|

|

市場調査レポート

商品コード

1284876

マイクロ射出成形プラスチックの世界市場:材料の種類別 (LCP、PEEK、PC、PE、POM、PMMA、PEI、PBT)・用途別 (医療、自動車、光学、エレクトロニクス)・地域別 (北米、アジア太平洋、欧州、中東・アフリカ、南米) の将来予測 (2028年まで)Micro Injection Molded Plastic Market by Material Type (LCP, PEEK, PC, PE, POM, PMMA, PEI, PBT), Application (Medical, Automotive, Optics, Electronics), and Region (North America, Asia Pacific, Europe, MEA, South America) - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| マイクロ射出成形プラスチックの世界市場:材料の種類別 (LCP、PEEK、PC、PE、POM、PMMA、PEI、PBT)・用途別 (医療、自動車、光学、エレクトロニクス)・地域別 (北米、アジア太平洋、欧州、中東・アフリカ、南米) の将来予測 (2028年まで) |

|

出版日: 2023年05月30日

発行: MarketsandMarkets

ページ情報: 英文 178 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のマイクロ射出成形プラスチックの市場規模 (金額ベース) は、2023年の12億米ドルから、2028年には21億米ドルまで、11.4%のCAGRで成長すると予測されます。

また、自動車・エレクトロニクス・医療産業の成長がマイクロ射出成形プラスチックの需要を牽引しています。特に自動車業界では近年、マイクロ射出成形プラスチックの需要が着実に増加しています。自動車用途では、マイクロ射出成形は自動車向け用途において、小型化、軽量化、性能向上、コスト削減など、多くの利点があります。自動車産業は電気・電子システムに大きく依存しており、マイクロ射出成形プラスチック部品は、コネクター、端子、その他の電気部品において重要な役割を担っています。これらの小さな部品は、さまざまな自動車システムの動作に不可欠であり、信頼性の高い接続を提供します。これらの要因が、特に自動車用途でマイクロ射出成形プラスチックの需要を押し上げています。

"PEIは予測期間中、金額ベースで2番目に急成長する種類となる"

PEI (ポリエーテルイミド) ベースのマイクロ射出成形プラスチックの需要は、いくつかの要因に影響されます。PEIは、耐熱性、機械的強度、耐薬品性、電気絶縁性などの特性があり、小型化・高性能化が求められる用途では、マイクロ射出成形に適しています。これらの要因が、マイクロ射出成形プラスチックにおけるPEI材料タイプの市場を世界的に押し上げる要因となっています。

"用途別では予測期間中、医療が金額ベースで最も急成長する"

医療業界向けマイクロ射出成形プラスチックの需要は、医療機器の小型化、患者ケアの向上、技術進歩に対するニーズの高まりにより、着実に増加しています。マイクロ射出成形は、公差の厳しい小型で精密なプラスチック部品の製造を可能にし、様々な医療用途に適しています。医療分野では、手術器具、埋込型デバイス、薬剤送達装置など、さまざまな用途で使用されています。これらの要因が、医療用マイクロ射出成形プラスチック市場を世界的に押し上げる要因となっています。

"アジア太平洋は予測期間中、金額ベースで最も急速に成長する地域となる"

アジア太平洋は、人件費が安く、原材料の入手が容易で、最新技術の採用率が高く、土地が確保できるため、自動車・医療・エレクトロニクスなど、さまざまな製造業にとって魅力的な選択肢となっています。インドや中国などの人口増加、環境に優しく費用対効果の高い電気自動車の需要、高度なエレクトロニクス製品の需要が、アジア太平洋のマイクロ射出成形プラスチック市場を牽引しています。Honda、Toyota、BMW、Nissanなどの大手自動車メーカーがこの地域に製造施設を設立しており、これが市場の需要をさらに促進しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- マクロ経済指標

第6章 業界動向

- サプライチェーン分析

- 顧客のビジネスに影響を与える動向と混乱

- エコシステムマッピング

- 主要な利害関係者と購入基準

- 参考価格分析

- 技術分析

- ケーススタディ分析

- 輸出入シナリオ

- 主要な会議とイベント (2023年)

- 世界の規制枠組み

- 特許分析

第7章 マイクロ射出成形プラスチック市場:材料の種類別

- イントロダクション

- 液晶ポリマー (LCP)

- ポリエーテルエーテルケトン (PEEK)

- ポリカーボネート (PC)

- ポリエチレン (PE)

- ポリオキシメチレン (POM)

- ポリメチルメタクリレート (PMMA)

- ポリエーテルイミド (PEI)

- ポリブチレンテレフタレート (PBT)

- その他のタイプ

第8章 マイクロ射出成形プラスチック市場:用途別

- イントロダクション

- 医療

- 自動車

- 光学

- エレクトロニクス

- その他の用途

第9章 マイクロ射出成形プラスチック市場:地域別

- イントロダクション

- 北米

- アジア太平洋

- 欧州

- 中東・アフリカ

- 南米

第10章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 主要企業のランキング

- 市場シェア分析

- 主要企業の収益分析

- 企業の製品フットプリント分析

- 企業評価クアドラント (ティア1)

- 競合ベンチマーキング

- スタートアップ/中小企業の評価クアドラント

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- ACCUMOLD LLC

- PARAGON MEDICAL

- SMC LTD.

- SPECTRUM PLASTICS GROUP, INC.

- ISOMETRIC MICRO MOLDING, INC.

- MAKUTA MICRO MOLDING

- PRECIKAM INC.

- MTD MICRO MOLDING

- MICRO MOLDING INC.

- MICRODYNE PLASTICS, INC.

- その他の企業

- OTTO MANNER GMBH-BARNES GROUP INC.

- POLYMERMEDICS LTD.

- MIKROTECH

- SOVRIN PLASTICS

- STACK PLASTICS

- AMERICAN PRECISION PRODUCTS

- D&M PLASTICS, LLC

- KNIGHTSBRIDGE PLASTICS INC.

- VEEJAY PLASTIC INJECTION MOLDING COMPANY

- MICROSYSTEMS UK

- MATRIX PLASTIC PRODUCTS

- YOMURA TECHNOLOGIES, INC.

第12章 隣接・関連市場

- イントロダクション

- 制限事項

- プラスチック射出成形機市場

- プラスチック射出成形機市場:地域別

第13章 付録

In terms of value, the micro injection molded plastics market is estimated to grow from USD 1.2 billion in 2023 to USD 2.1 billion by 2028, at a CAGR of 11.4%. The growth of the automotive, electronics and medical industries is also driving the demand for micro injection molded plastic. The automobile sector has seen a steady increase in the demand for micro injection molded plastics in recent years. For automotive applications, micro injection molding has a number of benefits, including miniaturization, weight reduction, enhanced performance, and cost savings. The automotive industry relies heavily on electrical and electronic systems, and micro injection molded plastic parts play a crucial role in connectors, terminals, and other electrical components. These tiny components are crucial for the operation of different automobile systems and offer dependable connectivity. All these factors are boosting the demand for micro injection molded plastic especially in automotive applications.

"PEI is expected to be the second fastest-growing type of the micro injection molded plastic market, in terms of value, during the forecast period."

The demand for micro injection molded plastics in PEI (Polyetherimide) is influenced by several factors. The specific demand for micro injection molded plastics in PEI depends on the application needs and industry demands, despite the fact that PEI itself is a high-performance thermoplastic with a variety of desirable qualities. PEI's characteristics, such as high-temperature resistance, mechanical strength, chemical resistance, and electrical insulation properties, make it suitable for micro injection molding in certain applications where miniaturization and high-performance are essential. All these factors boost the market for PEI material type in micro injection molded plastic globally.

"Medical is expected to be the fastest-growing application of the micro injection molded plastic market, in terms of value, during the forecast period."

The demand for micro injection molded plastics in the medical industry has been steadily increasing due to the growing need for miniaturized medical devices, improved patient care, and technological advancements. Micro injection molding enables the production of small and precise plastic components with tight tolerances, making it suitable for various medical applications. In medical they are used in various applications including surgical instruments, implantable devices, drug delivery systems, and others. All these factors boost the market for micro injection molded plastic in medical application globally.

"Asia Pacific is projected to be the fastest growing region, in terms of value, during the forecast period in the Micro injection molded plastic market."

Asia Pacific has low cost of labor, easy availability of raw materials, with high adoption rate for new and modern technologies and availability of land which makes the region an attractive option for various manufacturing industries including automotive, healthcare, electronics and others. The increasing population in countries like India and China, demand for eco-friendly, cost-effective electric vehicles and demand for advanced electronics products drive the market for micro injection molded plastics in Asia Pacific. Major automotive manufacturers such as Honda, Toyota, BMW, Nissan and others have established their manufacturing facilities in this region which further fuels the market demand.

- By Company Type: Tier 1 - 69%, Tier 2 - 23%, and Tier 3 - 8%

- By Designation: C-Level - 23%, Director Level - 37%, and Others - 40%

- By Region: North America - 32%, Europe - 21%, Asia Pacific - 28%, South America and Middle East & Africa - 12%, South America - 7%

The key players profiled in the report include Accumold LLC (US), Paragon Medical (US), SMC Ltd. (US), Spectrum Plastics Group, Inc. (US), Isometric Micro Molding, Inc. (US), Makuta Micro Molding (US), Precikam Inc. (Canada), MTD Micro Molding (US), among others.

Research Coverage

This report segments the market for micro injection molded plastic based on material type, application, and region and provides estimations of value (USD million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, key strategies, associated with the market for micro injection molded plastic.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the micro injection molded plastic market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on micro injection molded plastic offered by top players in the global market

- Analysis of key drives: (growth in automotive sector, demand from medical application, and growing healthcare expenditure and favorable reimbursement scenario), restraints (high initial and maintenance cost of machine), opportunities (rising trend of electric vehicles), and challenges (skilled personnel for operations) influencing the growth of micro injection molded plastic market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the micro injection molded plastic market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for micro injection molded plastic across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global micro injection molded plastic market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the micro injection molded plastic market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 MARKET DEFINITION AND INCLUSIONS, BY MATERIAL TYPE

- 1.2.3 MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.3 STUDY SCOPE

- FIGURE 1 MICRO INJECTION MOLDED PLASTIC MARKET SEGMENTATION

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 MICRO INJECTION MOLDED PLASTIC MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary interview participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1 (SUPPLY-SIDE): PRODUCT REVENUE

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1 BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

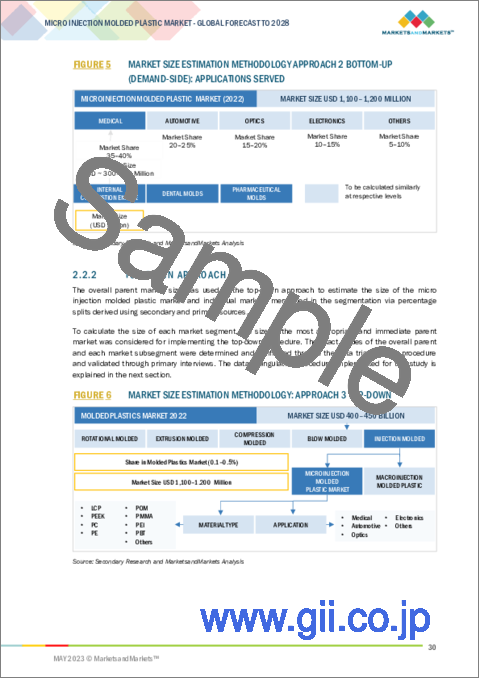

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 2 BOTTOM-UP (DEMAND-SIDE): APPLICATIONS SERVED

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 TOP-DOWN

- 2.3 DATA TRIANGULATION

- FIGURE 7 MICRO INJECTION MOLDED PLASTIC MARKET: DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- FIGURE 8 MARKET GROWTH PROJECTIONS (SUPPLY-SIDE)

- 2.4.2 DEMAND SIDE

- FIGURE 9 MARKET GROWTH PROJECTIONS (DEMAND-SIDE)

- 2.5 RECESSION IMPACT

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS

- 2.8 RISK ASSESSMENT

- TABLE 1 MICRO INJECTION MOLDED PLASTIC MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 10 PC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 MEDICAL SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA ACCOUNTED FOR HIGHEST CAGR IN 2022

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN MICRO INJECTION MOLDED PLASTIC MARKET

- FIGURE 13 HIGH DEMAND FOR MOLDED PLASTIC FROM EMERGING ECONOMIES TO DRIVE MARKET

- 4.2 MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION

- FIGURE 14 NORTH AMERICA TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE AND COUNTRY

- FIGURE 15 US AND PC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.4 MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION AND REGION

- FIGURE 16 MEDICAL APPLICATION TO DOMINATE MARKET ACROSS REGIONS DURING FORECAST PERIOD

- 4.5 MICRO INJECTION MOLDED PLASTIC MARKET, BY KEY COUNTRY

- FIGURE 17 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MICRO INJECTION MOLDED PLASTIC MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growth of automotive sector

- FIGURE 19 CAR PRODUCTION, BY COUNTRY, 2022 (MILLION UNITS)

- 5.2.1.2 Rising demand in medical applications

- 5.2.1.3 Increase in healthcare expenditure and favorable reimbursement scenario

- TABLE 2 HEALTH EXPENDITURE (% OF GDP), BY COUNTRY, 2014-2019

- 5.2.2 RESTRAINTS

- 5.2.2.1 High maintenance cost of machines

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising trend of electric vehicles

- TABLE 3 KEY AUTOMAKERS ANNOUNCEMENTS FOR ELECTRIC VEHICLES

- 5.2.4 CHALLENGES

- 5.2.4.1 Less economical for small production capacities

- 5.2.4.2 Requirement of skilled personnel

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 MICRO INJECTION MOLDED PLASTIC MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 4 MICRO INJECTION MOLDED PLASTIC MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

- TABLE 5 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020-2027 (USD BILLION)

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- FIGURE 21 SUPPLY CHAIN OF MICRO INJECTION MOLDED PLASTIC MARKET

- 6.1.1 RAW MATERIALS

- 6.1.2 MANUFACTURING

- 6.1.3 DISTRIBUTION NETWORK

- 6.1.4 END-USER INDUSTRIES

- 6.2 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 REVENUE SHIFT FOR MICRO INJECTION MOLDED PLASTIC MARKET

- 6.3 ECOSYSTEM MAPPING

- FIGURE 23 MICRO INJECTION MOLDED PLASTIC MARKET: ECOSYSTEM MAP

- TABLE 6 MICRO INJECTION MOLDED PLASTIC MARKET: ECOSYSTEM

- 6.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 7 IMPACT ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 6.4.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 8 KEY BUYING CRITERIA

- 6.5 INDICATIVE PRICING ANALYSIS

- 6.5.1 INDICATIVE SELLING PRICE OF KEY PLAYERS, BY MATERIAL TYPE

- FIGURE 26 INDICATIVE SELLING PRICE OF KEY PLAYERS FOR TOP THREE MATERIAL TYPES

- TABLE 9 INDICATIVE SELLING PRICE OF KEY PLAYERS FOR TOP THREE MATERIAL TYPES (USD)

- 6.6 TECHNOLOGY ANALYSIS

- 6.7 CASE STUDY ANALYSIS

- 6.7.1 ARBURG AND PLASTIKOS

- 6.7.2 SUMITOMO AND RENYMED

- 6.8 IMPORT-EXPORT SCENARIO

- 6.8.1 IMPORT SCENARIO OF MICRO INJECTION MOLDED PLASTIC

- FIGURE 27 MICRO INJECTION MOLDED PLASTIC IMPORT, BY KEY COUNTRY, 2013-2021

- TABLE 10 IMPORT OF MICRO INJECTION MOLDED PLASTIC, BY REGION, 2013-2021 (USD MILLION)

- 6.8.2 EXPORT SCENARIO OF MICRO INJECTION MOLDED PLASTIC

- FIGURE 28 MICRO INJECTION MOLDED PLASTIC EXPORT, BY KEY COUNTRY, 2013-2021

- TABLE 11 EXPORT OF MICRO INJECTION MOLDED PLASTIC, BY REGION, 2013-2021 (USD MILLION)

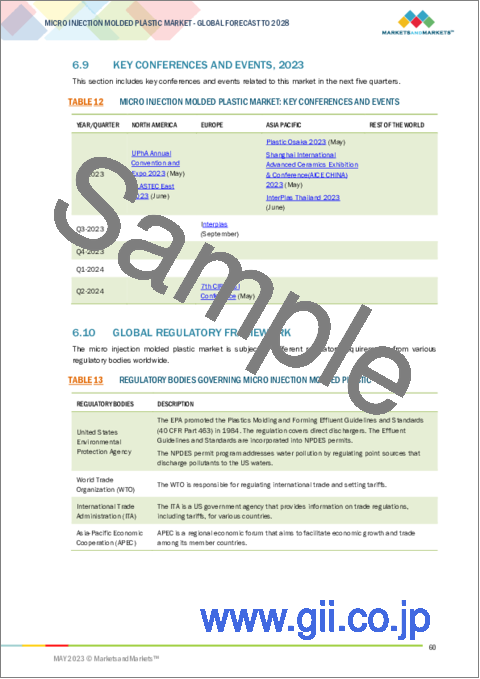

- 6.9 KEY CONFERENCES AND EVENTS, 2023

- TABLE 12 MICRO INJECTION MOLDED PLASTIC MARKET: KEY CONFERENCES AND EVENTS

- 6.10 GLOBAL REGULATORY FRAMEWORK

- TABLE 13 REGULATORY BODIES GOVERNING MICRO INJECTION MOLDED PLASTIC

- TABLE 14 REGULATIONS GOVERNING MICRO INJECTION MOLDED PLASTIC

- 6.11 PATENT ANALYSIS

- 6.11.1 INTRODUCTION

- 6.11.2 METHODOLOGY

- 6.11.3 DOCUMENT TYPES

- TABLE 15 GRANTED PATENTS ACCOUNTED FOR HIGHEST PATENT COUNT (2012-2022)

- FIGURE 29 PATENTS REGISTERED FOR MICRO INJECTION MOLDED PLASTIC (2012-2022)

- FIGURE 30 PATENT PUBLICATION TRENDS FOR MICRO INJECTION MOLDED PLASTIC (2012-2022)

- 6.11.4 INSIGHTS

- 6.11.5 LEGAL STATUS

- FIGURE 31 LEGAL STATUS OF MICRO INJECTION MOLDED PLASTIC PATENTS

- 6.11.6 JURISDICTION ANALYSIS

- FIGURE 32 MAXIMUM PATENTS FILED BY COMPANIES IN US

- 6.11.7 TOP APPLICANTS

- FIGURE 33 DOW INC. REGISTERED HIGHEST NUMBER OF PATENTS (2012-2022)

- TABLE 16 RECENT PATENTS BY DOW INC.

- TABLE 17 RECENT PATENTS BY BRISTOL MYERS SQUIBB

- TABLE 18 TOP 10 PATENT OWNERS IN US (2012-2022)

7 MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE

- 7.1 INTRODUCTION

- FIGURE 34 PEEK TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 19 MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2017-2021 (USD MILLION)

- TABLE 20 MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2022-2028 (USD MILLION)

- 7.2 LIQUID CRYSTAL POLYMERS

- 7.2.1 INCREASING CONSUMPTION IN AUTOMOTIVE AND ELECTRONICS SECTORS

- TABLE 21 LCP: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 22 LCP: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.3 POLYETHER ETHER KETONE

- 7.3.1 HIGH DEMAND FROM MEDICAL INDUSTRY

- TABLE 23 PEEK: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 24 PEEK: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.4 POLYCARBONATE

- 7.4.1 GOOD THERMAL RESISTANCE AND HIGH VISCOSITY

- TABLE 25 PC: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 26 PC: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.5 POLYETHYLENE

- 7.5.1 WIDELY USED IN FABRICATION AND PACKAGING

- TABLE 27 PE: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 28 PE: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.6 POLYOXYMETHYLENE

- 7.6.1 HIGH DEMAND IN AUTOMOTIVE AND INDUSTRIAL SECTORS

- TABLE 29 POM: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 30 POM: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.7 POLYMETHYL METHACRYLATE

- 7.7.1 DIVERSE APPLICATIONS IN VARIOUS INDUSTRIES

- TABLE 31 PMMA: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 32 PMMA: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.8 POLYETHERIMIDE

- 7.8.1 INCREASING CONSUMPTION IN BIOMEDICAL APPLICATIONS

- TABLE 33 PEI: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 34 PEI: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.9 POLYBUTYLENE TEREPHTHALATE

- 7.9.1 HIGH DEMAND IN ELECTRONICS INDUSTRY

- TABLE 35 PBT: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 36 PBT: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.10 OTHER TYPES

- TABLE 37 OTHER TYPES: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 38 OTHER TYPES: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2022-2028 (USD MILLION)

8 MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 35 MEDICAL APPLICATION TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 39 MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 40 MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 8.2 MEDICAL

- 8.2.1 USE OF MOLDED PLASTIC IN MINIATURIZATION AND NANOTECHNOLOGY

- TABLE 41 MEDICAL: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 42 MEDICAL: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2022-2028 (USD MILLION)

- 8.3 AUTOMOTIVE

- 8.3.1 RISING DEMAND FOR MICRO MOLDS IN COMPLEX VEHICLES

- TABLE 43 AUTOMOTIVE: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 44 AUTOMOTIVE: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2022-2028 (USD MILLION)

- 8.4 OPTICS

- 8.4.1 INCREASING USE OF MOLDED COMPONENTS IN ADVANCED WEARABLE DEVICES

- TABLE 45 OPTICS: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 46 OPTICS: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2022-2028 (USD MILLION)

- 8.5 ELECTRONICS

- 8.5.1 USE OF HIGH-PRECISION THERMOPLASTIC IN MICROELECTRONICS

- TABLE 47 ELECTRONICS: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 48 ELECTRONICS: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2022-2028 (USD MILLION)

- 8.6 OTHER APPLICATIONS

- TABLE 49 OTHER APPLICATIONS: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 50 OTHER APPLICATIONS: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2022-2028 (USD MILLION)

9 MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 36 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR MICRO INJECTION MOLDED PLASTIC DURING FORECAST PERIOD

- TABLE 51 MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 52 MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2022-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 37 NORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET SNAPSHOT

- 9.2.1 RECESSION IMPACT ON NORTH AMERICA

- 9.2.2 NORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE

- TABLE 53 NORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2017-2021 (USD MILLION)

- TABLE 54 NORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2022-2028 (USD MILLION)

- 9.2.3 NORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION

- TABLE 55 NORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 56 NORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.2.4 NORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY

- TABLE 57 NORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 58 NORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 9.2.4.1 US

- 9.2.4.1.1 Increasing demand for molded plastic from medical industry to drive market

- 9.2.4.1 US

- TABLE 59 US: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 60 US: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.2.4.2 Canada

- 9.2.4.2.1 Growth of automotive industry to fuel demand for micro injection molds

- 9.2.4.2 Canada

- TABLE 61 CANADA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 62 CANADA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.2.4.3 Mexico

- 9.2.4.3.1 Presence of major vehicle manufacturing facilities to propel market

- 9.2.4.3 Mexico

- TABLE 63 MEXICO: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 64 MEXICO: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.3 ASIA PACIFIC

- FIGURE 38 ASIA PACIFIC: MICRO INJECTION MOLDED PLASTIC MARKET SNAPSHOT

- 9.3.1 RECESSION IMPACT ON ASIA PACIFIC

- 9.3.2 ASIA PACIFIC: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE

- TABLE 65 ASIA PACIFIC: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2017-2021 (USD MILLION)

- TABLE 66 ASIA PACIFIC: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2022-2028 (USD MILLION)

- 9.3.3 ASIA PACIFIC: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION

- TABLE 67 ASIA PACIFIC: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 68 ASIA PACIFIC: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.3.4 ASIA PACIFIC: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY

- TABLE 69 ASIA PACIFIC: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 70 ASIA PACIFIC: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 9.3.4.1 China

- 9.3.4.1.1 Investment regulations and economic labor costs to propel market

- 9.3.4.1 China

- TABLE 71 CHINA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 72 CHINA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.3.4.2 Japan

- 9.3.4.2.1 Presence of major car manufacturers to fuel demand for micro injection molded plastic

- 9.3.4.2 Japan

- TABLE 73 JAPAN: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 74 JAPAN: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.3.4.3 India

- 9.3.4.3.1 Growth of medical device industry to drive market

- 9.3.4.3 India

- TABLE 75 INDIA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 76 INDIA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.4 EUROPE

- FIGURE 39 EUROPE: MICRO INJECTION MOLDED PLASTIC MARKET SNAPSHOT

- 9.4.1 RECESSION IMPACT ON EUROPE

- 9.4.2 EUROPE: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE

- TABLE 77 EUROPE: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2017-2021 (USD MILLION)

- TABLE 78 EUROPE: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2022-2028 (USD MILLION)

- 9.4.3 EUROPE: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION

- TABLE 79 EUROPE: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 80 EUROPE: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.4.4 EUROPE: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY

- TABLE 81 EUROPE: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 82 EUROPE: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 9.4.4.1 Germany

- 9.4.4.1.1 Growth of automotive industry to propel market

- 9.4.4.1 Germany

- TABLE 83 GERMANY: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 84 GERMANY: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.4.4.2 France

- 9.4.4.2.1 High foreign investments to drive market

- 9.4.4.2 France

- TABLE 85 FRANCE: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 86 FRANCE: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.4.4.3 UK

- 9.4.4.3.1 Presence of leading car producers to fuel market growth

- 9.4.4.3 UK

- TABLE 87 UK: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 88 UK: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 RECESSION IMPACT ON MIDDLE EAST & AFRICA

- 9.5.2 MIDDLE EAST & AFRICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE

- TABLE 89 MIDDLE EAST & AFRICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2017-2021 (USD MILLION)

- TABLE 90 MIDDLE EAST & AFRICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2022-2028 (USD MILLION)

- 9.5.3 MIDDLE EAST & AFRICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION

- TABLE 91 MIDDLE EAST & AFRICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 92 MIDDLE EAST & AFRICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.5.4 MIDDLE EAST & AFRICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY

- TABLE 93 MIDDLE EAST & AFRICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 94 MIDDLE EAST & AFRICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 9.5.4.1 Saudi Arabia

- 9.5.4.1.1 Growth of industrial sector to drive market

- 9.5.4.1 Saudi Arabia

- TABLE 95 SAUDI ARABIA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 96 SAUDI ARABIA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.5.4.2 South Africa

- 9.5.4.2.1 Increase in automobile production and export to fuel demand for molded plastic

- 9.5.4.2 South Africa

- TABLE 97 SOUTH AFRICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 98 SOUTH AFRICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.6 SOUTH AMERICA

- 9.6.1 RECESSION IMPACT ON SOUTH AMERICA

- 9.6.2 SOUTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE

- TABLE 99 SOUTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2017-2021 (USD MILLION)

- TABLE 100 SOUTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2022-2028 (USD MILLION)

- 9.6.3 SOUTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION

- TABLE 101 SOUTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 102 SOUTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.6.4 SOUTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY

- TABLE 103 SOUTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 104 SOUTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 9.6.4.1 Brazil

- 9.6.4.1.1 Infrastructural development to fuel market growth

- 9.6.4.1 Brazil

- TABLE 105 BRAZIL: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 106 BRAZIL: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.6.4.2 Argentina

- 9.6.4.2.1 Increasing use of molded plastics in medical industry to propel market

- 9.6.4.2 Argentina

- TABLE 107 ARGENTINA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 108 ARGENTINA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 109 MICRO INJECTION MOLDED PLASTIC MARKET: STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- 10.3 RANKING OF KEY MARKET PLAYERS

- FIGURE 40 RANKING OF TOP FIVE PLAYERS, 2022

- 10.4 MARKET SHARE ANALYSIS

- TABLE 110 MICRO INJECTION MOLDED PLASTIC MARKET: DEGREE OF COMPETITION

- FIGURE 41 ACCUMOLD LLC LED MICRO INJECTION MOLDED PLASTIC MARKET IN 2022

- 10.5 REVENUE ANALYSIS OF KEY COMPANIES

- FIGURE 42 REVENUE ANALYSIS OF KEY COMPANIES DURING LAST FIVE YEARS

- 10.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

- FIGURE 43 MICRO INJECTION MOLDED PLASTIC MARKET: COMPANY FOOTPRINT

- TABLE 111 MICRO INJECTION MOLDED PLASTIC MARKET: MATERIAL TYPE FOOTPRINT

- TABLE 112 MICRO INJECTION MOLDED PLASTIC MARKET: APPLICATION FOOTPRINT

- TABLE 113 MICRO INJECTION MOLDED PLASTIC MARKET: COMPANY REGIONAL FOOTPRINT

- 10.7 COMPANY EVALUATION QUADRANT (TIER 1)

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- FIGURE 44 COMPANY EVALUATION QUADRANT FOR MICRO INJECTION MOLDED PLASTIC (TIER 1)

- 10.8 COMPETITIVE BENCHMARKING

- TABLE 114 MICRO INJECTION MOLDED PLASTIC MARKET: KEY STARTUPS/SMES

- TABLE 115 MICRO INJECTION MOLDED PLASTIC MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.9 STARTUP/SME EVALUATION QUADRANT

- 10.9.1 RESPONSIVE COMPANIES

- 10.9.2 PROGRESSIVE COMPANIES

- 10.9.3 DYNAMIC COMPANIES

- 10.9.4 STARTING BLOCKS

- FIGURE 45 STARTUP/SME EVALUATION QUADRANT FOR MICRO INJECTION MOLDED PLASTIC MARKET

- 10.10 COMPETITIVE SCENARIO AND TRENDS

- 10.10.1 DEALS

- TABLE 116 MICRO INJECTION MOLDED PLASTIC MARKET: DEALS (2019-2023)

- 10.10.2 OTHER DEVELOPMENTS

- TABLE 117 MICRO INJECTION MOLDED PLASTIC MARKET: OTHER DEVELOPMENTS (2019-2023)

11 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weakness and competitive threats)**

- 11.1 KEY PLAYERS

- 11.1.1 ACCUMOLD LLC

- TABLE 118 ACCUMOLD LLC: COMPANY OVERVIEW

- 11.1.2 PARAGON MEDICAL

- TABLE 119 PARAGON MEDICAL: COMPANY OVERVIEW

- 11.1.3 SMC LTD.

- TABLE 120 SMC LTD.: COMPANY OVERVIEW

- 11.1.4 SPECTRUM PLASTICS GROUP, INC.

- TABLE 121 SPECTRUM PLASTICS GROUP, INC.: COMPANY OVERVIEW

- 11.1.5 ISOMETRIC MICRO MOLDING, INC.

- TABLE 122 ISOMETRIC MICRO MOLDING, INC.: COMPANY OVERVIEW

- 11.1.6 MAKUTA MICRO MOLDING

- TABLE 123 MAKUTA MICRO MOLDING: COMPANY OVERVIEW

- 11.1.7 PRECIKAM INC.

- TABLE 124 PRECIKAM INC.: COMPANY OVERVIEW

- 11.1.8 MTD MICRO MOLDING

- TABLE 125 MTD MICRO MOLDING: COMPANY OVERVIEW

- 11.1.9 MICRO MOLDING INC.

- TABLE 126 MICRO MOLDING INC.: COMPANY OVERVIEW

- 11.1.10 MICRODYNE PLASTICS, INC.

- TABLE 127 MICRODYNE PLASTICS, INC.: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weakness and competitive threats might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 OTTO MANNER GMBH - BARNES GROUP INC.

- TABLE 128 OTTO MANNER GMBH - BARNES GROUP INC.: COMPANY OVERVIEW

- 11.2.2 POLYMERMEDICS LTD.

- TABLE 129 POLYMERMEDICS LTD.: COMPANY OVERVIEW

- 11.2.3 MIKROTECH

- TABLE 130 MIKROTECH: COMPANY OVERVIEW

- 11.2.4 SOVRIN PLASTICS

- TABLE 131 SOVRIN PLASTICS: COMPANY OVERVIEW

- 11.2.5 STACK PLASTICS

- TABLE 132 STACK PLASTICS: COMPANY OVERVIEW

- 11.2.6 AMERICAN PRECISION PRODUCTS

- TABLE 133 AMERICAN PRECISION PRODUCTS: COMPANY OVERVIEW

- 11.2.7 D&M PLASTICS, LLC

- TABLE 134 D&M PLASTICS, LLC: COMPANY OVERVIEW

- 11.2.8 KNIGHTSBRIDGE PLASTICS INC.

- TABLE 135 KNIGHTSBRIDGE PLASTICS INC.: COMPANY OVERVIEW

- 11.2.9 VEEJAY PLASTIC INJECTION MOLDING COMPANY

- TABLE 136 VEEJAY PLASTIC INJECTION MOLDING COMPANY: COMPANY OVERVIEW

- 11.2.10 MICROSYSTEMS UK

- TABLE 137 MICROSYSTEMS UK: COMPANY OVERVIEW

- 11.2.11 MATRIX PLASTIC PRODUCTS

- TABLE 138 MATRIX PLASTIC PRODUCTS: COMPANY OVERVIEW

- 11.2.12 YOMURA TECHNOLOGIES, INC.

- TABLE 139 YOMURA TECHNOLOGIES, INC.: COMPANY OVERVIEW

12 ADJACENT & RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 PLASTIC INJECTION MOLDING MACHINE MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.4 PLASTIC INJECTION MOLDING MACHINE MARKET, BY REGION

- TABLE 140 PLASTIC INJECTION MOLDING MACHINE MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 141 PLASTIC INJECTION MOLDING MACHINE MARKET, BY REGION, 2020-2025 (USD MILLION)

- TABLE 142 PLASTIC INJECTION MOLDING MACHINE MARKET, BY REGION, 2016-2019 (UNITS)

- TABLE 143 PLASTIC INJECTION MOLDING MACHINE MARKET, BY REGION, 2020-2025 (UNITS)

- 12.4.1 NORTH AMERICA

- TABLE 144 NORTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 145 NORTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020-2025 (USD MILLION)

- TABLE 146 NORTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016-2019 (UNITS)

- TABLE 147 NORTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020-2025 (UNITS)

- 12.4.2 EUROPE

- TABLE 148 EUROPE: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 149 EUROPE: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020-2025 (USD MILLION)

- TABLE 150 EUROPE: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016-2019 (UNITS)

- TABLE 151 EUROPE: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020-2025 (UNITS)

- 12.4.3 ASIA PACIFIC

- TABLE 152 ASIA PACIFIC: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 153 ASIA PACIFIC: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020-2025 (USD MILLION)

- TABLE 154 ASIA PACIFIC: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016-2019 (UNITS)

- TABLE 155 ASIA PACIFIC: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020-2025 (UNITS)

- 12.4.4 MIDDLE EAST & AFRICA

- TABLE 156 MIDDLE EAST & AFRICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020-2025 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016-2019 (UNITS)

- TABLE 159 MIDDLE EAST & AFRICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020-2025 (UNITS)

- 12.4.5 SOUTH AMERICA

- TABLE 160 SOUTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 161 SOUTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020-2025 (USD MILLION)

- TABLE 162 SOUTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016-2019 (UNITS)

- TABLE 163 SOUTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020-2025 (UNITS)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS