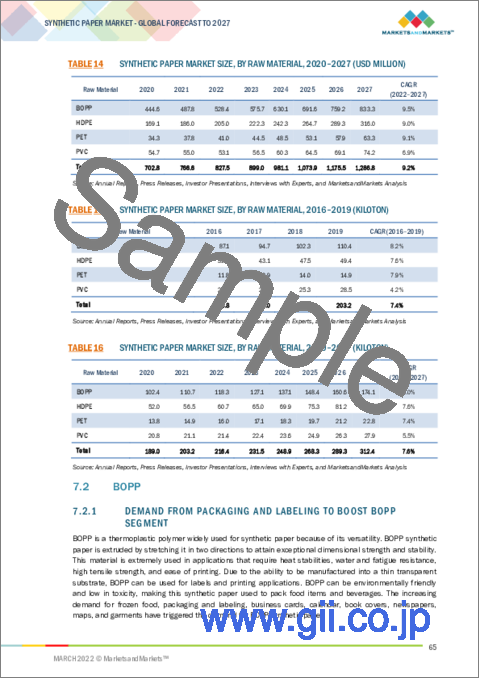

"BOPP is the largest raw material segment of the synthetic paper market"

Based on raw materials, the synthetic paper market includes BOPP, HDPE, PET, and PVC. The BOPP raw material segment led the application segment of the market in terms of both value and volume. BOPP is extensively used in applications that require heat stabilities, water and fatigue resistance, high tensile strength, and ease of printing. Due to the ability to be manufactured into a thin transparent substrate, BOPP can be used for labels and printing applications. BOPP can be environmentally friendly and low in toxicity, making this synthetic paper used to pack food items and beverages.

"Printing is the largest application segment of the synthetic paper market"

Based on applications, the synthetic paper market is divides into printing, labels & tags, packaging, and others. Printing is the largest application of synthetic paper. It has micropores on the surface, enabling better affinity for ink holding and providing a high-quality finish. Its properties such as durability, tear resistance, water resistance, scratch resistance, and abrasion resistance make it an important substrate against conventional papers. The synthetic paper has a lower static surface, which prevents double feeding and eases the printing process, making synthetic papers suitable with various printers for several printing applications. These printing applications include menus, personalized marketing materials, point of purchase displays, wrist bands, cards/envelopes, tickets/passes, and labels for various end-use industries.

"Industrial is the largest end-use industry segment of the synthetic paper market"

Based on end-use industry, the synthetic paper market is divides into industrial, institutional, and commercial/retail. The industrial end-use industry segment is the largest end-user of synthetic paper. Synthetic paper is used in industrial product identification tags, Industrial labels. Outdoor applications for synthetic paper include billboards, horticulture ID tags, and bus shelter displays. It is resistant to moisture and chemicals and maintains print color consistency in the face of UV exposure and various weather conditions. Furthermore, the non-tearable paper has superior strength and excellent printability with various printing techniques.

"Asia Pacific is the largest market for synthetic paper market"

The Asia Pacific region is projected to be the largest market, in terms of value. Asia Pacific is expected to grow at a CAGR of 9.4% during the forecast period. The growth of Asia-Pacific region can be attributed to the high economic growth rate and various eating habits, packaging & printing preferences of people across different countries of the region. Also, the multiplying population of the region presents a huge customer base for fast-moving consumer goods (FMCG) products and packaged food & beverages, which is expected to lead to the growth of the synthetic paper market during the forecast period. Asia Pacific is the largest and the most promising synthetic paper market and is expected to continue during the forecast period. Rising population, growth in disposable income, rapid industrialization, and increased urbanization are driving the synthetic paper market in Asia Pacific. The market in the region is mainly driven by various end-use industries, such as foods & beverages, cosmetics, pharmaceuticals, chemicals, and manufacturings.

The breakdown of primary interviews is given below:

- By Department: Sales/Export/Marketing - 60%, Production - 25%, and R&D -15%

- By Designation: Managers - 50%, CXOs - 30%, and Executives - 20%

- By Region: APAC - 42%, North America - 18%, Europe - 14%, Middle East & Africa - 22%, and South America - 4%

The key players in the synthetic paper market are PPG Industries, Inc. (US), Seiko Epson Corporation (Japan), Agfa-Gevaert Group (Belgium), Yupo Corporation (Japan), and Arjobex SAS (France).

