|

|

市場調査レポート

商品コード

1453779

ガス分離膜の世界市場:モジュール別、材料タイプ別、用途別、地域別-2030年までの予測Gas Separation Membrane Market by Module, Material Type, Application (Nitrogen Generation & Oxygen Enrichment, Hydrogen Recovery, CDR, Vapor/Gas Separation, Vapor/Vapor Separation, Air Dehydration, H2S Removal), and Region - Global Forecast to 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ガス分離膜の世界市場:モジュール別、材料タイプ別、用途別、地域別-2030年までの予測 |

|

出版日: 2024年03月15日

発行: MarketsandMarkets

ページ情報: 英文 257 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のガス分離膜の市場規模は、2023年の10億米ドルから2030年には16億米ドルに達し、予測期間中のCAGRは7.4%と予測されています。

クリーンエネルギーへの需要の高まりが、ガス分離膜の採用拡大を後押ししています。この技術には、サイズ、溶解度、化学反応性、分子量などの特徴的な特性に基づいて、混合物から様々なガスを分離するように設計された多様な方法とプロセスが含まれます。ガス分離技術は、ガス精製、環境保全、エネルギー生成、ヘルスケアなどのプロセスで重要な役割を果たし、広範な産業分野で応用されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2030年 |

| 検討単位 | 金額(100万米ドル)、数量(100万平方メートル) |

| セグメント | 材料タイプ別、モジュール別、用途別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

スパイラルワウンドモジュールは、ガス分離膜技術において重要な役割を果たしており、ガス分離の有効性と柔軟性で有名です。これらのモジュールは、平らなシート状の膜素材を中央のチューブにらせん状にきつく巻き付けることで製造されます。ガス分離のための広い表面積を提供し、混合ガスと膜材料との効率的な相互作用を促進します。その結果、高いガス処理能力が得られ、スパイラル巻きモジュールは大容量のガスを扱う用途に最適です。そのコンパクトな設計は、スペースに制約のある環境において有利です。

ガス分離膜は、窒素生成と酸素富化の両プロセスで重要な役割を果たします。窒素生成では、これらの膜は周囲の空気から窒素を選択的に抽出し、食品包装や電子機器製造などの用途で使用される高純度窒素の生成を保証します。逆に酸素富化では、ガス分離膜は酸素のみを透過させ、酸素濃縮器などのヘルスケアに不可欠な酸素富化ストリームを作り出します。これらの膜はガス製造の効率と信頼性を高め、工業プロセスから医療治療まで、さまざまな目的のために正確なガス組成を必要とする産業に利益をもたらします。

北米では、排出削減と大気の質の向上を目的とした厳しい環境規制が、効率的な汚染物質の捕捉と分離のためにガス分離膜を採用するよう産業界を促しています。さらに、この地域では、環境問題への関心と持続可能性の目標に後押しされ、クリーンエネルギー源への注目が高まっており、ガス分離膜の需要を促進しています。材料の強化、設計の改良、製造プロセスの改善を含むガス分離膜技術の継続的な進歩は、その有用性を拡大し、その有効性と効率を強化しています。さらに、気体分離膜は北米の石油・ガス、製薬、石油化学、飲食品産業など様々な分野で広く利用されています。この広範な採用は、これらの産業におけるガス精製、分離、回収プロセスでの役割に起因しています。

当レポートでは、世界のガス分離膜市場について調査し、モジュール別、材料タイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- ポーターのファイブフォース分析

- マクロ経済指標

- 規制状況

- 技術分析

- 貿易分析

- 価格分析

- エコシステム分析

- 顧客のビジネスに影響を与える動向/混乱

- 主要な会議とイベント

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 特許分析

- 投資と資金調達のシナリオ

- 用途/用途別資金調達

第6章 ガス分離膜市場、材料タイプ別

- イントロダクション

- ポリイミドおよびポリアミド

- ポリスルホン

- 酢酸セルロース

- その他

第7章 ガス分離膜市場、モジュール別

- イントロダクション

- プレートとフレーム

- スパイラルワウンド

- 中空糸

- その他

第8章 ガス分離膜市場、用途別

- イントロダクション

- 窒素の生成と酸素の富化

- 水素回収

- 二酸化炭素の除去

- 蒸気/ガスの分離

- 蒸気/蒸気分離

- 脱水

- H2S除去

- その他

第9章 ガス分離膜市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

第10章 競合情勢

- 概要

- 主要参入企業の戦略/秘策、2018年~2023年

- 収益分析、2020~2022年

- 市場シェア分析、2022年

- 企業評価と財務指標

- ブランド/製品の比較

- 企業評価マトリックス:主要企業、2023年

- 企業評価マトリックス:新興企業と中小企業、2023年

- 競合シナリオと動向

第11章 企業プロファイル

- 主要参入企業

- THEWAY MEMBRANES

- AIR LIQUIDE

- AIR PRODUCTS AND CHEMICALS, INC.

- HONEYWELL UOP

- UBE CORPORATION

- PARKER HANNIFIN CORPORATION

- FUJIFILM MANUFACTURING EUROPE B.V.

- DIC CORPORATION

- GENERON

- MEMBRANE TECHNOLOGY AND RESEARCH, INC.

- SLB

- その他の企業

- AIRRANE

- ATLAS COPCO AB

- EVONIK INDUSTRIES AG

- BORSIG MEMBRANE TECHNOLOGY GMBH

- COMPACT MEMBRANE SYSTEMS

- COBETTER FILTRATION EQUIPMENT CO.,LTD.

- GENRICH MEMBRANES PVT. LTD.

- JSC GRASYS.

- CONIFER SYSTEMS

- MEGAVISION MEMBRANE

- NOVAMEM

- PERMSELECT

- PERVATECH

- SEPRATEK

第12章 付録

The global gas separation membrane market size is projected to reach USD 1.6 billion by 2030 from USD 1.0 billion in 2023, at a CAGR of 7.4% during the forecast period. The growing demand for clean energy is driving the increased adoption of gas separation membranes. This technology encompasses diverse methods and processes designed to separate various gases from mixtures based on distinctive properties including size, solubility, chemical reactivity, or molecular weight. Gas separation technology finds extensive applications across a spectrum of industries, playing a vital role in processes such as gas purification, environmental conservation, energy generation, and healthcare.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Units Considered | Value (USD Million), Volume (Million Square Meter) |

| Segments | Material Type, Module, Application, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Spiral wound is the second largest module in terms of value in the gas separation membrane market, in 2022."

Spiral wound modules play a vital role in gas separation membrane technology, renowned for their effectiveness and flexibility in separating gases. These modules are constructed by tightly winding flat-sheet membrane material around a central tube in a spiral pattern. They offer extensive surface areas for gas separation, facilitating efficient interaction between the gas mixture and the membrane material. This results in high gas throughput, making spiral wound modules ideal for applications handling large gas volumes. Their compact design proves advantageous in space-constrained environments.

"Nitrogen generation & oxygen enrichment accounted for the second largest market share in terms of value in the gas separation membrane market, in 2022."

Gas separation membranes play a vital role in both nitrogen generation and oxygen enrichment processes. In nitrogen generation, these membranes selectively extract nitrogen from the surrounding air, ensuring the production of high-purity nitrogen used in applications such as food packaging and electronics manufacturing. Conversely, in oxygen enrichment, the gas separation membranes allow only oxygen to permeate through, creating an oxygen-enriched stream essential for healthcare applications such as oxygen concentrators. These membranes enhance the efficiency and dependability of gas production, benefiting industries requiring precise gas compositions for diverse purposes, ranging from industrial processes to medical therapies.

"North America is the second largest region in the gas separation membrane market in 2022."

In North America, strict environmental regulations aimed at emission reduction and enhancing air quality are prompting industries to embrace gas separation membranes for efficient pollutant capture and separation. Additionally, the region's increasing focus on clean energy sources, propelled by environmental concerns and sustainability objectives, is driving the demand for gas separation membranes. Ongoing advancements in gas separation membrane technology, encompassing material enhancements, design refinements, and manufacturing process improvements, are broadening their utility and bolstering their effectiveness and efficiency. Moreover, gas separation membranes are extensively utilized across diverse sectors in North America, including oil and gas, pharmaceuticals, petrochemicals, and food and beverage industries. This widespread adoption is attributed to their role in gas purification, separation, and recovery processes within these industries.

The breakdown of primary interviews has been given below.

- By Company Type: Tier 1 - 25%, Tier 2 - 50%, and Tier 3 - 25%

- By Designation: C Level Executives - 20%, Director Level - 30%, Others - 50%

- By Region: North America - 20%, Europe - 30%, APAC - 25%, Middle East & Africa - 10%, South America-15%.

The key players in the gas separation membrane market Air Liquide (France), Air Products and Chemicals, Inc. (US), UBE Corporation. (Japan), Honeywell UOP (US), FUJIFILM Manufacturing Europe B.V. (Netherlands), SLB (US), DIC Corporation (Japan), PARKER HANNIFIN CORPORATION (US), Membrane Technology and Research, Inc. (US), and Generon (US) among others. The gas separation membrane market report analyzes the key growth strategies, such as new product launches, investments & expansions, agreements, partnerships, and mergers & acquisitions to strengthen their market positions.

Research Coverage

This report provides detailed segmentation of the gas separation membrane market and forecasts its market size until 2030. The market has been segmented based on type (polyimide & polyaramide, polysulfone, cellulose acetate), module (spiral wound, hollow fiber, plate & frame), application (nitrogen generation & oxygen enrichment, hydrogen recovery, carbon dioxide removal, vapor / gas separation, vapor / vapor separation, air dehydration, H2S), and region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisitions associated with the market for the gas separation membrane market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the gas separation membrane market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising demand for membranes in carbon dioxide separation processes technology, Increasing demand in nitrogen generation and syngas cleaning, Environmental regulations and stringent emission standards), restraints (Technical disadvantages over other gas separation technologies, Plasticization of polymeric membranes in high-temperature applications), opportunities (Development of mixed matrix membranes, Rising demand for clean energy), and challenges (Upscaling and commercializing new membranes) influencing the growth of the gas separation membrane market.

- Market Penetration: Comprehensive information on the gas separation membranes offered by top players in the global gas separation membrane market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the gas separation membrane market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for gas separation membrane market across regions.

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the gas separation membrane market.

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 GAS SEPARATION MEMBRANE MARKET: SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 GAS SEPARATION MEMBRANE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of key primary interview participants-demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 GAS SEPARATION MEMBRANE MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 GAS SEPARATION MEMBRANE MARKET: TOP-DOWN APPROACH

- FIGURE 5 GAS SEPARATION MEMBRANE MARKET: MARKET SIZE ESTIMATION (TOP-DOWN APPROACH)

- 2.3 MARKET SIZING AND FORECASTING

- FIGURE 6 GAS SEPARATION MEMBRANE MARKET: DEMAND-SIDE FORECAST PROJECTIONS

- 2.4 DATA TRIANGULATION

- FIGURE 7 GAS SEPARATION MEMBRANE MARKET: DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISK ANALYSIS

- 2.8 IMPACT OF RECESSION ON GAS SEPARATION MEMBRANE MARKET

3 EXECUTIVE SUMMARY

- FIGURE 8 POLYIMIDE & POLYARAMIDE MATERIAL TYPE TO ACCOUNT FOR LARGEST SHARE OF GAS SEPARATION MEMBRANE MARKET IN 2030

- FIGURE 9 VAPOR/VAPOR SEPARATION TO BE FASTEST-GROWING APPLICATION IN GAS SEPARATION MEMBRANE MARKET DURING FORECAST PERIOD

- FIGURE 10 PLATE AND FRAME MODULE TO DOMINATE GAS SEPARATION MEMBRANE MARKET IN 2030

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING GAS SEPARATION MEMBRANE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GAS SEPARATION MEMBRANE MARKET

- FIGURE 12 RAPID INDUSTRIALIZATION AND EMERGING ECONOMIES TO DRIVE GAS SEPARATION MEMBRANE MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- 4.2 GAS SEPARATION MEMBRANE MARKET, BY MODULE

- FIGURE 13 PLATE AND FRAME MODULE TO HOLD LARGEST SHARE OF GAS SEPARATION MEMBRANE MARKET IN 2030

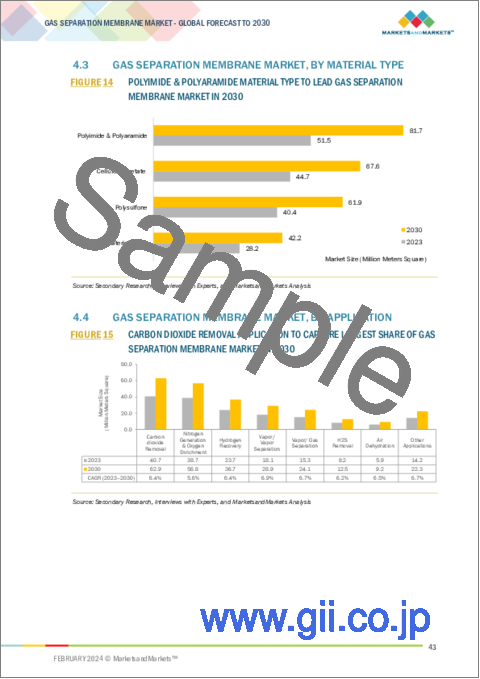

- 4.3 GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE

- FIGURE 14 POLYIMIDE & POLYARAMIDE MATERIAL TYPE TO LEAD GAS SEPARATION MEMBRANE MARKET IN 2030

- 4.4 GAS SEPARATION MEMBRANE MARKET, BY APPLICATION

- FIGURE 15 CARBON DIOXIDE REMOVAL APPLICATION TO CAPTURE LARGEST SHARE OF GAS SEPARATION MEMBRANE MARKET IN 2030

- 4.5 GAS SEPARATION MEMBRANE MARKET, BY REGION

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR IN GAS SEPARATION MEMBRANE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 GAS SEPARATION MEMBRANE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing need for membranes in carbon dioxide separation processes

- 5.2.1.2 Rising demand for membranes in nitrogen generation and syngas cleaning

- 5.2.1.3 Increasing implementation of environmental regulations and stringent emission standards

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technical disadvantages compared to alternative gas separation technologies

- 5.2.2.2 Plasticization of polymeric membranes in high-temperature applications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for clean energy

- TABLE 1 GLOBAL INVESTMENTS IN CLEAN ENERGY AND FOSSIL FUELS, 2015-2023 (USD BILLION)

- 5.2.3.2 Development of mixed matrix membranes

- 5.2.4 CHALLENGES

- 5.2.4.1 Upscaling and commercializing new membranes

- 5.2.4.2 Requirement for high initial investment for development and installation of polymeric membranes for separation

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 18 GAS SEPARATION MEMBRANE MARKET: VALUE CHAIN ANALYSIS

- 5.3.1 RAW MATERIAL SUPPLIERS

- 5.3.2 MANUFACTURERS

- 5.3.3 DISTRIBUTORS

- 5.3.4 END-USER INDUSTRIES

- 5.4 PORTER'S FIVE FORCE ANALYSIS

- FIGURE 19 GAS SEPARATION MEMBRANE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 BARGAINING POWER OF BUYERS

- 5.4.2 BARGAINING POWER OF SUPPLIERS

- 5.4.3 THREAT OF NEW ENTRANTS

- 5.4.4 THREAT OF SUBSTITUTES

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 2 GAS SEPARATION MEMBRANE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- TABLE 3 TRENDS OF PER CAPITA GDP, 2020-2022 (USD)

- TABLE 4 GDP GROWTH ESTIMATE AND PROJECTION OF KEY COUNTRIES, 2023-2027

- 5.5.2 OIL & GAS SECTOR STATISTICS

- TABLE 5 OIL PRODUCTION, BY COUNTRY, 2020-2021 (THOUSAND BARRELS/DAY)

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATIONS

- 5.6.1.1 North America

- 5.6.1.2 Europe

- 5.6.1.3 Asia Pacific

- 5.6.2 STANDARDS

- 5.6.2.1 ISO 21873-1

- 5.6.2.2 ASTM D1434

- 5.6.2.3 ISO 10156

- 5.6.2.4 ISO 10715

- 5.6.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.1 REGULATIONS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 PRESSURE SWING ADSORPTION (PSA) TECHNOLOGY

- 5.7.2 MEMBRANE CONDENSER TECHNOLOGY

- 5.7.3 MIXED MATRIX MEMBRANE

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO

- FIGURE 20 IMPORT DATA FOR HS CODE 842199-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.8.2 EXPORT SCENARIO

- FIGURE 21 EXPORT DATA FOR HS CODE 842199-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022

- FIGURE 22 AVERAGE SELLING PRICE TREND OF GAS SEPRATION MEMBRANES, BY REGION, 2022 (USD/METER SQUARE)

- 5.9.2 AVERAGE SELLING PRICE TREND OF PRODUCTS OFFERED BY KEY PLAYERS, BY APPLICATION, 2022

- FIGURE 23 AVERAGE SELLING PRICE TREND OF GAS SEPRATION MEMBRANES OFFERED BY KEY PLAYERS, BY APPLICATION, 2022 (USD/METER SQUARE)

- 5.9.3 AVERAGE SELLING PRICE TREND, BY MODULE, 2022

- FIGURE 24 AVERAGE SELLING PRICE TREND OF GAS SEPARATION MEMBRANES, BY MODULE, 2022 (USD/METER SQUARE)

- TABLE 9 GLOBAL AVERAGE SELLING PRICE OF GAS SEPARATION MEMBRANES, BY APPLICATION (USD/METER SQUARE)

- 5.10 ECOSYSTEM ANALYSIS

- FIGURE 25 GAS SEPARATION MEMBRANE: ECOSYSTEM

- TABLE 10 ROLE OF PLAYERS IN GAS SEPARATION MEMBRANE ECOSYSTEM

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 KEY CONFERENCES AND EVENTS

- TABLE 11 GAS SEPARATION MEMBRANE MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- 5.13.2 BUYING CRITERIA

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 AIR PRODUCTS PROVIDED GAS SEPARATION MEMBRANE TECHNOLOGY TO OIL FIELD FOR METHANE EXTRACTION

- 5.14.2 HONEYWELL UOP'S SEPAREX MEMBRANE TECHNOLOGY USED FOR NATURAL GAS PROCESSING TO ADHERE TO STRINGENT PURITY STANDARDS AND TRANSPORTATION REGULATIONS

- 5.14.3 FUJIFILM CORPORATION'S FUJIFILM APURA GAS SEPARATION MEMBRANES OFFER EFFICIENT AND LONG-LASTING NATURAL GAS TREATMENT

- 5.15 PATENT ANALYSIS

- 5.15.1 INTRODUCTION

- 5.15.2 METHODOLOGY

- 5.15.3 DOCUMENT TYPE

- TABLE 14 PATENTS SCENARIO

- FIGURE 29 PATENTS REGISTERED PERTAINING TO GAS SEPARATION MEMBRANES, 2012- 2023

- 5.15.4 PUBLICATION TRENDS OF PATENTS PERTAINING TO GAS SEPARATION MEMBRANES FOR PAST 12 YEARS

- FIGURE 30 NUMBER OF PATENTS PERTAINING TO GAS SEPARATION MEMBRANES IN LAST 12 YEARS

- 5.15.5 INSIGHT

- 5.15.6 LEGAL STATUS OF PATENTS PERTAINING TO GAS SEPARATION MEMBRANES

- 5.15.7 JURISDICTION ANALYSIS OF PATENTS PERTAINING TO GAS SEPARATION MEMBRANES

- FIGURE 31 TOP JURISDICTIONS OF PATENTS RELATED TO GAS SEPARATION MEMBRANES

- 5.15.8 TOP COMPANIES/APPLICANTS OF PATENTS PERTAINING TO GAS SEPARATION MEMBRANES

- FIGURE 32 TOP 10 PATENT APPLICANTS PERTAINING TO GAS SEPARATION MEMBRANES

- TABLE 15 PATENTS OWNED BY SAUDI ARABIAN OIL COMPANY PERTAINING TO GAS SEPARATION MEMBRANES

- TABLE 16 PATENTS OWNED BY HONEYWELL INTERNATIONAL INC. PERTAINING TO GAS SEPARATION MEMBRANES

- TABLE 17 PATENTS OWNED BY CHEVRON CORPORATION PERTAINING TO GAS SEPARATION MEMBRANES

- TABLE 18 TOP 10 PATENT OWNERS (US) IN LAST 12 YEARS PERTAINING TO GAS SEPARATION MEMBRANES

- 5.16 INVESTMENT AND FUNDING SCENARIO

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO, 2019-2023 (USD MILLION)

- 5.17 FUNDING, BY USE/APPLICATION

- FIGURE 34 RENEWABLE ENERGY FUNDING, 2023 (USD MILLION)

6 GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE

- 6.1 INTRODUCTION

- FIGURE 35 POLYIMIDE & POLYARAMIDE MATERIAL TYPE TO DOMINATE GAS SEPARATION MEMBRANE MARKET IN 2030

- TABLE 19 GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 20 GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 21 GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2019-2022 (MILLION METERS SQUARE)

- TABLE 22 GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2023-2030 (MILLION METERS SQUARE)

- 6.2 POLYIMIDE & POLYARAMIDE

- 6.2.1 NEED FOR MEMBRANES WITH ROBUST PERFORMANCE IN HARSH ENVIRONMENTS TO DRIVE SEGMENT

- 6.3 POLYSULFONE

- 6.3.1 RISING DEMAND FROM AUTOMOTIVE AND ELECTRONIC INDUSTRIES TO PROPEL SEGMENTAL GROWTH

- 6.4 CELLULOSE ACETATE

- 6.4.1 INCREASING USE IN APPLICATIONS REQUIRING LOW TEMPERATURE AND PRESSURE RESISTANCE TO CONTRIBUTE TO SEGMENTAL GROWTH

- 6.5 OTHER MATERIALS

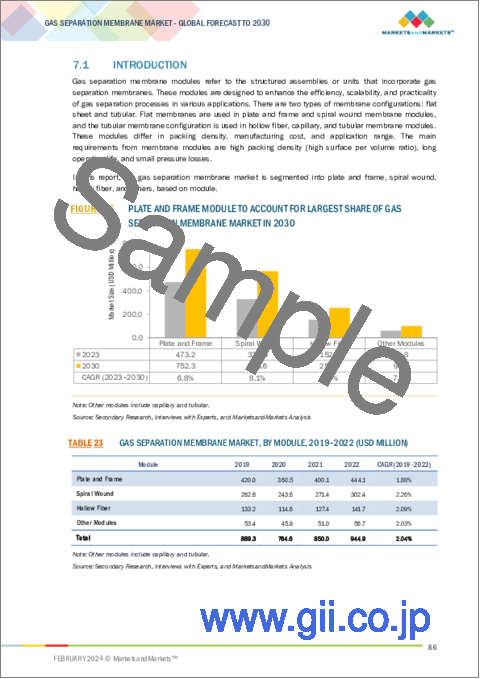

7 GAS SEPARATION MEMBRANE MARKET, BY MODULE

- 7.1 INTRODUCTION

- FIGURE 36 PLATE AND FRAME MODULE TO ACCOUNT FOR LARGEST SHARE OF GAS SEPARATION MEMBRANE MARKET IN 2030

- TABLE 23 GAS SEPARATION MEMBRANE MARKET, BY MODULE, 2019-2022 (USD MILLION)

- TABLE 24 GAS SEPARATION MEMBRANE MARKET, BY MODULE, 2023-2030 (USD MILLION)

- TABLE 25 GAS SEPARATION MEMBRANE MARKET, BY MODULE, 2019-2022 (MILLION METERS SQUARE)

- TABLE 26 GAS SEPARATION MEMBRANE MARKET, BY MODULE, 2023-2030 (MILLION METERS SQUARE)

- 7.2 PLATE AND FRAME

- 7.2.1 INCREASING FOCUS ON REDUCING FOULING TO BOOST DEMAND

- 7.3 SPIRAL WOUND

- 7.3.1 DEMAND FROM WATER TREATMENT AND FOOD INDUSTRIES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 7.4 HOLLOW FIBER

- 7.4.1 SUITABILITY FOR APPLICATIONS WITH SPACE CONSTRAINTS TO FUEL SEGMENTAL GROWTH

- 7.5 OTHER MODULES

8 GAS SEPARATION MEMBRANE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 37 CARBON DIOXIDE REMOVAL APPLICATION TO HOLD LARGEST SHARE OF GAS SEPARATION MARKET IN 2030

- TABLE 27 GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 28 GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 29 GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 30 GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 8.2 NITROGEN GENERATION & OXYGEN ENRICHMENT

- 8.2.1 GROWING DEMAND FROM FOOD & BEVERAGE AND AEROSPACE COMPANIES TO DRIVE MARKET

- 8.2.2 PACKAGING AND STORAGE

- 8.2.3 METAL MANUFACTURING AND FABRICATION

- 8.2.4 ELECTRONICS

- 8.2.5 OIL & GAS

- 8.2.6 OTHER NITROGEN GENERATION & OXYGEN ENRICHMENT APPLICATIONS

- 8.3 HYDROGEN RECOVERY

- 8.3.1 INCREASING NEED FOR HYDROGEN AT INDUSTRIAL SCALE TO FUEL MARKET GROWTH

- 8.3.2 HYDROGEN PURIFICATION IN REFINERIES

- 8.3.3 HYDROGEN RECOVERY FROM SYNGAS PROCESSES

- 8.3.4 HYDROGEN RECOVERY FROM PURGE GAS

- 8.4 CARBON DIOXIDE REMOVAL

- 8.4.1 GROWING DEMAND FOR SHALE GAS TO CONTRIBUTE TO MARKET GROWTH

- 8.4.2 NATURAL GAS

- 8.4.3 BIOGAS

- 8.5 VAPOR/GAS SEPARATION

- 8.5.1 INCREASING NEED FOR HIGH-TEMPERATURE AND PRESSURE-RESISTANT MEMBRANES IN INDUSTRIAL PROCESSES TO DRIVE MARKET

- 8.6 VAPOR/VAPOR SEPARATION

- 8.6.1 VARIOUS ADVANTAGES OVER ALTERNATIVE TECHNOLOGIES TO FUEL MARKET GROWTH

- 8.7 AIR DEHYDRATION

- 8.7.1 DURABILITY AND COST-EFFECTIVENESS ATTRIBUTES TO DRIVE MARKET

- 8.8 H2S REMOVAL

- 8.8.1 RISING AWARENESS ABOUT COMPLIANCE WITH ENVIRONMENTAL REGULATIONS TO SUPPORT MARKET GROWTH

- 8.9 OTHER APPLICATIONS

9 GAS SEPARATION MEMBRANE MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 38 GAS SEPARATION MEMBRANE MARKET IN INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 31 GAS SEPARATION MEMBRANE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 32 GAS SEPARATION MEMBRANE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 GAS SEPARATION MEMBRANE MARKET, BY REGION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 34 GAS SEPARATION MEMBRANE MARKET, BY REGION, 2023-2030 (MILLION METERS SQUARE)

- 9.2 NORTH AMERICA

- 9.2.1 IMPACT OF RECESSION ON GAS SEPARATION MEMBRANE MARKET IN NORTH AMERICA

- FIGURE 39 NORTH AMERICA: GAS SEPARATION MEMBRANE MARKET SNAPSHOT

- TABLE 35 NORTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 36 NORTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2019-2022 (MILLION METERS SQUARE)

- TABLE 38 NORTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2023-2030 (MILLION METERS SQUARE)

- TABLE 39 NORTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 40 NORTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2019-2022 (MILLION METERS SQUARE)

- TABLE 42 NORTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2023-2030 (MILLION METERS SQUARE)

- TABLE 43 NORTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 46 NORTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.2.2 US

- 9.2.2.1 Rising shale gas exploration activities to drive demand

- TABLE 47 US: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 48 US: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 49 US: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 50 US: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.2.3 CANADA

- 9.2.3.1 Growing natural gas production to contribute to market growth

- TABLE 51 CANADA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 52 CANADA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 53 CANADA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 54 CANADA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.2.4 MEXICO

- 9.2.4.1 Increasing demand for renewable energy to propel market

- TABLE 55 MEXICO: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 56 MEXICO: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 57 MEXICO: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 58 MEXICO: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.3 EUROPE

- 9.3.1 IMPACT OF RECESSION ON GAS SEPARATION MEMBRANE MARKET IN EUROPE

- FIGURE 40 EUROPE: GAS SEPARATION MEMBRANE MARKET SNAPSHOT

- TABLE 59 EUROPE: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 60 EUROPE: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 EUROPE: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2019-2022 (MILLION METERS SQUARE)

- TABLE 62 EUROPE: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2023-2030 (MILLION METERS SQUARE)

- TABLE 63 EUROPE: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 64 EUROPE: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 65 EUROPE: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2019-2022 (MILLION METERS SQUARE)

- TABLE 66 EUROPE: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2023-2030 (MILLION METERS SQUARE)

- TABLE 67 EUROPE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 68 EUROPE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 69 EUROPE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 70 EUROPE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.3.2 GERMANY

- 9.3.2.1 High consumption of natural gas to fuel market growth

- TABLE 71 GERMANY: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 72 GERMANY: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 73 GERMANY: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 74 GERMANY: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.3.3 NETHERLANDS

- 9.3.3.1 Presence of large natural gas reserves to drive market

- TABLE 75 NETHERLANDS: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 76 NETHERLANDS: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 77 NETHERLANDS: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 78 NETHERLANDS: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.3.4 FRANCE

- 9.3.4.1 Growing demand for electric vehicles and variable renewable electricity to boost market growth

- TABLE 79 FRANCE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 80 FRANCE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 81 FRANCE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 82 FRANCE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.3.5 ITALY

- 9.3.5.1 Constant improvements in packaging industry to contribute to market growth

- TABLE 83 ITALY: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 84 ITALY: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 85 ITALY: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 86 ITALY: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.3.6 SPAIN

- 9.3.6.1 Increasing demand for natural gas in residential and industrial applications to fuel market growth

- TABLE 87 SPAIN: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 88 SPAIN: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 89 SPAIN: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 90 SPAIN: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.3.7 RUSSIA

- 9.3.7.1 Increasing oil & gas exports to drive market

- TABLE 91 RUSSIA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 92 RUSSIA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 93 RUSSIA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 94 RUSSIA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.3.8 REST OF EUROPE

- TABLE 95 REST OF EUROPE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 96 REST OF EUROPE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 97 REST OF EUROPE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 98 REST OF EUROPE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.4 ASIA PACIFIC

- 9.4.1 IMPACT OF RECESSION ON GAS SEPARATION MEMBRANE MARKET IN ASIA PACIFIC

- FIGURE 41 ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET SNAPSHOT

- TABLE 99 ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2019-2022 (MILLION METERS SQUARE)

- TABLE 102 ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2023-2030 (MILLION METERS SQUARE)

- TABLE 103 ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2019-2022 (MILLION METERS SQUARE)

- TABLE 106 ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2023-2030 (MILLION METERS SQUARE)

- TABLE 107 ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 110 ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.4.2 CHINA

- 9.4.2.1 Growing use of nitrogen and oxygen gas in packaging, chemical, and other manufacturing applications to boost market growth

- TABLE 111 CHINA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 112 CHINA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 113 CHINA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 114 CHINA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.4.3 JAPAN

- 9.4.3.1 Consumer demand for sustainable packaging of food & beverages to foster market growth

- TABLE 115 JAPAN: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 116 JAPAN: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 117 JAPAN: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 118 JAPAN: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Rising requirement for clean hydrogen to drive market

- TABLE 119 SOUTH KOREA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 120 SOUTH KOREA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 121 SOUTH KOREA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 122 SOUTH KOREA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.4.5 INDIA

- 9.4.5.1 Government investments in domestic oil and natural gas exploration to contribute to market growth

- TABLE 123 INDIA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 124 INDIA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 125 INDIA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 126 INDIA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.4.6 REST OF ASIA PACIFIC

- TABLE 127 REST OF ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 130 REST OF ASIA PACIFIC: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.5 SOUTH AMERICA

- 9.5.1 IMPACT OF RECESSION ON GAS SEPARATION MEMBRANE MARKET IN SOUTH AMERICA

- TABLE 131 SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 132 SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 133 SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2019-2022 (MILLION METERS SQUARE)

- TABLE 134 SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2023-2030 (MILLION METERS SQUARE)

- TABLE 135 SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 136 SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 137 SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2019-2022 (MILLION METERS SQUARE)

- TABLE 138 SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2023-2030 (MILLION METERS SQUARE)

- TABLE 139 SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 140 SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 141 SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 142 SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.5.2 BRAZIL

- 9.5.2.1 Rising renewable energy consumption to foster market growth

- TABLE 143 BRAZIL: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 144 BRAZIL: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 145 BRAZIL: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 146 BRAZIL: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.5.3 ARGENTINA

- 9.5.3.1 Growing natural gas and food packaging markets to contribute to demand

- TABLE 147 ARGENTINA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 148 ARGENTINA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 149 ARGENTINA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 150 ARGENTINA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.5.4 REST OF SOUTH AMERICA

- TABLE 151 REST OF SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 152 REST OF SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 153 REST OF SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 154 REST OF SOUTH AMERICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 IMPACT OF RECESSION ON GAS SEPARATION MEMBRANE MARKET IN MIDDLE EAST & AFRICA

- TABLE 155 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2019-2022 (MILLION METERS SQUARE)

- TABLE 158 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY COUNTRY, 2023-2030 (MILLION METERS SQUARE)

- TABLE 159 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2019-2022 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2019-2022 (MILLION METERS SQUARE)

- TABLE 162 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY MATERIAL TYPE, 2023-2030 (MILLION METERS SQUARE)

- TABLE 163 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 166 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Saudi Arabia

- 9.6.2.1.1 Expansion of oil & gas industry to propel market

- 9.6.2.1 Saudi Arabia

- TABLE 167 SAUDI ARABIA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 168 SAUDI ARABIA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 169 SAUDI ARABIA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 170 SAUDI ARABIA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.6.2.2 UAE

- 9.6.2.2.1 Rising demand for processed foods to drive market

- 9.6.2.2 UAE

- TABLE 171 UAE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 172 UAE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 173 UAE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 174 UAE: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.6.2.3 Other GCC countries

- TABLE 175 OTHER GCC COUNTRIES: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 176 OTHER GCC COUNTRIES: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 177 OTHER GCC COUNTRIES: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 178 OTHER GCC COUNTRIES: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (MILLION METERS SQUARE)

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- TABLE 179 REST OF MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 180 REST OF MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 181 REST OF MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION, 2019-2022 (MILLION METERS SQUARE)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANE MARKET, BY APPLICATION,2023-2030 (MILLION METERS SQUARE)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2018-2023

- FIGURE 42 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN GAS SEPARATION MEMBRANE MARKET, 2018-2023

- 10.3 REVENUE ANALYSIS, 2020-2022

- FIGURE 43 REVENUE ANALYSIS OF KEY COMPANIES IN GAS SEPARATION MEMBRANE MARKET, 2020-2022

- TABLE 183 THREE-YEAR REVENUE ANALYSIS OF KEY COMPANIES IN GAS SEPARATION MEMBRANE MARKET

- 10.4 MARKET SHARE ANALYSIS, 2022

- FIGURE 44 SHARES OF LEADING COMPANIES IN GAS SEPARATION MEMBRANE MARKET, 2022

- TABLE 184 GAS SEPARATION MEMBRANE MARKET: DEGREE OF COMPETITION

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 45 COMPANY VALUATION OF LEADING COMPANIES IN GAS SEPARATION MEMBRANE MARKET, 2023

- FIGURE 46 FINANCIAL METRICS OF LEADING COMPANIES IN GAS SEPARATION MEMBRANE MARKET, 2022

- 10.6 BRAND/PRODUCT COMPARISON

- FIGURE 47 GAS SEPARATION MEMBRANE MARKET: BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- FIGURE 48 GAS SEPARATION MEMBRANE MARKET: COMPANY EVALUATION MATRIX FOR KEY COMPANIES, 2023

- 10.7.5 COMPANY FOOTPRINT

- 10.7.5.1 Module footprint

- 10.7.5.2 Application footprint

- 10.7.5.3 Region footprint

- 10.7.5.4 Overall footprint

- 10.8 COMPANY EVALUATION MATRIX: START-UPS AND SMES, 2023

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- FIGURE 49 GAS SEPARATION MEMBRANE MARKET: START-UPS AND SMES EVALUATION MATRIX, 2023

- 10.8.5 COMPETITIVE BENCHMARKING

- 10.8.5.1 List of key start-ups/SMES

- 10.8.5.2 COMPETITIVE BENCHMARKING OF key START-UPS/SMES

- 10.9 COMPETITIVE SCENARIO AND TRENDS

- 10.9.1 PRODUCT LAUNCHES

- TABLE 185 GAS SEPARATION MEMBRANE MARKET: PRODUCT LAUNCHES, APRIL 2018-OCTOBER 2021

- 10.9.2 DEALS

- TABLE 186 GAS SEPARATION MEMBRANE MARKET: DEALS, MAY 2018-NOVEMBER 2021

- 10.9.3 OTHER DEVELOPMENTS

- TABLE 187 GAS SEPARATION MEMBRANE MARKET: OTHER DEVELOPMENTS, JANUARY 2018-SEPTEMBER 2023

11 COMPANY PROFILES

- 11.1 KEY COMPANIES

- 11.2.15 THEWAY MEMBRANES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1.1 AIR LIQUIDE

- TABLE 188 AIR LIQUIDE: COMPANY OVERVIEW

- FIGURE 50 AIR LIQUIDE: COMPANY SNAPSHOT

- TABLE 189 AIR LIQUIDE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 AIR LIQUIDE: DEALS

- TABLE 191 AIR LIQUIDE: OTHER DEVELOPMENTS

- 11.1.2 AIR PRODUCTS AND CHEMICALS, INC.

- TABLE 192 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

- FIGURE 51 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

- TABLE 193 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCT LAUNCHES

- TABLE 195 AIR PRODUCTS AND CHEMICALS, INC.: DEALS

- TABLE 196 AIR PRODUCTS AND CHEMICALS, INC.: OTHER DEVELOPMENTS

- 11.1.3 HONEYWELL UOP

- TABLE 197 HONEYWELL UOP: COMPANY OVERVIEW

- FIGURE 52 HONEYWELL UOP: COMPANY SNAPSHOT

- TABLE 198 HONEYWELL UOP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 HONEYWELL UOP: DEALS

- 11.1.4 UBE CORPORATION

- TABLE 200 UBE CORPORATION: COMPANY OVERVIEW

- FIGURE 53 UBE CORPORATION: COMPANY SNAPSHOT

- TABLE 201 UBE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.5 PARKER HANNIFIN CORPORATION

- TABLE 202 PARKER HANNIFIN CORPORATION: COMPANY OVERVIEW

- FIGURE 54 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT

- TABLE 203 PARKER HANNIFIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.6 FUJIFILM MANUFACTURING EUROPE B.V.

- TABLE 204 FUJIFILM MANUFACTURING EUROPE B.V.: COMPANY OVERVIEW

- TABLE 205 FUJIFILM MANUFACTURING EUROPE B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 FUJIFILM MANUFACTURING EUROPE B.V.: EXPANSIONS

- 11.1.7 DIC CORPORATION

- TABLE 207 DIC CORPORATION: COMPANY OVERVIEW

- FIGURE 55 DIC CORPORATION: COMPANY SNAPSHOT

- TABLE 208 DIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.8 GENERON

- TABLE 209 GENERON: COMPANY OVERVIEW

- TABLE 210 GENERON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 GENERON: PRODUCT LAUNCHES

- 11.1.9 MEMBRANE TECHNOLOGY AND RESEARCH, INC.

- TABLE 212 MEMBRANE TECHNOLOGY AND RESEARCH, INC.: COMPANY OVERVIEW

- TABLE 213 MEMBRANE TECHNOLOGY AND RESEARCH, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 MEMBRANE TECHNOLOGY AND RESEARCH, INC.: DEALS

- TABLE 215 MEMBRANE TECHNOLOGY AND RESEARCH, INC.: EXPANSIONS

- 11.1.10 SLB

- TABLE 216 SLB: COMPANY OVERVIEW

- FIGURE 56 SLB: COMPANY SNAPSHOT

- TABLE 217 SLB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.2 OTHER COMPANIES

- 11.2.1 AIRRANE

- 11.2.2 ATLAS COPCO AB

- 11.2.3 EVONIK INDUSTRIES AG

- 11.2.4 BORSIG MEMBRANE TECHNOLOGY GMBH

- 11.2.5 COMPACT MEMBRANE SYSTEMS

- 11.2.6 COBETTER FILTRATION EQUIPMENT CO.,LTD.

- 11.2.7 GENRICH MEMBRANES PVT. LTD.

- 11.2.8 JSC GRASYS.

- 11.2.9 CONIFER SYSTEMS

- 11.2.10 MEGAVISION MEMBRANE

- 11.2.11 NOVAMEM

- 11.2.12 PERMSELECT

- 11.2.13 PERVATECH

- 11.2.14 SEPRATEK

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS