|

|

市場調査レポート

商品コード

1460073

EV充電ステーションの世界市場:充電レベル別、モード別、接続フェーズ別、DC急速充電別、充電ポイント別、用途別、設置タイプ別、充電インフラタイプ別、電気バス充電タイプ別、充電サービスタイプ別、充電ポイント事業者別、地域別 - 2030年までの予測EV Charging Station Market by Application, Level of Charging, Charging Point, Charging Infrastructure, Operation, DC Fast Charging, Charge Point Operator, Connection Phase, Service, Installation and Region - Global Forecast to 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| EV充電ステーションの世界市場:充電レベル別、モード別、接続フェーズ別、DC急速充電別、充電ポイント別、用途別、設置タイプ別、充電インフラタイプ別、電気バス充電タイプ別、充電サービスタイプ別、充電ポイント事業者別、地域別 - 2030年までの予測 |

|

出版日: 2024年04月02日

発行: MarketsandMarkets

ページ情報: 英文 396 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のEV充電ステーションの市場規模は、8.8%のCAGRで拡大し、2024年の73億米ドルから2030年には121億米ドルに成長すると予測されています。

EV充電ステーション市場の大幅な技術的成長とともに、電気自動車需要の増加などのパラメータが、予測期間中のEV充電ステーション市場の収益成長を促進すると予想されます。さらに、電気自動車の価格引き下げと、EV充電インフラを設置するための政府の政策や補助金は、EV充電ステーション市場に新たな機会を生み出すと思われます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 電レベル別、モード別、接続フェーズ別、DC急速充電別、充電ポイント別、用途別、設置タイプ別、充電インフラタイプ別、電気バス充電タイプ別、充電サービスタイプ別、充電ポイント事業者別、地域別 |

| 対象地域 | 中国、アジア太平洋、北米、中東、その他の地域 |

電気自動車(EV)の需要が急増する中、モード3のEV充電ステーションが人気を集めています。これらのステーションは、AC充電用のタイプ2のソケットを備えており、公共エリア、職場、集合住宅への設置に適していますが、個人での使用は意図されていません。モード3充電は世界中の公共充電ステーションで普及しており、標準的な家庭用コンセントよりも高い電力を供給できるレベル2のAC充電器を採用しています。モード3充電における最近の進歩は、充電速度、安全機能、ユーザーインターフェースの強化に重点を置いています。多くの国が、拡大するEV市場に対応するため、モード3充電インフラに多額の投資を行っています。例えば、EUは2025年までに100万カ所の公共充電ポイントを設置することを目標としており、中国は2030年までに120万カ所の公共充電ステーションを運営する計画です。米国では、大手自動車メーカーと電力会社が協力して充電ネットワークの拡充に取り組んでいるほか、さまざまな州がEVの普及と充電インフラ整備の目標を設定しています。モード3充電は、電力供給システムを介して電気ネットワークに継続的に接続する必要があり、ウォールボックス、業務用充電ポイント、その他AC電源を使用する自動充電システムで一般的に利用されています。

当レポートでは、世界のEV充電ステーション市場について調査し、充電レベル別、モード別、接続フェーズ別、DC急速充電別、充電ポイント別、用途別、設置タイプ別、充電インフラタイプ別、電気バス充電タイプ別、充電サービスタイプ別、充電ポイント事業者別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- EV充電のパフォーマンス指標

- エコシステムマップ

- 部品表

- 投資と資金調達のシナリオ

- バリューチェーン分析

- 価格分析

- 特許分析

- ケーススタディ

- 技術分析

- 規制状況

- 顧客のビジネスに影響を与える動向と混乱

- EV充電の進化

- 主な利害関係者と購入基準

- 主な会議とイベント

- EV充電ステーション市場における機会

- 充電の未来

- 充電システムのパワーブースター

第6章 EV充電ステーション市場、充電レベル別

- イントロダクション

- 運用データ

- レベル1

- レベル2

- レベル3

- 主な洞察

第7章 EV充電ステーション市場、モード別

- イントロダクション

- 運用データ

- モード1

- モード2

- モード3

- モード4

- 主な洞察

第8章 EV充電ステーション市場、接続フェーズ別

- イントロダクション

- 運用データ

- 単相

- 3相

- 主な洞察

第9章 EV充電ステーション市場、DC急速充電別

- イントロダクション

- 運用データ

- スローDC

- 高速DC

- DC超高速1

- DC超高速2

- 主な洞察

第10章 EV充電ステーション市場、充電ポイント別

- イントロダクション

- 運用データ

- AC充電

- DC充電

- 主な洞察

第11章 EV充電ステーション市場、用途別

- イントロダクション

- 運用データ

- プライベート

- セミパブリック

- パブリック

- 主な洞察

第12章 EV充電ステーション市場、設置タイプ別

- イントロダクション

- 運用データ

- ポータブル充電器

- 固定充電器

- 主な洞察

第13章 EV充電ステーション市場、充電インフラタイプ別

- イントロダクション

- 運用データ

- CCS

- CHADEMO

- タイプ1

- ナックス

- タイプ2

- GB/T高速

- 主な洞察

第14章 EV充電ステーション市場、電気バス充電タイプ別

- イントロダクション

- オフボードトップダウンパンタグラフ

- 車載ボトムアップパンタグラフ

- コネクタ経由で充電

第15章 EV充電ステーション市場、充電サービスタイプ別

- イントロダクション

- EV充電サービス

- バッテリー交換サービス

第16章 EV充電ステーション市場、充電ポイント事業者別

- イントロダクション

- アジア太平洋の充電ポイント事業者

- 欧州の充電ポイント事業者

- 北米の充電ポイント運営者

第17章 EV充電ステーション市場、地域別

- イントロダクション

- 中国

- アジア太平洋

- 欧州

- 北米

- 中東

- その他の地域

第18章 競合情勢

- イントロダクション

- 主要企業が採用する戦略、2020年~2023年

- 市場シェア分析、2023年

- 収益分析、2018年~2022年

- 企業評価マトリックス2023年

- スタートアップ/中小企業評価マトリックス、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第19章 企業プロファイル

- 主要な充電ポイントメーカー

- ABB

- BYD

- CHARGEPOINT

- TESLA

- SIEMENS

- SCHNEIDER ELECTRIC

- TRITIUM

- 主要な充電ポイント事業者

- ENGIE SA

- SHELL PLC

- TOTALENERGIES

- BP P.L.C.

- ENEL X GLOBAL RETAIL

- VIRTA LTD.

- ALLEGO

- その他の企業

- EFACEC

- BLINK CHARGING

- CLIPPERCREEK

- ELECTRIFY AMERICA

- OPCONNECT

- VOLTA

- EV SAFE CHARGE INC.

- EV CONNECT

- FREEWIRE TECHNOLOGIES

- IONITY

- WALLBOX

- HELIOX ENERGY

- SPARK HORIZON

- STAR CHARGE

- DBT

- CHARGE+

- DELTA ELECTRONICS, INC.

- TGOOD

- ALFEN NV

- IES SYNERGY

- LAFON

- BEEV

- FIMER

- INSTAVOLT

- FRESHMILE

- POD POINT

- VATTENFALL

- BE CHARGE

- MER

- ENBW

- RWE

第20章 市場への提言

第21章 付録

The global EV Charging Station market is estimated to grow from USD 7.3 billion in 2024 to USD 12.1 billion by 2030, at a CAGR of 8.8%. Parameters such as increase in demand for electric vehicles, along with significant technological growth of EV Charging Station market are expected to bolster the revenue growth of the EV Charging Station market during the forecast period. In addition, reducing prices of electric vehicles, paired with government policies and subsidies to setup EV Charging Infrastructure will create new opportunities for EV Charging Station market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Application, Level of Charging, Charging Point, Charging Infrastructure, Operation, DC Fast Charging, Charge Point Operator, Connection Phase, Service, Installation and Region |

| Regions covered | China, Asia Pacific, Europe, North America, Middle East and Rest Of the World |

"Mode 3 Charger segment is expected to be the largest market during the forecast period, by level of charging."

As the demand for electric vehicles (EVs) surges, Mode 3 EV charging stations are gaining popularity. These stations feature a type 2 socket for AC charging, suitable for installation in public areas, workplaces, and apartment complexes, but not intended for private use. Mode 3 charging is prevalent in public charging stations worldwide, employing level 2 AC chargers capable of delivering higher power than standard household outlets. Recent advancements in Mode 3 EV charging focus on enhancing charging speeds, safety features, and user interfaces. Many countries are investing significantly in Mode 3 charging infrastructure to accommodate the expanding EV market. For instance, the EU aims to establish one million public charging points by 2025, and China plans to operate 1.2 million public charging stations by 2030. In the United States, major automakers and utilities are collaborating to expand the charging network, while various states have set targets for EV adoption and charging infrastructure development. Mode 3 charging necessitates continuous connection to an electrical network through a power supply system and is commonly utilized in wall boxes, commercial charging points, and other automatic charging systems using AC power.

"Level 3 chargers expected to be the largest segment in EV Charging Station market during the forecast period"

The increasing demand for accessible rapid charging is set to boost the market. Level 3 chargers, having over 50 kW power, can swiftly charge an electric vehicle in under an hour. These chargers operate through a 480V direct current (DC) plug and deliver a commendable performance, covering approximately 270 km in just 30 minutes. While these chargers are the most expensive option, they cater to longer journeys, commercial vehicles like taxis, and individuals with limited access to home charging. ABB (Switzerland) has developed a rapid-charging station capable of juicing up an EV in less than half an hour, boasting power ratings of up to 400 kW. Currently, it stands as the fastest available recharging solution, adding an average of 80 to 130 kilometers in a mere 30-minute session. Tesla's supercharger can provide up to 270 km in the same duration, utilizing 480 V, 400 Amp current, and delivering 240 kW power. Charging stations of this caliber typically range from USD 30,000 to USD 50,000 on average, owing to significantly higher equipment costs and the need for transformer installation. Leading CPOs and CPMs are working to develop products for high power Level 3 charging. For instance, in January 2023, ChargePoint (US) and Stem (US) forged an agreement leveraging their AI-driven clean energy solutions and services to accelerate the deployment of EV charging and battery storage solutions. Similarly, in February 2022, Tritium (Australia) partnered with Wise EV (US), a subsidiary of renewable energy service provider Wise Power, to supply rapid chargers for a new nationwide EV charging network.

"North America is expected to have the significant growth during the forecast period."

North America includes developed nations such as the US and Canada, serving as a key regional center for esteemed Original Equipment Manufacturers (OEMs) renowned for delivering top-quality, high-performance vehicles. Notable OEMs like Tesla and GM prioritize the development of faster, cleaner, and high-performance electric vehicles, accompanied by charging infrastructure. Tesla's NACS EV charging has attained official North American Standard certification, representing a significant milestone in the EV charging domain. NACS aims to enhance installations, reduce costs, and improve accessibility. The widespread adoption of NACS by prominent automakers sets the standard for efficient and reliable charging infrastructure, ensuring that public EV networks, alongside those operated by Tesla, benefit from crucial federal funding support. Leading OEMs such as BMW, Nissan, Volkswagen, and Daimler have introduced electric vehicles in the region. The primary companies providing electric vehicle charging stations in the US include ChargePoint, Leviton, Blink Charging, SemaConnect, EVgo, and Volta. Numerous prominent companies, including Tesla, General Motors, EVgo, Pilot, Hertz, and BP, are actively expanding their networks by deploying thousands of public charging ports over the next two years. Canada anticipates a surge in demand for charging stations due to its burgeoning EVCS startup ecosystem and increasing EV presence.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 24%, Tier I - 67%, and Others - 9%

- By Designation: CXOs - 33%, Managers - 52%, and Executives - 15%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 28%, East China - 6%, Middle East - 3%, and Rest Of the World - 3%

The EV Charging Station market is dominated by major players including ABB (Switzerland), BYD (China), Chargepoint (US), Tesla (US), Siemens (Germany), among others. These companies have strong product portfolio as well as strong distribution networks at the global level.

Research Coverage:

This research report categorizes EV charging station market by level of charging (level 1, level 2, and level 3), application (private, semi-public, and public), based on charging point type (AC charging, DC charging), charging infrastructure type (CCS, CHAdeMO, Type 1, Tesla SC (NACS), GB/T Fast, and Type 2), electric bus charging type (off-board top-down pantographs, on-board bottom-up pantographs, and charging via connectors), charging service type (EV charging services and battery swapping services), charge point operator (Asia Pacific, Europe, North America), DC fast charging type [Slow DC (<49 kW), Fast DC (50-149 kW) and DC Ultra-Fast 1 (150-349 KW), and DC Ultra-Fast 2 (>349 kW), installation type (portable chargers and fixed chargers), operation (mode 1, mode 2, mode 3, and mode 4), connection phase (single phase and three phase), and Region (China, Asia Pacific, Europe, North America, Middle East and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the EV charging station market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent EV charging station market developments. This report covers the competitive analysis of upcoming startups in the EV charging station market ecosystem.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall EV Charging Station market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the current and future pricing trends of different EV Charging systems based on their capacity.

The report provides insight on the following pointers:

- Analysis of key drivers (Rising EV sales globally, government policies and subsidies to support faster setup of EV charging stations, increased electric vehicle range due to technological advancements, reducing prices of electric vehicles in global market), restraints (Lack of standardization of charging infrastructure, costly installation and maintenance of ultrafast EV charging stations, grid infrastructure limitations), challenges (Higher initial cost of electric vehicles compared to ICE vehicles, stringent regulations for installation of EV charging stations, dependence on fossil fuel electricity generation, shortage of lithium for use in EV batteries), and opportunities (Trend of V2G EV charging for electric vehicles, integration of IoT and smart infrastructure in EV charging stations for load management, development of EV charging stations using renewable sources, increasing demand for battery-swapping stations, plans for smart city deployment, shift to smart EV chargers).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the EV Charging Station market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the EV Charging Station market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the EV Charging Station market.

- Competitive Assessment: In-depth assessment of market ranking, growth strategies, and service offerings of leading players like ABB (Switzerland), Tritium (Australia), BYD (China), ChargePoint (US), Tesla (US) , and Charge Point Operators including BP (UK), Shell (UK), ENGIE (France), Total Energies (France), Enel X (Italy), among others in EV Charging Station market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 MARKET DEFINITION, BY CHARGING POINT TYPE

- TABLE 2 MARKET DEFINITION, BY APPLICATION

- TABLE 3 MARKET DEFINITION, BY CHARGING INFRASTRUCTURE TYPE

- TABLE 4 MARKET DEFINITION, BY CHARGING SERVICE TYPE

- TABLE 5 MARKET DEFINITION, BY DC FAST CHARGING TYPE

- TABLE 6 MARKET DEFINITION, BY INSTALLATION TYPE

- TABLE 7 MARKET DEFINITION, BY CHARGE POINT OPERATOR

- TABLE 8 MARKET DEFINITION, BY LEVEL OF CHARGING

- TABLE 9 MARKET DEFINITION, BY MODE

- TABLE 10 MARKET DEFINITION, BY CONNECTION PHASE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 11 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 EV CHARGING STATION MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 12 CURRENCY EXCHANGE RATES

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH PROCESS FLOW

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary participants

- FIGURE 4 INSIGHTS FROM INDUSTRY EXPERTS

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Primary interviewees from demand and supply sides

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 6 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 MARKET ESTIMATION NOTES

- 2.2.3 RECESSION IMPACT ANALYSIS

- 2.3 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- FIGURE 10 FACTORS IMPACTING EV CHARGING STATION MARKET

- 2.4.1 DEMAND AND SUPPLY-SIDE FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 11 EV CHARGING STATION MARKET DRIVERS

- FIGURE 12 EV CHARGING STATION MARKET OVERVIEW

- FIGURE 13 CHINA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 14 ULTRAFAST 1 SEGMENT TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

- FIGURE 15 AC CHARGING TO BE LARGEST SEGMENT DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EV CHARGING STATION MARKET

- FIGURE 16 RAPID URBANIZATION AND GOVERNMENT SUPPORT TO DRIVE MARKET

- 4.2 EV CHARGING STATION MARKET, BY LEVEL OF CHARGING

- FIGURE 17 LEVEL 3 SEGMENT TO ACQUIRE MAXIMUM MARKET SHARE IN 2024

- 4.3 EV CHARGING STATION MARKET, BY CHARGING POINT TYPE

- FIGURE 18 DC CHARGING TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.4 EV CHARGING STATION MARKET, BY CHARGING INFRASTRUCTURE TYPE

- FIGURE 19 TYPE 2 SEGMENT TO HOLD HIGHEST MARKET SHARE IN 2030

- 4.5 EV CHARGING STATION MARKET, BY APPLICATION

- FIGURE 20 PUBLIC SEGMENT TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- 4.6 EV CHARGING STATION MARKET, BY DC FAST CHARGING TYPE

- FIGURE 21 DC ULTRAFAST 2 SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- 4.7 EV CHARGING STATION MARKET, BY INSTALLATION TYPE

- FIGURE 22 FIXED SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.8 EV CHARGING STATION MARKET, BY MODE

- FIGURE 23 MODE 3 SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.9 EV CHARGING STATION MARKET, BY CONNECTION PHASE

- FIGURE 24 THREE PHASE SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.10 EV CHARGING STATION MARKET, BY REGION

- FIGURE 25 CHINA TO BE LARGEST MARKET FOR EV CHARGING STATIONS DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 26 CHARGING INFRASTRUCTURE SOLUTIONS

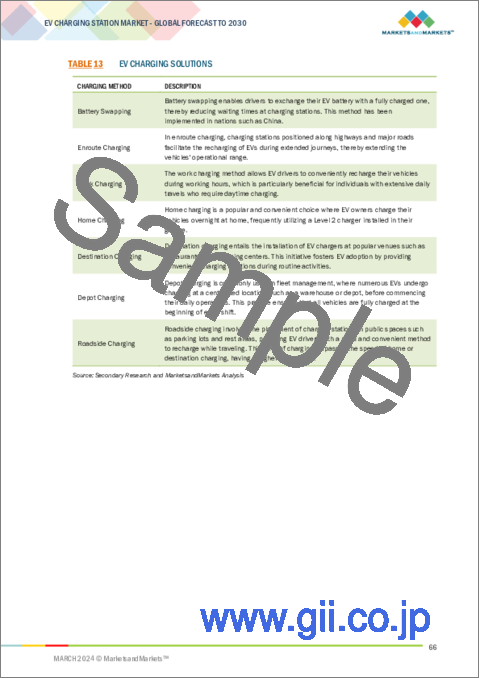

- TABLE 13 EV CHARGING SOLUTIONS

- 5.2 MARKET DYNAMICS

- FIGURE 27 EV CHARGING STATION MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in global electric vehicle sales

- FIGURE 28 GLOBAL BEV AND PHEV SALES, 2019-2023

- 5.2.1.2 Government subsidies to support development of EV charging infrastructure

- TABLE 14 EV CHARGING INCENTIVES

- 5.2.1.3 Improved vehicle range due to advancements in battery technology

- TABLE 15 RANGE AND COST OF DIFFERENT ELECTRIC VEHICLES

- 5.2.1.4 Reduced electric vehicle prices

- FIGURE 29 EV BATTERY PRICING ANALYSIS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of standardization for charging infrastructure

- FIGURE 30 TYPES OF EV CHARGING SOCKETS

- FIGURE 31 EV CHARGING STANDARDS

- 5.2.2.2 Costly installation and maintenance of ultrafast EV charging stations

- 5.2.2.3 Grid infrastructure limitations

- FIGURE 32 US GRID SCENARIO

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging trend of vehicle-to-grid (V2G) EV charging

- TABLE 16 BIDIRECTIONAL EV CHARGERS

- TABLE 17 ELECTRIC VEHICLE SALES WITH BIDIRECTIONAL CHARGING

- FIGURE 33 V2G INFRASTRUCTURE FOR EV CHARGING STATIONS

- FIGURE 34 OVERVIEW OF V2G CHARGING STATIONS

- 5.2.3.2 Integration of IoT and smart infrastructure in EV charging stations

- FIGURE 35 BENEFITS OF SMART EV CHARGING

- FIGURE 36 IOT IN EV CHARGING

- FIGURE 37 SERVICE OFFERINGS IN EV CHARGING

- TABLE 18 SMART CHARGING ELEMENTS

- 5.2.3.3 Development of EV charging stations using renewable sources

- FIGURE 38 ABB E-MOBILITY

- FIGURE 39 EV CHARGING THROUGH SOLAR POWER

- 5.2.3.4 Increasing demand for battery-swapping stations

- FIGURE 40 BATTERY SWAPPING STATION BUSINESS MODELS

- 5.2.3.5 Plans for smart city deployment

- 5.2.3.6 Shift to smart EV chargers

- FIGURE 41 SMART EV CHARGING INFRASTRUCTURE

- 5.2.4 CHALLENGES

- 5.2.4.1 Higher initial cost of electric vehicles compared to ICE vehicles

- FIGURE 42 COMPARISON OF DIRECT COSTS BETWEEN ICE AND BATTERY ELECTRIC VEHICLES

- 5.2.4.2 Stringent regulations for installation of EV charging stations

- 5.2.4.3 Dependence on fossil fuel electricity generation

- FIGURE 43 GLOBAL ENERGY CONSUMPTION

- 5.2.4.4 Shortage of lithium for use in EV batteries

- FIGURE 44 LITHIUM-ION BATTERY DEMAND, 2015-2030

- TABLE 19 IMPACT OF MARKET DYNAMICS

- 5.3 PERFORMANCE INDICATORS FOR EV CHARGING

- TABLE 20 PERFORMANCE INDICATORS FOR EV CHARGING

- 5.4 ECOSYSTEM MAP

- FIGURE 45 ECOSYSTEM MAP

- 5.4.1 OEMS

- 5.4.2 CHARGING POINT MANUFACTURERS

- 5.4.3 EV CHARGING POINT OPERATORS

- 5.4.4 PAYMENT PROCESSING COMPANIES

- 5.4.5 NAVIGATION AND MAPPING PROVIDERS

- TABLE 21 ROLE OF COMPANIES IN ECOSYSTEM

- 5.5 BILL OF MATERIALS

- FIGURE 46 BILL OF MATERIALS FOR AC CHARGERS, 2024 VS. 2030

- FIGURE 47 BILL OF MATERIALS FOR DC CHARGERS, 2024 VS. 2030

- 5.6 INVESTMENT AND FUNDING SCENARIO

- FIGURE 48 INVESTMENT AND FUNDING SCENARIO, 2020-2023

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 49 VALUE CHAIN ANALYSIS

- 5.8 PRICING ANALYSIS

- TABLE 22 EV CHARGING STATION COST SUMMARY

- 5.8.1 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 23 LEVEL 1 EV CHARGING STATION: REGIONAL PRICE TREND, 2020-2023

- TABLE 24 LEVEL 2 EV CHARGING STATION: REGIONAL PRICE TREND, 2020-2023

- TABLE 25 LEVEL 3 EV CHARGING STATION: REGIONAL PRICE TREND, 2020-2023

- 5.9 PATENT ANALYSIS

- FIGURE 50 PATENTS PUBLISHED, 2014-2023

- 5.9.1 LEGAL STATUS OF PATENTS

- FIGURE 51 LEGAL STATUS OF PATENTS, 2014-2023

- 5.9.2 TOP PATENT APPLICANTS

- FIGURE 52 TOP PATENT APPLICANTS, 2014-2023

- TABLE 26 PATENT ANALYSIS

- 5.10 CASE STUDIES

- 5.10.1 CHARGING STATION SIZE OPTIMIZATION

- 5.10.2 LOAD BALANCING SOLUTION FOR EV CHARGING

- 5.10.3 CHARGEPOINT EV CHARGING NETWORK

- 5.10.4 EVGO FAST-CHARGING NETWORK

- 5.10.5 CITY OF BOULDER EV CHARGING NETWORK

- 5.10.6 ELECTRIFY AMERICA CHARGING NETWORK

- 5.10.7 MERCEDES-BENZ EV CHARGING NETWORK IN CHINA

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 TURBOCHARGING FOR ELECTRIC VEHICLES

- FIGURE 53 PORSCHE TAYCAN TURBOCHARGING THROUGH MOBILE CHARGING STATION

- 5.11.2 SMART CHARGING SYSTEMS

- FIGURE 54 SMART CHARGING SYSTEMS

- 5.11.3 WIRELESS POWER TRANSFER

- FIGURE 55 WIRELESS EV CHARGING SYSTEMS

- 5.11.4 BIDIRECTIONAL CHARGERS

- FIGURE 56 BIDIRECTIONAL EV CHARGING ENERGY FLOW CYCLE

- 5.11.5 IOT INTEGRATION IN EV CHARGING STATIONS

- FIGURE 57 ROLE OF IOT IN EV CHARGING STATIONS

- 5.11.6 PLUG-AND-PLAY CHARGING

- FIGURE 58 PLUG-AND-PLAY CONNECTIVITY FOR EV CHARGING

- 5.11.7 OVERHEAD CHARGING

- FIGURE 59 SIEMENS EHIGHWAY SYSTEM

- 5.11.8 MEGAWATT CHARGING SYSTEMS

- FIGURE 60 MEGAWATT CHARGING PROJECTS, BY REGION

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 NETHERLANDS

- TABLE 27 NETHERLANDS: EV INCENTIVES

- TABLE 28 NETHERLANDS: EV CHARGING STATION INCENTIVES

- 5.12.2 GERMANY

- TABLE 29 GERMANY: EV INCENTIVES

- TABLE 30 GERMANY: EV CHARGING STATION INCENTIVES

- 5.12.3 FRANCE

- TABLE 31 FRANCE: EV INCENTIVES

- TABLE 32 FRANCE: EV CHARGING STATION INCENTIVES

- 5.12.4 UK

- TABLE 33 UK: EV INCENTIVES

- TABLE 34 UK: EV CHARGING STATION INCENTIVES

- 5.12.5 CHINA

- TABLE 35 CHINA: EV INCENTIVES

- TABLE 36 CHINA: EV CHARGING STATION INCENTIVES

- 5.12.6 US

- TABLE 37 US: EV INCENTIVES

- TABLE 38 US: EV CHARGING STATION INCENTIVES

- 5.12.7 CANADA

- TABLE 39 CANADA: EV INCENTIVES

- TABLE 40 CANADA: EV CHARGING STATION INCENTIVES

- 5.12.8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 41 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 42 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 43 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 61 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.14 EVOLUTION OF EV CHARGING

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 LEVEL 1

- 5.15.2 LEVEL 2

- 5.15.3 LEVEL 3

- 5.15.4 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 62 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 44 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.15.5 BUYING CRITERIA

- FIGURE 63 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 45 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.16 KEY CONFERENCES AND EVENTS

- TABLE 46 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.17 OPPORTUNITIES IN EV CHARGING STATION MARKET

- FIGURE 64 EV CHARGING BUSINESS MODELS

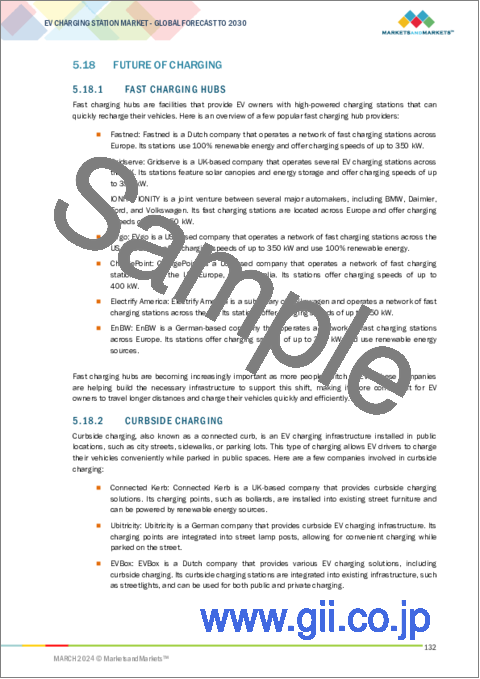

- 5.18 FUTURE OF CHARGING

- 5.18.1 FAST CHARGING HUBS

- 5.18.2 CURBSIDE CHARGING

- 5.18.3 INDUCTION CHARGING

- 5.19 POWER BOOSTER IN CHARGING SYSTEMS

- TABLE 47 COMPARISON BETWEEN BATTERY AND FLYWHEEL POWER BOOSTER

- TABLE 48 EXAMPLES OF FLYWHEEL POWER BOOSTER

6 EV CHARGING STATION MARKET, BY LEVEL OF CHARGING

- 6.1 INTRODUCTION

- FIGURE 65 EV CHARGING STATION MARKET, BY LEVEL OF CHARGING, 2024-2030 (USD MILLION)

- TABLE 49 EV CHARGING STATION MARKET, BY LEVEL OF CHARGING, 2020-2023 (THOUSAND UNITS)

- TABLE 50 EV CHARGING STATION MARKET, BY LEVEL OF CHARGING, 2024-2030 (THOUSAND UNITS)

- TABLE 51 EV CHARGING STATION MARKET, BY LEVEL OF CHARGING, 2020-2023 (USD MILLION)

- TABLE 52 EV CHARGING STATION MARKET, BY LEVEL OF CHARGING, 2024-2030 (USD MILLION)

- 6.2 OPERATIONAL DATA

- TABLE 53 EV CHARGING STATIONS, BY LEVEL

- 6.3 LEVEL 1

- 6.3.1 LOW OPERATIONAL COSTS TO DRIVE MARKET

- TABLE 54 LEVEL 1 EV CHARGING STATIONS

- TABLE 55 LEVEL 1: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 56 LEVEL 1: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 57 LEVEL 1: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 58 LEVEL 1: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.4 LEVEL 2

- 6.4.1 RISING INSTALLATION IN COMMERCIAL AREAS TO DRIVE MARKET

- TABLE 59 LEVEL 2 EV CHARGING STATIONS

- TABLE 60 LEVEL 2: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 61 LEVEL 2: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 62 LEVEL 2: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 63 LEVEL 2: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.5 LEVEL 3

- 6.5.1 NEED FOR ACCESSIBLE FAST CHARGING TO DRIVE MARKET

- TABLE 64 LEVEL 3 EV CHARGING STATIONS

- TABLE 65 LEVEL 3: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 66 LEVEL 3: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 67 LEVEL 3: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 LEVEL 3: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.6 KEY PRIMARY INSIGHTS

7 EV CHARGING STATION MARKET, BY MODE

- 7.1 INTRODUCTION

- FIGURE 66 EV CHARGING STATION MARKET, BY MODE, 2024-2030 (THOUSAND UNITS)

- TABLE 69 EV CHARGING STATION MARKET, BY MODE, 2020-2023 (THOUSAND UNITS)

- TABLE 70 EV CHARGING STATION MARKET, BY MODE, 2024-2030 (THOUSAND UNITS)

- 7.2 OPERATIONAL DATA

- TABLE 71 EV CHARGING STATIONS, BY MODE

- 7.3 MODE 1

- 7.3.1 INCREASING DEMAND FROM DEVELOPING ECONOMIES TO DRIVE MARKET

- FIGURE 67 MODE 1 CHARGING

- TABLE 72 MODE 1: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 73 MODE 1: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 7.4 MODE 2

- 7.4.1 ONGOING INVESTMENTS IN PUBLIC CHARGING INFRASTRUCTURE TO DRIVE MARKET

- FIGURE 68 MODE 2 CHARGING

- TABLE 74 MODE 2 CHARGING STATISTICS

- TABLE 75 MODE 2: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 76 MODE 2: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 7.5 MODE 3

- 7.5.1 EMPHASIS ON SAFETY FEATURES AND USER-FRIENDLY INTERFACES TO DRIVE MARKET

- FIGURE 69 MODE 3 CHARGING

- TABLE 77 MODE 3 CHARGING STATISTICS

- TABLE 78 MODE 3: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 79 MODE 3: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 7.6 MODE 4

- 7.6.1 GROWING DEMAND FOR ENHANCED DRIVING RANGE TO DRIVE MARKET

- FIGURE 70 MODE 4 CHARGING

- TABLE 80 MODE 4 CHARGING STATISTICS

- TABLE 81 MODE 4: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 82 MODE 4: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 7.7 KEY PRIMARY INSIGHTS

8 EV CHARGING STATION MARKET, BY CONNECTION PHASE

- 8.1 INTRODUCTION

- FIGURE 71 EV CHARGING STATION MARKET, BY CONNECTION PHASE, 2024-2030 (THOUSAND UNITS)

- TABLE 83 EV CHARGING STATION MARKET, BY CONNECTION PHASE, 2020-2023 (THOUSAND UNITS)

- TABLE 84 EV CHARGING STATION MARKET, BY CONNECTION PHASE, 2024-2030 (THOUSAND UNITS)

- 8.2 OPERATIONAL DATA

- TABLE 85 EV CHARGING STATIONS, BY CONNECTION PHASE

- 8.3 SINGLE PHASE

- 8.3.1 SHIFT TOWARD CLEAN TRANSPORTATION TO DRIVE MARKET

- TABLE 86 SINGLE PHASE EV CHARGING STATIONS

- TABLE 87 SINGLE PHASE: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 88 SINGLE PHASE: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 8.4 THREE PHASE

- 8.4.1 RISING DEMAND FOR FAST CHARGING SOLUTIONS TO DRIVE MARKET

- TABLE 89 THREE PHASE EV CHARGING STATIONS

- TABLE 90 THREE PHASE: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 91 THREE PHASE: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 8.5 KEY PRIMARY INSIGHTS

9 EV CHARGING STATION MARKET, BY DC FAST CHARGING TYPE

- 9.1 INTRODUCTION

- FIGURE 72 EV CHARGING STATION MARKET, BY DC FAST CHARGING TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 92 EV CHARGING STATION MARKET, BY DC FAST CHARGING TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 93 EV CHARGING STATION MARKET, BY DC FAST CHARGING TYPE, 2024-2030 (THOUSAND UNITS)

- 9.2 OPERATIONAL DATA

- TABLE 94 EV CHARGING STATIONS, BY DC FAST CHARGING TYPE

- 9.3 SLOW DC

- 9.3.1 WIDE SCOPE IN SEMI-PUBLIC APPLICATIONS TO DRIVE MARKET

- TABLE 95 SLOW DC: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 96 SLOW DC: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 9.4 FAST DC

- 9.4.1 NEED FOR ON-THE-GO CHARGING TO DRIVE MARKET

- TABLE 97 FAST DC: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 98 FAST DC: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 9.5 DC ULTRAFAST 1

- 9.5.1 GROWING DEMAND FOR HIGH POWER CHARGING STATIONS TO DRIVE MARKET

- TABLE 99 DC ULTRAFAST 1: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 100 DC ULTRAFAST 1: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 9.6 DC ULTRAFAST 2

- TABLE 101 DC ULTRAFAST 2: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 102 DC ULTRAFAST 2: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 9.6.1 400 KW

- 9.6.1.1 Enhanced charging utility and efficiency to drive market

- TABLE 103 400 KW: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 104 400 KW: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 9.6.2 MEGAWATT CHARGING SYSTEMS

- 9.6.2.1 Rising use in aerospace and marine applications to drive market

- TABLE 105 MEGAWATT CHARGING SYSTEMS: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 106 MEGAWATT CHARGING SYSTEMS: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 9.7 KEY PRIMARY INSIGHTS

10 EV CHARGING STATION MARKET, BY CHARGING POINT TYPE

- 10.1 INTRODUCTION

- FIGURE 73 EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 107 EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 108 EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 10.2 OPERATIONAL DATA

- TABLE 109 EV CHARGING STATIONS, BY CHARGING POINT TYPE

- 10.3 AC CHARGING

- 10.3.1 GOVERNMENT POLICIES FOR ELECTRIC VEHICLE SALES TO DRIVE MARKET

- TABLE 110 AC CHARGING: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 111 AC CHARGING: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 10.4 DC CHARGING

- 10.4.1 SURGE IN ADOPTION OF SUPERCHARGERS TO DRIVE MARKET

- TABLE 112 DC CHARGING: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 113 DC CHARGING: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 10.5 KEY PRIMARY INSIGHTS

11 EV CHARGING STATION MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- TABLE 114 EV CHARGING STATION MARKET, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 115 EV CHARGING STATION MARKET, BY APPLICATION, 2024-2030 (THOUSAND UNITS)

- FIGURE 74 EV CHARGING STATION MARKET, BY APPLICATION, 2024-2030 (THOUSAND UNITS)

- 11.2 OPERATIONAL DATA

- TABLE 116 EV CHARGING STATIONS, BY APPLICATION

- 11.3 PRIVATE

- 11.3.1 NEW PRODUCT DEVELOPMENTS BY PRIVATE CHARGING STATION PROVIDERS TO DRIVE MARKET

- TABLE 117 PRIVATE: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 118 PRIVATE: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 11.4 SEMI-PUBLIC

- 11.4.1 GOVERNMENT INITIATIVES TO INSTALL SEMI-PUBLIC CHARGING STATIONS TO DRIVE MARKET

- TABLE 119 SEMI-PUBLIC: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 120 SEMI-PUBLIC: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 11.5 PUBLIC

- 11.5.1 RISING INSTALLATION OF PUBLIC CHARGING STATIONS TO DRIVE MARKET

- TABLE 121 PUBLIC: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 122 PUBLIC: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 11.6 KEY PRIMARY INSIGHTS

12 EV CHARGING STATION MARKET, BY INSTALLATION TYPE

- 12.1 INTRODUCTION

- TABLE 123 COMPARISON BETWEEN PORTABLE AND FIXED CHARGERS

- FIGURE 75 EV CHARGING STATION MARKET, BY INSTALLATION TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 124 EV CHARGING STATION MARKET, BY INSTALLATION TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 125 EV CHARGING STATION MARKET, BY INSTALLATION TYPE, 2024-2030 (THOUSAND UNITS)

- 12.2 OPERATIONAL DATA

- TABLE 126 PORTABLE EV CHARGING SOLUTIONS

- 12.3 PORTABLE CHARGERS

- 12.3.1 EMERGING TREND OF CHARGING-AS-A-SERVICE TO DRIVE MARKET

- TABLE 127 PORTABLE CHARGERS: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 128 PORTABLE CHARGERS: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 12.4 FIXED CHARGERS

- 12.4.1 SUBSIDIZED ELECTRICITY AND INCENTIVES TO DRIVE MARKET

- TABLE 129 FIXED CHARGERS: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 130 FIXED CHARGERS: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 12.5 KEY PRIMARY INSIGHTS

13 EV CHARGING STATION MARKET, BY CHARGING INFRASTRUCTURE TYPE

- 13.1 INTRODUCTION

- FIGURE 76 PORSCHE TAYCAN CHARGING CONNECTORS

- TABLE 131 EV CHARGING STATION MARKET, BY CHARGING INFRASTRUCTURE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 132 EV CHARGING STATION MARKET, BY CHARGING INFRASTRUCTURE TYPE, 2024-2030 (THOUSAND UNITS)

- FIGURE 77 EV CHARGING STATION MARKET, BY CHARGING INFRASTRUCTURE TYPE, 2024-2030 (THOUSAND UNITS)

- 13.2 OPERATIONAL DATA

- TABLE 133 TYPES OF CHARGING INFRASTRUCTURE

- 13.3 CCS

- FIGURE 78 CCS KEY FINDINGS

- TABLE 134 CCS: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 135 CCS: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 13.4 CHADEMO

- FIGURE 79 CHADEMO KEY FINDINGS

- TABLE 136 CHADEMO: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 137 CHADEMO: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 13.5 TYPE 1

- FIGURE 80 TYPE 1 CHARGER KEY FINDINGS

- TABLE 138 TYPE 1: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 139 TYPE 1: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 13.6 NACS

- FIGURE 81 NACS KEY FINDINGS

- TABLE 140 NACS: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 141 NACS: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 13.7 TYPE 2

- FIGURE 82 TYPE 2 CHARGER KEY FINDINGS

- TABLE 142 TYPE 2: EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 143 TYPE 2: EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 13.8 GB/T FAST

- FIGURE 83 GB/T FAST CHARGER KEY FINDINGS

- TABLE 144 GB/T FAST: EV CHARGING STATION MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 145 GB/T FAST: EV CHARGING STATION MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- 13.9 KEY PRIMARY INSIGHTS

14 EV CHARGING STATION MARKET, BY ELECTRIC BUS CHARGING TYPE

- 14.1 INTRODUCTION

- TABLE 146 PANTOGRAPH BUS CHARGING

- FIGURE 84 COMPARISON BETWEEN PANTOGRAPH UP AND PANTOGRAPH DOWN FOR E-BUS CHARGING

- 14.2 OFF-BOARD TOP-DOWN PANTOGRAPHS

- 14.3 ONBOARD BOTTOM-UP PANTOGRAPHS

- 14.4 CHARGING VIA CONNECTORS

15 EV CHARGING STATION MARKET, BY CHARGING SERVICE TYPE

- 15.1 INTRODUCTION

- 15.2 EV CHARGING SERVICES

- TABLE 147 EV CHARGING POINTS, BY COUNTRY, 2023

- 15.3 BATTERY SWAPPING SERVICES

- TABLE 148 BATTERY SWAPPING SERVICES, BY KEY PLAYER

- FIGURE 85 FLOW FIGURE FOR AUTOMATED BATTERY SWAPPING

16 EV CHARGING STATION MARKET, BY CHARGE POINT OPERATOR

- 16.1 INTRODUCTION

- 16.2 ASIA PACIFIC CHARGE POINT OPERATORS

- 16.2.1 CHINA

- TABLE 149 CHINA: LEADING CHARGE POINT OPERATORS, 2018-2022 (UNITS)

- 16.2.2 INDIA

- TABLE 150 INDIA: LEADING CHARGE POINT OPERATORS, 2018-2022 (UNITS)

- 16.2.3 JAPAN

- TABLE 151 JAPAN: LEADING CHARGE POINT OPERATORS, 2018-2022 (UNITS)

- 16.2.4 SOUTH KOREA

- TABLE 152 SOUTH KOREA: LEADING CHARGE POINT OPERATORS, 2018-2022 (UNITS)

- 16.3 EUROPEAN CHARGE POINT OPERATORS

- 16.3.1 GERMANY

- TABLE 153 GERMANY: LEADING CHARGE POINT OPERATORS, 2018-2022 (UNITS)

- 16.3.2 FRANCE

- TABLE 154 FRANCE: LEADING CHARGE POINT OPERATORS, 2018-2022 (UNITS)

- 16.3.3 UK

- TABLE 155 UK: LEADING CHARGE POINT OPERATORS, 2018-2022 (UNITS)

- 16.3.4 DENMARK

- TABLE 156 DENMARK: LEADING CHARGE POINT OPERATORS, 2018-2022 (UNITS)

- 16.3.5 NETHERLANDS

- TABLE 157 NETHERLANDS: LEADING CHARGE POINT OPERATORS, 2018-2022 (UNITS)

- 16.3.6 NORWAY

- TABLE 158 NORWAY: LEADING CHARGE POINT OPERATORS, 2018-2022 (UNITS)

- 16.3.7 SWITZERLAND

- TABLE 159 SWITZERLAND: LEADING CHARGE POINT OPERATORS, 2018-2022 (UNITS)

- 16.3.8 SPAIN

- TABLE 160 SPAIN: LEADING CHARGE POINT OPERATORS, 2018-2022 (UNITS)

- 16.4 NORTH AMERICAN CHARGE POINT OPERATORS

- 16.4.1 US

- TABLE 161 US: LEADING CHARGE POINT OPERATORS, 2018-2022 (UNITS)

- 16.4.2 CANADA

- TABLE 162 CANADA: LEADING CHARGE POINT OPERATORS, 2018-2022 (UNITS)

17 EV CHARGING STATION MARKET, BY REGION

- 17.1 INTRODUCTION

- FIGURE 86 EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 163 EV CHARGING STATION MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 164 EV CHARGING STATION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 165 EV CHARGING STATION MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 166 EV CHARGING STATION MARKET, BY REGION, 2024-2030 (USD MILLION)

- 17.2 CHINA

- 17.2.1 GOVERNMENT INITIATIVES FOR ADOPTION OF ELECTRIC VEHICLES TO DRIVE MARKET

- TABLE 167 CHINA: EV CHARGING STATION MARKET HIGHLIGHTS

- TABLE 168 CHINA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 169 CHINA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.3 ASIA PACIFIC

- FIGURE 87 ASIA PACIFIC: EV CHARGING STATION MARKET SNAPSHOT

- FIGURE 88 EV CHARGING STATION NETWORK IN SOUTHEAST ASIA

- TABLE 170 ASIA PACIFIC: EV CHARGING STATION MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 171 ASIA PACIFIC: EV CHARGING STATION MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- 17.3.1 INDIA

- 17.3.1.1 Domestic shift toward electric vehicles to drive market

- TABLE 172 EV CHARGING STANDARDS IN INDIA

- FIGURE 89 STATES LEADING EV TRANSITION IN INDIA

- TABLE 173 INDIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 174 INDIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.3.2 JAPAN

- 17.3.2.1 Government efforts to improve EV infrastructure to drive market

- TABLE 175 JAPAN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 176 JAPAN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.3.3 SOUTH KOREA

- 17.3.3.1 Growing demand for electric and hybrid vehicles to drive market

- TABLE 177 SOUTH KOREA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 178 SOUTH KOREA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.3.4 SINGAPORE

- 17.3.4.1 Increasing investments in EV infrastructure to drive market

- TABLE 179 SINGAPORE: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 180 SINGAPORE: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.3.5 THAILAND

- 17.3.5.1 Development of fast-charging technology to drive market

- TABLE 181 THAILAND: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 182 THAILAND: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.3.6 TAIWAN

- 17.3.6.1 Government subsidies for EV charging solutions to drive market

- TABLE 183 TAIWAN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 184 TAIWAN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.3.7 INDONESIA

- 17.3.7.1 Rising demand for electric mobility solutions to drive market

- TABLE 185 INDONESIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 186 INDONESIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.4 EUROPE

- FIGURE 90 EUROPE: EV CHARGING POWER DEMAND FORECAST FOR 2030

- FIGURE 91 EUROPE: EV CHARGING STATION MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 187 EUROPE: EV CHARGING STATION MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 188 EUROPE: EV CHARGING STATION MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- 17.4.1 FRANCE

- 17.4.1.1 Focus on promoting low carbon emissions to drive market

- TABLE 189 FRANCE: EV CHARGING STATION MARKET HIGHLIGHTS

- TABLE 190 FRANCE: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 191 FRANCE: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.4.2 GERMANY

- 17.4.2.1 Significant presence of charge point operators to drive market

- TABLE 192 GERMANY: EV CHARGING STATION MARKET HIGHLIGHTS

- TABLE 193 GERMANY: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 194 GERMANY: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.4.3 NETHERLANDS

- 17.4.3.1 Emphasis on increasing domestic charging infrastructure to drive market

- TABLE 195 NETHERLANDS: EV CHARGING STATION MARKET HIGHLIGHTS

- TABLE 196 NETHERLANDS: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 197 NETHERLANDS: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.4.4 NORWAY

- 17.4.4.1 Exemption from taxes on EV purchases to drive market

- TABLE 198 NORWAY: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 199 NORWAY: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.4.5 SWEDEN

- 17.4.5.1 High adoption rate of electric vehicles to drive market

- TABLE 200 SWEDEN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 201 SWEDEN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.4.6 UK

- 17.4.6.1 Rising investments in ultra-low emission vehicles to drive market

- TABLE 202 UK: EV CHARGING STATION MARKET HIGHLIGHTS

- TABLE 203 UK: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 204 UK: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.4.7 DENMARK

- 17.4.7.1 Government efforts promoting private infrastructure for electric vehicles to drive market

- TABLE 205 DENMARK: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 206 DENMARK: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.4.8 AUSTRIA

- 17.4.8.1 Vast network of EV charging stations to drive market

- TABLE 207 AUSTRIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 208 AUSTRIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.4.9 SPAIN

- 17.4.9.1 Government investments for installation of EV charging infrastructure to drive market

- TABLE 209 SPAIN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 210 SPAIN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.4.10 SWITZERLAND

- 17.4.10.1 Partnerships between OEMs and electric energy distributors to install charging infrastructure to drive market

- TABLE 211 SWITZERLAND: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 212 SWITZERLAND: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.5 NORTH AMERICA

- FIGURE 92 NORTH AMERICA: EV CHARGING STATION MARKET SNAPSHOT

- TABLE 213 NORTH AMERICA: LEADING CHARGING POINT OPERATORS

- TABLE 214 NORTH AMERICA: EV CHARGING STATION MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 215 NORTH AMERICA: EV CHARGING STATION MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- 17.5.1 CANADA

- 17.5.1.1 Government subsidies and tax exemptions to drive market

- TABLE 216 CANADA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 217 CANADA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.5.2 US

- 17.5.2.1 Large-scale production of electric vehicles to drive market

- TABLE 218 US: EV CHARGING STATION MARKET HIGHLIGHTS

- TABLE 219 US: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 220 US: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.6 MIDDLE EAST

- FIGURE 93 MIDDLE EAST: EV CHARGING STATION MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 221 MIDDLE EAST: EV CHARGING STATION MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 222 MIDDLE EAST: EV CHARGING STATION MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- 17.6.1 ISRAEL

- 17.6.1.1 Presence of leading tech start-ups to drive market

- TABLE 223 ISRAEL: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 224 ISRAEL: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.6.2 UAE

- 17.6.2.1 Growing adoption of clean mobility solutions to drive market

- TABLE 225 UAE: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 226 UAE: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.6.3 SAUDI ARABIA

- 17.6.3.1 Rising installation of public EV charging stations to drive market

- TABLE 227 SAUDI ARABIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 228 SAUDI ARABIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.7 REST OF THE WORLD

- FIGURE 94 REST OF THE WORLD: EV CHARGING STATION MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 229 REST OF THE WORLD: EV CHARGING STATION MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 230 REST OF THE WORLD: EV CHARGING STATION MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- 17.7.1 BRAZIL

- 17.7.1.1 Rapid development of EV charging infrastructure through public and private investments to drive market

- TABLE 231 BRAZIL: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 232 BRAZIL: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.7.2 MEXICO

- 17.7.2.1 Increased adoption of zero-emission cars to drive market

- TABLE 233 MEXICO: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 234 MEXICO: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.7.3 SOUTH AFRICA

- 17.7.3.1 Falling prices of lithium-ion batteries to drive market

- TABLE 235 SOUTH AFRICA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 236 SOUTH AFRICA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

- 17.7.4 OTHER COUNTRIES

- TABLE 237 OTHER COUNTRIES: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 238 OTHER COUNTRIES: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2024-2030 (THOUSAND UNITS)

18 COMPETITIVE LANDSCAPE

- 18.1 INTRODUCTION

- 18.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2023

- TABLE 239 STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2023

- 18.3 MARKET SHARE ANALYSIS, 2023

- FIGURE 95 MARKET SHARE ANALYSIS OF EV CHARGING STATION MANUFACTURERS, 2023

- FIGURE 96 MARKET SHARE ANALYSIS OF EV CHARGING STATION OPERATORS, 2023

- 18.4 REVENUE ANALYSIS, 2018-2022

- FIGURE 97 REVENUE ANALYSIS OF EV CHARGING STATION MANUFACTURERS, 2018-2022

- FIGURE 98 REVENUE ANALYSIS OF EV CHARGING STATION OPERATORS, 2018-2022

- 18.5 COMPANY EVALUATION MATRIX, 2023

- 18.5.1 STARS

- 18.5.2 EMERGING LEADERS

- 18.5.3 PERVASIVE PLAYERS

- 18.5.4 PARTICIPANTS

- FIGURE 99 EV CHARGING STATION MANUFACTURERS: COMPANY EVALUATION MATRIX, 2023

- FIGURE 100 EV CHARGING STATION OPERATORS: COMPANY EVALUATION MATRIX, 2023

- 18.5.5 COMPANY FOOTPRINT

- FIGURE 101 COMPANY FOOTPRINT, 2023

- TABLE 240 CHARGING POINT TYPE FOOTPRINT, 2023

- TABLE 241 REGION FOOTPRINT, 2023

- 18.6 START-UP/SME EVALUATION MATRIX, 2023

- 18.6.1 PROGRESSIVE COMPANIES

- 18.6.2 RESPONSIVE COMPANIES

- 18.6.3 DYNAMIC COMPANIES

- 18.6.4 STARTING BLOCKS

- FIGURE 102 START-UP/SME EVALUATION MATRIX, 2023

- 18.6.5 COMPETITIVE BENCHMARKING

- TABLE 242 KEY START-UPS/SMES

- TABLE 243 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 18.7 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 103 COMPANY VALUATION OF EV CHARGING STATION MANUFACTURERS

- FIGURE 104 COMPANY VALUATION OF EV CHARGING STATION OPERATORS

- FIGURE 105 FINANCIAL METRICS OF EV CHARGING STATION MANUFACTURERS

- FIGURE 106 FINANCIAL METRICS OF EV CHARGING STATION OPERATORS

- 18.8 BRAND/PRODUCT COMPARISON

- FIGURE 107 COMPARISON BETWEEN EV CHARGE POINT MANUFACTURERS

- 18.9 COMPETITIVE SCENARIO

- 18.9.1 PRODUCT LAUNCHES

- TABLE 244 EV CHARGING STATION MARKET: PRODUCT LAUNCHES, 2020-2023

- 18.9.2 DEALS

- TABLE 245 EV CHARGING STATION MARKET: DEALS, 2020-2023

- 18.9.3 OTHERS

- TABLE 246 EV CHARGING STATION MARKET: OTHERS, 2020-2023

19 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 19.1 KEY CHARGING POINT MANUFACTURERS

- 19.1.1 ABB

- TABLE 247 ABB: COMPANY OVERVIEW

- FIGURE 108 ABB: COMPANY SNAPSHOT

- FIGURE 109 ABB: PROJECT HAMBURGER HOCHBAHN

- TABLE 248 ABB: PRODUCTS OFFERED

- TABLE 249 ABB: PRODUCT LAUNCHES

- TABLE 250 ABB: DEALS

- TABLE 251 ABB: OTHERS

- 19.1.2 BYD

- TABLE 252 BYD: COMPANY OVERVIEW

- FIGURE 110 BYD: COMPANY SNAPSHOT

- TABLE 253 BYD: PRODUCTS OFFERED

- TABLE 254 BYD: PRODUCT LAUNCHES

- TABLE 255 BYD: DEALS

- TABLE 256 BYD: OTHERS

- 19.1.3 CHARGEPOINT

- TABLE 257 CHARGEPOINT: COMPANY OVERVIEW

- FIGURE 111 CHARGEPOINT: COMPANY SNAPSHOT

- TABLE 258 CHARGEPOINT: PRODUCTS OFFERED

- TABLE 259 CHARGEPOINT: PRODUCT LAUNCHES

- TABLE 260 CHARGEPOINT: DEALS

- 19.1.4 TESLA

- TABLE 261 TESLA: COMPANY OVERVIEW

- FIGURE 112 TESLA: COMPANY SNAPSHOT

- FIGURE 113 VOLUME OF AVAILABLE TESLA SUPERCHARGERS

- TABLE 262 TESLA: PRODUCTS OFFERED

- TABLE 263 TESLA: PRODUCT LAUNCHES

- TABLE 264 TESLA: DEALS

- TABLE 265 TESLA: OTHERS

- 19.1.5 SIEMENS

- TABLE 266 SIEMENS: COMPANY OVERVIEW

- FIGURE 114 SIEMENS: COMPANY SNAPSHOT

- FIGURE 115 VERSICHARGE IEC

- TABLE 267 SIEMENS: PRODUCTS OFFERED

- TABLE 268 SIEMENS: PRODUCT LAUNCHES

- TABLE 269 SIEMENS: DEALS

- TABLE 270 SIEMENS: OTHERS

- 19.1.6 SCHNEIDER ELECTRIC

- TABLE 271 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- FIGURE 116 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 272 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

- TABLE 273 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 274 SCHNEIDER ELECTRIC: DEALS

- TABLE 275 SCHNEIDER ELECTRIC: OTHERS

- 19.1.7 TRITIUM

- TABLE 276 TRITIUM: COMPANY OVERVIEW

- FIGURE 117 TRITIUM: COMPANY SNAPSHOT

- FIGURE 118 TRITIUM: PLUG AND CHARGE SYSTEM ON RT50

- TABLE 277 TRITIUM: PRODUCTS OFFERED

- TABLE 278 TRITIUM: PRODUCT LAUNCHES

- TABLE 279 TRITIUM: DEALS

- TABLE 280 TRITIUM: OTHERS

- 19.2 KEY CHARGING POINT OPERATORS

- 19.2.1 ENGIE SA

- TABLE 281 ENGIE SA: COMPANY OVERVIEW

- FIGURE 119 ENGIE SA: COMPANY SNAPSHOT

- FIGURE 120 ENGIE SA: EV CHARGING POINTS

- TABLE 282 ENGIE SA: PRODUCTS OFFERED

- TABLE 283 ENGIE SA: PRODUCT LAUNCHES

- TABLE 284 ENGIE SA: DEALS

- TABLE 285 ENGIE SA: OTHERS

- 19.2.2 SHELL PLC

- TABLE 286 SHELL PLC: COMPANY OVERVIEW

- FIGURE 121 SHELL PLC: COMPANY SNAPSHOT

- TABLE 287 SHELL PLC: PRODUCTS OFFERED

- TABLE 288 SHELL PLC: PRODUCT LAUNCHES

- TABLE 289 SHELL PLC: DEALS

- TABLE 290 SHELL PLC: OTHERS

- 19.2.3 TOTALENERGIES

- TABLE 291 TOTALENERGIES: COMPANY OVERVIEW

- FIGURE 122 TOTALENERGIES: COMPANY SNAPSHOT

- TABLE 292 TOTALENERGIES: DEALS

- 19.2.4 BP P.L.C.

- TABLE 293 BP P.L.C.: COMPANY OVERVIEW

- FIGURE 123 BP P.L.C.: COMPANY SNAPSHOT

- TABLE 294 BP P.L.C.: GEOGRAPHICAL PRESENCE

- TABLE 295 BP P.L.C.: PRODUCTS OFFERED

- TABLE 296 BP P.L.C.: DEALS

- 19.2.5 ENEL X GLOBAL RETAIL

- TABLE 297 ENEL X GLOBAL RETAIL: COMPANY OVERVIEW

- FIGURE 124 ENEL X GLOBAL RETAIL: COMPANY SNAPSHOT

- TABLE 298 ENEL X GLOBAL RETAIL: PRODUCTS OFFERED

- TABLE 299 ENEL X GLOBAL RETAIL: DEALS

- 19.2.6 VIRTA LTD.

- TABLE 300 VIRTA LTD.: COMPANY OVERVIEW

- TABLE 301 VIRTA LTD.: DEALS

- 19.2.7 ALLEGO

- TABLE 302 ALLEGO: COMPANY OVERVIEW

- FIGURE 125 ALLEGO: COMPANY SNAPSHOT

- TABLE 303 ALLEGO: DEALS

- TABLE 304 ALLEGO: OTHERS

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 19.3 OTHER PLAYERS

- 19.3.1 EFACEC

- TABLE 305 EFACEC: COMPANY OVERVIEW

- 19.3.2 BLINK CHARGING

- TABLE 306 BLINK CHARGING: COMPANY OVERVIEW

- 19.3.3 CLIPPERCREEK

- TABLE 307 CLIPPERCREEK: COMPANY OVERVIEW

- 19.3.4 ELECTRIFY AMERICA

- TABLE 308 ELECTRIFY AMERICA: COMPANY OVERVIEW

- 19.3.5 OPCONNECT

- TABLE 309 OPCONNECT: COMPANY OVERVIEW

- 19.3.6 VOLTA

- TABLE 310 VOLTA: COMPANY OVERVIEW

- 19.3.7 EV SAFE CHARGE INC.

- TABLE 311 EV SAFE CHARGE INC.: COMPANY OVERVIEW

- 19.3.8 EV CONNECT

- TABLE 312 EV CONNECT: COMPANY OVERVIEW

- 19.3.9 FREEWIRE TECHNOLOGIES

- TABLE 313 FREEWIRE TECHNOLOGIES: COMPANY OVERVIEW

- 19.3.10 IONITY

- TABLE 314 IONITY: COMPANY OVERVIEW

- 19.3.11 WALLBOX

- TABLE 315 WALLBOX: COMPANY OVERVIEW

- 19.3.12 HELIOX ENERGY

- TABLE 316 HELIOX ENERGY: COMPANY OVERVIEW

- 19.3.13 SPARK HORIZON

- TABLE 317 SPARK HORIZON: COMPANY OVERVIEW

- 19.3.14 STAR CHARGE

- TABLE 318 STAR CHARGE: COMPANY OVERVIEW

- 19.3.15 DBT

- TABLE 319 DBT: COMPANY OVERVIEW

- 19.3.16 CHARGE+

- TABLE 320 CHARGE+: COMPANY OVERVIEW

- 19.3.17 DELTA ELECTRONICS, INC.

- TABLE 321 DELTA ELECTRONICS, INC.: COMPANY OVERVIEW

- 19.3.18 TGOOD

- TABLE 322 TGOOD: COMPANY OVERVIEW

- 19.3.19 ALFEN NV

- TABLE 323 ALFEN NV: COMPANY OVERVIEW

- 19.3.20 IES SYNERGY

- TABLE 324 IES SYNERGY: COMPANY OVERVIEW

- 19.3.21 LAFON

- TABLE 325 LAFON: COMPANY OVERVIEW

- 19.3.22 BEEV

- TABLE 326 BEEV: COMPANY OVERVIEW

- 19.3.23 FIMER

- TABLE 327 FIMER: COMPANY OVERVIEW

- 19.3.24 INSTAVOLT

- TABLE 328 INSTAVOLT: COMPANY OVERVIEW

- 19.3.25 FRESHMILE

- TABLE 329 FRESHMILE: COMPANY OVERVIEW

- 19.3.26 POD POINT

- TABLE 330 POD POINT: COMPANY OVERVIEW

- 19.3.27 VATTENFALL

- TABLE 331 VATTENFALL: COMPANY OVERVIEW

- 19.3.28 BE CHARGE

- TABLE 332 BE CHARGE: COMPANY OVERVIEW

- 19.3.29 MER

- TABLE 333 MER: COMPANY OVERVIEW

- 19.3.30 ENBW

- TABLE 334 ENBW: COMPANY OVERVIEW

- 19.3.31 RWE

- TABLE 335 RWE: COMPANY OVERVIEW

20 RECOMMENDATIONS BY MARKETSANDMARKETS

- 20.1 CHINA TO BE MOST LUCRATIVE MARKET FOR EV CHARGING STATIONS

- 20.2 ADVANCEMENTS IN EV CHARGING TECHNOLOGY TO BOOST DEMAND

- 20.3 DC ULTRAFAST CHARGERS AND MEGAWATT CHARGERS TO GROW RAPIDLY IN COMING YEARS

- 20.4 CONCLUSION

21 APPENDIX

- 21.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 21.2 DISCUSSION GUIDE

- 21.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 21.4 CUSTOMIZATION OPTIONS

- 21.4.1 FURTHER BREAKDOWN OF EV CHARGING STATION MARKET, BY CHARGING LEVEL, AT COUNTRY LEVEL (FOR COUNTRIES COVERED IN REPORT)

- 21.4.2 FURTHER BREAKDOWN OF EV CHARGING STATION MARKET, BY DC CHARGING, AT COUNTRY LEVEL (FOR COUNTRIES COVERED IN REPORT)

- 21.4.3 COMPANY INFORMATION

- 21.4.3.1 Profiles of additional market players (up to five)

- 21.5 RELATED REPORTS

- 21.6 AUTHOR DETAILS