Research Coverage

The synthetic paper market has been segmented based on application, end-use industry, and region. This report covers the synthetic paper market and forecasts its market size until 2027. It also provides detailed information on company profiles and competitive strategies adopted by the key players to strengthen their position in the synthetic paper market. The report also provides insights into the drivers and restraints in the synthetic paper market along with opportunities and challenges. The report also includes profiles of top manufacturers in the synthetic paper market.

Reasons to Buy the Report

The report is expected to help market leaders/new entrants in the following ways:

1. This report segments the synthetic paper market and provides the closest approximations of revenue numbers for the overall market and its segments across different verticals and regions.

2. This report is expected to help stakeholders understand the pulse of the synthetic paper market and provide information on key market drivers, restraints, challenges, and opportunities influencing the market growth.

3. This report is expected to help stakeholders obtain an in-depth understanding of the competitive landscape of the synthetic paper market and gain insights to improve the position of their businesses. The competitive landscape section includes detailed information on strategies, such as merger & acquisitions, new product developments, expansions, and collaborations.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- TABLE 1 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 SYNTHETIC PAPER MARKET SEGMENTATION

- 1.4.1 YEARS CONSIDERED

- 1.4.2 REGIONAL SCOPE

- FIGURE 2 SYNTHETIC PAPER MARKET, BY REGION

- 1.5 CURRENCY

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 LIMITATIONS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 SYNTHETIC PAPER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- FIGURE 4 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION: SUPPLY-SIDE

- 2.3 DATA TRIANGULATION

- FIGURE 8 SYNTHETIC PAPER MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS

- 2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY

- FIGURE 9 BOPP SEGMENT TO LEAD RAW MATERIAL SEGMENT

- FIGURE 10 PRINTING SEGMENT TO LEAD APPLICATION SEGMENT

- FIGURE 11 INDUSTRIAL SEGMENT TO LEAD END-USE INDUSTRY SEGMENT

- FIGURE 12 ASIA PACIFIC LED SYNTHETIC PAPER MARKET IN 2020

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE MARKET OPPORTUNITIES IN SYNTHETIC PAPER MARKET

- FIGURE 13 SYNTHETIC PAPER MARKET IN ASIA PACIFIC REGION TO OFFER ATTRACTIVE OPPORTUNITIES DURING FORECAST PERIOD

- 4.2 SYNTHETIC PAPER MARKET, BY REGION

- FIGURE 14 NORTH AMERICA TO BE FASTEST-GROWING REGION

- 4.3 SYNTHETIC PAPER MARKET IN ASIA PACIFIC, 2020

- FIGURE 15 CHINA AND PRINTING ACCOUNTED FOR LARGEST SHARES OF ASIA PACIFIC SYNTHETIC PAPER MARKET

- 4.4 SYNTHETIC PAPER MARKET: GLOBAL SNAPSHOT

- FIGURE 16 CANADIAN MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 OVERVIEW

- 5.2 MARKET DYNAMICS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SYNTHETIC PAPER MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Synthetic papers are eco-friendly and possess ideal physical properties

- 5.2.1.2 Synthetic papers have wide areas of application

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuation in the price of raw materials and crude oil

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Stringent government regulations and increasing concerns about pulp paper for environmental pollution

- 5.2.4 CHALLENGES

- 5.2.4.1 Exorbitant prices of synthetic papers

- 5.3 COVID-19 ECONOMIC ASSESSMENT

- FIGURE 18 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

- 5.4 COVID-19 IMPACT ON SYNTHETIC PAPER MARKET

- 5.4.1 INTRODUCTION

- 5.4.2 IMPACT ON PAPER AND PACKAGING INDUSTRY

- 5.4.3 IMPACT OF COVID-19 ON VARIOUS COUNTRIES

- FIGURE 19 PRE- AND POST-COVID-19 SCENARIO OF SYNTHETIC PAPER MARKET

6 INDUSTRY TRENDS

- 6.1 VALUE CHAIN

- 6.2 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 SYNTHETIC PAPER MARKET: PORTER'S FIVE FORCE ANALYSIS

- 6.2.1 THREAT OF NEW ENTRANTS

- 6.2.2 THREAT OF SUBSTITUTES

- 6.2.3 BARGAINING POWER OF SUPPLIERS

- 6.2.4 BARGAINING POWER OF BUYERS

- 6.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.3 V4 MANDATES

- 6.3.1 YC & YCC SHIFT

- 6.3.1.1 Revenue shift & new revenue pockets for synthetic paper manufacturers

- FIGURE 21 REVENUE SHIFT FOR SYNTHETIC PAPER SERVICE, SOLUTION, AND PRODUCT PROVIDERS

- 6.3.2 TRADE ANALYSIS

- TABLE 3 PAPER, PAPERBOARD, CELLULOSE WADDING, AND WEBS OF CELLULOSE FIBER IMPORT TRADE DATA, 2020 (USD THOUSAND)

- TABLE 4 PAPER, PAPERBOARD, CELLULOSE WADDING, AND WEBS OF CELLULOSE FIBER EXPORT TRADE DATA, 2020 (USD THOUSAND)

- 6.3.3 ECOSYSTEM

- FIGURE 22 SYNTHETIC PAPER MARKET ECOSYSTEM

- 6.3.4 PRICING ANALYSIS

- 6.3.5 TECHNOLOGY ANALYSIS

- 6.3.5.1 Cosmo Films upgraded synthetic paper to revolutionize industry

- 6.3.6 CASE STUDY ANALYSIS

- 6.3.6.1 In-Depth Optical Analysis

- 6.3.7 REGULATORY ANALYSIS

- 6.3.1 YC & YCC SHIFT

- 6.4 KEY CONFERENCES & EVENTS IN 2022

- TABLE 5 SYNTHETIC PAPER MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 6.5 REGULATORY LANDSCAPE

- 6.5.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.6 SYNTHETIC PAPER PATENT ANALYSIS

- 6.6.1 INTRODUCTION

- 6.6.2 METHODOLOGY

- 6.6.3 DOCUMENT TYPE

- FIGURE 23 PATENT ANALYSIS

- FIGURE 24 PUBLICATION TRENDS - LAST 10 YEARS

- 6.6.4 INSIGHT

- 6.6.5 LEGAL STATUS OF PATENTS

- FIGURE 25 STATUS OF PATENTS

- FIGURE 26 JURISDICTION ANALYSIS

- 6.6.6 TOP COMPANIES/APPLICANTS

- FIGURE 27 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NO OF PATENTS

- TABLE 9 LIST OF PATENTS BY EAST CHINA UNIVERSITY OF SCIENCE AND TECHNOLOGY

- TABLE 10 LIST OF PATENTS BY NAN YA PLASTICS CORPORATION

- TABLE 11 LIST OF PATENTS BY EASTMAN CHEM CO:

- TABLE 12 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

7 SYNTHETIC PAPER MARKET, BY RAW MATERIAL

- 7.1 INTRODUCTION

- FIGURE 28 BOPP TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- TABLE 13 SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016-2019 (USD MILLION)

- TABLE 14 SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2020-2027 (USD MILLION)

- TABLE 15 SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016-2019 (KILOTON)

- TABLE 16 SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2020-2027 (KILOTON)

- 7.2 BOPP

- 7.2.1 DEMAND FROM PACKAGING AND LABELING TO BOOST BOPP SEGMENT

- TABLE 17 BOPP MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 18 BOPP MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 7.3 HDPE

- 7.3.1 ABILITY TO BOND WITH SUBSTRATES AND TAMPER-EVIDENT PROPERTIES IS DRIVING DEMAND FOR HDPE SEGMENT

- TABLE 19 HDPE MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 20 HDPE MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 7.4 PET

- TABLE 21 PET MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 22 PET MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 7.5 PVC

- TABLE 23 PVC MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 24 PVC MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

8 SYNTHETIC PAPER MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 29 PRINTING APPLICATION SEGMENT TO LEAD SYNTHETIC PAPER MARKET

- TABLE 25 SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

- TABLE 26 SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 27 SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

- TABLE 28 SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 8.2 PRINTING

- 8.2.1 EXCELLENT PHYSICAL PROPERTIES OF SYNTHETIC PAPERS TO BOOST PRINTING SEGMENT OF SYNTHETIC PAPER MARKET

- TABLE 29 PRINTING SEGMENT MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 30 PRINTING SEGMENT MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 8.3 PACKAGING

- 8.3.1 SYNTHETIC PAPER BEING AN ECO-FRIENDLY SUBSTITUTE OF CELLULOSE-BASED PAPER TO BOOST MARKET

- TABLE 31 PACKAGING SEGMENT MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 32 PACKAGING SEGMENT MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 8.4 LABELS & TAGS

- 8.4.1 EXTENSIVE USAGE OF LABELS IN VARIOUS INDUSTRIES TO BOOST LABELS & TAGS SEGMENT

- TABLE 33 LABELS & TAGS SEGMENT MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 34 LABELS & TAGS SEGMENT MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 8.5 OTHERS

- TABLE 35 OTHER SEGMENT MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 36 OTHER SEGMENT MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

9 SYNTHETIC PAPER MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 30 INDUSTRIAL END-USE INDUSTRY SEGMENT TO SYNTHETIC PAPER MARKET

- TABLE 37 SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 38 SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 39 SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 40 SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 9.2 INDUSTRIAL

- 9.2.1 OPTIMUM CHEMICAL AND PHYSICAL PROPERTIES TO BOOST INDUSTRIAL SEGMENT

- TABLE 41 INDUSTRIAL SEGMENT MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 42 INDUSTRIAL SEGMENT MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 9.3 INSTITUTIONAL

- 9.3.1 IDEAL PROPERTIES OF SYNTHETIC PAPER TO BOOST INSTITUTIONAL SEGMENT OF SYNTHETIC MARKET

- TABLE 43 INSTITUTIONAL SEGMENT MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 44 INSTITUTIONAL SEGMENT MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 9.4 COMMERCIAL/RETAIL

- 9.4.1 EASE IN PRINTABILITY TO BOOST COMMERICIAL/RETAIL SEGMENT IN SYNTHETIC PAPER MARKET

- TABLE 45 COMMERCIAL/RETAIL SEGMENT MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 46 COMMERCIAL/RETAIL SEGMENT MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

10 SYNTHETIC PAPER MARKET: REGIONAL ANALYSIS

- 10.1 INTRODUCTION

- TABLE 47 INTERIM ECONOMIC OUTLOOK FORECAST, 2019-2021

- FIGURE 31 NORTH AMERICA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- 10.1.1 GLOBAL: SYNTHETIC PAPER MARKET, BY REGION

- TABLE 48 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

- TABLE 49 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 50 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY REGION, 2016-2019 (KILOTON)

- TABLE 51 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 10.1.2 GLOBAL: SYNTHETIC PAPER MARKET, BY RAW MATERIAL

- TABLE 52 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016-2019 (USD MILLION)

- TABLE 53 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2020-2027 (USD MILLION)

- TABLE 54 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016-2019 (KILOTON)

- TABLE 55 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2020-2027 (KILOTON)

- 10.1.3 GLOBAL: SYNTHETIC PAPER MARKET, BY APPLICATION

- TABLE 56 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

- TABLE 57 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 58 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

- TABLE 59 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 10.1.4 GLOBAL: SYNTHETIC PAPER MARKET, BY END-USE INDUSTRY

- TABLE 60 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 61 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 62 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 63 GLOBAL: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.2 ASIA PACIFIC

- FIGURE 32 ASIA PACIFIC: SYNTHETIC PAPER MARKET SNAPSHOT

- 10.2.1 ASIA PACIFIC: SYNTHETIC PAPER MARKET, BY COUNTRY

- TABLE 64 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 65 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 66 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2016-2019 (KILOTON)

- TABLE 67 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- 10.2.2 ASIA PACIFIC: SYNTHETIC PAPER MARKET, BY RAW MATERIAL

- TABLE 68 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016-2019 (USD MILLION)

- TABLE 69 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2020-2027 (USD MILLION)

- TABLE 70 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016-2019 (KILOTON)

- TABLE 71 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2020-2027 (KILOTON)

- 10.2.3 ASIA PACIFIC: SYNTHETIC PAPER MARKET, BY APPLICATION

- TABLE 72 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

- TABLE 73 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 74 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

- TABLE 75 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 10.2.4 ASIA PACIFIC: SYNTHETIC PAPER MARKET, BY END-USE INDUSTRY

- TABLE 76 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 77 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 78 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 79 ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.2.5 CHINA

- 10.2.5.1 China to continue dominating in Asia Pacific market

- TABLE 80 CHINA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 81 CHINA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 82 CHINA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 83 CHINA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.2.6 INDIA

- 10.2.6.1 Increasing demand in manufacturing, food, and pharmaceutical industries to drive synthetic paper market

- TABLE 84 INDIA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 85 INDIA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 86 INDIA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 87 INDIA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.2.7 JAPAN

- 10.2.7.1 Increasing governmental regulatory interventions concerning deforestation to drive synthetic paper market

- TABLE 88 JAPAN: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 89 JAPAN: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 90 JAPAN: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 91 JAPAN: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.2.8 TAIWAN

- 10.2.8.1 Food & beverage industry drives market

- TABLE 92 TAIWAN: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 93 TAIWAN: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 94 TAIWAN: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 95 TAIWAN: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.2.9 SOUTH KOREA

- 10.2.9.1 Growing packaging industry to boost synthetic paper market in country

- TABLE 96 SOUTH KOREA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 97 SOUTH KOREA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 98 SOUTH KOREA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 99 SOUTH KOREA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.2.10 REST OF ASIA PACIFIC

- TABLE 100 REST OF ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 101 REST OF ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 103 REST OF ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3 EUROPE

- 10.3.1 EUROPE: SYNTHETIC PAPER MARKET, BY COUNTRY

- TABLE 104 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 105 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 106 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2016-2019 (KILOTON)

- TABLE 107 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- 10.3.2 EUROPE: SYNTHETIC PAPER MARKET, BY RAW MATERIAL

- TABLE 108 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016-2019 (USD MILLION)

- TABLE 109 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2020-2027 (USD MILLION)

- TABLE 110 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016-2019 (KILOTON)

- TABLE 111 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2020-2027 (KILOTON)

- 10.3.3 EUROPE: SYNTHETIC PAPER MARKET, BY APPLICATION

- TABLE 112 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

- TABLE 113 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 114 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

- TABLE 115 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 10.3.4 EUROPE: SYNTHETIC PAPER MARKET, BY END-USE INDUSTRY

- TABLE 116 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 117 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 118 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 119 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3.5 GERMANY

- 10.3.5.1 Increasing demand from printing and paper technology to augment synthetic paper market

- TABLE 120 GERMANY: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 121 GERMANY: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 122 GERMANY: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 123 GERMANY: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3.6 FRANCE

- 10.3.6.1 Growing applications such as printing and labeling in various end-use industries to boost market

- TABLE 124 FRANCE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 125 FRANCE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 126 FRANCE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 127 FRANCE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3.7 UK

- 10.3.7.1 Growth of food & beverage as key industry to boost demand for synthetic paper

- TABLE 128 UK: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 129 UK: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 130 UK: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 131 UK: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3.8 ITALY

- 10.3.8.1 Increase in chemical industries and export of food items to drive the market

- TABLE 132 ITALY: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 133 ITALY: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 134 ITALY: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 135 ITALY: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3.9 SPAIN

- 10.3.9.1 Changing food habits to drive synthetic paper market

- TABLE 136 SPAIN: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 137 SPAIN: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 138 SPAIN: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 139 SPAIN: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3.10 RUSSIA

- 10.3.10.1 Automotive and construction industries to drive market

- TABLE 140 RUSSIA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 141 RUSSIA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 142 RUSSIA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 143 RUSSIA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3.11 REST OF EUROPE

- TABLE 144 REST OF EUROPE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 145 REST OF EUROPE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 146 REST OF EUROPE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 147 REST OF EUROPE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.4 NORTH AMERICA

- 10.4.1 NORTH AMERICA: SYNTHETIC PAPER MARKET, BY REGION

- TABLE 148 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 149 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 150 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2016-2019 (KILOTON)

- TABLE 151 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- 10.4.2 NORTH AMERICA: SYNTHETIC PAPER MARKET, BY RAW MATERIAL

- TABLE 152 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016-2019 (USD MILLION)

- TABLE 153 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2020-2027 (USD MILLION)

- TABLE 154 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016-2019 (KILOTON)

- TABLE 155 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2020-2027 (KILOTON)

- 10.4.3 NORTH AMERICA: SYNTHETIC PAPER MARKET, BY APPLICATION

- TABLE 156 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

- TABLE 157 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 158 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

- TABLE 159 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 10.4.4 NORTH AMERICA: SYNTHETIC PAPER MARKET, BY END-USE INDUSTRY

- TABLE 160 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 161 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 162 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 163 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.4.5 US

- 10.4.5.1 Increased preference for packaged food is expected to drive synthetic paper market

- TABLE 164 US: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 165 US: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 166 US: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 167 US: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.4.6 CANADA

- 10.4.6.1 Rising demand for durable substrates for outdoor applications is expected to drive market growth

- TABLE 168 CANADA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 169 CANADA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 170 CANADA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 171 CANADA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.4.7 MEXICO

- 10.4.7.1 Increasing number of paper packaging industries to drive market growth

- TABLE 172 MEXICO: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 173 MEXICO: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 174 MEXICO: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 175 MEXICO: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.5 SOUTH AMERICA

- 10.5.1 SOUTH AMERICA: SYNTHETIC PAPER MARKET, BY REGION

- TABLE 176 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 177 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 178 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2016-2019 (KILOTON)

- TABLE 179 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- 10.5.2 SOUTH AMERICA: SYNTHETIC PAPER MARKET, BY RAW MATERIAL

- TABLE 180 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016-2019 (USD MILLION)

- TABLE 181 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2020-2027 (USD MILLION)

- TABLE 182 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016-2019 (KILOTON)

- TABLE 183 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2020-2027 (KILOTON)

- 10.5.3 SOUTH AMERICA: SYNTHETIC PAPER MARKET, BY APPLICATION

- TABLE 184 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

- TABLE 185 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 186 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

- TABLE 187 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 10.5.4 SOUTH AMERICA: SYNTHETIC PAPER MARKET, BY END-USE INDUSTRY

- TABLE 188 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 189 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 190 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 191 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.5.5 BRAZIL

- 10.5.5.1 Growing need for an alternative to pulp paper to drive synthetic paper market in Brazil

- TABLE 192 BRAZIL: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 193 BRAZIL: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 194 BRAZIL: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 195 BRAZIL: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.5.6 ARGENTINA

- 10.5.6.1 Government's step to promote exports positively impacts Argentinian market

- TABLE 196 ARGENTINA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 197 ARGENTINA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 198 ARGENTINA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 199 ARGENTINA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.5.7 REST OF SOUTH AMERICA

- TABLE 200 REST OF SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 201 REST OF SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 202 REST OF SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 203 REST OF SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET, BY COUNTRY

- TABLE 204 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2016-2019 (KILOTON)

- TABLE 207 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- 10.6.2 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET, BY RAW MATERIAL

- TABLE 208 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016-2019 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2020-2027 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016-2019 (KILOTON)

- TABLE 211 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2020-2027 (KILOTON)

- 10.6.3 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET, BY APPLICATION

- TABLE 212 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

- TABLE 215 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 10.6.4 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET, BY END-USE INDUSTRY

- TABLE 216 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 219 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.6.5 SAUDI ARABIA

- 10.6.5.1 Increasing opportunities in end-use industries and availability of crude oil to fuel synthetic paper market

- TABLE 220 SAUDI ARABIA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 221 SAUDI ARABIA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 222 SAUDI ARABIA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 223 SAUDI ARABIA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.6.6 SOUTH AFRICA

- 10.6.6.1 Growth in pharmaceutical industry to fuel market

- TABLE 224 SOUTH AFRICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 225 SOUTH AFRICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 226 SOUTH AFRICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 227 SOUTH AFRICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.6.7 UAE

- 10.6.7.1 Substantial growth of printing applications to fuel synthetic paper market UAE

- TABLE 228 UAE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 229 UAE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 230 UAE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 231 UAE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.6.8 REST OF MIDDLE EAST & AFRICA

- TABLE 232 REST OF MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 233 REST OF MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 234 REST OF MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 235 REST OF MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- FIGURE 33 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENT AND ACQUISITION AS KEY GROWTH STRATEGY, 2017-202O

- 11.3 MARKET RANKING

- FIGURE 34 MARKET RANKING OF KEY PLAYERS, 2020

- 11.3.1 PPG INDUSTRIES INC.

- 11.3.2 SEIKO EPSON CORPORATION

- 11.3.3 AGFA-GEVAERT CORPORATION

- 11.3.4 YUPO CORPORATION

- 11.3.5 ARJOBEX SAS

- 11.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 35 REVENUE ANALYSIS FOR KEY COMPANIES IN SYNTHETIC PAPER MARKET

- 11.5 MARKET SHARE ANALYSIS

- TABLE 236 SYNTHETIC PAPER MARKET: MARKET SHARES OF KEY PLAYERS

- FIGURE 36 SHARE OF LEADING COMPANIES IN SYNTHETIC PAPER MARKET

- 11.6 COMPANY EVALUATION QUADRANT

- FIGURE 37 SYNTHETIC PAPER MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

- 11.6.1 STARS

- 11.6.2 PERVASIVE

- 11.6.3 EMERGING LEADERS

- 11.6.4 PARTICIPANTS

- 11.7 COMPETITIVE BENCHMARKING

- TABLE 237 SYNTHETIC PAPER MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 238 SYNTHETIC PAPER MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- FIGURE 38 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 39 BUSINESS STRATEGY EXCELLENCE

- 11.8 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 STARTING BLOCKS

- 11.8.4 DYNAMIC COMPANIES

- FIGURE 40 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES), 2020

- 11.9 COMPETITIVE SCENARIO AND TRENDS

- 11.9.1 DEALS

- TABLE 239 SYNTHETIC PAPER MARKET: DEALS, JANUARY 2019-DECEMBER 2020

- 11.9.2 OTHERS

- TABLE 240 SYNTHETIC PAPER MARKET: NEW PRODUCT DEVELOPMENT, SEPTEMBER 2017-SEPTEMBER 2020

12 COMPANY PROFILES

- 12.1 KEY COMPANIES

- (Business overview, Products and solutions, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)**

- 12.1.1 PPG INDUSTRIES, INC.

- TABLE 241 PPG INDUSTRIES, INC.: BUSINESS OVERVIEW

- FIGURE 41 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 242 PPG INDUSTRIES, INC.: PRODUCT OFFERED

- 12.1.2 SEIKO EPSON CORPORATION

- TABLE 243 SEIKO EPSON CORPORATION: BUSINESS OVERVIEW

- FIGURE 42 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

- TABLE 244 SEIKO EPSON CORPORATION: PRODUCT OFFERED

- 12.1.3 AGFA-GEVAERT GROUP

- TABLE 245 AGFA-GEVAERT GROUP: BUSINESS OVERVIEW

- FIGURE 43 AGFA-GEVAERT GROUP: COMPANY SNAPSHOT

- TABLE 246 AGFA-GEVAERT GROUP: PRODUCT OFFERED

- TABLE 247 AGFA-GEVAERT GROUP: DEALS

- 12.1.4 YUPO CORPORATION

- TABLE 248 YUPO CORPORATION: BUSINESS OVERVIEW

- TABLE 249 YUPO CORPORATION: PRODUCT OFFERED

- TABLE 250 YUPO CORPORATION: OTHERS

- 12.1.5 ARJOBEX SAS

- TABLE 251 ARJOBEX SAS: BUSINESS OVERVIEW

- TABLE 252 ARJOBEX SAS: PRODUCT OFFERED

- TABLE 253 NIPPON STEEL & SUMITOMO METAL CORPORATION: DEALS

- 12.1.6 AMERICAN PROFOL INC.

- TABLE 254 AMERICAN PROFOL INC.: BUSINESS OVERVIEW

- TABLE 255 AMERICAN PROFOL INC.: PRODUCT OFFERED

- 12.1.7 HOP INDUSTRIES CORPORATION

- TABLE 256 HOP INDUSTRIES CORPORATION: BUSINESS OVERVIEW

- TABLE 257 HOP INDUSTRIES CORPORATION: PRODUCT OFFERED

- 12.1.8 RELYCO SALES, INC.

- TABLE 258 RELYCO SALES, INC.: BUSINESS OVERVIEW

- TABLE 259 RELYCO SALES, INC.: PRODUCT OFFERED

- 12.1.9 TRANSILWRAP COMPANY, INC.

- TABLE 260 TRANSILWRAP COMPANY, INC.: BUSINESS OVERVIEW

- TABLE 261 TRANSILWRAP COMPANY, INC.: PRODUCT OFFERED

- TABLE 262 TRANSILWRAP COMPANY, INC.: OTHERS

- 12.1.10 MDV PAPIER-UND KUNSTSTOFFVEREDELUNG GMBH

- TABLE 263 MDV PAPIER-UND KUNSTSTOFFVEREDELUNG GMBH: BUSINESS OVERVIEW

- TABLE 264 MDV PAPIER-UND KUNSTSTOFFVEREDELUNG GMBH: PRODUCT OFFERED

- 12.2 OTHER PLAYERS

- 12.2.1 COSMO FILMS LTD.

- TABLE 265 COSMO FILMS LTD.: COMPANY OVERVIEW

- 12.2.2 NEENAH INC.

- TABLE 266 NEENAH INC.: COMPANY OVERVIEW

- 12.2.3 TOYOBO CO. LTD.

- TABLE 267 TOYOBO CO. LTD.: COMPANY OVERVIEW

- 12.2.4 HWASEUNG INDUSTRIES CO., LTD.

- TABLE 268 HWASEUNG INDUSTRIES CO., LTD: COMPANY OVERVIEW

- 12.2.5 INNOVIA FLIMS

- TABLE 269 INNOVIA FLIMS: COMPANY OVERVIEW

- 12.2.6 NAN YA PLASTICS CORPORATION

- TABLE 270 NAN YA PLASTICS CORPORATION: COMPANY OVERVIEW

- 12.2.7 VALERON STRENGTH FILMS

- TABLE 271 VALERON STRENGTH FILMS: COMPANY OVERVIEW

- 12.2.8 ALUMINIUM FERON GMBH & CO. KG

- TABLE 272 ALUMINIUM FERON GMBH & CO. KG: COMPANY OVERVIEW

- 12.2.9 HUANYUAN PLASTIC FILM CO., LTD.

- TABLE 273 HUANYUAN PLASTIC FILM CO., LTD.: COMPANY OVERVIEW

- 12.2.10 TAMERICA PRODUCTS INC.

- TABLE 274 TAMERICA PRODUCTS INC.: COMPANY OVERVIEW

- 12.2.11 RUIAN RIFO PACKAGING MATERIAL CO., LTD.

- TABLE 275 RUIAN RIFO PACKAGING MATERIAL CO., LTD.: COMPANY OVERVIEW

- 12.2.12 KAVERI METALLISING & COATING INDUSTRIES PVT. LTD.

- TABLE 276 KAVERI METALLISING & COATING INDUSTRIES PVT. LTD.: COMPANY OVERVIEW

- 12.2.13 SHIJIAZHUANG DADAO PACKAGING MATERIALS CO.LTD.

- TABLE 277 SHIJIAZHUANG DADAO PACKAGING MATERIALS CO.LTD.: COMPANY OVERVIEW

- 12.2.14 ELASTIN INTERNATIONAL CORP.

- TABLE 278 ELASTIN INTERNATIONAL CORP.: COMPANY OVERVIEW

- 12.2.15 MASTERPIECE GRAPHIX

- TABLE 279 MASTERPIECE GRAPHIX: COMPANY OVERVIEW

- *Details on Business overview, Products and solutions, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS